QuickLinks -- Click here to rapidly navigate through this documentFiled Pursuant to Rule 424(b)(3)

Registration No. 333-99075

PROSPECTUS

Amended Offers to Exchange

For each $1,000 principal amount of outstanding 91/2% Notes due 2003 and 101/4% Notes due 2006,

$1,000 principal amount of 12% Senior Notes due 2004 of Grupo TMM, S.A.

(Unconditionally Guaranteed on a Senior Basis by TMM Holdings, S.A. de C.V.),

plus accrued interest

And

Solicitations of Consents to Amend the Related Indentures

This prospectus amends and restates the terms of the exchange offers and consent solicitations described in our prospectuses dated March 5, 2003 and December 26, 2002. This prospectus supersedes in full the information in those prospectuses. (For a description of the material terms of the amended exchange offers that have changed from our previous exchange offers, see "Summary—Comparison of Amended Offer to Previous Offers.")

We refer to our 91/2% Notes due 2003 as the "2003 notes," to the 101/4% Notes due 2006 as the "2006 notes" and to the 2003 notes and the 2006 notes collectively as the "existing notes." For each $1,000 principal amount of existing notes, we are offering $1,000 principal amount of our unissued 12% Senior Notes due 2004, which we refer to as the "new notes," plus accrued interest. In conjunction with the exchange offers, we are soliciting consents from holders of the existing notes to eliminate substantially all of the restrictive covenants of the indentures governing the existing notes.

We are amending the exchange offer for the existing notes to (i) extend the offer until midnight on May 12, 2003, (ii) change the economic terms of the new notes and related guaranty as described below, (iii) eliminate the warrant component of the exchange offer consideration previously applicable to the 2003 notes and (iv) eliminate the consent fee component of the exchange offer consideration.

The terms of the new notes that we are offering in the exchange offer have been revised to (i) increase the interest rate on the new notes from 103/4% to 12% per annum; (ii) shorten the maturity of the new notes from February 1, 2010 to May 15, 2004 and (iii) make the other changes as more fully described under "Description of the New Notes." In addition, the new notes will require us to use all of the net proceeds from certain asset sales by us or our restricted subsidiaries or from any proceeds received from TFM if TFM has received proceeds from the VAT proceedings described in this prospectus, to repay the new notes prior to their maturity at a price equal to the principal amount thereof plus accrued unpaid interest to the repayment date.

The primary purpose for the exchange offers and the changes described in this prospectus is to provide us with sufficient time to complete the pending sales of our interest in our ports and terminals division and of our interest in TFM. In addition, we are seeking to amend the indentures governing the existing notes, as described herein.

The offers to exchange described herein will expire at midnight, New York City time, on May 12, 2003, unless extended. We refer to this date and time in this prospectus, if and as it is extended, as the "expiration date." In conjunction with this amendment to the exchange offers, we will promptly return all previously tendered existing notes and any tender prior to the date of this prospectus will be null and void. Any holder of existing notes that wishes to participate in the exchange offers must tender its notes on or after the date of this prospectus, even if such notes have been previously tendered to us for exchange. Tenders for exchange of existing notes that are made on or after the date of this prospectus are irrevocable and may not be withdrawn.

The exchange offers and the consent solicitations are conditioned, among other things, on the receipt of tenders of at least 80% of the aggregate principal amount of the 2003 notes and a majority in principal amount of the 2006 notes.

The new notes will be our unsecured senior obligations and will be guaranteed on a senior unsecured basis by TMM Holdings, S.A. de C.V. (the "Guarantor"). The new notes will bear interest from the settlement date of the exchange offers at the rate of 12% per year, payable at the maturity of the new notes, which is May 15, 2004. We will pay principal and interest on the new notes without deducting amounts we may be required to withhold or deduct for Mexican withholding taxes.

We may redeem all of the new notes at any time in the event of specified increases in Mexican withholding taxes, with the proceeds from certain offerings and with certain distributions or advances from our subsidiaries, in each case at a redemption price of 100% of the principal amount of the new notes and any accrued interest.

Application will be made to list the new notes on the New York Stock Exchange.

You should consider carefully the "Risk Factors" beginning on page 22 of this prospectus before you make a decision as to whether to tender your existing notes and consent to the proposed amendments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The dealer manager for the exchange offers is:

Citigroup

The date of this prospectus is April 29, 2003

TABLE OF CONTENTS

| | Page

|

|---|

| PRESENTATION OF FINANCIAL INFORMATION | | ii |

| ENFORCEMENT OF CIVIL LIABILITIES AGAINST NON-U.S. PERSONS | | ii |

| INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | | iii |

| FORWARD-LOOKING INFORMATION | | v |

| SUMMARY | | 1 |

| QUESTIONS AND ANSWERS RELATING TO THE EXCHANGE OFFERS AND CONSENT SOLICITATIONS | | 17 |

| RISK FACTORS | | 22 |

| THE EXCHANGE OFFERS AND CONSENT SOLICITATIONS | | 40 |

| THE PROPOSED AMENDMENTS | | 49 |

| EXCHANGE RATES AND EXCHANGE CONTROLS | | 52 |

| FINANCING FOR THE OFFERS | | 53 |

| CAPITALIZATION | | 53 |

| SELECTED CONSOLIDATED HISTORICAL FINANCIAL DATA | | 54 |

| RATIO OF EARNINGS TO FIXED CHARGES | | 57 |

| UNAUDITED PRO FORMA FINANCIAL INFORMATION | | 58 |

| OPERATING AND FINANCIAL REVIEW AND PROSPECTS | | 68 |

| QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISKS | | 90 |

| THE COMPANY | | 92 |

| THE GUARANTOR | | 121 |

| MANAGEMENT | | 122 |

| MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | | 128 |

| LEGAL PROCEEDINGS | | 130 |

| DESCRIPTION OF SIGNIFICANT INDEBTEDNESS AND RECEIVABLES SECURITIZATION FACILITY | | 132 |

| DESCRIPTION OF THE NEW NOTES | | 137 |

| COMPARISON OF MATERIAL DIFFERENCES BETWEEN THE 2003 NOTES, THE 2006 NOTES AND THE NEW NOTES | | 169 |

| MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | | 180 |

| MATERIAL MEXICAN FEDERAL INCOME TAX CONSIDERATIONS | | 185 |

| LEGAL MATTERS | | 187 |

| EXPERTS | | 187 |

| WHERE YOU CAN FIND MORE INFORMATION | | 187 |

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | | F-1 |

| ANNEX A—FORM OF SUPPLEMENTAL INDENTURE FOR THE 2003 NOTES | | A-1 |

| ANNEX B—FORM OF SUPPLEMENTAL INDENTURE FOR THE 2006 NOTES | | B-1 |

You should rely only on the information contained in this prospectus or in any supplement accompanying this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus or in any supplement accompanying this prospectus is accurate as of any date other than the date on the front of this prospectus.

i

PRESENTATION OF FINANCIAL INFORMATION

Our financial statements are published in dollars and prepared in conformity with accounting principles issued by the International Accounting Standards Committee ("International Accounting Standards" or "IAS"), which differ in certain significant respects from U.S. generally accepted accounting principles, which we refer to as "U.S. GAAP." We maintain our financial books and records in dollars. However, we keep our tax books and records in pesos. We record in our financial records the dollar equivalent of the actual peso charges at the time incurred using the then prevailing exchange rate. See Note 18 to our Financial Statements for a description of the principal differences between International Accounting Standards and U.S. GAAP applicable to us and a reconciliation to U.S. GAAP of our stockholders' equity and net income as of December 31, 2001 and 2002 and for each of the three years ended December 31, 2002. Sums presented in this prospectus may not add due to rounding.

ENFORCEMENT OF CIVIL LIABILITIES AGAINST NON-U.S. PERSONS

We have been advised by Haynes & Boone, S.C., our Mexican counsel, that no treaty is currently in effect between the United States and Mexico that covers the reciprocal enforcement of foreign judgments. Mexican courts have enforced judgments rendered in the United States by virtue of the legal principles of reciprocity and comity, consisting of the review in Mexico of the United States judgment in order to ascertain whether Mexican legal principles of due process and public policy (orden público) have been complied with without reviewing the merits of the subject matter of the case. Furthermore, we have been advised by Haynes & Boone, S.C. that there is doubt as to the enforceability, in original actions in Mexican courts, of liabilities predicated solely on the U.S. federal securities laws and as to the enforceability in Mexican courts of judgments of U.S. courts obtained in actions predicated upon the civil liability provisions of the U.S. federal securities laws.

