Interface Systems Holdings, Inc. February 18, 2016 2015 Business Update

2 Interface Security Systems ® 2015 This communication includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding, among other things, our plans, strategies and prospects, both business and financial. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions including, without limitation, the factors described under “Risk Factors” from time to time in our filings with the Securities Exchange Commission (“SEC”). Many of the forward-looking statements contained in this presentation may be identified by the use of forward-looking words such as “may,” “could,” “would,” “should,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “intend,” “understand,” among others. Important factors that could cause actual results to differ materially from the forward-looking statements we make in this presentation are set forth in other reports or documents that we file from time to time with the SEC, and include, but are not limited to: • our inability to maintain compliance with various covenants under the Revolving Credit Facility to borrow funds; • restrictions in the indentures governing the senior notes issued by Interface Grand Master Holdings, Inc. and the senior notes issued by Interface Master Holdings, Inc. on our ability to incur additional funded debt, other than amounts available under the Revolving Credit Facility; • our ability to compete effectively in a highly-competitive industry; • catastrophic events that may disrupt our business; • our ability to retain customers; • concentration of recurring monthly revenue (“RMR”) in a few top customers and concentration of our business in certain markets; • our ability to manage relationships with third-party providers, including telecommunication providers and broadband service providers; • our reliance on third-party component providers and the risk associated with any failure, supply chain disruption or interruption in products or services provided by these third parties; • our reliance on third-party software and service providers; • our ability to obtain or maintain necessary governmental licenses and comply with applicable laws and regulations; • changes in governmental regulation of communication monitoring; • our reliance on network and information systems and other technologies and our ability to manage disruptions caused by cyber-attacks, failure or destruction of our networks, systems, technologies or properties; • macroeconomic factors; • economic, credit, financial or other risks affecting our customers and their ability to pay us; • the uncertainty of our future operating results; • our ability to attract, train and retain an effective sales force; and • the loss of our senior management. All forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by this cautionary statement. We are under no duty or obligation to update any of the forward-looking statements after the date of this communication. Cautionary Statement Regarding Forward-Looking Statements

3 Interface Security Systems ® 2015 Business Overview Interface Security Systems Holdings, Inc. (“Interface”) provides a proprietary and comprehensive bundle of mission critical managed network, physical security and life safety systems, interactive video monitoring and business intelligence (“BI”) services over a payment card industry (“PCI”) compliant cloud based network to many of North America’s most recognized companies Our diverse customer base includes large multi-site commercial enterprises in the retail, hospitality, restaurant, QSR, convenience store and other industry vertical sectors Our Bundled Solutions enable multi-site customers to Simplify to the Power of One® Streamlines system operations and administration Enhances network efficiency and security Provides customers with superior data gathering and BI Analytics capabilities Our established sales, installation and service infrastructure provides the capability to manage large national account deployments and the addition of new customers to our existing infrastructure at low incremental costs as well as provide ongoing system maintenance and support Through our bundled service offering, we are able to reduce the number of vendors our customers must utilize and consolidate billing and services to a single vendor Supported by superior proprietary software and monitoring technology and technical “know-how” Industry leading monitoring and service backed by Service Level Agreements Highly referenceable customer base Seasoned Sales Engine with unique successful sales focus with large national accounts

