Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12 |

| | | | |

| ALLIED WORLD ASSURANCE COMPANY HOLDINGS, AG |

(Exact name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

ALLIED WORLD ASSURANCE COMPANY HOLDINGS, AG

NOTICE OF 2017

ANNUAL SHAREHOLDER MEETING |

May 26, 2017

| | |

| DATE: | | Wednesday, June 21, 2017 |

| TIME: | | 2:00 p.m., local time |

| PLACE: | | Corporate headquarters: Park Tower, 15th floor, Gubelstrasse 24, 6300 Zug, Switzerland |

ITEMS OF BUSINESS:

- ➢

- Elect the board of directors.

- ➢

- Elect the Chairman of the board of directors.

- ➢

- Elect the Compensation Committee members.

- ➢

- Elect the independent proxy.

- ➢

- Approve, on an advisory basis, 2016 executive compensation as required under U.S. securities laws.

- ➢

- Approve, on an advisory basis, the frequency of the shareholder vote on executive compensation as required under U.S. securities laws.

- ➢

- Approve the 2016 Annual Report and financial statements.

- ➢

- Approve the retention of disposable profits.

- ➢

- Elect Deloitte & Touche LLP as independent auditor and Deloitte AG as statutory auditor.

- ➢

- Elect PricewaterhouseCoopers AG as special auditor.

- ➢

- Discharge of the board of directors and executive officers from liabilities for their actions during the year ended December 31, 2016.

- ➢

- Transact any further business that lawfully may be brought before the meeting.

Table of Contents

| | |

| RECORD DATE: | | Only shareholders of record holding common shares, as shown on our transfer books, as of the close of business on May 25, 2017 are entitled to vote at the Annual Shareholder Meeting. |

MATERIALS

TO REVIEW: |

|

This document contains our Notice of 2017 Annual Shareholder Meeting and Proxy Statement. Our 2016 Annual Report accompanies this Proxy Statement but is not a part of our proxy solicitation materials. |

PROXY VOTING: |

|

It is important that your shares be represented and voted at the Annual Shareholder Meeting. Please promptly sign, date and return the enclosed proxy card in the return envelope furnished for that purpose whether or not you plan to attend the meeting. If you later desire to revoke your proxy for any reason, you may do so in the manner described in the attached proxy statement. |

| | |

| | By Order of the Board of Directors, |

| | |  |

| | Theodore Neos

Corporate Secretary |

Table of Contents

TABLE OF CONTENTS

-i-

Table of Contents

PROXY STATEMENT SUMMARY

| Allied World 2016 Highlights |

Although the market environment for insurers and reinsurers remained challenging, we continued to develop as a global specialty insurer with disciplined underwriting and a focused build-out of product capabilities. In North America, we further increased scale and penetration in our specialty casualty and property lines with a broad range of product offerings that drove our profitability. In our Global Markets Insurance segment, we successfully integrated our recent acquisitions in Hong Kong and Singapore and upgraded the infrastructure in the region to better position our Asian platform for profitable opportunities. We were also successful in implementing group-wide cost-saving initiatives.

In 2016, we generated net income of $255.3 million and our year-end diluted book value per share was $39.52, a 4.6% increase for the year. Our combined ratio was 96.2% and underwriting performance benefitted from profitable growth across our insurance and reinsurance businesses. Favorable reserve releases of $98.3 million, total return on the company’s investment portfolio of $219.9 million and successful management of expenses combined to contribute to our performance.

On December 18, 2016, we entered into a merger agreement with Fairfax Financial Holdings Limited (“Fairfax”), whereby Fairfax will acquire all of our outstanding common shares. Under the terms of the merger agreement, our shareholders will receive a combination of Fairfax subordinate voting shares and cash having a value equal to $54.00 per share (based on the closing price of Fairfax’s subordinate voting shares on December 16, 2016). The merger agreement has been unanimously approved by both companies’ Boards of Directors. The acquisition is expected to be consummated following the satisfaction of customary closing conditions.

-1-

Table of Contents

The following table contains key financial data for each of the last three fiscal years, including data as of each year end.

| | | | | | | | | | |

Operating Results | | 2016 | | 2015 | | 2014 | |

|---|

| |

($ in millions, except share, per share and percentage data)

| |

|---|

Total Assets |

|

$ |

13,179 |

|

$ |

13,512 |

|

$ |

12,419 |

|

Total Debt and Other Liabilities |

|

$ |

9,627 |

|

$ |

9,979 |

|

$ |

8,641 |

|

Total Shareholders’ Equity |

|

$ |

3,552 |

|

$ |

3,533 |

|

$ |

3,778 |

|

Diluted Book Value per Share |

|

$ |

39.52 |

|

$ |

37.78 |

|

$ |

38.27 |

|

Increase/(Decrease) in Diluted Book Value per Share |

|

4.6% |

|

(1.3 |

)% |

11.9% |

|

Gross Premiums Written |

|

$ |

3,066 |

|

$ |

3,093 |

|

$ |

2,935 |

|

Net Income |

|

$ |

255 |

|

$ |

84 |

|

$ |

490 |

|

Operating Income |

|

$ |

239 |

|

$ |

212 |

|

$ |

415 |

|

Total Return on Investments |

|

2.5% |

|

0.6% |

|

3.1% |

|

Net Income Return on Average Shareholders’ Equity |

|

7.2% |

|

2.3% |

|

13.4% |

|

Operating Return on Average Shareholders’ Equity |

|

6.7% |

|

5.8% |

|

11.4% |

|

Combined Ratio(1) |

|

96.2% |

|

95.1% |

|

85.2% |

|

Cash Dividends Paid |

|

$ |

92 |

|

$ |

114 |

|

$ |

77 |

|

Number of Common Shares Outstanding |

|

87,098,120 |

|

90,959,635 |

|

96,195,482 |

|

Weighted Average Common Shares Outstanding - Diluted |

|

89,800,894 |

|

94,174,460 |

|

99,591,773 |

|

Repurchase of Common Shares |

|

$ |

166 |

|

$ |

245 |

|

$ |

175 |

|

- (1)

- A measure of underwriting performance. The combined ratio represents the total cost per $100 of earned premium. A combined ratio below 100% demonstrates underwriting profit while a combined ratio above 100% demonstrates underwriting loss.

Detailed information of our financial and operational performance is contained in our Annual Report on Form 10-K that is included in our 2016 Annual Report accompanying this Proxy Statement. See our Annual Report on Form 10-K for a reconciliation of the non-GAAP financial measures included in the table above.

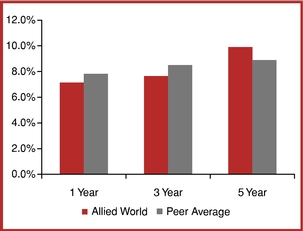

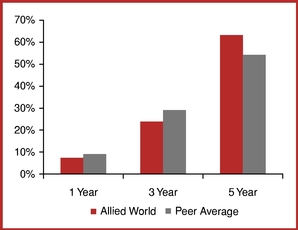

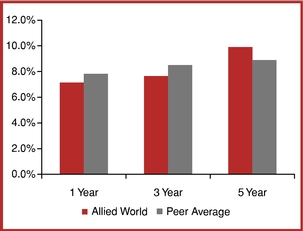

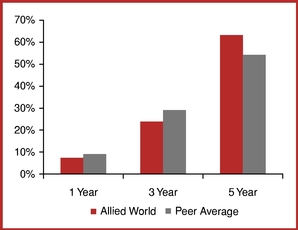

Company’s Performance Relative

to Its Peer Group as of December 31, 2016

(In quartiles. 1=first quartile, the highest level; 4=fourth quartile, the lowest level) |

| | | | | | | | | | | | | | | | |

Performance Metric | | 2016

(one year)

Rank | | 2014-2016

(three year)

Rank | | 2012-2016

(five year)

Rank | |

|---|

| Diluted Book Value per Share Growth (adjusted for dividends) | | | 3 | | | | 3 | | | | 2 | | |

