QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Willow Grove Bancorp, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

October 8, 2004

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Willow Grove Bancorp, Inc. The meeting will be held in the Fairway Room at North Hills Country Club located at 99 Station Avenue, North Hills, Pennsylvania, on Tuesday, November 9, 2004 at 11:00 a.m., Eastern Time.

At the annual meeting, you will be asked to elect three directors for three year terms and ratify the appointment of KPMG LLP as our independent auditors for the year ending June 30, 2005. Each of these matters is more fully described in the accompanying materials.

It is very important that you be represented at the annual meeting regardless of the number of shares you own or whether you are able to attend the meeting in person. We urge you to mark, sign, and date your proxy card today and return it in the envelope provided, even if you plan to attend the annual meeting. This will not prevent you from voting in person, but will ensure that your vote is counted if you are unable to attend.

Your continued support of and interest in Willow Grove Bancorp, Inc. is sincerely appreciated.

| | | Very truly yours, |

|

|

|

|

|

Frederick A. Marcell Jr.

President and Chief Executive Officer |

WILLOW GROVE BANCORP, INC.

Welsh & Norristown Roads

Maple Glen, Pennsylvania 19002

(215) 646-5405

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on November 9, 2004

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of Willow Grove Bancorp, Inc. will be held in the Fairway Room at North Hills Country Club located at 99 Station Avenue, North Hills, Pennsylvania, on Tuesday, November 9, 2004 at 11:00 a.m., Eastern Time, for the following purposes, all of which are more completely set forth in the accompanying Proxy Statement:

- (1)

- To elect three directors for a three-year term expiring in 2007 and until their successors are elected and qualified;

- (2)

- To ratify the appointment by the Board of Directors of KPMG LLP as our independent auditors for the fiscal year ending June 30, 2005; and

- (3)

- To transact such other business as may properly come before the meeting or at any adjournment thereof. We are not aware of any other such business.

Our stockholders of record as of September 24, 2004 are entitled to notice of and to vote at the annual meeting and at any adjournment of the annual meeting. Only those stockholders of record as of the close of business on that date will be entitled to vote at the annual meeting or at any such adjournment.

| | | BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

|

|

Christopher E. Bell

Corporate Secretary |

Maple Glen, Pennsylvania

October 8, 2004 |

|

|

You are cordially invited to attend the annual meeting. It is important that your shares be represented regardless of the number you own. Even if you plan to be present, you are urged to complete, sign, date and return the enclosed proxy promptly in the envelope provided. If you attend the annual meeting, you may vote either in person or by proxy. Any proxy given may be revoked by you in writing or in person at any time prior to the exercise of the proxy.

TABLE OF CONTENTS

| | Page

|

|---|

| About the Annual Meeting of Stockholders | | 1 |

Information with Respect to Nominees for Director, Continuing Directors and

Executive Officers | | 3 |

| | Election of Directors | | 3 |

| | Members of the Board of Directors Continuing in Office | | 4 |

| | Executive Officers Who Are Not Directors | | 5 |

| | Director Nominations | | 6 |

| | Committees and Meetings of the Board of Directors | | 6 |

| | Directors' Attendance at Annual Meetings | | 7 |

| | Directors' Compensation | | 7 |

| | Compensation Committee Interlocks and Insider Participation | | 7 |

| Management Compensation | | 8 |

| | Summary Compensation Table | | 8 |

| | Stock Options | | 9 |

| | Employment Agreements | | 9 |

| | Supplemental Executive Retirement Plan | | 10 |

| | Indebtedness of Management and Related Party Transactions | | 10 |

| Report of the Compensation Committee | | 11 |

| | Executive Salary Compensation | | 11 |

| | Executive Incentive Compensation | | 12 |

| | Deferred Compensation Plan | | 12 |

| Performance Graph | | 13 |

| Beneficial Ownership of Common Stock by Certain Beneficial Owners and Management | | 14 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 16 |

| Ratification of Appointment of Auditors | | 17 |

| | Audit Fees | | 17 |

| Report of the Audit Committee | | 18 |

| Stockholder Proposals, Nominations and Communications with the Board of Directors | | 18 |

| Annual Reports | | 19 |

| Other Matters | | 19 |

| Appendix A—Audit Committee Charter | | A-1 |

PROXY STATEMENT

OF

WILLOW GROVE BANCORP, INC.

ABOUT THE ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is furnished to holders of common stock of Willow Grove Bancorp, Inc., the parent holding company of Willow Grove Bank. Our Board of Directors is soliciting proxies to be used at the annual meeting of stockholders to be held in the Fairway Room at North Hills Country Club located at 99 Station Avenue, North Hills, Pennsylvania, on Tuesday, November 9, 2004 at 11:00 a.m., Eastern Time, and at any adjournment of the annual meeting for the purposes set forth in the Notice of Annual Meeting of Stockholders. This Proxy Statement is first being mailed to stockholders on or about October 8, 2004.

What is the purpose of the annual meeting?

At our annual meeting, stockholders will act upon the matters outlined in the notice of meeting, including the election of directors and ratification of our independent auditors. In addition, management will report on the performance of Willow Grove Bancorp and respond to questions from stockholders.

Who is entitled to vote?

Only our stockholders of record as of the close of business on the record date for the meeting, September 24, 2004, are entitled to vote at the meeting. On the record date, we had 9,780,933 shares of common stock, issued and outstanding and no other class of equity securities outstanding. For each issued and outstanding share of common stock you own on the record date, you will be entitled to one vote on each matter to be voted on at the meeting, in person or by proxy.

How do I submit my proxy?

After you have carefully read this proxy statement, indicate on your proxy form how you want your shares to be voted. Then sign, date and mail your proxy form in the enclosed prepaid return envelope as soon as possible. This will enable your shares to be represented and voted at the annual meeting.

If my shares are held in "street name" by my broker, could my broker automatically vote my shares for me?

Yes. Your broker may vote in his or her discretion on the election of directors and ratification of the auditors if you do not furnish instructions.

Can I attend the meeting and vote my shares in person?

Yes. All stockholders are invited to attend the annual meeting. Stockholders of record can vote in person at the annual meeting. If your shares are held in street name, then you are not the stockholder of record and you must ask your broker or other nominee how you can vote at the annual meeting.

1

Can I change my vote after I return my proxy card?

Yes. If you have not voted through your broker or other nominee, there are three ways you can change your vote or revoke your proxy after you have sent in your proxy form.

- •

- First, you may send a written notice to the Secretary of Willow Grove Bancorp, Mr. Christopher E. Bell, Corporate Secretary, Willow Grove Bancorp, Inc., Welsh & Norristown Roads, Maple Glen, Pennsylvania 19002, stating that you would like to revoke your proxy.

- •

- Second, you may complete and submit a new proxy form. Any earlier proxies will be revoked automatically.

- •

- Third, you may attend the annual meeting and vote in person. Any earlier proxy will be revoked. However, attending the annual meeting without voting in person will not revoke your proxy.

If you have instructed a broker or other nominee to vote your shares, you must follow directions you receive from your broker or other nominee to change your vote.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the record date will constitute a quorum. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of votes considered to be present at the meeting.

What are the Board of Directors' recommendations?

The recommendations of the Board of Directors are set forth under the description of each proposal in this proxy statement. In summary, the Board of Directors recommends that you voteFOR the nominees for director described herein andFOR ratification of the appointment of KPMG LLP for fiscal 2005.

The proxy solicited hereby, if properly signed and returned to us and not revoked prior to its use, will be voted in accordance with your instructions contained in the proxy. If no contrary instructions are given, each proxy signed and received will be voted in the manner recommended by the Board of Directors and, upon the transaction of such other business as may properly come before the meeting, in accordance with the best judgment of the persons appointed as proxies. Proxies solicited hereby may be exercised only at the annual meeting and any adjournment of the annual meeting and will not be used for any other meeting.

What vote is required to approve each item?

