Nevada Operations

Nevada, USA

Technical Report Summary

Report current as of:

December 31, 2021

Qualified Person:

Mr. Donald Doe, RM SME.

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

NOTE REGARDING FORWARD-LOOKING INFORMATION

This Technical Report Summary contains forward-looking statements within the meaning of the U.S. Securities Act of 1933 and the U.S. Securities Exchange Act of 1934 (and the equivalent under Canadian securities laws), that are intended to be covered by the safe harbor created by such sections. Such forward-looking statements include, without limitation, statements regarding Newmont’s expectation for its mines and any related development or expansions, including estimated cashflows, production, revenue, EBITDA, costs, taxes, capital, rates of return, mine plans, material mined and processed, recoveries and grade, future mineralization, future adjustments and sensitivities and other statements that are not historical facts.

Forward-looking statements address activities, events, or developments that Newmont expects or anticipates will or may occur in the future and are based on current expectations and assumptions. Additionally, forward-looking statements regarding Nevada Gold Mines are based largely upon information provided by the Operating Manager, Barrick, to Newmont. Although Newmont’s management believes that its expectations are based on reasonable assumptions, it can give no assurance that these expectations will prove correct. Such assumptions, include, but are not limited to: (i) there being no significant change to current geotechnical, metallurgical, hydrological and other physical conditions; (ii) permitting, development, operations and expansion of operations and projects being consistent with current expectations and mine plans, including, without limitation, receipt of export approvals; (iii) political developments in any jurisdiction in which Newmont operates being consistent with its current expectations; (iv) certain exchange rate assumptions being approximately consistent with current levels; (v) certain price assumptions for gold, copper, silver, zinc, lead and oil; (vi) prices for key supplies being approximately consistent with current levels; and (vii) other planning assumptions.

Important factors that could cause actual results to differ materially from those in the forward-looking statements include, among others, risks that estimates of mineral reserves and mineral resources are uncertain and the volume and grade of ore actually recovered may vary from our estimates, risks relating to fluctuations in metal prices; risks due to the inherently hazardous nature of mining-related activities; risks related to the jurisdictions in which we operate, uncertainties due to health and safety considerations, including COVID-19, uncertainties related to environmental considerations, including, without limitation, climate change, uncertainties relating to obtaining approvals and permits, including renewals, from governmental regulatory authorities; and uncertainties related to changes in law; as well as those factors discussed in Newmont’s filings with the U.S. Securities and Exchange Commission, including Newmont’s latest Annual Report on Form 10-K for the period ended December 31, 2021, which is available on newmont.com.

Newmont does not undertake any obligation to release publicly revisions to any “forward-looking statement,” including, without limitation, outlook, to reflect events or circumstances after the date of this document, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. Investors should not assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of that statement. Continued reliance on “forward-looking statements” is at investors’ own risk.

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

CONTENTS

| | | | | |

| Date: February 2022 | Page i |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

| | | | | |

| Date: February 2022 | Page ii |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

| | | | | |

| Date: February 2022 | Page iii |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

| | | | | |

| Date: February 2022 | Page iv |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

| | | | | |

| Date: February 2022 | Page v |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

| | | | | |

| Date: February 2022 | Page vi |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

| | | | | |

| Date: February 2022 | Page vii |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

TABLES

| | | | | |

| Date: February 2022 | Page viii |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

FIGURES

| | | | | |

| Date: February 2022 | Page ix |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

| | | | | |

| Date: February 2022 | Page x |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

| | | | | |

| Date: February 2022 | Page xi |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

1.0 EXECUTIVE SUMMARY

1.1 Introduction

This technical report summary (the Report) was prepared for Newmont Corporation (Newmont) on the Nevada Operations (Nevada Operations or the Project) that are located in Nevada.

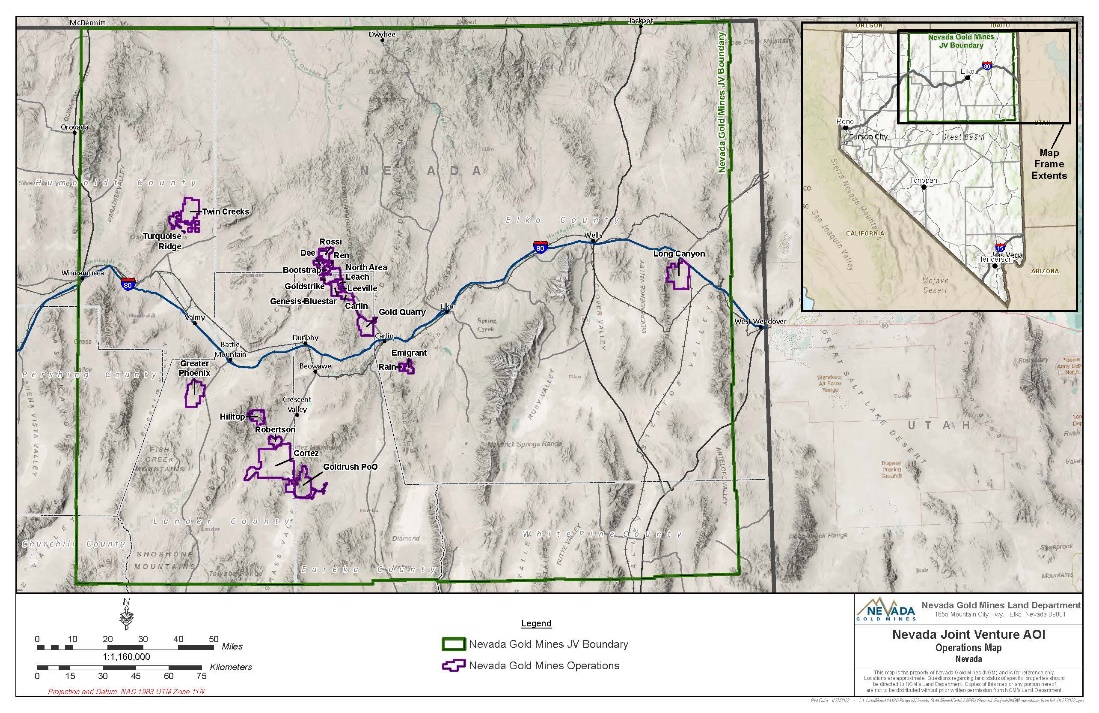

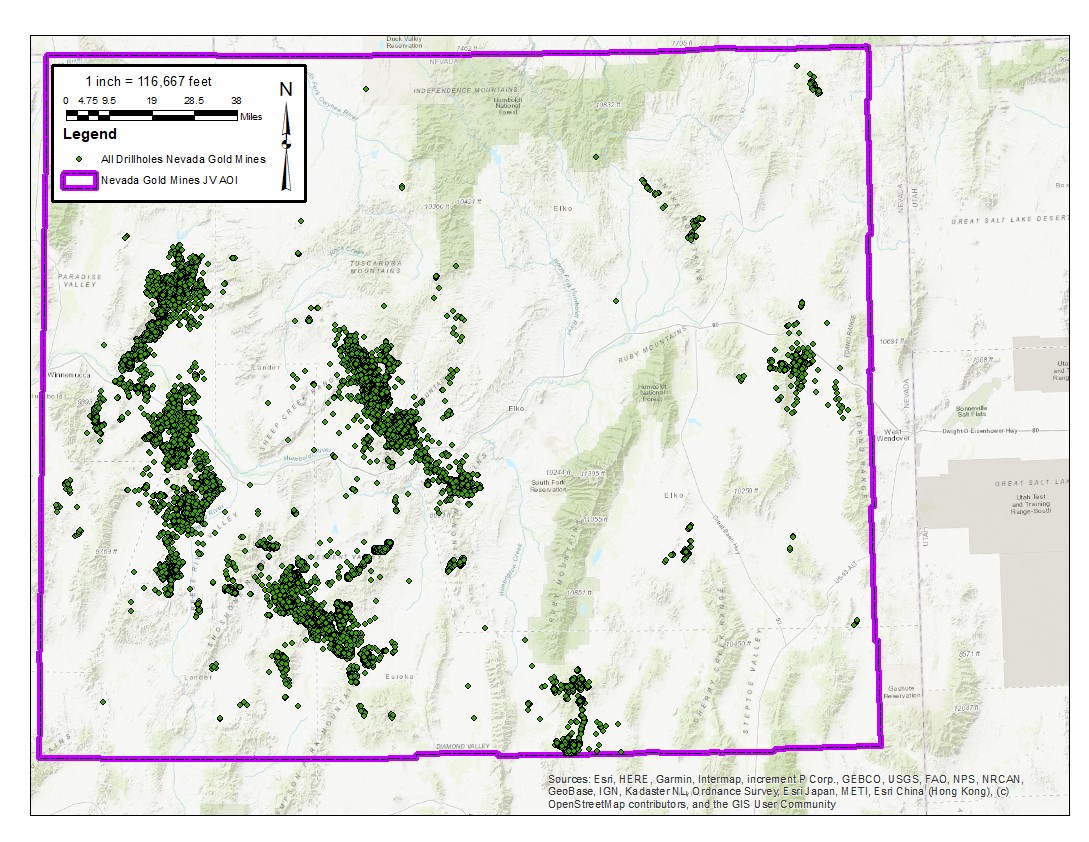

The Project is operated as a joint venture (JV) through Nevada Gold Mines, LLC (NGM). Barrick Gold Corporation (Barrick) is the JV operator and owns 61.5%, with Newmont owning the remaining 38.5% JV interest.

1.2 Terms of Reference

The Report was prepared to be attached as an exhibit to support mineral property disclosure, including mineral resource and mineral reserve estimates, for the Nevada Operations in Newmont’s Form 10-K for the year ending December 31, 2021.

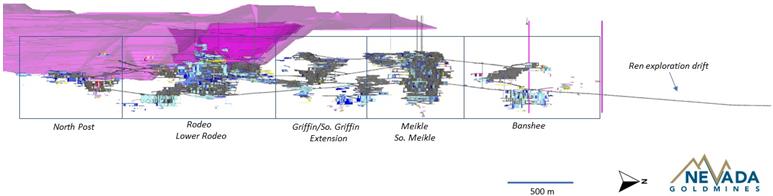

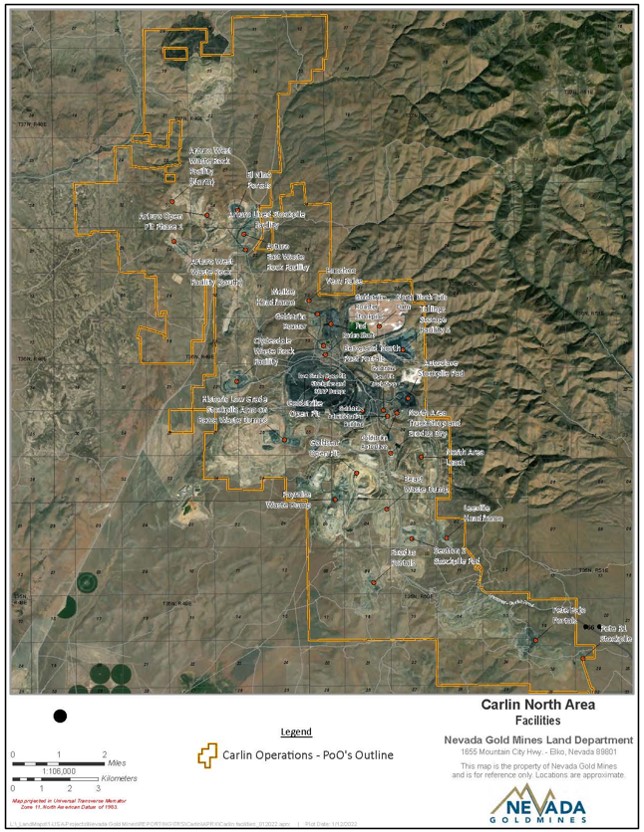

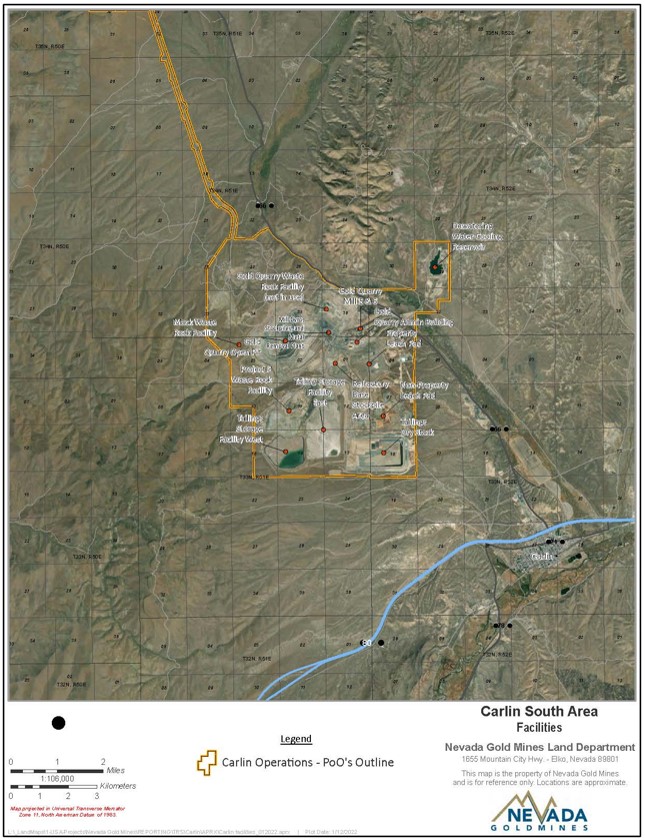

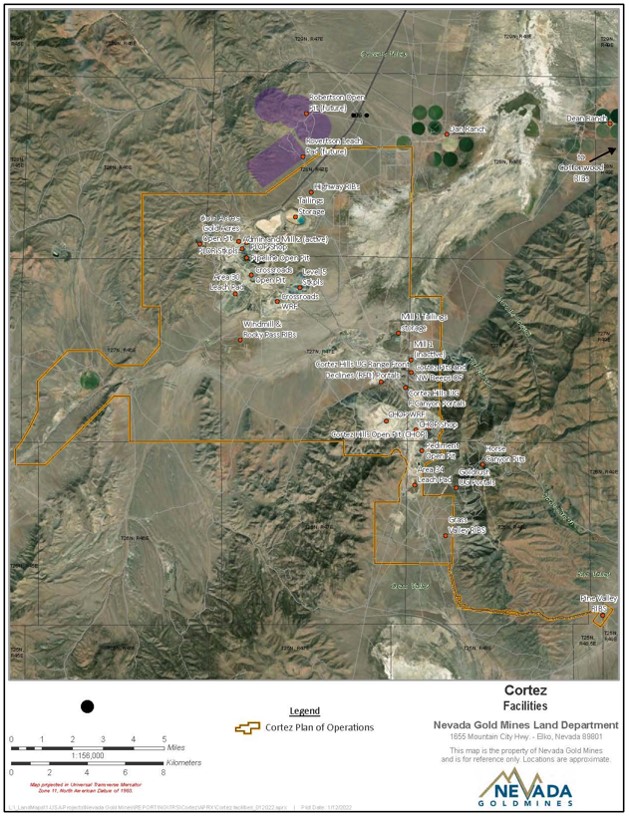

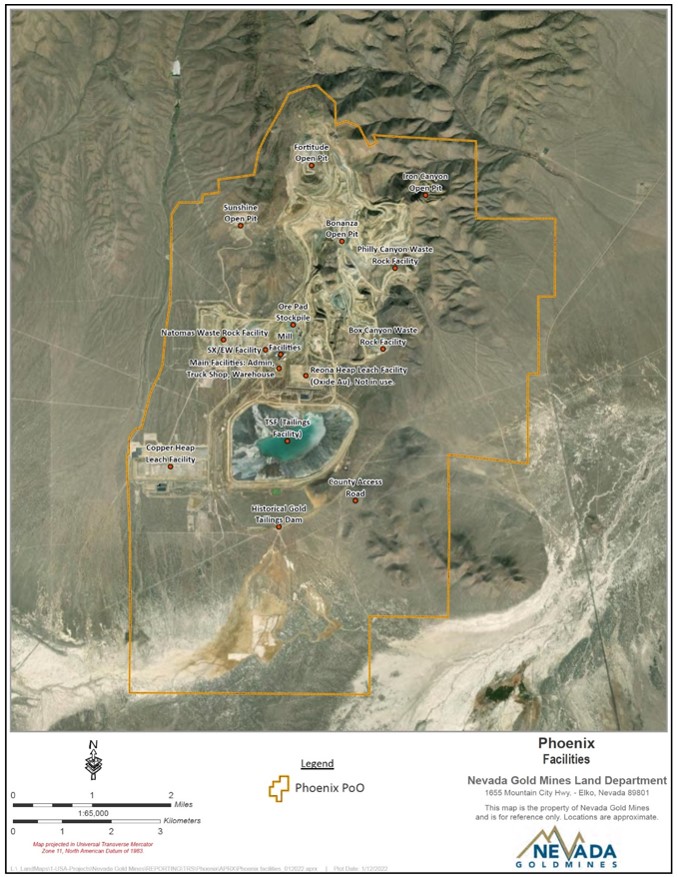

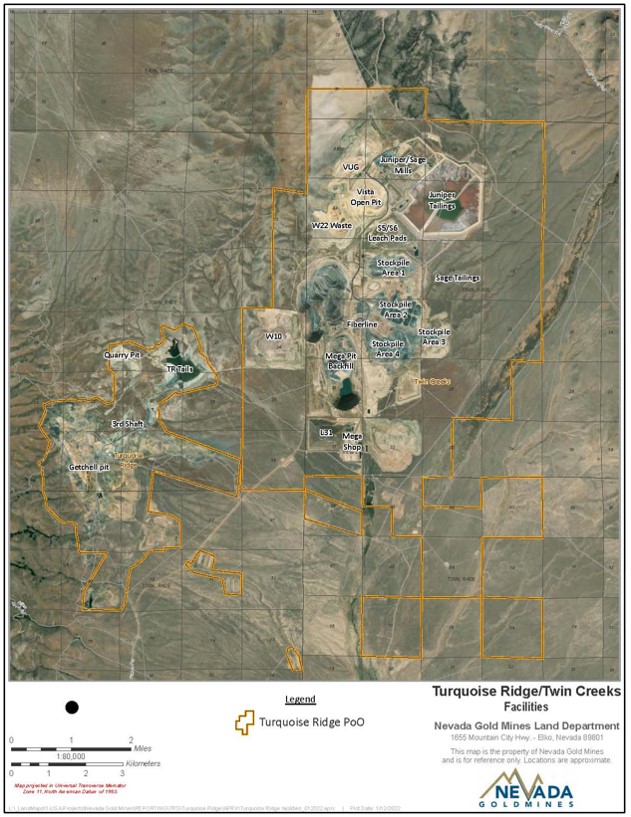

The Nevada Operations consist of 10 underground and 12 open pit active mining operations, two autoclave facilities, two roasting facilities, two oxide mills, two flotation plants and nine heap leach facilities, forming five major mining/processing complexes centered at Carlin, Cortez, Long Canyon, Phoenix and Turquoise Ridge.

