United States Steel Corporation Second Quarter 2015 Earnings Conference Call and Webcast July 29, 2015 © 2011 United States Steel Corporation Exhibit 99.1

2 Forward-looking Statements United States Steel Corporation This presentation contains information that may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “will” and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume growth, share of sales and earnings per share growth, and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward- looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward- looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to the risks and uncertainties described in “Item 1A. Risk Factors” and “Supplementary Data - Disclosures About Forward-Looking Statements” in our Annual Report on Form 10-K for the year ended December 31, 2014, and those described from time to time in our future reports filed with the Securities and Exchange Commission.

Segment EBIT $ Millions Adjusted EBITDA $ Millions Adjusted Diluted EPS $ / Share 2Q 2015 4Q 2014 3Q 2014 3Q 2014 4Q 2014 1Q 2015 Note: For reconciliation of non-GAAP amounts see Appendix 4Q 2014 3Q 2014 1Q 2015 Second Quarter 2015 Results 3 United States Steel Corporation Adjusted Net Income $ Millions 3Q 2014 4Q 2014 2Q 2015 Challenging environment reflected in results 1Q 2015 LTM 2Q 2015 LTM 1Q 2015 LTM 2Q 2015 LTM Market headwinds persistent in the second quarter Note: LTM = latest twelve months Aggressive short-term cost actions starting to positively affect results

Cash from Operations $ Millions 1Q 2015 4Q 2014 3Q 2014 LTM 2Q 2015 Note: Cash from operations in 3Q 2014 includes a reduction in cash of $80 million from the deconsolidation of U. S. Steel Canada, Inc., a voluntary pension contribution of $140 million and a litigation settlement of $58 million Total Estimated Liquidity $ Millions 1Q 2015 4Q 2014 3Q 2014 2Q 2015 Strong Cash Position and Liquidity 4 United States Steel Corporation Cash and Cash Equivalents $ Millions Net Debt $ Millions Liquidity position strengthened with the completion of a new $1.5 billion credit facility that matures in 2020 3Q 2014 4Q 2014 1Q 2015 2Q 2015 3Q 2014 4Q 2014 1Q 2015 2Q 2015 Strong cash position and liquidity to weather tough market conditions Note: LTM = latest twelve months