Grupo TMM is a fixed capital corporation (sociedad anónima) and the Guarantor is a variable capital corporation (sociedad anónima de capital variable) organized under the laws of Mexico. We are headquartered, managed and operated outside of the United States. Substantially all of our directors and officers and some of the experts named in this prospectus reside outside the United States, principally in Mexico. A substantial portion of the assets of these persons and of our company is located outside the United States. As a result, it may not be possible for investors to effect service of process within the United States upon such persons or us, or to enforce against them in the United States a judgment obtained in U.S. courts predicated upon the civil liability provisions of the U.S. federal securities laws or other laws of the United States.

We have appointed CT Corporation System, 111 Eighth Avenue, New York, New York 10011, as our authorized agent upon whom process may be served in any action arising out of or in connection with these exchange offers and consent solicitations. With respect to such actions, we have submitted to the jurisdiction of the courts of the State of New York sitting in the borough of Manhattan in New York City or of the United States for the Southern District of New York.

ii

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The following documents filed by us with the SEC are hereby incorporated by reference into this prospectus to the extent not modified or superseded by documents subsequently filed:

- •

- Annual Report on Form 20-F for the fiscal year ended December 31, 2001;

- •

- Report on Form 6-K dated April 24, 2003;

- •

- Report on Form 6-K dated April 22, 2003;

- •

- Report on Form 6-K dated April 21, 2003;

- •

- Report on Form 6-K dated April 14, 2003;

- •

- Report on Form 6-K dated April 7, 2003;

- •

- Report on Form 6-K dated March 21, 2003;

- •

- Report on Form 6-K dated March 7, 2003;

- •

- Report on Form 6-K dated February 26, 2003;

- •

- Report on Form 6-K dated February 19, 2003;

- •

- Report on Form 6-K dated February 18, 2003;

- •

- Report on Form 6-K dated February 13, 2003;

- •

- Report on Form 6-K dated February 12, 2003;

- •

- Report on Form 6-K dated February 7, 2003;

- •

- Report on Form 6-K dated January 6, 2003;

- •

- Report on Form 6-K dated December 30, 2002;

- •

- Report on Form 6-K dated December 11, 2002;

- •

- Report on Form 6-K dated October 30, 2002;

- •

- Report on Form 6-K dated October 24, 2002;

- •

- Report on Form 6-K dated October 16, 2002;

- •

- Report on Form 6-K dated October 11, 2002;

- •

- Report on Form 6-K dated September 24, 2002;

- •

- Report on Form 6-K dated September 13, 2002;

- •

- Report on Form 6-K dated September 9, 2002;

- •

- Report on Form 6-K dated July 31, 2002;

- •

- Report on Form 6-K dated July 22, 2002;

- •

- Report on Form 6-K dated July 1, 2002; and

- •

- Report on Form 6-K dated June 11, 2002.

Any statement contained in a document incorporated by reference shall be deemed to be modified or superseded for the purpose of this prospectus by any contradictory statement in this prospectus, but only to the extent such statement is contradictory. Any such statement that has been modified or superseded by a statement in this prospectus shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. All information appearing in this prospectus is qualified in its entirety by the

iii

information and financial statements (including notes thereto) appearing in the documents incorporated by reference, except to the extent set forth in the immediately preceding sentence.

All documents and reports filed by us pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the "Exchange Act," after the date of this prospectus and prior to the expiration of the exchange offers will be deemed to be incorporated by reference into this prospectus and to be a part hereof from the date of filing of such documents and reports. Any statement contained in this prospectus or incorporated herein by reference will be deemed to be modified or superseded to the extent that a statement contained in any documents and reports filed by us pursuant to Section 13 or 15(d) of the Exchange Act after the date of this prospectus modifies or supersedes such statement.

We will provide without charge to each person to whom this prospectus is delivered, upon written or oral request, copies of any or all documents and reports described above and incorporated by reference into this prospectus (other than exhibits to such documents, unless such exhibits are specifically incorporated by reference). Written or telephone requests for such copies should be directed to the information agent at the address and telephone numbers set forth on the back cover of this prospectus.

iv

FORWARD-LOOKING INFORMATION

This prospectus contains various forward-looking statements, including statements regarding, among other things, our financial performance and operating plans. These statements are based upon the current beliefs of our management, as well as upon assumptions made by management based upon information currently available to it. The words "believe," "expect," "likely," "anticipate" and similar expressions identify some of these forward-looking statements. These statements are subject to various risks and uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Should management's assumptions prove incorrect, actual results may vary materially and adversely from those anticipated or projected. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of their respective dates. We undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The following factors, as well as other factors described in this prospectus and the documents that are incorporated in this prospectus, could cause actual results to differ materially from our forward-looking statements:

- •

- our ability to complete the sales of our interests in our ports division or in our railroad operations;

- •

- our ability to extend the near-term maturities of our debt, particularly the 2003 notes;

- •

- our ability to extend or amend our receivables securitization facility if the sale of our interest in the ports division is not completed and otherwise to refinance our indebtedness on favorable terms;

- •

- in the event the sale of our interests in our ports division or our railroad operations is not completed, our ability to generate sufficient cash from operations to meet our obligations, including the ability of our subsidiaries, such as TFM, our principal operating subsidiary, to generate sufficient distributable cash flow and to distribute those cash flows in accordance with their existing agreements;

- •

- Mexican, U.S. and global economic and social conditions;

- •

- the effect of the North American Free Trade Agreement ("NAFTA") on the level of U.S.-Mexico trade;

- •

- conditions affecting the international shipping and transportation markets;

- •

- the timing of the receipt by TFM of the recent value added tax award;

- •

- our ability to reduce corporate overhead costs;

- •

- our ability to satisfy our contingent obligation to purchase shares of TFM owned by the government of Mexico if the sale of our railroad operations is not completed;

- •

- the ability of management to manage growth and successfully compete in new businesses;

- •

- the availability of capital to fund our expansion plans;

- •

- our ability to utilize a portion of the current and future tax loss carryforwards;

- •

- changes in legal or regulatory requirements in Mexico or the United States;

- •

- economic uncertainty caused by the economic slowdown in the United States following the terrorist attacks in 2001; and

- •

- other factors described in this prospectus and the documents incorporated by reference in this prospectus.

v

SUMMARY

This summary highlights selected information from this document and may not contain all of the information that is important to you. You should read carefully this entire document and the other documents to which we have referred. To understand the exchange offers and consent solicitations more fully and for a more complete description of the legal terms of the exchange offers and consent solicitations, see "Where You Can Find More Information" on page 187 of this prospectus.

In this document, unless specified otherwise, "we," "us," "our," "Grupo TMM" and "the company" refer to Grupo TMM, S.A. and its subsidiaries, and "you" refers to the holders of the existing notes.

References in this document to "$," "US$" or "dollars" are to United States dollars and references to "pesos" or "ps." are to Mexican pesos. This document contains translations of certain peso amounts into dollars at specified rates solely for the convenience of the reader. These translations should not be construed as representations that the peso amounts actually represent such dollar amounts or could be converted into dollars at the rates indicated or at any other rate.

As described below under "Summary—The Asset Sale Agreements" and under "The Company—The Asset Sales," we have recently entered into agreements pursuant to which we have agreed to sell our interests in our Railroad operations and our Ports and Terminals operations (other than our ports at Acapulco and Tuxpan). The agreements are subject to certain conditions as described below. This prospectus includes information about all of our operations, including those operations we have agreed to sell. See "The Company—The Asset Sales" and "Pro Forma Financial Information" for more information regarding the sales and impact on our financial position and results of operations of the completion of the asset sales.

The Company and the Guarantor

We offer an integrated regional network of rail and road transportation services, port management, specialized maritime operations and logistics. Our services include:

- •

- rail transport within Mexico and to and from the United States through our interest in TFM;

- •

- port and terminal operations in the ports of Manzanillo, Veracruz, Cozumel, Acapulco, Progreso and Tuxpan;

- •

- specialized maritime shipping, including:

• chartering supply ships to serve offshore oil rigs,

• furnishing towing services for ships at the Port of Manzanillo, and

• transporting automobiles, and refined petroleum and chemical products; and

• logistics operations, including:

• dedicated contract trucking, and

• integrated logistics outsourcing services.

