I N V E S T O R P R E S E N T AT I O N 1 s t Q U A R T E R 2 0 1 6

Cautionary note regarding forward -looking statements Any forward-looking statements made in this presentation reflect our current views with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve risks and uncertainties, which may cause actual results to differ materially from those set forth in these statements. For example, our forward-looking statements could be affected by pricing and policy term trends; increased competition; the adequacy of our loss reserves; negative rating agency actions; greater frequency or severity of unpredictable catastrophic events; the impact of acts of terrorism and acts of war; the company or its subsidiaries becoming subject to significant income taxes in the United States or elsewhere; changes in regulations or tax laws; changes in the availability, cost or quality of reinsurance or retrocessional coverage; adverse general economic conditions; and judicial, legislative, political and other governmental developments, as well as management's response to these factors, and other factors identified in our filings with the U.S. Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We are under no obligation (and expressly disclaim any such obligation) to update or revise any forward- looking statement that may be made from time to time, whether as a result of new information, future developments or otherwise. 2

Agenda Executive Summary Operating Segments North American Insurance Global Markets Insurance Reinsurance Financial Highlights Conclusion Appendix

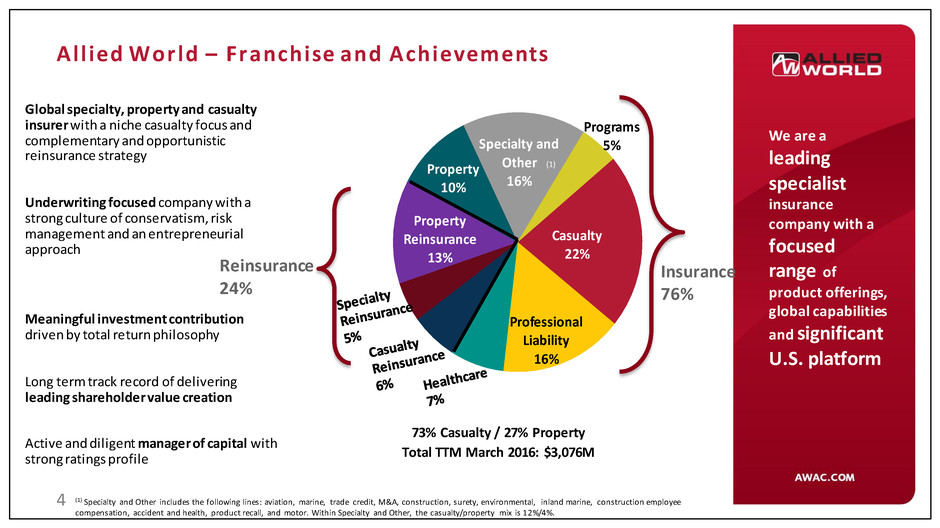

Allied World – Franchise and Achievements 4 Global specialty, property and casualty insurer with a niche casualty focus and complementary and opportunistic reinsurance strategy Underwriting focused company with a strong culture of conservatism, risk management and an entrepreneurial approach Meaningful investment contribution driven by total return philosophy Long term track record of delivering leading shareholder value creation Active and diligent manager of capital with strong ratings profile 73% Casualty / 27% Property Total TTM March 2016: $3,076M We are a leading specialist insurance company with a focused range of product offerings, global capabilities and significant U.S. platform (1) Specialty and Other includes the following lines: aviation, marine, trade credit, M&A, construction, surety, environmental, inland marine, construction employee compensation, accident and health, product recall, and motor. Within Specialty and Other, the casualty/property mix is 12%/4%. Insurance 76% Casualty 22% Professional Liability 16% Property Reinsurance 13% Property 10% Specialty and Other 16% Programs 5% (1) Reinsurance 24%

