- NMR Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Nomura (NMR) 6-KCurrent report (foreign)

Filed: 27 Apr 21, 9:28am

FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

Commission File Number: 1-15270

For the month of April 2021

NOMURA HOLDINGS, INC.

(Translation of registrant’s name into English)

9-1, Nihonbashi 1-chome

Chuo-ku, Tokyo 103-8645

Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Information furnished on this form:

| Exhibit Number | ||

| 1. | Nomura Reports Fourth Quarter and Full Year Financial Results | |

| 2. | ||

| 3. | ||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NOMURA HOLDINGS, INC. | ||||

Date: April 27, 2021 | By: | /s/ Yoshifumi Kishida | ||

Yoshifumi Kishida | ||||

| Senior Managing Director | ||||

Nomura Reports Fourth Quarter and Full Year Financial Results

| • | Three segment pretax income increased 35% YoY, although Q4 impacted by loss arising from transactions with US client |

| • | Retail client assets at record high of Y126.6trn; significant YoY increase in pretax income driven by diversified approach to clients and favorable market conditions |

| • | Strongest full year Asset Management pretax income recorded since year ended March 2002; record high assets under management of Y64.7trn on inflows |

| • | Global Markets Q4 net revenue impacted by loss arising from transactions with US client, while Investment Banking revenues stronger QoQ; Robust full year results in Fixed Income and Investment Banking |

| • | Year-end dividend of 15 yen per share, making annual dividend of 35 yen; ROE of 5.7% |

| • | Robust financial position with consolidated CET1 ratio of 15.7% and liquidity portfolio of Y5.7trn |

Tokyo, April 27, 2021—Nomura Holdings, Inc. today announced its consolidated financial results for the fourth quarter and full year ended March 2021.

For the full year period, net revenue was 1,401.9 billion yen (US$12.7billion)1, representing an increase of 9 percent year on year. Income before income taxes was 230.7 billion yen (US$2.1 billion) and net income attributable to Nomura Holdings shareholders was 153.1 billion yen (US$1.4 billion). Diluted net income attributable to Nomura Holdings shareholders per share was 48.63 yen.

Net revenue in the fourth quarter was 170 billion yen (US$1.5 billion), decreasing 58 percent quarter on quarter and 28 percent year on year. Loss before income taxes was 166.1 billion yen (US$1.5 billion) and net loss attributable to Nomura Holdings shareholders was 155.4 billion yen (US$1.4 billion). Diluted net loss attributable to Nomura Holdings shareholders per share was 50.78 yen.

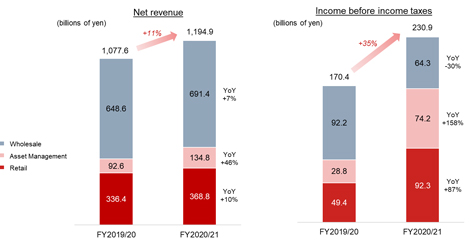

“We reported net revenue of 1,401.9 billion yen and net income of 153.1 billion yen for the full year. Total revenues from our three core business segments increased 11 percent and pretax income grew 35 percent year on year as business momentum from the record April to December period continued. Retail pretax income was 92.3 billion yen, 87 percent higher than the previous year, and Asset Management delivered its strongest full year pretax income since March 2002 of 74.2 billion yen. Although Wholesale performance was impacted by a loss of 245.7 billion yen arising from transactions with a US client, we delivered pretax income of 64.3 billion yen, a 30 percent decline year on year. In addition, we recognized an impairment charge of 47.7 billion yen from an equity stake in Nomura Real Estate Holdings. As a result, net income was 29 percent lower compared to last year,” said Nomura President and Group CEO Kentaro Okuda.

| 1 | US dollar amounts are included solely for the convenience of the reader and have been translated at the rate of 110.61 yen = 1 US dollar, the noon buying rate in New York for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York on March 31, 2021. This translation should not be construed to imply that the yen amounts actually represent, or have been or could be converted into, equivalent amounts in US dollars. |

“We take the matter with the US client very seriously. We remain committed to strengthening management and enhancing our risk management framework as we continue to build our operating platform to deliver consistent earnings across our global franchise.”

Three segment net revenue and income before income taxes

Divisional Performance

Retail

(billions of yen) | FY2020/21 Q4 | QoQ | YoY | |||||||||

Net revenue | 96.8 | -1 | % | +9 | % | |||||||

Income (loss) before income taxes | 26.1 | -8 | % | +42 | % | |||||||

Retail reported fourth quarter net revenue of 96.8 billion yen, down 1 percent quarter on quarter and up 9 percent year on year. Income before income taxes was 26.1 billion yen, down 8 percent quarter on quarter and 42 percent higher year on year.

Retail income before income taxes was significantly higher than the previous year, driven by an improvement in investor sentiment amid favorable market conditions, in addition to diversified approaches to clients and cost reductions. In the fourth quarter, the favorable market environment and diversified client interactions drove robust sales of Japanese secondary stocks and stronger recurring revenue. Retail client assets reached a record high of 126.6 trillion yen.

2

Asset Management

(billions of yen) | FY2020/21 Q4 | QoQ | YoY | |||||||||

Net revenue | 36.6 | -2 | % | 5.2x | ||||||||

Income (loss) before income taxes | 21.4 | -4 | % | — | ||||||||

Asset Management fourth quarter net revenue was 36.6 billion yen, down 2 percent quarter on quarter but jumped 5.2 times year on year. Income before income taxes was 21.4 billion yen, 4 percent lower quarter on quarter.

Asset Management delivered the strongest full year income before income taxes since the year ended March 2002. Assets under management were lifted by inflows to a record high of 64.7 trillion yen, while American Century Investments related gain/loss contributed to quarterly revenues.

Wholesale

(billions of yen) | FY2020/21 Q4 | QoQ | YoY | |||||||||

Net revenue | -0.8 | — | — | |||||||||

Income (loss) before income taxes | -165.9 | — | — | |||||||||

Wholesale booked a fourth quarter net loss of 0.8 billion yen. Loss before income taxes was 165.9 billion yen.

Wholesale booked stronger revenues in Fixed Income and Investment Banking compared to the previous year, while Equities delivered a solid performance until the third quarter but booked a loss arising from transactions with a US client in the fourth quarter.

Although Global Markets net revenue was impacted by the loss arising from transactions with the US client, the underlying business remained solid delivering resilient results.

Investment Banking net revenue was strong, underpinned by robust performance in M&A mainly in Japan and the Americas.

| ends | ||||

For further information please contact:

Name | Company | Telephone | ||

| Kenji Yamashita | Nomura Holdings, Inc. | 81-3-3278-0591 | ||

| Group Corporate Communications Dept. |

Nomura

Nomura is a global financial services group with an integrated network spanning over 30 countries. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three business divisions: Retail, Wholesale (Global Markets and Investment Banking), and Investment Management. Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership. For further information about Nomura, visit www.nomura.com.

3

| 1. | This document is produced by Nomura Holdings, Inc. (“Nomura”). Copyright 2021 Nomura Holdings, Inc. All rights reserved. |

| 2. | Nothing in this document shall be considered as an offer to sell or solicitation of an offer to buy any security, commodity or other instrument, including securities issued by Nomura or any affiliate thereof. Offers to sell, sales, solicitations to buy, or purchases of any securities issued by Nomura or any affiliate thereof may only be made or entered into pursuant to appropriate offering materials or a prospectus prepared and distributed according to the laws, regulations, rules and market practices of the jurisdictions in which such offers or sales may be made. |

| 3. | No part of this document shall be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of Nomura. |

| 4. | The information and opinions contained in this document have been obtained from sources believed to be reliable, but no representations or warranty, express or implied, are made that such information is accurate or complete and no responsibility or liability can be accepted by Nomura for errors or omissions or for any losses arising from the use of this information. |

| 5. | This document contains statements that may constitute, and from time to time our management may make “forward-looking statements” within the meaning of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. Any such statements must be read in the context of the offering materials pursuant to which any securities may be offered or sold in the United States. These forward-looking statements are not historical facts but instead represent only our belief regarding future events, many of which, by their nature, are inherently uncertain and outside our control. Important factors that could cause actual results to differ from those in specific forward-looking statements include, without limitation, economic and market conditions, political events and investor sentiments, liquidity of secondary markets, level and volatility of interest rates, currency exchange rates, security valuations, competitive conditions and size, and the number and timing of transactions. |

| 6. | The consolidated financial information in this document is unaudited. |

4

Update on Loss Arising from Business Activities

Tokyo, April 27, 2021—On March 29, 2021, Nomura Holdings, Inc. announced that an event had occurred at its subsidiaries, including US subsidiary Nomura Global Financial Products Inc., which could subject the firm to a significant loss arising from transactions with a US client.1

Nomura has booked a loss of 245.7 billion yen (approximately $2.3 billion) in its consolidated financial results for the year ended March 31, 2021. In addition, as of April 23, 2021, Nomura estimates a loss of approximately $570 million will be recorded in its consolidated financial results for the fiscal year ending March 2022. Nomura has unwound over 97% of its outstanding positions related to this event.

Nomura has also recognized a loss on valuation of 112.7 billion yen in its unconsolidated financial statements for the fiscal year ended March 31, 2021.

The loss on valuation is recorded as an extraordinary loss, and is due to a decrease in the net asset value of Nomura Holding America Inc. (NHA), a subsidiary holding company for the Americas. As the impairment charge is only recorded in the unconsolidated financial statements, there is no impact on Nomura’s consolidated financial results.

Through NHA, Nomura will continue to hold sufficient capital necessary for the business activities of its US subsidiaries.

As of March 31, 2021, Nomura maintained a consolidated Common Equity Tier 1 ratio of 15.7 percent, which is substantially higher than the minimum regulatory requirement. Accordingly, there are no issues related to the operations or financial soundness of Nomura Holdings or its subsidiaries.

| ends | ||||

For further information please contact:

Name | Company | Telephone | ||

| Kenji Yamashita | Nomura Holdings, Inc. | 81-3-3278-0591 | ||

| Group Corporate Communications Dept. |

Nomura

Nomura is a global financial services group with an integrated network spanning over 30 countries. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three business divisions: Retail, Wholesale (Global Markets and Investment Banking), and Investment Management. Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership. For further information about Nomura, visit www.nomura.com

| 1 | See https://www.nomuraholdings.com/news/nr/holdings/20210329/20210329.html |

Nomura Declares Year-end Dividend Payment

Tokyo, April 27, 2021—Nomura Holdings, Inc. today announced that it has declared a dividend of 15 yen per share to shareholders of record as of the end of March 2021. The dividend will be paid on June 1, 2021.

Recent dividends

| Q2 | Q4 | Annual Dividend | ||||

FY2018/19 | Y3.0 | Y3.0 | Y6.0 | |||

FY2019/20 | Y15.0 | Y5.0 | Y20.0 | |||

FY2020/21 | Y20.0 | Y15.0 | Y35.0 |

| ends | ||||

For further information please contact:

Name | Company | Telephone | ||

| Kenji Yamashita | Nomura Holdings, Inc. | 81-3-3278-0591 | ||

| Group Corporate Communications Dept. |

Nomura

Nomura is a global financial services group with an integrated network spanning over 30 countries. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three business divisions: Retail, Wholesale (Global Markets and Investment Banking), and Investment Management. Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership. For further information about Nomura, visit www.nomura.com.