Table of Contents

FORM6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule13a-16 or15d-16 of

the Securities Exchange Act of 1934

Commission File Number:1-15270

For the month of June 2020

NOMURA HOLDINGS, INC.

(Translation of registrant’s name into English)

9-1, Nihonbashi1-chome

Chuo-ku, Tokyo103-8645

Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form20-F or Form40-F.

Form20-F X Form40-F

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(7):

Table of Contents

Information furnished on this form:

EXHIBIT

Exhibit Number

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NOMURA HOLDINGS, INC. | ||||

| Date: June 1, 2020 | By: | /s/ Go Sugiyama | ||

| Go Sugiyama | ||||

| Senior Managing Director | ||||

Table of Contents

This document is a translation of the Japanese language original prepared solely for convenience of reference (certain portions of the Japanese language original applicable to voting procedures in Japan that are not applicable to shareholders outside Japan have been omitted). In the event of any discrepancy between this translated document and the Japanese language original, the Japanese language original shall prevail. Please note that certain portions of this document may not be applicable to shareholders outside Japan.

NOMURA

Notice of Convocation of the 116th Annual General Meeting of Shareholders

Nomura Holdings, Inc.

Table of Contents

To Our Shareholders

I would like to take this opportunity to thank all of you, our shareholders, for your ongoing support.

In the fiscal year ended March 31, 2020, we focused on delivering solutions to meet the diverse needs of clients, by working on the firm-wide initiative of business platform rebuilding announced in April 2019. Retail Division secured profit on par with the previous year’s level, while putting in place a structure for delivering better services through such initiatives as drasticre-allocation of sales partners and branch office consolidation. Asset Management Division has enjoyed fund inflows for 15 consecutive quarters. Wholesale Division achieved a significant recovery in revenue centering on trading business, while winning top positions in Japan-related M&A and IPO league tables.

As a result, in the fiscal year ended March 31, 2020, the Group’s net revenue (after interest expenses) totaled 1,287.8 billion yen, having significantly increased year over year.Pre-tax income amounted to 248.3 billion yen, and net profit came to 217 billion yen.

With regard to dividend, based upon our dividend policy, we have decided on 20 yen per share as an annual dividend.

In the wake of the global outbreak of coronavirus disease 2019(“COVID-19”), the financial market underwent a major fluctuation at the end of the fiscal year. Nomura was also confronted with a historic turmoil, but all employees continuously delivered services by working together. We will keep fulfilling our obligations as a key player in the financial market, an essential infrastructure of society.

In December 2019, we established Group Code of Conduct 2020. Guided by the Code, we will uphold our longstanding values of entrepreneurial leadership, teamwork and integrity. We are all committed to the firm’s mission to help create an affluent society through our expertise in the capital markets and our vision to be the most trusted partner for our clients.

Thank you very much for your continued support.

June 2020

Kentaro Okuda

President and Group CEO

1

Table of Contents

| (Securities Code: 8604) | ||||||||||||||

| June 5, 2020 | ||||||||||||||

To: Shareholders of Nomura Holdings, Inc.

| Koji Nagai | ||||||||||||

| Chairman of the Board of Directors | ||||||||||||

| Nomura Holdings, Inc. | ||||||||||||

| 1-9-1 Nihonbashi,Chuo-ku, Tokyo, JAPAN | ||||||||||||

Notice of Convocation of the Annual General Meeting of Shareholders

Dear Shareholder,

I would like to take this opportunity to thank you, our shareholder, for your support of Nomura Holdings, Inc. (the “Company”). The 116th Annual General Meeting of Shareholders will be held as described below.

Details

1. | Date and Time: |

| 10:00 a.m. on Tuesday, June 23, 2020 (JST) | |||||

2. | Place: |

| Grand Nikko Tokyo Daiba, “Palais Royal” (first basement) | |||||

| 2-6-1, Daiba,Minato-ku, Tokyo, JAPAN | ||||||||

3. | Agenda for the Meeting: | |||||||

| Matters to be Reported: | ||||||||

1. Report on the content of the business report and the consolidated financial statements and report on the results of the audits of the consolidated financial statements performed by the accounting auditor and the Audit Committee for the 116th fiscal year (covering the period from April 1, 2019 to March 31, 2020). | ||||||||

2. Report on the financial statements for the 116th fiscal year (covering the period from April 1, 2019 to March 31, 2020). | ||||||||

| Matter to be Resolved: | ||||||||

| Proposal: |

| Appointment of Ten Directors | ||||||

Matters regarding the exercise of voting rights:

If you exercise your voting rights through a proxy, only one proxy per shareholder will be permitted and such proxy must be a shareholder who holds voting rights at this General Meeting of Shareholders. Please also submit documentation evidencing the necessary power of attorney along with the proxy card.

End.

2

Table of Contents

With regard to the following matters, pursuant to relevant laws/regulations and the provisions of Article 25 of the Company’s Articles of Incorporation, they are not included in the materials annexed to this Notice of Convocation as they have been posted on the Company’s website (https://www.nomuraholdings.com/investor/shm/). Therefore, the materials annexed to this Notice of Convocation, on the occasion of the preparation of the Audit Report, were a part of the objects that the audit committee and accounting auditor audited.

| 1. | The notes to the consolidated financial statements; and |

| 2. | The notes to the financial statements. |

In the event of any subsequent revisions to the reference materials for the general meeting of shareholders, the business report, the consolidated financial statements, or the financial statements, there will be a posting on the Company’s website indicated above.

Regarding the Payment of theYear-end Dividend Distribution of the 116th Fiscal Year Surplus

At the Meeting of the Board of Directors of the Company held on May 8, 2020, a resolution was adopted for the payment, beginning on June 8, 2020, of the 5 yen per shareyear-end dividend distribution of the 116th fiscal year surplus.

3

Table of Contents

Reference Materials for the General Meeting of Shareholders

Proposal and Reference Matters

Proposal: Appointment of Ten Directors

As of the conclusion of this General Meeting, the term of office of all ten directors will expire. Therefore, based on the decision of the Nomination Committee, the Company requests the appointment of ten directors, including two new director nominees. Of the ten nominees, six are outside director nominees, and the two director nominees who will concurrently serve as executive officers are Kentaro Okuda and Toshio Morita

The nominees are as follows:

No. | Name | Positions in the Company | Attendance Record at Board of Directors | |||

1 | Koji Nagai Non-Executive Director Reappointment | Chairman of the Board of Directors Member of the Nomination Committee (to be appointed) Member of the Compensation Committee (to be appointed) | 100% (11/11 meetings) | |||

2 | Kentaro Okuda Executive Officer New Appointment | Representative Executive Officer and President Group CEO | (New Appointment) | |||

3 | Toshio Morita Executive Officer New Appointment | Representative Executive Officer | (New Appointment) | |||

4 | Hisato Miyashita Non-Executive Director Reappointment | Member of the Audit Committee (Full-Time) | 100% (11/11 meetings) | |||

5 | Hiroshi Kimura Outside Director, Independent Director Reappointment | Chairman of the Nomination Committee Chairman of the Compensation Committee | 100% (11/11 meetings) | |||

6 | Kazuhiko Ishimura Outside Director, Independent Director Reappointment | Member of the Nomination Committee Member of the Compensation Committee | 100% (11/11 meetings) | |||

7 | Noriaki Shimazaki Outside Director, Independent Director Reappointment | Chairman of the Audit Committee | 100% (11/11 meetings) | |||

8 | Mari Sono Outside Director, Independent Director Reappointment | Member of the Audit Committee | 100% (11/11 meetings) | |||

9 | Michael Lim Choo San Outside Director, Independent Director Reappointment | 100% (11/11 meetings) | ||||

10 | Laura Simone Unger Outside Director, Independent Director Reappointment | 100% (11/11 meetings) | ||||

| * | Two of them are females. |

4

Table of Contents

1. Koji Nagai(Jan. 25, 1959) | ||||

Chairman of the Board of Directors

Non-Executive Director Reappointment

Attendance at Meetings of the Board of Directors: 11/11

Number of shares held: 328,000 shares of common stock | Apr. 1981 | Joined the Company | ||

Apr. 2003 | Director of Nomura Securities Co., Ltd. | |||

Jun. 2003 | Senior Managing Director of Nomura Securities Co., Ltd. | |||

Apr. 2007 | Executive Managing Director of Nomura Securities Co., Ltd. | |||

Oct. 2008 | Senior Corporate Managing Director of Nomura Securities Co., Ltd. | |||

Apr. 2009 | Executive Managing Director and Executive Vice President of Nomura Securities Co., Ltd. | |||

Apr. 2011 | Co-COO and Deputy President of Nomura Securities Co., Ltd. | |||

Apr. 2012 | Senior Managing Director of the Company (concurrently Director and President of Nomura Securities Co., Ltd.) | |||

Aug. 2012 | Representative Executive Officer & Group CEO of the Company (concurrently Director and President of Nomura Securities Co., Ltd.) | |||

Jun. 2013 | Director, Representative Executive Officer & Group CEO of the Company (concurrently Director and President of Nomura Securities Co., Ltd.) | |||

Apr. 2017 | Director, Representative Executive Officer, President & Group CEO of the Company (concurrently Director and Chairman of Nomura Securities Co., Ltd.) | |||

Apr. 2020 | Chairman of the Board of Directors of the Company (concurrently Director and Chairman of Nomura Securities Co., Ltd.) (Current) | |||

(Significant concurrent positions) Director and Chairman of Nomura Securities Co., Ltd. | ||||

(Reasons for designation as a director nominee) Mr. Nagai has held positions including Director, Representative Executive Officer & Group CEO of the Company and Director and President of Nomura Securities Co., Ltd., and has served as Director and Chairman of the Company since April 2020.

