UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to.

Commission file number 001-33691

PROCERA NETWORKS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 33-0974674 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 47448 Fremont Boulevard | 94538 | |

| Fremont, California | (Zip Code) | |

| (Address of principal executive offices) |

Registrant’s telephone number, including area code: (510) 230-2777

Securities registered pursuant to Section 12(b) of the Act

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock par value $0.001 per share | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§232.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer þ | |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ☑

The aggregate market value of the voting stock held by non-affiliates of the registrant on June 30, 2014, based upon the closing price of the common stock on such date as reported on the NASDAQ Global Market, was approximately $155,061,041. Shares of voting stock held by directors, officers and stockholders or stockholder groups whose beneficial ownership exceeds 5% of the registrant’s common stock outstanding have been excluded in that such persons may be deemed to be affiliates. The number of shares owned by stockholders whose beneficial ownership exceeds 5% was determined based upon information supplied by such persons and upon Schedules 13D and 13G, if any, filed with the Securities and Exchange Commission. This assumption regarding affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of common stock outstanding as of March 10, 2015 was 20,767,968.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement for its 2015 Annual Stockholders’ Meeting or an amendment to this Annual Report on Form 10-K to be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2014 are incorporated by reference into Part III of this Annual Report on Form 10-K.

PROCERA NETWORKS, INC.

FISCAL YEAR 2014

Form 10-K

ANNUAL REPORT

| PART I | 4 | ||

| Item 1. | 16 | ||

| Item 1A. | 31 | ||

| Item 1B. | 31 | ||

| Item 2. | 31 | ||

| Item 3. | 31 | ||

| Item 4. | 31 | ||

| PART II | 32 | ||

| Item 5. | 32 | ||

| Item 6. | 34 | ||

| Item 7. | 35 | ||

| Item 7A. | 49 | ||

| Item 8. | 50 | ||

| Item 9. | 78 | ||

| Item 9A. | 78 | ||

| Item 9B. | 80 | ||

| PART III | 80 | ||

| Item 10. | 80 | ||

| Item 11. | 87 | ||

| Item 12. | 100 | ||

| Item 13. | 102 | ||

| Item 14. | 103 | ||

| PART IV | 104 | ||

| Item 15. | |||

| 106 | |||

| 108 | |||

| Exhibit 23.1 | |||

| Exhibit 23.2 | |||

| Exhibit 31.1 | |||

| Exhibit 31.2 | |||

| Exhibit 32.1 | |||

In addition to historical information, this Annual Report on Form 10-K contains forward-looking statements regarding our strategy, financial performance and revenue sources that involve a number of risks and uncertainties, including those discussed under the title “RISK FACTORS” in Item 1A. Forward-looking statements in this report include, but are not limited to, those relating to our potential for future revenues; revenue growth and profitability; markets for our products; our ability to continue to innovate and obtain intellectual property protection; operating expense targets; liquidity; new product development; the possibility of acquiring (and our ability to consummate any acquisition of) complementary businesses, products, services and technologies; the geographical dispersion of our sales; expected tax rates; our international expansion plans; and our development of relationships with providers of leading Internet technologies. In some cases, you can identify forward-looking statements by terms such as “believe”, “expects”, “anticipates”, “intends”, “estimates”, “projects”, “target”, “goal”, “plans”, “objective”, “should”, or similar expressions or variations on such expressions.

While these forward-looking statements represent our current judgment on the future direction of our business, such statements are subject to many risks and uncertainties which could cause actual results to differ materially from any future performance suggested in this Annual Report on Form 10-K due to a number of factors, including, without limitation, our ability to produce and commercialize new product introductions; our ability to successfully compete in an increasingly competitive market; the perceived need for our products; our ability to convince potential customers of the value of our products; the costs of competitive solutions; our reliance on third party suppliers; continued capital spending by prospective customers and macro-economic conditions. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We undertake no obligation to publicly release any revisions or updates to forward-looking statements to reflect events, information or circumstances arising after the date of this document, except as required by federal securities laws. Therefore, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in these forward-looking statements. See “RISK FACTORS” appearing in Item 1A.

Throughout this Annual Report on Form 10-K, we refer to Procera Networks, Inc., a Delaware corporation, as “Procera” or the “Company” and, together with its consolidated subsidiaries, as “we”, “our” and “us”, unless otherwise indicated. Any reference to “Netintact” refers collectively to our wholly owned subsidiaries, Procera Networks AB (formerly Netintact AB), a Swedish corporation, and Netintact, PTY, an Australian corporation.

PART I

We are a leading provider of Subscriber Experience Assurance, or SEA, solutions designed for network operators worldwide. Our PacketLogic solutions enable network operators to gain insights, make decisions, and take actions to ensure a high quality experience for Internet connected devices. Network operators deploy our technology to gain insights on their subscribers and networks, make decisions on service packaging and then deliver those solutions to subscribers connected to their network. We believe that the intelligence our products provide about subscribers and their experience enables our network operator customers to make better-informed business decisions and increases customer satisfaction in the highly competitive worldwide broadband market. Our network operator customers include service provider customers and enterprises. Our service provider customers include mobile service providers and broadband service providers, which include cable multiple system operators, or MSOs, telecommunications companies, Wi-Fi network operators, and Internet Service Providers, or ISPs. Our enterprise customers include educational institutions, commercial enterprises and government and municipal agencies. We sell our products directly to network operators; through partners, value added resellers and system integrators; and to other network solution suppliers for incorporation into their network solutions. Our products are delivered to network operators through pre-packaged hardware or as virtualized software, which we expect to become a larger part of our business going forward and open up new partnership opportunities.

Our SEA solutions are part of the high-growth market for mobile packet and broadband core and access products. This market is composed of three separate addressable market opportunities:

Deep Packet Inspection Market

Our products are sold either bundled with hardware or as pure software to deliver a solution that is a key element of the mobile packet and fixed broadband core ecosystems. Our solutions are often integrated with additional elements in the mobile packet and broadband core, including Policy Management and Charging functions, and are compliant with the widely adopted 3rd Generation Partnership Program, or 3GPP, standard. In order to respond to rapidly increasing demand for network capacity due to increasing subscribers and usage, service providers are seeking higher degrees of intelligence, optimization, network management, service creation and delivery in order to differentiate their offerings and deliver a high quality of experience to their subscribers. We believe the need to create more intelligent and innovative mobile and broadband networks will continue to drive demand for our products. We also sell our embedded Network Application Visibility Library, or NAVL, solutions to other network equipment vendors. Our embedded solutions enable network solutions suppliers to more quickly add application awareness to their platforms, since our NAVL Deep Packet Inspection, or DPI, engine products have been designed to be highly portable among many platforms and processors. NAVL eliminates the need for network solutions providers to research and develop their own DPI technology, saving significant time and resources while enabling them to more effectively compete in their market space. NAVL enables us to achieve indirect market share in the DPI market by supplying embedded solutions with our DPI engine. The market for DPI products was $887.0 million in 2014 and is expected to grow to just under $2.0 billion in 2018, a 2013–2018 compounded annual growth rate, or CAGR, of 22%.

