Exhibit 99.1

NORTHRIM BANCORP, INC.

NASDAQ: NRIM MAY 2014

FORWARD LOOKING STATEMENTS

This presentation may contain “forward-looking statements” as that term is defined for purposes of Section 21D of the Securities and Exchange Act. These statements are, in effect, management’s attempt to predict future events, and thus are subject to various risks and uncertainties. Readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. All statements, other than statements of historical fact, regarding our financial position, business strategy and management’s plans and objectives for future operations are forward-looking statements. When used in this report, the words “anticipate,” “believe,” “estimate,” “expect,” and “intend” and words or phrases of similar meaning, as they relate to Northrim and its management are intended to help identify forward-looking statements. Although we believe that management’s expectations as reflected in forward-looking statements are reasonable, we cannot assure readers that those expectations will prove to be correct. Forward looking statements are subject to various risks and uncertainties that may cause our actual results may differ materially and adversely from our expectations as indicated in the forward-looking statements. These risks and uncertainties include: our ability to maintain strong asset quality and to maintain or expand our market share or net interest margins; our ability to implement our marketing and growth strategies; our expected cost savings, synergies, and other financial benefits from the recently completed merger of Northrim with Alaska Pacific might not be realized within the expected time frames and costs or difficulties relating to integration matters might be greater than expected; and our ability to execute our business plan. Further, actual results may be affected by our ability to compete on price and other factors with other financial institutions; customer acceptance of new products and services; the regulatory environment in which we operate; and general trends in the local, regional and national banking industry and economy as those factors relate to our cost of funds and return on assets. In addition, there are risks inherent in the banking industry relating to collectability of loans and changes in interest rates. Many of these risks, as well as other risks that may have a material adverse impact on our operations and business, are identified in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, and from time to time are disclosed in our other filings with the SEC. However, you should be aware that these factors are not an exhaustive list, and you should not assume these are the only factors that may cause our actual results to differ from our expectations. These forward-looking statements are made only as of the date of this presentation, and Northrim does not undertake any obligation to release revisions to these forward-looking statements to reflect events or conditions after the date of this release.

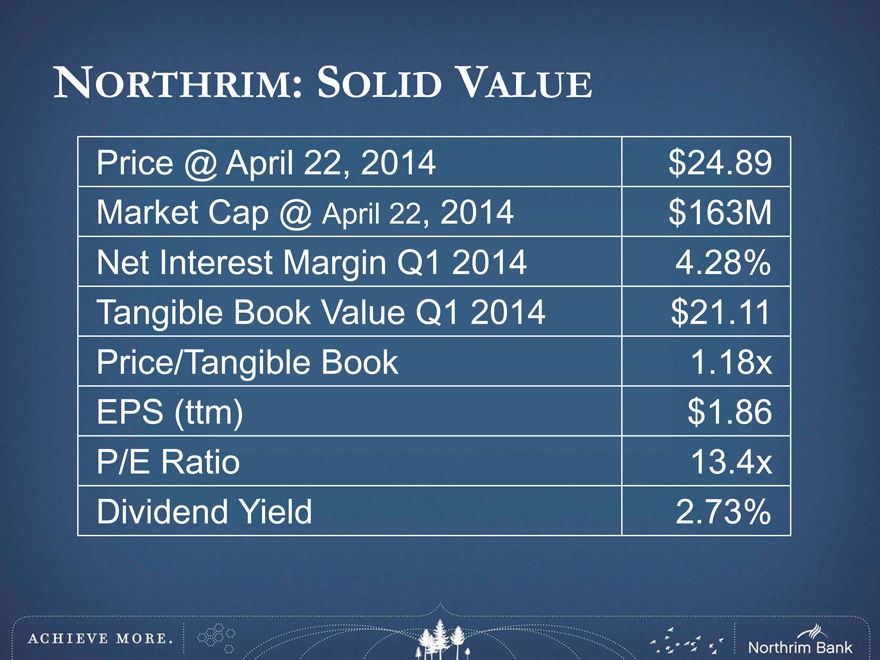

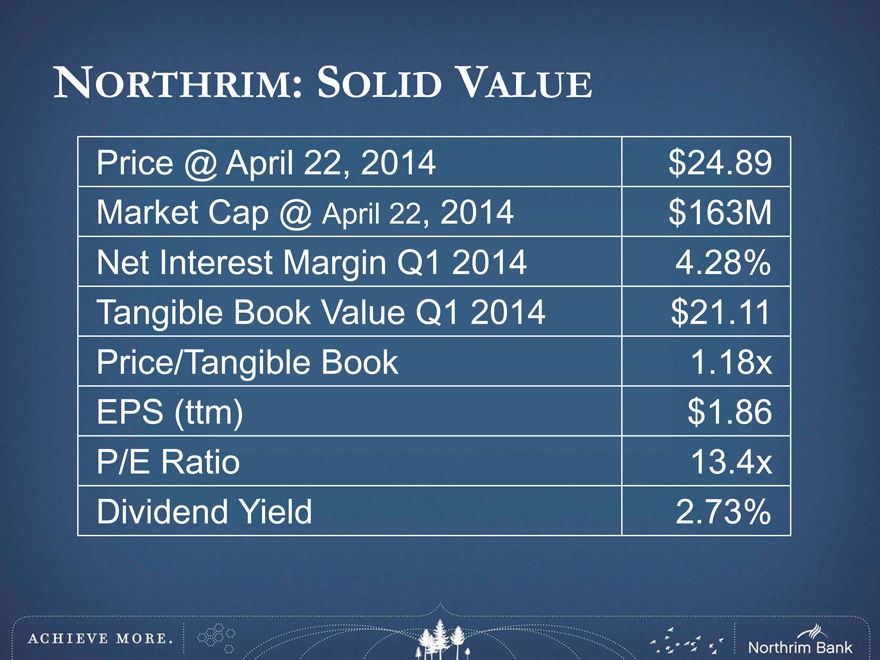

NORTHRIM: SOLID VALUE

Price @ April 22, 2014 $24.89

Market Cap @ April 22, 2014 $163M

Net Interest Margin Q1 2014 4.28%

Tangible Book Value Q1 2014 $21.11

Price/Tangible Book 1.18x

EPS (ttm) $1.86

P/E Ratio 13.4x

Dividend Yield 2.73%

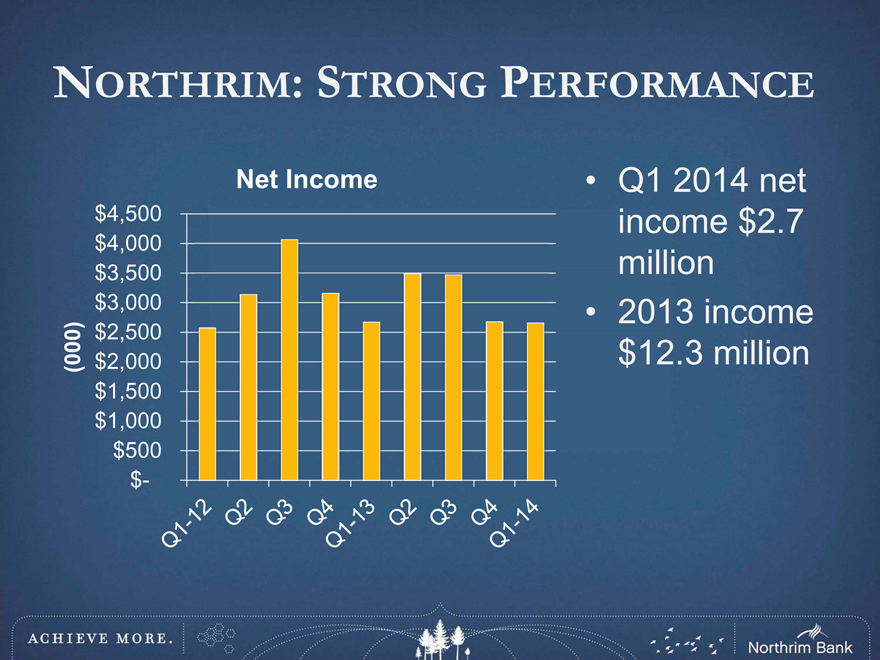

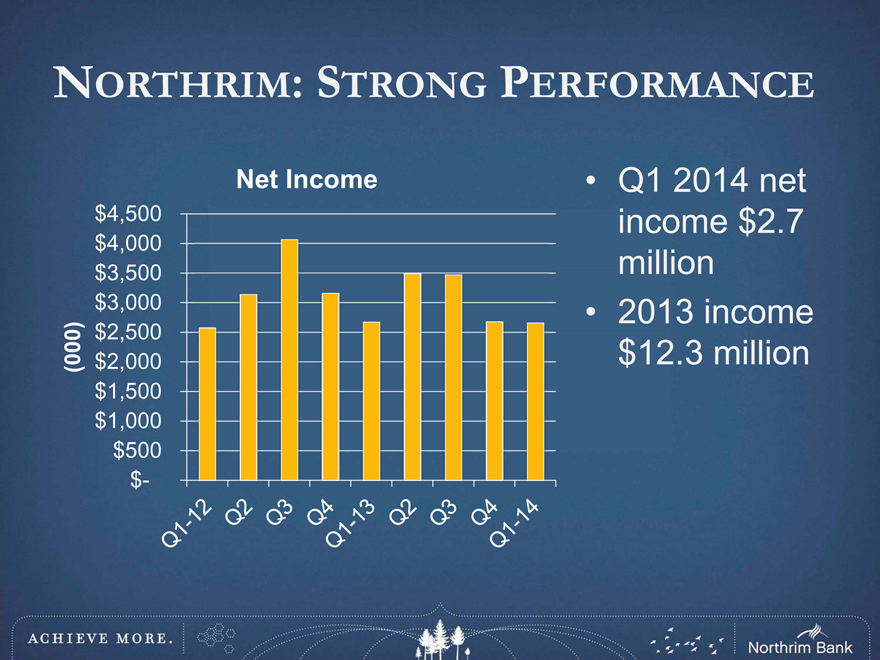

NORTHRIM: STRONG PERFORMANCE

Net Income

(000)

$4,500 $4,000 $3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $500 $-

Q1 2014 net income $2.7 million

2013 income

$12.3 million

Q1-12

Q2

Q3

Q4

Q1-13

Q2

Q3

Q4

Q1-14

NORTHRIM HISTORY

Opened for

business; Invested in Invested in Invested in Acquired Invested in Acquired

original startup of Elliott Cove Northrim Alaska Elliott Cove Alaska

offering Residential Capital Benefits First Bank Insurance Pacific

$8.2 million Mortgage Management Group & Trust Company Bank

1990 1995 1998 1999 2002 2004 2005 2006 2007 2008 2011 2013 2014

First Acquired Established Invested Total assets Affiliate

Alaska eight Northrim in Pacific crossed the Northrim

bank to Bank of Funding Wealth $1 billion Benefits

launch a America Services Advisors mark Group

website branches established

Enroll Alaska

STRATEGIES FOR SUCCESS

Northrim’s original strategies, and our execution, continue to serve us well today

