Interface Systems Holdings, Inc. February 25, 2015 2014 Business Update

2 Interface Security Systems ® 2015 This communication includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding, among other things, our plans, strategies and prospects, both business and financial. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions including, without limitation, the factors described under “Risk Factors” from time to time in our filings with the Securities Exchange Commission (“SEC”). Many of the forward-looking statements contained in this presentation may be identified by the use of forward-looking words such as “may,” “could,” “would,” “should,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “intend,” “understand,” among others. Important factors that could cause actual results to differ materially from the forward-looking statements we make in this presentation are set forth in other reports or documents that we file from time to time with the SEC, and include, but are not limited to: • our ability to compete effectively in a highly-competitive industry; • catastrophic events that may disrupt our business; • our ability to retain customers; • concentration of recurring monthly revenue (“RMR”) in a few top customers and concentration of our business in certain markets; • our ability to manage relationships with third-party providers, including telecommunication providers and broadband service providers; • our inability to maintain compliance with various covenants under our revolving credit facility to borrow funds; • restrictions in the indenture governing the 12.50% / 14.50% Senior Contingent Cash Pay Notes of Interface Master Holdings, Inc. on our ability to incur additional funded debt, other than amounts available under our revolving credit facility; • our reliance on third party component providers and the risk associated with any failure or interruption in products or services provided by these third parties; • our reliance on third party software and service providers; • our ability to obtain or maintain necessary governmental licenses and comply with applicable laws and regulations; • changes in governmental regulation of communication monitoring; • our reliance on network and information systems and other technologies and our ability to manage disruptions caused by cyber-attacks, failure or destruction of our networks, systems, technologies or properties; • macroeconomic factors; • economic, credit, financial or other risks affecting our customers and their ability to pay us; • the uncertainty of our future operating results; • our ability to attract, train and retain an effective sales force; and • the loss of our senior management. All forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by this cautionary statement. We are under no duty or obligation to update any of the forward-looking statements after the date of this communication. Cautionary Statement Regarding Forward-Looking Statements

3 Interface Security Systems ® 2015 Business Overview Interface Security Systems Holdings, Inc. (“Interface”) provides security and life safety systems, interactive video monitoring, private secure managed broadband and other IP managed services Our diverse customer base includes large multi-site commercial enterprises in the retail, hospitality, restaurant, QSR, convenience store and other industry vertical sectors Our established sales, installation and service infrastructure provides the capability to manage large national account deployments and the addition of new customers to our existing infrastructure at low incremental costs as well as provide ongoing system maintenance and support Our customer retention rate is among the highest in the industry (measured by RMR attrition) We enter into long-term (on average four years or more) contracts with our customers o Through our bundled service offering, we are able to reduce the number of vendors our customers must utilize and consolidate billing and services to a single vendor o Our standardized contracts and service level agreements reduce administrative costs while ensuring uniform service standards for multi-site customers o We design and install all of the required equipment (both hardware and software) for our bundled service offering We have channel partnership agreements in place with companies such as Cisco Systems, Honeywell Security (named Dealer of the Year for 2014) Cradlepoint (named Partner of the Year 2014), and Verizon Wireless to expand our national sales reach at minimal incremental cost Our focus on technology enabled bundled service offerings and industry verticals generates high ARPU and attractive dollar margins while minimizing capital requirements associated with customer acquisition

4 Interface Security Systems ® 2015 Business Update - RMR As of 12/31/14, actively billing $8.4M RMR o Commercial customers represent 91% of RMR; residential customers 9% of RMR o ARPU of $109.16 per month ($147.67 for commercial; $30.88 for residential) Top 10 customers accounted for 54.5% of total RMR o Approximately 19.5% of our total RMR was attributable to our largest customer o Average relationship length of 8 years Total of 77,400 customer sites; 33% residential / 67% commercial Approximately 43.2% of commercial customer sites subscribed to more than one service offering; 35.3% adopted our secured managed broadband service offering with other bundled services

5 Interface Security Systems ® 2015 Business Update - Attrition Average net attrition rate of 10.4% as of 12/31/14 vs. 10.0% 12/31/13. Attrition dollars decreased by $0.1M in 2014 vs. 2013. Several large customers were cancelled: o Local west coast fire alarm service customer with $40K RMR switched providers through a “low” bid process in 4Q14 o National account customer with $9K of RMR sold off all corporate owned stores to franchisees 4Q14. We retained the largest franchise owner with 100 locations. In 2015, we will provide a service bundle to this franchise owner of 100 Digital Witness sites as well as 200 other sites they currently own. The added sites and bundled RMR will more than replace the $9K RMR lost o YTD net attrition is 9.7% adjusted for these two customers Our national account customers with IP related bundled services (which excludes Digital Witness) are our “stickiest” with a twelve month average net attrition rate of 7.9% as of 12/31/14