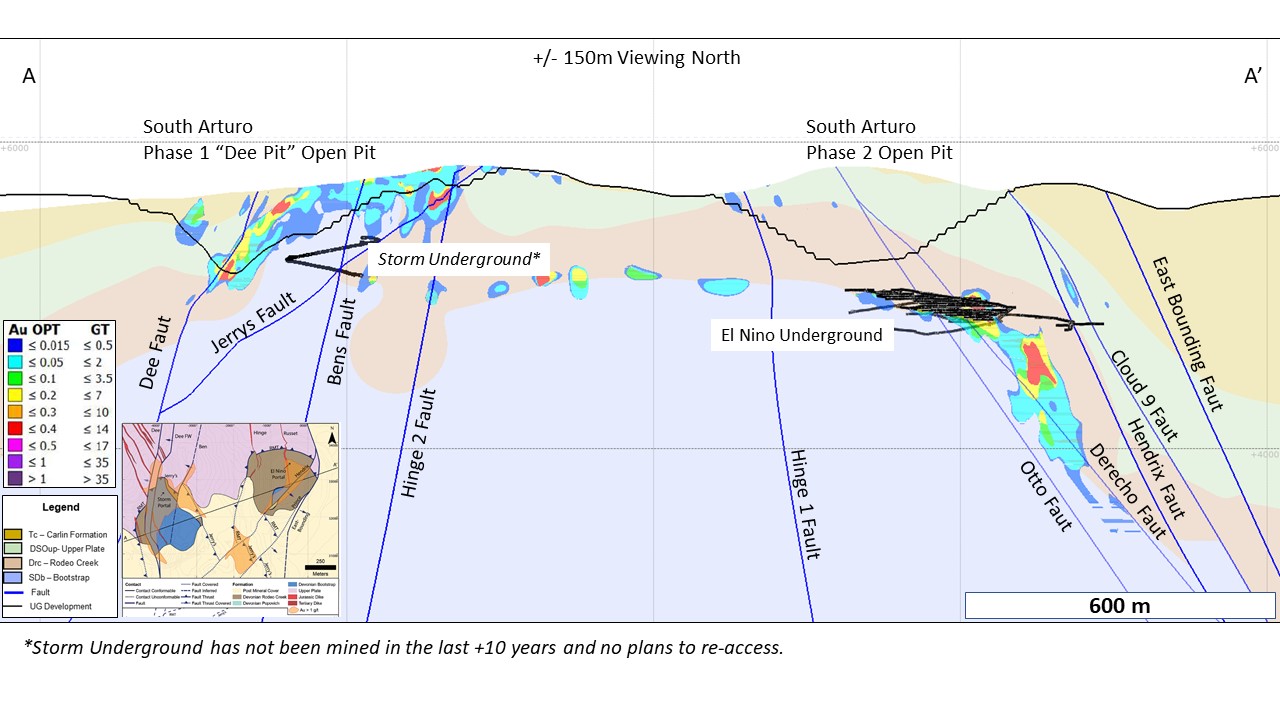

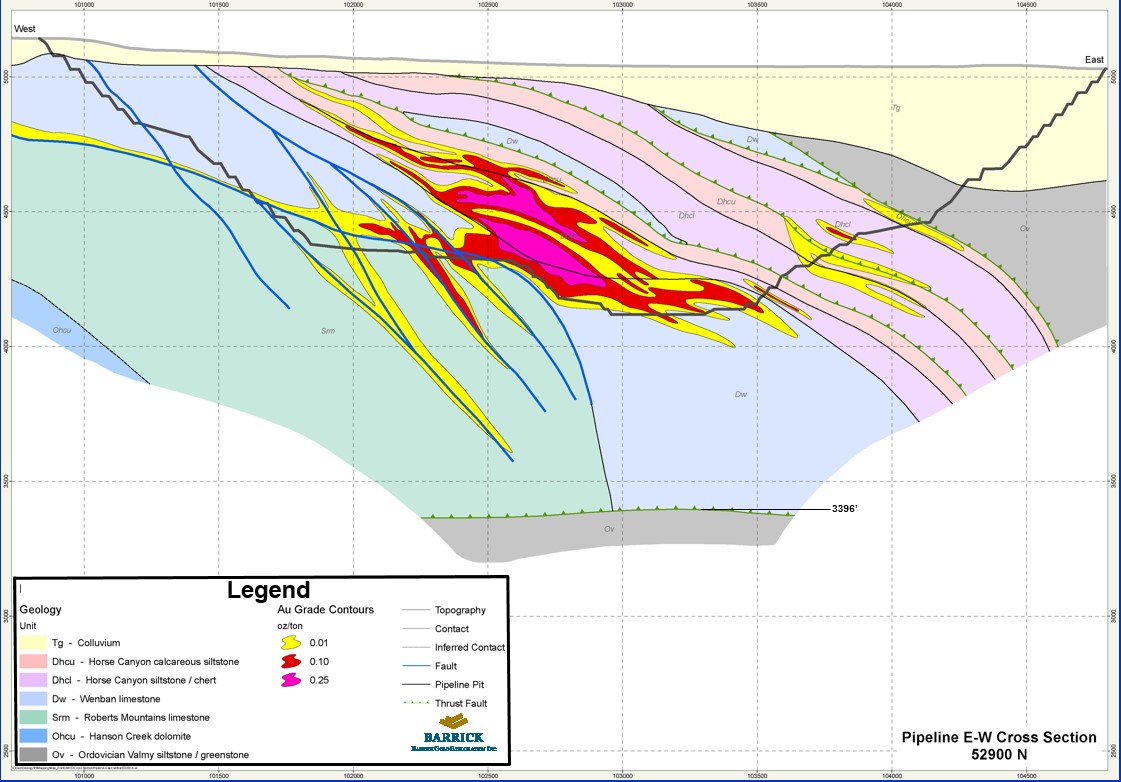

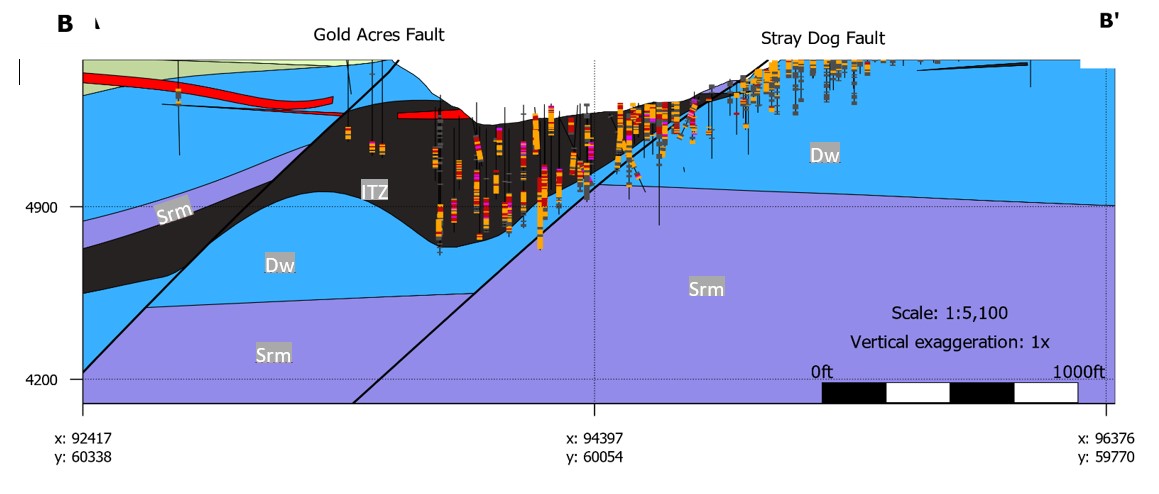

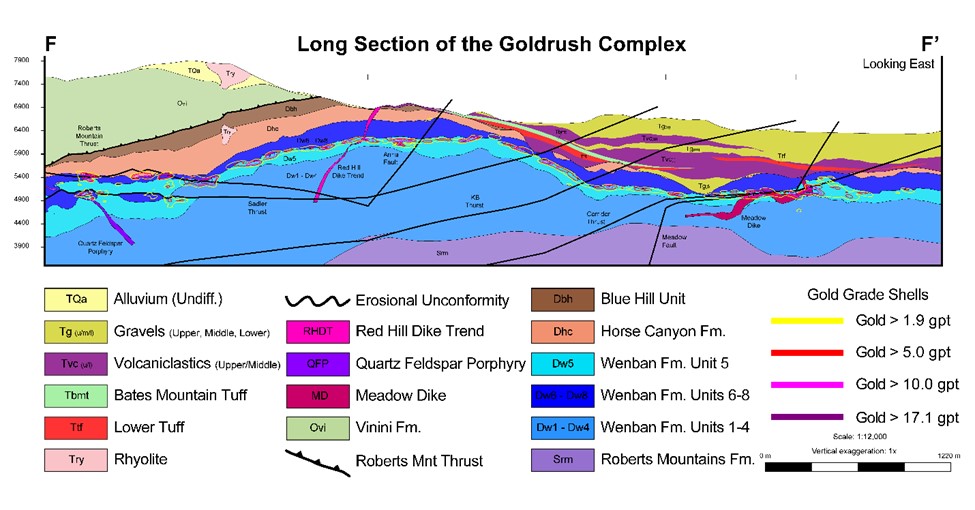

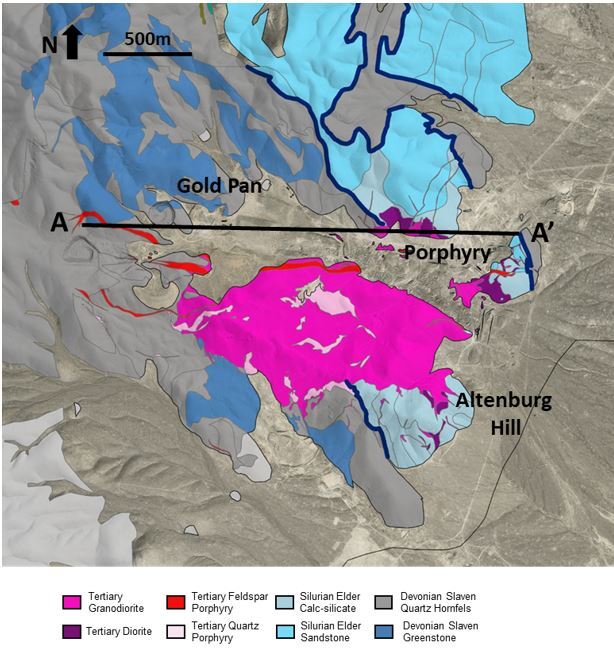

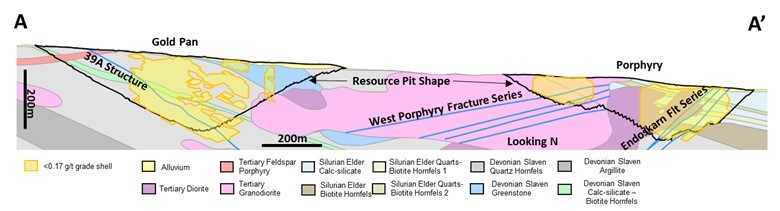

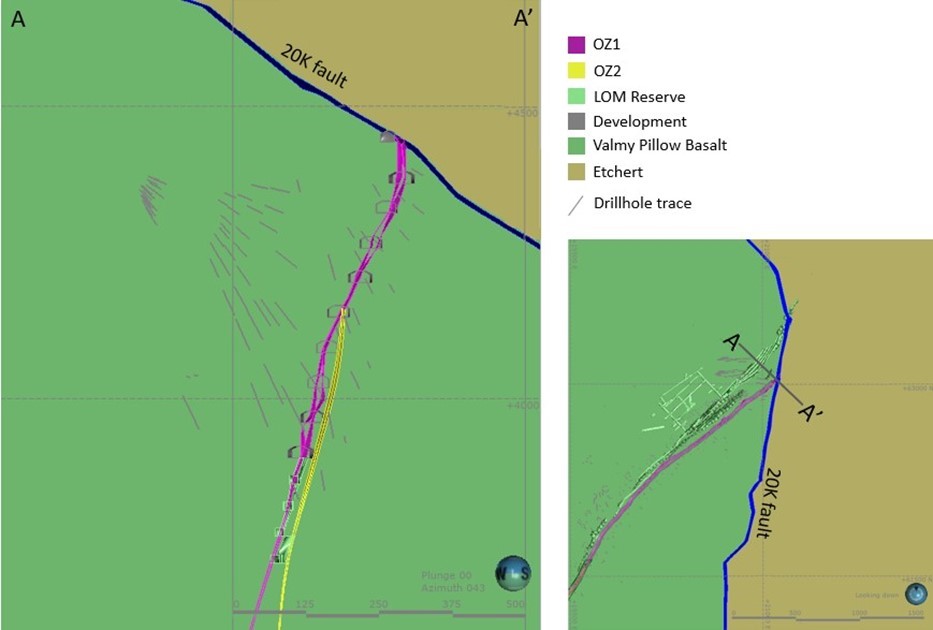

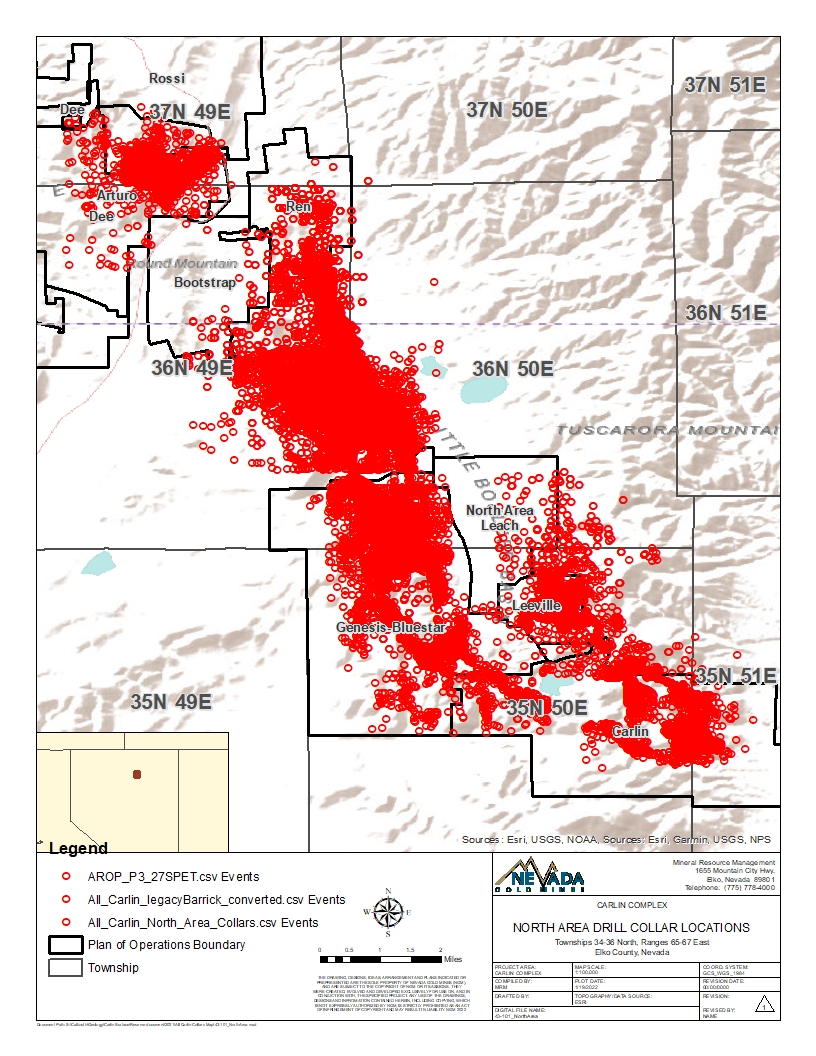

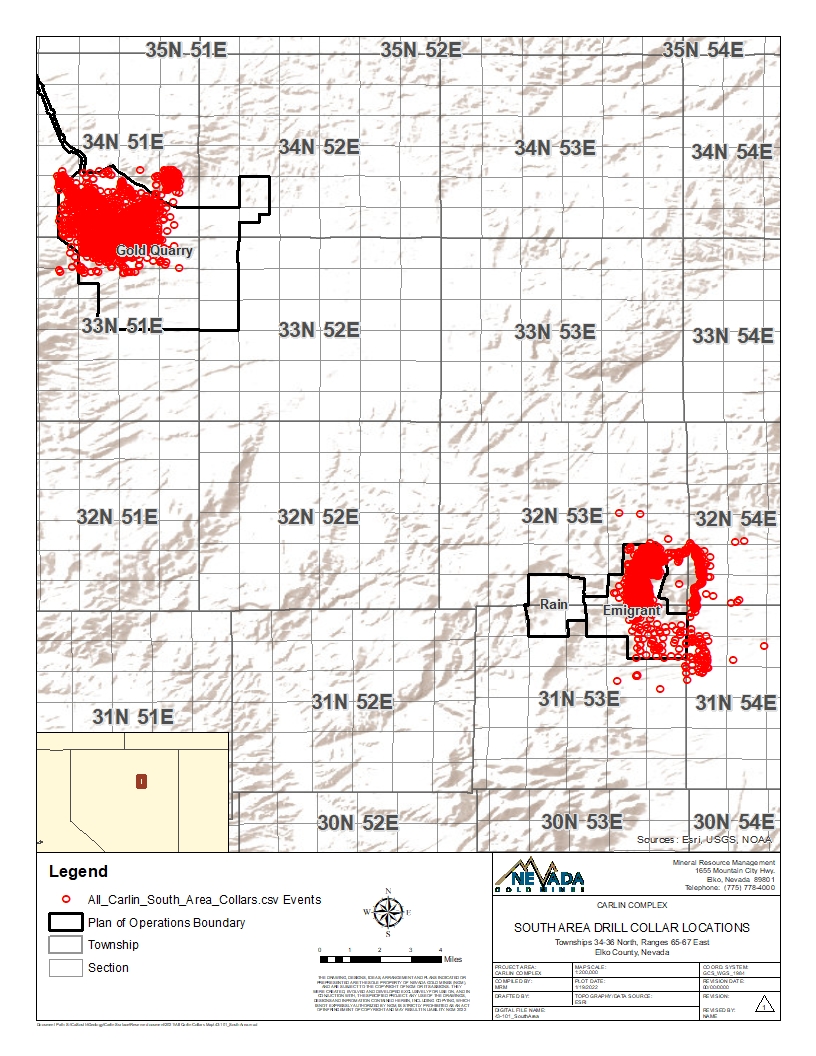

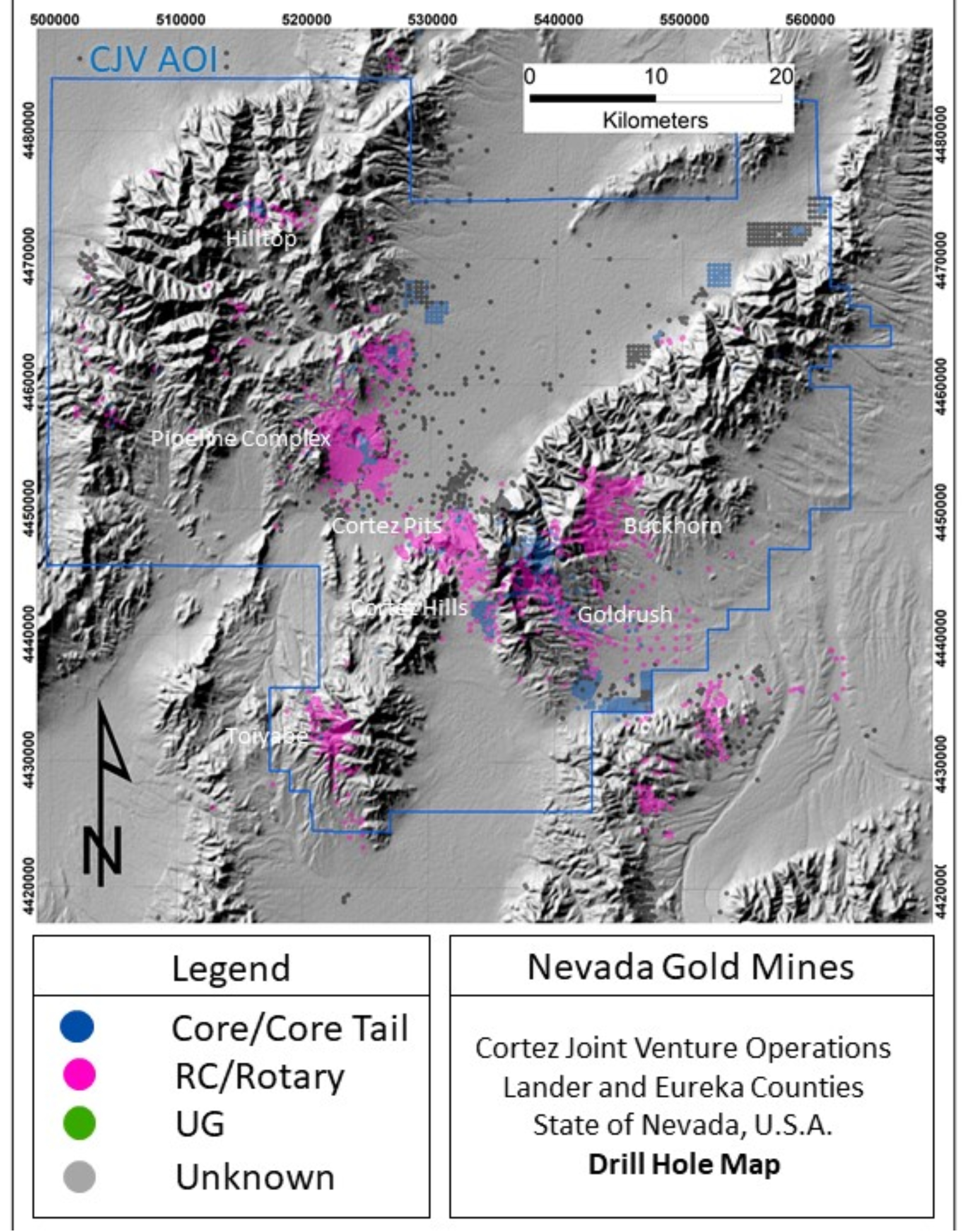

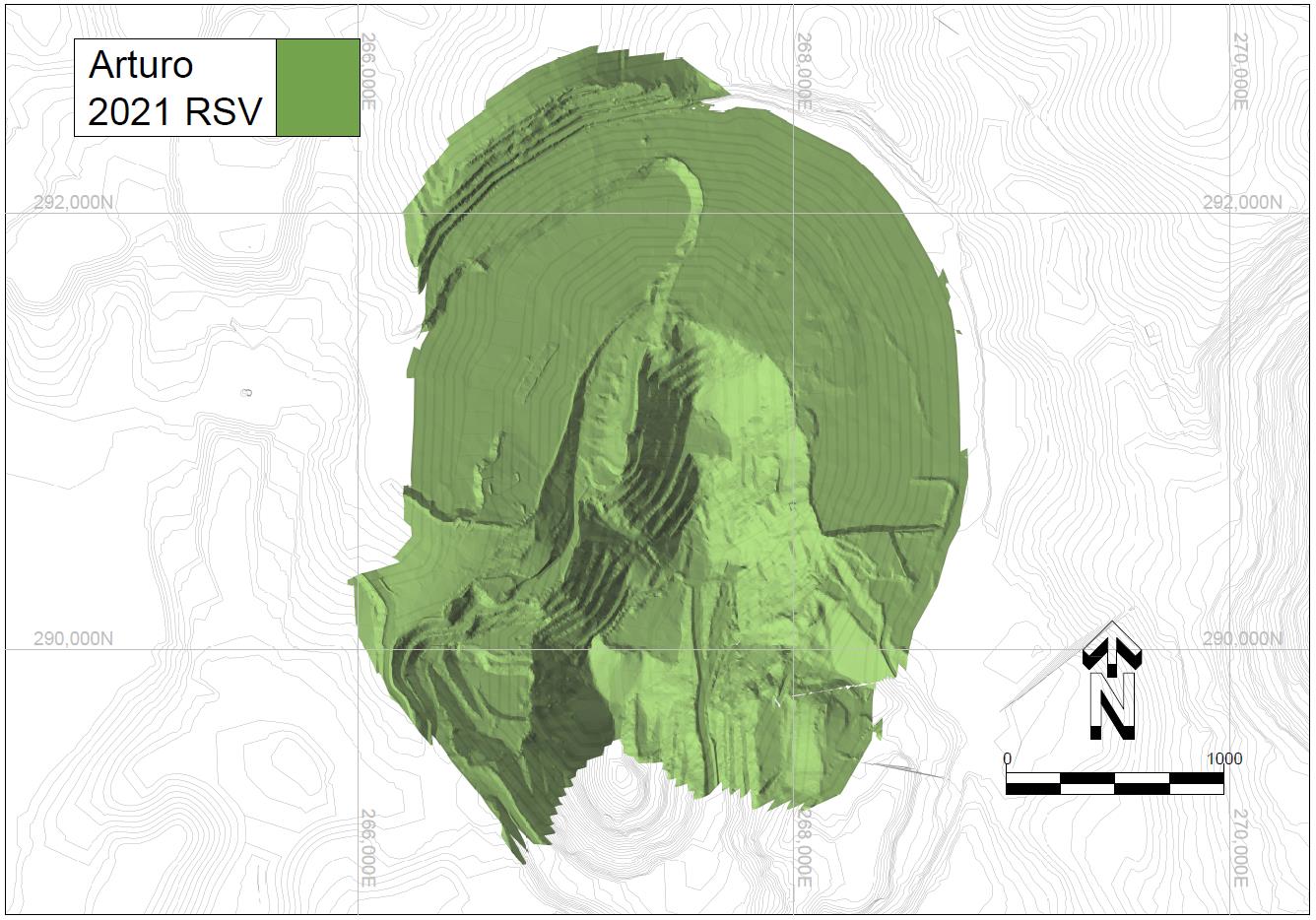

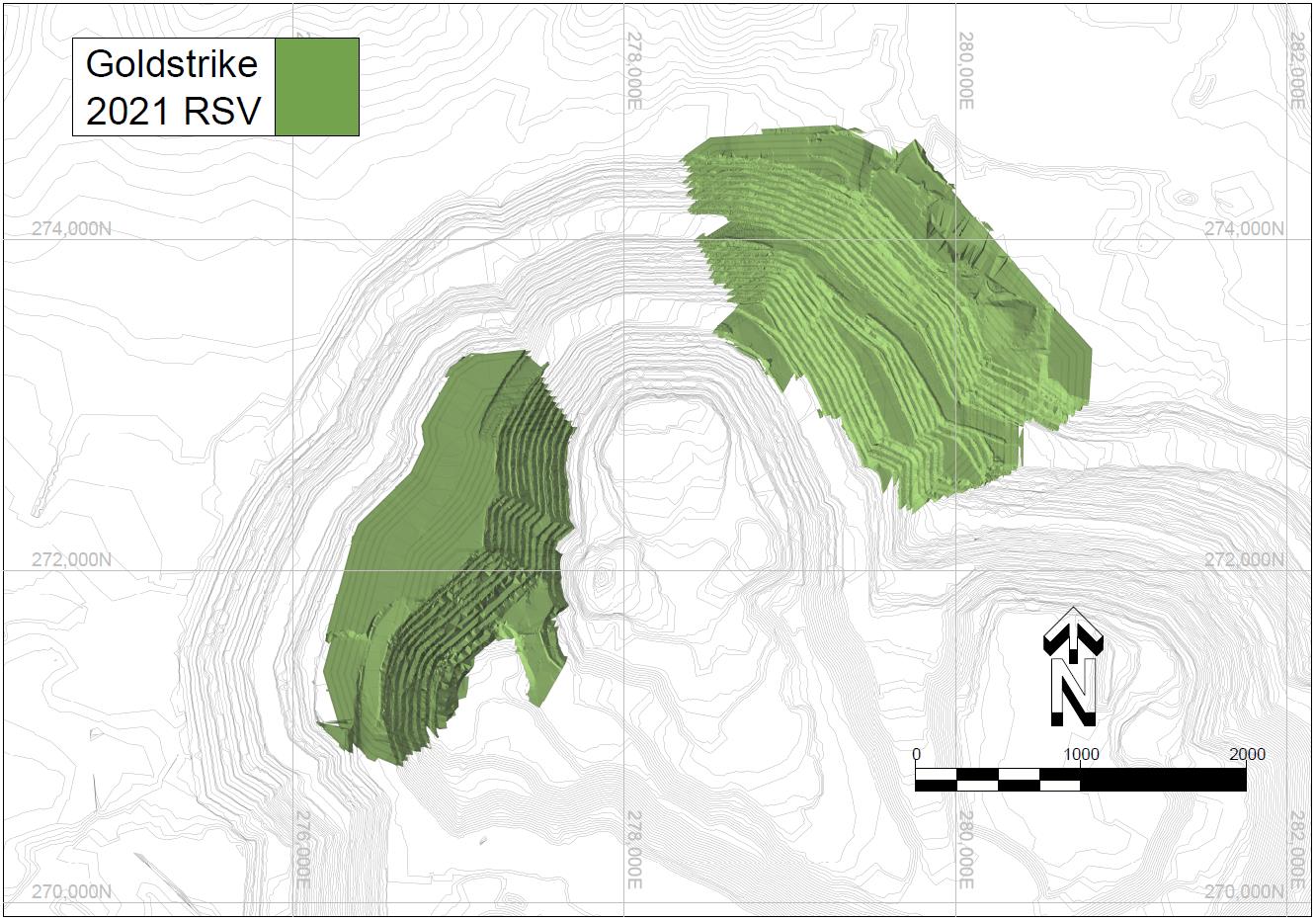

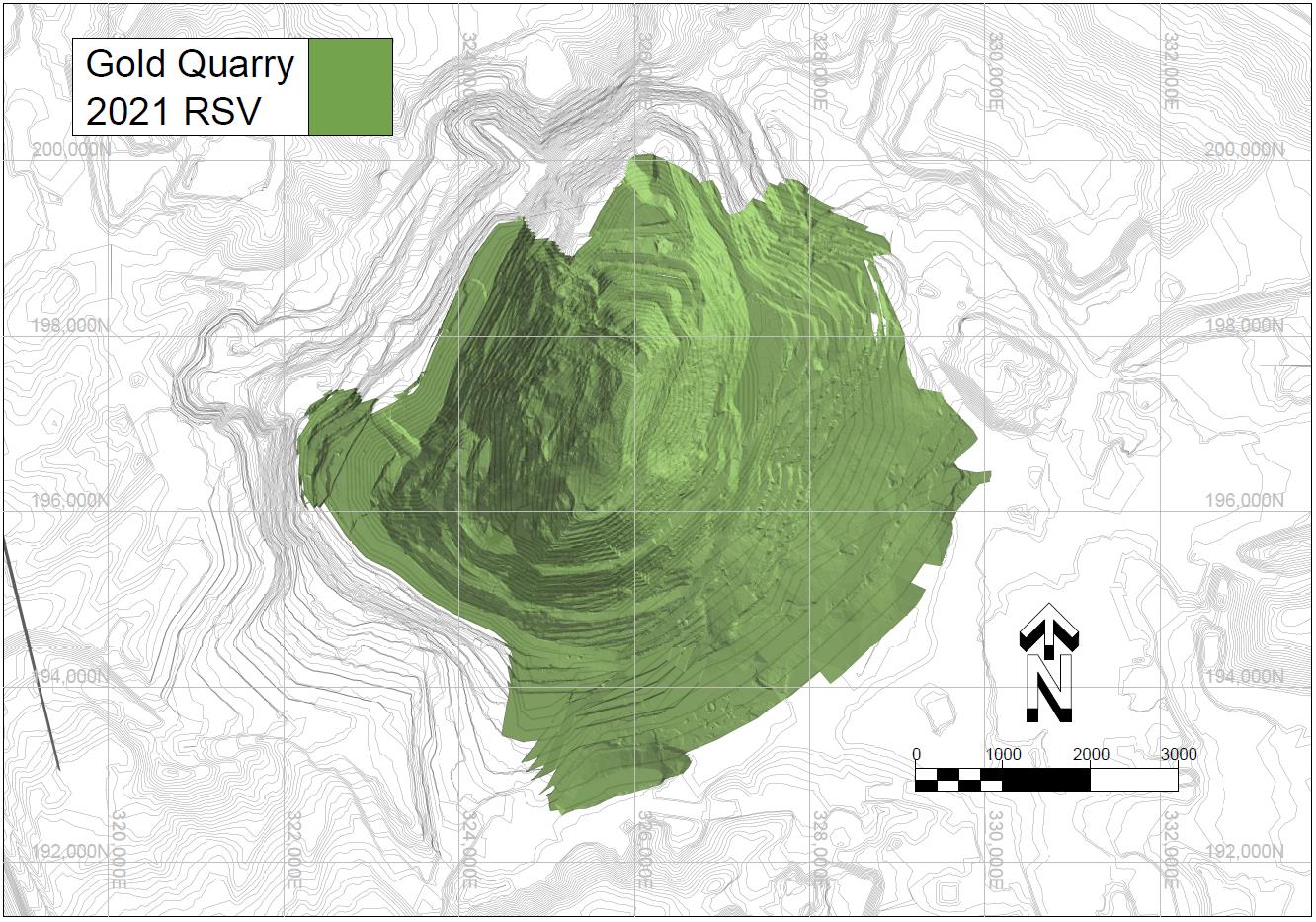

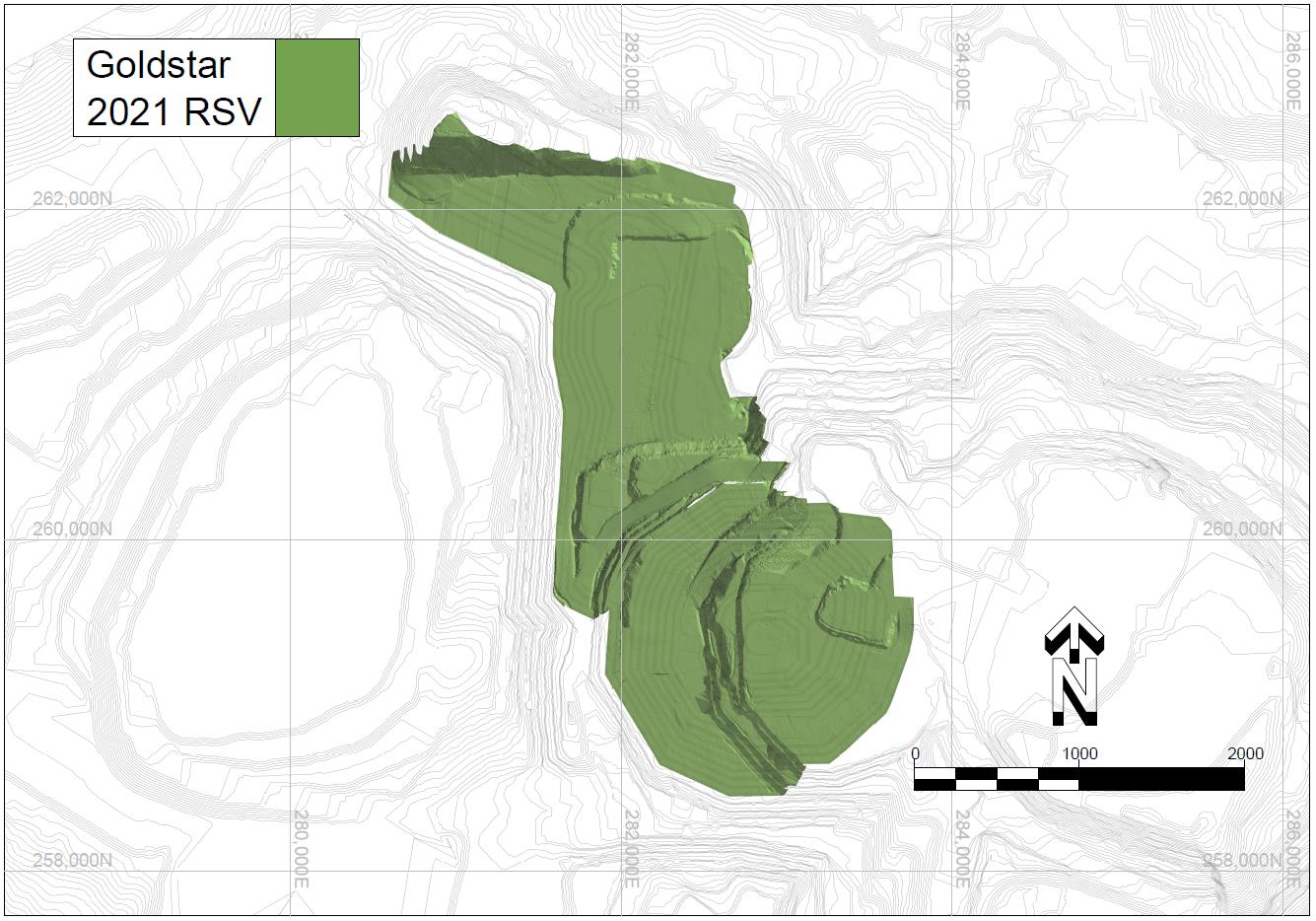

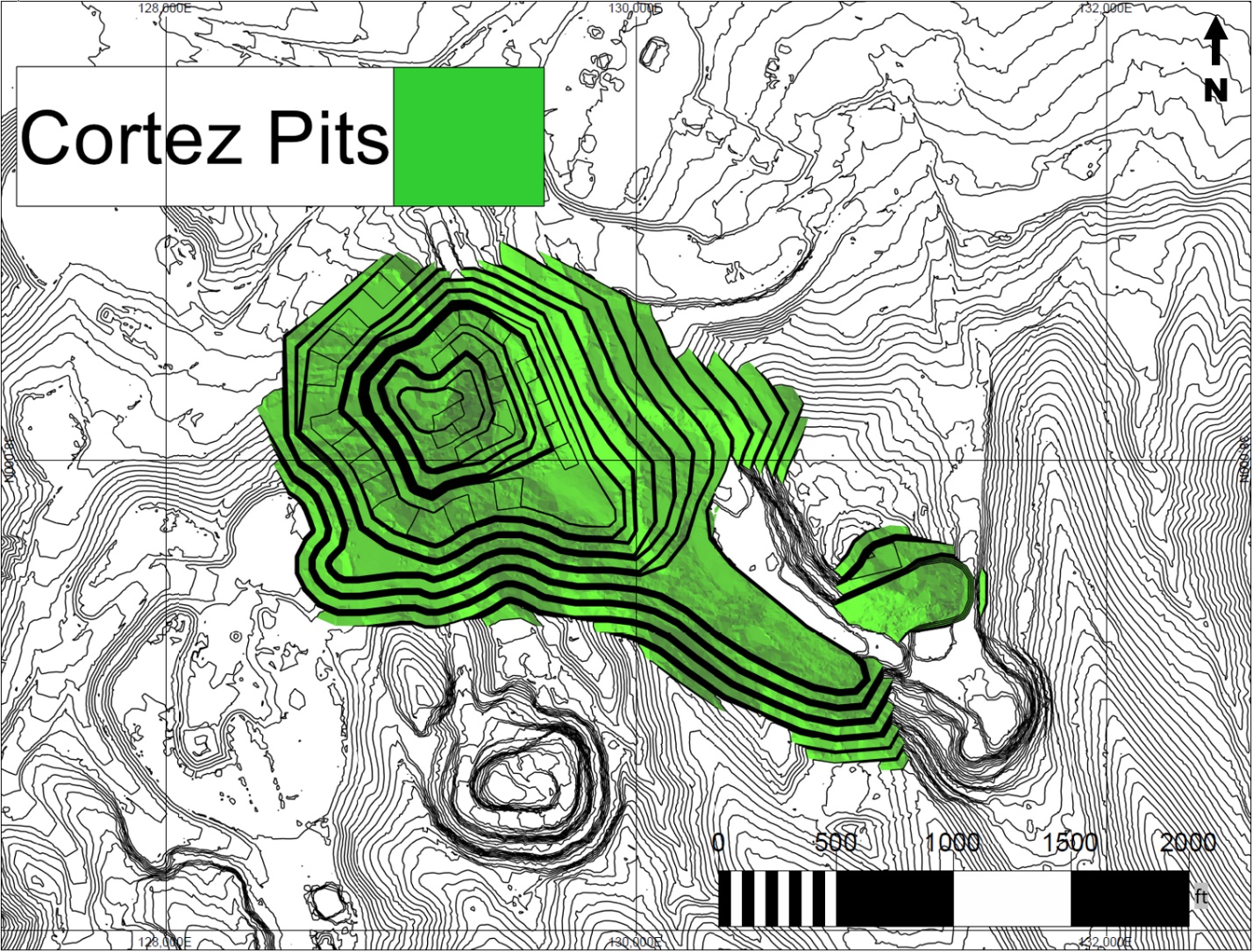

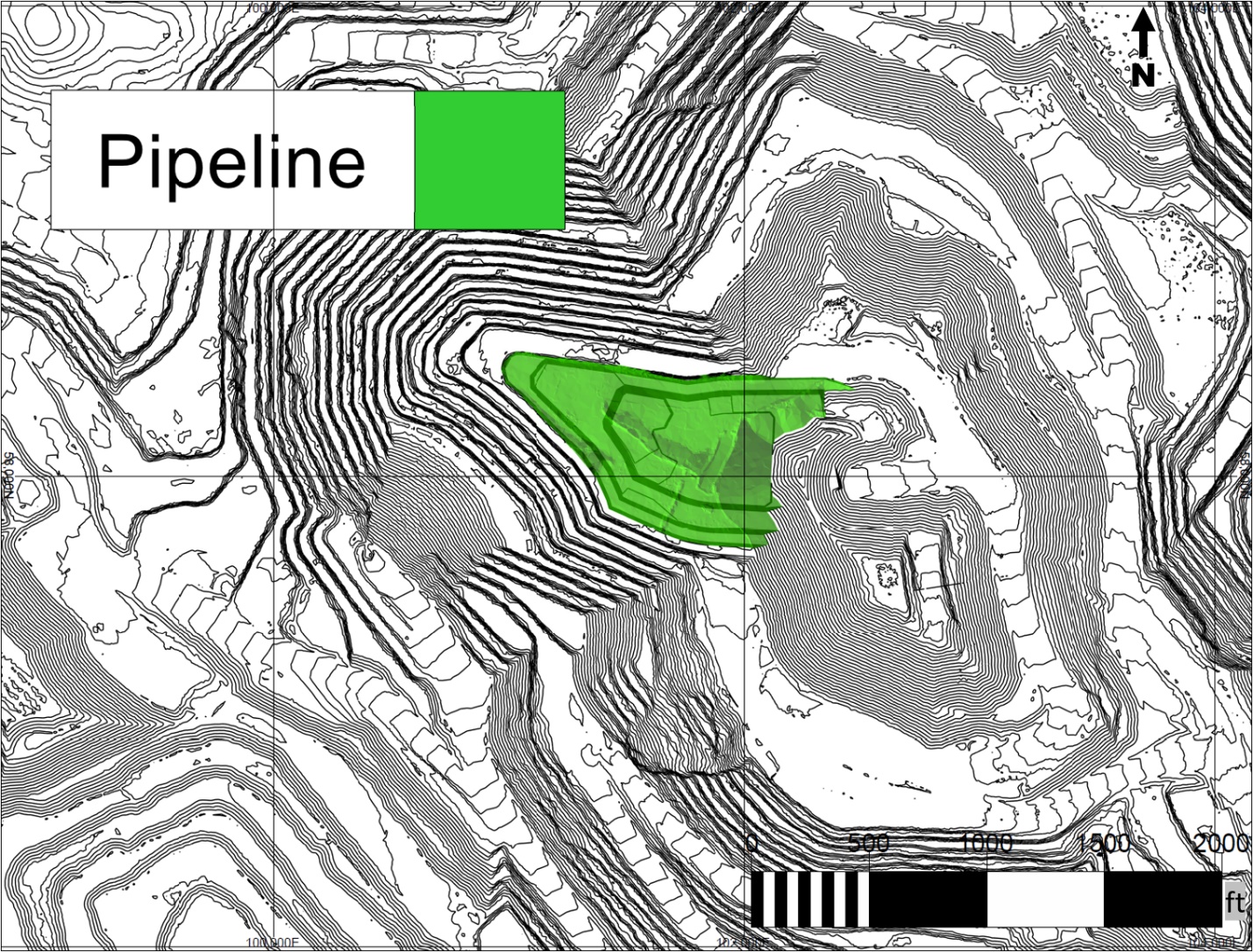

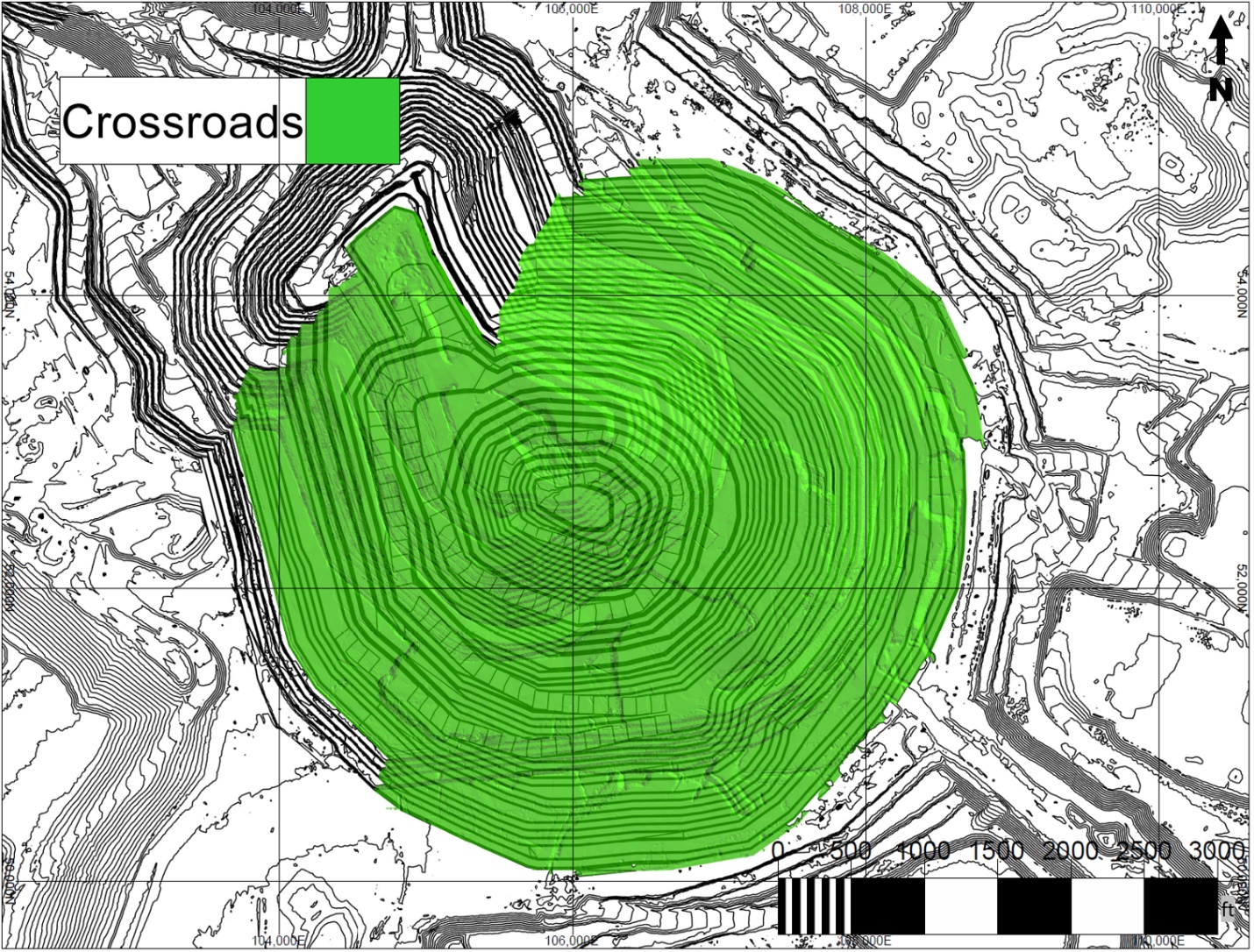

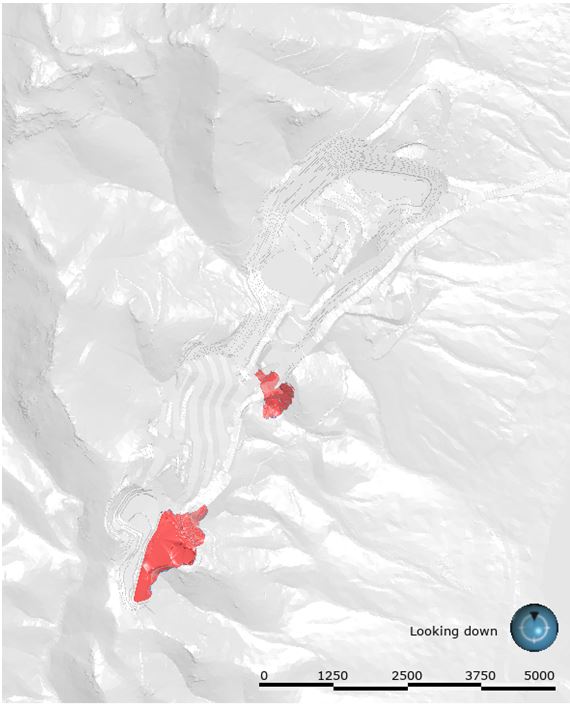

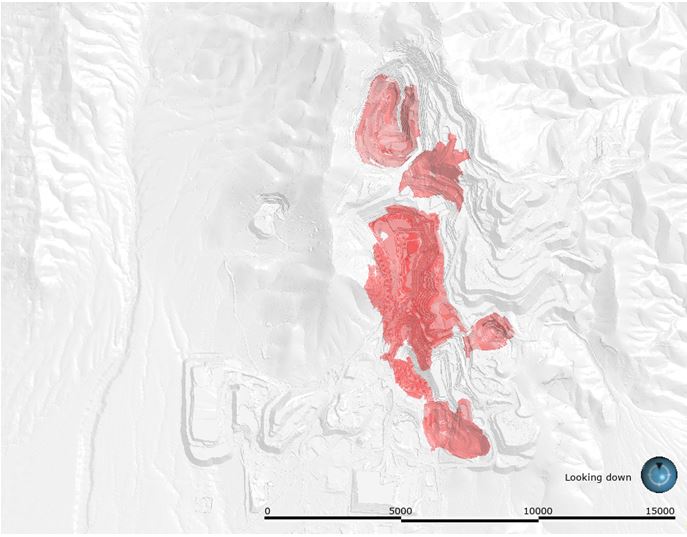

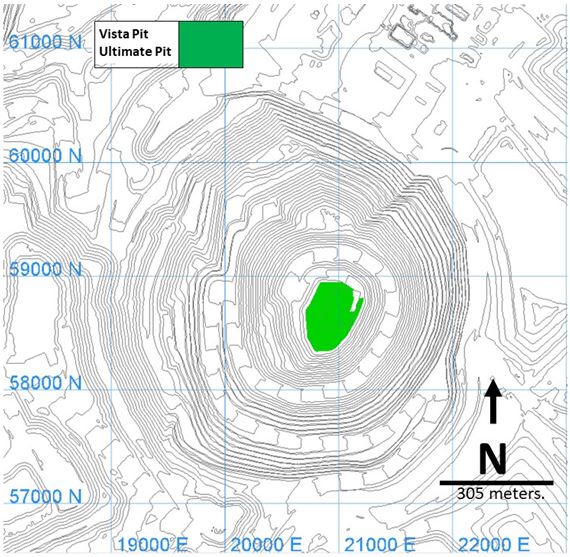

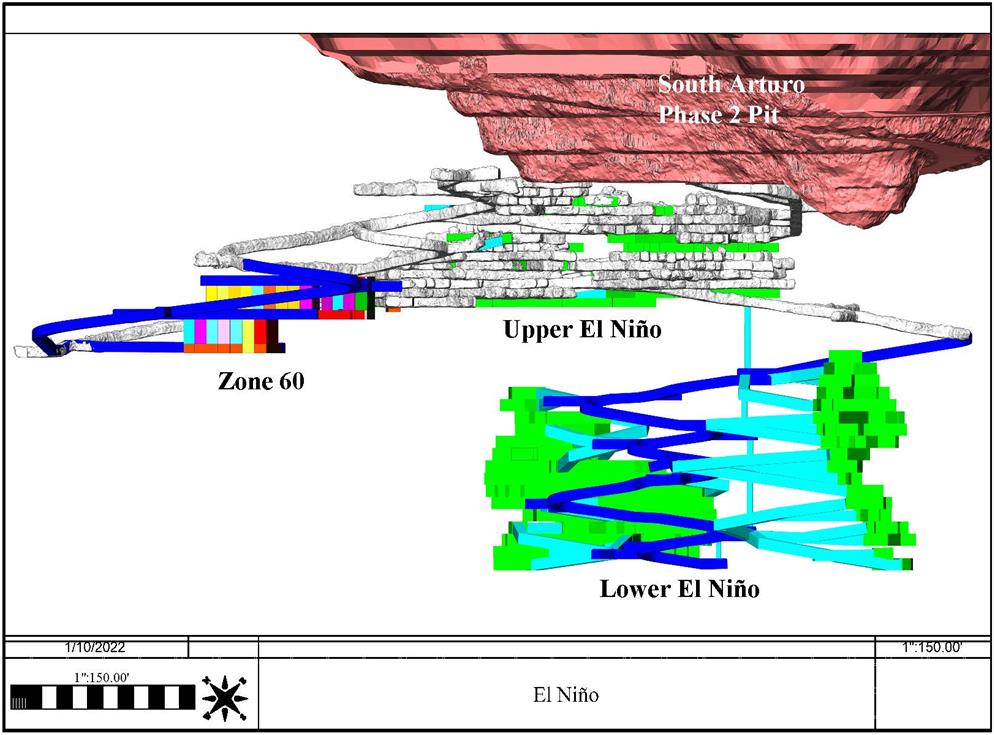

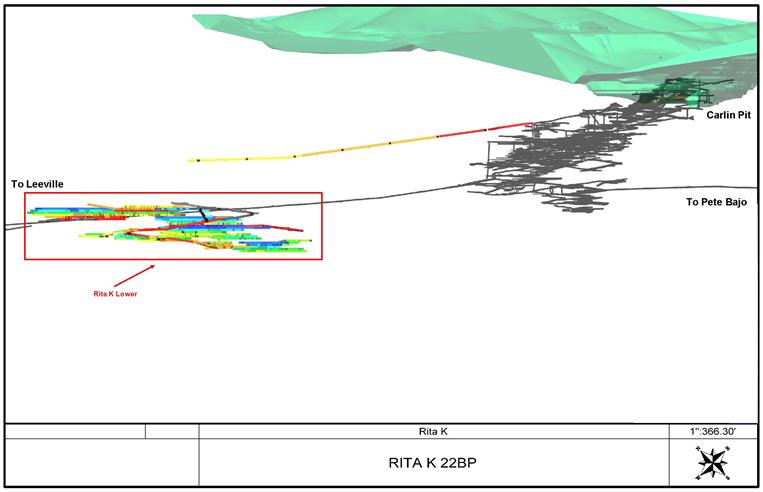

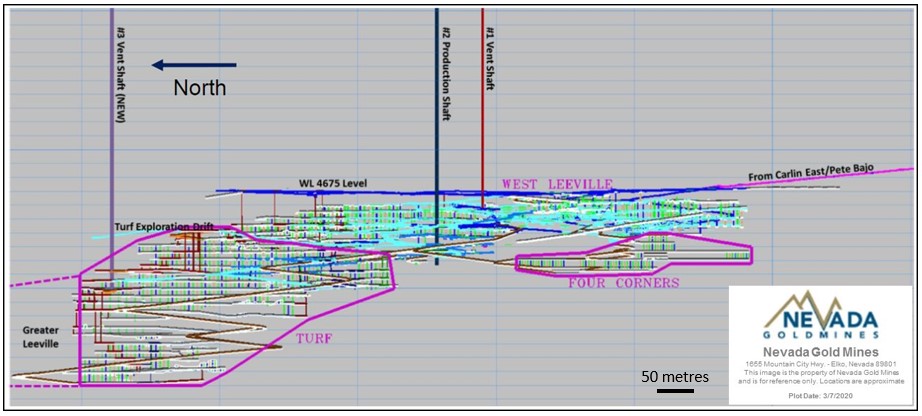

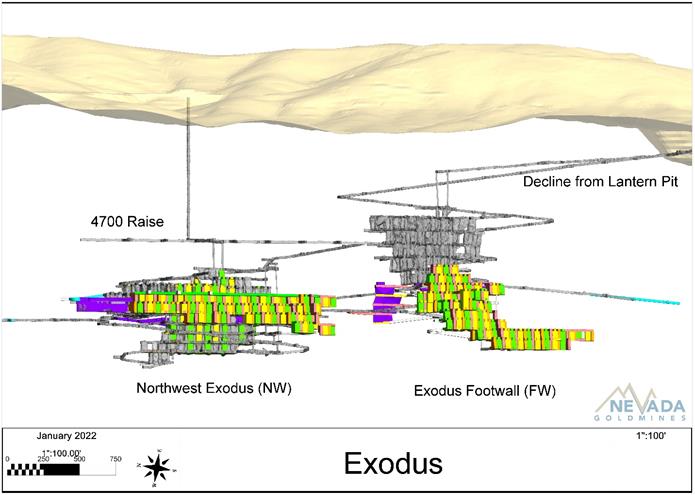

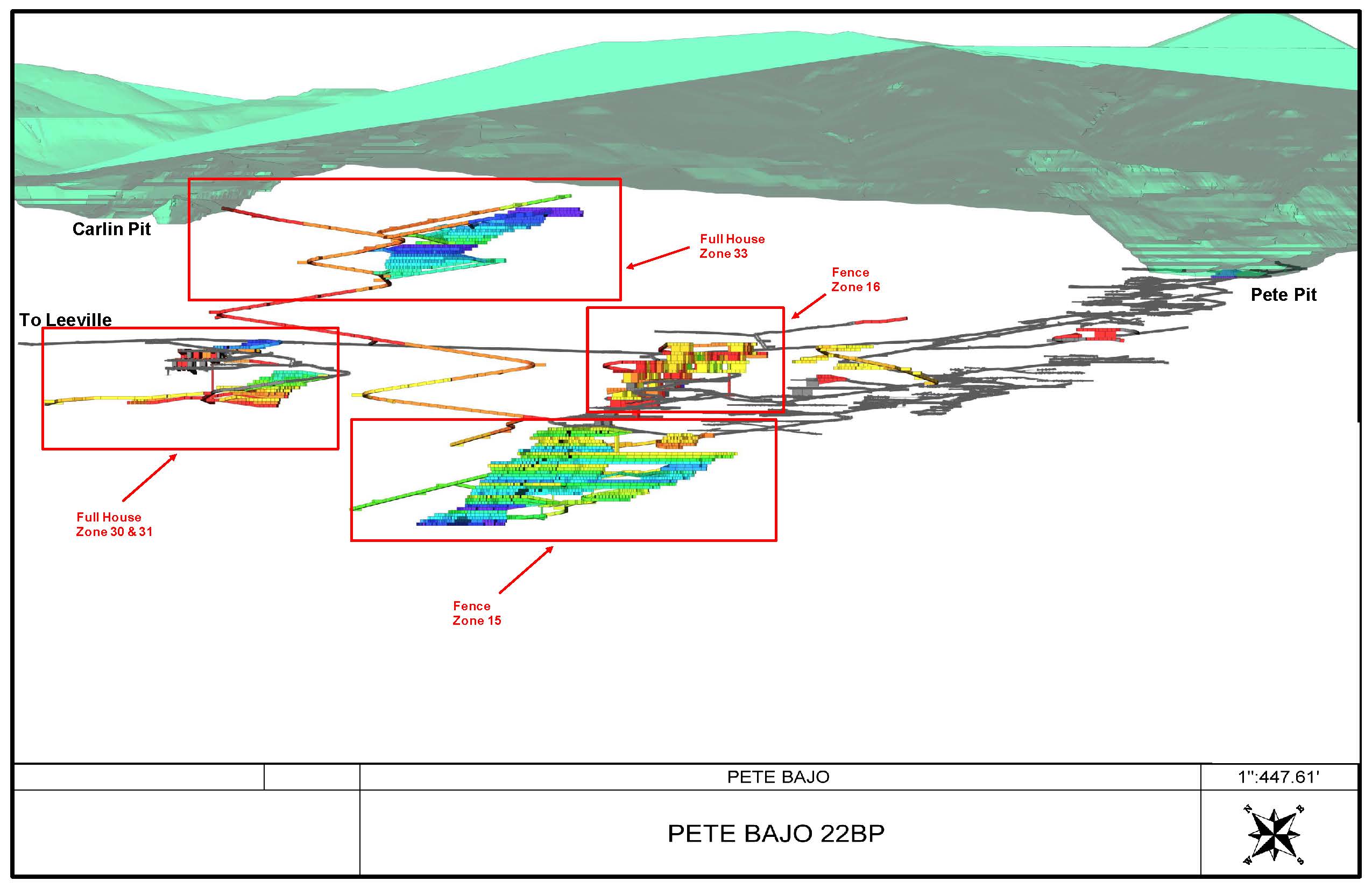

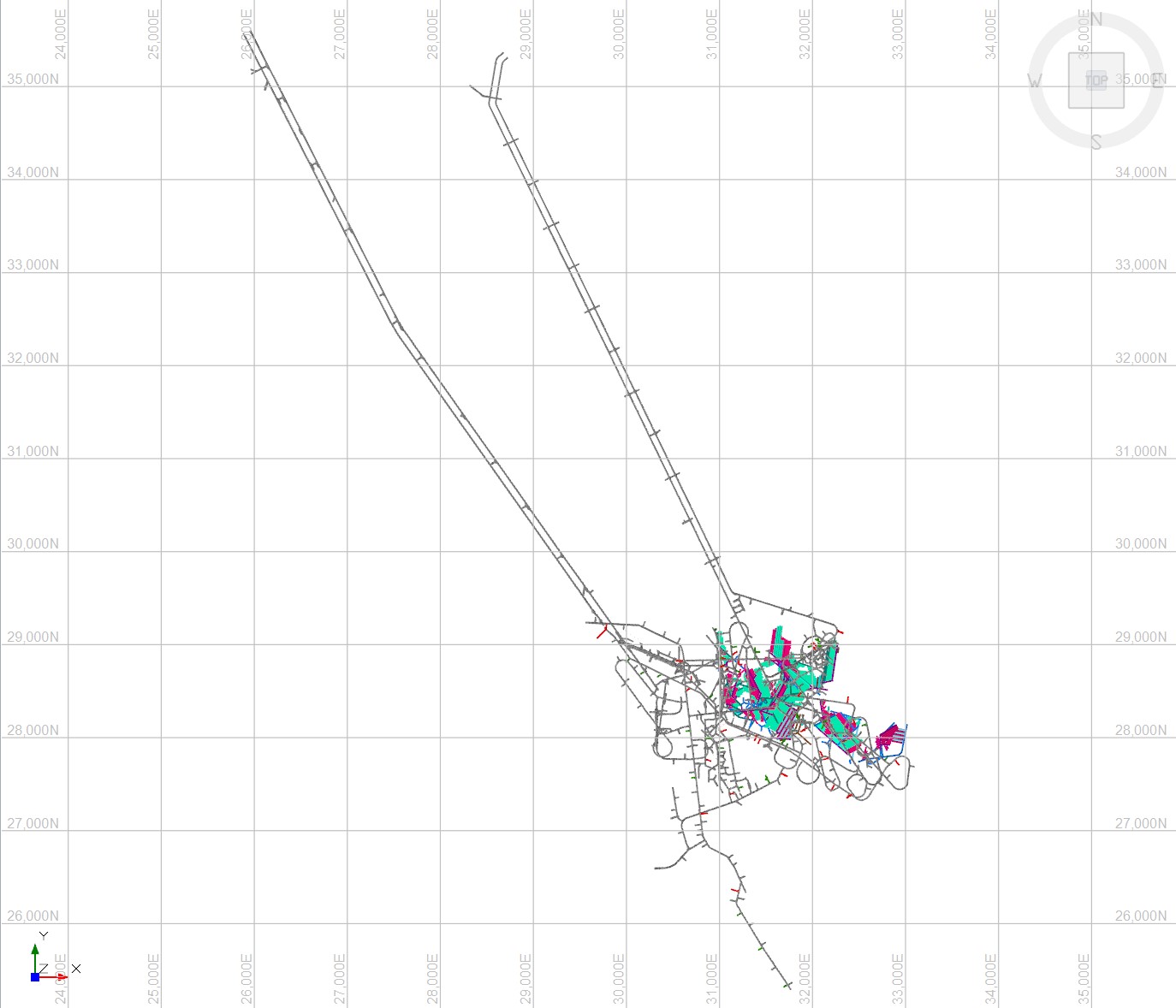

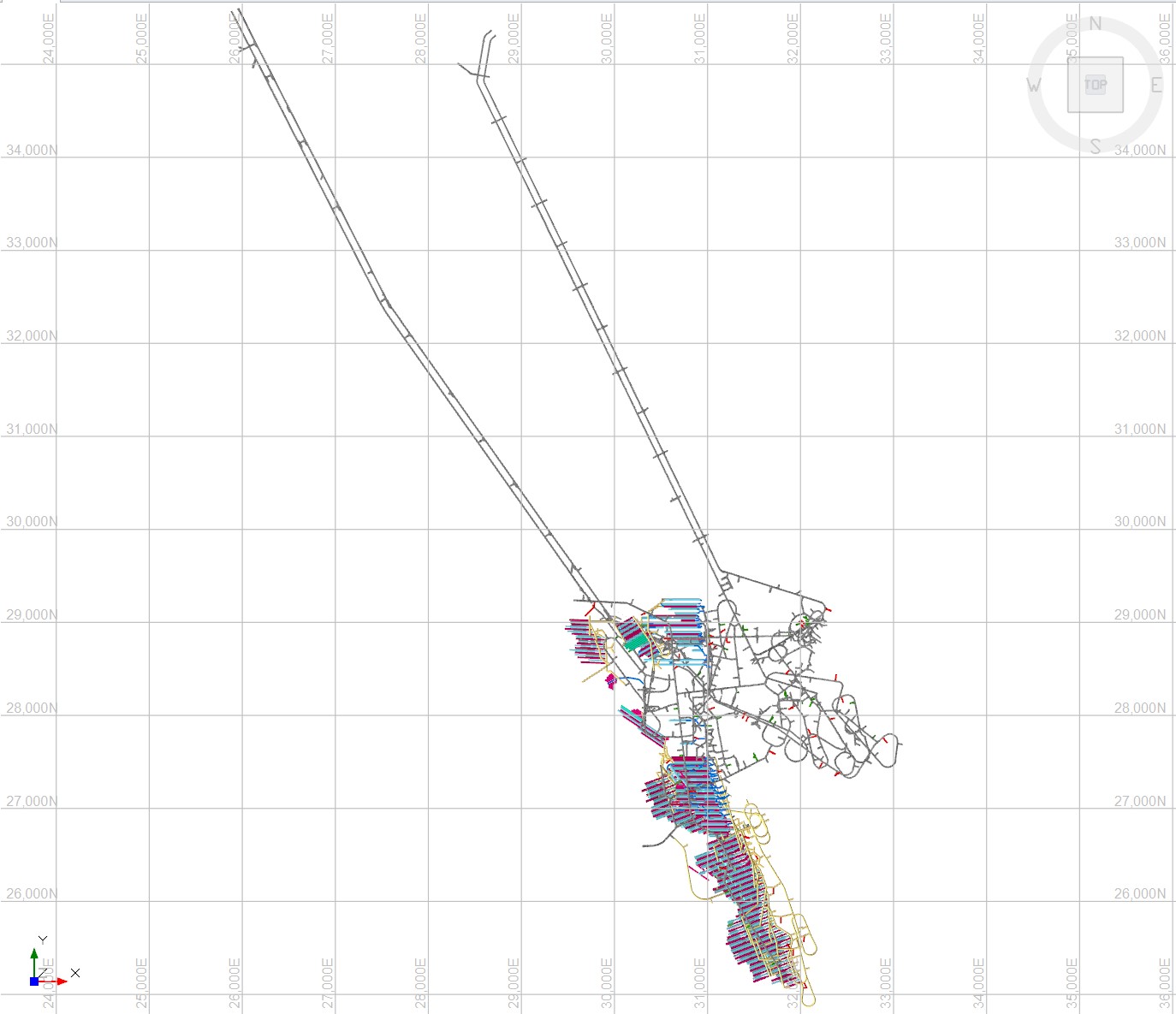

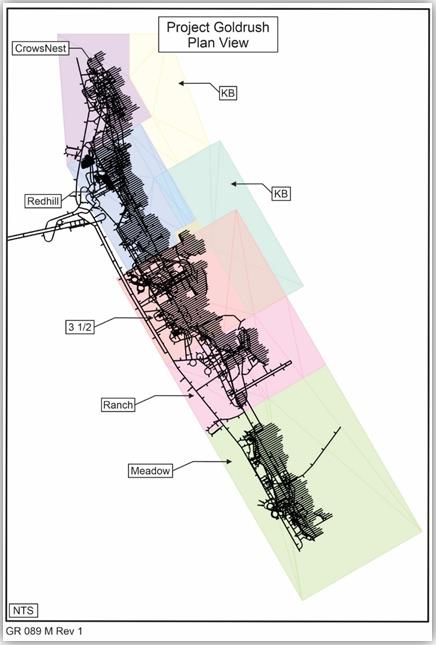

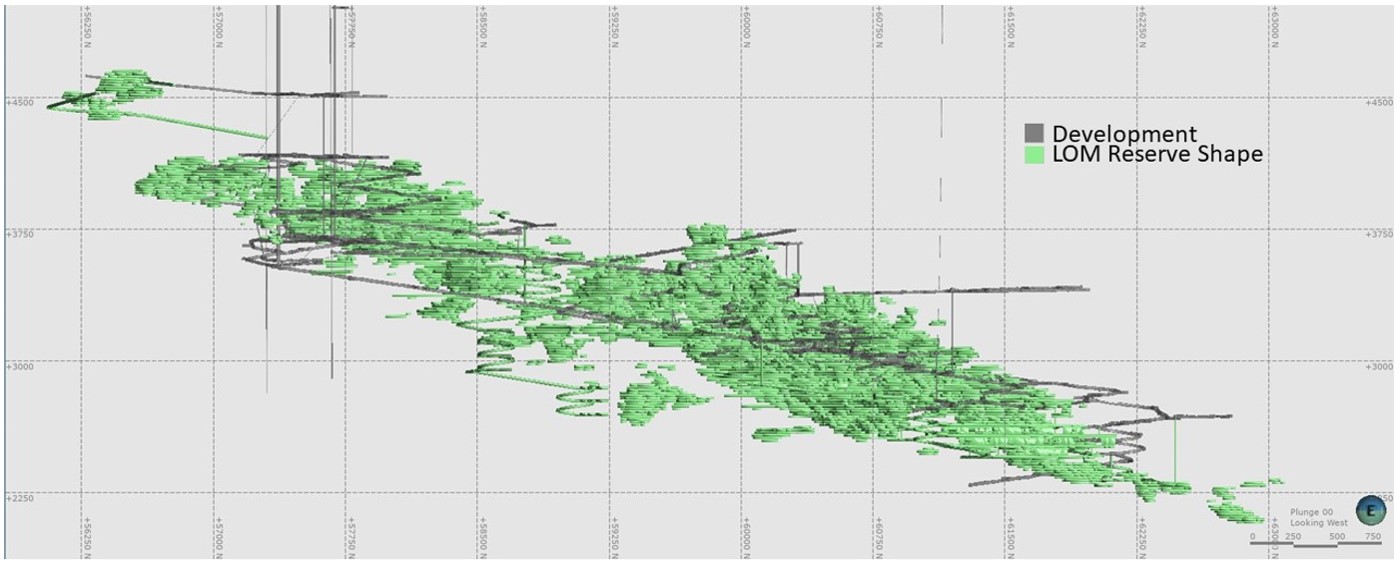

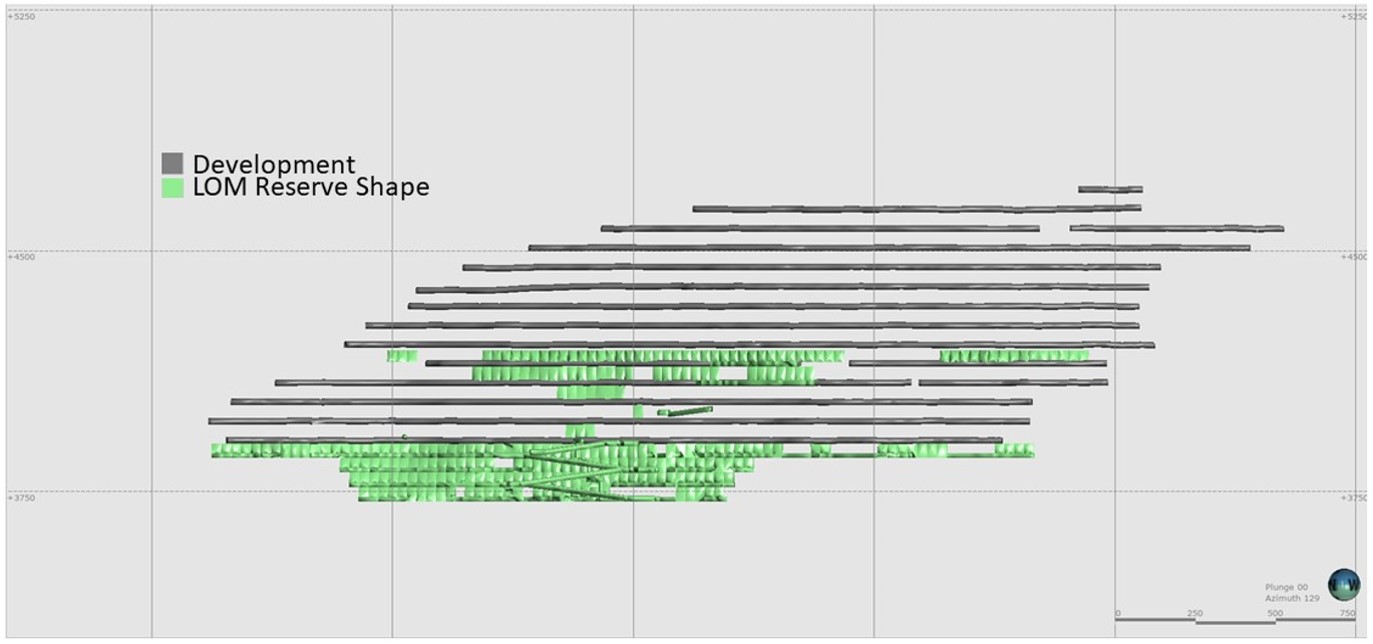

Active open pit mining operations include Crossroads, Gold Quarry, Goldstrike, Goldstar, Long Canyon, Phoenix, Pipeline, and Vista. Two deposits, the Mega Pit at Turquoise Ridge and the South Arturo deposit at Carlin that are planned to be mined using open pit methods, are not currently active, but are planned to be mined in 2022–2023. Active underground mining operations include Cortez Hills underground, Exodus, Goldstrike, El Niño, Leeville, Pete Bajo, Turquoise Ridge Underground, and Vista. Underground exploration development is underway at the Goldrush deposit.

Unless otherwise indicated, all financial values are reported in United States (US) currency (US$). Units may be in either metric or US customary units as identified in the text. Mineral resources and mineral reserves are reported using the definitions in Subpart 229.1300 – Disclosure by Registrants Engaged in Mining Operations in Regulation S–K 1300 (SK1300). The Report uses US English. The Report contains forward-looking information; refer to the note regarding forward-looking information at the front of the Report.

