EXHIBIT 99.1

Investor Day Presentation October 2022

Non - GAAP financial m easures As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non - GAAP financial measures contained in this presentation to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this document. This document contains the following non - GAAP financial measures: adjusted earnings before interest, taxes, depreciation and amo rtization (“adjusted EBITDA”), adjusted operating ratio (including and excluding gains on real estate transactions), return on invested capital (“ROIC”), net leverage, net debt and adjusted revenue attributable to the re mai ning company. This document also refers to free cashflow, a non - GAAP financial measure. We believe that the above adjusted financial measures facilitate analysis of the ongoing business operations of our business bec ause they exclude items that may not be reflective of, or are unrelated to, our business’ core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying busi nes ses. Other companies may calculate these non - GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non - GAAP financial measures should onl y be used as supplemental measures of our operating performance. Adjusted EBITDA include adjustments for transaction and integration costs as well as restructuring costs. Transaction and int egr ation adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin - off and may include transaction costs, consulting fees, retention awards, and internal salaries and wages (t o the extent the individuals are assigned full - time to integration and transformation activities)and certain costs related to integrating and converging IT systems. Restructuring costs primarily relate to severance costs assoc iat ed with business optimization initiatives. Management uses these non - GAAP financial measures in making financial, operating and planning decisions and evaluating our LTL business’ ongoing performance. We believe that adjusted EBITDA improve comparability from period to period by removing the impact of our capital structure ( int erest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses. We believe that adjusted operating ratio improve the comparability of our operating results from period to period by ( i ) removing the impact of certain transaction, integration and rebranding costs and restructuring costs, as well as amortizati on expenses and (ii) including the impact of pension income incurred in the reporting period as set out in the attached tables. We believ e t hat ROIC is an important metric as it measures how effectively we deploy our capital base. ROIC is calculated as net operating profit after tax (“NOPAT”) for the trailing twelve months ended June 30, 2022divided by invested cap ital as of June 30, 2022. NOPAT is calculated as adjusted EBITDA less corporate costs, depreciation expense, real estate gains and cash taxes plus operating lease interest. Invested capital is calculated as operating assets l ess non - debt liabilities. We believe that net leverage and net debt are important measures of our overall liquidity position and are calculated by removing cash and cash equivalents from our reported total debt. Adjusted revenue at tri buted to the remaining company is calculated as revenue for XPO less revenue from the Intermodal and RXO businesses and eliminations. We believe that free cash flow is an important measure of our ability to repay maturing deb t or fund other uses of capital that we believe will enhance stockholder value. Free cash flow is calculated as net cash provided by operating activities, less payment for purchases of property and equipment plus proceeds f rom sale of property and equipment. With respect to our financial targets for 2027 adjusted EBITDA and adjusted operating ratio, a reconciliation of these non - GAAP measures to the corresponding GAAP measures is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from these non - GAAP target measures. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward - looking statement of income and statement of cash flows prepared in accordance with GAAP that would be required to produce such a reconciliation. 2

Forward - looking s tatements This presentation includes forward - looking statements within the meaning of Section 27A of the Securities Act of 1933 and Sectio n 21E of the Securities Exchange Act of 1934, including statements relating to the planned spin - off, the expected timing of the spin - off, the anticipated benefits of the spin - off, the planned divesture of the European business, g rowth strategies and our targets for growth, profitability and efficiency. All statements other than statements of historical fact are, or may be deemed to be, forward - looking statements. In some cases, forward - looking statements can be identified by the use of forward - looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “efficiency,” “growth strategies,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “e xpe ct,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statemen ts are not forward - looking. These forward - looking statements are based on certain assumptions and analyses made by the company in light of its experience and its perception of historical trends, current conditions and e xpe cted future developments, as well as other factors the company believes are appropriate in the circumstances. These forward - looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual res ults, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward - looking statements. Factors that m ight cause or contribute to a material difference include our ability to effect the spin - off of our tech - enabled brokered transportation platform and meet the related conditions of the spin - off, the expected timing of the comple tion of the spin - off and the terms of the spin - off, our ability to achieve the expected benefits of the spin - off, our ability to retain and attract key personnel for the separate businesses, the risks discussed in our filings wi th the SEC, and the following: economic conditions generally; the severity, magnitude, duration and aftereffects of the COVID - 19 pandemic, including supply chain disruptions due to plant and port shutdowns and transportation del ays, the global shortage of certain components such as semiconductor chips, strains on production or extraction of raw materials, cost inflation and labor and equipment shortages, which may lower levels of servic e, including the timeliness, productivity and quality of service, and government responses to these factors; our ability to align our investments in capital assets, including equipment, service centers and warehouses, to our cus tomers’ demands; our ability to implement our cost and revenue initiatives; our ability to benefit from the proposed spin - off; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvem ent opportunities with respect to acquired companies; goodwill impairment, including in connection with the proposed spin - off; matters related to our intellectual property rights; fluctuations in currency exchange rates; fuel p rice and fuel surcharge changes; natural disasters, terrorist attacks, wars or similar incidents, including the conflict between Russia and Ukraine and increased tensions between Taiwan and China; risks and uncertainties regarding th e p otential timing and expected benefits of the proposed spin - off of our tech - enabled brokered transportation platform, including the risk that the spin - off may not be completed on the terms or timeline currently contemplat ed, if at all; the impact of the proposed spin - off of our tech - enabled brokered transportation platform on the size and business diversity of our company; the ability of the proposed spin - off of our tech - enabled brokered tr ansportation platform to qualify for tax - free treatment for U.S. federal income tax purposes; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; ou r indebtedness; our ability to raise debt and equity capital; fluctuations in fixed and floating interest rates; our ability to maintain positive relationships with our network of third - party transportation providers; our abi lity to attract and retain qualified drivers; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers and efforts by labor organizations to organize our emp loyees and independent contractors; litigation, including litigation related to alleged misclassification of independent contractors and securities class actions; risks associated with our self - insured claims; risks associated with defined benefit plans for our current and former employees; the impact of potential sales of common stock by our chairman; governmental regulation, including trade compliance laws, as well as changes in internationa l t rade policies, sanctions and tax regimes; governmental or political actions, including the United Kingdom’s exit from the European Union; and competition and pricing pressures. All forward - looking statements set forth in this presentation are qualified by these cautionary statements and there can be no a ssurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forw ard - looking statements set forth in this presentation speak only as of the date hereof, and we do not undertake any obligation to update forward - looking statements to reflect subsequent events or circumstances, changes in expectat ions or the occurrence of unanticipated events, except to the extent required by law. There can be no assurance that the planned spin - off or planned divesture of the European business will occur, or of the terms or timing of any transaction. Where required by law, no binding decision will be made with respect to the divestiture of the European business other than in compliance with applicable employee information and consultation requi rem ents. 3

Mario Harik LTL President; Chief Executive Officer Elect Presenters Jay Silberkleit Chief Information Officer Elect Marissa Christensen Vice President, National Sales Martin Ryan Senior Director, Pricing Matt Fassler Chief Strategy Officer 4 Tony Graham President, West Division

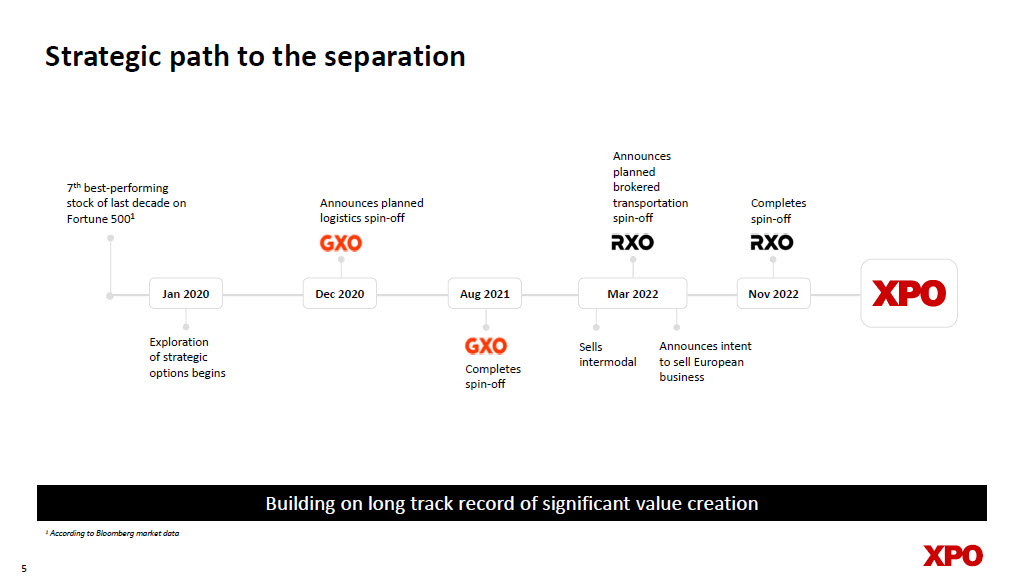

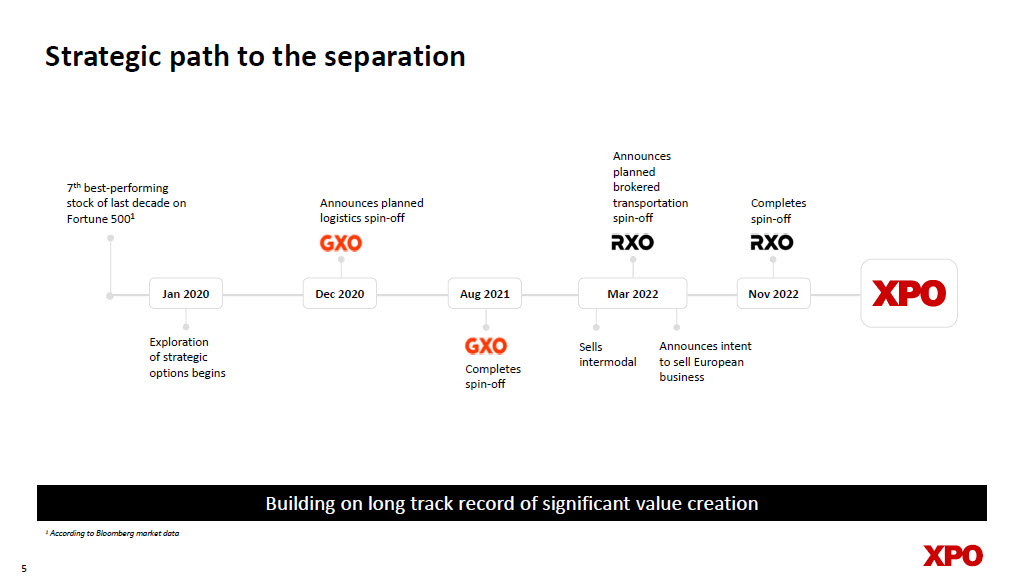

Strategic path to the separation Building on long track record of significant value creation Jan 2020 Dec 2020 Aug 2021 Mar 2022 Nov 2022 Exploration of strategic options begins Completes spin - off Announces planned logistics spin - off Sells intermodal Completes spin - off Announces planned brokered transportation spin - off 1 According to Bloomberg market data Announces intent to sell European business 7 th best - performing stock of last decade on Fortune 500 1 5

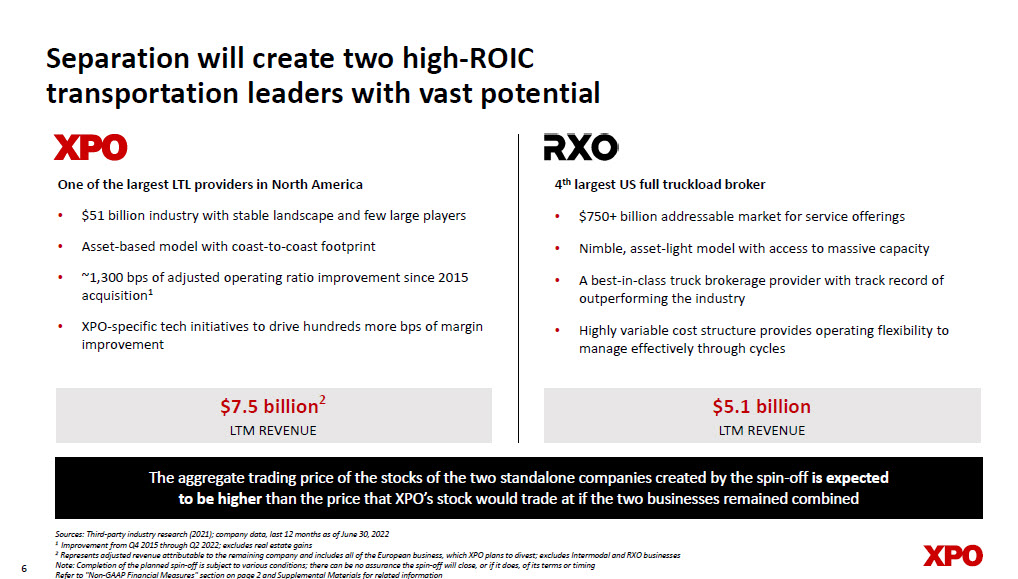

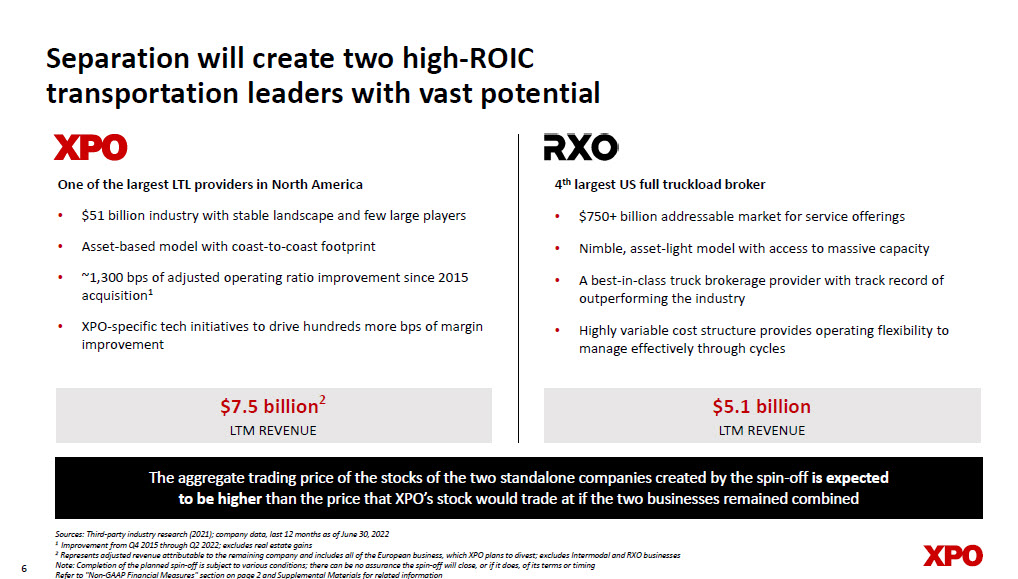

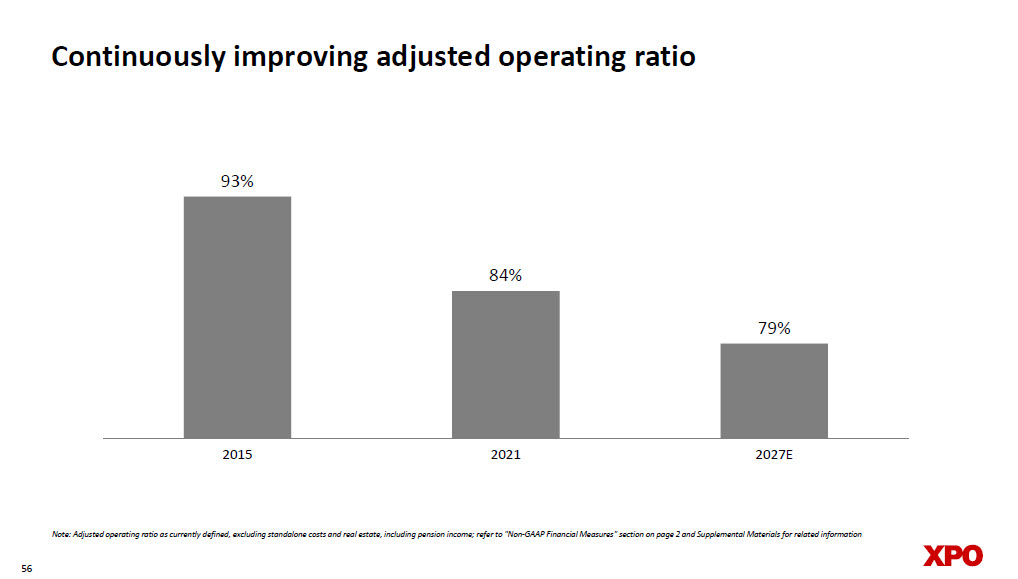

The aggregate trading price of the stocks of the two standalone companies created by the spin - off is expected to be higher than the price that XPO’s stock would trade at if the two businesses remained combined Separation will create two high - ROIC transportation leaders with vast potential One of the largest LTL providers in North America • $51 billion industry with stable landscape and few large players • Asset - based model with coast - to - coast footprint • ~1,300 bps of adjusted operating ratio improvement since 2015 acquisition 1 • XPO - specific tech initiatives to drive hundreds more bps of margin improvement 4 th largest US full truckload broker • $750+ billion addressable market for service offerings • Nimble, asset - light model with access to massive capacity • A best - in - class truck brokerage provider with track record of outperforming the industry • Highly variable cost structure provides operating flexibility to manage effectively through cycles Sources: Third - party industry research (2021); company data, last 12 months as of June 30, 2022 1 Improvement from Q4 2015 through Q2 2022; excludes real estate gains 2 Represents adjusted revenue attributable to the remaining company and includes all of the European business, which XPO plans to divest; excludes Intermodal and RXO businesses Note: Completion of the planned spin - off is subject to various conditions; there can be no assurance the spin - off will close, or if it does, of its terms or timing Refer to "Non - GAAP Financial Measures" section on page 2 and Supplemental Materials for related information $7.5 billion 2 LTM REVENUE 6 $5.1 billion LTM REVENUE

Reasons to invest in XPO Why LTL is an attractive growth industry XPO’s differentiation and competitive advantages Comprehensive growth plan Financial summary and outlook Agenda 7

