SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| x | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material pursuant to § 240.14a-12 |

Procera Networks, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1. | | Title of each class of securities to which transaction applies: |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | | Proposed maximum aggregate value of transaction: |

| | 5. | | Total fee paid: |

| | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1. | | Amount Previously Paid: |

| | 2. | | Form, Schedule or Registration Statement No.: |

| | 3. | | Filing Party: |

| | 4. | | Date Filed: |

PROCERA NETWORKS, INC.

4121 Clipper Court

Fremont, California 94538

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 30, 2013

Dear Stockholder:

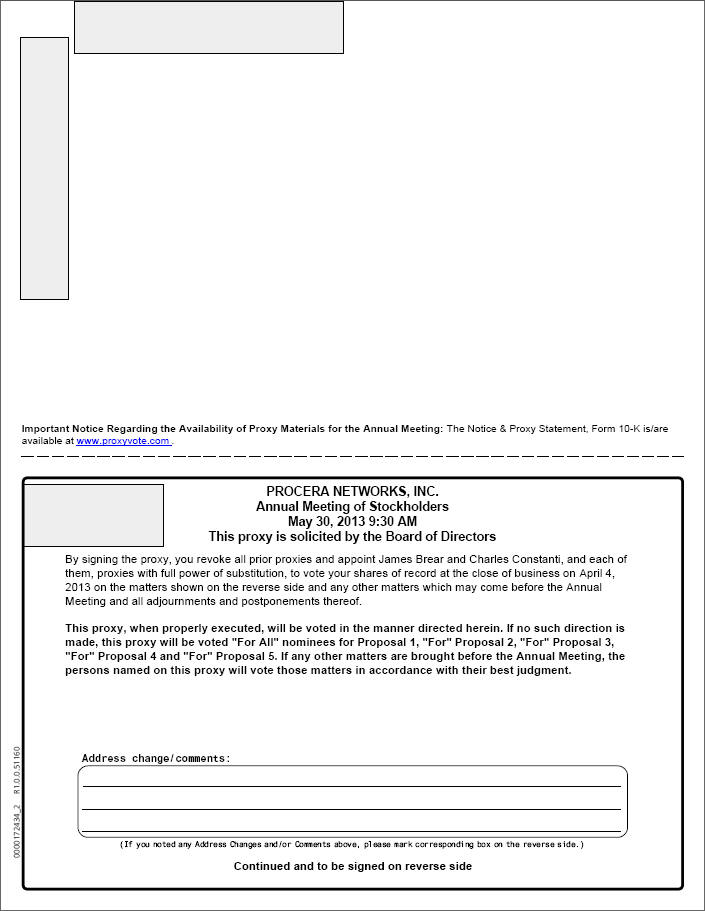

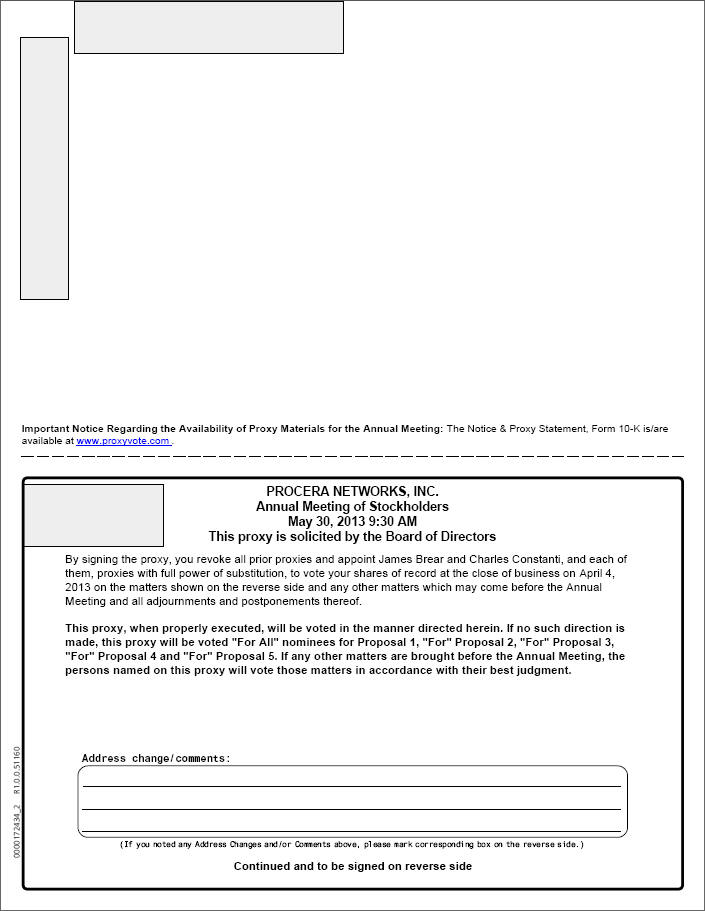

You are cordially invited to attend the Annual Meeting of Stockholders of Procera Networks, Inc., a Nevada corporation (the “Company”). The meeting will be held on Thursday, May 30, 2013 at 9:30 a.m. local time at the Company’s principal executive offices located at 4121 Clipper Court, Fremont, California 94538 for the following purposes:

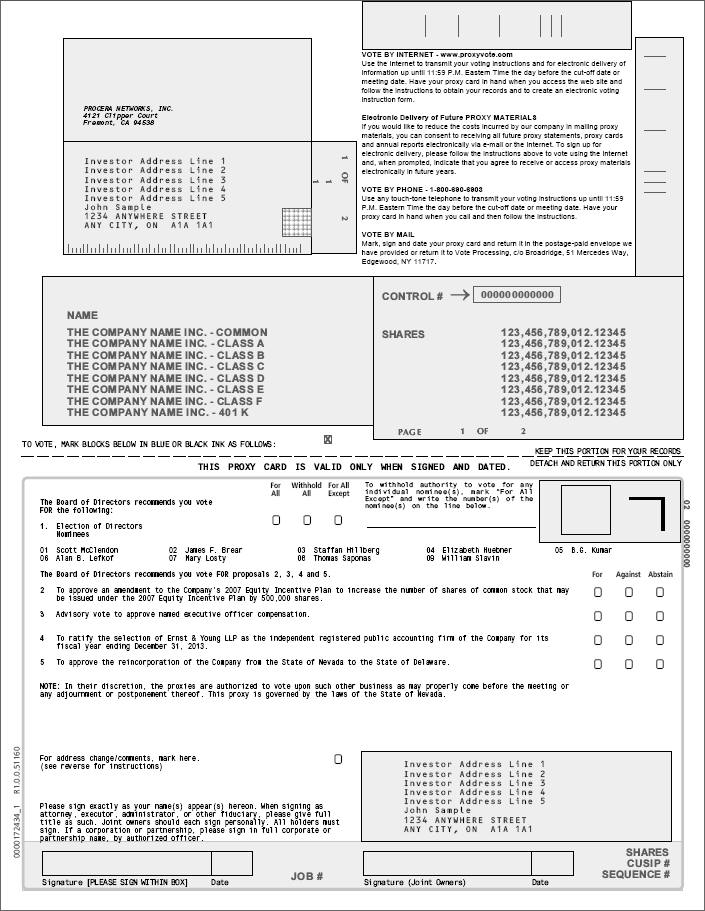

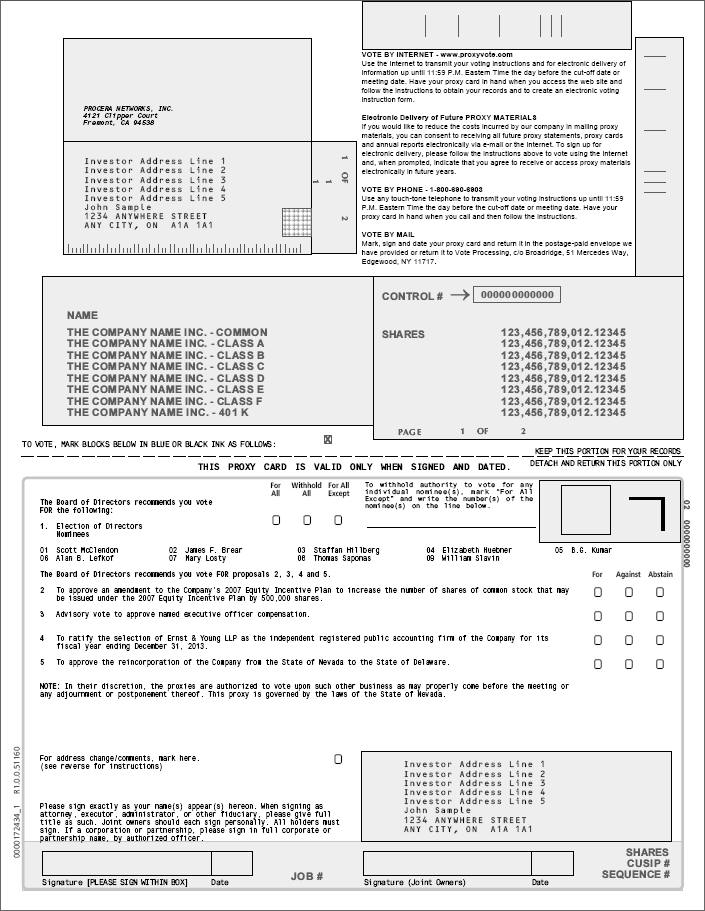

| | 1. | To elect the nine (9) nominees of the Company’s Board of Directors (the “Board”), James F. Brear, Staffan Hillberg, Elizabeth Huebner, B.G. Kumar, Alan B. Lefkof, Mary Losty, Scott McClendon, Thomas Saponas and William Slavin, to the Board to serve until the 2014 Annual Meeting of Stockholders. |

| | 2. | To approve an amendment to the Company’s 2007 Equity Incentive Plan (the “2007 Plan”) to increase the number of shares of common stock that may be issued under the 2007 Plan by 500,000 shares. |

| | 3. | To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Proxy Statement accompanying this Notice. |

| | 4. | To ratify the selection by the Audit Committee of the Board of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2013. |

| | 5. | To approve the reincorporation of the Company from the State of Nevada to the State of Delaware. |

| | 6. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is April 4, 2013. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment or postponement thereof.

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on Thursday, May 30, 2013 at 9:30 a.m. at 4121 Clipper Court, Fremont, California 94538. The proxy statement and annual report to stockholders are available at http://www.proceranetworks.com/annual. |

By Order of the Board of Directors

/s/ Charles Constanti

Charles Constanti

Vice President, Chief Financial Officer and

Corporate Secretary

Fremont, California

April 5, 2013

|

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please vote over the telephone or the Internet as instructed in these materials, or vote by completing, dating, signing and returning the proxy card that you may request, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder. |

PROCERA NETWORKS, INC.

4121 Clipper Court

Fremont, California 94538

PROXY STATEMENT

FOR THE 2013 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 30, 2013

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board of Directors (the “Board”) of Procera Networks, Inc. (sometimes referred to as “we”, “us” or “Procera”) is soliciting your proxy to vote at the 2013 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements of the Annual Meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement.

Why did I receive a notice regarding the availability of proxy materials on the Internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy of the proxy materials (including a proxy card) may be found in the Notice.

We intend to mail the Notice on or about April 19, 2013 to all stockholders of record entitled to vote at the Annual Meeting.

How do I attend the Annual Meeting?

The Annual Meeting will be held on Thursday, May 30, 2013 at 9:30 a.m. local time at our principal executive offices located at 4121 Clipper Court, Fremont, California 94538. Directions to the Annual Meeting may be found at http://www.proceranetworks.com/directions.html. Information on how to vote in person at the Annual Meeting is discussed below.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 4, 2013 will be entitled to vote at the Annual Meeting. On this record date, there were 20,547,549 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If at the close of business on April 4, 2013 your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If at the close of business on April 4, 2013 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization

1

holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker, bank or other agent.

What am I voting on?

There are five matters scheduled for a vote:

| | • | | Election of nine (9) directors; |

| | • | | An amendment to our 2007 Equity Incentive Plan (the “2007 Plan”) to increase the number of shares of common stock that may be issued under the 2007 Plan by 500,000 shares; |

| | • | | Advisory approval of the compensation of our named executive officers, as disclosed in this proxy statement in accordance with SEC rules; |

| | • | | Ratification of the selection by the Audit Committee of the Board of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2013; and |

| | • | | Our reincorporation from the State of Nevada to the State of Delaware. |

What if another matter is properly brought before the Annual Meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

What is the Procera Board’s voting recommendation?

Procera’s Board recommends that you vote your shares:

| | • | | “For” the nominees to the Board; |

| | • | | “For” the amendment to the 2007 Plan to increase the number of shares of common stock that may be issued under the 2007 Plan by 500,000 shares; |

| | • | | “For” the approval, on an advisory basis, of our named executive officer compensation, as set forth in this Proxy Statement; |

| | • | | “For” the ratification of the Audit Committee’s selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2013; and |

| | • | | “For” our reincorporation from the State of Nevada to the State of Delaware. |

How do I vote?

With respect to the election of directors, you may either vote “For” all the nominees to the Board or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple and depend upon whether your shares are registered in your name or are held by a bank, broker or other agent:

2

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy over the telephone, vote by proxy through the Internet or vote by proxy using a proxy card that you may request. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

| | • | | To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. |

| | • | | To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your vote must be received by 11:59 p.m., Eastern daylight time on May 29, 2013 to be counted. |

| | • | | To vote through the Internet, go to http://www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. Your vote must be received by 11:59 p.m., Eastern daylight time on May 29, 2013 to be counted. |

| | • | | To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered to you upon request and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a notice containing voting instructions from that organization rather than from us. Simply follow the voting instructions in the notice to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

|

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies. |

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the close of business on April 4, 2013.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of all nine (9) nominees for director, “For” the amendment to the 2007 Plan to increase the number of shares of common stock that may be issued under the 2007 Plan by 500,000 shares, “For” the advisory approval of the compensation of our named executive officers, “For” the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2013, and “For” our reincorporation from the State of Nevada to the State of Delaware. If any other matter is properly presented at the Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by mail, by telephone or by other means of communication.