1.3 Property Setting

The Nevada Operations are centered on northern Nevada, and are bisected by Interstate 80 (I-80), which provides access to most of the Project area.

Access for the Carlin Complex is generally from Elko, 26 miles west on I-80 to Carlin which is the closest town to the mine sites. In addition, various alternate access routes use Nevada State Route 766, and Elko and Eureka County roads. These roads are well maintained, and most are paved.

The Cortez Complex is reached by travelling approximately 32 miles east from the town of Battle Mountain on the I-80. Alternative access is from Elko, Nevada, approximately 45 miles

| | | | | | | | |

| Date: February 2022 | | Page 1-1 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

west to the Beowawe exit, then approximately 35 miles south on Nevada State Route 306, which extends southward from I-80.

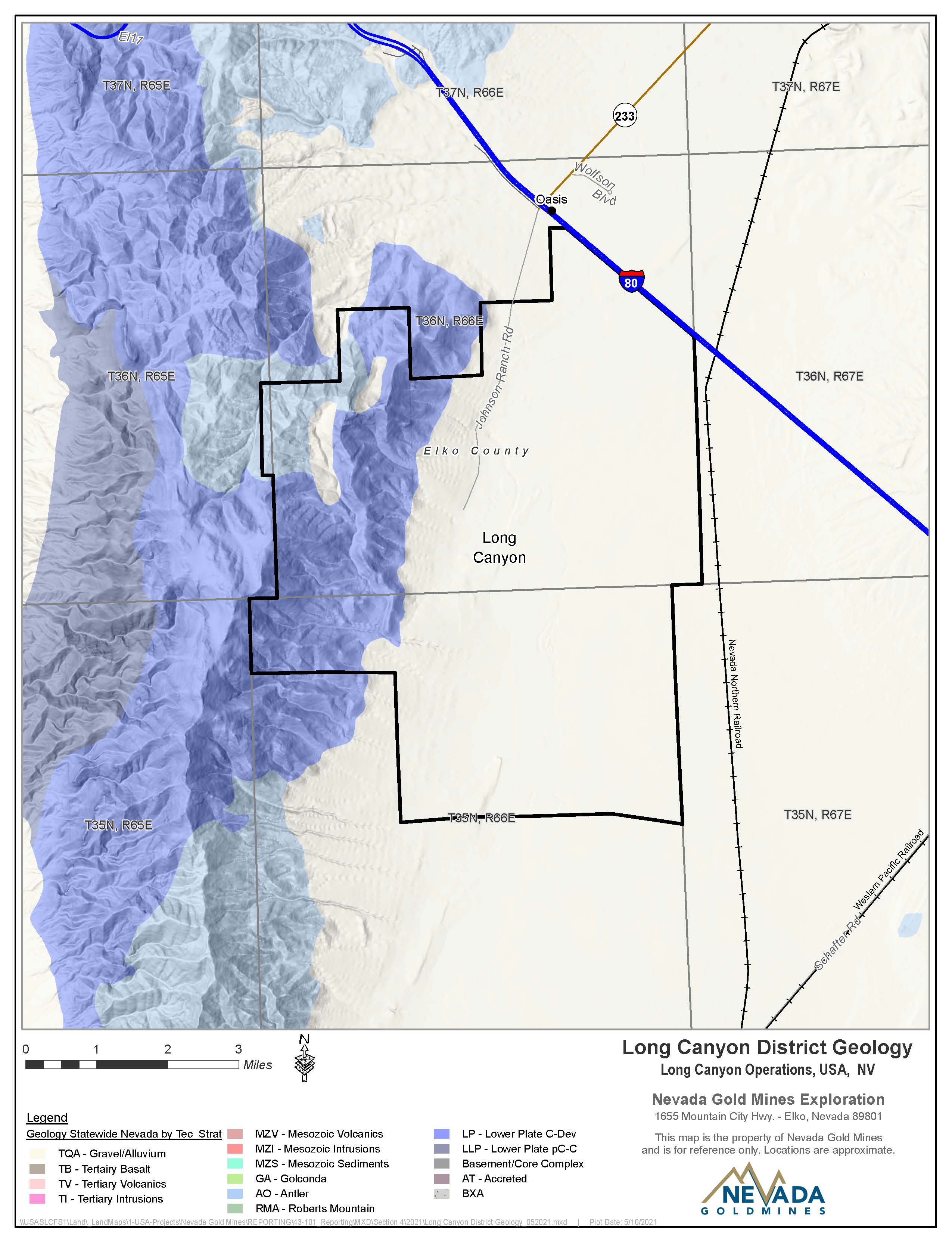

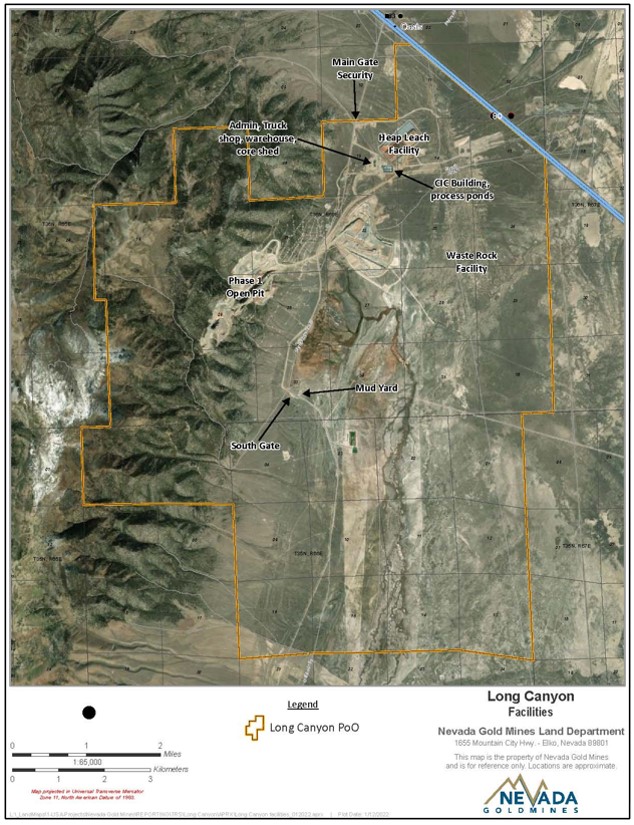

The Long Canyon Complex is accessed from either the I-80 east-bound route through Wells or I-80 west-bound through Wendover, with the main entrance just off the Oasis/Montello interchange. The mine area is within one mile of the freeway with the pit area about four miles west.

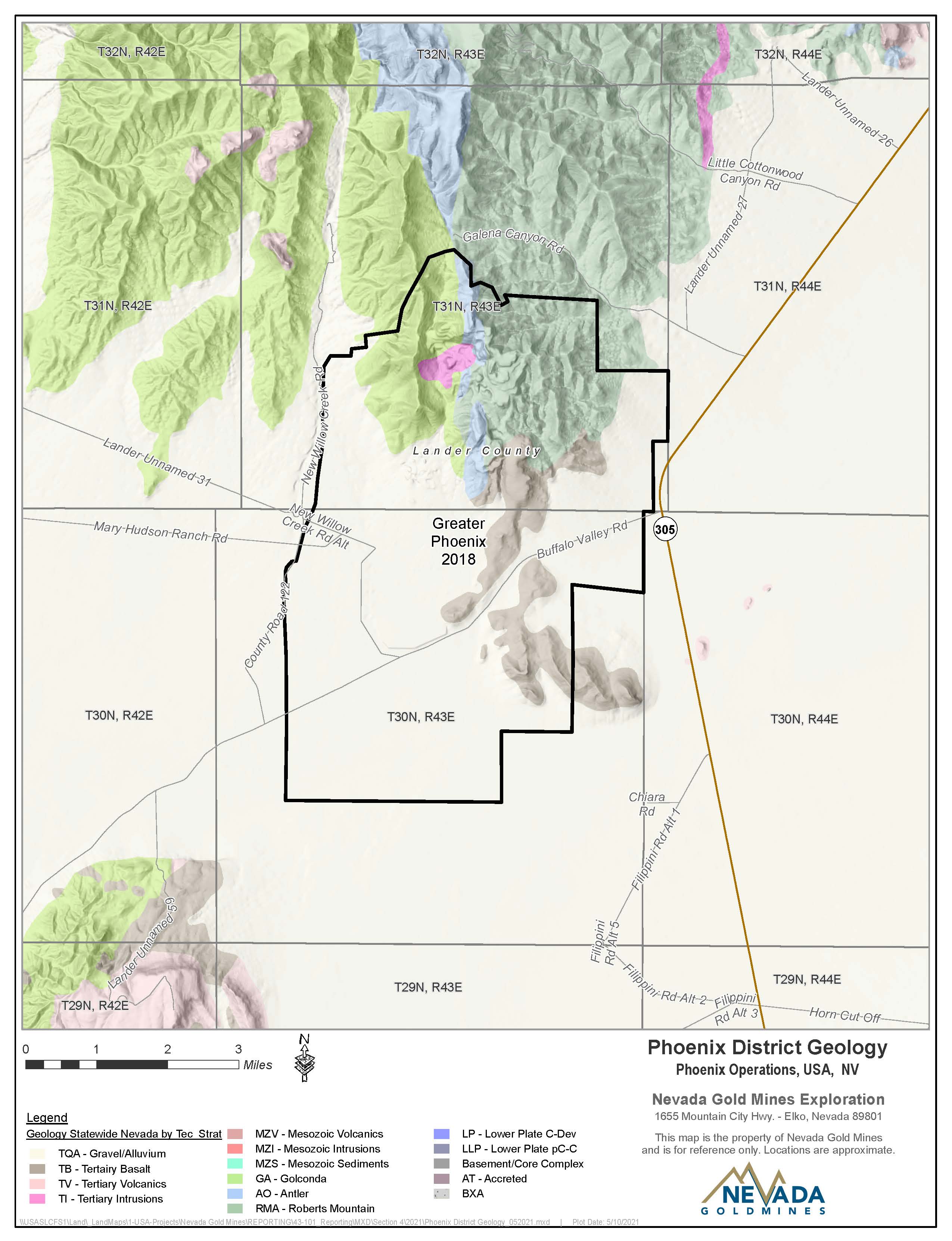

The Phoenix Complex is accessed from I-80 at Battle Mountain, traveling approximately 12 miles south on the paved Nevada State Route 305, and then west a short distance on a paved/gravel county access road.

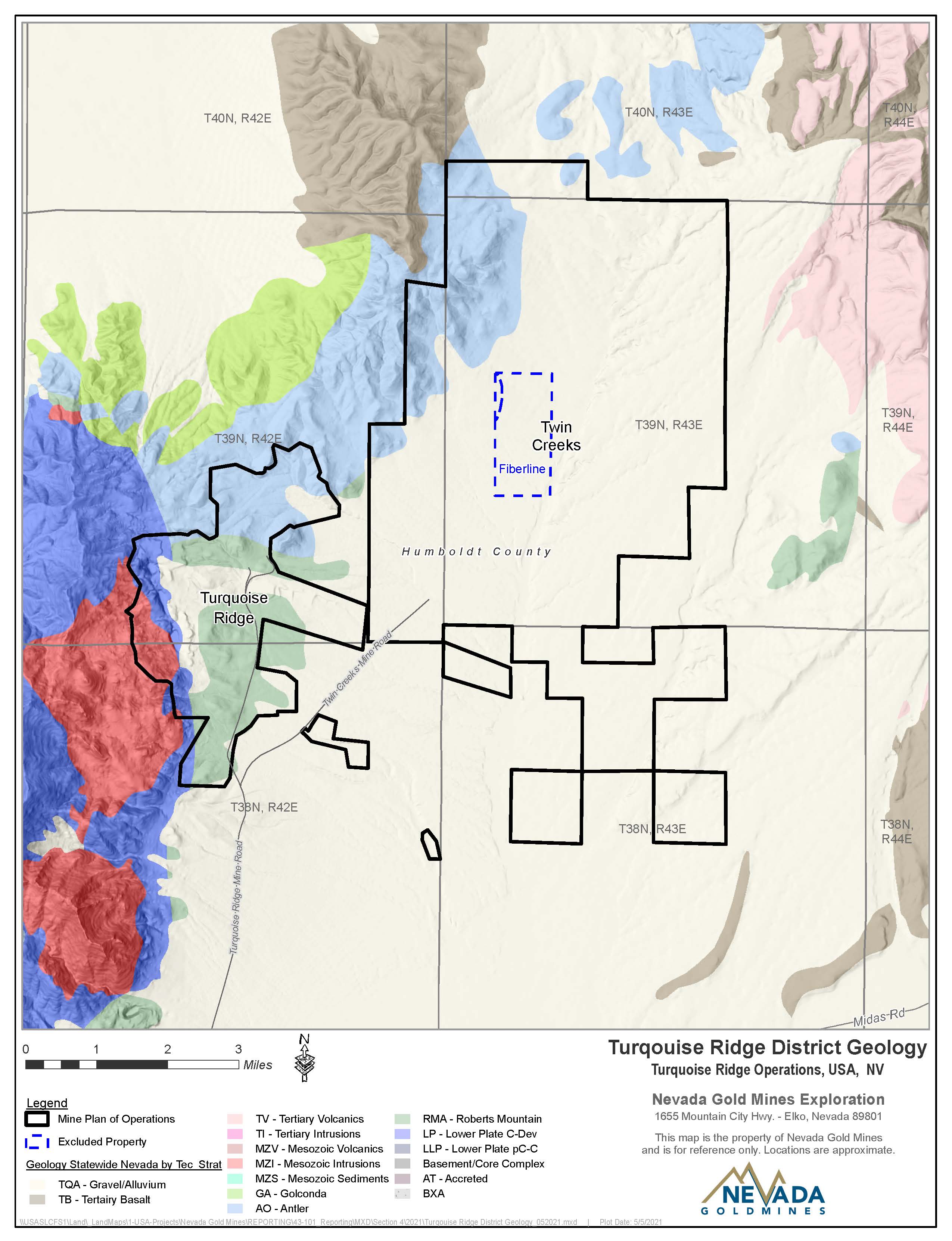

The Turquoise Ridge Complex is accessed from a turnoff at the settlement of Golconda, 25 miles east of Winnemucca, then following a paved road for a further 25 miles, and thereafter by an improved gravel road to the mine gates. It is then 10 miles to the west mine gate and 25 miles to the east mine gate.

