UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F/A

Amendment No. 1

| [ ] | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| [ ] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| [X ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIESEXCHANGE ACT OF 1934 |

For the six-month transitional year ended June 30, 2012

OR

| [ ] | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from ____________ to __________

Commission file number 0-52324

Olympus Pacific Minerals Inc.

(Exact name of Registrant as specified in its charter)

n/a.

(Translation of Registrant’s name into English)

Canada

(Jurisdiction of incorporation or organization)

Suite 500 –10 King Street East, Toronto, Ontario, Canada, M5C 1C3

(Address of principal executive offices)

Securities to be registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

None N/A

Securities to be registered pursuant to Section 12(g) of the Act: common shares

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 378, 781, 186

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [] No [X]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934.

Yes [X] No [ ]

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants was required to file such reports). And (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated file [ ] Accelerated file [ ] Non-accelerated file [X]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filling:

U.S. GAAP [ ] International Financial Reporting Standards as issued Other []

By the International Accounting Standards Board [ X]

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

[] Item 17 [ ] Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes [] No [X ]

Table of Contents

| GLOSSARY | iii |

| Cautionary Note Regarding Forward-Looking Information | vii |

| ITEM 1: Identity of Directors, Senior Management and Advisers | 1 |

| ITEM 2: Offer Statistics and Expected Timetable | 1 |

| ITEM 3: Key Information | 1 |

| 3A. Selected Financial Data | 1 |

| 3B. Capitalization and Indebtedness | 3 |

| 3C. Reasons for the Offer and Use of Proceeds | 3 |

| 3D. Risk Factors | 3 |

| ITEM 4: Information on the Company | 14 |

| 4A. History and Development of the Company | 14 |

| 4B. Business Overview | 21 |

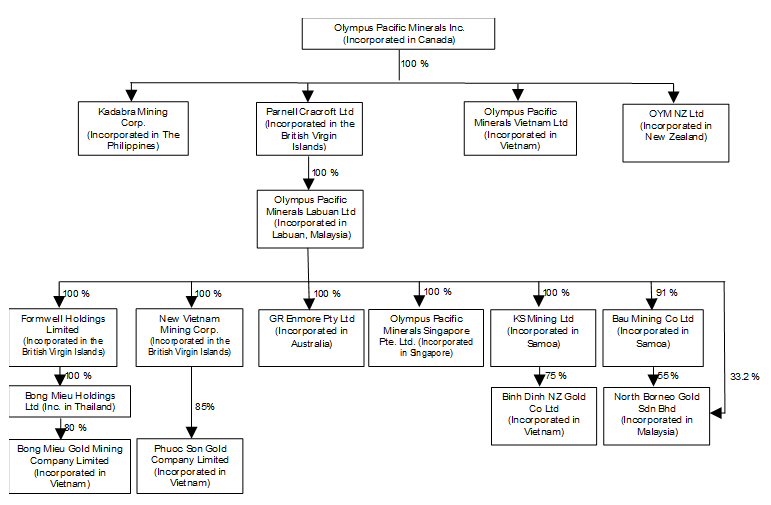

| 4C. Organizational Structure | 25 |

| 4D. Property, Plant and Equipment | 26 |

| ITEM 4A: Unresolved Staff Comments | 73 |

| ITEM 5: Operating and Financial Review and Prospects | 74 |

| 5A. Operating Results | 74 |

| 5B. Liquidity and Capital Resources | 80 |

| 5C. Research and development, patents and licenses, etc. | 81 |

| 5D. Trend Information | 81 |

| 5E. Off-Balance Sheet Arrangements | 82 |

| 5F. Tabular Disclosure of Contractual Obligations as at December 31, 2011 | 82 |

| ITEM 6: Directors, Senior Management, and Employees | 82 |

| 6A. Directors and Senior Management | 82 |

| 6B. Compensation | 86 |

| 6C. Board Practices | 92 |

| 6D. Employees | 94 |

| 6E. Share Ownership | 94 |

| ITEM 7: Major Shareholders and Related Party Transactions | 96 |

| 7A. Major Shareholders | 96 |

| 7B. Related Party Transactions | 97 |

| 7C. Interests of Experts and Counsel | 98 |

| ITEM 8: Financial Information | 98 |

| 8A. Consolidated Statements and Other Financial Information | 98 |

| 8B. Significant Changes | 98 |

| ITEM 9: The Offer and Listing | 98 |

| 9A. Offer and Listing Details | 98 |

| 9B. Plan of Distribution | 101 |

| 9C. Markets | 101 |

| 9D. Selling Shareholders | 101 |

| 9E. Dilution | 101 |

| 9F. Expenses of the Issue | 101 |

| ITEM 10: Additional Information | 101 |

| 10A. Share Capital | 101 |

| 10B. Memorandum and Articles of Association | 101 |

| 10C. Material Contracts | 101 |

| 10D. Exchange Controls | 103 |

| 10E. Taxation | 104 |

| 10E.1. Certain Canadian Federal Income Tax Consequences – General | 104 |

| 10E.2. Dividends | 104 |

| 10E.3. Disposition of Common Shares | 104 |

| 10E.4. United States Taxation | 105 |

| 10F. Dividends and Paying Agents | 110 |

| 10G. Statements by Experts | 110 |

| 10H. Documents on Display | 110 |

| 10I. Subsidiary Information | 110 |

| ITEM 11: Quantitative and Qualitative Disclosures about Market Risk | 110 |

| ITEM 12: Description of Securities other than Equity Securities | 110 |

| ITEM 13: Defaults, Dividend Arrearages and Delinquencies | 111 |

| ITEM 14: Material Modifications to the Rights of Security Holders and Use of Proceeds | 111 |

| ITEM 15: Controls and Procedures | 111 |

| ITEM 16: [RESERVED] | 113 |

| ITEM 16A. Audit Committee Financial Expert | 113 |

| ITEM 16B. Code of Ethics | 113 |

| ITEM 16C. Principal Accountant Fees and Services | 113 |

| ITEM 16D. Exemptions From the Listing Standards for Audit Committees | 114 |

| ITEM 16E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 114 |

| ITEM 16F. Change in Registrant’s Certifying Accountant | 115 |

| ITEM 17: Financial Statements | 116 |

| ITEM 18: Financial Statements | 116 |

| ITEM 19: Exhibits | 116 |

| 19A. Financial Statements | 116 |

| 19B. Exhibits | 116 |

| SIGNATURES | 1 |

GLOSSARY

Following is a glossary of terms used throughout this Annual Report.

| artisanal mining | mining at small-scale mines (and to a lesser extent quarries) that are labor intensive, with mechanization being at a low level and basic. Artisanal mining can encompass all small, medium, large, informal, legal and illegal miners who use rudimentary processes to extract valuable rocks and minerals from ore bodies. |

| bitumen | known as asphalt or tar, bitumen is the brown or black viscous residue from the vacuum distillation of crude petroleum. |

| breccia | a rock in which angular fragments are surrounded by a mass of finer-grained material. |

| C-horizon soil | the soil parent material, either created in situ or transported into its present location. Beneath the C horizon lies bedrock. |

| concentrate | a concentrate of minerals produced by crushing, grinding and processing methods such as gravity, flotation or leaching. |

| exploration stage | the search for mineral deposits which are not in either the development or production stage. |

| Form 43-101F1 | technical report issued pursuant to Canadian securities rules, the objective of which is to provide a summary of scientific and technical information concerning mineral exploration, development and production activities on a mineral property that is material to an issuer. Form 43-101F1is prepared in accordance with NI 43-101. Form 43-101F1 sets out specific requirements for the preparation and contents of a technical report. |

| feasibility study | a comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production. |

| gneiss | a coarse-grained, foliated rock produced by regional metamorphism. The mineral grains within gneiss are elongated due to pressure and the rock has a compositional banding due to chemical activity. |

| grade | the metal content of rock with precious metals. Grade can be expressed as troy ounces or grams per tonne of rock. |

| granodiorite | a medium to coarse-grained intrusive igneous rock, intermediate in composition between quartz diorite and quartz monzonite. |

| gold deposit | a mineral deposit mineralized with gold. |

| hydrothermal | the products or the actions of heated waters in a rock mass such as a mineral deposit precipitating from a hot solution. |

| igneous | a primary type of rock formed by the cooling of molten material. |

| inferred mineral resource | that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes. |

| intrusion | intrusive-molten rock which is intruded (injected) into spaces that are created by a combination of melting and displacement. |

| mafic | igneous rocks composed mostly of dark, iron- and magnesium-rich minerals. |

| metallurgical tests | scientific examinations of rock/material to determine the optimum extraction of metal contained. Core samples from diamond drill holes are used as representative samples of the mineralization for this test work. |

| mineral resource | a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. |

| NI 43-101 | National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators |

| ore | a naturally occurring rock or material from which minerals, such as gold, can be extracted at a profit; a determination of whether a mineral deposit contains ore is often made by a feasibility study. |

| open pit | a mining method whereby the mineral reserves are accessed from surface by the successive removal of layers of material usually creating a large pit at the surface of the earth. |

| ounce or oz. | a troy ounce or 20 pennyweights or 480 grains or 31.103 grams. |

| petrology | a field of geology which focuses on the study of rocks and the conditions by which they form. There are three branches of petrology, corresponding to the three types of rocks: igneous, metamorphic, and sedimentary. |

| pre-feasibility study | a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining methods, in the case of underground mining, or the pit configurations, in the case of an open pit, has been established, where effective methods of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, and economic factors and evaluation of other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve. |

| probable reserve (Canadian definition) | the economically mineable part of an indicated and, in some circumstances, a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

probable reserve (U.S. definition) | reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

| prospect | an area prospective for economic minerals based on geological, geophysical, geochemical and other criteria. |

| production stage | all companies engaged in the exploitation of a mineral deposit (reserve). |

proven reserve (Canadian definition) | the economically mineable part of a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

proven reserve (U.S. definition) | reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quantity are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral contents of reserves are well established. |

| qualified person | Has the meaning ascribed thereto in NI 43-101. |

| reserve | that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. Reserves are customarily stated in terms of “ore” when dealing with metalliferous minerals such as gold or silver. |

| schists | a metamorphic rock containing abundant particles of mica, characterized by strong foliation, and originating from a metamorphism in which directed pressure plays a significant role. |

| shaft | a vertical or inclined tunnel in an underground mine driven downward from surface. |

| shear | a tabular zone of faulting within which the rocks are crushed and flattened. |

| skarn | a lime-bearing silicate derived from nearly pure limestone and dolomite with the introduction of large amounts of silicon, aluminum, iron, and magnesium. |

| stoping | the act of mining in a confined space. |

| stratigraphic units | sequences of bedded rocks in specific areas. |

| strike | the direction of line formed by intersection of a rock surface with a horizontal plane. Strike is always perpendicular to direction of dip. |

thrust fault | a particular type of fault, or break in the fabric of the Earth’s crust with resulting movement of each side against the other, in which a lower stratigraphic position is pushed up and over another. This is the result of compressional forces. |

| toll treatment | processing or treatment of ore at an offsite processing facility. |

| trenching | the surface excavation of a linear trench to expose mineralization for sampling. |

| vein | a tabular body of rock typically of narrow thickness and mineralized occupying a fault, shear, fissure or fracture crosscutting another pre-existing rock. |

For ease of reference, the following conversion factors are provided:

| 1 mile (mi) | = 1.609 kilometres (km) | 2,204 pounds (lbs) | = 1 tonne |

| 1 yard (yd) | = 0.9144 meter (m) | 2,000 pounds/1 short ton | = 0.907 tonne |

| 1 acre | = 0.405 hectare (ha) | 1 troy ounce | = 31.103 grams |

| 1 kilometre (km) | = 1,000 meters | | |

Cautionary Note Regarding Forward-Looking Information

This report contains certain forward-looking statements relating to, but not limited to, management’s expectations, estimates, intentions, plans and beliefs. Forward-looking information can often be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “anticipate”, “project”, “goal”, “plan”, “intend”, “budget”, “estimate”, “may” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information may include, but is not limited to, statements regarding:

• reserve and resource estimates;

• estimates of future production;

• unit costs, costs of capital projects and timing of commencement of operations;

• production and recovery rates;

• financing needs, the availability of financing on acceptable terms or other sources of funding, if needed; and

• the timing of additional tests, feasibility studies and environmental or other permitting

Forward-looking statements should not be construed as guarantees of future performance. The forward-looking statements contained herein are based on our management’s current expectations, estimates, assumptions, opinion and analysis in light of its experience that, while considered reasonable at the time, may turn out to be incorrect or involve known and unknown risks, uncertainties and other factors that are inherently subject to a number of business and economic risks and uncertainties and contingencies that could cause actual results to differ materially from any forward-looking statement. Forward-looking statements involve significant known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any forward-looking statement. These risks, uncertainties and other factors include, but are not limited to, the following:

• failure to establish estimated resources and reserves;

• the grade and recovery of ore which is mined varying from estimates;

• capital and operating costs varying significantly from estimates;

• delays in obtaining or failures to obtain required governmental, environmental or other project approvals;

• changes in national and local government legislation, taxation or regulations, political or economic developments;

• the ability to obtain financing on favourable terms or at all;

• inflation;

• changes in currency exchange rates;

• fluctuations in commodity prices;

• delays in the development of projects; and

• other risks that we set forth in our filings with the SEC and other applicable securities regulatory authorities from time to time and available at www.sedar.com or www.sec.gov/edgar.

Due to the inherent risks associated with our business, readers are cautioned not to place undue reliance on forward-looking information. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and various future events will not occur. We disclaim any intention or obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by applicable laws.

PART I

| ITEM 1: | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable

| ITEM 2: | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not Applicable.

| 3A. | Selected Financial Data |

The following is selected financial data of Olympus Pacific Minerals Inc. (together with its consolidated subsidiaries, the “Company”, “Olympus” or “we”, “us”, “our” or similar identifying terminology), expressed in United States dollars, for the six-month transitional fiscal year ended June 30, 2012 and the fiscal years ended December 31, 2011 and 2010, prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”) for fiscal years ended December 31, 2009 and 2008, which differ substantially from United States generally accepted accounting principles (“US GAAP”). The Consolidated Financial Statements for the six-month transitional fiscal year ended June 30, 2012 and the fiscal years ended December 31, 2011 and 2010 comply with IFRS as published by the IASB. Prior to the adoption by the Company of IFRS, for a description of the differences between Canadian GAAP and US GAAP, and how these differences could affect the Company’s financial statements, please see Note 19 to the audited financial statements for the years ended December 31, 2010, 2009 and 2008 which are included in Item 19 of the Company’s 2010 20-F Annual Report dated June 7, 2011. Note 19 to the audited financial statements for the years ended December 31, 2010, 2009 and 2008 is incorporated by reference herein. This reconciliation is not required for financial statements prepared under IFRS, and accordingly has not been prepared for the six-month transitional fiscal year ended June 30, 2012 and fiscal years ended December 31, 2011 and 2010.

The selected financial data should be read in conjunction with the financial statements and other financial information included elsewhere in this Annual Report on Form 20-F.

| Table No. 1: | Selected Financial Data |

| | | Six-month Transitional Fiscal Year Ended June 30, 2012 Audited | | | Year Ended December 31, 2011 Audited | | | Year Ended December 31, 2010 Audited | |

| AMOUNTS IN ACCORDANCE WITH IFRS | | | | | | | | | |

| Revenue | | | 34,552,265 | | | | 47,976,630 | | | | 35,986,013 | |

| Income (Loss) for the Period | | | -18,326,891 | | | | 1,644,898 | | | | -12,773,072 | |

| Basic Earnings (Loss) Per Share | | | -0.040 | | | | 0.003 | | | | -0.042 | |

| Diluted (Loss) Per Share | | | -0.040 | | | | 0.003 | | | | -0.042 | |

| Dividends Per Share | | Nil | | | Nil | | | Nil | |

| Period-End Shares | | | 378,781,186 | | | | 380,593,907 | | | | 365,510,797 | |

| Cash | | | 3,397,728 | | | | 8,730,248 | | | | 4,105,325 | |

| Working Capital | | | -12,878,781 | | | | 3,210,632 | | | | 3,618,445 | |

| Mine Properties | | | 37,165,314 | | | | 37,896,565 | | | | 39,197,779 | |

| Deferred Exploration Expenditure | | | 21,428,562 | | | | 19,516,555 | | | | 13,621,774 | |

| Deferred Development Expenditure | | | 10,636,534 | | | | 20,276,490 | | | | 18,103,858 | |

| Long-Term Liabilities | | | 38,763,749 | | | | 47,257,310 | | | | 41,325,266 | |

| Capital Stock | | | 135,134,697 | | | | 135,846,955 | | | | 129,903,856 | |

| Non-Controlling Interest | | | 2,169,412 | | | | 5,920,409 | | | | 5,682,771 | |

| Shareholders’ Equity | | | 50,562,061 | | | | 71,524,794 | | | | 65,227,594 | |

| Total Assets | | | 121,117,149 | | | | 145,252,174 | | | | 123,192,405 | |

| (US$) | | Year Ended December 31, 2009 | | | Year Ended December 31, 2008 | |

| | | Audited | | | Audited | |

| AMOUNTS IN ACCORDANCE WITH CANADIAN GAAP | | | | | | |

| Revenue | | | 16,400,740 | | | | 7,275,324 | |

| Income (Loss) for the Period | | | -9,346,892 | | | | -20,200,995 | |

| Basic & Diluted Earnings (Loss) Per Share | | | -0.038 | | | | -0.087 | |

| Dividends Per Share | | Nil | | | Nil | |

| Period-End Shares | | | 268,458,779 | | | | 232,423,101 | |

| Cash | | | 5,718,725 | | | | 4,161,735 | |

| Working Capital | | | 7,400,950 | | | | 5,424,272 | |

| Mineral Properties | | | 7,203,352 | | | | 7,810,307 | |

| Deferred Development and Exploration | | | 25,049,053 | | | | 26,067,847 | |

| Long-Term Liabilities | | | 770,010 | | | | 1,046,883 | |

| Capital Stock | | | 97,318,003 | | | | 88,904,501 | |

| Non-Controlling Interest | | | -444,043 | | | Nil | |

| Shareholders’ Equity | | | 48,314,083 | | | | 48,940,283 | |

| Total Assets | | | 54,024,268 | | | | 54,282,352 | |

| | | | | | | | | |

| AMOUNTS IN ACCORDANCE WITH US GAAP | | Year Ended December 31, 2009 Audited | | | Year Ended December 31, 2008 Audited | |

| Net Comprehensive (Loss) | | | -8,056,464 | | | | -20,957,186 | |

| Income (Loss) Per Share – Basic & Diluted | | | -0.03 | | | | -0.05 | |

| Mineral Properties | | | 7,172,729 | | | | 7,779,684 | |

| Deferred Development and Exploration | | | 4,797,776 | | | | 3,545,531 | |

| Non-controlling Interest | | | -339,358 | | | Nil | |

| Shareholders’ Equity | | | 27,967,401 | | | | 26,313,898 | |

| Total Assets | | | 33,677,586 | | | | 32,655,967 | |

In this Transition Report on Form 20-F, unless otherwise specified, all dollar amounts are expressed in United States dollars.

| 3B. | Capitalization and Indebtedness |

Not applicable

| 3C. | Reasons for the Offer and Use of Proceeds |

Not Applicable.

The Company faces significant risk factors and uncertainties associated with its business and its industry, similar to those faced by other exploration and development companies in Southeast Asia, including the following general description of material risk factors:

There is a significant doubt regarding the ability of the Company to continue as a going concern. The Company’s audited annual consolidated financial statements as at and for the period ended June 30, 2012 were prepared on a going concern basis, under the historical cost basis, which assumes the Company will continue its operations for the foreseeable future and will be able to realize its assets and discharge its liabilities and commitments in the ordinary course of business.

During the six-month period ended June 30, 2012, the Company had a significant disruption to its operations at the Phuoc Son Mine which negatively impacted the cash-flows and the Company incurred a net loss of $18.3 million for the period. As at June 30, 2012, the Company’s current liabilities exceeded its current assets by $12.9 million and the Company has high debt levels. Further the Corporation currently has limited cash on hand and, since it is experiencing negative cash flow, its cash reserves are being depleted.

The Phuoc Son Mine has now resumed normal operations and management expects that net cash flows from operations will be positive in fiscal 2013. If the Company is able to increase production to targeted levels and the market price for gold remains robust through fiscal 2013, the Company’s liquidity position may improve.

The ability of the Company to continue as a going concern depends upon its ability to resume profitable operations or to continue to access debt or equity capital in the ordinary course. No assurance can be given that such capital will be available at all or on terms acceptable to the Company. Management is considering various alternatives, including a number of initiatives to raise additional capital or to restructure its existing debt. However, as at the date of this report the Company has not secured such further financing. Although the Company has been successful in securing the funds necessary to execute its business plan in the past, it is not possible to determine with certainty the success or adequacy of its financing initiatives.

Not all of the Company’s mineral properties contain a known commercially mineable mineral deposit. The business of mineral exploration and extraction involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. Major expenses may be required to locate, establish or expand mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. The long-term profitability of the Company’s operations will be in part directly related to the cost and success of its ability to develop the extraction and processing facilities and infrastructure at any site chosen for extraction. It is impossible to ensure that the exploration or development programs planned by the Company will result in a profitable commercial mining operation nor enable a continuation of those operations when established. Whether a mineral deposit is commercially viable depends on a number of factors, including, but not limited to the following: particular attributes of the deposit, such as ground conditions, depth, grade, size and proximity to infrastructure; the ability of the Company to maximize the recovery rate of ore extracted; cost of supplies; metal prices, which are volatile; and government regulations, including regulations relating to investment, mining, prices, taxes, royalties, land use and tenure, importing and exporting of minerals and environmental protection.

The Company’s resources and reserves estimates are subject to uncertainty. The Company’s mineral resources and mineral reserves are estimates based on a number of assumptions, any adverse changes in which could require the Company to lower its mineral resource and mineral reserve estimates. There is no certainty that any of the mineral resources or mineral reserves disclosed by the Company will be realized or that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that reserves can be mined or processed profitably. Until a deposit is actually mined and processed, the quantity and grades of mineral resources and mineral reserves must be considered as estimates only. Valid estimates made at a given time may significantly change when new information becomes available. Any material change in the quantity of mineral resources or mineral reserves, grade or stripping ratio may affect the economic viability of the Company’s properties. There can also be no assurance that any discoveries of new or additional reserves will be made. Any material reductions in estimates of mineral resources or mineral reserves could have a material adverse effect on the Company’s results of operations and financial condition. This risk may be particularly acute with respect to the Bong Mieu Central Gold Mine where the Company conducted a limited amount of drilling before making its decision to commence production.