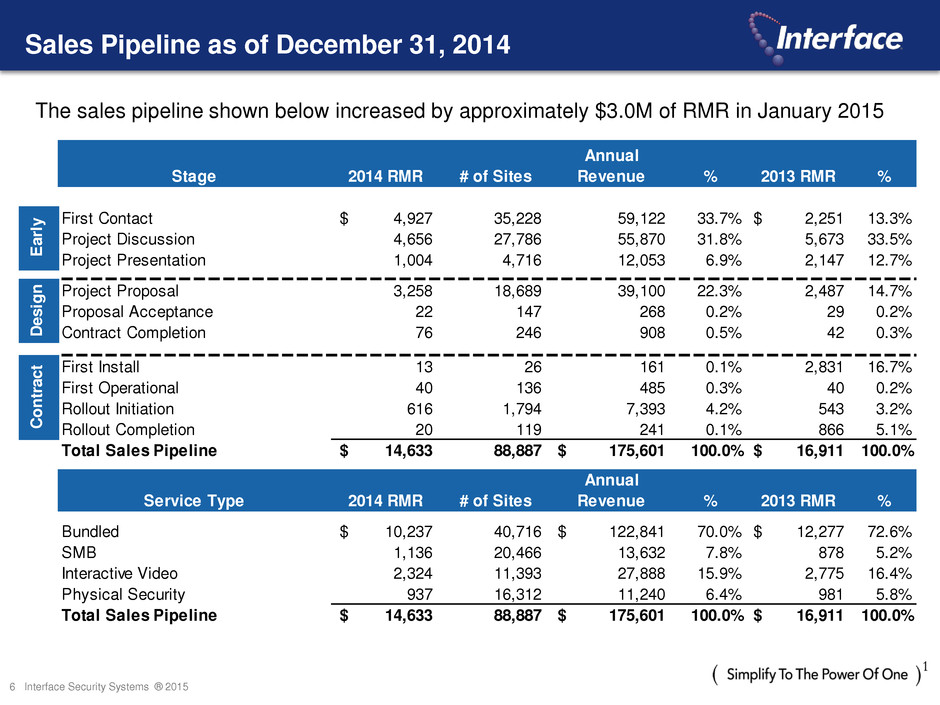

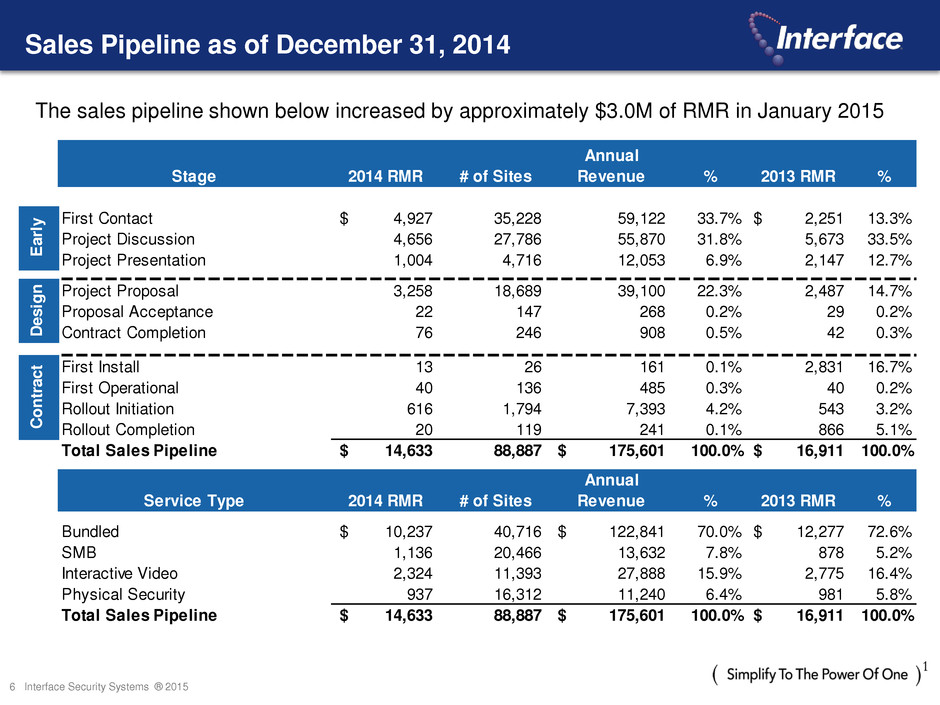

6 Interface Security Systems ® 2015 Sales Pipeline as of December 31, 2014 The sales pipeline shown below increased by approximately $3.0M of RMR in January 2015 Stage 2014 RMR # of Sites Annual Revenue % 2013 RMR % First Contact 4,927$ 35,228 59,122 33.7% 2,251$ 13.3% Project Discussion 4,656 27,786 55,870 31.8% 5,673 33.5% Project Presentation 1,004 4,716 12,053 6.9% 2,147 12.7% Project Proposal 3,258 18,689 39,100 22.3% 2,487 14.7% Proposal Acceptance 22 147 268 0.2% 29 0.2% Contract Completion 76 246 908 0.5% 42 0.3% First Install 13 26 161 0.1% 2,831 16.7% First Operational 40 136 485 0.3% 40 0.2% Rollout Initiation 616 1,794 7,393 4.2% 543 3.2% Rollout Completion 20 119 241 0.1% 866 5.1% Total Sales Pipeline 14,633$ 88,887 175,601$ 100.0% 16,911$ 100.0% Service Type 2014 RMR # of Sites Annual Revenue % 2013 RMR % Bundled 10,237$ 40,716 122,841$ 70.0% 12,277$ 72.6% SMB 1,136 20,466 13,632 7.8% 878 5.2% Interactive Video 2,324 11,393 27,888 15.9% 2,775 16.4% Physical Security 937 16,312 11,240 6.4% 981 5.8% Total Sales Pipeline 14,633$ 88,887 175,601$ 100.0% 16,911$ 100.0% Co nt ra ct Ea rly De sig n

7 Interface Security Systems ® 2015 Interface Proximity and Mobile Analytics • Beacon triggered messages recognize, track and engage customers • Targeting offers and customer messages to personalize shopping • Driving sales and collecting data about customer shopping behavior • Raise conversion rates beyond coupons and flyers • Measure traffic flow, dwell, demographics, redemption, and conversion rates instantly • Combine with loyalty programs and store apps • Business Insider Inc. estimates 1% of store sales for top-100 US retailers will be influenced by Beacon triggered messages with a total addressable market of 6% of sales volume • Significant RMR growth opportunity Introducing Bluetooth Low Energy Beacon Network and mobile platform for Retail Applications