Annualized Net Income Return on Average Equity (adjusted for other comprehensive income) |

|

|

3 |

|

|

|

4 |

|

|

|

2 |

|

|

Combined Ratio |

|

|

3 |

|

|

|

3 |

|

|

|

2 |

|

|

Total Shareholder Return |

|

|

1 |

|

|

|

3 |

|

|

|

1 |

|

|

-2-

Table of Contents

| Shareholder Voting Recommendations |

Our Board of Directors unanimously makes the following recommendations:

| | | | | | |

| | Proposal | | Vote

Recommendation | | See Page

Number

for More

Information |

|---|

| Proposal 1 | | Elect the Board of Directors | | FOR EACH NOMINEE | | p. 15 |

Proposal 2 |

|

Elect the Chairman of the Board of Directors |

|

FOR |

|

p. 26 |

Proposal 3 |

|

Elect the Compensation Committee Members |

|

FOR EACH NOMINEE |

|

p. 26 |

Proposal 4 |

|

Elect the Independent Proxy |

|

FOR |

|

p. 27 |

Proposal 5 |

|

Advisory Vote on 2016 Executive Compensation as Required Under U.S. Securities Laws |

|

FOR |

|

p. 27 |

Proposal 6 |

|

Advisory Vote on Frequency of the Shareholder Vote on Executive Compensation as Required Under U.S. Securities Laws |

|

EVERY YEAR |

|

p.28 |

Proposal 7 |

|

Approve the 2016 Annual Report and Financial Statements |

|

FOR |

|

p. 29 |

Proposal 8 |

|

Approve the Retention of Disposable Profits |

|

FOR |

|

p. 29 |

Proposal 9 |

|

Elect Deloitte & Touche LLP as Independent Auditor and Deloitte AG as Statutory Auditor |

|

FOR |

|

p. 30 |

Proposal 10 |

|

Elect PricewaterhouseCoopers AG as Special Auditor |

|

FOR |

|

p. 30 |

Proposal 11 |

|

Discharge of the Board of Directors and Executive Officers from Liabilities |

|

FOR |

|

p. 31 |

-3-

Table of Contents

| Corporate Governance Highlights |

The company is committed to strong corporate governance, which promotes the long-term interests of shareholders, strengthens the accountability of the board of directors (the “Board”) and management and helps build public trust in the company. Highlights include the following:

| | | | | | | | |

| | | | | | | | | |

| | |

Board and Other Governance Information

| | | | 2017 | | |

| | | | | | | | | |

| | | | | | | | | |

|

|

Size of Board

|

|

|

|

8 |

|

|

|

|

Average Age of Directors

|

|

|

|

62.6 |

|

|

|

|

Percentage of Independent Directors

|

|

|

|

87.5% |

|

|

|

|

Diverse Board (Gender, Experience and Skills)

|

|

|

|

Yes |

|

|

|

|

Majority Voting for Directors

|

|

|

|

Yes |

|

|

|

|

Annual Election of All Directors

|

|

|

|

Yes |

|

|

|

|

Annual Election of Chairman of the Board

|

|

|

|

Yes |

|

|

|

|

Annual Election of Compensation Committee Members

|

|

|

|

Yes |

|

|

|

|

Use of Independent Proxy to Represent Shareholders

|

|

|

|

Yes |

|

|

|

|

No Director Holds More than 3 Other Public Company Board Seats

|

|

|

|

Yes |

|

|

|

|

Lead Independent Director

|

|

|

|

Yes |

|

|

|

|

Separate Chairman and CEO

|

|

|

|

No |

|

|

|

|

CEO Holds No Other Public Company Board Seat

|

|

|

|

Yes |

|

|

|

|

Independent Directors Meet Without Management

|

|

|

|

Yes |

|

|

|

|

Annual Board and Committees Self-Evaluations

|

|

|

|

Yes |

|

|

|

|

Annual Equity Grant to Non-Employee Directors

|

|

|

|

Yes |

|

|

|

|

Board Orientation/Education Program

|

|

|

|

Yes |

|

|

|

|

Number of Board Meetings Held in 2016

|

|

|

|

15 |

|

|

|

|

Code of Business Conduct and Ethics for Directors and Executives

|

|

|

|

Yes |

|

|

|

|

Stock Ownership Policy for Directors and Senior Management

|

|

|

|

Yes |

|

|

|

|

Disclosure Committee for Financial Reporting

|

|

|

|

Yes |

|

|

|

|

Annual Approval of Executive Compensation

|

|

|

|

Yes |

|

|

|

|

Shareholder Ability to Call Special Meetings

|

|

|

|

Yes |

|

|

|

|

Policy Prohibiting Insider Pledging or Hedging of Company Common Shares

|

|

|

|

Yes |

|

|

| | | | | | | | | |

-4-

Table of Contents

You are being asked to vote on the election of the following eight directors to the Board. All directors are elected annually by a majority of the votes cast. Detailed information about each director’s background and key attributes, experience and skills can be found beginning on page 15 of this Proxy Statement.

| | | | | | | | | | | | | | | | | | | | | | |

| |

| | Director

Since | | Primary

Occupation | | Principal

Skills | |

| | Committees |

|---|

Name | | Age | | Independent | | AC | | CC | | ERC | | Exec | | IC | | N&CG |

|---|

| Barbara T. Alexander | | 68 | | 2009 | | Independent

Consultant |

| Corporate Finance,

Investment,

Strategic Planning |

| Yes | | C | | · | | · | | | | · | | |

| Scott Carmilani | | 52 | | 2003 | | President, CEO

and Chairman

Allied

World Assurance

Company

Holdings, AG | | Insurance and

Reinsurance

Industry

Leadership | | No | | | | | | | | C | | | | |

| Bart Friedman | | 72 | | 2006 | | Senior Counsel

Cahill Gordon

Reindel LLP |

| Investment,

Corporate

Governance |

| Lead

Independent

Director |

| | | · | | | | | | · | | C |

| Patricia L. Guinn | | 62 | | 2015 | | Former

Managing

Director

Towers Watson | | Insurance and

Reinsurance, Risk

Management | | Yes | | · | | | | · | | | | | | · |

| Fiona E. Luck | | 59 | | 2015 | | Former Senior

Executive

XL Group plc |

| Insurance and

Reinsurance,

Corporate Finance |

| Yes | | | | · | | · | | · | | | | |

| Patrick de Saint-Aignan | | 68 | | 2008 | | Former Advisory

Director

Morgan Stanley | | Corporate Finance,

Risk Management,

Investment | | Yes | | · | | · | | C | | | | · | | |

| Eric S. Schwartz | | 54 | | 2013 | | CEO and Founder

76 West

Holdings |

| Corporate Finance,

Investment |

| Yes | | | | · | | | | | | C | | |

| Samuel J. Weinhoff | | 66 | | 2006 | | Independent

Consultant | | Corporate Finance,

Insurance and

Reinsurance,

Strategic Planning | | Yes | | · | | C | | · | | · | | · | | · |

| | | | | | |

| C | | Chair | | | | |

| AC | | Audit Committee | | Exec | | Executive Committee |

| CC | | Compensation Committee | | IC | | Investment Committee |

| ERC | | Enterprise Risk Committee | | N&CG | | Nominating & Corporate Governance Committee |

-5-

Table of Contents

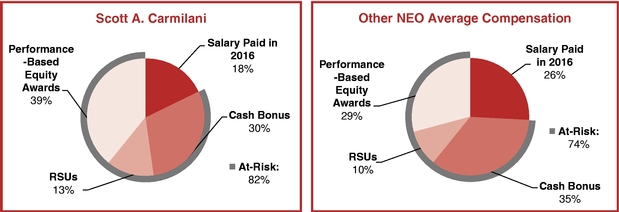

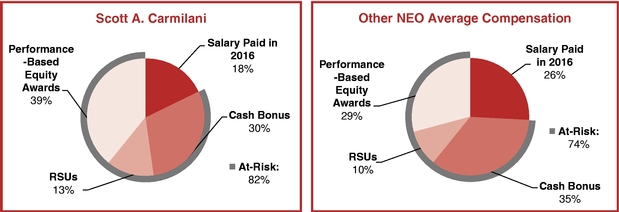

| Executive Compensation Philosophy and Goals |

The Compensation Committee believes that an effective executive compensation program is one that:

- ➢

- Rewards strong company and individual performance,

- ➢

- Aligns the interests of the executive officers with the company’s shareholders, and

- ➢

- Balances the objectives of pay-for-performance and retention.