The Nevada operations are crossed by a network of gravel roads, providing easy access to various portions of the sites. The majority of the roads are suitable for all-weather conditions; however, in extreme winter conditions, roads may be closed for snow removal.

The Union Pacific Rail line runs parallel to I-80. NGM operates the Dunphy Rail Terminal, which is located 27 miles west of Carlin, for the transportation of bulk commodities such as lubricants, fuel, and ball mill consumables. These bulk commodities are road-transported from the Dunphy Rail Terminal to each site using commercial trucking services. Elko is serviced by commercial flights to Salt Lake City, Utah.

The Nevada Operations are located in a high desert region. Operations are conducted year-round.

The Project is located in a major mining region and local resources including labor, water, power, natural gas, and local infrastructure for transportation of supplies are well established. Mining has been an active industry in northern Nevada for more than 150 years. Elko (pop. 20,300) is a local hub for mining operations in northern Nevada and services necessary for mining operations are readily available.

1.4 Ownership

NGM is a JV between Barrick and Newmont. Barrick is the JV operator and has a 61.5% interest, with Newmont owning the remaining 38.5% interest. The JV area of interest (AOI) covers a significant portion of northern Nevada.

1.5 Mineral Tenure, Surface Rights, Water Rights, Royalties and Agreements

The Nevada Operations currently includes 15 plans of operations (PoOs) and eight exploration PoOs. The area includes private land (surface and minerals) owned or controlled by NGM, and land owned by the federal government that is administered by the Bureau of Land Management (BLM).

| | | | | | | | |

| Date: February 2022 | | Page 1-2 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

Within the operations PoO areas are 9,205 lode, millsite, placer and patented claims covering an area of approximately 163,214 acres. Within the exploration PoO areas, 2,180 lode, millsite, placer and patented claims cover an area of approximately 43,363 acres. Between the operations and the exploration PoOs, NGM holds a total of 11,385 claims covering an area of approximately 206,578 acres.