Customer Experience Management (CEM) Market

In 2014, we introduced two significant products that increase our total addressable market: RAN Perspectives and our Insights Product Family. RAN Perspectives is a Subscriber Identity Module, or SIM-based applet, that a mobile operator can deploy on devices connected to their network. The applet will report the subscriber’s location and the signal strength and quality that their device has with the mobile network. This enables our solutions to have real-time location awareness and visibility into the Radio Access Network, or RAN, to complement our existing visibility into the broadband data network. Our Insights Product Family consists of unique visualization of our SEA solutions based on different roles inside of a network operator – Engineering, Customer Care, Marketing and Executives. By combining these two intelligence metrics, we are now competing in the Customer Experience Management, or CEM, market with companies such as Gigamon, NetScout, Ericsson, Huawei and other larger telecom vendors. MarketsandMarkets forecasts the CEM market to grow from $3.77 billion in 2014 to $8.39 billion in 2019. This represents a CAGR of 17.3% from 2014 to 2019.

Telecom Big Data Analytics Market

Procera’s Insights Product Family of products will compete with traditional big data products from companies such as IBM, Guavus and Zettics. Mind Commerce expects the Big Data driven telecom analytics market to grow at a CAGR of nearly 50% between 2014 and 2019. By the end of 2019, the market will eventually account for $5.4 billion in annual revenue.

Our products are marketed under the PacketLogic and NAVL brand names. We have a broad spectrum of products delivering SEA at the access, edge and core layers of the network. Our products are designed to offer maximum flexibility to our customers and enable differentiated services and revenue-enhancing applications, all while delivering a high quality of experience for subscribers. These products are offered as virtual or hardware appliances to customers, enabling them to choose their platform based upon their deployment needs and preferences.

On January 9, 2013, we completed our acquisition of Vineyard Networks Inc., or Vineyard, a privately held developer of Layer 7 DPI and application classification technology located in Kelowna, Canada. Vineyard’s integrated DPI and application classification technology provides enterprise and service provider networking infrastructure vendors with these capabilities through its integrated software suite, primarily through a variety of subscription-based original equipment manufacturer and partner agreements. This acquisition complements our hardware and application software-based DPI solutions, expands the way we sell solutions to customers, and increases our customer base, previously comprised primarily of network operators, thereby allowing us to provide complementary technology and solutions to a greater number of customers.

We were incorporated in the State of Nevada in 2002 and, in June 2013, we reincorporated from the State of Nevada to the State of Delaware. Our Company is headquartered in Fremont, California and we have key operating entities in Kelowna, Canada and Varberg, Sweden, as well as a geographically dispersed sales force. We sell our products through our direct sales force, resellers, distributors, system integrators and other equipment manufacturers in the Americas, Asia Pacific, Europe, the Middle East and Africa. Our corporate website address is www.proceranetworks.com. Investors may access our filings with the Securities and Exchange Commission, including our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and amendments to such reports on our website, free of charge, at www.proceranetworks.com, but the information on our website does not constitute part of this Annual Report on Form 10-K and is not incorporated by reference.

Industry Background

Network traffic has risen sharply in recent years as a result of the advent of ubiquitous broadband Internet Protocol, or IP, and mobile networks covering an increasing portion of the world’s population, the proliferation of sophisticated edge devices, including smartphones, tablets and laptops and the rise in connections, communications, social networking and data-intensive applications. According to the Cisco Visual Networking Index, globally, IP traffic will grow threefold from 2013 to 2018, a compound annual growth rate of 21%. Internet video is forecast to grow at a compound annual growth rate of 30%, up from 76.6 Exabytes per month in 2013. Mobile data traffic is forecast to reach 24 Exabytes per month in 2019, a compound annual growth rate of 57%.

Mobile data networks are an essential tool for consumers for streaming video, social networking and collaboration. Consumers are accessing content from multiple mobile broadband connections and have high expectations that this information will be available in real-time. Social networking, applications and entertainment content resides in the cloud in real-time and without quality access to the Internet, consumer access can be disrupted. Consumers are highly sensitive to disruptions and outages in mobile networks which can become headline news items. As networks advance in both speed and capacity, new advanced devices and applications will spur more competition for scarce bandwidth – including the Internet of Things, which is beginning to take hold through connected cars and other intelligent devices. This results in greater network congestion, causing network operators to balance subscriber demand for network bandwidth with the cost of building additional capacity. In addition, network providers must be able to adapt to evolving user behavior by rapidly introducing new services and business models to keep pace with demand, which we call service personalization. Our SEA solutions enable mobile and broadband network operators to provide high levels of personalization, service optimization, network assurance and rapid service creation to monetize network investments. Personalization is tailoring service plans to the needs of the consumer. For example, social networking users may judge Quality of Experience, or QoE, through their Facebook experience and video streamers may judge QoE by the speed and quality of Netflix or YouTube video downloads. A critical element for network operators to keep pace with demand and cope with evolving user behavior is to gain as much insight as possible into network activity at levels of detail that are not possible with existing routers, switches and broadband termination devices.

3GPP Policy Ecosystem

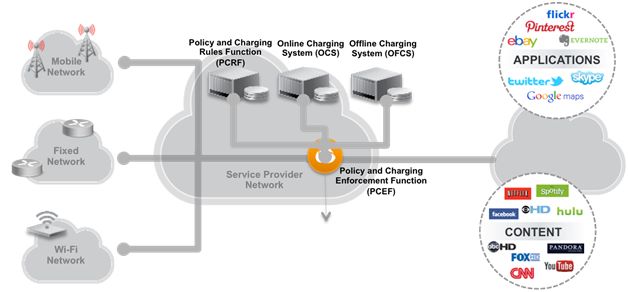

Within 3GPP, a framework has been defined for Policy Management and Policy Enforcement:

With the policy framework established by 3GPP, a management layer and an enforcement layer were created to control user behavior and network provisioning. The Policy and Charging Rules Function, or PCRF, was established as the policy decision point that establishes the policies that are applied to subscribers and mobile data traffic on the network. The Offline and Online Charging Systems (OFCS and OCS) were established as the charging entities on the network. The management layer on the network has specifically defined protocols for interacting with the network layer to translate the policy decisions into policy enforcement.

The policy enforcement layer on the network is designed to enforce policies as instructed by the policy management layer. However, different devices on the network have different levels of visibility and intelligence, translating to different capabilities for enforcing policies. More intelligent network elements can implement more sophisticated policies. Sophisticated policies go far beyond simple byte counters or session timers and can include subscriber, location, device and application awareness. Awareness gives a powerful advantage in the policy enforcement and billing ecosystem in that policy enforcement “instructions” for highly aware network elements can be much simpler than for “unaware” enforcement points. A contrasting example of this scenario would be if a PCRF is informed of congestion on a specific location, an intelligent policy enforcement point could be passed an instruction to “prioritize real-time applications at Site A”, where an unaware enforcement point would need to pass a number of new rules that might match specific devices and flows using access control lists, or a much less sophisticated congestion management policy that might make all users equally unsatisfied. The signaling load on the network normally will be considerably lower on an intelligent network than on an unaware network, as intelligent systems have a greater awareness of location, devices and applications for each active subscriber on the network.