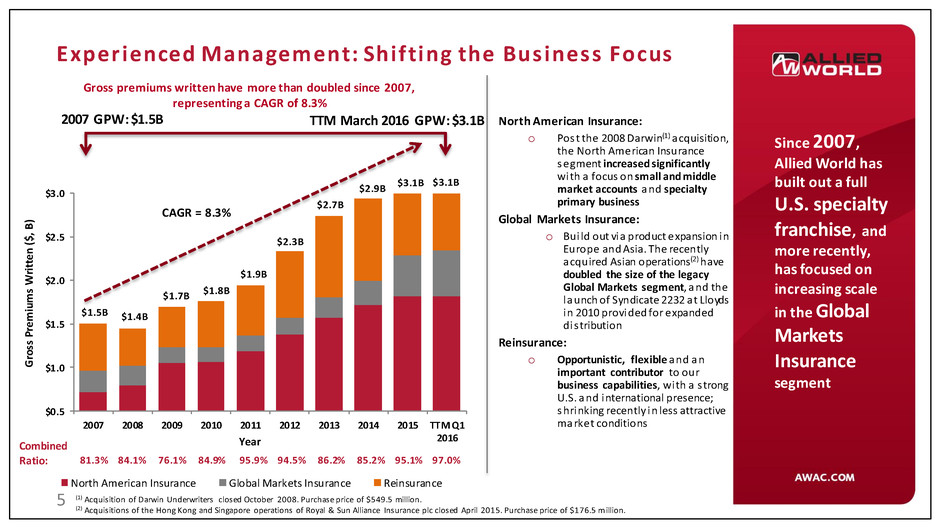

$0.5 $1.0 $1.5 $2.0 $2.5 $3.0 2007 2008 2009 2010 2011 2012 2013 2014 2015 TTM Q1 2016 G ro ss P re m iu m s W ri tt en ( $, B ) Year North American Insurance Global Markets Insurance Reinsurance Experienced Management: Shifting the Business Focus Since 2007, Allied World has built out a full U.S. specialty franchise, and more recently, has focused on increasing scale in the Global Markets Insurance segment North American Insurance: o Post the 2008 Darwin(1) acquisition, the North American Insurance segment increased significantly with a focus on small and middle market accounts and specialty primary business Global Markets Insurance: o Bui ld out via product expansion in Europe and Asia. The recently acquired Asian operations(2) have doubled the size of the legacy Global Markets segment, and the launch of Syndicate 2232 at Lloyds in 2010 provided for expanded dis tribution Reinsurance: o Opportunistic, flexible and an important contributor to our business capabilities, with a s trong U.S. and international presence; shrinking recently in less attractive market conditions Gross premiums written have more than doubled since 2007, representing a CAGR of 8.3% 5 2007 GPW: $1.5B TTM March 2016 GPW: $3.1B $1.5B $1.4B $1.7B $1.8B $1.9B $2.3B $2.7B $2.9B $3.1B CAGR = 8.3% 81.3% 84.1% 76.1% 84.9% 95.9% 94.5% 86.2% 85.2% 95.1% 97.0% Combined Ratio: $3.1B (1) Acquisition of Darwin Underwriters closed October 2008. Purchase price of $549.5 million. (2) Acquisitions of the Hong Kong and Singapore operations of Royal & Sun Alliance Insurance plc closed April 2015. Purchase price of $176.5 million.

$2,417 $3,213 $3,075 $3,149 $3,326 $3,520 $3,778 $3,533 $3,535 $499 $499 $798 $798 $798 $798 $818 $1,315 $1,317 -$646 -$682 -$1,475 -$1,658 -$1,975 -$2,197 -$2,449 -$2,809 -$2,882 $2,916 $3,712 $3,873 $3,947 $4,124 $4,318 $4,596 $4,848 $4,852 $15.35 $19.85 $24.76 $26.70 $30.86 $34.20 $38.27 $37.78 $38.13 2008 2009 2010 2011 2012 2013 2014 2015 Q1 2016 Accumulated Share and Warrant Repurchases & Dividends Debt Shareholders' Equity Diluted Book Value per Share Active Capital Management Improves Shareholder Value 6 Capital Management History Share Repurchases: o Over $2.3 bi l lion of shares and warrants repurchased since December 2007 o At the company's Annual Shareholder Meeting in April, shareholders approved a new, two- year, $500 mi l lion share repurchase authorization Dividends: o Over $524 mil lion of common dividends paid since going public in 2006 o Dividend yield of 2.9% Conservative Capital Position: o Financial leverage of 18.8% at March 31, 2016(3) Senior Debt Refinancing and Savings: o Is sued $500 mi llion of 4.35% senior notes due October 2025 to refinance the existing $500 mi llion of 7.50% senior notes due August 2016, generating annual interest expense savings of $15.8 mi llion (In millions, except for per share amounts) (1) Over $70 million of capital was returned to shareholders during the first quarter of 2016; the recent $500 million senior debt refinancing will generate $15.8 million of annual interest expense savings (1) Excludes $243.8 million syndicated loan that was repaid on February 23, 2009. (2)Includes the $500 million 4.35% senior notes due October 2025 intended to fund the maturity of the $500 million 7.50% senior notes due August 2016. (3)Adjusted for double leverage. Excluding the impact of the $500 million 4.35% senior notes due October 2025. Including that tranche, financial leverage is 27.1%. (2)

38.8% 40.6% 42.2% 43.0% 49.1% 50.5% 52.8% 61.7% 65.9% 68.7% 71.7% 79.2% 83.8% Axis RLI Arch Navigators Allied World ProAssurance Aspen Argo W.R. Berkley Endurance Markel XL Hanover Super ior Value Creation 7 Growth in book value per share calculated by taking change in book value per share from April 1, 2011 through March 31, 2016 adjusted for regular and special dividends. Diluted book value per share used when available; financial data updated as of March 31, 2016. ProAssurance has not reported March 31, 2016 quarterly earnings; its data is as of December 31, 2015. Source: SNL Financial, Company filings. Peer Average = 56.6% Allied World CAGR = 11.0% Five Year Growth in Book Value per Share April 2011 – March 2016