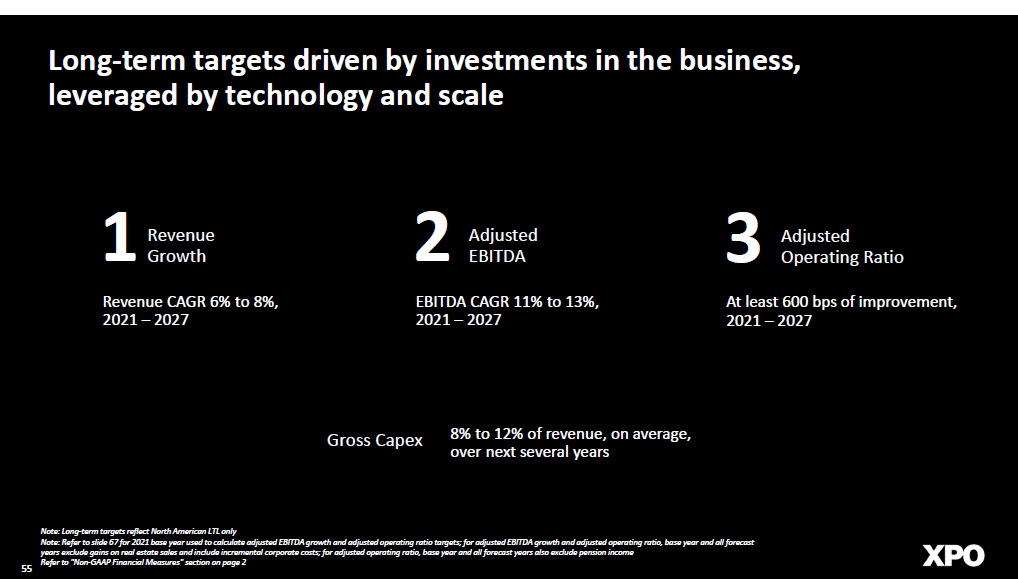

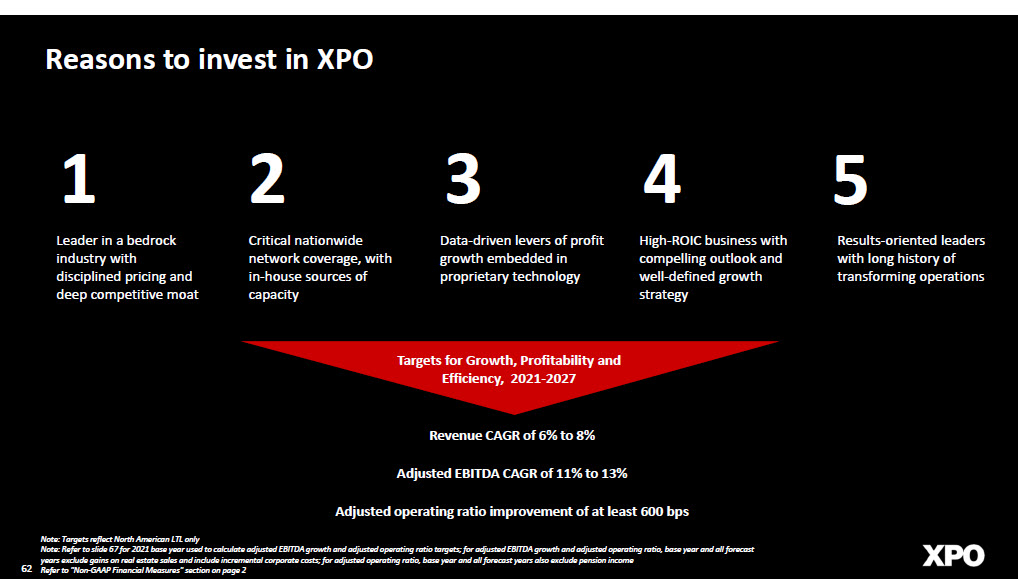

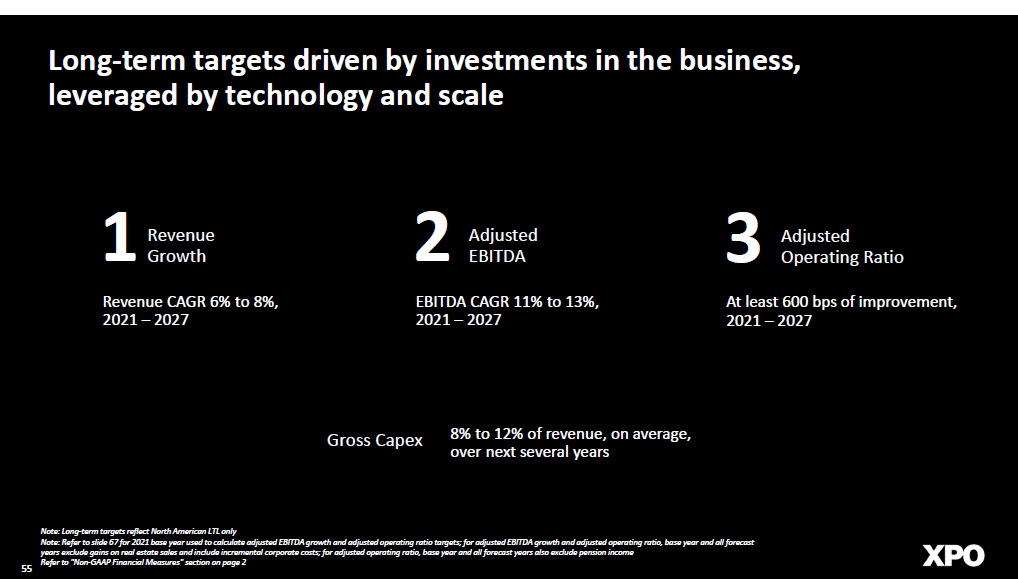

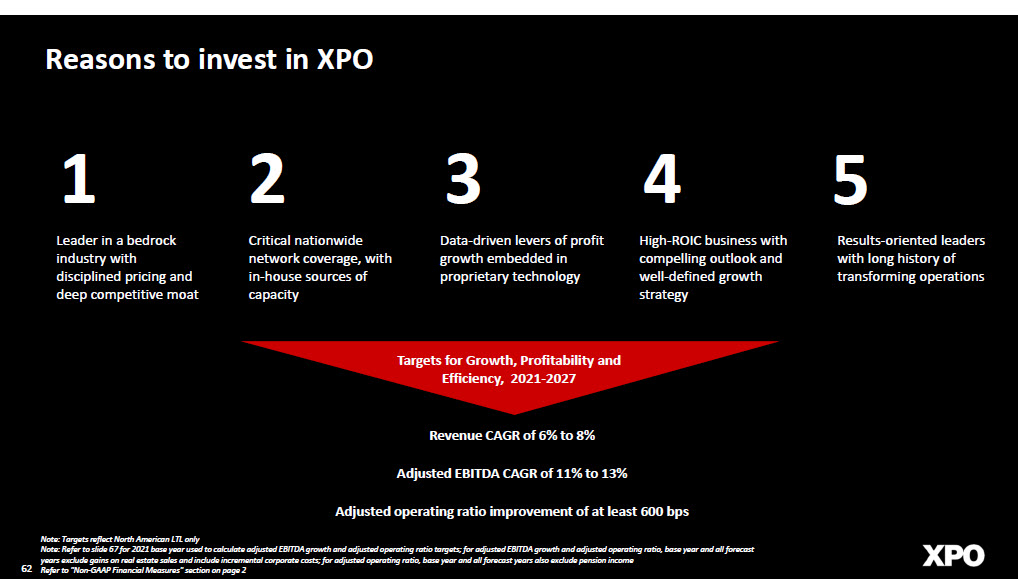

1 Leader in a bedrock industry with disciplined pricing and deep competitive moat 2 3 4 5 Reasons to invest in XPO Critical nationwide network coverage, with in - house sources of capacity Data - driven levers of profit growth embedded in proprietary technology High - ROIC business with compelling outlook and well - defined growth strategy Results - oriented leaders with long history of transforming operations Revenue CAGR of 6% to 8% Adjusted EBITDA CAGR of 11% to 13% Adjusted operating ratio improvement of a t least 600 bps Targets for Growth, Profitability and Efficiency, 2021 - 2027 8 Note: Targets reflect North American LTL only Note: Refer to slide 67 for 2021 base year used to calculate adjusted EBITDA growth and adjusted operating ratio targets; for ad justed EBITDA growth and adjusted operating ratio, base year and all forecast years exclude gains on real estate sales and include incremental corporate costs; for adjusted operating ratio, base year and all fore cast years also exclude pension income Refer to "Non - GAAP Financial Measures" section on page 2

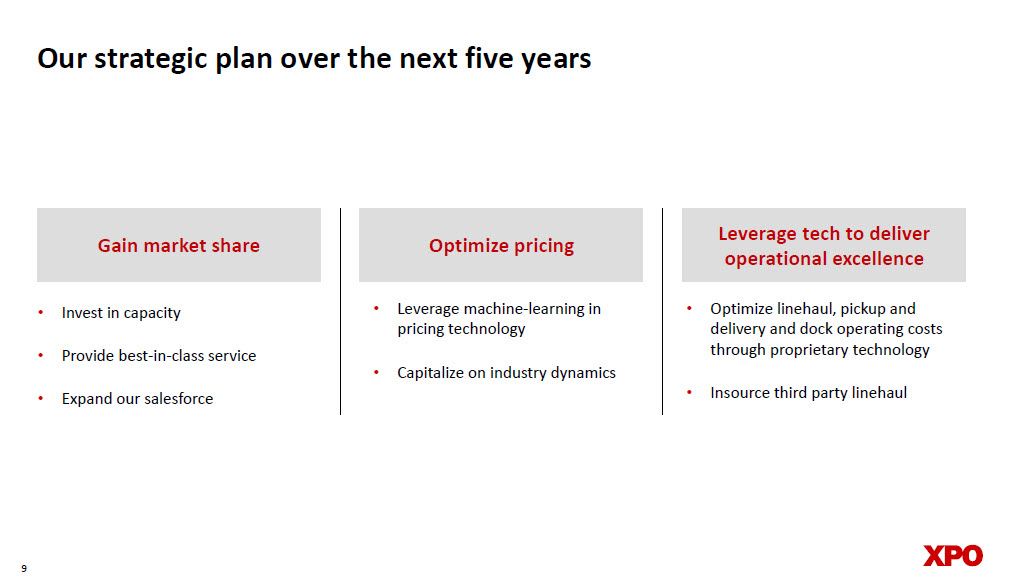

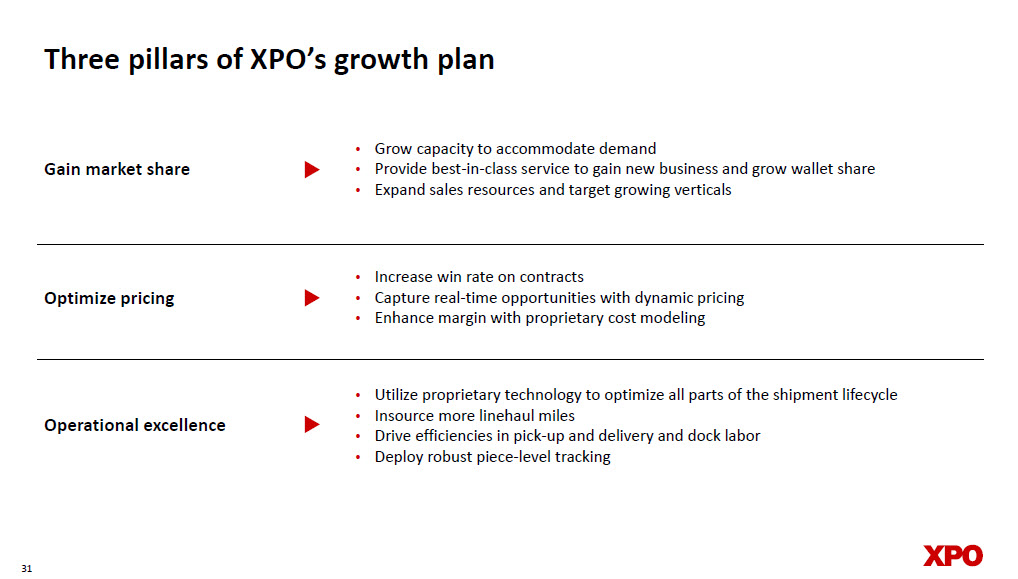

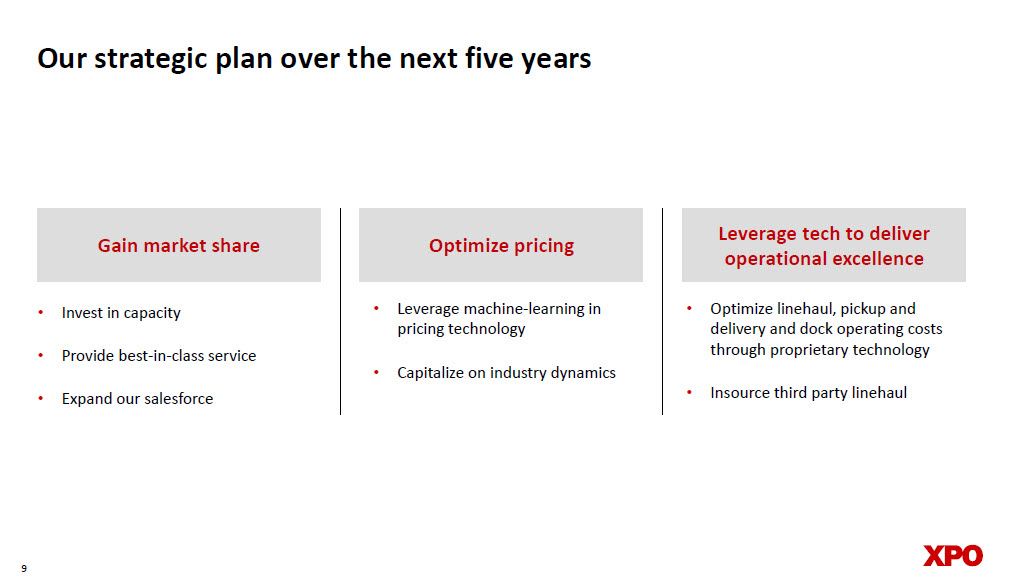

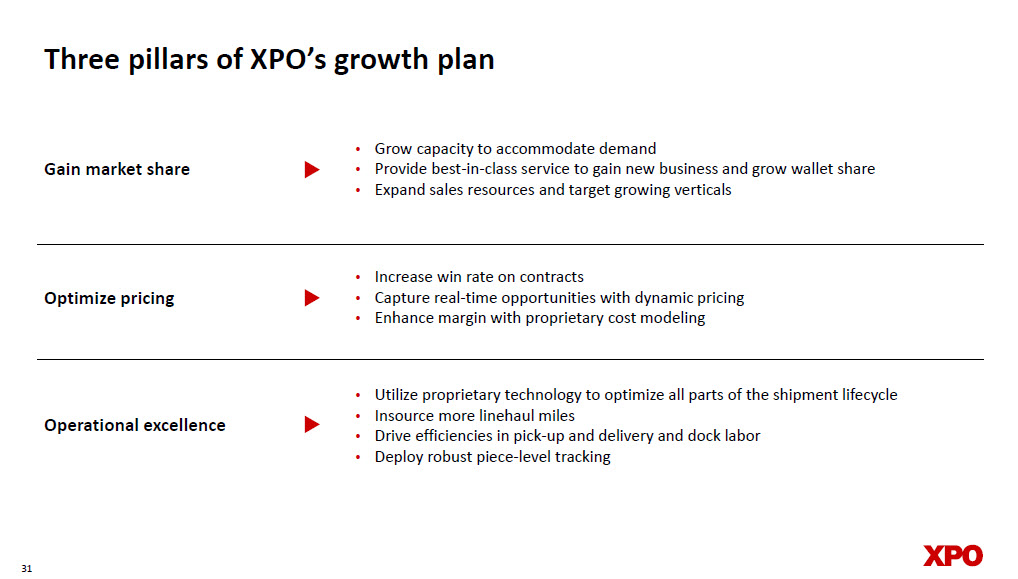

Our strategic plan over the next five years Gain market share Optimize pricing Leverage tech to deliver operational excellence • Invest in capacity • Provide best - in - class service • Expand our salesforce • Leverage machine - learning in pricing technology • Capitalize on industry dynamics • Optimize linehaul, pickup and delivery and dock operating costs through proprietary technology • Insource third party linehaul 9

11% to 13% adjusted EBITDA CAGR for six - year period 2021 - 2027 10 Combination of volume gains + pricing over inflation 6% to 7% 3% to 4% 2% Operating costs optimized through technology Linehaul insourced from third parties Expected contribution to adjusted EBITDA CAGR Drivers of profit growth 11% to 13%

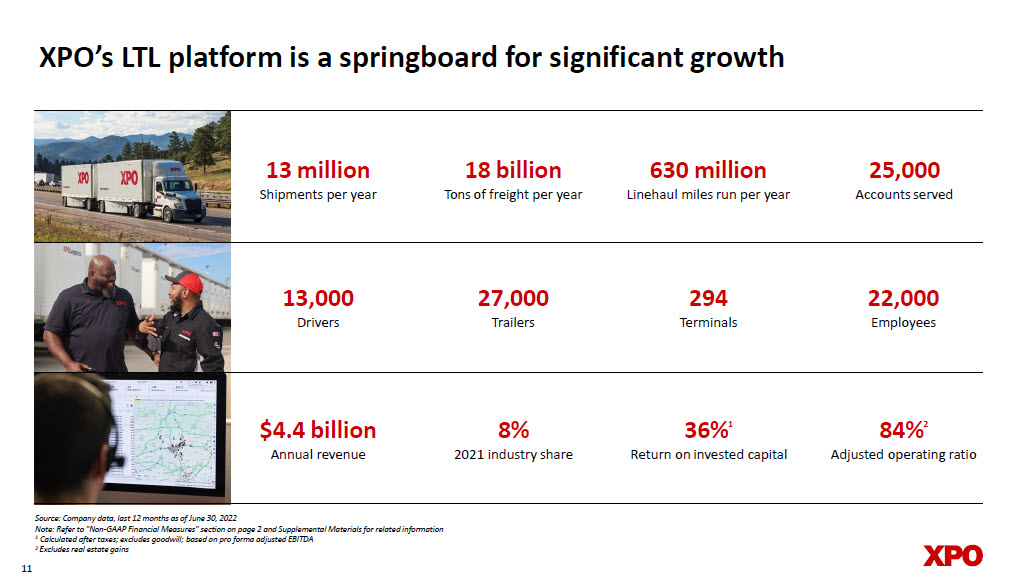

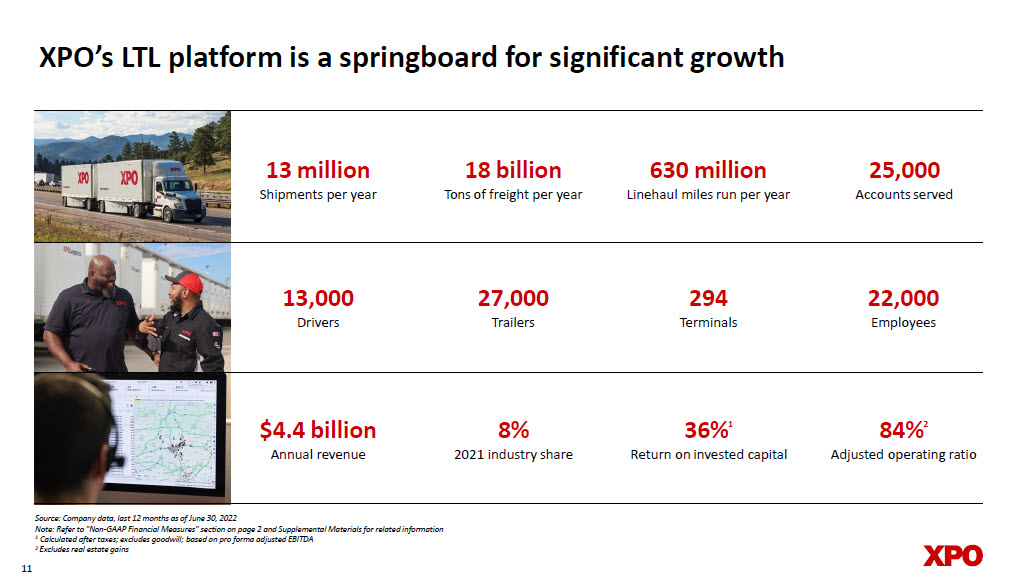

XPO’s LTL platform is a springboard for significant growth Source: Company data, last 12 months as of June 30, 2022 Note: Refer to "Non - GAAP Financial Measures" section on page 2 and Supplemental Materials for related information 1 Calculated after taxes; excludes goodwill; based on pro forma adjusted EBITDA 2 Excludes real estate gains 18 billion Tons of freight per year 630 million Linehaul miles run per year 13 million Shipments per year 2 5 ,000 Accounts served 8% 2021 industry share 84 % 2 Adjusted operating ratio $4. 4 billion Annual r evenue 3 6 % 1 Return on invested capital 11 22,0 0 0 Employees 13,0 0 0 Drivers 27,0 0 0 Trailers 294 Terminals

Why LTL is an attractive growth industry 12

North American LTL industry overview • Shipment is too small to require an entire truck, but larger than parcel, typically shipped on pallets • Freight for different customers consolidated in the same trailer • Networked hub - and - spoke operating model of terminals and other freight handling facilities • Industry growth only constrained by capacity of terminals, trucks, trailers and drivers Defining Characteristics $51 billion 2021 US market 76% Share held by top 10 players Sources: Third - party research; company filings 13