The Company has designated Mr. Nagai, who is well-versed in the business of the Nomura Group, as a director nominee with the expectation that, by having Mr. Nagai chair meetings of the Board of Directors as Chairman of the Board of Directors, he will contribute to enhancing the quality of discussions at meetings of the Board of Directors and operate meetings of the Board of Directors effectively and efficiently.

If his reappointment is approved, he is slated to continue serving as a member of the Nomination Committee and a member of the Compensation Committee after this Annual General Meeting of Shareholders.

Mr. Nagai does not concurrently serve as an executive officer and is anon-executive director. | ||||

(Notes)

| 1. | In October 2001, the Company reorganized and became a holding company, changed the company name from, “The Nomura Securities Co., Ltd.” to “Nomura Holdings, Inc.” and Nomura Securities Co., Ltd., the subsidiary newly established by the company divestiture, succeeded the securities company operations. With regard to biographical information based on the Company prior to October 2001, the references are to positions and responsibilities at The Nomura Securities Co., Ltd. |

| 2. | Since June 2003, the Company has put in place three committees (the nomination, compensation, and audit committees) and adopted a corporate governance structure that separates management’s oversight functions from business execution functions (Company with Three Board Committees). As the execution of the business of the Company, which is a Company with Three Board Committees, is performed by executive officers, directors who do not concurrently serve as executive officers(non-executive directors) do not perform such a function and perform mainly an oversight function. |

5

Table of Contents

2. Kentaro Okuda(Nov. 7, 1963) | ||||

Representative Executive Officer and President

Group CEO

Executive Officer New appointment

Number of shares held: 83,180 shares of common stock | Apr. 1987 | Joined the Company | ||

Apr. 2010 | Senior Managing Director of Nomura Securities Co., Ltd. | |||

Apr. 2012 | Senior Corporate Managing Director of Nomura Securities Co., Ltd. | |||

Aug. 2012 | Senior Corporate Managing Director of the Company (concurrently Senior Corporate Managing Director of Nomura Securities Co., Ltd.) | |||

Apr. 2013 | Senior Managing Director of the Company (concurrently Senior Corporate Managing Director of Nomura Securities Co., Ltd.) | |||

Apr. 2015 | Senior Managing Director of the Company (concurrently Executive Vice President of Nomura Securities Co., Ltd.) | |||

Apr. 2016 | Senior Managing Director of the Company (concurrently Executive Managing Director and Executive Vice President of Nomura Securities Co., Ltd.) | |||

Apr. 2017 | Senior Managing Director of the Company (concurrently Executive Vice President of Nomura Securities Co., Ltd.) | |||

Apr. 2018 | Executive Managing Director and GroupCo-COO of the Company (concurrently Director, Executive Managing Director and Deputy President of Nomura Securities Co., Ltd.) | |||

Apr. 2019 | Executive Managing Director and Deputy President, GroupCo-COO of the Company | |||

Apr. 2020 | Representative Executive Officer and President, Group CEO of the Company (concurrently Representative Director of Nomura Securities Co., Ltd.) (Current) | |||

(Significant concurrent positions) Representative Director of Nomura Securities Co., Ltd. | ||||

(Reasons for designation as a director nominee) Mr. Okuda has held positions including GroupCo-COO of the Company and Director,

The majority of the Board of Directors of the Company, including Outside Directors, is made | ||||

6

Table of Contents

3. Toshio Morita(Apr. 17, 1961)

| ||||

Representative Executive Officer

Executive Officer New appointment

Number of shares held: 263,102 shares of common stock | Apr. 1985 | Joined the Company | ||

Apr. 2008 | Executive Managing Director of Nomura Securities Co., Ltd. | |||

| Oct. 2008 | Senior Managing Director of Nomura Securities Co., Ltd. | |||

| Apr. 2010 | Senior Corporate Managing Director of Nomura Securities Co., Ltd. | |||

| Apr. 2011 | Senior Corporate Managing Director of the Company | |||

| Apr. 2012 | Senior Corporate Managing Director of the Company (concurrently Senior Corporate Managing Director of Nomura Securities Co., Ltd.) | |||

| Aug. 2012 | Executive Managing Director of the Company (concurrently Executive Vice President of Nomura Securities Co., Ltd.) | |||

| Apr. 2015 | Executive Managing Director of the Company (concurrently Representative Executive Officer and Executive Vice President of Nomura Securities Co., Ltd.) | |||

| Apr. 2016 | Representative Executive Officer and Deputy President of Nomura Securities Co., Ltd. | |||

| Apr. 2017 | Executive Managing Director of the Company (concurrently Director, Representative Executive Officer and President of Nomura Securities Co., Ltd.) | |||

| Apr. 2018 | Executive Managing Director and GroupCo-COO of the Company (concurrently Director, Representative Executive Officer and President of Nomura Securities Co., Ltd.) | |||

| Apr. 2019 | Executive Managing Director and GroupCo-COO of the Company (concurrently Representative Director and President of Nomura Securities Co., Ltd.) | |||

| Apr. 2020 | Representative Executive Officer of the Company (concurrently Representative Director and President of Nomura Securities Co., Ltd.) (Current) | |||

(Significant concurrent positions) | ||||

| Representative Director and President of Nomura Securities Co., Ltd. | ||||

(Reasons for designation as a director nominee) | ||||

Mr. Morita has held positions including GroupCo-COO of the Company and Director,

The majority of the Board of Directors of the Company, including outside directors, is made up | ||||

7

Table of Contents

4. Hisato Miyashita(Dec. 26, 1958)

| ||||

Member of the Audit Committee (Full-Time)

Non-Executive Director Reappointment

Attendance at Meetings of 11/11

Attendance at Meetings of 16/16

Number of shares held: 84,200 shares of common stock | Jul. 1987 | Joined the Company | ||

Jun. 1993 | Joined Union Bank of Switzerland (currently, UBS) | |||

| Aug. 1996 | Joined Bankers Trust Asia Securities Ltd. | |||

| Apr. 1998 | Joined Credit Suisse First Boston Securities (Japan) Limited | |||

| Dec. 1999 | Joined Nikko Citigroup Limited (currently, Citigroup Global Markets Japan Inc.) | |||

| Mar. 2005 | Executive Officer of Nikko Citigroup Limited, Internal Control Supervisory Manager | |||

| Jul. 2009 | Managing Director of Group Compliance Department of the Company | |||

| Apr. 2012 | Senior Managing Director of the Company, Head of Wholesale Compliance | |||

| Jun. 2012 | Senior Managing Director of the Company, Group Compliance Head (concurrently Senior Managing Director of Nomura Securities Co., Ltd.) | |||

| Apr. 2013 | Senior Managing Director of the Company, Group Compliance Head (concurrently Representative Executive Officer of Nomura Securities Co., Ltd., Internal Control Supervisory Manager) | |||

| Apr. 2015 | Senior Managing Director of the Company, Deputy Chief of Staff and Group Compliance Head (concurrently Representative Executive Officer and Senior Corporate Managing Director of Nomura Securities Co., Ltd., Internal Control Supervisory Manager) | |||

| Apr. 2016 | Advisor of the Company | |||

| Jun. 2016 | Director of the Company (Current) | |||

(Significant concurrent positions) | ||||

| Statutory Auditor of Nomura Financial Products & Services, Inc. | ||||

(Reasons for designation as a director nominee) | ||||

Mr. Miyashita has engaged in legal and compliance work for many years at a number of

If his reappointment is approved, he is slated to continue serving as a full-time member of the

Mr. Miyashita does not concurrently serve as an executive officer and is anon-executive | ||||

8

Table of Contents

Outside Director Nominees (Nominee Numbers 5 to 10)

All six Outside Director nominees satisfy the Independence Criteria established by the Company. Further, the Company has designated all Outside Director nominees as Independent Directors (an outside director who does not have any danger of having conflicts of interest with general shareholders in accordance with the rules of the Tokyo Stock Exchange, Inc.).

