Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission | ||

| þ | Definitive Proxy Statement | Only (as permitted by Rule 14a-6(e)(2)) | ||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

Newmont Mining Corporation

| ||||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| þ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

Table of Contents

| Newmont Mining Corporation 6363 South Fiddler’s Green Circle Greenwood Village, Colorado 80111 USA |

Notice of 2012 Annual Meeting of Stockholders

| Date of Meeting: | Tuesday, April 24, 2012 | |

| Time: | 11:00 a.m., local time | |

| Place: | Hotel du Pont 11th and Market Streets Wilmington, Delaware 19801 | |

| Purpose: | 1. Elect directors; | |

2. Ratify the Audit Committee’s appointment of PricewaterhouseCoopers LLP as Newmont’s independent auditors for 2012; | ||

3. To approve, on an advisory basis, the compensation of the Named Executive Officers; and | ||

4. Transact such other business that may properly come before the meeting. | ||

Record Date: | February 24, 2012 | |

Under the Securities and Exchange Commission rules, we have elected to use the Internet for delivery of Annual Meeting materials to our stockholders, enabling us to provide them with the information they need, while lowering the costs of delivery and reducing the environmental impact associated with our Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. It is important that your shares be represented at the Annual Meeting whether or not you are personally able to attend. If you are unable to attend, please promptly vote your shares by telephone or Internet or by signing, dating and returning the enclosed proxy card at your earliest convenience. Voting by the Internet or telephone is fast, convenient, and enables your vote to be immediately confirmed and tabulated, which helps Newmont reduce postage and proxy tabulation costs.Your vote is important so that your shares will be represented and voted at the Annual Meeting even if you cannot attend.

| By Order of the Board of Directors |

|

| Stephen P. Gottesfeld |

| Senior Vice President, General Counsel and Secretary |

March 7, 2012

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 24, 2012

Our Notice of Meeting, Proxy Statement and Annual Report are available at

http://bnymellon.mobular.net/bnymellon/NEM

Table of Contents

2012 Proxy Statement

| Page | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

Notes to Participants in Newmont Employee Retirement Savings Plans | 4 | |||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 17 | ||||

| 18 | ||||

Report of the Compensation Committee on Executive Compensation | 21 | |||

| 22 | ||||

| 22 | ||||

| 27 | ||||

| 28 | ||||

| 33 | ||||

| 47 | ||||

| 50 | ||||

| 55 | ||||

| 70 | ||||

| 71 | ||||

| 72 | ||||

Proposal No. 3—To Approve, on an Advisory Basis, the Compensation of the Named Executive Officers | 73 | |||

| 74 | ||||

i

Table of Contents

PROXY STATEMENT

Notice of Internet Availability of Proxy Materials.

On or about March 13, 2012, we will furnish a Notice of Internet Availability of Proxy Materials (“Notice”) to most of our stockholders containing instructions on how to access the proxy materials and to vote online. In addition, instructions on how to request a printed copy of these materials may be found on the Notice. For more information on voting your stock, please see “Voting Your Shares” below. If you received a Notice by mail, you will not receive a paper copy of the proxy materials unless you request such materials by following the instructions contained on the Notice. Your vote is important no matter the extent of your holdings.

Stockholders Entitled to Vote.

The holders of record of the following securities at the close of business on February 24, 2012, (the “Record Date”) are entitled to vote at Newmont Mining Corporation’s (“Newmont” or the “Company”) 2012 Annual Meeting of Stockholders to be held on Tuesday, April 24, 2012 (the “Annual Meeting”):

| • | common stock of Newmont, par value $1.60 per share, of which there were 490,193,745 shares outstanding as of the record date; and |

| • | exchangeable shares of Newmont Mining Corporation of Canada Limited, a Canadian federal corporation (“Newmont Canada”), of which there were 4,915,685 shares as of the record date entitled to vote pursuant to the terms of the Newmont Special Voting Stock described below. |

Newmont Common Stock. Each share of common stock that you own entitles you to one vote. Your Notice or proxy card shows the number of shares of common stock that you own. You may elect to vote in one of three methods:

| • | By Mail - If you have received or requested a paper copy of the proxy materials, please date and sign the proxy card and return it promptly in the accompanying envelope. |

| • | By Internet - If you received a Notice of Internet Availability of Proxy Materials, you can access our proxy materials and vote online. Instructions to vote online are provided in the Notice. |

| • | In Person - You may attend the Annual Meeting and vote in person. We will give you a ballot when you arrive. If your stock is held in the name of your broker, bank or another nominee (a “Nominee”), then you must present a proxy from that Nominee in order to verify that the Nominee has not already voted your shares on your behalf. |

| • | If you hold Newmont Common Stock at your Broker - If your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice or proxy materials, as applicable, are being forwarded to you by that organization. Your Voting Instruction Form from Broadridge or your Notice provides information on how to vote your shares. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. |

1

Table of Contents

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, the organization that holds your shares may generally vote on “routine” matters such as ratification of auditors but cannot vote on “non-routine” matters, which now include matters such as votes for the election of directors and the Say-on-Pay proposal. Thus, if the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.”

Newmont Exchangeable Shares. Each Newmont exchangeable share that you own has economic rights (such as the right to receive dividends and other distributions) that are, as nearly as practicable, equivalent to rights of shares of Newmont common stock. Holders of exchangeable shares have a right through a Voting and Exchange Trust Agreement (the “Voting Agreement”) to vote at stockholders’ meetings of Newmont. The exchangeable shares, however, are not shares issued by Newmont and, therefore, a holder of exchangeable shares is not a registered stockholder of Newmont, but is a registered stockholder of Newmont Canada. The exchangeable shares are exchangeable at the option of the holders into the Company’s common stock on a one-for-one basis. There are two ways to vote your exchangeable shares:

| • | By Mail - You may vote by signing and returning the enclosed Voting Instruction Form. This form permits you to instruct Computershare Trust Company of Canada, as trustee under the Voting Agreement (the “Trustee”), to vote at the Annual Meeting. The Trustee holds one share of special voting stock of Newmont (the “Newmont Special Voting Stock”) that is entitled to vote on all matters on which the shares of the Company’s common stock vote. The Newmont Special Voting Stock has a number of votes in respect to the Annual Meeting equal to the lesser of (a) the number of exchangeable shares outstanding on the record date (other than the Company’s exchangeable shares held by Newmont or its affiliates), or (b) 10% of the total number of votes corresponding to the common stock then outstanding. Based upon the foregoing, the Trustee will be entitled to cast up to 4,915,685 votes at the Annual Meeting. The Trustee must receive your voting instructions by 5:00 p.m. in Toronto, Ontario, Canada, on April 23, 2012. This will give the Trustee time to tabulate the voting instructions and vote on your behalf. The Trustee will exercise each vote attached to the Newmont Special Voting Stock only on the basis of instructions received from the relevant holders of exchangeable shares. In the absence of instructions from a holder as to voting, the Trustee will not have any voting rights with respect to such exchangeable shares. |

| • | In Person - You may attend the Annual Meeting and vote in person. As a holder of exchangeable shares, you may attend the Annual Meeting in person to vote directly the number of votes to which you are entitled under the Voting Agreement. Please refer to the Notice to Exchangeable Shareholders and Voting Instruction Form for additional instructions on voting at the meeting. |

Quorum, Tabulation and Broker Non-Votes and Abstentions.

Quorum. The holders of a majority of the outstanding shares of capital stock of the Company entitled to vote at the Annual Meeting must be present in person or represented by proxy in order to constitute a quorum for all matters to come before the meeting. For purposes of determining the presence of a quorum, “shares of capital stock of the Company” include all shares of common stock and the maximum number of shares of common stock that the Trustee of the Newmont exchangeable shares is entitled to vote at the Annual Meeting.

Tabulating Votes and Voting Results. Votes at the Annual Meeting will be tabulated by two inspectors of election who will be appointed by the Chairman of the meeting and who will not be candidates for election to the Board of Directors. The inspectors of election will treat shares of capital stock represented by a properly signed and returned proxy as present at the Annual Meeting for purposes of determining a quorum, without regard to whether the proxy is marked as casting a vote or abstaining.

