Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

____

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[LOGO] | Two great community banks..... |

| One great customer experience! |

[LOGO] | |

Willow Grove Bancorp, Inc.

(NASDAQ: WGBC)

Cohen Brothers Conference

March 14, 2006

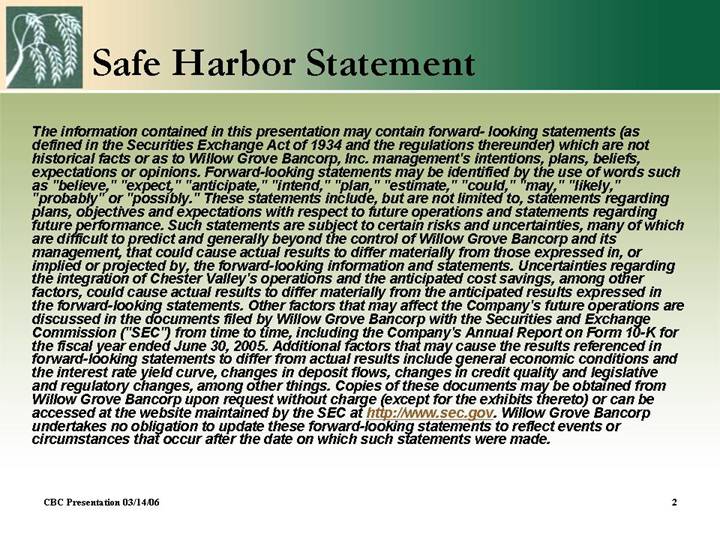

[GRAPHIC] | Safe Harbor Statement |

The information contained in this presentation may contain forward- looking statements (as defined in the Securities Exchange Act of 1934 and the regulations thereunder) which are not historical facts or as to Willow Grove Bancorp, Inc. management’s intentions, plans, beliefs, expectations or opinions. Forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “could,” “may,” “likely,” “probably” or “possibly.” These statements include, but are not limited to, statements regarding plans, objectives and expectations with respect to future operations and statements regarding future performance. Such statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the control of Willow Grove Bancorp and its management, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. Uncertainties regarding the integration of Chester Valley’s operations and the anticipated cost savings, among other factors, could cause actual results to differ materially from the anticipated results expressed in the forward-looking statements. Other factors that may affect the Company’s future operations are discussed in the documents filed by Willow Grove Bancorp with the Securities and Exchange Commission (“SEC”) from time to time, including the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2005. Additional factors that may cause the results referenced in forward-looking statements to differ from actual results include general economic conditions and the interest rate yield curve, changes in deposit flows, changes in credit quality and legislative and regulatory changes, among other things. Copies of these documents may be obtained from Willow Grove Bancorp upon request without charge (except for the exhibits thereto) or can be accessed at the website maintained by the SEC at http://www.sec.gov. Willow Grove Bancorp undertakes no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made.

CBC Presentation 03/14/06

2

• Our background

• Key drivers

• Financial highlights

3

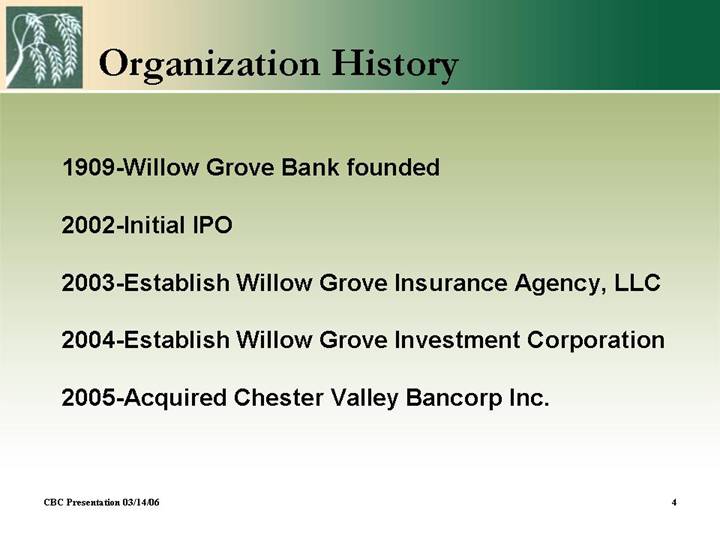

1909-Willow Grove Bank founded

2002-Initial IPO

2003-Establish Willow Grove Insurance Agency, LLC

2004-Establish Willow Grove Investment Corporation

2005-Acquired Chester Valley Bancorp Inc.