Directors are elected by a plurality of the votes cast with a quorum present. The three nominees for director who receive the greatest number of "for" votes will be elected directors. The affirmative vote of a majority of the total votes cast at the annual meeting is required for approval of the proposal to ratify the appointment of the independent auditors. Under the Pennsylvania Business Corporation Law, abstentions and broker non-votes do not constitute votes cast and will not affect the vote required for the election of directors or the proposal to ratify the appointment of the independent auditors. The proposals to elect directors and ratify the appointment of the independent auditors are considered "discretionary" items upon which brokerage firms may vote in their discretion on behalf of their clients if such clients have not furnished voting instructions.

2

INFORMATION WITH RESPECT TO NOMINEES FOR DIRECTOR,

CONTINUING DIRECTORS AND EXECUTIVE OFFICERS

Election of Directors

Our Articles of Incorporation provide that the Board of Directors shall be divided into three classes as nearly equal in number as possible. The directors are elected by our stockholders for staggered terms and until their successors are elected and qualified.

At the annual meeting, you will be asked to elect one class of directors, consisting of three directors, for a three-year term expiring in 2007 and until their successors are elected and qualified. Our Nominating and Corporate Governance Committee has recommended the nomination of Mr. Thomas J. Sukay to stand for election to the class of directors whose terms are expiring at this annual meeting. Mr. Sukay's name was submitted for consideration by the Chief Executive Officer, along with several other potential nominees. In addition, the Nominating and Corporate Governance Committee has recommended the re-election of Mr. Marcell and Mr. Weihenmayer as directors. No nominee for director is related to any other director or executive officer by blood, marriage or adoption. Stockholders are not permitted to use cumulative voting for the election of directors. Our Board of Directors has determined that Messrs. Hull, Kremp, Langan, O'Brien, Ramsey, Weihenmayer and Sukay and Ms. Loring are independent directors as defined in the Nasdaq listing standards.

Unless otherwise directed, each proxy signed and returned by a stockholder will be voted for the election of the nominees for director listed below. If any person named as a nominee should be unable or unwilling to stand for election at the time of the annual meeting, the proxies will nominate and vote for any replacement nominee or nominees recommended by our Board of Directors. At this time, the Board of Directors knows of no reason why any of the nominees listed below may not be able to serve as a director if elected.

The following tables present information concerning the nominees for director, and our continuing directors, all of whom also serve as directors of Willow Grove Bank. The indicated period of service as a director includes service as a director of Willow Grove Bank prior to the organization of Willow Grove Bancorp. Ages are reflected as of June 30, 2004.

Nominees for Director for Three-Year Terms Expiring in 2007

Name

| | Age

| | Position with Willow Grove Bancorp and

Principal Occupation During the Past Five Years

| | Director Since

|

|---|

Frederick A. Marcell Jr. |

|

66 |

|

Director, President and Chief Executive Officer. President and Chief Executive Officer of Willow Grove Bank since April 1992 and of Willow Grove Bancorp and its predecessor company, since December 1998. Director of the Federal Home Loan Bank of Pittsburgh, Pittsburgh, Pennsylvania since 2003. |

|

1992 |

William B. Weihenmayer |

|

57 |

|

Director. Independent real estate consultant, Huntingdon Valley, Pennsylvania, since March 1990; previously, a partner of The Linpro Company, a national real estate developer. |

|

1996 |

| | | | | | | |

3

Thomas J. Sukay |

|

50 |

|

Director. President and Chief Executive Officer of Sukay & Associates Inc., Collegeville, Pennsylvania, since 2004; formerly, Chief Financial Officer, Rosenbluth International Inc. a travel management company, Philadelphia, Pennsylvania, from August 2000 through September 2003; previously, Chief Financial Officer of Commerce Bancorp, Inc., Cherry Hill, New Jersey, from January 1999 through August 2000. |

|

2004 |

The Board of Directors recommends that you vote FOR election of the nominees for director.

Members of the Board of Directors Continuing in Office

Directors Whose Terms Expire in 2005

Name

| | Age

| | Position with Willow Grove Bancorp and

Principal Occupation During the Past Five Years

| | Director Since

|

|---|

William W. Langan |

|

63 |

|

Chairman of the Board. Retired since March 2001; previously, President and Owner of Marmetal Industries, Inc., a manufacturer of precision machined components and tooling for the marine, aerospace, utilities and related industries, Horsham, Pennsylvania. |

|

1986 |

A. Brent O'Brien |

|

66 |

|

Director. Former consultant to Bean, Mason & Eyer, Inc., an insurance broker firm in Doylestown, Pennsylvania, from 2000 to 2004; previously, President, Director and owner of Bean, Mason & Eyer, Inc. |

|

1996 |

Samuel H. Ramsey, III |

|

61 |

|

Director. Investment Advisor, Financial Network Investment Corporation, Bellevue, Washington since January 2004; previously, Investment Advisor, AXA Advisers, LLC, Bellevue, Washington from October 2000 to 2004 and owner of Samuel H. Ramsey, III, Certified Public Accountants from 1973 to 2002. |

|

1988 |

Directors Whose Terms Expire in 2006

Name

| | Age

| | Position with Willow Grove Bancorp and

Principal Occupation During the Past Five Years

| | Director Since

|

|---|

Lewis W. Hull |

|

87 |

|

Director. President, Chairman and controlling shareholder of HullVac Pump Corporation and Hull Freeze-dry Corporation since July 2002, a capital equipment manufacturer for industries including food, pharmaceuticals, telecommunications and plastics, Warminster, Pennsylvania; previously, Chairman of Hull Corp., Warminster, Pennsylvania. |

|

1973 |

| | | | | | | |

4

Charles F. Kremp, 3rd |

|

61 |

|

Director. Owner of Kremp Florist, Willow Grove, Pennsylvania. |

|

1994 |

Rosemary C. Loring, Esq. |

|

54 |

|

Director and, since November 2003, Vice Chair of the Board. President of the Remedy Intelligent Staffing franchise in Bucks and Montgomery Counties, Pennsylvania since 1996; previously, Regional Vice President-Consumer Banking for First Union National Bank. |

|

2000 |

Executive Officers Who Are Not Directors

Set forth below is the information with respect to the principal occupations during the last five years for the four executive officers of Willow Grove Bancorp and Willow Grove Bank who do not serve as directors. Ages are reflected as of June 30, 2004.

Name

| | Age

| | Principal Occupation During the Past Five Years

|

|---|

Joseph M. Matisoff |

|

58 |

|

Executive Vice President and Chief Operating Officer of Willow Grove Bancorp and Willow Grove Bank since July 2002; prior thereto, Senior Consultant with Ardmore Banking Advisors, Ardmore, Pennsylvania, from September 2001 to June 2002; President and Chief Executive Officer of Crusader Bank, Philadelphia, Pennsylvania, from August 2000 to September 2001; Senior Vice President and Chief Credit Officer of Cross Country Bank, Wilmington, Delaware, from February 1998 to August 2000. |

Christopher E. Bell |

|

46 |

|

Senior Vice President, Chief Financial Officer and Corporate Secretary of Willow Grove Bancorp since February 2002 and Senior Vice President and Chief Financial Officer of Willow Grove Bank since July 2000; previously, Senior Vice President and Chief Financial Officer of Willow Grove Bank and the former Willow Grove Bancorp from July 2000 to February 2002; prior thereto, Vice President and Controller of Willow Grove Bank. |

John T. Powers |

|

54 |

|

Senior Vice President of Willow Grove Bancorp and Senior Vice President, Community Banking and Corporate Secretary of Willow Grove Bank since 1986. |

Jerome P. Arrison |

|

52 |

|

Senior Vice President and Treasurer of Willow Grove Bank since December 2001; previously Vice President and Treasurer of Willow Grove Bank from July 1999 to December 2001. Prior thereto, Chief Operating Officer of Delaware First Financial, Wilmington, Delaware, from 1989 to July 1999. |

Ammon J. Baus |

|

55 |

|

Senior Vice President and Chief Lending Officer of Willow Grove Bank since March 2003. Prior thereto, Credit Risk Officer of Fleet National Bank (formerly Summit Bank, Princeton, New Jersey) from 1997 to 2003; Vice President of Commercial Banking, Summit Bank (formerly First Valley Bank) from 1994 to 1997. |