Broker Non-Votes and Abstentions. Abstentions and “broker non-votes” as to particular matters are counted for purposes of determining whether a quorum is present at the Annual Meeting. Abstentions are counted in tabulations of the votes cast on proposals presented to stockholders, whereas broker non-votes are not counted for purposes of determining whether a proposal has been approved. Abstentions have the same effect as votes

2

Table of Contents

against proposals presented to stockholders. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee does not have discretionary voting power and has not received instructions to do so from the beneficial owner.

Votes Required to Approve the Proposals.

Proposal | Vote Required | |

Election of Directors | Majority of votes cast for the Nominees. | |

Ratification of independent auditors for 2012 | Majority of stock present in person or by proxy and entitled to vote on the Ratification. | |

To approve, on an advisory basis, the compensation of the Named Executive Officers | Non-binding advisory vote – majority of stock present in person or by proxy and entitled to vote. |

Election of Directors. Brokers, banks and other financial institutions can no longer vote your stock on your behalf for the election of directors if you have not provided instructions on your voting instruction form, by telephone or Internet. For your vote to be counted, you must submit your voting instructions to your broker or custodian.

Ratify PricewaterhouseCoopers LLP as the Company’s Independent Auditors for 2012. The affirmative vote of a majority of the shares present and entitled to vote, in person or by proxy, at the Annual Meeting is required to ratify the Audit Committee’s appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors for 2012.

Advisory Say-On-Pay Vote. Because the vote on Compensation of the Named Executive Officers is advisory in nature, it will not: (1) affect any compensation already paid or awarded to any Named Executive Officer, (2) be binding on or overrule any decisions by the Board of Directors, (3) create or imply any additional fiduciary duty on the part of the Board of Directors, and (4) restrict or limit the ability of stockholders to make proposals for inclusion in proxy materials related to executive compensation.

Other Items. If any other items are presented at the Annual Meeting, they must receive an affirmative vote of a majority of the shares present and entitled to vote, in person or by proxy, in order to be approved.

Revocation of Proxy or Voting Instruction Form.

Revocation of Newmont Common Stock Proxy. A stockholder who executes a proxy may revoke it by delivering to the Secretary of the Company, at any time before the proxies are voted, a written notice of revocation bearing a later date than the proxy, or by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy). A stockholder also may substitute another person in place of those persons presently named as proxies. Written notice revoking or revising a proxy should be sent to the attention of the Secretary, Newmont Mining Corporation, at 6363 South Fiddler’s Green Circle, Greenwood Village, Colorado 80111 USA.

Revocation of Newmont Exchangeable Shares Voting Instruction Form. A registered holder of Newmont exchangeable shares who has submitted a Voting Instruction Form may revoke the Voting Instruction Form by completing and signing a Voting Instruction Form bearing a later date and depositing it with the Trustee. No notice of revocation or later-dated Voting Instruction Form, however, will be effective unless received by the Trustee prior to 5:00 p.m., Toronto time, on April 23, 2012.

A non-registered holder of Newmont exchangeable shares may revoke a Voting Instruction Form at any time by written notice to the intermediary, except that an intermediary is not required to act on a revocation of a Voting Instruction Form that is not received by the intermediary at least ten days prior to the Annual Meeting.

3

Table of Contents

The cost of preparing and mailing the Notice, requests for proxy materials, and the cost of solicitation of proxies on behalf of the Board of Directors will be borne by the Company. The proxy materials will be mailed to the holders of the Company’s common stock, and Newmont exchangeable shares, on March 13, 2012. In addition, solicitation of proxies and Voting Instruction Forms may be made by certain officers and employees of the Company by mail, telephone or in person. The Company has retained Georgeson Inc. to aid in the solicitation of brokers, banks, intermediaries and other institutional holders in the United States and Canada for a fee of $15,000. All costs of the solicitation will be borne by the Company. The Company also will reimburse brokerage firms and others for their expenses in forwarding proxy materials to beneficial owners of common stock and exchangeable shares.

Notes to Participants in Newmont Employee Retirement Savings Plans.

Participants in the Retirement Savings Plan of Newmont and Retirement Savings Plan for Hourly-Rated Employees of Newmont. If you are a participant in the Retirement Savings Plan of Newmont or Retirement Savings Plan for Hourly-Rated Employees of Newmont (401(k) Plans) and hold the Company’s common stock under either of the 401(k) Plans, you will be furnished a Notice containing instructions on how to access the proxy materials and to vote online. In addition, instructions on how to request a printed copy of these materials may be found on the Notice. The 401(k) Plans are administered by Vanguard, as trustee. The trustee, as the stockholder of record of the Company’s common stock held in the plans, will vote the shares held for you in accordance with the directions you provide. If you do not vote your shares by 11:59 p.m. Eastern time on April 19, 2012, the Trustee will vote your common shares in the 401(k) Plans in the same proportion as it votes shares as to which directions have been received.

Stockholder Proposals for the 2013 Annual Meeting.

For a stockholder proposal, including a proposal for the election of a director, to be included in the proxy statement and form of proxy for the 2013 Annual Meeting, the proposal must have been received by us at our principal executive offices no later than November 7, 2012. Proposals should be sent to the attention of the Secretary of the Company at 6363 South Fiddler’s Green Circle, Greenwood Village, Colorado 80111 USA. We are not required to include in our proxy statement and form of proxy a stockholder proposal that was received after that date or that otherwise fails to meet the requirements for stockholder proposals established by SEC regulations.

In addition, under our By-Laws, stockholders must give advance notice of nominations for directors or other business to be addressed at the 2013 Annual Meeting no later than the close of business on February 23, 2013. The advance notice must be delivered to the attention of the Secretary of the Company at 6363 South Fiddler’s Green Circle, Greenwood Village, Colorado 80111 USA.

The results of the voting at the 2012 Annual Meeting of Stockholders will be reported on Form 8-K and filed with the Securities and Exchange Commission within four business days after the end of the meeting.

4

Table of Contents

Proposal No. 1 — Election of Directors

If you hold your Newmont stock through a broker, bank or other financial institution, your Newmont stock will no longer be voted on your behalf on the election of directors unless you complete and return the Voting Instruction Form or follow the instructions provided to you to vote your stock via telephone or the Internet. If you do not instruct your broker, bank or other financial institution how to vote, your votes will be counted as “broker non-votes” and your shares will not be represented in the election of directors vote at the Annual Meeting.

Majority Vote Standard for the Election of Directors.

Our By-Laws were amended to require that in an uncontested election each director will be elected by a vote of the majority of the votes cast, which means the number of votes cast “for” a director’s election exceeds 50% of the number of votes cast with respect to that director’s election. Votes cast shall include votes to withhold authority, but shall exclude abstentions. Votes will not be deemed cast if no authority or direction is given.

If a nominee for director does not receive the vote of at least a majority of votes cast at the Annual Meeting, it is the policy of the Board of Directors that the director must tender his or her resignation to the Board. In such a case, the Corporate Governance and Nominating Committee will make a recommendation to the Board whether to accept or reject the tendered resignation, or whether other action should be taken, taking into account all of the facts and circumstances. The director who has tendered his or her resignation will not take part in the deliberations. For additional information, our Corporate Governance Guidelines are available on our website atwww.newmont.com/our-investors/our-governance.

Director Skills and Qualifications.

In addition to meeting the minimum qualifications set out by the Board of Directors under “Director Nomination Process and Review of Director Nominees,” each nominee also brings a strong and unique background and set of skills to the Board, giving the Board, as a whole, competence and experience in a wide variety of areas, including board service, corporate governance, compensation, executive management, private equity, finance, mining, operations, manufacturing, marketing, government, law, international business and health, safety, environmental and social responsibility. The unique background, skills and qualifications that led the Board of Directors and the Corporate Governance and Nominating Committee to the conclusion that each of the nominees should serve as a director for Newmont are set forth in the “Nominees” section below.

