Exhibit 99.2

AUGUST 2022 Investor Presen t a t ion

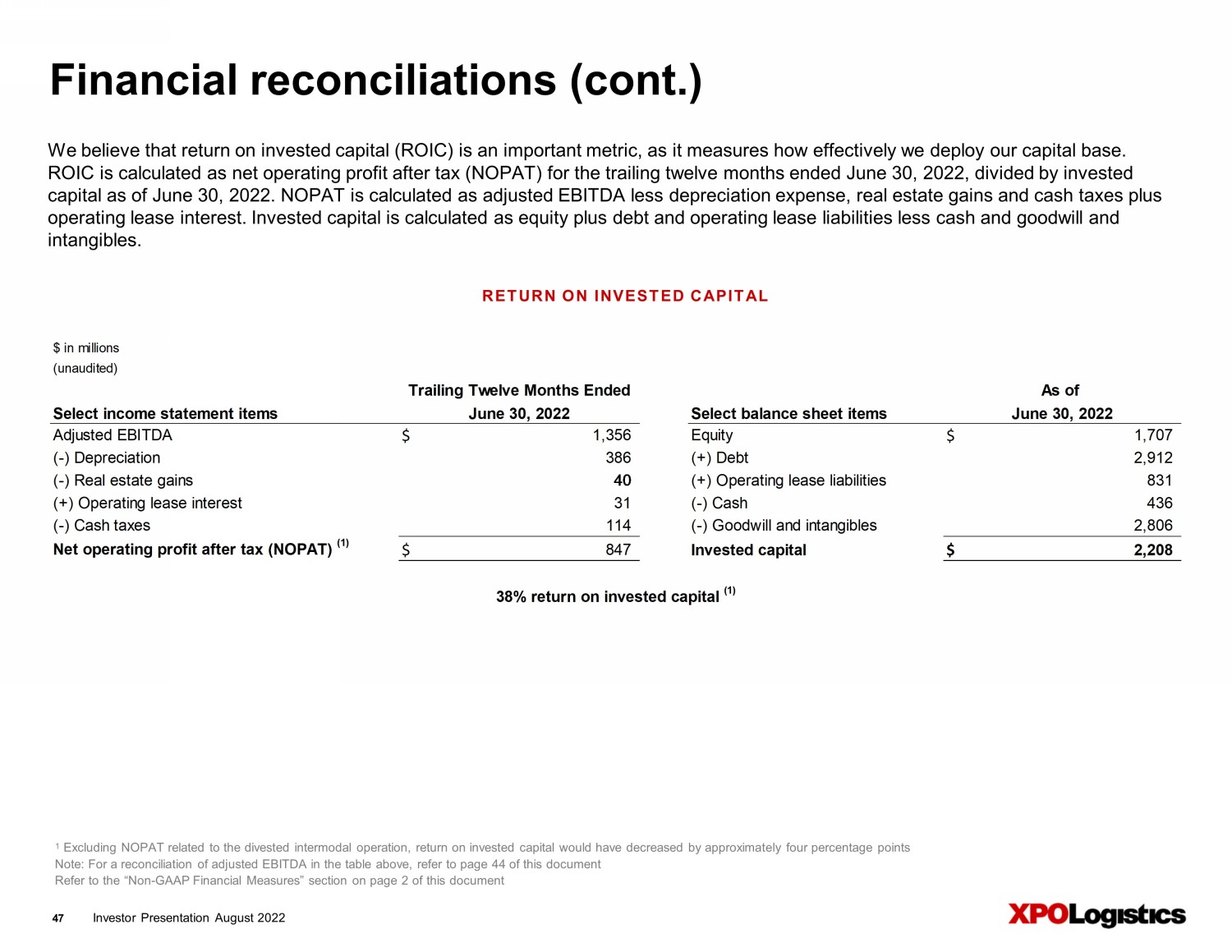

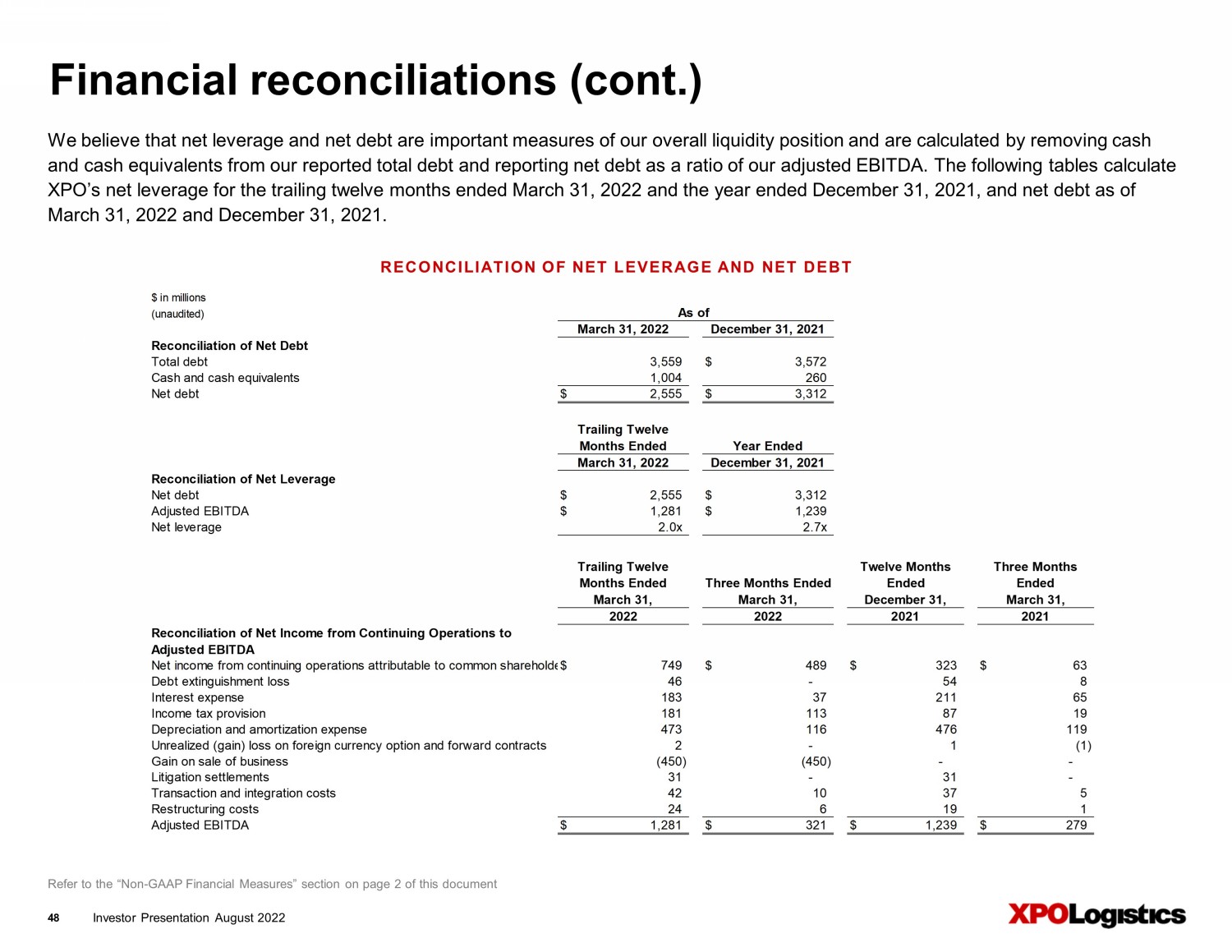

Investor Presentation August 2022 2 Non - GAAP financial measures As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non - GAAP financial measures contained in this document to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this document . This document contains the following non - GAAP financial measures : adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”) on a consolidated basis ; adjusted EBITDA margin on a consolidated basis ; adjusted net income from continuing operations attributable to common shareholders and adjusted diluted earnings from continuing operations per share (“adjusted EPS”) on a consolidated basis ; free cash flows ; adjusted operating income (including and excluding gains on real estate transactions) and adjusted operating ratio (including and excluding gains on real estate transactions) for North American less - than - truckload ; adjusted EBITDA excluding gains on real estate transactions for North American less - than - truckload ; adjusted EBITDA attributable to North American truck brokerage ; return on invested capital (ROIC) on a consolidated basis ; net leverage ; net debt ; and adjusted EBITDA attributable to RXO (planned spin - off) . We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business segments’ core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses . Other companies may calculate these non - GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies . These non - GAAP financial measures should only be used as supplemental measures of our operating performance . Adjusted EBITDA, adjusted EBITDA margin, adjusted net income from continuing operations attributable to common shareholders and adjusted EPS include adjustments for transaction and integration costs, as well as restructuring costs, litigation settlements and other adjustments as set forth in the attached tables . Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin - off and may include transaction costs, consulting fees, retention awards, and internal salaries and wages (to the extent the individuals are assigned full - time to integration and transformation activities) and certain costs related to integrating and converging IT systems . Restructuring costs primarily relate to severance costs associated with business optimization initiatives . Management uses these non - GAAP financial measures in making financial, operating and planning decisions and evaluating XPO’s and each business segment’s ongoing performance . We believe that free cash flow is an important measure of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value . We calculate free cash flow as net cash provided by operating activities from continuing operations, plus cash collected on deferred purchase price receivable, less payment for purchases of property and equipment plus proceeds from sale of property and equipment . We believe that adjusted EBITDA and adjusted EBITDA margin improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), litigation settlements, tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses . We believe that adjusted net income from continuing operations attributable to common shareholders and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains that management has determined are not reflective of our core operating activities, including amortization of acquisition - related intangible assets, litigation settlements, transaction and integration costs, restructuring costs and other adjustments as set out in the attached tables . We believe that adjusted operating income and adjusted operating ratio improve the comparability of our operating results from period to period by ( i ) removing the impact of certain transaction, integration and rebranding costs and restructuring costs, as well as amortization expenses and (ii) including the impact of pension income incurred in the reporting period as set out in the attached tables . We believe that return on invested capital (ROIC) is an important metric as it measures how effectively we deploy our capital base . ROIC is calculated as net operating profit after tax (NOPAT) for a trailing twelve month period divided by invested capital as of the end of such period . NOPAT is calculated as adjusted EBITDA less depreciation expense, real estate gains and cash taxes plus operating lease interest . Invested capital is calculated as equity plus debt and operating lease liabilities less cash and goodwill and intangibles . We believe that net leverage and net debt are important measures of our overall liquidity position and are calculated by removing cash and cash equivalents from our reported total debt and reporting net debt as a ratio of our reported adjusted EBITDA . We believe that adjusted EBITDA attributable to RXO (planned spin - off) improves comparability from period to period by removing adjustments set out in the attached tables that management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying business . We calculate adjusted EBITDA attributable to RXO (planned spin - off) as operating income of spin - off operations plus transaction and integrations costs and depreciation and amortization less other expense . With respect to our financial targets for full year 2022 adjusted EBITDA, adjusted diluted EPS and free cash flow, and our financial target for 2022 third quarter adjusted EBITDA, a reconciliation of these non - GAAP measures to the corresponding GAAP measures is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from these non - GAAP target measures . The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward - looking statement of income and statement of cash flows prepared in accordance with GAAP that would be required to produce such a reconciliation .