The Company may not meet key production or other cost estimates. A decrease in the amount of or a change in the timing of the mineral production outlook for the Company may impact the amount and timing of cash flow from operations. The actual impact of such a decrease of cash flow from operations would depend on the timing of any changes in production and on actual prices. Any change in the timing of these projected cash flows resulting from production shortfalls or labor disruptions would, in turn, result in delays in receipt of such cash flows and in using such cash to, as applicable, reduce debt levels and fund operating and exploration activities. Should such production shortfalls or labor disruptions occur, the Company may require additional financing to fund capital expenditures in the future. The level of capital and operating cost estimates which are used for determining and obtaining financing and other purposes are based on certain assumptions and are inherently subject to significant uncertainties. It is very likely that actual results for the Company’s projects will differ from its current estimates and assumptions, and these differences may be material. In addition, experience from actual mining or processing operations may identify new or unexpected conditions that could reduce production below, and/or increase capital and/or operating costs above, the current estimates. In particular, the Bong Mieu Central Gold Mine was put into production without a full feasibility study. Instead, the Company prepared a pre-feasibility study, which can underestimate a project’s capital and operating costs, while at the same time overestimating the amount of reserves, grade recovery from processing and mineralization. Accordingly, production estimates in respect of the Bong Mieu Central Gold Mine may be even less reliable. If actual results are less favorable than the Company currently estimates, the Company’s business, results of operations, financial condition and liquidity could be materially adversely impacted.

The Company is subject to various risk associated with its mining operations. By its nature, the business of mineral exploration, project development, mining and processing, contains elements of significant risks and hazards. The continuous success of the Company’s business is dependent on many factors including, but not limited to:

| · | discovery and/or acquisition of new ore reserves; |

| · | securing and maintaining title to tenements and obtaining necessary consents, permits or authorizations for exploration and mining; |

| · | successful design and construction of mining and processing facilities; |

| · | successful commissioning and operating of mining and processing facilities; |

| · | ongoing supplies of essentials goods and services; and |

| · | the performance of the technology incorporated into the processing facility. |

Specifically, the Company placed the Bong Mieu Central Gold Mine into production based on a pilot plant and bench scale testing. There can be no assurance that mineral or other metal recoveries in small scale laboratory tests will be duplicated in a larger scale test under on-site conditions or during production and the volume and grade of reserves mined and processed and recovery rates may not be the same as currently anticipated.

The Company is largely dependent upon its mining and milling operations at its Phuoc Son mine and any adverse condition affecting that operation may have a material adverse impact on the Company. The Company’s operations at the Phuoc Son property accounted for approximately 70% of the Company’s gold production for the six month transition year ended June 30, 2012 and is expected to account for approximately 82% of the Company’s gold production in 2012 (based on the Company’s production guidance of 60,000 ounces). During the six month transition year ended June 30, 2012, gold production at the Phuoc Son mine was below the Company’s expectation as a result of diminished tonnage output during engineering remediation of the Southern Deposit, compounded by higher than expected grade dilution during initial development of the Northern Deposit. Any adverse condition affecting mining or milling conditions at the Phuoc Son property could be expected to have a material adverse effect on the Company’s financial performance and results of operations. The Company also anticipates using revenue generated by its operations at Phuoc Son to finance a substantial portion of its capital expenditures during the Company’s 2013 fiscal year, including at the Company’s Bau Gold Property in East Malaysia. The Company likely will continue to be dependent on operations at the Phuoc Son property for a substantial portion of its gold production until the Bau Gold Property achieves commercial production or production is increased at the Bong Mieu Gold Property.

The Company is dependent upon its ability to raise funds in order to carry out its business. Mining operations, exploration and development involve significant financial risk and capital investment. The operations and expansion plans for the Company may also result in increases in capital expenditures and commitments. The Company may require additional funding to expand its business and may require additional capital in the future for, among other things, the development of the Bau Gold Project which is currently the subject of a feasibility study targeting production commencing in 2015, or the development of other deposits or additional processing capacity at the Company’s Phuoc Son or Bong Mieu projects. No assurance can be given that such capital will be available at all or available on terms acceptable to the Company. The Company may be required to seek funding from third parties if internally generated cash resources and available credit facilities are insufficient to finance these activities. In the event that the Company was unable to obtain adequate financing on acceptable terms, or at all, to satisfy its operating, development and expansion plans, its business and results of operations may be materially and adversely affected. The success and the pricing of any such capital raising and/or debt financing will be dependent upon the prevailing market conditions at that time, the availability of funds from lenders and other factors relating to the Company’s properties and operations.

The Company has debt and may be unable to service or refinance its debt, which could have negative consequences on the Company’s business, could adversely affect its ability to fulfill its obligations under its debt and may place the Company at a competitive disadvantage in its industry. In the first half of 2010 and 2011, the Company incurred indebtedness by way of convertible unsecured notes (“Convertible Notes”) and by way of secured redeemable gold delivery promissory notes (“Gold Loan Notes”). The existence of this debt could have negative consequences for the Company. For example, it could:

| · | increase the Company’s vulnerability to adverse industry and general economic conditions; |

| · | require the Company to dedicate a material portion of cash flow from operations to make scheduled principal or interest payments on the debt, thereby reducing the availability of its cash flow for working capital, capital investments and other business activities; |

| · | limit the Company’s ability to obtain additional financing to fund future working capital, capital investments and other business activities; |

| · | limit the Company’s flexibility to plan for, and react to, changes in its business and industry; and |

| · | place the Company at a competitive disadvantage relative to less leveraged competitors. |

Servicing the Company’s debt requires an allocation of cash and the Company’s ability to generate cash flow may be adversely affected by factors beyond its control. The Company’s business may not generate cash flow in an amount sufficient to enable it to pay the principal of, or interest on, its indebtedness or to fund other liquidity needs, including working capital, capital expenditures, project development efforts, strategic acquisitions, investments and alliances and other general corporate requirements. The Company’s ability to generate cash is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond its control. As such, the Company is faced with the risk that (i) the Company’s business will generate insufficient cash flow from operations or (ii) future sources of funding will not be available to the Company in amounts sufficient to enable it to fund its capital needs.

If the Company cannot fund its capital needs, it will have to take actions such as reducing or delaying capital expenditures, project development efforts, strategic acquisitions, investments and alliances; selling assets; restructuring or refinancing its debt; or seeking additional equity capital. The Company cannot provide assurance that any of these measures could, if necessary, be effected on commercially reasonable terms, or at all, or that they would permit the Company to meet its scheduled debt service obligations.

Restrictive covenants in the agreements governing the Company’s indebtedness restrict its ability to operate its business. The documentation governing the Convertible Notes and the Gold Loan Notes contain covenants that restrict the Company’s ability to, among other things, incur additional debt, pay dividends, make investments, enter into transactions with affiliates, merge or consolidate with other entities or sell all or substantially all of the Company’s assets. A breach of any of these covenants could result in a default thereunder, which could allow the noteholders or their representative to increase the interest rate payable and/or declare all amounts outstanding thereunder immediately due and payable. If the Company is unable to repay outstanding borrowings when due, the lenders and the collateral agent under the Gold Loan Notes and related agreements have the right to proceed against the collateral granted thereunder, including the shares in the Company’s subsidiary holding companies which control the Bong Mieu and Phuoc Son projects and the loans owed to the Company by BMGMC and PSGC. The Company may also be prevented from taking advantage of business opportunities that arise because of the limitations imposed on it by the restrictive covenants under its indebtedness.

The Company has entered into certain derivative arrangements which may not obtain their intended result. The Company’s Convertible Notes and Gold Loan Notes contain embedded derivative instruments. The use of such instruments involves certain inherent risks including credit risk, market liquidity risk and unrealized mark-to-market risk. Initially, the Company does not have any other hedging agreements in place but may enter into additional contracts from time to time. While hedging activities may protect the Company in certain circumstances, they may also cause it to be unable to take advantage of fluctuating market prices, and no assurances are given as to the effectiveness of the Company’s current or future hedging policies.

The Company will not be able to insure against all possible risks. Exploration for natural resources involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. The Company’s business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labor disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to the Company’s properties or the properties of others, delays, monetary losses and possible legal liability. If any such catastrophic event occurs, investors could lose their entire investment. Obtained insurance will not cover all the potential risks associated with the activities of the Company. Moreover, the Company may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution, political risk or other hazards as a result of exploration and production is not generally available to the Company or to other companies in the mining industry on acceptable terms. The Company might also become subject to liability for pollution or other hazards which may not be insured against or which the Company may elect not to insure against because of premium costs or other reasons. Losses from these events may cause the Company to incur significant costs that could have a material adverse effect upon its financial performance and results of operations. Should a catastrophic event arise, investors could lose their entire investment.

