NORTHERN DYNASTY MINERALS LTD.

Suite 1020 – 800 West Pender Street

Vancouver, British Columbia V6C 2V6

Telephone: 604-684-6365 / Fax: 604-684-8092

INFORMATION CIRCULAR

as at May 12, 2006

This Information Circular is furnished in connection with the solicitation of proxies by the management of Northern Dynasty Minerals Ltd. (the "Company") for use at the annual and extraordinary general meeting (the "Meeting") of its shareholders to be held on June 20, 2006 at the time and place and for the purposes set forth in the accompanying notice of the Meeting.

In this Information Circular, references to "the Company", "we" and "our" refer to Northern Dynasty Minerals Ltd. "Common Shares" means common shares in the capital of the Company. "Beneficial Shareholders" means shareholders who do not hold Common Shares in their own name and "intermediaries" refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Beneficial Shareholders.

GENERAL PROXY INFORMATION

Solicitation of Proxies

The solicitation of proxies will be primarily by mail, but proxies may be solicited personally or by telephone by directors, officers and regular employees of the Company. The Company will bear all costs of this solicitation. We have arranged for intermediaries to forward the meeting materials to beneficial owners of the Common Shares held of record by those intermediaries and we may reimburse the intermediaries for their reasonable fees and disbursements in that regard.

Appointment of Proxyholders

The individuals named in the accompanying form of proxy (the "Proxy") are officers and/or directors of the Company.If you are a shareholder entitled to vote at the Meeting, you have the right to appoint a person or company other than the persons designated in the Proxy, who need not be a shareholder, to attend and act for you and on your behalf at the Meeting. You may do so either by inserting the name of that other person in the blank space provided in the Proxy or by completing and delivering another suitable form of proxy.

The only methods by which you may appoint a person as proxy are submitting a proxy by mail, hand delivery or fax.

Voting by Proxyholder

The persons named in the Proxy will vote or withhold from voting the Common Shares represented thereby in accordance with your instructions on any ballot that may be called for. If you specify a choice with respect to any matter to be acted upon, your Common Shares will be voted accordingly. The Proxy confers discretionary authority on the persons named therein with respect to:

| (a) | each matter or group of matters identified therein for which a choice is not specified, other than the appointment of an auditor and the election of directors, | |

| (b) | any amendment to or variation of any matter identified therein, and | |

| (c) | any other matter that properly comes before the Meeting. |

In respect of a matter for which a choice is not specified in the Proxy, the persons named in the Proxy will vote the Common Shares represented by the Proxy for the approval of such matter.

- 2 -

Registered Shareholders

If you are a registered shareholder, you may wish to vote by proxy whether or not you attend the Meeting in person. If you submit a proxy, you must complete, date and sign the Proxy, and then return it to the Company’s transfer agent, Computershare Trust Company of Canada, by fax within North America at 1-866-249-7775, outside North America at 416-263-9524, or by mail or by hand delivery at 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or the adjournment thereof at which the Proxy is to be used.

Beneficial Shareholders

The following information is of significant importance to shareholders who do not hold Common Shares in their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered shareholders (those whose names appear on the records of the Company as the registered holders of Common Shares).

If Common Shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those Common Shares will not be registered in the shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the names of the shareholder’s broker or an agent of that broker. In the United States, the vast majority of such Common Shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms).

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every intermediary has its own mailing procedures and provides its own return instructions to clients.

If you are a Beneficial Shareholder:

You should carefully follow the instructions of your broker or intermediary in order to ensure that your Common Shares are voted at the Meeting.

The form of proxy supplied to you by your broker will be similar to the Proxy provided to registered shareholders by the Company. However, its purpose is limited to instructing the intermediary on how to vote on your behalf. Most brokers now delegate responsibility for obtaining instructions from clients to ADP Investor Communication Services ("ADP") in the United States and in Canada. ADP mails a voting instruction form in lieu of a Proxy provided by the Company. The voting instruction form will name the same persons as the Company’s Proxy to represent you at the Meeting. You have the right to appoint a person (who need not be a Beneficial Shareholder of the Company), other than the persons designated in the voting instruction form, to represent you at the Meeting. To exercise this right, you should insert the name of the desired representative in the blank space provided in the voting instruction form. The completed voting instruction form must then be returned to ADP by mail or facsimile or given to ADP by phone or over the internet, in accordance with ADP’s instructions. ADP then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting.If you receive a voting instruction form from ADP, you cannot use it to vote Common Shares directly at the Meeting - the voting instruction form must be completed and returned to ADP, in accordance with its instructions, well in advance of the Meeting in order to have the Common Shares voted.

Although as a Beneficial Shareholder you may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of your broker, you, or a person designated by you, may attend at the Meeting as proxyholder for your broker and vote your Common Shares in that capacity. If you wish to attend at the Meeting and indirectly vote your Common Shares as proxyholder for your broker, or have a person designated by you do so, you should enter your own name, or the name of the person you wish to designate, in the blank space on the voting instruction form provided to you and return the same to your broker in accordance with the instructions provided by such broker, well in advance of the Meeting.

Alternatively, you can request in writing that your broker send you a legal proxy which would enable you, or a person designated by you, to attend at the Meeting and vote your Common Shares.

- 3 -

Revocation of Proxies

In addition to revocation in any other manner permitted by law, a registered shareholder who has given a proxy may revoke it by:

| (a) | executing a proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the registered shareholder or the registered shareholder’s authorized attorney in writing, or, if the shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the proxy bearing a later date to Computershare Trust Company of Canada by fax within North America at 1-866-249-7775, outside North America at 416- 263-9524, or by mail or by hand delivery at 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 or at the address of the registered office of the Company at 1500 Royal Centre, 1055 West Georgia Street, P. O. Box 11117, Vancouver, British Columbia, V6E 4N7, at any time up to and including the last business day that precedes the day of the Meeting or, if the Meeting is adjourned, the last business day that precedes any reconvening thereof, or to the chairman of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law, or |

| (b) | personally attending the Meeting and voting the registered shareholder’s Common Shares. |

A revocation of a proxy will not affect a matter on which a vote is taken before the revocation.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

No director or executive officer of the Company, or any person who has held such a position since the beginning of the last completed financial year end of the Company, nor any nominee for election as a director of the Company, nor any associate or affiliate of the foregoing persons, has any substantial or material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted on at the Meeting other than the election of directors, the proposed amendment to the stock option plan or as otherwise set out herein.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

The Board of Directors (the "Board") of the Company has fixed May 12, 2006 as the record date (the "Record Date") for determination of persons entitled to receive notice of the Meeting. Only shareholders of record at the close of business on the Record Date who either attend the Meeting personally or complete, sign and deliver a form of proxy in the manner and subject to the provisions described above will be entitled to vote or to have their Common Shares voted at the Meeting.

As of May 12, 2006, there were 78,913,067 Common Shares without par value issued and outstanding, each carrying the right to one vote. No group of shareholders has the right to elect a specified number of directors, nor are there cumulative or similar voting rights attached to the Common Shares.

To the knowledge of the directors and executive officers of the Company, the only persons or corporations that beneficially owned, directly or indirectly, or exercised control or direction over, Common Shares carrying more than 10% of the voting rights attached to all outstanding Common of the Company as at May 12, 2006 were:

| Shareholder Name | Number of Common Shares Held | Percentage of Issued Common Shares |

| Galahad Gold plc and subsidiaries(1) | 17,673,695 | 22.4% |

| (1) | Certain of these Shares may be registered in the names of Galahad, Shambhala Gold Limited ("Shambhala") Ludgate 341 Limited ("Ludgate 341")and Ludgate 347 Limited ("Ludgate 347"). Ludgate 347 holds 1,176,500 warrants (at an exercise price of $5.00 expiring on September 18, 2006) Each warrant is exercisable to purchase one additional Share and. Galahad beneficial interest over 205,000 options granted to Ian Watson. Ian Watson, a director of the Company, is Chairman and Managing Director of Galahad. |

- 4 -

FINANCIAL STATEMENTS

The audited financial statements of the Company for the year ended December 31, 2005, with related management discussion and analysis and the report of the auditor, will be placed before the Meeting. These documents have been filed with the securities commissions or similar regulatory authorities in Alberta, British Columbia and Ontario, and are specifically incorporated by reference into, and form an integral part of, this information circular. Copies of the documents incorporated herein by reference may be obtained by a Shareholder upon request without charge from Investor Relations, Northern Dynasty Minerals Ltd., Suite 1020 –800 West Pender Street, Vancouver, British Columbia, V6C 2V6, telephone: 604-684-6365. These documents are also available through the Internet on SEDAR, which can be accessed atwww.sedar.com.