Agenda Executive Summary Operating Segments North American Insurance Global Markets Insurance Reinsurance Financial Highlights Conclusion Appendix

Healthcare 11% Inland Marine 5% Primary Casualty 13% Programs 9% D&O Private 3% D&O Public 9% E&O 10% Environmental 4% Excess Casualty 19% Other 1% M&A 2% Property 11% Primary Construction 3% North American Insurance Segment 9 The largest of the three segments, North American Insurance features niche product offerings and expertise across primary and excess lines Property and casualty insurance for small- and middle-market and Fortune 1,000 companies through 13 regional offices in North America: o Fortune 1,000-focused Bermuda platform is the largest direct business in Bermuda o Branch office network across the U.S. and Canada brings increased access to low limit accounts Admitted and excess & surplus lines (E&S) capabilities in all 50 states Recent growth has come from various lines entered over the last several years, including inland marine, primary construction, M&A, and environmental as well as attractive growth in professional liability and programs Most lines are largely at scale at present Total TTM March 2016 GPW: $1,814M (1) Other includes surety, trade credit, and product recall. (1)

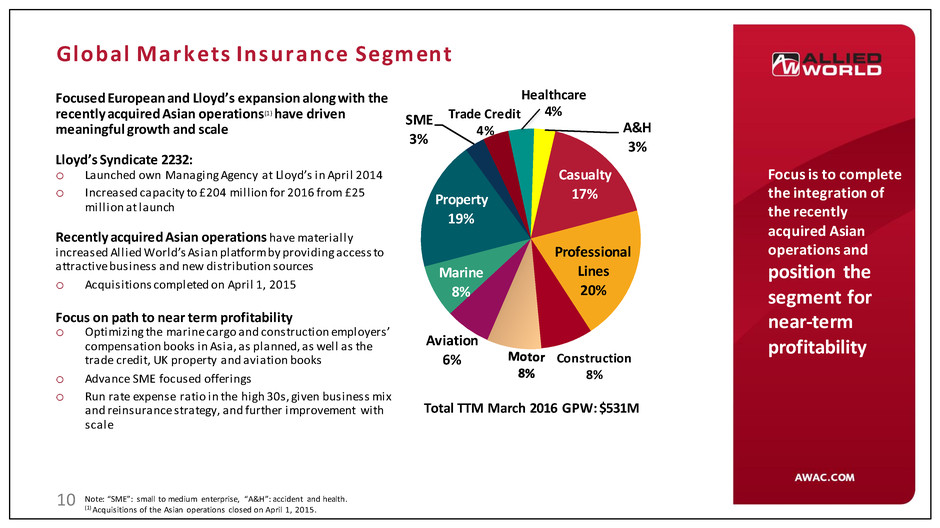

Global Markets Insurance Segment 10 Focus is to complete the integration of the recently acquired Asian operations and position the segment for near-term profitability Focused European and Lloyd’s expansion along with the recently acquired Asian operations(1) have driven meaningful growth and scale Lloyd’s Syndicate 2232: o Launched own Managing Agency at Lloyd’s in April 2014 o Increased capacity to £204 mill ion for 2016 from £25 mill ion at launch Recently acquired Asian operations have materially increased Allied World’s Asian platform by providing access to attractive business and new distribution sources o Acquisitions completed on April 1, 2015 Focus on path to near term profitability o Optimizing the marine cargo and construction employers’ compensation books in Asia, as planned, as well as the trade credit, UK property and aviation books o Advance SME focused offerings o Run rate expense ratio in the high 30s, given business mix and reinsurance strategy, and further improvement with scale Total TTM March 2016 GPW: $531M Note: “SME”: small to medium enterprise, “A&H”: accident and health. (1) Acquisitions of the Asian operations closed on April 1, 2015. A&H 3% Casualty 17% Professional Lines 20% Aviation 6% Marine 8% Property 19% SME 3% Trade Credit 4% Healthcare 4% Construction 8%

Reinsurance Segment 11 Lean global platform with flexibility to take advantage of opportunities as they arise Total TTM March 2016 GPW: $731M • Opportunistic positioning and ability to size up or down with market conditions o Over 60 employees via six offices o Strategic partnership with Aeolus Capital Management • Bermuda, U.S. and Swiss platforms have access to diverse opportunities via strong local relationships • Lloyd’s Syndicate 2232 coverholders in Miami and Singapore increase global reach to Latin American and Asian business o Efficient way to access a globally diversified book of business • Reduction in top line over the last year has been a reaction to market conditions as we have non-renewed several property and casualty treaties Global CAT 16% Global Property 5% North American Property 12% Global Marine & Aerospace 5% North American Casualty 14% Global Casualty 4% Specialty 3% Crop 15% North American CAT 20% Professional Liability 6%