We have taken a number of significant steps in recent years to expand our business through the use of joint ventures with strategic partners, to restructure our operations and to reduce our debt and improve our liquidity position.

We were formed on August 14, 1987 as a variable capital corporation (sociedad anónima de capital variable) organized under the laws of Mexico to serve as a holding company for investments by certain members of the Serrano Segovia family. On December 26, 2001, we completed a merger of our subsidiary, Transportación Marítima Mexicana, S.A. de C.V. ("TMM") with and into us, and we were the surviving entity. On September 13, 2002, we completed a reorganization that eliminated the variable portion of our capital stock and we became a fixed capital corporation. Consequently, our registered name changed from Grupo TMM, S.A. de C.V. to Grupo TMM, S.A. Following the reclassification, the Serrano Segovia family owns 46.5% of our outstanding Series A Shares. See "The Company—Reclassification of Series A and Series L Shares."

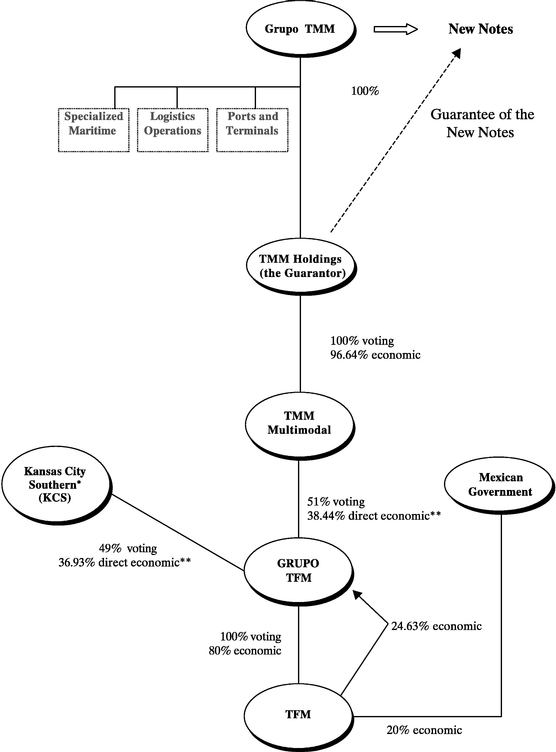

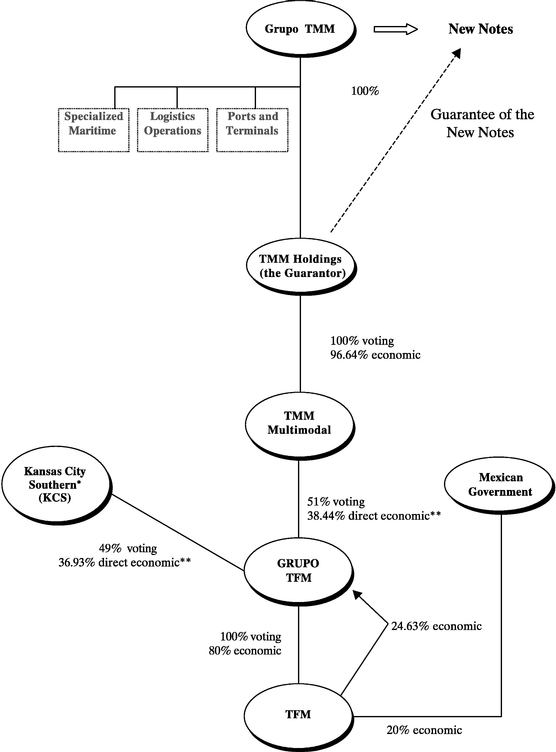

1

�� The Guarantor is a newly formed wholly owned subsidiary of the company which will indirectly hold our interest in Grupo TFM. Our interest in Grupo TFM is held through TMM Multimodal, in which we have an approximate 97% interest. TMM Multimodal, in turn, has a voting interest of 51% and a direct economic interest of 38.4% in Grupo TFM. Grupo TFM holds an 80% direct economic interest in TFM, which conducts our rail operations. The remaining 20% economic interest in TFM is owned by the Mexican government. Prior to these exchange offers, the Guarantor has not engaged in any other business. See "Summary—Corporate Structure."

Our headquarters are in Mexico City, D.F., located at Avenida de la Cúspide, No. 4755, Colonia Parques del Pedregal, 14010 Mexico City, D.F., Mexico, telephone from the United States 011-52-55-5629-8866. Our agent in the United States authorized to receive service of process in any proceeding arising out of or in connection with the exchange offers is CT Corporation System, with offices currently located at 111 Eighth Avenue, New York, New York 10011.

Recent Developments

The Asset Sale Agreements

We have entered into agreements to sell our interests in Grupo TFM, which owns TFM and through which our railroad operations are conducted, and our interest in our ports and terminals division (excluding our interest in ports at Acapulco and Tuxpan).

On April 21, 2003, we entered into an Acquisition Agreement with Kansas City Southern ("KCS"), which owns a 49% voting interest in Grupo TFM, to sell our entire interest in Grupo TFM to KCS (the "TFM Sale"). Under the agreement, KCS will acquire our interest in Grupo TFM for $200 million in cash and 18,000,000 shares of common stock of KCS. KCS has the right to elect to pay up to $80 million of the cash portion of the purchase price by delivering shares of KCS common stock valued for that purpose at $12.50 per share. On April 25, 2003, the closing price for shares of KCS common stock on the New York Stock Exchange was $11.21. In addition, we will have the right to receive an additional amount of up to $175 million in cash ($180 million if KCS elects to defer a portion of the payment) in the event that the pending VAT claim (described herein) against the Mexican government by TFM is successfully resolved and the amount received is greater than the purchase price of the "put" rights for the TFM shares held by the Mexican government. Upon completion of the TFM Sale, KCS will assume the company's obligations to make any payment upon the exercise by the Mexican government of its "put" rights for the 20% interest it holds in TFM and will indemnify the company against any obligation or liability relating to the exercise by the Mexican government of the put rights. Completion of the TFM Sale is subject to approval by the stockholders of KCS and TMM, receipt of certain governmental approvals in the United States and Mexico and other customary conditions. We currently expect that the sale will be completed in the third quarter of 2003. There is no assurance that the process required to obtain the necessary regulatory approvals will not delay the closing of the TFM Sale or that the TFM Sale will occur. See "The Company—The Asset Sales—The TFM Sale."

In addition, on April 10, 2003, we entered into an agreement with an affiliate of Stevedoring Services of America ("SSA"), our current joint venture partner in the ports and terminals division, to sell our interest in the ports and terminals division to SSA for approximately $114 million net in cash, subject to certain post-closing adjustments based on specified balance sheet items as of the closing date (which we refer to as the "Port Sale"). Completion of the Port Sale is subject to SSA obtaining sufficient financing to complete the acquisition, to SSA's completion of their diligence investigation and to other customary conditions. We currently expect to complete the Port Sale on or before May 6, 2003. See "The Company—The Asset Sales—Sale of Interest in the Ports Division."

Proceeds from the Port Sale will be used to provide funds for the repurchase of outstanding certificates under the company's existing receivables securitization facility as required by the terms of such facility, including those of the dealer manager's affiliate, Citibank, N.A., as a lender under the facility. The outstanding certificates under the facility as of December 31, 2002 were $86.7 million. Any net cash proceeds from the Port Sale that are not used to repurchase receivables under the facility will be available to reduce outstanding debt, including any untendered 2003 notes. Pursuant to the consent solicitations, the company is seeking the ability to use up to

2

$15 million of the proceeds from the Port Sale for working capital needs and to pay expenses relating to the exchange offers, the TFM Sale and Port Sale. If the exchange offers are completed, net cash proceeds from the TFM Sale will be used to repurchase new notes or, if the holders of new notes do not elect to have their notes repurchased, to retire other debt or for general corporate purposes.