Board of Directors Recommendation.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” ALL OF THE FOLLOWING NOMINEES AND, UNLESS A STOCKHOLDER GIVES INSTRUCTIONS ON THE PROXY CARD TO THE CONTRARY, THE PROXIES NAMED THEREON INTEND SO TO VOTE.

Each of the 11 persons named below is a nominee for election as a director at the Annual Meeting for a term of one year or until his/her successor is elected and qualified. Unless authority is withheld, the proxies will be voted for the election of such nominees. All such nominees are currently serving as directors of the Company. All such nominees were elected to the Board of Directors at the last Annual Meeting except for Bruce R. Brook and Jane Nelson, who were elected to the Board of Directors on October 25, 2011. If any such nominees cannot be a candidate for election at the Annual Meeting, then the proxies will be voted either for a substitute nominee designated by the Board of Directors or for the election of only the remaining nominees.

Glen A. Barton, a director of Newmont since 2001, is not eligible to stand for re-election due to the age retirement provision in our Corporate Governance Guidelines. Newmont and the Board of

5

Table of Contents

Directors express their deepest appreciation to Mr. Barton for his outstanding and dedicated service and leadership to Newmont, for his many contributions to the deliberations of the Board and as a valued member of the committees of the Board. No person is being nominated at the Annual Meeting to fill the vacancy created by his departure. Instead, the directors expect to reduce the size of the Board of Directors from twelve to eleven members, effective when Mr. Barton ceases to be a director.

The following table sets forth information as to each nominee for election, including his or her age (as of the Record Date), and background, including his or her principal occupation during the past five years, current directorships, and skills and qualifications, of each nominee:

BRUCE R. BROOK,56,currently serves as a Director for Boart Longyear Limited, Programmed Group (as Chairman) and CSL Limited.

Director Qualifications:

| • | Financial Expertise — Prior service as the Chairman of the Audit Committee of Lihir Gold Limited and as Chief Financial Officer of WMC Resources Limited, Deputy CFO of ANZ Banking Group Limited, Group Chief Accountant of Pacific Dunlop Limited, and General Manager, Group Accounting positions at CRA Limited and Pasminco Limited. Current Chairman of the Audit Committee of Boart Longyear Limited and member of the Audit Committee of CSL Limited. Currently serves as a member of the Financial Reporting Council, an agency of the Australian Commonwealth, which oversees the work of the Accounting Standards Board and the Auditing Standards Board, and advises the Australian Government on matters relating to corporate regulation. |

| • | International Experience —Extensive international experience as a director of multiple international companies, including Boart Longyear Limited, Programmed Group and CSL Limited. |

| • | Operational and Industry Expertise —Experience as a Director of Lihir Gold Limited, Energy Developments Limited and Consolidated Minerals Limited. Currently serves as a Director of Deep Exploration Technologies Co-operative Research Centre, a collaborative research program researching safer, more advanced and more cost effective geological exploration and drilling methods. |

Board Experience:

Service on the Company’s Board of Directors since 2011, as well as on the boards of several companies, including Boart Longyear Limited since February 2007, and CSL Limited since August 2011, and as Chairman of Programmed Group since June 2010. Former Director and Chairman of the Audit Committees of Lihir Gold Limited, Consolidated Minerals Limited, Energy Developments Limited and Snowy Hydro Limited.

VINCENT A. CALARCO, 69, Non-Executive Chairman of Newmont Mining Corporation from 2008 to present. Former Chairman of Crompton Corporation (now known as Chemtura Corporation), a specialty chemical company, having served in that position from 1996 to 2004. President and Chief Executive Officer thereof from 1985 to 2004.

Director Qualifications:

| • | CEO/Executive Management Skills —Experience as Chairman, President and Chief Executive Officer of Crompton Corporation and Non-Executive Chairman of Newmont. |

| • | Financial Expertise —Experience serving on the Company’s Audit Committee and as the Chairman of the Audit Committee of the Board of Directors of Consolidated Edison of New York. Extensive financial oversight experience in senior management roles. |

| • | International Experience —Extensive senior executive experience working with multinational operations at Crompton Corporation, which has global manufacturing facilities on five continents and conducts |

6

Table of Contents

business in over 120 countries, as well as experience establishing inter-industry relationships and negotiating product safety regulations as Chairman of several domestic and international chemical industry trade associations. |

| • | Operational and Industry Expertise —Extensive experience in the chemical industry, a process industry with similar operating characteristics and issues, and prior service on the Board of Directors of a copper mining company, Asarco Corporation. |

| • | Compensation Expertise —Current service as Chairman of the Compensation Committee of Citadel Plastics and participation in compensation, benefits and related decisions in senior executive roles. |

Board Experience:

Service on the Company’s Board of Directors since 2000, as well as on the boards of several other companies, including as a current director of Consolidated Edison, Inc. and CPG International Inc., and prior service as a director at Asarco Corporation.

JOSEPH A. CARRABBA, 59, Chairman, President and Chief Executive Officer of Cliffs Natural Resources Inc., formerly Cleveland-Cliffs Inc, since May 2007. Served as the company’s President and Chief Executive Officer from 2006 to 2007 and as President and Chief Operating Officer from 2005 to 2006. Previously served as President and Chief Operating Officer of Diavik Diamond Mines, Inc. from 2003 to 2005.

Director Qualifications:

| • | CEO/Executive Management Skills — Experience as Chairman, President and Chief Executive Officer of Cliffs Natural Resources Inc. and other executive management positions noted above. |

| • | Financial Expertise — Extensive financial management experience in senior executive roles. |

| • | Operational and Industry Expertise —Operational experience in the mining industry, including as former President and Chief Operating Officer of Cliffs Natural Resources Inc., former President and Chief Operating Officer of Diavik Diamond Mines, Inc. and former General Manager of Weipa Bauxite Operation of Comalco Aluminum. Awarded a Bachelor’s Degree in Geology from Capital University. |

| • | International Experience —Extensive senior executive experience working with multinational mining operations, including with Cliffs Natural Resources Inc., which has operations in North America, Australia, Latin America and Asia. |

| • | Health, Safety, Environmental and Social Responsibility Experience —Experience serving on the Company’s Operations and Safety Committee and the Environmental and Social Responsibility Committee. |

Board Experience:

Service on the Company’s Board of Directors since 2007, as well as on the boards of several other companies, including as a current director of Cliffs Natural Resources Inc. and KeyCorp.

NOREEN DOYLE, 62, Retired First Vice President of the European Bank for Reconstruction and Development (“EBRD”), having served in that position from 2001 to 2005, and in other executive positions with the EBRD since 1992.

Director Qualifications:

| • | Financial Expertise — Extensive experience in banking and finance at Bankers Trust Company and at the EBRD, including experience as head of risk management and head of banking at EBRD. Experience serving on the Company’s Audit Committee, including as Chair, and the Audit Committees of the Board of Directors of QinetiQ Group plc and Rexam PLC. |

7

Table of Contents

| • | International Experience — Extensive senior executive experience working with businesses, global and local, and governments throughout eastern Europe and the former Soviet Union. |

| • | Health, Safety, Environmental and Social Responsibility Experience — Experience at EBRD included specific focus on environmental specifications of projects and attention to the social dimensions of investment. Experience serving on the Company’s Environmental and Social Responsibility Committee. |

Board Experience:

Service on the Company’s Board of Directors since 2005, as well as on the boards of several other companies, including as a current director of Credit Suisse Group, QinetiQ plc and Rexam PLC. Member of advisory panels for Macquarie European Infrastructure Fund and Macquarie Renaissance Infrastructure Fund.

VERONICA M. HAGEN, 66, Chief Executive Officer of Polymer Group, Inc. since April 2007. President and Chief Executive Officer of Sappi Fine Paper North America from 2004 to 2007. Executive positions with Alcoa, Inc. since 1998, including Vice President and Chief Customer Officer from 2003 to 2004 and Vice President, Alcoa North American Extrusions from 2001 to 2003.