Strong balance sheet

Solid net interest margin

Focus on asset quality

Diversified income sources

Strategic Investments

Leadership to build Alaska’s economy

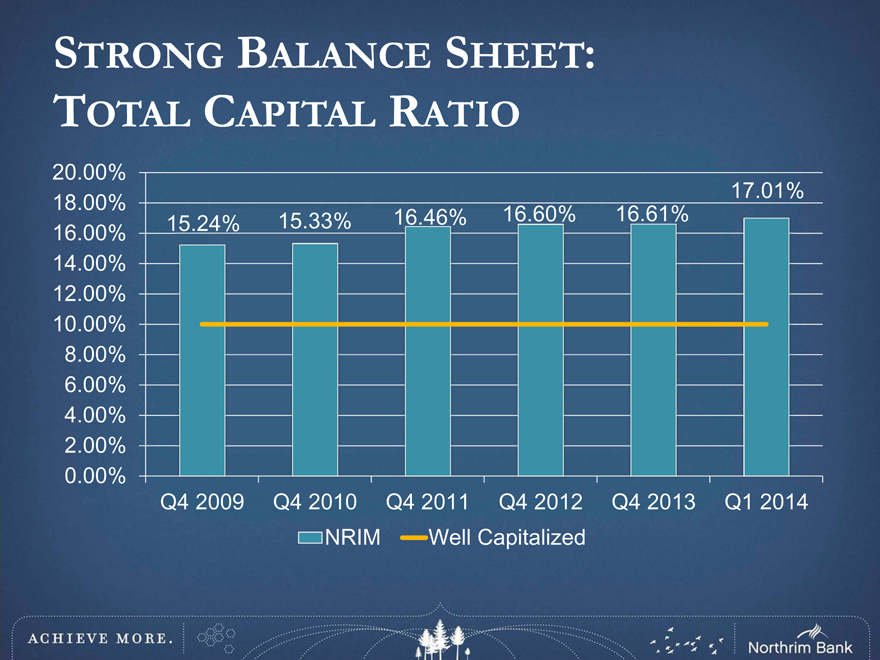

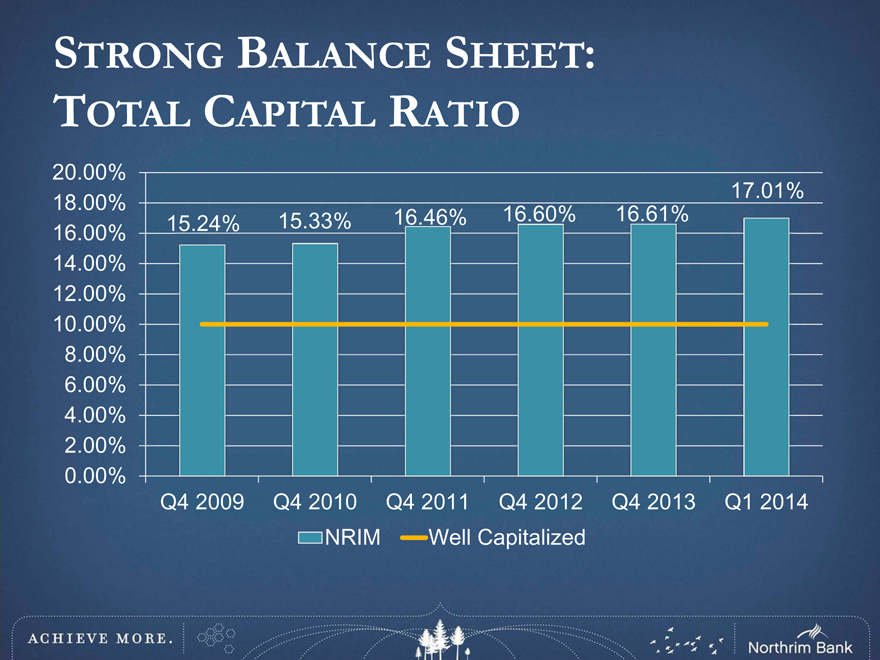

STRONG BALANCE SHEET: TOTAL CAPITAL RATIO

20.00%

17.01%

18.00%

15.24% 15.33% 16.46% 16.60% 16.61%

16.00%

14.00%

12.00%

10.00%

8.00%

6.00%

4.00%

2.00%

0.00%

Q4 2009 Q4 2010 Q4 2011 Q4 2012 Q4 2013 Q1 2014 NRIM Well Capitalized

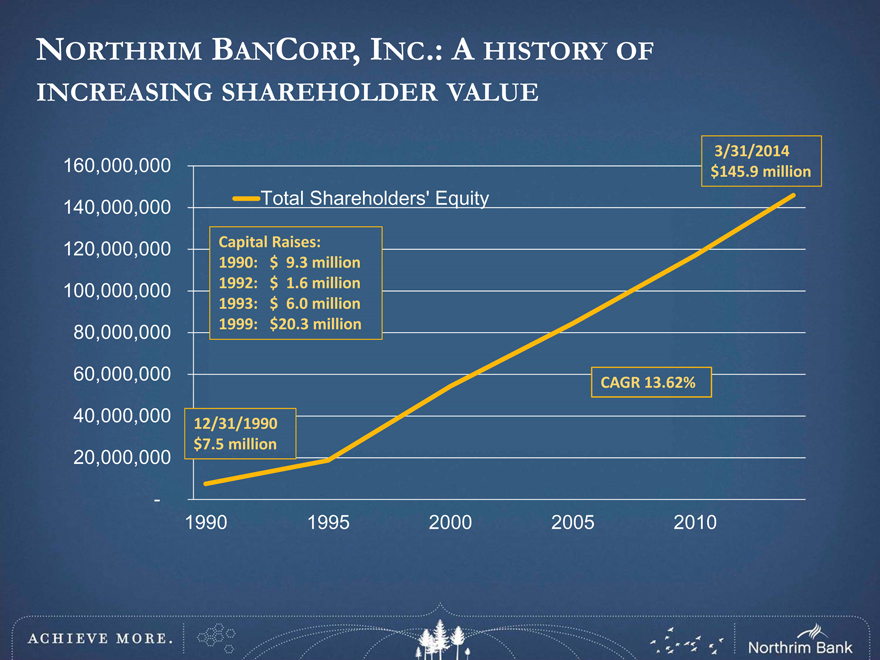

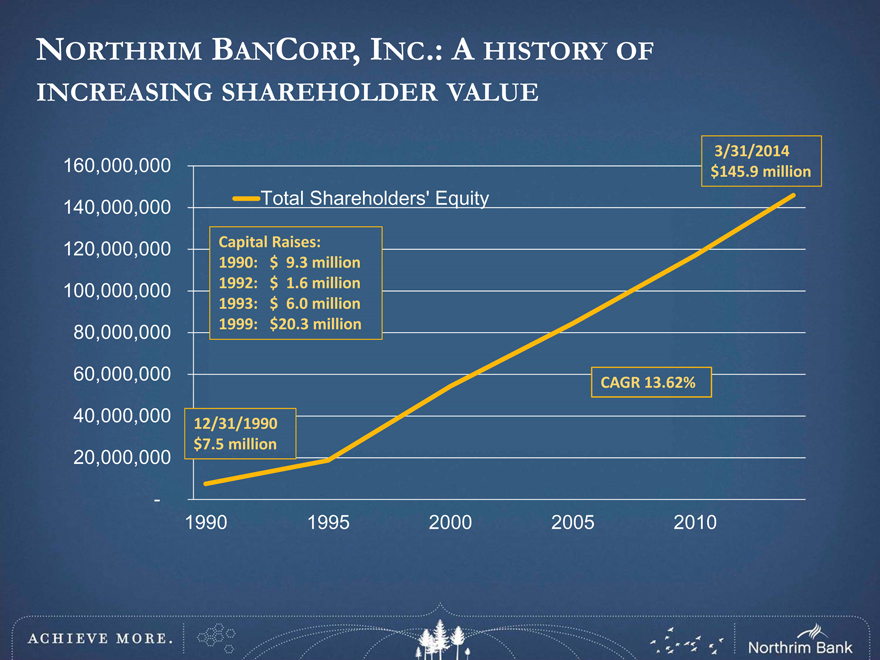

NORTHRIM BANCORP, INC.: A HISTORY OF INCREASING SHAREHOLDER VALUE

3/31/2014 160,000,000 $145.9 million

Total Shareholders’ Equity 140,000,000

120,000,000 Capital Raises: 1990: $ 9.3 million 100,000,000 1992: $ 1.6 million 1993: $ 6.0 million 80,000,000 1999: $20.3 million

60,000,000

CAGR 13.62%

40,000,000

12/31/1990

$7.5 million

20,000,000

-

1990 1995 2000 2005 2010

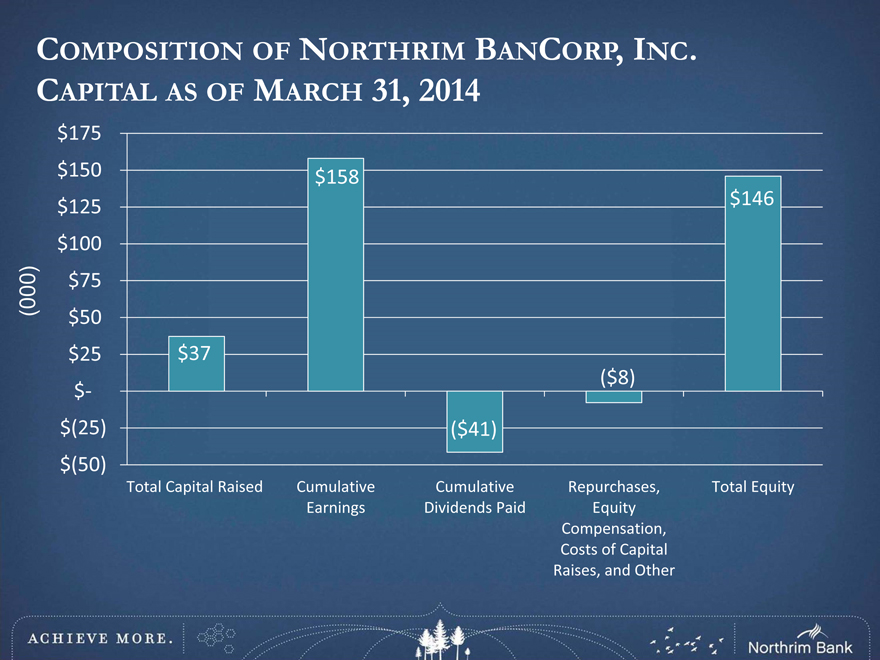

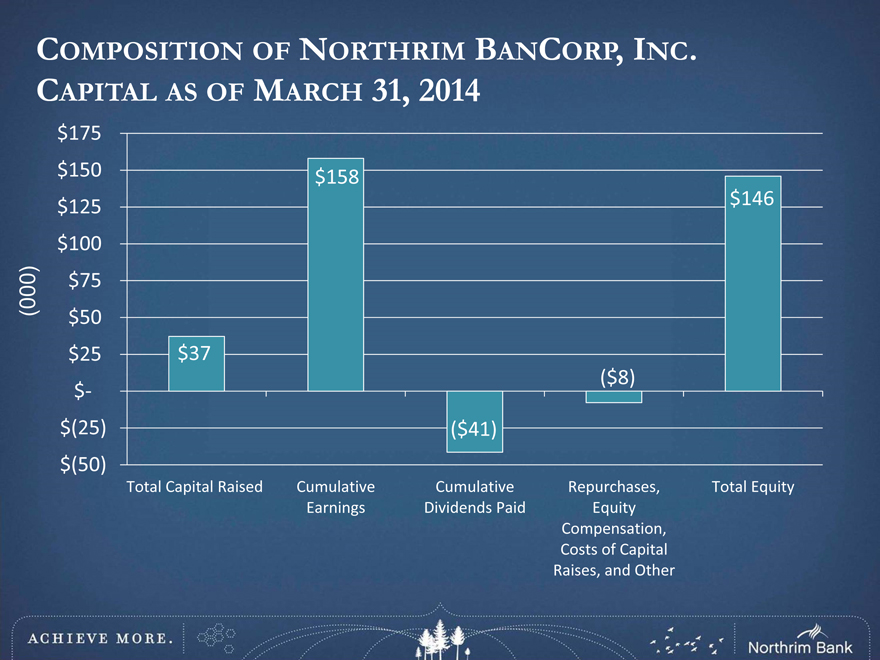

COMPOSITION OF NORTHRIM BANCORP, INC. CAPITAL AS OF MARCH 31, 2014

$175 $150 $158 $125 $146 $100

(000) $75 $50

$25 $37

($8) $- $(25) ($41) $(50)

Total Capital Raised Cumulative Cumulative Repurchases, Total Equity Earnings Dividends Paid Equity Compensation, Costs of Capital Raises, and Other

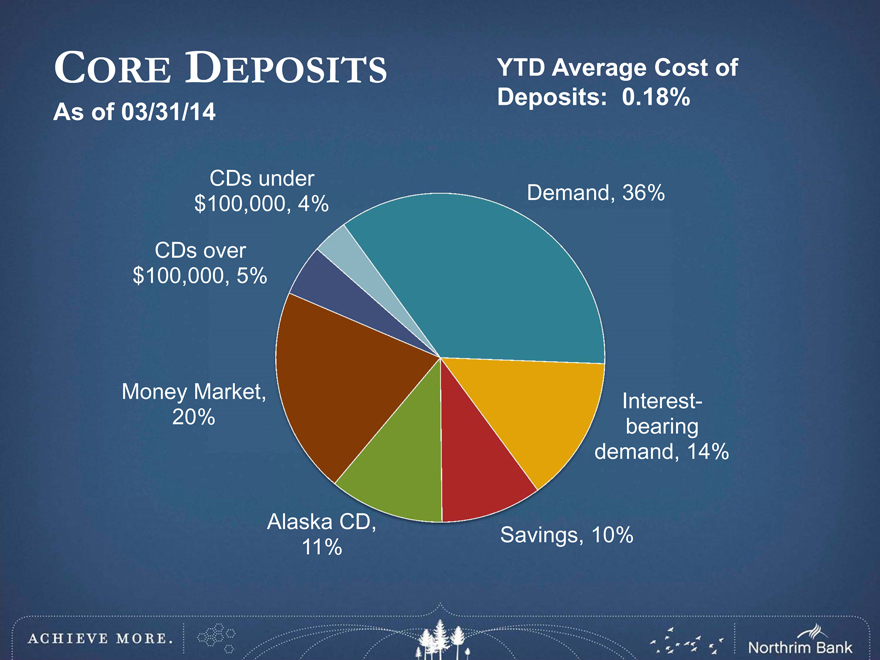

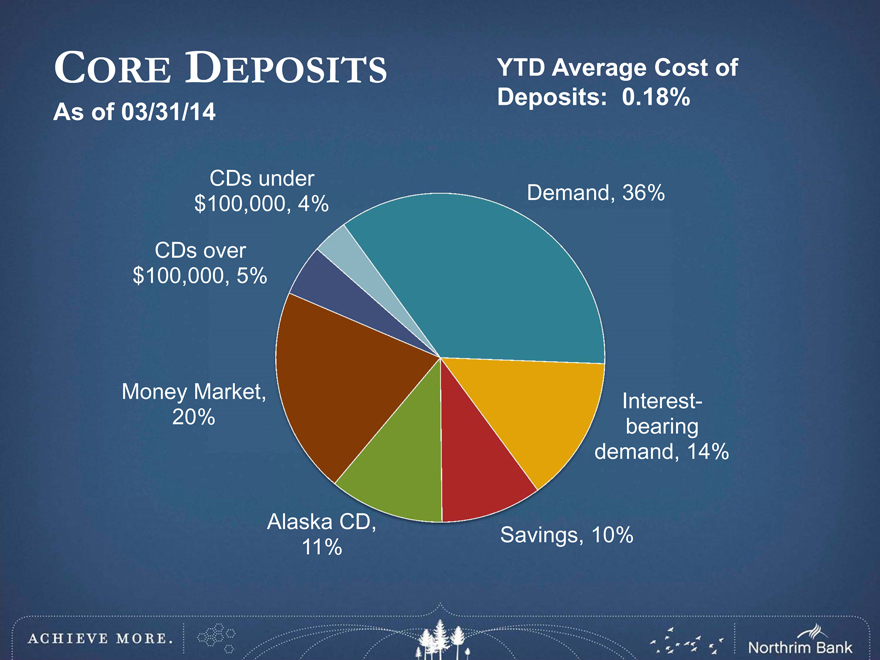

CORE DEPOSITS

As of 03/31/14

YTD Average Cost of Deposits: 0.18%

CDs under $100,000, 4%

CDs over $100,000, 5%

Money Market, 20%

Demand, 36%

Interest-bearing demand, 14%

Alaska CD,

Savings, 10% 11%

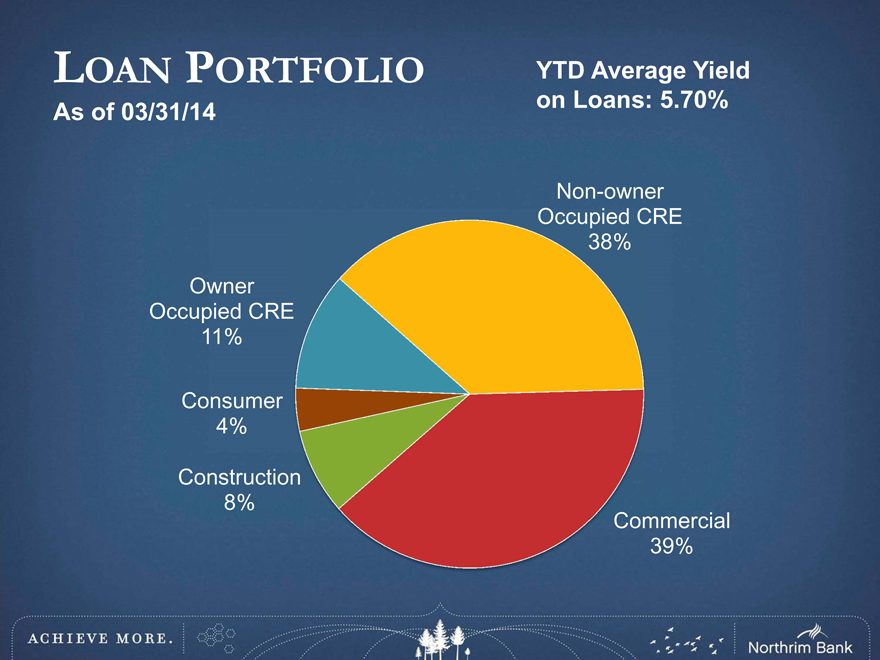

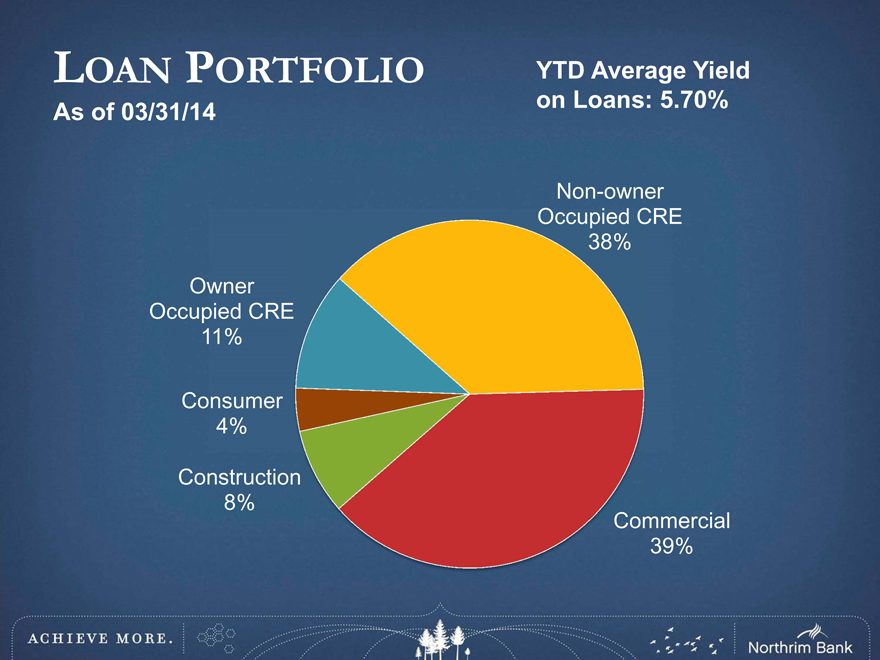

LOAN PORTFOLIO YTD Average Yield on Loans: 5.70% As of 03/31/14

Non-owner Occupied CRE

38% Owner Occupied CRE

11%

Consumer 4%

Construction 8%

Commercial 39%

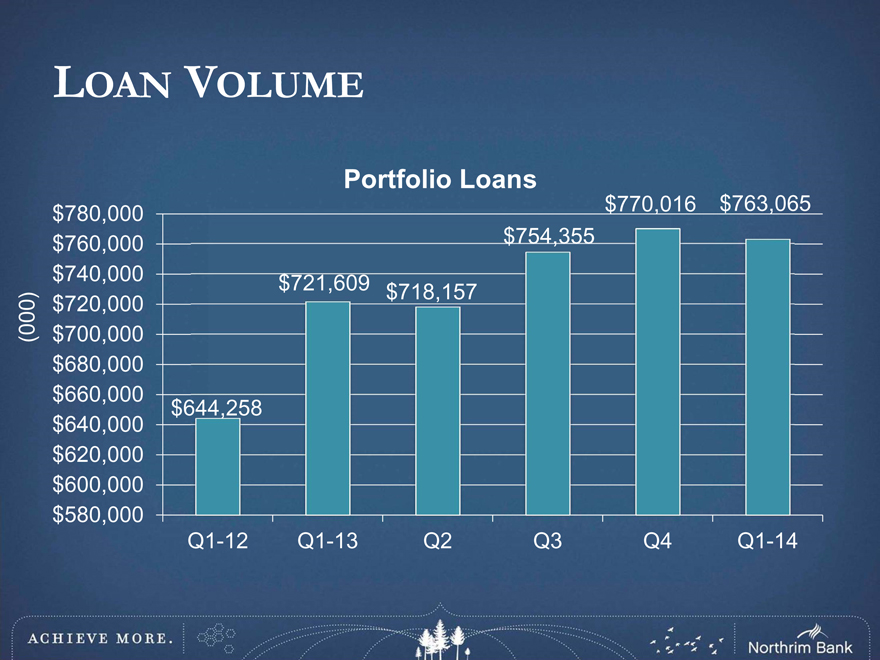

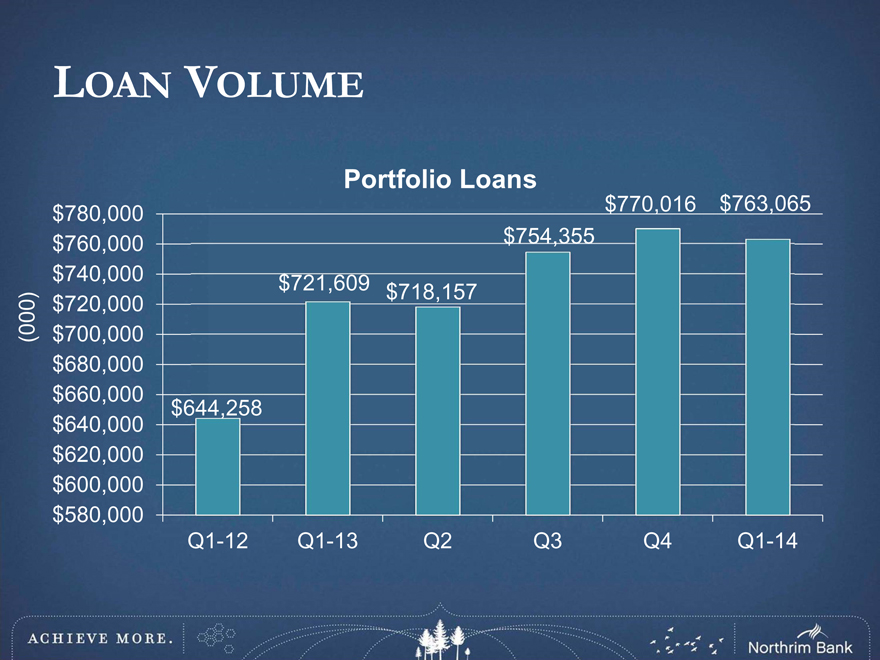

LOAN VOLUME

Portfolio Loans

$770,016 $763,065

$780,000

$760,000 $754,355

$740,000 $721,609

$718,157

$720,000

(000) $700,000

$680,000

$660,000

$644,258

$640,000

$620,000

$600,000

$580,000

Q1-12 Q1-13 Q2 Q3 Q4 Q1-14

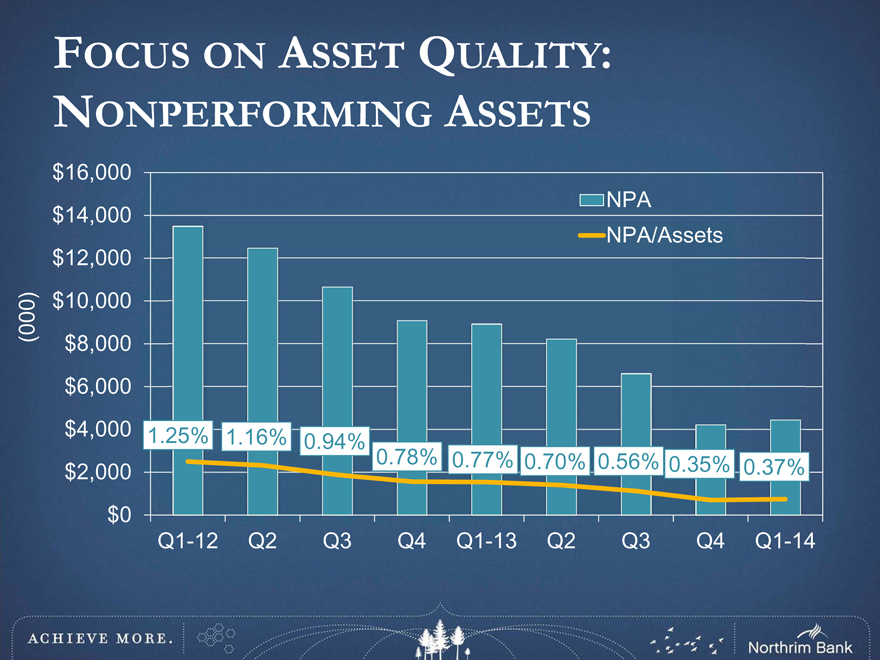

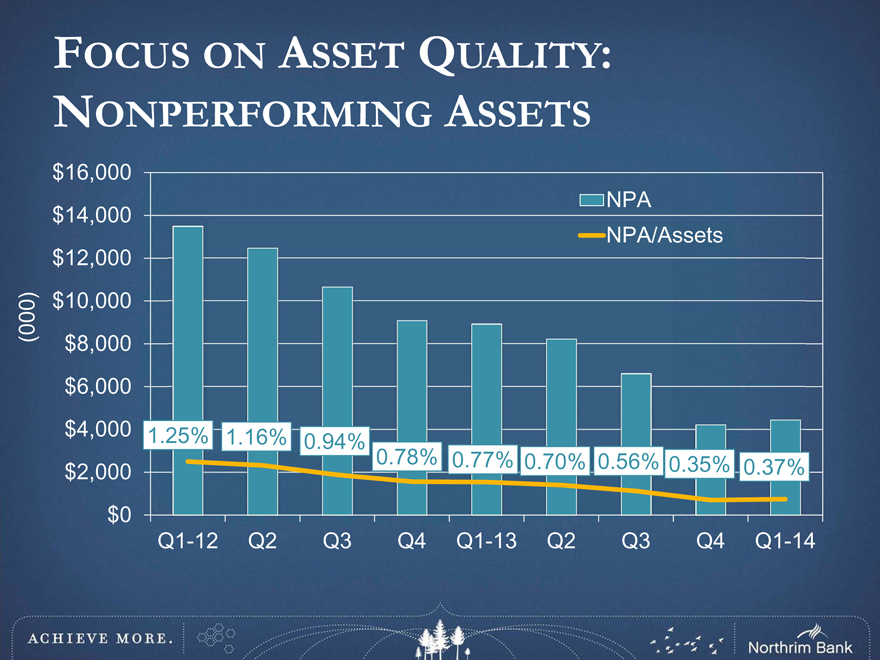

FOCUS ON ASSET QUALITY: NONPERFORMING ASSETS

$16,000 $14,000 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $0

(000)

1.25% 1.16% 0.94%

0.78% 0.77% 0.70% 0.56% 0.35%

0.37%

Q1-12 Q2 Q3 Q4 Q1-13 Q2 Q3 Q4 Q1-14

NPA NPA/Assets

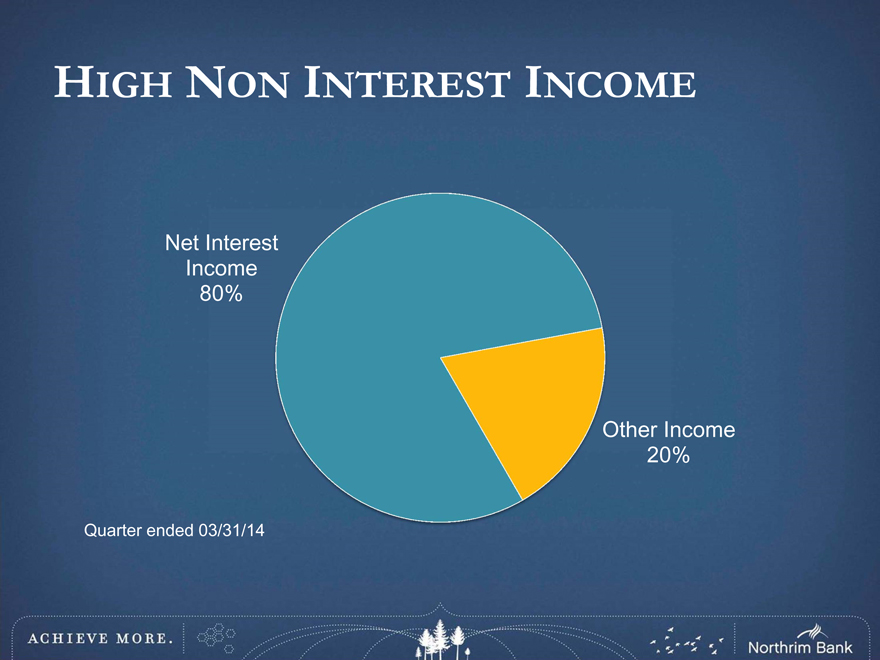

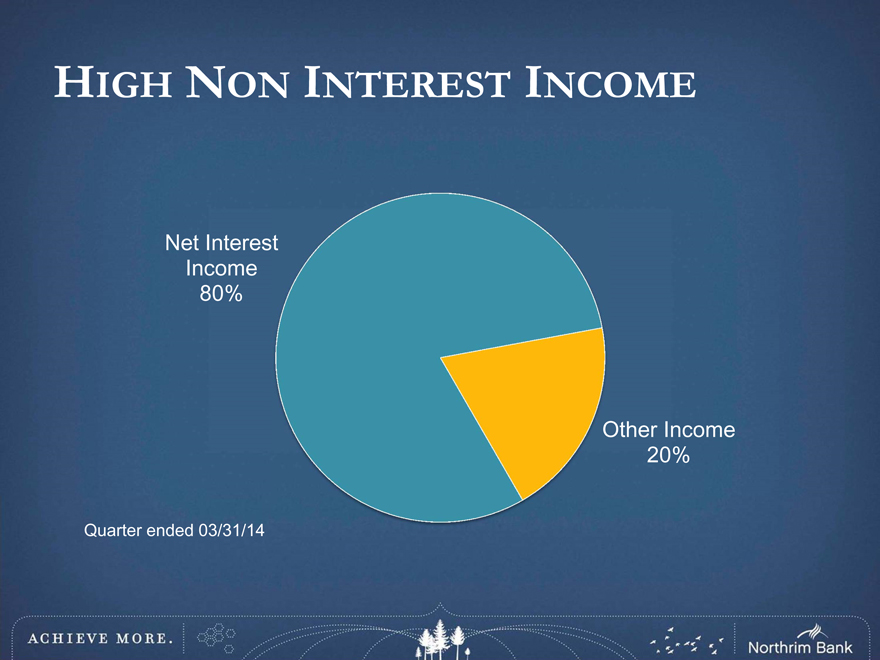

HIGH NON INTEREST INCOME

Net Interest

Income

80%

Other Income

20%

Quarter ended 03/31/14

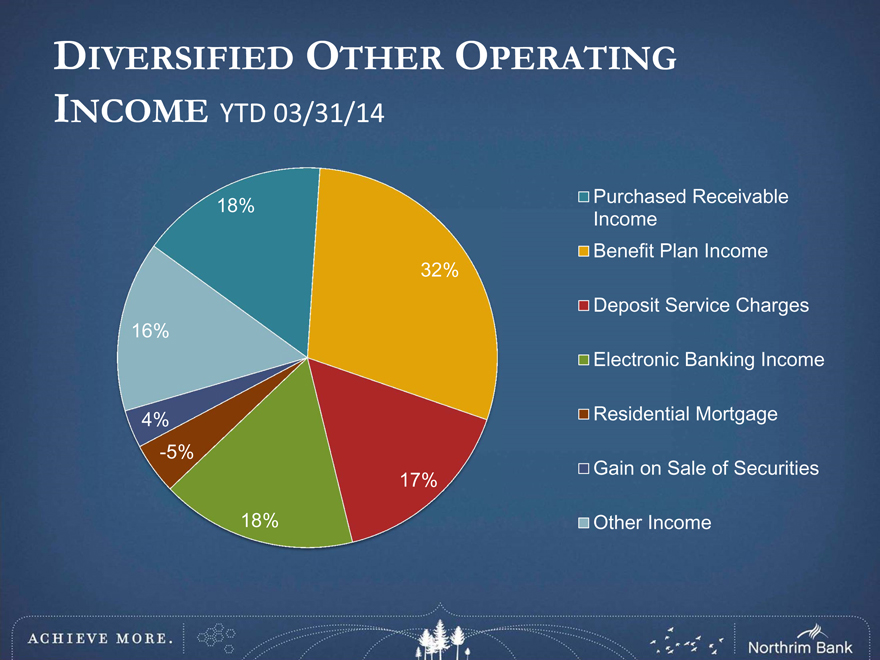

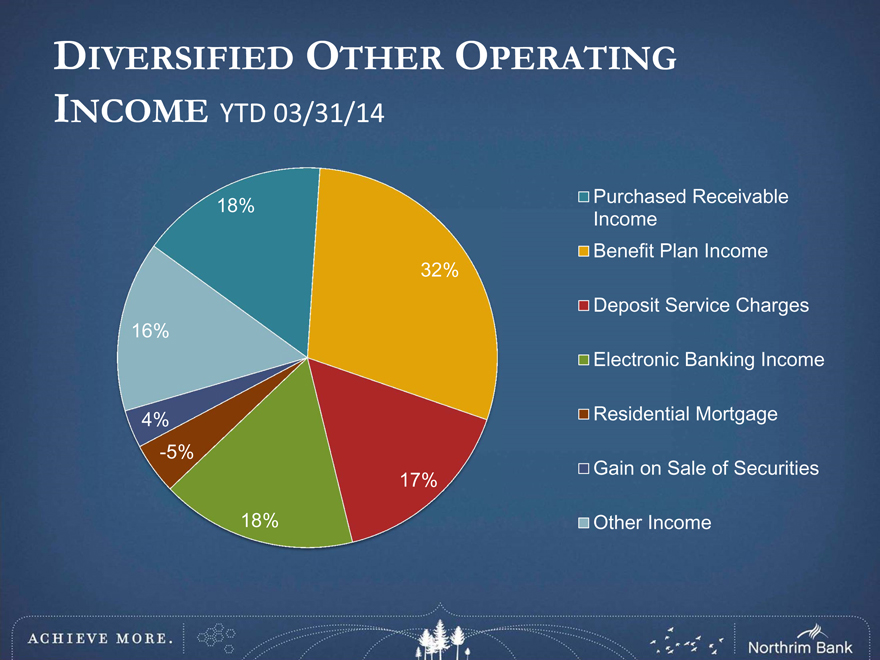

DIVERSIFIED OTHER OPERATING

INCOME YTD 03/31/14

18%

32%

16%

4%

-5%

17%

18%

Purchased Receivable Income Benefit Plan Income

Deposit Service Charges Electronic Banking Income Residential Mortgage Gain on Sale of Securities Other Income

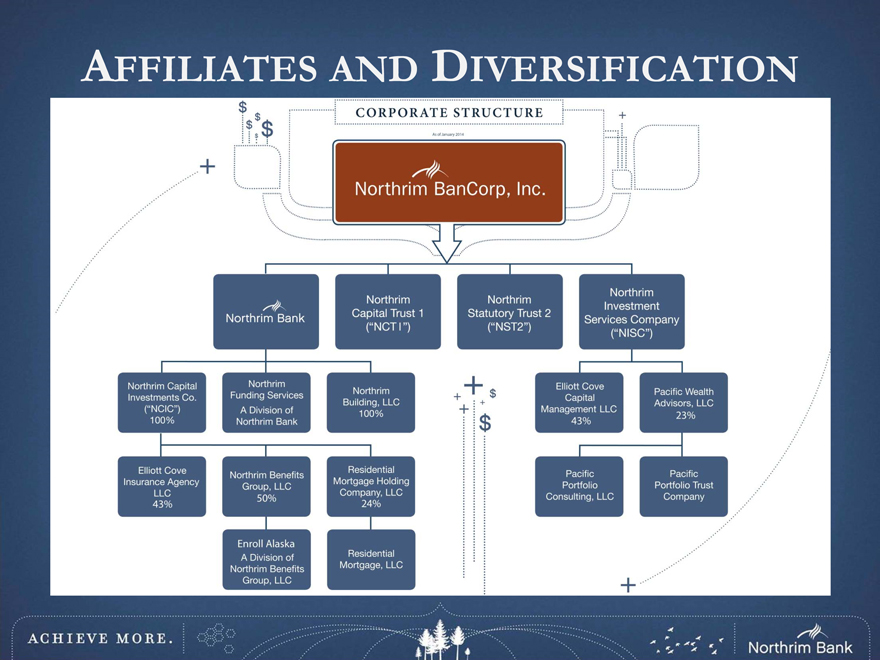

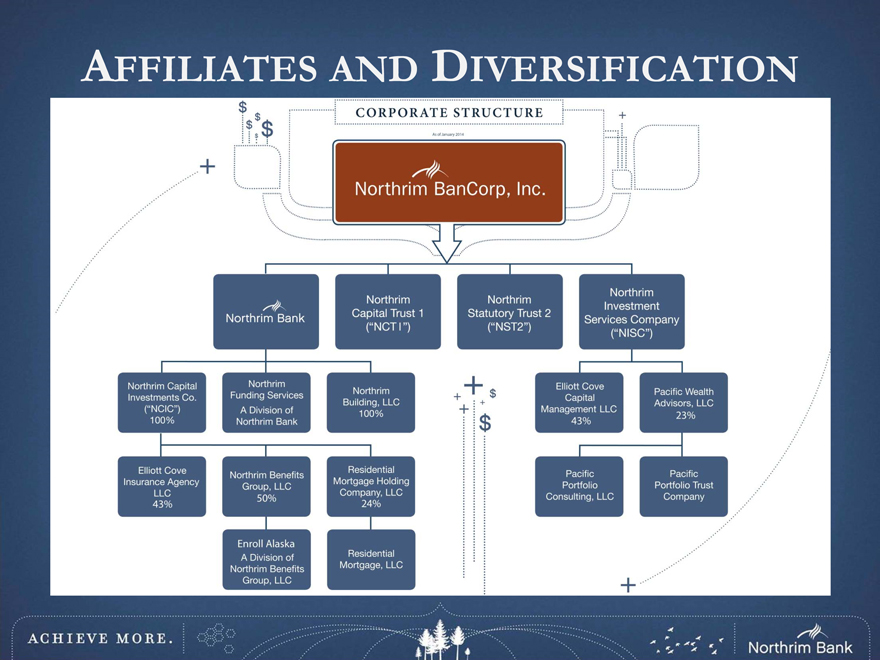

AFFILIATES AND DIVERSIFICATION

CORPORATE STRUCTURE

Northrim BanCorp, Inc.

Northrim Bank

Northim Capital Trust 1

(“NCTI”)

Northrim Statutory Trust 2 (“NST2”)

Northrim Investment Services Company (“NISC”)

Northrim Capital Investments Co. (“SNCIC”) 100%

Northrim Funding Services A Division of Northrim Bank

Northrim Building, LLC 100%

Elliott Cove Insurance Agency LLC 43%

Northrim Benefits Group, LLC 50%

Residential Mortgage Holding Company, LLC 24%

Enroll Alaska A Division of Northrim Benefits Group, LLC

Residential Mortgage, LLC

Elliott Cove Capital Management LLC 43%

Pacific Wealth Advisors, LLC 23%

Pacific Portfolio Consulting, LLC

Pacific Portfolio Trust Comapany

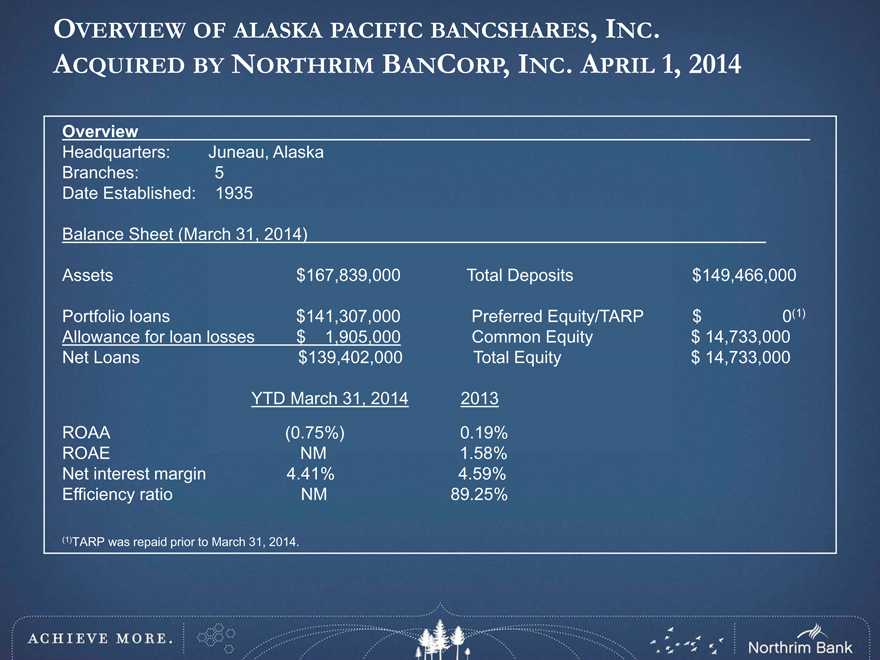

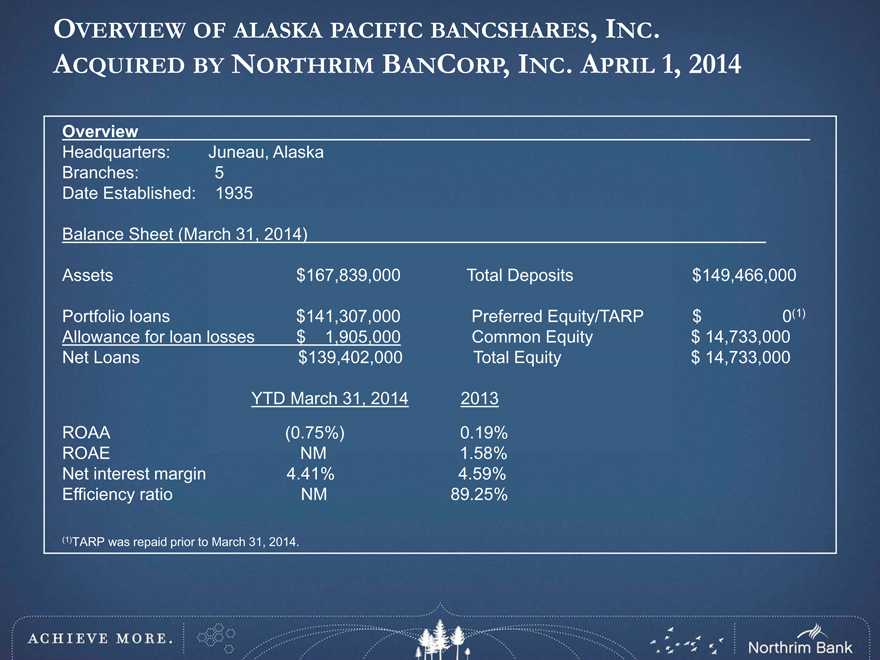

OVERVIEW OF ALASKA PACIFIC BANCSHARES, INC. ACQUIRED BY NORTHRIM BANCORP, INC. APRIL 1, 2014

Overview

Headquarters: Juneau, Alaska

Branches: 5

Date Established: 1935

Balance Sheet (March 31, 2014)

Assets $167,839,000 Total Deposits $ 149,466,000

Portfolio loans $141,307,000 Preferred Equity/TARP $ 0(1)

Allowance for loan losses $ 1,905,000 Common Equity $ 14,733,000

Net Loans $139,402,000 Total Equity $ 14,733,000

YTD March 31, 2014 2013

ROAA(0.75%) 0.19%

ROAE NM 1.58%

Net interest margin 4.41% 4.59%

Efficiency ratio NM 89.25%

(1) TARP was repaid prior to March 31, 2014.

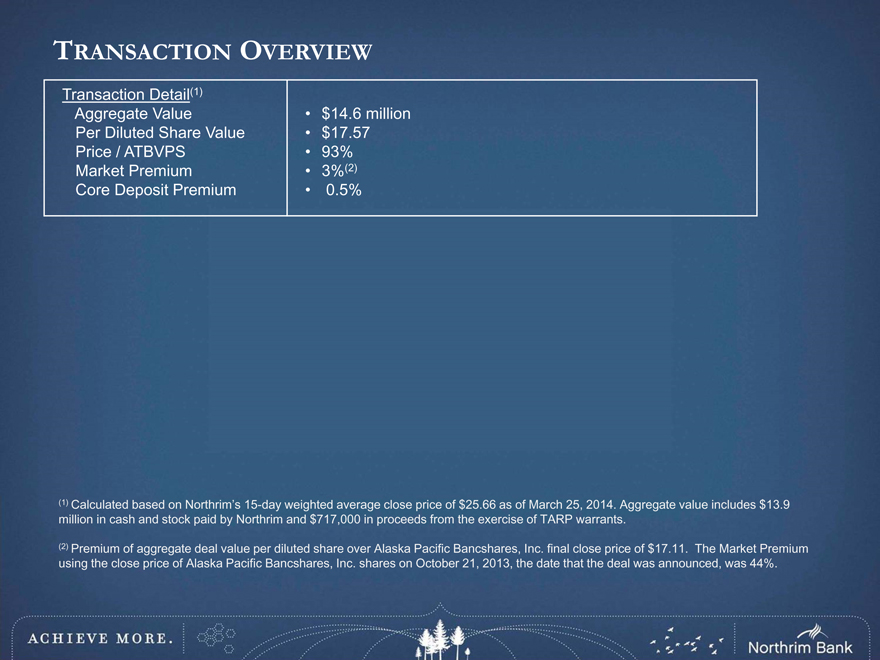

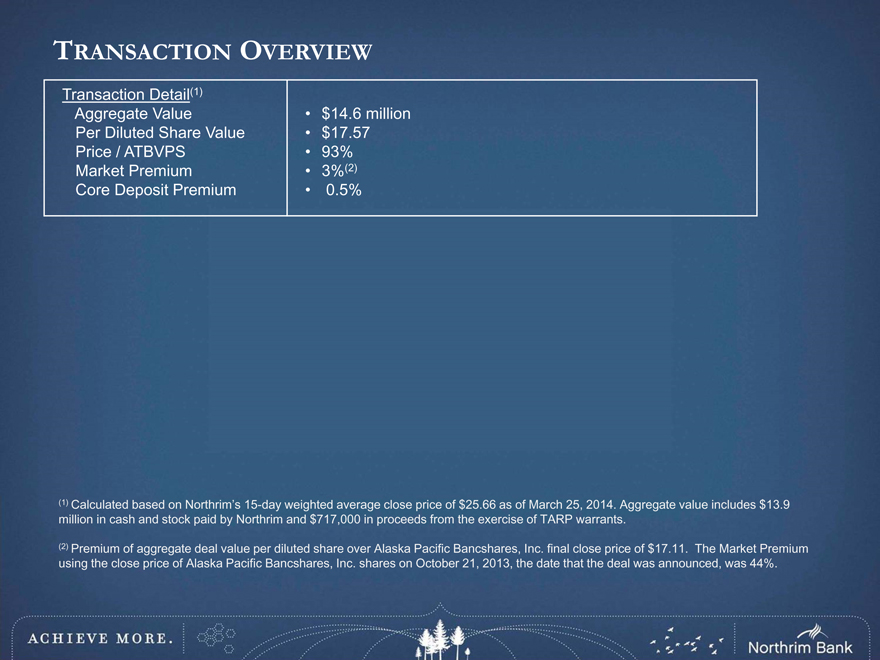

TRANSACTION OVERVIEW

Transaction Detail(1)

Aggregate Value • $ 14.6 million

Per Diluted Share Value • $ 17.57

Price / ATBVPS • 93%

Market Premium • 3%(2)

Core Deposit Premium • 0.5%

(1) Calculated based on Northrim’s 15-day weighted average close price of $25.66 as of March 25, 2014. Aggregate value includes $13.9 million in cash and stock paid by Northrim and $717,000 in proceeds from the exercise of TARP warrants.

(2) Premium of aggregate deal value per diluted share over Alaska Pacific Bancshares, Inc. final close price of $17.11. The Market Premium using the close price of Alaska Pacific Bancshares, Inc. shares on October 21, 2013, the date that the deal was announced, was 44%.

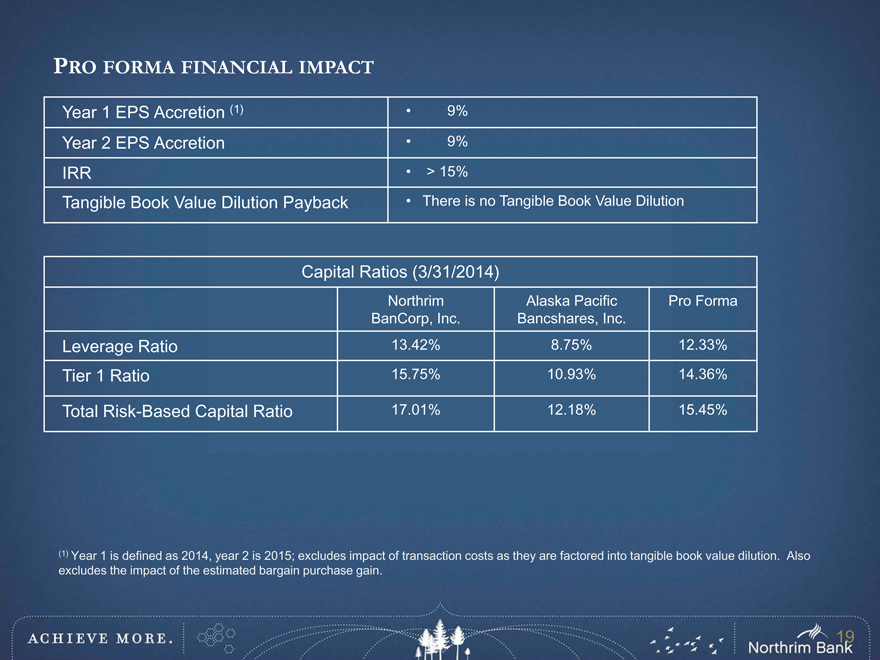

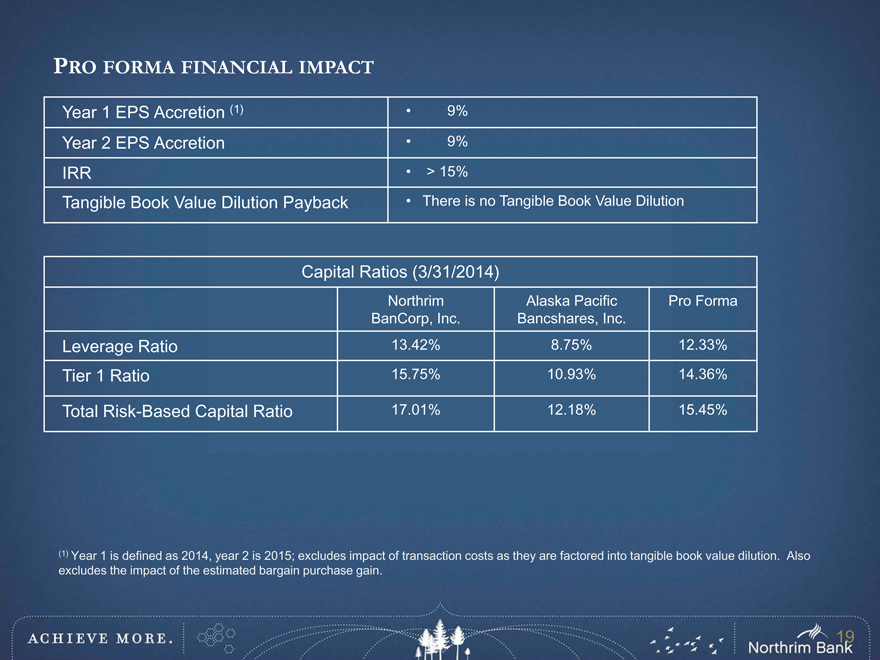

PRO FORMA FINANCIAL IMPACT

Year 1 EPS Accretion (1) •9%

Year 2 EPS Accretion •9%

IRR • > 15%

Tangible Book Value Dilution Payback • There is no Tangible Book Value Dilution

Capital Ratios (3/31/2014)

Northrim Alaska Pacific Pro Forma

BanCorp, Inc. Bancshares, Inc.

Leverage Ratio 13.42% 8.75% 12.33%

Tier 1 Ratio 15.75% 10.93% 14.36%

Total Risk-Based Capital Ratio 17.01% 12.18% 15.45%

(1) Year 1 is defined as 2014, year 2 is 2015; excludes impact of transaction costs as they are factored into tangible book value dilution. Also excludes the impact of the estimated bargain purchase gain.

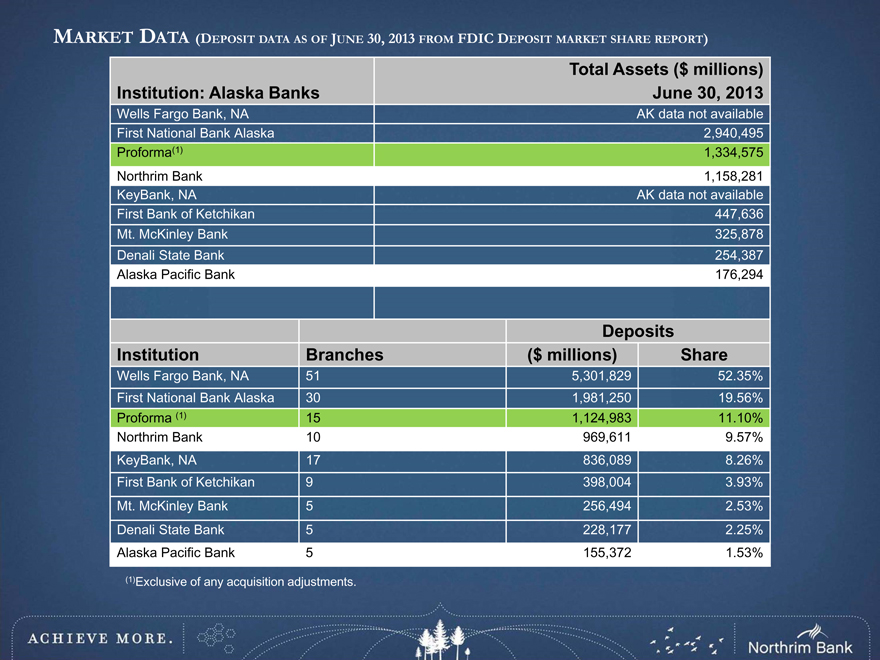

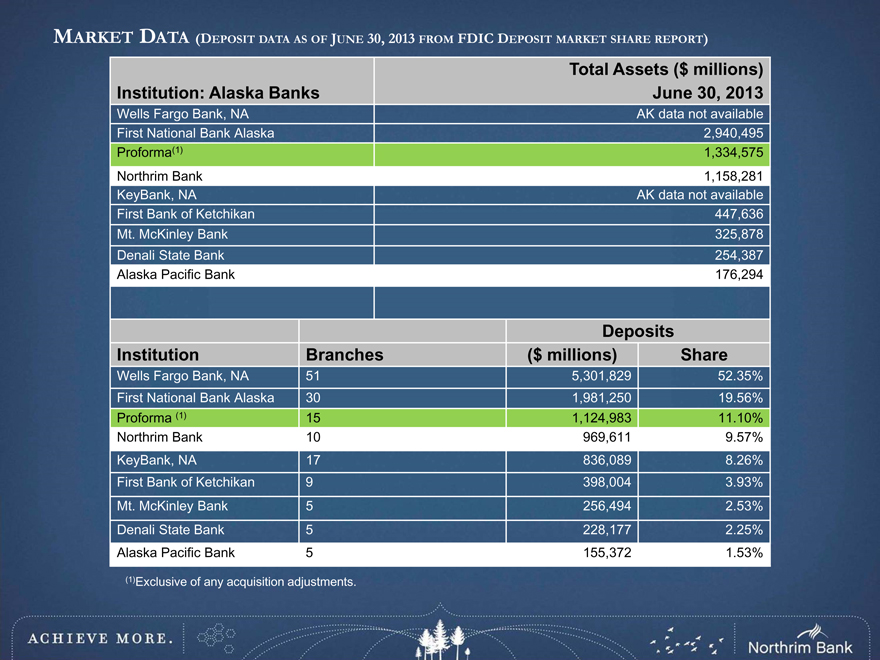

MARKET DATA (DEPOSIT DATA AS OF JUNE 30, 2013 FROM FDIC DEPOSIT MARKET SHARE REPORT)

Total Assets ($ millions)

Institution: Alaska Banks June 30, 2013

Wells Fargo Bank, NA AK data not available

First National Bank Alaska 2,940,495

Proforma(1) 1,334,575

Northrim Bank 1,158,281

KeyBank, NA AK data not available

First Bank of Ketchikan 447,636

Mt. McKinley Bank 325,878

Denali State Bank 254,387

Alaska Pacific Bank 176,294

Deposits

Institution Branches ($ millions) Share

Wells Fargo Bank, NA 51 5,301,829 52.35%

First National Bank Alaska 30 1,981,250 19.56%

Proforma (1) 15 1,124,983 11.10%

Northrim Bank 10 969,611 9.57%

KeyBank, NA 17 836,089 8.26%

First Bank of Ketchikan 9 398,004 3.93%

Mt. McKinley Bank 5 256,494 2.53%

Denali State Bank 5 228,177 2.25%

Alaska Pacific Bank 5 155,372 1.53%

(1)Exclusive of any acquisition adjustments.

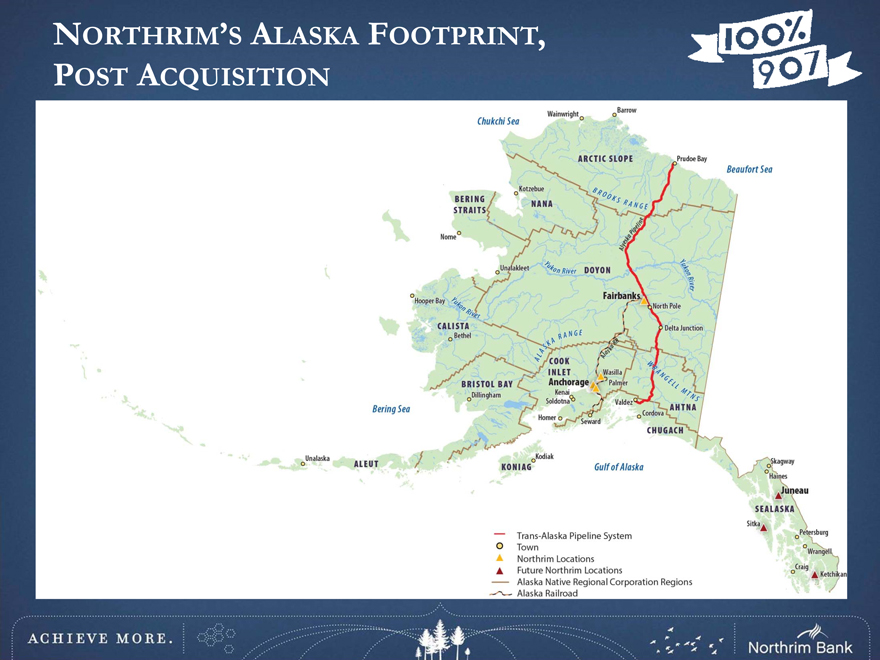

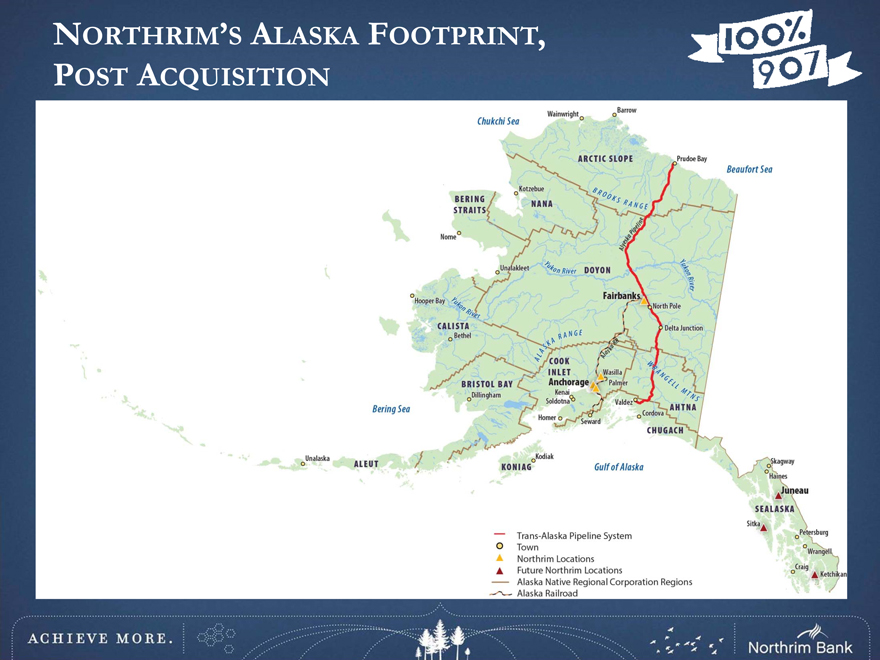

NORTHRIM’S ALASKA FOOTPRINT, POST ACQUISITION

100%

907

Trans-Alaska Pipeline System

Town

Northrim Locations

Future Northrim Locations

Alaska Native Regional Corporation Regions

Alaska Railroad

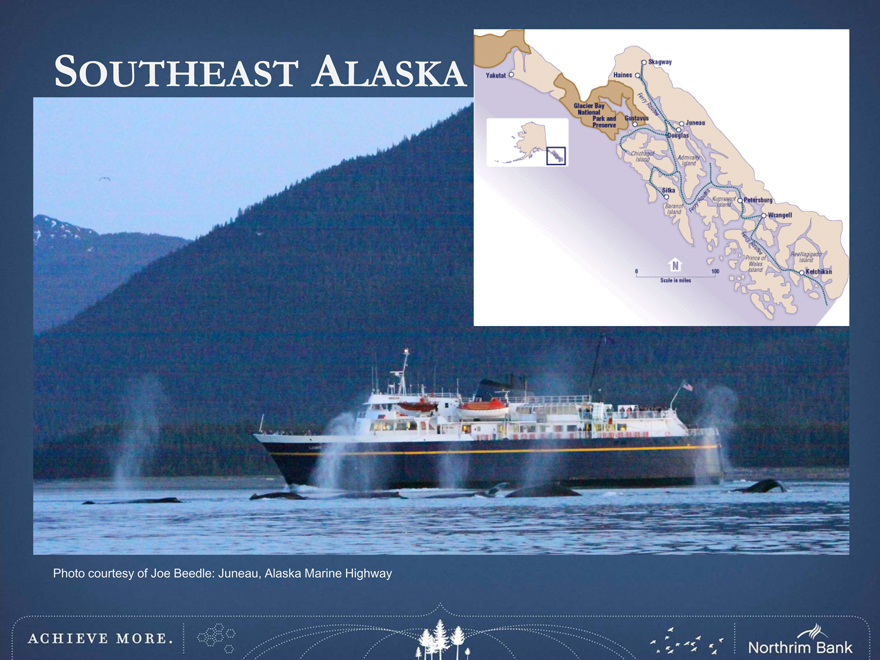

SOUTHEAST ALASKA

Photo courtesy of Joe Beedle: Juneau, Alaska Marine Highway

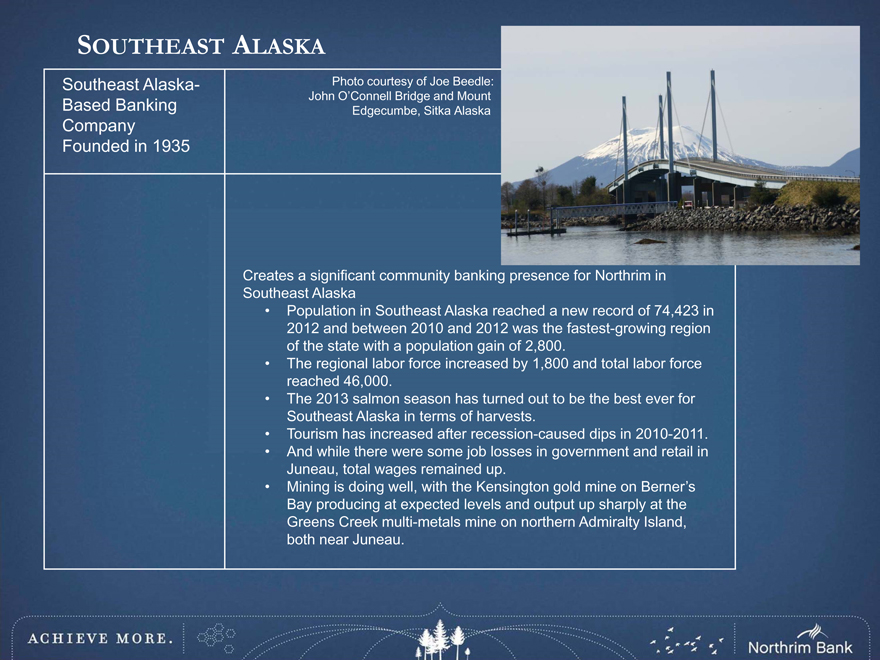

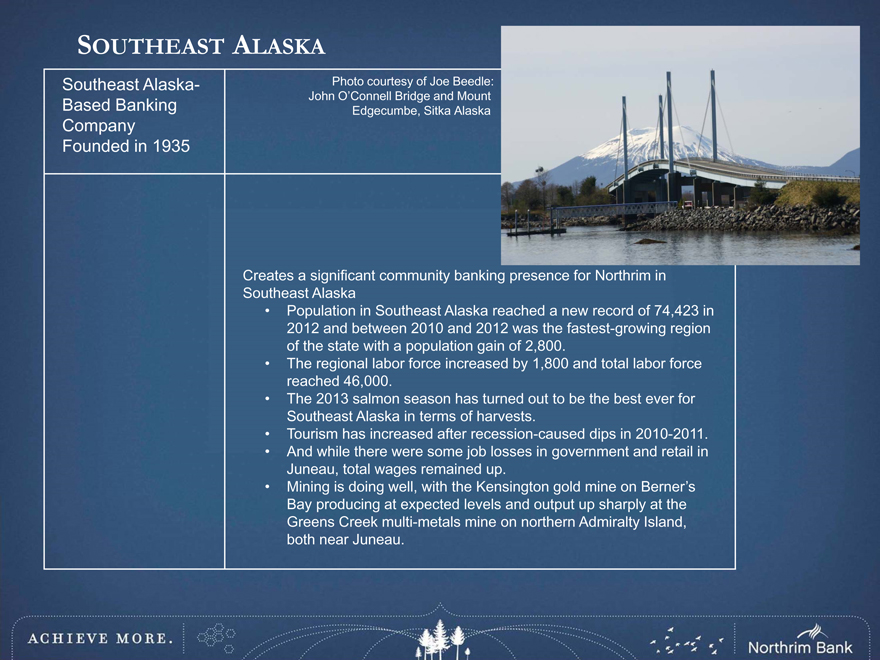

SOUTHEAST ALASKA

Southeast Alaska- Photo courtesy of Joe Beedle:

John O’Connell Bridge and Mount

Based Banking Edgecumbe, Sitka Alaska

Company

Founded in 1935

Population in Southeast Alaska reached a new record of 74,423 in 2012 and between 2010 and 2012 was the fastest-growing region of the state with a population gain of 2,800.

The regional labor force increased by 1,800 and total labor force reached 46,000.

The 2013 salmon season has turned out to be the best ever for Southeast Alaska in terms of harvests.

Tourism has increased after recession-caused dips in 2010-2011.

And while there were some job losses in government and retail in Juneau, total wages remained up.

Mining is doing well, with the Kensington gold mine on Berner’s Bay producing at expected levels and output up sharply at the Greens Creek multi-metals mine on northern Admiralty Island, both near Juneau.

Creates a significant community banking presence for Northrim in

Southeast Alaska

SOUTHEAST ALASKA

Financially Attractive

Opportunities for Additional Growth

Penetration into a diverse market

New product offerings and higher lending limits to existing Alaska Pacific customers

Affiliates opportunities

Opportunity for significant operational efficiencies and cost synergies

Accretive to earnings in year one(1)

No tangible book value dilution

Strong IRR (>15%)

(1) Excludes impact of transaction costs as they are factored into tangible book value dilution Photo courtesy of Joe Beedle

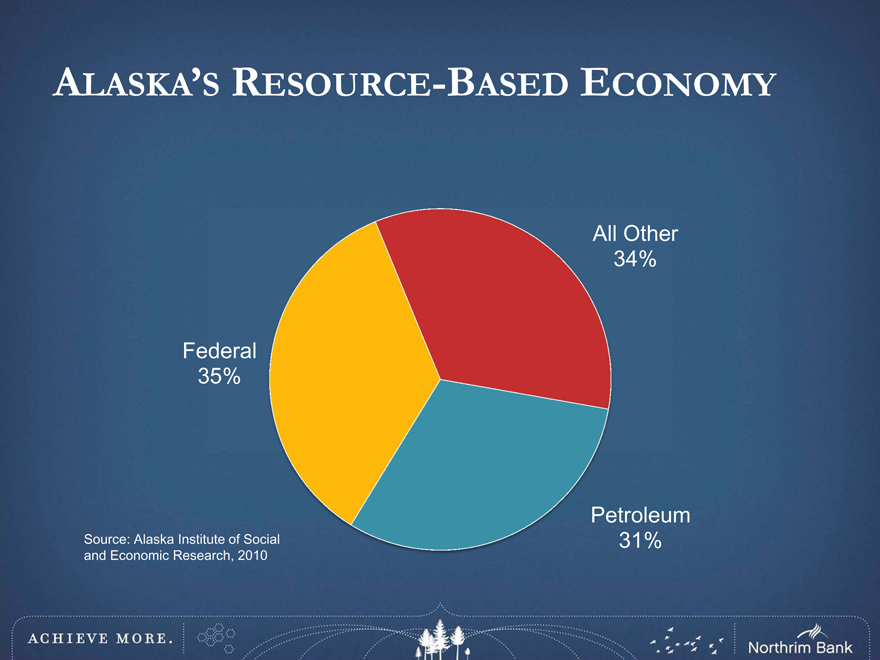

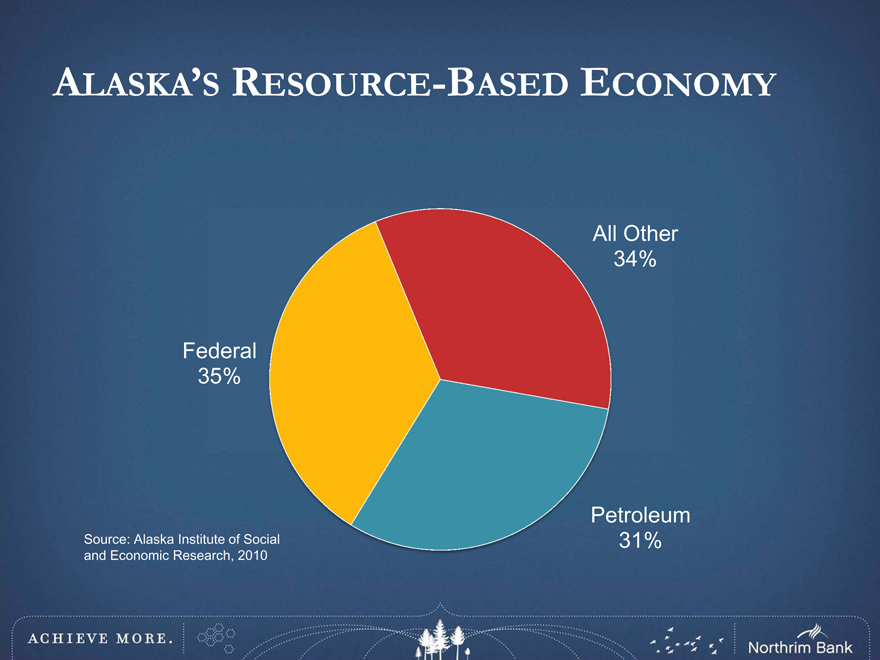

ALASKA’S RESOURCE-BASED ECONOMY

All Other 34%

Federal 35%

Petroleum

Source: Alaska Institute of Social 31%

and Economic Research, 2010

LEADERSHIP TO BUILD ALASKA’S

ECONOMY

Join the conversation at ALASKANOMICS.COM

Northrim’s Economic Overview Is Now Available

Northrim Bank

MISSION

TO BE ALASKA’S MOST TRUSTED FINANCIAL INSTITUTION

We are committed to adding value for our customers, communities, and shareholders.

VISION

TO BE ALASKA’S PREMIER BANK AND EMPLOYER OF CHOICE

We will be a leader in financial expertise, products and services, focused on continuous improvement and market growth.

VALUES

PROUD TO BE ALASKAN

We are Alaskan managed. We embody Alaska’s frontier spiril and values, and strongly support our communities.

SUPERIOR CUSTOMER FIRST SERVICE

We have a sincere appreciation for our customers. We want to build lasting customer relationships through professional, prompt, and caring service.

GROWTH

We look for growth opportunities for our customers, our institution and our employees. We strive to be better, personally and professionally.

INTEGRITY

We are trustworthy, reliable, and ethical, and provide our customers with secure, confidential services. We do what is right.

WE ARE

ENGAGED

We achieve more because we are dynamic, proactive, and innovative.

ACCOUNTABLE

We take personal responsibility. We do what we say we will do.

ALIGNED

We value alignment within teams and across departments. Together we are stronger.

QUESTIONS?