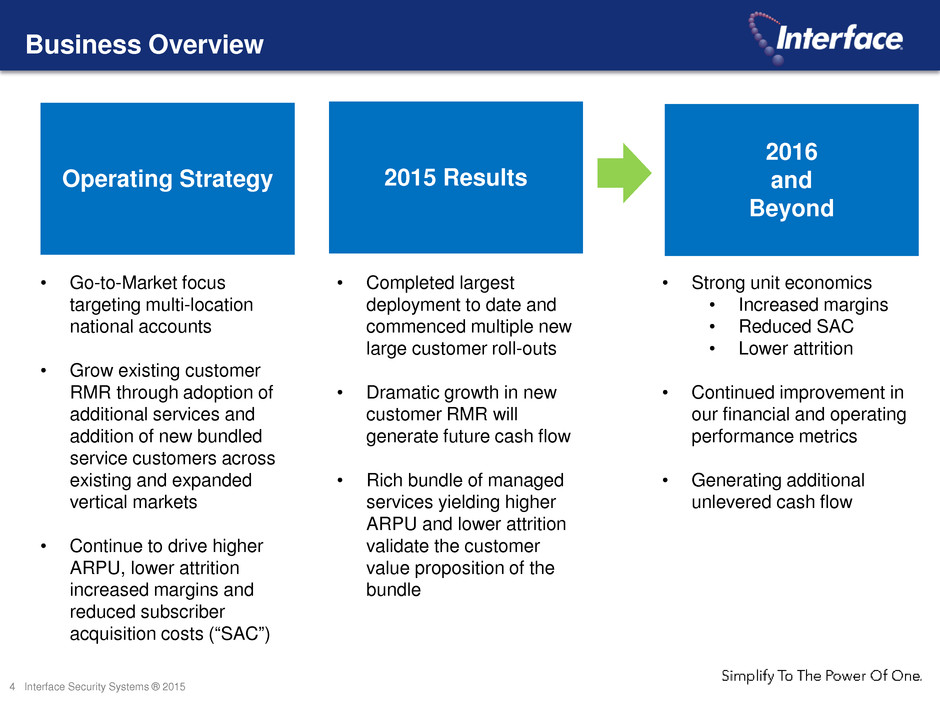

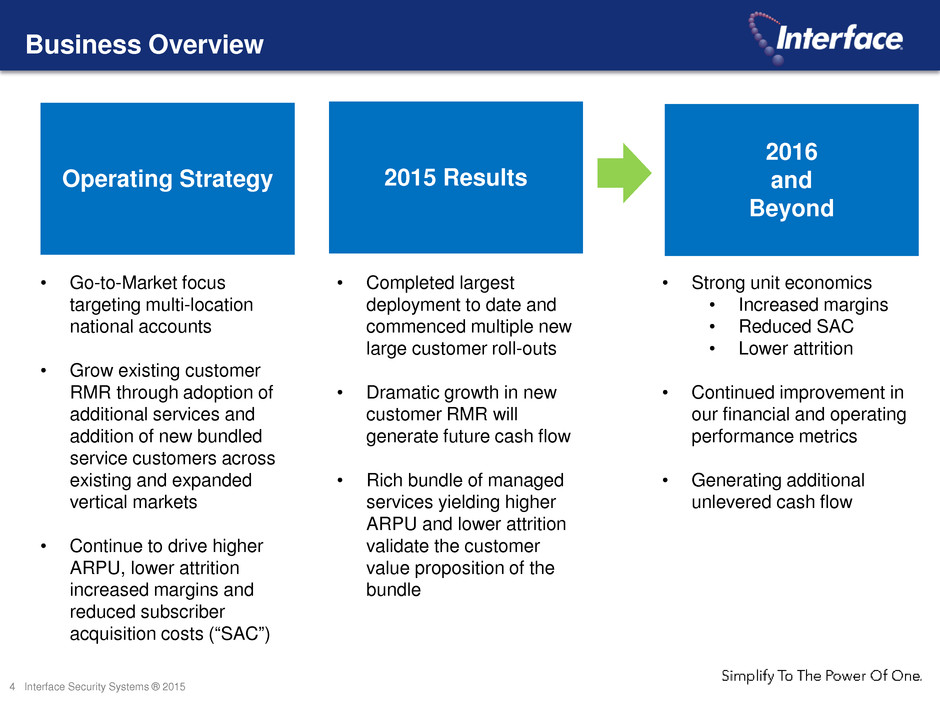

4 Interface Security Systems ® 2015 Business Overview Operating Strategy 2016 and Beyond 2015 Results • Go-to-Market focus targeting multi-location national accounts • Grow existing customer RMR through adoption of additional services and addition of new bundled service customers across existing and expanded vertical markets • Continue to drive higher ARPU, lower attrition increased margins and reduced subscriber acquisition costs (“SAC”) • Strong unit economics • Increased margins • Reduced SAC • Lower attrition • Continued improvement in our financial and operating performance metrics • Generating additional unlevered cash flow • Completed largest deployment to date and commenced multiple new large customer roll-outs • Dramatic growth in new customer RMR will generate future cash flow • Rich bundle of managed services yielding higher ARPU and lower attrition validate the customer value proposition of the bundle