Other Recent Developments

VAT Award

On September 25, 2002, the Mexican Magistrates Court of the First District (the "Federal Court") issued a judgment in favor of TFM on a value added tax claim, which has been pending in the Mexican courts since 1997. The claim arose out of the Mexican Treasury's delivery of a VAT credit certificate to a Mexican governmental agency rather than to TFM. By a unanimous decision, the Federal Court vacated a prior judgment of the Federal Tribunal of Fiscal and Administrative Justice (the "Fiscal Court") and remanded the case to the Fiscal Court with specific instructions to enter a new decision consistent with the guidance provided by the Federal Court's ruling. The Federal Court's ruling requires the fiscal authorities to issue the VAT credit certificate only in the name of TFM. On December 6, 2002, the upper chamber of the Fiscal Court again ruled against TFM. On January 8, 2003, TFM was officially notified of the new judgment of the Fiscal Court and on January 29, 2003, filed the appropriate appeal. TFM is considering filing an additional complaint against the Fiscal Court's new judgment, and in both instances believes that it will prevail. In the event TFM prevails, a third party who can establish that its rights have been adversely and improperly affected by the new ruling may seek to bring a claim, in a different proceeding, against TFM. However, TFM does not believe that any third party's rights would be improperly affected and believes that it would prevail in any such action.

The face value of the VAT certificate at issue is approximately $206 million, and the amount of any recovery will reflect adjustments for inflation and accruals of interest at statutory rates since 1997, in accordance with the legal codes applicable from time to time since that date.

If the TFM Sale is completed and the VAT claim is successfully resolved, the company will have the right to receive from KCS an additional cash payment of between $100 million and $175 million (up to $180 million if KCS elects to defer a portion of the payment). In order to receive any such payment, the amount of the payment must be in excess of the then current repurchase price under the put right held by the Mexican government with respect to its 20% interest in TFM or TFM must receive the Mexican government's interest in TFM as part of the settlement of the VAT claim. KCS is obligated to make the payment within 90 days after the VAT payment is received, however, it can elect to defer up to $50 million of the payment until not later than the first anniversary of the date TFM receives the VAT payment. If KCS elects to defer such amount, the amount due to the company will increase by $5 million (but not to more than $180 million).

Recent Results of Operations

On February 28, 2002, the company announced its fourth quarter and full year financial results. On a consolidated basis, the company reported revenues from consolidated operations of $255.7 million for the fourth quarter of 2002, compared to revenues from consolidated operations of $258.2 million for the same period of 2001. Reduced income was reported at TFM, Tex-Mex, Specialized Maritime and Logistics due to sluggish trade growth, automotive sector revenue declines in transit and at outsourcing facilities, and from dry docking of some tanker vessels. Consolidated EBITDA (Earnings before Income, Taxes and Depreciation) was $69.5 million for the fourth quarter of 2002, compared to $77.2 million in the fourth quarter of 2001.

For the full year, the company reported revenue from consolidated operations of $1.01 billion in 2002, compared to $1.0 billion for the same period in 2001. Annual revenue improvement was seen in the Ports and Terminals, Specialized Maritime and Logistics divisions due to new product offerings and an improved product mix, demonstrating the sustainability of these operations. Consolidated EBITDA was $297.4 million for the full year of 2002, compared to $302.5 million in the same period of 2001.

The company's consolidated fourth quarter operating income decreased $6.3 million, from $47.5 million in 2001 to $41.2 million in 2002 and net income for the quarter decreased from $1.6 million in 2001 to a loss of

3

$8.9 million in 2002. These results were directly impacted by the direct accounting effects of a 12.8 percent peso devaluation.

In 2002, the company's consolidated operating income decreased $5.1 million to $184.0 million due to increased costs at Ports and Terminals for increased security and reduction of storage revenue; at Specialized Maritime for routine but mandatory dry dock improvements to the tanker fleet; and at Logistics due to sluggish automotive movement activity at outsourced locations. Revenue reductions in the automotive sector and in grain imports from the U.S. negatively affected the Railroad division's results. Net income decreased to a loss of $42.6 million and was impacted, as stated above, primarily by peso devaluation.

The financial information presented for the fiscal years ended December 31, 2001 and 2002 was derived from our audited consolidated financial statements which are contained elsewhere herein. The financial data for the three months ended December 31, 2001 and 2002, was derived from our unaudited financial statements. The financial statements have been prepared from information published in Mexico and in accordance with IAS, which differ in significant respects from U.S. GAAP.

Our Liquidity Position

At December 31, 2002, we had $224.9 million of short term debt with face value of $227.3 million, including $13.3 million in face value of senior convertible notes (net of the fair market value of the note-linked securities issued in connection with these convertible notes) and $176.9 million of the 2003 Notes. The senior convertible notes require weekly payments in the amount of approximately $0.7 million and have a final maturity of May 2, 2003. See "Description of Significant Indebtedness and Receivables Securitization Facility—Senior Convertible Notes." The 2003 Notes mature on May 15, 2003. In addition, upon the completion of the Port Sale, we have an obligation to repurchase receivables held by the trust established under the receivables securitization facility to provide funds for the repurchase of the then outstanding certificates issued under the facility ($86.7 million as of December 31, 2002). If the Port Sale is not completed, we still have an obligation to provide funds for the repurchase of $49.9 million of such certificates on May 6, 2003. See "Description of Significant Indebtedness and Receivables Securitization Facility—Receivables Securitization Facility." In addition, we are contractually obligated to pay Promotora Servia, which is our affiliate, $26.9 million on April 30, 2003 (though we currently intend to enter into discussions to extend the due date of this payment).

We do not currently have sufficient liquidity to repay the obligations described above. There can be no assurance that the Port Sale or the TFM Sale will be completed and if either of these transactions is not completed, we may not be able to arrange an alternative disposition of these assets. In addition, if the exchange offers, TFM Sale and Port Sale are all completed, we will need to take additional steps in order to meet these obligations when due. These steps could include one or more of the following: receipt of the additional amounts payable by KCS upon the successful resolution of the pending VAT claim, sale of other or additional assets, such as shares of KCS Common Stock, refinancing these amounts, negotiation of waivers or extensions with the holders of these amounts or raising equity in order to meet these obligations when due.

There is no assurance that we will be successful in completing the TFM Sale and the Port Sale or taking such additional steps.

If we are unable to refinance or repay the 2003 notes at maturity or if we fail to meet our other obligations, we face a risk of Mexican reorganization-related proceedings

If we are unable to refinance or repay the 2003 notes at maturity in May 2003, or fail to meet our other obligations (such as our obligation to repurchase the receivables under the receivables securitization facility) holders of the 2003 notes and some of our creditors, as the case may be, could take legal action against us, including instituting a reorganization proceeding in Mexico. Further, we may choose to institute a voluntary reorganization proceeding under Mexican law. If any such proceedings were to be instituted, we could not predict the duration thereof or the ability of holders of existing notes to influence the outcome of such proceedings. We are not aware of any company of our size that has successfully completed a restructuring under the new Mexican reorganization law since the current regulation was passed in May of 2000. A reorganization proceeding is likely to result in significant changes to our existing obligations, including the existing notes, which

4

could include the cancellation or rescheduling of all or part of those obligations. During the pendency of any such proceeding, our ability to operate or manage our business, to retain employees, to maintain existing or create new client relationships, to continue to collect payments for our services or to obtain any type of funding or financing would likely be materially adversely affected. We believe that any such adverse effects would be exacerbated if the reorganization proceeding were protracted as the statutory provisions governing this proceeding remain largely untested.

The Exchange Offers and Consent Solicitations

| Securities For Which We Are Making These Exchange Offers | | We are making exchange offers for the full principal amount outstanding of both our 2003 notes and 2006 notes. |

| | | There are currently $176,875,000 in aggregate principal amount of 2003 notes outstanding and $200,000,000 in aggregate principal amount of 2006 notes outstanding. The CUSIP number of the 2003 notes is 893868AA7 and the ISIN number of the 2003 notes is US893868AA72. The CUSIP number of the 2006 notes is 893868AC3 and the ISIN number of the 2006 notes is US893868AC39. |

| Comparison of Amended Offers to Previous Offers | | We are amending the terms of our previous exchange offers as follows. |

| | | • Each holder of our outstanding 91/2% Notes due 2003 ("2003 notes") and each holder of our outstanding 101/4% Notes due 2006 ("2006 notes" and, together with 2003 notes, "existing notes") whose 2003 notes or 2006 notes are properly tendered and accepted will receive, for each $1000 principal amount of existing notes, $1,000 principal amount of 12% Senior Notes due 2004 of Grupo TMM, S.A. (the "new notes") (Unconditionally Guaranteed on a Senior Basis by TMM Holdings, S.A. de C.V.). No warrants and no consent fee are being offered in the amended exchange offers. |

| | | • The terms of the new notes that we are offering in the exchange offers have been revised to (i) increase the interest rate on the new notes from 103/4% to 12% per annum;

(ii) shorten the maturity of the new notes from February 1, 2010 to May 15, 2004 and (iii) make the other changes as more fully described under "Description of the New Notes," including a requirement that we use the proceeds of certain asset sales to retire new notes. |

| | | • The offers will expire at midnight, New York City time, on May 12, 2003. |

| | | In addition, we have amended the consent solicitations to seek the amendments described under "Summary—The Proposed Amendments" and "The Proposed Amendments." |

5

| All Previously Tendered Existing Notes to be Returned; New Tender Required | | In conjunction with the amendment to the exchange offers described in this prospectus, we will promptly return all previously tendered existing notes and any tender of existing notes made prior to the date of this prospectus will be null and void. Any holder of existing notes that wishes to participate in the exchange offers must tender their existing notes on or after the date of this prospectus, even if such existing notes have been previously tendered to us for exchange. |

| Consideration Offered in the Exchange Offers | | For each $1,000 principal amount of our existing notes properly tendered, we are offering $1,000 principal amount of our unissued 12% Senior Notes due 2004, plus accrued interest. |

| Consent Solicitations | | Concurrently with the exchange offers, we are soliciting consents to the proposed amendments to the indentures governing the existing notes from holders of each series of existing notes. For a complete description of the proposed amendments, see "The Proposed Amendments."Holders of existing notes of either series may give their consent to the proposed amendments applicable to that series only by tendering their existing notes in the exchange offers and will be deemed to have given their consent by so tendering. The terms of the indentures governing each series of existing notes provide that consents from holders of a majority in aggregate principal amount outstanding must be received in order to amend the indenture governing that series. However, the exchange offers and consent solicitations are subject to additional conditions as described in detail under "The Exchange Offers and Consent Solicitations—Conditions to the Exchange Offers." |

| Accrued Interest | | Interest to, but not including, the settlement date will be paid in cash on the settlement date in respect of existing notes tendered and accepted in the exchange offers. The new notes issued in the exchange offers will accrue interest from the settlement date. |

| Expiration Date | | The exchange offers will expire at midnight, New York City time, on May 12, 2003, unless extended by us in respect of either or both series of existing notes in our sole discretion. We will announce any extension of the expiration date no later than 9:00 a.m., New York City time, on the business day following the previously scheduled expiration date. |

| Settlement Date | | The new notes will be issued and accrued interest will be paid on the settlement date, which will be May 14, 2003 or as soon as practicable thereafter. |

6

| Conditions to the Exchange Offers and Consent Solicitations | | The exchange offers and consent solicitations are subject to the terms and conditions set forth under "The Exchange Offers and Consent Solicitations—Conditions to the Exchange Offers," including the condition that we receive valid and unrevoked tenders of at least 80% in aggregate outstanding principal amount of the 2003 notes and a majority in aggregate outstanding principal amount of the 2006 notes. As of April 28, 2003, we have received tenders of $44,814,000, or approximately 25.33%, of the aggregate principal amount of the 2003 notes and $156,921,000, or approximately 78.46%, of the aggregate principal amount of the 2006 notes. All previously tendered notes are, however, being returned in conjunction with the amendment of the exchange offer. |

| Procedures for Tendering | | In conjunction with the amendment to the exchange offers described in this prospectus, we will promptly return all previously tendered existing notes and any tender of existing notes made prior to the date of this prospectus will be null and void. Any holder of existing notes that wishes to participate in the exchange offers must tender its existing notes on or after the date of this prospectus, even if such existing notes have been previously tendered to us for exchange. If your existing notes are held by a broker, dealer, commercial bank, trust company or other custodian and you wish to tender them in the exchange offers, you should promptly contact the custodian and instruct the custodian to tender on your behalf. |

| | | If your existing notes are held by you as physical certificates registered in your name, and you wish to tender them in the exchange offers, you must (a) deliver these existing notes to a broker, dealer, commercial bank, trust company or other custodian that can act on your behalf and that has an account at the Depositary Trust Company ("DTC") and (b) instruct this custodian to tender your existing notes on your behalf. We are requiring this because the new notes will be available only in book-entry form through accounts at DTC. To participate in the exchange offers you must tender existing notes through a DTC account and have the new notes you will receive credited to a DTC account. If you need any assistance doing this, contact the information agent at its phone number listed on the back of this prospectus. |

| | | Existing notes held through DTC must be tendered only by book-entry transfer using DTC's ATOP (Automated Tender Offer Program) system. In order for a book-entry transfer to constitute a valid tender of your existing notes in the exchange offers, the exchange agent must receive an agent's message confirming your acceptance of the terms of the exchange offer and the book-entry transfer of your existing notes into the exchange agent's account at DTC prior to the expiration date.Holders tendering via DTC's ATOP system need not deliver a completed letter of transmittal to the exchange agent. See "The Exchange Offers and Consent Solicitations—How to Tender." |

7

| | | If your existing notes are held through Euroclear Bank S.A./N.V., as operator of the Euroclear System ("Euroclear") or Clearstream Banking, société anonyme ("Clearstream, Luxembourg"), you must comply with the procedures established by Euroclear or Clearstream, Luxembourg, as applicable, for the exchange offers. Euroclear and Clearstream, Luxembourg intend to collect from their direct participants (a) instructions to (1) tender existing notes held by them on behalf of their direct participants in the exchange offers, (2) "block" any transfer of existing notes so tendered until the completion of the exchange offers and (3) debit their account on the settlement date in respect of all existing notes accepted for exchange by us, and (b) irrevocable authorizations to disclose the names of the direct participants and information about the foregoing instructions. Upon the receipt of these instructions, Euroclear and Clearstream, Luxembourg will advise, indirectly, the exchange agent of the amount of existing notes being tendered and other required information. Euroclear and Clearstream, Luxembourg may impose additional deadlines in order to process properly these instructions. As a part of tendering through Euroclear or Clearstream, Luxembourg, you are required to become aware of any such deadlines. |

| Consequences to Existing Noteholders Not Tendering in the Exchange Offers | | For a description of the consequences to existing noteholders of not tendering in the exchange offers, see "Risk Factors—Factors Relating to the Exchange Offers and Consent Solicitations." |

| Withdrawal Rights | | Tenders for exchange of existing notes that are made on or after the date of this prospectus are irrevocable and may not be withdrawn. See "The Exchange Offers and Consent Solicitations—Expiration Date; Extensions; Amendments; Termination" and "—Withdrawal Rights." |

| Exchange Agent | | Citibank, N.A. is serving as the exchange agent (the "exchange agent") for the exchange offers. You can find the address and telephone number for Citibank, N.A. on the back cover page of this prospectus. |

| Information Agent | | Mellon Investor Services LLC is serving as the information agent (the "information agent") for the exchange offers. You can find the address and telephone number for Mellon Investor Services LLC on the back cover page of this prospectus. |

| Dealer Manager | | Citigroup Global Markets Inc. is the dealer manager for the exchange offers (the "dealer manager"). The address and telephone number of the dealer manager are set forth on the back cover page of this prospectus. |

8

| Solicitation Fees | | In respect of transfers on behalf of beneficial owners of $200,000 or less of principal amount of 2003 notes, the dealer manager will pay a solicitation fee to soliciting dealers (as defined below) duly identified in forms we are providing for this purpose (soliciting dealer designations) of $3.75 per $1,000 principal amount of 2003 notes for eligible 2003 notes that are tendered, accepted for payment and paid for pursuant to the exchange offers. A soliciting dealer will not be entitled to a solicitation fee for existing notes beneficially owned by such soliciting dealer. See "The Exchange Offers and Consent Solicitations—Solicitation Fees." |

| Use of Proceeds | | There will be no proceeds to us from the exchange offers. |

Funding for the

Exchange Offers | | We expect to finance our cash payment obligations for accrued interest in respect of the existing notes with cash on hand at the settlement date. |

The New Notes

| New Notes | | Up to $376,875,000 principal amount of 12% Notes due May 15, 2004. |

Interest Payment Dates |

|

Interest on the new notes will accrue from the settlement date and be paid at maturity. |