3

Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each Notice to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| | • | | You may submit another properly completed proxy card with a later date. |

| | • | | You may grant a subsequent proxy by telephone or through the Internet. |

| | • | | You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at 4121 Clipper Court, Fremont, California 94538. |

| | • | | You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or Internet proxy is the one that is counted.

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, for the election of directors, “For,” “Withhold” and broker non-votes; and, with respect to the other proposals, votes “For” and “Against,” abstentions and broker non-votes. Abstentions and broker non-votes have no effect and will not be counted towards the vote total for any proposal.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker, bank or other agent holding the shares as to how to vote on matters deemed “non-routine”. Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker, bank or other agent holding the shares. If the beneficial owner does not provide voting instructions, the broker, bank or other agent can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the New York Stock Exchange (“NYSE”), “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, reincorporations, stockholder proposals, elections of directors (even if not contested) and the advisory stockholder vote on executive compensation. The ratification of the selection the selection of the independent registered public accounting firm is generally considered to be “routine” and brokers, banks and other agents generally have discretionary voting power with respect to such proposal. Broker non-votes will be counted for the purpose of determining whether a quorum is present at the Annual Meeting.

How many votes are needed to approve each proposal?

| | • | | For the election of directors, the nine (9) nominees receiving the most “For” votes (from the holders of votes of shares present in person or represented by proxy and entitled to vote on the election of directors) will be elected. Only votes “For” or “Withheld” will affect the outcome. |

4

| | • | | To be approved, Proposal 2, the amendment to the 2007 Plan to increase the number of shares of common stock that may be issued under the 2007 Plan by 500,000 shares, must receive “For” votes from the holders of a majority of shares either present in person or represented by proxy and entitled to vote. Abstentions and broker non-votes will have no effect. |

| | • | | To be approved, Proposal 3, the advisory approval of the compensation of our named executive officers, must receive “For” votes from the holders of a majority of shares either present in person or represented by proxy and entitled to vote. Abstentions and broker non-votes will have no effect. |

| | • | | To be approved, Proposal 4, ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2013, must receive “For” votes from the holders of a majority of shares either present in person or represented by proxy and entitled to vote. Abstentions and broker non-votes will have no effect. |

| | • | | To be approved, Proposal 5, our reincorporation from the State of Nevada to the State of Delaware, must receive “For” votes from the holders of a majority of shares either present in person or represented by proxy and entitled to vote. Abstentions and broker non-votes will have no effect. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the Annual Meeting in person or represented by proxy. On the record date, there were 20,547,549 shares outstanding and entitled to vote. Thus, the holders of 10,273,775 shares must be present in person or represented by proxy at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other agent) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the Annual Meeting in person or represented by proxy may adjourn the Annual Meeting to another date.

Why is Procera proposing to reincorporate in Delaware?

We believe that reincorporation in Delaware will give us more flexibility, clarity and predictability with respect to our corporate legal and governance affairs. Generally, the corporate laws of the State of Delaware are more comprehensive, widely-used and extensively interpreted than the corporate laws of other states, including Nevada. In addition, Delaware provides a recognized body of corporate law that is consistently interpreted by Delaware courts, which we believe will facilitate corporate governance by our officers and directors.

How will the reincorporation be accomplished, and what will the effects be on Procera?

We are incorporated in Nevada and, as such, our corporation is currently governed by Nevada law. As a result of the reincorporation, we will be incorporated in Delaware and our corporation will be governed by Delaware law. The reincorporation will be effected by a plan of conversion, which will provide that we will: (1) file with the Secretary of State of the State of Nevada articles of conversion, and (2) file with the Secretary of State of the State of Delaware (i) a certificate of conversion and (ii) a certificate of incorporation. The plan of conversion, the articles of conversion, the certificate of conversion and certificate of incorporation will be substantially in the forms appended to this proxy statement asAppendix B,Appendix C,Appendix D andAppendix E, respectively. Approval of the reincorporation will also constitute approval of the forms of each of the foregoing documents.

In the reincorporation, each outstanding share of our common stock will automatically be converted into one share of common stock of Procera Networks, Inc., the Delaware corporation into which we will be deemed converted upon completion of the reincorporation (“Procera-Delaware”). Outstanding options to purchase shares of our common stock and other equity awards relating to our common stock likewise will become options to

5

purchase the same number of shares of common stock or equity awards, as applicable, of Procera-Delaware, with no change in the exercise price or other terms or provisions of the options or equity awards. Your proportional percentage ownership of Procera will remain unchanged and will not be affected in any way by the reincorporation.

Our business, directors, officers, employees, assets and liabilities and the location of our offices will remain unchanged by the reincorporation. Following the reincorporation, our name will continue to be “Procera Networks, Inc.” and our shares of common stock will continue to be listed on the Nasdaq Global Select Market under the symbol “PKT.”

How will the reincorporation affect my rights as a stockholder?

Your rights as a stockholder currently are governed by Nevada law and the provisions of our Articles of Incorporation, as amended, and our bylaws. As a result of the reincorporation, you will become a stockholder of Procera-Delaware with rights governed by Delaware law and the provisions of the Certificate of Incorporation and the bylaws of Procera-Delaware, which differ in some certain respects from your current rights. These important differences are discussed and summarized in this proxy statement under “Proposal 5 – Approval of the Reincorporation of the Company from the State of Nevada to the State of Delaware – Rights of our Stockholders Prior to and After the Reincorporation from Nevada to Delaware.” Forms of Procera-Delaware’s Certificate of Incorporation and bylaws are appended to this proxy statement asAppendix E andAppendix F, respectively.

Are dissenters’ rights available in connection with the Reincorporation?

No. Under Nevada law, stockholders are not entitled to dissenters’ rights in connection with a reincorporation if the shares held by the stockholder are of a class or series which is a “covered security” under Section 18(b)(1)(A) or (B) of the Securities Act of 1933, as amended. Because Procera’s common stock is currently listed on the Nasdaq Global Select Market, it satisfies the definition of “covered security”, and our stockholders will therefore not be entitled to dissenters’ rights in connection with the reincorporation.

Should I send in my stock certificates?

No. Please do not send us your stock certificates. Following the reincorporation, stock certificates previously representing our common stock may be delivered in effecting sales (through a broker or otherwise) of shares of Procera-Delaware common stock. It will not be necessary for you to exchange your existing stock certificates for stock certificates of Procera-Delaware, and if you do so, it will be at your own cost.

What are the tax consequences of the reincorporation to me?

