Exhibit 99.1

ALLIED WORLD

Investor Presentation

1st Quarter 2014

www.awac.com

Forward-Looking Statements & Safe Harbor

This presentation contains certain statements, estimates and forecasts with respect to future performance and events. These statements, estimates and forecasts are “forward-looking statements”. In some cases, forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “might,” “will,” “should,” “expect,” “plan,” “intend,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue” or the negatives thereof or variations thereon or similar terminology. All statements other than statements of historical fact included in this presentation are forward-looking statements and are based on various underlying assumptions and expectations and are subject to known and unknown risks, and may include projections of our future financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied in the forward-looking statements. As a result, there can be no assurance that the forward-looking statements included in this presentation will prove to be accurate or correct. In light of these risks, uncertainties and assumptions, the future performance or events described in the forward-looking statements in this presentation might not occur. Accordingly, you should not rely upon forward-looking statements as a prediction of actual results and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements that may be made from time to time. We are under no obligation (and expressly disclaim any such obligation) to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

2 ALLIED WORLD

Agenda

Executive Summary

Operating Segments

U.S. Insurance

International Insurance

Reinsurance

Financial Highlights

Conclusion

Appendix

3 ALLIED WORLD

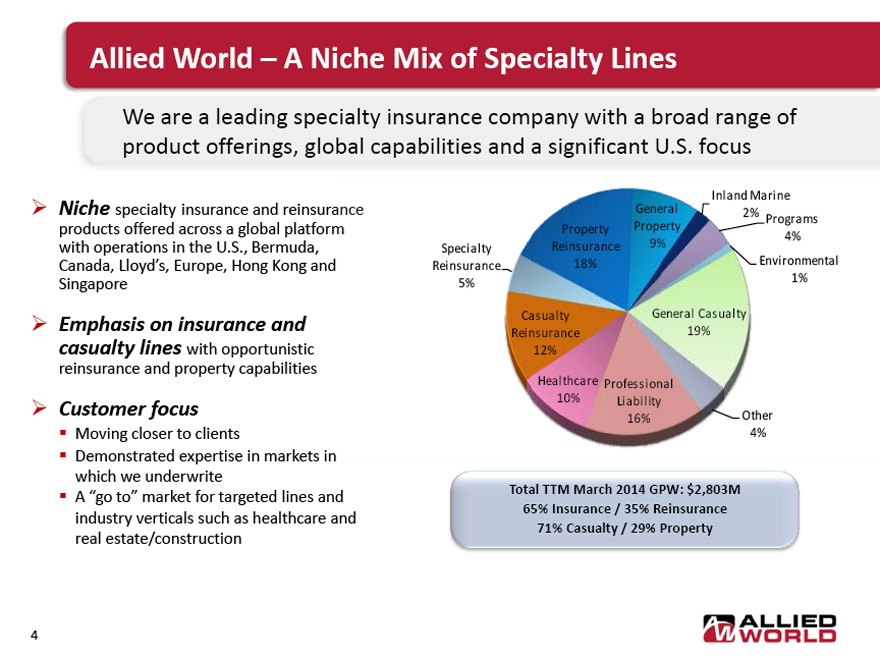

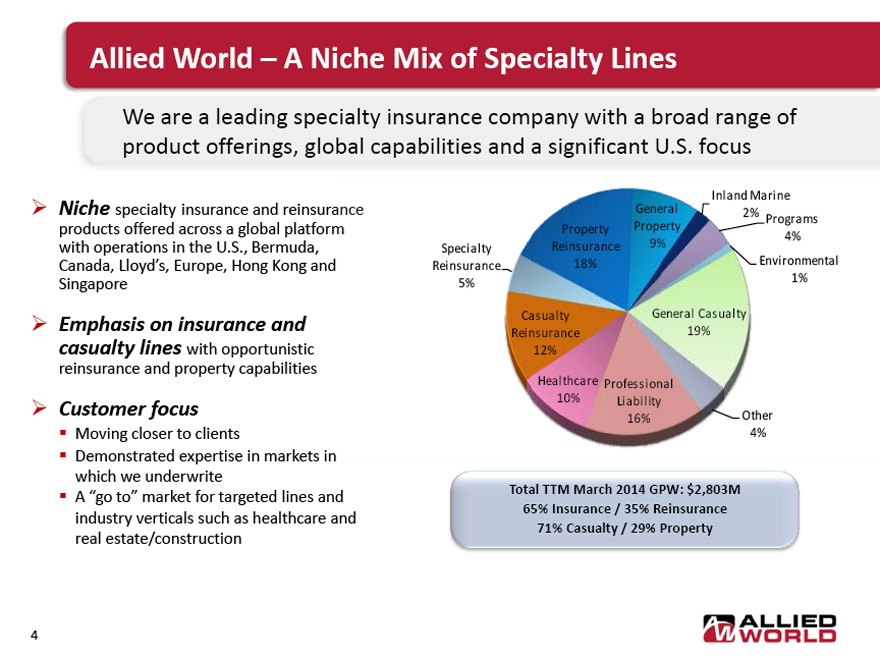

Allied World – A Niche Mix of Specialty Lines

We are a leading specialty insurance company with a broad range of product offerings, global capabilities and a significant U.S. focus

Niche specialty insurance and reinsurance products offered across a global platform with operations in the U.S., Bermuda, Canada, Lloyd’s, Europe, Hong Kong and Singapore

Emphasis on insurance and

casualty lines with opportunistic reinsurance and property capabilities

Customer focus

Moving closer to clients

Demonstrated expertise in markets in which we underwrite

A “go to” market for targeted lines and industry verticals such as healthcare and real estate/construction

Property Reinsurance 18%

Specialty Reinsurance 5%

Casualty Reinsurance 12%

Healthcare 10%

Professional Liability 16%

Other 4%

General Casualty 19%

Environmental 1%

Programs 4%

Inland Marine 2%

General Property 9%

Total TTM March 2014 GPW: $2,803M

65% Insurance / 35% Reinsurance

71% Casualty / 29% Property

4 ALLIED WORLD

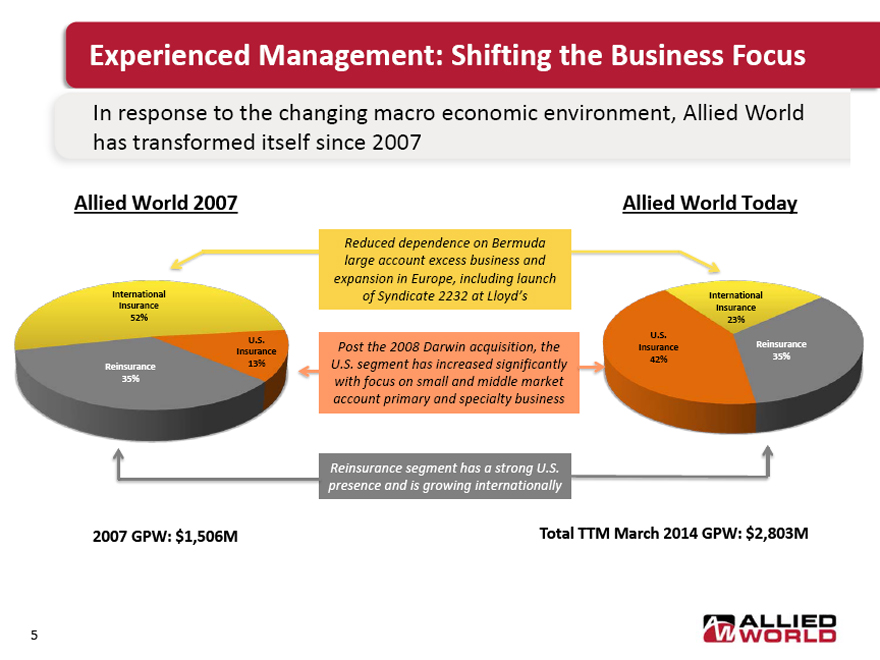

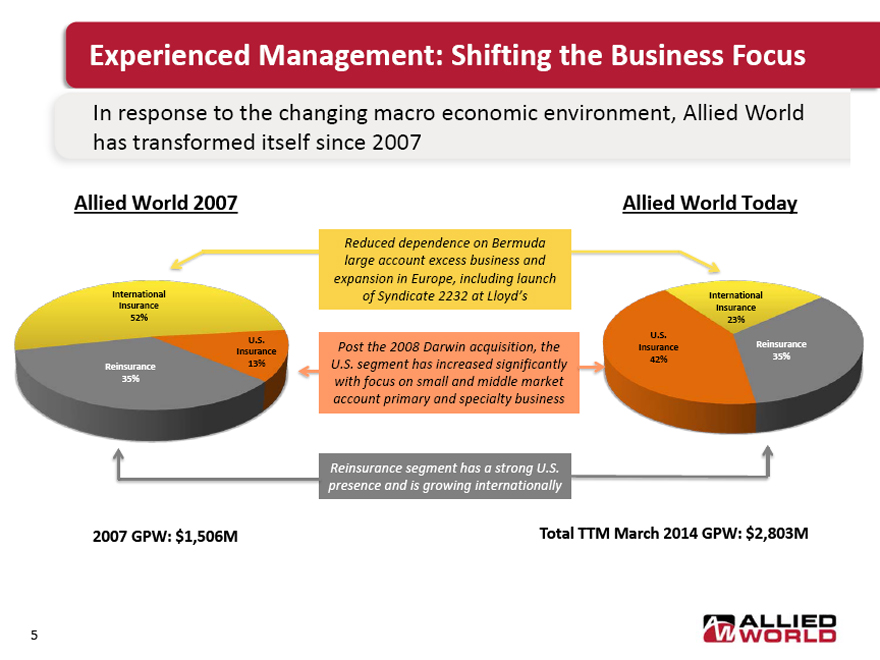

Experienced Management: Shifting the Business Focus

In response to the changing macro economic environment, Allied World has transformed itself since 2007

Allied World 2007

International Insurance 52%

U.S. Insurance 13%

Reinsurance 35%

Reduced dependence on Bermuda large account excess business and expansion in Europe, including launch of Syndicate 2232 at Lloyd’s

Post the 2008 Darwin acquisition, the U.S. segment has increased significantly with focus on small and middle market account primary and specialty business

Reinsurance segment has a strong U.S. presence and is growing internationally

Allied World Today

International Insurance 23%

U.S. Insurance 42%

Reinsurance 35%

2007 GPW: $1,506M

Total TTM March 2014 GPW: $2,803M

5 ALLIED WORLD

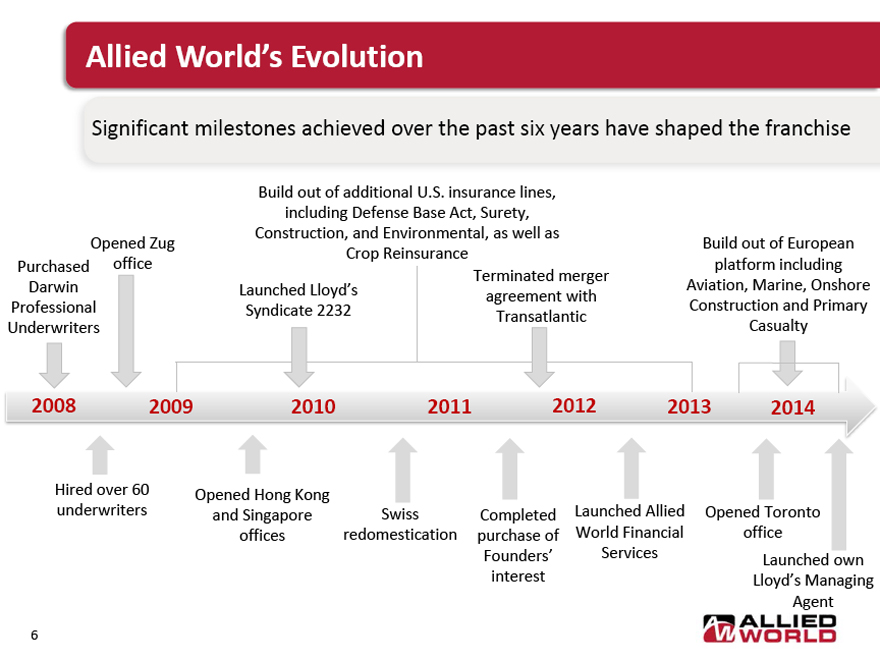

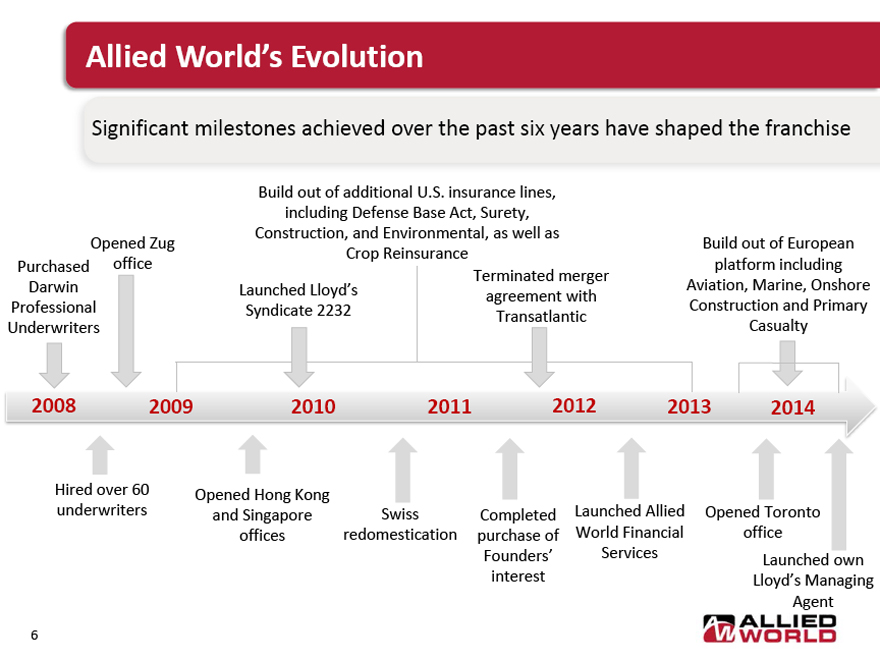

Allied World’s Evolution

Significant milestones achieved over the past six years have shaped the franchise

Build out of additional U.S. insurance lines, including Defense Base Act, Surety, Construction, and Environmental, as well as Crop Reinsurance