Director Qualifications:

| • | CEO/Executive Management Skills — Experience as Chief Executive Officer of Polymer Group, Inc., and former President and Chief Executive Officer of Sappi Fine Paper North America. |

| • | Industry and Operational Expertise — Extensive mining industry experience, including in executive positions with Alcoa, Inc., an international aluminum producer, for over 10 years, including as former Vice President and Chief Customer Officer and former Vice President, Alcoa North American Extrusions. |

| • | International Experience — Extensive senior executive experience including Chief Executive Officer of Polymer Group Inc., a company operating manufacturing facilities in seven countries. |

| • | Health, Safety, Environmental and Social Responsibility Experience — Experience serving on the Company’s Operations and Safety Committee and prior experience on the Environmental and Social Responsibility Committee. |

| • | Compensation Expertise — Experience serving as a member of the Company’s Compensation Committee. Participation in compensation, benefits and related decisions in senior executive roles. |

Board Experience:

Service on the Company’s Board of Directors since 2005, as well as on the boards of several other companies, including as a current director of Southern Company. Former director of Jacuzzi Brands, Inc.

MICHAEL S. HAMSON, 71, Chairman, Hamson Consultants Pty Ltd, a consulting company, since 1987; Joint Chairman and Chief Executive Officer of McIntosh Hamson Hoare Govett Limited (now Merrill Lynch Australia) from 1972 to 1986 and Director and Deputy Chairman of Normandy Mining Limited from 1987 to 2002.

Director Qualifications:

| • | CEO/Executive Management Skills — Experience as Chairman, Hamson Consultants Pty Ltd and former Joint Chairman and Chief Executive Officer of McIntosh Hamson Hoare Govett Limited. |

| • | Financial Expertise — Experience serving on the Company’s Audit Committee, the Audit Committee of the Board of Directors of Genesis Emerging Markets Fund Ltd., membership in the Charter Accountants Institute and financial management experience in senior executive roles. |

8

Table of Contents

| • | Legal Expertise — Extensive experience as practicing lawyer in multiple jurisdictions. |

| • | Industry and Operational Expertise — Experience as Director and Deputy Chairman of Normandy Mining Limited from 1987 to 2002. |

| • | International Experience — Extensive senior executive experience working in global banking activities with McIntosh Hamson Hoare Govett Limited. |

Board Experience:

Service on the Company’s Board of Directors since 2002, as well as on the boards of several other companies, including as a current director of Genesis Emerging Markets Fund Ltd.

JANE NELSON, 51, Founding Director of the Corporate Social Responsibility Initiative at Harvard Kennedy School, a nonresident senior fellow at the Brookings Institution, and a senior associate of the Programme for Sustainability Leadership at Cambridge University. She was a Director at the International Business Leaders Forum from 1993 to 2009, where she now serves as a senior advisor.

Director Qualifications:

| • | International Experience — Former director and current senior advisor at the International Business Leaders Forum, previously worked in the office of the United Nations Secretary-General, and for the Business Council for Sustainable Development in Africa, for FUNDES in Latin America, and as a Vice President at Citibank working in Asia, Europe and the Middle East. |

| • | Health, Safety, Environmental and Social Responsibility Expertise — Director of Harvard Kennedy School's Corporate Social Responsibility Initiative. One of the five track leaders for the Clinton Global Initiative, leading the track on Developing Human Capital in 2009. Served on advisory committees to over 40 global corporations, non-governmental organizations and government bodies since 1992. |

| • | Academic Experience — Director, Corporate Social Responsibility Initiative and adjunct lecturer in Public Policy, Harvard Kennedy School. Faculty, Corporate Social Responsibility executive education program, Harvard Business School. Nonresident senior fellow at the Brookings Institution and a senior associate at Cambridge University’s Programme for Sustainability Leadership. |

| • | Industry Expertise— Service on ExxonMobil’s External Citizenship Advisory Panel; Independent Advisory Panel, International Council on Mining and Metals Resource Endowment initiative; former external adviser to World Bank Group on social impacts in mining, oil and gas sector. |

Board Experience:

Currently serves on the Boards of Directors of Newmont Mining Corporation, FSG, the World Environment Center, and Chevron’s Niger Delta Partnership Initiative Foundation. Prior service on the Board of Directors of SITA (now SUEZ Environnement).

RICHARD T. O’BRIEN, 57, President and Chief Executive Officer of Newmont since July 2007. President and Chief Financial Officer of Newmont from April 2007 to July 2007; Executive Vice President and Chief Financial Officer during 2006 and 2007 and Senior Vice President and Chief Financial Officer from 2005 to 2006. Executive Vice President and Chief Financial Officer and Senior Vice President and Chief Financial Officer of AGL Resources from 2001 to 2005.

Director Qualifications:

| • | CEO/Executive Management Skills — President and Chief Executive Officer of the Company and other senior executive positions noted above. |

9

Table of Contents

| • | Financial Expertise — Extensive financial management experience in executive roles, including as President and Chief Financial Officer of the Company and other executive management positions noted above. Experience serving on the Audit Committees of Inergy, L.P. and Vulcan Materials Company. Awarded a Bachelor of Arts degree in economics from the University of Chicago. |

| • | Industry and Operational Experience — Over 20 years of broad financial and operational experience in the energy, power and natural resources businesses. |

| • | International Experience — Extensive senior executive experience working with the Company’s multinational mining operations. |

| • | Compensation Expertise — Participation in compensation, benefits and related decisions in senior executive roles. |

| • | Legal Expertise — Awarded a Doctor of Jurisprudence degree from Lewis and Clark College, Northwestern School of Law. |

Board Experience:

Service on the Company’s Board of Directors since 2007, as well as on the boards of several other companies, including as a current director of Inergy Holdings, L.P. and Vulcan Materials Company.

JOHN B. PRESCOTT, 71, Chairman of QR National Limited (“QR”) (formerly known as QR Limited and Queensland Rail since 2006). Member of the Australian Government’s Remuneration Tribunal since 2010. Retired Chairman of ASC Pty Ltd from 2000 to 2009. Retired director and executive of The Broken Hill Proprietary Company Limited (now BHP Billiton Ltd (“BHP”)), and Managing Director and Chief Executive Officer thereof from 1991 to 1998.

Director Qualifications:

| • | CEO/Executive Management Skills — Experience as Chairman of QR, and other executive management positions noted above. |

| • | Financial Expertise — Extensive financial management experience in executive roles and through attendance on the Audit Committee of the Board of Directors of QR. |

| • | Industry and Operational Experience — Experience in the mining industry as a senior executive with BHP, a natural resource company, and as a former director of Normandy Mining Limited, a mining company. |

| • | International Experience — Extensive senior executive experience working with multinational mining operations and Management Consultants and as Trustee of the Conference Board. |

| • | Compensation Expertise — Experience serving on the Company’s Compensation Committee and participation in compensation, benefits and related decisions in senior executive roles. Former managing Director of BHP. Member of Remuneration and Succession Committee of QR. Member of the Australian Government’s Remuneration Tribunal since March 2010. Former member of ASC Pty Ltd’s Remuneration Committee. |

| • | Health, Safety, Environmental and Social Responsibility Experience — Experience serving on the Company’s Operations and Safety Committee, including as Chairman, and on the Environmental and Social Responsibility Committee. Similar roles in BHP and QR. |

Board Experience:

Service on the Company’s Board of Directors since 2002, as well as on the boards of several other companies, including as Chairman of QR National and QR and prior service as a director at ASC Pty Ltd, BHP and Normandy Mining Limited.

10

Table of Contents

DONALD C. ROTH, 68, Managing Partner of EMP Global LLC, an international private equity firm, since 1992. Member of Advisory Committee to the National Treasury Management Agency, Republic of Ireland, since 1990. Vice President and Treasurer of the World Bank from 1988 to 1992.

Director Qualifications:

| • | Financial Expertise — Extensive financial management experience in various roles, including as former Vice President and Treasurer of the World Bank, as Chairman of the Audit Committee of Ireland’s National Pension Reserve Fund, and other executive management positions noted above. |

| • | International Experience — Extensive experience in international investment banking and capital markets. |

| • | Compensation Expertise — Experience serving as a member of the Company’s Compensation Committee, including as Chairman. Participation in compensation, benefits and related decisions in senior executive roles. |

Board Experience:

Service on the Company’s Board of Directors since 2004, as well as on the boards of several other companies, including as a current director of ISEQ Exchange Traded Fund Public Limited Company (Ireland).