The reincorporation is intended to be a tax-free reorganization under the Internal Revenue Code of 1986, as amended (the “Code”). Assuming the reincorporation qualifies as a reorganization, no gain or loss will be recognized to the holders of our capital stock as a result of consummation of the reincorporation, and no gain or loss will be recognized by us. Generally, you will have the same basis in and holding period with respect to the Procera-Delaware common stock received by you pursuant to the reincorporation as you have in the shares of our common stock held by you as of immediately prior to the time the reincorporation is consummated.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

6

Why did I receive a Notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, we provide stockholders access to our proxy materials via the Internet. On or about April 19, 2013, we are sending a Notice to our stockholders of record and beneficial owners. All stockholders will have the ability to access the proxy materials on a website referred to in the Notice. Stockholders may request to receive a full set of printed proxy materials by mail. Instructions on how to access the proxy materials on the Internet or request a printed copy may be found in the Notice.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 20, 2013, to our Corporate Secretary at 4121 Clipper Court, Fremont, California 94538. If you wish to bring a matter before the stockholders at next year’s annual meeting and you do not notify us between January 30, 2014 and March 1, 2014, for all proxies we receive, the proxyholders will have discretionary authority to vote on the matter, including discretionary authority to vote in opposition to the matter. You are advised that if our annual meeting of stockholder next year is advanced or delayed by more than 30 days from the anniversary date of this year’s annual meeting, the due dates for stockholder proposals may change. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

7

PROPOSAL 1

ELECTIONOF DIRECTORS

The Board consists of up to nine (9) directors. There are nine (9) nominees for director this year. Each director to be elected and qualified will hold office until the next annual meeting of stockholders and until his or her successor is elected, or, if sooner, until the director’s death, resignation or removal. Each of the nominees listed below is currently a member of the Board and was previously elected by our stockholders, except for Ms. Huebner. Ms. Huebner was recommended to the Board by the Nominating and Corporate Governance Committee and appointed to our Board on September 17, 2012.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. The nine (9) nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nine (9) nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by us. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

Nominees

The following is a brief biography of each nominee for director and a discussion of the specific experience, qualifications, attributes or skills of each nominee that led the Nominating and Corporate Governance Committee to recommend that person as a nominee for director, as of the date of this proxy statement.

The Nominating and Corporate Governance Committee seeks to assemble a Board that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct our business. To that end, the Nominating and Corporate Governance Committee has identified and evaluated nominees in the broader context of the Board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the Nominating and Corporate Governance Committee views as critical to effective functioning of the Board. The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the Nominating and Corporate Governance Committee to recommend that person as a nominee. However, each of the members of the Nominating and Corporate Governance Committee may have a variety of reasons why he or she believes a particular person would be an appropriate nominee for the Board, and these views may differ from the views of other members.

| | | | |

Name | | Age as of

March 31, 2013 | | Principal Occupation/ Position Held With Procera |

Scott McClendon | | 73 | | Chairperson of the Board |

James F. Brear | | 47 | | President, Chief Executive Officer and Director |

Staffan Hillberg | | 48 | | Director |

Elizabeth Huebner | | 55 | | Director |

B.G. Kumar | | 46 | | Director |

Alan B. Lefkof | | 60 | | Director |

Mary Losty | | 53 | | Director |

Thomas Saponas | | 63 | | Director |

William Slavin | | 67 | | Director |

8

Mr. Scott McClendon has served as a member of our Board since March 2004 and as Chairperson of the Board since November 2007. He is currently a member of the Audit Committee. Mr. McClendon has been the Chairman of the Board of Directors for Overland Storage (NASDAQ: OVRL) since March 2001. He also served as Overland’s interim Chief Executive Officer from November 2006 to August 2007 and its President and Chief Executive Officer from October 1991 to March 2001, and was an officer and employee until June 2001. Prior to his tenure with Overland, he was employed by Hewlett Packard Company, a global manufacturer of computing, communications and measurement products and services, for over 32 years in various positions in engineering, manufacturing, sales and marketing. He last served as the General Manager of the San Diego Technical Graphics Division and Site Manager of Hewlett Packard in San Diego, California. Mr. McClendon was a director of SpaceDev, Inc., an aerospace development company, from 2002 to 2008. Mr. McClendon holds a BSEE and an MSEE from Stanford University.

The Nominating and Corporate Governance Committee believes that Mr. McClendon’s executive, financial and business expertise, including a diversified background of managing and directing public technology-based companies, provides him with the qualifications and skills to serve as our director, and that Mr. McClendon’s years of service as our director bring historic knowledge and continuity to the Board.

Mr. James F. Brear has served as a member of our Board and as our Chief Executive Officer and President since February 2008. He is an industry veteran with more than 20 years of experience in the networking industry, and leads us to further our position as the leader in managing and monetizing the world’s most complex networks. Most recently, Mr. Brear served as vice president of worldwide sales and support for Bivio Networks, a maker of deep packet inspection platform technology. Under his leadership, the company rapidly expanded its worldwide sales presence, resulting in sales to a number of global Tier 1 service providers, government agencies, and Global OEMs. Prior to Bivio, Mr. Brear was vice president of worldwide sales for Tasman Networks (acquired by Nortel), a maker of converged WAN solutions for enterprise branch offices and service providers. Earlier in his career, Mr. Brear was the vice president of worldwide sales for Force10 Networks, where he was responsible for taking the company from a pre-revenue start-up to the industry leader in switch routers for high performance Gigabit and 10 Gigabit Ethernet. In addition, he spent five years with Cisco Systems where he held senior management positions in Europe and North America with responsibility for delivering more than $750M in annual revenues selling into the world’s largest service providers. Previously, Mr. Brear held a variety of sales management positions at both IBM and Sprint Communications. Mr. Brear holds a BA from the University of California at Berkeley.

The Nominating and Corporate Governance Committee believes that Mr. Brear’s current position as our Chief Executive Officer and extensive telecommunications sales expertise and business expertise, including experience at IBM, Cisco Systems and smaller companies where he achieved substantial sales growth, give him the qualifications and skills to serve as our director.

Mr. Staffan Hillberg has served as a member of our Board since January 2007. He is currently a member of the Compensation Committee and serves as the Chairperson of the Nominating and Corporate Governance Committee. Mr. Hillberg is currently the Chief Executive Officer of Wood & Hill Investment AB, a private equity group based in Sweden, and has served in this capacity since 2008. From 2004 to 2006, he held the position of Managing Partner at the MVI Group, one of the largest and oldest business angel networks in Europe with over 175 million Euros invested in 75 companies internationally. While at MVI he oversaw a number of successful exits among them, two initial public offerings in 2006 on the AIM exchange in London as well as an initial public offering on the Swiss Stock Exchange. From 2000 to 2003, he ran a local venture capital company as well as co-founded and was the Chief Executive Officer of the computer security company AppGate, from 1998 to 2000, with operations in Europe and the USA, raising US$20M from ABN Amro, Deutsche Telecom and GE Equity. From 1996 to1998, he was also responsible for the online activities of the Bonnier Group, the largest media group in Scandinavia, spearheading their internet activities and heading up their sponsorship of MIT Media Lab. Earlier he was the QuickTime Product Manager at Apple in Cupertino and before this Multimedia Evangelist with Apple Computer Europe in Paris, France, for two years. He has extensive experience as an

9

investor and business angel having been involved in the listing of two companies in Sweden, Mirror Image and Digital Illusions, where the latter was acquired by Electronic Arts. Mr. Hillberg attended the M.Sc. program at Chalmers University of Technology in Sweden and has an MBA from INSEAD in France.