Subscriber Experience

The broadband market is increasingly becoming a subscriber experience battleground. Incumbent operators are trying to retain their subscribers, and emerging competitive operators are trying to introduce disruptive billing models and an enhanced customer experience to poach subscribers. As the cost of re-acquiring subscribers can range from 5-7x the cost of acquiring a new subscriber, it is more important than ever for operators to ensure that they minimize customer losses while attracting as many high value subscribers as possible.

Our SEA solutions enable mobile and broadband network operators to provide exceptional levels of service to attract and maintain their subscriber base. SEA solutions use DPI technology as the core technology to gain awareness of subscribers, location, devices and applications. This awareness can then be used with an operator’s network to deliver superior collection of services and applications to mobile and broadband networks. This occurs in three distinct phases as operators deploy SEA solutions:

First, Operators Gain Insights from SEA solutions to understand the subscriber experience on their network. This intelligence ranges from very basic (traffic volume) to very sophisticated (location awareness), with each SEA metric adding specific value to the network operator’s network insights. Many of the more complex metrics add the most value, and therefore can have a greater impact on the ability of the operator to determine the real quality of experience delivered by their network:

With this information, network operators can Make Decisions on how to best package and deliver services to their subscribers. These decisions drive their overall business model, including how they will invest capital expenditures, or CAPEX, and operating expenses, or OPEX, to maintain their network as well as how they will offer services to their subscribers. Detailed insights enable them to tailor their service offerings to match the actual consumption of different subscriber groups through service personalization for maximizing revenue. It also allows them to optimize their return on investment on their capital by ensuring that investments in their network infrastructure have a direct impact on the subscriber experience. These decisions must combine the inputs of Engineering, Marketing, Customer Care, and Executives to ensure that the entire subscriber lifecycle is delivered with a high quality of experience. Each department must be presented with the relevant intelligence to their decision-making process, and that information must be tailored to their business needs. When these insights are presented visually with recommended actions, each department can move forward with their implementation plans.

Finally, the operators must take action to improve subscriber experience across their network and service offerings. This requires SEA solutions deployed in the network that can enforce policies at the same level of intelligence granularity that collected the initial subscriber experience intelligence. Enforcement must occur in real-time, as even momentary network issues are now visible to subscribers with services like streaming video, Voice over Internet Protocol, or VOIP, and social networking. Actions that can be taken on the network include congestion management, policy and charging, mitigation and traffic steering, each of which can be used to improve the subscriber experience.

Virtualization

Network Function Virtualization, or NFV, has been championed by network operators globally as a technology that will enable them to transform their networks into an agile infrastructure that is able to adapt to the changing landscape of broadband consumer usage.

In January 2013, the European Telecommunications Standards Institute, or ETSI, launched an initiative sponsored by seven of the largest operators in the world: AT&T, BT, Deutsche Telekom, Orange, Telecom Italia, Telefonica and Verizon to establish requirements and an architecture for the virtualization of network functions. Since that time it has grown to over 220 individual companies, including 37 of the world’s major service providers as well as representatives from both telecoms and IT vendors. The NFV member companies see tremendous potential in NFV for telecommunications deployments. The stated goals from the ETSI NFV initiative are focused around business benefits, but include potential solutions for challenges that may arise from the shift to commercial-off-the-shelf hardware from specialized hardware. The goals include reducing CAPEX through cost savings on hardware, reducing OPEX through cost savings on hardware (both support and through running multiple software packages on a single hardware platform), reducing time to market for new services through faster solution deployment on pre-positioned hardware platforms, and greater network flexibility through service orchestration technology. Network operators are demanding that solution providers of all types deliver their solutions in a virtualized offering, and this trend has the potential to shift the entire vendor landscape in the telecommunications market. Our technology is well suited for the shift to software-based solutions, and we believe we can take a leading role in the shift to virtualization for network operators.

In January 2013, the European Telecommunications Standards Institute, or ETSI, launched an initiative sponsored by seven of the largest operators in the world: AT&T, BT, Deutsche Telekom, Orange, Telecom Italia, Telefonica and Verizon to establish requirements and an architecture for the virtualization of network functions. Since that time it has grown to over 220 individual companies, including 37 of the world’s major service providers as well as representatives from both telecoms and IT vendors. The NFV member companies see tremendous potential in NFV for telecommunications deployments. The stated goals from the ETSI NFV initiative are focused around business benefits, but include potential solutions for challenges that may arise from the shift to commercial-off-the-shelf hardware from specialized hardware. The goals include reducing CAPEX through cost savings on hardware, reducing OPEX through cost savings on hardware (both support and through running multiple software packages on a single hardware platform), reducing time to market for new services through faster solution deployment on pre-positioned hardware platforms, and greater network flexibility through service orchestration technology. Network operators are demanding that solution providers of all types deliver their solutions in a virtualized offering, and this trend has the potential to shift the entire vendor landscape in the telecommunications market. Our technology is well suited for the shift to software-based solutions, and we believe we can take a leading role in the shift to virtualization for network operators.

Industry Growth Catalysts

According to Infonetics Research, the market for DPI products was $887.0 million in 2014 and is expected to grow to $2.0 billion in 2018, a 2013–2018 compounded annual growth rate of 22%. The increasing necessity for DPI will be spurred by growing subscriber demand for mobile content and applications, coupled with the network operators’ need to control usage, cost and create new personalized services. Growth will be aided in part by:

Increase in global broadband users – Broadband connectivity has become globally ubiquitous, particularly as underdeveloped and developing markets continue to gain increased broadband access. Global mobile broadband subscriptions passed 3.6 billion in 2014, and are predicted to grow to 4.6 billion by 2019. The number of unique devices (excluding machine-to-machine, or M2M) is forecasted to grow from 7.1 billion to a billion by 2020. We believe that the mobile network will continue to be the dominant broadband access network going forward. This increase in the number of broadband users is placing significant stress on bandwidth capacity. Network operators need to implement new tiered service plans and business models that utilize SEA solutions in order to effectively manage their user growth and deliver a high quality subscriber experience.

Device penetration – Mobile network operators have made significant investments in new technology to increase network performance and alleviate bandwidth congestion. At the same time, new mobile devices, including smartphones and tablets, are being introduced to take advantage of higher capacity 3G and LTE networks. IDC forecasts that mobile phones are expected to dominate overall device shipments, with 1.3 billion mobile phones shipped in 2014. It also forecasted that the worldwide tablet market will grow 47% with lower average selling prices attracting new users. Unlike legacy devices, new smartphones and tablets are designed to take advantage of data-intensive services, like video and gaming, which will deplete available capacity. In addition, The Internet of Things is beginning to take hold, with connected cars, mobile payments, and wearables making significant inroads in 2014, and will continue to become more pervasive in the future. Mobile network operators will need to continue to adopt SEA solutions that provide more sophisticated network insights and actions and include subscriber, location, device and application awareness.