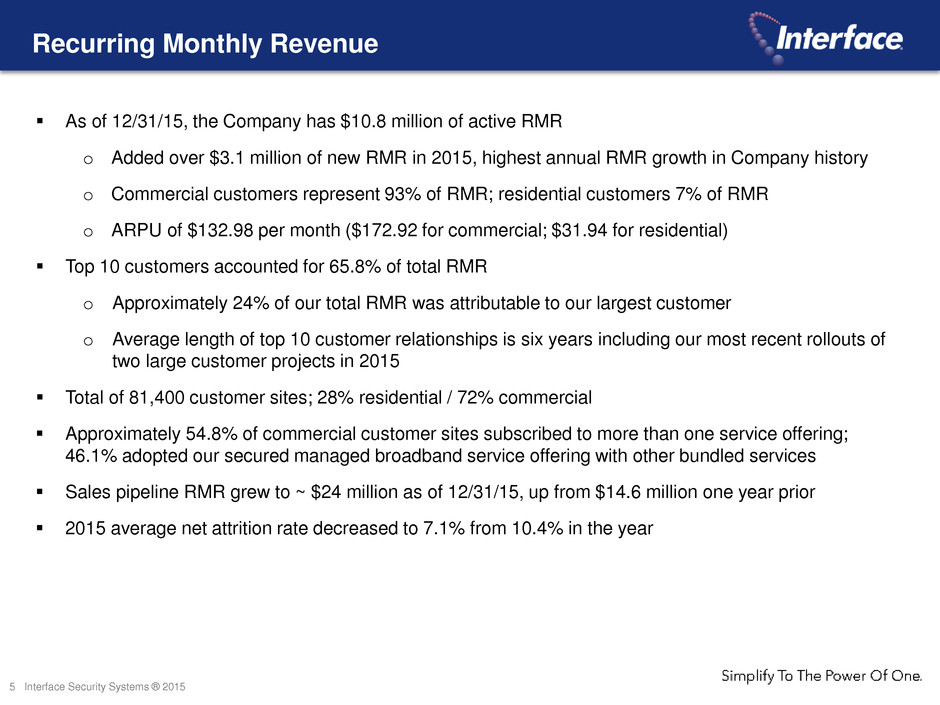

5 Interface Security Systems ® 2015 Recurring Monthly Revenue As of 12/31/15, the Company has $10.8 million of active RMR o Added over $3.1 million of new RMR in 2015, highest annual RMR growth in Company history o Commercial customers represent 93% of RMR; residential customers 7% of RMR o ARPU of $132.98 per month ($172.92 for commercial; $31.94 for residential) Top 10 customers accounted for 65.8% of total RMR o Approximately 24% of our total RMR was attributable to our largest customer o Average length of top 10 customer relationships is six years including our most recent rollouts of two large customer projects in 2015 Total of 81,400 customer sites; 28% residential / 72% commercial Approximately 54.8% of commercial customer sites subscribed to more than one service offering; 46.1% adopted our secured managed broadband service offering with other bundled services Sales pipeline RMR grew to ~ $24 million as of 12/31/15, up from $14.6 million one year prior 2015 average net attrition rate decreased to 7.1% from 10.4% in the year