The Nominating and Corporate Governance Committee believes that Mr. Hillberg’s extensive venture capital and business experience in Sweden and involvement in helping companies to grow and provide value to stockholders, give him the qualifications and skills to serve as our director. Additionally, Mr. Hillberg is Swedish and lives and works in Sweden. In consideration of our subsidiary in Sweden and the related high concentration of Swedish employees to our total employees, Mr. Hillberg’s knowledge of executing business in Sweden adds well-suited cultural diversity and perspective to our Board.

Ms. Elizabeth J. Huebner has served as a member of our Board since September 2012 and is currently the Chairperson of the Audit Committee. She has served as a director of Blucora, Inc. (formerly Infospace, Inc.) (Nasdaq: BCOR), an online search and tax preparation software company, since May 2009. Prior to retiring, Ms. Huebner was Chief Financial Officer from 2000 to 2006 at Getty Images, Inc., a provider of visual content and rights services. Prior to her service as Chief Financial Officer of Getty Images, Ms. Huebner was Chief Financial Officer of Primus Knowledge Solutions, Inc., a software company specializing in knowledge management and self-service.

The Nominating and Corporate Governance Committee believes that Ms. Huebner’s experience in management and finance provides insight and guidance that assists our Board in its oversight, financial review, and risk management obligations. Ms. Huebner has significant experience as an executive in the technology industry, and a strong background in finance and accounting. Our Board has determined that she is qualified as an “Audit Committee Financial Expert” under the SEC’s rules, and that expertise assists our Board in complying with its Audit Committee membership requirements and also enables her to provide significant insight on public accounting and financial statement matters.

Mr. B.G. Kumar has served as a member of our Board since August 2012. Mr. Kumar is currently Executive Vice President and President of the Networking and Applications Product Unit of GENBAND. He is responsible for managing all aspects of the business including research and development, product line management, and sustaining engineering divisions worldwide. Mr. Kumar joined GENBAND in July 2011. Prior to joining GENBAND, he served as the Executive Vice President, Engineering and Operations, at Mavenir Systems, a venture funded startup that delivers innovative convergence solutions for Tier-1 wireless operators. At Mavenir Systems, Mr. Kumar was responsible for its worldwide Engineering and Operations teams across 5 countries (US, Canada, UK, China and India). Prior to joining Mavenir, Mr. Kumar was Vice President of Softswitch Solutions at Tekelec, which he joined as a result of the acquisition by Tekelec of VocalData, where he was Vice President of Engineering from 2000-2004. Mr. Kumar began his career at Bell Labs, Lucent Technologies. He has an M.S. in Computer Science from the Florida Institute of Technology, where he also received a B.S. in Electrical Engineering.

The Nominating and Corporate Governance Committee believes that Mr. Kumar’s role as a member of the executive team at GENBAND and his experience in executive management, engineering and operations in high technology companies gives him the qualifications and skills to serve as our director.

Mr. Alan B. Lefkofhas served as a member of our Board since August 2012 and currently serves on the Compensation Committee and the Nominating and Corporate Governance Committee. Mr. Lefkof served as Corporate Vice President and General Manager of Motorola, Inc. and then the spinoff, Motorola Mobility Holdings, Inc., from February 2007 to February 2012. During the first three years of this five year period, he led the Broadband Solutions Group within the Home Division and then later was responsible for establishing the Software Solutions Group, where he sponsored and integrated several software company acquisitions. Mr. Lefkof served as a Director and as President and Chief Executive Officer of Netopia, Inc., a developer of broadband networking equipment and carrier-class software for the remote management of broadband services (NASDAQ:

10

NTPA), from June 1996 until it was acquired by Motorola, Inc. in February 2007. Prior to Netopia, Inc., Mr. Lefkof was President of Farallon Communications Inc., a local area networking company, from 1991 to 1996. From 1988 to 1990, he was President of the GRiD Division of Tandy Corporation, where Mr. Lefkof led the enterprise division for personal computers and laptops. Prior to that time, from 1982 to 1987, Mr. Lefkof held various positions with GRiD Systems Corporation, a Laptop and Pen-based computer company, including Chief Financial Officer, Vice President of Marketing and Director of Product Management. Mr. Lefkof began his career at McKinsey & Company, Inc., where he was a management consultant and held positions ranging from associate to senior engagement manager from 1977 to 1981. Mr. Lefkof earned an MBA in General Management from Harvard Business School and a BS in Management from Massachusetts Institute of Technology. Mr. Lefkof currently serves on the board of directors of Cognitive Electronics, Inc., a privately held company focused on Big Data analytics, and has previously served on the Board of Directors of other privately-held software companies. He also served as a member of the Board of Directors and was a member of the Audit and Compensation Committees of QuickLogic Corporation (NASDAQ: QUIK) from 2002 to 2004.

The Nominating and Corporate Governance Committee believes that Mr. Lefkof’s knowledge of and expertise in the software and communications industries, as well as his extensive management experience, give him the qualifications and skills to serve as our director.

Ms. Mary Losty has served as a member of our Board since March 2007. She is currently a member of the Audit Committee and the Nominating and Corporate Governance Committee. Ms. Losty retired in 2010 as the General Partner at Cornwall Asset Management, LLC, a portfolio management firm located in Baltimore, Maryland, where she was responsible for the firm’s investment in numerous companies since 1998. Ms. Losty’s prior experience includes working as a portfolio manager at Duggan & Associates from 1992 to 1998 and as an equity research analyst at M. Kimelman & Company from 1990 to 1992. Prior to that she worked as an investment banker at Morgan Stanley and Co., and for several years prior to that she was the top aide to James R. Schlesinger, a five-time U.S. cabinet secretary. Ms. Losty received both her BS and JD from Georgetown University, the latter with magna cum laude distinction. She is a member of the American Bar Association and a commissioner for Cambridge, Maryland’s Planning and Zoning Commission. Ms. Losty sits on the board of directors of the American Board of the United Nations University for Peace, an institution which enjoys the exclusive status of being sanctioned by all 192 member states of the United Nations, and was a director of Blue Earth, Inc. (formerly Genesis Fluid Solutions Holdings, Inc.) from 2009 to 2011. Ms. Losty was also a director of TWL Corporation from 2008 to 2009.

The Nominating and Corporate Governance Committee believes that Ms. Losty’s investing and business expertise give her the qualifications and skills to serve as our director, and are of particular importance as we continue to finance our operations.