Competitive pressure across network operators – The competition among network operators continues to increase as they battle for the latest generation of broadband users and seek to capture new revenue opportunities. It is incumbent upon network operators to upgrade their networks while they simultaneously improve user experience to grow their subscriber bases. Network operators who adapt best to the evolving requirements of their users with more flexible business models and service plans should be well positioned to attract and retain subscribers. In order to do so, we believe that operators will need to integrate SEA solutions into their existing network infrastructure.

Industry Challenges

The industry also faces a number of challenges as an increasing amount of bandwidth is necessary to run increasingly sophisticated and data-intense applications. These network operator challenges include:

De-coupling of usage and revenue – In recent years, network capacity and service speeds have increased along with progressively sophisticated edge devices connected to the network such as smartphones, tablets and laptops, resulting in a tremendous surge of network traffic. A large catalyst of this surge is the ease of capture, ingestion and delivery of video, coupled with emerging business models for video publishing. In addition, new business models and the increasing popularity of applications have turned mobile handsets into mobile entertainment devices. However, this surge in traffic has not been accompanied by a similar rise in revenue in large part due to unlimited usage subscriptions and application models that have circumvented the service provider billing systems, excluding the service providers’ revenue participation.

Multiple devices per user – As mobile connectivity becomes more pervasive, users in developed markets are increasingly adopting sophisticated devices. In addition to smartphones, a typical user can have multiple devices connected to the network, including tablets, e-readers, netbooks, laptops, televisions, gaming devices, digital music players, cameras, wearables, cars, and more. Machine-to-machine connectivity is becoming pervasive on the mobile network, further increasing the number of connected devices. This incremental device population is increasing traffic on the network, often without a proportional revenue increase.

New data-intensive applications – The advent of smartphones and tablets has enabled an ecosystem of applications that are increasing in popularity among users. Many of these applications are free to download and use, but are very data-intensive. Social networking applications in particular have led to constant subscriber connectivity and frequent information synchronization, which translates to higher session counts per user. Apple’s Siri and iCloud applications have dramatically increased background mobile data traffic for Apple devices and the increasing use of cloud-based services will only continue to drive bandwidth usage up on a per user basis.

Limited service differentiation – Mobile and broadband network operators have been limited in their ability to view and identify network traffic, which has therefore limited their ability to appropriately charge and differentiate themselves by offering advanced services. LTE mobile networks have begun to shift the charging models from unlimited to tiered service offerings, and many operators are adding more differentiation in their service offerings to accommodate both light and heavy users of applications, and offering value to high volume users of streaming services and social networking through many of their service plans.

Our Technology

The foundational element of our SEA solutions is our Datastream Recognition Definition Language, or DRDL, which is Procera’s core DPI technology. DRDL facilitates a broad range of criteria to properly identify the application of each individual datastream. The identification relies on bidirectional information, including header information, protocol, actual payload and other distinguishing characteristics of an application. This allows DRDL to properly identify even encrypted applications, which are becoming the norm on networks today.

The standard-syntax language of DRDL enables rapid development of new signatures. The DRDL database currently consists of over 2,300 signatures. DRDL interconnects control and data sessions of protocols like File Transfer Protocol, or FTP, VOIP and streaming media. During the identification process, DRDL aggregates detailed traffic properties like Multipurpose Internet Mail Extensions, or MIME, type, filename, chat channel and Session Initiation Protocol, or SIP, caller ID. A unique and integral feature of DRDL is the classification function. Connection flags classify the traffic based on its behavior. Typical classifications are “interactive”, “streaming”, “random-looking” and “bulky”. This classification system enables network operators to set preferences on unidentifiable traffic or when they need to be application agnostic.

We believe that our technology has several advantages that we extend to our mobile and broadband network operator customers, including:

Radical Simplicity – We believe our solutions are more powerful for service creation and service delivery than competitive solutions without sacrificing ease-of-use. Our Insights products are targeted at specific audiences inside the operator, and require little customization.

Service Flexibility – Our DRDL technology allows for a high degree of service flexibility. Our subscriber model is highly configurable to meet the varying needs of our customer base. We also enable our customers to provide mass personalization for their subscriber base, creating and delivering services based on individual customer needs and behaviors.

Granular Accuracy – We also provide deep visibility into our customers’ networks, enabling visibility to a subscriber level to determine location and device usage to enable a high degree of personalization and customer service. This also allows our customers to enforce policies on their network. RAN Perspectives and the Insights Product Family are especially notable in this area, with each providing unique details about subscriber connections that are not commonly available from other network intelligence solutions.

Performance & Scalability – We believe that our DRDL technology is robust and has industry-leading performance that supports millions of subscribers and tens of thousands of transactions per second.

Real-Time Analytics – All of our analytics are delivered in real-time, providing up-to-the-second visibility to our customers of subscriber location, behavior and activity. This allows our customers to deliver a high degree of QoS to their subscribers and manage network capacity. Our report studio technology delivers detailed business intelligence and reports, and has deep application visibility.

Virtualization – We believe that our software technology was designed as pure software, and as a result, has adapted to the NFV market shift faster than any of our competitors. We were the first to announce and demonstrate NFV based solutions, and our NFV solutions have a higher level of demonstrated performance than any other competitor to date.

Our Products & Solutions

We deliver SEA solutions for network operators, leveraging our industry-leading DRDL technology. Our solutions empower network operators with the ability to support more subscribers and services on their network with high performing and highly-scalable SEA systems. Our SEA solutions support deep levels of awareness and a broad universe of applications, enabling richer services to be offered to consumers. Our analytics and decision-making solutions provide highly targeted business intelligence reports that enable service providers to better understand consumer trends and rapidly respond to the dynamic subscriber experience landscape.

Product Lines

Our SEA solutions consist of four main product offerings that we market today:

Perspectives: Perspectives represents the Gain Insights component of the SEA solution. Each PacketLogic Perspective provides unique intelligence on the network and subscriber activity. The intelligence from each Perspective can be used for both analytics as well as enforcement throughout the PacketLogic solutions. The perspectives offered by Procera include:

| - | Traffic: Application awareness (i.e. classic DPI capabilities) |

| - | Subscriber: Subscriber awareness gained through integration with Business Support/Operational Support/Policy systems |

| - | RAN: Radio Access Network location and quality awareness from 3GPP signaling |

| - | Topology: Cable, Digital Subscriber Line, or DSL, fiber optics and WiFi location awareness through various Operational Support Systems integrations |

| - | Content: Uniform Resource Locator, or URL, categorization in real time of up to 100M URLs through various databases |

| - | Device: Device awareness through DPI and device database integrations |

| - | Routing: Peering awareness through integration with BGP signaling |

| - | Video: Over-the-top content and Managed Video service awareness through DPI on video traffic |

