QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to § 240.14a-11 or § 240.14a-12

|

MEDICAL STAFFING NETWORK HOLDINGS, INC. |

(Name of Registrant as Specified In Its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if other than Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No Fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | 1) | | Title of each class of securities to which transaction applies:

|

| | | 2) | | Aggregate number of securities to which transaction applies:

|

| | | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | 4) | | Proposed maximum aggregate value of transaction:

|

| | | 5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | 1) | | Amount Previously Paid:

|

| | | 2) | | Form, Schedule or Registration Statement No.:

|

| | | 3) | | Filing Party:

|

| | | 4) | | Date Filed:

|

901 Yamato Road, Suite 110

Boca Raton, FL 33431

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be Held on June 17, 2003

To the Stockholders of Medical Staffing Network Holdings, Inc.:

Notice is hereby given that our 2003 Annual Meeting of Stockholders (the "Annual Meeting") will be held at the Marriott Boca Raton at Boca Center, 5150 Town Center Circle, Boca Raton, Florida 33486 on Tuesday, June 17, 2003 at 12:00 p.m., local time, for the following purposes:

- 1.

- to elect three Class II directors to serve until our 2006 Annual Meeting; and

- 2.

- to approve an amendment to our 2001 Stock Incentive Plan to increase the number of shares of our common stock thereunder.

At the Annual Meeting, stockholders will also be presented with the report of our independent auditors regarding our financial statements for the year ended December 29, 2002, and may also be asked to consider and take action with respect to such other matters as may properly come before the Annual Meeting.

All stockholders of record at the close of business on Tuesday, April 22, 2003, are entitled to notice of, and to vote at, the Annual Meeting.

All stockholders are cordially invited to attend the meeting in person. However, to ensure that your shares are represented at the Annual Meeting, you are urged to complete, sign, date and return the accompanying proxy card promptly in the enclosed postage paid envelope. Please sign the accompanying proxy card exactly as your name appears on your share certificate(s). You may revoke your proxy at any time before it is voted at the Annual Meeting. If you attend the Annual Meeting, you may vote your shares in person even if you have returned a proxy.

By order of the Board of Directors,

Robert J. Adamson

President and

Chief Executive Officer

May 1, 2003

MEDICAL STAFFING NETWORK HOLDINGS, INC.

901 Yamato Road, Suite 110

Boca Raton, FL 33431

ANNUAL MEETING OF STOCKHOLDERS

June 17, 2003

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Medical Staffing Network Holdings, Inc. (the "Board") to be voted at our Annual Meeting of Stockholders to be held at the Marriott Boca Raton at Boca Center, 5150 Town Center Circle, Boca Raton, Florida 33486 on Tuesday, June 17, 2003 at 12:00 p.m., local time, or any postponement or adjournment thereof (the "Annual Meeting"). This Proxy Statement, the Notice of Annual Meeting and the accompanying form of proxy will be first mailed to stockholders on or about May 1, 2003.

As of April 22, 2003, the record date for the determination of persons entitled to receive notice of, and to vote at, the Annual Meeting, there were issued and outstanding 30,189,449 shares of our common stock, par value $.01 per share (the "Common Stock"). The Common Stock is our only class of equity securities outstanding and entitled to vote at the Annual Meeting. Holders of shares of our Common Stock are entitled to one vote on each matter to be voted upon by the stockholders at the Annual Meeting for each share held. The presence, in person or by proxy, of holders of at least a majority of our Common Stock outstanding and entitled to vote on the matters to be considered at the Annual Meeting is required to constitute a quorum for the transaction of business at the Annual Meeting.

At the Annual Meeting, stockholders will be asked to take the following actions:

- 1.

- To elect three Class II directors to serve until our 2006 Annual Meeting (the "Board Nominees Proposal").

- 2.

- To approve an amendment to our 2001 Stock Incentive Plan to increase the number of shares of our common stock thereunder (the "Incentive Plan Proposal").

The Board Nominees Proposal will be decided by the affirmative vote of a plurality of the voting rights attached to the Common Stock present, in person or by proxy, at the Annual Meeting, and entitled to vote thereon. The Incentive Plan Proposal will be decided by the affirmative vote of a majority of the voting rights attached to the Common Stock present, in person or by proxy, at the Annual Meeting, and entitled to vote thereon.

At the Annual Meeting, stockholders will also be presented with a report of our independent auditors regarding our financial statements for the year ended December 29, 2002, and may also be asked to consider and take action with respect to such other matters as may properly come before the Annual Meeting.

SOLICITATION AND REVOCATION

Proxies in the form enclosed are being solicited by, or on behalf of, the Board. The persons named in the accompanying form of proxy have been designated as proxies by the Board. Such persons designated as proxies serve as officers of Medical Staffing Network. Any stockholder desiring to appoint another person to represent him or her at the Annual Meeting may do so by completing and executing another form of proxy and delivering it to the Secretary of Medical Staffing Network at the address indicated above, before the time of the Annual Meeting. It is the responsibility of the stockholder appointing such other person to represent him or her to inform such person of this appointment.

All shares of Common Stock represented by properly executed proxies that are returned and not revoked will be voted in accordance with the instructions, if any, given thereon. If no instructions are provided in an executed proxy, it will be voted FOR each of the Proposals described herein and set forth on the accompanying form of proxy, and in accordance with the proxyholder's best judgment as to any other business as may properly come before the Annual Meeting. If a stockholder appoints a person other than the persons named in the enclosed form of proxy to represent him or her, such person will vote the shares in respect of which he or she is appointed proxyholder in accordance with the directions of the stockholder appointing him or her. Member brokerage firms of The New York Stock Exchange, Inc. (the "NYSE") that hold shares in street name for beneficial owners may, to the extent that such beneficial owners do not furnish voting instructions with respect to any or all proposals submitted for stockholder action, vote in their discretion upon all of the Proposals. Any "broker non-votes" and abstentions will not be counted as shares present in connection with proposals with respect to which they are not voted. Any stockholder who executes a proxy may revoke it at any time before it is voted by delivering to the Secretary of Medical Staffing Network a written statement revoking such proxy, by executing and delivering a later dated proxy, or by voting in person at the Annual Meeting. Attendance at the Annual Meeting by a stockholder who has executed and delivered a proxy to us shall not in and of itself constitute a revocation of such proxy.

We will bear the cost of solicitation of proxies. Our directors, officers, employees and our retained investor relations consultant, Corporate Communications, may solicit proxies, personally, by telephone, internet or otherwise, but such persons will not be specifically compensated for such services. We may also make, through bankers, brokers or other persons, a solicitation of proxies of beneficial holders of our Common Stock. Upon request, we will reimburse brokers, dealers, banks or similar entities acting as nominees for reasonable expenses incurred in forwarding copies of the proxy materials relating to the Annual Meeting to the beneficial owners of Common Stock that such persons hold of record.

BOARD NOMINEES PROPOSAL

The Board currently consists of seven directors. Our certificate of incorporation provides for the classification of the Board into three classes, as nearly equal in number as possible, with staggered terms of office and provides that upon expiration of the term of office of a class of directors, nominees for such class shall be elected for a term of three years or until their successors are duly elected and qualified. At the Annual Meeting, three nominees for director are to be elected as Class II directors. The nominees are Scott F. Hilinski, Anne Boykin and Philip A. Incarnati. The two Class I directors have two years remaining on their terms of office and the two Class III directors have one year remaining on their terms of office. If no contrary indication is made, proxies in the accompanying form are to be voted for such nominees or, in the event any such nominee is not a candidate or is unable to serve as a director at the time of election (which is not now expected), for any nominee that is designated by the Board to fill such vacancy, unless the board determines to reduce the number of directors pursuant to our bylaws. All nominees and all current Class I and Class III directors were elected by our stockholders prior to our initial public offering, except that Thomas E. Timbie was elected by the Board as a Class I director on July 17, 2002, Anne Boykin was elected by the Board as a

2

Class II director on July 17, 2002 and Philip A. Incarnati was elected by the Board as a Class II director on October 25, 2002.