Mr. Thomas Saponas has served as a member of our Board since April 2004. He is currently a member of the Audit Committee and serves as Chairperson of the Compensation Committee. Mr. Saponas served as the Senior Vice President and Chief Technology Officer of Agilent Technologies, Inc. (NYSE: A) from August 1999 until he retired in October 2003. Prior to being named Chief Technology Officer, from June 1998 to April 1999, Mr. Saponas was Vice President and General Manager of Hewlett-Packard’s Electronic Instruments Group. Mr. Saponas has held a number of positions since the time he joined Hewlett-Packard. Mr. Saponas served as General Manager of the Lake Stevens Division from August 1997 to June 1998 and General Manager of the Colorado Springs Division from August 1989 to August 1997. In 1986, he was a White House Fellow in Washington, D.C. Mr. Saponas has a BSEE/CS (Electrical Engineering and Computer Science) and an MSEE from the University of Colorado. Mr. Saponas is a director of nGimat, a nanotechnology company, and was a director of Keithley Instruments (NYSE: KEI), an electronic instruments company, from 2004 to 2010.

The Nominating and Corporate Governance Committee believes that Mr. Saponas’ senior technology and general business management expertise, and related experience at public technology-based companies, give him the qualifications and skills to serve as our director, and that Mr. Saponas’ years of service as our director bring historic knowledge and continuity to the Board.

11

Mr. William Slavin has served as a member of our Board since October 2010. He is currently a member of the Nominating and Corporate Governance Committee. Mr. Slavin served in various executive positions at International Business Machines Corporation (NYSE: IBM) from 1993 until he retired in June 2005 from his position as Vice President, with responsibility for acquisitions and divestitures for the new Business Consulting Services. During his service at IBM, Mr. Slavin helped establish the business consulting and systems integration business, held executive positions in the US, Asia and Europe, and served on IBM’s Corporate Senior Leadership Team and the Global Management Board for Business Consulting Services, the organization formed with the acquisition of PricewaterhouseCoopers Consulting. Prior to joining IBM, Mr. Slavin was a partner with KPMG, where he was responsible for the western US technology consulting practice. Earlier, he founded Slavin Associates, a technology consulting firm, which was merged into Peat Marwick. Prior to Slavin Associates, he was a Principal with A.T. Kearney, and held technical management positions with Control Data Corporation and Lockheed Missiles and Space Co. Mr. Slavin earned an MBA from the University of Santa Clara and a BA from Claremont McKenna College with majors in economic theory and mathematics.

The Nominating and Corporate Governance Committee believes that Mr. Slavin’s executive, business and strategic consulting and wide breadth of business expertise, including a diversified consulting and business development background, give him the qualifications and skills to serve as our director.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTEIN FAVOROF EACH NAMED NOMINEE

Information Regarding the Board of Directors and Corporate Governance

Independence of the Board of Directors

As required under The NASDAQ Stock Market LLC (“NASDAQ”) listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. The Board consults with our counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of the NASDAQ, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and us, our senior management and our independent auditors, the Board has affirmatively determined that the following seven (7) directors are independent directors within the meaning of the applicable NASDAQ listing standards: Mr. McClendon, Mr. Hillberg, Ms. Huebner, Mr. Lefkof, Ms. Losty, Mr. Saponas and Mr. Slavin. In making this determination, the Board found that none of these directors had a material or other disqualifying relationship with us. In addition to transactions required to be disclosed under SEC rules, the Board considered certain other relationships in making its independence determinations, and determined in each case that such other relationships did not impair the director’s ability to exercise independent judgment on our behalf.

Mr. Brear, our President and Chief Executive Officer, is not an independent director by virtue of his employment with us. The Board has also determined that Mr. Kumar, Executive Vice President, and President, Networking and Applications Product Unit of GENBAND, is not an independent director because GENBAND is a company with which we have entered into a Master OEM Purchase and Sales Agreement.

Board Leadership Structure

The Board has determined that having an independent director serve as Chairperson of the Board is in the best interest of our stockholders at this time, and that separation of the positions of Chairperson of the Board and Chief Executive Officer reinforces the independence of the Board in its oversight of our business and affairs. The structure ensures a greater role for the independent directors in the oversight of us and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board.

12

Role of the Board in Risk Oversight

We face a variety of risks, including liquidity and operational risks. The Board and each of its committees are involved in overseeing risk associated with us. The Audit Committee reviews and discusses with management and the independent accountants our guidelines and policies with respect to risk assessment and risk management, including our major financial risk exposures and the steps taken by management to monitor and control such exposures. The Audit Committee determines and approves, prior to commencement of the audit engagement, the scope and plan for the internal audit and confers with management and the independent accountant regarding the scope, adequacy and effectiveness of internal control over financial reporting, including any special audit steps taken in the event of a material control deficiency. The Audit Committee also reviews with management and the independent accountants any fraud, whether or not material, that includes management or other employees who have a significant role in our internal control over financial reporting. Furthermore, the Audit Committee establishes and oversees procedures for the receipt, retention and treatment of complaints that we receive regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. The Nominating and Corporate Governance Committee reviews, discusses and assesses, along with input from senior management, the performance of the Board and the committees of the Board at least annually. The Chief Executive Officer and the Nominating and Corporate Governance Committee periodically review succession matters related to the offices of chief executive officer and chief financial officer, and the Nominating and Corporate Governance Committee is responsible for making recommendations to the Board in connection with the selection of appropriate individuals to succeed to such positions. The Compensation Committee reviews, establishes and modifies, as needed, our compensation strategies and policies and is responsible for determining and approving (or, if it deems appropriate, recommending to the Board for determination and approval) the compensation of our executive officers and non-employee directors, taking into account the policies of the Compensation Committee and the performance of the individual, in addition to other factors. The Compensation Committee reviews and recommends to the Board for approval the frequency with which we will conduct say-on-pay votes, taking into account the results of the most recent stockholder advisory vote on the frequency of such say-on-pay votes, and reviews and approves the proposals regarding the say-on-pay vote and the frequency of the say-on-pay vote to be included in each of our annual meeting proxy statements. At least annually, the Compensation Committee reviews our incentive compensation arrangements to determine whether they encourage excessive risk-taking, reviews and discusses the relationship between our risk management policies and practices and compensation, and evaluates compensation policies and practices that would mitigate such risk.

Meetings of the Board of Directors

The Board met eight times and took action by unanimous written consent five times during the last fiscal year. All directors except for Mr. Kumar attended at least 75% of the aggregate number of meetings of the Board and of the committees on which they served that were held during the portion of the last fiscal year for which they were directors or committee members, respectively. It is our policy to invite directors and nominees for director to attend the Annual Meeting either in person or by telephone. We held one annual meeting of stockholders in 2012. James F. Brear, Mary Losty, Scott McClendon, Thomas Saponas and William Slavin attended the meeting in person or by teleconference.