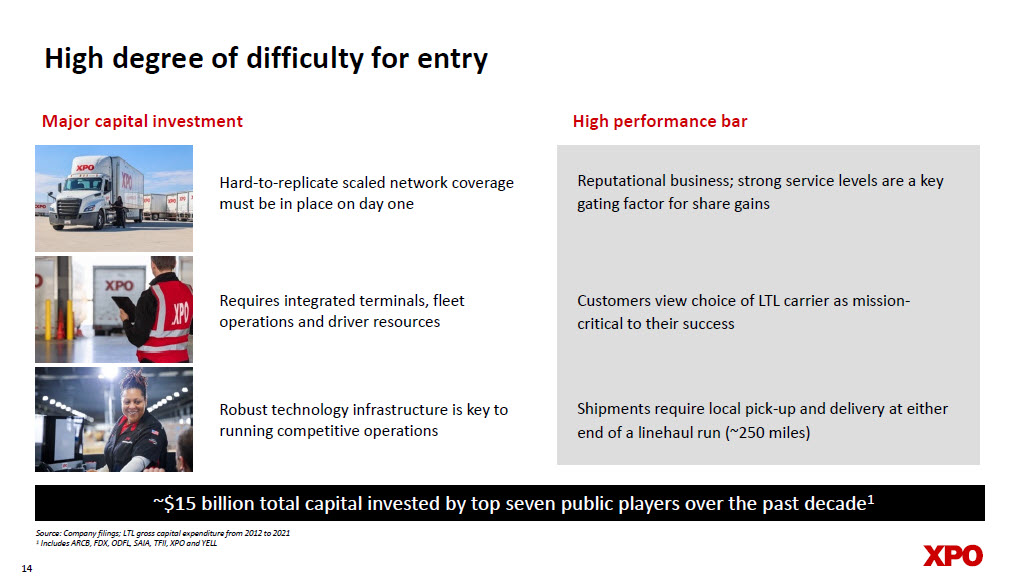

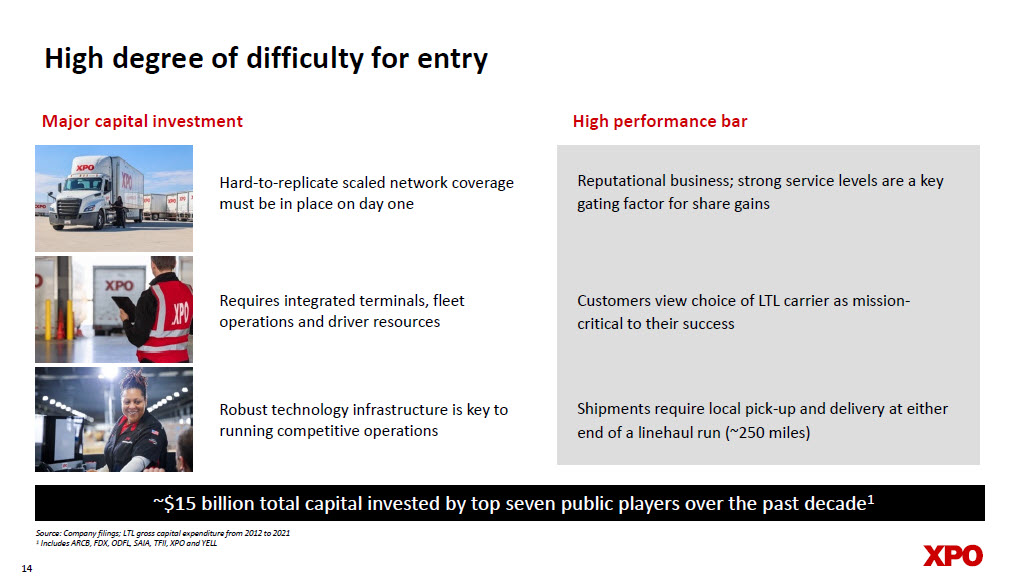

~$15 billion total capital invested by top seven public players over the past decade 1 High degree of difficulty for entry Major capital investment High performance bar Hard - to - replicate scaled network coverage must be in place on day one Reputational business; strong service levels are a key gating factor for share gains Requires integrated terminals, fleet operations and driver resources Customers view choice of LTL carrier as mission - critical to their success Robust technology infrastructure is key to running competitive operations Source: Company filings; LTL gross capital expenditure from 2012 to 2021 1 Includes ARCB, FDX, ODFL, SAIA, TFII, XPO and YELL Shipments require local pick - up and delivery at either end of a linehaul run (~250 miles) 14

$8.6 $5.2 $5.1 $4.1 $3.8 $3.2 $2.5 $2.4 $2.3 $1.5 Fourth largest domestic LTL provider with ability to gain share in a stable competitive landscape Sources: Third - party research; company filings Top 10 LTL carriers by revenue, 2021 $ in billions = top 10 LTL carriers by revenue a decade ago x x x x x x x x x 15 9 largest carriers were also in top 10 a decade ago

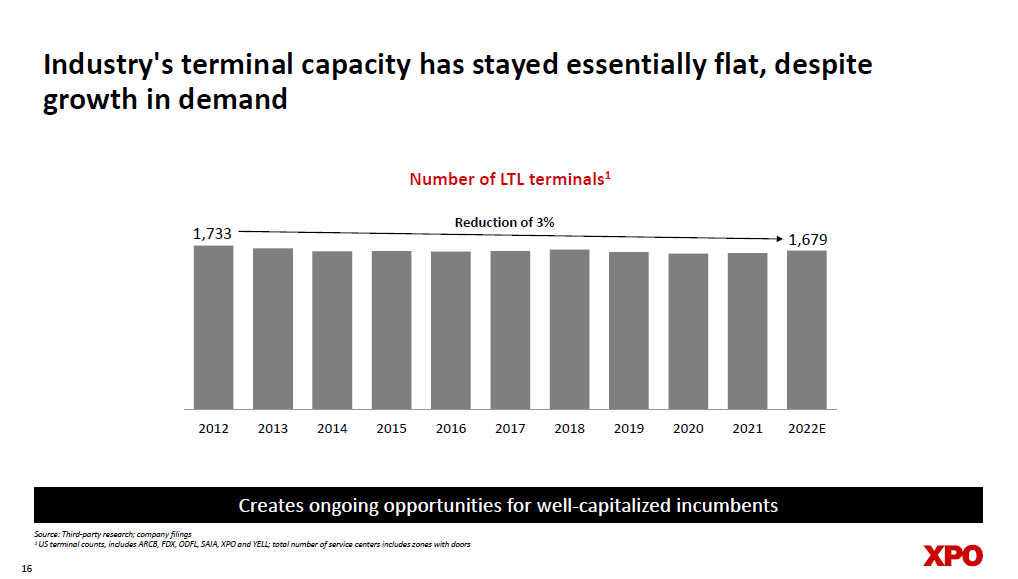

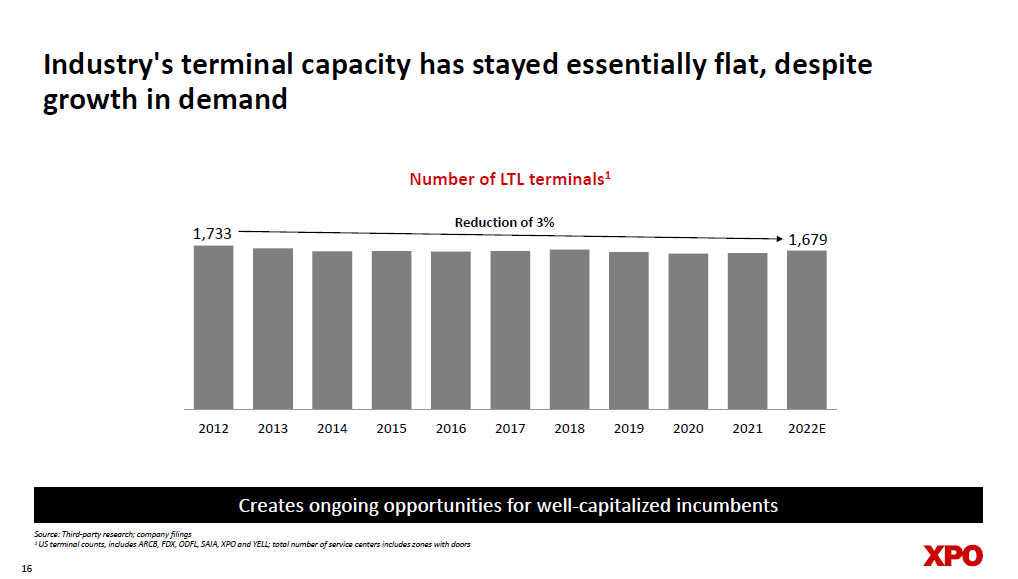

Industry's terminal capacity has stayed essentially flat, despite growth in demand 1,733 1,679 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022E Number of LTL terminals 1 Source: Third - party research; company filings 1 US terminal counts, includes ARCB, FDX, ODFL, SAIA, XPO and YELL; total n umber of service centers includes zones with doors Creates ongoing opportunities for well - capitalized incumbents Reduction of 3% 16

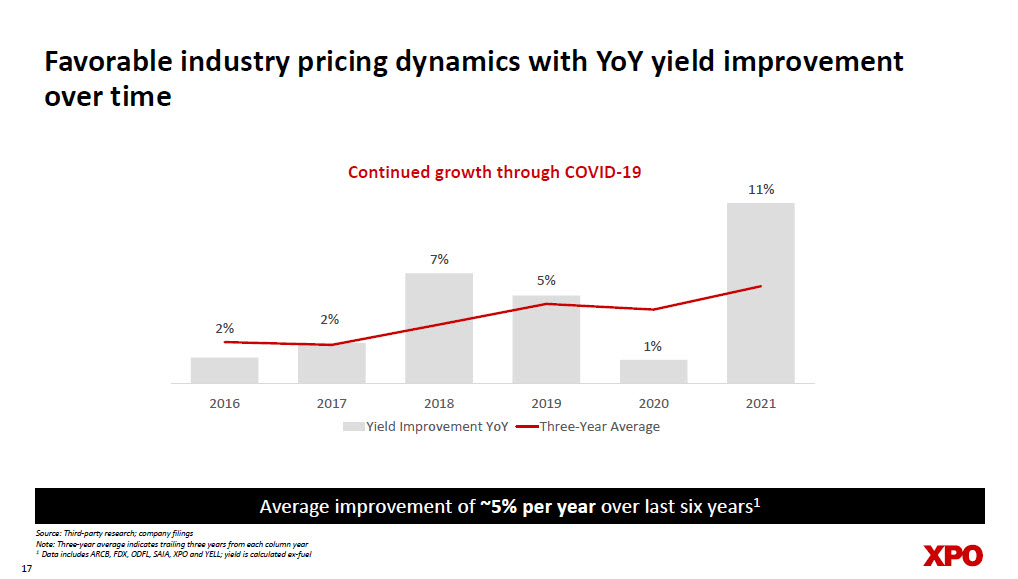

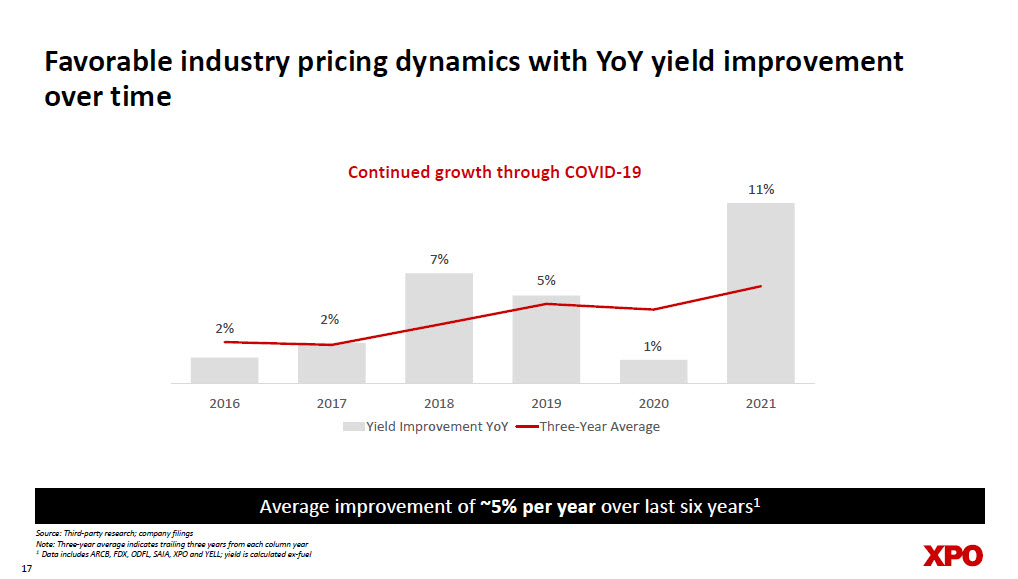

Favorable industry pricing dynamics with YoY yield improvement over time Continued growth through COVID - 19 Source: Third - party research; company filings Note: Three - year average indicates trailing three years from each column year 1 Data includes ARCB, FDX, ODFL, SAIA, XPO and YELL; yield is calculated ex - fuel Average improvement of ~5% per year over last six years 1 17 2% 2% 7% 5% 1% 11% 2016 2017 2018 2019 2020 2021 Yield Improvement YoY Three-Year Average

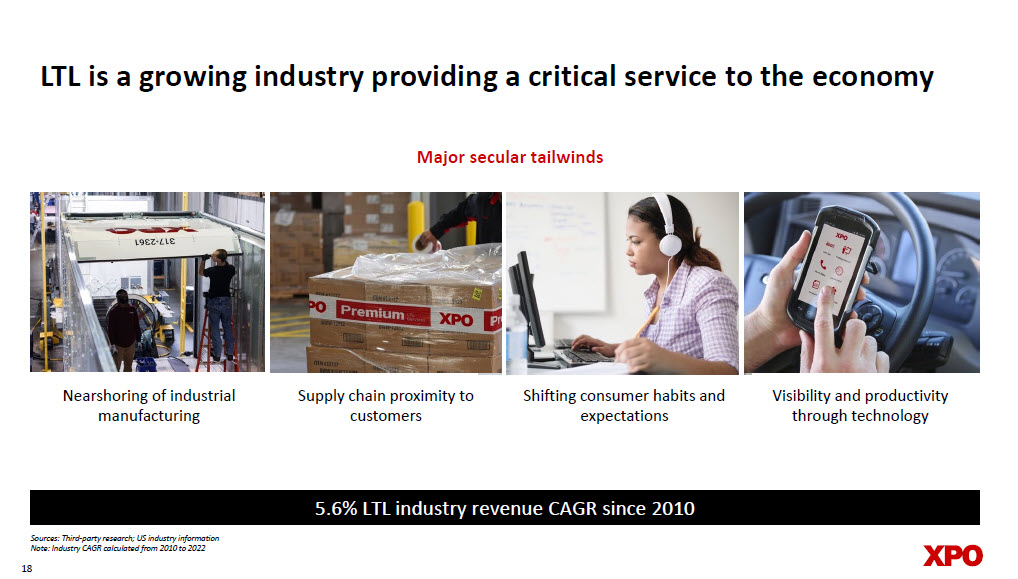

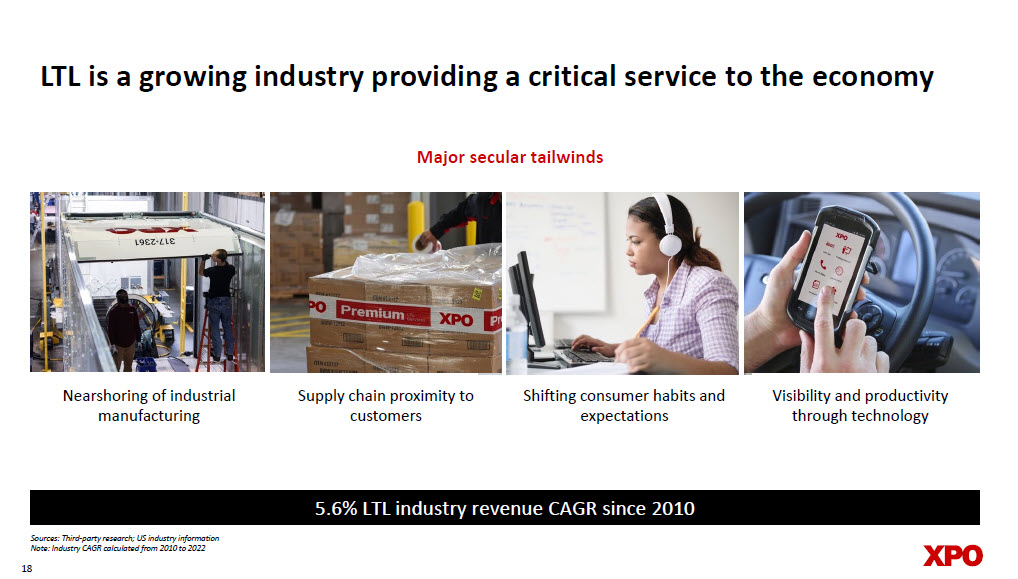

LTL is a growing industry providing a critical service to the economy 18 Nearshoring of industrial manufacturing Major secular tailwinds Supply chain proximity to customers Shifting consumer habits and expectations Visibility and productivity through technology Sources: Third - party research; US industry information Note: Industry CAGR calculated from 2010 to 2022 5.6% LTL industry revenue CAGR since 2010

XPO’s differentiation and competitive advantages 19

Strong competitive platform, with levers unique to XPO 20 Critical network scale, with in - house capabilities to grow capacity Quality people and service culture driving customer choice of XPO Differentiated technology optimizes network and pricing Well - defined strategy for share and profit growth

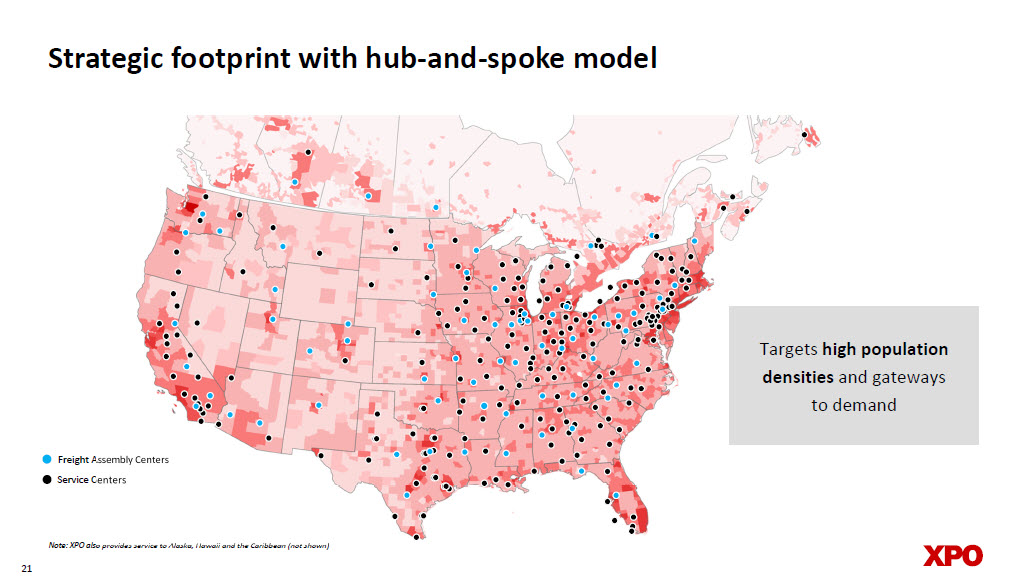

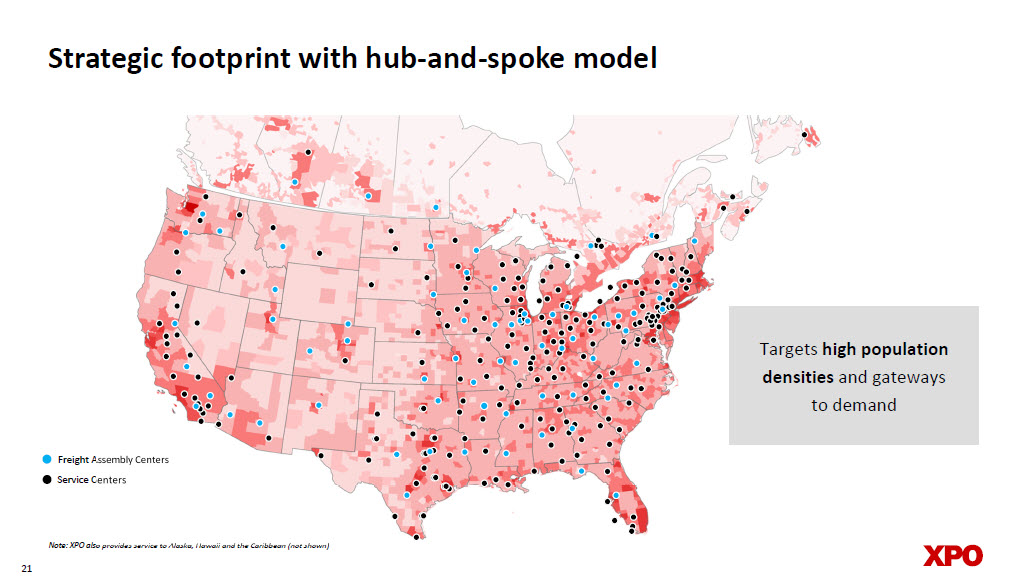

Strategic footprint with hub - and - spoke model Freight Assembly Centers Service Centers Note: XPO also provides service to Alaska, Hawaii and the Caribbean (not shown) 21 Targets high population densities and gateways to demand