The Board recommends a vote FOR the election of Scott F. Hilinski, Anne Boykin and Philip A. Incarnati as Class II directors.

Directors and Executive Officers

Set forth below is certain information concerning our executive officers and directors as of December 29, 2002, including their age.

Name

| | Age

| | Position

|

|---|

| Robert J. Adamson | | 44 | | President, Chief Executive Officer and Class III Director |

| Kevin S. Little | | 32 | | Chief Financial Officer, Secretary and Treasurer |

| Patricia G. Donohoe, RN | | 50 | | Executive Vice President of Business Development |

| Lynne S. Stacy, RN | | 43 | | Executive Vice President of Nurse Per Diem Operations |

| Jeffrey P. Jacobsen, NMT | | 48 | | Executive Vice President of Allied Staffing Operations |

| Joel Ackerman | | 37 | | Class I Director |

| Thomas E. Timbie | | 45 | | Class I Director |

| Scott F. Hilinski | | 34 | | Class II Director |

| Anne Boykin, PhD, RN | | 58 | | Class II Director |

| Philip A. Incarnati | | 49 | | Class II Director |

| David J. Wenstrup | | 38 | | Class III Director |

Nominees for Class II Director–Term Expiring 2006

Scott F. Hilinski became a director in June 1998. He has been a Managing Director of Nautic Partners, LLC, formerly known as Navis Partners, LLC, since June 2000. Prior to Nautic Partners, Mr. Hilinski was a Vice President for Fleet Equity Partners, a private equity firm. Mr. Hilinski is also a director of CompBenefits Corp., a dental and vision plan administrator, Great Smokies Diagnostic Laboratory, Inc., a specialized diagnostic laboratory, and Provider HealthNet Services, Inc., specializing in information technology outsourcing.

Anne Boykin, PhD, RN, became a director in July 2002. Since 1990, Dr. Boykin has been Dean and Professor of the Christine E. Lynn College of Nursing at Florida Atlantic University, and, since 1997, has also been Director of the Christine E. Lynn Center for Caring, and has over 35 years of experience in clinical nursing, nurse management, nurse education and academia.

Philip A. Incarnati became a director in October 2002. Since 1989, Mr. Incarnati has been the President and Chief Executive Officer of McLaren Health Care Corporation, a healthcare delivery system. Mr. Incarnati is also a director of Theragenics Corporation, a medical device manufacturer.

Class III Directors—Term Expiring 2004

Robert J. Adamson has served as our President, CEO and a director since our inception in March 1998. Prior to co-founding our company, he served for 15 months as Chief Operating Officer and Chief Financial Officer of TravelPro USA, a privately held consumer products company. Prior to joining TravelPro, Mr. Adamson was the President of StarMed Staffing, L.P., then a wholly owned subsidiary of Medical Resources, Inc. Mr. Adamson also served as the Co-President and Chief

3

Financial Officer of Medical Resources. Prior to his work at StarMed, Mr. Adamson was employed in various financial executive positions for eight years in the computer industry.

David J. Wenstrup became a director in October 2001 in connection with the closing of our recapitalization. Mr. Wenstrup is a general partner of Warburg Pincus & Co. and a managing director of Warburg Pincus LLC, where he has been employed since 1997. Prior to 1997, Mr. Wenstrup was with the Boston Consulting Group. Mr. Wenstrup is also a director of Sonus Corp., which owns and operates hearing care centers, Workscape Inc., a web-based human resources company, and Centennial HealthCare Corporation, an operator of skilled nursing facilities.

Class I Directors—Term Expiring 2005

Joel Ackerman became a director in October 2001 in connection with the closing of our recapitalization. Mr. Ackerman is a general partner of Warburg Pincus & Co. and a managing director of Warburg Pincus LLC where he has been employed since 1993. He is also a director of Coventry Health Care Inc., a managed healthcare company, Sonus Corp., ChartOne, Inc., an outsource provider of document and information services to medical records departments of hospitals and physician facilities, and Centennial HealthCare Corporation.

Thomas E. Timbie became a director in July 2002. He is the President of Timbie & Company, LLC, a financial and management consulting firm that Mr. Timbie founded in 2000. Prior to founding Timbie & Company, Mr. Timbie was the Interim Vice President and Chief Financial Officer of e-d.Network, Inc., a business-to-business exchange in the optical market, and the Vice President and Chief Financial Officer of Xomed Surgical Products, Inc., which was acquired by Medtronic, Inc. Mr. Timbie is a director and audit committee chairman of Wright Medical Group, Inc., a manufacturer and distributor of orthopedic implants and instrumentation, Indus International, Inc., a provider of asset management software products, professional services and hosted service offerings, and American Medical Systems Holdings, Inc., a manufacturer and distributor of medical devices to physicians who treat urological and gynecological disorders.

Non-Director Executive Officers

Kevin S. Little has served as our Chief Financial Officer, Secretary and Treasurer since our inception in March of 1998. Prior to co-founding our company, Mr. Little was a founder, Co-President and Chief Financial Officer of TBM Staffing, Inc. and President of our predecessor, Southeast Staffing Partners, Inc., each a healthcare staffing services company established in 1997. Prior to TBM Staffing and Southeast Staffing Partners, Inc., Mr. Little was Corporate Controller for Medical Resources, Inc. Before his work at Medical Resources, Inc., Mr. Little was employed at Ernst & Young LLP.

Patricia G. Donohoe, RN, has served as our Executive Vice President of Business Development since December 2001, and as Chief Operations Officer from March 1998 to December 2001. Prior to co-founding our company, she was a founder and Co-President of TBM Staffing, Inc. Prior to co-founding TBM, she was Regional Director of StarMed Staffing, L.P.

Lynne S. Stacy, RN, has served as our Executive Vice President of Nurse Per Diem Operations since March 2002 and has been with the Company since April 1998. Prior to March 2002, Ms. Stacy held the following positions with the Company: Regional Director from April 1998 to October 1998, National Director of Operations from October 1998 to January 2000, Director of New Business Operations from January 2000 to November 2001 and Vice President—Business Development from November 2001 to March 2002. Prior to joining the Company, Ms. Stacy was employed for seven years at Olsten Health Services.

Jeffrey P. Jacobsen, NMT, joined us in November 1999 through the acquisition of MTS Staffing Resource, Inc. Mr. Jacobsen has been our Executive Vice President of Allied Staffing Operations since

4

November 2001. Prior to November 2001, Mr. Jacobsen was Vice President of Allied Staffing Operations of MTS Staffing Resource, Inc., where he managed the operations and sales team. Prior to joining MTS Staffing Resource, Inc., Mr. Jacobsen served as the Manager of the Nuclear Medicine and Radiology Department at West Suburban Hospital Medical Center. Mr. Jacobsen terminated his employment with Medical Staffing Network effective April 2003 for personal reasons. Mr. Jacobsen's position has been filled internally.

Board Committees

During 2002, the Board met two times and acted by written consent ten times, the Audit Committee met three times, and the Compensation Committee met two times. During 2002, each of our directors attended all meetings of the Board and any committee on which they served. The Board has adopted and approved a corporate governance policy, as well as a written charter which outlines the responsibilities of the Audit Committee.

The Audit Committee of the Board currently consists of Messrs. Timbie and Incarnati and Dr. Boykin. The Board has determined that all members of the Audit Committee meet the independence standards of the New York Stock Exchange. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to

- •

- the integrity of our financial statements;

- •

- our compliance with legal and regulatory requirements;

- •

- the performance of the external independent auditors we use;

- •

- our operational risk management; and

- •

- the qualifications, performance, independence and terms of engagement of our independent auditors.

In addition, the Audit Committee provides an avenue for communication between our external independent auditors, financial management and the Board. The Audit Committee has the sole authority to employ our external independent auditors, and to approve any proposed non-audit work to be conducted by our auditors. The Audit Committee is expected to regularly review the external independent auditors' work plan, staffing comments, bills and work product.