Investor Presentation August 2022 3 Forward - looking statements This document includes forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended, including statements relating to the planned spin - off of our tech - enabled brokered services platform and the sale or listing of our European business, the expected timing of these transactions and the anticipated benefits of these transactions ; our full year 2022 financial targets of consolidated adjusted EBITDA and North American LTL adjusted EBITDA, depreciation and amortization (excluding amortization of acquisition - related intangible assets), interest expense, tax rate, adjusted diluted EPS (excluding amortization of acquisition - related intangible assets), gross capital expenditures, net capital expenditures and free cash flow ; our 2022 third quarter financial target of adjusted EBITDA ; our expectation of year - over - year improvement of more than 100 basis points in North American LTL adjusted operating ratio ; our 2022 financial target of at least $ 1 billion of adjusted EBITDA in the North American LTL segment, including gains on sales of real estate of up to $ 50 million in the 2022 fourth quarter ; and our ESG goals . All statements other than statements of historical fact are, or may be deemed to be, forward - looking statements . In some cases, forward - looking statements can be identified by the use of forward - looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms . However, the absence of these words does not mean that the statements are not forward - looking . These forward - looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances . These forward - looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward - looking statements . Factors that might cause or contribute to a material difference include our ability to effect the spin - off of our tech - enabled brokered services platform and meet the related conditions of the spin - off, our ability to complete the sale or listing of our European business, the expected timing of the completion of the transactions and the terms of the transactions, our ability to achieve the expected benefits of the transactions, our ability to retain and attract key personnel for the separate businesses, the risks discussed in our filings with the SEC, and the following : economic conditions generally ; the severity, magnitude, duration and aftereffects of the COVID - 19 pandemic, including supply chain disruptions due to plant and port shutdowns and transportation delays, the global shortage of certain components such as semiconductor chips, strains on production or extraction of raw materials, cost inflation and labor and equipment shortages, which may lower levels of service, including the timeliness, productivity and quality of service, and government responses to these factors ; our ability to align our investments in capital assets, including equipment, service centers and warehouses, to our customers’ demands ; our ability to implement our cost and revenue initiatives ; the effectiveness of our action plan, and other management actions, to improve our North American LTL business ; our ability to benefit from a sale, spin - off or other divestiture of one or more business units, and the impact of anticipated material compensation and other expenses, including expenses related to the acceleration of equity awards, to be incurred in connection with a substantial disposition ; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies ; goodwill impairment, including in connection with a business unit sale, spin - off or other divestiture ; matters related to our intellectual property rights ; fluctuations in currency exchange rates ; fuel price and fuel surcharge changes ; natural disasters, terrorist attacks, wars or similar incidents, including the conflict between Russia and Ukraine and increased tensions between Taiwan and China ; risks and uncertainties regarding the expected benefits of the spin - off of our logistics segment or a future spin - off of a business unit, the impact of the spin - off of our logistics segment or a future spin - off of a business unit on the size and business diversity of our company ; the ability of the spin - off of our logistics segment or a future spin - off of a business unit to qualify for tax - free treatment for U . S . federal income tax purposes ; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems ; our indebtedness ; our ability to raise debt and equity capital ; fluctuations in fixed and floating interest rates ; our ability to maintain positive relationships with our network of third - party transportation providers ; our ability to attract and retain qualified drivers ; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers and efforts by labor organizations to organize our employees and independent contractors ; litigation, including litigation related to alleged misclassification of independent contractors and securities class actions ; risks associated with our self - insured claims ; risks associated with defined benefit plans for our current and former employees ; the impact of potential sales of common stock by our chairman ; governmental regulation, including trade compliance laws, as well as changes in international trade policies, sanctions and tax regimes ; governmental or political actions, including the United Kingdom’s exit from the European Union ; and competition and pricing pressures . All forward - looking statements set forth in this document are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations . Forward - looking statements set forth in this document speak only as of the date hereof, and we do not undertake any obligation to update forward - looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law . Where required by law, no binding decision will be made with respect to the divestiture of the European business other than in compliance with applicable employee information and consultation requirements .

Investor Presentation August 2022 INVESTMENT HIGHLIGHTS AND SPIN - OFF 5 KEY FINANCIAL RESULTS AND GUIDANCE 13 XPO: LESS - THAN - TRUCKLOAD (LTL) 17 RXO: TRUCK BROKERAGE 24 SUPPLEMENTAL MATERIALS 33

Investor Presentation August 2022 Investor Presentation August 2022 5 Why invest in XPO today? Multiple catalysts for value creation, largely independent of macro conditions: XPO - specific levers for LTL transformation; spin - off of RXO brokered transportation platform; divestiture of European business; continued deleveraging 1 A top provider in highly attractive less - than - truckload and truck brokerage sectors 2 High - ROIC businesses benefitting from secular tailwinds and strong industry positioning 3 Company - specific initiatives in LTL to continue to improve operating ratio, increase volume and grow profit 4 Best - in - class truck brokerage business with soaring adoption of leading technology platform 5 Deleveraging while continuing to invest in growth, supported by strong adjusted EBITDA and free cash flow and strategic divestiture