Agenda Executive Summary Operating Segments North American Insurance Global Markets Insurance Reinsurance Financial Highlights Conclusion Appendix

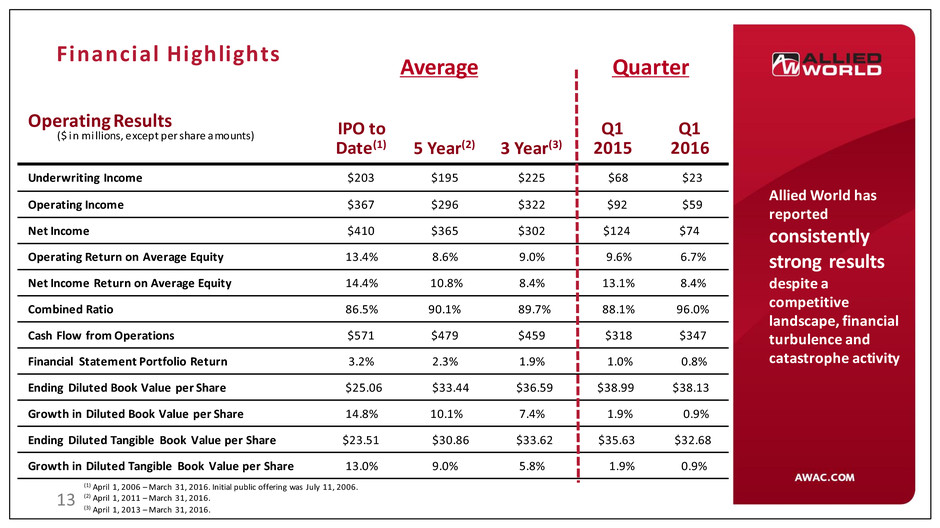

Operating Results IPO to Date(1) 5 Year(2) 3 Year(3) Q1 2015 Q1 2016 Underwriting Income $203 $195 $225 $68 $23 Operating Income $367 $296 $322 $92 $59 Net Income $410 $365 $302 $124 $74 Operating Return on Average Equity 13.4% 8.6% 9.0% 9.6% 6.7% Net Income Return on Average Equity 14.4% 10.8% 8.4% 13.1% 8.4% Combined Ratio 86.5% 90.1% 89.7% 88.1% 96.0% Cash Flow from Operations $571 $479 $459 $318 $347 Financial Statement Portfolio Return 3.2% 2.3% 1.9% 1.0% 0.8% Ending Diluted Book Value per Share $25.06 $33.44 $36.59 $38.99 $38.13 Growth in Diluted Book Value per Share 14.8% 10.1% 7.4% 1.9% 0.9% Ending Diluted Tangible Book Value per Share $23.51 $30.86 $33.62 $35.63 $32.68 Growth in Diluted Tangible Book Value per Share 13.0% 9.0% 5.8% 1.9% 0.9% Financial Highlights 13 Allied World has reported consistently strong results despite a competitive landscape, financial turbulence and catastrophe activity ($ in mi llions, except per share amounts) (1) April 1, 2006 – March 31, 2016. Initial public offering was July 11, 2006. (2) April 1, 2011 – March 31, 2016. (3) April 1, 2013 – March 31, 2016. Average Quarter

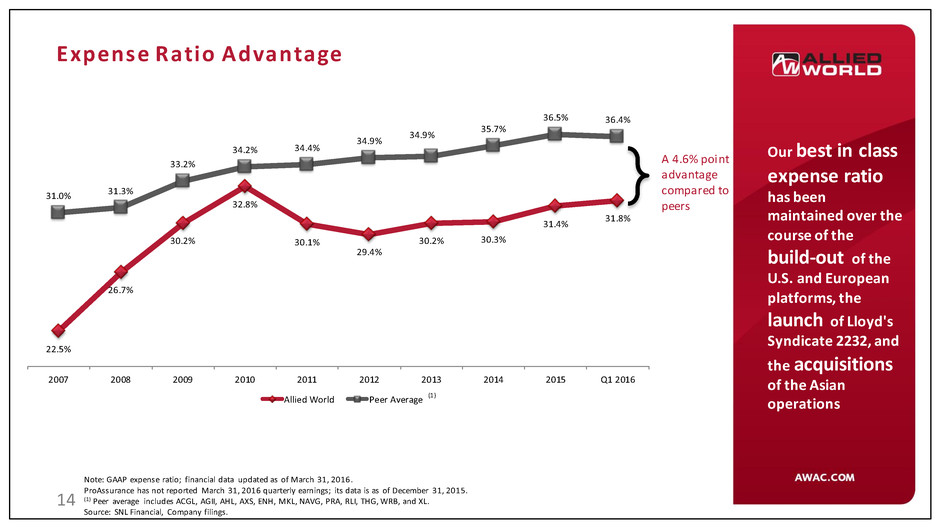

22.5% 26.7% 30.2% 32.8% 30.1% 29.4% 30.2% 30.3% 31.4% 31.8% 31.0% 31.3% 33.2% 34.2% 34.4% 34.9% 34.9% 35.7% 36.5% 36.4% 2007 2008 2009 2010 2011 2012 2013 2014 2015 Q1 2016 Allied World Peer Average Expense Ratio Advantage 14 Note: GAAP expense ratio; financial data updated as of March 31, 2016. ProAssurance has not reported March 31, 2016 quarterly earnings; its data is as of December 31, 2015. (1) Peer average includes ACGL, AGII, AHL, AXS, ENH, MKL, NAVG, PRA, RLI, THG, WRB, and XL. Source: SNL Financial, Company filings. A 4.6% point advantage compared to peers (1) Our best in class expense ratio has been maintained over the course of the build-out of the U.S. and European platforms, the launch of Lloyd's Syndicate 2232, and the acquisitions of the Asian operations

Growth Balanced with Underwriting Prof itability 15 Consistent performance amid strong topline growth and a presence in varied lines of business Five Year Performance Average Combined Ratio vs. Growth in Net Premiums Earned ProAssurance (as of December 31, 2015) not shown on chart (five year average combined ratio of 71.4% with net premium earned five year CAGR of 3.3%). ProAssurance has not reported March 31, 2016 quarterly earnings; its data is as of December 31, 2015. Financial data updated as of March 31, 2016. Source: SNL Financial, Company filings. Allied World Arch Argo Aspen Axis Endurance Hanover Markel Navigators XL RLI W.R. Berkley 0% 5% 10% 15% 20% 80% 85% 90% 95% 100% 105% Ne t P re mi um s E arn ed Fi ve -Ye ar CA GR Five Year Average Combined Ratio

AY 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 CY Total CY Original Loss Ratio 70.1% 65.3% 75.9% 103.1% 59.6% 58.4% 55.6% 45.9% 52.0% 65.8% 65.1% 56.0% 54.9% 63.7% 64.7% Prior Year Development 0.0% -4.9% -5.8% -3.6% -8.2% -10.2% -24.2% -18.8% -23.0% -17.4% -9.7% -9.0% -9.7% -3.3% -4.4% AY Original Loss Ratio 70.1% 70.1% 81.7% 106.7% 67.7% 68.6% 79.8% 64.7% 75.1% 83.2% 74.9% 65.0% 64.7% 67.0% 69.1% 2003 (57) (57) 2004 (27) (53) (79) 2005 (8) (46) 6 (49) 2006 (16) (43) (45) (8) (113) 2007 6 (34) (77) (6) (26) (137) 2008 (9) (88) (100) (74) (8) (34) (313) 2009 (17) (57) (118) (103) 12 2 32 (248) 2010 4 (11) (57) (147) (54) (25) (23) (1) (313) 2011 (0) (1) (22) (90) (42) (69) (22) (28) 20 (254) 2012 4 (4) (9) (11) (82) (91) (35) (8) 11 53 (170) 2013 15 (3) (12) (14) (25) (48) (52) (26) (38) 7 16 (180) 2014 5 (2) (6) 12 (25) (39) (10) (69) (44) (7) 18 (45) (213) 2015 (2) (9) (13) 8 3 21 4 (50) (56) (34) 32 33 (18) (82) 2016 3 (1) (1) (6) (2) (1) (2) (8) (20) 4 19 11 2 (23) (25) Subsequent Development (99) (351) (455) (438) (250) (283) (108) (191) (126) 24 85 (2) (16) (23) (2,232) Loss Ratio Points -22.7% -30.0% -33.2% -32.3% -18.1% -21.1% -8.3% -14.5% -9.3% 1.6% 4.9% -0.1% -0.8% -0.9% AY Developed 47.3% 40.1% 48.5% 74.4% 49.7% 47.5% 71.5% 50.2% 65.8% 84.9% 79.7% 64.9% 63.9% 66.1% 69.1% Cat Losses 16.3% 28.0% 9.0% 5.8% 17.7% 9.7% 0.6% 2.9% 2.4% AY Developed Excl. Cat Losses 47.3% 40.1% 32.2% 46.5% 49.7% 47.5% 62.4% 50.2% 59.9% 67.2% 70.0% 64.3% 61.0% 63.7% 69.1% Case Incurred through 2016 Q1 44.5% 37.3% 45.6% 66.2% 41.3% 40.5% 64.0% 42.6% 53.6% 69.5% 61.8% 41.7% 35.2% 21.3% 5.9% Remaining IBNR / EP Ratio @ 2016 Q1 2.8% 2.9% 3.0% 8.2% 8.3% 6.9% 7.5% 7.6% 12.2% 15.3% 17.9% 23.2% 28.8% 44.8% 63.1% Strong Underwriting Results Since Inception 16 (1) Pro-forma including Darwin development since inception; including acquired Asian operations starting from April 1, 2015. (2) Case incurred loss ratios by year are not directly comparable to our financial statements as reinsurance case incurred losses shown above are on a treaty year basis. Historical Loss Ratios Through March 31, 2016 ($M) (1) (2)