Executive Sessions

As required under applicable NASDAQ listing standards, our independent directors periodically meet in executive session at which only they are present.

13

Information Regarding Committees of the Board of Directors

The Board has three primary committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for 2012 for each of these committees of the Board:

| | | | | | | | | | | | |

Name | | Audit(1) | | | Compensation | | | Nominating and

Corporate

Governance | |

Scott McClendon | | | X | | | | X | (2) | | | | |

James F. Brear | | | | | | | | | | | | |

Staffan Hillberg | | | | | | | X | | | | X | * |

Elizabeth Huebner(3) | | | X | * | | | | | | | | |

B.G. Kumar(4) | | | | | | | | | | | | |

Alan B. Lefkof(4) | | | | | | | X | | | | X | |

Mary Losty | | | X | | | | | | | | X | |

Thomas Saponas | | | X | | | | X | * | | | | |

William Slavin | | | | | | | | | | | X | |

Total meetings in 2012 | | | 5 | | | | 6 | | | | 6 | |

Total actions by unanimous written consent in 2012 | | | — | | | | 3 | | | | — | |

| (1) | Paul Stich served on the Audit Committee and as its Chairperson until his service to the Board ended on August 27, 2012. Mr. McClendon served as Interim Chairperson of the Audit Committee until Ms. Hubener was appointed to the Board and as Chairperson of the Audit Committee effective September 17, 2012. |

| (2) | Mr. McClendon served on the Compensation Committee until August 27, 2012. |

| (3) | Appointed to the Board effective September 17, 2012. |

| (4) | Elected to the Board on August 27, 2012. |

Below is a description of each primary committee of the Board. Each of these committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board has determined that each member of each of these committees meets the applicable NASDAQ rules and regulations regarding “independence” and that each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to us.

Audit Committee

The Audit Committee of the Board is a separately-designated standing audit committee established by the Board in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee is composed of four directors: Ms. Huebner, Ms. Losty, Mr. McClendon and Mr. Saponas. The Board reviews the NASDAQ listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of the Audit Committee are independent (as independence is currently defined in the NASDAQ listing standards). The Board has concluded that Ms. Huebner is an “audit committee financial expert” as defined by the applicable SEC rules. The Audit Committee has adopted a written charter that is available on our website at http://www.proceranetworks.com/ir-corporate-governance.html.

The Audit Committee acts on behalf of the Board in fulfilling the Board’s oversight responsibilities with respect to our corporate accounting and financial reporting processes, the systems of internal control over financial reporting and audits of financial statements, and also assists the Board in its oversight of the quality and

14

integrity of our financial statements and reports and the qualifications, independence and performance of our independent registered public accounting firm. For this purpose, the Audit Committee performs several functions. The Audit Committee’s responsibilities include:

| | • | | appointing, determining the compensation of, retaining, overseeing and evaluating our independent registered public accounting firm and any other registered public accounting firm engaged for the purpose of performing other review or attest services for us; |

| | • | | prior to commencement of the audit engagement, reviewing and discussing with prospective independent registered public accounting firm a written disclosure by the prospective independent registered public accounting firm of all relationships between us, or persons in financial oversight roles, and such independent registered public accounting firm or their affiliates; |

| | • | | determining and approving engagements of the independent registered public accounting firm, prior to commencement of the engagement, and the scope of and plans for the audit; |

| | • | | monitoring the rotation of partners of the independent registered public accounting firm on our audit engagement; |

| | • | | reviewing with management and the independent registered public accounting firm any fraud that includes management or employees who have a significant role in our internal control over financial reporting and any significant changes in internal controls; |

| | • | | establishing and overseeing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or other auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; |

| | • | | reviewing management’s efforts to monitor compliance with our policies designed to ensure compliance with laws and rules; and |

| | • | | reviewing and discussing with management and the independent registered public accounting firm the results of the annual audit and the independent registered public accounting firm’s assessment of the quality and acceptability of our accounting principles and practices and all other matters required to be communicated to the Audit Committee by the independent registered public accounting firm under generally accepted accounting standards, the results of the independent registered public accounting firm’s review of our quarterly financial information prior to public disclosure and our disclosures in our periodic reports filed with the SEC. |

The Audit Committee reviews, discusses and assesses its own performance and composition at least annually. The Audit Committee also periodically, and at least annually, reviews and assesses the adequacy of its charter, including its role and responsibilities as outlined in its charter, and recommends any proposed changes to the Board for its consideration and approval.

15

Report of the Audit Committee of the Board of Directors1

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2012 with our management. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012.

Ms. Elizabeth Huebner

Ms. Mary Losty

Mr. Scott McClendon

Mr. Thomas Saponas

| 1 | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

Compensation Committee

The Compensation Committee of the Board is composed of three directors: Mr. Hillberg, Mr. Lefkof and Mr. Saponas. All members of the Compensation Committee are independent (as independence is currently defined in the NASDAQ listing standards). The Compensation Committee has adopted a written charter that is available on our website athttp://www.proceranetworks.com/ir-corporate-governance.html.

The Compensation Committee acts on behalf of the Board to fulfill the Board’s responsibilities in overseeing our compensation policies, plans and programs; and in reviewing and determining the compensation to be paid to our executive officers and non-employee directors. The responsibilities of the Compensation Committee include:

| | • | | reviewing, modifying and approving (or, if the Compensation Committee deems appropriate, making recommendations to the Board regarding) our overall compensation strategies and policies, and reviewing and approving corporate performance goals and objectives relevant to the compensation of our executive officers and senior management; |

| | • | | determining and approving (or, if the Compensation Committee deems appropriate, recommending to the Board for determination and approval) the compensation and terms of employment of our Chief Executive Officer, including seeking to achieve an appropriate level of risk and reward in determining the long-term incentive component of the Chief Executive Officer’s compensation; |

| | • | | determining and approving (or, if the Compensation Committee deems appropriate, recommending to the Board for determination and approval) the compensation and terms of employment of our executive officers and senior management; |

| | • | | evaluating and approving (or, if it deems appropriate, making recommendations to the full Board regarding) corporate performance goals and objectives relevant to the compensation of our executive officers and senior management; |

16

| | • | | reviewing and approving (or, if it deems appropriate, making recommendations to the Board regarding) the terms of employment agreements, severance agreements, change-of-control protections and other compensatory arrangements for our executive officers and senior management; |

| | • | | reviewing and approving the type and amount of compensation to be paid or awarded to non-employee directors; |

| | • | | reviewing and approving the adoption, amendment and termination of our stock option plans, stock appreciation rights plans, pension and profit sharing plans, incentive plans, stock bonus plans, stock purchase plans, bonus plans, deferred compensation plans and similar programs, as applicable; and administering all such plans, establishing guidelines, interpreting plan documents, selecting participants, approving grants and awards and exercising such other power and authority as may be permitted or required under such plans; |

| | • | | reviewing our incentive compensation arrangements to determine whether such arrangements encourage excessive risk-taking, and reviewing and discussing the relationship between our risk management policies and practices and compensation, and evaluating compensation policies and practices that could mitigate any such risk, at least annually; and |

| | • | | reviewing and recommending to the Board for approval the frequency with which we conduct a vote on executive compensation, taking into account the results of the most recent stockholder advisory vote on the frequency of the vote on executive compensation, and reviewing and approving the proposals and frequency of the vote on executive compensation to be included in our annual meeting proxy statements. |