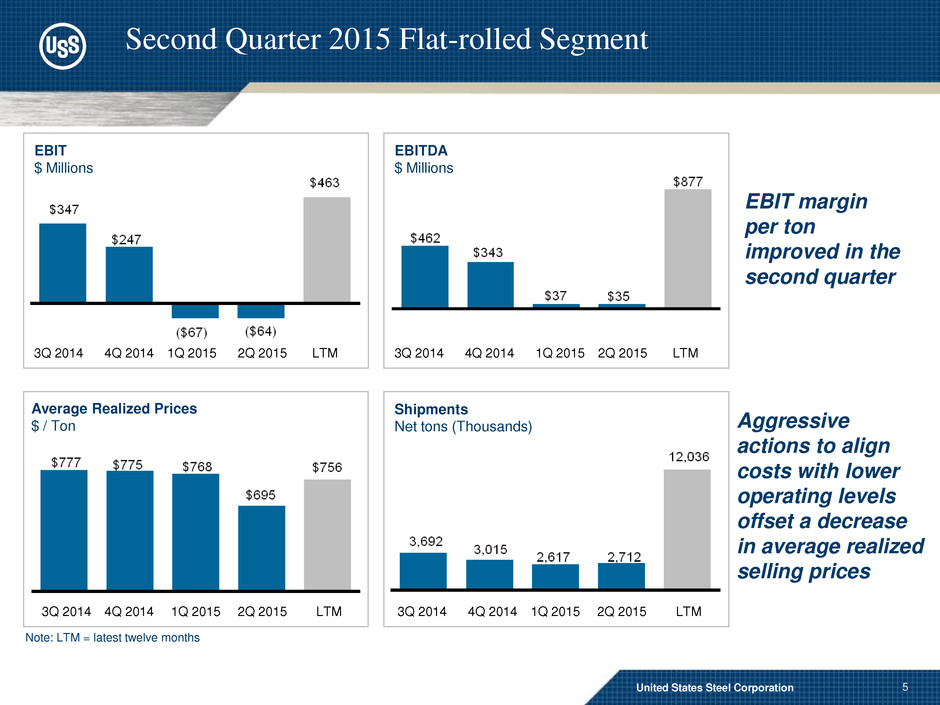

EBIT $ Millions Average Realized Prices $ / Ton 3Q 2014 4Q 2014 1Q 2015 Second Quarter 2015 Flat-rolled Segment 3Q 2014 4Q 2014 1Q 2015 Shipments Net tons (Thousands) 3Q 2014 4Q 2014 2Q 2015 Aggressive actions to align costs with lower operating levels offset a decrease in average realized selling prices 5 United States Steel Corporation EBITDA $ Millions 3Q 2014 4Q 2014 1Q 2015 2Q 2015 LTM 2Q 2015 LTM 2Q 2015 LTM 1Q 2015 LTM Note: LTM = latest twelve months EBIT margin per ton improved in the second quarter

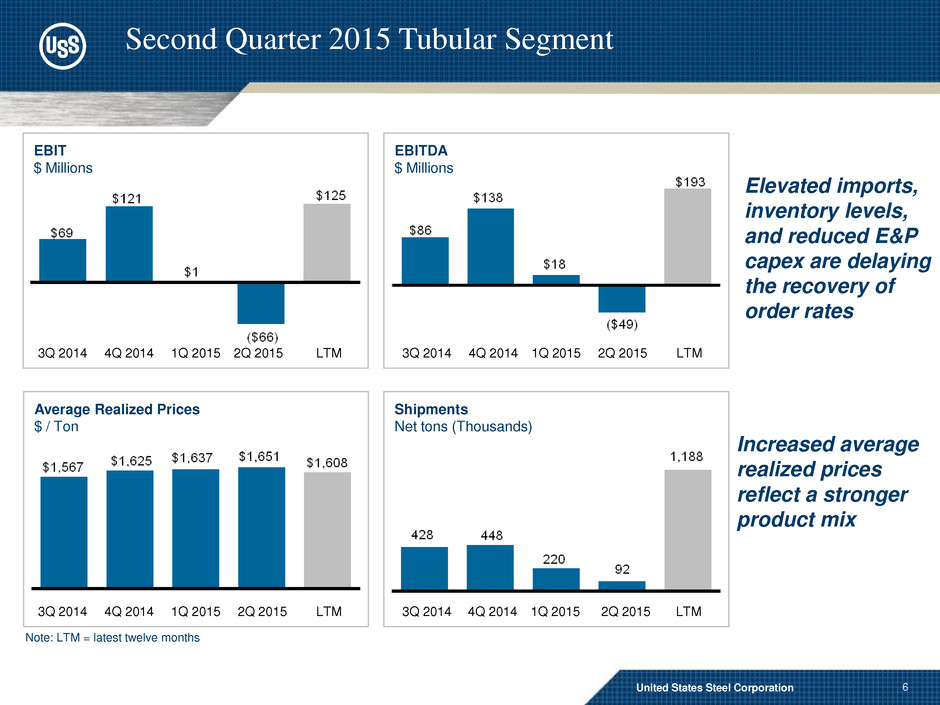

EBIT $ Millions Average Realized Prices $ / Ton 3Q 2014 4Q 2014 1Q 2015 Second Quarter 2015 Tubular Segment 3Q 2014 4Q 2014 1Q 2015 Shipments Net tons (Thousands) 3Q 2014 4Q 2014 1Q 2015 6 United States Steel Corporation EBITDA $ Millions 3Q 2014 4Q 2014 1Q 2015 Elevated imports, inventory levels, and reduced E&P capex are delaying the recovery of order rates 2Q 2015 LTM 2Q 2015 LTM 2Q 2015 LTM 2Q 2015 LTM Note: LTM = latest twelve months Increased average realized prices reflect a stronger product mix