VOTES NECESSARY TO PASS RESOLUTIONS

A simple majority of affirmative votes cast at the Meeting is required to pass the resolutions described herein. If there are more nominees for election as directors or appointment of the Company’s auditor than there are vacancies to fill as a consequence of additional nominations from the floor of the Meeting, those nominees receiving the greatest number of votes will be elected or appointed, as the case may be, until all such vacancies have been filled. If the number of nominees for election or appointment is equal to the number of vacancies to be filled, all such nominees will be declared elected or appointed by acclamation.

ELECTION OF DIRECTORS

The size of the Board of the Company is currently determined at eleven (11). The Board has resolved that the number of directors remain at eleven (11). Shareholders will therefore be asked to elect eleven (11) directors at the Meeting.

The term of office of each of the current directors will end at the conclusion of the Meeting. Unless the director’s office is earlier vacated in accordance with the provisions of theBusiness Corporations Act (British Columbia) ("BCA"), each director elected will hold office until the conclusion of the next annual general meeting of the Company, or if no director is then elected, until a successor is elected.

The following table sets out the names of management’s eleven nominees for election as directors, all major offices and positions with the Company and any of its significant affiliates each now holds, each nominee’s principal occupation, business or employment for the five preceding years for new director nominees, the period of time during which each has been a director of the Company and the number of Common Shares of the Company beneficially owned by each, directly or indirectly, or over which each exercised control or direction. The information as to shares and options beneficially owned or controlled are based on insider reports filed onwww.sedi.ca as at May 12, 2006.

Name of Nominee; Current Position with the Company and Province or State and Country of Residence | Period as a Director of the Company | Shares (and Options) Beneficially Owned or Controlled(10) (as reported by the nominees on www.sedi.ca) |

| Morris BEATTIE Director Vancouver, British Columbia | Since August 2005 | 10,000 Shares 130,000 Options(1) |

| David COPELAND Director Vancouver, British Columbia | Since June 1996 | 2,046,424 Shares(10) 205,000 Options(2) |

| Scott COUSENS Director Vancouver, British Columbia | Since June 1996 | 2,006,324 Shares(10) 205,000 Options(2) |

- 5 -

Name of Nominee; Current Position with the Company and Province or State and Country of Residence | Period as a Director of the Company | Shares (and Options) Beneficially Owned or Controlled(10) (as reported by the nominees on www.sedi.ca) |

| Robert DICKINSON Chairman of the Board and Director Vancouver, British Columbia | Since June 1994 | 3,115,324 Shares(3)(10) 205,000 Options(2) |

| David ELLIOTT Director Vancouver, British Columbia | Since July 2004 | 10,000 Shares 140,000 Options(4) |

| Gordon FRETWELL Director Vancouver, British Columbia | Since June 2004 | Nil Shares 140,000 Options(4) |

| Wayne KIRK Director San Rafael, CA, USA | Since July 2004 | 10,000 Shares 180,000 Options(5) |

| Jeffrey MASON Chief Financial Officer, Secretary and Director Vancouver, British Columbia | Since June 1996 | 2,000,324 Shares(10) 90,000 Options(6) |

| Walter SEGSWORTH Director West Vancouver, British Columbia | Since September 2004 | Nil Shares 190,000 Options(7) |

| Ronald THIESSEN President, Chief Executive Officer and Director Vancouver, British Columbia | Since November 1995 | 2,001,324 Shares(10) 250,000 Options(8) |

| Ian WATSON Director London, England | Since July 2003 | Nil Shares(9) 205,000 Options(2) |

| (1) | Mr. Beattie holds options to purchase 40,000 common shares at an exercise price of $5.31 per share expiring on November 30, 2007 and 90,000 common shares at an exercise price of $7.25 per share expiring on April 30, 2011. |

| (2) | Mr. Copeland, Mr. Cousens, Mr. Dickinson and Mr. Watson each hold options to purchase 115,000 common shares at an exercise price of $5.00 per share expiring on November 30, 2006 and 90,000 common shares at an exercise price of $7.25 per share expiring on April 30, 2011. |

| (3) | Certain of these common shares are held by United Mineral Services, a private company that is wholly owned by Mr. Dickinson. |

| (4) | Mr. Elliott and Mr. Fretwell, each hold options to purchase 50,000 common shares at $5.00 per share expiring on November 30, 2006 and 90,000 common shares at an exercise price of $7.25 per share expiring on April 30, 2011. |

| (5) | Mr. Kirk hold options to purchase 90,000 common shares at $5.00 per share expiring on November 30, 2006 and 90,000 common shares at an exercise price of $7.25 per share expiring on April 30, 2011. |

| (6) | Mr. Mason hold options to purchase 90,000 common shares at an exercise price of $7.25 per share expiring on April 30, 2011. |

| (7) | Mr. Segsworth holds options to purchase 100,000 common shares at $4.65 expiring on November 30, 2006 and 90,000 common shares at an exercise price of $7.25 per share expiring on April 30, 2011. |

| (8) | Mr. Thiessen hold options to purchase 115,000 Common Shares at an exercise price of $5.00 per share expiring on November 30, 2006 and 135,000 common shares at an exercise price of $7.25 per share expiring on April 30, 2011. |

| (9) | Mr. Watson is Chairman and Managing Director of Galahad Gold plc, which controls, directly and through subsidiaries, 17,673,695 common shares of Northern Dynasty. Certain of these common shares are registered in the names of Galahad, Shambhala, Ludgate |

- 6 -

347 and Ludgate 341. Ludgate 347 also holds 1,176,500 warrants (at an exercise price of $5.00 expiring on September 18, 2006). Each warrant is exercisable to purchase one additional share. Mr. Watson may hold all or a portion of his options for the benefit of Galahad as they may agree. | |

| (10) | As more particularly described herein under Interest of Informed Persons In Material Transactions, Hunter Dickinson Group Inc. ("HDGI") is a private company with certain directors in common with the Company and five of its seven shareholders are also directors of the Company. In March 2005, Northern Dynasty reached an agreement to acquire the 20% remaining interest in the Pebble Property from HDGI for a purchase price of 14,002,268 common shares of Northern Dynasty however this agreement has been superseded by an agreement dated April 20, 2006 which is expected to complete prior to the Meeting whereby the Company will purchase HDGI from these shareholders for the 14,002,268 shares. These 14,002,268 shares were issued on May 9, 2006. |

The following information as to principal occupation, business or employment is not within the knowledge of the management of the Company and has been furnished by the respective nominees.

MORRIS BEATTIE, Ph.D., P.Eng. – Director

Morris Beattie holds a Ph.D. in Mining and Mineral Process Engineering from the University of British Columbia. He is a Professional Engineer in the Province of British Columbia, a Chartered Engineer in the United Kingdom and a member of the Canadian Institute of Mining and Metallurgy and a Fellow of the Institution of Mining and Metallurgy in the United Kingdom.

With over 30 years in the mining industry, Dr. Beattie’s experience has encompassed work in base and precious metals and industrial minerals deposits. He spent the early phase of his career in extractive metallurgy at Bacon, Donaldson & Associates Ltd. More recently Dr. Beattie’s scope of activities has included due diligence studies, audits and economic evaluation of mining projects as well as contributions to project feasibility studies. He has held senior management roles with several technology and exploration companies, and presently holds a senior position with Galahad Gold Plc. He has also served as a director of various exploration and development stage mining companies.