5

Director Nominations

Nominations for director of Willow Grove Bancorp are made by the Nominating and Corporate Governance Committee of the Board of Directors of Willow Grove Bancorp and are ratified by the entire Board. In September 2004, the Nominating and Corporate Governance Committee adopted a written charter which is available on our website at www.willowgrovebank.com. The Charter sets forth certain criteria the committee may consider when recommending individuals for nomination including: ensuring that the Board of Directors, as a whole, is diverse and consists of individuals with various and relevant career experience, relevant technical skills, industry knowledge and experience, financial expertise (including expertise that could qualify a director as a "financial expert," as that term is defined by the rules of the SEC), local or community ties, minimum individual qualifications, including strength of character, mature judgment, familiarity with our business and industry, independence of thought and an ability to work collegially. The committee also may consider the extent to which the candidate would fill a present need on the Board of Directors. The Nominating and Corporate Governance Committee will also consider candidates for director suggested by other directors, as well as our management and stockholders. A stockholder who desires to recommend a prospective nominee for the Board should notify our Secretary or any member of the Nominating and Corporate Governance Committee in writing with whatever supporting material the stockholder considers appropriate. Any stockholder wishing to make a nomination must follow our procedures for stockholder nominations, which are described under "Stockholder Proposals, Nominations and Communications with the Board of Directors."

Committees and Meetings of the Board of Directors

During the fiscal year ended June 30, 2004, the Board of Directors of Willow Grove Bancorp met 14 times. No director of Willow Grove Bancorp attended fewer than 75% of the aggregate of the total number of Board meetings held during the period for which he or she has been a director and the total number of meetings held by all committees of the Board on which he or she served during the periods that he or she served.

The Board of Directors of Willow Grove Bancorp has established an audit committee, compensation committee and nominating and corporate governance committee. Members of the Board also serve on committees of Willow Grove Bank.

Audit Committee. The audit committee reviews with management and the independent auditors the systems of internal control, reviews the annual financial statements, including the Form 10-K and monitors Willow Grove Bancorp's adherence in accounting and financial reporting to generally accepted accounting principles. The audit committee is comprised of four directors who are independent directors as defined in the Nasdaq listing standards and the rules and regulations of the Securities and Exchange Commission. The current members of the audit committee are Messrs. Sukay and Weihenmayer, Ms. Loring and Mr. Ramsey, who is Chairman of the committee. The Board of Directors has determined that Mr. Ramsey is our Audit Committee Financial Expert. Mr. Ramsey has extensive accounting and financial experience due to his 30 years of practice as a CPA before his retirement in 2001. The audit committee met six times in fiscal 2004. The audit committee charter as presently in effect is attached hereto as Appendix A.

Compensation Committee. It is the responsibility of the compensation committee of the Board of Directors to, among other things, oversee Willow Grove Bancorp's compensation and incentive arrangements for management. The current members of the committee are Messrs. Hull and O'Brien and Mr. Langan, who is Chairman of the committee. No member of the compensation committee is a current or former officer or employee of Willow Grove Bancorp, Willow Grove Bank or any subsidiary. Each of the members is independent as defined in the Nasdaq listing standards. The report of the compensation committee with respect to compensation and benefits for the Chief Executive Officer and other executive officers is set forth on page 11. The compensation committee met three times in fiscal 2004.

6

Nominating and Corporate Governance Committee. The nominating and corporate governance committee reviews and makes nominations for the Board of Directors, which are then sent to the full Board of Directors for their ratification. The current members of the nominating and corporate governance committee are Messrs. O'Brien, Hull and Weihenmayer. Each of the members is independent as defined in the Nasdaq listing standards. The nominating and corporate governance committee met five times in fiscal 2004.

Directors' Attendance at Annual Meetings

Directors are expected to attend the annual meeting absent a valid reason for not doing so. In 2003 seven of our eight directors attended the annual meeting of stockholders.

Directors' Compensation

We do not pay separate compensation to directors for their service on its Board of Directors of Willow Grove Bancorp. Members of Willow Grove Bank's Board of Directors, except for Mr. Marcell, receive $1,300 per Board meeting held and $600 per committee meeting attended, except members of the audit committee who receive $900 per committee meeting, and the loan committee, investment/asset liability committee and compensation committee members who receive $750 per committee meeting. The Chairman of the Board of Directors receives $2,000 per Board meeting and the chairman of each committee receives $600 per committee meeting, except the chairmen of the audit committee and compensation committee who receive $1,200 and $750 per meeting, respectively. To receive such compensation for membership on the board, directors may not be absent for more than two board meetings during the fiscal year. Compensation for committee meetings is paid only to those committee members who attend. Board fees are subject to periodic adjustment by the Board of Directors.

We adopted a non-qualified retirement plan for the non-employee members of Willow Grove Bank's Board of Directors. The retirement plan provides for fixed annual payments at retirement of the participant's vested percentage multiplied by the annual director's fee at retirement for a period of ten years. An individual director becomes 20% vested in the retirement plan after six years of service, with the vesting benefit increasing by 20% per year through year ten. Assuming the completion of ten years of service, a participant who retired in fiscal 2003 would be entitled to receive payments of approximately $15,600 per year for 10 years. The retirement plan provides credit for years of service prior to the plan's adoption.

Our non-employee directors may receive additional compensation pursuant to Willow Grove Bank's Directors and Officers Incentive Compensation Plan calculated as a percentage of the director's fees paid on an annual basis. The percentage used under the incentive compensation plan is based upon Willow Grove Bank's performance for the prior fiscal year as measured by various criteria specified in the plan. During fiscal 2004, non-employee directors received incentive compensation ranging from $4,500 to $6,000 pursuant to this plan.

Compensation Committee Interlocks and Insider Participation

Determinations regarding compensation of our President and Chief Executive Officer, our senior management and our employees are reviewed and approved by Willow Grove Bancorp's Compensation Committee. Messrs. Hull, O'Brien and Langan who is the Committee's Chairman, serve as members of the Compensation Committee.

No person who served as a member of the Compensation Committee during fiscal 2004 was a current or former officer or employee of Willow Grove Bancorp or Willow Grove Bank or engaged in certain transactions with Willow Grove Bancorp or Willow Grove Bank required to be disclosed by regulations of the SEC. Additionally, there were no compensation committee "interlocks" during fiscal 2004, which generally means that no executive officer of Willow Grove Bancorp served as a director or member of the compensation committee of another entity, one of whose executive officers served as a director or member of the Compensation Committee.

7

MANAGEMENT COMPENSATION

Summary Compensation Table

The following table sets forth a summary of certain information concerning the compensation paid by Willow Grove Bank (including amounts deferred to future periods by the officers) for services rendered in all capacities during the fiscal years ended June 30, 2004, 2003 and 2002 to the President and Chief Executive Officer and four other executive officers of Willow Grove Bank whose salary plus bonus exceeded $100,000. Willow Grove Bancorp has not paid separate compensation to its officers and directors.

| |

| |

| |

| | Long Term Compensation

Awards

| |

|

|---|

| |

| | Annual Compensation(2)

| |

|

|---|

Name and Principal Position

| | Fiscal

Year

| | Restricted

Stock(3)(4)

| | Securities

Underlying

Options

| | All Other

Compensation

(5)(6)(7)

|

|---|

| | Salary

| | Bonus

|

|---|

Frederick A. Marcell Jr.(1)

President and Chief

Executive Officer | | 2004

2003

2002 | | $

| 242,215

239,327

205,000 | | $

| 57,200

29,000

— | | $

| —

511,600

— | | —

75,000

7,980 | | $

| 48,576

43,949

29,048 |

Joseph M. Matisoff

Executive Vice President and Chief

Operating Officer |

|

2004

2003 |

|

$

|

161,477

156,923 |

|

$

|

32,500

2,500 |

|

$

|

—

191,850 |

|

—

35,000 |

|

$

|

22,640

— |

Christopher E. Bell

Senior Vice President, Chief Financial

Officer and Corporate Secretary |

|

2004

2003

2002 |

|

$

|

134,228

132,749

119,615 |

|

$

|

29,000

23,250

— |

|

$

|

—

255,800

92,934 |

|

—

32,500

20,834 |

|

$

|

34,544

29,526

22,406 |

John T. Powers

Senior Vice President,

Community Banking |

|

2004

2003

2002 |

|

$

|

131,200

129,808

120,000 |

|

$

|

28,000

22,250

— |

|

$

|

—

255,800

— |

|

—

32,500

5,700 |

|

$

|

33,651

29,182

23,523 |

Jerome P. Arrison

Senior Vice President and

Treasurer, Willow Grove Bank |

|

2004

2003

2002 |

|

$

|

116,062

109,538

94,760 |

|

$

|

27,500

7,250

4,175 |

|

$

|

—

127,900

90,515 |

|

—

32,500

5,700 |

|

$

|

29,707

21,083

13,791 |

- (1)

- Willow Grove Bank maintains a supplemental executive retirement plan for the benefit of Mr. Marcell. Willow Grove Bank accrued $35,000, $60,000 and $60,000 with respect to such plan in fiscal 2004, 2003 and 2002, respectively.