Investor Presentation August 2022 6 ▪ One of the largest providers of less - than - truckload (LTL) transportation in North America ▪ Fourth largest US truckload transportation broker ▪ More than 90% of 2021 operating income derived from North American LTL and truck brokerage businesses ▪ European business has leading positions in key transport markets: France, the UK, Iberia (Spain and Portugal) XPO helps customers move their goods most efficiently through their supply chains. We deliver value in the form of technological innovations, process improvements, cost efficiencies and reliable outcomes. XPO is a leading provider of freight transportation services XPO KEY METRICS 1 2021 revenue $ 12.8 billion Locations 749 Employees ~4 3 ,000 Customers ~50,000 LTL industry size 2 ~$51 billion Truck brokerage industry size 3 ~$88 billion STRONG POSITIONING OF CORE BUSINESSES 1 Global data for locations, customers and employees as of June 30 , 2022; revenue excludes logistics segment spun off on August 2, 2021 2 Third - party research: US LTL industry revenue, 2021 3 Third - party research: US brokered truckload industry revenue, 2021; reflects brokered component of ~$400 billion total addressable truckload opportunity

Investor Presentation August 2022 Note: Partial list 7 Strategic partner to blue - chip customers in diverse sectors

Investor Presentation August 2022 8 Planned spin - off will create two standalone industry leaders, each with a long runway for earnings growth ▪ XPO will be asset - based: Third largest pure - play less - than - truckload provider o One of the few LTL networks in the US with national scale o Proprietary technology and other company - specific levers enhance efficiency and growth ▪ RXO will be asset - light: High - performing, tech - enabled brokered transportation platform o Best - in - class truck brokerage business with cutting - edge technology and access to massive capacity; generated over 80% of 2021 operating income from planned RXO operations o Complementary brokered services for managed transportation, last mile and global forwarding Aggregate trading price of the two stocks post - spin - off – XPO and RXO – is expected to be significantly higher than the price that XPO’s stock would trade at if the two businesses remained combined, c reating opportunities for more efficient use of equity XPO sold its intermodal operation in March 2022 and intends to divest its European business Note: Completion of the planned spin - off is subject to various conditions, including final approval by the XPO board of director s; there can be no assurance the spin - off will close, or if it does, of its terms or timing Spin - off moving toward completion in Q4 2022