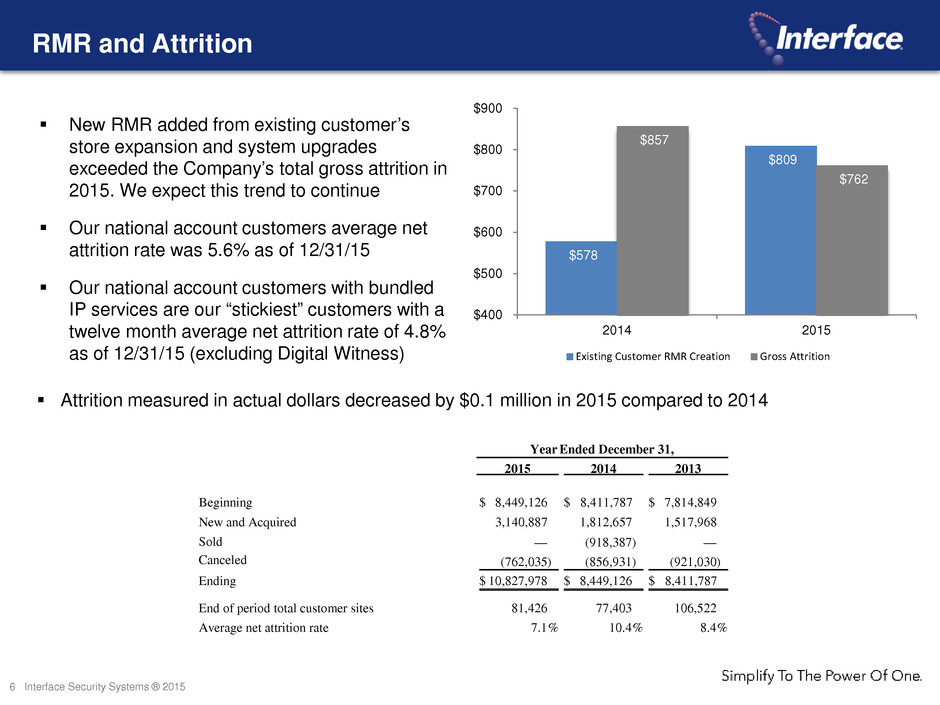

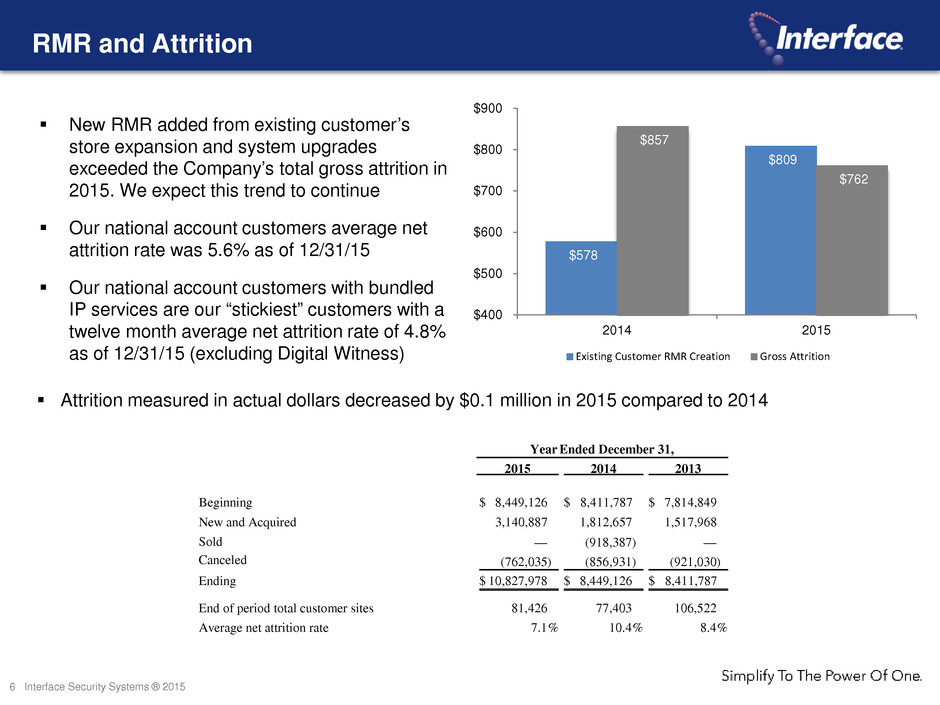

6 Interface Security Systems ® 2015 RMR and Attrition New RMR added from existing customer’s store expansion and system upgrades exceeded the Company’s total gross attrition in 2015. We expect this trend to continue Our national account customers average net attrition rate was 5.6% as of 12/31/15 Our national account customers with bundled IP services are our “stickiest” customers with a twelve month average net attrition rate of 4.8% as of 12/31/15 (excluding Digital Witness) Attrition measured in actual dollars decreased by $0.1 million in 2015 compared to 2014 Year Ended December 31, 2015 2014 2013 Beginning $ 8,449,126 $ 8,411,787 $ 7,814,849 New and Acquired 3,140,887 1,812,657 1,517,968 Sold — (918,387 ) — Canceled (762,035 ) (856,931 ) (921,030 ) Ending $ 10,827,978 $ 8,449,126 $ 8,411,787 End of period total customer sites 81,426 77,403 106,522 Average net attrition rate 7.1 % 10.4 % 8.4 % $578 $809 $857 $762 $400 $500 $600 $700 $800 $900 2014 2015 Existing Customer RMR Creation Gross Attrition