Prudent Reserving Philosophy 17 $113 $137 $313 $248 $313 $254 $170 $180 $213 $82 $64 $25 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Q1 2015 Q1 2016 o Over $2.2 bil l ion net favorable reserve development since inception o 71.5% of net reserves are IBNR Net Prior Year Reserve Releases(1) ($M) (1) Pro-forma including Darwin development since inception. March 31, 2016 Total: $5.1B Net Loss & Loss Adjustment Expenses Reserve Mix at March 31, 2016 IBNR Global Markets Insurance 7.9% Case Global Markets Insurance 6.6% IBNR Reinsurance 21.1% Case Reinsurance 8.4% IBNR North American Insurance 42.5% Net reserves approximately 4.0% above the mid-point of the range at March 31, 2016

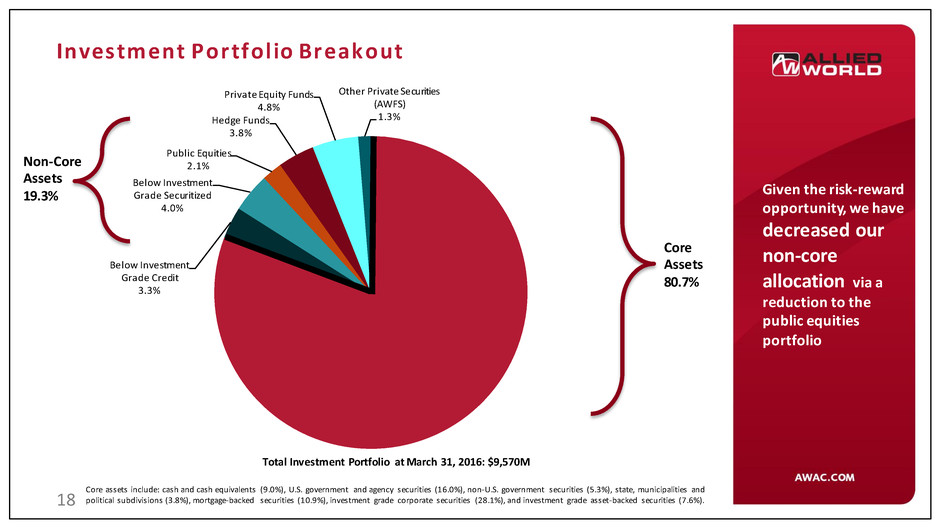

Investment Portfolio Breakout 18 Core Assets 80.7% Non-Core Assets 19.3% Total Investment Portfolio at March 31, 2016: $9,570M Core assets include: cash and cash equivalents (9.0%), U.S. government and agency securities (16.0%), non-U.S. government securities (5.3%), state, municipalities and political subdivisions (3.8%), mortgage-backed securities (10.9%), investment grade corporate securities (28.1%), and investment grade asset-backed securities (7.6%). Below Investment Grade Credit 3.3% Below Investment Grade Securitized 4.0% Public Equities 2.1% Hedge Funds 3.8% Private Equity Funds 4.8% Other Private Securities (AWFS) 1.3% Given the risk-reward opportunity, we have decreased our non-core allocation via a reduction to the public equities portfolio

3.2% 2.7% 2.5% 2.1% 1.9% 1.8% 1.5% 1.3% 1.1% 0.8% 0.7% 0.6% 0.4% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% RLI THG MKL AHL NAVG ACGL WRB AXS ENH AWH XL AGII PRA Inve stme nt Portfolio Re turn and Pe e r Comparison 19 • Portfolio was > 95% core fixed income in 2008 and has moved to a 80.7/19.3% core/non-core split as of March 31, 2016 o Intend to dynamically manage the portfolio and balance risk/reward, but the non-core portfolio remains an important component of the investment strategy o Peaked at a 30% allocation to non-core assets in 2014 March 31, 2016 Total Return(2) Peer Average = 1.6% Portfolio is managed for total return as it is a key driver of book value growth Composition of Allied World Total Investment Return Financial data as of March 31, 2016. ProAssurance has not reported; its data is as of December 31, 2015. (1) Blend of Barclays Aggregate benchmarks representative of the underlying sectors of our portfolio. (2) Source: Company filings. 6.7% 5.4% 2.9% 4.1% -0.1% 1.7% 0.4% 0.4% 1.2% 1.0% 0.7% -0.9% 1.4% 2.7% 1.4% 0.2% 0.6% -0.4% 7.8% 6.1% 2.0% 5.5% 2.6% 3.1% 0.6% 1.0% 0.8% 2009 2010 2011 2012 2013 2014 2015 Q1 15 Q1 16 Return from Fixed Income Strategy Return from Non-Core Strategy Customized Benchmark (1 ) (1)