Dr. Beattie currently is, or was within the past five years, an officer and/or director of the following public companies:

| Company | Positions Held | From | To |

| Northern Dynasty Minerals | Director | August 2005 | Present |

| Galahad Gold Plc | Director | January 2004 | Present |

| Skaergaard Minerals Corp (subsidiary of Galahad Gold Plc) | President | January 2004 | Present |

| International Molybdenum Plc | Director Executive Vice President | April 2005 | Present |

| Aldridge Resources Ltd | Director | Feb. 1997 | Nov. 2004 |

| Sur American Gold Corp | Director | April 1997 | Dec. 2003 |

DAVID COPELAND, P.Eng. – Director

David Copeland is a geological engineer who graduated in economic geology from the University of British Columbia. With over 30 years of experience, Mr. Copeland has undertaken assignments in a variety of capacities in mine exploration, discovery and development throughout the South Pacific, Africa, South America and North America. His principal occupation is President and Director of CEC Engineering Ltd., a consulting engineering firm that directs and co-ordinates advanced technical programs for exploration on behalf companies for which Hunter Dickinson Inc. (a private company with certain directors in common with the Company), provides consulting services. He is also a director of Hunter Dickinson Inc.

Mr. Copeland is, or was within the past five years, an officer and/or director of the following public companies:

- 7 -

| Company | Positions Held | From | To |

| Amarc Resources Ltd. | Director | September 1995 | Present |

| Anooraq Resources Corporation | Director | September 1996 | September 2004 |

| Casamiro Resource Corp. | Director | February 1995 | August 2002 |

| Continental Minerals Corporation | Director | November 1995 | Present |

| Farallon Resources Ltd. | Director | December 1995 | Present |

| Great Basin Gold Ltd. | Director | February 1994 | Present |

| Northern Dynasty Minerals Ltd. | Director | June 1996 | Present |

| Taseko Mines Limited | Director | January 1994 | Present |

SCOTT COUSENS – Director

Scott Cousens provides management, technical and financial services to a number of publicly traded companies. Mr. Cousens’ focus since 1991 has been the development of relationships within the international investment community. Substantial financings and subsequent corporate success has established strong ties with North American, European and Asian investors. In addition to financing initiatives he also oversees the corporate communications programs for the public companies to which Hunter Dickinson Inc. provides services.

Mr. Cousens is, or was within the past five years, an officer and/or director of the following public companies:

| Company | Positions Held | From | To |

| Amarc Resources Ltd. | Director | September 1995 | Present |

| Anooraq Resources Corporation | Director | September 1996 | Present |

| Continental Minerals Corporation | Director | June 1994 | Present |

| Farallon Resources Ltd. | Director | December 1995 | Present |

| Great Basin Gold Ltd. | Director | March 1993 | Present |

| Northern Dynasty Minerals Ltd. | Director | June 1996 | Present |

| Rockwell Ventures Inc. | Director | November 2000 | Present |

| Taseko Mines Limited | Director | October 1992 | Present |

ROBERT DICKINSON, B.Sc., M.Sc. – Chairman of the Board and Director

Robert Dickinson is an economic geologist who serves as a member of management of several mineral exploration companies, primarily those for whom Hunter Dickinson Inc. provides services. He holds a Bachelor of Science degree (Hons. Geology) and a Master of Science degree (Business Administration - Finance) from the University of British Columbia. Mr. Dickinson has also been active in mineral exploration over 40 years. He is a director of Hunter Dickinson Inc. He is also President and Director of United Mineral Services Ltd., a private investment company.

Mr. Dickinson is, or was within the past five years, an officer and/or director of the following public companies:

| Company | Positions Held | From | To |

Amarc Resources Ltd. | Director | April 1993 | Present |

| Co-Chairman | September 2000 | April 2004 | |

| Chairman | April 2004 | Present | |

| Anooraq Resources Corporation | Chairman | November 1990 | September 2004 |

| Director | October 2004 | Present |

- 8 -

| Company | Positions Held | From | To |

| Co-Chairman | October 2004 | Present | |

Continental Minerals Corporation | Director | June 2004 | Present |

| Chairman | June 2004 | January 2006 | |

| Co-Chairman | January 2006 | Present | |

Farallon Resources Ltd. | Director | July 1991 | Present |

| Chairman | April 2004 | September 2004 | |

| Co-Chairman | September 2004 | April 2006 | |

Great Basin Gold Ltd. | Director | May 1986 | Present |

| Co-Chairman | September 2000 | April 2004 | |

| Chairman | April 2004 | December 2005 | |

| Co-Chairman | December 2005 | Present | |

Northern Dynasty Minerals Ltd. | Director | June 1994 | Present |

| Co-Chairman | November 2001 | April 2004 | |

| Chairman | April 2004 | Present | |

| Rockwell Ventures Inc. | Director | November 2000 | Present |

| Chairman | November 2000 | Present | |

Taseko Mines Limited | Director | January 1991 | Present |

| Chairman | April 2004 | July 2005 | |

| Co-Chairman | July 2005 | May 2006 |

DAVID ELLIOTT, B.Comm., CA – Director

David Elliott graduated from the University of British Columbia with a Bachelor of Commerce degree and then acquired a Chartered Accountant designation with KPMG LLP. Mr. Elliott joined BC Sugar Company in 1976, working in a number of senior positions before becoming President and Chief Operating Officer of the operating subsidiary, Rogers Sugar. In 1997, he joined Lantic Sugar in Toronto as Executive Vice President. He also served as Chairman of the Canadian Sugar Institute. He became President and Chief Operating Officer of the International Group based in St Louis, Missouri in 1999, a company involved with food distribution as well as manufacturing and distribution of pet and animal feed. For several years, he worked with companies developing e-mail and data management services. Mr. Elliott also serves on the boards of the BC Cancer Foundation and the University of BC Alumni Association.

Mr. Elliott is, or was within the past five years, an officer and/or director of the following public companies:

| Company | Positions Held | From | To |

| Anooraq Resources Corporation | Director | April 2005 | Present |

| Great Basin Gold Ltd. | Director | July 2004 | Present |

| Northern Dynasty Minerals Ltd. | Director | July 2004 | Present |

| Taseko Mines Limited | Director | July 2004 | Present |

| StorageFlow Systems Corp. | Director | May 2002 | June 2003 |

| President | May 2002 | June 2004 |

- 9 -

GORDON FRETWELL, B.Comm., LLB – Director

Gordon Fretwell holds a B.Comm, degree and graduated from the University of British Columbia in 1979 with his Bachelor of Law degree. Formerly a partner in a large Vancouver law firm, Mr. Fretwell has, since 1991, been a self-employed solicitor (Gordon J. Fretwell Law Corporation) in Vancouver practicing primarily in the areas of corporate and securities law.

Mr. Fretwell is, or was within the past five years, an officer and/or director of the following public companies:

| Company | Positions Held | From | To |

| Continental Minerals Corporation | Director | February 2001 | Present |

| Northern Dynasty Minerals Ltd. | Director | June 2004 | Present |

| Quartz Mountain Resources Ltd. | Director and Secretary | January 2003 | Present |

| Rockwell Ventures Inc. | Director and Secretary | March 1998 | Present |

| Antarex Metals Ltd. | Director | December 2000 | September 2002 |

| Bell Resources Corporation | Director | June 2001 | Present |

| Benton Resources Corp. | Director | March 2005 | Present |

| Copper Ridge Explorations Inc. | Director and Secretary | September 1999 | Present |

| Grandcru Resources Corp. | Director | December 2002 | Present |

| Icon Industries Limited | Vice President of Legal Services | December 2000 | Present |

| Director | July 2004 | Present | |

| International Royalty Corporation | Director | February 2005 | Present |

| Keegan Resources Inc. | Director | February 2004 | Present |

| Pine Valley Mining Corp. | Director | August 2003 | Present |

Tri-Gold Resources Corp. | Director | July 2001 | October 2003 |

| Secretary | July 2001 | September 2003 | |

| CFO | November 2005 | January 2006 |

- 10 -

WAYNE KIRK, LLB – Director

Wayne Kirk is a retired California State Attorney and Professional Consultant. With over 35 years professional experience Mr. Kirk also has over 9 years senior executive experience in the mining industry.