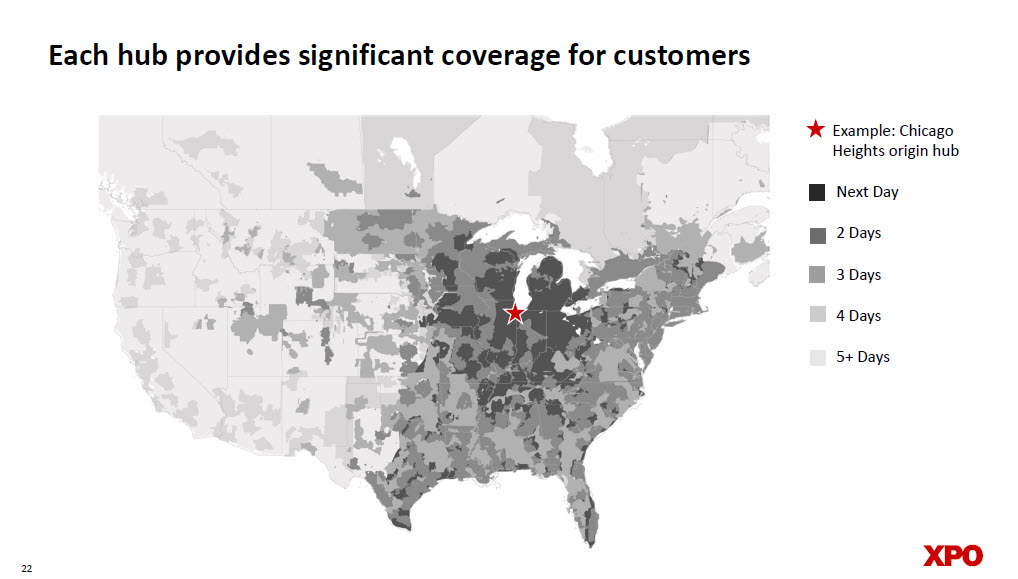

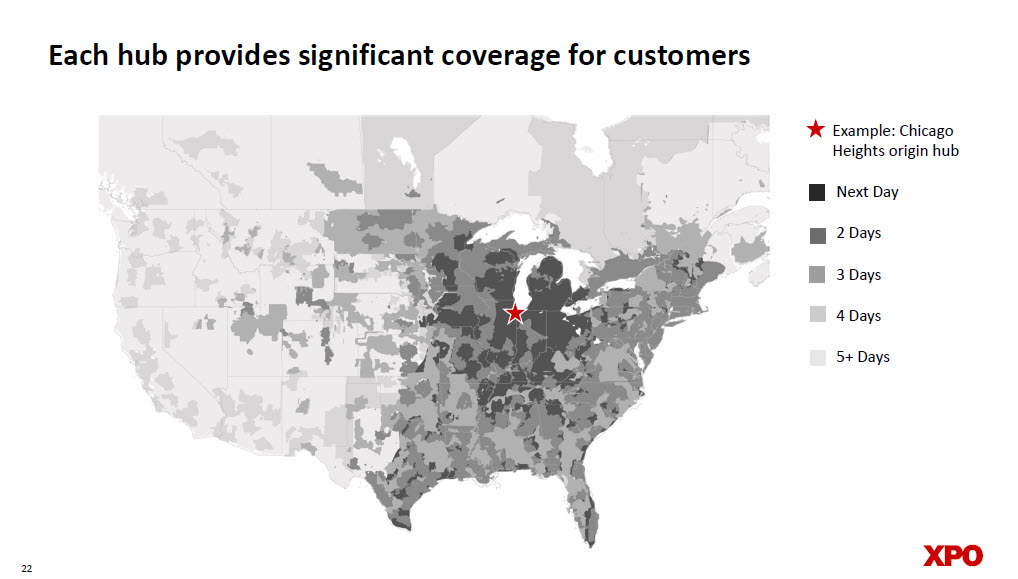

Each hub provides significant coverage for customers 22 Example: Chicago Heights origin hub Next Day 2 Days 3 Days 4 Days 5+ Days

In - house trailer manufacturing and 130 driver training schools are unique advantages Producing 4,700 trailers in 2022 Training 1,700 drivers in 2022 • Manufactures 28 ft. to 57 ft. units • Flexibility to adjust specs for customers as needed • Maintains OEM parts for in - house shops • Engineers new products • Tuition - free opportunity attracts career entrants • Ability to earn a wage for dock work while training • XPO - trained drivers tend to have better safety records and up to 57% less turnover than regular hires • Upskilling for experienced drivers 23 Self - reliant capabilities address equipment constraints and driver shortage

Proprietary technology is a key competitive advantage 24 Proprietary technology touches all components of LTL Feedback loop identifies areas of greatest impact Best - in - class engineers transform LTL operations Pricing platform to enhance yields and customer interactions Productivity tools optimize costs and enhance asset utilization

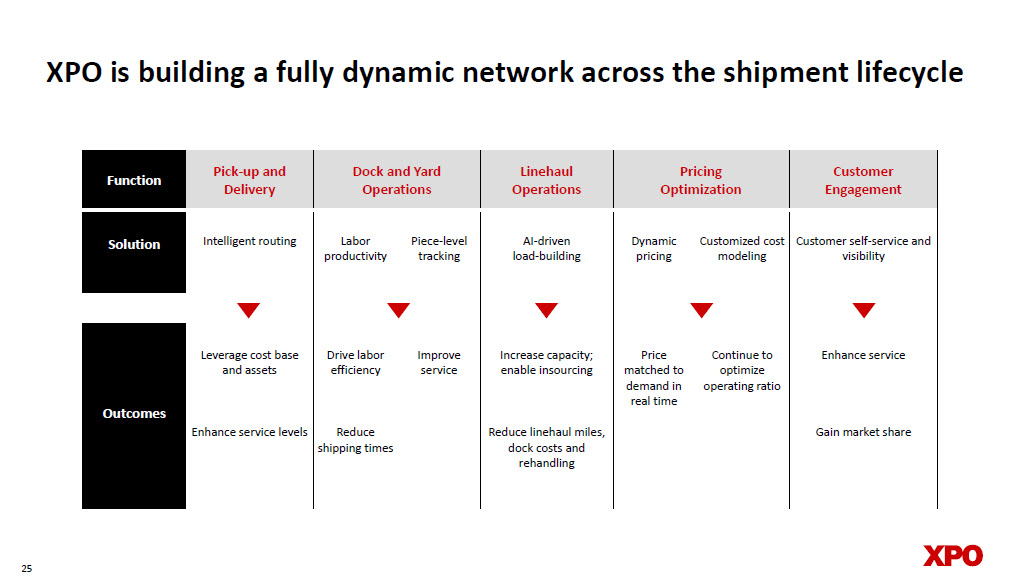

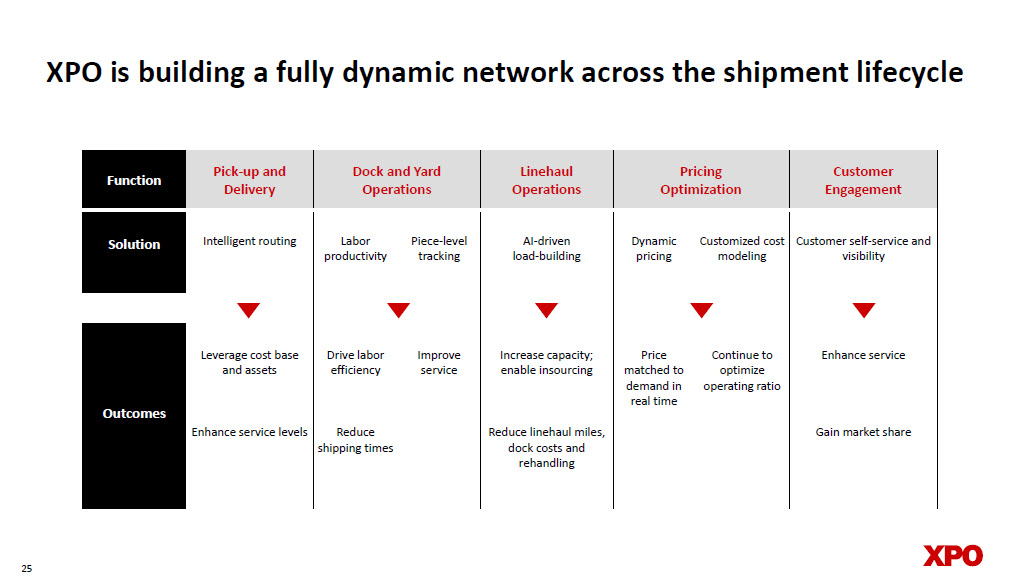

XPO is building a fully dynamic network across the shipment lifecycle Function Pick - up and Delivery Dock and Yard Operations Linehaul Operations Pricing Optimization Customer Engagement Solution Intelligent routing Labor productivity Piece - level tracking AI - driven load - building Dynamic pricing Customized cost modeling Customer self - service and visibility Outcomes Leverage cost base and assets Enhance service levels Drive labor efficiency Reduce shipping times Improve service Increase capacity; enable insourcing Reduce linehaul miles, dock costs and rehandling Price matched to demand in real time Continue to optimize operating ratio Enhance service Gain market share 25

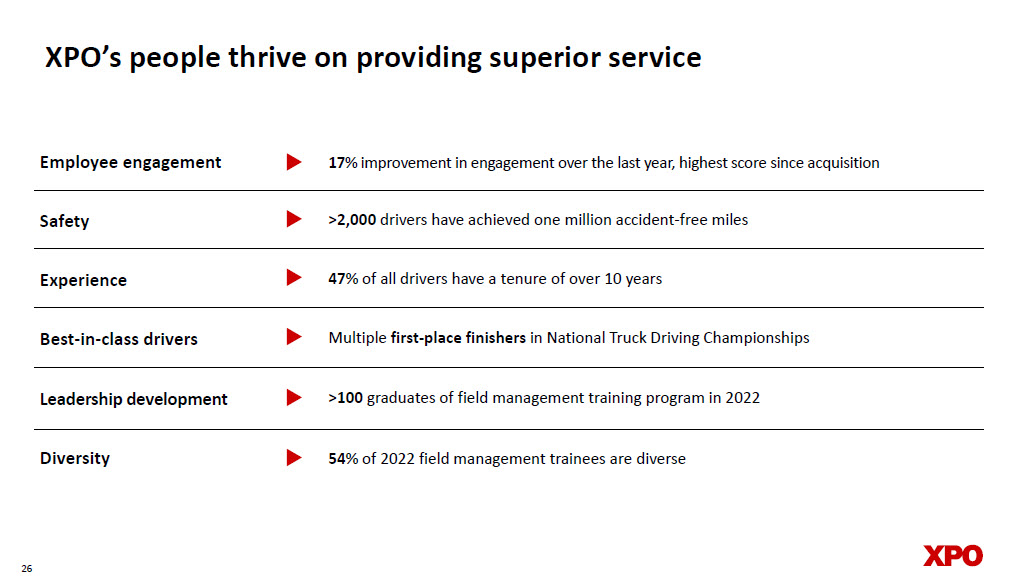

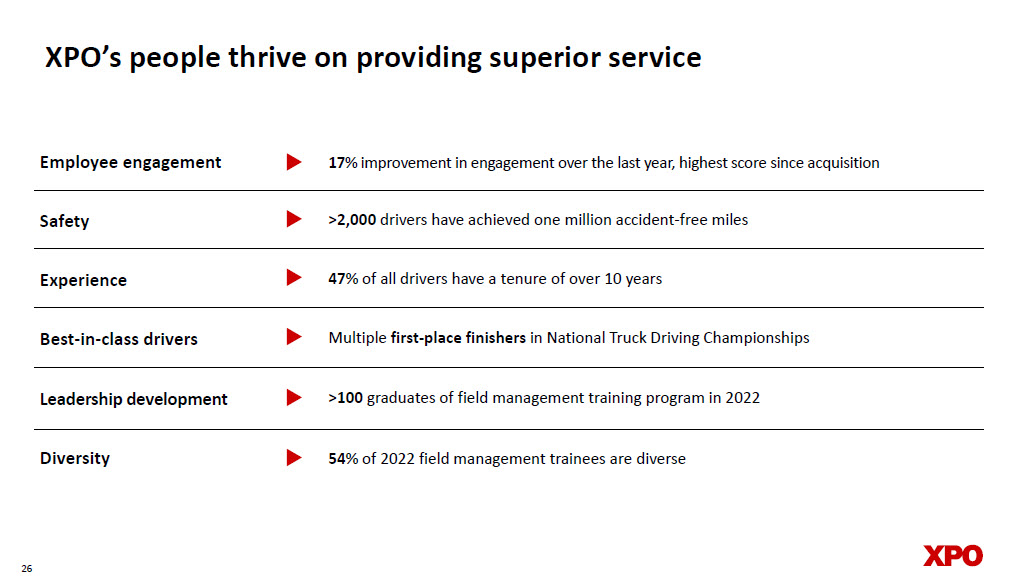

XPO’s people thrive on providing superior service 26 Employee engagement Safety Experience Best - in - class drivers Leadership development Diversity 17 % improvement in engagement over the last year, highest score since acquisition >2,000 drivers have achieved one million accident - free miles 47% of all drivers have a tenure of over 10 years Multiple first - place finishers in National Truck Driving Championships > 100 graduates of field management t raining program in 2022 54 % of 2022 field managemen t trainees are diverse

Quality service driving quality results Pride, a ccountability and ownership of results Damage - free freight handling; lower claims Knowledge leveraged by team culture On - time performance; brand ambassadors Pipeline of quality managers as network grows Recruitment and retention of best athletes Employee engagement Safety Experience Best - in - class drivers Leadership development Diversity 27

Robust ESG framework • Executive compensation tied to ESG targets • Core DE&I objectives for recruitment and retention • Collaborating with historically Black colleges and universities (HBCUs) and others • Promoting women and minority employees to middle and senior management roles • Communicating culture of belonging to a range of underrepresented groups • Road to Zero program tracks safety performance and accident - free miles • Technology enhances efficient use of resources • Launching electric truck pilot; 20 electric trucks arriving in 2023 • Taking steps to align climate - related disclosures to TCFD 1 , building on SASB 2 and GRI 3 reporting 1 Task Force on Climate - related Financial Disclosures 2 Sustainability Accounting Standards Board 3 Global Reporting Initiative ESG scorecard categories • Workforce and Talent • Employee and Community Safety • Diversity, Equity and Inclusion • Information Security • Environmental and Sustainability • Governance 28

Proven leadership team with valuable skill sets and experience Note: Number of years reflects years of relevant experience 29 Mario Harik CEO Elect 19 years Diana Brown SVP, Sales Ops. and Customer Experience 24 years Tanmay Mathur SVP, Linehaul 15 years David Phalen SVP, Pricing 28 years Greg DiPalma SVP, Strategic Sales Management 20 years Marissa Christensen Vice President, National Sales 17 years Carl Anderson CFO Elect 25 years Tim Staroba President, East Division 27 years Tony Graham President, West Division 35 years Jay Silberkleit CIO Elect 18 years Anthony Hoereth SVP, Sales 28 years

Comprehensive growth plan 30

Three pillars of XPO’s growth plan Gain market share Optimize pricing Operational excellence • Grow capacity to accommodate demand • Provide best - in - class service to gain new business and grow wallet share • Expand sales resources and target growing verticals • Increase win rate on contracts • Capture real - time opportunities with d ynamic pricing • Enhance margin with proprietary cost modeling • Utilize proprietary technology to optimize all parts of the shipment lifecycle • I nsource more linehaul miles • Drive efficiencies in pick - up and delivery and dock labor • Deploy robust piece - level tracking 31

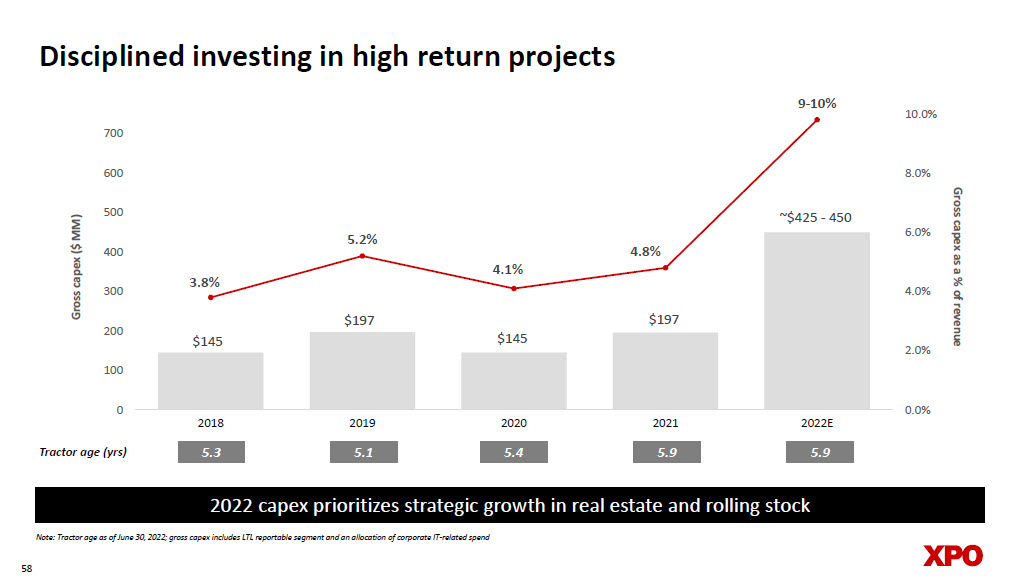

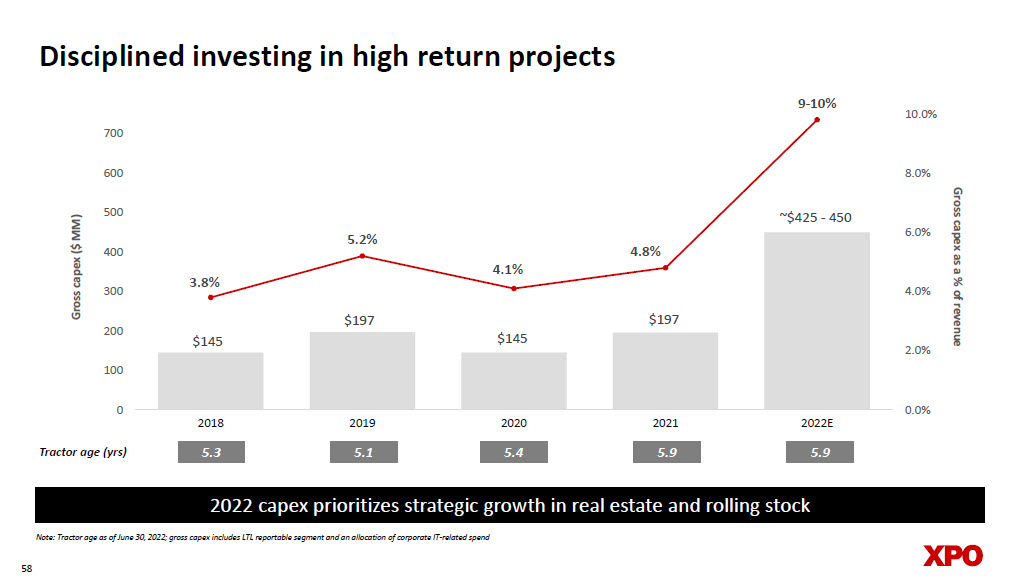

Strategic capex plan with concrete commercial goals 3.8% 5.2% 4.1% 4.8% 9 - 10% 2018 2019 2020 2021 2022E Gross capex as % of revenue Targeted investments • In 2021, began accelerating LTL 2.0 investments for share gains and high returns, after focusing on capital efficiency and margin expansion in LTL 1.0 strategy post - acquisition • Adding 900 net new doors from October 2021 to year - end 2023, increasing door count by ~6% • Investing in rolling stock to grow volume and insource third - party miles • Added second trailer production line doubling capacity XPO’s 2022 capex is 2x annual average to lean into top - line growth 32 Note: Gross capex includes LTL reportable segment and an allocation of corporate IT - related spend