SIMON R. THOMPSON, 52, Executive for the Anglo American group from 1995 to 2007; Executive Director of Anglo American plc from 2005 to 2007; Non-Executive Director of AngloGold Ashanti Ltd (South Africa) from 2004 to 2008; and Non-Executive Director of United Company Rusal (Russia) from 2007 to 2009. Non-Executive Chairman of Tullow Oil plc (United Kingdom), and Non-Executive Director of Sandvik AB (Sweden) and AMEC plc (United Kingdom).

Director Qualifications:

| • | Financial Expertise — Over 15 years experience in merchant and investment banking and financial management experience in executive roles. Service on the Audit Committee of the Boards of Directors of AMEC plc and Sandvik AB. |

| • | International Experience — Extensive experience in international investment banking, as well as multinational mining experience with Anglo American, which operates in Africa, Europe, South and North America, Australia and Asia. Additional international experience with Tullow Oil plc, an international oil and gas exploration and production company operating in Africa, the United Kingdom, the Netherlands and South Asia. |

| • | Industry and Operational Experience — Over 15 years experience in the mining industry, including as former Chief Executive of the base metals mining division of Anglo America, Executive Chairman of the industrial minerals division and the Exploration Division of Anglo American, and other positions noted above. Awarded a Masters Degree in Geology from Oxford University. |

| • | Health, Safety, Environmental and Social Responsibility Expertise — Experience acting as Chairman of the Health, Safety and Environment committee of United Company Rusal and Chairman of the Compliance and Ethics committee of AMEC plc. Serves on the Company’s Environmental, Social Responsibility, Operations and Safety Committee and was formerly Chairman of the Environmental and Social Responsibility Committee. Member of Remuneration Committee of AMEC plc and Tullow Oil plc. |

Board Experience:

Service on the Company’s Board of Directors since 2008, as well as on the boards of several other companies, including as the current Non-Executive Chairman of Tullow Oil plc (United Kingdom) and a Non-Executive Director of AMEC plc (United Kingdom) and Sandvik AB (Sweden).

11

Table of Contents

Director Nomination Process and Review of Director Nominees.

We have established a process for identifying and nominating director candidates that has resulted in the election of a highly-qualified and dedicated Board of Directors. The following is an outline of the process for nomination of candidates for election to the Board: (a) the Chief Executive Officer, the Corporate Governance and Nominating Committee or other members of the Board of Directors identify the need to add new Board members, with careful consideration of the mix of qualifications, skills and experience represented on the Board of Directors; (b) the Chairman of the Corporate Governance and Nominating Committee coordinates the search for qualified candidates with input from management and other Board members; (c) the Corporate Governance and Nominating Committee engages a candidate search firm to assist in identifying potential nominees, if it deems such engagement necessary and appropriate; (d) selected members of management and the Board of Directors interview prospective candidates; and (e) the Corporate Governance and Nominating Committee recommends a nominee and seeks full Board endorsement of the selected candidate, based on its judgment as to which candidate will best serve the interests of Newmont’s stockholders.

The Board of Directors has determined that directors should possess the following minimum qualifications: (a) the highest personal and professional ethics, integrity and values; (b) commitment to representing the long-term interest of the stockholders; (c) broad experience at the policy-making level in business, government, education, technology or public interest; and (d) sufficient time to effectively fulfill duties as a Board member. The Corporate Governance and Nominating Committee considers any candidates submitted by stockholders on the same basis as any other candidate. Any stockholder proposing a nomination should submit such candidate’s name, along with curriculum vitae or other summary of qualifications, experience and skills to the Secretary, Newmont Mining Corporation, 6363 South Fiddler’s Green Circle, Greenwood Village, Colorado 80111 USA.

Newmont considers diversity, age and skills in deciding on nominees. The Corporate Governance and Nominating Committee considers a broad range of diversity, not limited to merely race, gender or national origin, but considering all relevant background and experience. We consider this through discussions at the Corporate Governance and Nominating Committee meetings. In evaluating a director candidate, the Corporate Governance and Nominating Committee considers factors that are in the best interests of the Company and its stockholders.

The Board affirmatively determines the independence of each director and each nominee for election as director. For each individual deemed to be independent, the Board has determined (a) that there is no relationship with the Company, or (b) the relationship is immaterial. The Board has considered the independence standards of the New York Stock Exchange and adopted more stringent categorical independence standards described below.

The Board has determined that the relationships that fall within the standards described in its independence standards are categorically immaterial. As such, provided that no law, rule or regulation precludes a determination of independence, the following relationships are not considered to be material relationships with the Company for purposes of assessing independence: service as an officer, director, employee or trustee or greater than five percent beneficial ownership in (i) a supplier of goods or services to the Company if the annual sales to the Company are less than $1 million or two percent of the gross revenues or sales of the supplier, whichever is greater; (ii) a lender to the Company if the total amount of the Company’s indebtedness is less than one percent of the total consolidated assets of the lender; (iii) a charitable organization if the total amount of the Company’s total annual charitable contributions to the organization is less than $1 million or two percent of that organization’s total annual gross receipts (excluding any amounts received through the Company’s employee matching program for charitable contributions), whichever is greater; or (iv) any relationship arising out of a transaction, or series of transactions, in which the amount involved is less than $60,000.

In making its independence determinations, the Board considered the circumstances described below.

Mr. Brook is a director of Boart Longyear Limited, which provides drilling services to the Company, and Programmed Group, which provides certain staffing to the Company. These relationships both meet the categorical independence standards in (i) above.

12

Table of Contents

Mr. Hamson is a director of Genesis Emerging Markets Ltd. The committee administering the investment of Company funds for its pension plan selected one of the Genesis Emerging Market funds as one investment in its portfolio. This relationship meets categorical independence standard (i) above.

Mr. Thompson is a director of Sandvik AB, an international engineering group that provides certain products to the Company including certain mining equipment for rock excavation. Mr. Thompson also is a director of AMEC plc, an international engineering and project management company, which provides certain consulting services to the Company. These relationships both meet the categorical independence standard (i) above.

Based on the foregoing analysis, the Board determined that the following directors are independent:

Bruce R. Brook | Veronica M. Hagen | John B. Prescott | ||

Vincent A. Calarco | Michael S. Hamson | Donald C. Roth | ||

Joseph A. Carrabba | Jane Nelson | Simon R. Thompson | ||

Noreen Doyle |

In addition, based on these standards, the Board has affirmatively determined that Richard T. O’Brien is not independent because he is President and Chief Executive Officer of the Company.

Stock Ownership of Directors and Executive Officers.

As of February 24, 2012, the directors and executive officers of the Company as a group beneficially owned, in the aggregate, 1,978,339 shares of the Company’s outstanding capital stock, constituting, in the aggregate, less than 1% of the Company’s outstanding capital stock.

No director or executive officer beneficially owned (a) more than 1% of the outstanding shares of the Company’s common stock or the exchangeable shares, or (b) shares voting power in excess of 1% of the voting power of the outstanding capital stock of the Company. Each director and executive officer has sole voting power and dispositive power with respect to all shares beneficially owned by them, except as set forth below.

The following table sets forth the beneficial ownership of common stock as of February 24, 2012, held by (a) each current director and nominee; (b) the Chief Executive Officer, the Chief Financial Officer and each of the other highly compensated executive officers (the “Named Executive Officers”); and (c) all current directors and executive officers as a group. The address for each of the named individuals below is c/o Newmont Mining Corporation, 6363 South Fiddler’s Green Circle, Greenwood Village, Colorado 80111 USA.

Name of Beneficial Owner | Common Stock(1) | Restricted Stock, Restricted Stock Units and Director Stock Units(2)(3) | 401(k) Plan(4) | Option Shares(5) | Beneficial Ownership Total | |||||||||||||||

Non-Employee Directors | ||||||||||||||||||||

Glen A. Barton(6) | 11,707 | 9,213 | — | — | 20,920 | |||||||||||||||

Bruce R. Brook | 1,811 | — | — | — | 1,811 | |||||||||||||||

Vincent A. Calarco | 4,686 | 14,258 | — | — | 18,944 | |||||||||||||||

Joseph A. Carrabba | — | 11,764 | — | — | 11,764 | |||||||||||||||

Noreen Doyle | — | 14,079 | — | — | 14,079 | |||||||||||||||

Veronica M. Hagen | — | 14,079 | — | — | 14,079 | |||||||||||||||

Michael S. Hamson(7) | 9,408 | 12,214 | — | — | 21,622 | |||||||||||||||

Jane Nelson | — | 1,811 | — | — | 1,811 | |||||||||||||||

John B. Prescott(8) | 10,220 | 10,059 | — | — | 20,279 | |||||||||||||||

Donald C. Roth | 1,081 | 14,258 | — | — | 15,339 | |||||||||||||||

Simon R. Thompson | — | 12,194 | — | — | 12,194 | |||||||||||||||

Named Executive Officers | ||||||||||||||||||||

Richard T. O’Brien | 188,354 | 100,000 | 1,623 | 309,509 | 599,486 | |||||||||||||||

Russell Ball | 55,961 | — | 1,856 | 122,036 | 179,853 | |||||||||||||||

13

Table of Contents

Name of Beneficial Owner | Common Stock(1) | Restricted Stock and Director Stock Units(2)(3) | 401(k) Plan(4) | Option Shares(5) | Beneficial Ownership Total | |||||||||||||||

Randy Engel | 50,108 | — | 3,437 | 82,818 | 136,363 | |||||||||||||||

Brian Hill | 61,314 | — | 532 | 61,334 | 123,180 | |||||||||||||||

Guy Lansdown | 62,339 | — | 1,084 | 62,061 | 125,484 | |||||||||||||||

All directors and executive officers as a group, including those named above (26 persons) | 477,712 | 229,917 | 23,281 | 1,102,747 | 1,978,339 | |||||||||||||||

| (1) | Represents shares of the Company’s common stock held, or which the officer has the right to acquire within 60 days after February 24, 2012, pursuant to Performance Leveraged Stock Units (“PSUs”) and Financial Performance Stock (“FPS”). PSUs and FPS are awards granted by the Company and payable, subject to performance vesting requirements, as set forth more fully below in the CD&A, in shares of the Company’s common stock. Shares underlying PSUs vesting within 60 days after February 24, 2012, for which the performance measurements have been met, are included in this column as follows: Richard T. O’Brien, 41,422; Russell Ball, 12,820; Randy Engel, 12,366; Brian Hill, 13,727; Guy Lansdown, 13,727, and all executive offers as a group, 119,871. Shares underlying FPSs vesting within 60 days after February 24, 2012, for which the performance measurements have been met, are included in this column as follows: Richard T. O’Brien, 41,163; Russell Ball, 14,923; Randy Engel, 13,758; Brian Hill, 17,224; Guy Lansdown, 16,539, and all executive offers as a group, 126,013. |

| (2) | For 2011, director stock units (“DSUs”) were awarded to all non-employee directors under the 2005 Stock Incentive Plan, except Messrs. Barton, Brook, Hamson and Prescott elected to receive shares of the Company’s common stock. The DSUs represent the right to receive shares of common stock and are immediately fully vested and non-forfeitable. The holders of DSUs do not have the right to vote the underlying shares; however, the DSUs accrue dividend equivalents, which are paid at the time the common shares are issued. Upon retirement from the Board of Directors, the holder of DSUs is entitled to receive one share of common stock for each director stock unit. Director stock units are included in this column as follows: Glen A. Barton, 9,213; Vincent A. Calarco, 14,258; Joseph A. Carrabba, 11,764; Noreen Doyle, 14,079; Veronica M. Hagen, 14,079; Michael S. Hamson, 12,214; Jane Nelson, 1,811; John B. Prescott, 10,059; Donald C. Roth, 14,258; and Simon R. Thompson, 12,194. |

| (3) | Restricted Stock Awards (“RSAs”) and Restricted Stock Units (“RSUs”) of the Company’s common stock are awarded under the Company’s 2005 Stock Incentive Plan. RSAs can be voted, but are subject to forfeiture risk and other restrictions. RSAs are included in this column as follows: Richard T. O’Brien, 100,000. The RSUs do not have voting rights, and are subject to forfeiture risk and other restrictions. The RSUs accrue dividend equivalents, which are paid at the time the units vest and common stock is issued. Shares underlying RSUs vesting within 60 days after February 24, 2012, are included in this column as follows: all executive officers as a group, 260,872. This column does not include RSUs that vest more than 60 days after February 24, 2012. |

| (4) | Includes equivalent shares of the Company’s common stock held by the trustee in the Company’s 401(k) Plans for each participant as of the February 29, 2012, plan statement date. Each participant in such plan instructs the trustee as to how the participant’s shares should be voted. |

| (5) | Shares of the Company’s common stock that the executive officers have the right to acquire through stock option exercises within 60 days after February 24, 2012. |

| (6) | Mr. Barton’ ownership includes 6,581 shares of common stock held by the Glen Barton Revocable Trust. Mr. Barton retains voting and investment power of these shares. |

| (7) | Mr. Hamson’s ownership includes 2,421 shares of common stock held in trust for Mr. Hamson’s Superannuation Fund, and 4,943 shares of common stock held in trust for Mr. Hamson’s spouse in her Superannuation Fund. Mr. Hamson shares voting and investment power with his spouse. |

| (8) | Mr. Prescott’s ownership includes 10,220 shares of common stock held in trust for Mr. Prescott’s Superannuation Fund. Mr. Prescott’s spouse is also a director of the trust. Mr. Prescott shares voting and investment power with his spouse. |

Stock Ownership of Certain Beneficial Owners.

The following table sets forth information with respect to each person known by the Company to be the beneficial owner of more than 5% of any class of the Company’s voting securities. The share information contained herein is based on investor filings with the SEC pursuant to Section 13(d) of the Securities Exchange Act of 1934.

Name and Address of Beneficial Owner | Title of Class | Amount and Nature of Beneficial Ownership | Percentage of Class | |||||||

BlackRock, Inc. | Common Stock | (1 | ) | 8.98 | % | |||||

40 East 52nd Avenue | ||||||||||

New York, NY 10022 | ||||||||||

| Capital World Investors, a Division of Capital Research and Management Company | Common Stock | (2 | ) | 7.6 | % | |||||

333 South Hope Street | ||||||||||

Los Angeles, CA 90071 | ||||||||||

| (1) | As of December 30, 2011, BlackRock, Inc. and its subsidiaries had sole power to vote and dispose of 43,924,548 shares of Newmont common stock. |

| (2) | As of December 30, 2011, Capital World Investors, a Division of Capital Research and Management Company (“CRMC”) beneficially owned 37,163,695 shares of common stock. Capital World Investors is deemed to be the beneficial owner of such shares as a result of CRMC acting as investment adviser to various investment companies registered under Section 8 of the Investment Company Act of 1940. Capital World Investors reported that it had sole power to vote and dispose of all such shares. It disclaimed beneficial ownership of all reported shares. |

14

Table of Contents

Effective January 1, 2012, the annual compensation for non-employee directors for their service on the Board of Directors is as follows:

Annual Retainer: | $100,000 for each Director | |

| $25,000 for the Chairman of the Audit Committee | ||

| $5,000 for each Audit Committee Member | ||

| $20,000 for the Chairman of the Compensation Committee | ||

| $10,000 for the Chairman of each standing committee, other than the Chairman of the Audit Committee and the Chairman of the Compensation Committee | ||

| $240,000 for the Non-Executive Chairman of the Board | ||

Attendance Fees: | $2,000 for each Committee Meeting | |

| No attendance fees for Board meetings, except $2,000 for every meeting in excess of 15 per year. | ||

Stock Award: | $130,000 of common stock or director stock units each year under the 2005 Stock Incentive Plan. The fair market value is determined on the third business day following election by the Board or re-election at the Company’s Annual Meeting. |

During 2011, the annual compensation for non-employee directors for their service on the Board of Directors was the same as set forth above, except the Stock Award or Director Stock Unit was $120,000.