The Compensation Committee’s objectives for the company’s compensation programs are to:

- ➢

- Drive and reward employee performance that supports the company’s business objectives and financial success;

- ➢

- Attract and retain talented and highly-skilled employees;

- ➢

- Align the interests of the executives with the company’s shareholders by:

- ·

- having asubstantial portion of compensation in long-term, performance-based equity awards, a large portion of which is“at risk” with vesting dependent on thecompany achieving certain performance targets over time, particularly at the senior officer level where such persons can more directly affect the company’s financial success;

- ·

- regularly evaluating the company’s compensation programs to help ensure that they do not encourage excessive risk taking; and

- ·

- tying incentive opportunity to ablend of metrics that focus on key company objectives, correlate with the creation of shareholder value and encourage prudent risk taking; and

- ➢

- Remain competitive with other insurance and reinsurance companies, particularly other insurance and reinsurance companies with which the company competes for talent.

The Compensation Committee values the opinions expressed by shareholders on the design and effectiveness of the company’s executive compensation programs. Prior to 2016, shareholders strongly supported the company’s executive compensation programs, approving the advisory votes on executive compensation with 98.4%, 98.8% and 98.9% support in 2013, 2014 and 2015, respectively.

At the company’s Annual Shareholder Meeting held in April 2016, shareholders approved the company’s binding executive compensation proposal with 99.4% support. However, shareholders approved the company’s advisory say-on-pay proposal with a lower level of support of 64.3%, even though the company’s compensation program design had not materially changed from prior years and overall compensation levels had substantially decreased commensurate with the company’s financial performance. As part of the proxy solicitation process, and following the 2016 Annual Shareholder Meeting, the company engaged in an extensive shareholder outreach effort, contacting its 28 largest institutional shareholders representing approximately 63% of its outstanding shares. Members of the company’s management, its Investor Relations Department and, in some cases, the independent Chair of the Compensation Committee, conducted conference calls with those shareholders that responded to outreach efforts to solicit shareholder feedback, respond to questions and ensure that shareholders understand the company’s executive compensation programs and are afforded an opportunity to voice any concerns.

-6-

Table of Contents

Shareholders noted that they generally supported the company’s compensation program design, particularly the emphasis on long-term, performance-based equity awards that reflected the company’s strong pay-for-performance philosophy. Shareholders also noted that they appreciated the company’s outreach efforts and the opportunity to engage in discussions with the independent Chair of the Compensation Committee. Although shareholders did not identify any specific issues with the company’s executive compensation programs, the Compensation Committee deliberated on the results of the 2016 say-on-pay vote in multiple meetings and considered shareholder feedback, market data and advice from its independent compensation consultant in its ongoing review of the compensation program design.

-7-

Table of Contents

PROXY STATEMENT

| GENERAL MEETING INFORMATION |

- Q:

- Why am I receiving these materials?

- A:

- You are receiving these materials because you are a shareholder of Allied World Assurance Company Holdings, AG as of the Record Date (as defined below). The Board is soliciting the enclosed proxy to be voted at the 2017 Annual General Meeting of the company’s shareholders to be held at 2:00 p.m., local time, on Wednesday, June 21, 2017 at the company’s corporate headquarters, Park Tower, 15th floor, Gubelstrasse 24, 6300 Zug, Switzerland (the “Annual Shareholder Meeting”). This Proxy Statement summarizes the information you need to know to vote at the Annual Shareholder Meeting.

- When the enclosed proxy card is properly executed and returned, the company’s registered voting shares (the “common shares”) it represents will be voted, subject to any direction to the contrary, at the Annual Shareholder MeetingFOR the matters specified in the Notice of Annual Shareholder Meeting attached hereto and described more fully herein.

- This Proxy Statement, the attached Notice of Annual Shareholder Meeting and the enclosed proxy card are being first mailed to shareholders on or about May 26, 2017. A copy of the company’s Annual Report to Shareholders for the fiscal year ended December 31, 2016 accompanies this Proxy Statement. The Annual Report contains the company’s audited consolidated financial statements and its audited Swiss statutory financial statements prepared in accordance with Swiss law for the year ended December 31, 2016 as well as additional disclosures required under Swiss law.

- Although the Annual Report and this Proxy Statement are being mailed together, the Annual Report is not part of this Proxy Statement.

- Except as the context otherwise requires, references in this Proxy Statement to “we,” “us,” “our” and the “company” refer to Allied World Assurance Company Holdings, AG and its direct and indirect subsidiaries on a consolidated basis. Also, in this Proxy Statement, “$” and “USD” refer to U.S. dollars, “CHF” refers to Swiss francs and “local time” means the time in Switzerland.

- Q:

- Who is entitled to vote?

- A:

- The Board has set May 25, 2017, as the record date for the Annual Shareholder Meeting (the “Record Date”). Holders of our common shares as of the close of business on the Record Date will be entitled to vote at the Annual Shareholder Meeting. As of May 1, 2017, there were outstanding 87,484,665 common shares.

- Beneficial owners of our common shares and shareholders registered in our share register with common shares at the close of business on the Record Date are entitled to vote at the Annual Shareholder Meeting. Shareholders not registered in our share register as of the Record Date will not be entitled to attend, vote or grant proxies to vote at the Annual Shareholder Meeting. No shareholder will be entered in our share register as a shareholder with voting rights between the close of business on the Record Date and the opening of business on the day following the Annual Shareholder Meeting. Continental Stock Transfer & Trust Company, as transfer agent, which maintains our share register, will, however, continue to register transfers of our registered shares in the share register

-8-

Table of Contents

- in its capacity as transfer agent during this period.

- Q:

- What is the difference between holding shares as a shareholder of record and as a beneficial owner?

- A:

- Most of our shareholders hold their shares through a bank, brokerage firm or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially.

- Shareholder of Record

- If your common shares are registered directly in your name, as registered shares entitled to voting rights, in our share register operated by our transfer agent, Continental Stock Transfer & Trust Company, you are considered, with respect to those shares, the shareholder of record and these proxy materials are being sent to you directly by us. As the shareholder of record, you have the right to grant your voting proxy directly to the independent proxy mentioned in the proxy card (see “How do I appoint and vote via an independent proxy if I am a shareholder of record?” below), grant your voting proxy to any other person (who does not need to be a shareholder) or vote in person at the Annual Shareholder Meeting.

- Beneficial Owner

- If your common shares are held by a bank, brokerage firm or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your bank, brokerage firm or other nominee who is considered, with respect to those shares,

- the shareholder of record. As the beneficial owner, you have the right to direct your bank, broker or other nominee on how to vote your common shares and are also invited to attend the Annual Shareholder Meeting. However, since you are not the shareholder of record, you may only vote these common shares in person at the Annual Shareholder Meeting if you follow the instructions described below under the heading “How do I vote?” Your bank, brokerage firm or other nominee has enclosed a voting instruction card for you to use in directing your bank, broker or other nominee as to how to vote your common shares, which may contain instructions for voting by telephone or electronically.

- Q:

- How many votes are required to transact business at the Annual Shareholder Meeting?

- A:

- A quorum is required to transact business at the Annual Shareholder Meeting. Without giving effect to the limitation on voting rights described below, the quorum required at the Annual Shareholder Meeting is two or more persons present in person and representing in person or by proxy throughout the meeting more than 50% of the total issued and outstanding common shares registered in our share register.

- Q:

- What will I be voting on, what vote is required and how will abstentions and “broker non-votes” be counted?