(Reference) “Independence Criteria” for Outside Directors of Nomura Holdings, Inc.

Outside Directors of Nomura Holdings, Inc. shall satisfy the requirements set forth below to maintain their independence from the Nomura Group.

| 1. | The person, currently, or within the last three years, shall not correspond to a person listed below. |

| (1) | Person Related to the Company |

A person satisfying any of the following requirements shall be considered a Person Related to the Company:

| • | Executive (*1) of another company where any Executive of the Company serves as a director or officer of that company; |

| • | Major shareholder of the Company (directly or indirectly holding more than 10% of the voting rights) or Executive of such major shareholder; or |

| • | Partner of the Company’s accounting auditor or employee of such firm who works on the Company’s audit. |

| (2) | Executive of a Major Lender (*2) of the Company. |

| (3) | Executive of a Major Business Partner (*3) of the Company (including Partners, etc.). |

| (4) | A person receiving compensation from the Nomura Group of more than 10 million yen per year, excluding director/officer compensation. |

| (5) | A person executing the business of an institution receiving more than a Certain Amount of Donation (*4) from the Company. |

| 2. | The person’s spouse, relatives within the second degree of kinship or anyone who lives with the person shall not correspond to a person listed below (excluding persons in unimportant positions): |

| (1) | Executive of the Nomura Group; or |

| (2) | A person identified in any of subsections (1) ~ (5) in Section 1 above. |

(Notes)

| *1: | Executive shall mean Executive Directors (gyoumu shikkou torishimariyaku), Executive Officers (shikkouyaku) and important employees (jyuuyou na shiyounin), including Senior Managing Directors (shikkouyakuin), etc. |

| *2: | Major Lender shall mean a lender from whom the Company borrows an amount equal to or greater than 2% of the consolidated total assets of the Company. |

| *3: | Major Business Partner shall mean a business partner whose transactions with the Company exceed 2% of such business partner’s consolidated gross revenues in the last completed fiscal year. |

| *4: | Certain amount of donation shall mean, with respect to any given institution, any amount that exceeds 2% of the donee institution’s gross revenue or ordinary income, whichever is greater, or donations that exceed 10 million yen per year. |

End.

9

Table of Contents

5. Hiroshi Kimura(Apr. 23, 1953)

| ||||

Chairman of the Nomination Committee

Chairman of the Compensation Committee

Outside Director, Independent Director Reappointment

Number of years in office: 5 years

Attendance at Meetings of 11/11

Attendance at Meetings of the Nomination Committee: 9/9

Attendance at Meetings of Committee: 8/8

Number of shares held: 200 shares of common stock

| Apr. 1976 | Joined Japan Tobacco and Salt Public Corporation (currently, Japan Tobacco Inc.) (“JT”) | ||

| Jun. 1999 | Director of JT | |||

| Jun. 2001 | Resigned as Director of JT | |||

| Jun. 2005 | Director of JT | |||

| Jun. 2006 | President and CEO and Representative Director of JT | |||

| Jun. 2012 | Chairman of the Board of JT | |||

| Jun. 2014 | Special Advisor of JT | |||

| Jun. 2015 | Outside Director of the Company (Current) | |||

| Jul. 2016 | Advisor of JT | |||

| Mar. 2018 | Honorary Company Fellow of JT (Current) | |||

(Significant concurrent positions) Honorary Company Fellow of JT | ||||

(Reasons for designation as an outside director nominee) Mr. Kimura has extensive experience with respect to corporate management, and including the

The Company has designated him as an outside director nominee with the expectation that he

If his reappointment is approved, he is slated to continue serving as Chairman of the | ||||

10

Table of Contents

6. Kazuhiko Ishimura(Sep. 18, 1954)

| ||||

Member of the

Member of the Compensation Committee

Outside Director, Independent Director Reappointment

Number of years in office: 2 years

Attendance at Meetings of 11/11

Attendance at Meetings of 9/9

Attendance at Meetings of Committee: 8/8

Number of shares held: 0 shares of common stock | Apr. 1979 | Joined Asahi Glass Co., Ltd. (currently, AGC Inc.) (“AGC”) | ||

Jan. 2006 | Executive Officer and GM of Kansai Plant of AGC | |||

Jan. 2007 | Senior Executive Officer and GM of Electronics & Energy General Division of AGC | |||

Mar. 2008 | Representative Director and President & COO of AGC | |||

Jan. 2010 | Representative Director and President & CEO of AGC | |||

Jan. 2015 | Representative Director & Chairman of AGC | |||

Jan. 2018 | Director & Chairman of AGC | |||

Jun. 2018 | Outside Director of the Company (Current) | |||

Mar. 2020 | Director of AGC (Current) | |||

Apr. 2020 | President of the National Institute of Advanced Industrial Science and Technology (Current) | |||

(Significant concurrent positions) Director of AGC Outside Director of TDK Corporation Outside Director of IHI Corporation President of the National Institute of Advanced Industrial Science and Technology | ||||

(Reasons for designation as an outside director nominee) Mr. Ishimura has extensive experience with respect to corporate management, and including

The Company has designated him as an outside director nominee with the expectation that he

If his reappointment is approved, he is slated to continue serving as a member of the | ||||

11

Table of Contents

7. Noriaki Shimazaki(Aug. 19, 1946)

| ||||

Chairman of the Audit Committee

Outside Director, Independent Director Reappointment

Number of years in office: 4 years

Attendance at Meetings of 11/11

Attendance at Meetings of 16/16

Number of shares held: 15,400 shares of common stock | Apr. 1969 | Joined Sumitomo Corporation | ||

Jun. 1998 | Director of Sumitomo Corporation | |||

Apr. 2002 | Representative Director and Managing Director of Sumitomo Corporation | |||

Jan. 2003 | Member of the Business Accounting Council of the Financial Services Agency | |||

Apr. 2004 | Representative Director and Senior Managing Executive Officer of Sumitomo Corporation | |||

Apr. 2005 | Representative Director and Executive Vice President of Sumitomo Corporation | |||

Jan. 2009 | Trustee of the IASC Foundation (currently, IFRS Foundation) | |||

Jul. 2009 | Special Advisor of Sumitomo Corporation | |||

Jun. 2011 | Director of the Financial Accounting Standards Foundation | |||

Jun. 2011 | Chairman of Self-regulation Board and Public Governor of the Japan Securities Dealers Association | |||

Sep. 2013 | Advisor of the IFRS Foundation Asia-Oceania Office (Current) | |||

Sep. 2013 | Advisor of the Japanese Institute of Certified Public Accountants (Current) | |||

Jun. 2016 | Outside Director of the Company (concurrently Director of Nomura Securities Co., Ltd.) (Current) | |||

(Significant concurrent positions) | ||||

Outside Director of Loginet Japan Co., Ltd. Director of Nomura Securities Co., Ltd. (*) | ||||

(Reasons for designation as an outside director nominee) | ||||

Mr. Shimazaki has extensive experience with respect to corporate management and a high degree of expertise with regard to international accounting systems corresponding to a Sarbanes-Oxley Act of 2002 financial expert. Including the holding in the past of positions such as Representative Director and Executive Vice President of Sumitomo Corporation, Member of the Business Accounting Council of the Financial Services Agency, Trustee of IASC Foundation and Director of the Financial Accounting Standards Foundation, such achievements and related insights have been evaluated highly both within and outside of the Company.

The Company has designated him as an outside director nominee with the expectation that he will apply his extensive experience and high degree of expertise and independence to perform a full role as an outside director in determining important managerial matters and overseeing the business execution of the Company.

If his reappointment is approved, he is slated to continue serving as a member of the Audit Committee (Chairman) after this Annual General Meeting of Shareholders.

* Mr. Shimazaki, at Nomura Securities Co., Ltd, is anon-executive director and serves as Chairman of the Audit and Supervisory Committee. Since he is an outside director of the Company, in accordance with Article 2, Item 15(c) of the Companies Act, he is not an outside director of Nomura Securities Co., Ltd. and is instead a director. | ||||

12

Table of Contents

8. Mari Sono(Feb. 20, 1952)

| ||||

Member of the Audit

Outside Director, Independent Director Reappointment

Number of years in office: 3 years

Attendance at Meetings of 11/11

Attendance at Meetings of 16/16

Number of shares held: 0 shares of common stock | Oct. 1976 | Joined NISSHIN Audit Corporation (*) | ||

Mar. 1979 | Registered as Certified Public Accountant | |||

Nov. 1988 | Partner of CENTURY Audit Corporation (*) | |||

Nov. 1990 | Member of “Certified Public Accountant Examination System Subcommittee”, Certified Public Accountant Examination and Investigation Board, Ministry of Finance | |||

Apr. 1992 | Member of “Business Accounting Council”, Ministry of Finance | |||

Dec. 1994 | Senior Partner, CENTURY Audit Corporation (*) | |||

Oct. 2002 | Member of Secretariat of the Information Disclosure, Cabinet Office (currently, Secretariat of the Information Disclosure and Personal Information Protection Review Board, Ministry of Internal Affairs and Communications) | |||

Apr. 2005 | External Comprehensive Auditor, Tokyo | |||

Jul. 2008 | Senior Partner of Ernst & Young ShinNihon LLC | |||

Aug. 2012 | Retired from Ernst & Young ShinNihon LLC | |||

Dec. 2013 Jun. 2017 | Commissioner of the Securities and Exchange Surveillance Commission Outside Director of the Company (Current) | |||

(Significant concurrent positions) | ||||

| None | ||||

(Reasons for designation as an outside director nominee) | ||||

Ms. Sono has a high degree of expertise with respect to corporate accounting based on many years of experience as a Certified Public Accountant and has held positions such as External Comprehensive Auditor, Tokyo, and Member of “Business Accounting Council,” Ministry of Finance. Further, after retiring from the Audit Firm, she served as Commissioner of the Securities and Exchange Surveillance Commission, and such achievements and related insights have been evaluated highly both within and outside of the Company.