4

| Holding Company Structure |

Willow Grove Bancorp, Inc.

NASDAQ: WGBC

Willow Grove Bank | Philadelphia Corporation

for Investment Services |

| |

• Savings Bank • 28 Full Service Offices • $1.6 billion in Assets* • $1.0 billion in Deposits* • First Financial Investments, Inc. • Willow Grove Investment Corp. • Willow Grove Insurance Agency | • Full Service Broker-Dealer • Registered Investment Advisor |

* As of 12/31/05

5

| Deep Management Team, Track Record of Success |

Name | | Function | | Age | | Years in

Fin. Serv. | | Prior

Institutions | |

Donna M. Coughey | | President & CEO | | 56 | | 34 | | Chester Valley, Mellon, Marine Midland | |

| | | | | | | | | |

Joseph T. Crowley, CPA | | CFO & Treasurer | | 44 | | 21 | | Chester Valley, Applied Card, Crusader Holding Co., KPMG | |

| | | | | | | | | |

Ammon J. Baus | | Chief Credit Officer | | 56 | | 35 | | Fleet, PNC, First Fidelity | |

| | | | | | | | | |

G. Richard Bertolet | | Chief Lending and Sales Officer | | 58 | | 37 | | Chester Valley, Mellon | |

| | | | | | | | | |

John Powers | | Regional President – Willow Grove Division | | 55 | | 38 | | Sun East FCU, Western Savings Bank | |

| | | | | | | | | |

Colin N. Maropis | | Regional President – First Financial Division | | 53 | | 29 | | Chester Valley, Sun Life of Canada | |

6

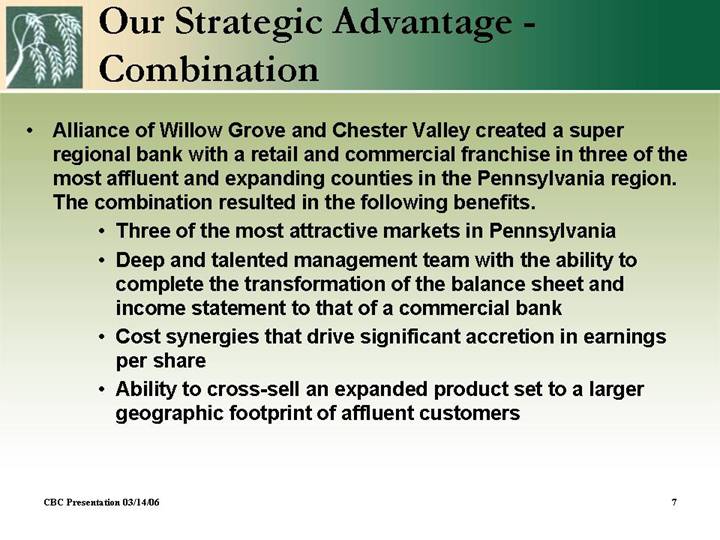

| Our Strategic Advantage - Combination |

• Alliance of Willow Grove and Chester Valley created a super regional bank with a retail and commercial franchise in three of the most affluent and expanding counties in the Pennsylvania region. The combination resulted in the following benefits.