- A:

- The following chart describes the proposals to be considered at the meeting, the vote required to adopt each proposal and the manner in which the votes will be counted:

| | | | | | | | |

| | Proposal | | Vote Required | | Effect of

Abstentions | | Effect of

“Broker Non-Votes” |

|---|

|

|

|

|

|

|

|

|

|

| 1 | | Elect the Board of Directors | | Majority of votes cast | | Vote not counted | | Vote not counted |

2 |

|

Elect the Chairman of the Board of Directors |

|

Majority of votes cast |

|

Vote not counted |

|

Vote not counted |

3 |

|

Elect the Compensation Committee Members |

|

Majority of votes cast |

|

Vote not counted |

|

Vote not counted |

-9-

Table of Contents

| | | | | | | | |

| | Proposal | | Vote Required | | Effect of

Abstentions | | Effect of

“Broker Non-Votes” |

|---|

|

|

|

|

|

|

|

|

|

| 4 | | Elect the Independent Proxy | | Majority of votes cast | | Vote not counted | | Vote not counted |

5 |

|

Advisory Vote on 2016 Executive Compensation as Required Under U.S. Securities Laws |

|

Majority of votes cast |

|

Vote not counted |

|

Vote not counted |

6 |

|

Advisory Vote on Frequency of the Shareholder Vote on Executive Compensation as Required Under U.S. Securities Laws |

|

Majority of votes cast |

|

Vote not counted |

|

Vote not counted |

7 |

|

Approve the 2016 Annual Report and Financial Statements |

|

Majority of votes cast |

|

Vote not counted |

|

Brokers have discretion to vote |

8 |

|

Approve the Retention of Disposable Profits |

|

Majority of votes cast |

|

Vote not counted |

|

Brokers have discretion to vote |

9 |

|

Elect Deloitte & Touche LLP as Independent Auditor and Deloitte AG as Statutory Auditor |

|

Majority of votes cast |

|

Vote not counted |

|

Brokers have discretion to vote |

10 |

|

Elect PricewaterhouseCoopers AG as Special Auditor |

|

Majority of votes cast |

|

Vote not counted |

|

Brokers have discretion to vote |

11 |

|

Discharge of the Board of Directors and Executive Officers from Liabilities |

|

Majority of votes cast |

|

Vote not counted |

|

Vote not counted |

- ·

- Abstentions and “broker non-votes” will be counted toward the presence of a quorum at the Annual Shareholder Meeting.

- ·

- “Broker non-votes” are shares held by banks or brokers for which voting instructions have not been received from the beneficial owners or the persons entitled to vote those shares and for which the bank or broker does not have discretionary voting power under rules applicable to broker-dealers. If you own shares through a bank or brokerage firm and you do not instruct your bank or broker how to vote, your bank or broker will nevertheless have discretion to vote your shares on “routine” matters, such as the election of Deloitte & Touche LLP, our independent auditors. More importantly, without instructions from you, your bank or broker will not have discretion to vote on “non-routine” matters, such as the election of directors, the votes on executive compensation, the payment of the dividend to our shareholders and any shareholder proposals.

-10-

Table of Contents

- Q:

- How does the voting take place at the Annual Shareholder Meeting?

- A:

- A vote will be taken on all matters properly brought before the Annual Shareholder Meeting. Each shareholder present who elects to vote in person and each person holding a valid proxy is entitled to one vote for each common share owned or represented.

- Q:

- How many votes do I have?

- A:

- Holders of our common shares are entitled to one vote per share on each matter to be voted upon by the shareholders at the Annual Shareholder Meeting, unless you own Controlled Shares that constitute 10% or more of the issued common shares, in which case your voting rights with respect to those Controlled Shares will be limited, in the aggregate, to a voting power of approximately 10% pursuant to a formula specified in Article 14 of our Articles of Association. Our Articles of Association define “Controlled Shares” generally to include all shares of the company directly, indirectly or constructively owned or beneficially owned by any person or group of persons.

- Q:

- How do I vote?

- A:

- The manner in which your shares may be voted depends on how your shares are held. If you own shares of record, meaning that your common shares are represented by certificates or book entries in your name so that you appear as a shareholder of record in the company’s share register maintained by our transfer agent, Continental Stock Transfer & Trust Company, a proxy card for voting those shares will be included with this Proxy Statement. You may direct how your shares are to be voted by completing, signing and returning the proxy card in the enclosed envelope. You may also vote your common shares in person at the Annual Shareholder Meeting.

- If you own shares through a bank, brokerage firm or other nominee you may instead receive from your bank, brokerage firm or

- nominee a voting instruction form with this Proxy Statement that you may use to instruct them as to how your shares are to be voted. As with a proxy card, you may direct how your shares are to be voted by completing, signing and returning the voting instruction form in the envelope provided. Many banks, brokerage firms and other nominees have arranged for internet or telephonic voting of shares and provide instructions for using those services on the voting instruction form. If you want to vote your shares in person at the meeting, you must obtain a proxy from your bank, broker or nominee giving you the right to vote your common shares at the Annual Shareholder Meeting.

- We have requested that banks, brokers and other nominees forward solicitation materials to the beneficial owners of common shares and will reimburse the banks, brokers and other nominees for their reasonable out-of-pocket expenses for forwarding the materials.

- Q:

- Who will count the vote?

- A:

- A representative from Baker McKenzie Zurich, a law firm, will act as the inspector of elections and will be responsible for tabulating the votes cast by proxy (which will have been certified by our independent transfer agent) or in person at the Annual Shareholder Meeting. Under Swiss law, we are responsible for determining whether or not a quorum is present and the final voting results.

- Q:

- What does it mean if I receive more than one set of the Proxy Statement and proxy card?

- A:

- Generally, it means that you hold shares registered in more than one account. You should complete, sign and return each proxy card you receive to ensure that all of your shares are voted.

- Q:

- What happens if I sign and return my proxy card but do not indicate how to vote my shares?

- A:

- If no instructions are provided in an executed proxy card, the common shares represented

-11-

Table of Contents

- by the proxy will be voted at the Annual Shareholder Meeting in accordance with the Board’s recommendation for each proposal. As to any other business that may properly come before the Annual Shareholder Meeting, you may provide general instructions, as indicated on the proxy card, as to how such other business is to be voted. If you provide no instruction, the common shares represented by the proxy will be voted in accordance with the Board’s recommendation as to such business.

- Q:

- How do I appoint and vote via an independent proxy if I am a shareholder of record?

- A:

- If you are a shareholder of record as of the Record Date, under Swiss law you may authorize the independent proxy, Buis Buergi AG, Muehlebachstrasse 8, P.O. Box 672, CH-8024 Zurich, Switzerland, e-mail at proxy@bblegal.ch, with full rights of substitution, to vote your common shares on your behalf. If you authorize the independent proxy to vote your shares without giving instructions (or without giving clear instructions), your shares will be voted in accordance with the recommendations of the Board with regard to the items listed in the notice of meeting. If new agenda items (other than those in the notice of meeting) or new proposals or motions with respect to those agenda items set forth in the notice of meeting are being put forth before the Annual Shareholder Meeting, you may provide general instructions, as indicated on the proxy card, as to how such other business is to be voted. If you provide no instruction, the common shares represented by the proxy will be voted in accordance with the Board’s recommendation as to such business. Proxy cards authorizing the independent proxy to vote your shares must be sent directly to the independent proxy, arriving no later than 6:00 a.m., local time, on June 21, 2017. If sending by e-mail to the independent proxy, you must attach the executed proxy card in order for your vote to be counted.

- Q:

- Can I change my vote after I have mailed my signed proxy card or otherwise instructed how my shares are to be voted?

- A:

- Yes. You may change your vote:

- ·

- By providing the Corporate Secretary with written notice of revocation, by voting in person at the Annual Shareholder Meeting or by executing a later-dated proxy card;provided, however, that the action is taken in sufficient time to permit the necessary examination and tabulation of the subsequent proxy or revocation before the vote is taken;

- ·

- If you have granted your proxy to the independent proxy, by providing Buis Buergi AG with written notice of revocation, by voting in person at the Annual Shareholder Meeting or by executing a later-dated independent proxy card. Revocation of, or changes to, proxies issued to the independent proxy must be received by the independent proxy by 6:00 a.m., local time, on June 21, 2017 either by mail to Buis Buergi AG, Muehlebachstrasse 8, P.O. Box 672, CH-8024 Zurich, Switzerland or by e-mail at proxy@bblegal.ch; or

- ·

- If you own shares through a bank, brokerage firm or other nominee, by obtaining a proxy from your bank, broker or nominee giving you the right to vote your common shares at the Annual Shareholder Meeting.