The Case for Growth XPO footprint in Atlanta ripe for strategic expansion • Significant capacity allocated to linehaul • Limited capacity for pick - up and delivery in growing market Opened 99 - door terminal in April 2022 • Project IRR >50%; required minimal capex, leased facility • Serving more metro customers and linehaul into Florida Rationale for investment Key results In top quintile for population growth (2016 - 2021) LTL linehaul gateway to Florida, with 15 of the fastest - growing US MSAs • Outperforming expectations • YoY in September, XPO’s Atlanta market tonnage rose 38% • Backlogs down sharply from peaks • Network fluidity and on - time service have improved in Florida • Expanding FAC operations; adding regional capacity • Gained significantly more local P&D opportunity Atlanta market is on the fast track 33

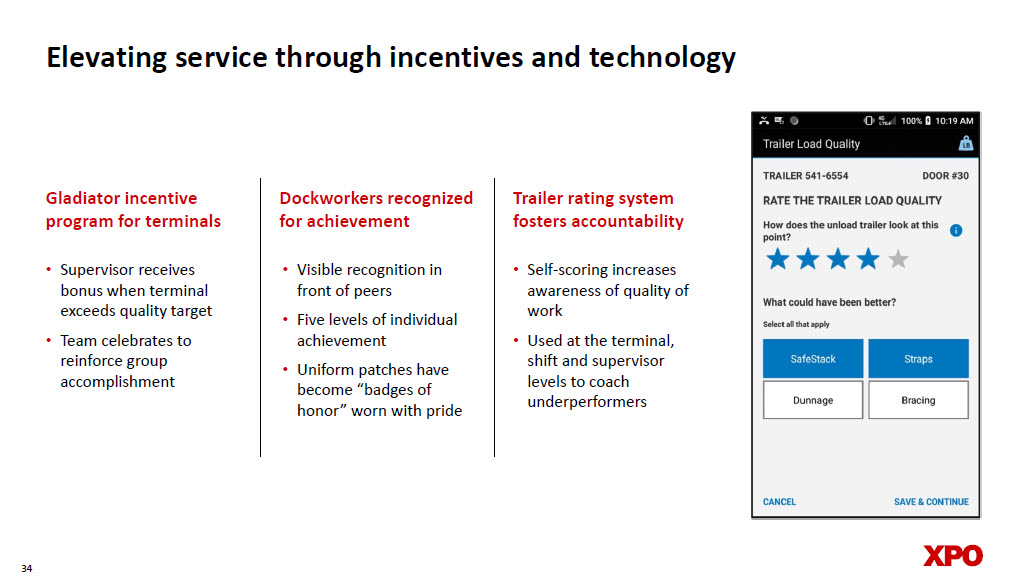

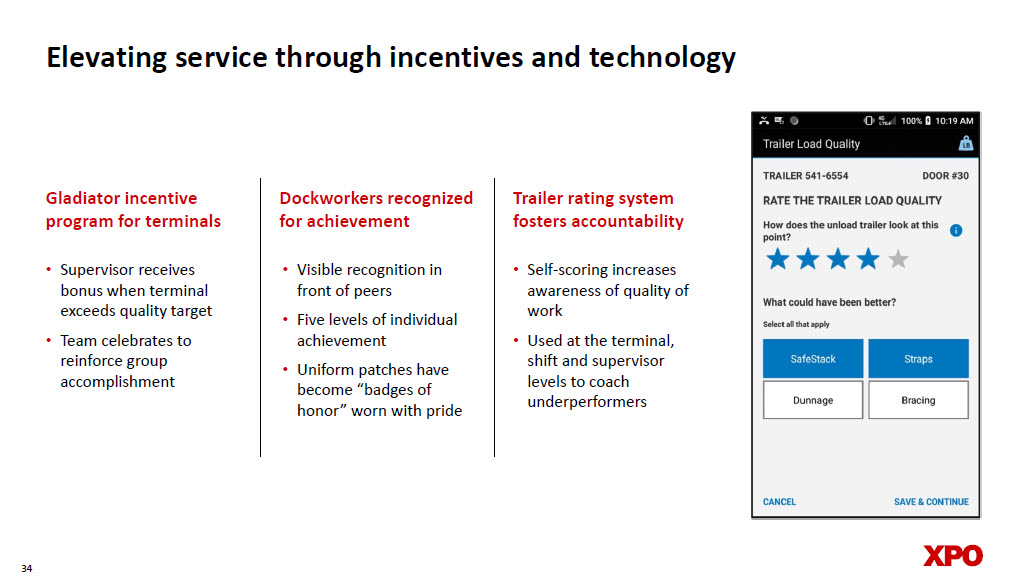

Elevating service through incentives and technology 34 Gladiator incentive program for terminals • Supervisor receives bonus when terminal exceeds quality target • Team celebrates to reinforce group accomplishment Dockworkers recognized for achievement • Visible recognition in front of peers • Five levels of individual achievement • Uniform patches have become “badges of honor” worn with pride Trailer rating system fosters accountability • Self - scoring increases awareness of quality of work • Used at the terminal, shift and supervisor levels to coach underperformers

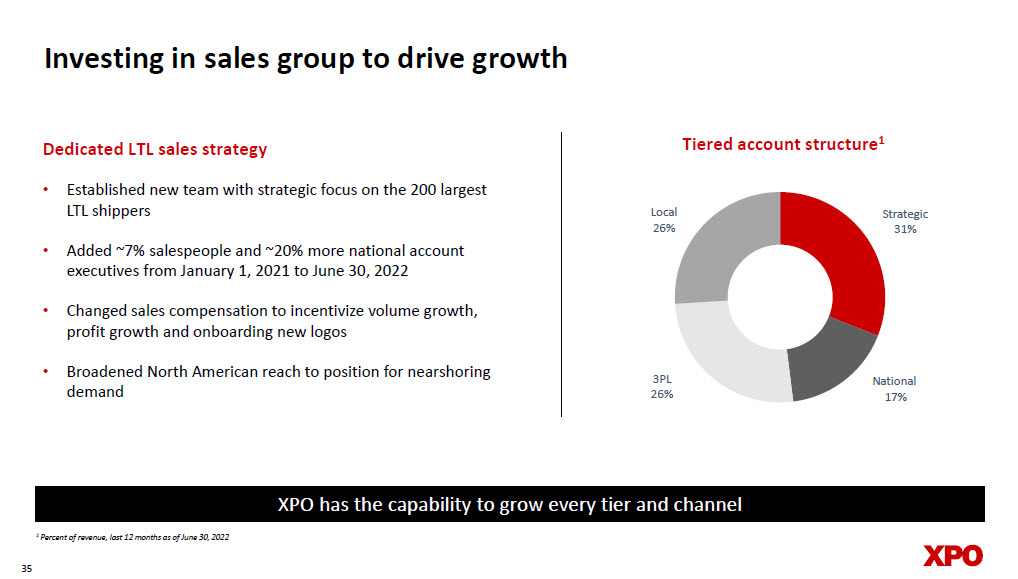

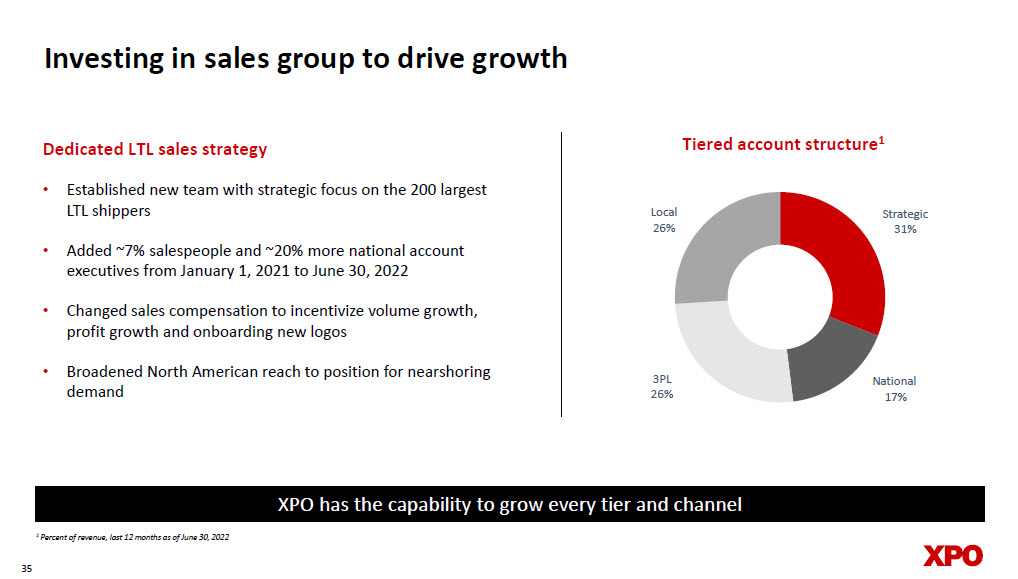

Investing in sales group to drive growth Tiered account structure 1 Dedicated LTL sales strategy • Established new team with strategic focus on the 200 largest LTL shippers • Added ~7% salespeople and ~20% more national account executives from January 1, 2021 to June 30, 2022 • Changed sales compensation to incentivize volume growth, profit growth and onboarding new logos • Broadened North American reach to position for nearshoring demand XPO has the capability to grow every tier and channel 35 Strategic 31% National 17% 3PL 26% Local 26% 1 Percent of revenue, last 12 months as of June 30, 2022

XPO’s vertical mix 1 36 Note: Logistics customer revenue distributed between Industrial and Other; vertical mix numbers might not sum up to 100% due to rounding 1 LTM revenue as of June 30, 2022 Large upside expected from manufacturing and nearshoring as industrial sector repositions after COVID - 19 Mix of verticals with durable long - term demand, led by industrial No single c ustome r m ore than 2% o f revenue Average t enure of t op 10 customers 16 Years 25,000 Total accounts as of June 30, 2022 Industrial 65% Consumer and Retail / E - Commerce 28% Other 8%

Mission - critical partner to blue - chip customers with diverse end markets Selected customers 37

Industrial distribution Key customer requirements • High network velocity to deliver next - day and two - day service • Weekly scoring and monthly reviews with leaders of top shipping sites • On - site customer visits to collaborate with XPO teams and inspect damage - free loading and safety XPO’s solutions • Coordinated monitoring by dedicated support team, generating weekly metrics and corrective planning as needed • Detailed tracking of on - time performance, damages and more • Quarterly reviews of safety performance, financial health, technology capabilities and end - customer feedback • Deep technology integration to ensure data flows between XPO and customer systems in real time • Planning summits with executive leadership of both companies $10 billion distributor of industrial supplies relies on XPO for scale, safety and quality of service Long - term support of customer since 1983 38 Superior results • Over $50 million annual revenue, with plan to expand in 2023

Industrial manufacturing Deep collaboration at all levels has driven rapid relationship growth over the last five years Fortune 100 equipment manufacturer 39 Key customer requirements • Nationwide coverage, including remote areas • Additional trailer capacity for peak season • Custom technology integration for scorecards and invoicing XPO’s solutions • Dedicated XPO team acts as an extension of customer, managing inbound/outbound and dealer channels, including returns • Proactively resolves issues and brainstorms on improvements • Reviews freight routing to reduce handling and mitigate damages • Customer collaborates with XPO to increase utilization of dock drops • Weekly calls with all major operations sites, monthly business reviews and biannual executive operating reviews Superior results • Over $50 million annual revenue, nearly doubled in 60 months • Pursuing opportunities of $10+ million on top of current business

Construction Major construction firm sought to consolidate LTL relationships to support M&A growth strategy Strategic partnership for NAFTA coverage 40 Key customer requirements • Experienced LTL service across US, Canada and Mexico, with border services • Enough network scale to consolidate LTL with one national carrier • Strategic partnership with intense focus on service quality XPO’s solutions • Onboarding support for strategic locations added to customer’s network, and joint visits prior to go - live of every new site • Internal processes to ensure volumes are on track: performance monitoring, action plans and frequent customer communication • Premium customer care team manages service exceptions • Executive co - sponsorship, including quarterly reviews Superior results • Grew revenue from $11 million in 2020, to nearly $22 million in 2022, with volume outpacing two - year plan • Pursuing incremental revenue to grow to ~$35 million by 2024

Retail Sought to replace LTL incumbent with an innovative partner willing to invest in capacity and technology Omnichannel B2C and B2B retail chain 41 Key customer requirements • Solutions - focused national provider with strong technology • Investment in doors and other capacity in key growth markets • Timely customer service response for corporate and vendor distribution centers XPO’s solutions • Onboarded in 30 days, including deep technology integration • Strong operations sponsors overseeing service execution • Premium care customer service team responds to inquiries and proactively communicates service exceptions and resolutions • Executive - level sponsors and mutual commitment to collaboration Superior results • Customer declares onboarding experience with XPO is the best they’ve seen from any carrier • Revenue of over $20 million in 2022, up from $4 million in 2021

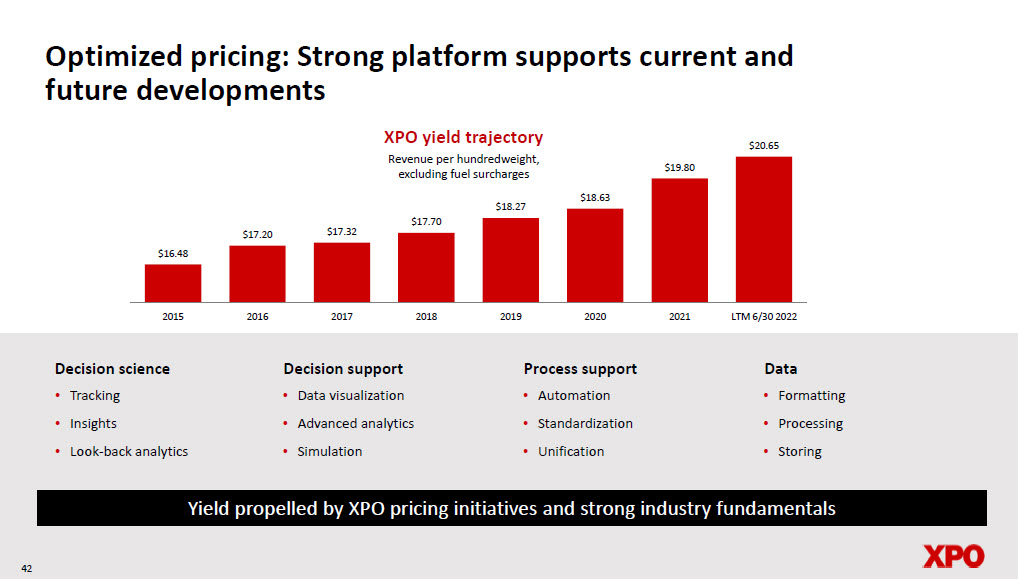

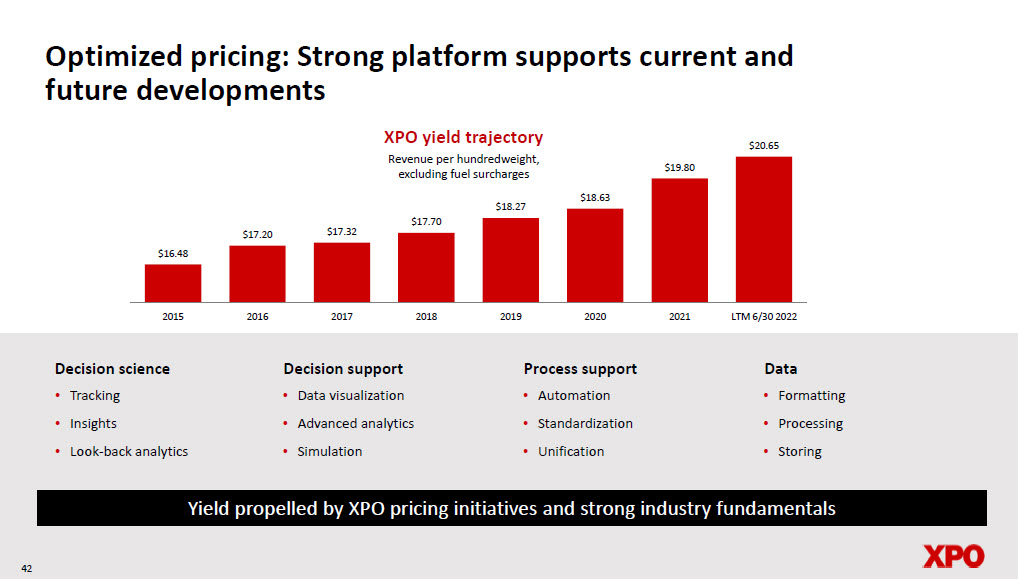

Optimized pricing: Strong platform supports current and future developments Yield propelled by XPO pricing initiatives and strong industry fundamentals 42 $16.48 $17.20 $17.32 $17.70 $18.27 $18.63 $19.80 $20.65 2015 2016 2017 2018 2019 2020 2021 LTM 6/30 2022 XPO yield trajectory Revenue per hundredweight, excluding fuel surcharges Decision support • Data visualization • Advanced analytics • Simulation Process support • Automation • Standardization • Unification Decision science • Tracking • Insights • Look - back analytics Data • Formatting • Processing • Storing

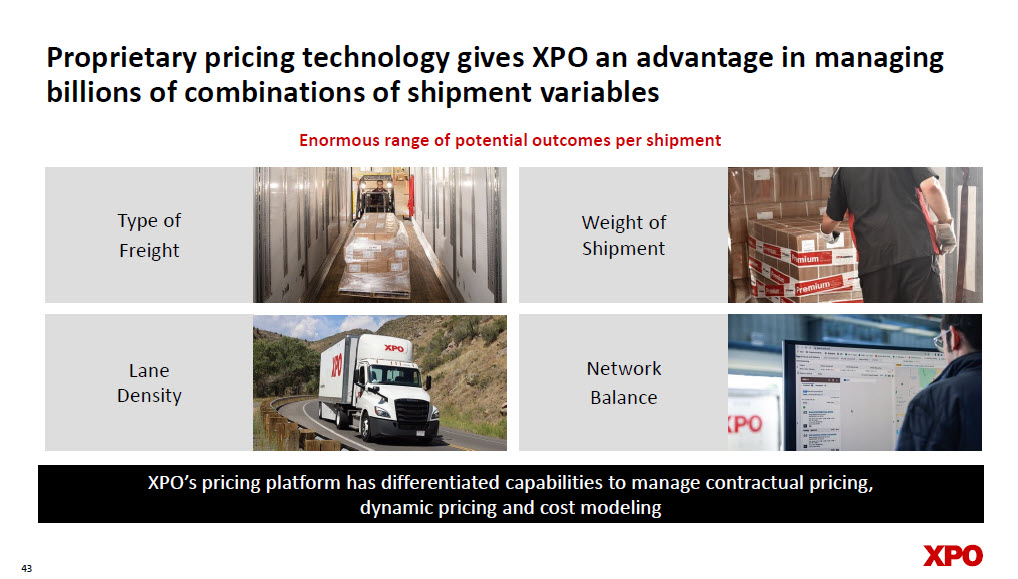

Proprietary pricing technology gives XPO an advantage in managing billions of combinations of shipment variables 43 Type of Freight Lane Density Weight of Shipment Network Balance Enormous range of potential outcomes per shipment XPO’s pricing platform has differentiated capabilities to manage contractual pricing, dynamic pricing and cost modeling

New contractual pricing platform is delivering widespread benefits 44 ~ 8 0% reduction in response time, due to automating manual processes Win rate for renewal RFPs increased 60% from Q2 2021 to Q2 2022 due to better KPI analysis ~ 80% reduction in manual calculations to create models, with major time and accuracy improvements later Visual guides map terminals impacted by onboarding new volume, with projected impact to P&L Capability Impact Aggregate all key customer data Enables XPO to examine customer activities holistically and opportunistically Set customer - specific prices Store cost scenarios with future edit flexibility Assess pricing against capacity simulations Source: Company data

Dynamic pricing drives profitability by responding to real - time network opportunities 45 Virtuous cycle of feedback loops and instantaneous adjustments O ptimizes for capacity while taking into account the customer’s willingness to pay Local sales team can activate an account instantly Smaller customers may lack data to inform a full RFP Capability Impact Machine learning - based algorithms instantly capture network dynamics Enables thoughtful, profitable and competitive pricing at every level Balances pricing quotes to drive both price and volume through network Accelerates customer onboarding without contractual process delays Serves accounts that do not warrant a labor - intensive pricing discussion