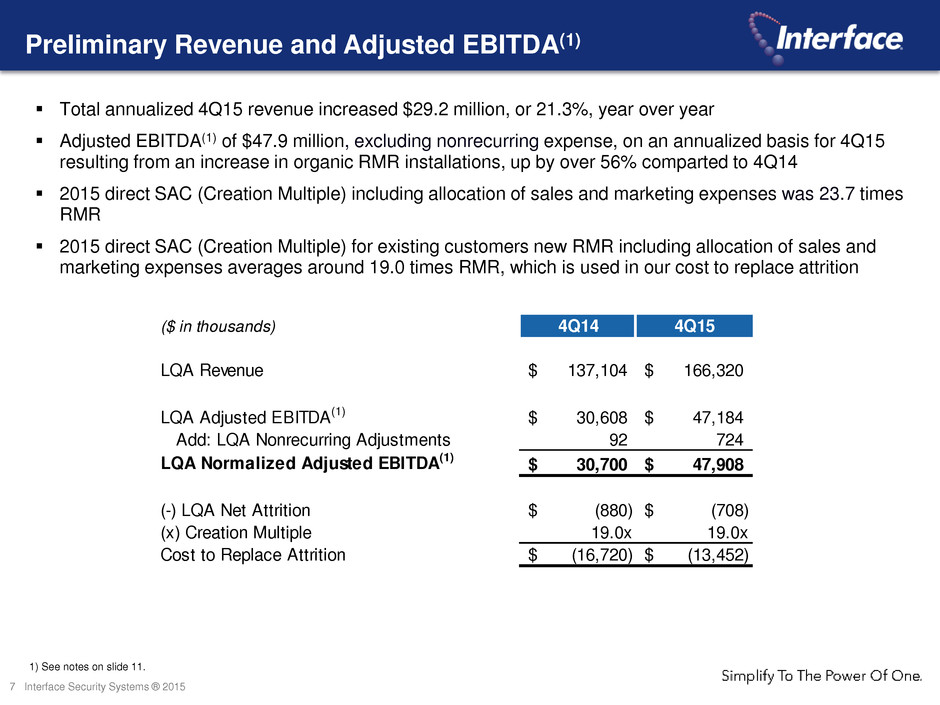

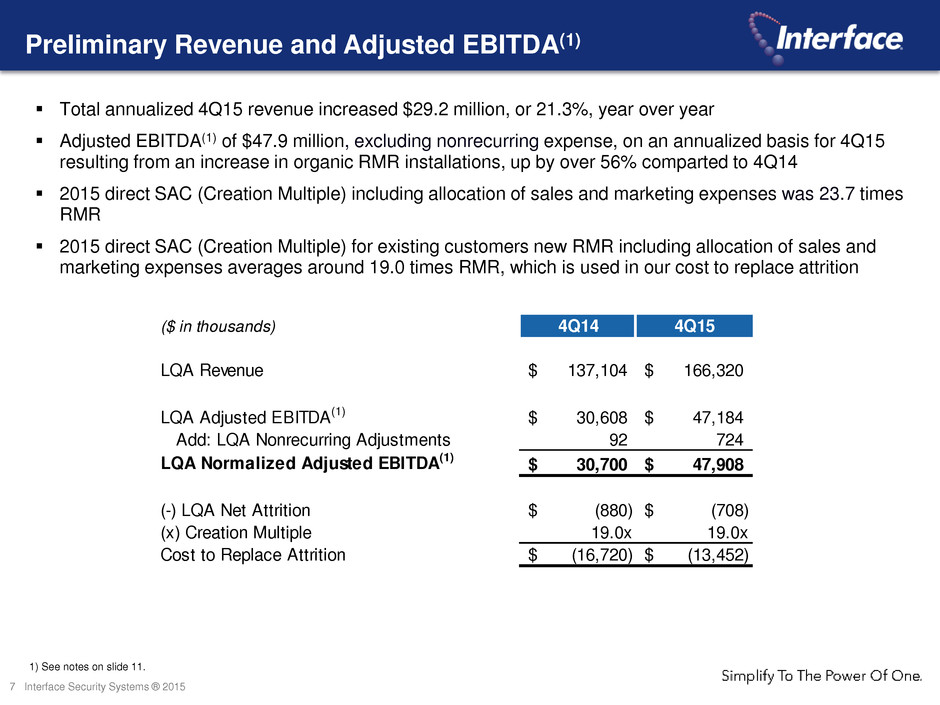

7 Interface Security Systems ® 2015 Preliminary Revenue and Adjusted EBITDA(1) Total annualized 4Q15 revenue increased $29.2 million, or 21.3%, year over year Adjusted EBITDA(1) of $47.9 million, excluding nonrecurring expense, on an annualized basis for 4Q15 resulting from an increase in organic RMR installations, up by over 56% comparted to 4Q14 2015 direct SAC (Creation Multiple) including allocation of sales and marketing expenses was 23.7 times RMR 2015 direct SAC (Creation Multiple) for existing customers new RMR including allocation of sales and marketing expenses averages around 19.0 times RMR, which is used in our cost to replace attrition 1) See notes on slide 11. ($ in thousands) 4Q14 4Q15 LQA Revenue 137,104$ 166,320$ LQA Adjusted EBITDA(1) 30,608$ 47,184$ Add: LQA Nonrecurring Adjustments 92 724 LQA Normalized Adjusted EBITDA(1) 30,700$ 47,908$ (-) LQA Net Attrition (880)$ (708)$ (x) Creation Multiple 19.0x 19.0x Cost to Replace Attrition (16,720)$ (13,452)$