- (2)

- Does not include amounts attributable to miscellaneous benefits received by the named executive officer. In the opinion of our management, the costs of providing such benefits to the named executive officers did not exceed the lesser of $50,000 or 10% of the total annual salary and bonus reported for the individual.

- (3)

- Reflects the value of shares of restricted stock on the date of grant awarded pursuant to the 1999 and 2002 Recognition Plans. Such restricted stock vests over five years, 20% per year from the date of the grant. Dividends paid on the restricted common stock are held in trust and paid to the recipient when the restricted stock is earned.

- (4)

- As of June 30, 2004, Messrs. Marcell, Matisoff, Bell, Powers and Arrison had 40,179, 12,000, 24,599, 20,272 and 14,322 shares of unearned restricted stock, respectively, pursuant to the 1999 and 2002 Recognition Plans, which had fair market values of $642,462, $191,880, $393,338, $324,149 and $229,009 at June 30, 2004, respectively.

(Footnotes continued on following page)

8

- (5)

- Under Willow Grove Bank's 401(k)/Employee Stock Ownership Plan ("401(k)/ESOP") for fiscal 2004, $3,708, $4,693, $4,707, $4,486 and $3,968 was allocated to the 401(k) accounts of Messrs. Marcell, Matisoff, Bell, Powers and Arrison, respectively.

- (6)

- Under Willow Grove Bank's money purchase pension plan in fiscal 2004, $8,250, $3,300, $5,486, $5,363 and $4,733 was allocated to the accounts of Messrs. Marcell, Matisoff, Bell, Powers and Arrison, respectively.

- (7)

- Includes the fair market value on June 30, 2004, of a share of Willow Grove Bancorp common stock ($15.99) multiplied by the 2,290, 916, 1,523, 1,488 and 1,314 shares allocated to the employee stock ownership plan accounts of Messrs. Marcell, Matisoff, Bell, Powers and Arrison, respectively, during fiscal 2004.

Stock Options

Aggregate Option Exercises in Last Fiscal Year and Year End Option Values

The following table sets forth, with respect to each executive officer named in the Summary Compensation table, information with respect to exercise of stock options, the number of options held at the end of the June 30, 2004 fiscal year and the value with respect thereto.

| |

| |

| | Number of

Unexercised Options

at Fiscal Year End

| | Value of Unexercised

in the Money Options

at Fiscal Year End(1)

|

|---|

Name

| | Shares

acquired

on Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Frederick A. Marcell Jr. | | — | | $ | — | | 48,837 | | 72,450 | | $ | 440,660 | | $ | 320,727 |

| Joseph M. Matisoff | | — | | | — | | 7,000 | | 28,000 | | | 22,400 | | | 89,600 |

| Christopher E. Bell | | 1,824 | | | 25,765 | | 14,833 | | 40,325 | | | 84,609 | | | 200,842 |

| John T. Powers | | 1,000 | | | 13,336 | | 27,298 | | 34,528 | | | 260,764 | | | 170,764 |

| Jerome P. Arrison | | 1,000 | | | 14,320 | | 9,928 | | 30,332 | | | 52,053 | | | 120,347 |

- (1)

- Calculated by determining the difference between the fair market value of a share of the common stock underlying the options at June 30, 2004 ($15.99) and the exercise price of the options ($12.79, $8.33 and $3.97 for options granted in fiscal 2003, 2002 and 1999, respectively).

Employment Agreements

Willow Grove Bank entered into employment agreements in fiscal 2004 with each of Messrs. Marcell, Matisoff, Bell, Powers, Arrison and Baus, which agreements superseded existing employment agreements with such persons. Willow Grove Bank agreed to employ Mr. Marcell for a term of two years and Messrs. Matisoff, Bell, Powers, Arrison and Baus for a term of one year, in each case in their current respective positions. The agreements with the executives set a base salary at their then current salary levels, which may be increased from time to time by the Board of Directors. The terms of the executives' employment agreements are extended annually for a successive additional one-year period on each annual anniversary unless Willow Grove Bank provides not less than 30 days prior notice not to extend the employment term. Concurrently with the execution of the Willow Grove Bank agreements, Mr. Marcell also entered into an agreement with Willow Grove Bancorp, the primary purpose of which is to provide certain additional compensation in the event that certain tax liabilities are incurred by Mr. Marcell as a result of payments received upon a change in control.

Each of the employment agreements is terminable with or without cause by Willow Grove Bank. The executives have no right to compensation or other benefits pursuant to the employment agreements for any period after voluntary termination without good cause (as defined in the

9

agreement) or termination by Willow Grove Bank for cause, disability, retirement or death. In the event that (1) the executive terminates his employment because of failure to comply with any material provision of the employment agreement by Willow Grove Bank or Willow Grove Bank changes the Executive's title or duties or (2) the employment agreement is terminated by Willow Grove Bank other than for cause, disability, retirement or death, Mr. Marcell will be entitled to the payment of his base salary for the remaining unexpired term of his employment agreement and the other executives will be entitled to one time their base salary as cash severance. In the event that the executive's employment is terminated following a change in control, as defined, or the executive terminates his employment as a result of certain adverse actions which are taken with respect to his employment following a change in control, as defined, the executives will be entitled to a cash severance amount equal to two times (three in the case of Mr. Marcell) their average annual compensation over the past five calendar years, or such shorter period of employment of the employment agreement. With the exception of Mr. Marcell, benefits under the employment agreements will be reduced to the extent necessary to ensure that the executives do not receive any "parachute payment" as such term is defined under Section 280G of the Internal Revenue Code. Under Mr. Marcell's agreements, he will be entitled to an additional payment such that, on an after-tax basis, he will be indemnified for the 20% excise tax under Section 4989 of the Internal Revenue Code.

Although the above-described employment agreements could increase the cost of any acquisition of control of Willow Grove Bancorp, our management does not believe that the terms thereof would have a significant anti-takeover effect. Willow Grove Bancorp and/or Willow Grove Bank may determine to enter into similar employment agreements with other officers in the future.

Supplemental Executive Retirement Plan

We maintain a supplemental executive retirement plan in order to supplement the retirement benefits payable to Mr. Marcell pursuant to Willow Grove Bank's qualified plans. The supplemental executive retirement plan provides for payments for a period of ten years beginning at retirement based on a percentage of annual cash compensation. Assuming Mr. Marcell remains in our employ until age 68, the supplemental executive retirement plan provides for an annual benefit equal to 50% of his annual cash compensation. In the event that Mr. Marcell retires prior to age 68, his benefit will be reduced in increments of 5% per year. Following a change in control, as defined in the supplemental executive retirement plan, Mr. Marcell may terminate his employment and receive benefits as if he had worked until age 68. Willow Grove Bank accrued $35,000, $60,000 and $60,000 on a pre-tax basis, or approximately $24,000, $40,000 and $40,000 after tax, for each of the years ended June 30, 2004, 2003 and 2002, respectively, which included estimated costs for past service.

Indebtedness of Management and Related Party Transactions

In accordance with applicable federal laws and regulations, Willow Grove Bank offers mortgage loans to its directors, officers and employees as well as members of their immediate families for the financing of their primary residences and certain other loans. These loans are generally made on substantially the same terms as those prevailing at the time for comparable transactions with non-affiliated persons. It is the belief of management that these loans neither involve more than the normal risk of collectibility nor present other unfavorable features.