The following table summarizes the total compensation paid or earned by the Company’s non-employee directors during 2011:

2011 Directors Compensation

Name(1) | Fees Earned or Paid in Cash ($)(2) | Stock Awards(3) ($) | All Other Compensation ($) | Total ($) | ||||||||||||

Glen A. Barton | $ | 124,000 | $ | 120,000 | –0– | $ | 244,000 | |||||||||

Bruce R. Brook | $ | 27,000 | $ | 120,000 | –0– | $ | 147,000 | |||||||||

Vincent A. Calarco | $ | 375,000 | $ | 120,000 | –0– | $ | 495,000 | |||||||||

Joseph A. Carrabba | $ | 118,000 | $ | 120,000 | –0– | $ | 238,000 | |||||||||

Noreen Doyle | $ | 148,000 | $ | 120,000 | –0– | $ | 268,000 | |||||||||

Veronica M. Hagen | $ | 122,000 | $ | 120,000 | –0– | $ | 242,000 | |||||||||

Michael S. Hamson | $ | 115,000 | $ | 120,000 | –0– | $ | 235,000 | |||||||||

Jane Nelson | $ | 29,000 | $ | 120,000 | –0– | $ | 149,000 | |||||||||

John B. Prescott | $ | 118,000 | $ | 120,000 | –0– | $ | 238,000 | |||||||||

Donald C. Roth | $ | 144,000 | $ | 120,000 | –0– | $ | 264,000 | |||||||||

Simon R. Thompson | $ | 122,000 | $ | 120,000 | –0– | $ | 242,000 | |||||||||

| (1) | Mr. O’Brien’s compensation is shown in the Summary Compensation Table. |

15

Table of Contents

| (2) | The amounts reported in this column represent all cash paid in 2011 for the annual retainer fee, chairmanships of the Board, and of the committees, as well as fees paid for attendance at committee meetings. Details are as follows: |

Name | Annual Retainer Fees ($) | Chairmanships ($) | Committee Meeting Fees ($) | Total ($) | ||||||||||||

Glen A. Barton | $ | 100,000 | $ | 0 | $ | 24,000 | $ | 124,000 | ||||||||

Bruce R. Brook | $ | 25,000 | $ | 0 | $ | 2,000 | $ | 27,000 | ||||||||

Vincent A. Calarco | $ | 105,000 | $ | 250,000 | $ | 20,000 | $ | 375,000 | ||||||||

Joseph A. Carrabba | $ | 100,000 | $ | 0 | $ | 18,000 | $ | 118,000 | ||||||||

Noreen Doyle | $ | 105,000 | $ | 25,000 | $ | 18,000 | $ | 148,000 | ||||||||

Veronica M. Hagen | $ | 100,000 | $ | 0 | $ | 22,000 | $ | 122,000 | ||||||||

Michael S. Hamson | $ | 105,000 | $ | 0 | $ | 10,000 | $ | 115,000 | ||||||||

Jane Nelson | $ | 25,000 | $ | 0 | $ | 4,000 | $ | 29,000 | ||||||||

John B. Prescott | $ | 100,000 | $ | 10,000 | $ | 8,000 | $ | 118,000 | ||||||||

Donald C. Roth | $ | 100,000 | $ | 20,000 | $ | 24,000 | $ | 144,000 | ||||||||

Simon R. Thompson | $ | 100,000 | $ | 10,000 | $ | 12,000 | $ | 122,000 | ||||||||

| (3) | For 2011, all non-employee directors elected to receive $120,000 in the form of director stock units (“DSUs”), except Messrs. Barton, Brook, Hamson and Prescott who elected to receive their awards in the form of the Company’s common stock. The amounts set forth next to each award represent the aggregate grant date fair value of such award computed in accordance with Financial Accounting Standards Board Codification Topic 718 (“ASC 718”). The number of shares of common stock was calculated based on the fair value of the Company’s common stock on the third business day following re-election at the Company’s Annual Meeting for Messrs. Barton, Hamson and Prescott and on the third day following election to the Board for Mr. Brook, by taking the average of the high and low sales prices for a share of common stock on the New York Stock Exchange for such date, as reported by Bloomberg Professional, the independent commercial reporting service selected by the Compensation Committee of the Board of Directors. There are no other assumptions made in the valuation of the stock awards. |

Retirement. The Company has no current retirement plan for non-employee directors.

Outstanding Awards. The following table shows outstanding equity compensation for all non-employee directors of the Company as of December 31, 2011:

| Stock Awards(1) | ||||||||

Name | Aggregate Director Stock Units Outstanding (#) | Market Value of Outstanding Director Stock Units ($) | ||||||

Glen A. Barton | 9,213 | $ | 552,872 | |||||

Bruce R. Brook | - | - | ||||||

Vincent A. Calarco | 14,258 | $ | 855,623 | |||||

Joseph A. Carrabba | 11,764 | $ | 705,958 | |||||

Noreen Doyle | 14,079 | $ | 844,881 | |||||

Veronica M. Hagen | 14,079 | $ | 844,881 | |||||

Michael S. Hamson | 12,214 | $ | 732,962 | |||||

Jane Nelson | 1,811 | $ | 108,678 | |||||

John B. Prescott | 10,059 | $ | 603,641 | |||||

Donald C. Roth | 14,258 | $ | 855,623 | |||||

Simon R. Thompson | 12,194 | $ | 731,762 | |||||

| (1) | In 2011, Messrs. Barton, Brook, Hamson and Prescott elected to receive their director equity awards in the form of common stock rather than in the form of DSUs, which amount is included in the Common Stock column of the Stock Ownership of Directors and Executive Officers Table set forth above. See footnote 2 to such table. |

Share Ownership Guidelines. All directors are encouraged to have a significant long-term financial interest in the Company. To encourage alignment of the interests of the directors and the stockholders, each director is expected to own, or acquire within three years of becoming a director, shares of the Company’s common stock having a market value of five times the annual cash retainer payable under the Company’s director compensation policy. All directors meet the share ownership guidelines or fall within the three year exception period.

Compensation Consultant. The Board of Directors has engaged Frederic W. Cook & Co. (“Cook & Co.”) during 2011 to assist in the evaluation of independent director compensation. For a description of executive compensation consulting services provided by Cook & Co. to the Compensation Committee of the Board of Directors, see page 29 of the Compensation, Discussion and Analysis.

16

Table of Contents

Committees of the Board of Directors and Attendance.

Attendance at Meetings. During 2011, the Board of Directors held eight meetings. Each incumbent director attended 75% or more of all meetings of the Board of Directors and committees of the Board of Directors on which he or she served. It is the policy and practice of the Company that nominees for election at the Annual Meeting of Stockholders attend the meeting. All of the Board members at the time of the 2011 Annual Meeting of Stockholders held on April 19, 2011, attended the meeting.

Board Committees. The Board of Directors has, in addition to other committees, Audit, Compensation, Corporate Governance and Nominating, and Environmental, Social Responsibility, Operations and Safety Committees. All members of these four committees are independent, as defined in the listing standards of the New York Stock Exchange and the Company’s Corporate Governance Guidelines. Each Committee functions under a written charter adopted by the Board which are available on our website athttp://www.newmont.com/our-investors/our-governance. The current members of these Committees and the number of meetings held in 2011 are shown in the following table:

Committees of the Board of Directors.