In addition, NGM holds a number of fee properties, within the operations and exploration PoOs. Collectively, these cover an area of approximately 78,621 acres.

On 11 March, 2019, Barrick and Newmont announced the formation of the NGM JV. Newmont, Barrick, and their respective affiliates that held properties in the AOI contributed to NGM the respective rights, titles and interests in, to, or under, all properties located in the AOI and any other assets, properties or rights located in Nevada. Newmont and Barrick excluded certain development and exploration properties that the companies held within the AOI from the JV; these included Newmont’s Fiberline and Mike projects, and Barrick’s Fourmile project. The JV has a mechanism for the potential contribution of the excluded properties to NGM in the future.

A number of agreements exist with federal, state, and third-party entities and these are monitored using a land management database.

NGM holds all necessary surface rights for the current mining operations. Additional surface rights will be required, for future mining projects. The Goldrush PoO is currently moving through the National Environmental Policy Act (NEPA) process (see discussion in Chapter 1.17.3).

NGM currently maintains a combination of approximately 1,250 active surface and groundwater rights within 38 hydrographic basins. NGM holds all necessary water rights for the LOM plan envisaged in this Report.

There are numerous royalties that pertain to the active mines within the Nevada Operations. Royalty payments vary, as the payments depend upon actual tonnages mined, the amount of gold recovered from that mined material, the deposit being mined, the receiving entity, and the type of royalty. A number of the claims have inactive royalties attached, which are not currently triggered as the claims are not being mined. In connection with the formation of Nevada Gold Mines, each of Barrick and Newmont was granted a 1.5% net smelter returns royalty over the respective properties they contributed to the NGM JV. Each of these “retained royalties” is only payable once the aggregate production from the properties subject to the royalty exceeds the publicly reported mineral reserves and mineral resources as of December 31, 2018. The state of Nevada imposes a 5% Net Proceeds of Minerals Tax on the value of all minerals severed in the State. This tax is calculated and paid based on a prescribed net income formula. Separately, a Nevada Mining Education Tax based on gross revenue, was introduced during 2021.

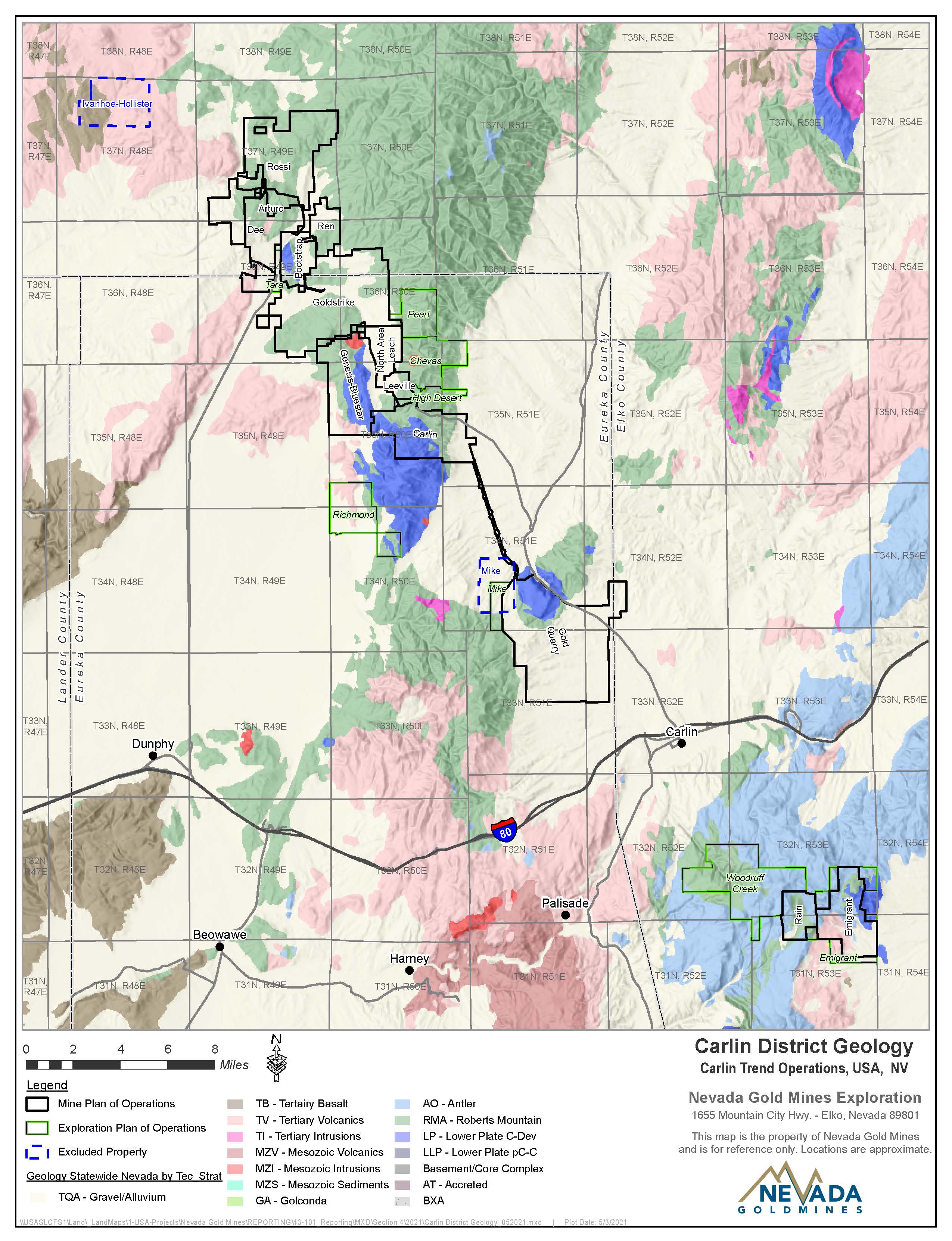

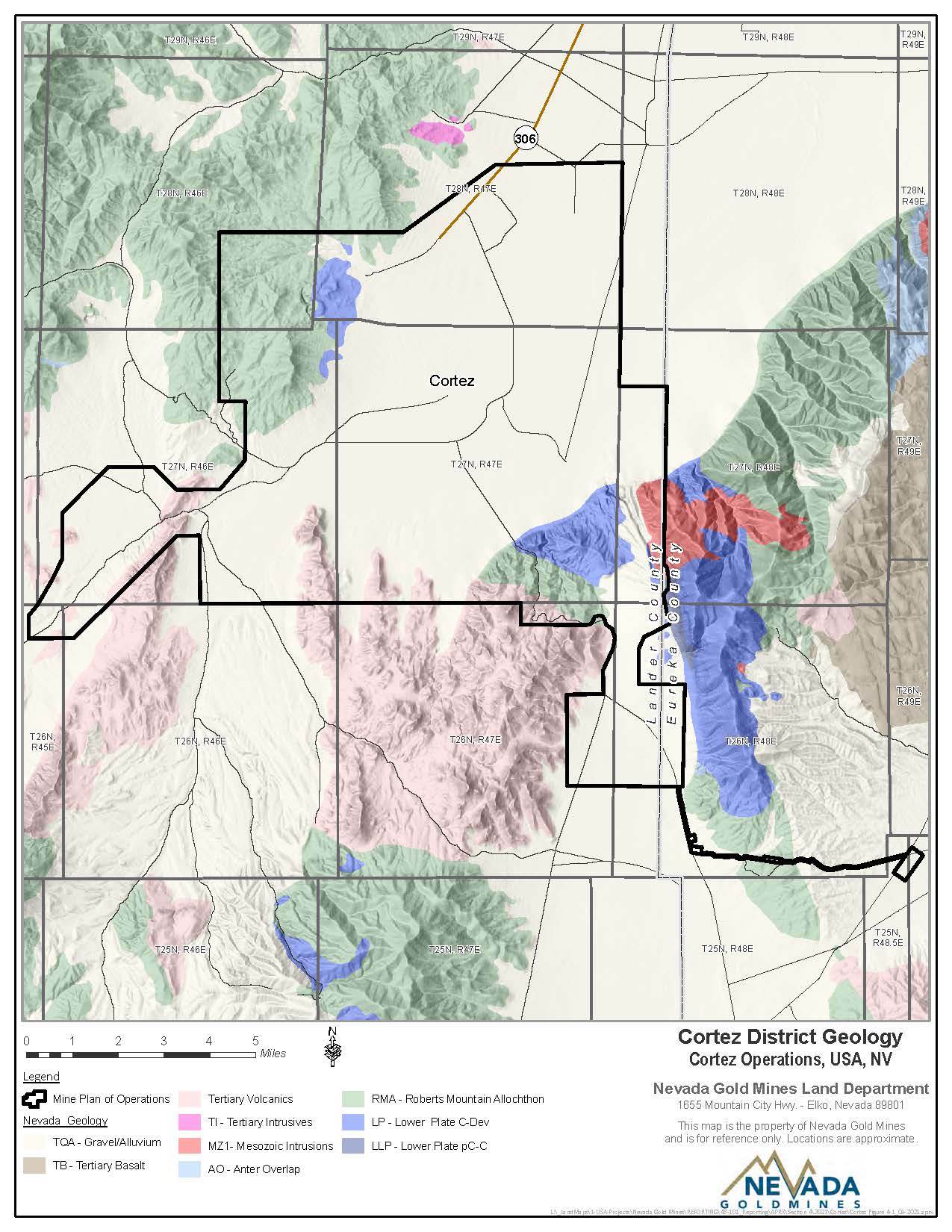

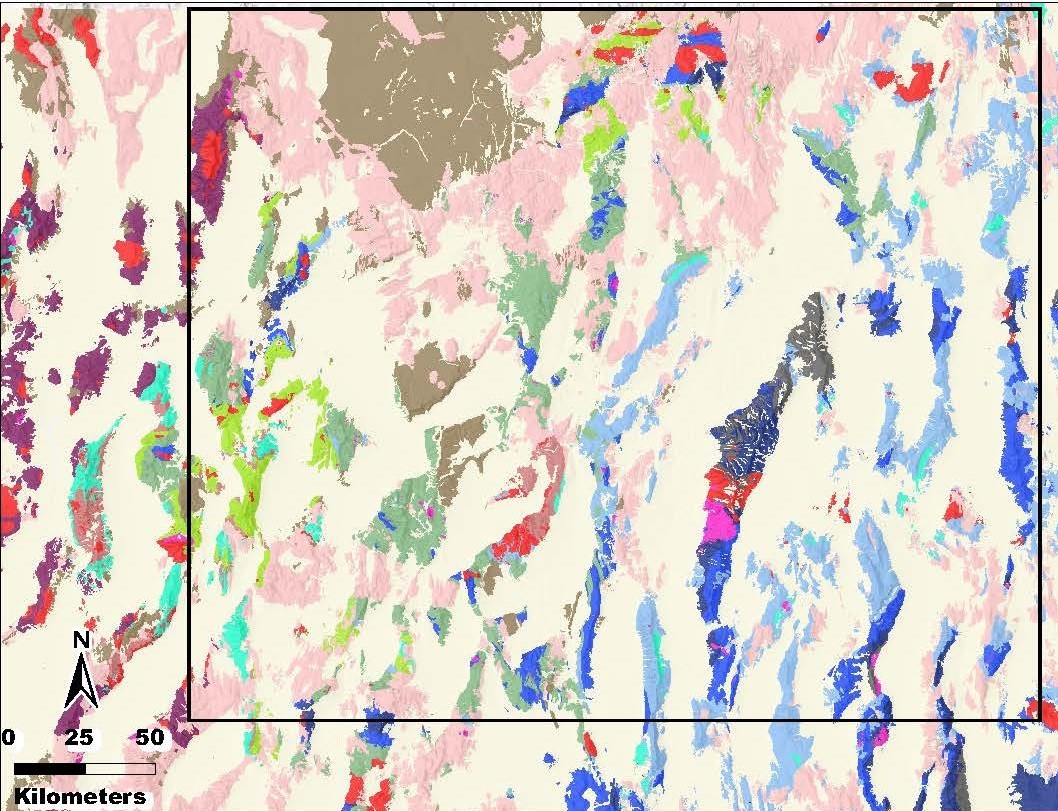

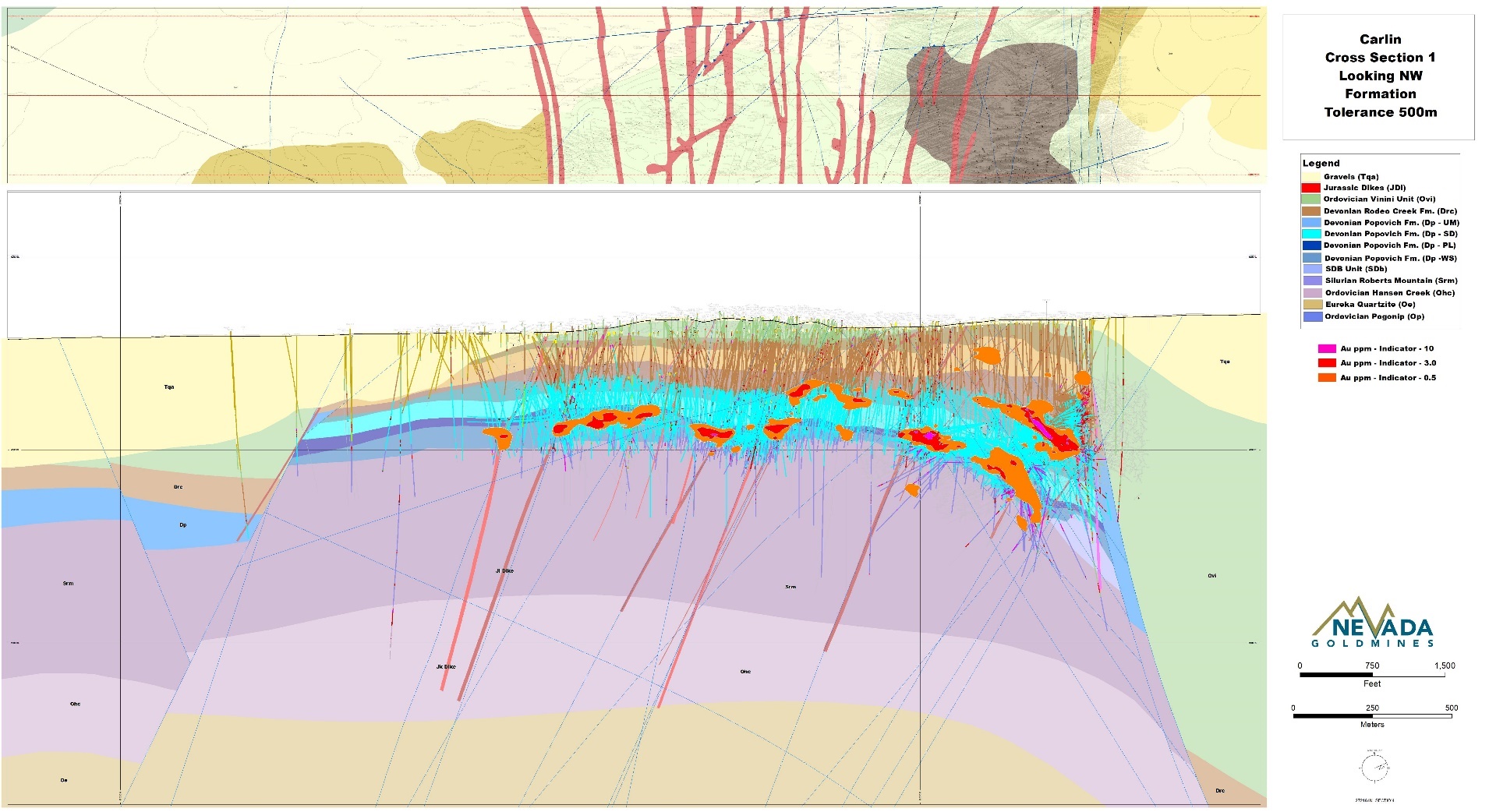

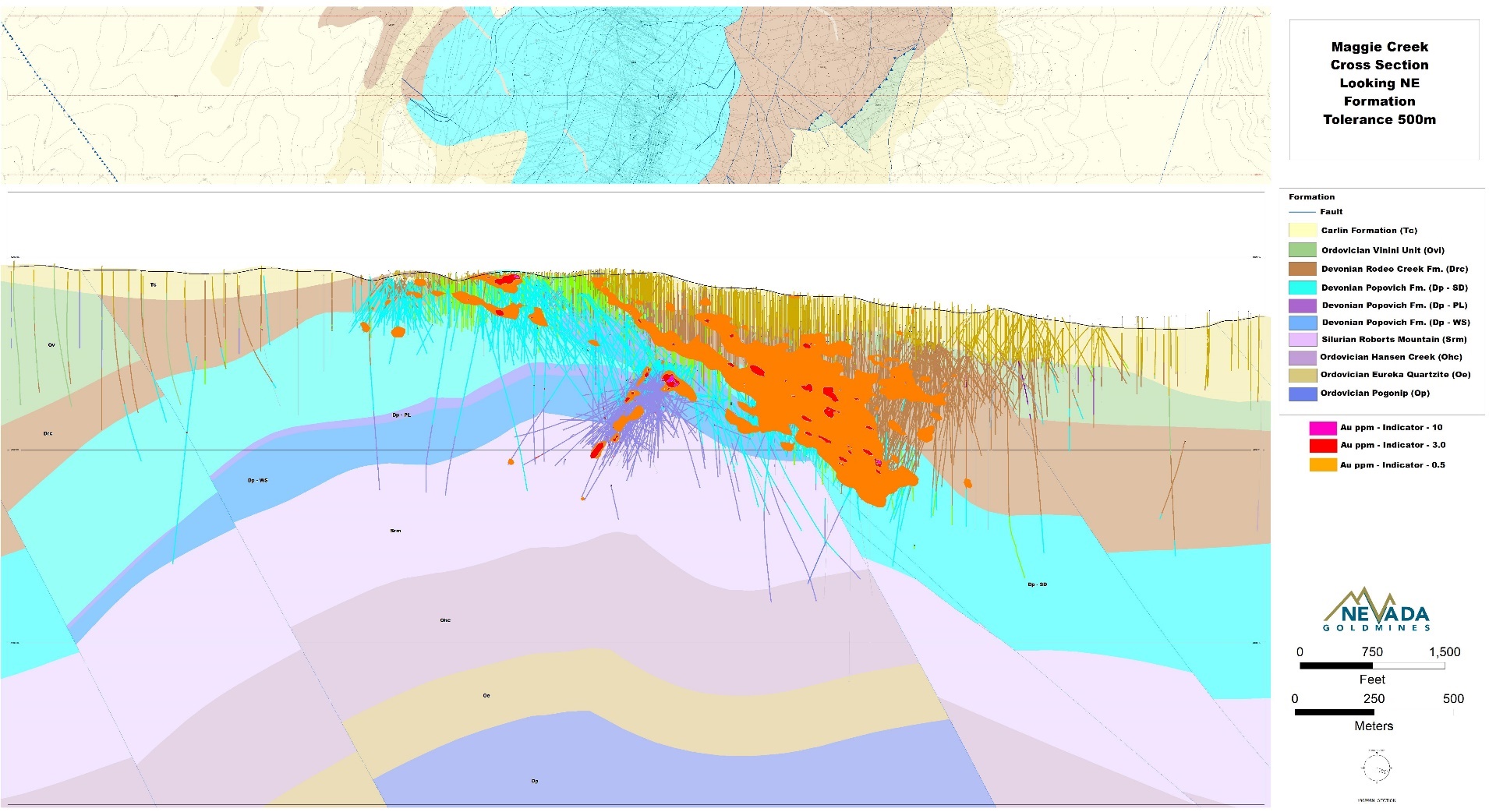

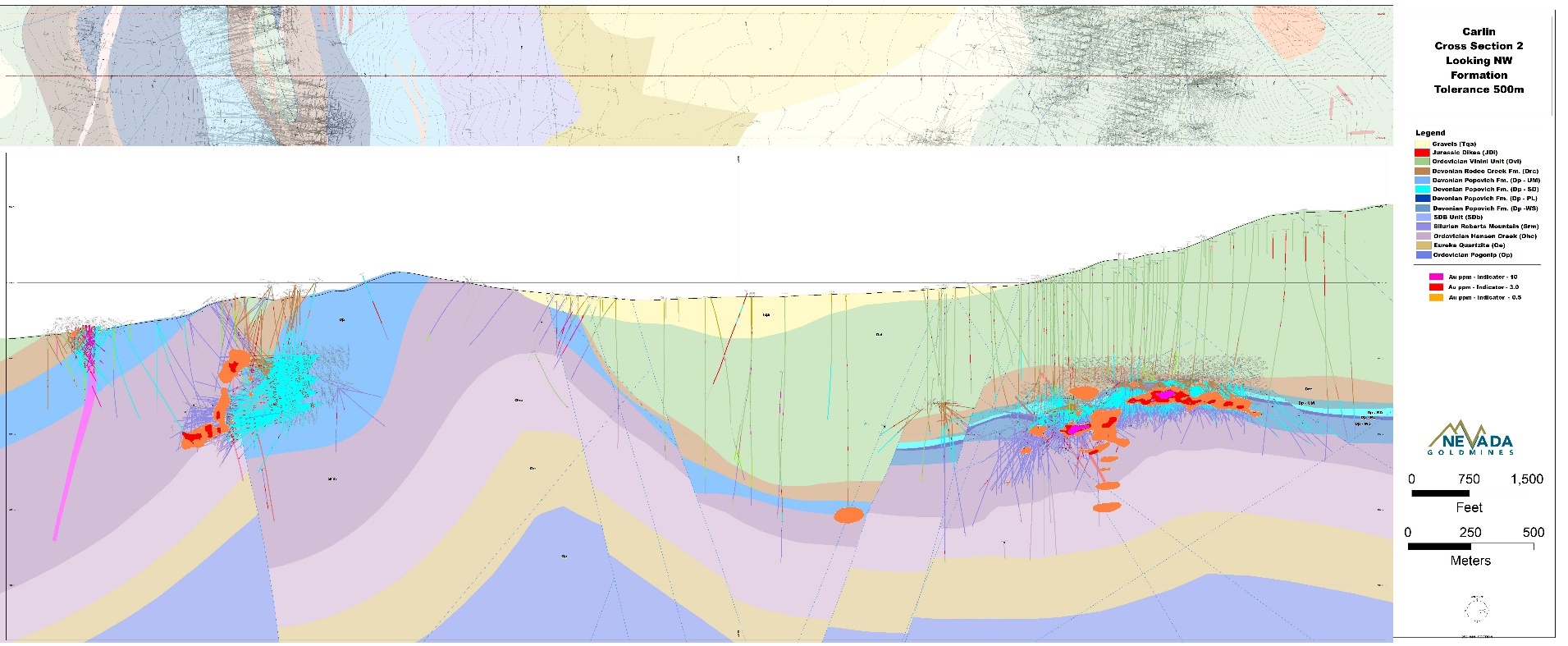

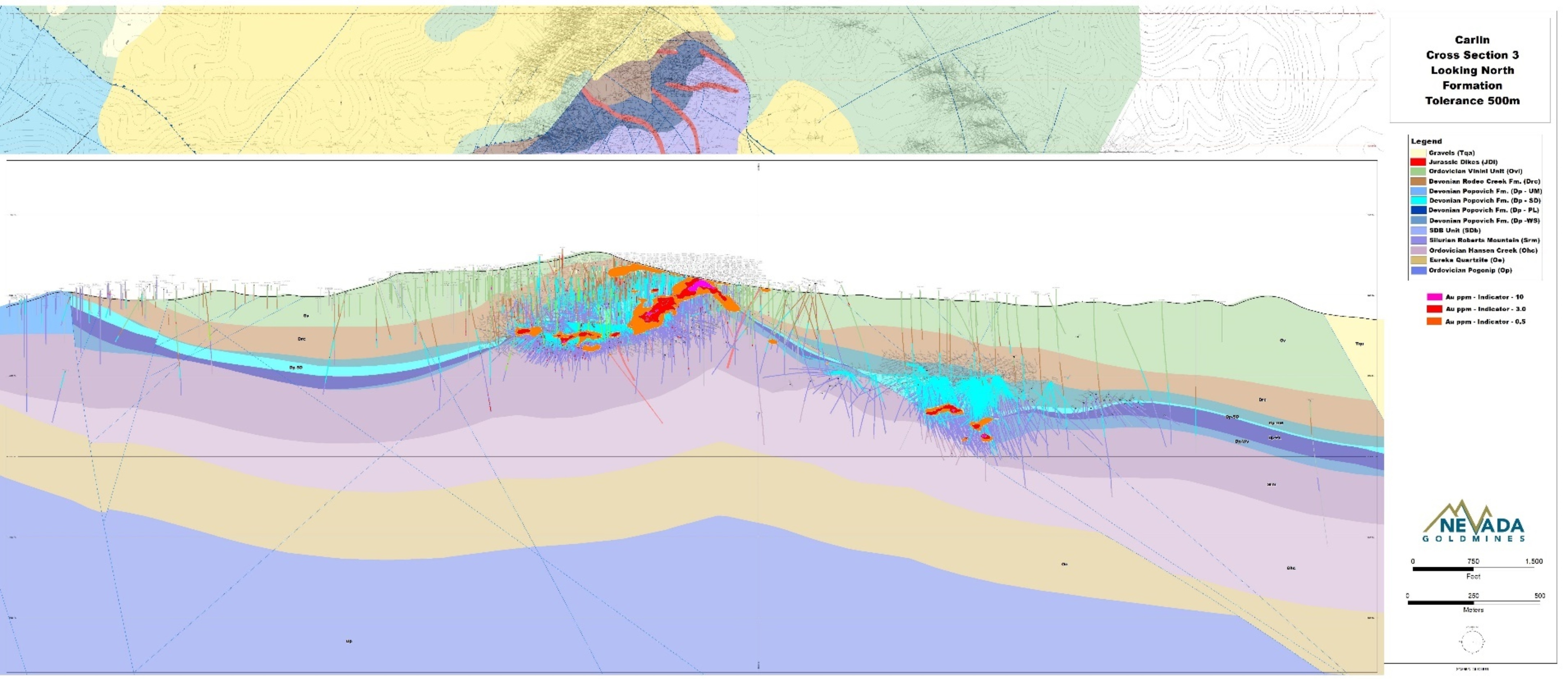

1.6 Geology and Mineralization

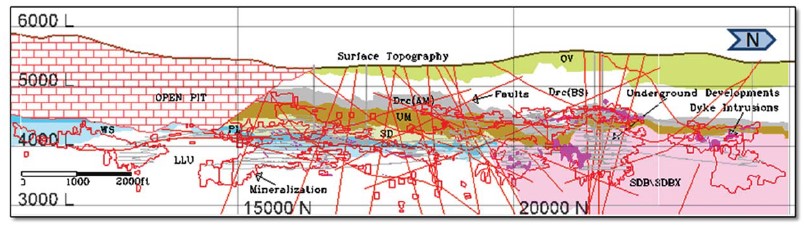

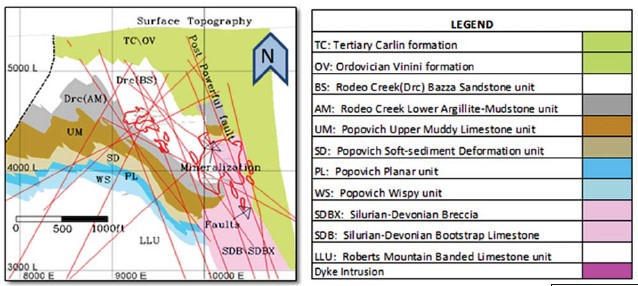

The deposits that comprise the Nevada Operations are considered to be examples of Carlin-style carbonate-hosted disseminated gold–silver deposits and intrusion-related gold–copper–silver skarn deposits.