The Company is subject to commodity price fluctuations. If the price of gold declines, the Company’s properties may not be economically viable. The Company’s revenues are, and are expected to be for the foreseeable future in large part derived from the extraction and sale of precious metals, particularly gold. The price of those commodities has fluctuated widely, particularly in recent years, and is affected by numerous factors beyond the Company’s control including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new or improved mining and production methods. The effect of these factors on the price of base and precious metals cannot be predicted and the combination of these factors may result in the Company not receiving adequate returns on invested capital or the investments retaining their respective values. If the price of gold (including other base and precious metals) is below the cost to produce gold, the properties will not be mined at a profit. Fluctuations in the gold price affect the Company’s reserve estimates, its ability to obtain financing and its financial condition as well as requiring reassessments of feasibility and operational requirements of a project. Reassessments may cause substantial delays or interrupt operations until the reassessment is finished.

The Company may not be able to compete with other mining companies for mineral properties, financing, personnel and technical expertise. The resource industry is intensely competitive in all of its phases, and the Company competes for mineral properties, financing, personnel and technical expertise with many companies possessing greater financial resources and technical facilities than it does. Competition could prevent the Company from conducting its business activities or prevent profitability of existing or future properties or operations if the Company were unable to obtain suitable properties for exploration in the future, secure financing for its operations or attract and retain mining experts. The Company’s inability to effectively compete could substantially impair its results of operations.

If the Company does not comply with all applicable regulations, it may be forced to halt its business activities. The activities the Company engages in are subject to various laws in the different jurisdictions in which the Company operates governing, among other matters, land use, the protection of the environment, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances and mine safety. The Company may not be able to obtain all necessary licenses and permits required to carry out the exploration, development or mining of the projects. Unfavorable amendments and/or back-dating of changes to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures which could result in a cessation of operations by the Company. Failure to comply with applicable laws and regulations may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. The Company may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violation of applicable laws or regulations. Large increases in capital expenditures resulting from any of the above factors could force the Company to cease business activities which could cause investors to lose their investment.

Non-compliance with environmental regulation may hurt the Company’s ability to perform its business activities. The Company’s operations are subject to environmental regulation in the jurisdiction in which it operates. Environmental legislation is still evolving in these jurisdictions and it is expected to evolve in a manner which may require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. If there are future changes in environmental regulation, or changes in its interpretations, possibly backdated, they could impede the Company’s current and future business activities and negatively impact the profitability of operations.

Land reclamation requirements for exploration properties may be burdensome and may divert funds from the Company’s exploration programs. Although variable, depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies, as well as companies with mining operations, in order to minimize long term effects of land disturbance. Reclamation may include requirements to control dispersion of potentially deleterious effluents and to reasonably re-establish pre-disturbance land forms and vegetation. In order to carry out reclamation obligations imposed on the Company in connection with its mineral exploration, the Company must allocate financial resources that might otherwise be spent on further exploration programs.

Mining operations and projects are vulnerable to supply chain disruption and the Company’s operations and development projects could be adversely affected by shortages of, as well as lead times to deliver, strategic spares, critical consumables, mining equipment or metallurgical plant. The Company’s operations and development projects could be adversely affected by shortages of, as well as lead times to deliver, strategic spares, critical consumables, mining equipment and metallurgical plant. In the past, the Company and other gold mining companies have experienced shortages in critical consumables, particularly as production capacity in the global mining industry has expanded in response to increased demand for commodities, and it has experienced increased delivery times for these items. These shortages have also resulted in unanticipated increases in the price of certain of these items. Shortages of strategic spares, critical consumables, mining equipment or metallurgical plant, which could occur in the future, could result in production delays and production shortfalls, and increases in prices result in an increase in both operating costs and the capital expenditure to maintain and develop mining operations.

The Company and other gold mining companies, individually, have limited influence over manufacturers and suppliers of these items. In certain cases there are only limited suppliers for certain strategic spares, critical consumables, mining equipment or metallurgical plant who command superior bargaining power relative to the Company, or it could at times face limited supply or increased lead time in the delivery of such items.

If the Company experiences shortages, or increased lead times in delivery of strategic spares, critical consumables, mining equipment or processing plant, its results of operations and financial condition could be adversely affected.

If the Company is unable to obtain and keep in good standing certain licenses and permits, it will be unable to explore, develop or mine any of its property interests. The current and future operations of the Company require licenses and permits from various governmental authorities and such operations are and will be subject to laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, use of explosives, land use, surface rights, environmental protection, safety and other matters, and are dependent upon the grant, or as the case may be, the maintenance of appropriate licenses, concessions, leases, permits and regulatory consents which may be withdrawn or made subject to limitations. The maintaining of tenements, obtaining renewals, or getting tenements granted, often depends on the Company being successful in obtaining required statutory approvals for its proposed activities and that the licenses, concessions, leases, permits or consents it holds will be renewed as and when required. There is no assurance that such renewals will be given as a matter of course and there is no assurance that new conditions will not be imposed in connection therewith. There can be no assurance that the Company will be able to obtain or maintain all necessary licenses or permits that may be required to commence construction, development or operation of mining facilities at these properties on terms which enable operations to be conducted at economically justifiable costs.

If the Company does not make certain payments or fulfill other contractual obligations, it may lose its option rights and interests in its joint ventures. There is a risk that the Company may be unable to meet its share of costs incurred under any option or joint venture agreements to which it is presently or becomes a party in the future and the Company may have its interest in the properties subject to such agreements reduced as a result. Furthermore, if other parties to such agreements do not meet their share of such costs, the Company may be unable to finance the cost required to complete recommended programs. The loss of any option rights or interest in joint ventures on properties material to the Company could have a material adverse effect on the Company.

Title to the Company’s assets can be challenged or impugned, which could prevent the Company from exploring, developing or operating at any of its properties. There is no guarantee that title to concessions will not be challenged or impugned to the detriment of the Company. In Malaysia, Vietnam and the Philippines, the system for recording title to the rights to explore, develop and mine natural resources is such that a title opinion provides only minimal comfort that the holder has title. For example, in Vietnam, mining laws are in a state of flux, continuously being reviewed and updated, and the system is new and as yet untested. If title to assets is challenged or impugned, the Company may not be able to explore, develop or operate its properties as permitted or enforce its rights with respect to the properties.