EBIT $ Millions Average Realized Prices $ / Ton 3Q 2014 4Q 2014 1Q 2015 Second Quarter 2015 U. S. Steel Europe Segment 3Q 2014 4Q 2014 1Q 2015 Shipments Net tons (Thousands) 3Q 2014 4Q 2014 1Q 2015 7 United States Steel Corporation EBITDA $ Millions 3Q 2014 4Q 2014 1Q 2015 Negatively impacted by strong U.S. dollar 2Q 2015 LTM 2Q 2015 LTM 2Q 2015 LTM 2Q 2015 LTM Note: LTM = latest twelve months Consistent profitability and cash generation

Carnegie Way Benefits1 – FY 2015 Impact $ Millions 8 Carnegie Way Continuing to Deliver 55% 12% United States Steel Corporation 1 Carnegie Way benefits are based on the incremental impact in 2015 as compared to 2014 as the base year.

9 Carnegie Way transformation Phase 1: Earning the right to grow in search of: • Economic profits • Customer satisfaction and loyalty • Process improvements and focused investment Phase 2: Driving profitable growth with: • Innovation and Technology • Differentiated customer solutions • Focused M&A Strategic Approach United States Steel Corporation

10 United States Steel Corporation Business Update Short term actions taken are expected to reduce costs in the last two quarters of 2015 by at least $175 million Operating updates • Steelmaking facilities • Flat-rolled finishing facilities • Tubular facilities Strategic initiatives • Commercial entity management structure • Reliability centered maintenance • Operational excellence Recent activity

11 United States Steel Corporation Flat-rolled May and June are first back-to- back months with auto sales levels over 17 million SAAR since 2006 May construction spend is the highest since October 2008 June Architectural Billing Index rose 7% over May; all US regions grew Service center carbon flat-rolled inventory at 2.4 months supply; 0.3 drop from May Imports remain a headwind for all of our flat-rolled markets U. S. Steel Europe V4* car production growth expected to outpace the average EU in 2015 Appliance growth in V4 expected to outperform average EU growth in 2015 EU construction output expected to grow slightly in 2015. New and renovation projects in the residential sector will be a primary driver. Tubular Imports remain challenging 2Q oil directed rig counts down 37% from 1Q 2Q natural gas directed rig counts down 23% from 1Q WTI oil prices up 19% from 1Q. EIA forecasts $55.51/barrel for 2015. Market Updates Major industry summary and market fundamentals * Visegrad Group – Czech Republic, Hungary, Poland and Slovakia

12 United States Steel Corporation 2015 Outlook 2015 Adjusted EBITDA Guidance $0.7 to $0.9 billion Improved tailwinds now offsetting headwinds Headwinds Spot and Index prices remain low Imports remain at historically high levels Rig counts remain at very low levels U.S. dollar strength continues Supply chain inventory rebalance making slow progress Tailwinds improved Carnegie Way benefits increasing Short term cost actions taking effect Spot and Index prices beginning to recover Supply chain inventories decreasing

United States Steel Corporation Second Quarter 2015 Earnings Conference Call and Webcast Q & A July 29, 2015 © 2011 United States Steel Corporation United States Steel Corporation 13

© 2011 United States Steel Corporation Appendix 14 United States Steel Corporation