The Company has designated her as an outside director nominee with the expectation that she will apply her extensive experience and high degree of expertise and independence to perform a full role as an outside director in determining important managerial matters and overseeing the business execution of the Company.

If her reappointment is approved, she is slated to continue serving as a member of the Audit Committee after this Annual General Meeting of Shareholders. | ||||

(Supplementary note regarding independence) | ||||

Although Ms. Sono was, in the past, a Senior Partner of Ernst & Young ShinNihon LLC (“E&Y”), the current corporate auditor of the Company, for the reasons set forth below, the Company has determined that Ms. Sono’s background does not compromise her independence as an Outside Director.

The fact that just under eight years have passed since Ms. Sono retired from E&Y, after which she has had no involvement whatsoever in E&Y’s management and financial policy.

The fact that Ms. Sono, during her tenure at E&Y, was never involved in an accounting audit of the Company and also never belonged to the Financial Division that is responsible for accounting audits of financial institutions.

Further, in addition to satisfying the Company’s Independence Criteria for Outside Directors and requirements for Independent Directors as established by the Tokyo Stock Exchange, Inc., Ms. Sono also satisfies independence requirements for an audit committee member of the Company as established by the New York Stock Exchange.

* Each of the corporations is currently Ernst & Young ShinNihon LLC | ||||

13

Table of Contents

9. Michael Lim Choo San(Sep. 10, 1946)

| ||||

Outside Director, Independent Director Reappointment

Number of years in office: 9 years

Attendance at Meetings of 11/11

Number of shares held: 0 shares of common stock | Aug. 1972 | Joined Price Waterhouse, Singapore | ||

Jan. 1992 | Managing Partner of Price Waterhouse, Singapore | |||

| Oct. 1998 | Member of the Singapore Public Service Commission (Current) | |||

| Jul. 1999 | Executive Chairman of PricewaterhouseCoopers, Singapore | |||

| Sep. 2002 | Chairman of the Land Transport Authority of Singapore | |||

| Sep. 2004 | Independent Director of Olam International Limited | |||

| Jun. 2011 | Outside Director of the Company (Current) | |||

| Nov. 2011 | Chairman of the Accounting Standards Council, Singapore | |||

| Apr. 2013 | Chairman of the Singapore Accountancy Commission | |||

| Sep. 2016 | Non-Executive Chairman of Fullerton Healthcare Corporation Limited (Current) | |||

(Significant concurrent positions) | ||||

Non-Executive Chairman of Fullerton Healthcare Corporation Limited Non-Executive Chairman of Nomura Singapore Ltd. | ||||

(Reasons for designation as an outside director nominee) | ||||

Mr. Lim is well-versed in international accounting systems and has held positions, including

The Company has designated him as an outside director nominee with the expectation that he | ||||

14

Table of Contents

10. Laura Simone Unger(Jan. 8, 1961)

| ||||

Outside Director, Independent Director Reappointment

Number of years in office: 2 years

Attendance at Meetings of 11/11

Number of shares held: (1,000 ADRs (*)) | Jan. 1988 | Enforcement Attorney of the U.S. Securities and Exchange Commission (“SEC”) | ||

| Oct. 1990 | Counsel of the U.S. Senate Committee on Banking, Housing and Urban Affairs | |||

| Nov. 1997 | Commissioner of the SEC | |||

| Feb. 2001 | Acting Chairperson of the SEC | |||

| Jul. 2002 | Regulatory Expert of CNBC | |||

| May 2003 | Independent Consultant of JPMorgan Chase & Co. | |||

| Aug. 2004 | Independent Director of CA Inc. | |||

| Jan. 2010 | Special Advisor of Promontory Financial Group | |||

| Dec. 2010 | Independent Director of CIT Group Inc. (Current) | |||

Nov. 2014 Jun. 2018 | Independent Director of Navient Corporation (Current) Outside Director of the Company (Current) | |||

(Significant concurrent positions) | ||||

Independent Director of CIT Group Inc. Independent Director of Navient Corporation Independent Director of Nomura Securities International, Inc. | ||||

(Reasons for designation as an outside director nominee) | ||||

Ms. Unger, by serving as a Commissioner and as Acting Chairman of the SEC, etc., is well-

The Company has designated her as an outside director nominee with the expectation that she

* American Depositary Receipts | ||||

15

Table of Contents

(Notes)

| 3. | There are no particular conflicts of interest between the Company and each of the 10 nominees. |

| 4. | The Company has entered into agreements to limit Companies Act Article 423 Paragraph 1 liability for damages (limitation of liability agreements) with each of the following director nominees: Mr. Hisato Miyashita, Mr. Hiroshi Kimura, Mr. Kazuhiko Ishimura, Mr. Noriaki Shimazaki, Ms. Mari Sono, Mr. Michael Lim Choo San, and Ms. Laura Simone Unger. Liability under each such agreement is limited to either 20 million yen or the amount prescribed by laws and regulations, whichever is greater. If Mr. Hisato Miyashita, Mr. Hiroshi Kimura, Mr. Kazuhiko Ishimura, Mr. Noriaki Shimazaki, Ms. Mari Sono, Mr. Michael Lim Choo San, and Ms. Laura Simone Unger are each reappointed at this Annual General Meeting of Shareholders, the Company is planning to maintain the limitation of liability agreements stated above with each of them. |

| 5. | Outside director nominee Mr. Noriaki Shimazaki had concurrently served as an outside director of UKC Holdings Corporation (currently, Restar Holdings Corporation) (“UKC”) until March 2019. UKC, for submitting annual securities reports and quarterly reports containing false statements concerning important matters during the period from June 2015 to February 2017, received an administrative monetary penalty payment order in accordance with the Financial Instruments and Exchange Act from the Financial Services Agency in December 2018. |

Mr. Noriaki Shimazaki, although not recognizing this until such facts became clear, on a regular basis had been carrying out activities such as making recommendations standing from the perspective of compliance with laws and regulations as an outside director, and further, after such facts became clear, by engaging in activities such as making recommendations regarding maters such as recurrence prevention measures to the board of directors as the Chairman of the “Committee to Consider the Third-Party Committee’s Report,” the duties as an outside director were performed.

| 6. | The outside director nominees Mr. Hiroshi Kimura and Mr. Kazuhiko Ishimura both concurrently serve as outside directors of IHI Corporation (“IHI”) (Mr. Hiroshi Kimura is scheduled to resign at the end of June, 2020). IHI, regarding its civil aero engine maintenance business, received an order in accordance with the Aircraft Manufacturing Industry Act in March 2019 to carry out repairs in accordance with the repair methods approved by the Ministry of Economy, Trade and Industry, and received a business improvement order in accordance with the Civil Aeronautics Act from the Ministry of Land, Infrastructure, Transport and Tourism in April 2019. |

Both of them, although not recognizing this until such facts became clear, on a regular basis had been carrying out activities such as making recommendations standing from the perspective of compliance with laws and regulations, and further, after such facts became clear, by engaging in activity such as asking for an investigation of the facts and appropriate recurrence prevention measures to be taken at meetings of the board of directors, the duties as outside directors were performed.

| 7. | The Company and Nomura Securities Co., Ltd., a subsidiary of the Company, received a business improvement order from the Financial Services Agency in May 2019, after Nomura Securities Co., Ltd. was found to have improperly handled information relating to the listing and delisting criteria for the upper market, which was under review by the Tokyo Stock Exchange, Inc. In response to this incident, the Company and Nomura Securities Co., Ltd. have reviewed the organizational structure of the equity business within the Wholesale division, and developed a system to strictly controlnon-public information that could have a material impact on investment decisions. In December 2019, Nomura Group has established the “Nomura Group Code of Conduct” as guidelines for action to be taken in order to increase awareness of the importance of responding to the role expected from the society as a financial services group. At the same time, Nomura Group has developed an internal management system to promote appropriate actions (Conduct) based on the Code of Conduct. |

The outside director nominees Mr. Hiroshi Kimura, Mr. Kazuhiko Ishimura, Mr. Noriaki Shimazaki, Ms. Mari Sono, Mr. Michael Lim Choo San, and Ms. Laura Simone Unger, had not been aware of this fact until the occurrence of this incident, but on a regular basis they have made remarks from the viewpoint of legal compliance at the Board of Directors meetings of the Company, etc., and further, after the occurrence of this incident, they have made a variety of proposals regarding the establishment of improvement measures, measures for their implementation, and measures to keep them firmly established and functioning effectively.