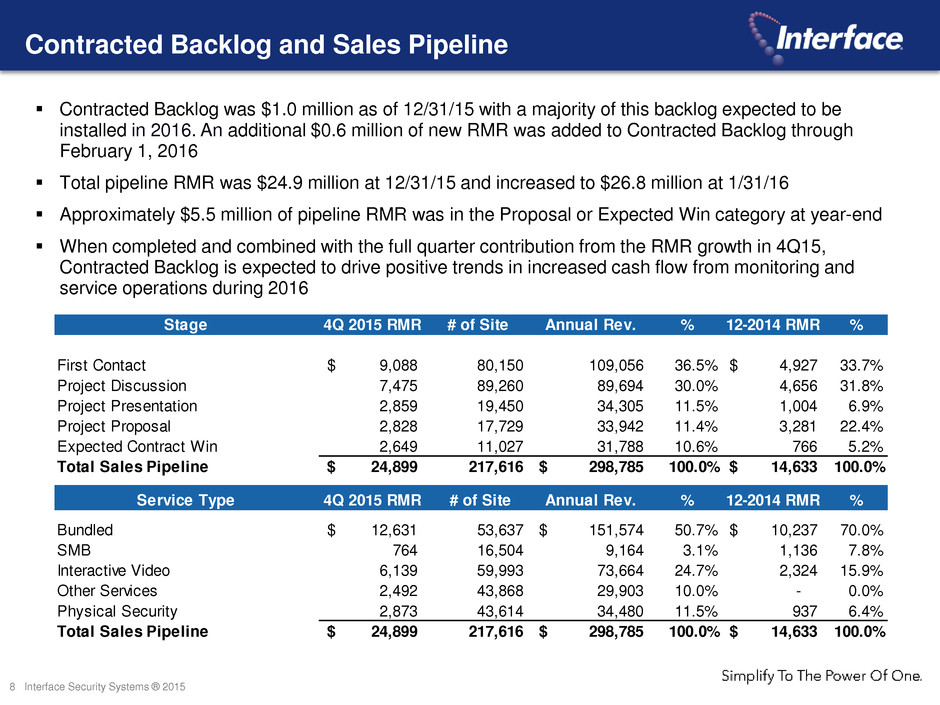

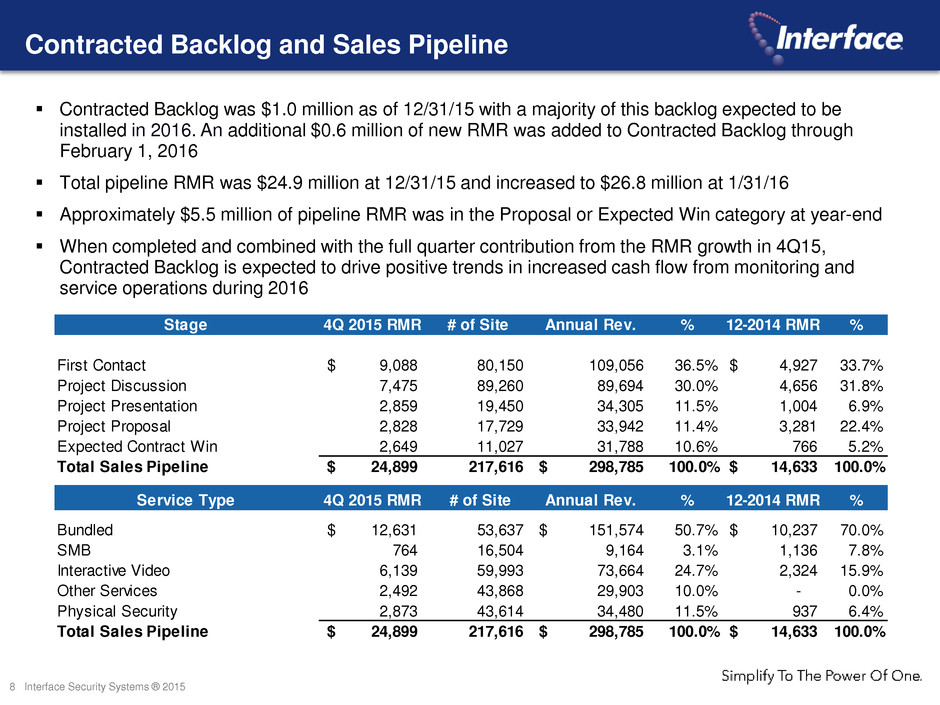

8 Interface Security Systems ® 2015 Contracted Backlog and Sales Pipeline Contracted Backlog was $1.0 million as of 12/31/15 with a majority of this backlog expected to be installed in 2016. An additional $0.6 million of new RMR was added to Contracted Backlog through February 1, 2016 Total pipeline RMR was $24.9 million at 12/31/15 and increased to $26.8 million at 1/31/16 Approximately $5.5 million of pipeline RMR was in the Proposal or Expected Win category at year-end When completed and combined with the full quarter contribution from the RMR growth in 4Q15, Contracted Backlog is expected to drive positive trends in increased cash flow from monitoring and service operations during 2016 Stage 4Q 2015 RMR # of Site Annual Rev. % 12-2014 RMR % First Contact 9,088$ 80,150 109,056 36.5% 4,927$ 33.7% Project Discussion 7,475 89,260 89,694 30.0% 4,656 31.8% Project Presentation 2,859 19,450 34,305 11.5% 1,004 6.9% Project Proposal 2,828 17,729 33,942 11.4% 3,281 22.4% Expected Contract Win 2,649 11,027 31,788 10.6% 766 5.2% Total Sales Pipeline 24,899$ 217,616 298,785$ 100.0% 14,633$ 100.0% Service Type 4Q 2015 RMR # of Site Annual Rev. % 12-2014 RMR % Bundled 12,631$ 53,637 151,574$ 50.7% 10,237$ 70.0% SMB 764 16,504 9,164 3.1% 1,136 7.8% Interactive Video 6,139 59,993 73,664 24.7% 2,324 15.9% Other Services 2,492 43,868 29,903 10.0% - 0.0% Physical Security 2,873 43,614 34,480 11.5% 937 6.4% Total Sales Pipeline 24,899$ 217,616 298,785$ 100.0% 14,633$ 100.0%