Purchased Darwin Professional Underwriters

Opened Zug office

Launched Lloyd’s Syndicate 2232

Terminated merger agreement with Transatlantic

Build out of European platform including Aviation, Marine, Onshore Construction and Primary Casualty

2008 2009 2010 2011 2012 2013 2014

Hired over 60 underwriters

Opened Hong Kong and Singapore offices

Swiss redomestication

Completed purchase of Founders’ interest

Launched Allied World Financial Services

Opened Toronto office Launched own Lloyd’s Managing Agent

6 ALLIED WORLD

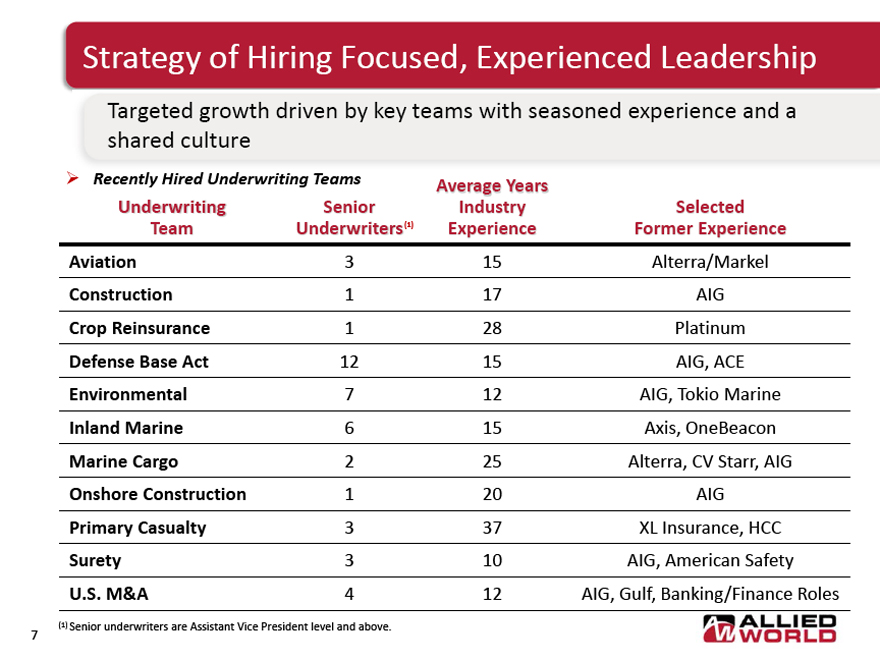

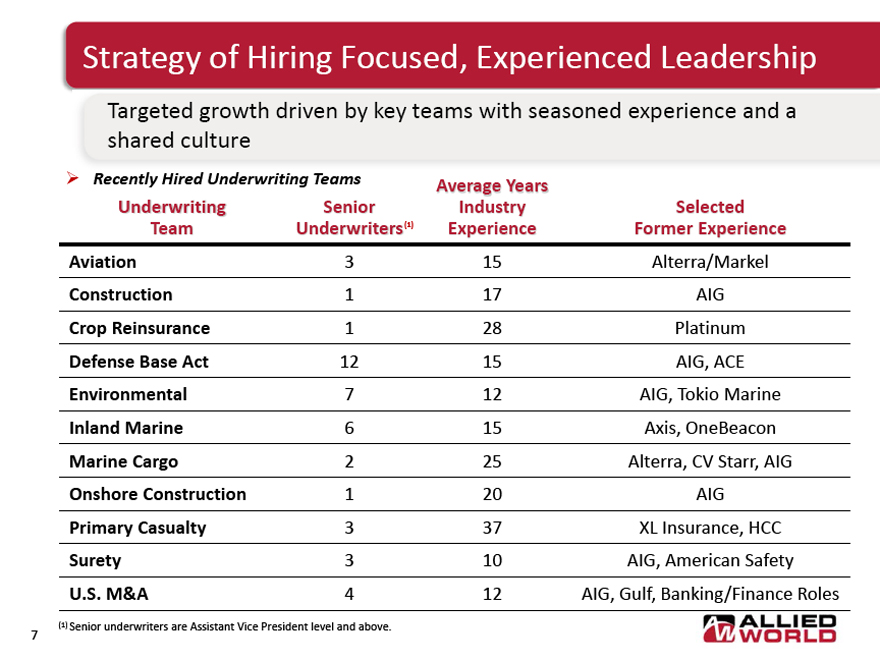

Strategy of Hiring Focused, Experienced Leadership

Targeted growth driven by key teams with seasoned experience and a shared culture

Ø Recently Hired Underwriting Teams

Underwriting Team Senior Underwriters (1) Average Years Industry Experience Selected Former Experience

Aviation 3 15 Alterra/Markel

Construction 1 17 AIG

Crop Reinsurance 1 28 Platinum

Defense Base Act 12 15 AIG, ACE

Environmental 7 12 AIG, Tokio Marine

Inland Marine 6 15 Axis, OneBeacon

Marine Cargo 2 25 Alterra, CV Starr, AIG

Onshore Construction 1 20 AIG

Primary Casualty 3 37 XL Insurance, HCC

Surety 3 10 AIG, American Safety

U.S. M&A 4 12 AIG, Gulf, Banking/Finance Roles

(1) Senior underwriters are Assistant Vice President level and above.

7 ALLIED WORLD

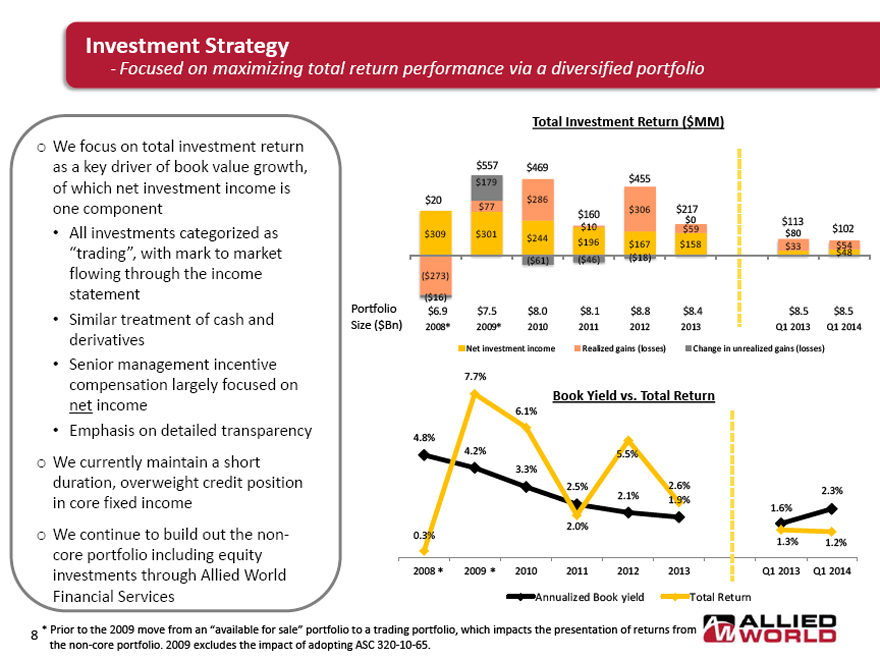

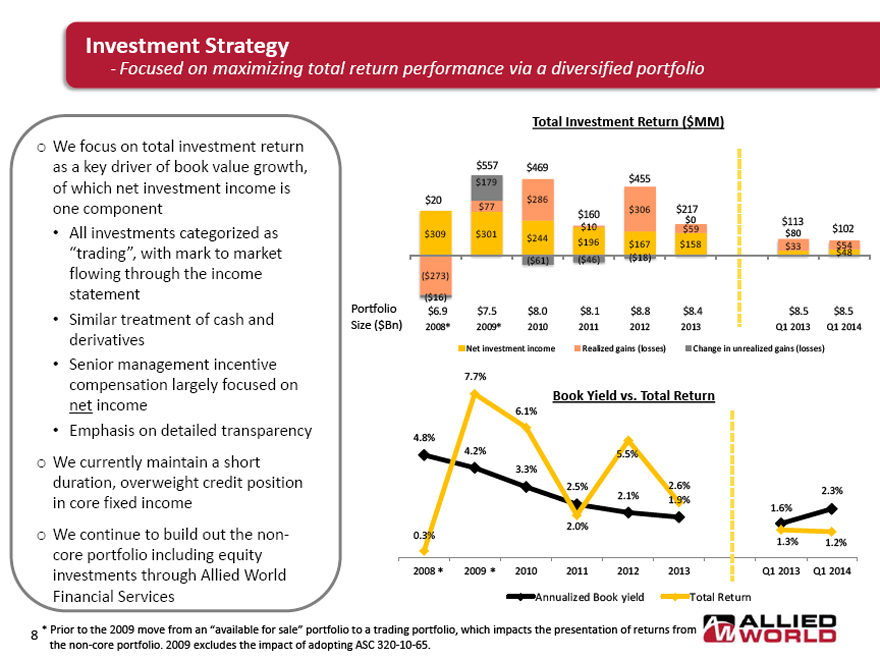

Investment Strategy

- Focused on maximizing total return performance via a diversified portfolio

We focus on total investment return as a key driver of book value growth, of which net investment income is one component

All investments categorized as “trading”, with mark to market flowing through the income statement

Similar treatment of cash and derivatives

Senior management incentive compensation largely focused on net income

Emphasis on detailed transparency

We currently maintain a short duration, overweight credit position in core fixed income

We continue to build out the non-core portfolio including equity investments through Allied World Financial Services

Total Investment Return ($MM)

Portfolio

Size ($Bn)

$20

$309

($273)

($16)

$6.9

2008*

$557

$179

$77

$301

$7.5

2009*

$469

$286

$244

($61)

$8.0

2010

$160

$10

$196

($46)

$8.1

2011

$455

$306

$167

($18)

$8.8

2012

$217

$0

$59

$158

$8.4

2013

$113

$80

$33

$8.5

Q1 2013

$102

$54

$48

$8.5

Q1 2014

Net investment income Realized gains (losses) Change in unrealized gains (losses)

Book Yield vs. Total Return

4.8%

0.3%

2008 *

7.7%

4.2%

2009 *

6.1%

3.3%

2010

2.5%

2.0%

2011

5.5%

2.1%

2012

2.6%

1.9%

2013

1.6%

1.3%

Q1 2013

2.3%

1.2%

Q1 2014

Annualized Book yield Total Return

* Prior to the 2009 move from an “available for sale” portfolio to a trading portfolio, which impacts the presentation of returns from the non-core portfolio. 2009 excludes the impact of adopting ASC 320-10-65.

8 ALLIED WORLD

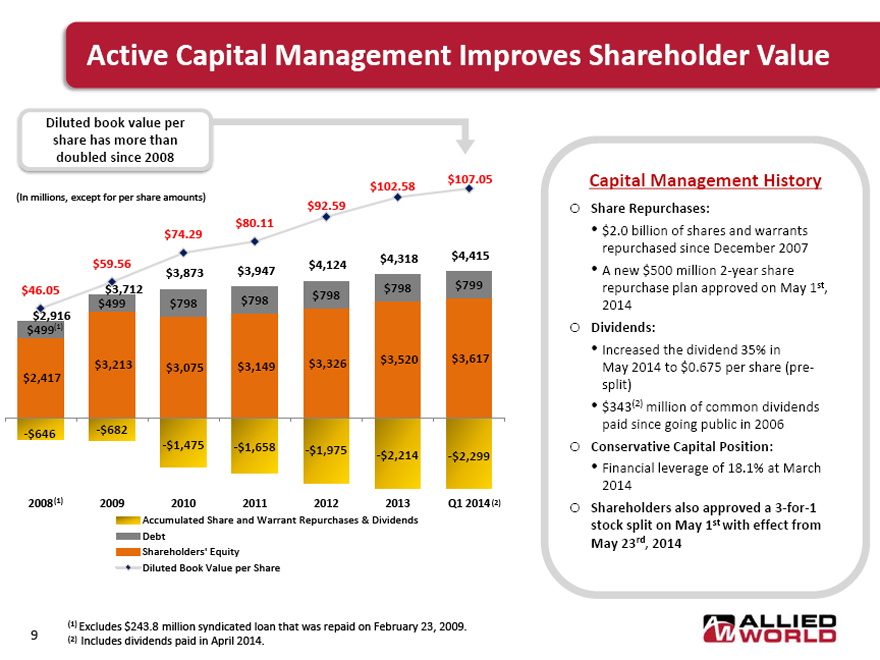

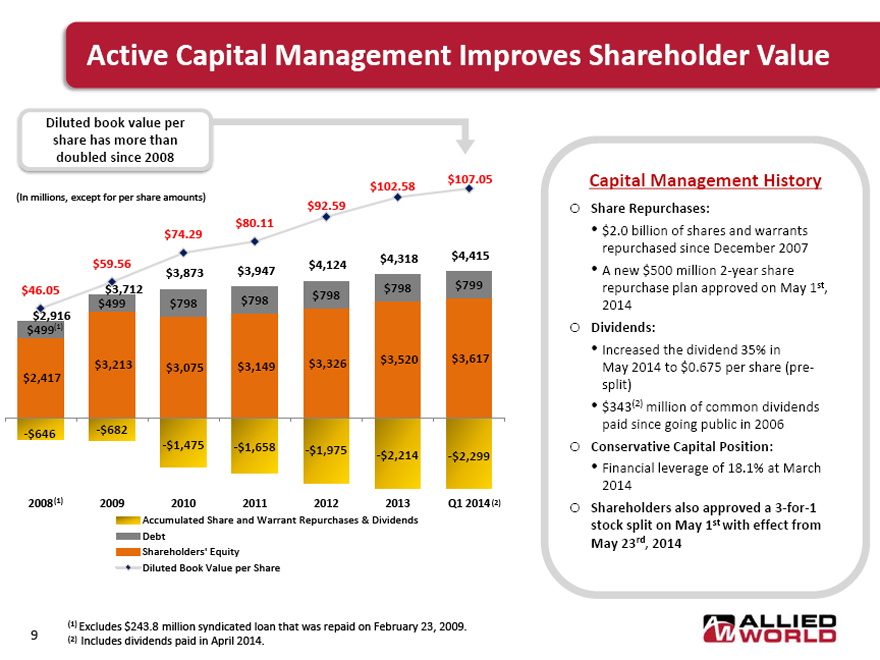

Active Capital Management Improves Shareholder Value

Diluted book value per share has more than doubled since 2008

(In millions, except for per share amounts)

$46.05

$2,916

$499(1)

$2,417

-$646

$59.56

$3,712

$499

$3,213

-$682

$74.29

$3,873

$798

$3,075

-$1,475

$80.11

$3,947

$798

$3,149

-$1,658

$92.59

$4,124

$798

$3,326

-$1,975

$102.58

$4,318

$798

$3,520

-$2,214

$107.05

$4,415

$799

$3,617

-$2,299

2008(1) 2009 2010 2011 2012 2013 Q1 2014 (2)

Accumulated Share and Warrant Repurchases & Dividends

Debt

Shareholders’ Equity

Diluted Book Value per Share

Capital Management History

Share Repurchases:

$2.0 billion of shares and warrants repurchased since December 2007

A new $500 million 2-year share repurchase plan approved on May 1st, 2014

Dividends:

Increased the dividend 35% in May 2014 to $0.675 per share (pre-split)

$343(2) million of common dividends paid since going public in 2006

Conservative Capital Position:

Financial leverage of 18.1% at March 2014

Shareholders also approved a 3-for-1 stock split on May 1st with effect from May 23rd, 2014

(1) Excludes $243.8 million syndicated loan that was repaid on February 23, 2009.