Mr. Kirk is a citizen of the United States and is a resident of California. A Harvard University graduate, Mr. Kirk received his law degree in 1968. From 1992 to 2001 Mr. Kirk was the Vice President, General Counsel and Corporate Secretary of Homestake Mining Company. Prior to his retirement in June 2004 he spent two years as Special Counsel for the law firm, Thelen Reid & Priest, in San Francisco.

Mr. Kirk is, or was within the past five years, an officer and/or director of the following public companies:

| Company | Positions Held | From | To |

| Anooraq Resources Corporation | Director | July 2005 | Present |

| Great Basin Gold Ltd. | Director | July 2004 | Present |

| Northern Dynasty Minerals Ltd. | Director | July 2004 | Present |

| Taseko Mines Limited | Director | July 2004 | Present |

Homestake Mining Company | Vice President, General Counsel, and Corporate Secretary | September 1992 | December 2001 |

JEFFREY MASON, B.Comm., CA – Director, Chief Financial Officer and Secretary

Jeffrey Mason holds a Bachelor of Commerce degree from the University of British Columbia and obtained his Chartered Accountant designation while specializing in the mining, forestry and transportation sectors at the international accounting firm of Deloitte & Touche. Following comptrollership positions at an international commodity mercantilist and Homestake Mining Group of companies including responsibility for North American Metals Corp. and the Eskay Creek Project, Mr. Mason has spent the last several years as a corporate officer and director to a number of publicly-traded mineral exploration companies. Mr. Mason is also employed as Chief Financial Officer of Hunter Dickinson Inc. and his principal occupation is the financial administration of the public companies to which Hunter Dickinson Inc. provides services.

Mr. Mason is, or was within the past five years, an officer and or director of the following public companies:

| Company | Positions Held | From | To |

Amarc Resources Ltd. | Director | September 1995 | Present |

| Secretary | September 1995 | Present | |

| Chief Financial Officer | September 1998 | Present | |

Anooraq Resources Corporation | Director | April 1996 | September 2004 |

| Secretary | September 1996 | Present | |

| Chief Financial Officer | February 1999 | Present | |

Continental Minerals Corporation | Director | June 1995 | Present |

| Secretary | November 1995 | Present | |

| Chief Financial Officer | June 1998 | Present |

- 11 -

| Company | Positions Held | From | To |

Farallon Resources Ltd. | Director | August 1994 | Present |

| Secretary | December 1995 | Present | |

| Chief Financial Officer | December 1997 | Present | |

Great Basin Gold Ltd. | Director | February 1994 | Present |

| Secretary | February 1994 | Present | |

| Chief Financial Officer | June 1998 | Present | |

Northern Dynasty Minerals Ltd. | Director | June 1996 | Present |

| Secretary | June 1996 | Present | |

| Chief Financial Officer | June 1998 | Present | |

| Quartz Mountain Resources Ltd. | Principal Accounting Officer | January 2005 | Present |

Rockwell Ventures Inc. | Director | November 2000 | Present |

| Chief Financial Officer | November 2000 | Present | |

Taseko Mines Limited | Director | February 1994 | Present |

| Secretary | February 1994 | Present | |

| Chief Financial Officer | November 1998 | Present |

WALTER SEGSWORTH, P.Eng. – Director

Walter Segsworth has been an active and respected member of the international mining industry for over 30 years. He has an excellent track record in employee safety, environmental excellence and turn around production situations. During Mr. Segsworth’s tenure as President, Chief Operating Officer and Director at Homestake Mining Company, the Company set a 125 year gold production record and its operating costs reached 25 year lows. Mr. Segsworth is a past Director and Chairman of the Mining Associations of Canada and British Columbia, and was voted British Columbia Mining Industry Person of the Year in 1996. He is a member of the Canadian Institute of Mining, Metallurgy and Petroleum and until recently, was part of the Mining Curriculum Advisory Board of the Michigan Technological University, from which he earned his degree in Mining Engineering.

Mr. Segsworth is, or was within the past five years, an officer and/or director of the following public companies:

| Company | Positions Held | From | To |

| Northern Dynasty Minerals Ltd. | Director | September 2004 | Present |

| Anooraq Resources Corporation | Director | March 2004 | Present |

| Great Basin Gold Ltd. | Director | January 2003 | Present |

| Cumberland Resources | Director | May 2002 | Present |

| Expatriate Resources Ltd. | Director | February 2001 | Present |

| Homestake Mining Company | President and Chief Operating Officer | April 1999 | December 2001 |

| Director | February 2001 | December 2001 | |

| Novagold Resources Inc. | Director | May 2002 | November 2002 |

| UEX Corporation | Director | March 2002 | Present |

- 12 -

RONALD THIESSEN, CA –Director

Ronald Thiessen is a Chartered Accountant with professional experience in finance, taxation, mergers, acquisitions and re-organizations. Since 1986, Mr. Thiessen has been involved in the acquisition and financing of mining and mineral exploration companies. Mr. Thiessen is employed by Hunter Dickinson Inc., a company providing management and administrative services to several publicly-traded companies and focuses on directing corporate development and financing activities. He is also a director of Hunter Dickinson Inc. Mr. Thiessen is, or was within the past five years, an officer and/or director of the following public companies:

| Company | Positions Held | From | To |

Amarc Resources Ltd. | Director | September 1995 | Present |

| President and Chief Executive Officer | September 2000 | Present | |

Anooraq Resources Corporation | Director | April 1996 | Present |

| President and Chief Executive Officer | September 2000 | Present | |

| Casamiro Resource Corp. | Director and President | February 1990 | August 2002 |

Continental Minerals Corporation | Director | November 1995 | Present |

| President and Chief Executive Officer | September 2000 | January 2006 | |

| Co-Chairman | January 2006 | Present | |

Farallon Resources Ltd. | Director | August 1994 | Present |

| President and Chief Executive Officer | September 2000 | September 2004 | |

| Co-Chairman | September 2004 | April 2006 | |

| Chairman | April 2006 | Present | |

Great Basin Gold Ltd. | Director | October 1993 | Present |

| President and Chief Executive Officer | September 2000 | December 2005 | |

| Co-Chairman | December 2005 | Present | |

Northern Dynasty Minerals Ltd. | Director | November 1995 | Present |

| President and Chief Executive Officer | November 2001 | Present | |

Rockwell Ventures Inc. | Director | November 2000 | Present |

| President and Chief Executive Officer | November 2000 | Present | |

Taseko Mines Limited | Director | October 1993 | Present |

| President and Chief Executive Officer | September 2000 | July 2005 | |

| Co-Chairman | July 2005 | May 2006 | |

| Chairman | May 2006 | Present | |

| Tri-Gold Resources Corp. | Director | July 1992 | Present |

- 13 -

IAN WATSON – Director

Mr. Watson is a financier with a background in mining finance and investment banking. His principal occupation is Chairman and Managing Director of Galahad Gold plc. Galahad is quoted on the AIM Market of the London Stock Exchange and is the largest single shareholder in the Company. Previously, he was a consultant to American Barrick, now Barrick Gold Corporation and was one of the founders of Centennial Minerals Ltd. and was its Chairman until 1985. Three years after it started, Centennial's success was reflected in a friendly, recommended take-over by Pegasus Gold PLC.

Mr Watson is, or was within the past five years an officer and or a director of the following companies:

| Company | Positions Held | From | To |

| Northern Dynasty Minerals Ltd. | Director | July 2003 | Present |

| Galahad Gold plc | Chairman and Managing Director | September 2002 | Present |

| Highpoint Telecommunications Inc. | Chairman and Chief Executive Officer | April 1998 | May 2002 |

| International Molybdenum plc | Non-executive Chairman and Director | December 2004 | Present |

| Uramin Inc. | Director | July 2005 | Present |

APPOINTMENT OF AUDITOR

De Visser Gray, Chartered Accountants, 401 – 905 West Pender Street, Vancouver, British Columbia, will be nominated at the Meeting for reappointment as auditor of the Company for the ensuing year, at a remuneration to be fixed by the Audit Committee.

AUDIT COMMITTEE AND RELATIONSHIP WITH AUDITOR

Multilateral Instrument 52-110 of the Canadian Securities Administrators ("MI52-110") requires the Company, to disclose annually certain information concerning the constitution of its audit committee and its relationship with its independent auditor, as set forth in the following:

The Audit Committee’s Charter

The audit committee has a adopted a charter, a copy which was attached as Schedule "A" to the 2005 shareholders’ information circular which is available for download atwww.sedar.com or from the Company’s website (www.northerndynasty.com).

Composition of the Audit Committee

The members of the audit committee are David Elliott, Gordon Fretwell and Wayne Kirk. All members are independent directors and all members are considered to be financially literate and Mr Elliott is a Chartered Accountant and hence a financial expert.

A member of the audit committee is independent if the member has no direct or indirect material relationship with the Company. A material relationship means a relationship which could, in the view of the Company’s board of directors, reasonably interfere with the exercise of a member’s independent judgement.

A member of the audit committee is considered financially literate if the member has the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Company.

- 14 -

Relevant Education and Experience

As a result of their education and experience, each member of the audit committee has familiarity with, an understanding of, or experience in:

the accounting principles used by the Company to prepare its financial statements, and the ability to assess the general application of those principles in connection with estimates, accruals and reserves;

reviewing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Company's financial statements, and

an understanding of internal controls and procedures for financial reporting.

Reliance on Certain Exemptions

The Company’s auditors, De Visser Gray, Chartered Accountants, of Vancouver, BC, have not provided any material non-audit services during the most recently-completed fiscal year.

Pre-Approval Policies and Procedures

The Company has procedures for the review and pre-approval of any services performed by its auditors. The procedures require that all proposed engagements of its auditors for audit and non-audit services be submitted to the audit committee for approval prior to the beginning of any such services. The audit committee considers such requests, and, if acceptable to a majority of the audit committee members, pre-approves such audit and non-audit services by a resolution authorizing management to engage the Company’s auditors for such audit and non-audit services, with set maximum dollar amounts for each itemized service. During such deliberations, the audit committee assesses, among other factors, whether the services requested would be considered "prohibited services" as contemplated by the regulations of the US Securities and Exchange Commission, and whether the services requested and the fees related to such services could impair the independence of the auditors.

External Auditor Service Fees

The audit committee has reviewed the nature and amount of the non-audited services provided by De Visser Gray to the Company to ensure auditor independence. Fees incurred with De Visser Gray for audit and non-audit services in the last two fiscal years are outlined in the following table.

| Nature of Services | Fees Paid to Auditor in Year Ended December 31, 2005 | Fees Paid to Auditor in Year Ended December 31, 2004 |

| Audit Fees(1) | $ 15,000 | $ 10,000 |

| Audit-Related Fees(2) | – | – |

| Tax Fees(3) | 1,000 | 1,000 |

| All Other Fees(4) | – | – |

| Total | $ 16,000 | $ 11,000 |

| (1) | "Audit Fees" include fees necessary to perform the annual audit and quarterly reviews of the Company’s consolidated financial statements. Audit Fees include fees for review of tax provisions and for accounting consultations on matters reflected in the financial statements. Audit Fees also include audit or other attest services required by legislation or regulation, such as comfort letters, consents, reviews of securities filings and statutory audits. |

| (2) | "Audit-Related Fees" include services that are traditionally performed by the auditor. These audit-related services include employee benefit audits, due diligence assistance, accounting consultations on proposed transactions, internal control reviews and audit or attest services not required by legislation or regulation. |

| (3) | "Tax Fees" include fees for all tax services other than those included in "Audit Fees" and "Audit-Related Fees". This category includes fees for tax compliance, tax planning and tax advice. Tax planning and tax advice includes assistance with tax audits and appeals, tax advice related to mergers and acquisitions, and requests for rulings or technical advice from tax authorities. |

| (4) | "All Other Fees" include all other non-audit services. |

- 15 -

CORPORATE GOVERNANCE

General

The Board believes that good corporate governance improves corporate performance and benefits all shareholders. The Canadian Securities Administrators (the "CSA") have adopted National Policy 58-201Corporate Governance Guidelines, which provides non-prescriptive guidelines on corporate governance practices for reporting issuers such as the Company. In addition, the CSA have implemented National Instrument 58-101Disclosure of Corporate Governance Practices, which prescribes certain disclosure by the Company of its corporate governance practices. This section sets out the Company’s approach to corporate governance and addresses the Company’s compliance with NI 58-101.

1. Board of Directors

Directors are considered to be independent if they have no direct or indirect material relationship with the Company. A "material relationship" is a relationship which could, in the view of the Company’s Board of Directors, be reasonably expected to interfere with the exercise of a director’s independent judgment.

The board facilitates its independent supervision over management in several ways including by holding regular meetings at which members of management or non-independent directors are not in attendance, by retaining independent consultants where it deems necessary.

The independent members of the Board of Directors of the Company are Messrs Elliott, Fretwell, Kirk and Segsworth.

The non-independent directors are Messrs. Beattie, Copeland, Cousens, Dickinson, Mason, Thiessen, and Watson.

The Board notes that a majority of its members are not independent however the Board feels that the significant number of independent directors and their skill-sets and experience give the Board the necessary balance. The Board met four times in 2005. All directors were in attendance at all meetings, either by phone or in person, except the following who were absent from the number of meetings set opposite their names, as follows:

| David Copeland | 1 | |

| Robert Dickinson | 1 | |

| David Elliott | 1 | |

| Gordon Fretwell | 1 | |

| Brian Mountford | 1 |

2. Other Directorships

The section entitled "Election of Directors" in this Information Circular gives details of other reporting issuers of which each director is a director or officer.

3. Orientation and Continuing Education

When new directors are appointed, they receive orientation, commensurate with their previous experience, on the Company’s properties, business and industry and on the responsibilities of directors. Board meetings typically include presentations by the Company’s management and employees to give the directors additional insight into the Company’s business.

4. Ethical Business Conduct

The Board has adopted a formal ethics policy which is available for download from the Company’s website. The Board also understands that the fiduciary duties placed on individual directors by the Company’s governing corporate legislation and the common law and the restrictions placed by applicable corporate legislation on an individual directors’ participation in decisions of the Board in which the director has an interest have been sufficient to ensure that the Board operates independently of management and in the best interests of the Company.

- 16 -

5. Nomination of Directors

The Board considers its size each year when it considers the number of directors to recommend to the shareholders for election at the annual meeting of shareholders, taking into account the number required to carry out the Board’s duties effectively and to maintain a diversity of views and experience.

The Board has established a nominating and governance committee, however the nominating functions has been basically performed by the Board as a whole.

6. Compensation

The Compensation Committee determines compensation for the directors and the CEO. The Compensation Committee comprises Messrs Fretwell, Kirk, Elliott, Mason and Watson hence a majority are independent. The Compensation committee met four times in 2005 and all directors were in attendance except the following who were absent from the number of meetings set opposite their names, as follows:

| Gordon Fretwell | 1 | |

| Wayne Kirk | 1 | |

| Jeffrey Mason | 1 | |

| Ian Watson | 2 |

Further information about the functioning of this Committee follows below.

7. Other Board Committees

The Board has one other committee other than the audit committee, nominating and governance committee, and the compensation committee, namely a special committee formed to consider the terms of acquisition of the 20% carried interest in the Pebble Project which was held by Hunter Dickinson Group Inc. a private corporation owned by seven persons, five of whom are directors. The members of the Special Committee are Messrs Fretwell, Watson, Elliott and Segsworth, none of whom have any personal interest in the subject matter of the acquisition considered by the Special Committee (see also interest of Informed Persons in Material Transactions). The Special Committee met and communicated extensively throughout 2005/2006.

8. Assessments

The Board monitors the adequacy of information given to directors, communication between the Board and management and the strategic direction and processes of the Board and committees. The Board and its committees have considered self-assessment procedures and may formalize procedures to accommodate this in the future. The Board is satisfied with the overall project and corporate achievements of the Company and believes this reflects well on the Board and its practices.

COMPENSATION OF EXECUTIVE OFFICERS

Executive Compensation

In this section "Named Executive Officer" means the Chief Executive Officer, the Chief Financial Officer and each of the three most highly compensated executive officers, other than the Chief Executive Officer and Chief Financial Officer, who were serving as executive officers at the end of the most recently completed fiscal year and whose total salary and bonus exceeds $150,000 as well as any additional individuals for whom disclosure would have been provided except that the individual was not serving as an officer of the Company at the end of the most recently completed financial year end.

The compensation paid to the Named Executive Officers during the Company’s three most recently completed financial years is as set out below:

- 17 -

Summary Compensation Table

NAMED EXECUTIVE OFFICER | Year | Annual Compensation | Long Term Compensation | All Other Compensation ($) | ||||

| Awards | Payouts | |||||||

Salary ($) | Bonus ($) | Other Annual Compen- sation ($) | Securities Under Options Granted (#) | Shares or Units Subject to Resale Restrictions ($) | LTIP Payouts ($) | |||

| Ronald Thiessen President, Chief Executive Officer and Director | 2005 2004 2003 | 177,211 69,284 74,160 | Nil Nil Nil | Nil Nil Nil | Nil 115,000 85,000 | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil |

| Jeffrey Mason Secretary, Chief Financial Officer and Director | 2005 2004 2003 | 106,554 51,945 55,950 | Nil Nil Nil | Nil Nil Nil | Nil 115,000 85,000 | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil |

| Bruce Jenkins(1) Chief Operating Officer of Northern Dynasty Mines Inc. (a wholly owned subsidiary of the Company) | 2005 2004 2003 | 203,225 148,567 12,415 | Nil Nil Nil | Nil Nil Nil | 50,000 230,000 20,000 | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil |

| Stephen Hodgson Vice-President, Engineering | 2005 2004 2003 | 158,000 Nil Nil | Nil Nil Nil | Nil Nil Nil | 250,000 Nil Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil |

Notes:

| (1) | Mr. Jenkins compensation was paid to Sidev Holdings Ltd., a private company controlled by Mr. Jenkins. |

| (2) | An Executive Committee, consisting of Messrs. Dickinson, Thiessen, Jenkins, and Hodgson, is not a committee of the Board, but performs a policy-making function of the Company. |

Long-Term Incentive Plan Awards

A long term incentive plan ("LTIP") is "a plan providing compensation intended to motivate performance over a period greater than one financial year" and does not include option or stock appreciation rights ("SARs") plans or plans for compensation through shares or units that are subject to restrictions on resale. The Company did not award any LTIPs to any Named Executive Officer during the most recently completed financial year.

Options

The share options granted to the Named Executive Officers during the financial year ended December 31, 2005 were as follows:

Option Grants During the Most Recently Completed Financial Year

NAMED EXECUTIVE OFFICERS | Securities Under Options/SARs Granted (#) | % of Total Options/SARs Granted to Employees in Financial Year | Exercise or Base Price ($/Security) | Market Value of Securities Underlying Options/SARs on the Date of Grant ($/Security) | Expiration Date |

| Ronald Thiessen | nil | – | – | – | – |

| Jeffrey Mason | nil | – | – | – | – |

| Bruce Jenkins | 50,000 | 5.1 % | $ 5.31 | $ 5.31 | November 30, 2007 |

| Stephen Hodgson | 250,000 | 25.2 % | $ 5.31 | $ 5.31 | November 30, 2007 |

- 18 -

The share options exercised by the Named Executive Officers during the financial year ended December 31, 2005 and the values of such options at the end of such year were as follows:

Aggregate Option Exercises During the Most Recently Completed Financial Year and

Financial Year-End Option Values

NAMED EXECUTIVE OFFICERS | Securities Acquired on Exercise (#) | Aggregate Value Realized ($) | Unexercised Options/SARs at FY- End (#) Exercisable/ Unexercisable | Value of Unexercised in-the-Money Options/SARs at FY- End ($) Exercisable/ Unexercisable |

| Ronald Thiessen | 85,000 | $43,350 | 115,000 / Nil | $132,250 / Nil |

| Jeffrey Mason | 85,000 | $43,350 | 115,000 / Nil | $132,250 / Nil |

| Bruce Jenkins | 30,000 | $10,000 | 236,666 / 33,334 | $267,000 / $28,000 |

| Stephen Hodgson | Nil | Nil | 83,333 / 166,667 | $70,000 / $140,000 |

The value of the unexercised in-the-money options at the financial year December 31, 2005 is $601,500.

Defined Benefit or Actuarial Plan Disclosure

The Company does not have a pension plan under which benefits are determined primarily by final compensation (or average final compensation) and years of service.

Termination of Employment, Change in Responsibilities and Employment Contracts

There are no compensatory plan(s) or arrangement(s), with respect to the Named Executive Officer resulting from the resignation, retirement or any other termination of employment of the officer’s employment or from a change of the Named Executive Officer’s Responsibilities following a change in control.

Compensation Committee Disclosure

The Company has a Compensation Committee of which the current members are Messrs. Elliott, Fretwell (Chair), Kirk, Mason and Watson. Each member of this Committee is an independent director (has no direct or indirect material relationship with the Company) with the exception of Mr. Mason, who is the Chief Financial Officer of the Company, and Mr. Watson, who is the Managing Director of a principal shareholder of the Company. The function of this committee is to assist the Board of Directors in fulfilling its responsibilities relating to the compensation practices of the executive officers of the Company. Specifically, this Committee has been empowered to evaluate the performance of the President of the Company and to recommend to the Board of Directors the compensation level of the President; to review the compensation levels of the executive officers of the Company and to report thereon to the Board of Directors; to conduct such surveys and studies as the Committee deems appropriate to determine competitive salary levels; to review the strategic objectives of and administer the stock option plan of the Company; to review management’s strategy for succession planning and to consider any other matters which, in the Committee’s judgment, should be taken into account in reaching the recommendation to the Board of Directors concerning the compensation levels of the Company’s executive officers.

Report on Executive Compensation

This report on executive compensation has been authorized by the Compensation Committee. The Board assumes responsibility for reviewing and monitoring the long-range compensation strategy for the senior management of the Company although the Compensation Committee guides it in this role. As part of its mandate, the Board determines the type and amount of compensation for the President and Chief Executive Officer. The Board also determines the compensation of the Chief Financial Officer. In addition, the Board reviews the methodology utilized by the Company for setting salaries of employees throughout the organization.

- 19 -

The Company’s Compensation Committee receives independent competitive market information on compensation levels for executives.

Messrs. Thiessen and Mason do not serve the Company solely on a full-time basis, and their compensation from the Company is allocated based on the estimated amount of time spent on the work of the Company. Messrs. Jenkins and Hodgson work on the Company's activities on a substantially full-time basis.

Philosophy and Objectives

The compensation program for the senior management of the Company is designed to ensure that the level and form of compensation achieves certain objectives, including:

| (a) | attracting and retaining talented, qualified and effective executives; | |

| (b) | motivating the short and long-term performance of these executives; and | |

| (c) | better aligning their interests with those of the Company’s shareholders. |

In compensating its senior management, the Company has employed a combination of base salary, bonus compensation and equity participation through its stock option plan.

Base Salary

In the Board’s view, paying base salaries which are competitive in the markets in which the Company operates is a first step to attracting and retaining talented, qualified and effective executives. Competitive salary information on comparable companies within the industry is compiled from a variety of sources, including surveys conducted by independent consultants and national and international publications.

Bonus Compensation

The Company’s primary objective is to achieve certain strategic objectives and milestones. The Board considers executive bonus compensation dependent upon the Company meeting those strategic objectives and milestones. In the most recently completed fiscal year, no milestone bonuses were structured nor paid to senior executives of the Company. Bonuses were paid to certain senior executives of the Company during 2006 in respect of 2005.

Equity Participation

The Company believes that encouraging its executives and employees to become shareholders is the best way of aligning their interests with those of its shareholders. Equity participation is accomplished through the Company’s stock option plan. Stock options are granted to senior executives taking into account a number of factors, including the amount and term of options previously granted, base salary and bonuses and competitive factors. Options are generally granted to senior executives which vest on terms established by the Board. Given the evolving nature of the Company’s business, the Board continues to review and redesign the overall compensation plan for senior management so as to continue to address the objectives identified above.

Compensation of the Chief Executive Officer

The compensation of the Chief Executive Officer is approved annually by the Board of Directors. Base salary and bonus levels are determined taking into account independent market survey data.

At least annually, the Compensation Committee is to review the grants of stock options to management and employees. Options have been granted to the Chief Executive Officer taking into account competitive compensation factors and the belief that options help align the Chief Executive Officer with the interests of shareholders. However, during the most recently completed fiscal year, no stock options were granted to the Chief Executive Officer.

- 20 -

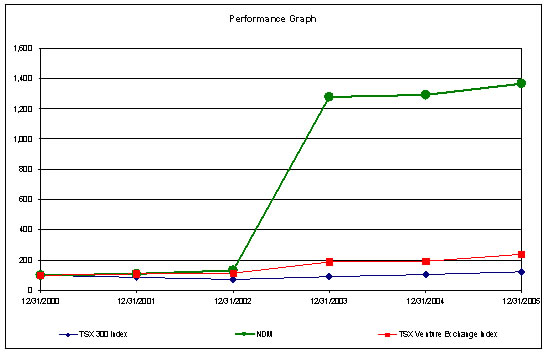

Performance Graph

The following graph compares the total cumulative return to a shareholder for the last five years who invested $100 in Shares of the Company on December 31, 2000 with the total cumulative return on the Canadian Venture Exchange Main Index ("CDNX") which became the TSX Venture Exchange ("TSXV") from January 1, 2001 to December 31, 2005.

Notes:

1. On August l, 2001 the TSX acquired the CDNX and the CDNX was renamed the TSXV.

Compensation of Directors

Effective January 1, 2005 each director of the Company who is an independent director (namely Messrs Elliott, Fretwell, Kirk and Segsworth) is paid an annual director’s fee of $35,000 plus an additional fee of $5,000 for the Audit Committee Chairperson and $3,000 for other Committee Chairpersons. Executive officers do not receive additional compensation for serving as directors.

Mr. Beattie was the only director who received options under the Company’s share option plan during the financial year December 31, 2005. On March 28, 2005, he received 40,000 options exercisable at $5.31 until November 30, 2007, vesting 33% on September 28, 2005, 33% on March 28, 2006, and the remainder on September 28, 2006.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The only equity compensation plan which the Company has in place is the share option plan (the "Plan") which was previously approved by shareholders on July 4, 2005. The Plan has been established to provide incentive to qualified parties to increase their proprietary interest in the Company and thereby encourage their continuing association with the Company. The Plan is administered by the Compensation Committee. The Plan provides that options will be issued to directors, officers, employees or consultants of the Company or a subsidiary of the Company. The shareholders previously approved the issuance of a maximum of 11,300,000 Shares under the Plan. Management proposes to change the plan to a "rolling" plan whereby a maximum number of shares determined as fixed percentage of the Company’s issued and outstanding shares at any time is reserved for options (see "Particulars of Other Matters to Acted Upon").

The following table sets out equity compensation plan information as at the end of the financial year ended December 31, 2005.

- 21 -

Equity Compensation Plan Information

Plan Category | Number of securities to be issued upon exercise of outstanding options and rights (a) | Weighted-average exercise price of outstanding options and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

| Equity compensation plans approved by security holders - (the Plan) | 2,974,166 | $ 5.05 | 4,452,667 |

| Equity compensation plans not approved by security holders | Nil | Nil | Nil |

| Total | 2,974,166 | $ 5.05 | 4,452,667 |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

No directors, proposed nominees for election as directors, executive officers or their respective associates or affiliates, or other management of the Company were indebted to the Company as of the end most recently completed financial year or as at the date hereof.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

An informed person is one who, generally speaking, is a director or executive officer or a 10% shareholder of the Company, which persons are deemed to have an information advantage over other shareholders. To the knowledge of management of the Company, no informed person or nominee for election as a director of the Company or any associate or affiliate of any informed person or proposed director had any interest in any transaction which has materially affected or would materially affect the Company or any of its subsidiaries during the year ended December 31, 2005, or has any interest in any material transaction in the current year, other than as set out herein.

A. Private Placements

During the year ended December 31, 2005, and to the date of this information circular, informed persons of the Company (including companies owned, controlled, or directed by such person) participated in the following private placements as follows:

| Date of placement | Description of placement | Informed Person Participation |

| March 2005 | 7,247,000 units at a price of $4.25 per unit. Each unit was comprised of one common share and one warrant exercisable to purchase one additional share at a price of $5.00 until September 18, 2006. | Galahad Gold plc – 1,176,500 units |

B. Completion of Purchase of Pebble Property 20% Interest

On March 15, 2005 the Company announced it had reached an agreement to purchase the remaining 20% interest (the "20% Interest") in the Pebble Property from a related party, for 14,002,268 shares. It was subsequently determined, based on professional advice, that the acquisition structure required amendment prior to completion which has resulted in revised acquisition agreements dated for reference April 20th, 2006 which are expected to complete prior to the Meeting. The background and further particulars of this transaction as it evolved were described in the 2005 information circular sent to shareholders and are further particularized below.

- 22 -

Pursuant to an Assignment Agreement dated October 29, 2001 (the "Assignment Agreement") between the Company and Hunter Dickinson Group Inc. ("HDGI"), a related party to the Company, the Company was assigned by HDGI an 80% interest in two Pebble Property options ( the "Options") owned by HDGI, which included a call right for the Company to also acquire the 20% Interest (which was a carried interest to the point where the call right was exercised or expired). The Options had been obtained by HDGI from the arms-length owner of the Pebble Property, Teck Cominco American Incorporated ("Teck Cominco") and subject to certain terms and conditions, the Options gave HDGI the right to purchase and/or joint venture the Pebble copper-gold-molybdenum mining claims located in southwestern Alaska. One of the Options granted the right to purchase 100% of the lands containing the (then) known gold/copper mineralized resource at Pebble (the "Resource Lands Option") and the second Option granted the right to purchase a 50% interest in the exploration lands surrounding the Resource Lands (the "Exploration Lands Option") and to thereafter form a 50:50 joint venture. Alternatively, Teck Cominco could elect to sell its 50% interest in the Exploration Lands for shares of the Company worth $4 million which it elected to do leaving the Company and HDGI entitled to acquire 100% of the Exploration Lands as well as 100% of the Resource Lands.

HDGI is a related party by virtue of (i) having certain directors in common with the Company, and (ii) certain of its shareholders or their associates being at the time significant shareholders and/or directors of the Company. Under the Assignment Agreement HDGI assigned the 80% interest in the two Options for $1 plus the reimbursement to it of initial expenses incurred in connection with the Options. The Assignment Agreement was presented to and ratified by shareholders of the Company on June 28, 2002. The ratification vote also authorized the Company’s management to acquire the 20% Interest for its fair value, as independently appraised and subject to TSXV acceptance.

The Assignment Agreement provided that if the Company proceeded to exercise the 80% Options it could also acquire the 20% Interest. As a consequence of deciding to exercise the 80% interest in the Options, the Company was in position to acquire HDGI’s 20% Interest and so the Company formed the Special Committee to review and advise the Board in connection with the merits of the acquisition of the 20% Interest. The Special Committee is described above under the Corporate Governance disclosure above and it retained separate legal and financial advisors in connection with its deliberations. As a consequence of the unanimous recommendation of the Special Committee, the Company agreed with HDGI on March 15, 2005 to acquire the 20% Interest for 14,002,268 shares, which was share consideration based on a deemed value per share of $6.37. No commissions fees were payable in respect of the acquisition of the 20% Interest. The agreed number of shares was based on negotiations between the Company and HDGI with reference to an independent valuation of the carried interests performed by Ross Glanville & Associates Ltd. The valuation was publicly filed atwww.sedar.com. The TSXV and the American Stock Exchange ("AMEX") accepted the March 15, 2005 acquisition transaction in May and June 2005, respectively.

However, as a consequence of professional advice it was agreed in April 2006 that the acquisition of the 20% Interest would instead be completed by way of an acquisition of 100% of the shares of HDGI by the Company. HDGI’s only material asset is the 20% Interest and, net of its cash, it has no material liabilities. As a consequence of the acquisition of HDGI, the Company will be giving up potentially depletable tax cost basis which it would have obtained if the 20% Interest had been acquired directly from HDGI. However the discounted present value of these tax costs, based on amortization on an assumed 30 year mine life commencing in 2011 or later, was deemed by the Special Committee to be not material to the Company in the context of the benefits of achieving the 100% working interest in the Pebble Project by acquiring the 20% Interest. The five shareholders of HDGI who are insiders of the Company and who will each receive 2,000,324 shares for selling their HDGI shares to the Company are Messrs Dickinson, Mason, Copeland, Thiessen, and Cousens. Under the terms of the April 20, 2006, agreement these parties agreed to certain resale restrictions tied to time, share performance and new funding of the Company and as well, they agreed to reimburse the Company for up to $200,000 in professional fees in connection with the restructuring of the March, 2005 agreement. The TSXV advised in writing that they had no objection to the restructured agreement and AMEX gave similar verbal confirmation.

- 23 -

On completion of the acquisition of HDGI, Northern Dynasty, through one or more of its Alaskan subsidiaries, will indirectly own a 100% right title and interest in the entire Pebble property (subject only to a net profits interest by Teck Cominco in the Exploration Lands portion of the Pebble Property).

MANAGEMENT CONTRACTS

The details of the Company's services contract with Hunter Dickinson are described in the Company’s Annual Information Form filed atwww.sedar.com for the year ended December 31, 2005.

Except as set out herein in respect of Hunter Dickinson Inc., there are no management functions of the Company which are to any substantial degree performed by a person or company other than the directors or senior officers of the Company.

PARTICULARS OF MATTERS TO BE ACTED UPON

Approval of Change of Share Option Plan to a 10% Rolling Plan

The Company’s share option plan was approved by shareholders at the Company’s annual general meeting held on July 4, 2005 (the "Existing Plan"). Under the Existing Plan, the total number of Shares reserved for share incentive options for granting at the discretion of the Company’s board of directors to eligible optionees (the "Optionees") was fixed at 11,300,000 Shares (approximately 20% of the issued and outstanding Shares as at the record date for the 2005 annual general meeting). As at May 12, 2006, 3,625,300 (approximately 4.6% of the current issued and outstanding Shares) options were outstanding and 4,425,034 (approximately 5.6% of the current issued and outstanding Shares) options to purchase Shares have been exercised by the Optionees under the Existing Plan. There remain only a further 3,249,666 (approximately 4.1% of the current issued and outstanding Shares) Shares available for granting as options under the Existing Plan.

In January 2005 the TSXV revised its policies to permit a company to have a share option plan with a rolling maximum based on a percentage of a company’s outstanding securities. In addition, certain amendments to the options are permitted if the ability to amend the option is contained in the share option plan approved by shareholders.

As of May 12, 2006, there were 78,913,067 Shares issued and outstanding. Pursuant to the proposed plan (the "2006 Plan"), which is based on a percentage of up to 10% of the rolling number of the Company's outstanding Shares, as the outstanding options are exercised and the issued and outstanding Shares of the Company increases, the number of options available for granting to eligible Optionees will increase.

Material Terms of the Proposed 2006 Plan

The following is a summary of the material terms of the 2006 Plan:

persons who are directors, officers, employees, consultants to the Company or its affiliates, or who are employees of a management company providing services to the Company are eligible to receive grants of options under the 2006 Plan;

all options granted under the 2006 Plan are non-assignable and non-transferable and are exercisable for a period of up to 10 years depending on whether the Company achieves Tier 1 status on the TSX-V;

for stock options granted to employees or service providers (inclusive of management company employees), the Company must ensure that the proposed Optionee is a bona fide employee or

- 24 -

- service provider (inclusive of a management company employee), as the case may be, of the Company or of any of its subsidiaries;

- if an Optionee ceases to be employed by the Company or management company (other than as a result of termination with cause) or ceases to act as a director or officer of the Company or a subsidiary of the Company, any option held by such Optionee may be exercised within 90 days after the date such Optionee ceases to be employed or act as an officer or director (30 days if the Optionee is engaged in investor relations activities);

- the exercise price of the option is established by the board of directors at the time of the option is granted, subject to a the minimum exercise price of not less than the Market Price (defined in the policies of TSXV to be generally the prevailing market price less up to a 15% discount). In the event the Company achieves a listing on a more senior exchange this provision will be changed to the 5 day weighted average price of the Company’s shares immediately prior to the date of grant;

- no individual Optionee can be granted an option or options to purchase more than 5% of the outstanding listed shares of the Company in a one year period; and

- subject to the policies of the TSXV, the 2006 Plan may be amended without shareholder approval to:

- make amendments which are of a "housekeeping" or clerical nature only;

- change the vesting provisions of an option;

- change the termination provision of an option granted hereunder which does not entail an extension beyond the original expiry date of such option; and

- make such amendments as reduce, and do not increase, the benefits of the 2006 Plan to Service Providers.

- make amendments which are of a "housekeeping" or clerical nature only;

Disinterested Shareholder Approval

In accordance with the requirements of the TSXV and the terms of the 2006 Plan, the 2006 Plan must be approved by the disinterested shareholders if under the New Plan:

the number of options granted to insiders of the Company may exceed 10% of the Company’s outstanding listed Shares; and

the number of options granted to insiders of the Company within a one year period may exceed 10% of the Company’s outstanding listed Shares.

"Disinterested Shareholder Approval" means the approval by a majority of the votes cast by all shareholders of the Company at the Meeting, excluding votes attached to Shares beneficially owned by insiders of the Company to whom the options have been granted under the Existing Plan and associates of those insiders.

For the purposes of the disinterested shareholder vote, a total of 28,873,415 Shares held by insiders entitled to receive or benefit under the 2006 Plan will not be eligible to vote on the resolution. An insider is a director, or senior officer of the Company, a director or senior officer of a company that is an insider or subsidiary of the Company, a person that beneficially owns or controls, directly or indirectly, voting Shares carrying more than 10% of the voting rights attached to all outstanding voting Shares of the Company. If the 2006 plan does not pass by the vote of a majority of disinterested shareholders, a second vote will be held as described below. At

- 25 -

the Meeting, the Company’s transfer agent and registrar will be directed to exclude votes on this resolution by such insiders and associates.

If the resolution is not approved by the disinterested shareholders, then a second vote will be held where insiders and their associates will be permitted to vote, and the 2006 Plan may be approved; however, in this instance, insiders will not be granted options for more than 10% of the outstanding listed Shares and option grants to insiders in a one year period will not exceed 10% of the outstanding listed Shares.

At the Meeting, shareholders will be asked to consider and, if thought fit, pass a resolution as follows:

"RESOLVED THAT THE COMPANY ADOPT A SHARE OPTION PLAN AND THAT UP TO 10% OF THE COMPANY’S ISSUED AND OUTSTANDING SHARES AT THE TIME THE OPTION IS GRANTED BE RESERVED FOR ISSUANCE TO ELIGIBLE OPTIONEES SUBJECT TO THE TERMS OF THE 2006 PLAN PRESENTED TO THE MEETING."

Recommendation