Guarantee |

|

The Guarantor, our wholly owned subsidiary, will irrevocably and unconditionally agree to pay to the holders of the new notes the principal of and premium, if any, interest and additional amounts, if any, on the new notes in full, as and when due, regardless of any defense, right of set-off or counterclaim that we may have or assert, except to the extent paid by us. |

|

|

The Guarantor's assets consist solely of shares representing approximately 97% of the common stock of TMM Multimodal, S.A. de C.V. ("TMM Multimodal"), which in turn holds a 51% voting interest and a direct economic interest of 38.4% in Grupo TFM. If the TFM Sale is completed, TMM Multimodal will own 18 million shares of common stock of KCS. See "The Company—The Asset Sales." Any proceeds from the subsequent sale of shares of common stock of KCS would be required to be applied to repurchase new notes as set forth under "Description of the New Notes—Certain Covenants—Restrictions on Asset Dispositions." The securities the Guarantor holds directly and indirectly may be subject to governmental and other approvals and restrictions, including a right of first refusal in favor of KCS and other transfer restrictions. In addition, after the TFM Sale, the shares of common stock of KCS will also be subject to certain restrictions on transfers. See "Risk Factors—Factors relating to the new notes—The shares of Grupo TFM held indirectly by the Guarantor may be difficult to sell in the event that the Guarantor is called upon to satisfy the guarantee of the new notes." |

|

|

|

9

|

|

The Guarantor's obligations under the guarantee will terminate if we obtain investment grade ratings for the new notes from both Standard & Poor's, a division of McGraw-Hill Inc. (which we refer to herein as Standard & Poor's), and Moody's Investors Service, Inc. (which we refer to herein as Moody's). |

|

|

The Guarantor's obligations under the guarantee are its unsecured obligations and are separate from, and in addition to, our obligations under the new notes. The Guarantor's assets, consisting of common stock of TMM Multimodal, had a book value of $374.1 million as of December 31, 2002. The book value of the shares is not necessarily representative of the fair market value of the shares. The shares of KCS common stock to be acquired in the TFM Sale would have had an aggregate value of approximately $199 million at April 21, 2003 (based on the closing price of KCS common stock on the NYSE on that date), net of the cash portion of the purchase price for the TFM Sale. The Guarantor's indebtedness will consist of its guarantee of the new notes (which will have an aggregate principal amount outstanding of up to $376,875,000, depending upon the level of participation in the exchange offers). As of December 31, 2002 we had $21.2 million of indebtedness (on an unconsolidated basis) that would not be guaranteed by the Guarantor. Any existing notes that are not exchanged will also not be guaranteed. Any of our obligations that are not guaranteed would have no direct claim against the Guarantor or its assets in the event of our bankruptcy. |

Withholding Tax and Payment of Additional Amounts |

|

Payments of interest to holders of the new notes will be subject to Mexican withholding tax. Subject to certain exceptions, we will pay additional amounts in respect of payments on the new notes and the Guarantor will pay additional amounts in respect of payments on the guarantee so that, in each case, the net amount received by each holder after the payment of any Mexican withholding tax will be equal to the amount that would have been received if no such taxes had been applicable. See "Description of the New Notes—Payment of Additional Amounts." For a discussion of the tax consequences of holding and disposing of the new notes, see "Material United States Federal Income Tax Consequences." |

Optional Tax Redemption |

|

We may at our option redeem the new notes at any time at 100% of the principal amount of the new notes, together with any accrued interest, if the Mexican withholding tax rate on payments of interest in respect of the new notes is increased, as a result of a change in Mexican law, to a rate in excess of 4.9%. See "Description of the New Notes—Optional Tax Redemption." |

|

|

|

10

Offer to Purchase Upon a Change of Control |

|

Upon a change of control, holders of new notes will have the right, subject to certain restrictions and conditions, to require us to purchase all or any part of their new notes at 100% of the principal amount thereof plus accrued and unpaid interest and additional amounts, if any. We have certain other outstanding indebtedness that is subject to acceleration upon a change of control. There can be no assurance that we will have sufficient funds available at the time of any change of control to repurchase any tendered new notes. See "Description of the New Notes—Change of Control" and "Risk Factors—Factors Relating to the New Notes—We may not be able to finance a change of control offer." |

Offer to Purchase Upon Receipt of VAT Award Funds. |

|

If: |

|

|

• Prior to the TFM Sale, TFM receives amounts in respect of the currently pending VAT dispute and we or any of our restricted subsidiaries receive, directly or indirectly, any proceeds from TFM (whether by way of dividends, advances, the purchase of capital stock), or |

|

|

• at or after the TFM Sale, we receive from KCS the additional payments to which we are entitled in the event of a successful resolution of the pending VAT dispute, |

|

|

then, holders of new notes will have the right, subject to certain restrictions and conditions, to require us to apply the net cash amount so received by us or our restricted subsidiaries, net of any taxes payable on receipt of such amounts and out-of-pocket expenses related thereto, to purchase all or any part of their new notes at 100% of the principal amount thereof, plus accrued and unpaid interest and additional amounts, if any. |

Redemption Upon Certain Asset Sales |

|

If we or any of our restricted subsidiaries complete certain asset sales, holders of new notes will have the right, subject to certain restrictions and conditions, to require us to apply the net cash proceeds of such asset sale to redeem or to offer to purchase all or any part of their new notes at 100% of the principal amount thereof plus accrued and unpaid interest and additional amounts, if any. |

|

|

|

11

| Mandatory Sinking Fund | | None. |

| Certain Covenants | | The new notes indenture will contain certain covenants that, among other things, will limit our ability and the ability of our restricted subsidiaries to: |

| | | • pay dividends and make other restricted payments, |

| | | • sell assets, |

| | | • incur liens, |

| | | • engage in sale and leaseback transactions, |

| | | • incur additional indebtedness, |

| | | • make investments, and |

| | | • engage in transactions with affiliates. |

| | | Certain of the covenants will be suspended during any period of time that we maintain an investment grade rating of the new notes from both Standard & Poor's and Moody's. See "Description of the New Notes—Certain Covenants." |

Covenants Applicable to the

Guarantor | | The new notes indenture will also contain certain covenants applicable to the Guarantor and its subsidiary, TMM Multimodal, that will, among other things: |

| | | • prevent them from incurring any liens, other than permitted liens, or indebtedness for borrowed money other than, in the case of the Guarantor, the guarantee; and |

| | | • limit their ability to sell the securities that each company currently owns. |

| | | These covenants will also be reflected in the Guarantor's Bylaws, which we will covenant not to amend in any manner detrimental to the holders of new notes. If we would be allowed to sell shares of TMM Multimodal rather than Grupo TFM and the Guarantor has ceased to own at least a majority of the economic and voting interests in TMM Multimodal, these covenants will cease to apply to TMM Multimodal. |

| | | The new notes trustee will hold one share of the common stock of the Guarantor on behalf of and for the benefit of the holders of the new notes. The vote of 100% of the shares of the Guarantor will be required to amend the Bylaws of the Guarantor. |

| Ranking of the New Notes | | The new notes will constitute our direct, unsecured and unconditional obligations and will rankpari passu in right of payment with all of our existing and future unsecured and unsubordinated indebtedness, subject to priorities, recognized by statute, such as tax and labor obligations. The new notes will be structurally subordinated to all obligations of our subsidiaries other than the Guarantor ($1,027.5 million as of December 31, 2002 ($1,023.1 million of which is indebtedness of TFM) and approximately $217 million on a pro forma basis after giving effect to the Port Sale, the TFM Sale and the application of the net cash proceeds from such sales). |

12

| Ranking of the Guarantee | | The new notes will also benefit from the guarantee. The guarantee will constitute the direct, unsecured and unconditional obligations of the Guarantor and will rankpari passuin right of payment with all of our existing and future unsecured and unsubordinated indebtedness, subject to priorities recognized by statute, such as tax and labor obligations. The Guarantor will not have any other obligations that have the benefit of the guarantee and will be restricted by the new notes indenture from incurring additional indebtedness for borrowed money. The new notes will be structurally subordinated to all obligations of our subsidiaries other than the Guarantor ($1,027.5 million as of December 31, 2002; approximately $4.0 million on a pro forma basis). As of December 31, 2002, we had $21.2 million of indebtedness (on an unconsolidated basis) that would not be guaranteed by the Guarantor and would have no direct claim against the Guarantor in the event of our bankruptcy. As a result of the guarantee of the new notes, holders of our other indebtedness, including any existing notes that remain outstanding after the exchange offers will not be entitled to receive any of the proceeds from the sale of the shares of TMM Multimodal or Grupo TFM or, after the TFM Sale, shares of KCS common stock, until the holders of the new notes are paid in full. |

| Listing | | Application will be made to list the new notes on the New York Stock Exchange. |

| Trustee and Principal Paying Agent | | The Bank of New York will be the new notes trustee and principal paying agent for the new notes. |

| Governing Law | | The new notes will be governed by the laws of the State of New York. |

The Proposed Amendments

If you tender your existing notes in the exchange offers, you will be consenting to amend the indentures governing the 2003 notes and the 2006 notes. These amendments will eliminate substantially all of the covenants contained in each of the indentures, including:

- •

- the limitations on:

- •

- indebtedness;

- •

- payment of dividends and the granting of loans;

- •

- dividend and other payment restrictions on subsidiaries;

- •

- transactions with affiliates;

- •

- liens;

- •

- sale and leaseback transactions;

- •

- asset sales; and

13

- •

- the requirements to:

- •

- make an offer to purchase upon a change of control or with the proceeds from certain asset sales; and

- •

- pay taxes and other claims.

The supplemental indentures would also eliminate events of default that are triggered if, among other things:

- •

- we fail to comply with any of the covenants and provisions described above;

- •

- we or any of our restricted subsidiaries default under our or such restricted subsidiary's debt obligations in excess of $10 million;

- •

- we or any of our restricted subsidiaries are subject to certain bankruptcy events; or

- •

- we or any of our restricted subsidiaries have a final judgment in excess of $10 million rendered against us or them.

The primary purpose of the proposed amendments is to eliminate the restrictive covenants and other provisions described above and to permit the TFM Sale and certain applications of the proceeds from the Port Sale, whether before or after the completion of the exchange offers.

IF YOU TENDER EXISTING NOTES PURSUANT TO THE EXCHANGE OFFERS, YOU WILL BE DEEMED TO HAVE GIVEN YOUR CONSENT TO THE PROPOSED AMENDMENTS WITH RESPECT TO THE EXISTING NOTES TENDERED.

The terms of the indenture governing each of the 2003 notes and the 2006 notes provide that the proposed amendments must be approved by the holders of a majority of the outstanding principal amount of the respective series of existing notes issued under the existing indentures. Any existing notes held by the company are not considered to be outstanding for this purpose. As of the date of this prospectus, no existing notes were held by the company and therefore no existing notes would be excluded from the amount outstanding for this purpose.

The proposed amendments to the indenture governing each series of the existing notes will become effective only upon the consummation of the exchange offers and the execution of the respective supplemental indenture.

Risk Factors

See the "Risk Factors" section of this prospectus beginning on page 22 for a description of risks you should carefully consider in deciding whether to tender your existing notes in the exchange offers.

14

Corporate Structure

The following diagram illustrates our basic corporate structure after the shares of TMM Multimodal are transferred to the Guarantor. This diagram does not give effect to the Port Sale or the TFM Sale. After the Port Sale, our Ports and Terminals business will consist of our interest in the operations at Acapulco and Tuxpan. After the TFM Sale, we will no longer own an interest in Grupo TFM and TMM Multimodal will own shares of Class A Common Stock of KCS, which are convertible into an aggregate of 18,000,000 shares of KCS common stock (representing an approximate 21.3% economic interest (and a 20% voting interest) in KCS based on the number of shares of KCS common stock and options to purchase KCS common stock outstanding at March 31, 2003). See "The Company—The Asset Sales."

- *

- Through its wholly owned subsidiaries.

- **

- Without giving effect to the additional indirect interest created by the interest in Grupo TFM held by TFM.

15

Summary Consolidated Historical Financial Data

The following tables set forth summary historical financial data for Grupo TMM and its consolidated subsidiaries. The financial information presented for the fiscal years ended December 31, 2000, 2001 and 2002 was derived from our audited consolidated financial statements of which the consolidated balance sheets as of December 31, 2001 and 2002, and the related consolidated statements of income and cashflows for each of the three years ended December 31, 2000, 2001 and 2002 and accompanying notes are contained elsewhere herein (the "Financial Statements").

The Financial Statements have been prepared in accordance with IAS, which differ in certain significant respects from U.S. GAAP. See Note 18 to our Financial Statements for the years ended December 31, 2000, 2001 and 2002 for a description of the principal differences between IAS and U.S. GAAP applicable to us.

The following data should be read in conjunction with, and is qualified in its entirety by reference to "Operating and Financial Review and Prospects" and to our Financial Statements and the related Notes thereto included elsewhere herein.

| | At December 31,

| |

|---|

| | 2002

| | 2001

| | 2000

| | 1999

| | 1998

| |

|---|

| | (dollars in millions, except share and per share data)

| |

|---|

| CONSOLIDATED INCOME STATEMENT DATA (IAS): | | | | | | | | | | | | | | | | |

| Transportation and service revenues | | $ | 1,008.6 | | $ | 1,000.1 | | $ | 989.9 | | $ | 844.7 | | $ | 740.7 | |

| Operating income | | | 184.0 | | | 189.1 | | | 197.6 | | | 148.3 | | | 111.1 | |

| Net income (loss) for the period | | | (42.6 | ) | | 8.9 | | | 1.7 | | | (62.6 | ) | | (9.6 | ) |

| Net income (loss) per share(a) | | | (0.748 | ) | | 0.477 | | | 0.099 | | | (4.571 | ) | | (2.980 | ) |

| Book value per share | | | 2.454 | | | 3.106 | | | 0.538 | | | 0.439 | | | 14.378 | |

| Weighted average shares outstanding (000s)(b) | | | 56,963 | | | 18,694 | | | 17,442 | | | 13,705 | | | 3,220 | |

| U.S. GAAP: | | | | | | | | | | | | | | | | |

| Transportation and services revenues | | | 1,008.6 | | | 1,000.1 | | | 989.9 | | | 844.7 | | | 740.7 | |

| Operating income | | | 214.0 | | | 242.3 | | | 170.9 | | | 135.4 | | | 107.7 | |

| Net income (loss) for the period | | | 10.6 | | | 17.8 | | | (1.3 | ) | | (70.8 | ) | | (19.7 | ) |

| Net income (loss) per share | | | 0.187 | | | 0.954 | | | (0.072 | ) | | (5.163 | ) | | (6.104 | ) |

BALANCE SHEET DATA

(at end of period) (IAS): | | | | | | | | | | | | | | | | |

| Total assets | | | 2,727.2 | | | 2,818.2 | | | 2,671.2 | | | 2,946.6 | | | 3,126.9 | |

| Long term debt | | | 1,206.8 | | | 953.2 | | | 1,192.8 | | | 1,045.2 | | | 1,315.5 | |

| Minority interest | | | 765.5 | | | 1,089.4 | | | 1,104.9 | | | 1,024.5 | | | 1,057.2 | |

| Capital stock(c) | | | 121.2 | | | 121.2 | | | 29.9 | | | 29.9 | | | 5.9 | |

| Total stockholders' equity(c) | | | 139.8 | | | 176.9 | | | 9.4 | | | 7.6 | | | 46.3 | |

| U.S. GAAP | | | | | | | | | | | | | | | | |

| Total assets | | | 2,800.1 | | | 2,717.6 | | | 2,566.5 | | | 2,862.3 | | | — | |

| Minority interest | | | 818.6 | | | 1,035.7 | | | 1,020.9 | | | 955.5 | | | — | |

| Capital stock | | | 121.2 | | | 121.2 | | | 29.9 | | | 29.9 | | | — | |

| Total stockholders' equity | | | 159.7 | | | 129.4 | | | (9.3 | ) | | (8.1 | ) | | — | |

- (a)

- Based on the weighted average of outstanding shares during each period, and restated to reflect the reverse stock split, which occurred in October 2001, prior to the merger of Transportación Marítima Mexicana, S.A. de C.V. with and into Grupo TMM. See "The Company—General." The aggregate number of our Series A Shares outstanding as of December 31, 2002 was 56,963,137. See "The Company—Reclassification of Series A and Series L Shares."

- (b)

- For 2002, reflects the reclassification of our Series A and Series L Shares.

- (c)

- The large increase from 2000 to 2001 in the figures for capital stock, book value per share, and total stockholders equity is a result of the merger of our predecessor, Transportación Marítima Mexicana, S.A. de C.V. with and into Grupo TMM and the additional shares issued in connection therewith. See Notes 1 and 12 of the Notes to our Financial Statements.