As more fully described in its charter, the Audit Committee oversees Medical Staffing Network's financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process including the system of internal control. The Audit Committee is directly responsible for the appointment and oversight of the work of Ernst & Young LLP ("Ernst & Young"), Medical Staffing Network's independent auditors, for the purpose of preparing or issuing an audit report. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the annual report with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with Ernst & Young, who are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States, their judgments as to the quality, not just the acceptability, of Medical

5

Staffing Network's accounting principles and such other matters as are required to be discussed with the Audit Committee under accounting principles generally accepted in the United States. Ernst & Young reported to the Audit Committee:

- •

- all critical accounting policies and practices to be used;

- •

- all alternative treatments within accounting principles generally accepted in the United States for policies and practices related to material items that were discussed with management, including ramifications of the use of such alternative disclosures and treatments and the treatment preferred by Ernst & Young; and

- •

- other material written communications between Ernst & Young and management.

In addition, the Audit Committee has discussed with Ernst & Young its independence from management and Medical Staffing Network, including the matters in the written disclosures required by the Independence Standards Board.

The Audit Committee discussed with Ernst & Young the overall scopes and plans for their audit. The Audit Committee met with the independent auditors, with and without management present, to discuss the results of their audit, their evaluation of our internal control, and the overall quality of Medical Staffing Network's financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 29, 2002 for filing with the Securities and Exchange Commission.

The information contained in this report shall not be deemed to be "soliciting material" or to be "filed" with the Securities and Exchange Commission, nor shall such information or report be incorporated by reference into any future filing by us under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate it by reference in such filing.

The Compensation Committee of the Board currently consists of Messrs. Adamson, Wenstrup and Hilinski. The Compensation Committee has responsibility for senior officer and director compensation. It has the authority to establish compensation policies and programs, and to grant options and restricted shares under our stock 2001 Stock Incentive Plan. The Board has determined that Messrs. Wenstrup and Hilinski meet the independence standards of the NYSE.

General. The Compensation Committee administers Medical Staffing Network's executive compensation. It has structured Medical Staffing Network's compensation program with a view toward ensuring our financial strength, encouraging high levels of growth and maximizing long-term stockholder value. The goal of the Compensation Committee is to establish compensation levels that will enable Medical Staffing Network to attract, motivate, reward and retain qualified executives. The program is designed to focus and direct the energies and efforts of key executives toward achieving specific company, divisional and strategic objectives. The program has three principal components: base salary, discretionary cash bonuses and long-term incentive compensation paid in the form of stock

6

options. In addition, executive officers may elect to participate in Medical Staffing Network's tax-deferred savings plan and other benefit plans generally available to all employees.

Base Salary. The current base salaries for certain of Medical Staffing Network's executive officers, including the chief executive officer, were fixed pursuant to written employment agreements. See "—Employment Agreements." Any adjustments in the base salaries of executive officers who are party to an employment agreement, other than the chief executive officer, and the base salaries of executive officers who are not party to an employment agreement, will be determined by the Compensation Committee based upon a combination of data derived from current surveys of compensation levels for similar positions in public companies of comparable size and industry type and a subjective review of the officer's performance by the chief executive officer and the attainment of financial and operational objectives, with no specified weight being given to any of these factors.

Bonuses. To reward superior performance and contributions made by key executives, Medical Staffing Network awards discretionary cash bonuses annually based on the achievement of specific financial and operational goals. The relevant goals and the weight assigned to each goal are tailored to each executive officer based upon his or her area of responsibility. For fiscal 2002, Medical Staffing Network's executive officers (other than the chief executive officer) received discretionary cash bonuses ranging from zero to 83% of their base salaries. Each officer receives a detailed memorandum setting forth the financial and operational goals that must be achieved in order to earn the maximum discretionary cash bonus and the relative weight assigned to each goal. Individual cash incentive awards are determined at the end of the fiscal quarter based upon achievement of the specified financial and operational goals.

2001 Stock Incentive Plan. Pursuant to the Company's 2001 Stock Incentive Plan, Medical Staffing Network may award its executive officers and key employees incentive stock options and nonqualified stock options. Grants made since Medical Staffing Network's inception through the end of fiscal 2002 have generally been limited to those made in connection with initial employment or promotion. Under the plan, the Committee may grant option awards and determine the exercise period, exercise price and such other conditions and restrictions as it deems appropriate for each grant. In fiscal 2002, the Committee granted 20,000 options under the plan to executive officers.

Chief Executive Officer Compensation. The current base compensation of Robert Adamson, the Company's chief executive officer, was determined in August 2001 pursuant to the terms of his employment agreement with the Company. See "—Employment Agreements." Mr. Adamson's employment agreement provides for an annual base salary of $400,000. In the 2002 fiscal year, Mr. Adamson did not receive a discretionary cash bonus and was not granted any options.

Deductibility of Executive Compensation. Under federal income tax law, a public company may not deduct non-performance based compensation in excess of $1.0 million paid to its chief executive officer or any of its four highest paid other executive officers. No executive officer of Medical Staffing Network received in fiscal 2002 non-performance based compensation in excess of this limit, and, at this time, Medical Staffing Network does not expect that any executive officer of the Company will receive compensation in excess of this limit in fiscal 2003. Accordingly, the Compensation Committee did not need to take any action to preserve the deductibility of the compensation paid to its executive officers. The Compensation Committee will continue to monitor this situation, however, and will take appropriate action if it is warranted in the future.

7

Director Compensation

We pay our Audit Committee chairman, Mr. Timbie, $5,000 per fiscal quarter and the other members of the Audit Committee, Mr. Incarnati and Dr. Boykin, $2,500 per fiscal quarter. Messrs. Timbie and Incarnati and Dr. Boykin, upon joining the Board, also received a one-time grant of options to purchase 25,000 shares of our common stock. Other than Audit Committee members, we do not compensate our directors for serving on the Board. We do, however, reimburse each member of the Board for out-of-pocket expenses incurred in connection with attending our Board and committee meetings.

Executive Compensation

The following table sets forth summary information concerning the compensation awarded to or earned by our Chief Executive Officer and by each of our four other most highly compensated executive officers (the "named executive officers") who earned in excess of $100,000 in cash compensation during the year ended December 29, 2002.

Summary Compensation Table

| | Annual Compensation

| | Long-Term Compensation

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other Annual

Compensation

(1)

| | Restricted

Stock

Award(s)(2)

| | Securities

Underlying

Options

|

|---|

Robert J. Adamson

President and Chief Executive Officer | | 2002

2001

2000 | | $

| 265,590

400,000

325,000 | | $

| —

1,567,081

265,993 | | $

| 251,094

859,021

1,419 | | —

—

2,240,644 | | —

796,076

— |

Kevin S. Little

Chief Financial Officer |

|

2002

2001

2000 |

|

$

|

139,697

175,000

165,000 |

|

$

|

—

802,930

132,967 |

|

$

|

96,233

330,827

1,419 |

|

—

—

836,405 |

|

—

227,450

— |

Patricia G. Donohoe, RN

Executive Vice President of Business Development |

|

2002

2001

2000 |

|

$

|

112,014

175,000

165,000 |

|

$

|

—

609,041

132,967 |

|

$

|

94,543

330,827

1,419 |

|

—

—

836,405 |

|

20,000

—

— |

Lynne S. Stacy, RN

Executive Vice President of Nurse Per Diem Operations |

|

2002

2001

2000 |

|

$

|

119,594

97,552

89,553 |

|

$

|

99,650

237,900

37,030 |

|

$

|

1,975

1,856

965 |

|

—

—

— |

|

—

60,838

4,220 |

Jeffrey P. Jacobsen, NMT

Executive Vice President of Allied Staffing Operations |

|

2002

2001

2000 |

|

$

|

152,931

140,000

125,000 |

|

$

|

64,014

175,000

90,000 |

|

$

|

3,645

9,450

9,450 |

|

—

—

— |

|

—

79,607

— |

- (1)

- Represents bonuses paid to Messrs. Adamson and Little, and Ms. Donohoe in the amount of the interest accrued on loans made by us to such persons relating to their purchase of restricted stock from us, plus an amount necessary for such persons to pay taxes due with respect to such bonuses. In addition, amounts include matching 401(k) contributions for all named executive officers above.

- (2)

- Restricted stock awards were purchased by the named executive officers in consideration for a note secured by the underlying shares.

8

Option/SAR Grants in Last Fiscal Year

The following table sets forth certain information concerning stock options granted during fiscal year 2002 to each of our named executive officers who received grants in 2002.

| | Individual Grants

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term(1)

|

|---|

| | Number of

Securities

Underlying

Options/SARs

Granted

| | Percent of Total

Options/SARs

Granted to

Employees in

Fiscal Year 2002

| |

| |

|

|---|

| | Exercise

Price Per

Share

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Robert J. Adamson | | — | | — | | | — | | — | | | — | | | — |

| Kevin S. Little | | — | | — | | | — | | — | | | — | | | — |

| Patricia G. Donohoe, RN | | 20,000 | | 11.9 | % | $ | 15.00 | | 12/2012 | | $ | 188,668 | | $ | 478,123 |

| Lynne S. Stacy, RN | | — | | — | | | — | | — | | | — | | | — |

| Jeffrey P. Jacobsen, NMT | | — | | — | | | — | | — | | | — | | | — |

- (1)

- Potential realizable values are net of exercise price, but before taxes associated with exercise. Amounts representing hypothetical gains are those that could be achieved if options are exercised at the end of the option term. The assumed 5% and 10% rates of stock price appreciation are provided in accordance with rules of the Securities and Exchange Commission, and do not represent our estimate or projection of the future stock price.

Fiscal Year-End Option Values

The following table sets forth information concerning the exercise of stock options by our named executive officers during fiscal year 2002 and stock options held by our named executive officers as of December 29, 2002.

| |

| |

| | Number of Securities

Underlying Unexercised

Options/SARs

| | Value of Unexercised

In-the-Money

Options/SARs(1)

|

|---|

| | Shares

Acquired on

Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Robert J. Adamson | | — | | — | | 265,359 | | 530,717 | | $ | 2,611,133 | | $ | 5,222,255 |

| Kevin S. Little | | — | | — | | 75,187 | | 151,633 | | | 746,039 | | | 1,492,069 |

| Patricia G. Donohoe, RN | | — | | — | | — | | 20,000 | | | — | | | 18,000 |

| Lynne S. Stacy, RN | | 1,668 | | 41,984 | | 14,442 | | 48,928 | | | 153,955 | | | 539,251 |

| Jeffrey P. Jacobsen, NMT | | — | | — | | 19,902 | | 59,705 | | | 195,836 | | | 587,497 |

- (1)

- The value of each unexercised in-the-money stock option is equal to the difference between the closing price of our Common Stock on the NYSE on December 27, 2002 of $15.90 and the per share exercise price of the stock options.

Employment Agreements

On August 20, 2001, we entered into amended and restated employment agreements with Robert J. Adamson, Kevin S. Little and Patricia G. Donohoe, amending and restating their original employment agreements, dated June 1, 1998. Mr. Adamson serves as our Chief Executive Officer, Mr. Little serves as our Chief Financial Officer and Ms. Donohoe serves as our Executive Vice President of Business Development. Subject to earlier termination as described below, the employment terms for each of Mr. Adamson and Mr. Little expire on December 26, 2004, while the term for Ms. Donohoe expires on October 26, 2004; provided that, unless we or Mr. Adamson, Mr. Little or Ms. Donohoe, as the case may be, gives written notice of non-renewal not later than ninety days prior

9

to the end of the term (or any extension of the term), the term will be automatically extended by one additional year.

The employment agreements provide annual base salaries as follows:

Name of Executive

| | Annual Base Salary

|

|---|

| Robert J. Adamson | | $ | 400,000 |

| Kevin S. Little | | $ | 175,000 |

| Patricia G. Donohoe | | $ | 175,000 |

However, in 2002 Mr. Adamson was paid a base salary of $265,590, Mr. Little was paid a base salary of $139,697 and Ms. Donohoe was paid a base salary of $112,014. Messrs. Adamson and Little and Ms. Donohoe each agreed to be paid a base salary for 2002 which was lower than the amount to which they were entitled under their employment agreements.

In addition, the employment agreements provide for participation in our bonus incentive pool on terms determined by our Board.

Each of the above agreements contains the following additional provisions:

Notwithstanding the employment term described above, the employee's employment will end on the earlier to occur of:

- •

- a termination of employee's employment due to the employee's death or disability,

- •

- a termination by us with or without "cause," as defined in the agreements, and

- •

- a termination by the employee with or without "good reason," as defined in the agreements.

In the event that the employee's employment terminates for any reason, the employee will receive all accrued but unpaid compensation through the date of such termination.

In the event that the employee's employment is terminated by us without cause (other than by reason of death or disability), or the employee voluntarily resigns with good reason, in addition to the amounts described in the preceding paragraph, the employee will continue to receive his or her base salary for a period of twelve months following the date of such termination, and to the extent permissible under our health plans, continuation of health benefits during such period.

If the employee's employment is terminated within twelve months following a "change in control" of Medical Staffing Network, as defined in the agreements, in addition to the payments described in the preceding paragraph, the employee will receive a lump-sum payment equal to two times the sum of the employee's base salary and other compensation provided under the employment agreement. In addition, if at the time of such termination the employee holds any stock options or warrants, we will cash out those options or warrants based upon the spread between the fair market value of the underlying shares and the applicable exercise price, if any. With respect to restricted stock held by the employee, all forfeiture provisions shall be deemed fully met, the shares of restricted stock will be surrendered to us and the employee will receive in return the difference between (x) the fair market value of the shares of restricted stock and (y) the sum of the principal amount and accrued interest on the promissory note payable by the employee in respect of the restricted stock, if any.

In the event that

- •

- any amount or benefit paid or distributed to the employee pursuant to the employee's employment agreement, taken together with any amounts or benefits otherwise paid or distributed to the employee, are or become subject to the excise tax imposed under Section 4999 of the Internal Revenue Code of 1986, as amended, or any similar tax that may hereafter be imposed, and

10

- •

- it would be economically advantageous to the employee to reduce such payments to avoid imposition of an excise tax,

the payments shall be reduced to an amount which maximizes the aggregate present value of such payments without causing such payments to be subject to any excise tax. This reduction will only be made if the net after-tax amount to be received by the employee after giving effect to the reduction will be greater than the net after-tax amount that would be received by the employee without the reduction.

Following any termination of the employee's employment, the employee will remain subject to certain restrictive covenants, including noncompetition, nonsolicitation and noninterference restrictions for a period of up to three years.

On November 1, 1999, we entered into an employment agreement with Mr. Jacobsen, who served as our Executive Vice President of Allied Staffing Operations. The employment term expired on October 31, 2002, but Mr. Jacobsen continued to be employed under identical terms to those set out in the employment agreement. In March 2003, Mr. Jacobsen terminated his employment effective April 2003. Mr. Jacobsen received an annual base salary of $155,000, and was eligible for participation in our incentive bonus pool provided certain performance targets were achieved. Notwithstanding the employment term described above, Mr. Jacobsen's employment would have ended on the earlier to occur of: (i) his death, (ii) upon his disability which results in non-performance of duties for more than thirty (30) days, (iii) upon thirty (30) days' written notice by either party, or (iv) immediately for "cause," as defined in the agreement.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serve as members of the board of directors or compensation committee of any entity that has an executive officer serving as a member of our Board or Compensation Committee.

Certain Transactions

On October 26, 2001, we entered into a stockholders agreement with Warburg Pincus Private Equity VIII, L.P. and certain of our other stockholders. The provisions of the stockholders agreement terminated upon consummation of our initial public offering on April 23, 2002, except that

- •

- for as long as any investor that is a party to the stockholders agreement beneficially owns at least 20% of our outstanding shares, we are obligated to nominate and use our best efforts to have two individuals designated by that investor elected to the Board; and

- •

- for as long as any investor that is a party to the stockholders agreement beneficially owns at least 10% of our outstanding shares, we are obligated to nominate and use our best efforts to have one individual designated by that investor elected to the Board.

Accordingly, Warburg Pincus has the right under the stockholders agreement to designate two persons to the Board. Currently, the directors designated by Warburg Pincus are Joel Ackerman and David J. Wenstrup.

As of April 23, 2002, the date that our initial public offering was consummated, there was approximately $62.4 million of outstanding principal and accrued interest under our senior unsecured notes. A portion of the proceeds of our initial public offering was used to repay all of the outstanding

11

principal and accrued interest under the senior secured notes. Our officers, directors and stockholders held all of the senior unsecured notes prior to repayment.

In connection with the purchase of restricted stock prior to our initial public offering by Robert J. Adamson, Kevin S. Little and Patricia G. Donohoe (each one of our executive officers), we loaned the following:

Executive/Director

| | Amounts

Loaned in

1998

| | Amounts Loaned

in 2000

| | Largest Aggregate Amount

of Indebtedness

Outstanding in 2002

| | Amount Outstanding on

December 29, 2002

|

|---|

| Robert J. Adamson | | $ | 826,875 | | $ | 2,880,000 | | $ | 2,627,815 | | — |

| Kevin S. Little | | $ | 337,500 | | $ | 1,007,500 | | $ | 970,562 | | — |

| Patricia G. Donohoe | | $ | 337,500 | | $ | 1,007,700 | | $ | 952,700 | | — |

On December 29, 2002, Messrs. Adamson and Little and Ms. Donohoe repaid in full the outstanding balances of their loans. All of the loans were evidenced by promissory notes, bearing interest at the prime rate announced from time to time byThe Wall Street Journal. From January 1, 1998 through December 29, 2002, interest rates reflected by the prime rate ranged from 4.25% to 9.5%. The amounts borrowed in 1998 were due in 2008 and the amounts borrowed in 2000 were due in 2010.

Anne Boykin, a Class II Director and member of the Audit Committee, is the Dean of the College of Nursing at Florida Atlantic University. During the 2002 fiscal year, we paid approximately $100,000 in donations to the Florida Atlantic University Foundation to support the University's center for nursing.

Philip Incarnati, a Class II Director and member of the Audit Committee, is the chief executive officer of a healthcare delivery system that utilizes our staffing services in the ordinary course of business. During the 2002 fiscal year, we were paid approximately $140,000 for these services.

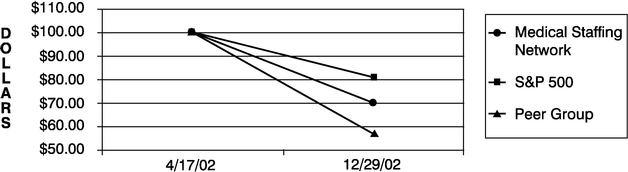

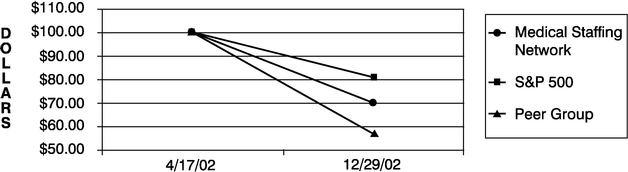

Performance Graph

Comparison of Cumulative Total Stockholder Return Value of a $100 Investment on April 17, 2002

Cumulative total stock holder returns are shown for Medical Staffing Network, the S&P 500 and a Peer Group assuming an investment of $100 on April 17, 2002, the date of our initial public offering. The Peer Group is comprised of Rehabcare Group, Inc., AMN Healthcare Services, Inc., and Cross Country, Inc., each a company operating in the medical staffing industry and having a comparable market capitalization to Medical Staffing Network.

12

Principal Stockholders

The table below sets forth information regarding beneficial ownership of our common stock as of April 22, 2003 for each stockholder who we know beneficially owns more than 5% of our outstanding shares of common stock, each of our directors, each of our named executive officers, and all of our directors and executive officers as a group.

Name of Beneficial Owner

| | Shares

Subject to

Options

| | Total

Shares

Beneficially

Owned

| | Percentage

of Common

Stock Beneficially

Owned

|

|---|

| Warburg Pincus Private Equity VIII, L.P.(1)(2) | | — | | 14,453,136 | | 47.9% |

| Nautic Partners V, LP(3) | | — | | 3,022,016 | | 10.0% |

| Robert J. Adamson(5) | | 263,359 | | 935,669 | | 3.9% |

| Kevin S. Little(6) | | 75,187 | | 355,508 | | 1.4% |

| Patricia G. Donohoe, RN | | — | | 347,730 | | 1.2% |

| Lynne S. Stacy, RN | | 18,356 | | — | | * |

| Jeffrey P. Jacobsen, NMT | | 19,902 | | — | | * |

| Joel Ackerman(1)(2) | | — | | 14,453,136 | | 47.9% |

| David J. Wenstrup(1)(2) | | — | | 14,453,136 | | 47.9% |

| Scott F. Hilinski(3) | | — | | 3,022,016 | | 10.0% |

| Thomas E. Timbie | | — | | — | | — |

| Anne Boykin, PhD, RN | | — | | — | | — |

| Philip A. Incarnati | | — | | — | | — |

| All directors and executive officers as a group (eight) persons | | 376,804 | | 19,114,059 | | 63.8% |

- *

- Less than one percent of the outstanding shares of common stock

- (1)

- The stockholder is Warburg Pincus Private Equity VIII, L.P., including two related limited partnerships ("WP VIII"). Warburg, Pincus & Co. ("WP") is the sole general partner of each of these entities. WP VIII is managed by Warburg Pincus LLC ("WP LLC"). The address of the Warburg Pincus entities is 466 Lexington Avenue, New York, New York 10017.

- (2)

- Messrs. Ackerman and Wenstrup, directors of Medical Staffing Network, are general partners of WP and managing directors and members of WP LLC. All shares indicated as owned by Messrs. Ackerman and Wenstrup are included because of their affiliation with the Warburg Pincus entities. Neither Mr. Ackerman nor Mr. Wenstrup owns any shares individually and each disclaims beneficial ownership of all shares owned by the Warburg Pincus entities. Their address is c/o Warburg Pincus LLC, 466 Lexington Avenue, New York, NY 10017. See Note 1 above.

- (3)

- The total shares listed under Nautic Partners V, LP ("NP5"), formerly known as Navis Partners V, LP, consist of shares held by NP5 and the following entities: Fleet Equity Partners VI, LP ("FEP6"), Fleet Venture Resources, Inc. ("FVR"), Kennedy Plaza Partners III, LP ("KPP3"), Chisholm Partners IV, LP ("CP4"), and Kennedy Plaza Partners II, LLC ("KPP2"). These entities and certain persons affiliated with them may be deemed to be a group within the meaning of Section 13(d)(3). Mr. Scott Hilinski, who may be deemed to share beneficial ownership of some of these shares, is a director of Medical Staffing Network. The address of NP5 is 50 Kennedy Plaza, Providence, RI 02903. By virtue of an agreement dated June 30, 2000, among FleetBoston Financial Corporation ("FBF") and certain other parties thereto (the "Management Agreement") FBF delegated voting and investment power over certain of the shares to certain persons and entities named therein who are affiliated with the shareholder entities named above. Certain of such persons and entities granted Mr. Hilinski a power of attorney to execute such voting and investment power on their behalf. Pursuant to the Management Agreement, Silverado IV Corp. ("S4C") was given sole voting and investment power over the 135,989 shares owned by FEP6.

13

Mr. Hilinski, SC4, and the persons who control SC4, Robert M. Van Degna and Habib Y. Gorgi, may be deemed to share beneficial ownership of the shares held by FEP6. Mr. Hilinski is a Vice President of S4C. Mr. Hilinski is a Managing Director of Nautic Management V, LP ("NM5"), formerly known as Navis Management V, LP, the General Partner of NP5 and Manager of KPP3. NP5 owns 2,012,663 shares. Mr. Hilinski, NM5 and the persons who control NM5, Mr. Van Degna, Mr. Gorgi, Riordon B. Smith, Bernard V. Buonanno, III, Gregory M. Barr, and Michael W. Joe, may be deemed to share beneficial ownership of the shares held by NP5. KPP3 owns 2,014 shares. Mr. Hilinski, NM5 and the persons who control NM5, Mr. Van Degna, Mr. Gorgi, Mr. Smith, Mr. Buonanno, III, Mr. Barr, and Mr. Joe, may be deemed to share beneficial ownership of the shares held by KPP3. Mr. Hilinski is also a Managing Director of Chisholm Management IV, LP, the General Partner of CP4 and Manager of KPP2. CP4 owns 537,414 shares. Mr. Hilinski, Chisholm Management IV, LP and the persons who control Chisholm Management IV, LP, Mr. Van Degna, Mr. Gorgi, Mr. Smith, Mr. Buonanno, III, Mr. Barr, and Mr. Joe, may be deemed to share beneficial ownership of the shares held by CP4. KPP2 owns 16,624 shares. Mr. Hilinski, Chisholm Management IV, LP and the persons who control Chisholm Management IV, LP, Mr. Van Degna, Mr. Gorgi, Mr. Smith, Mr. Buonanno, III, Mr. Barr, and Mr. Joe, may be deemed to share beneficial ownership of the shares held by KPP2. FVR holds 317,312 shares that were obtained as part of a co-investment arrangement with CP4 under the Management Agreement. Mr. Hilinski together with certain persons named in the Management Agreement may be deemed to share beneficial ownership of the shares held by FVR by virtue of the Management Agreement and the power of attorney described above. All shares indicated as owned by the aforementioned entities are included due to the Management Agreement, Mr. Hilinski's affiliation with each such entity or each such entity's affiliation with one or more other named shareholder entities or persons who exercise control over such entities. Each of Mr. Hilinski, Mr. Van Degna, Mr. Gorgi, Mr. Smith, Mr. Buonanno, III, Mr. Barr, and Mr. Joe disclaim beneficial ownership of all shares held by FEP6, FVR, CP4, KPP2, NP5 and KPP3, except for their pecuniary interest therein. Each aforementioned entity disclaims beneficial ownership of all shares not owned by it other than its pecuniary interests therein.

- (4)

- The total shares listed for Robert J. Adamson include shares held by Mr. Adamson and the following entities: RJA Holdings Limited Partnership ("RJA Holdings") and RJA Capital Limited Partnership ("RJA Capital"). As President of the General Partner of RJA Holdings and RJA Capital, Mr. Adamson is deemed to beneficially own the 31,295 shares held by RJA Holdings and the 903,194 shares held by RJA Capital.

- (5)

- The total shares listed for Kevin S. Little include shares held by Mr. Little and KSL Capital Limited Partnership ("KSL Capital"). As President of the General Partner of KSL Capital, Mr. Little is deemed to beneficially own the 355,059 shares held by KSL Capital.

Compliance with Section 16(a) of the Exchange Act

The following of our officers and directors, and the following holders of ten percent or more of our outstanding Common Stock, filed their Forms 3 after the effective date of our Registration Statement on Form S-1 relating to our initial public offering: Robert Adamson, Kevin Little, Patricia Donohoe, Jeffrey Jacobsen, Joel Ackerman, David Wenstrup, Scott Hilinski, Warburg Pincus and Nautic Partners.

14

INCENTIVE PLAN PROPOSAL

Subject to the requisite affirmative shareholder vote at the Annual Meeting, the Board has adopted an amendment to our 2001 Stock Incentive Plan (the "Incentive Plan") increasing the aggregate number of shares of our Common Stock for issuance thereunder by 500,000 shares of Common Stock. The Board believes that it would be in the best interests of Medical Staffing Network to give employees a greater stake in the company through increased stock holdings.

Summary of Incentive Plan

The following summary describes the Incentive Plan. This summary is qualified in its entirety by reference to the specific provisions of the Incentive Plan, a copy of which is on file with the Securities and Exchange Commission.

We originally adopted the Incentive Plan on November 14, 2001. The purpose of the Incentive Plan is to provide an incentive to improve the performance, encourage the continued employment and increase the proprietary interest of certain of our directors, officers, advisors, employees and independent consultants by giving such individuals the opportunity to share in our long-term success through stock ownership and to afford them the opportunity for additional compensation related to the value of the common stock. The approximate number of individuals eligible to participate in the Incentive Plan is 300. The proceeds of the sale of common stock received under the Incentive Plan will constitute general funds of Medical Staffing Network and may be used by it for any purpose. Unless sooner terminated, the Incentive Plan will expire on November 14, 2011, after which date no awards may be granted.

The Incentive Plan is administered by our Board of directors, or a committee designated by our board of directors (the entity administering the Incentive Plan hereafter called the "Committee"). To the extent practicable, each member of the Committee is a "nonemployee director" within the meaning of the rules promulgated under Section 16(b) and an "outside director" within the meaning of Section 162(m) of the Internal Revenue Code. The Committee, in its sole discretion, determines which individuals may participate in the Incentive Plan and the type, extent and terms of the awards to be granted. In addition, the Committee interprets the Incentive Plan and makes all other determinations with respect to the administration of the Incentive Plan.

The Incentive Plan provides for the grants of options and restricted stock as the Committee may from time to time deem appropriate. The terms and conditions of awards granted under the Incentive Plan are set out in award agreements between Medical Staffing Network and the individuals receiving such awards. Such terms include vesting conditions and the expiration dates for the awards.

The Incentive Plan allows for the grant of "incentive stock options," which are intended to qualify for favorable tax treatment under Section 422 of the Internal Revenue Code, and "non-qualified stock options," which are not intended to qualify as incentive stock options. The exercise price of options granted under the Incentive Plan is determined by the Committee at the time of grant; provided, however, that the exercise price of an option will not be less than the par value of the common stock, and in the case of incentive stock options, or options otherwise intended to qualify as "performance-based compensation" under Section 162(m) of the Internal Revenue Code, will not be less than one

15

hundred (100%) of the fair market value of the common stock on the date of grant. Options will vest and become exercisable within such period or periods (not to exceed ten years) as determined by the Committee and set forth in the applicable award agreement. Options that have become exercisable may be exercised by delivery of written notice of exercise to the Committee accompanied by full payment of the option exercise price and any applicable withholding.

The Incentive Plan also allows for the grants of restricted stock, which is common stock subject to vesting. Restricted stock vests in accordance with periods set by the Committee in the applicable award agreement. Certificates in respect of restricted stock are not generally delivered to the recipient at the time of grant; instead, the certificates are generally held by us during the restricted period during which the restricted stock remains subject to vesting. In addition, during the applicable restricted period, shares of restricted stock are subject to transfer restrictions and forfeiture in the event of a recipient's termination of employment with us. The Committee may impose other conditions at the time the award is granted.

Prior to the amendment for which stockholder approval is being sought, a maximum of 2,274,499 shares of Common Stock are available for issuance pursuant to the terms of the Incentive Plan; provided, however, that no more than 200,000 shares of Common Stock may be issued to any one person pursuant to awards of options during any one year.

The Incentive Plan provides for proportionate adjustments to reflect stock splits, stock dividends or other changes in the capital stock. In addition, in certain merger situations or upon the sale of all or substantially all of our assets (a "Corporate Event") where we are not the ultimate surviving parent entity following the Corporate Event, we will require the successor corporation or parent thereof to assume all outstanding awards; provided, however, that the Committee may, in its discretion and in lieu of requiring such assumption, provide that

- •

- all outstanding awards will terminate as of the consummation of such Corporate Event, and accelerate the exercisability of, or cause all vesting restrictions to lapse on, all outstanding Awards to a date at least ten days prior to the date of such Corporate Event, and/or

- •

- holders of awards will receive a cash payment in respect of cancellation of their awards based on the amount (if any) by which the per share consideration being paid for the common stock in connection with such Corporate Event, and in the case of options, less any applicable exercise price.

Market Value

The market value of our Common Stock as of April 22, 2003 was $7.60 per share.

Except as otherwise determined by the Committee, a person's rights and interest under the Incentive Plan, including any amounts payable pursuant to an award, may not be sold, assigned, donated, or transferred or otherwise disposed of, mortgaged, pledged or encumbered except, in the event of a participant's death, to a designated beneficiary to the extent permitted by the Incentive Plan, or in the absence of such designation, by will or the laws of descent and distribution; provided, however, the Committee may, in its sole discretion, allow in an award agreement for transfer of awards other than incentive stock options to other persons or entities.

16

Our Board may at any time terminate the Incentive Plan. In addition, our Board may at any time, and from time to time, amend the Incentive Plan; provided, however, that without further stockholder approval, no amendment to the Incentive Plan will increase the maximum number of shares of common stock which may be issued under the Incentive Plan.

The following is a brief discussion of the Federal income tax consequences of transactions with respect to options under the Incentive Plan based on the Internal Revenue Code, as in effect as of the date of this summary. This discussion is not intended to be exhaustive and does not describe any state or local tax consequences.

Incentive Stock Options. No taxable income is realized by the optionee upon the grant or exercise of an incentive stock option. If Common Stock is issued to an optionee pursuant to the exercise of an incentive stock option, and if no disqualifying disposition of such shares is made by such optionee within two years after the date of grant or within one year after the transfer of such shares to such optionee, then:

- •

- upon the sale of such shares, any amount realized in excess of the exercise price will be taxed to such optionee as a long-term capital gain and any loss sustained will be a long-term capital loss; and

- •

- no deduction will be allowed to Medical Staffing Network for Federal income tax purposes.

If the common stock acquired upon the exercise of an incentive stock option is disposed of prior to the expiration of either holding period described above, generally,

- •

- the optionee will realize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of such shares at exercise (or, if less, the amount realized on the disposition of such shares) over the exercise price paid for such shares, and

- •

- the Company will be entitled to deduct such amount for Federal income tax purposes if the amount represents an ordinary and necessary business expense.

Any further gain (or loss) realized by the optionee upon the sale of the common stock will be taxed as short-term or long-term capital gain (or loss), depending on how long the shares have been held, and will not result in any deduction by Medical Staffing Network.

If an incentive stock option is exercised more than three months following termination of employment (subject to certain exceptions for disability or death), the exercise of the option will generally be taxed as the exercise of a nonqualified stock option, as described below.

For purposes of determining whether an optionee is subject to an alternative minimum tax liability, an optionee who exercises an incentive stock option generally would be required to increase his or her alternative minimum taxable income, and compute the tax basis in the stock so acquired, in the same manner as if the optionee had exercised a nonqualified stock option. Each optionee is potentially subject to the alternative minimum tax. In substance, a taxpayer is required to pay the higher of his/her alternative minimum tax liability or his/her "regular" income tax liability. As a result, a taxpayer has to determine his/her potential liability under the alternative minimum tax.

Nonqualified Stock Options. With respect to nonqualified stock options:

- •

- no income is realized by the optionee at the time the option is granted;

- •

- generally, at exercise, ordinary income is realized by the optionee in an amount equal to the excess, if any, of the fair market value of the shares on such date over the exercise price, and

17

Restricted Stock. Participants who receive grants of restricted stock generally will be required to include as taxable ordinary income the fair market value of the restricted stock at the time they are no longer subject to forfeiture or restrictions on transfer for purposes of Section 83 of the Internal Revenue Code (the "Restrictions"), less any purchase price paid by the participant for the restricted stock. Thus, the participant generally will realize taxable income at the end of the restricted period. However, a participant who so elects under Section 83(b) of the Internal Revenue Code (an "83(b) Election") within 30 days of the date of grant of the restricted stock will incur taxable ordinary income on the date of grant equal to the excess of the fair market value of such shares of restricted stock (determined without regard to the Restrictions) over the purchase price paid by the participant for the restricted stock. If the shares subject to an 83(b) Election are forfeited, the participant will be entitled only to a capital loss for tax purposes equal to the purchase price, if any, of the forfeited shares. With respect to the sale of the shares after the restricted period has expired, the holding period to determine whether the participant has long-term or short-term capital gain or loss generally begins when the restrictions expire and the tax basis for such shares generally will be based on the fair market value of the shares on that date. However, if the participant makes an 83(b) Election, the holding period commences on the date of such election and the tax basis will be equal to the fair market value of the shares on the date of the election (determined without regard to the Restrictions). Medical Staffing Network generally will be entitled to a tax deduction equal to the amount that is taxable as ordinary income to the participant, subject to applicable withholding requirements.

Special Rules Applicable to Corporate Insiders. As a result of the rules under Section 16(b) of the Securities Exchange Act of 1934, and depending upon the particular exemption from the provisions of Section 16(b) utilized, officers and directors of Medical Staffing Network and persons owning more than ten percent of the outstanding shares of stock of Medical Staffing Network ("Insiders") may not receive the same tax treatment as set forth above with respect to the grant and/or exercise of options. Generally, Insiders will not be subject to taxation until the expiration of any period during which they are subject to the liability provisions of Section 16(b) with respect to any particular option. Insiders should check with their own tax advisers to ascertain the appropriate tax treatment for any particular option.

Because the grant of awards under the Incentive Plan is entirely within the discretion of the Committee, we cannot forecast the extent or nature of awards that will be granted in the future. Therefore, we have omitted the tabular disclosure of the benefits or amounts allocated under the Incentive Plan. Information with respect to compensation paid and other benefits, including options granted in respect of the 2002 fiscal year to the named executive officers, is set forth in the Summary Compensation Table.

18

Equity Compensation Plan Information

Plan category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

| | Weighted average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance

|

|---|

| | (a)

| | (b)

| | (c)

|

|---|

| Equity compensation plans approved by security holders(1) | | 1,883,451 | | $ | 7.37 | | 387,184 |

| Equity compensation plans not approved by security holders(2) | | 215,488 | | $ | 2.16 | | — |

| Total | | 2,098,939 | | $ | 6.84 | | 387,184 |

- (1)

- Includes options granted pursuant to our 2001 Stock Incentive Plan.

- (2)

- Includes options granted pursuant to our Amended and Restated Stock Option Plan, which has been frozen by the Board, such that no further options will be granted thereunder.

Amended and Restated Stock Option Plan

Our Amended and Restated Stock Option Plan reserves 1,151,016 shares of Common Stock for issuance of incentive (tax-qualified under Section 422 of the Internal Revenue Code) and nonqualified stock options to our employees and consultants. As of December 29, 2002, we have granted and outstanding options covering 215,488 shares at a weighted exercise price equal to $2.16 per share. Notwithstanding the number of shares reserved under the Amended and Restated Stock Option Plan, our Board, in its capacity as plan administrator, has frozen the plan such that no further options will be granted under this plan.

The plan is administered by our Board, or a committee designated by our Board comprised of at least two members of our Board. The Board has the authority to:

- •

- select plan participants;

- •

- determine when awards will be made to plan participants;

- •

- determine the form and amounts of awards;

- •

- determine any limitations, restrictions and conditions applicable to each award;

- •

- prescribe, amend and rescind rules and regulations relating to the plan; and

- •

- make all other decisions relating to the administration of the plan.

Under the plan, the Board also determines the exercise price at the time of the grant; provided, that the exercise price for incentive stock options will not be less than 100% of the fair market value of a share on the date of grant. If a plan participant who holds an incentive stock option also owns, or is deemed to own, more than 10% of the combined voting power of all of our classes of stock, the option period shall not exceed five years and the exercise price of the option may not be less than 110% of the fair market value on the grant date. Except as described above, options under the plan are generally granted for a ten-year term, but may terminate earlier if the employment with us terminates before the end of the ten-year period.

In the event of a "change in control event," all unexercised options granted under the plan immediately vest. For purposes of the plan, a "change in control event" means the replacement of 50% or more of the directors of our operating subsidiary, Medical Staffing Network, Inc., as a direct or indirect result of:

- •

- a cash tender offer for our operating subsidiary's common stock;

19

- •

- a solicitation of proxies other than by our operating subsidiary's management or board of directors;

- •

- acquisition of beneficial ownership of shares having 25% or more of the total number of votes that may be cast for the election of directors of our operating subsidiary by a third party or a "group" as defined in Section 13(d)(3) of the Securities Exchange Act of 1934, for the purpose of changing control of our operating subsidiary; or

- •

- any merger, business combination, sale of assets, or other extraordinary corporate transaction undertaken for the purpose of changing control of our operating subsidiary.

INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

General

We have not yet selected an accounting firm to perform an independent audit for the 2003 fiscal year, because our Board generally makes this selection later in the calendar year. Ernst & Young served as our principal accountant for the 2002 fiscal year. Representatives of Ernst & Young are expected to attend the Annual Meeting and will have the opportunity to make a statement and are expected to be available to answer appropriate questions.

Audit Fees

Ernst & Young has billed us an aggregate of $193,000 in fees for professional services rendered for the audit of our annual financial statements for 2002 and the review of our financial statements included in our Forms 10-Q for the 2002 fiscal year.

Financial Information Systems Design and Implementation Fees

Ernst & Young did not render any professional services to us relating to the design and implementation of our financial information systems during the 2002 fiscal year.

All Other Fees

Ernst & Young has billed us an aggregate of $1,234,000 in fees for all other professional services rendered during the 2002 fiscal year. These professional services were comprised of the audit-related services and tax services described below.

- •

- Audit-Related Fees. Ernst & Young billed us an aggregate of $1,167,000 in fees for audit-related services rendered during the 2002 fiscal year relating to our initial public offering, filings with the Securities and Exchange Commission, and audits and due diligence in connection with proposed and consummated acquisitions.

- •

- Tax Fees. Ernst & Young billed us an aggregate of $67,000 in fees for services rendered during the 2002 fiscal year relating to tax advice, compliance, planning and consulting.

The Audit Committee considered whether, and is satisfied that, the provision of these services by Ernst & Young is compatible with maintaining Ernst & Young's independence.

ADDITIONAL INFORMATION

Other Action at the Annual Meeting

A copy of our Annual Report to Stockholders for the year ended December 29, 2002, including financial statements for the year ended December 29, 2002 and the auditors' report thereon, is included with this proxy statement. The financial statements and auditors' report will be formally laid before the Annual Meeting, but no stockholder action is required thereon.

20

As of the date of this proxy statement, we have no knowledge of any business, other than that which we have described in this proxy statement, that will be presented for consideration at the Annual Meeting. In the event any other business is properly presented at the Annual Meeting, it is intended that the persons named in the accompanying proxy will have authority to vote such proxy in accordance with their judgment on such business.

Stockholder Proposals for 2004 Annual General Meeting of Stockholders

Stockholder proposals must be received in writing by the Secretary of Medical Staffing Network no later than December 28, 2003 and must comply with the requirements of the Securities and Exchange Commission and our bylaws in order to be considered for inclusion in our proxy statement and form of proxy relating to the annual meeting of our stockholders to be held in 2004. Such proposals should be directed to the attention of the Secretary, Medical Staffing Network Holdings, Inc., 901 Yamato Road, Suite 110, Boca Raton, Florida 33431. Stockholders who intend to nominate persons for election as directors at our annual meetings must comply with the advance notice procedures and other provisions set forth in our bylaws in order for such nominations to be properly brought before the 2004 annual meeting. These provisions require, among other things, that written notice a stockholder be received by the Secretary of Medical Staffing Network not less than 60 days nor more than 90 days prior to the first anniversary of the Annual Meeting.

If a stockholder proposal is introduced in the 2004 annual meeting of stockholders without any discussion of the proposal in our proxy statement, and the stockholder does not notify us on or before March 12, 2004, as required by SEC Rule 14a-4 (c)(1), of the intent to raise such proposal at the annual general meeting of stockholders, then proxies received by us for the 2004 Annual General Meeting will be voted by the persons named as such proxies in their discretion with respect to such proposal. Notice of such proposal is to be sent to the above address.

Boca Raton, Florida

May 1, 2003

21

APPENDIX A

MEDICAL STAFFING NETWORK HOLDINGS, INC.

FIRST AMENDMENT TO THE

MSN HOLDINGS, INC.

2001 INCENTIVE PLAN

WHEREAS, Medical Staffing Network Holdings, Inc. (the "Company") currently maintains and sponsors the MSN Holdings, Inc. Stock Incentive Plan (the "Plan"); and

WHEREAS, Section 15(a) of the Plan provides that the Board of Directors of the Company (the "Board") may amend the Plan at any time; and

WHEREAS, the Board has determined it to be in the best interests of the Company to amend the Plan as hereinafter set forth.

NOW, THEREFORE, pursuant to the authority reserved to the Board, the Plan is hereby amended as follows:

- 1.

- The name of the Plan is hereby amended from the "MSN Holdings, Inc. 2001 Stock Incentive Plan" to be the "Medical Staffing Network Holdings, Inc. 2001 Stock Incentive Plan."

- 2.

- Effective as of the date of approval by the Company's shareholders owning a majority of the Company's outstanding common stock, par value $.01 per share, Section 4(a) is amended by deleting it in its entirety and replacing it with the following:

- "(a)

- Share Reserve. Subject to Section 9 hereof relating to adjustments, the total number of shares of Stock which may be granted pursuant to Awards hereunder shall not exceed, in the aggregate, 2,774,499 shares of Stock."

- 3.

- Except as modified by this Second Amendment, all of the terms and conditions of the Plan shall remain valid and in full force and effect.

IN WITNESS WHEREOF, the undersigned, a duly authorized officer of the Company, has executed this instrument as of the 18th day of April 2003, on behalf of the Board.

|

|

By: |

|

Name: Kevin S. Little

Title: Chief Financial Officer,

Secretary and Treasurer

|

A-1

APPENDIX B

MEDICAL STAFFING NETWORK HOLDINGS, INC.

AMENDED AND RESTATED

AUDIT COMMITTEE CHARTER

March 27, 2003

Board of Directors

The Board of Directors (the "Board") of Medical Staffing Network Holdings, Inc. (the "Company") hereby amends and restates the charter of the Board's Audit Committee (the "Committee"), providing the Committee with authority, responsibility, and specific powers as described below.

Purpose

The purpose of the Committee is to oversee the broad range of issues surrounding the accounting and financial reporting processes of the Company and its subsidiaries and audits of the financial statements of the Company and its subsidiaries. The Committee's primary focus will be (1) to assist the Board in monitoring (a) the integrity of the financial statements of the Company and its subsidiaries, (b) the compliance by the Company and its subsidiaries with legal and regulatory requirements, (c) the independent auditor's qualifications and independence, and (d) the performance of the Company's independent auditors, and (2) to prepare the internal control report that the United States Securities and Exchange Commission (the "SEC") rules require be included in the Company's annual proxy statement.

Organization