Historically, the Compensation Committee has made recommendations to the Board for most of the significant adjustments to annual compensation, bonus objectives and equity awards at one or more meetings held during or leading up to the first quarter of the year and in the third quarter of the year. However, the Compensation Committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the efficacy of our compensation strategy, potential modifications to that strategy and new trends, plans or approaches to compensation, at various meetings throughout the year. Generally, the Compensation Committee’s process comprises two related elements: the determination of compensation levels and the establishment of performance objectives for the current year. For executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the Compensation Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee, which determines or makes recommendations to the Board with respect to his compensation, including any equity awards to be granted. For all executives and non-employee directors, as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, executive and director stock ownership information, our stock performance data, analyses of historical executive compensation levels and current company-wide compensation levels and recommendations of the Compensation Committee’s compensation consultant, including analyses of executive and director compensation paid at other companies identified by the compensation consultant.

The Compensation Committee reviews and discusses with management our Compensation Discussion and Analysis, and recommends to the Board that the Compensation Discussion and Analysis be approved for inclusion in our annual reports on Form 10-K, registration statements, proxy statements or information statements, as applicable.

17

Compensation Committee Processes and Procedures

The Compensation Committee holds regular or special meetings as its members deem necessary or appropriate. The Compensation Committee, through the chairperson of the Compensation Committee, reports all material activities of the Compensation Committee to the Board from time to time, or whenever so requested by the Board. The charter of the Compensation Committee grants the Compensation Committee full access to all of our books, records, facilities and personnel, as well as authority to select, retain and obtain, at our expense, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. In particular, the Compensation Committee has the sole authority to retain and terminate any compensation consultants to assist in its evaluation of director, chief executive officer or senior executive compensation, including sole authority to approve the consultant’s reasonable fees and other retention terms. The Compensation Committee is directly responsible for the appointment, compensation and oversight of the work of any internal or external legal, accounting or other advisors and consultants retained by the Compensation Committee. The Compensation Committee may select an internal or external legal, accounting or other advisor or consultant only after considering the independence of such internal or external legal, accounting or other advisor or consultant using factors established by law and the rules and regulations of the SEC and Nasdaq.

During the past year, the Compensation Committee engaged Compensia, Inc. as a compensation consultant. As part of its engagement, Compensia, Inc. was requested by the Compensation Committee to develop a comparative group of companies and to perform analyses of competitive performance and compensation levels for the comparative group. Compensia, Inc. has not provided any services to Procera other than this engagement, and receives compensation from Procera only for services provided to the Compensation Committee.

Under its charter, the Compensation Committee may form, and delegate authority to, subcommittees as appropriate.

The Compensation Committee reviews, discusses and assesses its own performance and composition at least annually. The Compensation Committee also periodically, and at least annually, reviews and assesses the adequacy of its charter, including its role and responsibilities as outlined in its charter, and recommends any proposed changes to the Board for its consideration and approval.

Compensation Committee Interlocks and Insider Participation

As noted above, the Compensation Committee consists of three directors, each of whom is a non-employee director: Mr. Hillberg, Mr. Lefkof and Mr. Saponas. Mr. McClendon served on the Compensation Committee until August 27, 2012. None of the aforementioned individuals was, during 2012, an officer or employee of ours, was formerly an officer of ours or had any relationship requiring disclosure by us under Item 404 of Regulation S-K. No interlocking relationship as described in Item 407(e)(4) of Regulation S-K exists between any of our executive officers or Compensation Committee members, on the one hand, and the executive officers or compensation committee members of any other entity, on the other hand, nor has any such interlocking relationship existed in the past.

18

Compensation Committee Report2

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis (“CD&A”) contained in this proxy statement. Based on this review and discussion, the Compensation Committee has recommended to the Board of Directors that the CD&A be included in this proxy statement and incorporated in our Annual Report on Form 10-K for the year ended December 31, 2012.

Mr. Staffan Hillberg

Mr. Alan B. Lefkof

Mr. Thomas Saponas

| 2 | The material in this report is not “soliciting material,” is furnished to, but not deemed “filed” with, the SEC and is not deemed to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, other than our Annual Report on Form 10-K, where it shall be deemed to be “furnished,” whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board is composed of four directors: Mr. Hillberg, Mr. Lefkof, Ms. Losty and Mr. Slavin. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in the NASDAQ listing standards). The Nominating and Corporate Governance Committee has adopted a written charter that is available on our website athttp://www.proceranetworks.com/ir-corporate-governance.html.

The Nominating and Corporate Governance Committee acts on behalf of the Board to fulfill the Board’s responsibilities in overseeing all aspects of our nominating and corporate governance functions. The responsibilities of the Nominating and Corporate Governance Committee include:

| | • | | making recommendations to the Board regarding corporate governance issues; |

| | • | | identifying, reviewing and evaluating candidates to serve as directors (consistent with criteria approved by the Board); |

| | • | | determining the minimum qualifications for service on the Board, including the right to modify such qualifications from time to time; |

| | • | | reviewing and evaluating incumbent directors; |

| | • | | serving as a focal point for communication between candidates, non-committee members and our management; |

| | • | | recommending to the Board for selection candidates to serve as nominees for director for the annual meeting of stockholders; |

| | • | | making other recommendations to the Board regarding matters relating to the directors, including director compensation; and |

| | • | | considering recommendations for nominees and proposals submitted by stockholders. |

The Nominating and Corporate Governance Committee periodically, and at least annually, reviews, discusses and assesses the performance of the Board and committees of the Board. In fulfilling this responsibility, the Nominating and Corporate Governance Committee seeks input from senior management, the

19

full Board and others. In assessing the Board, the Nominating and Corporate Governance Committee evaluates the overall composition of the Board, the Board’s contribution as a whole and its effectiveness in serving our best interests and the best interests of our stockholders.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also considers such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to our affairs, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of our stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, our operating requirements and the long-term interests of our stockholders.

In conducting this assessment, the Nominating and Corporate Governance Committee considers diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board and us, to maintain a balance of knowledge, experience and capability. While the Nominating and Corporate Governance Committee considers diversity as one of a number of factors in identifying nominees for director, it does not have a formal policy in this regard. The Nominating and Corporate Governance Committee views diversity broadly to include diversity of experience, skills and viewpoint, as well as traditional diversity concepts such as race or gender. In consideration of our subsidiary in Sweden and the related high concentration of Swedish employees to our total employees, one of our independent directors is Swedish and lives in Sweden. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to us during their terms, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for NASDAQ purposes, which determination is based upon applicable NASDAQ listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote.