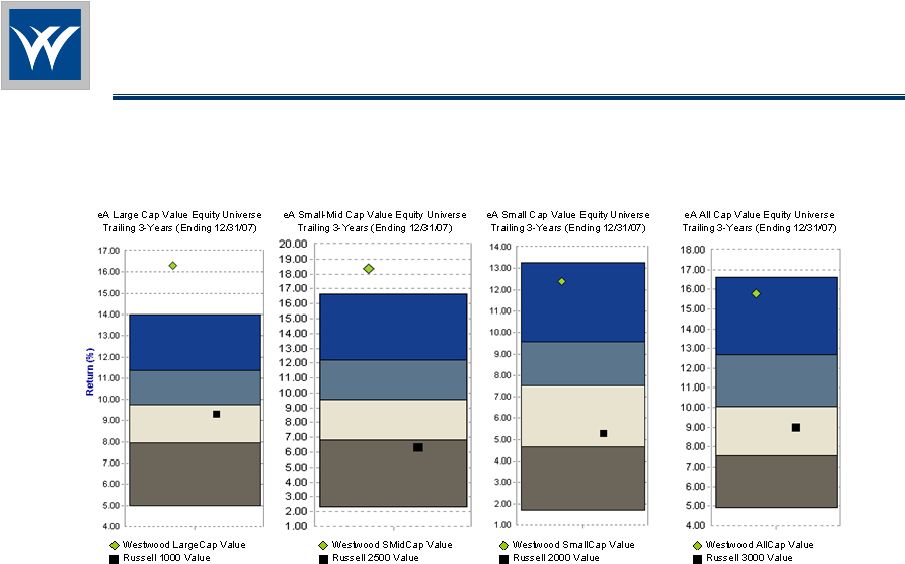

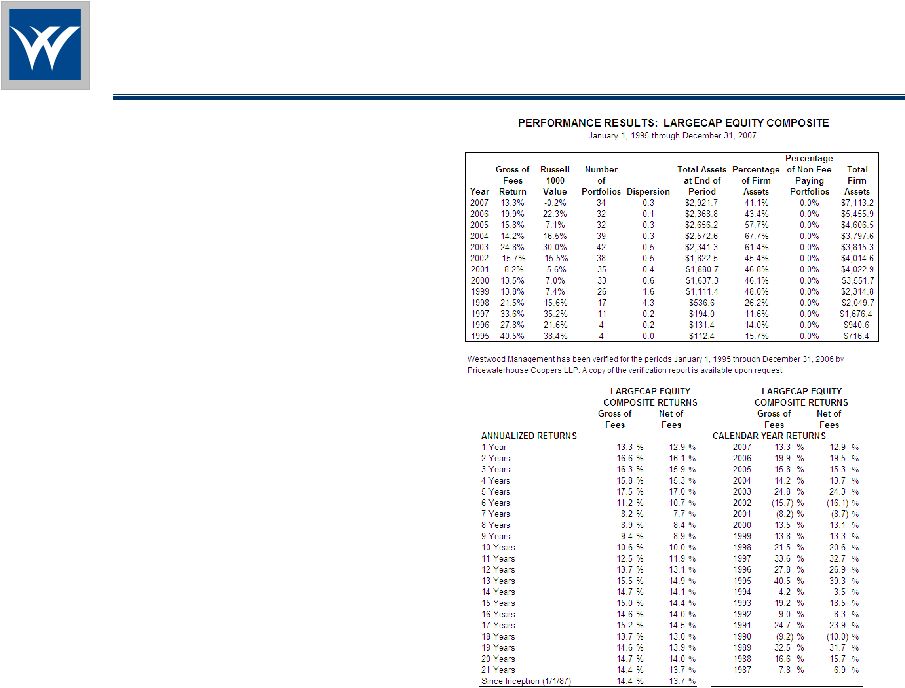

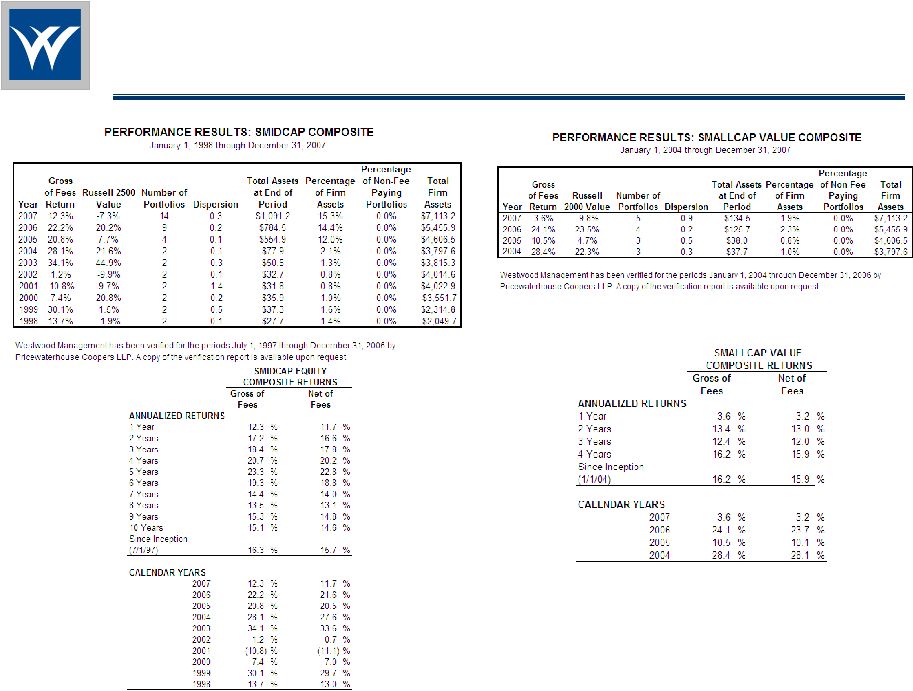

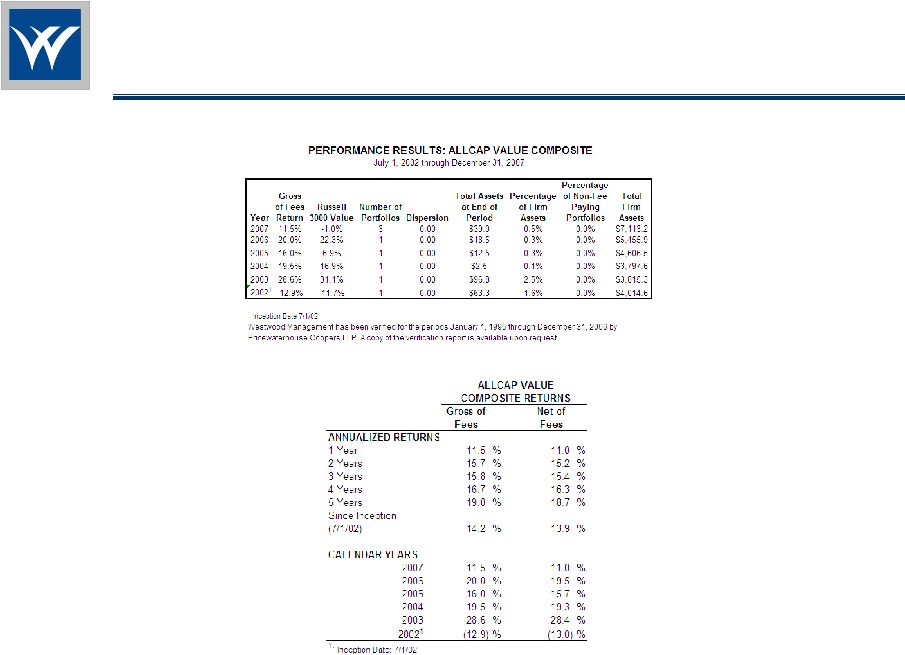

Disclosure Information Westwood Management Corp. (Westwood) has prepared and presented this report in compliance with the Global Investment Performance Standards (GIPS ® ). GIPS ® has not been involved with the preparation or review of this report. Past performance is no guarantee of future results. Westwood is a registered investment advisory firm that provides investment supervisory services, managing equity and fixed income portfolios. Westwood is a wholly owned subsidiary of Westwood Holdings Group, Inc. (NYSE: WHG). The inception dates for the Westwood composites are: LargeCap Equity (1/1/87); SMidCap Equity (7/1/97); SmallCap Value (1/1/04); AllCap Equity (7/1/02); REIT (7/1/95); Income Opportunity (1/1/03); Fixed Income - Core (4/1/85); Fixed Income - Intermediate Bond (10/1/90); Balanced (1/1/87); MLP Infrastructure Renewal Fund (1/1/03). A complete list and description of the firm's composites and historical performance records are available upon request. The calculation of returns is computed on a monthly basis (starting 1/1/02) for the composites; including accrued dividends and interest income. Securities are valued as of trade-date. Monthly returns are asset-weighted based on the portfolio market values at the beginning of each month. Accounts in the composite, must be under management for the entire reporting period. The minimum portfolio size for inclusion in the Westwood Composites, except the MLP Infrastructure Renewal Fund Composite, is $5 million dollars beginning January 1st, 2006. The minimum portfolio size for the MLP Infrastructure Renewal Fund Composite is $1 million dollars beginning January 1st, 2004. Carve-outs returns are allocated using the beginning of period allocation method. The currency used to express performance in all composites is US dollars. Additional information regarding policies for calculating and reporting returns is available upon request. The comparative index returns include interest and dividend income but do not include potential transaction costs or management fees. Performance results are calculated gross of investment management fees but after all trading expenses. The net of fees composite returns may not be reflective of performance in your account. Actual results may vary depending on level of assets and fee schedule. Performance results net of management fees reflect the actual rate of fees paid and after all trading expenses. Westwood’s fee schedules are: LargeCap Equity 0.75% on the first $25 million, negotiable thereafter; SMidCap Equity 0.85% on the first $25 million, negotiable thereafter; SmallCap Value 1.00% on the first $10 million, negotiable thereafter; AllCap Equity 0.80% on the first $10 million, negotiable thereafter; REIT 0.75% on the first $10 million, negotiable thereafter; Income Opportunity 0.80% on the first $10 million, negotiable thereafter; Fixed Income - Core Bond 0.40% on the first $10 million, negotiable thereafter; Fixed Income - Intermediate Bond 0.40% on the first $10 million, negotiable thereafter; Balanced 0.625% on the first $25 million, negotiable thereafter; MLP Infrastructure Renewal Fund 1.00% on the first $10 million, negotiable thereafter. All fees are stated in annual rates and are typically billed quarterly. More information on Westwood's management fees is available upon request in its Form ADV, Part II. Internal dispersion is calculated using the asset-weighted standard deviation of all portfolios that were included in the composite for the entire year. Westwood Management is in compliance with GIPS ® standards since January 1, 1993. Westwood Management has been verified for the periods January 1, 1995 through December 31, 2006 by PricewaterhouseCoopers LLP. A copy of the verification report is available upon request. |