(2) Includes dividends paid in April 2014.

9 ALLIED WORLD

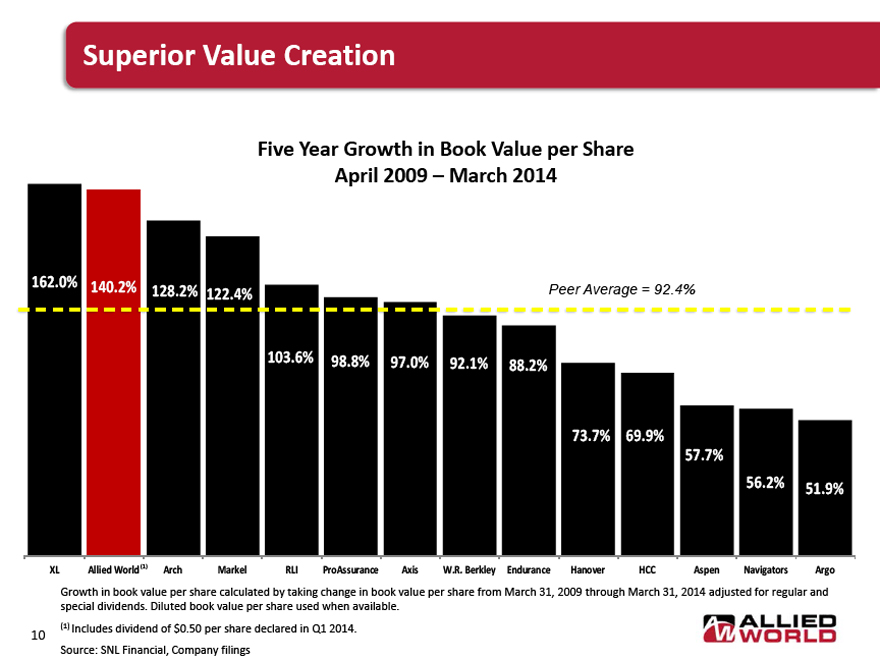

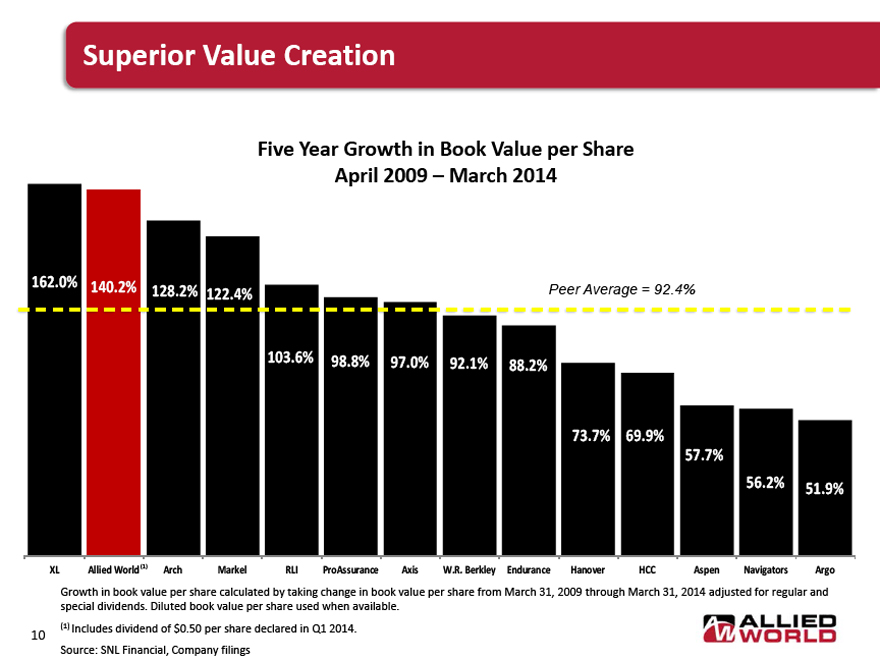

Superior Value Creation

Five Year Growth in Book Value per Share April 2009 - March 2014

162.0% 140.2% 128.2% 122.4% Peer Average = 92.4% 103.6% 98.8% 97.0% 92.1% 88.2% 73.7% 69.9% 57.7% 56.2% 51.9%

XL Allied World (1) Arch Markel RLI ProAssurance Axis W.R. Berkley Endurance Hanover HCC Aspen Navigators Argo

Growth in book value per share calculated by taking change in book value per share from March 31, 2009 through March 31, 2014 adjusted for regular and special dividends. Diluted book value per share used when available.

(1) Includes dividend of $0.50 per share declared in Q1 2014.

Source: SNL Financial, Company filings

10 ALLIED WORLD

Agenda

ü Executive Summary

q Operating Segments

¡ U.S. Insurance

¡ International Insurance

¡ Reinsurance

q Financial Highlights

q Conclusion

q Appendix

11 ALLIED WORLD

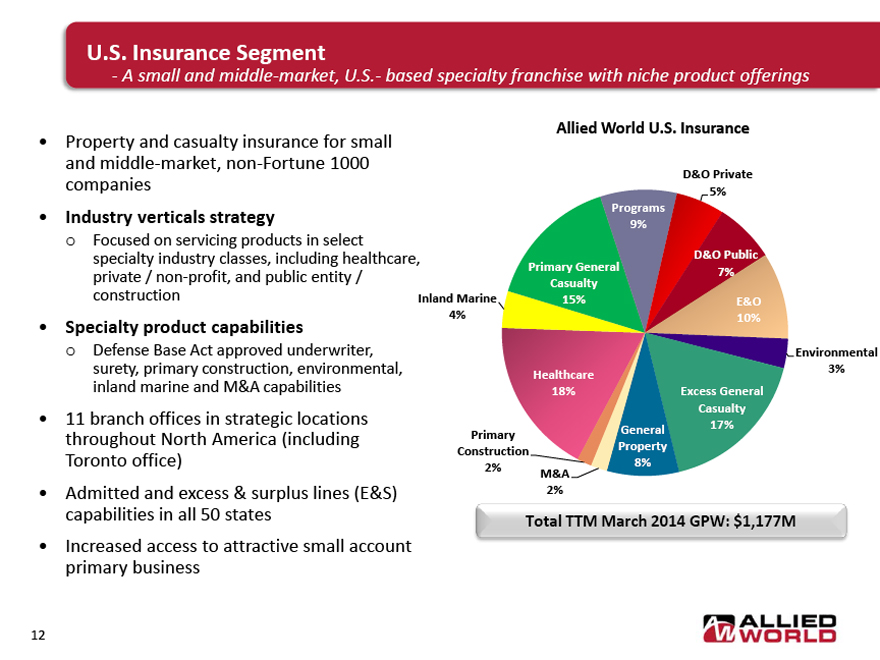

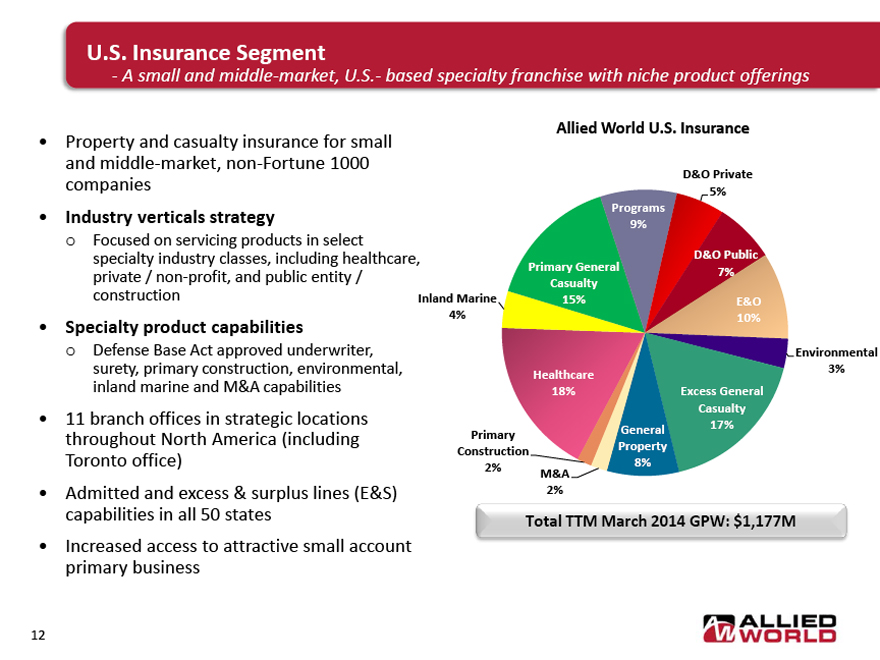

U.S. Insurance Segment

- A small and middle-market, U.S.- based specialty franchise with niche product offerings

Property and casualty insurance for small and middle-market, non-Fortune 1000 companies

Industry verticals strategy

o Focused on servicing products in select specialty industry classes, including healthcare, private / non-profit, and public entity / construction

Specialty product capabilities

o Defense Base Act approved underwriter, surety, primary construction, environmental, inland marine and M&A capabilities

11 branch offices in strategic locations throughout North America (including Toronto office)

Admitted and excess & surplus lines (E&S) capabilities in all 50 states

Increased access to attractive small account primary business

Allied World U.S. Insurance

Programs 9%

Primary General Casualty 15%

Inland Marine 4%

Healthcare 18%

Primary Construction General 2%

General Property 8%

M&A 2%

D&O Private 5%

D&O Public 7%

E&O 10%

Excess General Casualty 17%

Environmental 3%

Total TTM March 2014 GPW: $1,177M

12 ALLIED WORLD

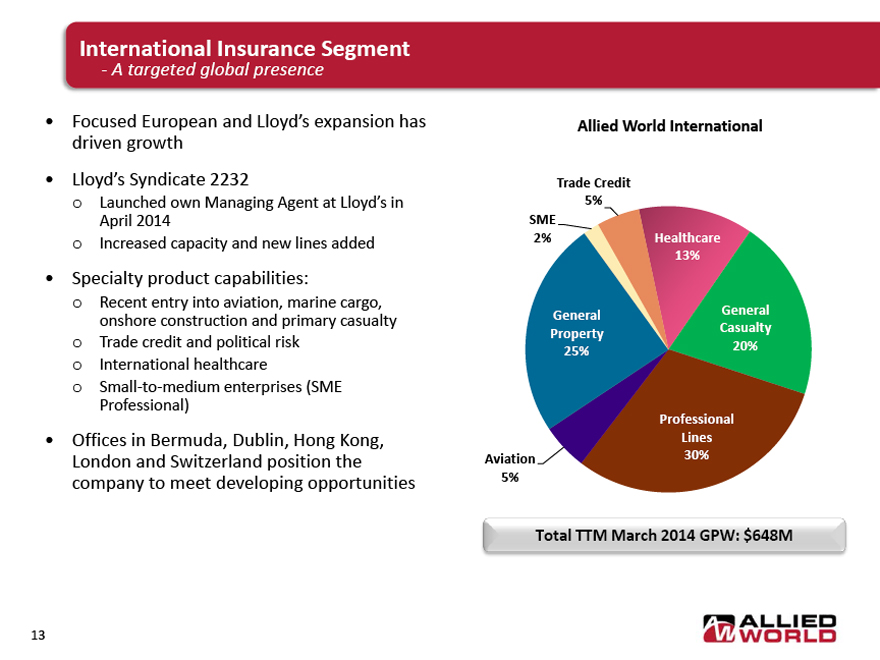

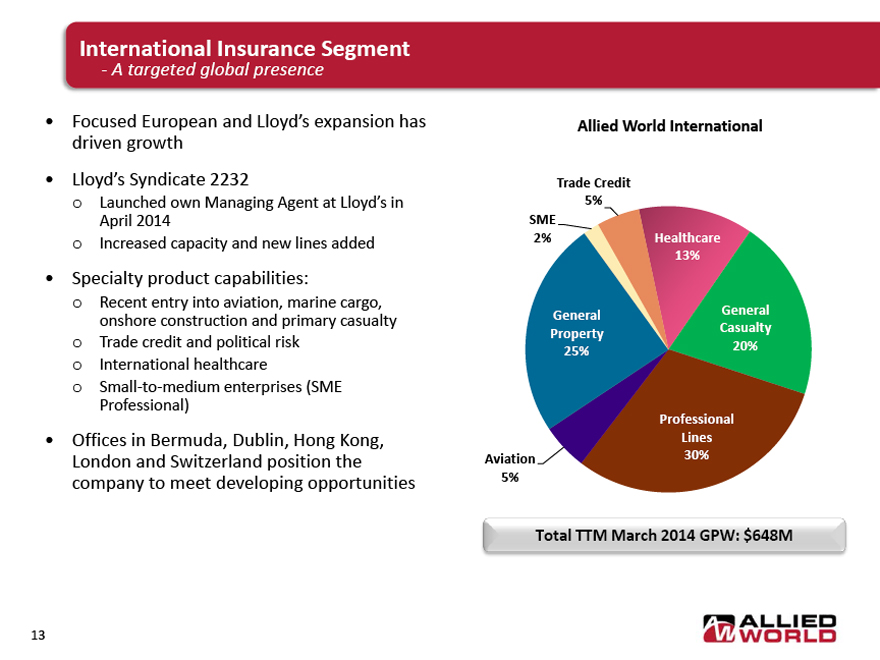

International Insurance Segment

- A targeted global presence

Focused European and Lloyd’s expansion has driven growth

Lloyd’s Syndicate 2232

Launched own Managing Agent at Lloyd’s in April 2014

Increased capacity and new lines added

Specialty product capabilities:

Recent entry into aviation, marine cargo, onshore construction and primary casualty

Trade credit and political risk

International healthcare

Small-to-medium enterprises (SME Professional)

Offices in Bermuda, Dublin, Hong Kong, London and Switzerland position the company to meet developing opportunities

Allied World International

Trade Credit 5%

SME 2%

Healthcare 13%

General Property 25%

Aviation 5%

General Casualty 20%

Professional Lines 30%

Total TTM March 2014 GPW: $648M

13 ALLIED WORLD

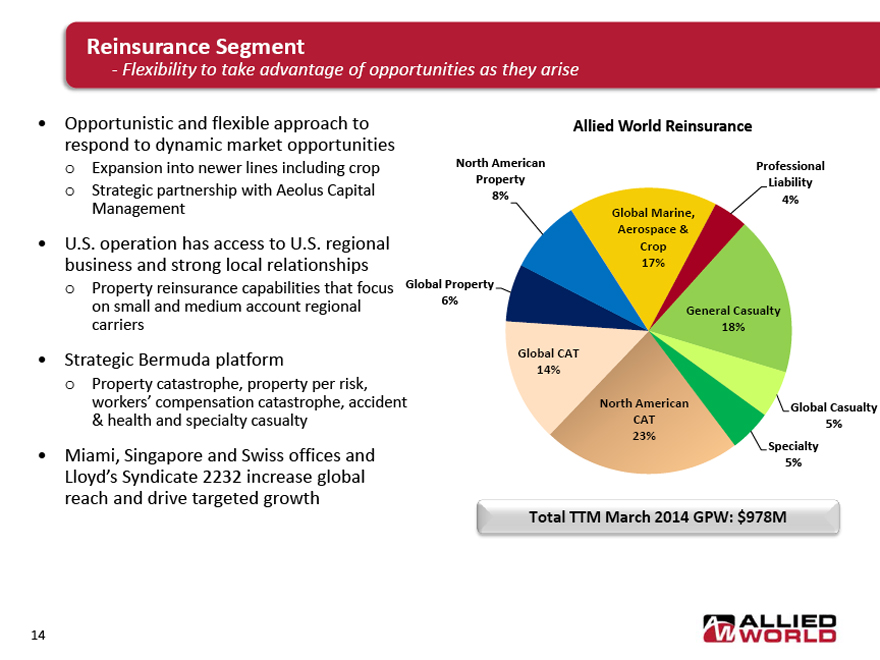

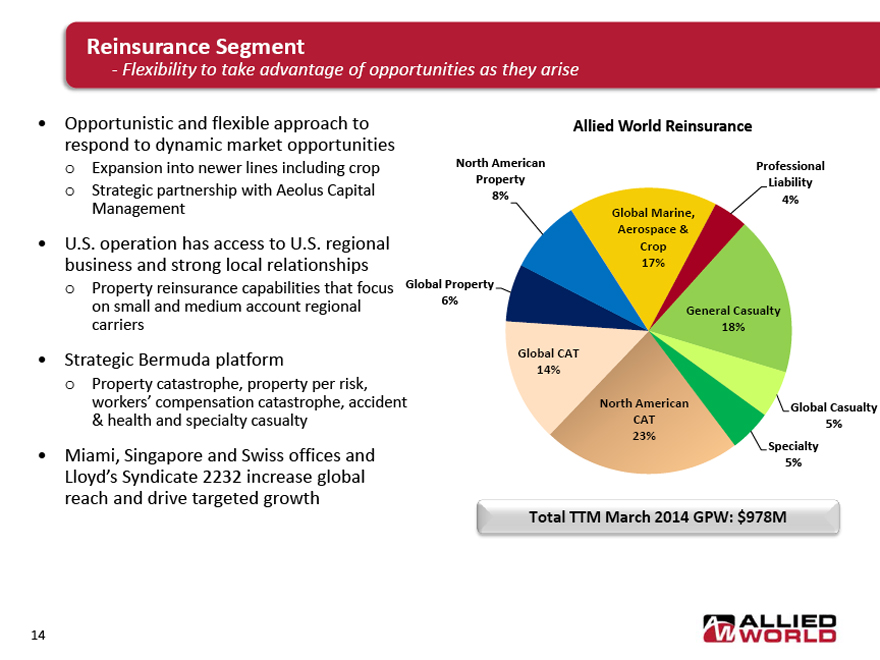

Reinsurance Segment

- Flexibility to take advantage of opportunities as they arise

Opportunistic and flexible approach to respond to dynamic market opportunities

Expansion into newer lines including crop

Strategic partnership with Aeolus Capital Management

U.S. operation has access to U.S. regional business and strong local relationships

Property reinsurance capabilities that focus on small and medium account regional carriers

Strategic Bermuda platform

Property catastrophe, property per risk, workers’ compensation catastrophe, accident & health and specialty casualty

Miami, Singapore and Swiss offices and Lloyd’s Syndicate 2232 increase global reach and drive targeted growth

Allied World Reinsurance

North American Property 8%

Global Property 6%

Global CAT 14%

Global Marine, Aerospace & Crop 17%

North American CAT 23%

Professional Liability 4%

General Casualty 18%

Global Casualty 5%

Specialty 5%

Total TTM March 2014 GPW: $978M

14 ALLIED WORLD

Page Intentionally Left Blank

15 ALLIED WORLD

Agenda

Executive Summary

Operating Segments

U.S. Insurance

International Insurance

Reinsurance

Financial Highlights

Conclusion

Appendix

16 ALLIED WORLD

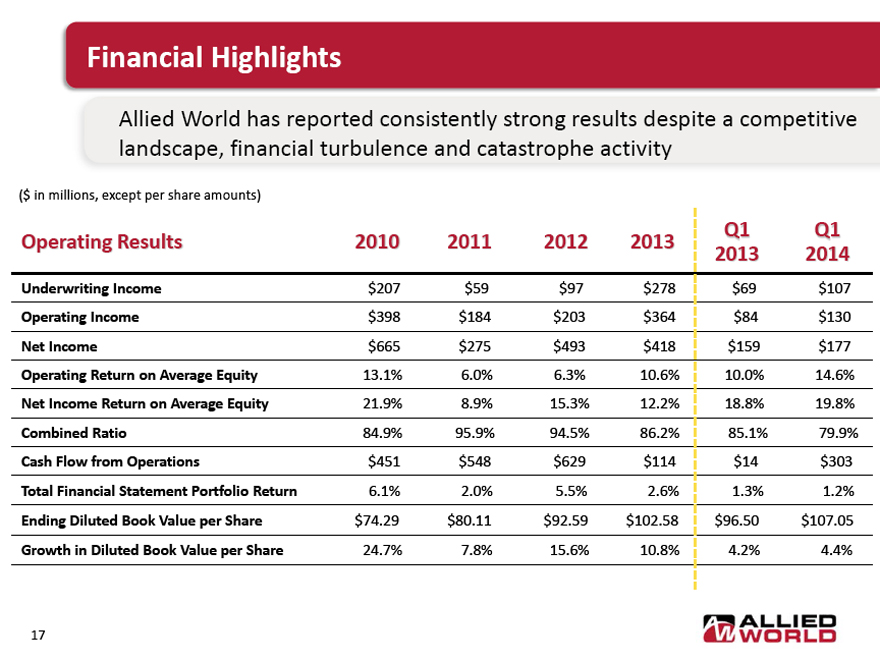

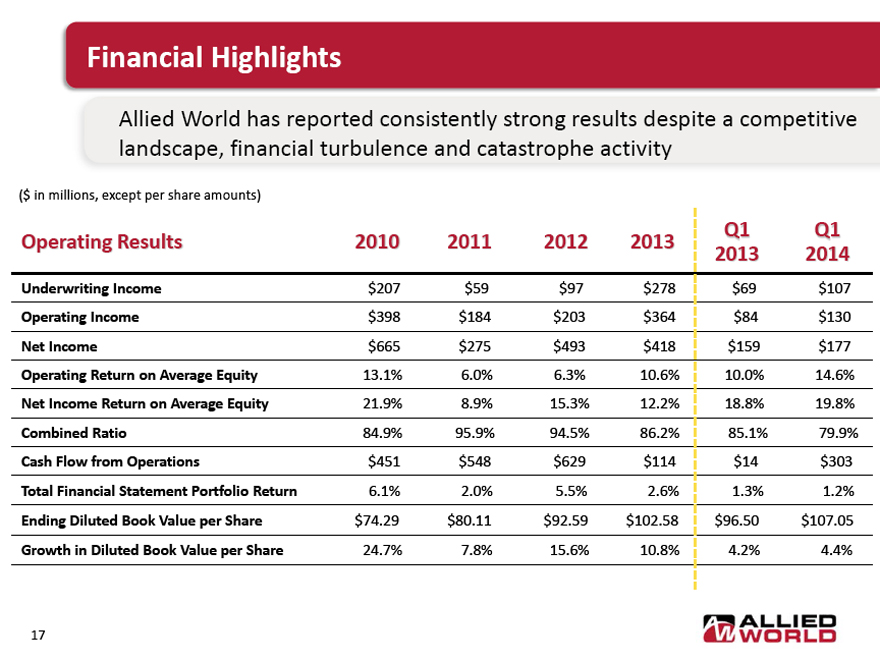

Financial Highlights

Allied World has reported consistently strong results despite a competitive landscape, financial turbulence and catastrophe activity

($ in millions, except per share amounts)

Operating Results 2010 2011 2012 2013 Q1 2013 Q1 2014

Underwriting Income $207 $59 $97 $278 $69 $107

Operating Income $398 $184 $203 $364 $84 $130

Net Income $665 $275 $493 $418 $159 $177

Operating Return on Average Equity 13.1% 6.0% 6.3% 10.6% 10.0% 14.6%

Net Income Return on Average Equity 21.9% 8.9% 15.3% 12.2% 18.8% 19.8%

Combined Ratio 84.9% 95.9% 94.5% 86.2% 85.1% 79.9%

Cash Flow from Operations $451 $548 $629 $114 $14 $303

Total Financial Statement Portfolio Return 6.1% 2.0% 5.5% 2.6% 1.3% 1.2%

Ending Diluted Book Value per Share $74.29 $80.11 $92.59 $102.58 $96.50 $107.05

Growth in Diluted Book Value per Share 24.7% 7.8% 15.6% 10.8% 4.2% 4.4%

17 ALLIED WORLD

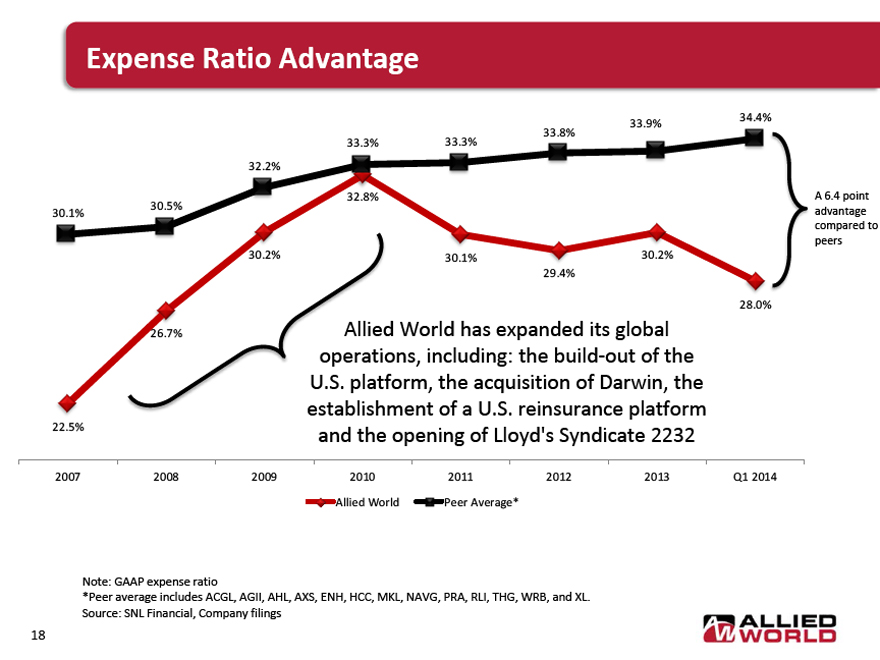

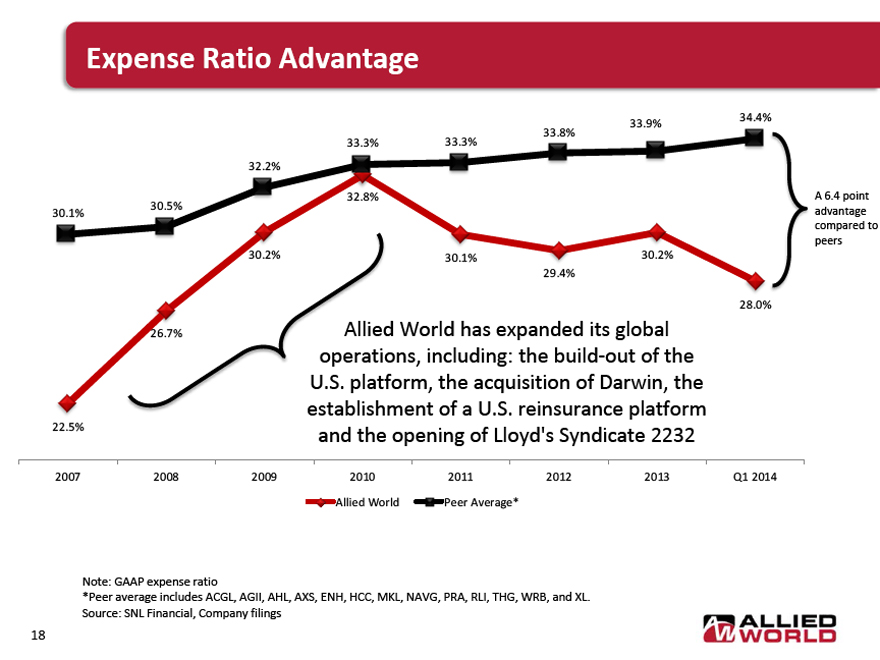

Expense Ratio Advantage

33.9%

34.4%

33.8%

33.3%

33.3%

32.2%

30.5%

32.8%

A 6.4 point advantage compared to peers

30.1%

30.2%

26.7%

22.5%

30.1%

30.2%

29.4%

28.0%

Allied World has expanded its global operations, including: the build-out of the U.S. platform, the acquisition of Darwin, the establishment of a U.S. reinsurance platform and the opening of Lloyd’s Syndicate 2232

2007

2008

2009

2010

2011

2012

2013

Q1 2014

Allied World Peer Average*

Note: GAAP expense ratio

*Peer average includes ACGL, AGII, AHL, AXS, ENH, HCC, MKL, NAVG, PRA, RLI, THG, WRB, and XL. Source: SNL Financial, Company filings

18 ALLIED WORLD

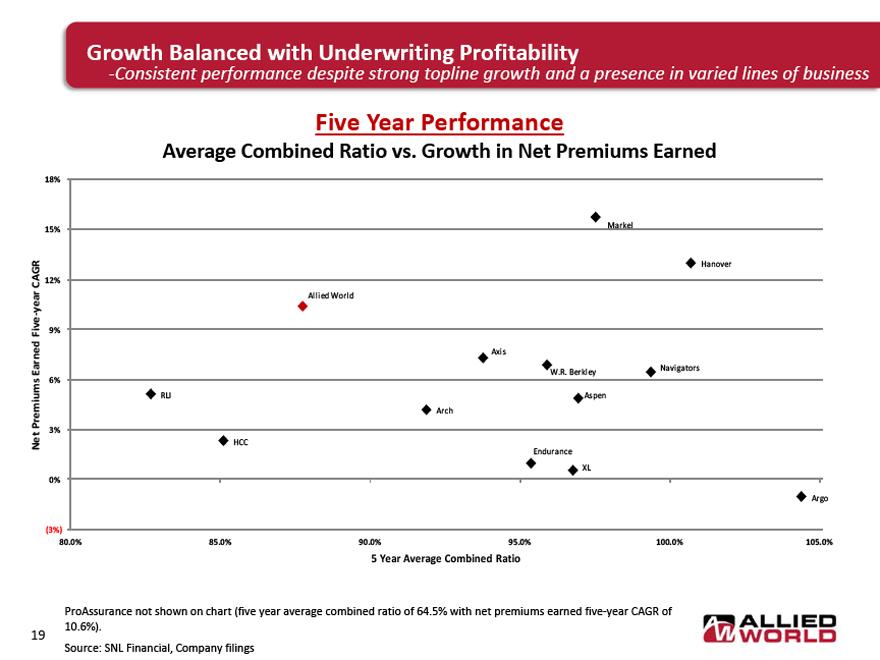

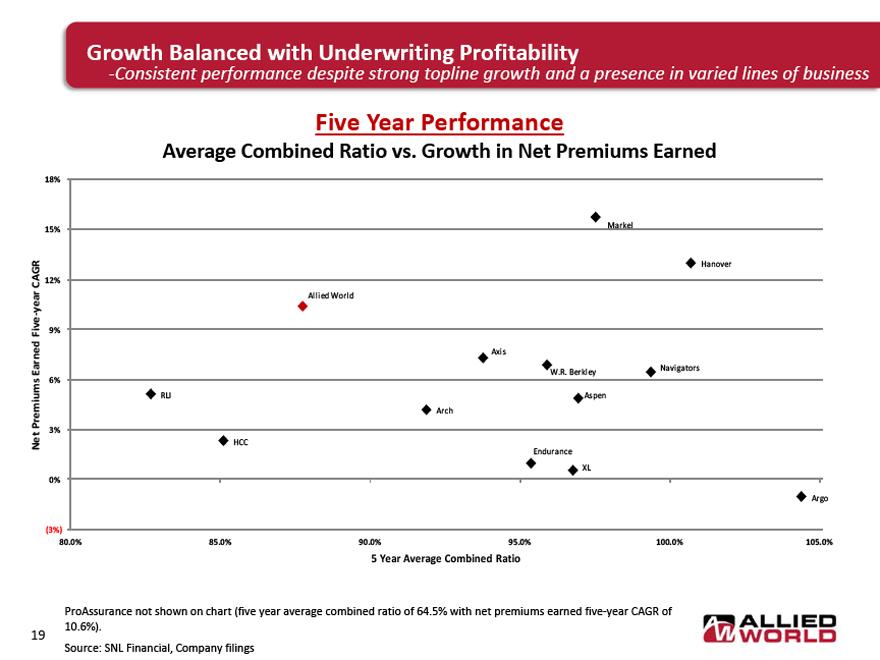

Growth Balanced with Underwriting Profitability

-Consistent performance despite strong topline growth and a presence in varied lines of business

Five Year Performance

Average Combined Ratio vs. Growth in Net Premiums Earned

Net Premiums Earned Five-year CAGR

18%

15%

12%

9%

6%

3%

0%

(3%)

Markel

Hanover

Allied World

Axis

W.R. Berkley

Navigators

RLI

Aspen

Arch

HCC

Endurance

XL

Argo

80.0%

85.0%

90.0%

95.0%

100.0%

105.0%

5 Year Average Combined

Ratio

ProAssurance not shown on chart (five year average combined ratio of 64.5% with net premiums earned five-year CAGR of 10.6%).

Source: SNL Financial, Company filings

19 ALLIED WORLD

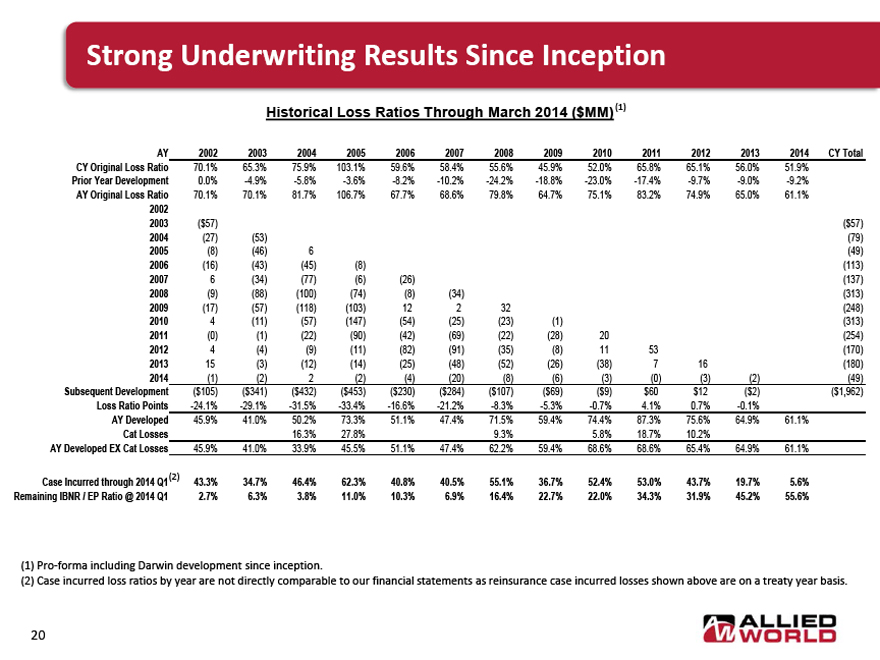

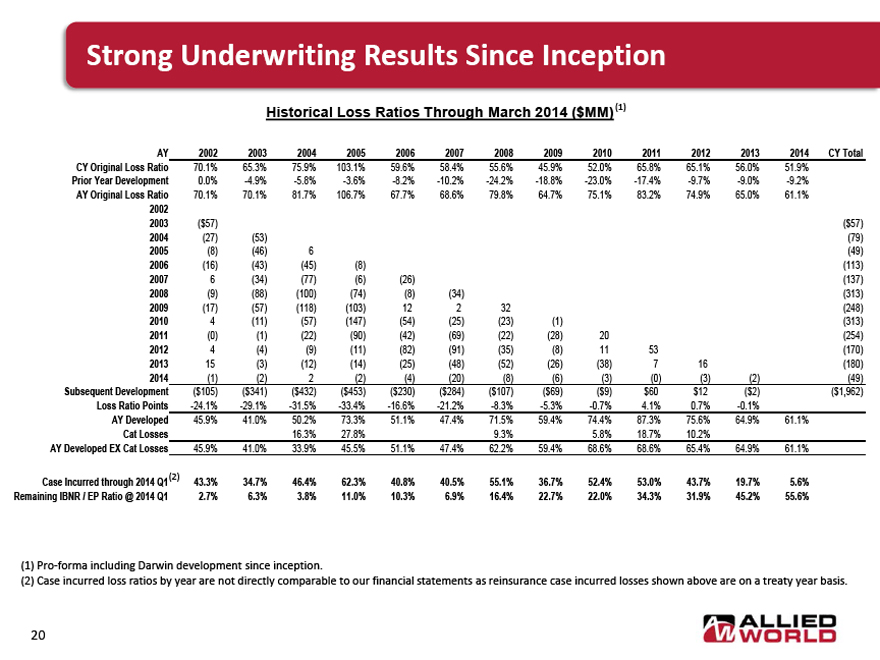

Strong Underwriting Results Since Inception

Historical Loss Ratios Through March 2014 ($MM) (1)

AY 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 CY Total

CY Original Loss Ratio 70.1% 65.3% 75.9% 103.1% 59.6% 58.4% 55.6% 45.9% 52.0% 65.8% 65.1% 56.0% 51.9%

Prior Year Development 0.0% -4.9% -5.8% -3.6% -8.2% -10.2% -24.2% -18.8% -23.0% -17.4% -9.7% -9.0% -9.2%

AY Original Loss Ratio 70.1% 70.1% 81.7% 106.7% 67.7% 68.6% 79.8% 64.7% 75.1% 83.2% 74.9% 65.0% 61.1%

2002

2003 ($57) ($57)

2004 (27) (53) (79)

2005 (8) (46) 6 (49)

2006 (16) (43) (45) (8) (113)

2007 6 (34) (77) (6) (26) (137)

2008 (9) (88) (100) (74) (8) (34) (313)

2009 (17) (57) (118) (103) 12 2 32 (248)

2010 4 (11) (57) (147) (54) (25) (23) (1) (313)

2011 (0) (1) (22) (90) (42) (69) (22) (28) 20 (254)

2012 4 (4) (9) (11) (82) (91) (35) (8) 11 53 (170)

2013 15 (3) (12) (14) (25) (48) (52) (26) (38) 7 16 (180)

2014 (1) (2) 2 (2) (4) (20) (8) (6) (3) (0) (3) (2) (49)

Subsequent Development ($105) ($341) ($432) ($453) ($230) ($284) ($107) ($69) ($9) $60 $12 ($2) ($1,962)

Loss Ratio Points -24.1% -29.1% -31.5% -33.4% -16.6% -21.2% -8.3% -5.3% -0.7% 4.1% 0.7% -0.1%

AY Developed 45.9% 41.0% 50.2% 73.3% 51.1% 47.4% 71.5% 59.4% 74.4% 87.3% 75.6% 64.9% 61.1%

Cat Losses 16.3% 27.8% 9.3% 5.8% 18.7% 10.2%

AY Developed EX Cat Losses 45.9% 41.0% 33.9% 45.5% 51.1% 47.4% 62.2% 59.4% 68.6% 68.6% 65.4% 64.9% 61.1%

Case Incurred through 2014 Q1(2) 43.3% 34.7% 46.4% 62.3% 40.8% 40.5% 55.1% 36.7% 52.4% 53.0% 43.7% 19.7% 5.6%

Remaining IBNR / EP Ratio @ 2014 Q1 2.7% 6.3% 3.8% 11.0% 10.3% 6.9% 16.4% 22.7% 22.0% 34.3% 31.9% 45.2% 55.6%

(1) Pro-forma including Darwin development since inception.

(2) Case incurred loss ratios by year are not directly comparable to our financial statements as reinsurance case incurred losses shown above are on a treaty year basis.

20 ALLIED WORLD

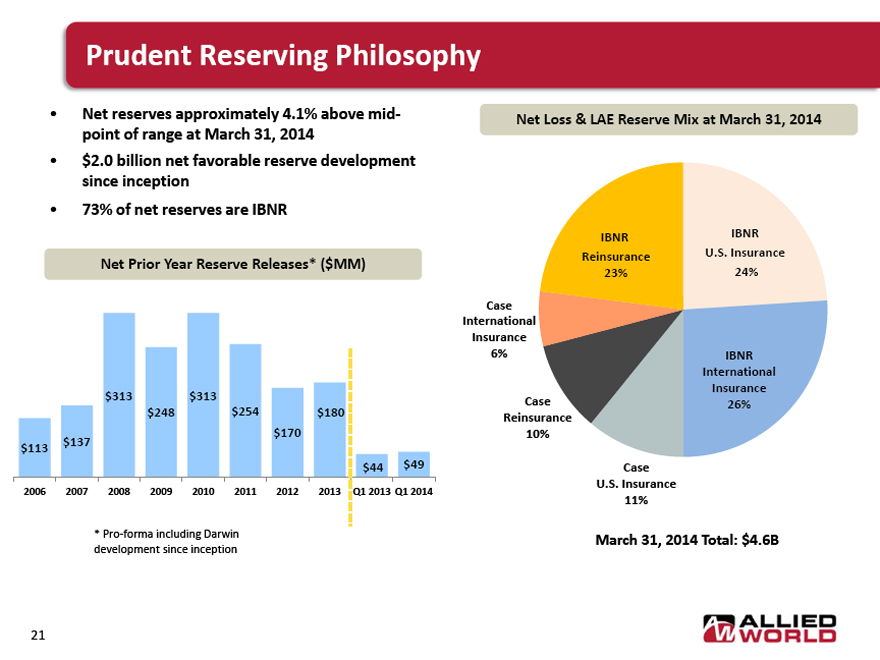

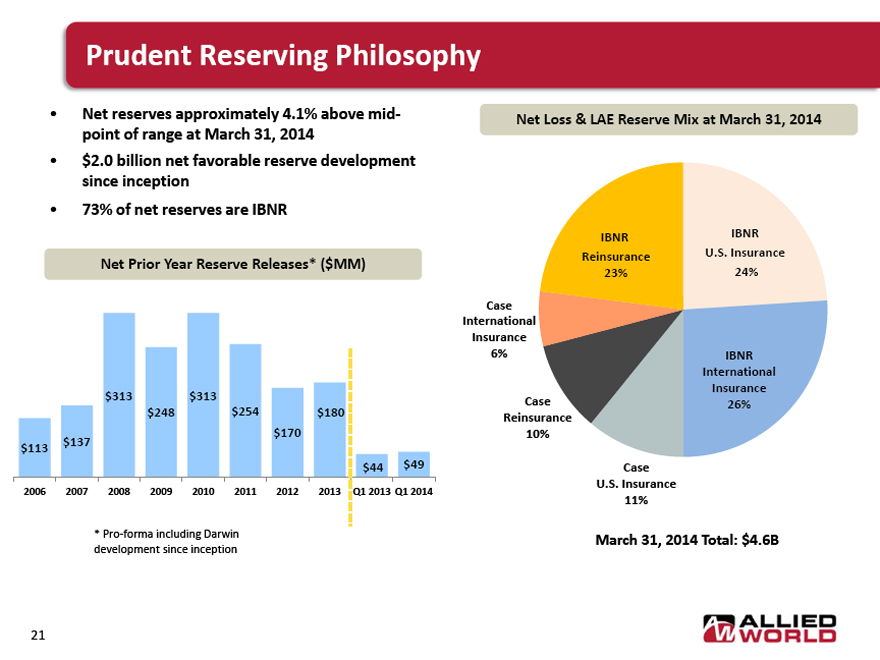

Prudent Reserving Philosophy

Net reserves approximately 4.1% above mid-point of range at March 31, 2014

$2.0 billion net favorable reserve development since inception

73% of net reserves are IBNR

Net Prior Year Reserve Releases* ($MM)