Section 22(h) of the Federal Reserve Act generally provides that any credit extended by a savings institution, such as Willow Grove Bank, to its executive officers, directors and, to the extent otherwise permitted, principal stockholder(s), or any related interest of the foregoing, must be on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions by the savings institution with non-affiliated parties; unless the loans are made pursuant to a benefit or compensation program that (a) is widely available to employees of the institution and (b) does not give preference to any director, executive officer or principal stockholder, or certain affiliated interests of either, over other employees of the savings institution, and must not involve more than the normal risk of repayment or present other unfavorable features. Willow Grove Bank's policy is in compliance with Section 22(h) of the Federal Reserve Act.

10

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee establishes the policies for the compensation of senior management and staff of Willow Grove Bancorp, Inc. and Willow Grove Bank to promote recruiting and retaining the best qualified management, developing and implementing methods to motivate executives, rewarding management for exemplary performance, and ensuring that the compensation of senior management is aligned with Willow Grove Bancorp's objective of enhancing shareholder value.

In fiscal 2003, Willow Grove Bancorp initiated a Salary Administration Program which covers senior management and all other employees of Willow Grove Bancorp and Willow Grove Bank. The program identifies each job position, includes a description of the position and ranks such position relative to other positions at Willow Grove Bancorp and Willow Grove Bank. The program includes salary survey information based on institutions reporting information both from within and outside of our market area and based on general industry data. The program then establishes our salary ranges by employment position based upon our internal rankings and our review of the relevant salary surveys.

Executive Salary Compensation

The Compensation Committee of the Board of Directors has the primary responsibility for establishing compensation for Willow Grove Bancorp's President/CEO, Willow Grove Bancorp's other executive officers named in the Summary Compensation Table included in this proxy statement (the "named executive officers") and the other members of the senior management team. Based upon its work during the year, the committee recommends new salary levels to the full Board of Directors, excluding Mr. Marcell, and such recommended levels are then acted upon. In formulating its recommendations to the full Board concerning the compensation of Willow Grove Bancorp's President/ CEO, the other named executive officers and other members of senior management, the Compensation Committee considers certain factors including, but not limited to, the overall performance of Willow Grove Bancorp during the most recent fiscal year based on factors such as total returns to shareholders and selected performance ratios for Willow Grove Bancorp such as return on shareholders' equity. In addition, the Committee assesses the subject officer's individual contributions in areas such as market share, asset quality and efficiency ratio, and Willow Grove Bank's ratings with Federal regulators. The Committee also considers compensation paid by competing financial institutions, as outlined in the Salary Administration Program. Finally, when considering compensation of the President/CEO, the Committee assesses his overall management effectiveness and leadership as well as his involvement in matters outside Willow Grove Bancorp and Willow Grove Bank which enhance our corporate standing such as community development efforts and participation in various professional organizations and charitable endeavors.

For the fiscal year ended June 30, 2004, Mr. Marcell's salary totaled $242,215 representing a 1% increase from fiscal year ending June 30, 2003. In determining his salary, the Committee considered such factors including, but not limited to, Willow Grove Bancorp's profitability in its most recent fiscal year, total returns to shareholders, including market appreciation and increased cash dividends, and achievement of certain strategic goals as set forth in our strategic plan.

With respect to the named executive officers other than the President/CEO, the Committee considered performance evaluations prepared by the President/CEO, evaluated their performance based on the officer's interaction with the Board of Directors, and measured their standing in the relevant salary range as defined by the Salary Administration Program as of January 1, 2003. For fiscal 2004, the Committee recommended and the Board approved salaries for the President/CEO and the other named executive officers and members of senior management that were between the mid-point to the upper two-thirds of the relevant salary ranges as outlined in the Salary Administration Program.

Based in part upon a recommendation from the President/CEO and senior management, the Committee deferred any salary increases for the senior management team during the first six months of

11

fiscal 2004. This action was taken in light of anticipated interest rate margin compression due to market rates of interest. The Committee and the Board approved a salary increase of 2% per annum effective as of January 1, 2004 for the President/CEO, the other named executive officers and other members of senior management.

Executive Incentive Compensation

There is in place an incentive plan covering directors, the President/CEO, the other named executive officers and certain other officers. Incentive compensation is determined by the Compensation Committee and the full Board based upon a review of certain quantitative and qualitative formulas which are set forth in the incentive plan and are designed to measure Willow Grove Bancorp's performance with respect to specified regulatory and audit standards, goals for returns on equity, efficiency ratios, and asset quality standards. Quantitative comparison to peer performance is measured and factored into the incentive compensation formula. The incentive plan also provides for a discretionary incentive amount for the President/CEO and senior management which is expressed as a percentage of base salary. The maximum discretionary portion of the incentive plan for the President/CEO is 2.5% and for senior management is 5% of base salary. During fiscal year 2004, the President/CEO and other named executive officers were eligible for an incentive bonus based upon Willow Grove Bancorp's performance for the year ended June 30, 2003 and other factors. Based upon its review of Willow Grove Bancorp's performance and the provisions of the incentive plan, the Committee recommended and the Board approved an incentive bonus of $57,200, or 23% of base salary, to the President /CEO in fiscal 2004, while the incentive bonuses to the other named executive officers and other members of senior management ranged from 3% to 23% of their base salary in fiscal 2004.

Deferred Compensation Plan

The Committee submitted and the Board approved a Deferred Compensation Plan that became effective October 1, 2003. The purpose of this plan is to provide non-employee Directors of Willow Grove Bancorp, Inc. and its subsidiaries, as well as certain senior managers, with the opportunity to elect to defer receipt of specified portions of their compensation and to have such deferred amounts treated as if invested in specified investment vehicles.

The Committee met three times during the fiscal year.

No members of the Compensation Committee were considered insiders/employees, nor were there interlocking relationships or relationships with Willow Grove Bancorp, Inc. requiring disclosure. All Compensation Committee recommendations and issues regarding executive compensation were submitted to the full Board of Directors for approval, however, Mr. Marcell did not participate in the consideration of his compensation.

| | | | | William W. Langan

Compensation Committee Chairman |

| | | | | Lewis W. Hull

A. Brent O'Brien |

12

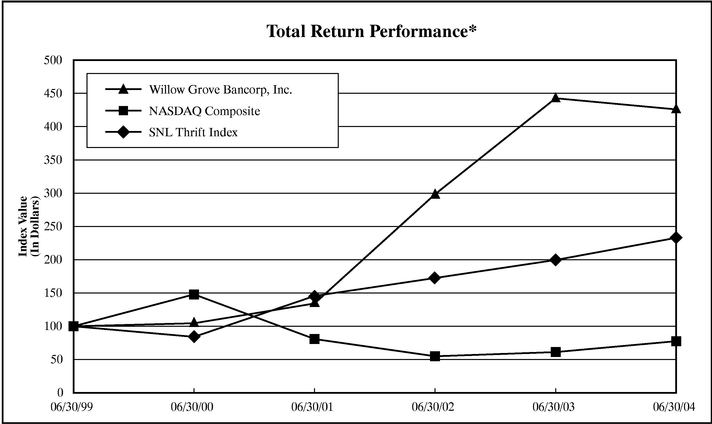

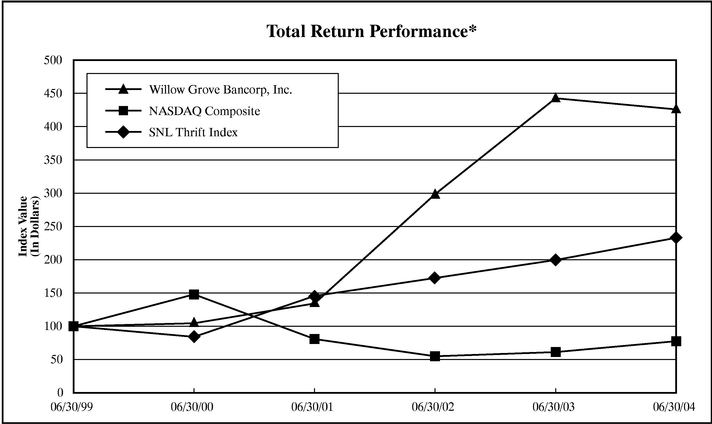

PERFORMANCE GRAPH

The following graph demonstrates comparison of the cumulative total returns for the common stock of Willow Grove Bancorp, the NASDAQ Composite Index and the SNL Securities Thrift Index for the periods indicated. The graph includes adjustments to reflect the reorganization we completed on April 3, 2002 and assumes that an investor originally purchased shares of our predecessor mid-tier company on June 30, 1999 and exchanged his or her shares in April 2002 pursuant to the exchange ratio for our second step conversion. The graph below represents $100 invested in our common stock at its closing price on June 30, 1999. The cumulative total returns include the payment of dividends by Willow Grove Bancorp.