In addition, the outside director nominee Mr. Noriaki Shimazaki, concurrently serves as director of Nomura Securities Co., Ltd. Although he was not aware of this fact until the occurrence of the incident as described above, he made remarks from the viewpoint of legal compliance at the Board of Directors meetings of Nomura Securities Co., Ltd. and other meetings, and after the occurrence of the incident, as the chairperson of the Audit and Supervisory Committee, he made various proposals regarding the establishment of improvement measures, measures for their implementation, and measures to keep them firmly established and functioning effectively.

Reference

The structure below is planned for the Nomination Committee, the Compensation Committee and the Audit Committee after the conclusion of this Annual General Meeting of Shareholders:

Nomination Committee: Hiroshi Kimura (chairman), Kazuhiko Ishimura, and Koji Nagai

Compensation Committee: Hiroshi Kimura (chairman), Kazuhiko Ishimura, and Koji Nagai

Audit Committee: Noriaki Shimazaki (chairman), Mari Sono, and Hisato Miyashita

End.

16

Table of Contents

(Reference)Board of Directors after this Annual General Meetings of Shareholders

Name | Positions | Committee Participation1 | Experience | |||||||||||||||

| Nomination | Compensation | Audit | Corporate management | International business | Securities industry | Accounting/ Financial | Legal/ Regulations | |||||||||||

| Koji Nagai | Non-Executive Director (Chairman of the Board of Directors) |

|

| ✓ | ✓ | ✓ | ||||||||||||

| Kentaro Okuda | Representative Executive Officer, President Group CEO | ✓ | ✓ | ✓ | ||||||||||||||

| Toshio Morita | Representative Executive Officer | ✓ | ✓ | |||||||||||||||

| Hisato Miyashita | Non-Executive Director |

| ✓ | ✓ | ✓ | |||||||||||||

| Hiroshi Kimura | Outside Director |

|

| ✓ | ✓ | |||||||||||||

| Kazuhiko Ishimura | Outside Director |

|

| ✓ | ✓ | |||||||||||||

| Noriaki Shimazaki | Outside Director |

| ✓ | ✓ | ✓ | |||||||||||||

| Mari Sono | Outside Director |

| ✓ | ✓ | ||||||||||||||

| Michael Lim Choo San | Outside Director | ✓ | ✓ | |||||||||||||||

| Laura Simone Unger | Outside Director | ✓ | ✓ | |||||||||||||||

| 1. |

|

17

Table of Contents

[English Translation]

(Attachments to Notice of Convocation of the Annual General Meeting of Shareholders)

Report for the 116th Fiscal Year

From April 1, 2019 to March 31, 2020

| I. | Current State of Nomura Group |

| 1. | Fundamental Management Policy and Structure of Business Operations |

| (1) | Fundamental Management Policy |

Nomura Group’s management vision is to enhance its corporate value by deepening society’s trust in the firm and increasing the satisfaction of stakeholders, including shareholders and clients.

focused on

In this fiscal year, as “Asia’s global investment bank” Nomura focused on providing high value-added solutions to clients globally, and, contributing to economic growth and development of society while recognizing its wider social responsibility.

To enhance its corporate value, Nomura emphasized Earnings Per Share (“EPS”) as a management index.

| (2) | Structure of Business Operations |

Nomura Group’s divisions are comprised of four divisions (Retail Division, Asset Management Division, Wholesale Division and Merchant Banking Division). All divisions work together to manage business operations across the Group. Nomura Group shall delegate its powers to each of these business divisions to an appropriate extent and establish its business execution structure by enhancing professional skills, while strengthening global linkages among these business divisions , and fully demonstrating Nomura Group’s comprehensive capabilities.

| 2. | Progress and Results of the Nomura Group’s Business Activities |

| (1) | Summary |

Although the global economy continued to expand during the fiscal year ended March 31, 2020, the spread of the novel coronavirus from the beginning of 2020 hampered economic activity, including consumption and production. In the U.S., real Gross Domestic Product (“GDP”) growth slowed from 2018, but the economy continued to show solid growth supported by healthy personal consumption and increased government spending. At the same time, companies were cautious on capital expenditure, reflecting uncertainties such as heightened U.S.-China trade friction through the summer. To ameliorate the impact on the economy of U.S.-China trade friction and the novel coronavirus outbreak, the Federal Reserve Board (FRB) intensified monetary policy easing, lowering the policy interest rate and resuming quantitative easing measures, in addition to which the U.S. government embarked on fiscal expansion. In China, exports slowed on the U.S.-China trade friction and the spread of the novel coronavirus in developed economies, and companies reined in capital expenditures. Moreover, smaller businesses and service industries were not yet back to normal operating rates, putting a damper on employment conditions and domestic consumer spending. In response, government authorities encouraged banks to step up lending, giving rise to an outlook for a gradual credit expansion in the country. On the fiscal policy front, the Chinese government put forth enhanced economic stimulus measures, such as temporarily removing the tacit ceiling of 3% on the ratio of the budget deficit to GDP. In Europe, U.S.-China trade friction depressed external demand, and stricter EU emission standards for new vehicles dampened production output, but consumer spending remained firm thanks to solid employment. The spread of the novel coronavirus in March 2020, however, prompted governments in many European countries to institutestay-at-home orders, which greatly restricted consumption and production activities in the region.

While Japan’s economy had been showing growth, albeit modest, through the first half of the fiscal year ended March 31, 2020, a hike to the consumption tax rate implemented in October 2019 caused personal consumption to fall sharply. Exports were weak from the second half of 2018 on the impact of U.S.-China trade friction and this weighed on companies’ capital expenditure, but following the consumption tax hike the drop in capital expenditure came sharply into focus. Since the start of 2020, the novel coronavirus outbreak resulted in a sharp decline in inbound tourists and related demand, and personal consumption fell further as people stayed home. The economic slowdown had an impact on corporate earnings as well, and recurring profits look likely to fall for the first time in eight years for the fiscal year ended March 31, 2020. Furthermore, with concerns regarding the escalating impact on the economy and corporate earnings of the novel coronavirus outbreak, the stock market fell sharply in the second half of the fiscal year ended March 31, 2020, and market volatility was high.

18

Table of Contents

From a regulatory perspective, in addition to the implementation of Basel III requirements relating to capital ratio, liquidity ratio, and leverage ratio, Nomura has been identified as one of Domestic Systemically Important Banks. Nomura will continue to monitor closely and take necessary measures in responding to wide-ranging reforms as part of the global tightening of financial regulations. Also, amid the global economic downturn caused by the spread ofCOVID-19 and subsequent changes in monetary policies by central banks as well as uncertainty created by Brexit in January 2020, Nomura is contemplating and implementing appropriate measures by paying necessary attention to the changes in global operating environment.

In April 2019, we announced plans to rebuild our business platform. As a result of our ongoing initiatives and our continued focus on providing solutions to our clients in areas where we have a competitive advantage, pretax income rebounded strongly, while our environment is changing drastically.

We posted net revenue of 1,287.8 billion yen for the year ended March 31, 2020, an increase of 15.3% from the previous fiscal year.Non-interest expenses decreased by 10.0% to 1,039.6 billion yen, income before income taxes was 248.3 billion yen, and net income attributable to the shareholders of Nomura Holdings, Inc. was 217.0 billion yen. Return on equity was 8.2%. EPS(1) for the year ended March 31, 2020 was 66.20 yen an increase from (29.92) yen for the year ended March 31, 2019. We have decided to pay a dividend of 5 yen per share to shareholders of record as of March 31, 2020. As a result, the total annual dividend will be 20 yen per share.

(Note):

| 1. | Diluted net income (loss) attributable to Nomura Holdings’ shareholders per share. |

Consolidated Financial Results

| Billions of yen | % Change | |||||||||||

| For the year ended | (B-A)/(A) | |||||||||||

| March 31, 2019 (A) | March 31, 2020 (B) | |||||||||||

Net revenue | 1,116.8 | 1,287.8 | 15.3 | |||||||||

Non-interest expenses | 1,154.5 | 1,039.6 | (10.0 | ) | ||||||||

|

|

|

|

|

| |||||||

Income (loss) before income taxes | (37.7 | ) | 248.3 | — | ||||||||

Income tax expense | 57.0 | 28.9 | (49.3 | ) | ||||||||

|

|

|

|

|

| |||||||

Net income (loss) | (94.7 | ) | 219.4 | — | ||||||||

|

|

|

|

|

| |||||||

Less: Net income attributable to noncontrolling interests | 5.7 | 2.4 | (58.7 | ) | ||||||||

|

|

|

|

|

| |||||||

Net income (loss) attributable to NHI shareholders | (100.4 | ) | 217.0 | — | ||||||||

|

|

|

|

|

| |||||||

Return on shareholders’ equity | (3.7 | %) | 8.2 | % | — | |||||||

|

|

|

|

|

| |||||||

19

Table of Contents

| (2) | Segment Information |

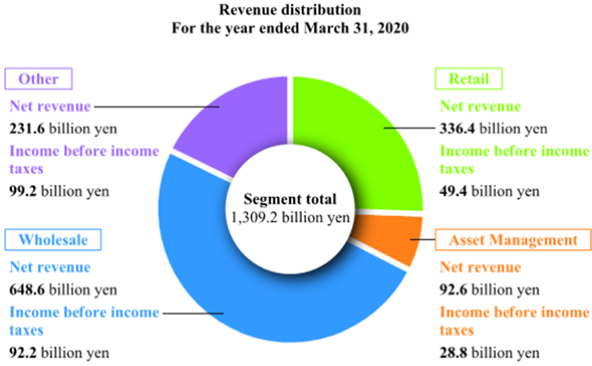

We report our operations and business results by reporting segment that corresponds to the following three divisions: Retail, Asset Management and Wholesale.

Business Segment Results

| Billions of yen | % Change | |||||||||||

| For the year ended | (B-A)/(A) | |||||||||||

| March 31, 2019 (A) | March 31, 2020 (B) | |||||||||||

Net revenue | 1,124.0 | 1,309.2 | 16.5 | |||||||||

Non-interest expenses | 1,154.5 | 1,039.6 | (10.0 | ) | ||||||||

|

|

|

|

|

| |||||||

Income (loss) before income taxes | (30.5 | ) | 269.6 | — | ||||||||

|

|

|

|

|

| |||||||

In business segment totals, which exclude unrealized gain (loss) on investments in equity securities held for operating purposes, net revenue for the fiscal year ended March 31, 2020 was 1,309.2 billion yen, an increase of 16.5% from the previous year.Non-interest expenses for the fiscal year ended March 31, 2020 decreased by 10.0% from the previous year to 1,039.6 billion yen. Income before income taxes was 269.6 billion yen for the fiscal year ended March 31, 2020.

20

Table of Contents

Operating Results of Retail

| Billions of yen | % Change | |||||||||||

| For the year ended | (B-A)/(A) | |||||||||||

| March 31, 2019 (A) | March 31, 2020 (B) | |||||||||||

Net revenue | 339.5 | 336.4 | (0.9 | ) | ||||||||

Non-interest expenses | 290.0 | 286.9 | (1.1 | ) | ||||||||

|

|

|

|

|

| |||||||

Income before income taxes | 49.5 | 49.4 | (0.1 | ) | ||||||||

|

|

|

|

|

| |||||||

Net revenue decreased by 0.9% from the previous fiscal year to 336.4 billion yen, andnon-interest expenses decreased by 1.1% to 286.9 billion yen. As a result, income before income taxes decreased by 0.1% to 49.4 billion yen.

Based on the basic concept of “Enriching clients by responding to their asset concerns”, Retail Division has been working on consulting business in close cooperation with each customer with the aim of becoming “the most trusted partner”. In the current fiscal year, sales of investment trusts and equities were sluggish due to the decline in customers’ investment mindset against the backdrop of the unstable market environment. However, signs of changes are beginning to appear, as we have made a transition to the sales structure that meets the needs of our clients. In addition to Asset Management, we will enhance our products and services such as; Real Estate, Inheritance, or Succession, which aims to provide various solutions and advices to clients’ entire asset. We are also taking digital approaches in addition toface-to-face approaches, to provide services to a wider range of clients. We will further strengthen our digital approach.

Operating Results of Asset Management

| Billions of yen | % Change | |||||||||||

| For the year ended | (B-A)/(A) | |||||||||||

| March 31, 2019 (A) | March 31, 2020 (B) | |||||||||||

Net revenue | 97.8 | 92.6 | (5.4 | ) | ||||||||

Non-interest expenses | 63.7 | 63.8 | 0.3 | |||||||||

|

|

|

|

|

| |||||||

Income before income taxes | 34.2 | 28.8 | (15.8) | |||||||||

|

|

|

|

|

| |||||||

Net revenue decreased by 5.4% from the previous fiscal year to 92.6 billion yen.Non-interest expenses increased by 0.3% to 63.8 billion yen. As a result, income before income taxes decreased by 15.8% to 28.8 billion yen.

In the investment trust business, the inflow to ETFs, funds that contribute to asset formation and funds for defined contribution pension plans for the 100 years of life is continuing. On the other hand, there was an outflow of funds such as emerging markets funds. In the investment advisory business, although we saw cash inflow mainly from public pension funds, there was an outflow mainly from high yield related products in overseas. As a result, revenue decreased as assets under management decreased from the end of the previous fiscal year as of March 31, 2020, and due to the valuation of American Century Investments, our strategic partner.

21

Table of Contents

Operating Results of Wholesale

| Billions of yen | % Change | |||||||||||

| For the year ended | ||||||||||||

| March 31, 2019 (A) | March 31, 2020 (B) | (B-A)/(A) | ||||||||||

Net revenue | 555.4 | 648.6 | 16.8 | |||||||||

Non-interest expenses | 666.8 | 556.4 | (16.6 | ) | ||||||||

|

|

|

|

|

| |||||||

Income (loss) before income taxes | (111.4 | ) | 92.2 | — | ||||||||

|

|

|

|

|

| |||||||

The Wholesale Division consists of two businesses, Global Markets which is engaged in the trading, sales and structuring of financial products, and Investment Banking which is engaged in financing and advisory businesses.

Net revenue increased by 16.8% from the previous fiscal year to 648.6 billion yen.Non-interest expenses decreased by 16.6% to 556.4 billion yen from previous year when we recognized a loss of 81.0 billion yen from the goodwill impairment attributable to Wholesale. As a result, income before income taxes was 92.2 billion yen. Income before income taxes for the year ended March 31, 2020 includes approximately 35 billion yen mark down mainly on our loan-related positions due to market dislocation in March.

Global Markets

In the year ended March 2020, we focused on core strengths in each region and stabilizing our performance, following strategic repositioning of business undertaken in April 2019. As a result, we delivered steady performance in both Fixed Income and Equities and continued to remain engaged with our clients, despite geopolitical uncertainties leading to challenging market environment for most part of the year.

Investment Banking

In this fiscal year, the global IB business performed stably until the third quarter, but the decline in customer activity and in the market caused by the spread of the new coronavirus infection in the fourth quarter affected business results. On the other hand, the diversification of revenue opportunities that we have worked on mainly overseas has progressed. Europe, Middle East and Africa (“EMEA”) and Asiaex-Japan (“AEJ”) revenues from M&A and DCM (debt-related fundraising business) exceeded the previous fiscal year’s revenue respectively. We provide custom-made solutions by carefully grasping the needs of our clients.

On April 1, 2020, we completed the acquisition of Greentech Capital, LLC, an M&A boutique that is strong in renewable energy technologies and facilities.

Other

| Billions of yen | % Change | |||||||||||

| For the year ended | ||||||||||||

| March 31, 2019 (A) | March 31, 2020 (B) | (B-A)/(A) | ||||||||||

Net revenue | 131.3 | 231.6 | 76.4 | |||||||||

Non-interest expenses | 134.0 | 132.4 | (1.2 | ) | ||||||||

|

|

|

|

|

| |||||||

Income (loss) before income taxes | (2.8 | ) | 99.2 | — | ||||||||

|

|

|

|

|

| |||||||

Net revenue increased by 76.4% from the previous fiscal year to 231.6 billion yen including realized gain of 73.3 billion yen from the sale of Nomura Research Institute ordinary shares in July, 2019.Non-interest expenses decreased by 1.2% to 132.4 billion yen. As a result, income before income taxes was 99.2 billion yen.