- Attendance at the Annual Shareholder Meeting by a shareholder who has executed and delivered a proxy card to the independent proxy shall not in and of itself constitute a revocation of such proxy. Only your vote at the Annual Shareholder Meeting will revoke your proxy.

- Q:

- What else will happen at the Annual Shareholder Meeting?

- A:

- At the Annual Shareholder Meeting, shareholders will also receive the report of our independent auditors and our financial

-12-

Table of Contents

- statements for the year ended December 31, 2016.

- Q:

- Who pays the costs of soliciting proxies?

- A:

- We will bear the cost of the solicitation of proxies. Solicitation will be made by mail, and may be made by our directors, officers and employees, personally or by telephone, facsimile or other electronic means, for which our directors, officers and employees will not receive any additional compensation. Proxy cards and materials also will be distributed to beneficial owners of common shares through banks, brokers, custodians, nominees and other parties, and the company expects to reimburse such parties for their reasonable charges and expenses. Georgeson has been retained to assist us in the solicitation of proxies at a fee not expected to exceed $10,000, plus out-of-pocket expenses.

- Q:

- How may I receive a copy of the Company’s Annual Report on Form 10-K?

- A:

- We will furnish without charge to any shareholder a copy of our Annual Report on

- Form 10-K for the year ended December 31, 2016, filed with the U.S. Securities and Exchange Commission (“SEC”). A copy of such report may be obtained upon written request to the Corporate Secretary, attention: Theodore Neos, at Allied World Assurance Company Holdings, AG, Park Tower, 15th floor, Gubelstrasse 24, 6300 Zug, Switzerland, or via e-mail at secretary@awac.com. Each such request must include a representation that, as of May 25, 2017, the person making the request was an owner of our common shares. The Annual Report on Form 10-K, and all of the company’s filings with the SEC, can be accessed through our website at www.awac.com under the “SEC Filings” link located in the section entitled “Investors.” As permitted by the SEC’s rules, we will not furnish any exhibits to the Annual Report on Form 10-K without charge, but will provide along with such report a list of such exhibits and information about the charges for providing them.

-13-

Table of Contents

| Organizational Matters Required by Swiss Law |

Admission to the Annual Shareholder Meeting

Shareholders who are registered in our share register on the Record Date will receive the Proxy Statement and proxy card from Continental Stock Transfer & Trust Company, our transfer agent. Beneficial owners of shares will receive instructions from their bank, brokerage firm or other nominee acting as shareholder of record to indicate how they wish their shares to be voted. Beneficial owners who wish to vote in person at the Annual Shareholder Meeting must obtain a power of attorney from their bank, brokerage firm or other nominee that authorizes them to vote the shares held by them on their behalf. In addition, you must bring to the Annual Shareholder Meeting an account statement or letter from your bank, brokerage firm or other nominee indicating that you are the owner of the common shares. Shareholders of record registered in our share register are entitled to participate in and vote at the Annual Shareholder Meeting. Each share is entitled to one vote. The exercise of voting rights is subject to the voting restrictions set out in the company’s Articles of Association, a summary of which is contained in “— How many votes do I have?” Please see the questions and answers provided under “— General Meeting Information” for further information.

Granting a Proxy

If you are a shareholder of record, please see “— How do I vote?” and “— How do I appoint and vote via an independent proxy if I am a shareholder of record?” above in the Proxy Statement for more information on appointing an independent proxy.

Registered shareholders who have appointed the independent proxy as a proxy may not vote in person at the Annual Shareholder Meeting or send a proxy of their choice to the meeting unless they revoke or change their proxies. Revocations to the independent proxy must be received by him by no later than 6:00 a.m., local time, on June 21, 2017 either by mail to Buis Buergi AG, Muehlebachstrasse 8, P.O. Box 672, CH-8024 Zurich, Switzerland or by e-mail at proxy@bblegal.ch.

As indicated on the proxy card, with regard to the items listed on the agenda and without any explicit instructions to the contrary, the independent proxy will vote according to the recommendations of the Board. If new agenda items (other than those on the agenda) or new proposals or motions regarding agenda items set out in the invitation to the Annual Shareholder Meeting are being put forth before the meeting, the independent proxy will vote in accordance with the position of the Board in the absence of other specific instructions.

Beneficial owners who have not obtained a power of attorney from their bank, brokerage firm or other nominee are not entitled to participate in or vote at the Annual Shareholder Meeting.

Admission Office

The admission office opens on the day of the Annual Shareholder Meeting at 1:30 p.m. local time. Shareholders of record attending the meeting are kindly asked to present their proxy card as proof of admission at the entrance.

Annual Report of Allied World Assurance Company Holdings, AG

The company’s 2016 Annual Report, which accompanies this Proxy Statement, contains the company’s audited consolidated financial statements, its audited statutory financial statements prepared in accordance with Swiss law and the remuneration report of the board of directors and executives required under Swiss law. The 2016 Annual Report can be accessed through the company’s website at www.awac.com under the “Financial Reports” link located in the section entitled “Investors.” Copies of the 2016 Annual Report may be obtained without charge upon written request to the Corporate Secretary, attention: Theodore Neos, at Allied World Assurance Company Holdings, AG, Park Tower, 15th floor, Gubelstrasse 24, 6300 Zug, Switzerland, or via e-mail at secretary@awac.com. The 2016 Annual Report may be physically inspected at the company’s headquarters at Park Tower, 15th floor, Gubelstrasse 24, 6300 Zug, Switzerland.

-14-

Table of Contents

PROPOSAL 1

ELECT THE BOARD OF DIRECTORS

Each member of our Board is being nominated for election at this Annual Shareholder Meeting. Each of the nominees is a current member of the Board and was recommended for appointment to the Board by the Nominating & Corporate Governance Committee to serve until the Annual Shareholder Meeting in 2018.

Your Board unanimously recommends a vote FOR each of the nominees as listed on the enclosed proxy card. It is not expected that any of the nominees will become unavailable for election as a director but, if any nominee should become unavailable prior to the meeting, proxies will be voted in accordance with the general instructions provided on the proxy card with regard to such other person as your Board shall recommend and nominate. In the absence of other specific instructions, proxies will be voted as your Board shall recommend.

The biography of each nominee below contains information regarding the person’s service as a director on the Board, his or her business experience, director positions at other companies held currently or at any time during the last five years, and his or her applicable experiences, qualifications, attributes and skills.

Nominees for Election

| | | | |

| | | | | |

| | | Barbara T. Alexander, 68 | | |

| | | | | |

| | |

Position, Principal Occupation and Business Experience:

Ms. Alexander has been an independent consultant since January 2004. Prior to that, she was a Senior Advisor to UBS AG and predecessor firms from October 1999 to January 2004, and Managing Director of the North American Construction and Furnishings Group in the Corporate Finance Department of UBS from 1992 to October 1999. From 1987 to 1992, Ms. Alexander was a Managing Director in the Corporate Finance Department of Salomon Brothers Inc. From 1972 to 1987, she held various positions at Salomon Brothers, Smith Barney, Investors Diversified Services, and Wachovia Bank and Trust Company. Ms. Alexander is currently a member of the board of directors of QUALCOMM Incorporated, where she is Chairperson of the Compensation Committee; and Choice Hotels International, Inc., where she is Chairperson of the Audit Committee and a member of the Diversity Committee. Ms. Alexander previously served on the board of directors of KB Home from October 2010 to April 2014, Federal Home Loan Mortgage Corporation (Freddie Mac) from November 2004 to March 2010, Centex Corporation from July 1999 to August 2009, Burlington Resources Inc. from January 2004 to March 2006 and Harrah’s Entertainment Inc. from February 2002 to April 2007. Ms. Alexander was selected as one of seven Outstanding Directors in Corporate America in 2003 by Board Alert magazine and was one of five Director of the Year honorees in 2008 by the Forum for Corporate Directors. She has also served on the board of directors of HomeAid America, Habitat for Humanity International and Covenant House.