Differentiated cost modeling enables accurate assessment for margin expansion 46 Fully controllable, proprietary solution excels at producing highly accurate estimations of outcomes Generates a m ore accurate allocation of sales and corporate costs, reflecting fair cost of effort Flexibility to t ailor special services to customer needs Capability Impact Algorithms accommodate unique cost structures in modeling Proprietary cost model optimizes price by customer and lane to be both competitive and profitable Calculates operating ratio per customer per lane Tracks customer characteristics accurately for future analysis

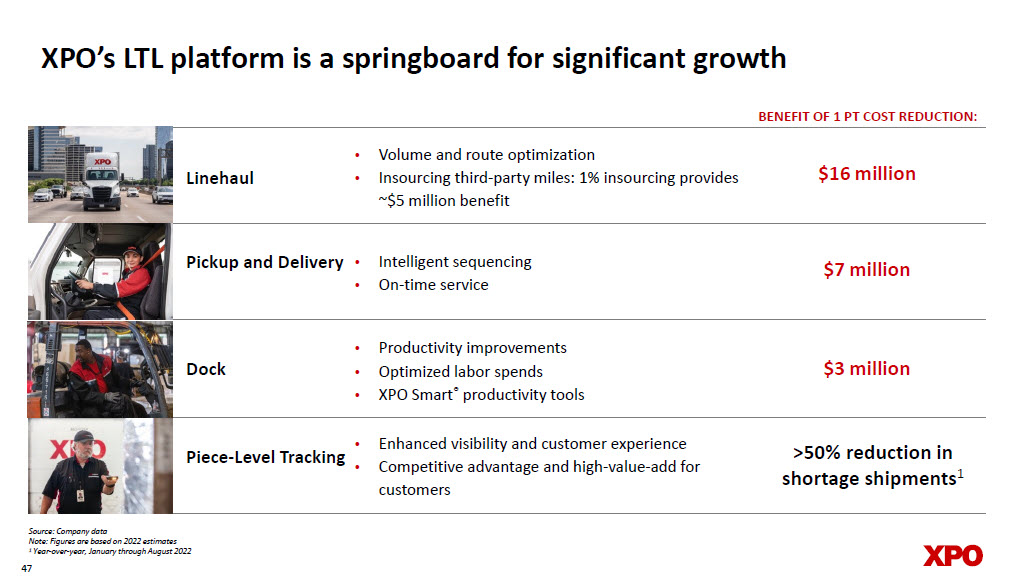

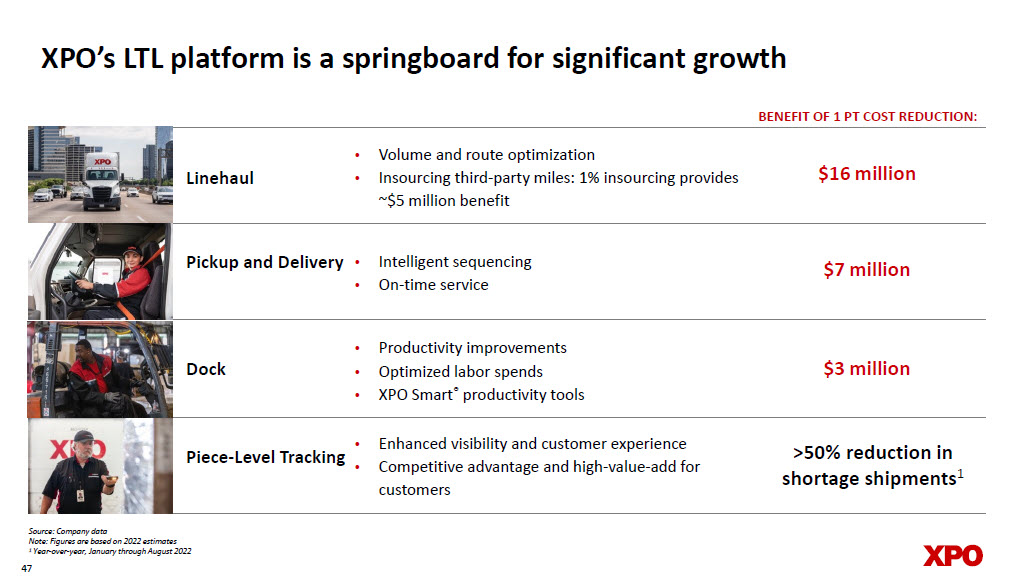

XPO’s LTL platform is a springboard for significant growth Source: Company data Note: Figures are based on 2022 estimates 1 Year - over - year, January through August 2022 Linehaul $ 1 6 million 47 $7 million $3 million Pickup and Delivery Dock Piece - Level Tracking • Volume and route optimization • Insourcing third - party miles: 1 % insourcing provides ~$5 million benefit • Intelligent sequencing • On - time service • P roductivity improvements • O ptimized labor spends • XPO Smart ® productivity tools • Enhanced visibility and customer experience • Competitive advantage and high - value - add for customers BENEFIT OF 1 PT COST REDUCTION: >50% reduction in shortage shipments 1

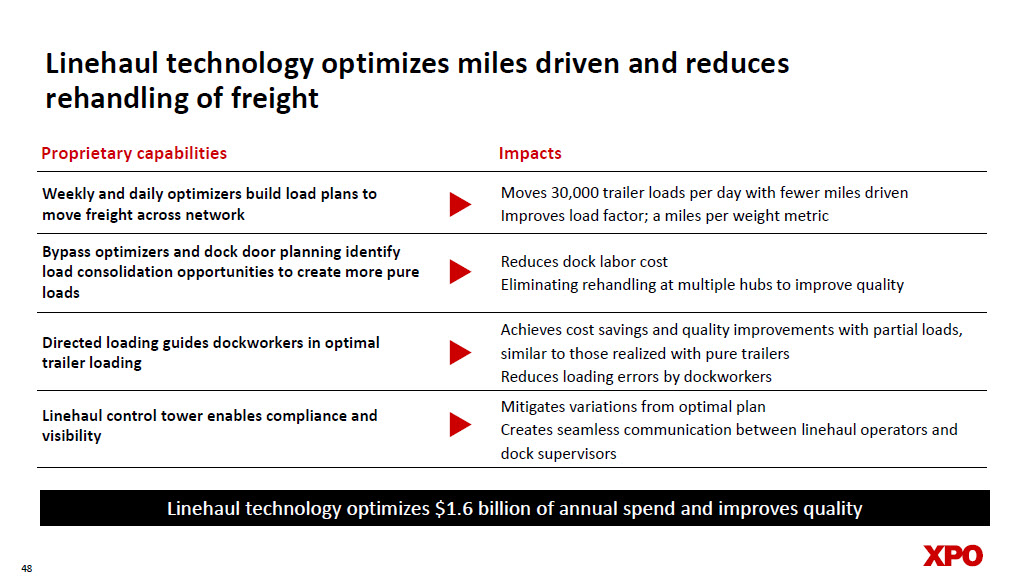

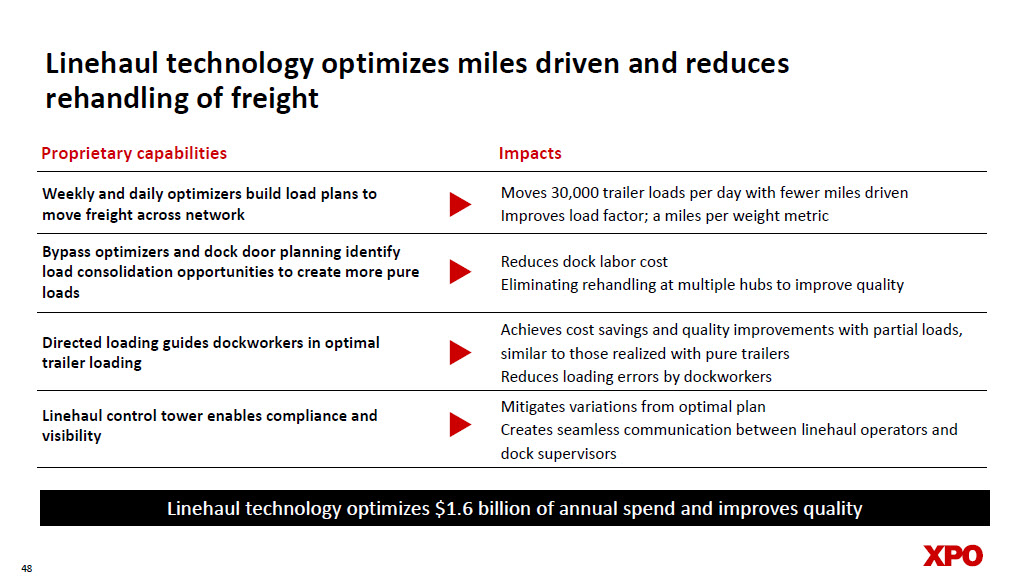

48 Moves 30,000 trailer loads per day with fewer miles driven Improves load factor; a miles per weight metric Reduces dock labor cost Eliminating rehandling at multiple hubs to improve quality Achieves cost savings and quality improvements with partial loads, similar to those realized with pure trailers Reduces loading errors by dockworkers Mitigates variations from optimal plan Creates seamless communication between linehaul operators and dock supervisors Proprietary capabilities Impacts Weekly and daily optimizers build load plans to move freight across network Linehaul technology optimizes $1.6 billion of annual spend and improves quality Bypass optimizers and dock door planning identify load consolidation opportunities to create more pure loads Directed loading guides dockworkers in optimal trailer loading Linehaul control tower enables compliance and visibility Linehaul technology optimizes miles driven and reduces rehandling of freight

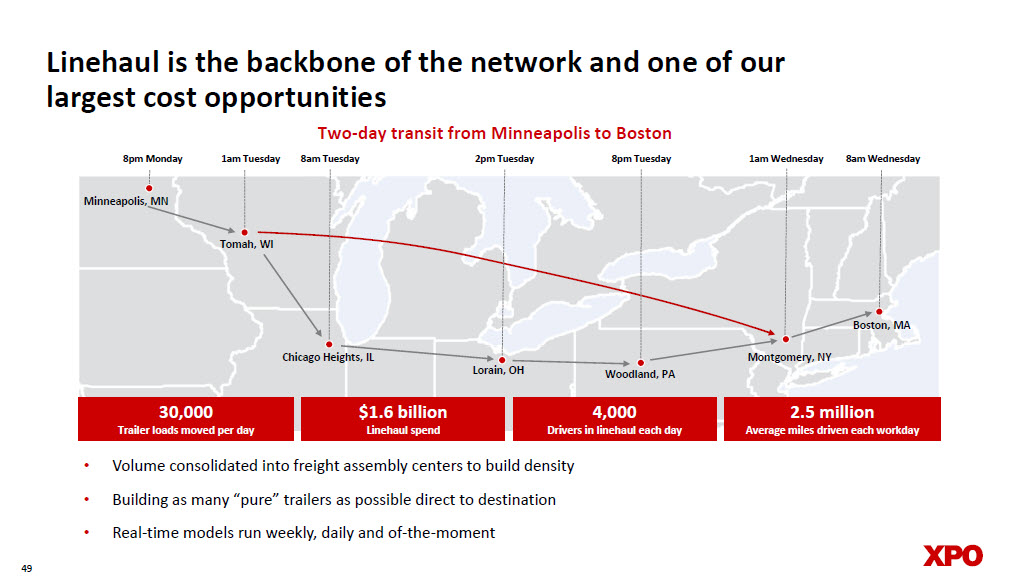

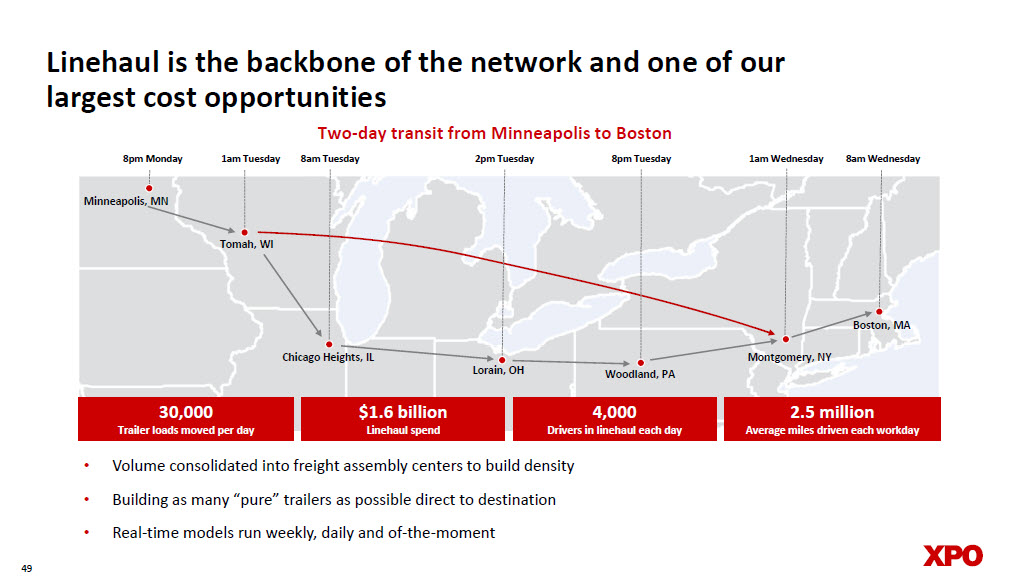

Minneapolis, MN Boston, MA Tomah, WI Chicago Heights, IL Lorain, OH Woodland, PA Montgomery, NY 8pm Monday 1am Tuesday 8am Tuesday 2pm Tuesday 8pm Tuesday 1am Wednesday 8am Wednesday 30,000 Trailer loads moved per day $1.6 billion Linehaul spend 4,000 Drivers in linehaul each day 2.5 million Average miles driven each workday Linehaul is the backbone of the network and one of our largest cost opportunities • Volume consolidated into freight assembly centers to build density • Building as many “pure” trailers as possible direct to destination • Real - time models run weekly, daily and of - the - moment Two - day transit from Minneapolis to Boston 49

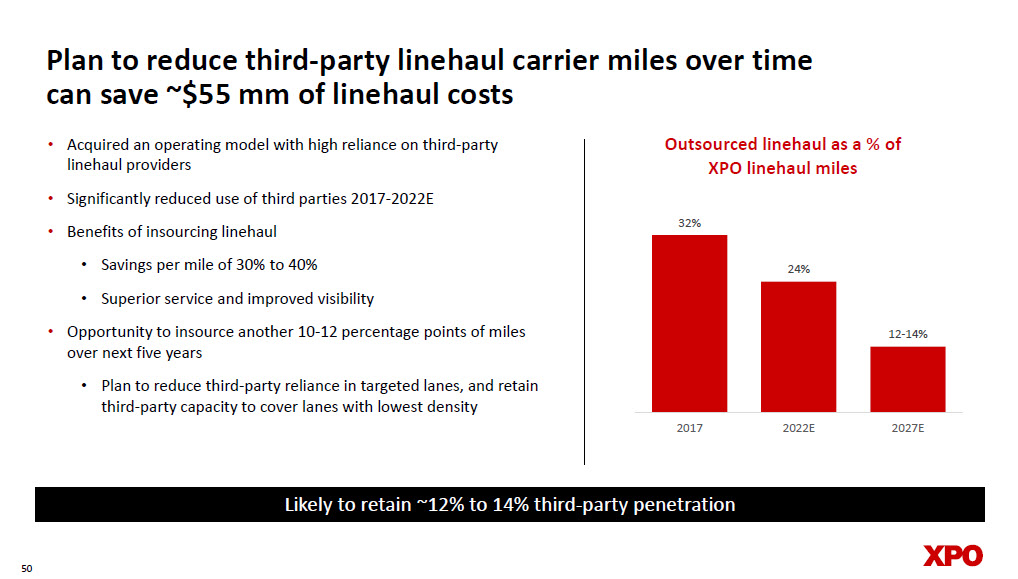

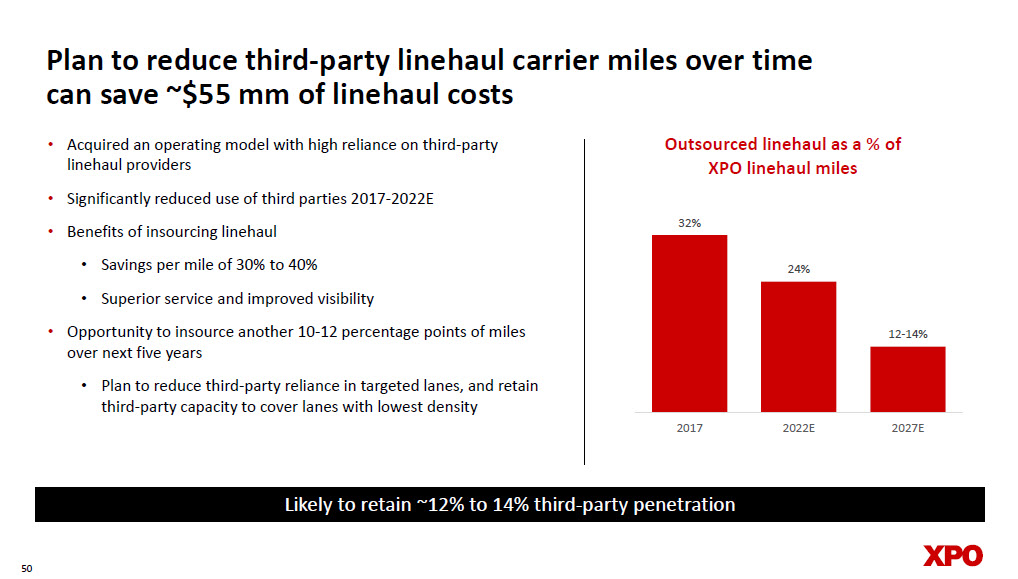

Plan to reduce third - party linehaul carrier miles over time can save ~$55 mm of linehaul costs Outsourced linehaul as a % of XPO linehaul miles • Acquired an operating model with high reliance on third - party linehaul providers • Significantly reduced use of third parties 2017 - 2022E • Benefits of insourcing linehaul • Savings per mile of 30% to 40% • Superior service and improved visibility • Opportunity to insource another 10 - 12 percentage points of miles over next five years • Plan to reduce third - party reliance in targeted lanes, and retain third - party capacity to cover lanes with lowest density Likely to retain ~12% to 14% third - party penetration 50 32% 24% 12 - 14% 2017 2022E 2027E