$313

$313

$248

$254

$180

$170

$113

$137

$44

$49

2006

2007

2008

2009

2010

2011

2012

2013

Q1 2013

Q1 2014

* Pro-forma including Darwin development since inception

Net Loss & LAE Reserve Mix at March 31, 2014

IBNR

IBNR

Reinsurance

U.S. Insurance

23%

24%

Case

International

Insurance

6%

IBNR

International

Insurance

Case

26%

Reinsurance

10%

Case

U.S. Insurance

11%

March 31, 2014 Total: $4.6B

21 ALLIED WORLD

Allied World - Investment Portfolio Breakout

Non-Core Assets

28.5% Other Private Securities Equities 9.7% Core Fixed Income Assets 71.5%

(AWFS)

1.7%

MBS/ABS High Yield

3.4%

Private Equity Funds

2.7%

Hedge Funds

6.6%

Floating Rate Bank Loans

4.4%

Total Investment Portfolio at March 31, 2014: $8,604M

*Floating Rate Bank Loans included in the non-investment grade corporate securities bucket.

Core assets include: cash and cash equivalents (8.3%), U.S. government securities (13.2%), U.S. government agencies (4.0%), non-U.S. government securities and agencies (2.1%), state, municipalities and political subdivisions (2.7%), mortgage-backed securities (12.2%), investment grade corporate securities (22.8%), and investment grade asset-backed securities (6.2%).

22 ALLIED WORLD

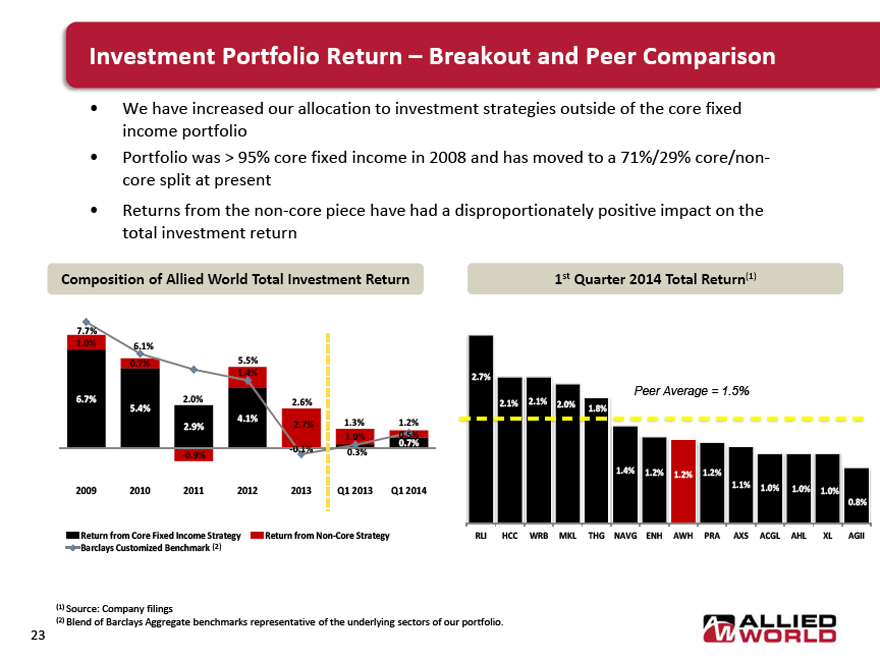

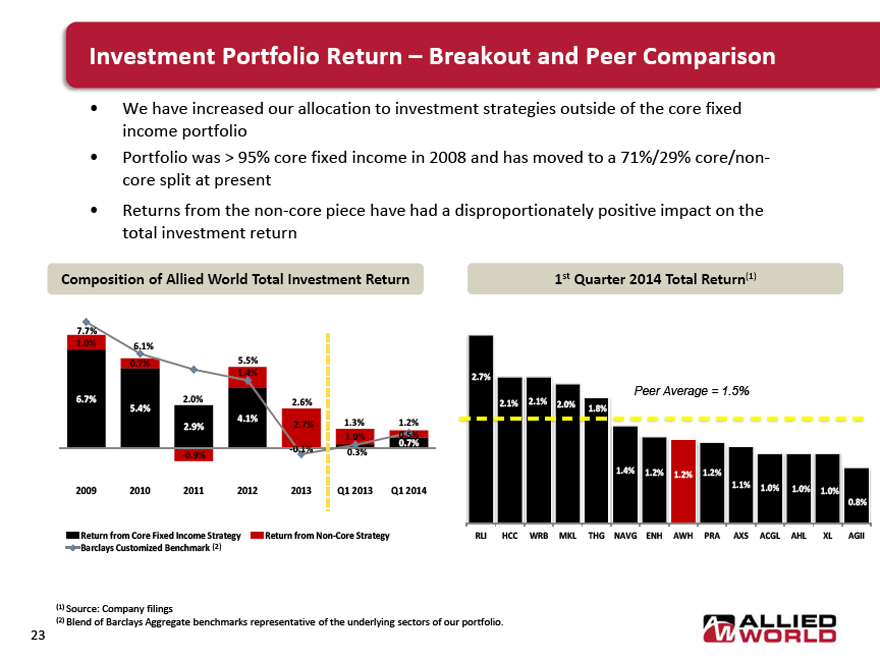

Investment Portfolio Return - Breakout and Peer Comparison

We have increased our allocation to investment strategies outside of the core fixed income portfolio

Portfolio was > 95% core fixed income in 2008 and has moved to a 71%/29% core/non- core split at present

Returns from the non-core piece have had a disproportionately positive impact on the total investment return

Composition of Allied World Total Investment Return

7.7% 6.1% 2.0% 5.5% 2.6% 1.3% 1.2%

1.0% 0.7% -0.9% 1.4% 2.7% 1.0% 0.5%

6.7% 5.4% 2.9% 4.1%

-0.1% 0.7% 0.3%

2009

2010

2011

2012

2013

Q1 2013

Q1 2014

2.7%

Peer Average = 1.5%

2.1% 2.1% 2.0% 1.8% 1.4% 1.2% 1.2% 1.2% 1.1% 1.0% 1.0% 1.0% 0.8%

Return from Core Fixed Income Strategy

Return from Non-Core Strategy

Barclays Customized Benchmark (2)

1st Quarter 2014 Total Return(1)

RLI HCC WRB MKL THG NAVG ENH AWH PRA AXS ACGL AHL XL AGII

(1) Source: Company filings

(2) Blend of Barclays Aggregate benchmarks representative of the underlying sectors of our portfolio.

23 ALLIED WORLD

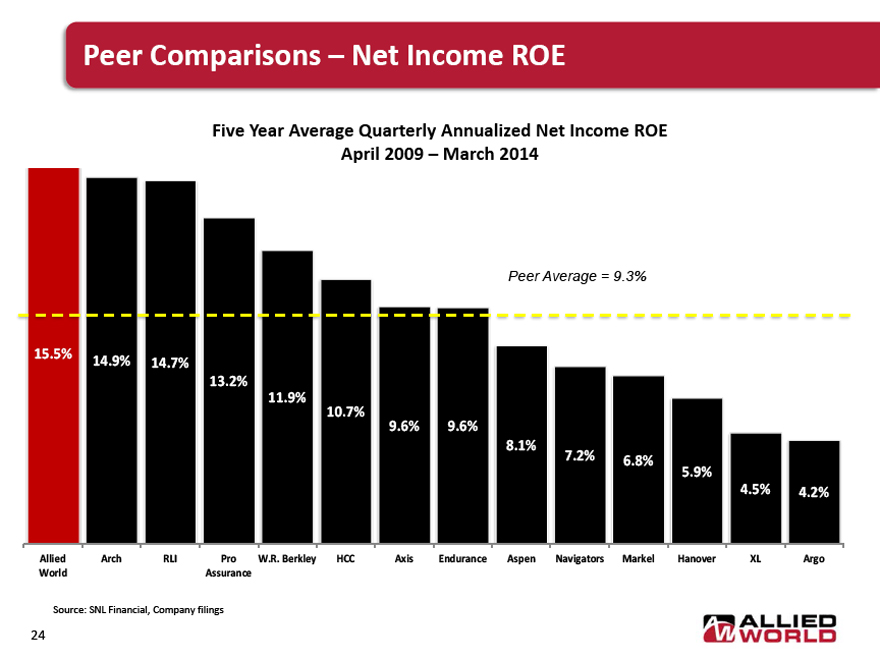

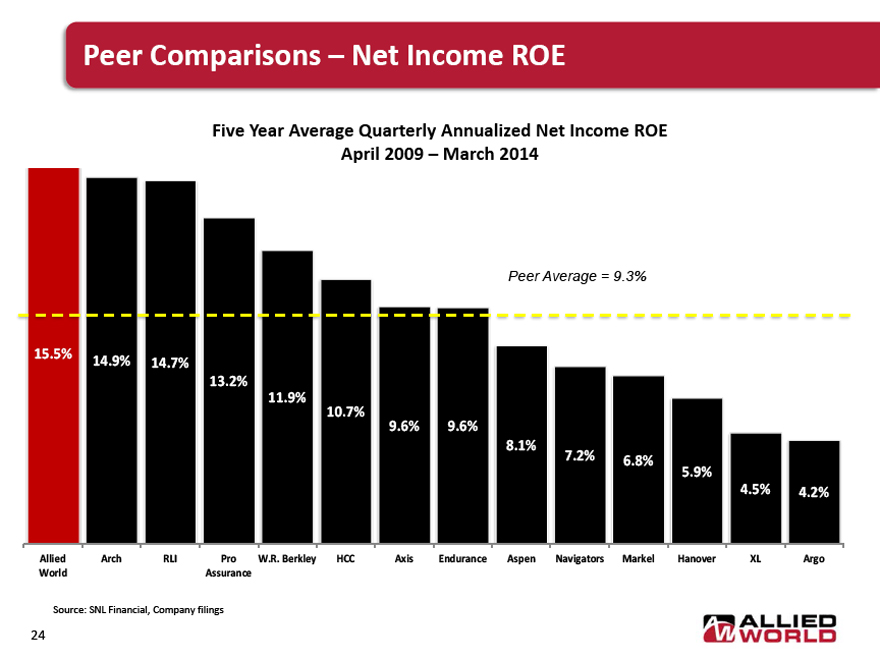

Peer Comparisons - Net Income ROE

Five Year Average Quarterly Annualized Net Income ROE April 2009 - March 2014

Peer Average = 9.3%

15.5% 14.9% 14.7% 13.2% 11.9% 10.7% 9.6% 9.6% 8.1% 7.2% 6.8% 5.9% 4.5% 4.2%

Allied World Arch RLI Pro Assurance W.R. Berkley HCC Axis Endurance Aspen Navigators Markel Hanover XL Argo

Source: SNL Financial, Company filings

ALLIED WORLD

24

Agenda

Executive Summary

Operating Segments

U.S. Insurance

International Insurance

Reinsurance

Financial Highlights

Conclusion

Appendix

ALLIED WORLD

25

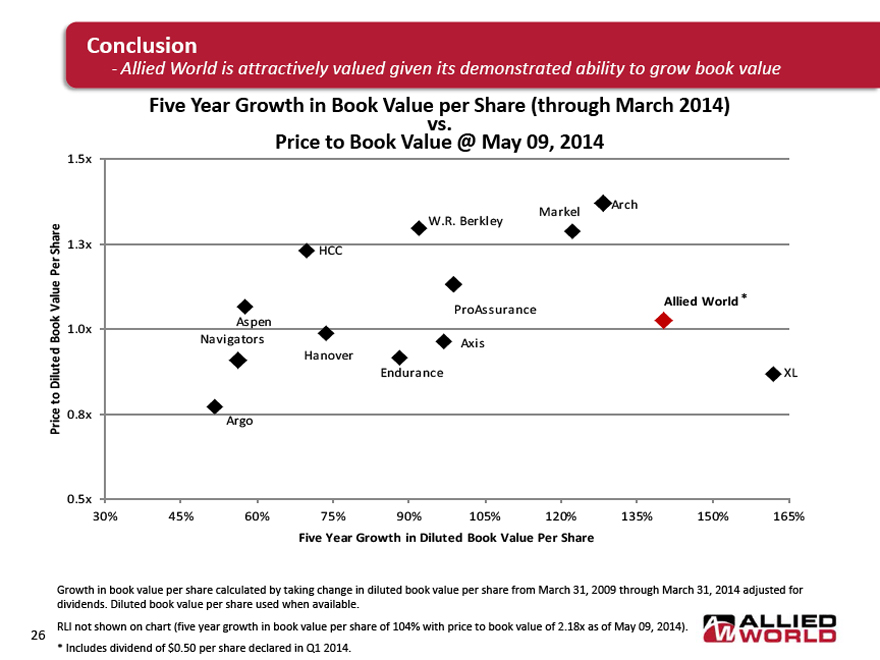

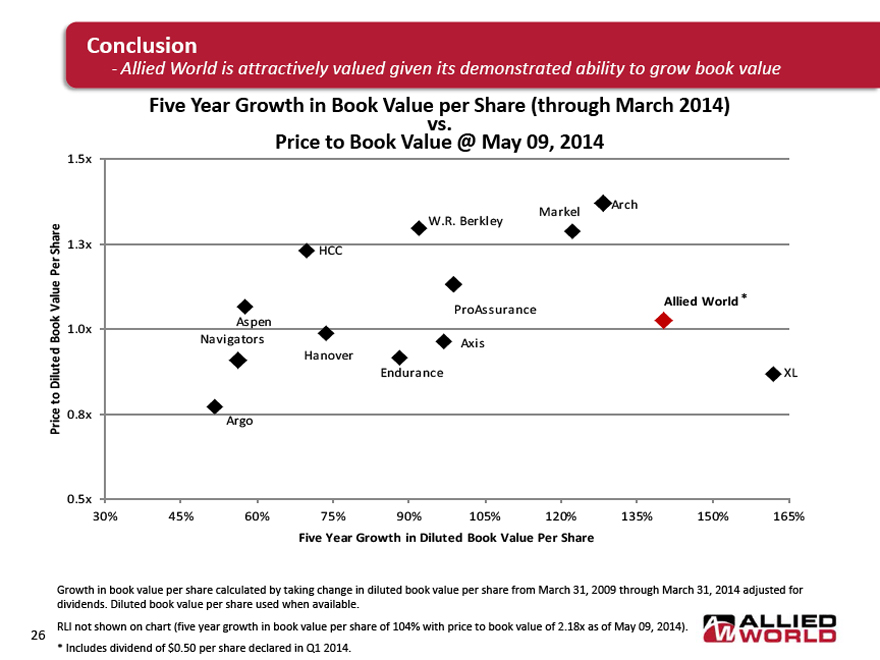

Conclusion

- Allied World is attractively valued given its demonstrated ability to grow book value

Five Year Growth in Book Value per Share (through March 2014) vs.