9 Interface Security Systems ® 2015 Summary • Bundled service offerings are gaining broader market acceptance as evidenced by 2015 RMR growth and pipeline expansion • Ecosystem Partners are a growing part of our go-to-market strategy with increased generation of qualified leads and warm referrals • Gross and net RMR growth up in 2015 over 2014 • Pipeline is robust, maturing and expanding • Our largest deployment is on schedule and on budget • Ongoing investments in new product developments and infrastructure leading to expanded RMR opportunities • Uniquely equipped to meet the rapidly changing technology demands of today’s retail, commercial and small business enterprises • Expect strong sales results in 2016 • Estimated release of 4th quarter and year-end 2015 financial results at end of March 2016

10 Interface Security Systems ® 2015 Appendix

11 Interface Security Systems ® 2015 The Company uses certain financial measures, including EBITDA and Adjusted EBITDA, as supplemental measures of our operating performance that are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). They are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income, operating income or any other performance measures derived in accordance with GAAP or as an alternative to cash flows from operating activities as a measure of our liquidity. These measures are used in the internal management of our business, along with the most directly comparable GAAP financial measures, in evaluating our operating performance. In addition, our presentation of Adjusted EBITDA is consistent with the equivalent measurements that are contained in our Revolving Credit Facility and the indenture governing the Senior Secured Notes. EBITDA represents net loss attributable to Interface Security Systems Holdings, Inc. before interest expense, interest income, income taxes, depreciation and amortization. Adjusted EBITDA represents EBITDA as further adjusted for gain or loss of sale of long-lived assets, accrued but not currently payable management fees, sales and installation costs, net of sales and installation revenue, related to organic RMR growth, plus 50% of non-capitalized corporate and service center administrative costs related to organic RMR growth, less capitalized subscriber system assets. Our calculation of Adjusted EBITDA does not include any adjustments for expenses related to the sale of the Transferred Assets, financing of the Revolving Credit Facility or costs of preparing for the initial registration of the registration and exchange of the Senior Secured Notes. These expenses for the three months ended December 31, 2014 were $0.1 million and $2.7 million for the year ended December 31, 2014. Our measurement of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies and are not measures of performance calculated in accordance with GAAP. We have included information concerning EBITDA and Adjusted EBITDA because we believe that such information is used by certain investors as supplemental measures of a company’s historical ability to service debt. We believe these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of high yield issuers, many of which present EBITDA and Adjusted EBITDA when reporting their results. Our presentation of EBITDA and Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items. Non-GAAP Financial Measures

12 Interface Security Systems ® 2015 EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, or as a substitute for analysis of, our operating results or cash flows as reported under GAAP. Some of these limitations are: • they do not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments; • they do not reflect changes in, or cash requirements for, our working capital needs; • they do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; • although depreciation is a non-cash charge, the assets being depreciated will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements; • they are not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows; and • other companies in our industry may calculate these measures differently than we do, limiting their usefulness as comparative measures. Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as measures of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA and Adjusted EBITDA only for supplemental purposes. Please see our consolidated financial statements contained elsewhere in this report. For a reconciliation of net loss to EBITDA and adjusted EBITDA, see slide 13 in the appendix. Non-GAAP Financial Measures (continued)