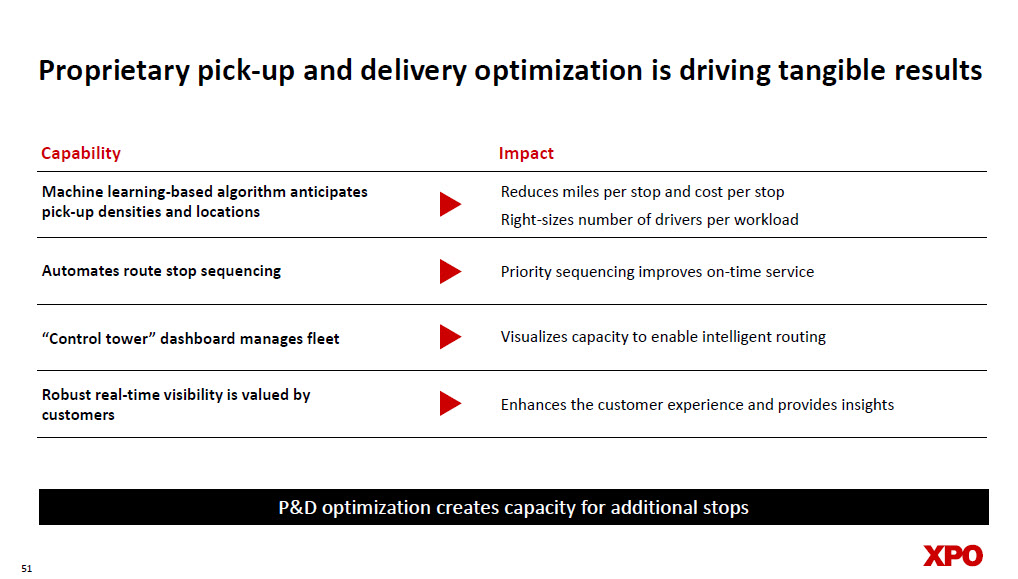

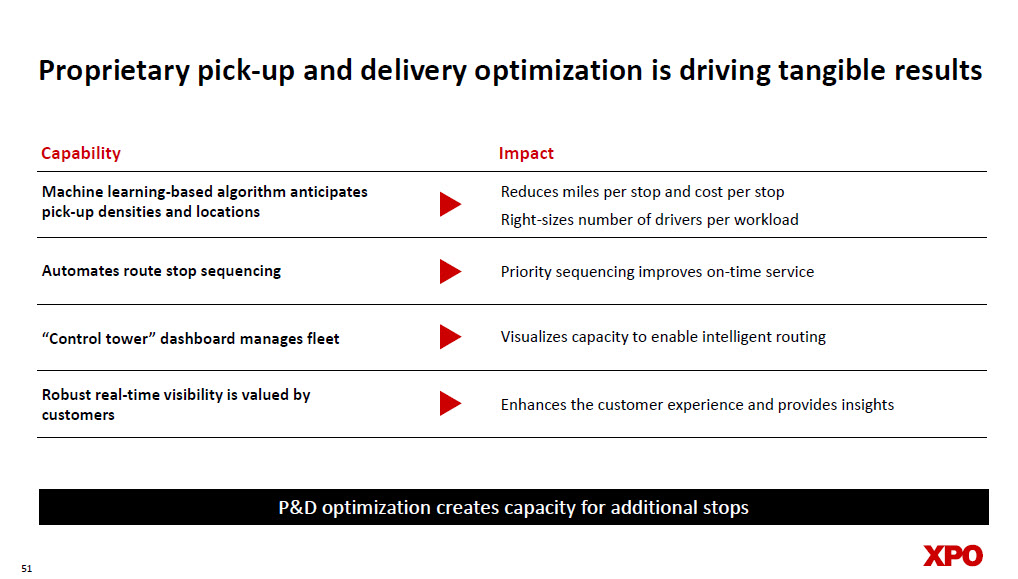

Proprietary pick - up and delivery optimization is driving tangible results 51 Reduces miles per stop and cost per stop Right - sizes number of drivers per workload Priority sequencing improves on - time service Visualizes capacity to enable intelligent routing Enhances the customer experience and provides insights Capability Impact P&D optimization creates capacity for additional stops Machine learning - based algorithm anticipates pick - up densities and locations Automates route stop sequencing “Control tower” dashboard manages fleet Robust real - time visibility is valued by customers

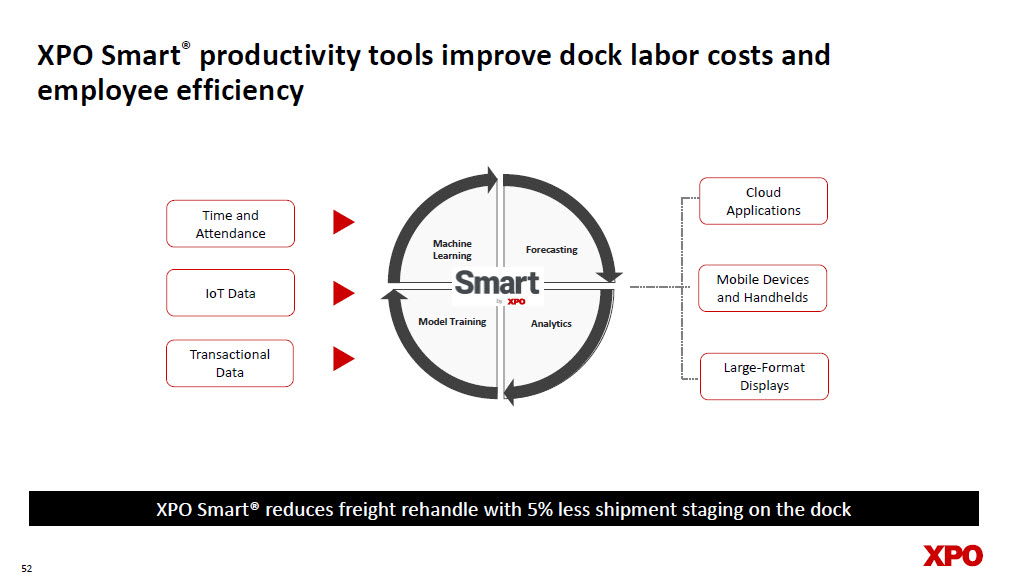

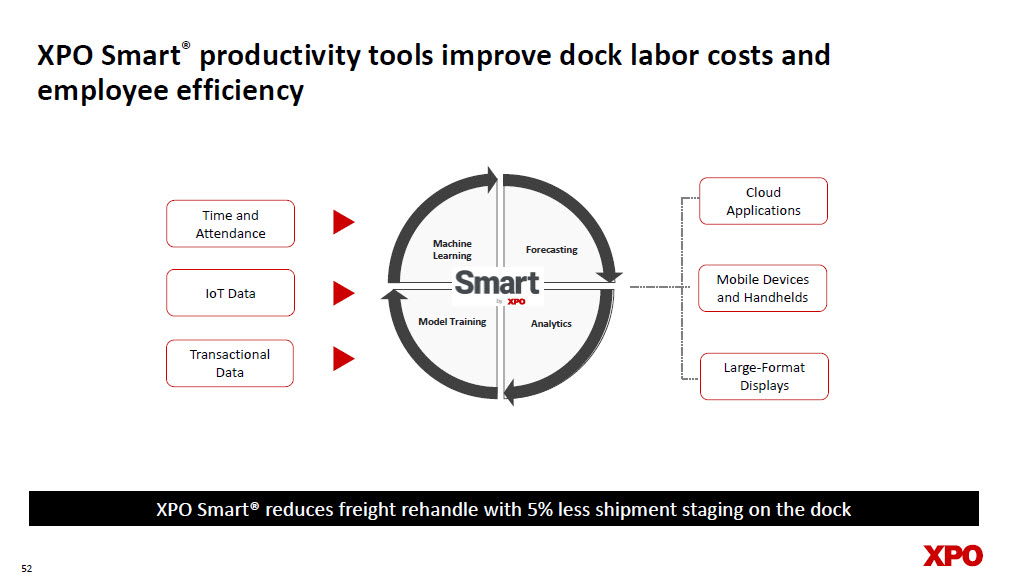

XPO Smart ® productivity tools improve dock labor costs and employee efficiency XPO Smart® reduces freight rehandle with 5% less shipment staging on the dock Forecasting Analytics Model Training Machine Learning Time and Attendance IoT Data Transactional Data Cloud Applications Mobile Devices and Handhelds Large - Format Displays 52

53 XPO’s piece - level tracking reduces trailer misloads and improves visibility Piece - level tracking has potential to reduce shortage claims by 25% to 50% Assigns unique identifiers to shipments with multiple pieces • Tracks per pallet vs. per shipment, enabling rapid resolution of misplaced freight • Optimizes downstream processes, such as trailer loading and dock - level planning • Favorable impact on claims • Enhances customer experience by increasing visibility at the pallet level for peace of mind and planning • Generates granular data that informs network - wide technology • Competitive advantage and high - value - add for customers Identifies missing piece for dockworker to load Prevents dockworker from closing trailer if piece is missing Prevents dockworker from loading freight at the wrong door PRO # scan displays best door to load freight; documents loading complete

Financial summary and outlook 54

3 At least 600 bps of improvement, 2021 – 2027 Adjusted Operating Ratio Long - term targets driven by investments in the business, leveraged by technology and scale 55 8% to 12% of revenue, on average, over next several years Gross Capex 1 Revenue CAGR 6% to 8%, 2021 – 2027 Revenue Growth Note: Long - term targets reflect North American LTL only Note: Refer to slide 67 for 2021 base year used to calculate adjusted EBITDA growth and adjusted operating ratio targets; for ad justed EBITDA growth and adjusted operating ratio, base year and all forecast years exclude gains on real estate sales and include incremental corporate costs; for adjusted operating ratio, base year and al l forecast years also exclude pension income Refer to "Non - GAAP Financial Measures" section on page 2 2 EBITDA CAGR 11% to 13%, 2021 – 2027 Adjusted EBITDA

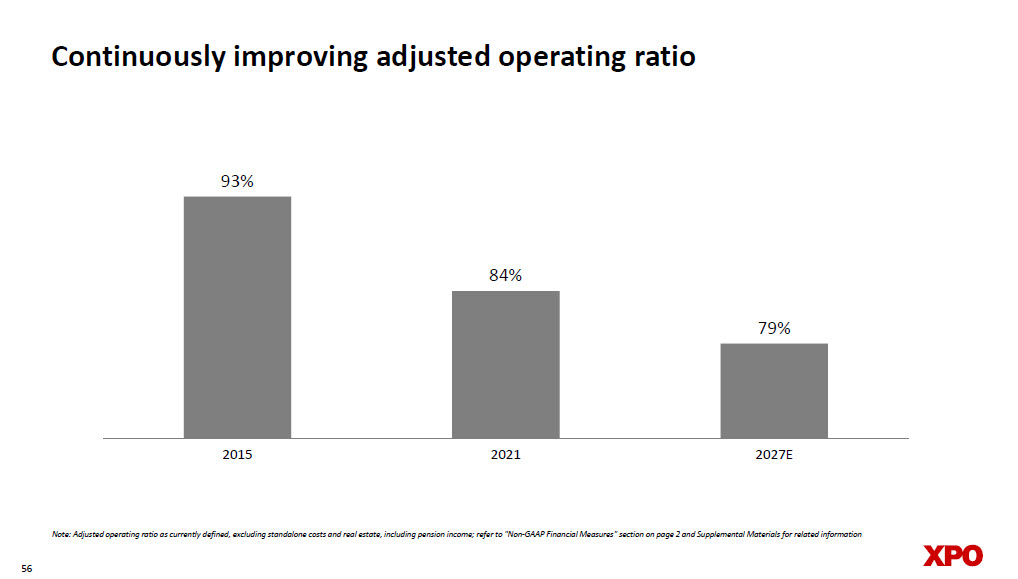

Continuously improving adjusted operating ratio Note: Adjusted operating ratio as currently defined, excluding standalone costs and real estate, including pension income; re fer to "Non - GAAP Financial Measures" section on page 2 and Supplemental Materials for related information 56 93% 84% 79% 2015 2021 2027E

At least 600 bps of adjusted operating ratio improvement from 2021 - 2027 Note: Adjusted operating ratio excludes real estate gains; refer to "Non - GAAP Financial Measures" section on page 2 and Suppleme ntal Materials for related information 57 84% 88% 82% 4% 2021 Includes corporate costs, removes pension income PF 2021 PF 2027E At least 600 bps improvement

Disciplined investing in high return projects 58 2022 capex prioritizes strategic growth in real estate and rolling stock $145 $197 $145 $197 ~$425 - 450 3.8% 5.2% 4.1% 4.8% 9 - 10% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 0 100 200 300 400 500 600 700 2018 2019 2020 2021 2022E Gross capex as a % of revenue Gross capex ($ MM) Tractor age (yrs) 5.3 5.1 5.4 5.9 5.9 Note: Tractor age as of June 30, 2022; gross capex includes LTL reportable segment and an allocation of corporate IT - related spe nd

33% 38% 38% 36% 2019 2020 2021 LTM 6/30 2022 Capital allocation generates robust returns Standalone return on invested c apital ROIC above 30% 59 Note: The company expects a near - term moderation in LTL ROIC given its planned capex, followed by a return to current levels and with a much higher level of earnings, outpacing revenue growth Note: ROIC is calculated on an after - tax basis; excludes goodwill; includes corporate allocation Refer to "Non - GAAP Financial Measures" section on page 2 and Supplemental Materials for related information

Strong track record of deleveraging the balance sheet Net leverage 60 2.9 x 3.3 x 2.7 x 2.0 x 2019 2020 2021 PF 2022E PF for spin - off of RXO Cash proceeds from RXO used to pay down debt Note: Refer to "Non - GAAP Financial Measures" section on page 2 and Supplemental Materials for related information; 2019 and 2020 net leverage is prior to the GXO spin - off

Disciplined capital allocation to maximize opportunities as a standalone company Adjusted EBITDA conversion to free cash expected to average >30% over the forecast period 1 61 Organic Growth • Deployment of capital in high - return projects • Technology and productivity initiatives elevating service and driving profitability Debt Reduction • Targeting investment grade credit metrics Return of Capital to Shareholders • Balanced approach of returning capital to shareholders 1 Free cash flow conversion is calculated as free cash flow divided by adjusted EBITDA. Refer to “Non - GAAP Financial Measures” se ction on page 2.

1 Leader in a bedrock industry with disciplined pricing and deep competitive moat 2 3 4 5 Reasons to invest in XPO Critical nationwide network coverage, with in - house sources of capacity Data - driven levers of profit growth embedded in proprietary technology High - ROIC business with compelling outlook and well - defined growth strategy Results - oriented leaders with long history of transforming operations Revenue CAGR of 6% to 8% Adjusted EBITDA CAGR of 11% to 13% Adjusted operating ratio improvement of a t least 600 bps Targets for Growth, Profitability and Efficiency, 2021 - 2027 62 Note: Targets reflect North American LTL only Note: Refer to slide 67 for 2021 base year used to calculate adjusted EBITDA growth and adjusted operating ratio targets; for ad justed EBITDA growth and adjusted operating ratio, base year and all forecast years exclude gains on real estate sales and include incremental corporate costs; for adjusted operating ratio, base year and al l forecast years also exclude pension income Refer to "Non - GAAP Financial Measures" section on page 2

Supplemental materials 63

Mario Harik LTL President; Chief Executive Officer Elect Q&A participants Jay Silberkleit Chief Information Officer Elect Marissa Christensen Vice President, National Sales Martin Ryan Senior Director, Pricing Matt Fassler Chief Strategy Officer 64 Tony Graham President, West Division

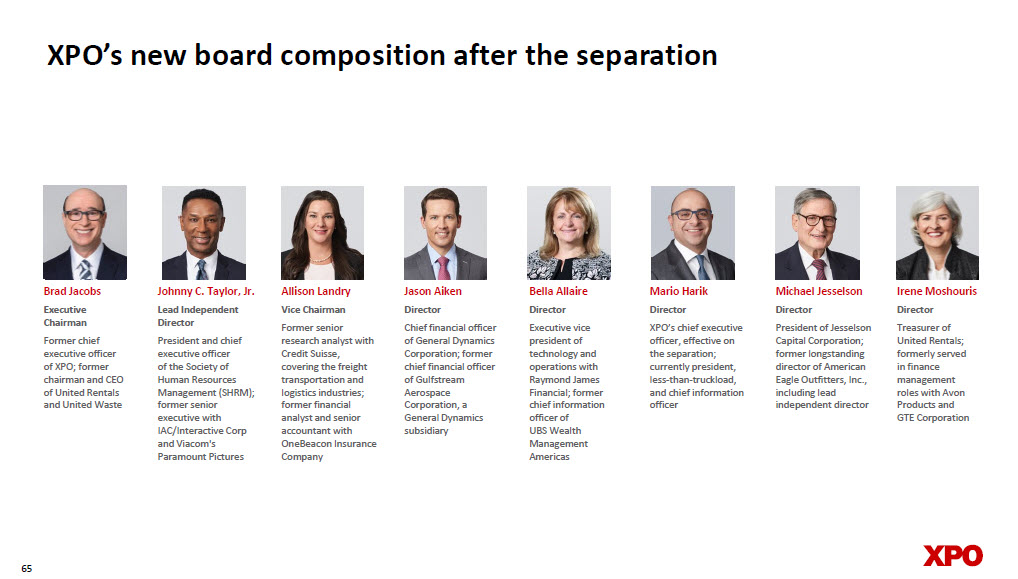

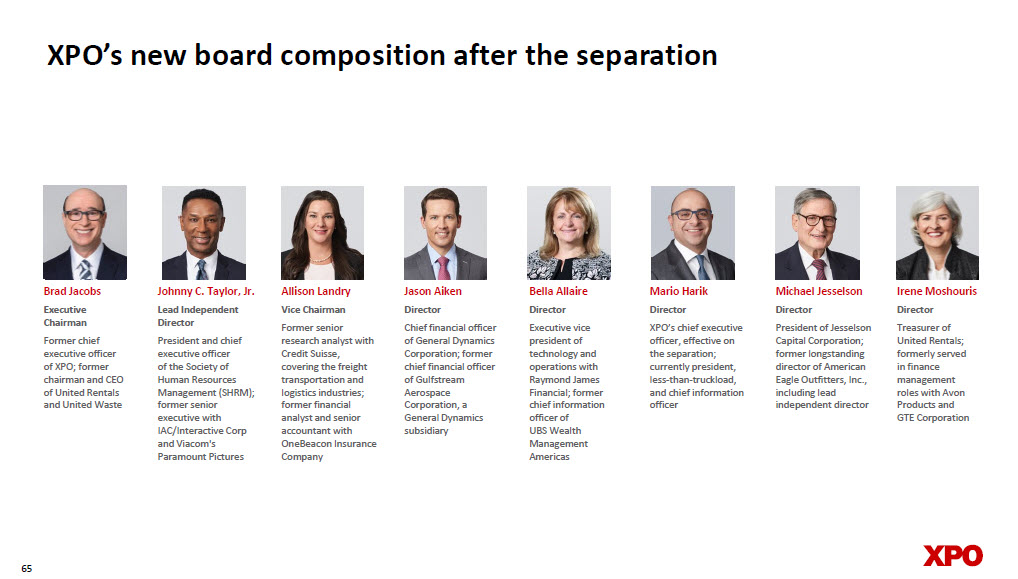

XPO’s new board composition after the separation Brad Jacobs Executive Chairman Former chief executive officer of XPO; former chairman and CEO of United Rentals and United Waste Johnny C. Taylor, Jr. Lead Independent Director President and chief executive officer of the Society of Human Resources Management (SHRM); former senior executive with IAC/Interactive Corp and Viacom's Paramount Pictures Bella Allaire Director Executive vice president of technology and operations with Raymond James Financial ; f ormer chief information officer of UBS Wealth Management Americas Allison Landry Vice Chairman Former senior research analyst with Credit Suisse, covering the freight transportation and logistics industries; former financial analyst and senior accountant with OneBeacon Insurance Company Irene Moshouris Director Treasurer of United Rentals; formerly served in finance management roles with Avon Products and GTE Corporation Mario Harik Director XPO’s chief executive officer, effective on the separation; currently president, less - than - truckload, and chief information officer Jason Aiken Director Chief financial officer of General Dynamics Corporation; former chief financial officer of Gulfstream Aerospace Corporation , a General Dynamics subsidiary 65 Michael Jesselson Director President of Jesselson Capital Corporation; former longstanding director of American Eagle Outfitters, Inc., including lead independent director

Reconciliations 66 66

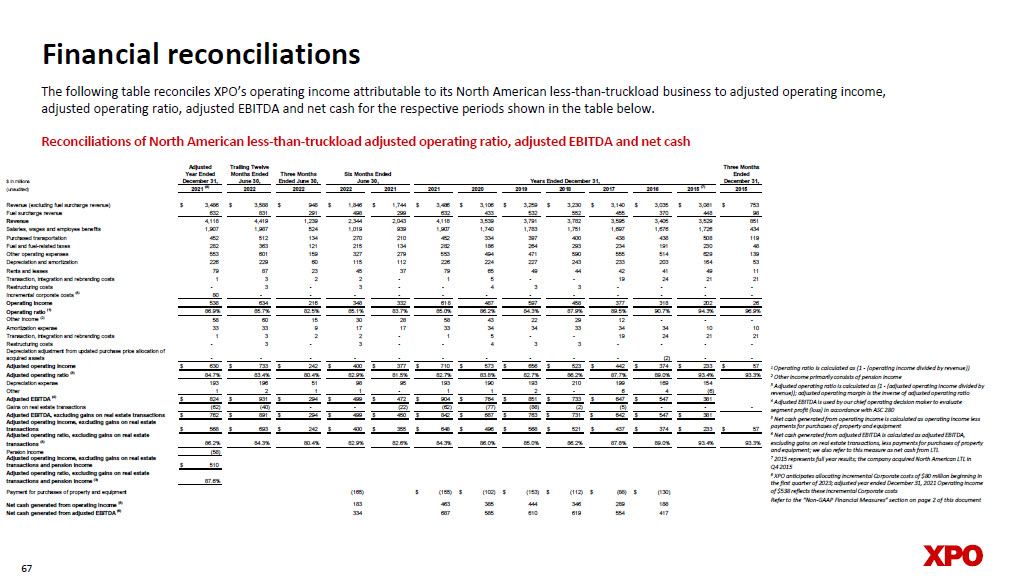

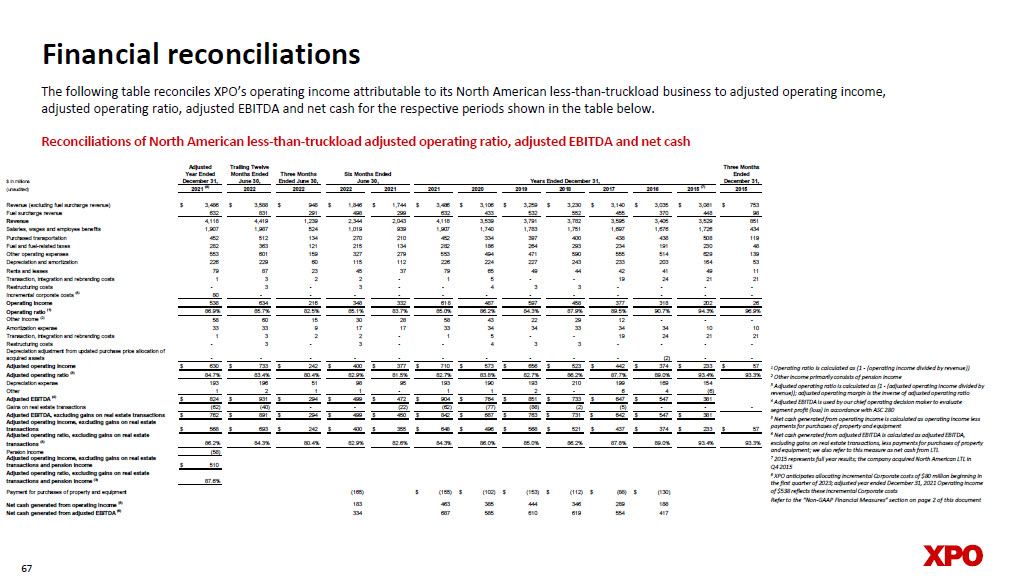

Financial reconciliations 67 The following table reconciles XPO’s operating income attributable to its North American less - than - truckload business to adjuste d operating income, adjusted operating ratio, adjusted EBITDA and net cash for the respective periods shown in the table below. 1 Operating ratio is calculated as (1 - (operating income divided by revenue)) 2 Other income primarily consists of pension income 3 Adjusted operating ratio is calculated as (1 - (adjusted operating income divided by revenue)); adjusted operating margin is the inverse of adjusted operating ratio 4 Adjusted EBITDA is used by our chief operating decision maker to evaluate segment profit (loss) in accordance with ASC 280 5 Net cash generated from operating income is calculated as operating income less payments for purchases of property and equipment 6 Net cash generated from adjusted EBITDA is calculated as adjusted EBITDA, excluding gains on real estate transactions, less payments for purchases of property and equipment; we also refer to this measure as net cash from LTL 7 2015 represents full year results; the company acquired North American LTL in Q4 2015 8 XPO anticipates allocating incremental Corporate costs of $80 million beginning in the first quarter of 2023; adjusted year ended December 31, 2021 Operating income of $538 reflects these incremental Corporate costs Refer to the “Non - GAAP Financial Measures” section on page 2 of this document Reconciliations of North American less - than - truckload adjusted operating ratio, adjusted EBITDA and net cash $ in millions (unaudited) Revenue (excluding fuel surcharge revenue) $ 3,486 $ 3,588 $ 948 $ 1,846 $ 1,744 $ 3,486 $ 3,106 $ 3,259 $ 3,230 $ 3,140 $ 3,035 $ 3,081 $ 753 Fuel surcharge revenue 632 831 291 498 299 632 433 532 552 455 370 448 98 Revenue 4,118 4,419 1,239 2,344 2,043 4,118 3,539 3,791 3,782 3,595 3,405 3,529 851 Salaries, wages and employee benefits 1,907 1,987 524 1,019 939 1,907 1,740 1,783 1,751 1,697 1,676 1,726 434 Purchased transportation 452 512 134 270 210 452 334 397 400 438 438 508 119 Fuel and fuel-related taxes 282 363 121 215 134 282 186 264 293 234 191 230 48 Other operating expenses 553 601 159 327 279 553 494 471 590 555 514 629 139 Depreciation and amortization 226 229 60 115 112 226 224 227 243 233 203 164 53 Rents and leases 79 87 23 45 37 79 65 49 44 42 41 49 11 Transaction, integration and rebranding costs 1 3 2 2 - 1 5 - - 19 24 21 21 Restructuring costs - 3 - 3 - - 4 3 3 - - - - Incremental corporate costs (8) 80 - - - - - - - - - - - - Operating income 538 634 216 348 332 618 487 597 458 377 318 202 26 Operating ratio (1) 86.9% 85.7% 82.5% 85.1% 83.7% 85.0% 86.2% 84.3% 87.9% 89.5% 90.7% 94.3% 96.9% Other income (2) 58 60 15 30 28 58 43 22 29 12 - - - Amortization expense 33 33 9 17 17 33 34 34 33 34 34 10 10 Transaction, integration and rebranding costs 1 3 2 2 - 1 5 - - 19 24 21 21 Restructuring costs - 3 - 3 - - 4 3 3 - - - - Depreciation adjustment from updated purchase price allocation of acquired assets - - - - - - - - - - (2) - - Adjusted operating income $ 630 $ 733 $ 242 $ 400 $ 377 $ 710 $ 573 $ 656 $ 523 $ 442 $ 374 $ 233 $ 57 Adjusted operating ratio (3) 84.7% 83.4% 80.4% 82.9% 81.5% 82.7% 83.8% 82.7% 86.2% 87.7% 89.0% 93.4% 93.3% Depreciation expense 193 196 51 98 95 193 190 193 210 199 169 154 Other 1 2 1 1 - 1 1 2 - 6 4 (6) Adjusted EBITDA (4) $ 824 $ 931 $ 294 $ 499 $ 472 $ 904 $ 764 $ 851 $ 733 $ 647 $ 547 381 Gains on real estate transactions (62) (40) - - (22) (62) (77) (88) (2) (5) - - - Adjusted EBITDA, excluding gains on real estate transactions $ 762 $ 891 $ 294 $ 499 $ 450 $ 842 $ 687 $ 763 $ 731 $ 642 $ 547 $ 381 Adjusted operating income, excluding gains on real estate transactions $ 568 $ 693 $ 242 $ 400 $ 355 $ 648 $ 496 $ 568 $ 521 $ 437 $ 374 $ 233 $ 57 Adjusted operating ratio, excluding gains on real estate transactions (3) 86.2% 84.3% 80.4% 82.9% 82.6% 84.3% 86.0% 85.0% 86.2% 87.8% 89.0% 93.4% 93.3% Pension income (58) Adjusted operating income, excluding gains on real estate transactions and pension income $ 510 Adjusted operating ratio, excluding gains on real estate transactions and pension income (3) 87.6% Payment for purchases of property and equipment (165) $ (155) $ (102) $ (153) $ (112) $ (88) $ (130) Net cash generated from operating income (5) 183 463 385 444 346 289 188 Net cash generated from adjusted EBITDA (6) 334 687 585 610 619 554 417 2018 2017 2016 2015 (7) 2021 (8) 2022 2021 2021 2020 2015 Three Months Ended December 31, Three Months Ended June 30, 2022 Years Ended December 31, Trailing Twelve Months Ended June 30, 2022 Adjusted Year Ended December 31, 2019 Six Months Ended June 30,

Financial reconciliations (cont.) 68 The following tables calculate XPO’s net leverage and net debt for the periods presented. We believe that net leverage and ne t d ebt are important measures of our overall liquidity position and are calculated by removing cash and cash equivalents from our reported total debt. Reconciliations of leverage and net debt $ in millions (unaudited) Reconciliation of Net Debt Total debt $ 3,572 $ 6,707 $ 5,266 Less: Cash and cash equivalents 260 2,054 377 Net debt $ 3,312 $ 4,653 $ 4,889 Reconciliation of Net Leverage Net debt $ 3,312 $ 4,653 $ 4,889 Adjusted EBITDA $ 1,239 $ 1,393 $ 1,668 Net leverage 2.7x 3.3x 2.9x Reconciliation of Net Income to Adjusted EBITDA Net income $ 323 $ 117 440 Debt extinguishment loss 54 - 5 Interest expense 211 325 292 Income tax provision 87 31 129 Depreciation and amortization expense 476 766 739 Unrealized (gain) loss on foreign currency option and forward contracts 1 (2) 9 Litigation settlements 31 - - Transaction and integration costs 37 100 5 Restructuring costs 19 56 49 Adjusted EBITDA $ 1,239 $ 1,393 $ 1,668 As of December 31, 2021 2020 2019 2021 2020 2019 Years Ended December 31, Years Ended December 31, 2021 (1) 2020 2019 Note: 2019 and 2020 net leverage is prior to the GXO spin - off 1 2021 net income is from continuing operations Refer to the “Non - GAAP Financial Measures” section on page 2 of this document

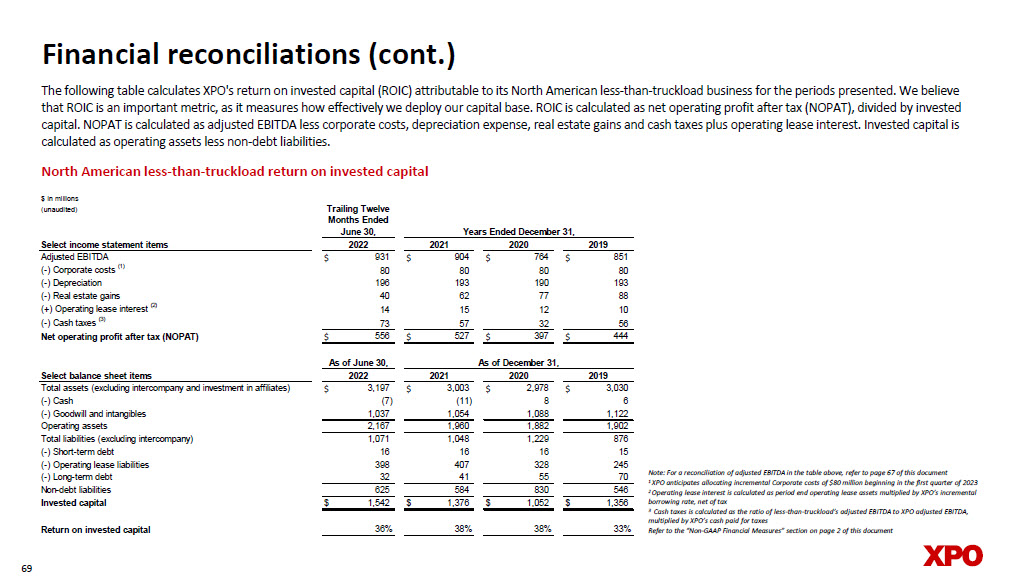

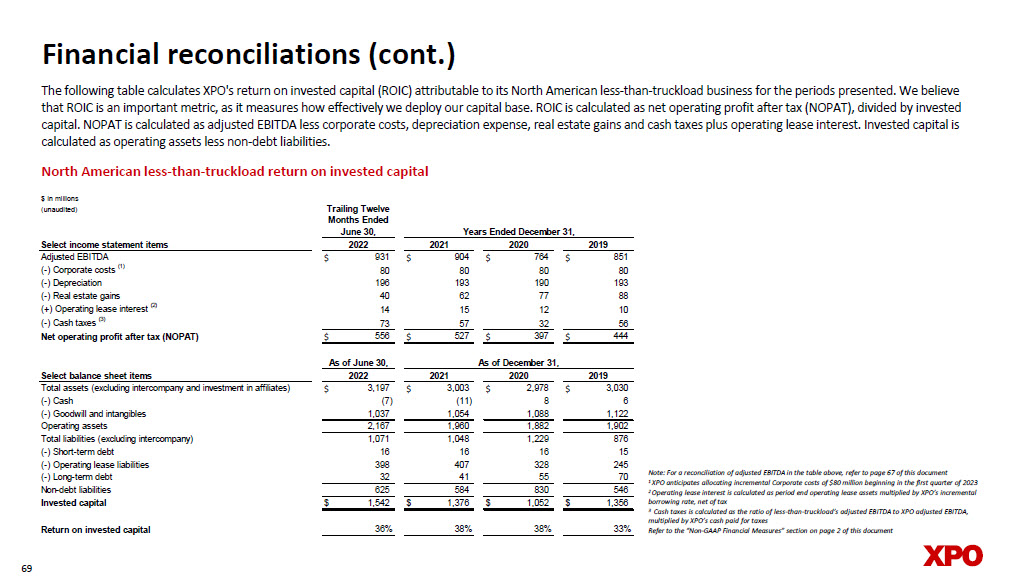

Financial reconciliations (cont.) 69 The following table calculates XPO's return on invested capital (ROIC) attributable to its North American less - than - truckload bu siness for the periods presented. We believe that ROIC is an important metric, as it measures how effectively we deploy our capital base. ROIC is calculated as net operat ing profit after tax (NOPAT), divided by invested capital. NOPAT is calculated as adjusted EBITDA less corporate costs, depreciation expense, real estate gains and cash taxes plu s operating lease interest. Invested capital is calculated as operating assets less non - debt liabilities. Note: For a reconciliation of adjusted EBITDA in the table above, refer to page 67 of this document 1 XPO anticipates allocating incremental Corporate costs of $80 million beginning in the first quarter of 2023 2 Operating lease interest is calculated as period end operating lease assets multiplied by XPO’s incremental borrowing rate, net of tax 3 Cash taxes is calculated as the ratio of less - than - truckload’s adjusted EBITDA to XPO adjusted EBITDA, multiplied by XPO’s cash paid for taxes Refer to the “Non - GAAP Financial Measures” section on page 2 of this document North American less - than - truckload return on invested capital $ in millions (unaudited) Select income statement items Adjusted EBITDA $ 931 $ 904 $ 764 $ 851 (-) Corporate costs (1) 80 80 80 80 (-) Depreciation 196 193 190 193 (-) Real estate gains 40 62 77 88 (+) Operating lease interest (2) 14 15 12 10 (-) Cash taxes (3) 73 57 32 56 Net operating profit after tax (NOPAT) $ 556 $ 527 $ 397 $ 444 Select balance sheet items Total assets (excluding intercompany and investment in affiliates) $ 3,197 $ 3,003 $ 2,978 $ 3,030 (-) Cash (7) (11) 8 6 (-) Goodwill and intangibles 1,037 1,054 1,088 1,122 Operating assets 2,167 1,960 1,882 1,902 Total liabilities (excluding intercompany) 1,071 1,048 1,229 876 (-) Short-term debt 16 16 16 15 (-) Operating lease liabilities 398 407 328 245 (-) Long-term debt 32 41 55 70 Non-debt liabilities 625 584 830 546 Invested capital $ 1,542 $ 1,376 $ 1,052 $ 1,356 Return on invested capital 36% 38% 38% 33% As of June 30, As of December 31, 2022 2021 2020 2019 Trailing Twelve Months Ended June 30, Years Ended December 31, 2022 2021 2020 2019

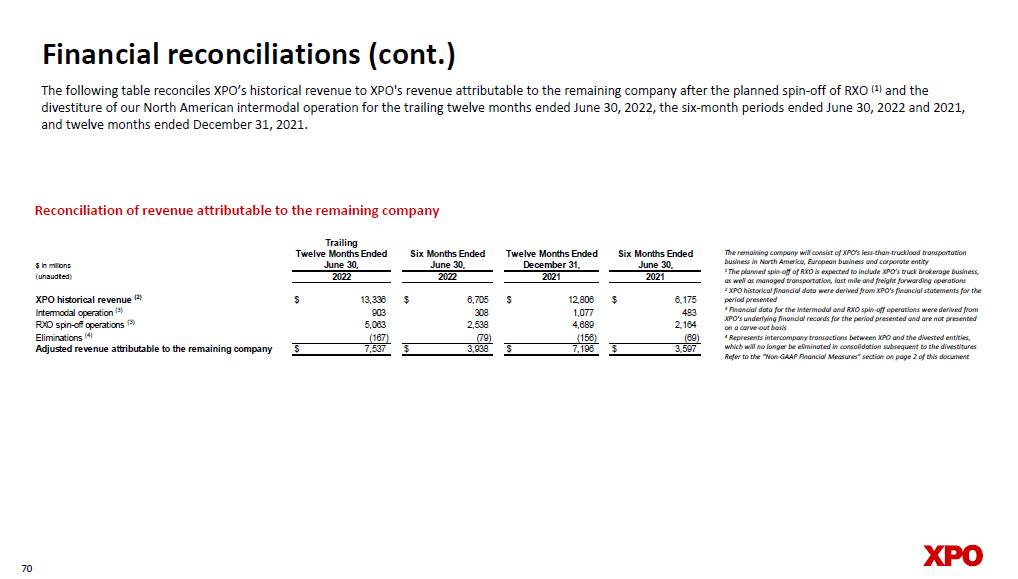

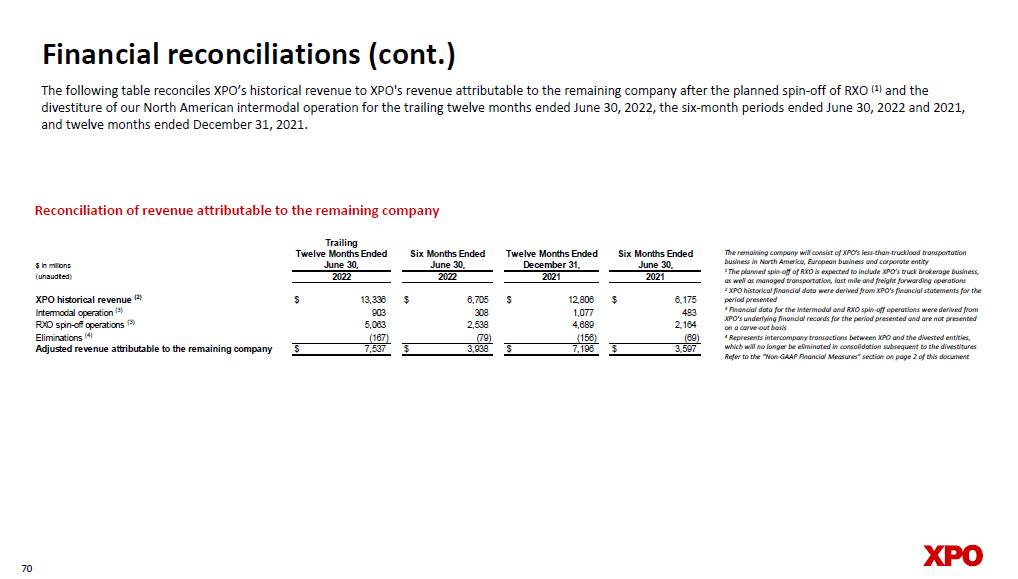

Financial reconciliations (cont.) 70 The following table reconciles XPO’s historical revenue to XPO's revenue attributable to the remaining company after the plan ned spin - off of RXO (1) and the divestiture of our North American intermodal operation for the trailing twelve months ended June 30, 2022, the six - month periods ended June 30, 2022 and 2021, and twelve months ended December 31, 2021. The remaining company will consist of XPO's less - than - truckload transportation business in North America, European business and corporate entity 1 The planned spin - off of RXO is expected to include XPO’s truck brokerage business, as well as managed transportation, last mile and freight forwarding operations 2 XPO historical financial data were derived from XPO's financial statements for the period presented 3 Financial data for the Intermodal and RXO spin - off operations were derived from XPO's underlying financial records for the period presented and are not presented on a carve - out basis 4 Represents intercompany transactions between XPO and the divested entities, which will no longer be eliminated in consolidation subsequent to the divestitures Refer to the “Non - GAAP Financial Measures” section on page 2 of this document Reconciliation of revenue attributable to the remaining company $ in millions (unaudited) XPO historical revenue (2) $ 13,336 $ 6,705 $ 12,806 $ 6,175 Intermodal operation (3) 903 308 1,077 483 RXO spin-off operations (3) 5,063 2,538 4,689 2,164 Eliminations (4) (167) (79) (156) (69) Adjusted revenue attributable to the remaining company $ 7,537 $ 3,938 $ 7,196 $ 3,597 Trailing Twelve Months Ended Six Months Ended Twelve Months Ended Six Months Ended June 30, June 30, December 31, June 30, 2022 2022 2021 2021