UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10603

Western Asset Premier Bond Fund

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 777-0102

Date of fiscal year end: December 31

Date of reporting period: June 30, 2020

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

| | |

| Semi-Annual Report | | June 30, 2020 |

WESTERN ASSET

PREMIER BOND FUND

(WEA)

Beginning in January 2021, as permitted by regulations adopted by the Securities and Exchange Commission, the Fund intends to no longer mail paper copies of the Fund’s shareholder reports like this one, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you invest through a financial intermediary and you already elected to receive shareholder reports electronically (“e-delivery”), you will not be affected by this change and you need not take any action. If you have not already elected e-delivery, you may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. That election will apply to all Legg Mason Funds held in your account at that financial intermediary. If you are a direct shareholder with the Fund, you can call the Fund at 1-888-888-0151, or write to the Fund by regular mail at P.O. Box 505000, Louisville, KY 40233 or by overnight delivery to Computershare, 462 South 4th Street, Suite 1600, Louisville, KY 40202 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. That election will apply to all Legg Mason Funds held in your account held directly with the fund complex.

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund’s investment objective is to provide current income and capital appreciation by investing primarily in a diversified portfolio of investment grade bonds.

Under normal market conditions, the Fund expects to invest substantially all (but at least 80%) of its total managed assets in bonds, including corporate bonds, U.S. government and agency securities and mortgage-related securities, and at least 65% of its total managed assets in bonds that, at the time of purchase, are of investment grade quality. The Fund may invest up to 35% of its total managed assets in bonds of below investment grade quality (commonly referred to as “junk bonds”) at the time of purchase. The Fund may invest in securities or instruments other than bonds (including preferred stock) and may invest up to 10% of its total managed assets in instruments denominated in currencies other than the U.S. dollar. The Fund may invest in a variety of derivative instruments for investment or risk management purposes. The Fund expects that the average effective duration of its portfolio will range between 3.5 and seven years, although this target duration may change from time to time. Trust preferred interests and capital securities are considered bonds and not preferred stock for purposes of the foregoing guidelines.

| | |

| II | | Western Asset Premier Bond Fund |

Letter from the president

Dear Shareholder,

We are pleased to provide the semi-annual report of Western Asset Premier Bond Fund for the six-month reporting period ended June 30, 2020. Please read on for Fund performance information during the Fund’s reporting period.

Special shareholder notice

On July 31, 2020, Franklin Resources, Inc. (“Franklin Resources”) acquired Legg Mason, Inc. in an all-cash transaction. As a result of the transaction, Western Asset Management Company, LLC, Western Asset Management Company Limited, Western Asset Management Company Pte. Ltd., Western Asset Management Company Ltd and Legg Mason Partners Fund Advisor, LLC, (“LMPFA”) became indirect, wholly-owned subsidiaries of Franklin Resources. Under the Investment Company Act of 1940, as amended, consummation of the transaction automatically terminated the management and subadvisory agreements that were in place for the Fund prior to the transaction. The Fund’s manager and subadvisers continue to provide uninterrupted services with respect to the Fund pursuant to new management and subadvisory agreements that were approved by Fund shareholders.

Franklin Resources, whose principal executive offices are at One Franklin Parkway, San Mateo, California 94403, is a global investment management organization operating, together with its subsidiaries, as Franklin Templeton. As of June 30, 2020, after giving effect to the transaction described above, Franklin Templeton’s asset management operations had aggregate assets under management of approximately $1.4 trillion.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.lmcef.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

| | |

| Western Asset Premier Bond Fund | | III |

Letter from the president

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

July 31, 2020

| | |

| IV | | Western Asset Premier Bond Fund |

Performance review

For the six months ended June 30, 2020, Western Asset Premier Bond Fund returned -3.57% based on its net asset value (“NAV”)i and -7.62% based on its New York Stock Exchange (“NYSE”) market price per share. The Fund’s unmanaged benchmarks, the Bloomberg Barclays U.S. Corporate High Yield Indexii and the Bloomberg Barclays U.S. Credit Indexiii, returned -3.80% and 4.82%, respectively, for the same period. The Lipper Corporate BBB-Rated Debt Closed-End Funds (Leveraged) Category Averageiv returned 0.82% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

During this six-month period, the Fund made distributions to shareholders totaling $0.40 per share. As of June 30, 2020, the Fund estimates that all of the distributions were sourced from net investment income.* The performance table shows the Fund’s six-month total return based on its NAV and market price as of June 30, 2020. Past performance is no guarantee of future results.

| | | | |

Performance Snapshot as of June 30, 2020 (unaudited) | | | |

| Price Per Share | | 6-Month

Total Return** | |

| $13.72 (NAV) | | | -3.57 | %† |

| $13.13 (Market Price) | | | -7.62 | %‡ |

All figures represent past performance and are not a guarantee of future results. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

** Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses, including management fees, operating expenses, and other Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors may pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions, including returns of capital, if any, at NAV.

‡ Total return assumes the reinvestment of all distributions, including returns of capital, if any, in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

Looking for additional information?

The Fund is traded under the symbol “WEA” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available online under the symbol “XWEAX” on most financial websites. Barron’s and The Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites as well as www.lmcef.com (click on the name of the Fund).

| * | This estimate is not for tax purposes. The Fund will issue a Form 1099 with final composition of the distributions for tax purposes after year-end. A return of capital is not taxable and results in a reduction in the tax basis of a shareholder’s investment. For more information about a distribution’s composition, please refer to the Fund’s distribution press release or, if applicable, the Section 19 notice located in the press release section of our website, www.lmcef.com (click on the name of the Fund). |

| | |

| Western Asset Premier Bond Fund | | V |

Performance review (cont’d)

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in Western Asset Premier Bond Fund. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

July 31, 2020

RISKS: The Fund is a diversified closed-end management investment company designed primarily as a long-term investment and not as a trading vehicle. The Fund is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Fund will achieve its investment objective. The Fund’s common stock is traded on the New York Stock Exchange. Similar to stocks, the Fund’s share price will fluctuate with market conditions and, at the time of sale, may be worth more or less than the original investment. Shares of closed-end funds often trade at a discount to their net asset value. Diversification does not assure against market loss. The Fund’s investments are subject to a number of risks, including credit, inflation and interest rate risks. As interest rates rise, bond prices fall, reducing the value of a fixed income investment’s price. The Fund may invest in high-yield bonds (commonly referred to as “junk” bonds), which are rated below investment grade and carry more risk than higher-rated securities. To the extent that the Fund invests in asset-backed, mortgage-backed or mortgage-related securities, its exposure to prepayment and extension risks may be greater than if it invested in other fixed income securities. Leverage may result in greater volatility of NAV and the market price of common shares and increases a shareholder’s risk of loss. Investing in foreign securities is subject to certain risks not associated with domestic investing, such as currency fluctuations, and social, political, and economic uncertainties which could result in significant volatility. These risks are magnified in emerging or developing markets. Emerging market countries tend to have economic, political, and legal systems that are less developed and are less stable than those of more developed countries. The Fund may make significant investments in derivative instruments. Derivative instruments can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. The Fund may also invest in money market funds, including funds affiliated with the Fund’s manager and subadvisers.

| | |

| VI | | Western Asset Premier Bond Fund |

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | Net asset value (“NAV”) is calculated by subtracting total liabilities and outstanding preferred stock (if any) from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is the Fund’s market price as determined by supply of and demand for the Fund’s shares. |

| ii | The Bloomberg Barclays U.S. Corporate High Yield Index covers the universe of fixed-rate, non-investment grade debt, including corporate and non-corporate sectors. Pay-in-kind (“PIK”) bonds, Eurobonds and debt issues from countries designated as emerging markets are excluded, but Canadian and global bonds (SEC registered) of issuers in non-emerging market countries are included. Original issue zero coupon bonds, step-up coupon structures and 144-A securities are also included. |

| iii | The Bloomberg Barclays U.S. Credit Index is an index composed of corporate and non-corporate debt issues that are investment grade (rated Baa3/BBB- or higher). |

| iv | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended June 30, 2020, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 7 funds in the Fund’s Lipper category. |

| | |

| Western Asset Premier Bond Fund | | VII |

(This page intentionally left blank.)

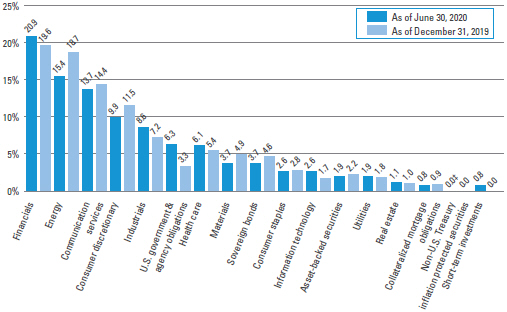

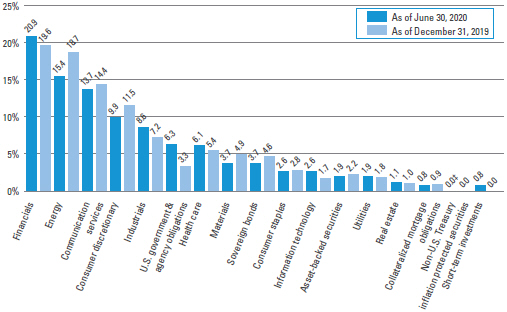

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the Fund’s portfolio as of June 30, 2020 and December 31, 2019 and does not include derivatives such as forward foreign currency contracts. The Fund’s portfolio is actively managed. As a result, the composition of its portfolio holdings and sectors is subject to change at any time. |

| ‡ | Represents less than 0.1%. |

| | |

| Western Asset Premier Bond Fund 2020 Semi-Annual Report | | 1 |

Schedule of investments (unaudited)

June 30, 2020

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face Amount† | | | Value | |

| Corporate Bonds & Notes — 110.4% | | | | | | | | | | | | | | | | |

| Communication Services — 14.9% | | | | | | | | | | | | | | | | |

Diversified Telecommunication Services — 3.6% | | | | | | | | | | | | | | | | |

Altice France Holding SA, Senior Secured Notes | | | 10.500 | % | | | 5/15/27 | | | | 450,000 | | | $ | 497,666 | (a) |

Altice France SA, Senior Secured Notes | | | 7.375 | % | | | 5/1/26 | | | | 1,560,000 | | | | 1,628,406 | (a) |

Altice France SA, Senior Secured Notes | | | 8.125 | % | | | 2/1/27 | | | | 430,000 | | | | 470,805 | (a) |

CenturyLink Inc., Senior Secured Notes | | | 4.000 | % | | | 2/15/27 | | | | 1,050,000 | | | | 1,022,212 | (a) |

Orange SA, Senior Notes | | | 9.000 | % | | | 3/1/31 | | | | 600,000 | | | | 979,661 | |

Verizon Communications Inc., Senior Notes | | | 5.150 | % | | | 9/15/23 | | | | 580,000 | | | | 660,856 | |

Verizon Communications Inc., Senior Notes | | | 4.329 | % | | | 9/21/28 | | | | 500,000 | | | | 602,187 | |

Windstream Services LLC/Windstream Finance Corp., Secured Notes | | | 10.500 | % | | | 6/30/24 | | | | 970,000 | | | | 58,200 | *(a)(b) |

Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 5,919,993 | |

Entertainment — 1.1% | | | | | | | | | | | | | | | | |

Netflix Inc., Senior Notes | | | 5.875 | % | | | 11/15/28 | | | | 410,000 | | | | 467,619 | |

Netflix Inc., Senior Notes | | | 6.375 | % | | | 5/15/29 | | | | 310,000 | | | | 360,124 | |

TWDC Enterprises 18 Corp., Senior Notes | | | 3.000 | % | | | 2/13/26 | | | | 500,000 | | | | 551,773 | |

Walt Disney Co., Senior Notes | | | 8.875 | % | | | 4/26/23 | | | | 400,000 | | | | 481,653 | |

Total Entertainment | | | | | | | | | | | | | | | 1,861,169 | |

Media — 7.3% | | | | | | | | | | | | | | | | |

Cable Onda SA, Senior Notes | | | 4.500 | % | | | 1/30/30 | | | | 590,000 | | | | 601,101 | (a) |

CCO Holdings LLC/CCO Holdings Capital Corp., Senior Notes | | | 5.125 | % | | | 5/1/27 | | | | 350,000 | | | | 362,617 | (a) |

CCO Holdings LLC/CCO Holdings Capital Corp., Senior Notes | | | 5.000 | % | | | 2/1/28 | | | | 410,000 | | | | 423,735 | (a) |

Charter Communications Operating LLC/Charter Communications Operating Capital Corp., Senior Secured Notes | | | 4.200 | % | | | 3/15/28 | | | | 1,000,000 | | | | 1,122,408 | |

Charter Communications Operating LLC/Charter Communications Operating Capital Corp., Senior Secured Notes | | | 6.384 | % | | | 10/23/35 | | | | 420,000 | | | | 556,166 | |

See Notes to Financial Statements.

| | |

| 2 | | Western Asset Premier Bond Fund 2020 Semi-Annual Report |

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face Amount† | | | Value | |

Media — continued | | | | | | | | | | | | | | | | |

Charter Communications Operating LLC/Charter Communications Operating Capital Corp., Senior Secured Notes | | | 6.484 | % | | | 10/23/45 | | | | 1,130,000 | | | $ | 1,499,349 | |

Comcast Corp., Senior Notes | | | 3.700 | % | | | 4/15/24 | | | | 1,000,000 | | | | 1,107,360 | |

Comcast Corp., Senior Notes | | | 7.050 | % | | | 3/15/33 | | | | 1,000,000 | | | | 1,526,365 | |

DISH DBS Corp., Senior Notes | | | 5.875 | % | | | 11/15/24 | | | | 1,160,000 | | | | 1,156,189 | |

DISH DBS Corp., Senior Notes | | | 7.750 | % | | | 7/1/26 | | | | 1,180,000 | | | | 1,253,007 | |

Time Warner Cable LLC, Senior Secured Notes | | | 7.300 | % | | | 7/1/38 | | | | 720,000 | | | | 993,268 | |

Univision Communications Inc., Senior Secured Notes | | | 9.500 | % | | | 5/1/25 | | | | 470,000 | | | | 500,550 | (a) |

Virgin Media Secured Finance PLC, Senior Secured Notes | | | 5.500 | % | | | 8/15/26 | | | | 770,000 | | | | 789,901 | (a) |

Total Media | | | | | | | | | | | | | | | 11,892,016 | |

Wireless Telecommunication Services — 2.9% | | | | | | | | | | | | | | | | |

CSC Holdings LLC, Senior Notes | | | 6.625 | % | | | 10/15/25 | | | | 610,000 | | | | 635,538 | (a) |

CSC Holdings LLC, Senior Notes | | | 10.875 | % | | | 10/15/25 | | | | 201,000 | | | | 216,546 | (a) |

CSC Holdings LLC, Senior Notes | | | 6.500 | % | | | 2/1/29 | | | | 560,000 | | | | 613,550 | (a) |

Sprint Capital Corp., Senior Notes | | | 6.875 | % | | | 11/15/28 | | | | 420,000 | | | | 512,505 | |

Sprint Capital Corp., Senior Notes | | | 8.750 | % | | | 3/15/32 | | | | 30,000 | | | | 42,967 | |

Sprint Communications Inc., Senior Notes | | | 7.000 | % | | | 8/15/20 | | | | 260,000 | | | | 261,427 | |

Sprint Communications Inc., Senior Notes | | | 11.500 | % | | | 11/15/21 | | | | 280,000 | | | | 310,737 | |

Sprint Corp., Senior Notes | | | 7.875 | % | | | 9/15/23 | | | | 760,000 | | | | 856,896 | |

VEON Holdings BV, Senior Notes | | | 5.950 | % | | | 2/13/23 | | | | 570,000 | | | | 617,946 | (a) |

Vodafone Group PLC, Senior Notes | | | 4.375 | % | | | 5/30/28 | | | | 500,000 | | | | 595,059 | |

Total Wireless Telecommunication Services | | | | | | | | | | | | | | | 4,663,171 | |

Total Communication Services | | | | | | | | | | | | | | | 24,336,349 | |

| Consumer Discretionary — 10.1% | | | | | | | | | | | | | | | | |

Auto Components — 1.4% | | | | | | | | | | | | | | | | |

Adient Global Holdings Ltd., Senior Notes | | | 4.875 | % | | | 8/15/26 | | | | 580,000 | | | | 477,969 | (a) |

Adient US LLC, Senior Secured Notes | | | 9.000 | % | | | 4/15/25 | | | | 360,000 | | | | 389,367 | (a) |

American Axle & Manufacturing Inc., Senior Notes | | | 6.500 | % | | | 4/1/27 | | | | 600,000 | | | | 583,497 | |

JB Poindexter & Co. Inc., Senior Notes | | | 7.125 | % | | | 4/15/26 | | | | 790,000 | | | | 800,713 | (a) |

Total Auto Components | | | | | | | | | | | | | | | 2,251,546 | |

See Notes to Financial Statements.

| | |

| Western Asset Premier Bond Fund 2020 Semi-Annual Report | | 3 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face Amount† | | | Value | |

Automobiles — 2.5% | | | | | | | | | | | | | | | | |

Daimler Finance North America LLC, Senior Notes | | | 8.500 | % | | | 1/18/31 | | | | 1,000,000 | | | $ | 1,524,807 | |

Ford Motor Co., Senior Notes | | | 8.500 | % | | | 4/21/23 | | | | 440,000 | | | | 466,125 | |

Ford Motor Co., Senior Notes | | | 9.000 | % | | | 4/22/25 | | | | 580,000 | | | | 628,763 | |

Ford Motor Credit Co. LLC, Senior Notes | | | 4.250 | % | | | 9/20/22 | | | | 200,000 | | | | 196,792 | |

General Motors Co., Senior Notes | | | 5.400 | % | | | 10/2/23 | | | | 100,000 | | | | 108,206 | |

General Motors Co., Senior Notes | | | 6.125 | % | | | 10/1/25 | | | | 130,000 | | | | 146,242 | |

General Motors Co., Senior Notes | | | 4.200 | % | | | 10/1/27 | | | | 750,000 | | | | 764,675 | |

General Motors Co., Senior Notes | | | 6.600 | % | | | 4/1/36 | | | | 140,000 | | | | 151,490 | |

Total Automobiles | | | | | | | | | | | | | | | 3,987,100 | |

Diversified Consumer Services — 0.4% | | | | | | | | | | | | | | | | |

Carriage Services Inc., Senior Notes | | | 6.625 | % | | | 6/1/26 | | | | 430,000 | | | | 453,569 | (a) |

Weight Watchers International Inc., Senior Notes | | | 8.625 | % | | | 12/1/25 | | | | 210,000 | | | | 216,956 | (a) |

Total Diversified Consumer Services | | | | | | | | | | | | | | | 670,525 | |

Hotels, Restaurants & Leisure — 3.2% | | | | | | | | | | | | | | | | |

1011778 BC ULC/New Red Finance Inc., Senior Secured Notes | | | 5.750 | % | | | 4/15/25 | | | | 250,000 | | | | 262,969 | (a) |

Colt Merger Sub Inc., Senior Secured Notes | | | 5.750 | % | | | 7/1/25 | | | | 360,000 | | | | 362,952 | (a)(c) |

IRB Holding Corp., Senior Secured Notes | | | 7.000 | % | | | 6/15/25 | | | | 430,000 | | | | 444,007 | (a) |

Marston’s Issuer PLC, Secured Notes (3 mo. GBP LIBOR + 2.550%) | | | 3.218 | % | | | 7/15/35 | | | | 540,000 | GBP | | | 542,629 | (d)(e) |

NCL Corp. Ltd., Senior Secured Notes | | | 12.250 | % | | | 5/15/24 | | | | 920,000 | | | | 966,299 | (a) |

Saga PLC, Senior Notes | | | 3.375 | % | | | 5/12/24 | | | | 530,000 | GBP | | | 514,125 | (d) |

Silversea Cruise Finance Ltd., Senior Secured Notes | | | 7.250 | % | | | 2/1/25 | | | | 348,000 | | | | 329,258 | (a) |

Viking Cruises Ltd., Senior Notes | | | 5.875 | % | | | 9/15/27 | | | | 130,000 | | | | 77,699 | (a) |

VOC Escrow Ltd., Senior Secured Notes | | | 5.000 | % | | | 2/15/28 | | | | 980,000 | | | | 729,919 | (a) |

Wynn Resorts Finance LLC/Wynn Resorts Capital Corp., Senior Notes | | | 7.750 | % | | | 4/15/25 | | | | 990,000 | | | | 1,001,459 | (a) |

Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 5,231,316 | |

Household Durables — 0.7% | | | | | | | | | | | | | | | | |

Lennar Corp., Senior Notes | | | 5.000 | % | | | 6/15/27 | | | | 430,000 | | | | 465,931 | |

Lennar Corp., Senior Notes | | | 4.750 | % | | | 11/29/27 | | | | 250,000 | | | | 271,800 | |

Newell Brands Inc., Senior Notes | | | 4.875 | % | | | 6/1/25 | | | | 420,000 | | | | 440,649 | |

Total Household Durables | | | | | | | | | | | | | | | 1,178,380 | |

See Notes to Financial Statements.

| | |

| 4 | | Western Asset Premier Bond Fund 2020 Semi-Annual Report |

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face Amount† | | | Value | |

Specialty Retail — 1.6% | | | | | | | | | | | | | | | | |

Maxeda DIY Holding BV, Senior Secured Notes | | | 6.125 | % | | | 7/15/22 | | | | 660,000 | EUR | | $ | 682,745 | (d) |

Party City Holdings Inc., Senior Notes | | | 6.125 | % | | | 8/15/23 | | | | 300,000 | | | | 63,000 | (a) |

Party City Holdings Inc., Senior Notes | | | 6.625 | % | | | 8/1/26 | | | | 320,000 | | | | 67,200 | (a) |

PetSmart Inc., Senior Secured Notes | | | 5.875 | % | | | 6/1/25 | | | | 1,710,000 | | | | 1,719,585 | (a) |

Sally Holdings LLC/Sally Capital Inc., Senior Notes | | | 5.500 | % | | | 11/1/23 | | | | 100,000 | | | | 97,562 | |

Total Specialty Retail | | | | | | | | | | | | | | | 2,630,092 | |

Textiles, Apparel & Luxury Goods — 0.3% | | | | | | | | | | | | | | | | |

Hanesbrands Inc., Senior Notes | | | 4.875 | % | | | 5/15/26 | | | | 450,000 | | | | 454,417 | (a) |

Total Consumer Discretionary | | | | | | | | | | | | | | | 16,403,376 | |

| Consumer Staples — 3.8% | | | | | | | | | | | | | | | | |

Beverages — 1.1% | | | | | | | | | | | | | | | | |

Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide Inc., Senior Notes | | | 4.700 | % | | | 2/1/36 | | | | 540,000 | | | | 636,870 | |

Anheuser-Busch InBev Worldwide Inc., Senior Notes | | | 4.000 | % | | | 4/13/28 | | | | 1,000,000 | | | | 1,154,868 | |

Total Beverages | | | | | | | | | | | | | | | 1,791,738 | |

Food & Staples Retailing — 1.1% | | | | | | | | | | | | | | | | |

CVS Pass-Through Trust | | | 5.789 | % | | | 1/10/26 | | | | 256,407 | | | | 274,962 | (a) |

CVS Pass-Through Trust | | | 7.507 | % | | | 1/10/32 | | | | 337,044 | | | | 420,262 | (a) |

CVS Pass-Through Trust, Secured Trust | | | 5.880 | % | | | 1/10/28 | | | | 307,123 | | | | 346,489 | |

CVS Pass-Through Trust, Secured Trust | | | 6.943 | % | | | 1/10/30 | | | | 328,619 | | | | 376,464 | |

CVS Pass-Through Trust, Senior Secured Trust | | | 6.036 | % | | | 12/10/28 | | | | 319,382 | | | | 361,145 | |

Total Food & Staples Retailing | | | | | | | | | | | | | | | 1,779,322 | |

Food Products — 1.0% | | | | | | | | | | | | | | | | |

Kraft Heinz Foods Co., Senior Notes | | | 3.950 | % | | | 7/15/25 | | | | 126,000 | | | | 133,777 | |

Kraft Heinz Foods Co., Senior Notes | | | 3.875 | % | | | 5/15/27 | | | | 30,000 | | | | 31,395 | (a) |

Kraft Heinz Foods Co., Senior Notes | | | 4.250 | % | | | 3/1/31 | | | | 110,000 | | | | 116,879 | (a) |

Kraft Heinz Foods Co., Senior Notes | | | 5.500 | % | | | 6/1/50 | | | | 340,000 | | | | 363,786 | (a) |

Pilgrim’s Pride Corp., Senior Notes | | | 5.750 | % | | | 3/15/25 | | | | 70,000 | | | | 69,898 | (a) |

Pilgrim’s Pride Corp., Senior Notes | | | 5.875 | % | | | 9/30/27 | | | | 920,000 | | | | 922,314 | (a) |

Total Food Products | | | | | | | | | | | | | | | 1,638,049 | |

See Notes to Financial Statements.

| | |

| Western Asset Premier Bond Fund 2020 Semi-Annual Report | | 5 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Tobacco — 0.6% | | | | | | | | | | | | | | | | |

Altria Group Inc., Senior Notes | | | 4.800 | % | | | 2/14/29 | | | | 500,000 | | | $ | 584,180 | |

Reynolds American Inc., Senior Notes | | | 5.850 | % | | | 8/15/45 | | | | 260,000 | | | | 320,487 | |

Total Tobacco | | | | | | | | | | | | | | | 904,667 | |

Total Consumer Staples | | | | | | | | | | | | | | | 6,113,776 | |

| Energy — 21.6% | | | | | | | | | | | | | | | | |

Oil, Gas & Consumable Fuels — 21.6% | | | | | | | | | | | | | | | | |

Anadarko Finance Co., Senior Notes | | | 7.500 | % | | | 5/1/31 | | | | 570,000 | | | | 532,428 | |

Apache Corp., Senior Notes | | | 4.250 | % | | | 1/15/44 | | | | 250,000 | | | | 190,462 | |

Blue Racer Midstream LLC/Blue Racer Finance Corp., Senior Notes | | | 6.125 | % | | | 11/15/22 | | | | 50,000 | | | | 49,861 | (a) |

Conoco Phillips Canada Funding Co., Senior Notes | | | 7.400 | % | | | 12/1/31 | | | | 450,000 | | | | 664,898 | |

Continental Resources Inc., Senior Notes | | | 3.800 | % | | | 6/1/24 | | | | 560,000 | | | | 525,106 | |

Continental Resources Inc., Senior Notes | | | 4.375 | % | | | 1/15/28 | | | | 210,000 | | | | 185,222 | |

Continental Resources Inc., Senior Notes | | | 4.900 | % | | | 6/1/44 | | | | 250,000 | | | | 199,604 | |

Diamondback Energy Inc., Senior Notes | | | 3.500 | % | | | 12/1/29 | | | | 400,000 | | | | 388,196 | |

Ecopetrol SA, Senior Notes | | | 5.875 | % | | | 9/18/23 | | | | 45,000 | | | | 48,314 | |

Ecopetrol SA, Senior Notes | | | 5.375 | % | | | 6/26/26 | | | | 750,000 | | | | 791,145 | |

Ecopetrol SA, Senior Notes | | | 5.875 | % | | | 5/28/45 | | | | 2,510,000 | | | | 2,648,790 | |

EOG Resources Inc., Senior Notes | | | 3.150 | % | | | 4/1/25 | | | | 2,250,000 | | | | 2,476,299 | |

EQM Midstream Partners LP, Senior Notes | | | 6.000 | % | | | 7/1/25 | | | | 250,000 | | | | 253,855 | (a) |

EQM Midstream Partners LP, Senior Notes | | | 6.500 | % | | | 7/1/27 | | | | 220,000 | | | | 225,878 | (a) |

EQT Corp., Senior Notes | | | 3.900 | % | | | 10/1/27 | | | | 800,000 | | | | 653,204 | |

KazMunayGas National Co. JSC, Senior Notes | | | 4.750 | % | | | 4/19/27 | | | | 770,000 | | | | 837,298 | (a) |

Kinder Morgan Inc., Senior Notes | | | 7.750 | % | | | 1/15/32 | | | | 190,000 | | | | 265,886 | |

Kinder Morgan Inc., Senior Notes | | | 5.550 | % | | | 6/1/45 | | | | 1,500,000 | | | | 1,833,686 | |

Lukoil International Finance BV, Senior Notes | | | 4.750 | % | | | 11/2/26 | | | | 1,000,000 | | | | 1,112,880 | (a) |

MEG Energy Corp., Secured Notes | | | 6.500 | % | | | 1/15/25 | | | | 290,000 | | | | 270,831 | (a) |

MEG Energy Corp., Senior Notes | | | 7.000 | % | | | 3/31/24 | | | | 376,000 | | | | 323,399 | (a) |

MEG Energy Corp., Senior Notes | | | 7.125 | % | | | 2/1/27 | | | | 260,000 | | | | 216,775 | (a) |

Montage Resources Corp., Senior Notes | | | 8.875 | % | | | 7/15/23 | | | | 680,000 | | | | 539,318 | |

See Notes to Financial Statements.

| | |

| 6 | | Western Asset Premier Bond Fund 2020 Semi-Annual Report |

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Oil, Gas & Consumable Fuels — continued | | | | | | | | | | | | | | | | |

NGPL PipeCo LLC, Senior Notes | | | 7.768 | % | | | 12/15/37 | | | | 490,000 | | | $ | 599,583 | (a) |

Noble Energy Inc., Senior Notes | | | 5.050 | % | | | 11/15/44 | | | | 500,000 | | | | 455,829 | |

Oasis Petroleum Inc., Senior Notes | | | 6.500 | % | | | 11/1/21 | | | | 520,000 | | | | 117,000 | |

Oasis Petroleum Inc., Senior Notes | | | 6.875 | % | | | 3/15/22 | | | | 33,000 | | | | 5,548 | |

Oasis Petroleum Inc., Senior Notes | | | 6.875 | % | | | 1/15/23 | | | | 517,000 | | | | 87,890 | |

Occidental Petroleum Corp., Senior Notes | | | 6.200 | % | | | 3/15/40 | | | | 250,000 | | | | 210,469 | |

Petrobras Global Finance BV, Senior Notes | | | 4.375 | % | | | 5/20/23 | | | | 310,000 | | | | 316,045 | |

Petrobras Global Finance BV, Senior Notes | | | 5.999 | % | | | 1/27/28 | | | | 1,460,000 | | | | 1,533,146 | |

Petrobras Global Finance BV, Senior Notes | | | 5.750 | % | | | 2/1/29 | | | | 1,000,000 | | | | 1,028,385 | |

Petrobras Global Finance BV, Senior Notes | | | 6.750 | % | | | 1/27/41 | | | | 920,000 | | | | 965,351 | |

Range Resources Corp., Senior Notes | | | 5.000 | % | | | 3/15/23 | | | | 280,000 | | | | 241,672 | |

Range Resources Corp., Senior Notes | | | 4.875 | % | | | 5/15/25 | | | | 190,000 | | | | 144,044 | |

Range Resources Corp., Senior Notes | | | 9.250 | % | | | 2/1/26 | | | | 1,365,000 | | | | 1,229,565 | (a) |

Rockies Express Pipeline LLC, Senior Notes | | | 7.500 | % | | | 7/15/38 | | | | 350,000 | | | | 339,500 | (a) |

Sabine Pass Liquefaction LLC, Senior Secured Notes | | | 5.750 | % | | | 5/15/24 | | | | 440,000 | | | | 495,752 | |

Sabine Pass Liquefaction LLC, Senior Secured Notes | | | 5.000 | % | | | 3/15/27 | | | | 1,850,000 | | | | 2,071,625 | |

Targa Resources Partners LP/Targa Resources Partners Finance Corp., Senior Notes | | | 6.750 | % | | | 3/15/24 | | | | 500,000 | | | | 500,308 | |

Targa Resources Partners LP/Targa Resources Partners Finance Corp., Senior Notes | | | 6.500 | % | | | 7/15/27 | | | | 250,000 | | | | 251,250 | |

Targa Resources Partners LP/Targa Resources Partners Finance Corp., Senior Notes | | | 6.875 | % | | | 1/15/29 | | | | 20,000 | | | | 21,013 | |

Transcontinental Gas Pipe Line Co. LLC, Senior Notes | | | 7.850 | % | | | 2/1/26 | | | | 1,000,000 | | | | 1,303,133 | |

Transportadora de Gas del Peru SA, Senior Notes | | | 4.250 | % | | | 4/30/28 | | | | 1,750,000 | | | | 1,889,685 | (a) |

Transportadora de Gas del Sur SA, Senior Notes | | | 6.750 | % | | | 5/2/25 | | | | 300,000 | | | | 259,220 | (a) |

Western Midstream Operating LP, Senior Notes | | | 4.050 | % | | | 2/1/30 | | | | 2,200,000 | | | | 2,126,025 | |

See Notes to Financial Statements.

| | |

| Western Asset Premier Bond Fund 2020 Semi-Annual Report | | 7 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Oil, Gas & Consumable Fuels — continued | | | | | | | | | | | | | | | | |

Western Midstream Operating LP, Senior Notes | | | 5.300 | % | | | 3/1/48 | | | | 100,000 | | | $ | 81,625 | |

Western Midstream Operating LP, Senior Notes | | | 5.250 | % | | | 2/1/50 | | | | 1,680,000 | | | | 1,462,012 | |

Williams Cos. Inc., Senior Notes | | | 3.700 | % | | | 1/15/23 | | | | 470,000 | | | | 497,296 | |

Williams Cos. Inc., Senior Notes | | | 4.550 | % | | | 6/24/24 | | | | 60,000 | | | | 66,601 | |

Williams Cos. Inc., Senior Notes | | | 7.500 | % | | | 1/15/31 | | | | 443,000 | | | | 567,947 | |

Williams Cos. Inc., Senior Notes | | | 8.750 | % | | | 3/15/32 | | | | 39,000 | | | | 57,902 | |

WPX Energy Inc., Senior Notes | | | 8.250 | % | | | 8/1/23 | | | | 210,000 | | | | 233,865 | |

YPF SA, Senior Notes | | | 8.500 | % | | | 7/28/25 | | | | 950,000 | | | | 708,838 | (a) |

Total Energy | | | | | | | | | | | | | | | 35,101,459 | |

| Financials — 29.4% | | | | | | | | | | | | | | | | |

Banks — 22.6% | | | | | | | | | | | | | | | | |

Bank of America Corp., Junior Subordinated Notes (5.875% to 3/15/28 then 3 mo. USD LIBOR + 2.931%) | | | 5.875 | % | | | 3/15/28 | | | | 350,000 | | | | 358,237 | (e)(f) |

Bank of America Corp., Senior Notes | | | 5.000 | % | | | 5/13/21 | | | | 1,100,000 | | | | 1,143,616 | |

Bank of America Corp., Subordinated Notes | | | 4.250 | % | | | 10/22/26 | | | | 2,200,000 | | | | 2,525,646 | |

Barclays Bank PLC, Subordinated Notes | | | 10.179 | % | | | 6/12/21 | | | | 610,000 | | | | 659,772 | (a) |

Barclays Bank PLC, Subordinated Notes | | | 7.625 | % | | | 11/21/22 | | | | 4,750,000 | | | | 5,173,936 | |

Barclays PLC, Junior Subordinated Notes (8.000% to 6/15/24 then 5 year Treasury Constant Maturity Rate + 5.672%) | | | 8.000 | % | | | 6/15/24 | | | | 550,000 | | | | 570,227 | (e)(f) |

Barclays PLC, Subordinated Notes | | | 5.200 | % | | | 5/12/26 | | | | 1,000,000 | | | | 1,118,195 | |

BBVA Bancomer SA, Subordinated Notes (5.125% to 1/18/28 then 5 year Treasury Constant Maturity Rate + 2.650%) | | | 5.125 | % | | | 1/18/33 | | | | 950,000 | | | | 887,153 | (a)(e) |

BNP Paribas SA, Junior Subordinated Notes (7.375% to 8/19/25 then USD 5 year ICE Swap Rate + 5.150%) | | | 7.375 | % | | | 8/19/25 | | | | 510,000 | | | | 559,442 | (a)(e)(f) |

BPCE SA, Subordinated Notes | | | 5.150 | % | | | 7/21/24 | | | | 1,000,000 | | | | 1,117,240 | (a) |

CIT Group Inc., Senior Notes | | | 5.250 | % | | | 3/7/25 | | | | 312,000 | | | | 324,057 | |

Citigroup Inc., Junior Subordinated Notes (5.950% to 5/15/25 then 3 mo. USD LIBOR + 3.905%) | | | 5.950 | % | | | 5/15/25 | | | | 900,000 | | | | 895,351 | (e)(f) |

See Notes to Financial Statements.

| | |

| 8 | | Western Asset Premier Bond Fund 2020 Semi-Annual Report |

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Banks — continued | | | | | | | | | | | | | | | | |

Citigroup Inc., Junior Subordinated Notes (6.300% to 5/15/24 then 3 mo. USD LIBOR + 3.423%) | | | 6.300 | % | | | 5/15/24 | | | | 500,000 | | | $ | 501,218 | (e)(f) |

Citigroup Inc., Subordinated Notes | | | 3.500 | % | | | 5/15/23 | | | | 500,000 | | | | 532,950 | |

Citigroup Inc., Subordinated Notes | | | 4.125 | % | | | 7/25/28 | | | | 800,000 | | | | 906,807 | |

Citigroup Inc., Subordinated Notes | | | 6.625 | % | | | 6/15/32 | | | | 1,000,000 | | | | 1,372,352 | |

Credit Agricole SA, Junior Subordinated Notes (8.125% to 12/23/25 then USD 5 year ICE Swap Rate + 6.185%) | | | 8.125 | % | | | 12/23/25 | | | | 1,080,000 | | | | 1,237,275 | (a)(e)(f) |

HSBC Holdings PLC, Junior Subordinated Notes (6.000% to 5/22/27 then USD 5 year ICE Swap Rate + 3.746%) | | | 6.000 | % | | | 5/22/27 | | | | 400,000 | | | | 397,834 | (e)(f) |

HSBC Holdings PLC, Junior Subordinated Notes (6.500% to 3/23/28 then USD 5 year ICE Swap Rate + 3.606%) | | | 6.500 | % | | | 3/23/28 | | | | 1,130,000 | | | | 1,160,583 | (e)(f) |

Intesa Sanpaolo SpA, Subordinated Notes | | | 5.017 | % | | | 6/26/24 | | | | 1,320,000 | | | | 1,353,282 | (a) |

Intesa Sanpaolo SpA, Subordinated Notes | | | 5.710 | % | | | 1/15/26 | | | | 2,070,000 | | | | 2,182,826 | (a) |

JPMorgan Chase & Co., Junior Subordinated Notes (6.000% to 8/1/23 then 3 mo. USD LIBOR + 3.300%) | | | 6.000 | % | | | 8/1/23 | | | | 2,600,000 | | | | 2,627,733 | (e)(f) |

JPMorgan Chase & Co., Junior Subordinated Notes (6.100% to 10/1/24 then 3 mo. USD LIBOR + 3.330%) | | | 6.100 | % | | | 10/1/24 | | | | 400,000 | | | | 410,167 | (e)(f) |

JPMorgan Chase & Co., Subordinated Notes | | | 4.950 | % | | | 6/1/45 | | | | 500,000 | | | | 673,724 | |

Lloyds Banking Group PLC, Subordinated Notes | | | 4.650 | % | | | 3/24/26 | | | | 1,500,000 | | | | 1,670,740 | |

NatWest Markets NV, Subordinated Notes | | | 7.750 | % | | | 5/15/23 | | | | 140,000 | | | | 159,652 | |

Royal Bank of Scotland Group PLC, Junior Subordinated Notes (8.625% to 8/15/21 then USD 5 year ICE Swap Rate + 7.598%) | | | 8.625 | % | | | 8/15/21 | | | | 450,000 | | | | 468,887 | (e)(f) |

See Notes to Financial Statements.

| | |

| Western Asset Premier Bond Fund 2020 Semi-Annual Report | | 9 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Banks — continued | | | | | | | | | | | | | | | | |

Royal Bank of Scotland Group PLC, Subordinated Notes | | | 6.000 | % | | | 12/19/23 | | | | 150,000 | | | $ | 168,128 | |

Royal Bank of Scotland Group PLC, Subordinated Notes | | | 5.125 | % | | | 5/28/24 | | | | 1,330,000 | | | | 1,456,425 | |

Santander UK Group Holdings PLC, Subordinated Notes | | | 5.625 | % | | | 9/15/45 | | | | 1,000,000 | | | | 1,230,356 | (a) |

UniCredit SpA, Subordinated Notes (7.296% to 4/2/29 then USD 5 year ICE Swap Rate + 4.914%) | | | 7.296 | % | | | 4/2/34 | | | | 740,000 | | | | 841,250 | (a)(e) |

Wells Fargo & Co., Senior Notes | | | 3.000 | % | | | 10/23/26 | | | | 2,000,000 | | | | 2,181,426 | |

Total Banks | | | | | | | | | | | | | | | 36,866,487 | |

Capital Markets — 4.1% | | | | | | | | | | | | | | | | |

Credit Suisse Group AG, Junior Subordinated Notes (7.250% to 9/12/25 then 5 year Treasury Constant Maturity Rate + 4.332%) | | | 7.250 | % | | | 9/12/25 | | | | 1,350,000 | | | | 1,388,063 | (a)(e)(f) |

Goldman Sachs Group Inc., Senior Notes | | | 5.250 | % | | | 7/27/21 | | | | 800,000 | | | | 840,182 | |

Goldman Sachs Group Inc., Senior Notes | | | 3.500 | % | | | 11/16/26 | | | | 1,750,000 | | | | 1,926,003 | |

Morgan Stanley, Senior Notes (4.431% to 1/23/29 then 3 mo. USD LIBOR + 1.628%) | | | 4.431 | % | | | 1/23/30 | | | | 1,000,000 | | | | 1,192,295 | (e) |

UBS Group AG, Junior Subordinated Notes (7.000% to 1/31/24 then USD 5 year ICE Swap Rate + 4.344%) | | | 7.000 | % | | | 1/31/24 | | | | 1,250,000 | | | | 1,299,306 | (a)(e)(f) |

Total Capital Markets | | | | | | | | | | | | | | | 6,645,849 | |

Diversified Financial Services — 2.2% | | | | | | | | | | | | | | | | |

AerCap Ireland Capital DAC/AerCap Global Aviation Trust, Senior Notes | | | 4.450 | % | | | 12/16/21 | | | | 680,000 | | | | 686,891 | |

AerCap Ireland Capital DAC/AerCap Global Aviation Trust, Senior Notes | | | 4.625 | % | | | 7/1/22 | | | | 230,000 | | | | 232,646 | |

Ahold Lease USA Inc. Pass-Through-Trust, Senior Secured Notes | | | 8.620 | % | | | 1/2/25 | | | | 374,226 | | | | 413,404 | |

GE Capital International Funding Co. Unlimited Co., Senior Notes | | | 4.418 | % | | | 11/15/35 | | | | 500,000 | | | | 508,942 | |

See Notes to Financial Statements.

| | |

| 10 | | Western Asset Premier Bond Fund 2020 Semi-Annual Report |

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Diversified Financial Services — continued | | | | | | | | | | | | | | | | |

Global Aircraft Leasing Co. Ltd., Senior Notes (6.500% Cash or 7.250% PIK) | | | 6.500 | % | | | 9/15/24 | | | | 1,580,000 | | | $ | 1,062,550 | (a)(g) |

International Lease Finance Corp., Senior Notes | | | 5.875 | % | | | 8/15/22 | | | | 700,000 | | | | 736,791 | |

Total Diversified Financial Services | | | | | | | | | | | | | | | 3,641,224 | |

Insurance — 0.5% | | | | | | | | | | | | | | | | |

MetLife Inc., Junior Subordinated Notes | | | 10.750 | % | | | 8/1/39 | | | | 500,000 | | | | 772,479 | |

Total Financials | | | | | | | | | | | | | | | 47,926,039 | |

| Health Care — 8.4% | | | | | | | | | | | | | | | | |

Biotechnology — 0.3% | | | | | | | | | | | | | | | | |

AbbVie Inc., Senior Notes | | | 3.800 | % | | | 3/15/25 | | | | 500,000 | | | | 555,331 | (a) |

Health Care Providers & Services — 3.7% | | | | | | | | | | | | | | | | |

Centene Corp., Senior Notes | | | 4.750 | % | | | 1/15/25 | | | | 810,000 | | | | 830,299 | |

Centene Corp., Senior Notes | | | 4.250 | % | | | 12/15/27 | | | | 240,000 | | | | 248,214 | |

Centene Corp., Senior Notes | | | 4.625 | % | | | 12/15/29 | | | | 370,000 | | | | 391,275 | |

DaVita Inc., Senior Notes | | | 5.125 | % | | | 7/15/24 | | | | 210,000 | | | | 213,885 | |

HCA Inc., Senior Secured Notes | | | 4.500 | % | | | 2/15/27 | | | | 1,000,000 | | | | 1,115,874 | |

HCA Inc., Senior Secured Notes | | | 4.125 | % | | | 6/15/29 | | | | 550,000 | | | | 607,369 | |

Humana Inc., Senior Notes | | | 3.950 | % | | | 3/15/27 | | | | 1,200,000 | | | | 1,362,528 | |

LifePoint Health Inc., Senior Secured Notes | | | 6.750 | % | | | 4/15/25 | | | | 330,000 | | | | 341,550 | (a) |

Magellan Health Inc., Senior Notes | | | 4.900 | % | | | 9/22/24 | | | | 915,000 | | | | 929,315 | |

Total Health Care Providers & Services | | | | | | | | | | | | | | | 6,040,309 | |

Pharmaceuticals — 4.4% | | | | | | | | | | | | | | | | |

Bausch Health Cos. Inc., Senior Notes | | | 6.125 | % | | | 4/15/25 | | | | 1,490,000 | | | | 1,513,363 | (a) |

Bristol-Myers Squibb Co., Senior Notes | | | 3.400 | % | | | 7/26/29 | | | | 780,000 | | | | 909,425 | (a) |

Bristol-Myers Squibb Co., Senior Notes | | | 4.625 | % | | | 5/15/44 | | | | 250,000 | | | | 333,542 | (a) |

Teva Pharmaceutical Finance Co. BV, Senior Notes | | | 2.950 | % | | | 12/18/22 | | | | 575,000 | | | | 556,154 | |

Teva Pharmaceutical Finance IV BV, Senior Notes | | | 3.650 | % | | | 11/10/21 | | | | 330,000 | | | | 330,404 | |

Teva Pharmaceutical Finance Netherlands III BV, Senior Notes | | | 2.200 | % | | | 7/21/21 | | | | 1,550,000 | | | | 1,521,968 | |

Teva Pharmaceutical Finance Netherlands III BV, Senior Notes | | | 2.800 | % | | | 7/21/23 | | | | 1,046,000 | | | | 991,046 | |

See Notes to Financial Statements.

| | |

| Western Asset Premier Bond Fund 2020 Semi-Annual Report | | 11 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Pharmaceuticals — continued | | | | | | | | | | | | | | | | |

Teva Pharmaceutical Finance Netherlands III BV, Senior Notes | | | 6.000 | % | | | 4/15/24 | | | | 760,000 | | | $ | 782,667 | |

Teva Pharmaceutical Finance Netherlands III BV, Senior Notes | | | 3.150 | % | | | 10/1/26 | | | | 180,000 | | | | 161,394 | |

Total Pharmaceuticals | | | | | | | | | | | | | | | 7,099,963 | |

Total Health Care | | | | | | | | | | | | | | | 13,695,603 | |

| Industrials — 10.6% | | | | | | | | | | | | | | | | |

Aerospace & Defense — 1.5% | | | | | | | | | | | | | | | | |

Boeing Co., Senior Notes | | | 3.200 | % | | | 3/1/29 | | | | 250,000 | | | | 247,698 | |

Boeing Co., Senior Notes | | | 6.125 | % | | | 2/15/33 | | | | 600,000 | | | | 709,681 | |

Boeing Co., Senior Notes | | | 3.750 | % | | | 2/1/50 | | | | 500,000 | | | | 449,720 | |

TransDigm Inc., Senior Secured Notes | | | 8.000 | % | | | 12/15/25 | | | | 920,000 | | | | 970,936 | (a) |

Total Aerospace & Defense | | | | | | | | | | | | | | | 2,378,035 | |

Airlines — 3.7% | | | | | | | | | | | | | | | | |

America West Airlines Inc. Pass-Through Trust | | | 8.057 | % | | | 7/2/20 | | | | 740,756 | | | | 740,722 | |

Continental Airlines Pass-Through Trust | | | 8.048 | % | | | 11/1/20 | | | | 24 | | | | 24 | |

Continental Airlines Pass-Through Trust, Senior Secured Trust | | | 6.703 | % | | | 6/15/21 | | | | 70,059 | | | | 69,096 | |

Delta Air Lines Inc., Senior Notes | | | 3.625 | % | | | 3/15/22 | | | | 460,000 | | | | 435,874 | |

Delta Air Lines Inc., Senior Notes | | | 3.800 | % | | | 4/19/23 | | | | 640,000 | | | | 572,047 | |

Delta Air Lines Inc., Senior Notes | | | 2.900 | % | | | 10/28/24 | | | | 310,000 | | | | 251,660 | |

Delta Air Lines Inc., Senior Notes | | | 7.375 | % | | | 1/15/26 | | | | 710,000 | | | | 687,617 | |

Delta Air Lines Inc., Senior Secured Notes | | | 7.000 | % | | | 5/1/25 | | | | 1,370,000 | | | | 1,415,647 | (a) |

Delta Air Lines Pass-Through Certificates Trust | | | 8.021 | % | | | 8/10/22 | | | | 51,118 | | | | 48,074 | |

Mileage Plus Holdings LLC/Mileage Plus Intellectual Property Assets Ltd., Senior Secured Notes | | | 6.500 | % | | | 6/20/27 | | | | 920,000 | | | | 922,594 | (a)(c) |

United Airlines Pass-Through Trust | | | 4.750 | % | | | 4/11/22 | | | | 190,758 | | | | 169,603 | |

US Airways Pass-Through Trust | | | 7.125 | % | | | 10/22/23 | | | | 923,524 | | | | 792,860 | |

Total Airlines | | | | | | | | | | | | | | | 6,105,818 | |

Building Products — 1.5% | | | | | | | | | | | | | | | | |

Standard Industries Inc., Senior Notes | | | 5.000 | % | | | 2/15/27 | | | | 1,870,000 | | | | 1,898,807 | (a) |

Standard Industries Inc., Senior Notes | | | 4.750 | % | | | 1/15/28 | | | | 511,000 | | | | 519,511 | (a) |

Total Building Products | | | | | | | | | | | | | | | 2,418,318 | |

See Notes to Financial Statements.

| | |

| 12 | | Western Asset Premier Bond Fund 2020 Semi-Annual Report |

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Industrial Conglomerates — 0.1% | | | | | | | | | | | | | | | | |

General Electric Co., Junior Subordinated Notes (5.000% to 1/21/21 then 3 mo. USD LIBOR + 3.330%) | | | 5.000 | % | | | 1/21/21 | | | | 260,000 | | | $ | 203,479 | (e)(f) |

Machinery — 0.3% | | | | | | | | | | | | | | | | |

Vertical US Newco Inc., Senior Secured Notes | | | 5.250 | % | | | 7/15/27 | | | | 460,000 | | | | 460,000 | (a)(c) |

Professional Services — 0.7% | | | | | | | | | | | | | | | | |

IHS Markit Ltd., Senior Notes | | | 5.000 | % | | | 11/1/22 | | | | 1,000,000 | | | | 1,073,820 | (a) |

Trading Companies & Distributors — 2.8% | | | | | | | | | | | | | | | | |

Ashtead Capital Inc., Secured Notes | | | 4.125 | % | | | 8/15/25 | | | | 1,950,000 | | | | 1,993,875 | (a) |

United Rentals North America Inc., Secured Notes | | | 3.875 | % | | | 11/15/27 | | | | 1,180,000 | | | | 1,179,044 | |

United Rentals North America Inc., Senior Notes | | | 6.500 | % | | | 12/15/26 | | | | 1,060,000 | | | | 1,115,014 | |

United Rentals North America Inc., Senior Notes | | | 5.500 | % | | | 5/15/27 | | | | 160,000 | | | | 165,430 | |

United Rentals North America Inc., Senior Notes | | | 4.875 | % | | | 1/15/28 | | | | 110,000 | | | | 112,922 | |

Total Trading Companies & Distributors | | | | | | | | | | | | | | | 4,566,285 | |

Total Industrials | | | | | | | | | | | | | | | 17,205,755 | |

| Information Technology — 2.1% | | | | | | | | | | | | | | | | |

Communications Equipment — 0.1% | | | | | | | | | | | | | | | | |

CommScope Inc., Senior Notes | | | 8.250 | % | | | 3/1/27 | | | | 170,000 | | | | 175,008 | (a) |

IT Services — 0.4% | | | | | | | | | | | | | | | | |

DXC Technology Co., Senior Notes | | | 7.450 | % | | | 10/15/29 | | | | 500,000 | | | | 611,410 | |

Semiconductors & Semiconductor Equipment — 0.3% | | | | | | | | | | | | | |

Broadcom Corp./Broadcom Cayman Finance Ltd., Senior Notes | | | 3.125 | % | | | 1/15/25 | | | | 500,000 | | | | 534,426 | |

Technology Hardware, Storage & Peripherals — 1.3% | | | | | | | | | | | | | |

Seagate HDD Cayman, Senior Notes | | | 4.750 | % | | | 1/1/25 | | | | 1,220,000 | | | | 1,309,862 | |

Seagate HDD Cayman, Senior Notes | | | 4.875 | % | | | 6/1/27 | | | | 260,000 | | | | 282,379 | |

Western Digital Corp., Senior Notes | | | 4.750 | % | | | 2/15/26 | | | | 430,000 | | | | 445,046 | |

Total Technology Hardware, Storage & Peripherals | | | | | | | | | | | | 2,037,287 | |

Total Information Technology | | | | | | | | | | | | | | | 3,358,131 | |

| Materials — 5.3% | | | | | | | | | | | | | | | | |

Chemicals — 1.0% | | | | | | | | | | | | | | | | |

Braskem America Finance Co., Senior Notes | | | 7.125 | % | | | 7/22/41 | | | | 920,000 | | | | 945,484 | (d) |

See Notes to Financial Statements.

| | |

| Western Asset Premier Bond Fund 2020 Semi-Annual Report | | 13 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Chemicals — continued | | | | | | | | | | | | | | | | |

Braskem Finance Ltd., Senior Notes | | | 5.375 | % | | | 5/2/22 | | | | 230,000 | | | $ | 242,077 | (a) |

Braskem Netherlands Finance BV, Senior Notes | | | 4.500 | % | | | 1/10/28 | | | | 500,000 | | | | 469,755 | (a) |

Total Chemicals | | | | | | | | | | | | | | | 1,657,316 | |

Containers & Packaging — 1.1% | | | | | | | | | | | | | | | | |

ARD Finance SA, Senior Secured Notes (6.500% Cash or 7.250% PIK) | | | 6.500 | % | | | 6/30/27 | | | | 640,000 | | | | 634,282 | (a)(g) |

Ardagh Packaging Finance PLC/Ardagh Holdings USA Inc., Senior Notes | | | 6.000 | % | | | 2/15/25 | | | | 760,000 | | | | 780,079 | (a) |

Greif Inc., Senior Notes | | | 6.500 | % | | | 3/1/27 | | | | 300,000 | | | | 306,056 | (a) |

Pactiv LLC, Senior Notes | | | 7.950 | % | | | 12/15/25 | | | | 50,000 | | | | 53,432 | |

Total Containers & Packaging | | | | | | | | | | | | | | | 1,773,849 | |

Metals & Mining — 2.0% | | | | | | | | | | | | | | | | |

Anglo American Capital PLC, Senior Notes | | | 4.125 | % | | | 9/27/22 | | | | 210,000 | | | | 219,134 | (a) |

ArcelorMittal SA, Senior Notes | | | 7.250 | % | | | 10/15/39 | | | | 430,000 | | | | 514,422 | |

First Quantum Minerals Ltd., Senior Notes | | | 7.250 | % | | | 4/1/23 | | | | 210,000 | | | | 200,870 | (a) |

Freeport-McMoRan Inc., Senior Notes | | | 5.400 | % | | | 11/14/34 | | | | 220,000 | | | | 218,095 | |

Freeport-McMoRan Inc., Senior Notes | | | 5.450 | % | | | 3/15/43 | | | | 580,000 | | | | 570,363 | |

Teck Resources Ltd., Senior Notes | | | 6.000 | % | | | 8/15/40 | | | | 210,000 | | | | 222,771 | |

Vale Overseas Ltd., Senior Notes | | | 6.875 | % | | | 11/10/39 | | | | 940,000 | | | | 1,230,747 | |

Total Metals & Mining | | | | | | | | | | | | | | | 3,176,402 | |

Paper & Forest Products — 1.2% | | | | | | | | | | | | | | | | |

Mercer International Inc., Senior Notes | | | 7.375 | % | | | 1/15/25 | | | | 940,000 | | | | 938,139 | |

Suzano Austria GmbH, Senior Notes | | | 5.750 | % | | | 7/14/26 | | | | 950,000 | | | | 1,041,257 | (a) |

Total Paper & Forest Products | | | | | | | | | | | | | | | 1,979,396 | |

Total Materials | | | | | | | | | | | | | | | 8,586,963 | |

| Real Estate — 1.6% | | | | | | | | | | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 1.6% | | | | | | | | | | | | | |

CoreCivic Inc., Senior Notes | | | 4.750 | % | | | 10/15/27 | | | | 670,000 | | | | 558,214 | |

Diversified Healthcare Trust, Senior Notes | | | 9.750 | % | | | 6/15/25 | | | | 240,000 | | | | 258,150 | |

MPT Operating Partnership LP/MPT Finance Corp., Senior Notes | | | 6.375 | % | | | 3/1/24 | | | | 260,000 | | | | 268,207 | |

MPT Operating Partnership LP/MPT Finance Corp., Senior Notes | | | 5.000 | % | | | 10/15/27 | | | | 1,500,000 | | | | 1,545,982 | |

Total Real Estate | | | | | | | | | | | | | | | 2,630,553 | |

See Notes to Financial Statements.

| | |

| 14 | | Western Asset Premier Bond Fund 2020 Semi-Annual Report |

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Utilities — 2.6% | | | | | | | | | | | | | | | | |

Electric Utilities — 2.1% | | | | | | | | | | | | | | | | |

FirstEnergy Corp., Senior Notes | | | 7.375 | % | | | 11/15/31 | | | | 1,770,000 | | | $ | 2,588,295 | |

Pampa Energia SA, Senior Notes | | | 7.375 | % | | | 7/21/23 | | | | 390,000 | | | | 332,957 | (d) |

Pampa Energia SA, Senior Notes | | | 7.500 | % | | | 1/24/27 | | | | 630,000 | | | | 510,914 | (a) |

Total Electric Utilities | | | | | | | | | | | | | | | 3,432,166 | |

Independent Power and Renewable Electricity Producers — 0.5% | | | | | | | | | |

Minejesa Capital BV, Senior Secured Notes | | | 4.625 | % | | | 8/10/30 | | | | 810,000 | | | | 825,034 | (a) |

Total Utilities | | | | | | | | | | | | | | | 4,257,200 | |

Total Corporate Bonds & Notes (Cost — $162,955,663) | | | | | | | | 179,615,204 | |

| Senior Loans — 12.7% | | | | | | | | | | | | | | | | |

| Communication Services — 4.0% | | | | | | | | | | | | | | | | |

Diversified Telecommunication Services — 0.1% | | | | | | | | | | | | | |

Level 3 Financing Inc., 2027 Term Loan B (3 mo. USD LIBOR + 1.750%) | | | 1.928 | % | | | 3/1/27 | | | | 168,664 | | | | 159,809 | (e)(h)(i) |

Media — 2.1% | | | | | | | | | | | | | | | | |

Charter Communications Operating LLC, Term Loan B1 (1 mo. USD LIBOR + 1.750%) | | | 1.930 | % | | | 4/30/25 | | | | 3,036,710 | | | | 2,938,439 | (e)(h)(i) |

Charter Communications Operating LLC, Term Loan B2 (1 mo. USD LIBOR + 1.750%) | | | 1.930 | % | | | 2/1/27 | | | | 497,493 | | | | 479,529 | (e)(h)(i) |

Total Media | | | | | | | | | | | | | | | 3,417,968 | |

Wireless Telecommunication Services — 1.8% | | | | | | | | | | | | | |

T-Mobile USA Inc., Term Loan (1 mo. USD LIBOR + 3.000%) | | | 3.178 | % | | | 4/1/27 | | | | 2,900,000 | | | | 2,900,000 | (e)(h)(i)(j) |

Total Communication Services | | | | | | | | | | | | | | | 6,477,777 | |

| Consumer Discretionary — 4.1% | | | | | | | | | | | | | | | | |

Hotels, Restaurants & Leisure — 3.5% | | | | | | | | | | | | | | | | |

Hilton Worldwide Finance LLC, Refinance Term Loan B2 (1 mo. USD LIBOR + 1.750%) | | | 1.935 | % | | | 6/22/26 | | | | 5,863,291 | | | | 5,496,835 | (e)(h)(i) |

Wyndham Hotels & Resorts Inc., Term Loan B (1 mo. USD LIBOR + 1.750%) | | | 1.928 | % | | | 5/30/25 | | | | 253,218 | | | | 240,051 | (e)(h)(i) |

Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 5,736,886 | |

Specialty Retail — 0.6% | | | | | | | | | | | | | | | | |

Michaels Stores Inc., 2018 New Replacement Term Loan B | | | 3.500-3.568 | % | | | 1/30/23 | | | | 289,173 | | | | 265,798 | (e)(h)(i)(j) |

See Notes to Financial Statements.

| | |

| Western Asset Premier Bond Fund 2020 Semi-Annual Report | | 15 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Specialty Retail — continued | | | | | | | | | | | | | | | | |

Party City Holdings Inc., 2018 Replacement Term Loan | | | 3.250-4.100 | % | | | 8/19/22 | | | | 622,028 | | | $ | 301,424 | (e)(h)(i) |

PetSmart Inc., Term Loan B2 (3 mo. USD LIBOR + 4.000%) | | | 5.000 | % | | | 3/11/22 | | | | 325,628 | | | | 322,304 | (e)(h)(i) |

Total Specialty Retail | | | | | | | | | | | | | | | 889,526 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 6,626,412 | |

| Energy — 0.4% | | | | | | | | | | | | | | | | |

Oil, Gas & Consumable Fuels — 0.4% | | | | | | | | | | | | | | | | |

Chesapeake Energy Corp., Term Loan A (1 mo. USD LIBOR + 8.000%) | | | 9.000 | % | | | 6/24/24 | | | | 1,260,000 | | | | 733,950 | (e)(h)(i) |

| Financials — 0.4% | | | | | | | | | | | | | | | | |

Diversified Financial Services — 0.4% | | | | | | | | | | | | | | | | |

Finco I LLC, 2018 Replacement Term Loan (1 mo. USD LIBOR + 2.000%) | | | 2.178 | % | | | 12/27/22 | | | | 748,704 | | | | 723,123 | (e)(h)(i) |

| Health Care — 0.3% | | | | | | | | | | | | | | | | |

Health Care Providers & Services — 0.3% | | | | | | | | | | | | | | | | |

Option Care Health Inc., First Lien Term Loan B (3 mo. USD LIBOR + 4.500%) | | | 4.678 | % | | | 8/6/26 | | | | 457,700 | | | | 445,876 | (e)(h)(i) |

| Industrials — 1.8% | | | | | | | | | | | | | | | | |

Airlines — 1.4% | | | | | | | | | | | | | | | | |

Delta Air Lines Inc., Initial Term Loan | | | — | | | | 4/27/23 | | | | 1,000,000 | | | | 984,000 | (j) |

JetBlue Airways Corp., Term Loan (3 mo. USD LIBOR + 5.250%) | | | 6.250 | % | | | 6/17/24 | | | | 550,000 | | | | 540,146 | (e)(h)(i)(j) |

Mileage Plus Holdings Inc., Initial Term Loan | | | — | | | | 6/25/27 | | | | 770,000 | | | | 765,806 | (j) |

Total Airlines | | | | | | | | | | | | | | | 2,289,952 | |

Machinery — 0.4% | | | | | | | | | | | | | | | | |

Vertical Midco Gmbh, Term Loan B | | | — | | | | 6/30/27 | | | | 650,000 | | | | 637,000 | (j) |

Total Industrials | | | | | | | | | | | | | | | 2,926,952 | |

| Information Technology — 1.6% | | | | | | | | | | | | | | | | |

Technology Hardware, Storage & Peripherals — 1.6% | | | | | | | | | | | | | | | | |

Dell International LLC, Refinancing Term Loan B1 (1 mo. USD LIBOR + 2.000%) | | | 2.750 | % | | | 9/19/25 | | | | 2,696,746 | | | | 2,632,698 | (e)(h)(i) |

See Notes to Financial Statements.

| | |

| 16 | | Western Asset Premier Bond Fund 2020 Semi-Annual Report |

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Utilities — 0.1% | | | | | | | | | | | | | | | | |

Electric Utilities — 0.1% | | | | | | | | | | | | | | | | |

Panda Temple Power LLC, Second Lien Term Loan (1 mo. USD LIBOR + 8.000% PIK) | | | 9.000 | % | | | 2/7/23 | | | | 176,340 | | | $ | 176,340 | (e)(g)(h)(i) |

Total Senior Loans (Cost — $21,827,123) | | | | | | | | | | | | | | | 20,743,128 | |

| U.S. Government & Agency Obligations — 9.0% | | | | | | | | | | | | | | | | |

U.S. Government Obligations — 9.0% | | | | | | | | | | | | | | | | |

U.S. Treasury Notes | | | 1.375 | % | | | 1/31/21 | | | | 1,550,000 | | | | 1,560,747 | |

U.S. Treasury Notes | | | 1.375 | % | | | 5/31/21 | | | | 2,000,000 | | | | 2,022,070 | (k) |

U.S. Treasury Notes | | | 1.750 | % | | | 3/31/22 | | | | 300,000 | | | | 308,309 | |

U.S. Treasury Notes | | | 1.625 | % | | | 5/31/23 | | | | 1,250,000 | | | | 1,302,856 | (k) |

U.S. Treasury Notes | | | 2.750 | % | | | 8/31/23 | | | | 1,400,000 | | | | 1,513,449 | (k) |

U.S. Treasury Notes | | | 2.875 | % | | | 9/30/23 | | | | 2,500,000 | | | | 2,717,627 | (k) |

U.S. Treasury Notes | | | 2.125 | % | | | 3/31/24 | | | | 1,500,000 | | | | 1,607,373 | (k) |

U.S. Treasury Notes | | | 1.500 | % | | | 1/31/27 | | | | 1,000,000 | | | | 1,067,754 | |

U.S. Treasury Notes | | | 0.500 | % | | | 5/31/27 | | | | 500,000 | | | | 500,576 | |

U.S. Treasury Notes | | | 0.625 | % | | | 5/15/30 | | | | 2,000,000 | | | | 1,994,766 | |

Total U.S. Government & Agency Obligations (Cost — $13,960,544) | | | | | | | | | | | | | | | 14,595,527 | |

| Sovereign Bonds — 5.2% | | | | | | | | | | | | | | | | |

Argentina — 0.5% | | | | | | | | | | | | | | | | |

Argentine Republic Government International Bond, Senior Notes | | | 5.625 | % | | | 1/26/22 | | | | 690,000 | | | | 286,705 | *(b) |

Argentine Republic Government International Bond, Senior Notes | | | 4.625 | % | | | 1/11/23 | | | | 680,000 | | | | 284,686 | *(b) |

Provincia de Buenos Aires, Senior Notes | | | 9.950 | % | | | 6/9/21 | | | | 410,000 | | | | 173,229 | *(a)(b) |

Total Argentina | | | | | | | | | | | | | | | 744,620 | |

Brazil — 0.2% | | | | | | | | | | | | | | | | |

Brazil Notas do Tesouro Nacional Serie F, Notes | | | 10.000 | % | | | 1/1/21 | | | | 900,000 | BRL | | | 171,806 | |

Brazil Notas do Tesouro Nacional Serie F, Notes | | | 10.000 | % | | | 1/1/23 | | | | 1,100,000 | BRL | | | 229,891 | |

Total Brazil | | | | | | | | | | | | | | | 401,697 | |

Indonesia — 2.7% | | | | | | | | | | | | | | | | |

Indonesia Government International Bond, Senior Notes | | | 4.125 | % | | | 1/15/25 | | | | 300,000 | | | | 326,496 | (a) |

Indonesia Government International Bond, Senior Notes | | | 3.850 | % | | | 7/18/27 | | | | 300,000 | | | | 325,562 | (a) |

Indonesia Government International Bond, Senior Notes | | | 3.500 | % | | | 1/11/28 | | | | 2,420,000 | | | | 2,579,843 | |

See Notes to Financial Statements.

| | |

| Western Asset Premier Bond Fund 2020 Semi-Annual Report | | 17 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face Amount† | | | Value | |

Indonesia — continued | | | | | | | | | | | | | | | | |

Indonesia Treasury Bond, Senior Notes | | | 8.250 | % | | | 7/15/21 | | | | 2,696,000,000 | IDR | | $ | 195,024 | |

Indonesia Treasury Bond, Senior Notes | | | 7.000 | % | | | 5/15/22 | | | | 14,227,000,000 | IDR | | | 1,026,814 | |

Total Indonesia | | | | | | | | | | | | | | | 4,453,739 | |

Mexico — 0.3% | | | | | | | | | | | | | | | | |

Mexico Government International Bond, Senior Notes | | | 3.750 | % | | | 1/11/28 | | | | 500,000 | | | | 521,268 | |

Peru — 0.9% | | | | | | | | | | | | | | | | |

Peruvian Government International Bond, Senior Notes | | | 2.783 | % | | | 1/23/31 | | | | 1,340,000 | | | | 1,431,790 | |

Russia — 0.6% | | | | | | | | | | | | | | | | |

Russian Federal Bond — OFZ | | | 7.750 | % | | | 9/16/26 | | | | 61,630,000 | RUB | | | 977,619 | |

Total Sovereign Bonds (Cost — $8,253,093) | | | | | | | | | | | | | | | 8,530,733 | |

| Asset-Backed Securities — 2.8% | | | | | | | | | | | | | | | | |

American Home Mortgage Investment Trust, 2007-A 4A (1 mo. USD LIBOR + 0.900%) | | | 1.085 | % | | | 7/25/46 | | | | 470,755 | | | | 220,528 | (a)(e) |

Argent Securities Inc., Asset-Backed Pass-Through Certificates, 2003-W3 M1

(1 mo. USD LIBOR + 1.125%) | | | 1.310 | % | | | 9/25/33 | | | | 32,125 | | | | 29,647 | (e) |

Bayview Financial Asset Trust, 2007- SR1A M1 (1 mo. USD LIBOR + 0.800%) | | | 1.747 | % | | | 3/25/37 | | | | 471,262 | | | | 431,873 | (a)(e) |

Bayview Financial Asset Trust, 2007- SR1A M4 (1 mo. USD LIBOR + 1.500%) | | | 3.161 | % | | | 3/25/37 | | | | 48,751 | | | | 46,722 | (a)(e) |

Bear Stearns Asset Backed Securities Trust, 2006-SD3 1PO, STRIPS, PO | | | 0.000 | % | | | 8/25/36 | | | | 211,641 | | | | 157,670 | |

CWABS Asset Backed Notes Trust, 2007-SEA2 1A1 (1 mo. USD LIBOR + 1.000%) | | | 1.185 | % | | | 8/25/47 | | | | 6,501 | | | | 6,401 | (a)(e) |

Financial Asset Securities Corp. AAA Trust, 2005-1A 1A3B (1 mo. USD LIBOR + 0.410%) | | | 0.594 | % | | | 2/27/35 | | | | 235,513 | | | | 213,406 | (a)(e) |

Firstfed Corp. Manufactured Housing Contract, 201996-1 B | | | 8.060 | % | | | 10/15/22 | | | | 177,679 | | | | 70 | (a) |

GSAMP Trust, 2003-SEA2 A1 | | | 5.421 | % | | | 7/25/33 | | | | 580,551 | | | | 593,512 | |

Indymac Manufactured Housing Contract Pass-Through Certificates, 1997-1 A5 | | | 6.970 | % | | | 2/25/28 | | | | 30,155 | | | | 30,580 | |

See Notes to Financial Statements.

| | |

| 18 | | Western Asset Premier Bond Fund 2020 Semi-Annual Report |

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Asset-Backed Securities — continued | | | | | | | | | | | | | | | | |

Morgan Stanley ABS Capital I Inc. Trust, 2004-HE7 (1 mo. USD LIBOR + 0.900%) | | | 1.085 | % | | | 8/25/34 | | | | 1,183,712 | | | $ | 1,154,008 | (e) |

Morgan Stanley ABS Capital I Inc. Trust Series, 2003-SD1 A1 (1 mo. USD LIBOR + 1.000%) | | | 1.185 | % | | | 3/25/33 | | | | 8,341 | | | | 7,971 | (e) |

Oakwood Mortgage Investors Inc., 2002-B A3 | | | 6.060 | % | | | 6/15/32 | | | | 60,505 | | | | 63,142 | (e) |

Origen Manufactured Housing Contract Trust, 2006-A A2 | | | 2.075 | % | | | 10/15/37 | | | | 725,088 | | | | 689,025 | (e) |

Origen Manufactured Housing Contract Trust, 2007-A A2 | | | 2.704 | % | | | 4/15/37 | | | | 978,724 | | | | 852,667 | (e) |

Total Asset-Backed Securities (Cost — $3,997,941) | | | | | | | | | | | | 4,497,222 | |

| Collateralized Mortgage Obligations (l) —1.1% | | | | | | | | | | | | | | | | |

Banc of America Funding Trust, 2004-B 6A1 | | | 2.466 | % | | | 12/20/34 | | | | 183,819 | | | | 143,980 | (e) |

Bear Stearns ALT-A Trust, 2004-3 A1 (1 mo. USD LIBOR + 0.640%) | | | 0.825 | % | | | 4/25/34 | | | | 105,891 | | | | 104,130 | (e) |

CHL Mortgage Pass-Through Trust, 2005-7 1A1 (1 mo. USD LIBOR + 0.540%) | | | 0.725 | % | | | 3/25/35 | | | | 317,896 | | | | 304,631 | (e) |

Fannie Mae Trust, 2004-W15 1A2 | | | 6.500 | % | | | 8/25/44 | | | | 84,763 | | | | 100,276 | |

HarborView Mortgage Loan Trust, 2004-10 4A | | | 3.634 | % | | | 1/19/35 | | | | 64,139 | | | | 60,756 | (e) |

Impac CMB Trust Series, 2004-10 2A (1 mo. USD LIBOR + 0.640%) | | | 0.825 | % | | | 3/25/35 | | | | 104,667 | | | | 93,211 | (e) |

Impac CMB Trust Series, 2005-2 2A2 (1 mo. USD LIBOR + 0.800%) | | | 0.985 | % | | | 4/25/35 | | | | 32,488 | | | | 30,247 | (e) |

MAFI II Remic Trust 1998-B, 201998-BI B1 | | | 6.556 | % | | | 11/20/24 | | | | 209,063 | | | | 196,578 | (e) |

MERIT Securities Corp., 2011PA 3A1 (1 mo. USD LIBOR + 0.620%) | | | 1.061 | % | | | 4/28/27 | | | | 37,245 | | | | 36,126 | (a)(e) |

MERIT Securities Corp., 2011PA B3 (1 mo. USD LIBOR + 2.250%) | | | 3.910 | % | | | 9/28/32 | | | | 497,963 | | | | 351,759 | (a)(e) |

Prime Mortgage Trust, 2005-2 2XB, IO | | | 1.743 | % | | | 10/25/32 | | | | 1,176,203 | | | | 88,029 | (e) |

Prime Mortgage Trust, 2005-5 1X, IO | | | 1.111 | % | | | 7/25/34 | | | | 1,672,998 | | | | 61,015 | (e) |

RAMP Series Trust, 2005-SL2 APO, STRIPS, PO | | | 0.000 | % | | | 2/25/32 | | | | 3,033 | | | | 2,656 | |

Regal Trust IV (11th District Cost of Funds + 1.500%) | | | 2.489 | % | | | 9/29/31 | | | | 1,608 | | | | 1,557 | (a)(e) |

See Notes to Financial Statements.

| | |

| Western Asset Premier Bond Fund 2020 Semi-Annual Report | | 19 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Premier Bond Fund

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Collateralized Mortgage Obligations (l) — continued | | | | | | | | | | | | | | | | |

Sequoia Mortgage Trust, 2003-2 A2 (6 mo. USD LIBOR + 0.680%) | | | 1.308 | % | | | 6/20/33 | | | | 8,317 | | | $ | 7,904 | (e) |

Sequoia Mortgage Trust, 2004-10 A1A (1 mo. USD LIBOR + 0.620%) | | | 0.810 | % | | | 11/20/34 | | | | 6,936 | | | | 6,473 | (e) |

Structured Asset Securities Corp., 1998-RF2 A | | | 4.739 | % | | | 7/15/27 | | | | 95,816 | | | | 93,925 | (a)(e) |

Structured Asset Securities Corp. Mortgage Pass-Through Certificates, 2003-9A 2A2 | | | 3.620 | % | | | 3/25/33 | | | | 52,752 | | | | 52,735 | (e) |

WaMu Mortgage Pass-Through Certificates Series Trust, 2004-AR6 A (1 mo. USD LIBOR + 0.420%) | | | 0.605 | % | | | 5/25/44 | | | | 91,065 | | | | 90,205 | (e) |

Washington Mutual MSC Mortgage Pass-Through Certificates Trust, 2004-RA1 2A | | | 7.000 | % | | | 3/25/34 | | | | 5,730 | | | | 6,076 | |

Total Collateralized Mortgage Obligations (Cost — $1,551,684) | | | | | | | | | | | | | | | 1,832,269 | |

| Convertible Bonds & Notes — 0.8% | | | | | | | | | | | | | | | | |

| Communication Services — 0.8% | | | | | | | | | | | | | | | | |

Media — 0.8% | | | | | | | | | | | | | | | | |

DISH Network Corp., Senior Notes (Cost — $1,112,425) | | | 3.375 | % | | | 8/15/26 | | | | 1,370,000 | | | | 1,261,927 | |

| Non-U.S. Treasury Inflation Protected Securities — 0.1% | | | | | | | | | | | | | | | | |

Argentina — 0.1% | | | | | | | | | | | | | | | | |

Argentina Treasury Bond (Cost — $94,246) | | | 1.000 | % | | | 8/5/21 | | | | 9,866,631 | ARS | | | 89,808 | (m) |

| | | | | | | | | | | | |

| | | | | | Shares | | | | |

| Common Stocks — 0.0%†† | | | | | | | | | | | | |

| Energy — 0.0%†† | | | | | | | | | | | | |

Energy Equipment & Services — 0.0%†† | | | | | | | | | | | | |

Hercules Offshore Inc. (Escrow) (Cost — $752,543) | | | | | | | 16,942 | | | | 14,649 | *(m)(n) |

| | | | | | | | | | | | |

| | | Rate | | | | | | | |

| Preferred Stocks — 0.0%†† | | | | | | | | | | | | |

| Financials — 0.0%†† | | | | | | | | | | | | |

Diversified Financial Services — 0.0%†† | | | | | | | | | | | | |

Corporate Backed Trust Certificates (Cost — $0) | | | 7.375 | % | | | 33,900 | | | | 136 | *(b) |

Total Investments before Short-Term Investments (Cost — $214,505,262) | | | | | | | | | | | 231,180,603 | |

See Notes to Financial Statements.

| | |

| 20 | | Western Asset Premier Bond Fund 2020 Semi-Annual Report |

Western Asset Premier Bond Fund

| | | | | | | | | | | | |

| Security | | Rate | | | Shares | | | Value | |

| Short-Term Investments — 1.2% | | | | | | | | | | | | |

Western Asset Premier Institutional Government Reserves, Premium Shares (Cost — $1,952,833) | | | 0.109 | % | | | 1,952,833 | | | $ | 1,952,833 | (o) |

Total Investments** — 143.3% (Cost — $216,458,095) | | | | | | | | 233,133,436 | |

Liabilities in Excess of Other Assets — (43.3)% | | | | | | | | (70,397,034 | ) |

Total Net Assets — 100.0% | | | | | | | | | | $ | 162,736,402 | |

| † | Face amount denominated in U.S. dollars, unless otherwise noted. |

| †† | Represents less than 0.1%. |

| * | Non-income producing security. |

| ** | The entire portfolio is subject to lien, granted to the lender, to the extent of the borrowing outstanding and any additional expenses. |

| (a) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Trustees. |

| (b) | The coupon payment on these securities is currently in default as of June 30, 2020. |

| (c) | Securities traded on a when-issued or delayed delivery basis. |

| (d) | Security is exempt from registration under Regulation S of the Securities Act of 1933. Regulation S applies to securities offerings that are made outside of the United States and do not involve direct selling efforts in the United States. This security has been deemed liquid pursuant to guidelines approved by the Board of Trustees. |

| (e) | Variable rate security. Interest rate disclosed is as of the most recent information available. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (f) | Security has no maturity date. The date shown represents the next call date. |

| (g) | Payment-in-kind security for which the issuer has the option at each interest payment date of making interest payments in cash or additional securities. |

| (h) | Interest rates disclosed represent the effective rates on senior loans. Ranges in interest rates are attributable to multiple contracts under the same loan. |

| (i) | Senior loans may be considered restricted in that the Fund ordinarily is contractually obligated to receive approval from the agent bank and/or borrower prior to the disposition of a senior loan. |

| (j) | All or a portion of this loan is unfunded as of June 30, 2020. The interest rate for fully unfunded term loans is to be determined. |

| (k) | All or a portion of this security is held by the counterparty as collateral for open reverse repurchase agreements. |

| (l) | Collateralized mortgage obligations are secured by an underlying pool of mortgages or mortgage pass-through certificates that are structured to direct payments on underlying collateral to different series or classes of the obligations. The interest rate may change positively or inversely in relation to one or more interest rates, financial indices or other financial indicators and may be subject to an upper and/or lower limit. |

| (m) | Security is valued in good faith in accordance with procedures approved by the Board of Trustees (Note 1). |

| (n) | Security is valued using significant unobservable inputs (Note 1). |

| (o) | In this instance, as defined in the Investment Company Act of 1940, an “Affiliated Company” represents Fund ownership of at least 5% of the outstanding voting securities of an issuer, or a company which is under common ownership or control with the Fund. At June 30, 2020, the total market value of investments in Affiliated Companies was $1,952,833 and the cost was $1,952,833 (Note 8). |

See Notes to Financial Statements.

| | |

| Western Asset Premier Bond Fund 2020 Semi-Annual Report | | 21 |

Schedule of investments (unaudited) (cont’d)

June 30, 2020

Western Asset Premier Bond Fund

| | |

Abbreviation(s) used in this schedule: |

| |

| ARS | | — Argentine Peso |

| |

| BRL | | — Brazilian Real |

| |

| EUR | | — Euro |

| |

| GBP | | — British Pound |

| |

| ICE | | — Intercontinental Exchange |

| |

| IDR | | — Indonesian Rupiah |

| |

| IO | | — Interest Only |

| |

| JSC | | — Joint Stock Company |

| |

| LIBOR | | — London Interbank Offered Rate |

| |

| OFZ | | — Obligatsyi Federal’novo Zaima (Russian Federal Loan Obligation) |

| |

| PIK | | — Payment-In-Kind |

| |

| PO | | — Principal Only |

| |

| RUB | | — Russian Ruble |

| |

| STRIPS | | — Separate Trading of Registered Interest and Principal Securities |

| |

| USD | | — United States Dollar |

At June 30, 2020, the Fund had the following open reverse repurchase agreements:

| | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Rate | | | Effective

Date | | | Maturity

Date | | Face Amount

of Reverse

Repurchase