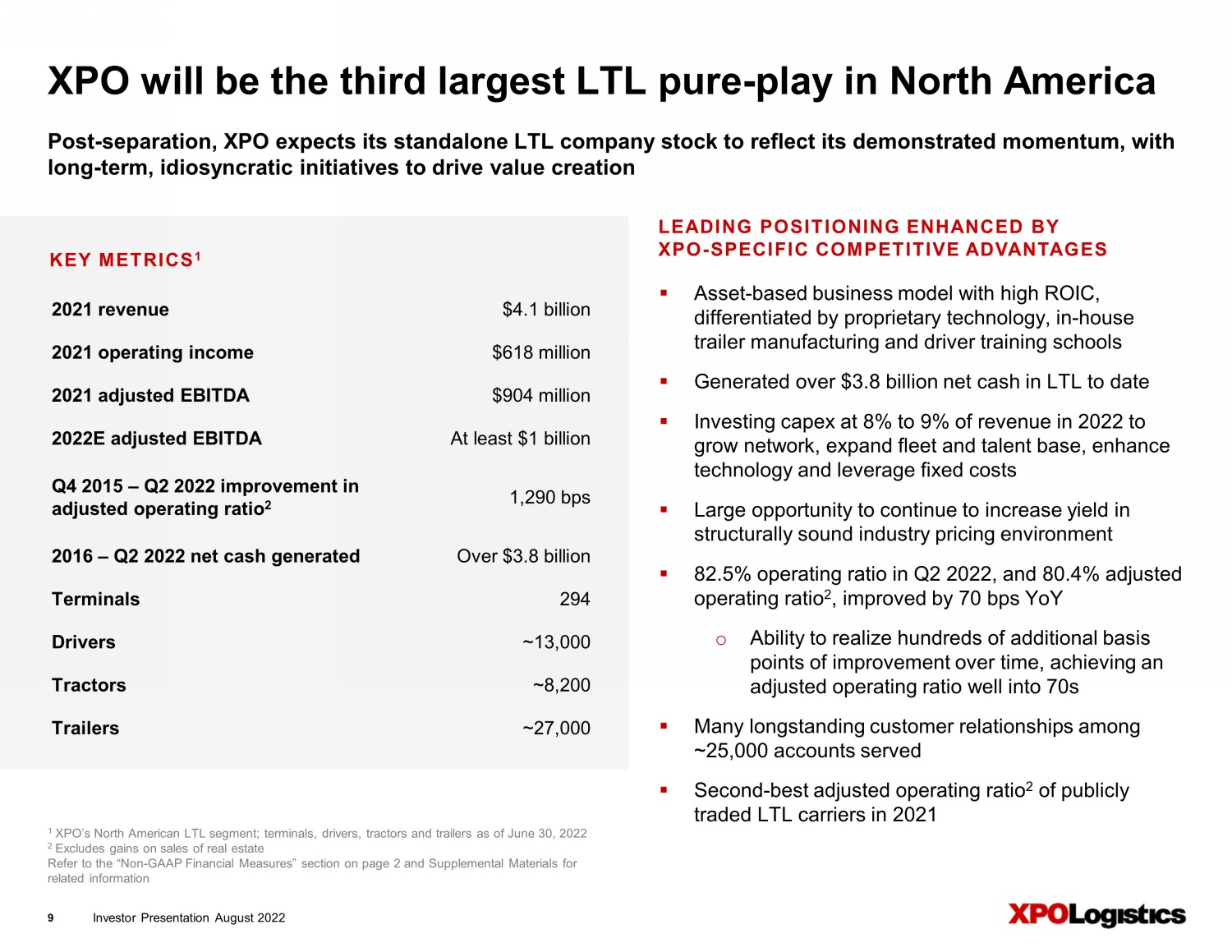

Investor Presentation August 2022 1 XPO’s North American LTL segment; terminals, drivers, tractors and trailers as of June 30, 2022 2 Excludes gains on sales of real estate Refer to the “Non - GAAP Financial Measures” section on page 2 and Supplemental Materials for related information 9 ▪ Asset - based business model with high ROIC, differentiated by proprietary technology, in - house trailer manufacturing and driver training schools ▪ Generated over $3.8 billion net cash in LTL to date ▪ Investing capex at 8% to 9% of revenue in 2022 to grow network, expand fleet and talent base, enhance technology and leverage fixed costs ▪ Large opportunity to continue to increase yield in structurally sound industry pricing environment ▪ 82.5% operating ratio in Q2 2022, and 80.4% adjusted operating ratio 2 , improved by 70 bps YoY o Ability to realize hundreds of additional basis points of improvement over time, achieving an adjusted operating ratio well into 70s ▪ Many longstanding customer relationships among ~25,000 accounts served ▪ Second - best adjusted operating ratio 2 of publicly traded LTL carriers in 2021 Post - separation, XPO expects its standalone LTL company stock to reflect its demonstrated momentum, with long - term, idiosyncratic initiatives to drive value creation XPO will be the third largest LTL pure - play in North America LEADING POSITIONING ENHANCED BY XPO - SPECIFIC COMPETITIVE ADVANTAGES 2021 revenue $4.1 billion 2021 operating income $618 million 2021 adjusted EBITDA $904 million 2022E adjusted EBITDA At least $1 billion Q4 2015 – Q2 2022 improvement in adjusted operating ratio 2 1,290 bps 2016 – Q2 2022 net cash generated Over $3.8 billion Terminals 294 Drivers ~13,000 Tractors ~8,200 Trailers ~27,000 KEY METRICS 1