15 Major end-markets summary North American Flat-rolled Segment Automotive June sales met expectations at 17.1 million SAAR; inventories in line at 60 days. May and June are first back-to-back months with levels over 17 million since 2006. 3Q build schedule does not decline as much as typical years; down less than 3% this year versus an average the last 3 years of down 7.6%. Industrial Equipment Not much change month over month; business levels remain consistent within each segment. Mining slow; construction equipment demand slightly improving with construction market. 2015 railcar demand & backlogs remain steady, but not increasing. Tin Plate AISI reports show domestic mills shipments down 11% y-o-y; more a function of imports flooding the market as USA apparent consumption up 3% through May. Imports of 453,000 tons in 1H up 15%. Appliance OEM shipment forecasts for 2015 suggest 3% to 5% growth over 2014. Pipe and Tube Structural tubing demand has softened in the last 30 days. Line pipe project inquiries are slowly increasing. OCTG remained soft in 2Q, with participants hoping a bottom is near. Construction US Housing Starts up 9.8% in June; SAAR at 1.17 million units up 26.6% y-o-y. May construction spending increased 1% q-o-q; highest spend since October 2008. 2015 industry forecasts still up 5-6%, but this increase recently tempered from prior forecasts. June Architectural Billings Index increased over 7% in June up to 55.7; all USA regions grew. Service Center Carbon Flat Rolled on order as of July 1 at 1.8 months. Shipments increased 191k tons in June, but tons/day falls slightly. Inventory drops 106k tons, falls to 2.4 months supply (unadjusted); -0.3 months drop from end of May. YTD shipments are down 5.4% for carbon flat rolled; total steel is down 5.0%. United States Steel Corporation Sources: Wards / Dodge / Customer Financial Reports / MSCI / FMI US Census Bureau / MBMA / AISI / Railway Age / AIA

16 Market industry summary Tubular Segment United States Steel Corporation Sources: Baker Hughes, US Energy Information Administration, Preston Publishing, Internal Oil Directed Rig Count The oil directed rig count averaged 682 during 2Q, a decrease of 37% q-o-q. There are currently 659 active oil rigs. Gas Directed Rig Count The natural gas directed rig count averaged 223 during 2Q, a decrease of 23% q-o-q. There are currently 216 active natural gas rigs. Natural Gas Storage Level Currently 2.8 Tcf, 28% above year-ago levels and 3% above the five year average. Oil Price The West Texas Intermediate oil price averaged $57.85 per barrel during 2Q, up $9 or 19% from 1Q. U.S. Energy Information Administration forecasts an average 2015 price of $55.51 per barrel. Natural Gas Price The Henry Hub natural gas price averaged $2.75 per million Btu during 2Q, down $0.15 or 5% q-o-q. The U.S. Energy Information Administration forecasts an average 2015 natural gas price of $2.97 per million Btu. Imports During 2Q, import share of OCTG apparent market demand is projected to exceed 55%. OCTG Inventory June 2015 OCTG inventory is estimated to be approximately 10 months of supply.

17 Major end-markets summary United States Steel Corporation Automotive In 3Q, EU car production is expected to amount to 4.1 million units, an increase of 8% y-o-y. In 2015, total EU car production is forecasted to grow by 4% to roughly 17.5 million units. V4 car production is anticipated to increase by 11.8% y-o-y in Q3 2015 and for 2015 we expect 7.5% growth y-o-y to 3.2 million units. Significant growth is expected mainly from GM Poland, Audi Hungary, Mercedes Hungary and PSA Slovakia. Appliance In 3Q, EU appliance production is projected to grow by 4% y-o-y and by 6% q-o-q. During the same period, V4 production is projected to grow 8% y-o-y, and 14% q-o-q. In 2015 the EU appliance sector will rise by 3% y-o-y; V4 market by 7% y-o-y. The positive trend in the V4 market is driven mainly by Slovak Whirlpool and Polish OEMs. (Samsung, LG, BSH) Tin Plate 3Q demand is expected to decline 3% q-o-q due to the transition out of the busy season after similar demand seen in 2Q as in previous years. Continuing cheap imports from Asia in 3Q are expected mainly to southern Europe. Overall 2015 consumption is expected to grow by 2% y-o-y. Construction The outlook for 2H is for construction activity to gradually gain momentum in most EU countries. France and Italy are expected to lag the modest pick-up in activity due to weak government finances and high unemployment. New and renovation projects in the residential sector will provide the main boost in 2015, projected growth of EU construction activity is around 1.2% in 2015. Service Centers The outlook for real steel consumption is moderately positive, due to activity in most steel-using sectors gaining traction. Higher activity levels at down-stream steel users imply that inventories in the supply chain will need to be raised slightly. The key uncertainty for EU steel producers is whether imports will prevent them from benefiting from the mildly positive trend in EU steel demand. U. S. Steel Europe Segment Sources: Eurofer, USSK Marketing, EASSC, IHS, Euroconstruct, ESTA, ACEA