22

Table of Contents

| 3. | Financing Situation |

| (1) | Funding situation |

In terms of funding, the Company, Nomura Securities Co., Ltd., Nomura Europe Finance N.V., Nomura Bank International plc, Nomura International Funding Pte. Ltd. , and Nomura Global Finance Co., Ltd. are the main group entities that borrow externally, issue debt instruments and engage in other funding activities. By raising funds to match the currencies and liquidities of our assets or by using foreign exchange swaps as necessary, we pursue optimization of our funding structures.

| (2) | Capital Expenditures |

Capital expenditures focus primarily on investment in systems with the objective in encouraging business activities further in Japan and overseas. In Retail Division, we have improved online-based services in order to provide more convenient services for our clients. In Wholesale Division, we have been continuously enhancing the trading systems as well as strengthening the infrastructure system in order to navigate through the global markets and achieve best execution more stably and efficiently.

| 4. | Results of Operations and Assets |

| (in billions of yen except per share data in yen) | ||||||||||||||||||||

| Item |

Period | 113th Fiscal Year (April 1, 2016 to March 31, 2017) | 114th Fiscal Year (April 1, 2017 to March 31, 2018) | 115th Fiscal Year (April 1, 2018 to March 31, 2019) | 116th Fiscal Year (April 1, 2019 to March 31, 2020) | |||||||||||||||

Total Revenue | 1,715.5 | 1,972.2 | 1,835.1 | 1,952.5 | ||||||||||||||||

Net revenue | 1,403.2 | 1,497.0 | 1,116.8 | 1,287.8 | ||||||||||||||||

Income (loss) before income taxes | 322.8 | 328.2 | (37.7 | ) | 248.3 | |||||||||||||||

Net income (loss) attributable to NHI shareholders | 239.6 | 219.3 | (100.4 | ) | 217.0 | |||||||||||||||

Basic-Net income (loss) attributable to NHI shareholders per share | 67.29 | 63.13 | (29.90 | ) | 67.76 | |||||||||||||||

Diluted-Net income (loss) attributable to NHI shareholders per share | 65.65 | 61.88 | (29.92 | ) | 66.20 | |||||||||||||||

Total assets | 42,532.0 | 40,343.9 | 40,969.4 | 43,999.8 | ||||||||||||||||

Total NHI shareholders’ equity | 2,789.9 | 2,749.3 | 2,631.1 | 2,653.5 | ||||||||||||||||

(Note)

Stated in accordance with accounting principles generally accepted in the U.S.

| 5. | Management Challenges and Strategies |

The Nomura Group’s management vision is to enhance its corporate value by deepening society’s trust in the firm and increasing the satisfaction of stakeholders, including shareholders and clients.

In order to revamp our business model transformation in Japan and further improve profitability of our overseas operations, we were shifted to a business operating model to accelerate division’s leadership as from May 2019.

We will continue to strive to maintain a business foundation that is capable of sustainable growth in any future conditions. Also, we recognize that ESG (Environmental, Social and Governance) initiatives are an important theme for sustainable growth.

Although the environment is undergoing major changes due to the spread ofCOVID-19, we activated Business Continuity Plans to provide financial services. We will continue to fulfill our responsibility critical to the proper functioning of society.

We will ensure our flexible and prompt response to changes in the global business environment, maintain an appropriate financial standing and make effective use of management resources through improved capital efficiency, etc.

The challenges and strategies in each division are as follows:

23

Table of Contents

[Retail Division]

Based on the basic concept of “Enriching clients by responding to their asset concerns”, Retail Division aims to become a financial institution that is required by many people. We will continue working on improving the skills of our Partners, and enhance wide range of products and services in order to accurately respond to diversifying clients’ asset issues such as; Asset Succession or anxiety about lack of funds after retirement. Furthermore, in order to deliver products and services to clients who have never used Nomura, we will expand our online services and strengthen our remote consulting structure through call centers and other functions.

[Asset Management Division]

In our investment trust business, we will pursue providing clients with a diverse range of investment opportunities to meet investors’ various needs, focusing on asset formation and retirement layers, where asset management needs are expected to increase further in the future. In our investment advisory business, we will aim to increase assets under management and expand our client base worldwide by providing value-added investment services.

Through our continued effort to deliver superior investment performance, as well as meeting various investment needs, we aim to become an asset management company highly regarded by investors from around the world.

[Wholesale Division]

The Wholesale division faces challenges presented by increasingly sophisticated needs of clients and technological advancement, coupled with challenged from uncertain market environment and potential economic downturn recently on the back ofCOVID-19. To ensure continuity of service as well as added value to clients, we will continue to enhance collaboration across regions and divisions as well as ensure tight risk control. We will continue efforts to diversify business portfolio and deploy financial resources to selective, high growth opportunities.

Global Markets aims to provide uninterrupted liquidity to our clients while positioning portfolio to weather a possible economic downturn, keeping tight risk control and discipline. Additionally, opportunistically pursue growth opportunities in areas like asset-side structured business / structured finance as well as client coverage and continue to make progress in digitization of Flow business and improved efficiency, differentiation.

In Investment Banking, we will continue to support our clients’ cross-border M&A ambitions, facilitate their fundraising activities both in Japan and other geographies, as well as provide the full product suite of our Solutions Business as our clients continue to pursue the globalization of their business activities.

24

Table of Contents

[Merchant Banking Division]

The Marchant Banking Division will primarily provide equity as a new solution for business reorganizations and revitalizations, business succession as well as management buyouts to cater to the increasingly diversified and sophisticated needs of our clients. The Marchant Banking Division will, under proper management of risk, focus on support for improving the enterprise value of portfolio companies, and will contribute to expansion of the private equity market.

[Risk Management and Compliance, etc.]

At the Nomura Group, the types and levels of risks for the purpose of achieving strategic objectives and business plans based on management philosophy is set forth as the Risk Appetite. We will continue to develop a risk management framework which ensures financial soundness, enhances corporate value, and is strategically aligned to the business plan and incorporated in decision making by senior management.

With regard to compliance, we will continue to focus on improving the management structure to comply with local laws and regulations in the countries where we operate. We also continue to review our internal systems and rules so that all executive management and employees can work autonomously with high ethical standards.

In March 2019, there was an incident that information related to the listing and delisting criteria for the upper market under review by the Tokyo Stock Exchange was handled improperly from the viewpoint of ensuring fair and sound markets in the course of communicating information at Nomura Securities Co., Ltd. In May the same year, Japan’s Financial Services Agency issued a business improvement order against Nomura Holdings and Nomura Securities for their management control framework relating to information management. We have taken this matter very seriously, and are reviewing our organizational structures and developing rules. In addition, in order to ensure not only compliance with laws and regulations, but also that all executive management and employees are able to act in accordance with social norms, Nomura Group has established the “Nomura Group Code of Conduct” as guidelines for action to be taken, and is developing an effective internal management system to promote appropriate actions (Conduct) based on the Code of Conduct.

In addition, Nomura Group established the Nomura Founding Principles and Corporate Ethics Day in 2015. Commemorated annually, this day aims to remind all of our executive officers and employees of the lessons learned from the incident and to renew our determination to prevent similar incidents from recurring in the future and further improve public trust In this initiative, we strive to maintain a sound corporate culture through discussions on appropriate conduct, and will make further efforts to enable all of our executive officers and employee to act with high ethical standards as professionals engaged in capital markets.

As described above, we are working to achieve our management targets and devote our efforts to the stability and further develop financial and capital markets. Also, we aim to be a financial services group that society needs and our clients trust.

| 6. | Major Business Activities |

Nomura Group primarily operates in investment and financial services focusing on the securities business. We provide wide-ranging services to customers for both financing and investment through operations in Japan and other major financial capital markets around the world. Such services include securities trading and brokerage, underwriting and distribution, arrangement of offering and distribution, arrangement of private placement, principal finance, asset management, and other securities and financial business. We divide our business segments into four divisions of Retail, Asset Management, Wholesale and Merchant Banking.

In order to respond to our clients’ increasingly diversified needs, we will further increase our lineup of services available to clients by focusing efforts on private side products and services such as private equities and privately placed bonds, in addition to products in public markets such as listed stocks and corporate bonds that we have been providing so far.

25

Table of Contents

| 7. | Organizational Structure |

| (1) | Principal place of business in Japan |

The Company: Head office (Tokyo)

Nomura Securities Co., Ltd. (Head office and local branches — 128 locations in total): Tokyo (Head office and local branches — 24 locations in total), Kanto area excluding Tokyo (29 branches), Hokkaido area (5 branches), Tohoku area (9 branches), Hokuriku area (4 branches), Chubu area (15 branches), Kinki area (18 branches), Chugoku area (9 branches), Shikoku area (4 branches) and Kyushu and Okinawa area (11 branches)

Nomura Asset Management Co., Ltd. (Tokyo, Osaka, Fukuoka)

The Nomura Trust & Banking Co., Ltd. (Tokyo)

Nomura Facilities, Inc. (Tokyo)

Nomura Financial Products & Services, Inc. (Tokyo)

| (2) | Principal place of business overseas |

Nomura Securities International, Inc. (New York, U.S.)

Nomura International plc (London, U.K.)