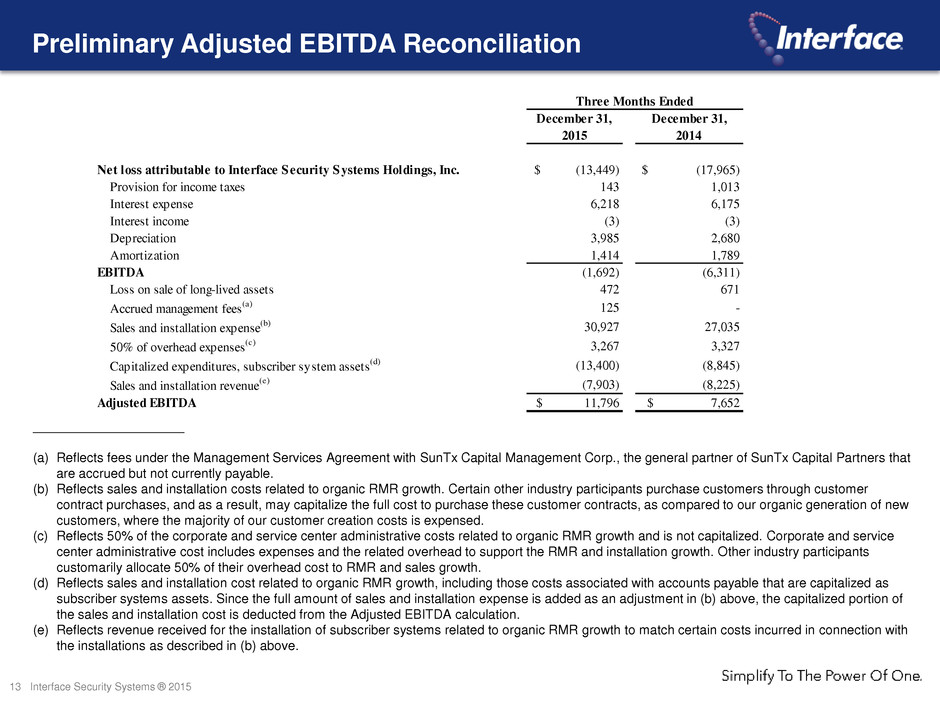

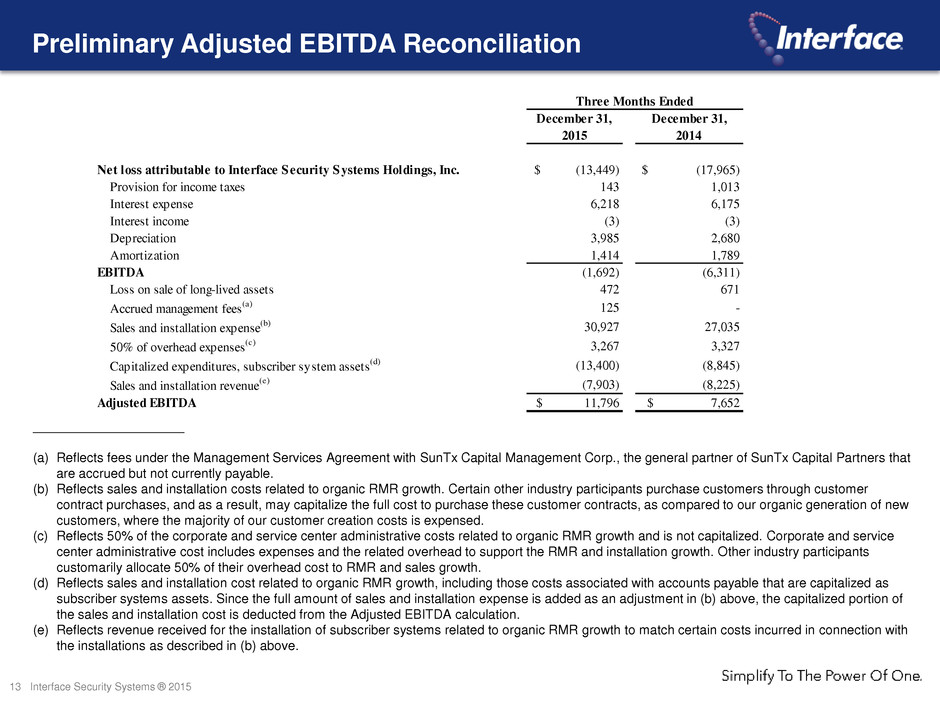

13 Interface Security Systems ® 2015 Preliminary Adjusted EBITDA Reconciliation _____________________ (a) Reflects fees under the Management Services Agreement with SunTx Capital Management Corp., the general partner of SunTx Capital Partners that are accrued but not currently payable. (b) Reflects sales and installation costs related to organic RMR growth. Certain other industry participants purchase customers through customer contract purchases, and as a result, may capitalize the full cost to purchase these customer contracts, as compared to our organic generation of new customers, where the majority of our customer creation costs is expensed. (c) Reflects 50% of the corporate and service center administrative costs related to organic RMR growth and is not capitalized. Corporate and service center administrative cost includes expenses and the related overhead to support the RMR and installation growth. Other industry participants customarily allocate 50% of their overhead cost to RMR and sales growth. (d) Reflects sales and installation cost related to organic RMR growth, including those costs associated with accounts payable that are capitalized as subscriber systems assets. Since the full amount of sales and installation expense is added as an adjustment in (b) above, the capitalized portion of the sales and installation cost is deducted from the Adjusted EBITDA calculation. (e) Reflects revenue received for the installation of subscriber systems related to organic RMR growth to match certain costs incurred in connection with the installations as described in (b) above. December 31, December 31, 2015 2014 Net loss attributable to Interface Security Systems Holdings, Inc. $ (13,449) $ (17,965) Provision for income taxes 143 1,013 Interest expense 6,218 6,175 Interest income (3) (3) Depreciation 3,985 2,680 Amortization 1,414 1,789 EBITDA (1,692) (6,311) Loss on sale of long-lived assets 472 671 Accrued management fees(a) 125 - Sales and installation expense(b) 30,927 27,035 50% of overhead expenses(c) 3,267 3,327 Capitalized expenditures, subscriber system assets(d) (13,400) (8,845) Sales and installation revenue(e) (7,903) (8,225) Adjusted EBITDA $ 11,796 $ 7,652 Three Months Ended

www.interfacesystems.com