16

QUESTIONS AND ANSWERS RELATING TO THE EXCHANGE OFFERS AND CONSENT SOLICITATIONS

Subject to the terms and conditions set forth in this prospectus and in the related letter of transmittal and consent, we are offering to exchange $376,875,000 aggregate principal amount of our new notes, for all of our outstanding $176,875,000 principal amount of 2003 notes and $200,000,000 principal amount of 2006 notes. Each of the exchange offers will expire at midnight, New York City time, on May 12, 2003, unless we extend it. Set forth below are some of the questions you, as holder of the existing notes, may have and answers to those questions.

- Q.

- What is the purpose of the exchange offers and consent solicitations?

- A.

- The purpose of the exchange offers is to extend the maturity of our 2003 notes, which mature on May 15, 2003, to provide us with sufficient time to complete the Port Sale and TFM Sale. If we do not complete the exchange offers and do not extend the maturity of our 2003 notes, we will not be able to repay the 2003 notes at maturity unless we find an alternate means of financing, which is highly unlikely. See "Risk Factors—Risks Related to Our Liquidity Position" and "Factors relating to the exchange offers and consent solicitations—If the exchange offer for the 2003 notes is not completed, we may be unable to repay the 2003 notes at maturity" for more information about the impact of not completing the exchange offers. For information about the effect that completing the exchange offers may have on our financial position, please see "Unaudited Pro Forma Financial Information."

The primary purpose of the consent solicitations is to amend the indentures governing the existing notes to eliminate virtually all of the restrictive covenants and certain events of default allowing, among other things, the TFM Sale. See "The Proposed Amendments" and "Description of the New Notes" for more detailed information.

We did not engage in negotiations with holders of the 2003 notes or the 2006 notes with respect to the exchange offers prior to commencement of the exchange offers.

- Q.

- What is Grupo TMM offering in exchange for my existing notes?

- A.

- For each $1,000 principal amount of existing notes that you validly tender, you will receive $1,000 principal amount of the new notes, plus any accrued and unpaid interest in cash. See "The Exchange Offers and Consent Solicitations" for a more detailed description of the exchange offers.

- Q.

- What are the new notes?

- A.

- The new notes are unsecured senior notes that will mature on May 15, 2004, which is after the maturity of the 2003 notes. The new notes will accrue interest at an annual rate of 12%. Interest on the new notes will be payable at maturity. The new notes will rankpari passu with the existing notes to the extent any existing notes remain untendered. However, unlike the existing notes, the new notes will be guaranteed by the Guarantor. The new notes will have restrictive covenants similar to those of the 2003 notes in effect prior to the consummation of the exchange offers and the consent solicitations adjusted to permit the completion of the TFM Sale, to allow the use of $15 million of the Port Sale proceeds for working capital purposes and payment of fees and expenses related to the exchange offer, TFM Sale or Port Sale and to reflect the additional covenants applicable to the Guarantor. However, if the exchange offers are consummated and the consent of a majority of holders of the 2003 notes and the 2006 notes are obtained, virtually all of the restrictive covenants and certain events of default of the 2003 notes and the 2006 notes, as applicable, will be eliminated. See "Description of the New Notes" for a more detailed description of the new notes.

- Q.

- What is the effect of the guarantee of the new notes by the Guarantor?

- A.

- The payment of the principal of and the interest on the new notes will be unconditionally guaranteed on a senior unsecured basis by the Guarantor, a new subsidiary of ours formed for the purpose of holding our indirect interest in Grupo TFM and guaranteeing the new notes. The Guarantor will

17

indirectly hold all of the company's interest in Grupo TFM and, after the completion of the TFM Sale, all of the shares of KCS common stock received in the TFM Sale. The Guarantor will not have any other assets. In addition, the new notes indenture will restrict the Guarantor from engaging in other businesses and from incurring additional indebtedness for borrowed money. As a result, if there is a payment default by us on the new notes, proceeds from any sale of the assets of the Guarantor, consisting of its indirect ownership of the shares of Grupo TFM and, after the TFM Sale, the shares of KCS common stock would be available to satisfy the claims of the holders of the new notes. These assets would not be available to the holders of any untendered existing notes, or to our other creditors, until the new notes have been paid in full. The shares of Grupo TFM held indirectly by the Guarantor are, and, after completion of the TFM Sale, the shares of KCS common stock that will be held indirectly by the Guarantor will be, subject to certain restrictions on transfer. However, in the event any portion of our receivables securitization facility remains in place after the Port Sale, the holders of the certificates issued by the trust established under the facility would continue to have a call option on the shares held by TMM Multimodal. For more information, see "Risk Factors—The shares of Grupo TFM indirectly held by the Guarantor may be difficult to sell in the event that the Guarantor is called upon to satisfy the guarantee of the new notes," "—You may not be able to enforce the guarantee under the new notes," "—Certain bankruptcy considerations," "The Company—The Asset Sales—The TFM Sale" and "Description of the New Notes—the Guarantee." The Guarantor's obligations under the guarantee will terminate if we obtain investment grade ratings for the new notes from both Standard & Poor's and Moody.

- Q.

- How will the guarantee be affected if Grupo TMM files or is subject to bankruptcy proceedings in Mexico?

- A.

- In the event that Grupo TMM files or is subject to bankruptcy proceedings in Mexico, the guarantee will not be affected, as the Guarantor is a separate legal entity. However, the obligations of the Guarantor are unsecured obligations of the Guarantor, subject to rights of creditors generally. As of December 31, 2002, we had $21.2 million of indebtedness (on an unconsolidated basis and excluding the senior convertible notes which will be amortized in full prior to the completion of the exchange offers) that would not be guaranteed by the Guarantor and would have no direct claim against the Guarantor in the event of our bankruptcy. As a result of the guarantee of the new notes, holders of our other indebtedness, including any 2003 notes that remain outstanding after the exchange offers, will not be entitled to receive any of the proceeds from the sale of the shares of Grupo TFM or, after the TFM Sale, the KCS common stock, until the holders of the new notes are paid in full.

- Q.

- When can the Guarantor or TMM Multimodal sell or transfer the securities it currently owns?

- A.

- Unless and until the Guarantor's obligations under the guarantee terminate because we have obtained investment grade ratings for the new notes from both Standard & Poor's and Moody's, neither the Guarantor nor TMM Multimodal may sell or transfer the securities it currently owns except in a Qualifying Disposition or to satisfy the Guarantor's obligation pursuant to the guarantee. To be a Qualifying Disposition, a sale or transfer requires that we obtain a fairness opinion, that any securities received in such transaction meet specified criteria and that the sale or transfer not be to any of our Affiliates. The TFM Sale will be a Qualifying Disposition. See "Description of the Notes—The Guarantee" and "—Certain Covenants—Additional Covenants Applicable to the Guarantor."

In the event the securities are sold in a Qualifying Disposition as described above, then any Net Cash Proceeds from such Qualifying Disposition up to the amount required to repurchase, redeem or repay the new notes shall be either (i) applied to repurchase, redeem or otherwise repay the new notes, or (ii) promptly irrevocably deposited with the new notes trustee under the terms of an irrevocable trust agreement in form and substance satisfactory to the new notes trustee, as trust funds in trust solely for the benefit of the holders of the new notes for the purpose of paying principal and interest on the new notes.

18

- Q.

- Will the new notes be freely tradable?

- A.

- Yes. The new notes have been registered with the SEC and are therefore freely tradable by holders other than "affiliates" of the company. We intend to apply to list the new notes for trading on the New York Stock Exchange.

- Q.

- When will the exchange offers and consent solicitations expire?

- A.

- The exchange offers and consent solicitations will expire at midnight, New York City time, on May 12, 2003, unless we extend either or both of the exchange offers and consent solicitations at our sole discretion.

- Q.

- How will I be notified if the exchange offers or consent solicitations are extended?

- A.

- If we extend the expiration date for either exchange offer and consent solicitation, we will make a public announcement of the extension not later than 9:00 a.m., New York City time, on the business day after the previously scheduled expiration date.

- Q.

- How do I tender my existing notes?

- A.

- Existing notes may be tendered only by book-entry transfer using DTC's ATOP (Automated Tender Offer Program) system. See "The Exchange Offers and Consent Solicitations—How to Tender."

If your existing notes are held by a broker, dealer, commercial bank, trust company or other custodian and you wish to tender them in the exchange offers, you should promptly contact the custodian and instruct the custodian to tender on your behalf.