Price to Book Value @ May 09, 2014

Price to Diluted Book Value Per Share

1.5x

1.3x

1.0x

0.8x

0.5x

HCC

W.R. Berkley

Markel

Arch

Allied World *

ProAssurance

Aspen

Navigators

Axis

Hanover

Endurance

Argo

XL

30% 45% 60% 75% 90% 105% 120% 135% 150% 165%

Five Year Growth in Diluted Book Value Per Share

Growth in book value per share calculated by taking change in diluted book value per share from March 31, 2009 through March 31, 2014 adjusted for dividends. Diluted book value per share used when available.

RLI not shown on chart (five year growth in book value per share of 104% with price to book value of 2.18x as of May 09, 2014).

* Includes dividend of $0.50 per share declared in Q1 2014.

ALLIED WORLD

26

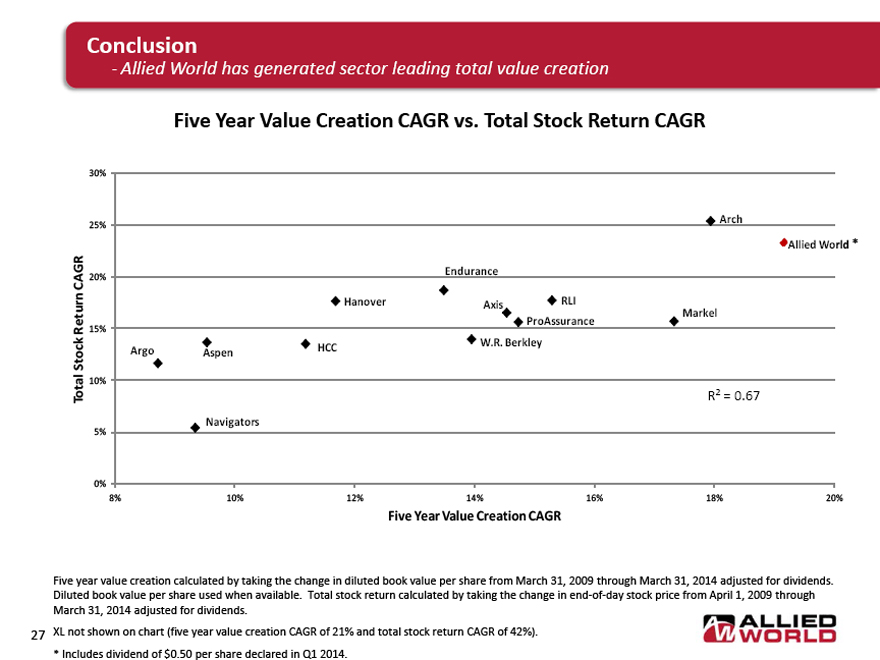

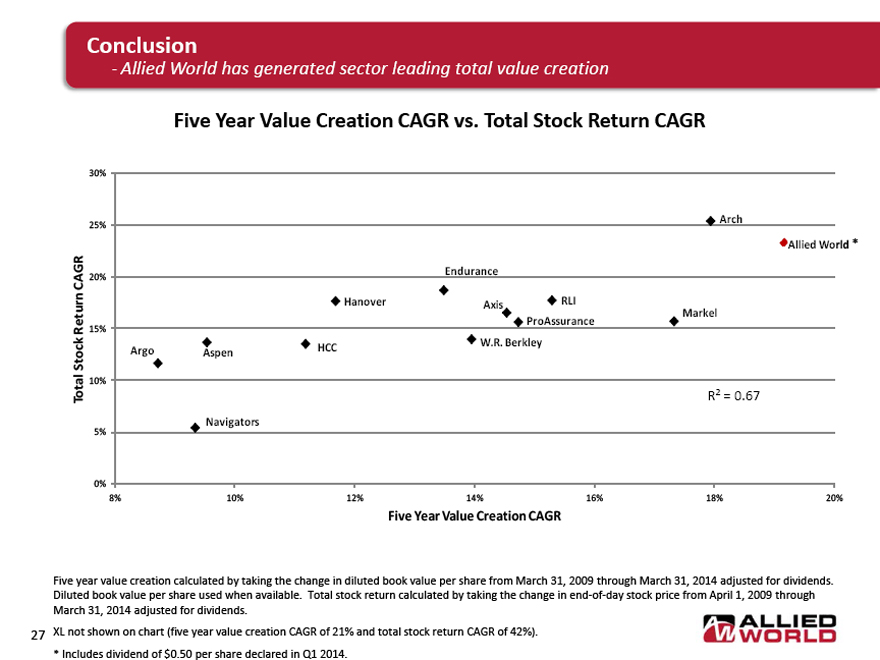

Conclusion

- Allied World has generated sector leading total value creation

Five Year Value Creation CAGR vs. Total Stock Return CAGR

Total Stock Return CAGR

30% 25% 20% 15% 10% 5% 0%

Argo

Aspen Navigators

HCC

Hanover

Endurance Axis W.R. Berkley

RLI ProAssurance

Arch Markel R2 = 0.67

Allied World *

8% 10% 12% 14% 16% 18% 20%

Five Year Value Creation CAGR

Five year value creation calculated by taking the change in diluted book value per share from March 31, 2009 through March 31, 2014 adjusted for dividends. Diluted book value per share used when available. Total stock return calculated by taking the change in end-of-day stock price from April 1, 2009 through March 31, 2014 adjusted for dividends.

XL not shown on chart (five year value creation CAGR of 21% and total stock return CAGR of 42%).

* Includes dividend of $0.50 per share declared in Q1 2014.

ALLIED WORLD

27

Agenda

Executive Summary

Operating Segments

U.S. Insurance

International Insurance

Reinsurance

Financial Highlights

Conclusion

Appendix

ALLIED WORLD

28

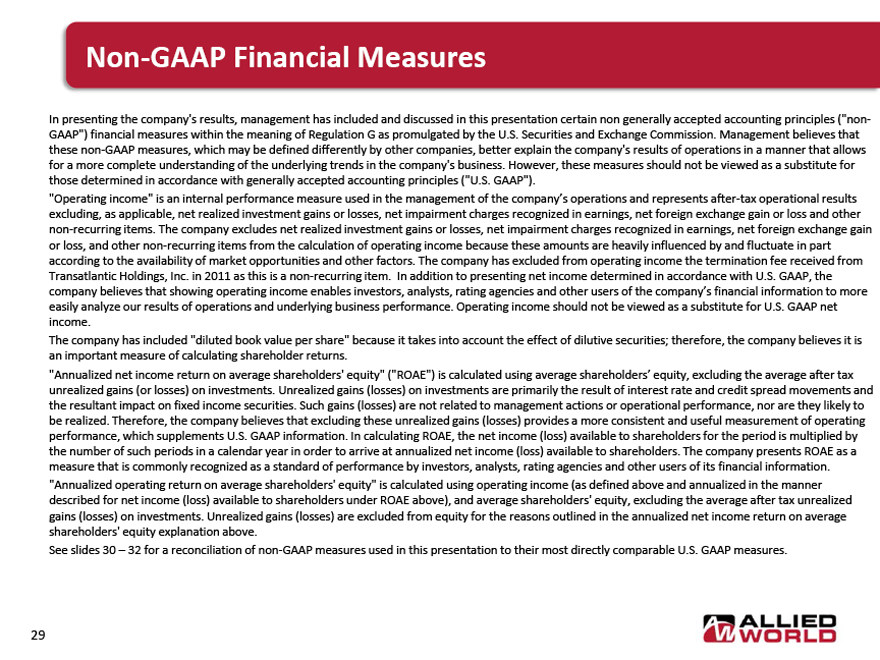

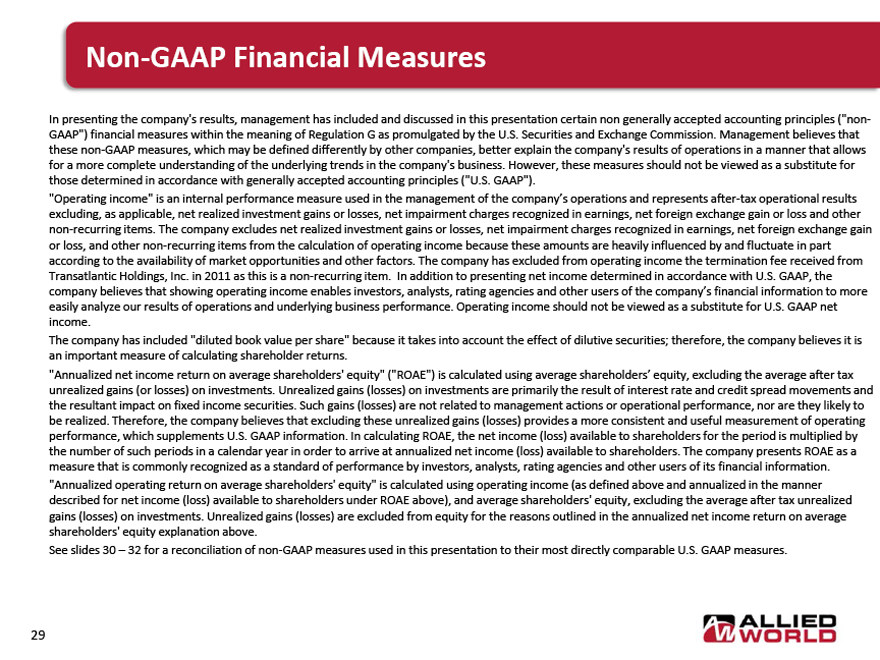

Non-GAAP Financial Measures

In presenting the company’s results, management has included and discussed in this presentation certain non generally accepted accounting principles (“non-GAAP”) financial measures within the meaning of Regulation G as promulgated by the U.S. Securities and Exchange Commission. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain the company’s results of operations in a manner that allows for a more complete understanding of the underlying trends in the company’s business. However, these measures should not be viewed as a substitute for those determined in accordance with generally accepted accounting principles (“U.S. GAAP”).

“Operating income” is an internal performance measure used in the management of the company’s operations and represents after-tax operational results excluding, as applicable, net realized investment gains or losses, net impairment charges recognized in earnings, net foreign exchange gain or loss and other non-recurring items. The company excludes net realized investment gains or losses, net impairment charges recognized in earnings, net foreign exchange gain or loss, and other non-recurring items from the calculation of operating income because these amounts are heavily influenced by and fluctuate in part according to the availability of market opportunities and other factors. The company has excluded from operating income the termination fee received from Transatlantic Holdings, Inc. in 2011 as this is a non-recurring item. In addition to presenting net income determined in accordance with U.S. GAAP, the company believes that showing operating income enables investors, analysts, rating agencies and other users of the company’s financial information to more easily analyze our results of operations and underlying business performance. Operating income should not be viewed as a substitute for U.S. GAAP net income.

The company has included “diluted book value per share” because it takes into account the effect of dilutive securities; therefore, the company believes it is an important measure of calculating shareholder returns.

“Annualized net income return on average shareholders’ equity” (“ROAE”) is calculated using average shareholders’ equity, excluding the average after tax unrealized gains (or losses) on investments. Unrealized gains (losses) on investments are primarily the result of interest rate and credit spread movements and the resultant impact on fixed income securities. Such gains (losses) are not related to management actions or operational performance, nor are they likely to be realized. Therefore, the company believes that excluding these unrealized gains (losses) provides a more consistent and useful measurement of operating performance, which supplements U.S. GAAP information. In calculating ROAE, the net income (loss) available to shareholders for the period is multiplied by the number of such periods in a calendar year in order to arrive at annualized net income (loss) available to shareholders. The company presents ROAE as a measure that is commonly recognized as a standard of performance by investors, analysts, rating agencies and other users of its financial information. “Annualized operating return on average shareholders’ equity” is calculated using operating income (as defined above and annualized in the manner described for net income (loss) available to shareholders under ROAE above), and average shareholders’ equity, excluding the average after tax unrealized gains (losses) on investments. Unrealized gains (losses) are excluded from equity for the reasons outlined in the annualized net income return on average shareholders’ equity explanation above.

See slides 30 - 32 for a reconciliation of non-GAAP measures used in this presentation to their most directly comparable U.S. GAAP measures.