U. S. Steel Commercial – Contract vs. Spot Contract vs. spot mix by segment – twelve months ended June 30, 2015 Firm 31% Market Based Quarterly * 18% Flat-rolled ** Market Based Monthly * 12% Tubular U. S. Steel Europe Spot 29% Cost Based 9% Contract: 71% Spot: 29% Firm 38% Market Based Quarterly* 1% Spot 45% Cost Based 4% Program 54% Contract: 55% Spot: 45% Market Based Monthly* 12% Spot 46% Program: 54% Spot: 46% United States Steel Corporation 18 Market Based Semi-annual * 1% *Annual contract volume commitments with price adjustments in stated time frame ** Excludes shipments for U. S. Steel Canada, Inc.

19 United States Steel Corporation Other Items Capital Spending Second quarter actual $104 million, 2015 estimate $500 million Depreciation, Depletion and Amortization Second quarter actual $138 million, 2015 estimate $565 million Pension and Other Benefits Costs Second quarter actual $60 million, 2015 estimate $245 million Pension and Other Benefits Cash Payments (excluding any VEBA contributions and voluntary pension contributions) Second quarter actual $65 million, 2015 estimate $300 million

20 Global OSHA Recordable Incidence Rates January 2010 through June 2015 United States Steel Corporation Safety Performance Rates Frequency of Injuries (per 200,000 manhours) Data for 2010 forward includes Lone Star Tubular Operations, Bellville Tubular Operations, Rig Site Services, Tubular Processing Houston, Offshore Operations Houston, and Wheeling Machine Products. Data for 2011 forward includes Transtar. Data for 2010 through 2011 includes U. S. Steel Serbia. 19% Improvement 2010 to 2015 Global Days Away From Work Incidence Rates January 2010 through June 2015 18% Improvement 2010 to 2015

21 United States Steel Corporation Adjusted Results ($ millions) LTM 2Q 2015 1Q 2015 4Q 2014 3Q 2014 Reported net earnings (loss) ($268) ($261) ($75) $275 ($207) Loss on shutdown of coke production facilities 65 ─ 65 ─ ─ Loss on write-down of retained interest in U. S. Steel Canada 136 136 ─ ─ ─ Loss on deconsolidation of U. S. Steel Canada and other charges 385 ─ ─ 1 384 Impairment of carbon alloy facilities at Gary Works 161 ─ ─ (2) 163 Write-off of pre-engineering costs at Keetac 30 ─ ─ ─ 30 Gain on sale of real estate assets (45) ─ ─ ─ (45) Restructuring and other charges 10 10 ─ ─ ─ Adjusted net earnings (loss) $474 ($115) ($10) $274 $325 Reconciliation of reported and adjusted net earnings

22 United States Steel Corporation Adjusted Results ($ per share) LTM 2Q 2015 1Q 2015 4Q 2014 3Q 2014 Reported diluted EPS (LPS) ($1.90) ($1.79) ($0.52) $1.83 ($1.42) Loss on shutdown of coke production facilities 0.45 ─ 0.45 ─ ─ Loss on write-down of retained interest in U. S. Steel Canada 0.93 0.93 ─ ─ ─ Loss on deconsolidation of U. S. Steel Canada and other charges 2.55 ─ ─ 0.01 2.54 Impairment of carbon alloy facilities at Gary Works 1.06 ─ ─ (0.02) 1.08 Write-off of pre-engineering costs at Keetac 0.21 ─ ─ ─ 0.21 Gain on sale of real estate assets (0.30) ─ ─ ─ (0.30) Restructuring and other charges 0.07 0.07 ─ ─ ─ Additional dilutive effects of securities 0.05 ─ ─ ─ 0.05 Adjusted diluted EPS (LPS) $3.12 ($0.79) ($0.07) $1.82 $2.16 Reconciliation of reported and adjusted diluted EPS