5.5% 6.1% 7.3% 7.4% 7.7% 8.0% 8.6% 10.6% 10.8% 11.1% 11.4% 11.8% 14.9% Axis W.R. Berkley Allied World RLI XL Markel Navigators ProAssurance Arch Aspen Hanover Endurance Argo Peer Comparisons – Net Income ROE 20 Financial data updated as of March 31, 2016. ProAssurance has not reported March 31, 2016 quarterly earnings; its data is as of December 31, 2015. Source: SNL Financial, Company filings. Peer Average = 9.2% Five Year Average Quarterly Annualized Net Income ROE April 2011 – March 2016

Agenda Executive Summary Operating Segments North American Insurance Global Markets Insurance Reinsurance Financial Highlights Conclusion Appendix

Conclusion 22 Allied World is attractively valued given its demonstrated ability to grow book value Five Year Growth in Book Value per Share (through March 31, 2016) vs. Price to Book Value @ May 5, 2016 Growth in book value per share calculated by taking change in diluted book value per share from April 1, 2011 through March 31, 2016 adjusted for dividends. Diluted book value per share used when available; RLI not shown on chart (five year growth in book value per share of 84% with price to book value of 3.2x as of May 5, 2016). ProAssurance has not reported March 31, 2016 quarterly earnings; its data is as of December 31, 2015. Financial data updated as of March 31, 2016; trading data is as May 5, 2016 Allied World Arch Argo Aspen AxisEndurance Hanover Markel Navigators XL ProAssurance W.R. Berkley 0.7x 0.9x 1.1x 1.3x 1.5x 1.7x 20.0% 40.0% 60.0% 80.0% 100.0% Pr ice to Di lut ed Bo ok Va lue Pe r S ha re Five Year Growth in Diluted Book Value Per Share

Allied World RLI Arch W.R. Berkley Aspen Axis Endurance Hanover Navigators Argo ProAssurance Markel XL 5.0% 10.0% 15.0% 20.0% 25.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% Tot al S toc k R etu rn C AG R Five Year Value Creation CAGR Conclusion 23 Allied World has generated sector leading total value creation Five Year Value Creation CAGR vs. Total Stock Return CAGR Five year value creation calculated by taking the change in diluted book value per share from April 1, 2011 through March 31, 2016 adjusted for dividends. Diluted book value per share used when available. Total stock return calculated by taking the change in end-of-day stock price from March 31, 2011 through March 31, 2016 adjusted for dividends; financial data updated as of Q1 2016. ProAssurance has not reported March 31, 2016 quarterly earnings; its data is as of December 31, 2015. R2 = 0.17

Agenda Executive Summary Operating Segments North American Insurance Global Markets Insurance Reinsurance Financial Highlights Conclusion Appendix

Non-GAAP Financial Measures In presenting the company's results, management has included and discussed in this presentation certain non-generally accepted accounting principles ("non- GAAP") financial measures within the meaning of Regulation G as promulgated by the U.S. Securities and Exchange Commission. M anagement believes that these non-GAAP measures, which may be defined differently by other companies, better explain the company's results of operations in a manner that allows for a more complete understanding of the underlying trends in the company's business. However, these measures should not be viewed as a substitute for those determined in accordance with generally accepted accounting principles ("U.S. GAAP"). "Operating income" is an internal performance measure used in the management of the company’s operations and represents after-tax operational results excluding, as applicable, net realized investment gains or losses, net impairment charges recognized in earnings, net foreign exchange gain or loss and other non- recurring items. The company excludes net realized investment gains or losses, net impairment charges recognized in earnings, net foreign exchange gain or loss, and other non-recurring items from the calculation of operating income because these amounts are heavily influenced by and fluctuate in part according to the availability of market opportunities and other factors. The company has excluded from operating income the termination fee received from Transatlantic Holdings, Inc. in 2011 as this is a non-recurring item. In addition to presenting net income determined in accordance with U.S. GAAP, the company believes that showing operating income enables investors, analysts, rating agencies and other users of the company’s financial information to more easily analyze our results of operations and underlying business performance. Operating income should not be viewed as a substitute for U.S. GAAP net income. "Annualized return on average shareholders' equity" ("ROAE") is calculated using average shareholders’ equity, excluding the average after tax other comprehensive income or loss, which may include unrealized gains (losses) on investments and currency translation adjustments. Unrealized gains (losses) on investments are primarily the result of interest rate and credit spread movements and the resultant impact on fixed income securities. Such gains (losses) are not related to management actions or operational performance, nor are they likely to be realized. Therefore, the company believes that excluding these amounts provides a more consistent and useful measurement of operating performance, which supplements U.S. GAAP information. In calculating ROAE, the net income (loss) available to shareholders for the period is multiplied by the number of such periods in a calendar year in order to arrive at annualized net income (loss) available to shareholders. The company presents ROAE as a measure that is commonly recognized as a standard of performance by investors, analysts, rating agencies and other users of its financial information. "Annualized operating return on average shareholders' equity" is calculated using operating income (as defined above and annualized in the manner described for net income (loss) available to shareholders under ROAE above), and average shareholders' equity, excluding the average after tax unrealized gains (losses) on investments. Unrealized gains (losses) are excluded from equity for the reasons outlined in the annualized return on average shareholders' equity explanation above. "Tangible shareholders' equity and diluted book value per share" are calculated using total shareholders' equity excluding goodwill and intangible assets. The company has included tangible shareholders’ equity because it represents a more liquid measure of the company's net assets than total shareholders' equity. The company also has included diluted book value per share because it takes into account the effect of dilutive securities; therefore, the company believes it is an important measure of calculating shareholder returns. See slides 26 – 28 for a reconciliation of non-GAAP measures used in this presentation to their most directly comparable U.S. GAAP measures. 25