• Three of the most attractive markets in Pennsylvania

• Deep and talented management team with the ability to complete the transformation of the balance sheet and income statement to that of a commercial bank

• Cost synergies that drive significant accretion in earnings per share

• Ability to cross-sell an expanded product set to a larger geographic footprint of affluent customers

7

| The Combined Franchise Footprint |

Strong branch network with room for franchise expansion

between First Financial and Willow Grove Divisions

[GRAPHIC]

Willow Grove Division

1 Dresher

2 Hatboro

3 Holland

4 Huntingdon Valley

5 Maple Glen – Main Office

6 North Wales

7 Philadelphia – Bustleton

8 Philadelphia – Rhawnhurst

9 Philadelphia – Somerton

10 Roslyn Valley

11 Southampton

12 Warminster

13 Warminster – Kmart Plaza

14 Willow Grove

First Financial Division

15 Airport Village

16 Avondale

17 Brandywine Square

18 Coatesville

19 Devon

20 Downingtown – Main Office

21 Eagle

22 Exton – Lionville

23 Frazer – Malvern

24 Kennett Square

25 Oxford – Late-2006

26 Thorndale

27 West Chester

28 Westtown

8

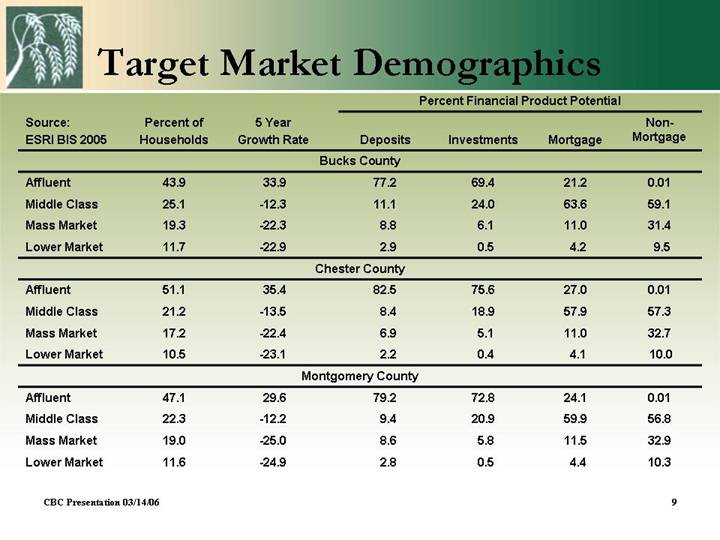

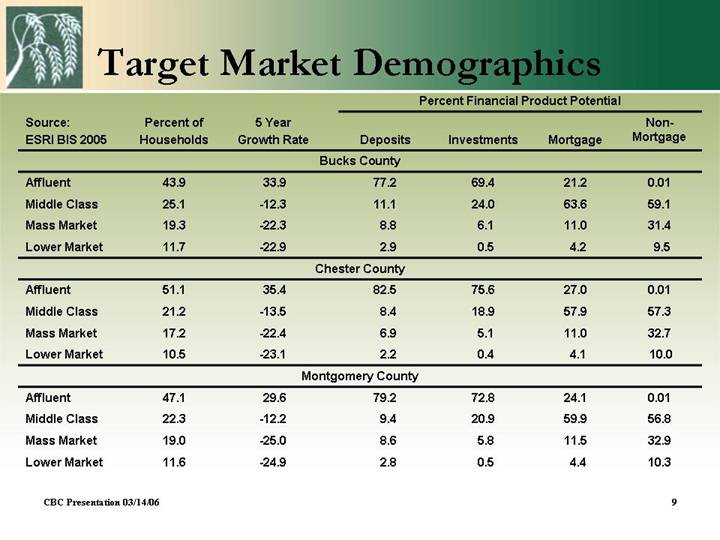

| Target Market Demographics |

| | | | | | Percent Financial Product Potential | |

Source:

ESRI BIS 2005 | | Percent of

Households | | 5 Year

Growth Rate | | Deposits | | Investments | | Mortgage | | Non-

Mortgage | |

Bucks County | |

Affluent | | 43.9 | | 33.9 | | 77.2 | | 69.4 | | 21.2 | | 0.01 | |

Middle Class | | 25.1 | | -12.3 | | 11.1 | | 24.0 | | 63.6 | | 59.1 | |

Mass Market | | 19.3 | | -22.3 | | 8.8 | | 6.1 | | 11.0 | | 31.4 | |

Lower Market | | 11.7 | | -22.9 | | 2.9 | | 0.5 | | 4.2 | | 9.5 | |

| | | | | | | | | | | | | |

Chester County | |

Affluent | | 51.1 | | 35.4 | | 82.5 | | 75.6 | | 27.0 | | 0.01 | |

Middle Class | | 21.2 | | -13.5 | | 8.4 | | 18.9 | | 57.9 | | 57.3 | |

Mass Market | | 17.2 | | -22.4 | | 6.9 | | 5.1 | | 11.0 | | 32.7 | |

Lower Market | | 10.5 | | -23.1 | | 2.2 | | 0.4 | | 4.1 | | 10.0 | |

| | | | | | | | | | | | | |

Montgomery County | |

Affluent | | 47.1 | | 29.6 | | 79.2 | | 72.8 | | 24.1 | | 0.01 | |

Middle Class | | 22.3 | | -12.2 | | 9.4 | | 20.9 | | 59.9 | | 56.8 | |

Mass Market | | 19.0 | | -25.0 | | 8.6 | | 5.8 | | 11.5 | | 32.9 | |

Lower Market | | 11.6 | | -24.9 | | 2.8 | | 0.5 | | 4.4 | | 10.3 | |

9

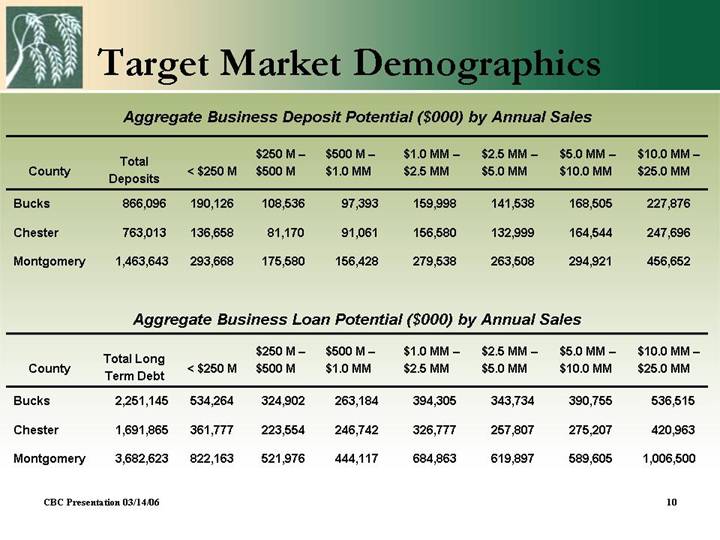

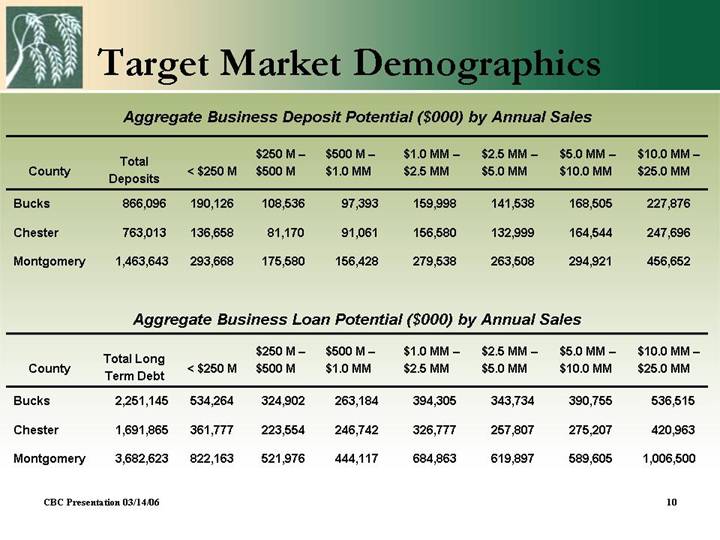

Aggregate Business Deposit Potential ($000) by Annual Sales

County | | Total

Deposits | | < $250 M | | $250 M –

$500 M | | $500 M –

$1.0 MM | | $1.0 MM –

$2.5 MM | | $2.5 MM –

$5.0 MM | | $5.0 MM –

$10.0 MM | | $10.0 MM –

$25.0 MM | |

Bucks | | 866,096 | | 190,126 | | 108,536 | | 97,393 | | 159,998 | | 141,538 | | 168,505 | | 227,876 | |

Chester | | 763,013 | | 136,658 | | 81,170 | | 91,061 | | 156,580 | | 132,999 | | 164,544 | | 247,696 | |

Montgomery | | 1,463,643 | | 293,668 | | 175,580 | | 156,428 | | 279,538 | | 263,508 | | 294,921 | | 456,652 | |

Aggregate Business Loan Potential ($000) by Annual Sales

County | | Total Long

Term Debt | | < $250 M | | $250 M –

$500 M | | $500 M –

$1.0 MM | | $1.0 MM –

$2.5 MM | | $2.5 MM –

$5.0 MM | | $5.0 MM –

$10.0 MM | | $10.0 MM –

$25.0 MM | |

Bucks | | 2,251,145 | | 534,264 | | 324,902 | | 263,184 | | 394,305 | | 343,734 | | 390,755 | | 536,515 | |

Chester | | 1,691,865 | | 361,777 | | 223,554 | | 246,742 | | 326,777 | | 257,807 | | 275,207 | | 420,963 | |

Montgomery | | 3,682,623 | | 822,163 | | 521,976 | | 444,117 | | 684,863 | | 619,897 | | 589,605 | | 1,006,500 | |

10

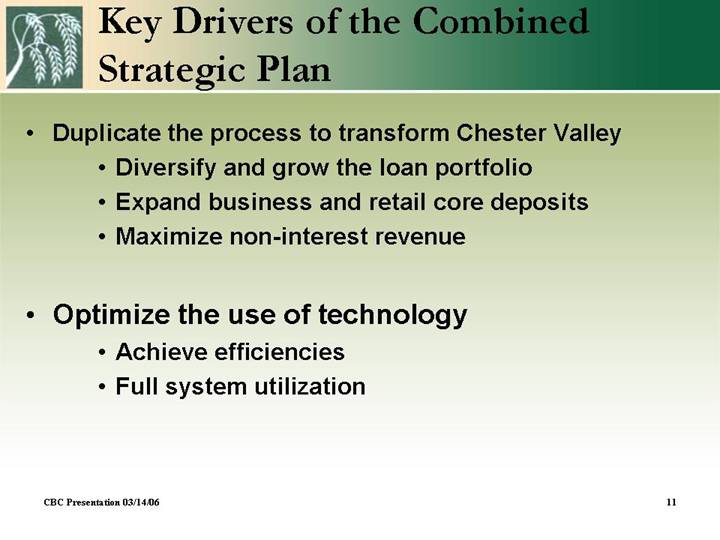

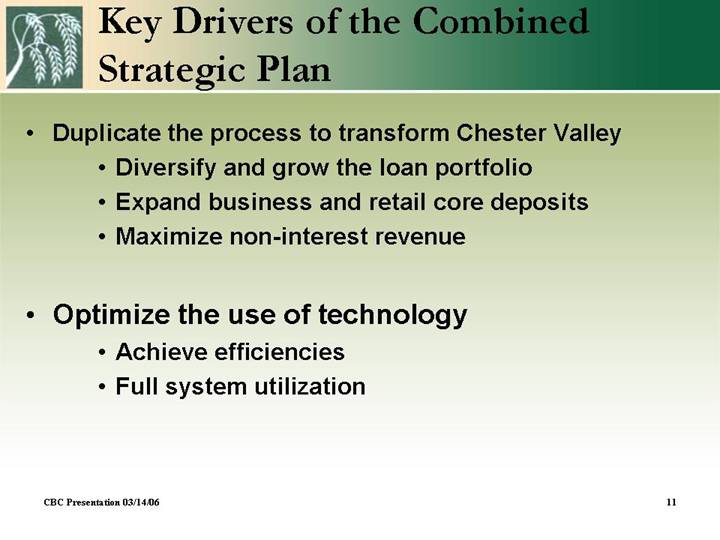

| Key Drivers of the Combined Strategic Plan |

• Duplicate the process to transform Chester Valley

• Diversify and grow the loan portfolio

• Expand business and retail core deposits

• Maximize non-interest revenue

• Optimize the use of technology

• Achieve efficiencies

• Full system utilization

11

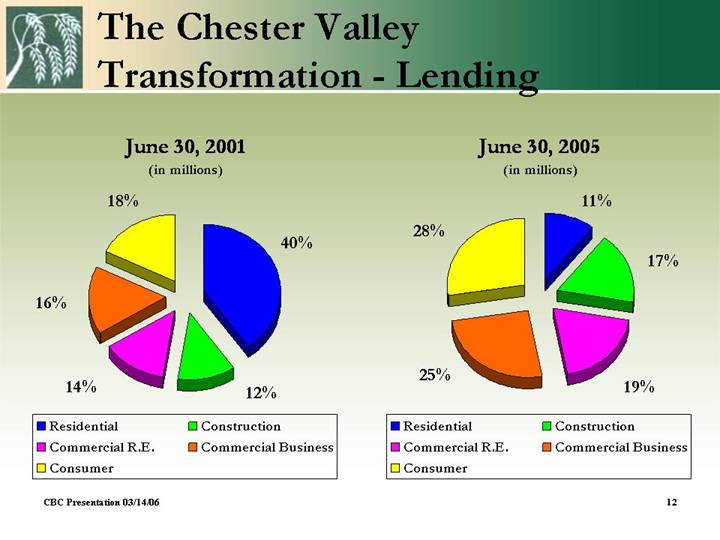

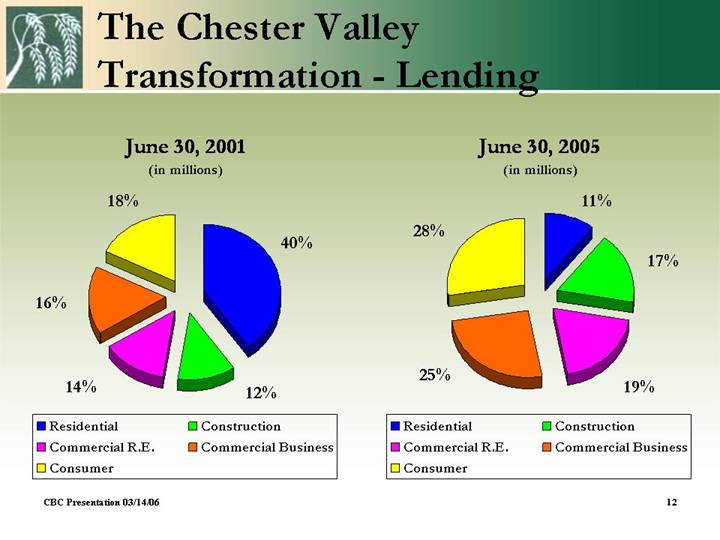

| The Chester Valley Transformation - Lending |

June 30, 2001 | June 30, 2005 |

(in millions) | (in millions) |

| |

[CHART] | [CHART] |

12

Small Business Commercial Loan Growth

(in thousands)

| | 06/30/01 | | 06/30/05 | |

Outstandings | | $ | 3,171 | | $ | 28,860 | |

CAGR | | — | | 73.69 | % |

| | | | | |

# of loans | | 45 | | 405 | |

| | | | | | | |

13

| The Chester Valley Transformation - Deposits |

June 30, 2001 | June 30, 2005 |

(in millions) | (in millions) |

| |

[CHART] | [CHART] |

14

| The Chester Valley Transformation — Fee Income |

[CHART]

15

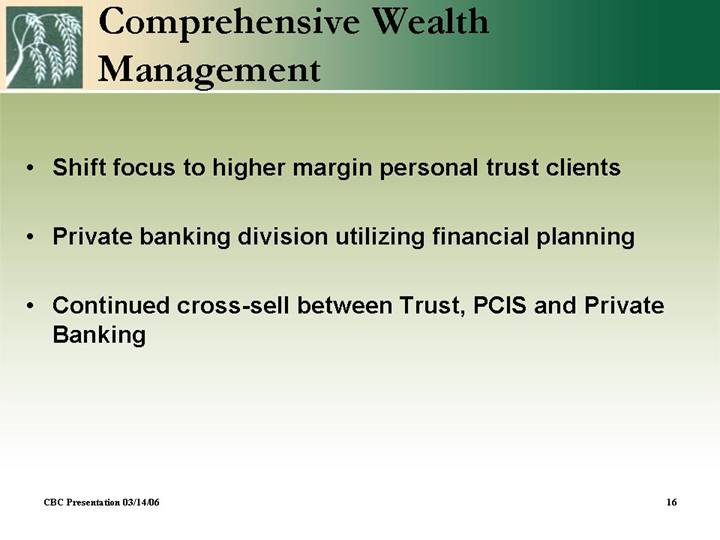

| Comprehensive Wealth

Management |

• Shift focus to higher margin personal trust clients

• Private banking division utilizing financial planning

• Continued cross-sell between Trust, PCIS and Private Banking

16

| Optimizing the use of Technology |

• System conversion complete

• 100% check imaged with web access

• Systems integration on every workstation

• National lock box system

• Efficiency through system utilization

17

Willow Grove Bancorp, Inc.

Financial Review

18

| | 2Q FY2005 | | 2Q FY2006 | | % Change | |

| | | | | | | |

Net Income | | $ | 2.0 | mil | $ | 3.9 | mil | +93.3 | % |

| | | | | | | |

Total Assets | | $ | 959.3

(6/30/05) | mil | $ | 1.6 | bil | +64.5 | % |

| | | | | | | |

EPS | | $ | 0.21 | | $ | 0.27 | | +28.6 | % |

| | | | | | | |

Avg. Interest Rate Spread | | 2.90 | % | 3.72 | % | +82 | bps |

| | | | | | | |

Net Interest Margin | | 3.29 | % | 3.80 | % | +51 | bps |

19

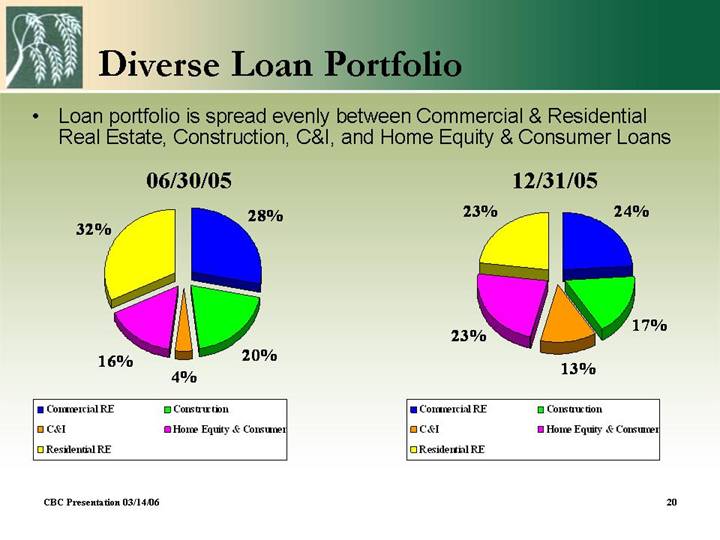

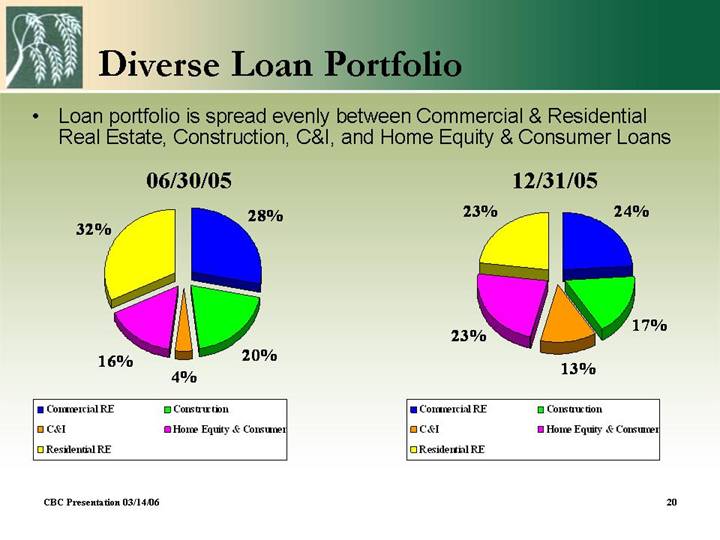

• Loan portfolio is spread evenly between Commercial & Residential Real Estate, Construction, C&I, and Home Equity & Consumer Loans

06/30/05 | 12/31/05 |

| |

[CHART] | [CHART] |

20

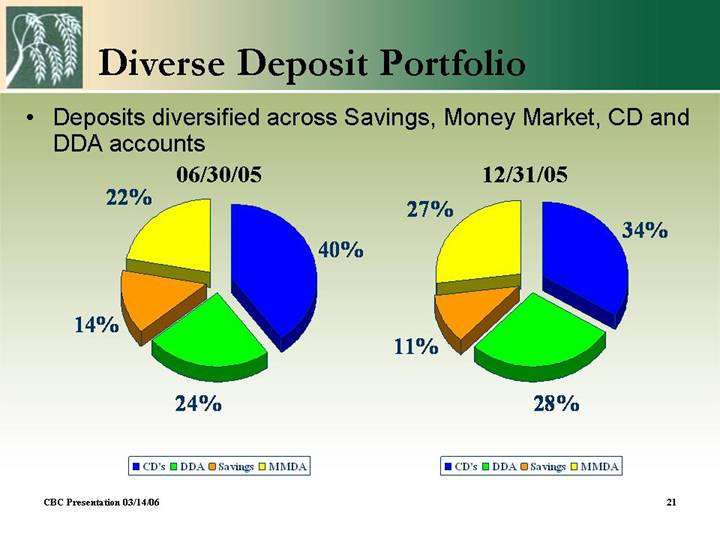

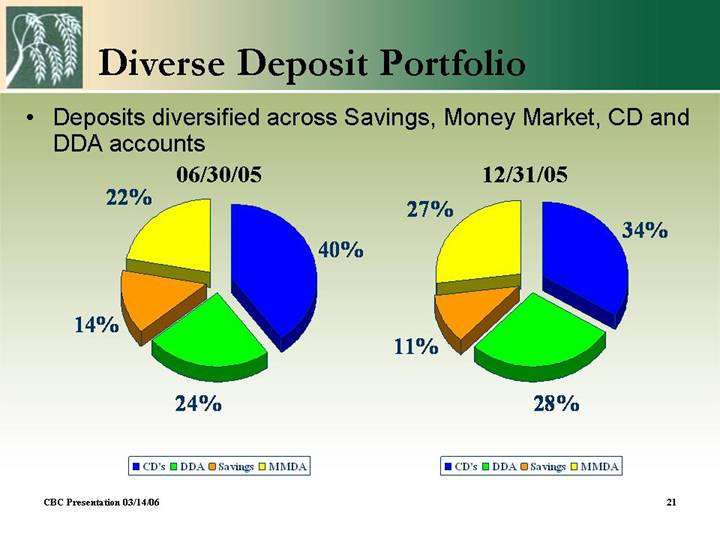

| Diverse Deposit Portfolio |

• Deposits diversified across Savings, Money Market, CD and DDA accounts

06/30/05 | 12/31/05 |

| |

[CHART] | [CHART] |

21

Assets

[CHART]

22

Loans Receivable, Net

[CHART]

23

Net Income

[CHART]

*Note: September 2005 figures for net income represent first quarter results, adjusted for special non recurring charges and the operating results of Chester Valley Bancorp for only one month.

24

Margin | Interest Spread |

| |

[CHART] | [CHART] |

25

• Full service, community bank serving the most attractive banking market in Pennsylvania

• Integration of Chester Valley on schedule, seeing cost benefits and product cross selling opportunities already

• Headquarter moved to King of Prussia, central to both franchises, plan to expand branch footprint

• Diverse loan and deposit portfolios

• Achieved record net income and EPS in 2Q FY 2006

• Improvement in net interest margin and interest rate spread

26

Thank You!