29

ALLIED

WORLD

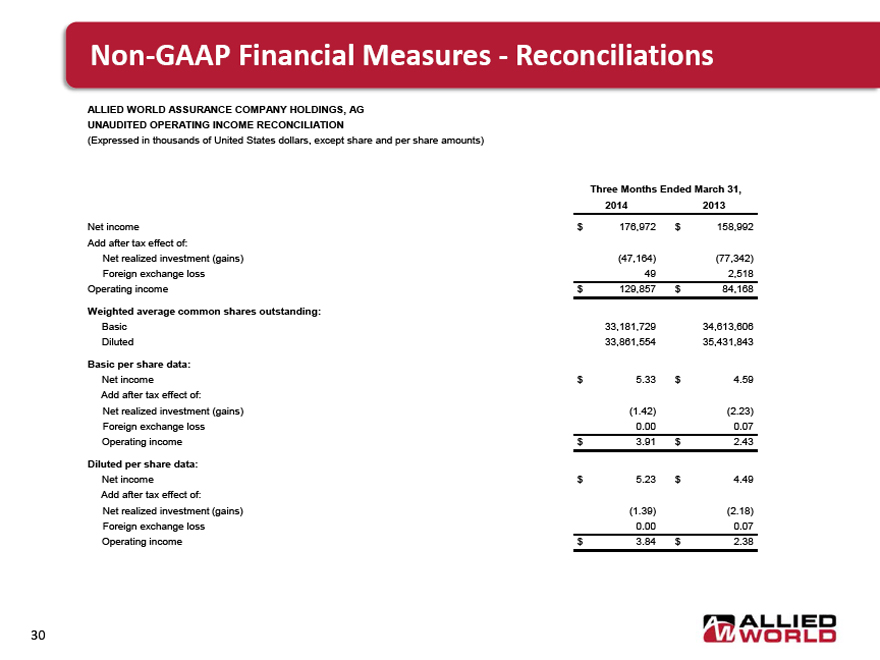

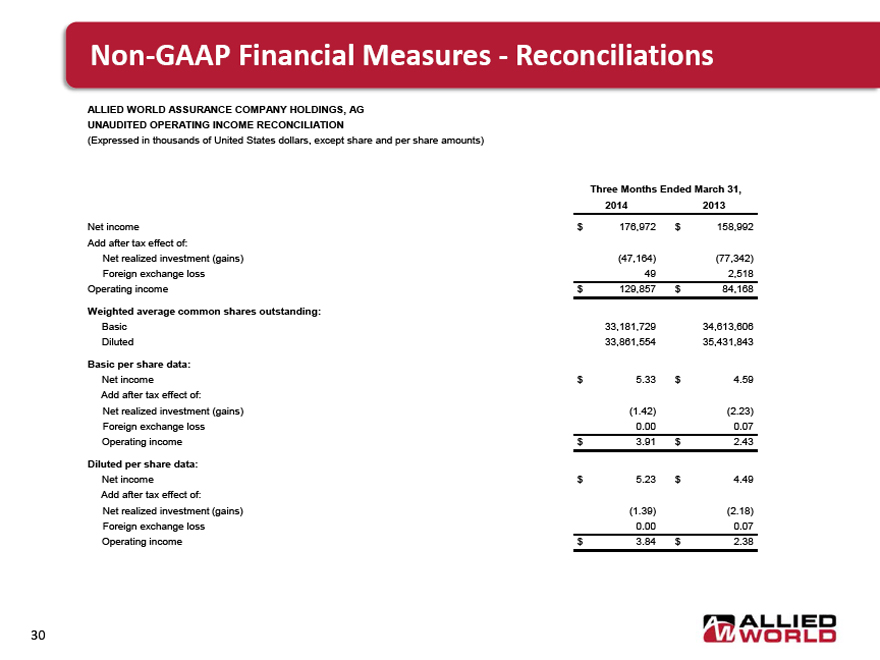

Non-GAAP Financial Measures - Reconciliations

ALLIED WORLD ASSURANCE COMPANY HOLDINGS, AG

UNAUDITED OPERATING INCOME RECONCILIATION

(Expressed in thousands of United States dollars, except share and per share amounts)

Three Months Ended March 31,

2014 2013

Net income $ 176,972 $ 158,992

Add after tax effect of:

Net realized investment (gains) (47,164) (77,342)

Foreign exchange loss 49 2,518

Operating income $ 129,857 $ 84,168

Weighted average common shares outstanding:

Basic 33,181,729 34,613,606

Diluted 33,861,554 35,431,843

Basic per share data:

Net income $ 5.33 $ 4.59

Add after tax effect of:

Net realized investment (gains) (1.42) (2.23)

Foreign exchange loss 0.00 0.07

Operating income $ 3.91 $ 2.43

Diluted per share data:

Net income $ 5.23 $ 4.49

Add after tax effect of:

Net realized investment (gains) (1.39) (2.18)

Foreign exchange loss 0.00 0.07

Operating income $ 3.84 $ 2.38

30

ALLIED

WORLD

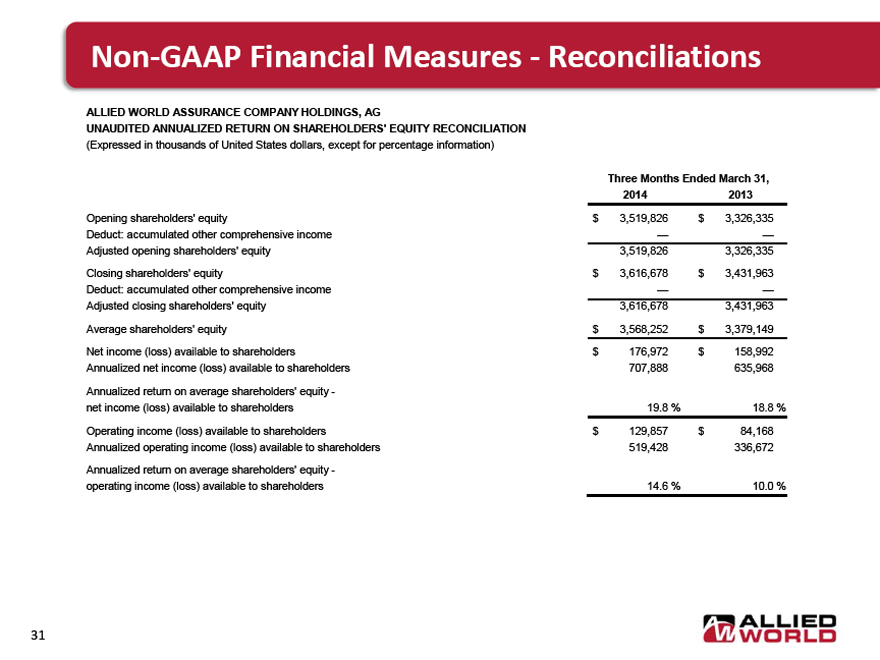

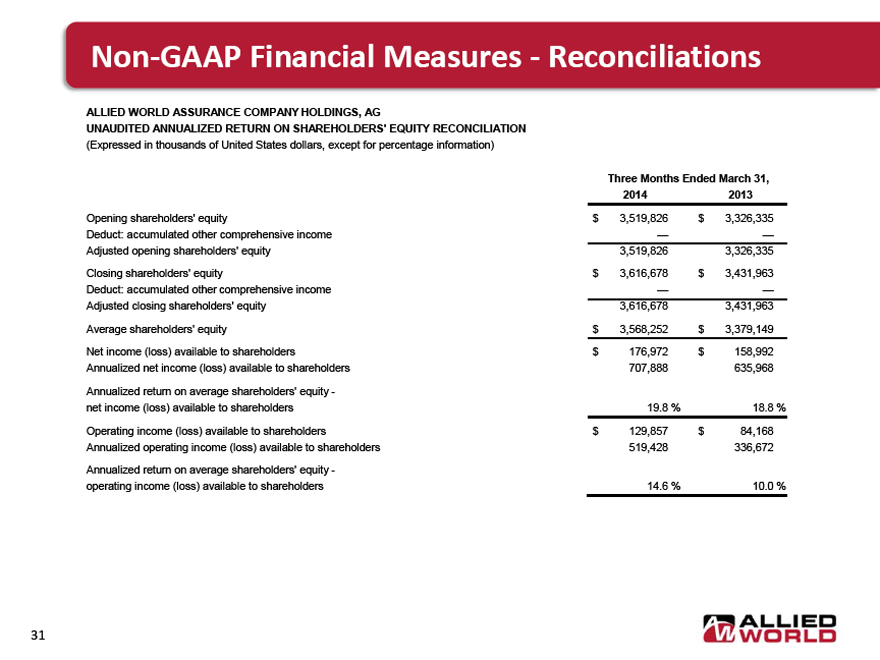

Non-GAAP Financial Measures - Reconciliations

ALLIED WORLD ASSURANCE COMPANY HOLDINGS, AG

UNAUDITED ANNUALIZED RETURN ON SHAREHOLDERS’ EQUITY RECONCILIATION

(Expressed in thousands of United States dollars, except for percentage information)

Three Months Ended March 31,

2014 2013

Opening shareholders’ equity $ 3,519,826 $ 3,326,335

Deduct: accumulated other comprehensive income - -

Adjusted opening shareholders’ equity 3,519,826 3,326,335

Closing shareholders’ equity $ 3,616,678 $ 3,431,963

Deduct: accumulated other comprehensive income - -

Adjusted closing shareholders’ equity 3,616,678 3,431,963

Average shareholders’ equity $ 3,568,252 $ 3,379,149

Net income (loss) available to shareholders $ 176,972 $ 158,992

Annualized net income (loss) available to shareholders 707,888 635,968

Annualized return on average shareholders’ equity - net income (loss) available to shareholders 19.8 % 18.8 %

Operating income (loss) available to shareholders $ 129,857 $ 84,168

Annualized operating income (loss) available to shareholders 519,428 336,672

Annualized return on average shareholders’ equity - operating income (loss) available to shareholders 14.6 % 10.0 %

31

ALLIED

WORLD

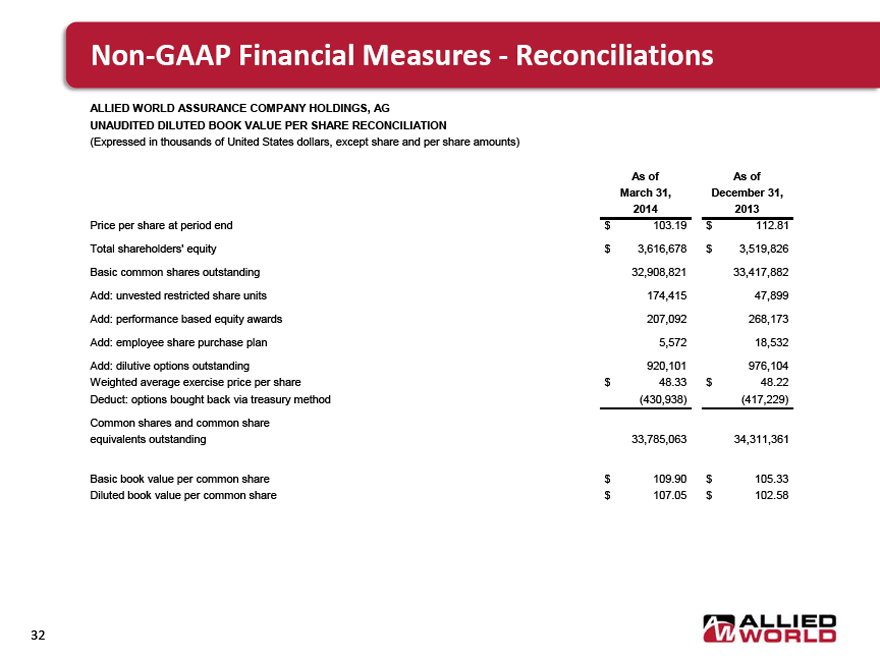

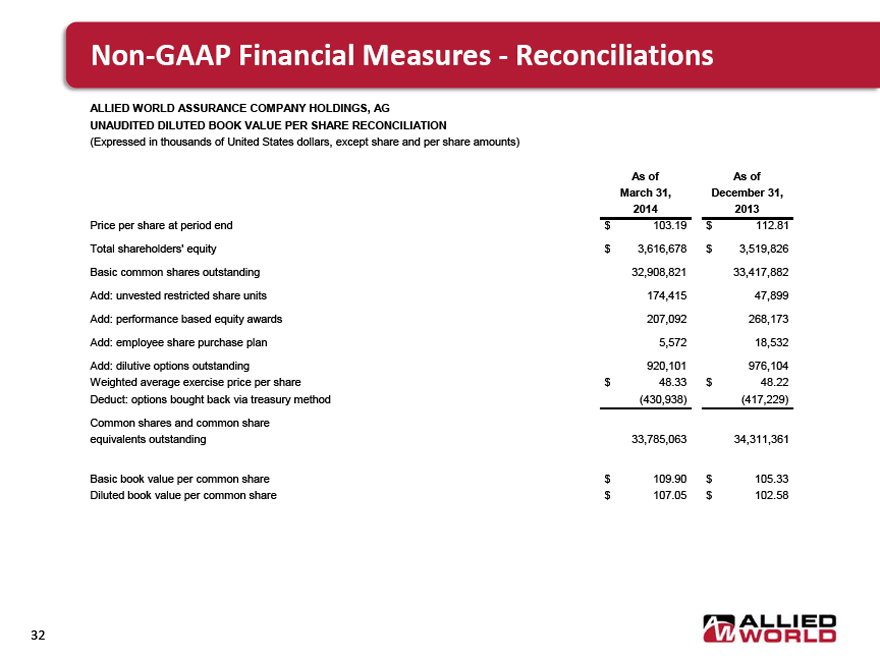

Non-GAAP Financial Measures - Reconciliations

ALLIED WORLD ASSURANCE COMPANY HOLDINGS, AG

UNAUDITED DILUTED BOOK VALUE PER SHARE RECONCILIATION

(Expressed in thousands of United States dollars, except share and per share amounts)

As of March 31, 2014 As of December 31, 2013

Price per share at period end $ 103.19 $ 112.81

Total shareholders’ equity $ 3,616,678 $ 3,519,826

Basic common shares outstanding 32,908,821 33,417,882

Add: unvested restricted share units 174,415 47,899

Add: performance based equity awards 207,092 268,173

Add: employee share purchase plan 5,572 18,532

Add: dilutive options outstanding 920,101 976,104

Weighted average exercise price per share $ 48.33 $ 48.22

Deduct: options bought back via treasury method (430,938) (417,229)

Common shares and common share equivalents outstanding 33,785,063 34,311,361

Basic book value per common share $ 109.90 $ 105.33

Diluted book value per common share $ 107.05 $ 102.58

32

ALLIED

WORLD