Non-GAAP Financial Measures - Reconcil iation 26 ALLIED WORLD ASSURANCE COMPANY HOLDINGS, AG UNAUDITED OPERATING INCOME RECONCILIATION (Expressed in thousands of United States dollars, except share and per share amounts) Net income $ 74,099 $ 124,356 Add after tax effect of: Net realized investment (gains) losses (12,079) (42,572) Foreign exchange (gain) loss (3,011) 9,897 Operating income $ 59,009 $ 91,681 Weighted average common shares outstanding: Basic 90,254,512 95,935,551 Diluted 91,559,225 97,577,029 Basic per share data: Net income $ 0.82 $ 1.30 Add after tax effect of: Net realized investment (gains) losses (0.13) (0.44) Foreign exchange (gain) loss (0.03) 0.10 Operating income $ 0.66 $ 0.96 Diluted per share data: Net income $ 0.81 $ 1.27 Add after tax effect of: Net realized investment (gains) losses (0.13) (0.44) Foreign exchange (gain) loss (0.03) 0.10 Operating income $ 0.65 $ 0.93 2016 2015 Three Months Ended March 31,

Non-GAAP Financial Measures - Reconcil iation 27 ALLIED WORLD ASSURANCE COMPANY HOLDINGS, AG UNAUDITED ANNUALIZED RETURN ON SHAREHOLDERS' EQUITY RECONCILIATION (Expressed in thousands of United States dollars, except for percentage information) Opening shareholders' equity $ 3,532,542 $ 3,778,291 Add: accumulated other comprehensive loss 9,297 — Adjusted opening shareholders' equity $ 3,541,839 $ 3,778,291 Closing shareholders' equity $ 3,535,463 $ 3,829,067 Add: accumulated other comprehensive loss 6,168 — Adjusted closing shareholders' equity $ 3,541,631 $ 3,829,067 Average adjusted shareholders' equity $ 3,541,735 $ 3,803,679 Net income (loss) available to shareholders $ 74,099 $ 124,356 Annualized net income (loss) available to shareholders $ 296,396 $ 497,424 Annualized return on average shareholders' equity - net income available to shareholders 8.4% 13.1% Operating income available to shareholders $ 59,009 $ 91,681 Annualized operating income available to shareholders $ 236,036 $ 366,724 Annualized return on average shareholders' equity - operating income available to shareholders 6.7% 9.6% Three Months Ended March 31, 2016 2015

Non-GAAP Financial Measures - Reconcil iation 28 ALLIED WORLD ASSURANCE COMPANY HOLDINGS, AG UNAUDITED DILUTED BOOK VALUE PER SHARE RECONCILIATION (Expressed in thousands of United States dollars, except share and per share amounts) Price per share at period end $ 34.94 $ 37.19 Total shareholders' equity $ 3,535,463 $ 3,532,542 Total tangible shareholders' equity $ 3,030,049 $ 3,027,792 Basic common shares outstanding 89,840,448 90,959,635 Add: unvested restricted stock units 1,243,533 819,309 Add: performance based equity awards 595,572 591,683 Add: employee purchase plan 38,885 53,514 Add: dilutive stock options outstanding 1,947,836 1,968,607 Weighted average exercise price per share $ 16.88 $ 16.87 Deduct: stock options bought back via treasury method (941,259) (892,993) Common shares and common share equivalents outstanding 92,725,015 93,499,755 Basic book value per common share $ 39.35 $ 38.84 Diluted book value per common share $ 38.13 $ 37.78 Basic tangible book value per common share $ 33.73 $ 33.29 Diluted tangible book value per common share $ 32.68 $ 32.38 As of March 31, 2016 As of December 31, 2015