Key Attributes, Experience and Skills:

Having been a member of numerous public company boards of directors, Ms. Alexander is familiar with a full range of corporate and board functions. She also has extensive experience in corporate finance, investment and strategic planning matters. The Board believes that, among other qualifications, Ms. Alexander’s extensive experience in corporate finance, investment and strategic planning matters gives her the skills to serve as a director. | | Director Since:

August 2009

Board Committees:

Audit (Chair),

Compensation,

Enterprise Risk and

Investment

Other Current

Public Boards:

QUALCOMM

Incorporated

(NASDAQ: QCOM)

and

Choice Hotels

International (NYSE:

CHH) |

-15-

Table of Contents

| | | | |

| | | | | |

| | | Scott A. Carmilani, 52 | | |

| | | | | |

| | |

Position, Principal Occupation and Business Experience:

Mr. Carmilani was elected our President and Chief Executive Officer in January 2004 and was appointed Chairman of the Board in January 2008. Mr. Carmilani was, prior to joining our company as Executive Vice President in February 2002, the President of the Mergers & Acquisition Insurance Division of subsidiaries of American International Group, Inc. (“AIG”) and responsible for the management, marketing and underwriting of transactional insurance products for clients engaged in mergers, acquisitions or divestitures. Mr. Carmilani was previously the Regional Vice-President overseeing the New York general insurance operations of AIG. Before that he was the Divisional President of the Middle Market Division of National Union Fire Insurance Company of Pittsburgh, Pa., which underwrites directors and officers liability, employment practice liability and fidelity insurance for middle-market-sized companies. Prior to joining our company, he held a succession of underwriting and management positions with subsidiaries of AIG since 1987. Mr. Carmilani is currently a member of the board of trustees of the Visiting Nurse Association (VNA) Health Group, Inc. of New Jersey.

Key Attributes, Experience and Skills:

The Board believes that, among other qualifications, Mr. Carmilani’s extensive expertise and experience in the insurance and reinsurance industry give him the skills to serve as a director. | | Director Since:

September 2003

Board Committees:

Executive (Chair)

Other Current

Public Boards:

None |

| | | | |

| | | | | |

| | | Bart Friedman, 72 | | |

| | | | | |

| | |

Position, Principal Occupation and Business Experience:

Mr. Friedman was elected Vice Chairman of the Board in July 2006 and was appointed Lead Independent Director of the Board in January 2008. Mr. Friedman was a partner at Cahill Gordon & Reindel LLP, a New York law firm (“Cahill”), from 1980 to 2016 and has served as Senior Counsel at Cahill since January 2017. Mr. Friedman specializes in corporate governance, special committees and director representation. Mr. Friedman worked early in his career at the SEC. Mr. Friedman is currently chairman of the board of directors of Sanford Bernstein Mutual Funds, where he is a member of the Audit Committee and the Nominating and Governance Committee, and a member of the board of directors of Ovid Therapeutics Inc., where he is chairman of the Audit Committee. He is also the chairman of the Audit Committee of The Brookings Institution, a member of the board of directors of the Lincoln Center for the Performing Arts, where he is chairman of the Audit Committee and the Compensation Committee, and a member of the board of trustees of the Cooper-Hewitt Smithsonian Design Museum, where he serves as Treasurer.

Key Attributes, Experience and Skills:

The Board believes that, among other qualifications, Mr. Friedman’s extensive expertise and experience in corporate governance and investment matters give him the skills to serve as a director. | | Director Since:

March 2006

Lead Independent

Director

Board Committees:

Compensation,

Investment and

Nominating &

Corporate

Governance (Chair)

Other Current

Public Boards:

Sanford Bernstein

Mutual Funds |

-16-

Table of Contents

| | | | |

| | | | | |

| | | Patricia L. Guinn, 62 | | |

| | | | | |

| | |

Position, Principal Occupation and Business Experience:

Ms. Guinn retired from Towers Watson in June 2015 where she served as Managing Director of its Risk and Financial Services segment and a member of its Management Committee since 2010. Prior to this, she held a variety of leadership roles at Towers Perrin, one of Towers Watson’s predecessor companies, which she joined in 1976. For more than 30 years, Ms. Guinn has consulted on risk management, mergers and acquisitions, financial analysis and performance measurement for insurance companies. She is currently a member of the board of directors of Reinsurance Group of America, Incorporated. Ms. Guinn previously served on the board of directors of Towers Perrin from 2001 to 2005 and again from 2008 to 2010. Ms. Guinn is currently a director of the International Insurance Society. She is a Fellow of the Society of Actuaries, a member of the American Academy of Actuaries and a Chartered Enterprise Risk Analyst.

Key Attributes, Experience and Skills:

The Board believes that, among other qualifications, Ms. Guinn’s extensive experience in the insurance and reinsurance industry as well as expertise with risk management matters give her the skills to serve as a director. | | Director Since:

December 2015

Board Committees:

Audit, Enterprise Risk

and Nominating &

Corporate Governance

Other Current

Public Boards:

Reinsurance Group of

America, Incorporated

(NYSE: RGA) |

| | | | |

| | | | | |

| | | Fiona E. Luck, 59 | | |

| | | | | |

| | |

Position, Principal Occupation and Business Experience:

Ms. Luck served as Executive Vice President and Chief of Staff at XL Group plc (“XL”) from June 2006 until June 2009 and then Special Advisor to the Chief Executive Officer until January 2010. From 1999 to 2006, she served in various roles at XL, including as Executive Vice President of Group Operations and Interim Chief Financial Officer. From 1997 to 1999, she served as Senior Vice President of Financial Lines and later as Executive Vice President of Joint Ventures and Strategic Alliances at ACE Bermuda Insurance Ltd. From 1983 to 1997, she served in various roles at Marsh and McLennan, Inc., including as Managing Director and Head of the Global Broking operations in Bermuda. She is currently a member of the board of directors of the Bermuda Monetary Authority where she serves on its Audit & Risk Management Committee, Human Capital Committee and Non-Executive Directors Committee; and Gen Life Ltd and Gen Two Ltd. She previously served on the board of directors of Catlin Group Ltd from August 2012 until its merger with XL in May 2015 where she was Chair of the Compensation Committee and a member of the Audit, Investment and Nomination Committees. She also served on the board of directors of Kenbelle Capital LP from 2012 to 2015, Hardy Underwriting Bermuda Ltd. from 2010 to 2012 and Primus Guaranty Ltd. from 2007 to 2009. Ms. Luck also serves on the board of trustees of the David Shepherd Wildlife Foundation and the board of directors of Knowledge Quest. She is a member of the Institute of Chartered Accountants of Scotland.

Key Attributes, Experience and Skills:

The Board believes that, among other qualifications, Ms. Luck’s extensive expertise and experience in the insurance and reinsurance industry give her the skills to serve as a director. | | Director Since:

December 2015

Board Committees:

Compensation,

Enterprise Risk and

Executive

Other Current

Public Boards:

None |

-17-

Table of Contents

| | | | |

| | | | | |

| | | Patrick de Saint-Aignan, 68 | | |

| | | | | |

| | |

Position, Principal Occupation and Business Experience:

Mr. de Saint-Aignan held multiple positions at Morgan Stanley internationally from 1974 to 2007, where he was a Managing Director and, most recently, an Advisory Director. He held responsibilities in corporate finance and capital markets and headed successively Morgan Stanley’s global fixed income derivatives and debt capital markets activities, its office in Paris, France, and the firm-wide risk management function. He was also a Founder, Director and Chairman of the International Swaps and Derivatives Association (1985-1992); Censeur on the Supervisory Board of IXIS Corporate and Investment Bank (2005-2007); a member of the board of directors of Bank of China Limited (2006-2008), where he was Chairman of the Audit Committee and a member of the Risk Policy Committee and the Personnel and Remuneration Committee; and a member of the board of directors and non-executive Chairman of the European Kyoto Fund (2010-2011). Mr. de Saint-Aignan is currently a member of the board of directors of State Street Corporation, where he is a member of its Risk Committee and its Examining and Audit Committee.