Presentation: Presentation represents the Make Decisions component of the SEA solution. The intelligence gathered in the PacketLogic Perspectives is presented to different audiences inside the network operator depending on when and how they need to see that data. The Presentation products offered by Procera include:

| - | Engineering Insights: Engineering-centric presentation on network and subscriber intelligence showing typical application and content consumption, subscriber tiering, peering usage and quality, network trends and forecasts, and location-specific usage and quality measurements |

| - | Customer Care Insights: Single-subscriber views designed to provide first-line customer care with a complete picture of a subscriber’s usage and network quality, including potential root cause analysis of issues that the customer may be experiencing |

| - | LiveView: A real-time view of the network designed for network engineers, with network segmentation by different perspectives (subscriber, application, location, service plans, etc.) that can be drilled down to a single subscriber session |

Products: Products represent the Take Action component of the SEA solutions. The products that we offer to the market today are:

| - | Statistics: Collection and storage of the statistical intelligence gleaned by Perspectives |

| - | Policy and Charging: Enforcement based on charging or policies set by PacketLogic or other integrations |

| - | Congestion Management: Managing congestion in the network through fair usage or sophisticated queuing and policing capabilities |

| - | Traffic Steering: Intelligent mirroring or service chaining based upon subscriber, application, service, or device characteristics to 3rd party services |

Platforms: Platforms represent the deployment form factor of software in the Procera solutions. The Platforms that we offer today include:

| - | PacketLogic/V: Virtual Platform for NFV deployments that can be packaged as equivalent to the PacketLogic appliances |

| - | PL20000: Up to 600 billions of bits per second, or Gbps, and ten million subscribers |

| - | PL9000: Up to 120Gbps and three million subscribers |

| - | PL8000: Up to 70Gbps and three million subscribers |

| - | PL7000: Up to 5Gbps and five hundred thousand subscribers |

Network Application Visibility Library – NAVL is Procera’s embedded DPI software engine that provides real-time, Layer-7 classification of network traffic. Running on popular processors and operating systems, NAVL allows integrators to remain focused on core competencies while implementing industry-leading DPI functionality from Procera in their products. The resultant savings in time-to-market and variable labor costs is significant. NAVL provides superior performance in application identification and metadata extraction enabling throughput levels of up to 4-8Gbps per core or processor, depending on configuration. Using a wide variety of inspection techniques including: surgical pattern matching, conversation semantics, protocol dissection, behavioral and statistical analysis, as well as future flow awareness and association, NAVL is among one of the most advanced technologies available for core DPI applications.

Product Benefits

Our solutions provide many benefits to our customers, including the following:

Superior Accuracy – Our proprietary DRDL and NAVL software solution allows us to provide our customers with a high degree of application identification accuracy and the flexibility to regularly update our software to keep up with the rapid introduction of new applications.

Higher Scalability – Our family of products is scalable from a few hundred megabits to 600 gigabits of traffic per second, up to 10 million subscribers and up to 480 million simultaneous data flows, which is critical to service providers as they upgrade to LTE (enabling higher bandwidth mobile phone networks), FTTX (high bandwidth fiber to the home or neighborhood used by telecom broadband network providers) and DOCSIS 3.0 (a high bandwidth broadband cable standard) technologies in the access network. NAVL, our software DPI engine, scales linearly with the number of processors and cores through its zero-copy, no-lock approach to data acquisition and inspection.

Platform Flexibility – Our PacketLogic products are deployable in many locations in the network and leverage off-the-shelf hardware or virtualized environments. Our products can rapidly leverage advances in computing technology which we believe to be a better solution than those that are dependent upon specific network silicon processors or hardware platforms. NAVL, our software DPI engine, is deployed on all industry standard platforms and operating systems.

Drop-in Simplicity – The NAVL product provides a software DPI solution that can be implemented simply on a broad array of processors and operating systems with little or no customization. The easy-to-use API ensures that integration partners can be up and running quickly in a matter of days compared to competitive offerings that often require weeks of integration planning and project management.

Global Services

Our products and solutions are supported by our Global Services team that provides a suite of services that include both pre- and post-sales technical services to our direct field sales organization, channel partners and customers; professional services for planning, implementation and deployment; customer services for support post-deployment; training for our customers to maximize use of our SEA products and solutions; and consulting services to assist in all service phases from initial planning and evaluation to onsite testing and operation. Customers also have access to the technical support team via a web-based partner portal, email and interactive chat forum. Issues are logged and tracked using a computerized tracking system that provides automatic levels of escalation and quick visibility into problems by our Research and Development organization. This tracking system also provides input to our development team for new feature requests from our worldwide customer base.

Limitations of Alternative Solutions

We believe that current generation DPI products available in the market have significant deficiencies, perhaps the greatest of which is their limited ability to accurately identify traffic types and applications. Because these DPI products provide limited visibility into traffic flows, they provide a limited ability to manage network traffic. First-generation DPI products were a good start at introducing network operators to the value of network visibility, and introduced the opportunity to provide some level of differentiated services. As applications have become more complex and increasingly web-based, differentiating between applications has become more challenging to products that have limited application signatures used to identify network traffic and less sophisticated application identification mechanisms.

Growth Strategy

Our goal is to become the leading provider of SEA solutions to mobile and broadband network operators on a global scale. We believe our PacketLogic and NAVL solutions position us to effectively compete for a larger share of the growing DPI market, as well as enter the Customer Experience Management and Telco Big Data markets. Additionally, our NAVL products provide an additional route to market for DPI technology through our integration partners and customers. We plan to achieve our strategic growth objectives through the following efforts:

Expand our technology advantage – Our technology was designed with the ability to rapidly identify new application signatures, and thereby adapt to a dynamic IP network environment across multiple hardware platforms. We are further developing our products and solutions based on feedback from our customers and industry experts as well as our ongoing research and development of technology, products and solutions that we believe will add value to our customers. We currently intend to build upon our innovations, continue to release leading-edge products with state-of-the-art capabilities and regularly release new solution features and performance upgrades. Our recent release of our patent-pending RAN Perspectives solution is an example of our organic innovations that has enabled us to enter new markets.

Expand our customer footprint with leading mobile and broadband network operators – Our PacketLogic and NAVL product lines provide us with a solution that can address the network needs of leading mobile and broadband network operators. We have built a team with deep network operator experience, both from a technology perspective and from selling to network operators. We have experienced significant traction in the network operator space, and these achievements have provided us with improved access to potential customers and valuable references, which we believe will continue to enhance our sales growth effort. In addition, we intend to increase our indirect distribution channel. We currently intend to utilize existing value added reseller partners and add new partners to increase our ability to address geographic regions and a greater quantity of customers. Our NAVL product has been implemented in a number of OEM products that serve the mobile and broadband market, thereby ensuring further adoption of our technology.

Pursue new partnerships – We currently intend to establish partnerships with complementary mobile packet core ecosystem vendors to increase the value we can provide and gain additional access to leading mobile and broadband network operators. Where feasible from a business as well as technical perspective, we intend to provide broader solutions by bundling our products with complementary products and technologies from other solution providers. We believe that the flexibility of our software platform gives us the potential to efficiently integrate with complementary solutions and thereby deliver greater benefits to our customers and enhance our ability to compete against competitors whose solutions are more hardware constrained. We believe that the push to virtualization will open up partnership opportunities for Procera, and we have already begun to partner with larger vendors as a result of our NFV progress.

Maximize opportunities with existing customers by increasing our share within their network footprint – We will continue to seek to increase our market share within our existing customers’ networks by expanding our product footprint within these networks. Typically, our first order from a new network operator represents a small portion of their total network as measured by either a single product function or by geography. We believe we can successfully sell additional solutions to our existing customers following their initial purchase as they realize the benefits of our products and seek to extend their SEA capabilities throughout their networks. In addition, many service providers operate dual networks (i.e., mobile and broadband) and in these instances, we believe there are opportunities for us to offer our solutions for each network. We have many captive mobile and broadband network operators that are well positioned to increase service creation and network performance. We believe we are well positioned to experience significant growth with these customers as they build out their capabilities and infrastructure.

Customers

We sell our products and solutions both directly and indirectly to our end-customers. As of December 31, 2014, we had customers in over 80 countries, representing approximately 700 customers throughout the world. Our customers are mobile and broadband network operators, which include cable MSOs, telecommunications companies, Wi-Fi operators and ISPs. Our enterprise customers include educational institutions, commercial enterprises and government and municipal agencies. Our service provider customers serve subscriber customers and enterprise customers operating private networks to optimize their internal networks.

Our current customers and anticipated future customers include the following:

Mobile Network Operators – Mobile network operators are constrained by the bandwidth of their wireless signals and infrastructure. Additional upgrades in bandwidth and network infrastructure are immediately consumed by new applications and devices that place greater stress on the network. Managing network traffic and broadband usage more intelligently can greatly improve QoE for subscribers and save significant resources for network operators.

MSOs – Multi-system operators, or MSOs, are constrained by the bandwidth of their network and the varying number of users connecting to any given loop in the network. Controlling network traffic by application type can greatly improve the quality of the experience of the average subscriber.

Fixed-Line Telecommunications Network Operators – Fixed-line telecommunications network operators use fiber infrastructure or DSL to offer broadband services to end customers. Many fixed-line telecommunications network operators also operate mobile networks and provide either bundled service to end customers or mobile and broadband service on a stand-alone basis. These service bundles are increasingly including video services as networks increase in capacity and capabilities. Adding intelligence to their networks can help them offer differentiated services.

Wi-Fi Operators – Wi-Fi operators offer Wi-Fi connectivity in many locations around the world. These offerings may be from standalone Wi-Fi operators, or be a combined offering from a mobile, fixed, or cable operator using Wi-Fi to complement their existing service offering and extend their connectivity reach for the operator.

ISPs – ISPs generally lease, rather than own, access infrastructure. They compete by attempting to offer the best of breed Internet service. ISPs’ greatest competitive advantages are brand and customer relationships. Our SEA solutions can improve the performance of ISPs by making the use of their bandwidth more efficient and by allowing them to offer best of breed quality.

Education, Business and Government Entities – Education institutions generally provide Internet access to students, faculty and employees. Education institutions are particularly vulnerable to low QoS for legitimate educational purposes because students frequently have made extensive use of high-bandwidth applications such as peer-to-peer services. Businesses and government entities rely on large and complex networks for communication infrastructure. They typically rely on service providers for Internet access and interconnectivity, and can use SEA to optimize the use of their expensive network resources, prioritize business critical applications and limit leisure or unauthorized use of expensive network resources.

Telecommunications and Enterprise Network Equipment Manufacturers – Network equipment and software manufacturers serving the enterprise and service provider markets can implement NAVL for application identification and metadata extraction. In so doing, these companies cut their development cycle and speed time to market while maintaining focus and energy on their core value proposition. To date, companies with solutions in all categories of this segment have implemented DPI purchased from Procera and demand continues to grow across numerous product types including but not limited to: Routers, Switches, Firewalls, intrusion detection and prevention systems, SIMs, security information and event management, Gateways and unified threat management.

For the year ended December 31, 2014, no single customer accounted for more than 10% of net revenues. For the year ended December 31, 2013, revenue from three customers, Shaw Communications, Inc., British Telecommunications plc and Itochu Techno-Solutions Corp. represented 13%, 12% and 10% of net revenues, respectively, with no other single customer accounting for more than 10% of net revenues. For the year ended December 31, 2012, revenue from one customer, Shaw Communications, Inc., represented 16% of net revenues, with no other single customer accounting for more than 10% of net revenues.

Foreign Operations

Sales made to customers located outside the United States as a percentage of total net revenues were 83%, 77% and 67% for the years ended December 31, 2014, 2013 and 2012, respectively. Revenues derived from foreign sales generally are subject to additional risks such as fluctuations in exchange rates, tariffs, the imposition of other trade barriers and potential currency restrictions. To date, however, we have experienced no significant negative impact from such risks. Further information regarding our foreign operations, as required by Item 101(d) of Regulation S-K, can be found in the Consolidated Financial Statements and related notes herein.

Business Segments and Geographic Information

We have one reportable operating segment. Our Chief Operating Decision Maker, our Chief Executive Officer, evaluates our performance and makes decisions regarding allocation of resources based on certain metrics including segment revenue, gross profit and certain operating income (loss) measures. See Note 16 – “Segment Information and Revenue by Geographic Region” of the Notes to Consolidated Financial Statements for details.

Partners

We have established critical technology, distribution and business partnerships to further promote our brand and suite of solutions for network operators. We believe these partnerships provide an immediate opportunity to extend our capabilities into adjacent, complementary points within the mobile packet core and broadband core. For example, we entered into a joint solution with one of our key technology partners that provides integrated policy management and PCRF functionality on top of our DPI platform – Revenue Express.

Competition

The market for our products and services is highly competitive as mobile and broadband network operators seek to manage the rapid growth of data on both broadband and mobile networks. Our primary competitors include:

| · | Allot Communications Ltd.; |

| · | Blue Coat Systems, Inc.; |

| · | Brocade Communications Systems, Inc.; |

| · | Cisco Systems, Inc.; |

| · | Citrix Systems, Inc. (acquired Bytemobile); |

| · | Ericsson; |

| · | F5 Networks, Inc.; |

| · | Gigamon; |

| · | Huawei Technologies Co., Ltd.; |

| · | Qosmos; |

| · | Science Applications International Corporation (acquired Cloudshield Technologies); |

| · | Sandvine Corporation; and |

| · | NetScout (acquired Tektronix, Inc.). |

We also face competition from vendors supplying platform products with some limited DPI functionality, such as switches and routers, session border controllers and VoIP switches. In addition, we face competition from large integrators that package third-party DPI solutions into their products, including Alcatel-Lucent and Ericsson. It is possible that these companies will develop their own DPI solutions or strategically acquire existing competitor DPI vendors in the future.

Most of our competitors are larger and more established enterprises with substantially greater financial and other resources. Some competitors may be willing to reduce prices and accept lower profit margins to compete with us. As a result of such competition, we could lose market share and sales, or be forced to reduce our prices to meet competition. However, we do not believe there is a dominant supplier in our market. Based on our belief in the superiority of our technology, we believe that we have an opportunity to increase our market share and benefit from what we believe will be growth in the DPI market.

Our primary method of differentiation from our competition is the breadth of the intelligence we can obtain, which comes from our DRDL technology as well as our new sources of intelligence like RAN Perspectives, which does not rely on only our traditional solutions. However, we also believe we effectively compete with respect to price and service. Our products now address service provider requirements ranging from 1 megabit (edge applications) to the 600 gigabit per second market (core applications).

Backlog

Our sales are made primarily pursuant to standard purchase orders for the delivery of products. Quantities of our products to be delivered and delivery schedules may vary based on changes in customers’ needs or circumstances. Customer orders generally can be cancelled, modified or rescheduled on short notice without significant penalty to the customer. In addition, most of our revenue in any quarter depends on customer orders for our products that we receive and fill in the same quarter. For these reasons, our backlog as of any particular date is not representative of actual sales for any succeeding period, and therefore we believe that backlog is not necessarily a reliable indicator of our future revenue trends.

Sales and Marketing

We use a combination of direct sales and channel partnerships to sell our products and services. As of December 31, 2014, we had 46 employees in sales and many independent channel partners worldwide. We also engage a worldwide network of value added resellers to reach particular geographic regions and markets.

Our marketing organization is focused on building our brand awareness, managing channel marketing efforts and supporting our sales force in additional capacities. As of December 31, 2014, we had 13 marketing professionals globally.

Research and Development

We have built a team of skilled software programmers who continue to develop enhancements to our PacketLogic modules and proprietary DRDL and NAVL processing software engines. We have enhanced our products with features and functionality to address the needs of mobile and broadband network operators, as well as to provide new functionality for network protection and subscriber management. As of December 31, 2014, we had 79 employees in research and development. Historically, substantially all of our research and development has been performed by our employees in Sweden. On January 9, 2013, we acquired Vineyard in Canada to expand our research and development efforts and enhance stability and disaster recovery capabilities. Our research and development costs were $16.7 million, $17.5 million, and $7.5 million for the years ended December 31, 2014, 2013 and 2012, respectively.

Intellectual Property

Our intellectual property is central to our competitive position and our future success will depend on our continued ability to protect our core technologies. We believe that our DRDL signature compiler, and the inherent complexity of our software-based PacketLogic and NAVL solutions, makes it difficult to copy or replicate our features. We rely primarily on patent law, trademark law, copyright law, trade secret law and contractual rights to protect our intellectual property rights in our proprietary software. To help ensure this protection, we include proprietary information and confidentiality provisions in our agreements with customers, third parties and employees.

Manufacturing

We purchase our hardware from a select group of supplier partners. We have negotiated minimum production quantities and lead times in our contracts to prevent supply shortages. We or our supplier partners will then load our proprietary software for specific orders, final testing and fulfillment. We believe that our process allows us to focus on development of our PacketLogic and NAVL software solutions, reduce manufacturing costs and more quickly adjust to changes in demand. We have not historically experienced any production capacity shortages and do not foresee a need to alter our process in the future.

We source completed hardware boards and chassis included in our products from leading industry suppliers, including Advantech Technologies Inc., Lanner Electronics, Inc., Dell Inc. and RadiSys Corporation. The hardware used in our products is comprised of standard components which are less susceptible to supply shortages and significant lead times. We believe our reliance on standard hardware components facilitates quicker time to market, rapid design cycles and the ability to take advantage of the latest semiconductor industry advances.

Employees

As of December 31, 2014, we had a total of 204 employees and 22 full-time independent contractors. As of December 31, 2014, we had 39 operations and technical support employees, 79 research and development employees, 59 sales and marketing employees and 27 general and administrative employees. As of December 31, 2014, our headcount was 52 employees in the United States, 83 employees in Sweden, 37 employees in Canada, seven employees in the United Kingdom, and a total of 25 employees in Malaysia, Hong Kong, Japan, Singapore, Austria, Australia, France, Germany, Korea, Argentina, Brazil, Russia, Spain, Taiwan, Thailand, South Africa and the United Arab Emirates.

Executive Officers of the Company

Set forth below are the name, age, position(s) and a description of the business experience of each of our executive officers as of December 31, 2014:

| Name | Age | Position(s) | Employee Since | |||

| James F. Brear | 49 | President, Chief Executive Officer and Director (Principal Executive Officer) | 2008 | |||

| Charles Constanti | 51 | Vice President, Chief Financial Officer and Secretary (Principal Financial & Accounting Officer) | 2009 |

James F. Brear joined us as our President, Chief Executive Officer and a member of our Board of Directors in February 2008. Mr. Brear is a Silicon Valley industry veteran with more than 20 years of experience in the networking industry, most recently as Vice President of Worldwide Sales and Support for Bivio Networks, a maker of deep packet inspection platform technology, from July 2006 to January 2008. From September 2004 to July 2006, Mr. Brear was Vice President of Worldwide Sales for Tasman Networks (acquired by Nortel), a maker of converged WAN solutions for enterprise branch offices and service providers for managed WAN services. From April 2004 to July 2004, Mr. Brear served as Vice President of Sales at Foundry Networks, a provider of switching, routing, security and application traffic management solutions. Earlier in his career, Mr. Brear was the Vice President of Worldwide Sales for Force10 Networks (acquired by Dell) from March 2002 to April 2004, during which time the company grew from a pre-revenue start-up to the industry leader in switch routers for high performance Gigabit and 10 Gigabit Ethernet. In addition, he spent five years with Cisco Systems from July 1997 to March 2002 where he held senior management positions in Europe and North America with responsibility for delivering more than $750 million in annual revenues selling into the world’s largest service providers. Previously, Mr. Brear held a variety of sales management positions at both IBM and Sprint Communications. He is a member of the Young Presidents Organization (YPO) and holds a Bachelor of Arts degree from the University of California at Berkeley.

Charles Constanti joined us as our Chief Financial Officer in May 2009 and has over 25 years of public company financial experience. Most recently, Mr. Constanti was the vice president and CFO of Netopia, Inc., a NASDAQ-listed telecommunications equipment and software company, from April 2005 until its acquisition in February 2007 by Motorola, Inc., where he subsequently held a senior finance position until May 2009. From May 2001 to April 2005, Mr. Constanti was the vice president and corporate controller of Quantum Corporation, for which he earlier served in different accounting and finance positions since January 1997. Previously, Mr. Constanti held various finance positions at BankAmerica Corporation and was an auditor for PricewaterhouseCoopers. Mr. Constanti is an inactive certified public accountant. He earned a B.S., magna cum laude, in Accounting from Binghamton University.

Significant Employees of the Company

Set forth below are the name, age, position and a description of the business experience of each of our significant employees as of December 31, 2014:

| Name | Age | Position | Employee Since | |||

| Alexander Haväng | 36 | Chief Technical Officer | 2006 | |||

| Andy Lovit | 54 | Senior Vice President Global Sales and Services | 2014 |

Alexander Haväng has been our Chief Technology Officer since August 2006 when we acquired Netintact AB. Mr. Haväng was a founder of Netintact AB, which was formed in August 2000. Mr. Haväng is responsible for our strategic technology direction. Mr. Haväng is widely known and a respected authority in the open source community, and is the lead architect for PacketLogic. Earlier in his career, Mr. Haväng was one of the chief architects for the open source streaming server software Icecast, along with the secure file transfer protocol GSTP. Mr. Haväng studied computer science at the Linköping University in Sweden.

Andy Lovit joined us as our Senior Vice President Global Sales and Services in September 2014 and brings more than 25 years of sales and executive management technology leadership experience to Procera. Mr. Lovit joined Procera from Fortress Solutions, where he served as the Senior Vice President of Global Field Operations from November 2012 to September 2014. Prior to Fortress Solutions, Mr. Lovit served as Senior Vice President and General Manager Americas for ATEME SA, an advanced video compression solutions provider, from September 2011 to November 2012. Prior to ATEME SA, Mr. Lovit served as Vice President of Worldwide Field Operations for Bivio Networks, which provided DPI Cyber Security Solutions to Global Service Providers and Governments from September 2008 to September 2011. Prior to Bivio Networks, Mr. Lovit served as Vice President of Worldwide Sales for AirTight Networks, Inc., a wireless security solutions provider, from July 2007 to August 2008. Prior to AirTight Networks, Mr. Lovit served as Senior Vice President of Service Provider Sales for Ericsson’s Multimedia/Television Group, which acquired TANDBERG Television from March 2006 to July 2007. Prior to Ericsson Multimedia/Television Group (TANDBERG Television), Mr. Lovit was Vice President of Global Sales and Field Operations for SkyStream Networks from January 2003 to March 2006 where he successfully grew revenue, which resulted in SkyStream Networks being acquired by TANDBERG Television. He has also held executive management positions at Paradyne Corporation, Onetta (acquired by Bookham Technologies), Mayan Networks, and 3Com. Mr. Lovit holds a Bachelor of Science degree in Business Administration from The Ohio State University.

Available information

Our annual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K, and all amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge on our website at www.proceranetworks.com as soon as reasonably practicable after we electronically file such reports with the Securities and Exchange Commission, or the SEC. Information contained in, or accessible through, our website is not incorporated by reference into and does not form a part of this report.

The SEC also maintains a website containing reports, proxy and information statements, annual filings and other relevant information available free of charge to the public at www.sec.gov.

You should carefully consider the risks described below, together with all of the other information included in this Annual Report on Form 10-K, in considering our business and prospects. Set forth below and elsewhere in this report and in other documents we file with the SEC are descriptions of the risks and uncertainties that could cause our actual results to differ materially from the results contemplated by the forward-looking statements contained in this report. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. Each of these risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our common stock.

Risks Related to Our Business

We have a limited operating history on which to evaluate our Company.

The products we sell today are derived primarily from the products of the Netintact companies that we acquired in 2006. We are continually working to improve our operations on a combined basis.

Furthermore, we have only recently launched many of our products and services on a worldwide basis, and we are continuing to develop relationships with distribution partners and otherwise exploit sales channels in new markets. Therefore, investors should consider the risks and uncertainties frequently encountered by companies in new and rapidly evolving markets, which include the following:

| · | successfully introducing new products and entering new markets; |

| · | successfully servicing and upgrading new products once introduced; |

| · | increasing brand recognition; |

| · | developing strategic relationships and alliances; |

| · | managing expanding operations and sales channels; |

| · | successfully responding to competition; and |

| · | attracting, retaining and motivating qualified personnel. |

If we are unable to address these risks and uncertainties, our results of operations and financial condition may be adversely affected.

Our actual operating results may differ significantly from our guidance and investor expectations.

From time to time, we may release guidance in our earnings releases, earnings conference calls or otherwise, regarding our future performance that represents our management’s estimates as of the time of release of the guidance. Any such guidance, which will include forward-looking statements, will be based on projections prepared by our management.

Projections are based upon a number of assumptions and estimates that, while presented with numerical specificity, are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. These projections are also based upon specific assumptions with respect to future business decisions, some of which will change. We may state possible outcomes as high and low ranges, which are intended to provide a sensitivity analysis as variables are changed but are not intended to indicate that actual results could not fall outside of the suggested ranges. The principal reason why we may release guidance is to provide an opportunity for our management to discuss our business outlook with analysts and investors. With or without our guidance, analysts and other investors may publish their own expectations regarding our business, financial performance and results of operations. We do not accept any responsibility for any projections or reports published by any such third persons.

Guidance is necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying the guidance furnished by us will not materialize or will vary significantly from actual results. Accordingly, our guidance is only an estimate of what our management believes is realizable as of the time of release. Actual results will vary from our guidance, and the variations may be material. If our actual performance does not meet or exceed our guidance or investor expectations, the trading price of our common stock may decline.

In addition, historically we have received, and in the future we may receive, a material portion of a quarter’s sales orders during the last two weeks of the quarter. Accordingly, there is a risk that our revenue may move from one quarter to the next, or not be realized at all, if we cannot fulfill all of the orders and satisfy all the revenue recognition criteria under our accounting policies before the quarter ends. If completed purchase orders are not obtained in a timely manner, our products are not shipped on time, we fail to manage our inventory properly, we fail to release new products on schedule or we are unable to fulfill orders for any other reason, our revenue for that quarter could fall below our expectations or those of securities analysts and investors, which may result in a decline in our stock price.

Our PacketLogic family of products is our primary product line. A substantial majority of our current revenues and a significant portion of our future growth depend on our ability to continue its commercialization.

A substantial majority of our current revenues and much of our anticipated future growth depend on the development, introduction and market acceptance of new and enhanced products in our PacketLogic product line that address additional market requirements in a timely and cost-effective manner. In the past, we have experienced delays in product development and such delays may occur in the future. Our future growth will largely be determined by market acceptance and continued development of our PacketLogic product line.

If additional customers do not adopt, purchase and deploy our PacketLogic products, our revenues will not grow and may decline. In addition, should our prospective customers fail to recognize, or our current customers lose confidence in, the value or effectiveness of our PacketLogic product line, the demand for our products and services will likely decline. Any significant price compression in our targeted markets as a result of newly introduced solutions could have a material adverse effect on our business. Moreover, when we announce new products or product enhancements that have the potential to replace or shorten the life cycle of our existing products, customers may defer purchasing our existing products. These actions could harm our operating results by unexpectedly decreasing sales and exposing us to greater risk of product obsolescence.

Marketing and sales of our products to large broadband service providers often involve a lengthy evaluation and sales cycle, which may cause our revenues to fluctuate from period to period and could result in us expending significant resources without making any sales.