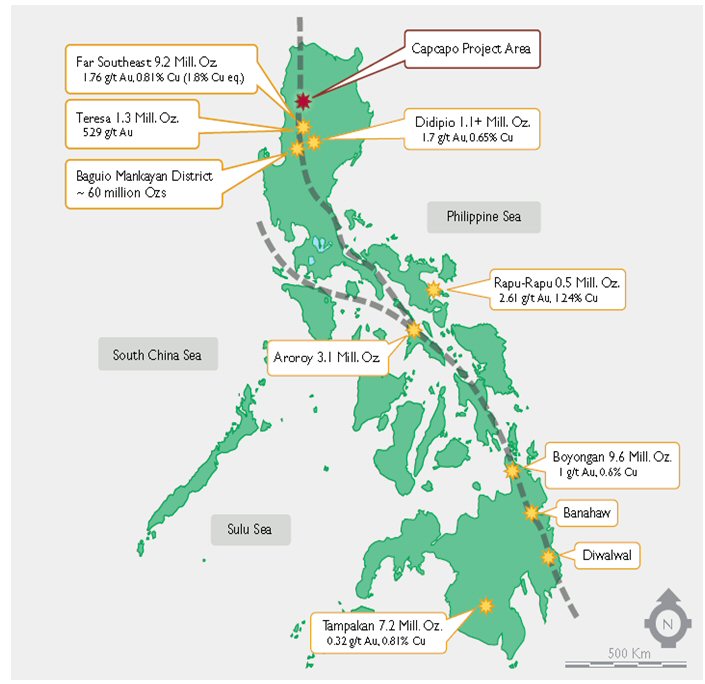

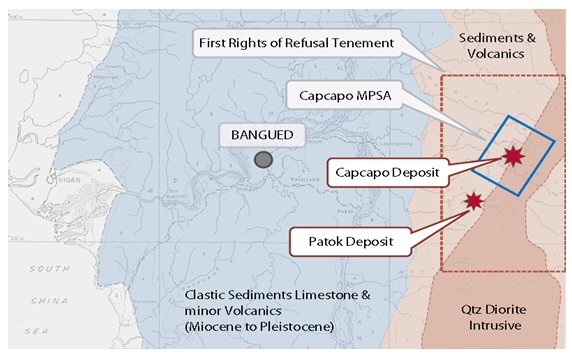

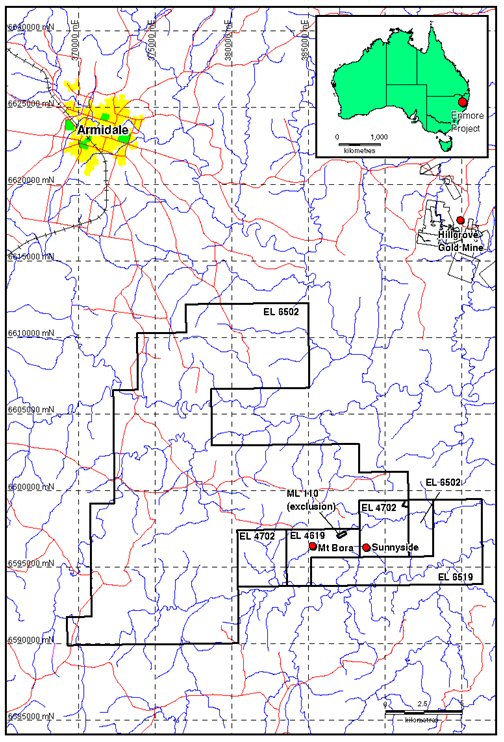

Political and economic instability in the jurisdictions in which the Company operates could make it more difficult or impossible for the Company to conduct its business activities. The Company’s exploration, development and operation activities occur in Malaysia, Vietnam, the Philippines and Australia. As such, the Company may be affected by possible political or economic instability in those countries. The risks include, but are not limited to, terrorism, military repression, fluctuations in currency exchange rates and high rates of inflation. Changes in resource development or investment policies or shifts in political attitude in those countries may prevent or hinder the Company’s business activities and render its properties unprofitable by preventing or impeding future property exploration, development or mining. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, restrictions on repatriation of earnings, royalties and duties, income taxes, nationalization of properties or businesses, expropriation of property, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. The laws on foreign investment and mining are still evolving in Vietnam and it is not known how they will evolve. The effect of these factors cannot be accurately predicted. There may be risks in Malaysia and the Philippines including nationality restriction in the ownership of mining properties regarding the payment of permitting fees and obtaining the free, prior and informed consent of affected indigenous peoples.

Vietnamese tax laws are open to interpretation and, with respect to mining and refining, there are no clear precedents to properly guide the Company’s tax policies. Management considers that the Company has made adequate provision for tax liabilities to the Vietnamese national, provincial and local authorities based on correspondence with such authorities, and on external advice received. However, because Vietnam’s tax laws, especially with respect to mining and refining, are evolving and open to interpretation, there is a risk that material additional and/or back-dated taxes and penalties may be levied on the Company, which could adversely impact its results of operations.

Exchange rate and interest rate fluctuations may increase the Company’s costs. The profitability of the Company may decrease when affected by fluctuations in the foreign currency exchange rates between the United States Dollar and the Canadian Dollar, Malaysian Ringgit, Vietnamese Dong, Philippines Peso and Australian Dollar. Exchange rate fluctuations affect the costs of exploration and development activities that the Company incurs in United States dollar terms. The Company does not currently take any steps to hedge against currency fluctuations. In the event of interest rates rising, the liabilities of the Company that are tied to market interest rates would increase the Company’s borrowing costs.

The Company’s stock price could be volatile. The market price of the Company’s common shares, like that of the common shares of many other natural resource companies, has been and is likely to remain volatile. Results of exploration and mining activities, the price of gold and silver, future operating results, changes in estimates of the Company’s performance by securities analysts, market conditions for natural resource shares in general, and other factors beyond the control of the Company, could cause a significant decline in the market price of the Company’s common shares and results in the need to revalue derivative liabilities.

In the US, the Company’s common shares are “Penny Stock” which imposes significant restrictions on broker-dealers recommending the stock for purchase. Securities and Exchange Commission (“SEC”) regulations define "penny stock" to include common stock that has a market price of less than $5.00 per share, subject to certain exceptions. These regulations include the following requirements: broker-dealers must deliver, prior to the transaction, a disclosure schedule prepared by the SEC relating to the penny stock market; broker-dealers must disclose the commissions payable to the broker-dealer and its registered representative; broker-dealers must disclose current quotations for the securities; if a broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealers presumed control over the market; and a broker-dealer must furnish its customers with monthly statements disclosing recent price information for all penny stocks held in the customer’s account and information on the limited market in penny stocks. Additional sales practice requirements are imposed on broker-dealers who sell penny stocks to persons other than established customers and accredited investors. For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and must have received the purchaser’s written consent to the transaction prior to sale. For so long as the Company’s common shares are subject to these penny stock rules, these disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the shares. Accordingly, this may result in a lack of liquidity in the common shares and investors may be unable to sell their shares at prices considered reasonable by them.

The Company may not be able to comply with the requirements of Section 404 of the Sarbanes-Oxley Act. Section 404 of the Sarbanes-Oxley Act of 2002 (‘‘SOX’’) requires an annual assessment by management of the effectiveness of the Company’s internal control over financial reporting. Section 404 of SOX also requires an annual attestation report by the Company’s independent auditors addressing the effectiveness of the Company’s internal control over financial reporting. The Company has completed its Section 404 assessment and received the auditors’ attestation as of June 30, 2012.

If the Company fails to maintain the adequacy of its internal control over financial reporting, as such standards are modified, supplemented or amended from time to time, the Company may not be able to conclude that it has effective internal control over financial reporting in accordance with Section 404 of SOX. The Company’s failure to satisfy the requirements of Section 404 of SOX on an ongoing, timely basis could result in the loss of investor confidence in the reliability of its financial statements, which in turn could harm the Company’s business and negatively impact the trading price of its common shares and securities convertible or exchangeable for common shares. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm the Company’s operating results or cause it to fail to meet its reporting obligations. Future acquisitions of companies may provide the Company with challenges in implementing the required processes, procedures and controls in its acquired operations. Acquired companies may not have disclosure controls and procedures or internal control over financial reporting that are as thorough or effective as those required by securities laws currently applicable to the Company. No evaluation can provide complete assurance that the Company’s internal control over financial reporting will prevent misstatement due to error or fraud or will detect or uncover all control issues or instances of fraud, if any. The effectiveness of the Company’s controls and procedures could also be limited by simple errors or faulty judgments. In addition, as the Company continues to expand, the challenges involved in maintaining adequate internal control over financial reporting will increase and will require that the Company continue to improve its internal control over financial reporting. Although the Company intends to devote substantial time and incur substantial costs, as necessary, to ensure ongoing compliance, the Company cannot be certain that it will be successful in continuing to comply with Section 404 of SOX.

The Company does not plan to pay any dividends in the foreseeable future. The Company has not paid a dividend in the past and it is unlikely that the Company will declare or pay a dividend for the foreseeable future. The declaration, amount and date of distribution of any dividends in the future will be decided by the Board of Directors from time-to-time, based upon, and subject to, the Company’s earnings, financial requirements, loan covenants and other conditions prevailing at the time.

Shareholders could suffer dilution of the value of their investment if the Company issues additional shares. There are a number of outstanding securities and agreements pursuant to which common shares may be issued in the future, including pursuant to the Convertible Notes, stock options and warrants. If these shares are issued, this may result in further dilution to the Company’s shareholders.

In the event that key employees leave the Company or its subsidiaries, the Company would be harmed since it is heavily dependent upon them for all aspects of the Company’s activities. The Company is dependent on key employees and contractors, and on a relatively small number of key directors and officers, the loss of any of whom could have, in the short-term, a negative impact on the Company’s business and results of operations. The Company has a consulting agreement or employment agreement, as applicable, with each of the Company’s officers.

Management may be subject to conflicts of interest due to their affiliations with other resource companies. Because some of the Company directors and officers have private mining interests and also serve as officers and/or directors of other public mining companies, their personal interests may be in conflict with the interests of the Company. Because of their activities, situations may arise where these persons are presented with mining opportunities, which may be desirable for the Company, as well as other companies in which they have an interest, to pursue. If the Company is unable to pursue such opportunities because of its officers’ and/or directors’ conflicts, this would reduce the Company’s opportunities to increase its future profitability and revenues. In addition to competition for suitable mining opportunities, the Company competes with these other companies for investment capital, and technical resources, including geologists, metallurgists, mining engineers and others. Similarly, if the Company is unable to obtain necessary investment capital and technical resources because of its officers’ and directors’ conflicts, the Company would not be able to obtain potential profitable properties or interests which would reduce the Company’s opportunities to increase its future revenues and income. Any material potential conflicts of interest is directed to the Company’s board of directors and is resolved on a case by case basis in accordance with applicable Canadian law. In addition, each of the directors is required to declare and refrain from voting on any matter in which such directors may have a conflict of interest in accordance with the procedures set forth in applicable laws. Nevertheless, potential conflicts of interests could deny the Company access to important corporate opportunities.

Future sales of common shares by existing shareholders could decrease the trading price of the common shares. Sales of large quantities of the common shares in the public markets or the potential of such sales could decrease the trading price of the common shares and could impair the Company’s ability to raise capital through future sales of common shares.

The profitability of the Company’s operations and the cash flow generated by these operations are significantly affected by fluctuations in input production prices, many of which are linked to the prices of oil and steel. Fuel, energy and consumables, including diesel, heavy fuel oil, chemical reagents, explosives, tires, steel and mining equipment consumed in mining operations form a relatively large part of the operating costs and/or capital expenditures of any mining company. The Company has no influence over the cost of these consumables, many of which are linked to some degree to the price of oil and steel.

The price of oil has recently been volatile. The Company’s mines at Bong Mieu and Phuoc Son are most vulnerable to changes in the price of oil. Furthermore, the price of steel which is used in the manufacture of most forms of fixed and mobile mining equipment is also a relatively large contributor to the operating costs and capital expenditure of a mining company and has also been volatile recently.

Fluctuations in the price of oil and steel have a significant impact upon operating cost and capital expenditure estimates and, in the absence of other economic fluctuations, could result in significant changes in the total expenditure estimates for new mining projects or render certain projects not viable.

Inflation may have a material adverse effect on the Company’s operational results. Most of the Company’s operations are located in countries that have experienced high rates of inflation during certain periods. Since the Company is unable to influence the market price at which it sells gold, it is possible that significantly higher future inflation in the countries in which the Company operates may result in an increase in future operational costs in local currencies without a concurrent devaluation of the local currency of operations against the dollar or an increase in the dollar price of gold. This could have a material adverse effect upon the Company’s results of operations and its financial condition. Significantly higher and sustained inflation in the future, with a consequent increase in operational costs, could result in operations being reduced or rationalized at higher cost mines.

Mining companies such as the Company are increasingly required to consider and ensure the sustainable development of, and provide benefits to, the communities and countries in which they operate. As a result of public concern about the perceived ill effects of economic globalization, businesses generally and multinational corporations such as the Company face increasing public scrutiny of their activities. These businesses are under pressure to demonstrate that, as they seek to generate satisfactory returns on investment to shareholders, other stakeholders, including employees, communities surrounding operations and the countries in which they operate, benefit and will continue to benefit from their commercial activities. Such pressure tends to be particularly focused on companies whose activities are perceived to have a high impact on their social and physical environment. The Company’s failure to adequately perceive and address these pressures could lead to reputational damage, legal suits and social spending obligations.

In addition, the location of mining operations often coincides with the location of existing towns and villages, natural water courses and other infrastructure. Mining operations must therefore be designed to minimize their impact on such communities and the environment, either by changing mining plans to avoid any such impact, modifying mining plans and operations, or relocating the relevant people to an agreed location. These measures may include agreed levels of compensation for any adverse impact the mining operation may continue to have upon the community. The Company is subject to the above factors at its mining and exploration sites. The cost of these measures could increase capital and operating costs and therefore could have an adverse impact upon the Company’s results of operations.

ITEM 4: INFORMATION ON THE COMPANY

4A. History and Development of the Company

Olympus Pacific Minerals Inc. was formed under the laws of the Province of Ontario, Canada on July 4, 1951 under the name “Meta Uranium Mines Limited”. Effective August 24, 1978, the Company changed its name from “Meta Uranium Mines Limited” to “Metina Developments Inc.” The Company reincorporated under the Company Act (British Columbia) under the name “Olympus Holdings Ltd.” on November 5, 1992 and simultaneously consolidated its share capital on a 4.5:1 basis. The Company further consolidated its share capital on a 3:1 basis and changed its name from “Olympus Holdings Ltd.” to “Olympus Pacific Minerals Inc.” on November 29, 1996. The Company was continued under the Business Corporations Act (Yukon) on November 17, 1997 and the Canada Business Corporations Act on July 13, 2006.

Operations in Vietnam

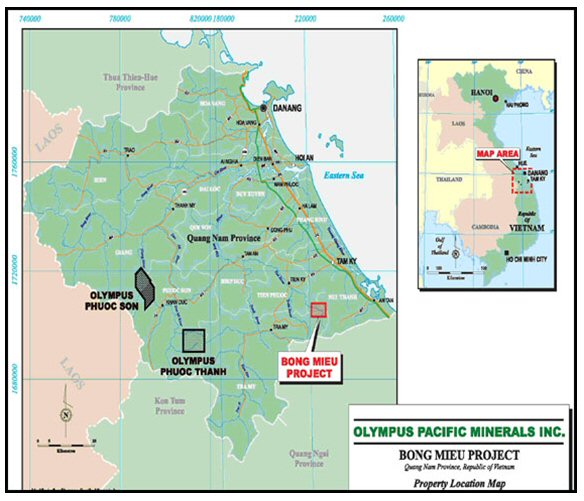

On February 26, 1997, as subsequently amended on August 18, 1997, the Company entered into an agreement with Ivanhoe Mines Limited (formerly Indochina Goldfields Ltd., “Ivanhoe”) and Zedex Ltd. (formerly Iddison Group Vietnam Limited, Iddison Holdings Limited, Iddison Limited and IT Capital Limited, with the agreement being referred to herein as the “Ivanhoe Agreement”). Pursuant to the Ivanhoe Agreement, which closed on September 11, 1997, the Company acquired from Ivanhoe all of the shares of Formwell Holdings Limited (“Formwell”), which holds 100% of the shares of Bong Mieu Holdings Limited, which in turn holds 80% of the shares of Bong Mieu Gold Mining Company Limited (“Bogomin”). Bogomin, together with then local and national branches of the government of the Socialist Republic of Vietnam, holds various mining and exploration licenses comprising the Bong Mieu gold property in Quang Nam-Da Nang Province in the Socialist Republic of Vietnam. Refer to Item 4D for further details on the Bong Mieu Gold Property.

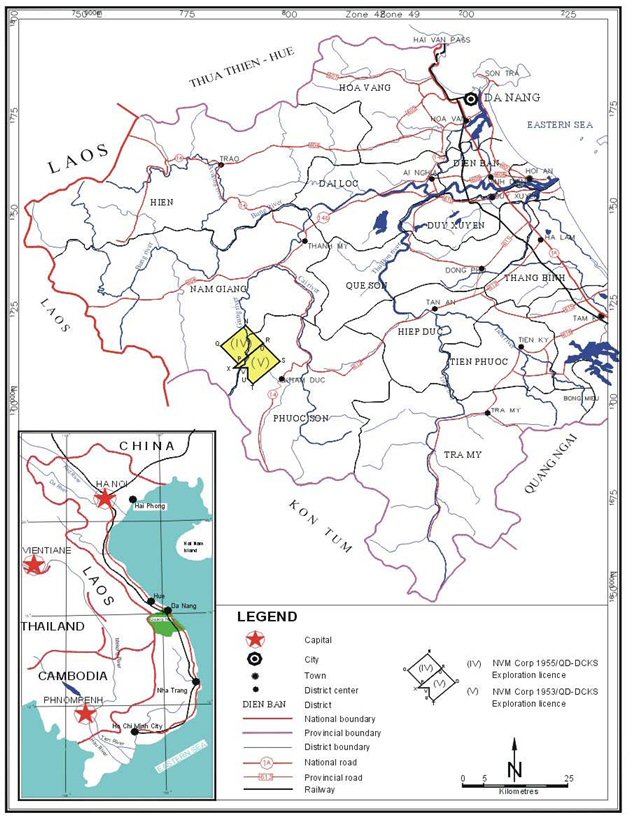

Also in September 1997, the Company acquired an interest in the Phuoc Son Gold Property by entering into a joint venture agreement with Ivanhoe and Zedex Ltd., regarding a joint venture company, New Vietnam Mining Corporation (“NVMC”), which holds an 85% interest in the Phuoc Son Gold Property. Initially, NVMC was comprised of the Company (57.18%), Ivanhoe (32.64%) and Zedex Ltd. (10.18%) with the Company as the operator of the project.

In 2003, NVMC, entered into a joint venture agreement with Mien Trung Industrial Company (“MINCO”), a mining company then controlled by the local provincial government, resulting in the formation of the Phuoc Son Gold Company Limited (“PSGC”) for the purposes of exploration and extraction activities and any other related activities.

On March 1, 2004, the Company entered into a Vend-in Agreement and, on June 21, 2004, an Extension of Vend-in Agreement, with Ivanhoe and Zedex Ltd. (the “Vendors”) to acquire the remaining 42.82% interest held by the Vendors in NVMC. The sale was concluded in June 2004, resulting in the Company owning 100% of NVMC, which owns 85% of PSGC. MINCO currently owns 15% of PSGC. Refer to Item 4D for further details on the Phuoc Son Gold Property.

The Company commenced production at the Bong Mieu Gold Property with the construction of the Bong Mieu Central Gold Mine (Ho Gan) which was completed in 2006. The Bong Mieu Underground project was subsequently placed into commercial production on April 1, 2009.

Following the receipt by the Company on March 26, 2008 of a positive independent feasibility study, the Company determined to construct a plant at the Phuoc Son Gold Property. The Company partially funded the plant construction by the treatment of high-grade ore from Phuoc Son’s Dak Sa deposit at the Bong Mieu gold processing plant on a toll treatment basis.

In March 2010, the Company obtained private placement funding of CAD$12,750,000. The net funds were used towards the establishment of the Phuoc Son processing plant. The financing was in the form of nine percent unsecured convertible promissory notes which mature on March 26, 2014. The holders are entitled to convert the notes and any accrued interest owing at a conversion rate of CAD$0.42 per common share.

In June 2010, the Company obtained further private placement funding of US$21,960,000. The net proceeds also were used towards the construction of the Phuoc Son processing plant and for general exploration and corporate purposes. The financing was in the form of gold delivery notes which mature on May 31, 2013, bear interest at a rate of eight percent and obligate the Company to physically deliver gold in six semi-annual increments of which two deliveries remain.

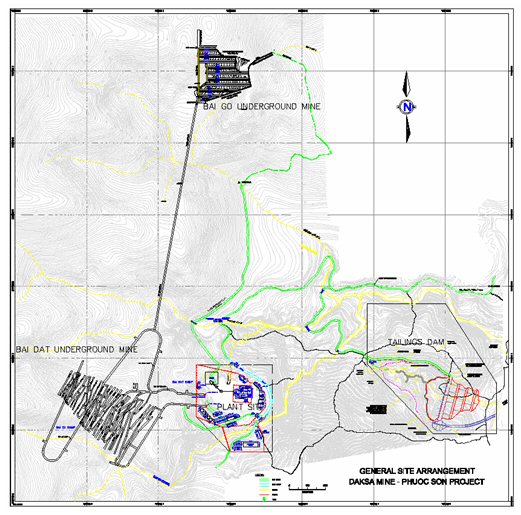

The Phuoc Son gold plant was commissioned in June 2011, has been in commercial production since July 1, 2011 and achieved full scale processing in the fourth quarter, 2011 processing order from the South Deposit (Bai Dat) at the Dak Sa area. Commercial production from the North Deposit (Bai Go) at the Dak Sa area commenced in July 2012. The principal capital expenditures relating to the new Phuoc Son plant include infrastructure, machinery and equipment and buildings, which total $27M.

Effective January 1, 2011, the Vietnamese government imposed a 10% gold export tax. As a result, the Company refines all gold from the Company’s Vietnam mines in Vietnam to 99.99 gold, pursuant to an agreement with a local Vietnamese refinery, which enables the Company to export gold from Vietnam without incurring the export tax.

Operations in Malaysia

The Company’s initial interest in North Borneo Gold Sdn Bhd (a Malaysian company, hereinafter referred to as “NBG”) came about as a result of the Company’s amalgamation with Zedex Minerals Limited (“Zedex”) on January 12, 2010. NBG is governed by a joint venture agreement between the Company and a local Malaysian company and is the operator of the Bau Gold Project.

The Bau Gold Project comprises consolidated mining and exploration tenements that collectively cover more than 1,340 km2 of the most highly-prospective ground within the historic Bau Goldfield, in Sarawak, East Malaysia. This goldfield has been operating since 1864, with estimated historic gold production of approximately 3-4 million oz. gold of which approximately two million oz. of gold production has been recorded.

On September 30, 2010 (as amended on May 20, 2011 and further amended on January 20, 2012), the Company entered into an agreement to acquire a further 43.50% interest in NBG. The settlement is to be paid in several tranches as set out below and will bring the Company’s effective interest to 93.55% by January 2014.

| | | Purchase Price | | Purchase Date | | North Borneo Gold Sdn Bhd Class A Shares | | | Company's Effective Holding | |

| Tranche 1 | | $ | 7,500,000 | | 9/30/2010 | | | 31,250 | | | | 62.55 | % |

| Tranche 2 | | $ | 7,500,000 | | 10/30/2010 | | | 31,250 | | | | 75.05 | % |

| Tranche 3a | | $ | 6,000,000 | | 5/20/2011 | | | 13,700 | | | | 80.53 | % |

| Tranche 3b | | $ | 3,000,000 | | 1/20/2012 | | | 6,800 | | | | 83.25 | % |

| Tranche 3c | | $ | 2,000,000 | | 1/28/2013 | | | 4,500 | | | | 85.05 | % |

| Tranche 4a | | $ | 3,000,000 | | 9/13/2013 | | | 7,000 | | | | 87.85 | % |

| Tranche 4b | | $ | 6,000,000 | | 1/21/2014 | | | 14,250 | | | | 93.55 | % |

| | | | | | | | | | | | | | |

| | | | | | | | | 108,750 | | | | 93.55 | % |