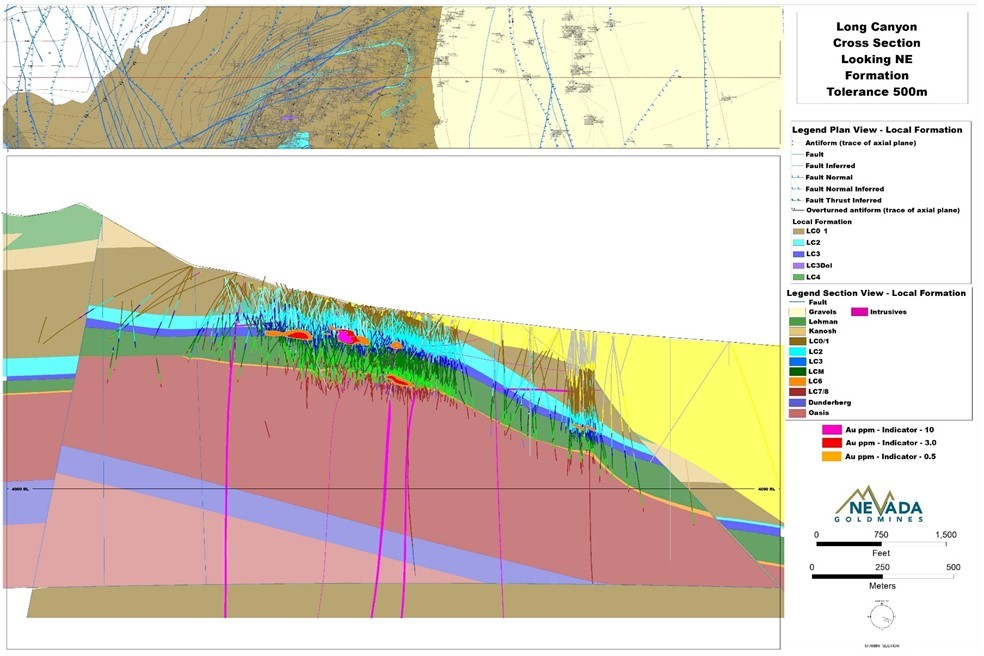

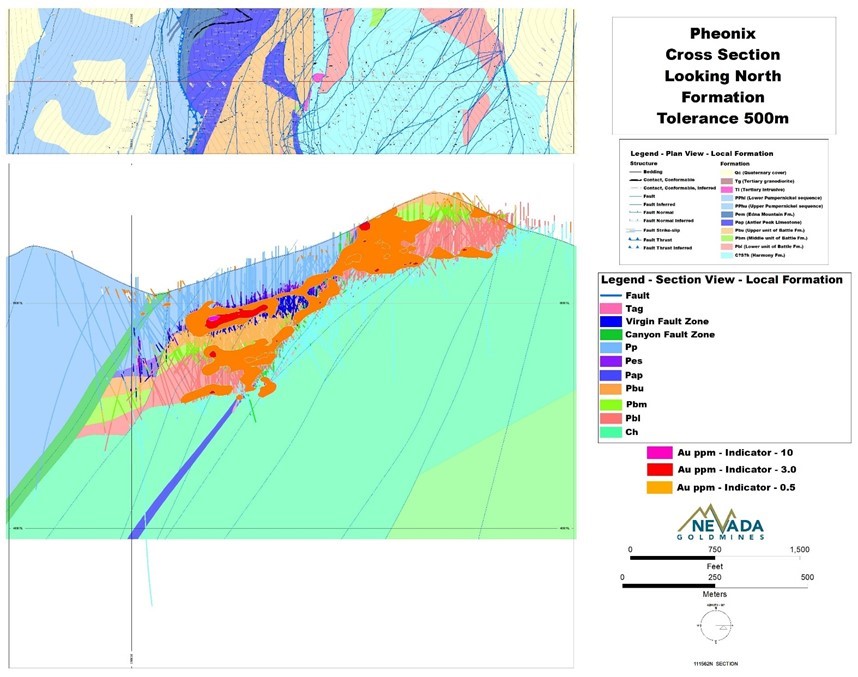

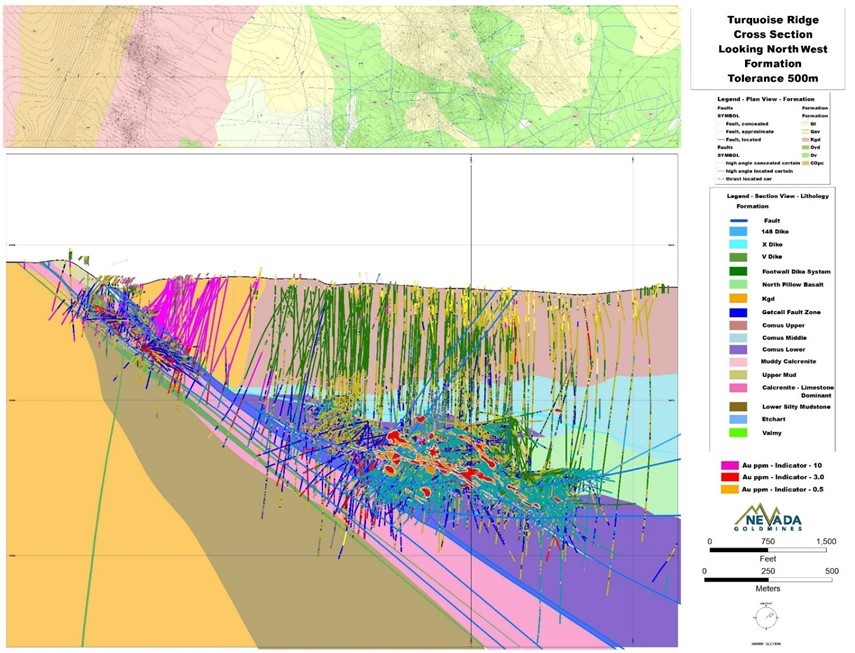

The geology of northern Nevada displays a complicated sequence of orogeny and tectonism. Within the Project area, the mineralization is reported based on five mining complexes, Carlin, Cortez, Long Canyon, Phoenix and Turquoise Ridge.

| | | | | | | | |

| Date: February 2022 | | Page 1-3 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

Mineralization is hosted in lower Paleozoic sedimentary rocks or associated with Late Jurassic–Eocene intrusions. The majority of the deposits have some structural control, with mineralization commonly associated with the Roberts Mountains thrust. Pervasiveness and intensity of alteration varies both within and between gold deposits, depending on magnitude of the mineralizing system, nature of the host rock, and structural preparation.

Carlin Trend-style mineralization consists primarily of micrometer-sized gold and sulfides disseminated in zones of siliciclastic and decarbonated calcareous rocks and commonly associated with jasperoids. Mineralization is predominantly in the form of oxides, sulfides, or sulfide minerals in carbonaceous rocks, and the ore type determines how and where it is processed. Copper oxide mineralization locally contains minor amounts chalcanthite, malachite, chrysocolla, azurite, and lesser cuprite. In hypogene mineralization, chalcopyrite occurs as disseminations and bedded replacements with skarn and silicate minerals, and in conjunction with pyrite.

1.7 History and Exploration

Early-stage exploration included geological mapping, geochemical samples (stream sediment, soil, and rock chip samples), geophysical surveys (airborne and ground magnetics; radiometrics and electromagnetics; gravity, resistivity, and controlled-source audio-frequency telluromagnetics and magnetotellurics (MT); self-potential; induced-polarization (IP); time domain pole-dipole IP; time domain MT/IP using a distributed assay system; electrical logging of drill holes; and downhole IP. The majority of the surface-based grass roots exploration tools are superseded by mining and drill data.

Exploration potential exists adjacent to many of the deposits, along strike and at depth along favorable mineralized structures and within the favorable host lithologies.

1.8 Drilling and Sampling

Across the entire AOI, drilling totals over 203,000 drill holes for >82 Mft of drilling. Over the Project history, drilling included reverse circulation (RC), core, air rotary, mud rotary, and Cubex methods.

Logging conducted depended on the operator of the complex at the time the information was collected, and the drill type. Typically, logging collected information such as lithology, stratigraphy, basic structural data, recovery, alteration, and mineralization. For mining operations, logging could also record metallurgical type, intensity codes for metallurgy and alteration, and geotechnical parameters.

Collar surveys have used optical surveys, field estimates, Brunton compass and pacing, compass-and-string distance measurements, and for underground operations, measurements from surveyed control points, face, ribs and sill to triangulate each collar location. Down-hole surveys included downhole single-shot or multi-shot film camera (typical for most underground surveys), use of a downhole precession gyroscopic survey tool, a gyroscopic tool requiring initial orientation with a compass, and north-seeking or conventional gyroscopic tools.

Sampling is variable by mining complex and mineralization style. Air-rotary and mud-rotary drill holes were sampled on 5–100 ft intervals. Cubex drilling was sampled on 5–10 ft intervals. RC

| | | | | | | | |

| Date: February 2022 | | Page 1-4 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

drill holes were typically sampled on 5 ft intervals. Core samples were nominally taken at 5 ft intervals, but could vary to a minimum of 1 ft to respect lithological contacts.

The majority of the density data were from measurements collected by exploration or mine site personnel using the water displacement method.

Given the long history of the Nevada Operations, there are numerous laboratories that were used over the Project history. Laboratories were both independent and non-independent. In the earlier stages of Project testwork, the idea of laboratory accreditation had not been developed. In later assay campaigns, accreditations were not typically recorded in the database. Currently, all independent laboratories used for chemical analysis are accredited for selected analytical techniques.

Sample preparation has varied over the 60 years of modern Project history, in line with advancing scientific knowledge, changes in equipment, and operational experience. Currently, sample preparation procedures include drying, crushing and pulverizing. As with sample preparation, analytical methods have changed over the Project history. Currently, sample analytical procedures include:

•ALS Chemex: fire assays (FA) and atomic absorption (AA) finish for gold; samples reporting >0.1 oz/st Au on the initial assay re-assayed by FA with gravimetric finish; cyanide leach gold assays for initial FAs >0.008 oz/st Au; cyanide leach and preg rob capacity; LECO testing; multi-element analyses by aqua regia digestion/inductively coupled plasma-atomic emission spectroscopy (ICP-AES)/ICP-mass spectroscopy (ICP-MS), 51 elements or 48 element analyses by four acid and ICP-AES/ICP-MS; other analyses may be requested, and include arsenic, total carbon, total sulfur, sulfide sulfur, carbonate carbon, and organic carbon;

•AAL: 1 assay ton fire assays with an AA finish for gold;

•Mine laboratories: 1 assay ton fire assays with an AA finish for gold; samples with gold grade >0.438 oz/st are completed by a ½ assay ton fire assay with a gravimetric finish. If the sample gold grade is above the open pit cut-off grade, the samples are analyzed for cyanide leach, % preg rob, total carbon, total sulfur, sulfide sulfur, carbonate, and organic carbon for ore characterization purposes. On request, underground muck samples can be equal weight composited for further ore characterization analyses including total carbon, total sulfur, sulfide sulfur, carbonate carbon, organic carbon, and arsenic.

Prior to the mid-1990s, few companies had rigorous quality assurance and quality control (QA/QC) programs in place. QA/QC had typically consisted, where undertaken, of reanalysis of drill core or other samples when later sampling indicated a potential problem. In the case of the NGM Operations, QA/QC samples were submitted for RC and core samples from about 1990. Typical QA/QC measures include submission of blank materials, certified or standard reference materials (standards), and field duplicate samples. Check assays may not be routinely performed. Typical checks were undertaken on pulps and coarse reject samples to test the analytical processes and preparation procedure, respectively.

Project geologists review the assay results and periodically request a batch re-run and/or entire hole based on expected versus actual results. Analyses that appear to be outside best practice guidelines for exploration of two standard deviations will result in a request of the laboratory that completed the original analysis to undertake a re-run of the sample batch that the failed control was in. Check assay programs are the responsibility of the individual geologists.

| | | | | | | | |

| Date: February 2022 | | Page 1-5 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

Several systems and programs are used to control and ensure assay data quality. These include standards for technician training, periodic process checks, equipment preventive maintenance, centralized reagent/standard preparation, control samples (reference materials) and blanks assayed with the samples, data verification, periodic check assays, and participation in industry round-robin programs.

1.9 Data Verification

Validation checks are performed by NGM operations personnel on data used to support estimation comprise checks on surveys, collar coordinates, lithology data (cross-checking from photographs), and assay data. Errors noted are rectified in the database prior to data being flagged as approved for use in resource estimation.

A number of third-party consultants have performed external data reviews. These external reviews were undertaken in support of acquisitions, support of feasibility-level studies, and in support of technical reports, producing independent assessments of the database quality. No significant problems with the database, sampling protocols, flowsheets, check analysis program, or data storage were noted.

The QP visited the Nevada Operations on many occasions, most recently to the Carlin Complex in 2019, and visited the Goldrush project during 2021. He inspected the underground workings at Leeville and Pete Bajo, viewed the open pit operations, and toured the Gold Quarry roaster. During the Goldrush visit he inspected the underground workings, reviewed core, and met with project representatives. The QP also toured the planned locations for some of the surface infrastructure. The QP’s personal inspection supports the use of the data in mineral resource and mineral reserve estimation, and in mine planning.

1.10 Metallurgical Testwork

During the 60+ year history of Nevada Operations mine development, a significant number of metallurgical studies and accompanying laboratory-scale and/or pilot plant tests have been completed. Either internal metallurgical research facilities or external consultants undertake the research. Recent external testwork was performed at McClelland Laboratories, Hazen Research, Macpherson Laboratories, McGill University, Svedala, and Outukumpu. Internal testwork facilities included the Goldstrike Metallurgical Laboratory, Gold Quarry Metallurgical Laboratory, Newmont Metallurgical Services in Englewood, Colorado and the AuTec Metallurgical Laboratory located in Vancouver, British Columbia, Canada.

Metallurgical testwork included: mineralogy; head grades and screen analyses; bottle roll, bench and column cyanide leaching; carbon adsorption/activation tests; direct cyanide leach testwork; carbon-in-leach tests; agglomeration tests; cyanide amenability tests; bench or circulating fluidized bed roasting tests; calcine tests; magnetic separation testwork; bench-top roaster followed by CIL testwork; bench-top alkaline pressure leach tests followed by CIL tests; calcium thiosulfate and resin leach tests; bench-top alkaline pressure leach tests followed by thiosulfate resin in leach testwork; sulfidization acidification re-neutralization and thickening or SART testwork; reagent consumption reviews; impurity reviews; standard autoclaving and leach tests; grindability (comminution) tests (SMC, breakage parameter, Bond work index, drop weight index, rod work index, unconfined compressive strength, semi-autogenous grind (SAG) power index); thickener testwork; batch and pilot plant tests

| | | | | | | | |

| Date: February 2022 | | Page 1-6 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

These test programs were sufficient to establish the optimal processing routes for the non-refractory and refractory ores, and the weathering state of the ores (oxide, leached, enriched, transition, sulfide), and was performed on mineralization that was typical of the deposits. The results obtained supported estimation of recovery factors for the various ore types depending on the process method selected.

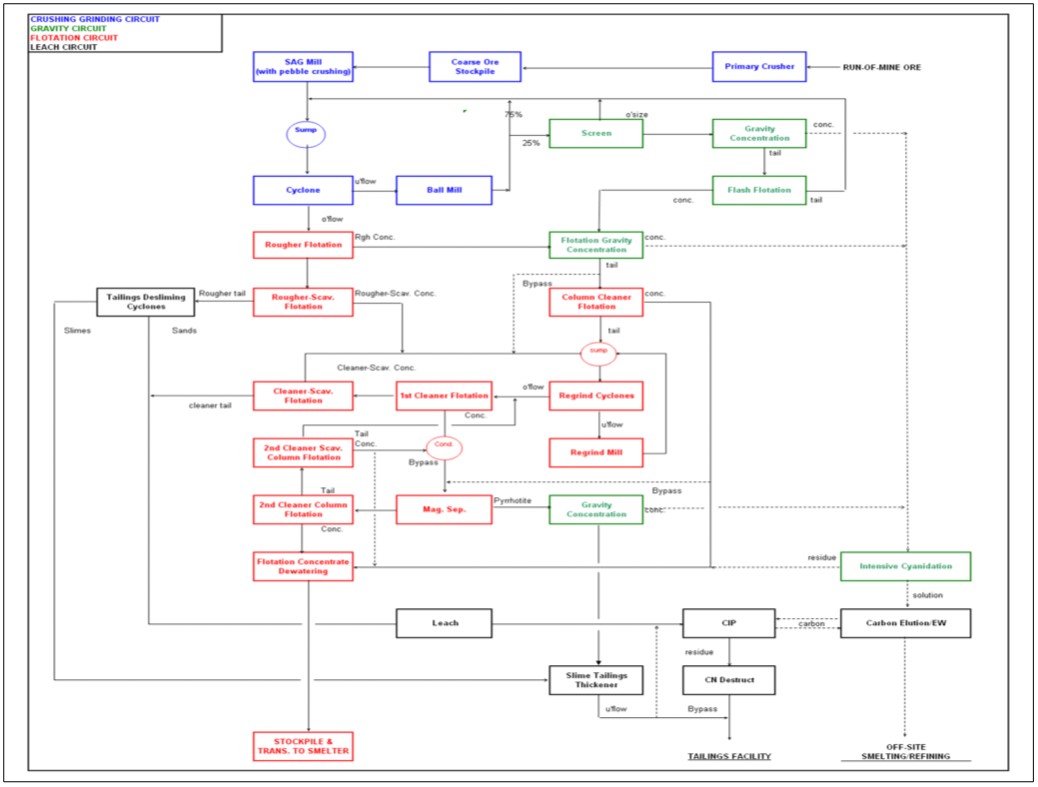

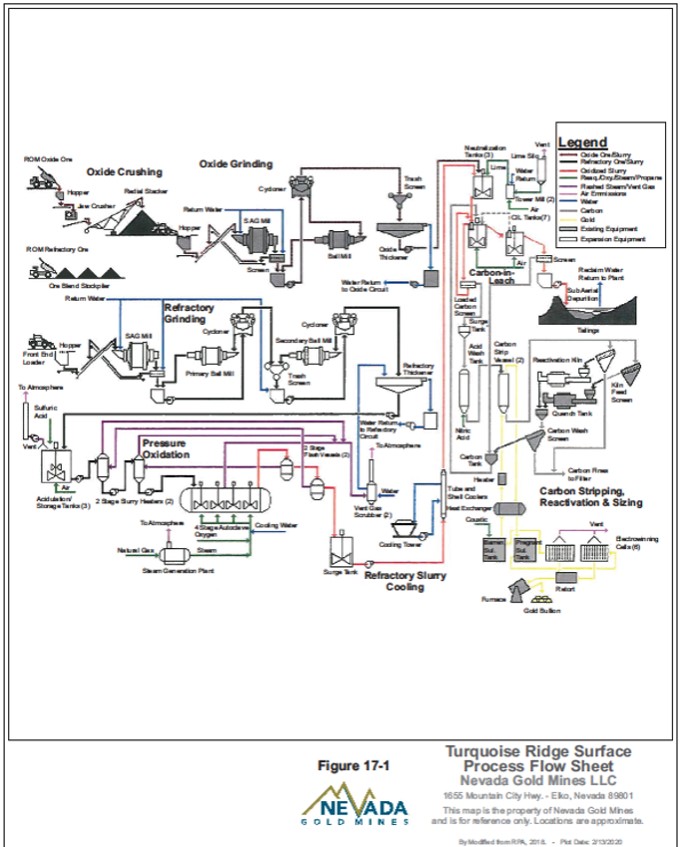

Numerous processing methods are used within the Nevada Operations, including CIL for higher-grade oxide ore, heap leaching for lower-grade oxide ore, roasting for carbonaceous refractory ore, and pressure oxidation (POX) for higher-grade sulfidic ore.

Future ore testing is completed according to the needs of the optimized blend planning for the combined NGM operations. Current ore testing is completed monthly by performing testwork on feed stockpile samples.

Gold recovery is a function of the processing method (e.g., heap leaching, CIL, roasting, and arsenic concentration for refractory ore) and the lithology of the mineralization being processed. As applicable, recovery estimates include consideration of the head grade, cyanide-soluble gold to fire assay gold ratio, sulfide sulfur concentration, total organic carbon concentration, and silica concentration.

Copper recovery models were derived from a statistical review of the metallurgical data and range in complexity from simple, fixed recoveries to complex, multi-variable equations. The following input variables were available as possible drivers of recovery: head grade, copper leach ore type, alteration type, formation, and various trace elements.

Recovery ranges projected for the LOM operations include:

•Gold:

◦Oxide leach: 57–75%;

◦Oxide mill: 73–88%;

◦Goldstrike roaster: 84–92%;

◦Goldstrike autoclave: 50–96%;

◦Gold Quarry roaster: 84–92%;

◦Sage (Turquoise Ridge) autoclave: average 84%;

◦Phoenix mill: average 70%;

•Copper:

◦Phoenix mill: average 71%;

◦Copper leach: average 49%;

•Silver:

◦Phoenix mill: average 38%.

Samples selected for metallurgical testing during feasibility and development studies were representative of the various styles of mineralization within the different deposits. Samples were selected from a range of locations within the deposits. Sufficient samples were taken, and tests were performed using sufficient sample mass for the respective tests undertaken. Variability assessments are supported by production and extensive open pit and underground exposures.

| | | | | | | | |

| Date: February 2022 | | Page 1-7 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

Depending upon the specific processing facility, several processing factors or deleterious elements could have an economic impact on extraction efficiency of a certain ore source, based either on the presence, absence, or concentration of the following constituents in the processing stream:

•Organic carbon;

•Sulfide sulfur;

•Carbonate carbon;

•Arsenic

•Mercury;

•Antimony;

•Copper.

However, under normal ore routing and blending practices at NGM where material from several sites may be processed at one facility, the above list of constituents is typically not a concern.

1.11 Mineral Resource Estimation

1.11.1 Estimation Methodology

Estimation was typically performed by Nevada Operations personnel. All mineralogical, drilling, and background data and information were provided to the estimators by the geological staff at the operations or by exploration staff.

Exploratory data analysis was undertaken on sample and composite data, as required, to understand the statistical features within and between geologic and mineralization domains. High-grade anomalous values were controlled through the use of top-cutting and/or high-grade estimation restrictions, applied by deposit and domain. Composite lengths varied by complex and planned mining method, ranging from 2.5–20 ft. Variographic analyses were completed by domain.

Estimation and interpolation methods varied by deposit. The following methods were used: ordinary kriging, indicator kriging (IK), local indicator kriging (LIK), inverse distance weighting to the second power (ID2), inverse distance weighting to the third power (ID3), and inverse distance weighting to the fifth power (ID5). Typically, alternate grade interpolations (including nearest neighbor) were performed for use in model validation and sensitivity testing. Depending on the deposit, interpolation was performed in multiple (up to eight) passes. Search neighborhoods were based on variography, mineralization geometry, or on selected drill spacings. Minimum and maximum numbers of informing samples varied by deposit, as did the number of samples allowed to be used from a single drill hole. Dynamic anisotropy could be used to allow for a localized change in the strike, dip, and plunge orientation of the mineralization. Block models were flagged for mining depletion.

Mineralization solids were checked for conformity to drill hole data, continuity, similarity between sections, overlaps, appropriate terminations between holes and into undrilled areas. Validation procedures were undertaken on the estimations. These could include comparison of global mean grades, visual comparisons to composite grades, comparisons to reconciliation (when

| | | | | | | | |

| Date: February 2022 | | Page 1-8 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

available), change of support corrections estimated using a discrete Gaussian model under a diffusion model assumption, grade-tonnage curves, slope of regression calculations, comparison to NN analysis and swath plots.

Blocks were classified in the model, based on relative confidence in the estimated grades, into measured, indicated, and inferred. Criteria for classification were defined within each deposit, and based on various combinations of: proximity to nearby drilling data (distances to nearest 1, 2, or 3 drill holes); geostatistical drill spacing studies; qualitative assessment of confidence in the underlying geologic interpretations; historical classification assignments; and classification smoothing algorithms.

Mineralization considered potentially amenable to open pit mining methods was constrained within a conceptual pit shell using the Lerchs–Grossmann (LG) algorithm within Vulcan software. Mineralization considered potentially amenable to underground methods was constrained within mineable shapes generated using Mineable Stope Optimizer (MSO) software.

Commodity prices used in resource estimation are based on long-term analyst and bank forecasts. An explanation of the derivation of the commodity prices is provided in Chapter 16.2. The estimated timeframe used for the price forecasts is the 24-year LOM that supports the mineral reserve estimates.

The resources are reported at varying cut-off values, which are based on the material type being mined, the mining method and the designated process facility. As a result, cut-off values can vary significantly by material type.

1.11.2 Mineral Resource Statement

Mineral resources are reported using the mineral resource definitions set out in SK1300. The reference point for the estimate is in situ. Mineral resources are reported exclusive of those mineral resources converted to mineral reserves.

Mineral resources are reported on a 100% basis. Barrick owns a 61.5% JV interest, with Newmont owning the remaining 38.5% JV interest.

The mineral resource estimates for the Nevada Operations are provided as follows:

•Gold: Table 1-1 (measured and indicated) and Table 1-2 (inferred);

•Silver: Table 1-3 (measured and indicated) and Table 1-4 (inferred);

•Copper: Table 1-5 (measured and indicated) and Table 1-6 (inferred).

Tonnages in the tables are metric tonnes.