Nomura International (Hong Kong) Limited

Nomura Singapore Limited

Instinet Incorporated (New York, U.S.)

| (3) | Status of Employees |

| Employees | Increase / Decrease | |||||||

Total | 26,629 | 1,239 Decrease | ||||||

(Notes)

| 1. | Number of employees consists of the total number of employees of the Company and its consolidated subsidiaries (excluding temporary employees). |

| 2. | Number of employees excludes employees seconded outside the Company and its consolidated subsidiaries. |

| (4) | Status of Significant Subsidiaries |

Name | Location | Capital (in millions) | Percentage of Voting Rights | Type of Business | ||||||||||||

Nomura Securities Co., Ltd. | Tokyo, Japan | ¥ | 10,000 | 100 | % | Securities | ||||||||||

Nomura Asset Management Co., Ltd. | Tokyo, Japan | ¥ | 17,180 | 100 | % | Investment Trust Management / Investment Advisory | ||||||||||

The Nomura Trust & Banking Co., Ltd. | Tokyo, Japan | ¥ | 35,000 | 100 | % | Banking / Trust | ||||||||||

Nomura Facilities, Inc. | Tokyo, Japan | ¥ | 480 | 100 | % | Business Space / Facility Management | ||||||||||

Nomura Financial Products & Services, Inc. | Tokyo, Japan | ¥ | 176,775 | 100 | % | Financial | ||||||||||

Nomura Asia Pacific Holdings Co., Ltd. | Tokyo, Japan | ¥ | 10 | 100 | % | Holding Company | ||||||||||

Nomura Holding America Inc. | New York, U.S. | US$ | 6,157.25 | 100 | % | Holding Company | ||||||||||

Nomura Securities International, Inc. | New York, U.S. | US$ | 3,650.00 | 100 | %* | Securities | ||||||||||

Nomura America Mortgage Finance, LLC | New York, U.S. | US$ | 1,783.49 | 100 | %* | Holding Company | ||||||||||

Instinet Incorporated | New York, U.S. | US$ | 1,329.70 | 100 | %* | Holding Company | ||||||||||

Nomura Europe Holdings plc | London, U.K. | US$ | 11,391.32 | 100 | % | Holding Company | ||||||||||

Nomura International plc | London, U.K. | US$ | 11,241.23 | 100 | %* | Securities | ||||||||||

Nomura International (Hong Kong) Limited | Hong Kong | ¥ | 182,311 | 100 | %* | Securities | ||||||||||

Nomura Singapore Limited | Singapore, Singapore | S$ | 239.00 | 100 | %* | Securities / Financial | ||||||||||

(Notes)

| 1. | “Capital” is stated in the currency on which each subsidiary’s books of record are maintained. “Capital” of a subsidiary, whosepaid-in capital is zero or is in nominal amount (primarily subsidiaries located in the U.S.), is disclosed in amount including additionalpaid-in capital. Percentages with “*” in the “Percentage of Voting Rights” column include voting rights from indirect ownership of shares. |

| 2. | The total number of consolidated subsidiaries and consolidated variable interest entities as of March 31, 2020 was 1,342. The total number of entities accounted for under the equity method of accounting such as Nomura Research Institute, Ltd. and Nomura Real Estate Holdings, Inc. was 13 as of March 31, 2020. |

26

Table of Contents

| 8. | Major Lenders |

Lender | Type of Loan | Loan Amount (in millions of yen) | ||||

MUFG Bank, Ltd | Long-term borrowing | 368,002 | ||||

Mizuho Bank, Ltd. | Long-term borrowing | 367,505 | ||||

Sumitomo Mitsui Banking Corporation | Long-term borrowing | 359,898 | ||||

Resona Bank, Ltd. | Long-term borrowing | 49,479 | ||||

Sumitomo Mitsui Trust Bank, Limited. | Long-term borrowing | 180,379 | ||||

Mizuho Trust & Banking Co., Ltd. | Long-term borrowing | 30,000 | ||||

The Chiba Bank, Ltd. | Long-term borrowing | 44,326 | ||||

The Shizuoka Bank, Ltd. | Long-term borrowing | 35,246 | ||||

The Norinchukin Bank | Long-term borrowing | 48,697 | ||||

Meiji Yasuda Life Insurance Company | Long-term borrowing | 31,643 | ||||

| 9. | Capital Management Policy |

We seek to enhance shareholder value and to capture growing business opportunities by maintaining sufficient levels of capital. We will continue to review our levels of capital as appropriate, taking into consideration the economic risks inherent to operating our businesses, the regulatory requirements, and maintaining our ratings necessary to operate businesses globally.

We believe that raising corporate value over the long term and paying dividends is essential to rewarding shareholders. We will strive to pay dividends using a consolidatedpay-out ratio of 30 percent of each semi-annual consolidated earnings as a key indicator.

Dividend payments will be determined taking into account a comprehensive range of factors such as the tightening of Basel regulations and other changes to the regulatory environment as well as the company’s consolidated financial performance.

Dividends will in principle be paid on a semi-annual basis with record dates of September 30 and March 31.

Additionally we will aim for a total payout ratio, which includes dividends and share buybacks, of at least 50 percent.

With respect to the retained earnings, in order to implement measures to adapt to regulatory changes and to increase shareholder value, we seek to efficiently invest in business areas where high profitability and growth may reasonably be expected, including the development and expansion of infrastructure.

Dividends for the Fiscal Year

Based on our Capital Management Policy described above, we paid a dividend of 15 yen per share to shareholders of record as of September 30, 2019 and have decided to pay a dividend of 5 yen per share to shareholders of record as of March 31, 2020. As a result, the total annual dividend will be 20 yen per share.

The following table sets forth the details of dividends paid for the fiscal year ended March 31, 2020:

Resolution of Board of Directors | Record Date | Total Amount of Dividends (in millions of yen) | Dividend Per Share (yen) | |||||||

October 29, 2019 | September 30, 2019 | 48,483 | 15.00 | |||||||

May 8, 2020 | March 31, 2020 | 15,195 | 5.00 | |||||||

| 10. | Other Important Matters Related to the Current Situation of the Corporate Group |

We tendered to the self-tender offer made by Nomura Research Institute, Ltd. (“NRI”). Upon the settlement on August 21, 2019, we sold 101,889,300 ordinary shares we held at ¥159,966 million to NRI. NRI remains an equity method affiliate of NHI.

27

Table of Contents

II. Stocks

1. | Total Number of Authorized Shares: | 6,000,000,000 | shares |

The total number of classes of shares authorized to be issued in each class is as follows.

Type | Total Number of Shares Authorized to be Issued in Each Class | |||

Common Stock | 6,000,000,000 | |||

Class 1 Preferred Stock | 200,000,000 | |||

Class 2 Preferred Stock | 200,000,000 | |||

Class 3 Preferred Stock | 200,000,000 | |||

Class 4 Preferred Stock | 200,000,000 | |||

| 2. | Total Number of Issued Shares:Common Stock | 3,493,562,601 | shares | |||||

| 3. | Number of Shareholders: | 349,668 | ||||||

| 4. | Major Shareholders (Top 10): | |||||||

| Number of Shares Owned and Percentage of Shares Owned | ||||||||

Names of Shareholders | (in thousand shares) | (%) | ||||||

The Master Trust Bank of Japan, Ltd. (Trust Account) | 228,152 | 7.50 | ||||||

Japan Trustee Services Bank, Ltd. (Trust Account) | 163,096 | 5.36 | ||||||

Japan Trustee Services Bank, Ltd. (Trust Account 5) | 70,680 | 2.32 | ||||||

JP Morgan Chase Bank 385151 | 53,546 | 1.76 | ||||||

Northern Trust Co. (AVFC) Re Silchester International Investors International Value Equity Trust | 51,872 | 1.70 | ||||||

Japan Trustee Services Bank, Ltd. (Trust Account 7) | 50,758 | 1.67 | ||||||

State Street Bank West Client-Treaty 505234 | 49,110 | 1.61 | ||||||

Northern Trust Co. (AVFC) Re U.S. Tax Exempted Pension Funds | 39,176 | 1.28 | ||||||

Japan Trustee Services Bank, Ltd. (Trust Account 1) | 36,260 | 1.19 | ||||||

SSBTC Client Omnibus Account | 34,172 | 1.12 | ||||||

(Note)

| 1. | The Company has 454,625 thousand shares of treasury stock as of March 31, 2020 which is not included in the major shareholders list above. |

| 2. | Figures for Number of Shares Owned are rounded down to the nearest thousand and figures for Percentage of Shares Owned are calculated excluding treasury stock. |

28

Table of Contents

| 5. | Status of Treasury Stock Repurchase, Disposition and Number of Shares Held in Treasury: |

| (1) | Repurchased shares |

Common Stock | 299,381,781 | shares | ||

Total Repurchase Amount (in thousands of yen) | 150,009,244 |

Stocks acquired according to resolution of the Board, included above, are as follows;

Common Stock | 299,362,300 | shares | ||

Total Repurchase Amount (in thousands of yen) | 149,999,997 |