Key Attributes, Experience and Skills:

The Board believes that, among other qualifications, Mr. de Saint-Aignan’s broad experience and expertise in corporate finance, risk management and investment matters as well as his international business background give him the skills to serve as a director. | | Director Since:

August 2008

Board Committees:

Audit, Compensation,

Enterprise Risk (Chair)

and Investment

Other Current

Public Boards:

State Street Corporation

(NYSE: STT) |

-18-

Table of Contents

| | | | |

| | | | | |

| | | Eric S. Schwartz, 54 | | |

| | | | | |

| | |

Position, Principal Occupation and Business Experience:

Mr. Schwartz is the founder and has been Chief Executive Officer of 76 West Holdings, a private investment company, since June 2008. In support of the activities of 76 West, he has served as Chairman of Applied Data Finance, LLC, a non-prime consumer finance company, since November 2014; as a director of Demica Limited, a trade finance company, since July 2014; as former Chairman and more recently a director of Jefferson National Financial Corp., an insurance company focused on the variable annuity market, since January 2012; as Chairman of Gold Bullion International LLC, a precious metals dealer, since January 2012; as a director of Indostar Capital Finance, a finance company based in India, since April 2011; and as a director of Binary Event Network, an electronic prediction marketplace, since May 2011. He served as a director of Atlanta Hawks Basketball & Entertainment, LLC from March 2014 to June 2015. He also served as Chairman-elect of Nikko Asset Management from June 2008 until its sale in June 2009; and as a director of Prosper Marketplace, an internet-based consumer lending company, from March 2012 until January 2013. Mr. Schwartz is a former Co-CEO of Goldman Sachs Asset Management. He joined The Goldman Sachs Group, Inc. (“Goldman Sachs”) in 1984 and served in various leadership positions at the firm during his tenure at Goldman Sachs. In 1994, he became a partner in the Equity Capital Markets unit of Goldman Sachs’ Investment Banking Division and later served as Co-Head of its Global Equities and Investment Management Divisions. He joined Goldman Sachs’ Management Committee in 2001 and was named Co-Head of its Partnership Committee in 2005. In June 2007, he retired from Goldman Sachs. He serves as a member of the Investment Committee for the endowment of UJA-Federation New York, where he served as its Chairman for many years, and as a director of the Food Bank for New York City, Securing America’s Future Energy, City Harvest and The Jewish Community Center Krakow, Poland.

Key Attributes, Experience and Skills:

The Board believes that, among other qualifications, Mr. Schwartz’s broad experience and expertise in corporate finance and investment matters as well as his international business background give him the skills to serve as a director. | | Director Since:

October 2013

Board Committees:

Compensation and

Investment (Chair)

Other Current

Public Boards:

None |

-19-

Table of Contents

| | | | |

| | | | | |

| | | Samuel J. Weinhoff, 66 | | |

| | | | | |

| | |

Position, Principal Occupation and Business Experience:

Mr. Weinhoff has served as a consultant to the insurance industry since 2000. Prior to this, Mr. Weinhoff was head of the Financial Institutions Group for Schroder & Co. from 1997 until 2000. He was also a Managing Director at Lehman Brothers, where he worked from 1985 to 1997. Mr. Weinhoff had ten years prior experience at the Home Insurance Company and the Reliance Insurance Company in a variety of positions, including excess casualty reinsurance treaty underwriter, investment department analyst, and head of corporate planning and reporting. Mr. Weinhoff is currently the Lead Director on the board of directors of Infinity Property and Casualty Corporation where he is a member of the Executive Committee and Chairman of the Nominating and Governance Committee. Mr. Weinhoff served on the board of directors of Inter-Atlantic Financial, Inc. from July 2007 to October 2009.

Key Attributes, Experience and Skills:

The Board believes that, among other qualifications, Mr. Weinhoff’s extensive insurance and reinsurance industry experience as well as expertise in corporate finance and strategic planning matters give him the skills to serve as a director. | | Director Since:

July 2006

Board Committees:

Audit, Compensation

(Chair), Enterprise Risk,

Executive, Investment

and Nominating &

Corporate Governance

Other Current

Public Boards:

Infinity Property and

Casualty Corporation

(NASDAQ: IPCC) |

| Board and Committee Membership(1) |

| | | | | | | | | | | | |

Name | | Audit | | Compensation | | Enterprise Risk | | Executive | | Investment | | Nominating |

|---|

Barbara T. Alexander* | | C | | · | | · | | | | · | | |

Scott A. Carmilani | | | | | | | | C | | | | |

Bart Friedman** | | | | · | | | | | | · | | C |

Patricia L. Guinn* | | · | | | | · | | | | | | · |

Fiona E. Luck* | | | | · | | · | | · | | | | |

Patrick de Saint-Aignan* | | · | | · | | C | | | | · | | |

Eric S. Schwartz* | | | | · | | | | | | C | | |

Samuel J. Weinhoff* | | · | | C | | · | | · | | · | | · |

| | | | | | | | | | | | | |

Number of 2016 Meetings | | 5 | | 4 | | 4 | | 0 | | 4 | | 3 |

| | | | | | |

· Member |

|

C Chair |

|

* Independent Director |

|

** Lead Independent Director |

- (1)

- All committees, except the Executive Committee, are comprised of independent directors only.

Director Independence

The Board has determined that Mses. Alexander, Guinn and Luck, and Messrs. Friedman, de Saint-Aignan, Schwartz and Weinhoff are independent directors under the listing standards of the New York Stock Exchange (the “NYSE”). We require that a majority of our directors meet the criteria for independence under applicable law and the rules of the NYSE. The Board has adopted a policy to assist it and the Nominating & Corporate Governance Committee in their determination as to whether a nominee or director qualifies as independent. This policy contains categorical standards for determining independence and includes the independence standards required by the SEC and the NYSE, as well as standards published by institutional investor groups and other corporate governance experts. In making its determination of independence, the Board applied these standards for director independence and determined that no material relationship existed between the company and these directors. A copy of the Board Policy on Director Independence was attached as an appendix to the company’s Proxy Statement filed with the SEC on March 13, 2015.

-20-

Table of Contents

Meetings and Committees of the Board

During the year ended December 31, 2016, there were fifteen meetings of our Board, five meetings of the Audit Committee, four meetings of the Compensation Committee, four meetings of the Enterprise Risk Committee, no meeting of the Executive Committee, four meetings of the Investment Committee and three meetings of the Nominating & Corporate Governance Committee. Each of our directors other than Mr. Friedman attended at least 75% of the aggregate number of Board meetings and committee meetings of which he or she was a member during the period he or she served on the Board. Mr. Friedman missed three Board meetings and contemporaneous committee meetings due to medical issues, bringing his overall attendance rate to less than 75% of the aggregate number of Board meetings and committee meetings of which he was a member in 2016. Our non-management directors meet separately from the other directors in an executive session at least quarterly. Mr. Friedman, our Vice Chairman of the Board and Lead Independent Director, or his designee, served as the presiding director of the executive sessions of our non-management and independent directors held in 2016. The Lead Independent Director also has the authority to call meetings of the independent directors or full Board.