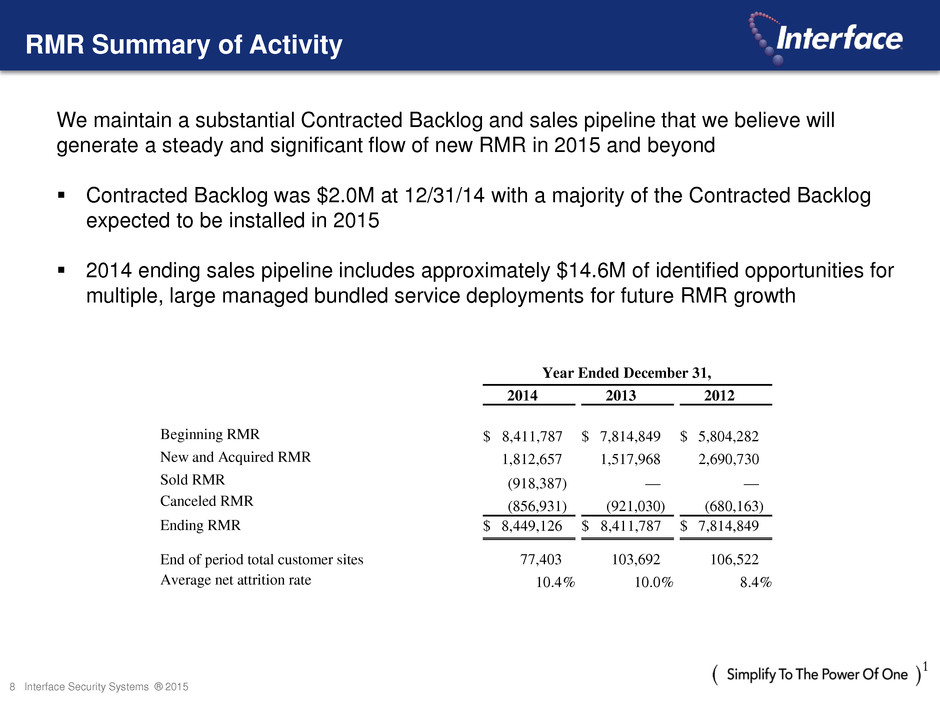

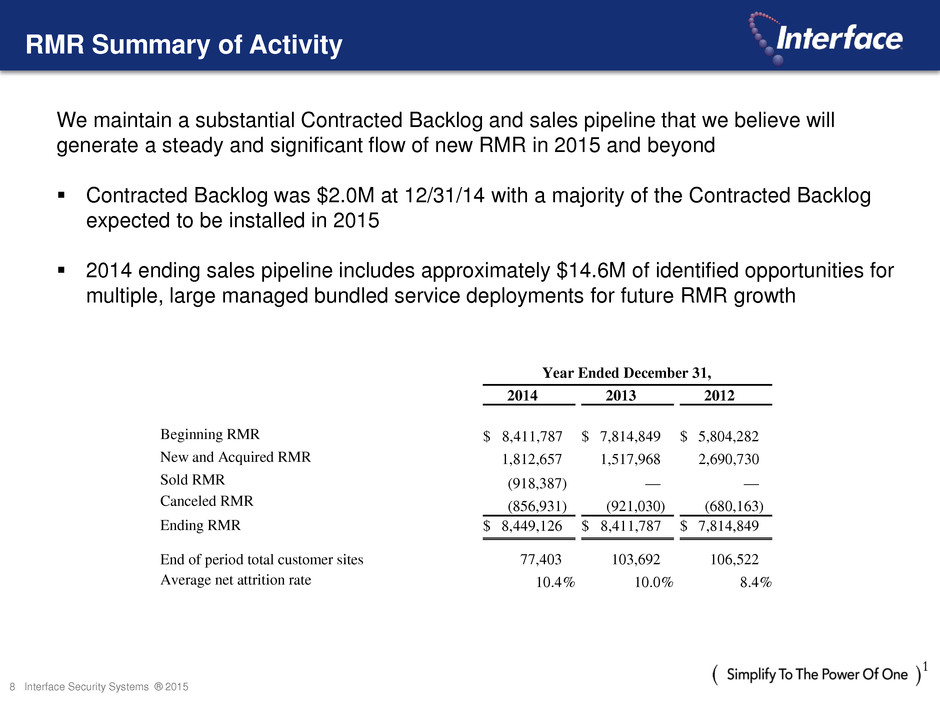

8 Interface Security Systems ® 2015 RMR Summary of Activity Year Ended December 31, 2014 2013 2012 Beginning RMR $ 8,411,787 $ 7,814,849 $ 5,804,282 New and Acquired RMR 1,812,657 1,517,968 2,690,730 Sold RMR (918,387 ) — — Canceled RMR (856,931 ) (921,030 ) (680,163 ) Ending RMR $ 8,449,126 $ 8,411,787 $ 7,814,849 End of period total customer sites 77,403 103,692 106,522 Average net attrition rate 10.4 % 10.0 % 8.4 % We maintain a substantial Contracted Backlog and sales pipeline that we believe will generate a steady and significant flow of new RMR in 2015 and beyond Contracted Backlog was $2.0M at 12/31/14 with a majority of the Contracted Backlog expected to be installed in 2015 2014 ending sales pipeline includes approximately $14.6M of identified opportunities for multiple, large managed bundled service deployments for future RMR growth

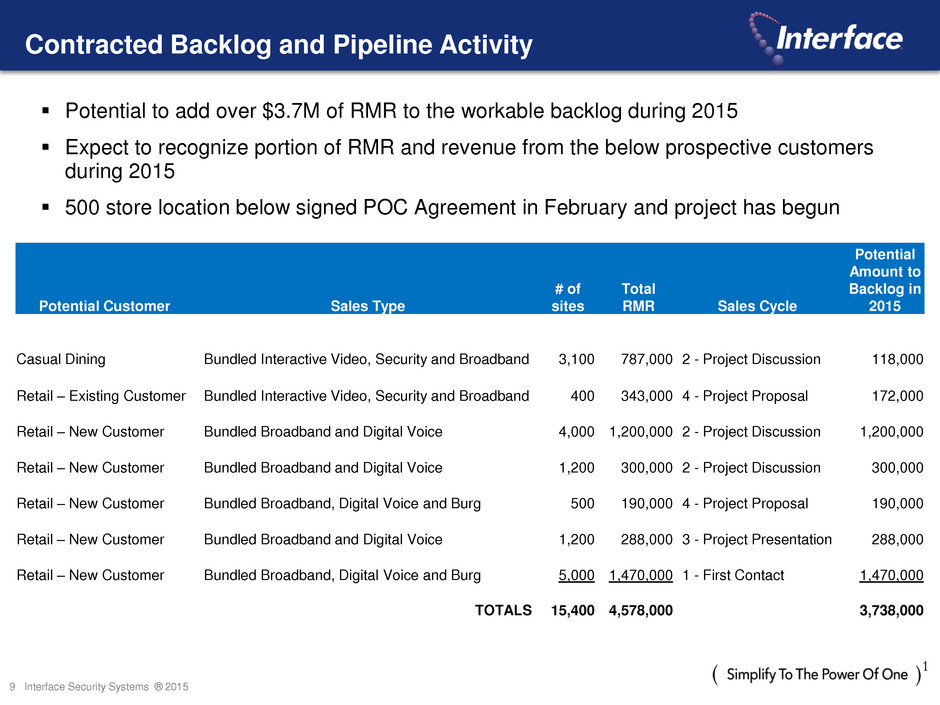

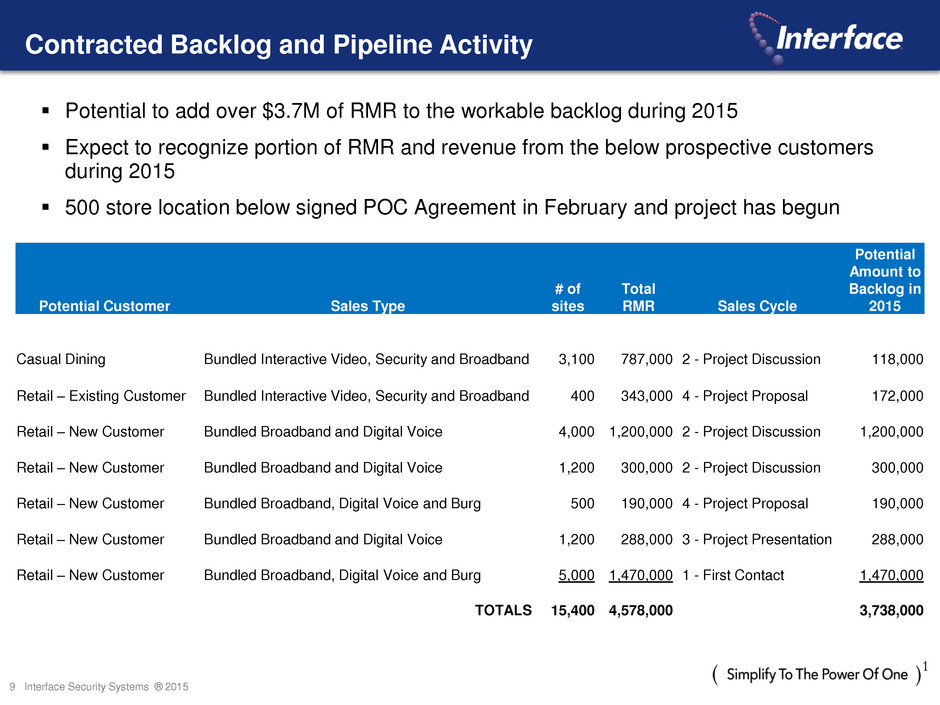

9 Interface Security Systems ® 2015 Contracted Backlog and Pipeline Activity Potential to add over $3.7M of RMR to the workable backlog during 2015 Expect to recognize portion of RMR and revenue from the below prospective customers during 2015 500 store location below signed POC Agreement in February and project has begun Potential Customer Sales Type # of sites Total RMR Sales Cycle Potential Amount to Backlog in 2015 Casual Dining Bundled Interactive Video, Security and Broadband 3,100 787,000 2 - Project Discussion 118,000 Retail – Existing Customer Bundled Interactive Video, Security and Broadband 400 343,000 4 - Project Proposal 172,000 Retail – New Customer Bundled Broadband and Digital Voice 4,000 1,200,000 2 - Project Discussion 1,200,000 Retail – New Customer Bundled Broadband and Digital Voice 1,200 300,000 2 - Project Discussion 300,000 Retail – New Customer Bundled Broadband, Digital Voice and Burg 500 190,000 4 - Project Proposal 190,000 Retail – New Customer Bundled Broadband and Digital Voice 1,200 288,000 3 - Project Presentation 288,000 Retail – New Customer Bundled Broadband, Digital Voice and Burg 5,000 1,470,000 1 - First Contact 1,470,000 TOTALS 15,400 4,578,000 3,738,000

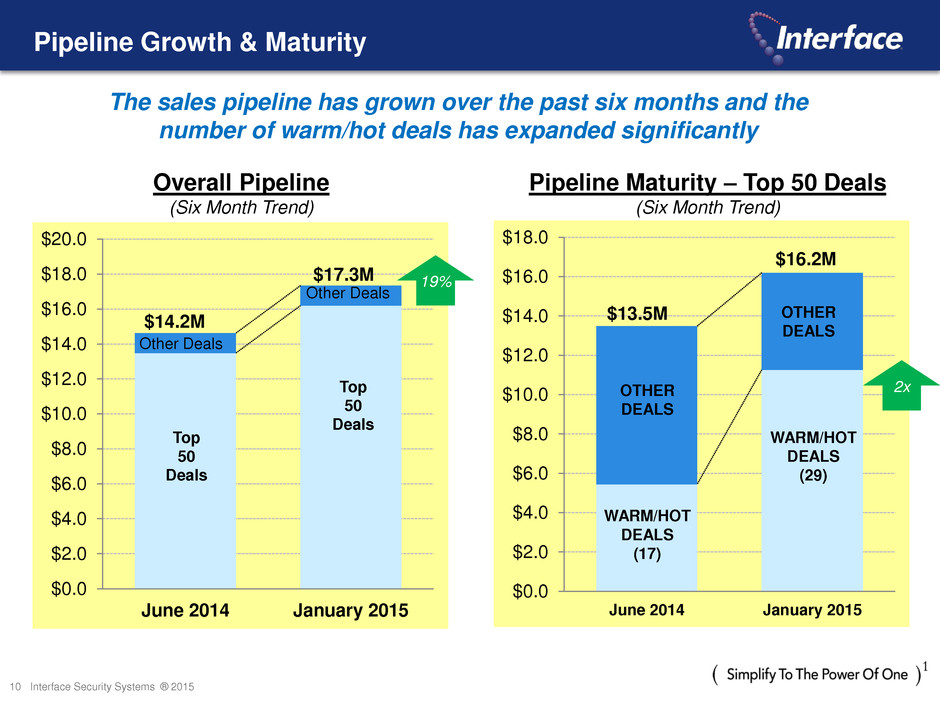

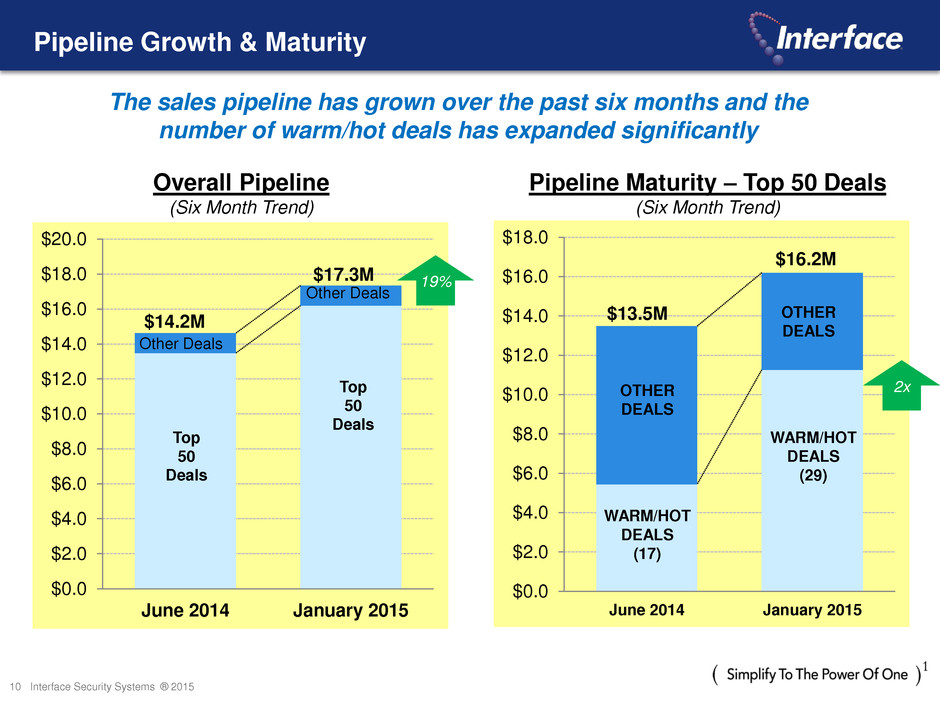

10 Interface Security Systems ® 2015 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 June 2014 January 2015 Overall Pipeline (Six Month Trend) Pipeline Maturity – Top 50 Deals (Six Month Trend) Pipeline Growth & Maturity The sales pipeline has grown over the past six months and the number of warm/hot deals has expanded significantly OTHER DEALS $16.2M $13.5M 2x $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 June 2014 January 2015 Top 50 Deals Other Deals $17.3M $14.2M 19% WARM/HOT DEALS (29) Top 50 Deals Other Deals OTHER DEALS WARM/HOT DEALS (17)

11 Interface Security Systems ® Interface & Family Dollar

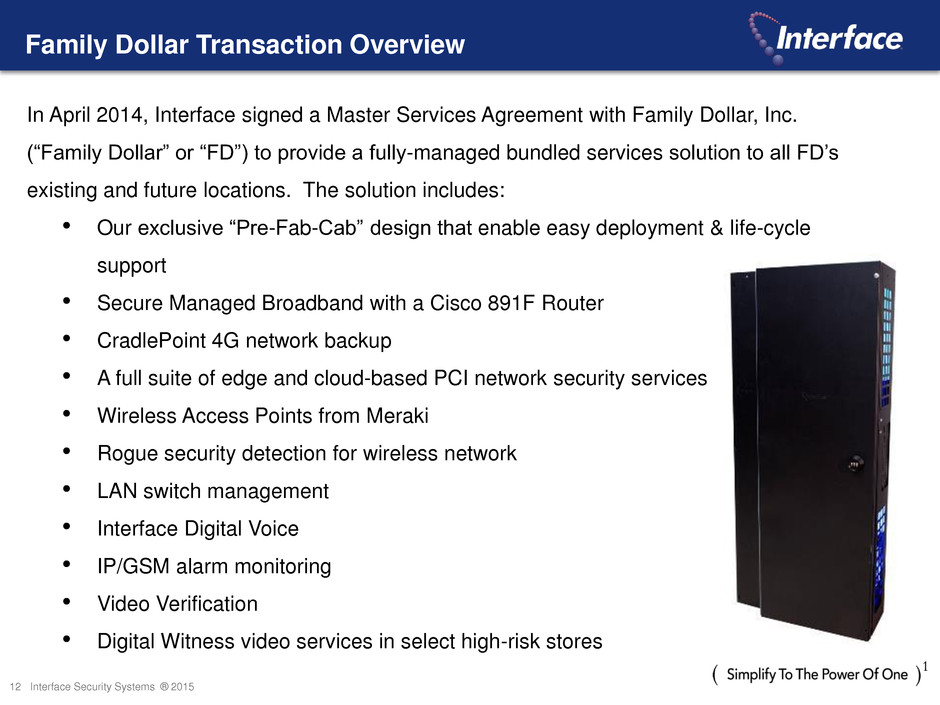

12 Interface Security Systems ® 2015 Family Dollar Transaction Overview In April 2014, Interface signed a Master Services Agreement with Family Dollar, Inc. (“Family Dollar” or “FD”) to provide a fully-managed bundled services solution to all FD’s existing and future locations. The solution includes: • Our exclusive “Pre-Fab-Cab” design that enable easy deployment & life-cycle support • Secure Managed Broadband with a Cisco 891F Router • CradlePoint 4G network backup • A full suite of edge and cloud-based PCI network security services • Wireless Access Points from Meraki • Rogue security detection for wireless network • LAN switch management • Interface Digital Voice • IP/GSM alarm monitoring • Video Verification • Digital Witness video services in select high-risk stores

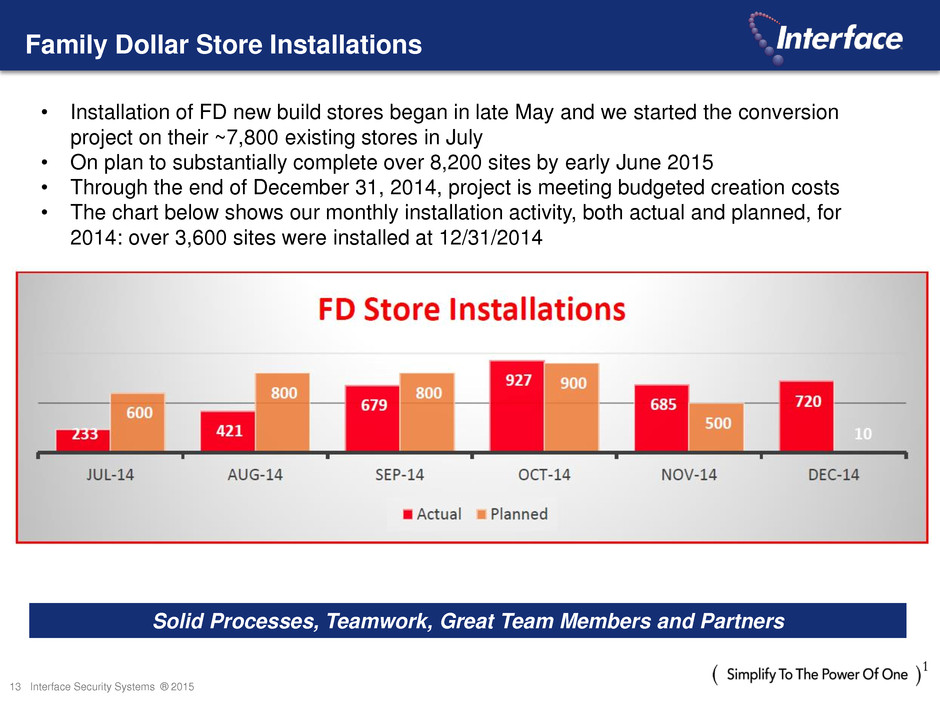

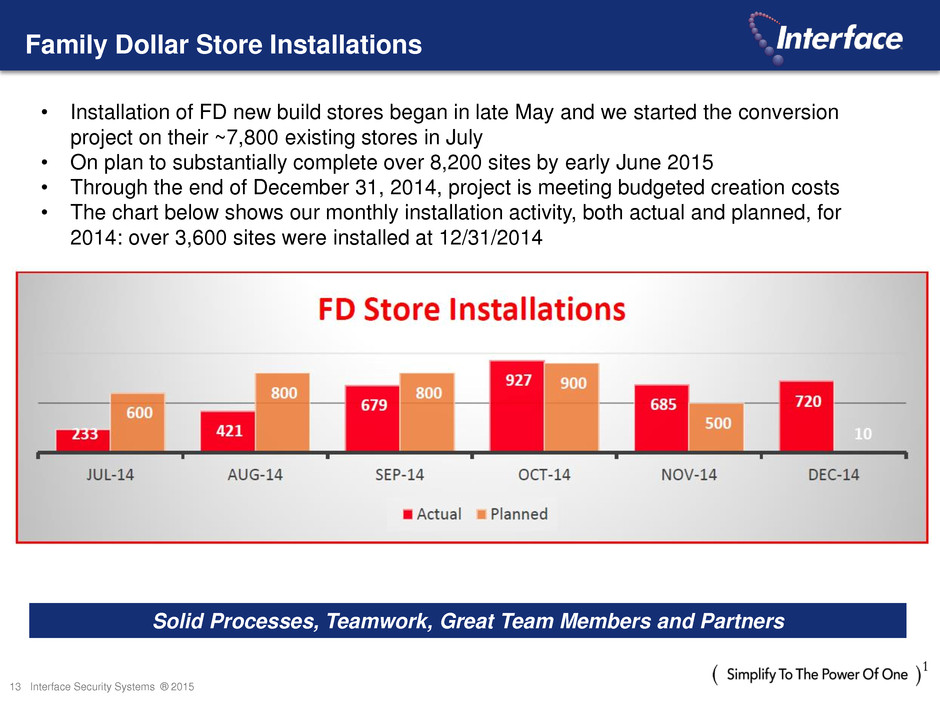

13 Interface Security Systems ® 2015 Family Dollar Store Installations • Installation of FD new build stores began in late May and we started the conversion project on their ~7,800 existing stores in July • On plan to substantially complete over 8,200 sites by early June 2015 • Through the end of December 31, 2014, project is meeting budgeted creation costs • The chart below shows our monthly installation activity, both actual and planned, for 2014: over 3,600 sites were installed at 12/31/2014 Solid Processes, Teamwork, Great Team Members and Partners

14 Interface Security Systems ® 2015 Summary • Bundled service offerings are gaining broader market acceptance as evidenced by 2014 RMR growth and pipeline expansion • Channel partners are a growing part of our sales ecosystem generating leads and referrals • Gross and net RMR growth up in 2014 over 2013 • Pipeline is robust, maturing and expanding • Family Dollar deployment is on schedule and on budget • Ongoing investments in new product developments and infrastructure • Uniquely equipped to meet the rapidly changing technology demands of today’s retail, commercial and small business enterprises • Expect strong sales results in 2015 • Estimated release of 4th quarter and year end 2014 financial results end of March 2015

www.interfacesystems.com