| | Period Ending

|

|---|

Index

|

|---|

| | 6/30/99

| | 06/30/00

| | 06/30/01

| | 06/30/02

| | 06/30/03

| | 06/30/04

|

|---|

| Willow Grove Bancorp, Inc. | | 100.00 | | 104.55 | | 134.30 | | 298.48 | | 442.63 | | 425.87 |

| NASDAQ Composite | | 100.00 | | 147.94 | | 80.83 | | 54.94 | | 61.23 | | 77.62 |

| SNL Thrift Index | | 100.00 | | 84.10 | | 145.59 | | 172.55 | | 199.61 | | 232.91 |

- *

- Source: SNL Securities, LC

13

BENEFICIAL OWNERSHIP OF COMMON STOCK

BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of September 24, 2004, the voting record date, certain information as to the common stock beneficially owned by (i) each person or entity, including any "group" as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, who or which was known to us to be the beneficial owner of more than 5% of the issued and outstanding common stock, (ii) the directors of Willow Grove Bancorp, (iii) certain executive officers of Willow Grove Bancorp; and (iv) all directors and executive officers of Willow Grove Bancorp as a group.

Name of Beneficial

Owner or Number of

Persons in Group

| | Amount and Nature

of Beneficial

Ownership as of

September 24, 2004(1)

| | Percent of

Common Stock(19)

| |

|---|

Willow Grove Bank 401(k)/Employee Stock

Ownership Plan Trust

Welsh & Norristown Roads

Maple Glen, Pennsylvania 19002 |

|

1,163,546 |

(2) |

11.9 |

% |

Private Capital Management, L.P.

8889 Pelican Bay Boulevard

Naples, Florida 34108 |

|

1,011,412 |

(3) |

10.3 |

|

Bank of America Corporation

100 North Tryon Street, Floor 25

Bank of America Corporate Center

Charlotte, North Carolina 28255 |

|

597,100 |

(4) |

6.1 |

|

| Directors: | | | | | |

| | Lewis W. Hull | | 52,759 | (5)(6) | * | |

| | Charles F. Kremp, 3rd | | 102,207 | (5) | 1.0 | |

| | William W. Langan | | 85,339 | (5)(7) | * | |

| | Rosemary C. Loring, Esq. | | 59,144 | (5)(8) | * | |

| | Frederick A. Marcell Jr. | | 215,338 | (5)(9)(10) | 2.2 | |

| | A. Brent O'Brien | | 54,608 | (5)(11) | * | |

| | Samuel H. Ramsey, III | | 104,016 | (5)(12) | 1.1 | |

| | Thomas J. Sukay | | 5,000 | | * | |

| | William B. Weihenmayer | | 76,650 | (5)(13) | * | |

Other Named Executive Officers: |

|

|

|

|

|

| | Joseph M. Matisoff | | 25,150 | (5)(10)(14) | * | |

| | Christopher E. Bell | | 88,726 | (5)(10)(15) | * | |

| | John T. Powers | | 100,439 | (5)(10)(16) | 1.0 | |

| | Jerome P. Arrison | | 33,762 | (5)(17) | * | |

All Directors and Executive Officers as a group

(14 persons) |

|

1,005,795 |

(5)(18) |

10.0 |

|

- *

- Represents less than 1% of the outstanding stock.

- (1)

- Based upon filings made pursuant to the Securities Exchange Act of 1934 and information furnished by the respective individuals. Under regulations promulgated pursuant to the Securities Exchange Act of 1934, shares of common stock are deemed to be beneficially owned by a person if he or she directly or indirectly has or shares (i) voting power, which includes the power to vote or to direct the voting of the shares, or

(Footnotes continued on following page)

14

(ii) investment power, which includes the power to dispose or to direct the disposition of the shares. Unless otherwise indicated, the named beneficial owner has sole voting and dispositive power with respect to the shares.

- (2)

- The Willow Grove Bank 401(k)/ESOP trust was established pursuant to the Willow Grove Bank 401(k)/ESOP by an agreement between Willow Grove Bank and Messrs. Marcell, Matisoff, Bell and Powers who act as trustees of the plan. As of June 30, 2003, 407,167 shares held in the trust had been allocated to the accounts of participating employees. Under the terms of the 401(k)/ESOP, the plan trustees vote all allocated shares in accordance with the instructions of the participating employees. Any unallocated shares are generally required to be voted by the plan trustee in the same ratio on any matter as to those shares for which instructions are given by the participant's under the employee stock ownership plan provisions.

- (3)

- Based on a Schedule 13G/A, dated February 13, 2004, filed by Private Capital Management, L.P. ("PCM"), a registered investment adviser, Bruce S. Sherman and Gregg J. Powers, chief executive officer and president of PCM, respectively, PCM and Messrs. Sherman and Powers exercise in these capacities shared voting power and shared dispositive power with respect to the 1,011,412 shares of Common Stock held by PCM's clients and managed by PCM.

- (4)

- The information concerning Bank of America Corporation is based upon an amended statement on Schedule 13G/A filed with the SEC on June 7, 2004 by Bank of America Corporation and certain other reporting persons identified in such Schedule 13G/A. Bank of America Corporation reports that it shares voting power with respect to 579,000 of the shares shown and shares dispositive power with respect to all of the shares shown.

- (5)

- Includes options to acquire shares of our common stock that are exercisable on September 24, 2004, or 60 days thereafter, under our 1999 and 2002 Stock Option Plans, and shares over which the directors or officers have voting power which have been granted pursuant to the 1999 and 2002 Recognition and Retention Plans and are held in the associated trust, as follows:

Name

| | Number of Shares

Underlying Options

| | Number of Shares Held in

Recognition Plan Trust

|

|---|

| | Lewis W. Hull | | 7,649 | | 12,307 |

| | Charles F. Kremp, 3rd | | 14,564 | | 12,307 |

| | William W. Langan | | 35,818 | | 14,044 |

| | Rosemary C. Loring, Esq. | | 15,416 | | 10,263 |

| | Frederick A. Marcell Jr. | | 56,499 | | 40,179 |

| | A. Brent O'Brien | | 26,361 | | 12,307 |

| | Samuel H. Ramsey, III | | 18,153 | | 12,307 |

| | Thomas J. Sukay | | — | | — |

| | William B. Weihenmayer | | 3,649 | | 12,307 |

| | Joseph M. Matisoff | | 7,000 | | 12,000 |

| | Christopher E. Bell | | 16,657 | | 24,599 |

| | John T. Powers | | 32,406 | | 20,272 |

| | Jerome P. Arrison | | 10,840 | | 14,322 |

| All Directors and Executive Officers as a group (14 persons) | | 247,512 | | 197,214 |

- (6)

- Includes 32,803 shares held jointly with Mr. Hull's son.

- (7)

- Includes 24,202 shares held by Mr. Langan's spouse over which Mr. Langan disclaims beneficial ownership.

- (8)

- Includes 11,500 shares held by Ms. Loring's spouse and 19,400 shares held in Ms. Loring's individual retirement account.