1.11.3 Factors That May Affect the Mineral Resource Estimate

Factors that may affect the mineral resource estimate include: changes to long-term metal price assumptions; changes in local interpretations of mineralization geometry and continuity of mineralized zones; changes to geological and grade shape and geological and grade continuity assumptions; changes to input parameters used in the pit shells and stope outlines constraining the mineral resources; changes to the cut-off grades used to constrain the estimates; variations

| | | | | | | | |

| Date: February 2022 | | Page 1-9 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

in geotechnical, mining, and processing recovery assumptions; and changes to environmental, permitting and social license assumptions.

| | | | | | | | |

| Date: February 2022 | | Page 1-10 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

Table 1-1: Measured and Indicated Mineral Resource Statement (Gold)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Complex | Measured Mineral Resources | Indicated Mineral Resources | Measured and Indicated

Mineral Resources |

Tonnage

(x 1,000 t) | Grade

(g/t Au) | Cont. Gold

(x 1,000 oz) | Tonnage

(x 1,000 t) | Grade

(g/t Au) | Cont. Gold

(x 1,000 oz) | Tonnage

(x 1,000 t) | Grade

(g/t Au) | Cont. Gold

(x 1,000 oz) |

| Carlin | 45,400 | 3.56 | 5,210 | 140,100 | 1.73 | 7,780 | 185,500 | 2.18 | 12,980 |

| Cortez | 700 | 7.02 | 170 | 99,500 | 1.20 | 3,850 | 100,300 | 1.25 | 4,010 |

| Long Canyon | 500 | 3.47 | 60 | 9,800 | 4.05 | 1,280 | 10,400 | 4.02 | 1,340 |

| Turquoise Ridge | 15,300 | 3.10 | 1,530 | 33,700 | 3.57 | 3,870 | 49,100 | 3.42 | 5,400 |

| Phoenix | 7,600 | 0.53 | 130 | 218,200 | 0.45 | 3,140 | 225,800 | 0.45 | 3,270 |

| Total | 69,600 | 3.17 | 7,090 | 501,300 | 1.24 | 19,910 | 571,000 | 1.47 | 27,000 |

Table 1-2: Inferred Mineral Resource Statement (Gold)

| | | | | | | | | | | |

| Complex | Inferred Mineral Resources |

Tonnage

(x 1,000 t) | Grade

(g/t Au) | Cont. Gold

(x 1,000 oz) |

| Carlin | 110,700 | 2.1 | 7,510 |

| Cortez | 124,400 | 1.6 | 6,380 |

| Long Canyon | 2,600 | 3.6 | 300 |

| Turquoise Ridge | 18,200 | 2.0 | 1,200 |

| Phoenix | 49,200 | 0.4 | 580 |

| Total | 305,000 | 1.6 | 15,970 |

Table 1-3: Measured and Indicated Mineral Resource Statement (Silver)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Complex | Measured Mineral Resources | Indicated Mineral Resources | Measured and Indicated

Mineral Resources |

Tonnage

(x 1,000 t) | Grade

(g/t Ag) | Cont. Silver

(x 1,000 oz) | Tonnage

(x 1,000 t) | Grade

(g/t Ag) | Cont. Silver

(x 1,000 oz) | Tonnage

(x 1,000 t) | Grade

(g/t Ag) | Cont. Silver

(x 1,000 oz) |

| Phoenix | 7,600 | 5.57 | 1,360 | 218,200 | 5.54 | 38,860 | 225,800 | 5.54 | 40,220 |

| Total | 7,600 | 5.57 | 1,360 | 218,200 | 5.54 | 38,860 | 225,800 | 5.54 | 40,220 |

| | | | | | | | |

| Date: February 2022 | | Page 1-11 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

Table 1-4: Inferred Mineral Resource Statement (Silver)

| | | | | | | | | | | |

| Complex | Inferred Mineral Resources |

Tonnage

(x 1,000 t) | Grade (g/t Ag) | Cont. Silver

(x 1,000 oz) |

| Phoenix | 49,200 | 5.6 | 8,840 |

| Total | 49,200 | 5.6 | 8,840 |

Table 1-5: Measured and Indicated Mineral Resource Statement (Copper)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Area | Measured Mineral Resources | Indicated Mineral Resources | Measured and Indicated

Mineral Resources |

Tonnage

(x 1,000 t) | Grade

(Cu %) | Cont. Copper

(M lbs) | Tonnage

(x 1,000 t) | Grade

(Cu %) | Cont. Copper

(M lbs) | Tonnage

(x 1,000 t) | Grade

(Cu %) | Cont. Copper

(M lbs) |

| Phoenix | 8,000 | 0.14 | 20 | 289,600 | 0.14 | 880 | 297,600 | 0.14 | 910 |

| Total | 8,000 | 0.14 | 20 | 289,600 | 0.14 | 880 | 297,600 | 0.14 | 910 |

Table 1-6: Inferred Mineral Resource Statement (Copper)

| | | | | | | | | | | |

| Area | Inferred Mineral Resources |

Tonnage

(x 1,000 t) | Grade

(Cu %) | Cont. Copper

(M lbs) |

| Phoenix | 51,600 | 0.1 | 150 |

| Total | 51,600 | 0.1 | 150 |

Notes to Accompany Mineral Resource Tables:

1.Mineral resources are current as at December 31, 2021, using the definitions in SK1300. The Qualified Person responsible for the estimate is Mr. Donald Doe, RM SME, Group Executive, Reserves, a Newmont employee.

2.The reference point for the mineral resources is in situ.

3.Mineral resources are reported on a 100% basis. Barrick owns a 61.5% JV interest, with Newmont owning the remaining 38.5% JV interest.

4.Mineral resources are reported exclusive of mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

5.Mineral Resources that are potentially amenable to open pit mining methods are constrained within a designed pit shell. Mineral Resources that are potentially amenable to underground mining methods are constrained within conceptual stope designs. Parameters used are summarized in Table 11-1 and Table 11-2.

6.Tonnages are metric tonnes rounded to the nearest 100,000. Gold and silver grades are rounded to the nearest 0.01 gold grams per tonne. Copper grade is in %. Gold and silver ounces and copper pounds are estimates of metal contained in tonnages and do not include allowances for processing losses. Contained (cont.) gold and silver ounces are reported as troy ounces, rounded to the nearest 10,000. Copper is reported as pounds and rounded to the nearest 10 million pounds. Rounding of tonnes and contained metal content as required by reporting guidelines may result in apparent differences between tonnes, grade and contained metal content. Due to rounding, some cells may show a zero (“0”). Totals may not sum due to rounding.

| | | | | | | | |

| Date: February 2022 | | Page 1-12 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

1.12 Mineral Reserve Estimation

1.12.1 Estimation Methodology

Measured and indicated mineral resources were converted to mineral reserves. Mineral reserves in the Nevada Operations area are estimated for the Carlin, Cortez, Long Canyon, Phoenix and Turquoise Ridge complexes using open pit mining, and the Carlin, Cortez, and Turquoise Ridge complexes using underground mining. Stockpiled material is also included in the mineral reserve estimates. All Inferred blocks are classified as waste in the cashflow analysis that supports mineral reserve estimation.

Mineral Reserves are supported by a mine plan, an engineering analysis, and the application of modifying factors.

For the open pits, optimization work involved floating cones at a series of gold prices. The generated nested pit shells were evaluated using the reserve gold price of US$1,200/oz (and $2.75/lb Cu and $16.50/oz Ag for Phoenix) and a 5% discount rate. The pit shells with the highest net present value (NPV) were selected for detailed engineering design work. A realistic schedule was developed in order to determine the optimal pit shell for each deposit; schedule inputs include the minimum mining width, and vertical rate of advance, mining rate and mining sequence. The block models were constructed to include the expected dilution based on mining methods, bench height and other factors. The current mine and process reconciliation data appear to support this assumption.

Underground mines are designed using zones that are amenable to different mining methods based on geotechnical and access considerations, the deposit shape, orientation and grade, and mining depths.

Cut-off grades were determined based on a combination of the selected metal price, applicable royalty payments, mining costs, process operating costs, and on-site (and off-site) metal recoveries by material type, and selected process method. Operational cut-off grades ranged from:

•Carlin Complex: 0.20–7.06 g/t Au;

•Cortez Complex: 0.17–3.41 g/t Au;

•Long Canyon: 0.24 g/t Au;

•Turquoise Ridge Complex: 0.17–7.99 g/t Au.

Revenue from the Phoenix Complex is generated from three products: gold, silver, and copper. A revenue cut-off, rather than a grade cut-off, is used that integrates the economics (recovery, metal prices, and costs) of all three metals. The revenue calculation only includes incremental mining costs beyond the pit rim. The mineral reserves for the Phoenix Complex are reported using a zero-dollar net revenue cut-off.

The mine plans assume use of a number of different mining methods and variants including: long-hole stoping; long-hole stope retreat; underhand drift-and-fill; and overhand drift-and-fill.

Stopes were created using Mineable Stope Optimizer (MSO) software at the required stope height, length and cut-off criteria based on the mine area. The stope widths depend on the

| | | | | | | | |

| Date: February 2022 | | Page 1-13 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

stope cut-off and dilution (over-break) added to stope design, and the mining method used. A set of marginal stopes could also be considered in the reserve process.

Blocks that were modelled as waste or low-grade were included in a designed stope shape as internal dilution. Additional tonnage dilution percentages could be added by site personnel, where required, based on historical reconciliation data for a particular mining method. Cut-off grades are determined based on a combination of the selected metal price, applicable royalty payments, mining costs, process operating costs, and on-site (and off-site) metal recoveries by material type, selected process method, and mining method.

Stockpile estimates were based on mine dispatch data; the grade comes from closely-spaced blasthole sampling and tonnage sourced from truck factors. The stockpile volumes were typically updated based on monthly surveys. The average grade of the stockpiles was adjusted based on the material balance to and from the stockpile.

Commodity prices used in mineral reserve estimation are based on long-term analyst and bank forecasts. An explanation of the derivation of the commodity prices is provided in Chapter 16.2. The estimated timeframe used for the price forecasts is the 24-year LOM that supports the mineral reserve estimates.

1.12.2 Mineral Reserve Statement

Mineral reserves have been classified using the mineral reserve definitions set out in SK1300. The reference point for the mineral reserve estimate is the point of delivery to the process facilities. Mineral reserves are reported on a 100% basis. Barrick owns a 61.5% JV interest, with Newmont owning the remaining 38.5% JV interest.

The mineral resource estimates for the Nevada Operations are provided as follows:

•Gold: Table 1-7;

•Silver Table 1-8;

•Copper: Table 1-9.

Tonnages in the table are metric tonnes.

| | | | | | | | |

| Date: February 2022 | | Page 1-14 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

Table 1-7: Proven and Probable Mineral Reserve Statement (Gold)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Area | Proven Mineral Reserves | Probable Mineral Reserves | Proven and Probable Mineral Reserves |

Tonnage

(x 1,000 t) | Grade

(g/t Au) | Cont. Gold

(x 1,000 oz) | Tonnage

(x 1,000 t) | Grade

(g/t Au) | Cont. Gold

(x 1,000 oz) | Tonnage

(x 1,000 t) | Grade

(g/t Au) | Cont. Gold

(x 1,000 oz) |

| Carlin | 38,300 | 6.01 | 7,400 | 129,800 | 2.70 | 11,280 | 168,000 | 3.46 | 18,670 |

| Cortez | 3,500 | 4.43 | 500 | 103,000 | 4.16 | 13,780 | 106,500 | 4.17 | 14,290 |

| Long Canyon | 300 | 1.43 | 20 | 600 | 1.06 | 20 | 1,000 | 1.18 | 40 |

| Turquoise Ridge | 42,900 | 5.09 | 7,030 | 32,600 | 6.59 | 6,920 | 75,600 | 5.74 | 13,940 |

| Phoenix | 13,500 | 0.72 | 310 | 155,800 | 0.59 | 2,960 | 169,300 | 0.60 | 3,270 |

| Total | 98,500 | 4.82 | 15,260 | 421,800 | 2.58 | 34,960 | 520,300 | 3.00 | 50,220 |

Table 1-8: Proven and Probable Mineral Reserve Statement (Silver)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Area | Proven Mineral Reserves | Probable Mineral Reserves | Proven and Probable

Mineral Reserves |

Tonnage

(x 1,000 t) | Grade

(g/t Ag) | Cont. Silver

(x 1,000 oz) | Tonnage

(x 1,000 t) | Grade

(g/t Ag) | Cont. Silver

(x 1,000 oz) | Tonnage

(x 1,000 t) | Grade

(g/t Ag) | Cont. Silver

(x 1,000 oz) |

| Phoenix | 13,500 | 7.40 | 3,200 | 155,800 | 6.35 | 31,810 | 169,300 | 6.43 | 35,010 |

| Total | 13,500 | 7.40 | 3,200 | 155,800 | 6.35 | 31,810 | 169,300 | 6.43 | 35,010 |

| | | | | | | | |

| Date: February 2022 | | Page 1-15 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

Table 1-9: Proven and Probable Mineral Reserve Statement (Copper)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Area | Proven Mineral Reserves | Probable Mineral Reserves | Proven and Probable Mineral Reserves |

Tonnage

(x 1,000 t) | Grade

(Cu %) | Cont. Copper

(M lbs) | Tonnage

(x 1,000 t) | Grade

(Cu %) | Cont. Copper

(M lbs) | Tonnage

(x 1,000 t) | Grade

(Cu %) | Cont. Copper

(M lbs) |

| Phoenix | 17,800 | 0.17 | 70 | 208,300 | 0.17 | 770 | 226,100 | 0.17 | 830 |

| Total | 17,800 | 0.17 | 70 | 208,300 | 0.17 | 770 | 226,100 | 0.17 | 830 |

Notes to Accompany Mineral Reserve Tables:

1.Mineral reserves are current as at December 31, 2021. Mineral reserves are reported using the definitions in SK1300. The Qualified Person responsible for the estimate is Mr. Donald Doe, RM SME, Group Executive, Reserves, a Newmont employee.

2.The point of reference for the estimates is the point of delivery to the process facilities.

3.Mineral reserves are reported for Nevada Gold Mines on a 100% basis. Barrick owns a 61.5% joint venture interest, with Newmont owning the remaining 38.5% joint venture interest.

4.Mineral reserves that will be mined using open pit mining methods are constrained within a designed pit shell. Mineral reserves that will be mined by underground mining methods are constrained within conceptual stope designs. Parameters used are summarized in Table 12-1 and Table 12-2.

5.Tonnages are metric tonnes rounded to the nearest 100,000. Gold and silver grades are rounded to the nearest 0.01 gold grams per tonne. Copper grade is in %. Gold and silver ounces and copper pounds are estimates of metal contained in tonnages and do not include allowances for processing losses. Contained (cont.) gold and silver ounces are reported as troy ounces, rounded to the nearest 10,000. Copper is reported as pounds and rounded to the nearest 10 million pounds. Rounding of tonnes and contained metal content as required by reporting guidelines may result in apparent differences between tonnes, grade and contained metal content. Due to rounding, some cells may show a zero (“0”). Totals may not sum due to rounding.

| | | | | | | | |

| Date: February 2022 | | Page 1-16 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

1.12.3 Factors That May Affect the Mineral Reserve Estimate

Factors that may affect the mineral reserve estimates include: changes to long-term metal price assumptions; changes in local interpretations of mineralization geometry and continuity of mineralized zones; changes to geological and grade shape and geological and grade continuity assumptions; changes to input parameters used in the pit shells and stope outlines constraining the mineral reserves; changes to the cut-off grades used to constrain the estimates; variations in geotechnical, mining, and processing recovery assumptions; and changes to environmental, permitting and social license assumptions.

1.13 Mining Methods

Open pit mining is conducted using conventional techniques and an Owner-operated conventional truck and shovel fleet. Underground mining is currently conducted using conventional stoping methods, and conventional mechanized equipment.

Nevada Operations personnel and external consultants completed geotechnical studies and provided geotechnical recommendations that form the basis for pit designs. Ground control management plans were developed, and are regularly updated.

The Nevada Operations have hydrological models constructed for key operational areas, used to predict the rate of dewatering and for well-location planning. The models are regularly updated.

Ultimate open pit designs were developed based on pit optimization analysis. The pit limits incorporate geotechnical and hydrological recommendations into final high walls and are designed to include ramps and access to haulage routes to waste rock storage facilities (WRSFs) and processing facilities. Some deposits include phased pit designs which are used to sequence the mining operation. Phases are designed to optimize the economics of the operation and/or provide access to selected ore for blending purposes. Haul road effective widths for two-way travel range from 98–141 ft with a maximum grade of 10%. For single-lane haul roads, a minimum road width of 80 ft could be used for the bottom benches of the pit. Bench heights vary from 20–40 ft, and can be 60 ft where triple-benching is employed. Blast patterns are laid out according to material type using rock type designations.

Underground mining is mechanized, using large-scale equipment. The most common mining methods are a combination of cut-and-fill mining variants with cemented rock (CRF) or paste backfill, and long-hole stoping with, depending on ground conditions, either cemented or uncemented backfill. Depending on the operation, material is loaded into haul trucks and hauled to surface using declines, or hoisted via shafts.

The currently active and proposed waste rock storage facilities (WRSFs) have adequate capacity for the LOM. The management of waste rock is based on categorizing by waste rock types based on analytical parameters, with additional refining of waste polygons based on geologic interpretation.

The open pit production schedules have significant variation in ore delivery over time and there is a high proportion of the ore that is stockpiled after mining and before processing. There are several stockpile options, all of which are based upon the grade of material and varying from leach ore to mill ore. Leach material is generally delivered directly to the leach pads.

| | | | | | | | |

| Date: February, 2022 | | Page 1-17 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

The number of loading and hauling units allocated to each deposit varies depending on the operational needs from the open pit mine plans. The equipment list also includes the auxiliary equipment needed to support mining and the re-handling of the ore from the stockpile pad into the mill feeders. Underground equipment requirements include large-scale load–haul–dump (LHD) vehicles and haulage trucks, jumbos, and auxiliary equipment.

The LOM plan assumes 577 Mt of ore and 1,202 Mt of waste will be mined.

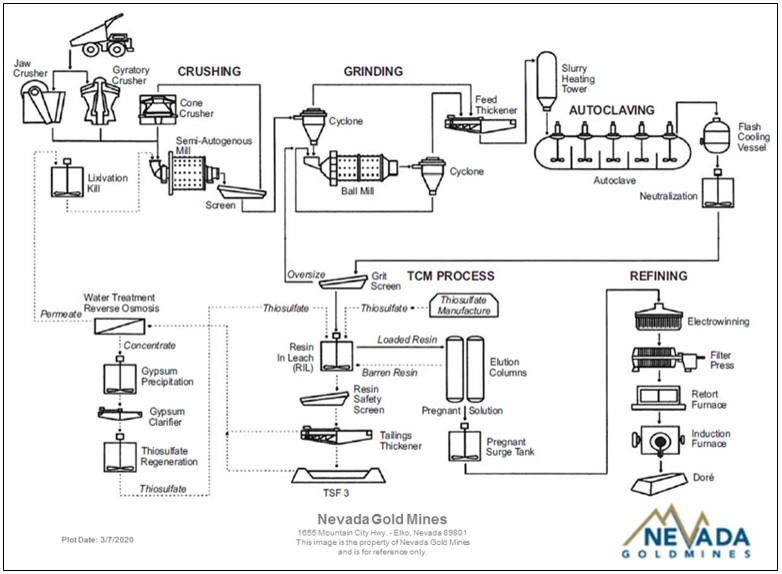

1.14 Recovery Methods

The designs of the process facilities design were based on a combination of metallurgical testwork, previous study designs, and previous operating experience. The designs are generally conventional to the gold industry. The Goldstrike autoclave uses a thiosulfate–resin-in-leach process which is not conventional, but is successful in processing high alkaline, preg-robbing ore from the Carlin Complex. The Goldstrike autoclave is planned to be converted to CIL in 2022–2023 when the high alkaline, preg-robbing, low-grade, double refractory stockpiles are consumed.

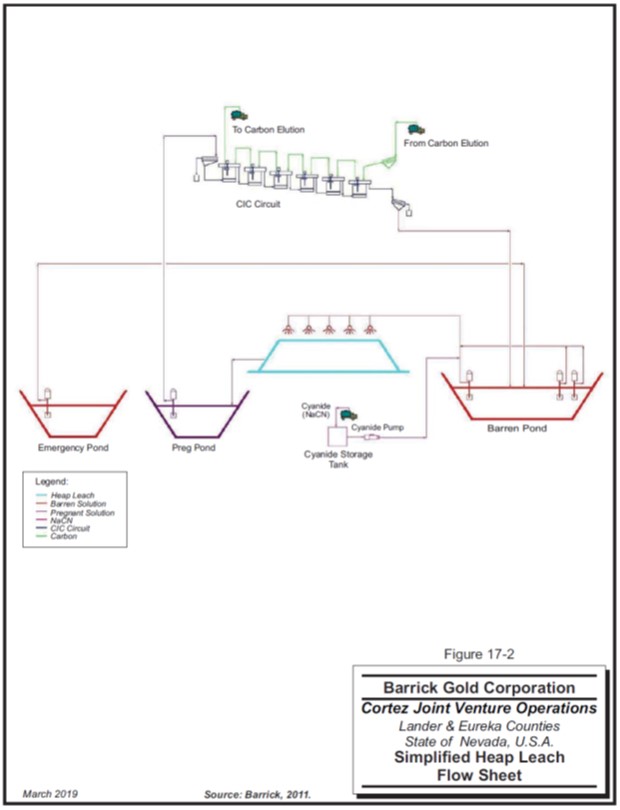

The gold heap leach process consists of a conventional run-of-mine leach pad, followed by leaching, solution collection, and pumping. Solution is collected in the leach pad drain system and then pumped to activated carbon columns (CIC) where gold loads onto activated carbon. Gold-laden carbon is reclaimed from the CIC circuit and transported to a centralized carbon stripping system where the gold is stripped from the carbon and recovered by electro-winning. Stripped carbon is recycled and reused. The gold heap leach produces doré.

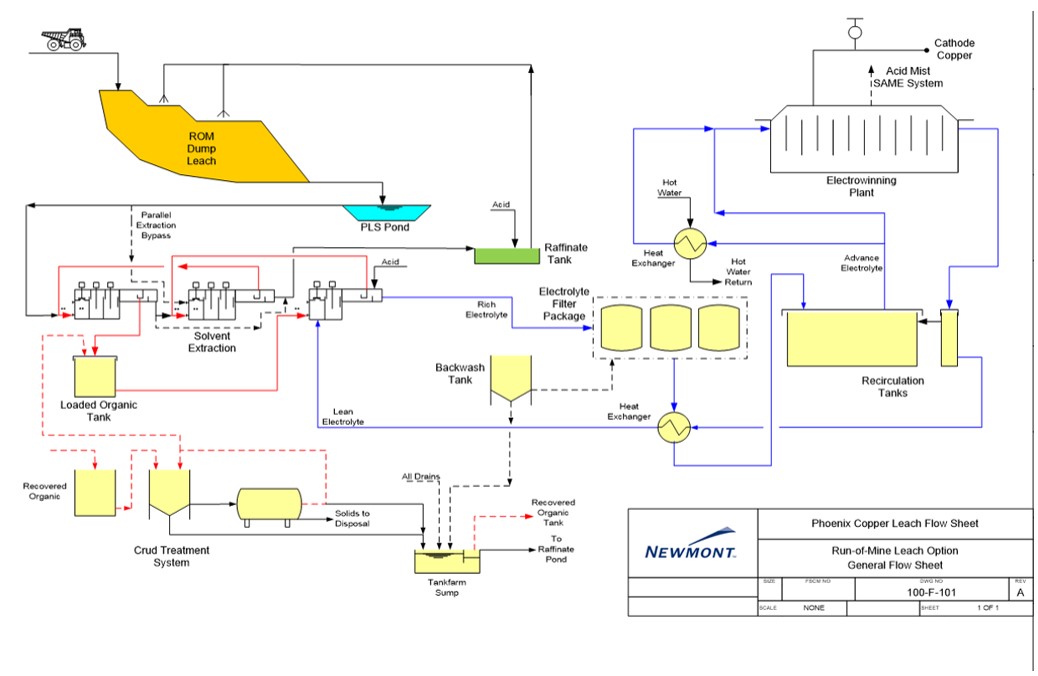

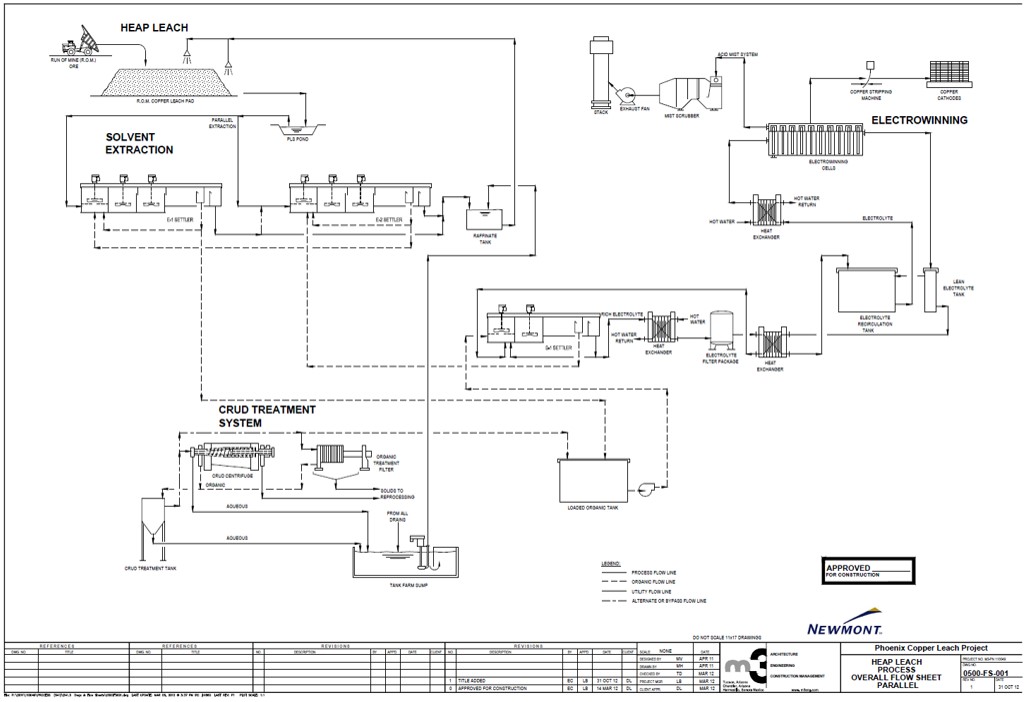

The Phoenix copper leach process consists of a conventional run-of-mine leach pad designed to facilitate the stacking of copper oxide and transition ores as well as the subsequent leaching, solution collection, and pumping. The copper heap leach produces copper cathode.

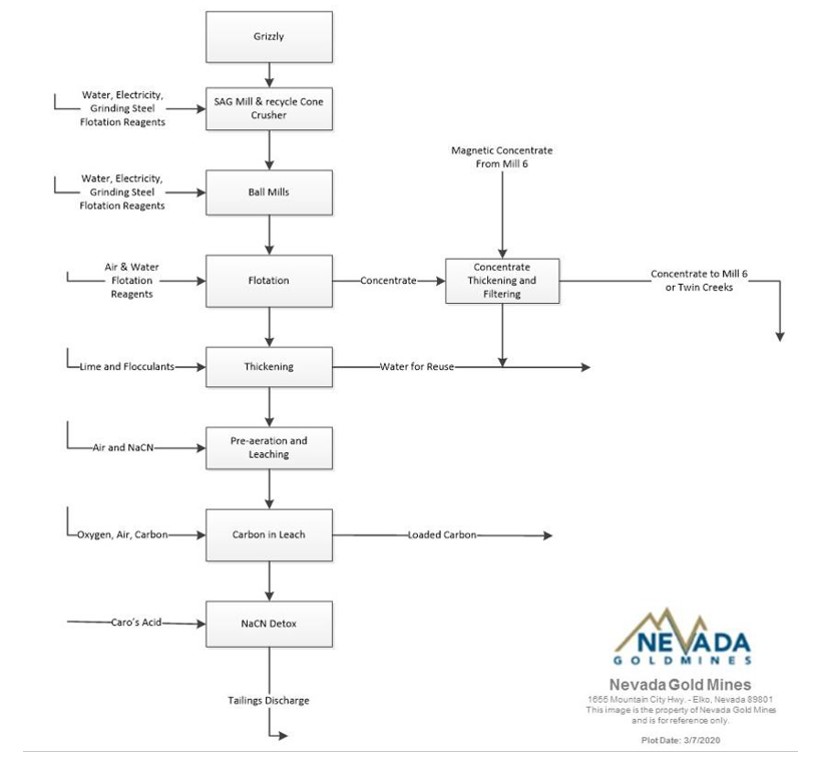

The Gold Quarry concentrator (formerly referred to as Mill 5) relies on oxide pit, oxide stockpile, low-carbonate sulfide material, and high-carbonate sulfide material. The Gold Quarry concentrator uses a combination of flotation and cyanide leaching to recover gold. Gold recovery from the flotation process is dependent upon the application of the appropriate amount of grinding to liberate the pyrite and enable the sulfide mineral(s) to be selectively floated away from the bulk of the ore. Gold recovery from the carbon-in-leach (CIL) process is typically a function of the ease of solution access to gold particles.

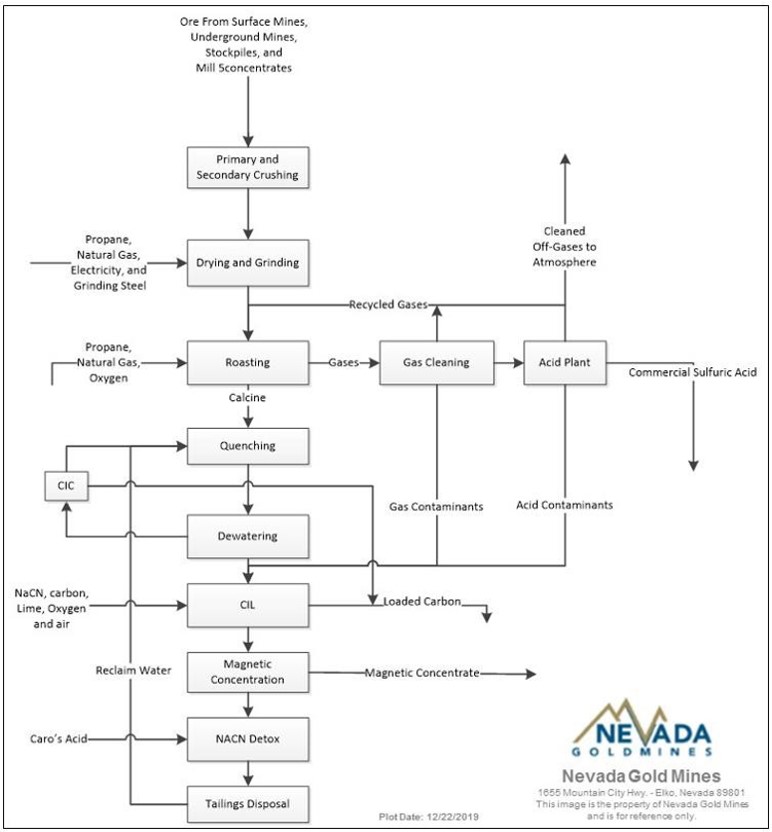

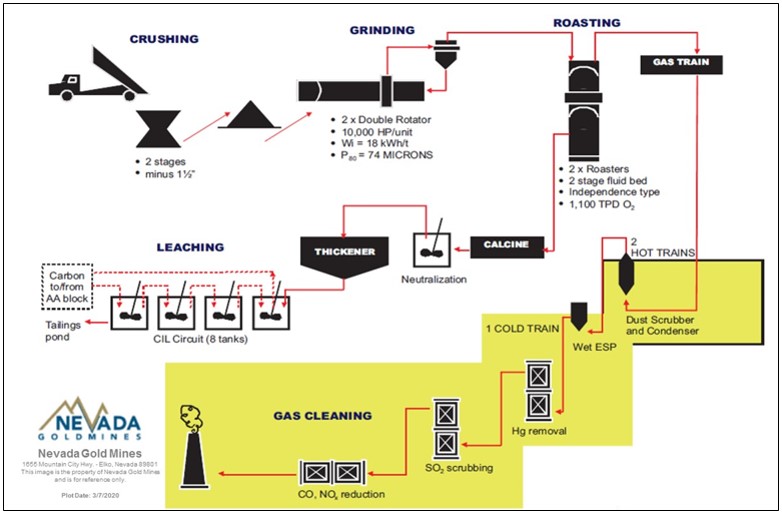

The Gold Quarry roaster (formerly referred to as Mill 6) is fed with refractory ores from open pit and underground ores from Cortez, Gold Quarry, Goldstar, stockpile material and flotation concentrates from the Gold Quarry concentrator. Because the final processing steps are the same as in the oxide mill, the performance of a roasting facility is similarly driven by the same parameters with the addition of sufficient retention time in the roaster in contact with sufficient oxygen to complete the oxidizing process.

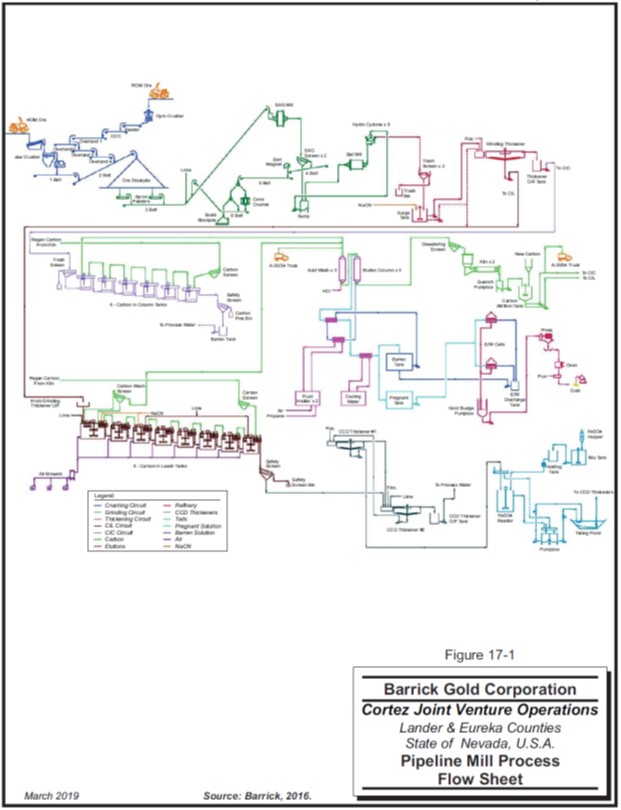

The Pipeline mill treats material from the Crossroads/Pipeline open pit, Cortez Pits open pit, Cortez Hills underground, and historical stockpiles derived from mining of the Pipeline and Cortez Hills open pits. The process consists of crushing and grinding, a CIL circuit, carbon stripping and reactivation circuits, and doré refining. The final product is doré.

| | | | | | | | |

| Date: February, 2022 | | Page 1-18 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

Run-of-mine higher-grade oxide ore from the Turquoise Ridge Surface sources are blended for gold grade, hardness, and carbonate content and fed to the Juniper oxide mill. The process consists of grinding, a CIL circuit, elution and electrowinning. The final product is doré.

The Phoenix solvent extraction–electrowinning (SX/EW) plant is fed with material derived from the Fortitude and Bonanza open pits. The SX plant consists of leaching, solvent extraction, and copper electrolysis, to produce cathode copper.

The Phoenix mill treats material from open pit sources at the Phoenix Complex. The plant has a copper/gold specific flotation system designed to provide concentrate products for sale to an outside smelter. The process consists of crushing and grinding, flotation, conventional CIP processing, to produce copper concentrates. Gold is also recovered by gravity separation.

The Goldstrike autoclave treats material from Goldstrike Betze Open Pit. The process consists of crushing and grinding, pressure oxidation using autoclaves, thiosulfate–resin-in-leach circuits, elution and electrowinning. The autoclave is planned to be converted to CIL in 2022–2023 once all of the high alkaline, preg-robbing, low-grade, double refractory stockpiles are depleted. The final product is doré.

The Sage autoclave treats material from Turquoise Ridge Underground and open pit sources, plus historical stockpiles. The process consists of crushing and grinding, pressure oxidation using autoclaves, a CIL circuit, elution and electrowinning. The final product is doré.

The Goldstrike roaster treats open pit and underground material from numerous sources including the South Arturo open pits, El Niño underground, Goldstrike underground, Goldstrike open pit, historical stockpiles derived from mining of the Goldstrike open pit, Goldstar open pit, Leeville underground, Pete Bajo underground, Exodus underground, Cortez Crossroads/Pipeline open pit, Cortez Hills underground, historical stockpiles derived from mining of the Cortez Hills and Crossroads/Pipeline open pits, and Goldrush underground. The process includes crushing and grinding, roasting, and a roaster CIL circuit. The product is transferred to the Goldstrike autoclave circuit for elution and electrowinning to produce doré.

The major consumables in the gold heap leach facilities are antiscalant, cyanide and lime. The copper heap leach pads use sulfuric acid. The Phoenix SX/EW plant uses sulfuric acid (electrolyte), cobalt, diluent, extractant, diatomaceous earth, clay, and starch. Mill facilities use grinding media, balls for ball mills, lime, cyanide, collector, frother, and hydrogen peroxide. The Goldstrike autoclave requires calcium thiosulfate and resin. Both autoclaves use grinding media, balls for ball mills, lime, and cyanide. The roasters require oxygen, grinding steel, cyanide, lime and sulfur.

Metallurgical facilities comprise nine heap leach facilities, two oxide plants, two flotation plants, two autoclave facilities and two roaster facilities.

Gold recovery from heap leaching is a function of solution application and management, particle size distribution, time, and mineralogy. Cyanide leach kinetics in the heap leach pads is most strongly affected by ore characteristics.

1.15 Infrastructure

The majority of the key infrastructure to support the Nevada Operations mining activities envisaged in the LOM is in place. New infrastructure is required to support the proposed

| | | | | | | | |

| Date: February, 2022 | | Page 1-19 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

Goldrush operations in the Cortez Complex. A third shaft at the Turquoise Ridge Complex is under construction.

There are nine heap leach pads in the Project area, all of which are actively being leached. There is sufficient capacity in the heap leach pads and planned heap leach pad expansions for LOM planning purposes.

There are 67 WRSFs in the Project area, of which 36 are inactive and undergoing reclamation, and 31 are active. A total of 24 pits are permitted for partial or full waste backfill. There is sufficient capacity in the existing WRSFs and planned WRSF expansions for LOM planning purposes.

There are 19 TSFs in the Project area, of which 11 are inactive and undergoing reclamation, and eight are active. There is sufficient capacity in the active TSFs and planned TSF expansions for LOM planning purposes.

Water supply for processing operations is sourced, depending on the facility, from well fields, TSF reclaim, storm run-off water, and pit dewatering. Potable water is provided by permitted water wells and supporting treatment and infrastructure facilities. The current water sources, assuming similar climate conditions to those experienced by the operations in the past, will be sufficient for the LOM plan.

Water management operations include systems of dewatering wells, water gathering and conveyance facilities, water storage, water use, and various management options for discharge of excess water. Water not used for mining or milling can be pumped to storage reservoirs. Rapid infiltration basins are used to capture storm run-off water to avoid that water coming into contact with mining operations. The NDEP allows selected complexes within the Nevada Operations, through discharge permits, to discharge groundwater from pumping operations to groundwater vis percolation, infiltration, and irrigation. The current water management practices are expected to be applicable for the LOM plan.

There are no accommodation facilities at any of the complexes. Personnel reside in adjacent settlements including Battle Mountain, Carlin, Elko, Golconda, Wells, West Wendover and Winnemucca.

Electrical power for the Carlin, Cortez, Turquoise Ridge, and Phoenix Complexes is obtained via TS Power Plant and from the Western 102 power plant (both of which are owned and operated by NGM) with transmission by NV Energy. Power for Gold Quarry, Long Canyon, and Goldrush is supplied via the Wells Rural Electric Power Company.

1.16 Markets and Contracts

1.16.1 Market Studies

NGM has established contracts and buyers for the gold bullion and copper concentrate and cathode products from the Nevada Operations, and has an internal marketing group that monitors markets for its key products. Together with public documents and analyst forecasts, these data support that there is a reasonable basis to assume that for the LOM plan, that the key products will be saleable at the assumed commodity pricing.

| | | | | | | | |

| Date: February, 2022 | | Page 1-20 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

1.16.2 Commodity Pricing

Barrick, as operator of the NGM JV, provides the commodity price guidance. Barrick uses a combination of historical and current contract pricing, contract negotiations, knowledge of its key markets from a long operations production record, short-term versus long-term price forecasts prepared by the company’s internal marketing group, public documents, and analyst forecasts when considering long-term commodity price forecasts.

Higher metal prices are used for the mineral resource estimates to ensure the mineral reserves are a sub-set of, and not constrained by, the mineral resources, in accordance with industry-accepted practice.

The long-term commodity price and exchange rate forecasts are:

Mineral reserves:

•Gold: US$1,200.00/oz;

•Silver: US$16.50/oz;

•Copper: US$2.75/lb;

Mineral resources:

•Gold: US$1,500.00/oz;

•Silver: US$20.50/oz

•Copper: US$3.50/lb.

1.16.3 Contracts

NGM has contracts in place for the majority of the copper concentrate. The terms contained within the concentrate sales contracts are typical and consistent with standard industry practice for high-gold, low-copper concentrates. NGM’s bullion is sold on the spot market, by marketing experts retained in-house by NGM/Barrick. NGM provides Newmont with the date and number of ounces that will be credited to Newmont’s account, and invoices Newmont for how much NGM is owed, such that Newmont receives credits for the ounces (based on the JV interest) and Newmont pays NGM for the ounces. The terms contained within the sales contracts are typical and consistent with standard industry practice and are similar to contracts for the supply of bullion elsewhere in the world.

The largest in-place contracts other than for product sales cover items such as bulk commodities, operational and technical services, mining and process equipment, and administrative support services. Contracts are negotiated and renewed as needed.

1.17 Environmental, Permitting and Social Considerations

1.17.1 Environmental Studies and Monitoring

Baseline and supporting environmental studies were completed to assess both pre-existing and ongoing site environmental conditions, as well as to support decision-making processes during operations start-up. Characterization studies were completed for climate, air quality, hydrology

| | | | | | | | |

| Date: February, 2022 | | Page 1-21 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

and surface water quality, hydrogeology, flora, fauna, soils, agriculture and land use, and the socioeconomic environment.

The Goldrush project is situated in a culturally- and biologically sensitive area, with numerous cultural sites and within sage grouse habitat. Major study areas in support of the planned mining operation include air quality, hazardous material and solid waste, noise, waste rock characterization, soils, biological resources, wildlife, special status species, visual and cultural resources, Native American Traditional Values, social and economic values, and environmental justice.

Plans were developed and implemented to address aspects of operations such as waste and fugitive dust management, spill prevention and contingency planning, water management, and noise levels. These plans will be extended to Goldrush as they become operational.

As part of its permitting requirements, NGM has submitted and received approval on numerous PoOs and Reclamation Plans for each area. NGM has additionally submitted and/or provided information to support Environmental Assessments (EA) or Environmental Impact Statements (EIS) for each area containing public lands. The additionally submitted information includes various baseline and supporting studies on various natural resources. Existing operations were reviewed by the BLM and Nevada Division of Environmental Protection Bureau of Mining Regulation and Reclamation (NDEP–BMRR). BLM NEPA analysis under an EA or EIS can result in a Determination of NEPA Adequacy (DNA), Findings of No Significant Impacts (FONSI), or a Record of Decision (ROD). These determinations are issued by the BLM for those operations where PoOs contain public lands. The PoOs are updated and amended, as necessary, to allow for continuation of mining or additional mine development.

1.17.2 Closure and Reclamation Considerations

Initial closure planning is included within all proposals and reclamation plan documents during the permitting process. Closure planning is integrated with mine and reclamation planning to the extent practicable during active operations. Concurrent reclamation of lands as mining progresses is a primary consideration for NGM. Reclamation plans are regularly reviewed and revised at a minimum of every three years to ensure adequate financial assurances have been put in place for required reclamation activities. Approvals are required from both the BLM and NDEP for reclamation and closure plan amendments and bond adjustments.

Various mine facilities are located within the PoO boundaries on both private lands and the federal lands administered by the BLM. Only approved facility disturbance can be constructed within PoO boundaries. All PoO boundaries and private lands within the PoO are under the jurisdiction of the NDEP–BMRR. The reclamation boundaries define limits of approved disturbance for mining within each PoO boundary. A Nevada industry-standard method or Standard Reclamation Cost Estimator (SRCE) model is used by NGM to calculate the liabilities.

NGM currently has posted approximately US$2.14 B in financial assurances in the form of letters of credit and surety bonds to cover mine closure costs. Additionally, there are several trusts associated with closure cost planning.

Estimated closure costs used in the cashflow analysis total US$0.9 B. This cost estimate is based on the actual disturbance.

| | | | | | | | |

| Date: February, 2022 | | Page 1-22 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

The Goldrush project will require development of a temporary closure plan, a tentative plan for permanent closure/interim closure plan, a plan of operations that includes a reclamation plan and reclamation surety estimate, and a plan for monitoring the post-closure stability of the site.

1.17.3 Permitting

As part of its permitting requirements, NGM has submitted PoOs and Reclamation Plans for each operation. NGM has submitted and/or provided information to support NEPA evaluation for each area containing public lands. The PoOs are updated and amended as necessary to allow for continuation of mining or additional mine development. The Nevada Operations have the required permits to operate or will be applying for the permits as they are required for mine development.

Additional permits will be required to support planned operations at Goldrush, with about 20 key permits required. The permitting approach assumes off-site transport of ore for processing at Goldstrike and Gold Quarry. Goldrush is going through NEPA review. This will result in completion of an Environmental Impact Statement which will be followed by Record of Decision from the BLM. The start of the NEPA process is completion of baseline studies and submission of a PoO to the BLM.

1.17.4 Social Considerations, Plans, Negotiations and Agreements

Nevada Gold Mines is one of the largest direct employers in the area and also generates significant indirect employment.

Stakeholder engagement is a primary pillar of that strategy and includes participation in local civic activities; city/town council and county commission meetings; serving on boards and committees; town hall meetings; and one-to-one engagement. From this engagement, NGM listens to, and partners with, local organizations to identify a social investment strategy. Education, health, economic development and cultural heritage are key areas for community investments. NGM has also partnered with local law enforcement on public safety initiatives and conservation groups on environmental conservation programs.

Also as part of the community affairs program, NGM engages with 10 tribal communities. Engagement with partner tribes includes regularly-held meetings called “Dialogue Meetings”; tribal council meetings; community committees; one-to-one engagements and sponsorship of several community-driven initiatives. Through this engagement, NGM works with tribal councils to identify and support community priorities in programs aimed at improving community health and well-being, education attainment, cultural heritage preservation, and economic development.

The Cortez Complex, including the Goldrush project, operates on lands traditionally used by the Western Shoshone tribes and bands. As the Goldrush project develops, NGM will hold public meetings (and advertise a local grievance mechanism according to the Grievance Management Procedure) if internal strategy deems appropriate so that citizens in the surrounding areas may come to learn more about the project and express their support or concerns.

| | | | | | | | |

| Date: February, 2022 | | Page 1-23 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

1.18 Capital Cost Estimates

Capital costs were based on recent prices or operating data and are at a minimum at a pre-feasibility level of confidence, having an accuracy level of ±25% and a contingency range not exceeding 15%.

Capital costs included funding for infrastructure, pit dewatering, development drilling, and permitting as well as miscellaneous expenditures required to maintain production. Mobile equipment re-build/replacement schedules and fixed asset replacement and refurbishment schedules were included. Sustaining capital costs reflected current price trends.

The LOM capital cost estimate is US$2.6 B (Table 1-10).

Table 1-10: Capital Cost Estimate

| | | | | | | | |

| Area | Unit | Value |

| Mine | US$ B | 1.3 |

| Process | US$ B | 0.8 |

| General and administrative | US$ B | 0.2 |

| Goldrush pre-production | US$ B | 0.4 |

| Total | US$ B | 2.6 |

Note: Numbers have been rounded; totals may not sum due to rounding.

1.19 Operating Cost Estimates

Operating costs were based on actual costs seen during operations and are projected through the LOM plan, and are at a minimum at a pre-feasibility level of confidence, having an accuracy level of ±25% and a contingency range not exceeding 15%.

Historical costs were used as the basis for operating cost forecasts for supplies and services unless there are new contract terms for these items. Labor and energy costs were based on budgeted rates applied to headcounts and energy consumption estimates.

The LOM operating costs are estimated at US$34.9 B (Table 1-11). The average mining costs (open pit and underground) over the LOM are US$10.47/t mined, autoclave costs are US$34.01/t processed, roaster costs are US$24.12/t processed, oxide mill costs are US$10.46/t processed, heap leach costs are US$3.53/t processed, and general and administrative costs (inclusive of transport costs) are US$5.78/t processed.

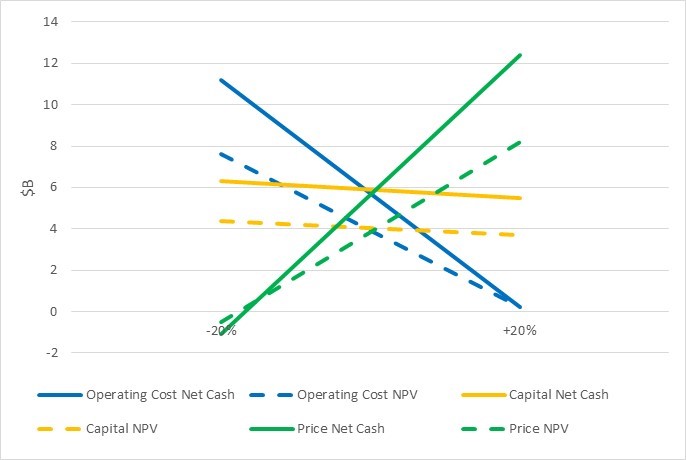

1.20 Economic Analysis

1.20.1 Economic Analysis

The financial model that supports the mineral reserve declaration is a standalone model that calculates annual cashflows based on scheduled ore production, assumed processing recoveries, metal sale prices, projected operating and capital costs and estimated taxes.

The financial analysis is based on an after-tax discount rate of 5%. All costs and prices are in unescalated “real” dollars. The currency used to document the cashflow is US$.

| | | | | | | | |

| Date: February, 2022 | | Page 1-24 |

| | | | | |

Nevada Gold Mines Joint Venture Nevada Operations Technical Report Summary | |

| |

All costs are based on the 2022 budget. Revenue is calculated from the recoverable metals and long-term metal price and exchange rate forecasts.

Taxes assume a rate of 21% plus the Nevada Net Proceeds Tax of 5% and the Nevada Mining Education Tax.

The economic analysis is based on 100% equity financing and is reported on a 100% project ownership basis. The economic analysis assumes constant prices with no inflationary adjustments. Barrick owns a 61.5% JV interest, with Newmont owning the remaining 38.5% JV interest.

Table 1-11: Operating Cost Estimate

| | | | | | | | |

| Item | Units | Value |

| Mining | US$B | 18.6 |

| Rehandle | US$B | 0.8 |

| Autoclaves | US$B | 4.8 |

| Roasters | US$B | 5.2 |

| Oxide Mill | US$B | 0.4 |

| Leach | US$B | 0.6 |

| G&A | US$B | 3.3 |

| Transport | US$B | 1.1 |

| Total | US$B | 34.9 |

Note: Numbers have been rounded; totals may not sum due to rounding.

Within the NGM JV, copper sales are generally in the form of concentrate, which is sold to smelters for further treatment and refining, and cathode. Copper is sold in either concentrate or cathode form. These sales are to third party customers. Generally, if a secondary metal expected to be mined is significant to the NGM JV, co-product accounting is applied. When the NGM JV applies co-product accounting at an operation, revenue is recognized for each co-product metal sold, and shared costs applicable to sales are allocated based on the relative sales values of the co-product metals produced. Generally, if a secondary metal expected to be mined is not significant to the Joint Venture, by-product accounting is applied. As copper and silver production at each of the NGM operations is not significant to the NGM JV, production from copper and silver are accounted for as by-product sales. Revenues from by-product sales are credited by NGM and Barrick as a by-product credit.

For the purposes of showing a complete cashflow analysis for the Nevada Operations as a whole, silver was treated as a by-product credit.

The economic analysis is based on 100% equity financing and is reported on a 100% project ownership basis. The economic analysis assumes constant prices with no inflationary adjustments.

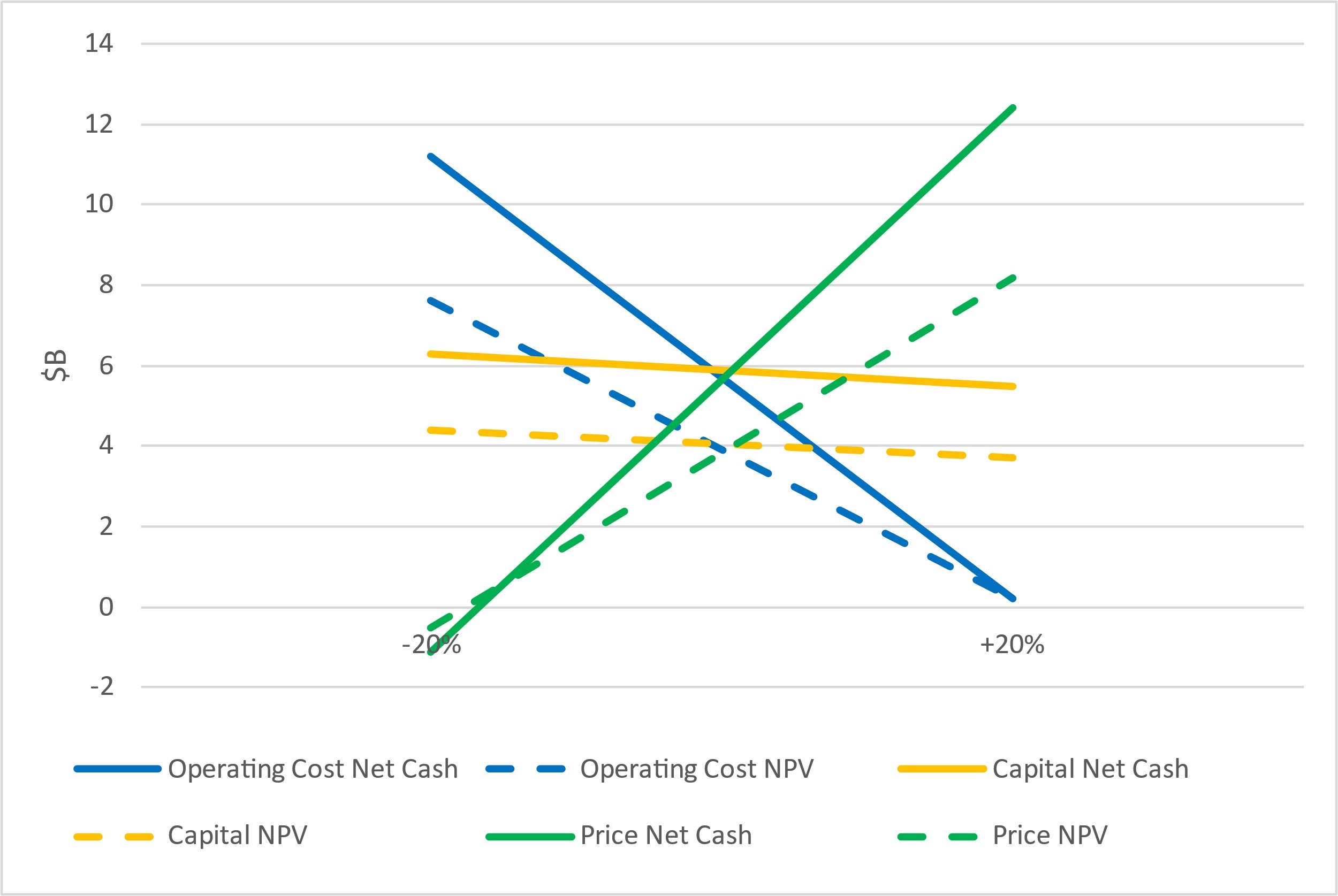

The NPV5% is $4.2 B. Due to the profile of the cashflow, considerations of payback and internal rate of return are not relevant.

A summary of the financial results is provided in Table 1-12.

| | | | | | | | |

| Date: February, 2022 | | Page 1-25 |

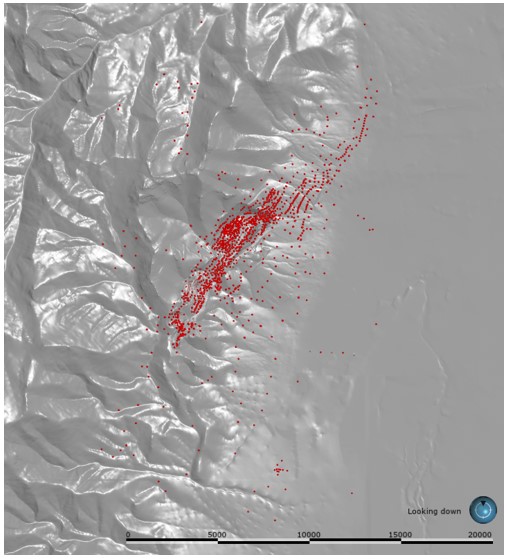

| | | | | |