Audit Committee Members(1) | Functions of the Committee | Meetings in 2011 | ||||

Noreen Doyle, Chair(2) Bruce R. Brook(3) Vincent A. Calarco Michael S. Hamson | • assists the Board in its oversight of the integrity of the Company’s financial statements. | 6 | ||||

• assists the Board in its oversight of the Company’s compliance with legal and regulatory requirements and corporate policies and controls. | ||||||

• authority to retain and terminate the Company’s independent auditors. | ||||||

• approve auditing services and related fees and pre-approve any non-audit services. | ||||||

• responsible for confirming the independence and objectivity of the independent auditors. | ||||||

• please refer to “Report of the Audit Committee” on page 72. | ||||||

Compensation Committee Members | Functions of the Committee | Meetings in 2011 | ||||

Donald C. Roth, Chairman Glen A. Barton Joseph A. Carrabba Veronica M. Hagen | • determines the components and compensation of the Company’s key employees, including its executive officers. | 8 | ||||

• reviews plans for management development and senior executive succession. | ||||||

• administers (determines) awards of stock based compensation, including stock options, restricted stock and restricted stock units, which are subject to ratification by the full Board of Directors. | ||||||

• please refer to “Report of the Compensation Committee on Executive Compensation” and the “Compensation, Discussion and Analysis” beginning on pages 21 and 22, respectively. | ||||||

Corporate Governance and Nominating Committee Members | Functions of the Committee | Meetings in 2011 | ||||

Vincent A. Calarco, Chairman Glen A. Barton Noreen Doyle(4) Donald C. Roth | • proposes slates of directors to be nominated for election or re-election. | 5 | ||||

• proposes slates of officers to be elected. | ||||||

• conducts annual Board and committee evaluations. | ||||||

• conducts evaluations of the performance of the Chief Executive Officer. | ||||||

• responsible for recommending amount of director compensation. | ||||||

• advises Board of corporate governance issues. | ||||||

17

Table of Contents

Environmental, Social Responsibility, Operations and Safety Committee Members(5) | Functions of the Committee | Meetings in 2011 | ||||

John B. Prescott, Chairman Joseph A. Carrabba Veronica M. Hagen Jane Nelson(7) Simon R. Thompson | • assists the Board in its oversight of operations and safety issues. | 5(6) | ||||

• assists the Board in its oversight of sustainable development, environmental affairs, community relations and communications issues. | ||||||

• assists the Board in furtherance of its commitments to adoption of best practices in mining operations, promotion of a healthy and safe work environment, and environmentally sound and socially responsible resource development. | ||||||

• administers the Company’s policies, processes, standards and procedures designed to accomplish the Company’s goals and objectives relating to these issues. | ||||||

| (1) | The Board of Directors has determined that each of the members of the Audit Committee is an Audit Committee Financial Expert, as a result of their knowledge, abilities, education and experience. |

| (2) | Noreen Doyle serves on audit committees for two other public companies and two non-public companies. The Board has determined that such service does not impair her ability to effectively serve on the Company’s Audit Committee. |

| (3) | Bruce Brook was appointed to the Audit Committee following his election to the Board on October 25, 2011. |

| (4) | Noreen Doyle was appointed a member of the Corporate Governance and Nominating Committee on October 25, 2011. |

| (5) | On October 25, 2011, the Board of Directors resolved to combine the responsibilities and functions of each of the Environmental and Social Responsibility Committee and the Operations and Safety Committee to form the Environmental, Social Responsibility, Operations and Safety Committee (the “ESROS Committee”). The ESROS Committee will be comprised of at least three directors appointed by the Board. In appointing members of the ESROS Committee, the Board will consider breadth of industry or relevant country experience and knowledge regarding operations and safety issues. The authority, structure, operations, purpose, responsibilities and specific duties of the ESROS Committee are described under its written charter adopted by the Board which is available on our website at http://www.newmont.com/our-investors/our-governance. |

| (6) | The Environmental and Social Responsibility Committee and the Operations and Safety Committee were combined to form the ESROS Committee on October 25, 2011. Prior to that date, each of the Operations and Safety Committee and the Environmental and Social Responsibility Committee held three meetings. The combined ESROS Committee held two meetings in 2011. |

| (7) | Jane Nelson was appointed to the ESROS Committee following her election to the Board on October 25, 2011. |

Corporate Governance Guidelines and Charters. The Company has adopted Corporate Governance Guidelines that outline important policies and practices regarding the governance of the Company. In addition, each of the committees has adopted a charter outlining responsibilities and operations. The Corporate Governance Guidelines and the charters are available on our website athttp://www.newmont.com/our-investors/our-governance.

Board Leadership and Independent Chairman. The Board of Directors selects the Chairman of the Board in the manner and upon the criteria that it deems best for the Company at the time of selection. The Board of Directors does not have a prescribed policy on whether the roles of the Chairman and Chief Executive Officer should be separate or combined. At all times, the Board of Directors has either a Non-Executive Chairman or lead director of the Board, which Chairman or lead director will meet the Company’s independence criteria and will be elected annually by the independent members of the Board of Directors.

Before 2008, the positions of Chairman of the Board and Chief Executive Officer were held by a single person. Due to the potential efficiencies of having the Chief Executive Officer also serve in the role of Chairman of the Board and the long tenure of the Chief Executive Officer, the Board of Directors determined that the interests of the Company and its stockholders were best served by the leadership and direction provided by a single person as Chairman and Chief Executive Officer. In 2007, the Board of Directors considered a stockholder proposal included in the 2007 Proxy Statement regarding the separation of such roles. The Board agreed to separate the roles as of January 1, 2008, in response to the stockholder vote and the Board’s determination regarding what was in the best interest of the Company at such time. The Board will continue to evaluate whether this leadership structure is in the best interests of the stockholders on a regular basis.

18

Table of Contents

In January 2008, the independent members of the Board of Directors elected Vincent A. Calarco as independent Non-Executive Chairman of the Board. Mr. Calarco has been re-elected each year since 2008 as Non-Executive Chairman. He presides at independent directors sessions scheduled at each regular Board meeting. The Non-Executive Chairman serves as liaison between the Chief Executive Officer and the other independent directors, approves meeting agendas and schedules and notifies other members of the Board of Directors regarding any significant concerns of stockholders or interested parties of which he or she becomes aware. The Non-Executive Chairman presides at stockholders meetings and provides advice and counsel to the Chief Executive Officer.

Board Oversight of Risk Management.The Board of Directors is engaged in company-wide risk management oversight. Directors are entitled to rely on management and the advice of the Company’s outside advisors and auditors, but must at all times have a reasonable basis for such reliance. The Board of Directors relies upon the Chief Executive Officer and Chief Financial Officer to supervise the day-to-day risk management, each of whom provides reports directly to the Board of Directors and certain Board Committees, as appropriate. The Company has a global Enterprise Risk Management team, led by the Company’s Vice President and Treasurer. The Enterprise Risk Management team’s objectives include conducting the compensation risk assessment and reporting the process and findings to the Audit Committee and the Compensation Committee regularly, and to the full Board of Directors on at least an annual basis.

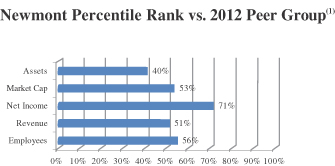

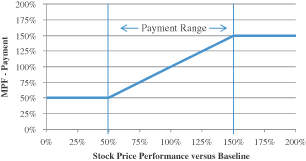

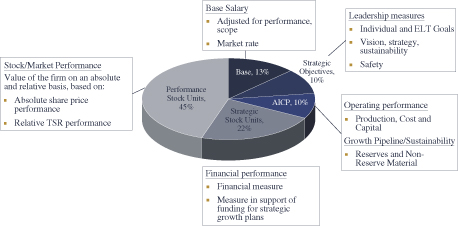

The Board of Directors also delegates certain oversight responsibilities to its Board Committees. For a description of the functions of the various Board Committees, see “Board Committees” above. For example, while the primary responsibility for financial and other reporting, internal controls, compliance with laws and regulations, and ethics rests with the management of the Company, the Audit Committee provides risk oversight with respect to the Company’s financial statements, the Company’s compliance with legal and regulatory requirements and corporate policies and controls, the independent auditor’s selection, retention, qualifications, objectivity and independence, and the performance of the Company’s internal audit function. Additionally, the Compensation Committee provides risk oversight with respect to the Company’s compensation program. For a discussion of the Compensation Committee and Enterprise Risk Management team’s assessments of compensation-related risks, see “Compensation Discussion and Analysis — Risk Assessment.” The Environmental, Social Responsibility, Operations and Safety Committee provides oversight and direction with regard to environmental, social responsibility, community relations, safety and operating risks.