- (9)

- Includes 81,610 shares held in Mr. Marcell's accounts in Willow Grove Bank's 401(k)/ESOP, 684 shares held by Mr. Marcell's spouse in her IRA account over which Mr. Marcell disclaims beneficial ownership and 16,411 shares held in the Deferred Compensation Plan, over which Mr. Marcell disclaims beneficial ownership, except to the extent of his personal pecuniary interest therein.

- (10)

- Excludes shares held in the 401(k)/ESOP other than the 81,610, 916, 19,748 and 25,773 shares allocated to the individual accounts of Messrs. Marcell, Matisoff, Bell and Powers, respectively. Messrs. Marcell, Matisoff, Bell

(Footnotes continued on following page)

15

and Powers, as trustees of the 401(k)/ESOP, vote all shares of Willow Grove Bancorp common stock held in the plan trust. The trustees must vote allocated shares in accordance with the instructions of the participating employees. The trustees disclaim beneficial ownership of shares held in the 401(k)/ESOP over which they share voting and dispositive power.

- (11)

- Includes 2,245 shares held by Mr. O'Brien's spouse.

- (12)

- Includes 17,324 shares held in a trust for which Mr. Ramsey is a beneficiary and 4,674 shares held in the Deferred Compensation Plan, over which Mr. Ramsey disclaims beneficial ownership, except to the extent of his personal pecuniary interest therein.

- (13)

- Includes 15,416 shares held by Mr. Weihenmayer's spouse, 5,000 shares held by Mr. Weihenmayer's son over which Mr. Weihenmayer disclaims beneficial ownership and 4,674 shares held in the Deferred Compensation Plan, over which Mr. Weihenmayer disclaims beneficial ownership, except to the extent of his personal primary interest therein.

- (14)

- Includes 1,000 shares held jointly with Mr. Matisoff's spouse, 1,200 shares held in Mr. Matisoff's individual retirement account, 916 shares which have been allocated to Mr. Matisoff's account in the 401(k)/ESOP and 2,034 shares held in the Deferred Compensation Plan, over which Mr. Matisoff disclaims beneficial ownership, except to the extent of his personal pecuniary interest therein.

- (15)

- Includes 4,104 shares held jointly with Mr. Bell's spouse, 466 shares held by Mr. Bell's spouse, 19,748 shares held in Mr. Bell's accounts in Willow Grove Bank's 401(k)/ESOP, 6,727 shares in Mr. Bell's individual retirement account and 4,053 shares held in the Deferred Compensation Plan, over which Mr. Bell disclaims beneficial ownership, except to the extent of his personal pecuniary interest therein.

- (16)

- Includes 21,651 shares held jointly with Mr. Powers' spouse, 337 shares held by Mr. Powers' children and 25,773 shares held in Mr. Powers' accounts in Willow Grove Bank's 401(k)/ESOP and 5,455 shares which have been allocated to Mr. Power's ESOP account in the 401(k)/ESOP.

- (17)

- Includes 4,850 shares held in Mr. Arrison's accounts in Willow Grove Bank's 401(k)/ESOP.

- (18)

- The amount of common stock beneficially owned by all directors and executive officers as a group does not include the unallocated shares held in the ESOP trust.

- (19)

- Each beneficial owner's percentage ownership is determined by assuming that options held by such person (but not those held by any other person) and that are exercisable within 60 days of the voting record date have been exercised.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the officers and directors, and persons who own more than 10% of Willow Grove Bancorp's common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Officers, directors and greater than 10% stockholders are required by regulation to furnish Willow Grove Bancorp with copies of all Section 16(a) forms they file. We know of no person who owns 10% or more of our common stock other than the Willow Grove Bank 401(k)/ESOP and Private Capital Management, L.P.

Based solely on our review of the copies of such forms furnished to us, or written representations from our officers and directors, we believe that during, and with respect to, the fiscal year ended June 30, 2004, our officers and directors complied in all respects with the reporting requirements promulgated under Section 16(a) of the Securities Exchange Act of 1934 other than Mr. Arrison who was late reporting one discretionary transaction in the 401(k)/ESOP.

16

RATIFICATION OF APPOINTMENT OF AUDITORS

The Audit Committee of the Board of Directors of Willow Grove Bancorp has appointed KPMG LLP, independent certified public accountants, to perform the audit of our financial statements for the year ending June 30, 2005, and further directed that the selection of auditors be submitted for ratification by the shareholders at the annual meeting.

We have been advised by KPMG LLP that neither that firm nor any of its associates has any relationship with Willow Grove Bancorp or its subsidiaries other than the usual relationship that exists between independent certified public accountants and clients. KPMG LLP will have one or more representatives at the annual meeting who will have an opportunity to make a statement, if they so desire, and will be available to respond to appropriate questions.

In determining whether to appoint KPMG LLP as our auditors, the Audit Committee considered whether the provision of services, other than auditing services, by KPMG LLP is compatible with maintaining the auditors' independence. In addition to performing auditing services as well as reviewing our public filings, our auditors performed tax-related services, including the completion of our corporate tax returns, in fiscal 2004. The Audit Committee believes that KPMG LLP's performance of these other services is compatible with maintaining the auditor's independence.

The Board of Directors recommends that you vote FOR the ratification of the appointment of

KPMG LLP as independent auditors for the fiscal year ending June 30, 2005.

Audit Fees

The following table sets forth the aggregate fees paid by us to KPMG LLP for professional services rendered by KPMG LLP in connection with the audit of Willow Grove Bancorp's consolidated financial statements for fiscal 2004 and 2003, as well as the fees paid by us to KPMG LLP for audit-related services, tax services and all other services rendered by KPMG LLP to us during fiscal 2004 and 2003.

| | Year Ended June 30,

|

|---|

| | 2004

| | 2003

|

|---|

| Audit fees (1) | | $ | 148,900 | | $ | 115,844 |

| Audit-related fees (2) | | | 75,264 | | | 91,032 |

| Tax fees (3) | | | 27,750 | | | 31,500 |

| All other fees | | | — | | | — |

| | |

| |

|

| | Total | | $ | 251,914 | | $ | 238,376 |

| | |

| |

|

- (1)

- Audit fees consist of fees incurred in connection with the audit of our annual financial statements and the review of the interim financial statements included in our quarterly reports filed with the Securities and Exchange Commission, as well as work generally only the independent auditor can reasonably be expected to provide, such as statutory audits, consents and assistance with and review of documents filed with the Securities and Exchange Commission.

- (2)

- Audit-related fees primarily consist of fees incurred in connection with the provision of due diligence services, audits of the financial statements of our employee benefit plans and agreed-upon procedures performed in connection with student loans.

- (3)

- Tax fees consist primarily of fees paid in connection with preparing federal and state income tax returns and other tax related services.

The Audit Committee selects our independent auditors and pre-approves all audit services to be provided by it to Willow Grove Bancorp. The Audit Committee also reviews and pre-approves all audit-

17

related and non-audit related services rendered by our independent auditors in accordance with the Audit Committee's charter. In its review of these services and related fees and terms, the Audit Committee considers, among other things, the possible effect of the performance of such services on the independence of our independent auditors. The Audit Committee pre-approves certain audit-related services and certain non-audit related tax services which are specifically described by the Audit Committee on an annual basis and separately approves other individual engagements as necessary. The Chair of the Audit Committee has been delegated the authority to approve non-audit related services in lieu of the full Audit Committee. On a quarterly basis, the Chair of the Audit Committee presents any previously-approved engagements to the full Audit Committee.

Each new engagement of KPMG LLP was approved in advance by the Audit Committee or its Chair, and none of those engagements made use of thede minimis exception to pre-approval contained in the Securities and Exchange Commission's rules.

REPORT OF THE AUDIT COMMITTEE

The functions of the audit committee include the following: performing all duties assigned by the Board of Directors, reviewing with management and independent public accountants the basis for the reports issued by Willow Grove Bank and Willow Grove Bancorp, Inc. pursuant to federal regulatory requirements, meeting with the independent public accountants to review the scope of audit services, significant accounting changes and audit conclusions regarding significant accounting estimates, assessments as to the adequacy of internal controls and the resolution of any significant deficiencies or material control weaknesses, and assessing compliance with laws and regulations and overseeing the internal audit function. The audit committee also reviews and assesses the adequacy of its Charter on an annual basis.

The audit committee has reviewed and discussed Willow Grove Bancorp's audited financial statements with management. The audit committee has discussed with Willow Grove Bancorp's independent auditors, KPMG LLP, the matters required to be discussed by the Statement on Auditing Standards No. 61, "Communication with audit committees." The audit committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees" and has discussed with KPMG LLP, the independent auditor's independence. Based on the review and discussions referred to above in this report, the audit committee recommended to the Board of Directors that the audited financial statements be included in Willow Grove Bancorp's Annual Report on Form 10-K for fiscal year 2004 for filing with the Securities and Exchange Commission.

| | | Samuel H. Ramsey, III

Audit Committee Chairman

Rosemary C. Loring, Esq.

Thomas J. Sukay

William B. Weihenmayer |

STOCKHOLDER PROPOSALS, NOMINATIONS AND

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Stockholder Proposals. Any proposal which a stockholder wishes to have included in the proxy materials of Willow Grove Bancorp relating to the next annual meeting of stockholders of Willow Grove Bancorp, which is scheduled to be held in November 2005, must be received at the principal executive offices of Willow Grove Bancorp, Welsh & Norristown Roads, Maple Glen, Pennsylvania 19002, Attention: Christopher E. Bell, Corporate Secretary, no later than June 10, 2005. If such proposal is in compliance with all of the requirements of Rule 14a-8 under the Securities Exchange Act

18

of 1934, as amended, it will be included in the proxy statement and set forth on the form of proxy issued for such annual meeting of stockholders. It is urged that any such proposals be sent certified mail, return receipt requested.

Stockholder proposals which are not submitted for inclusion in Willow Grove Bancorp's proxy materials pursuant to Rule 14a-8 may be brought before an annual meeting pursuant to Section 2.10 of Willow Grove Bancorp's Bylaws. Notice of the proposal must be given in writing and delivered to, or mailed and received at, our principal executive offices by June 10, 2005. The notice must include the information required by Section 2.10 of our Bylaws.

Stockholder Nominations. Our Bylaws provide that, subject to the rights of the holders of any class or series of stock having a preference over the common stock as to dividends or upon liquidation, all nominations for election to the Board of Directors, other than those made by the Board or a committee thereof, shall be made by a stockholder who has complied with the notice and information requirements contained in Section 3.12 of our Bylaws. Written notice of a stockholder nomination generally must be communicated to the attention of the secretary and either delivered to, or mailed and received at, our principal executive offices not later than, with respect to an annual meeting of stockholders, 120 days prior to the anniversary date of the mailing of proxy materials by us in connection with the immediately preceding annual meeting of stockholders or, in the case of this annual meeting, by June 12, 2004.

Other Stockholder Communications. Stockholders who wish to communicate with the Board may do so by sending written communications addressed to the Board of Directors of Willow Grove Bancorp, Inc., c/o Christopher E. Bell, Corporate Secretary, at Welsh and Norristown Roads, Maple Glen, Pennsylvania 19002. Mr. Bell will forward such communications to the director or directors to whom they are addressed.

ANNUAL REPORTS

A copy of Willow Grove Bancorp's Annual Report to Stockholders for the year ended June 30, 2004 accompanies this Proxy Statement. Such annual report is not part of the proxy solicitation materials.

Upon receipt of a written request, we will furnish an additional copy of Willow Grove Bancorp's Annual Report on Form 10-K (without exhibits) for fiscal 2004, as filed with the SEC. Such written requests should be directed to Mr. Christopher E. Bell, Chief Financial Officer, Willow Grove Bancorp, Inc., Welsh & Norristown Roads, Maple Glen, Pennsylvania 19002. The Form 10-K is not part of the proxy solicitation materials.

OTHER MATTERS

Management is not aware of any business to come before the annual meeting other than the matters described above in this proxy statement. However, if any other matters should properly come before the meeting, it is intended that the proxies solicited hereby will be voted with respect to those other matters in accordance with the judgment of the persons voting the proxies.

The cost of the solicitation of proxies will be borne by Willow Grove Bancorp. Willow Grove Bancorp will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending the proxy materials to the beneficial owners of Willow Grove Bancorp's common stock. In addition to solicitations by mail, directors, officers and employees of Willow Grove Bancorp may solicit proxies personally or by telephone without additional compensation.

19

WILLOW GROVE BANCORP, INC.

WILLOW GROVE BANK

AUDIT COMMITTEE CHARTER

(Amended and Restated as of September 28, 2004)

I. Audit Committee Purpose

The Audit Committee (the "Committee") of Willow Grove Bancorp, Inc. (the "Company") is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities. The Committee's primary duties and responsibilities are to:

- •

- Appoint and oversee the Company's independent auditors in accordance with Section 301 of the Sarbanes-Oxley Act of 2002 and Section 10A(m)(2) of the Securities Exchange Act of 1934, as amended ("Exchange Act").

- •

- Monitor the integrity of the Company's financial reporting processes and systems of internal controls regarding finance, accounting, legal, and regulatory compliance.

- •

- Monitor the qualifications, independence, and performance of the Company's independent auditors.

- •

- Provide an avenue of communication among the independent auditors, management, and the Board of Directors and with respect to any complaints relating to accounting, internal controls or auditing matters and the confidential anonymous submission by employees regarding questionable accounting or auditing matters.

The Committee has the ability to retain, at the Company's expense, special legal, accounting, or other consultants or experts it deems necessary to carry out its duties.

II. Committee Membership and Meetings

The Committee shall consist of a minimum of three independent directors as such independence is defined for Committee members by the NASDAQ's listing standards and the Exchange Act and the rules thereunder.

All members of the Committee shall have sufficient financial experience and ability to enable them to discharge their responsibilities including the ability to read and understand fundamental financial statements, including the Company's balance sheet, income statement and cash flow statement. At least one member of the Committee must have past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual's financial sophistication.

III. Committee Duties and Responsibilities

The Committee shall meet at least four times per year or more frequently as deemed necessary; the Committee shall review the Audit Charter on an annual basis and have the Charter appended to the Company's proxy materials at least every three years in accordance with regulations of the Securities and Exchange Commission ("SEC"). The Committee should meet privately in executive session at least annually with management, the internal auditor, the independent auditors, and as a committee to discuss any matters that the Committee or each of these groups believe should be discussed. The Committee, or at least its Chairman, should communicate with management and the independent auditors no less than quarterly to review the Company's financial statements and significant findings based upon the auditor's limited review procedures. The Chairman or another

A-1

member of the Committee selected thereby should review the Company's earnings releases with management and the independent auditors prior to their release.

The Committee shall have the following additional responsibilities with respect to the Company and its consolidated subsidiaries.

1. Affirm an understanding with the outside auditors that they must report directly to the Committee and that the Committee has the ultimate authority and responsibility to select, retain, oversee and approve the compensation of the outside auditors.

2. Meet with the independent auditors and financial management of the Company to review both the scope of the proposed annual audit and the procedures to be utilized, and at the conclusion of such audit, meet with independent auditors independently of management to discuss their comments and recommendations.

3. Review and approve the internal audit function of the Company including (a) its purpose, independence, authority, and reporting obligations (b) the annual audit program, budget, and staffing, (c) coordination of the audit plan with the independent auditor, and (d) the appointment, termination, and compensation of the internal audit staff.

4. Approve, in advance, the provision by the independent auditor of all permissible audit and non-audit services (with the exception of certain de minimus non-audit services constituting not more than 5% of all auditing revenues paid during the fiscal year; not initially recognized to be non-audit; and promptly brought to the attention of the audit committee and approved prior to completion).

5. If necessary to discharge the duties and responsibilities of the Committee, engage and determine funding for independent counsel and other advisers.

6. Review the independent auditor's examination of the Company's (a) financial statements, (b) evaluation of the internal system of audit and financial controls, and (c) financial statements contained in the annual report to shareholders.

7. Review with management, internal audit, and others that the Committee deems appropriate, the Company's internal system of audit and financial controls and the results of such audits.

8. Review the Company's financial reporting process, its accounting standards and principles, and any significant changes to these standards and principles in their application.