Board Leadership Structure

The Board has chosen a leadership structure that combines the role of the Chief Executive Officer and the Chairman of the Board while also having a Lead Independent Director. The Lead Independent Director assumes many of the responsibilities typically held by a non-executive chairman of the board and a list of his responsibilities is provided in the chart below. The company’s rationale for combining the Chief Executive Officer and Chairman of the Board positions relates principally to the Board’s belief that at this stage of our development, the company and its shareholders will be best served if the Chairman is in close proximity to the senior management team on a regular and continual basis.

| | | | | |

| | | | | | |

| | | | | | |

| | Lead Independent Director | | |

| | | | | | |

| | The Lead Independent Director is elected solely by and from the independent directors. Responsibilities include: | | |

| | | | | | |

| |

| | · organizing and presiding over all meetings of the Board at which the Chairman of the Board is not present, including all executive sessions of the non-management and independent directors; | |

|

| | | | | | |

| |

| | · serving as the liaison between the Chairman of the Board and the non-management directors; | |

|

| | | | | | |

| |

| | · overseeing the information sent to the Board by management; | |

|

| | | | | | |

| |

| | · approving meeting agendas and schedules for the Board to assure that there is sufficient time for discussion of all agenda items; | |

|

| | | | | | |

| |

| | · facilitating communication between the Board and management; | |

|

| | | | | | |

| |

| | · being available to communicate with and respond to certain inquiries of the company’s shareholders; and | |

|

| | | | | | |

| |

| | · performing such other duties as requested by the Board. | |

|

| | | | | | |

Our Board has also approved Corporate Governance Guidelines, a Code of Business Conduct and Ethics and a Code of Ethics for Chief Executive Officer and Senior Financial Officers. Printed copies of these documents as well as the committee charters discussed below are available by sending a written

-21-

Table of Contents

request to our Corporate Secretary. The foregoing information is available on our website at www.awac.com under “Investors — Corporate Information — Governance Documents”.

Audit Committee. Pursuant to its charter, the Audit Committee is responsible for overseeing our independent auditors, internal auditors, compliance with legal and regulatory standards and the integrity of our financial reporting. Each member of the Audit Committee has been determined by the Board to be “financially literate” within the meaning of the NYSE Listing Standards and each has been designated by the Board as an “audit committee financial expert,” as defined by the applicable rules of the SEC, based on either their extensive prior accounting and auditing experience or having a range of experience in varying executive positions in the insurance or financial services industry.

Compensation Committee. Pursuant to its charter, the Compensation Committee has the authority to establish compensation policies and recommend compensation programs to the Board, including administering all equity and incentive compensation plans of the company. Pursuant to its charter, the Compensation Committee also has the authority to review the competitiveness of the non-management directors’ compensation programs and recommend to the Board these compensation programs and all payouts made thereunder. Additional information on the Compensation Committee’s consideration of executive compensation, including a discussion of the roles of the company’s Chief Executive Officer and the independent compensation consultant in such executive compensation consideration, is included in “Executive Compensation — Compensation Discussion and Analysis.”

Enterprise Risk Committee. Pursuant to its charter, the Enterprise Risk Committee oversees management’s assessment and mitigation of the company’s enterprise risks and reviews and recommends to the Board for approval the company’s overall firm-wide risk appetite statement and oversees management’s compliance therewith.

Executive Committee. The Executive Committee has the authority to oversee the general business and affairs of the company to the extent permitted by Swiss law.

Investment Committee. Pursuant to its charter, the Investment Committee is responsible for adopting and overseeing compliance with the company’s Investment Policy Statement, which contains investment guidelines and other parameters for the investment portfolio. The Investment Committee oversees the company’s overall investment strategy and the company’s investment risk exposures.

Nominating & Corporate Governance Committee. Pursuant to its charter, the Nominating & Corporate Governance Committee is responsible for identifying individuals believed to be qualified to become directors and to recommend such individuals to the Board and to oversee corporate governance matters and practices.

The criteria adopted by the Board for use in evaluating the suitability of all nominees for director include the following:

| | | |

| | · | | high personal and professional ethics, values and integrity; |

| | · | | education, skill and experience with insurance, reinsurance or other businesses and organizations that the Board deems relevant and useful, including whether such attributes or background would contribute to the diversity of the Board; |

| | · | | ability and willingness to serve on any committees of the Board; and |

| | · | | ability and willingness to commit adequate time to the proper functioning of the Board and its committees. |

-22-

Table of Contents

In addition to considering candidates suggested by shareholders, the Nominating & Corporate Governance Committee considers candidates recommended by current directors, officers and others. The Nominating & Corporate Governance Committee screens all director candidates. The Nominating & Corporate Governance Committee determines whether or not the candidate meets the company’s general qualifications and specific qualities for directors and whether or not additional information is appropriate.

The Board and the Nominating & Corporate Governance Committee do not have a specific policy regarding diversity. Instead, in addition to the general qualities that the Board requires of all nominees and directors, such as high personal and professional ethics, values and integrity, the Board and the Nominating & Corporate Governance Committee strive to have a diverse group of directors with differing experiences, qualifications, attributes and skills to further enhance the quality of the Board. As we are an insurance and reinsurance company that (i) sells products that protect other companies and individuals from complex risks, (ii) has a significant investment portfolio and (iii) faces operational risks similar to those at other international companies, the Board and the Nominating & Corporate Governance Committee believe that having a group of directors who have the range of experience and skills to understand and oversee this type of business is critical. The Board and the Nominating & Corporate Governance Committee do not believe that each director must be an expert in every aspect of our business, but instead strive to have well-rounded, collegial directors who contribute to the diversity of ideas and strengthen the Board’s capabilities as a whole. Through their professional careers and experiences, the Board and the Nominating & Corporate Governance Committee believe that each director has obtained certain attributes that further the goals discussed above.

Risk Oversight

While the assumption of risk is inherent to our business, we believe we have developed a strong risk management culture throughout our organization that is fostered and maintained by our senior management, with oversight by the Board through its committees. The Board primarily delegates its risk management oversight to three of its committees: the Audit Committee, the Enterprise Risk Committee and the Investment Committee, who regularly report to the Board. The Audit Committee primarily oversees those risks that may directly or indirectly impact the company’s financial statements, the Enterprise Risk Committee primarily oversees the company’s business and operational risks and the Investment Committee primarily oversees the company’s investment portfolio risks. The Enterprise Risk Committee also reviews and recommends for approval by the Board our overall firm-wide risk appetite statement, and oversees management’s compliance with this statement. Each committee has broad powers to ensure that it has the resources to satisfy its duties under its charter, including the ability to request reports from any officer or employee of the company and the authority to retain special counsel or other experts and consultants as it deems appropriate.

Each of these committees receives regular reports from senior management who have day-to-day risk management responsibilities, including from our Chief Executive Officer. The Audit Committee receives reports from our Chief Executive Officer, Chief Financial Officer, Chief Actuary, General Counsel, Chief Information Officer, Head of Internal Audit and the company’s independent auditors. These reports address various aspects of risk assessment and management relating to the company’s financial statements. The Enterprise Risk Committee meets regularly with our Chief Executive Officer; President, Underwriting and Global Risk; Chief Risk Officer; and Chief Actuary as part of its oversight of the company’s underwriting, pricing and claims risks. Throughout the year, the Enterprise Risk Committee will also receive reports from other operational areas. To assist it in its oversight of the company’s investment risk exposures, the Investment Committee receives reports from our senior investment personnel.

-23-

Table of Contents

As open communications and equal access to information can be an important part of the Board’s risk oversight, all of the directors receive the information sent to each committee prior to any committee meeting. Board members are also encouraged to, and often do, attend all committee meetings regardless of whether he or she is a member of such committee.

Director Compensation

In 2016, compensation for our non-management directors consisted of the following:

| Fees for Non-Management Directors |

| | | | | | | | | | | | |

| | Position | | Annual Cash Retainers | | Annual Value

of RSU Award | |

|---|

| | Board Member | |

|

$ |

85,000 |

|

|

|

$ |

90,000 | | |

| | Lead Independent Director | |

|

$ |

15,000 | | | |

— | | |

| | Audit Committee and Enterprise Risk Committee Chair | |

|

$ |

50,000 |

|

|

|

— | | |

| | Compensation Committee and Investment Committee Chair | |

|

$ |

35,000 | | | |

— | | |

| | Nominating & Corporate Governance Committee Chair | |

|

$ |

8,000 |

|

|

|

— | | |

| | Audit Committee Member | |

|

$ |

25,000 | | | |

— | | |

Our non-management directors received $3,000 for each Board meeting attended and $2,000 for each committee meeting attended. We also provide to all non-management directors reimbursement of expenses incurred in connection with their service on the Board, including the reimbursement of director educational expenses.