23 United States Steel Corporation Adjusted Results ($ millions) LTM 2Q 2015 1Q 2015 4Q 2014 3Q 2014 Reported (loss) earnings before interest and income taxes (EBIT) ($323) ($392) ($187) $397 ($141) Depreciation expense 578 138 144 138 158 EBITDA 255 (254) (43) 535 17 Loss on shutdown of coke production facilities 153 ─ 153 ─ ─ Loss on write-down of retained interest in U. S. Steel Canada 255 255 ─ ─ ─ Loss on deconsolidation of U. S. Steel Canada and other charges 416 ─ ─ 3 413 Impairment of carbon alloy facilities at Gary Works 195 ─ ─ (4) 199 Write-off of pre-engineering costs at Keetac 37 ─ ─ ─ 37 Gain on sale of real estate assets (55) ─ ─ ─ (55) Restructuring and other charges 19 19 ─ ─ ─ Adjusted EBITDA $1,275 $20 $110 $534 $611 Reconciliation of adjusted EBITDA

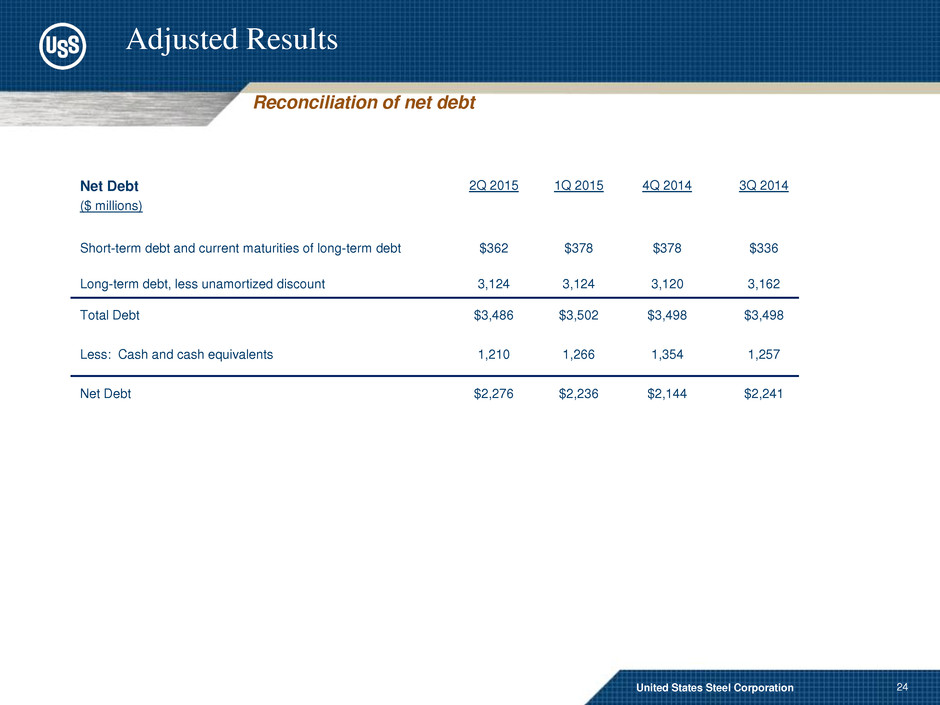

24 United States Steel Corporation Adjusted Results Net Debt ($ millions) 2Q 2015 1Q 2015 4Q 2014 3Q 2014 Short-term debt and current maturities of long-term debt $362 $378 $378 $336 Long-term debt, less unamortized discount 3,124 3,124 3,120 3,162 Total Debt $3,486 $3,502 $3,498 $3,498 Less: Cash and cash equivalents 1,210 1,266 1,354 1,257 Net Debt $2,276 $2,236 $2,144 $2,241 Reconciliation of net debt