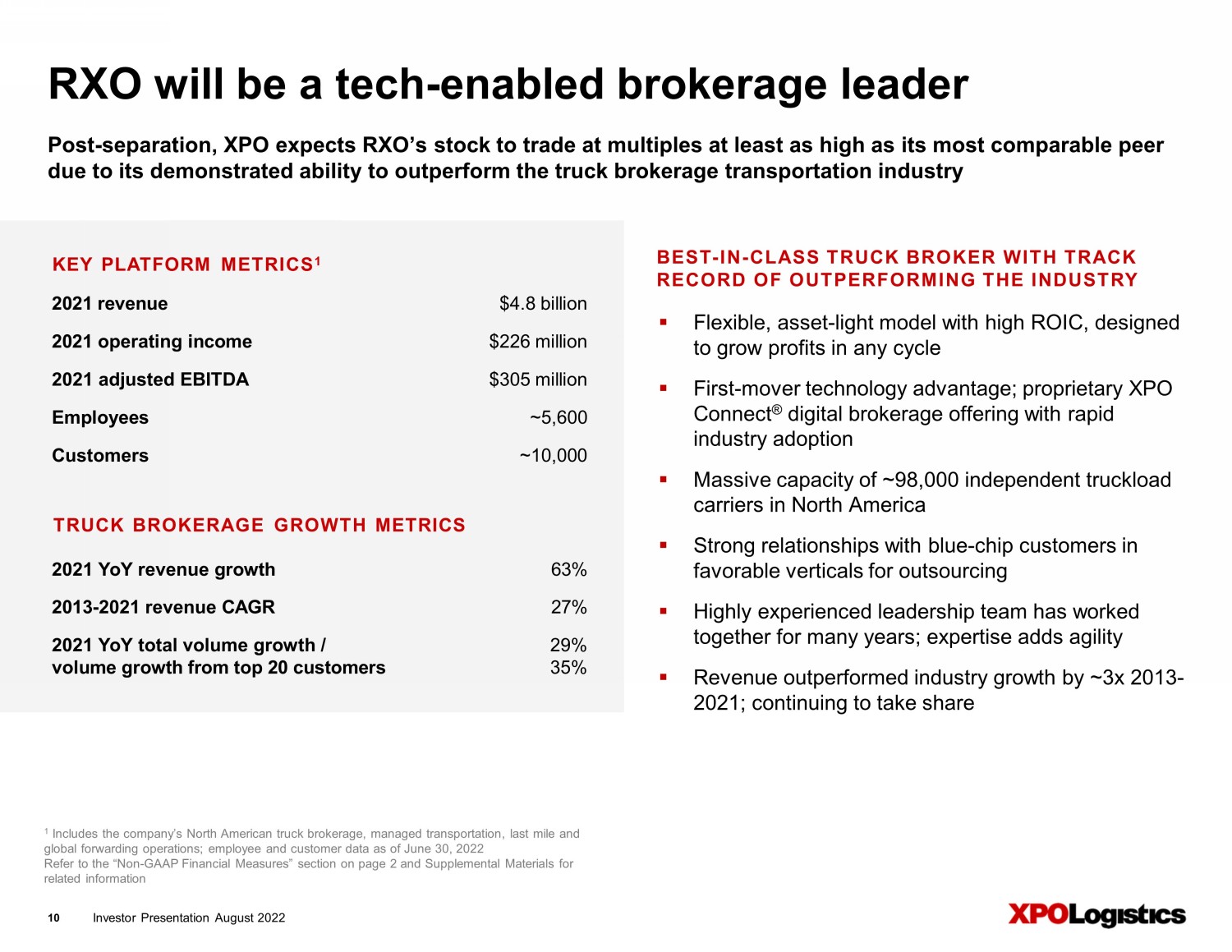

Investor Presentation August 2022 10 ▪ Flexible, asset - light model with high ROIC, designed to grow profits in any cycle ▪ First - mover technology advantage; proprietary XPO Connect ® digital brokerage offering with rapid industry adoption ▪ Massive capacity of ~98,000 independent truckload carriers in North America ▪ Strong relationships with blue - chip customers in favorable verticals for outsourcing ▪ Highly experienced leadership team has worked together for many years; expertise adds agility ▪ Revenue outperformed industry growth by ~3x 2013 - 2021; continuing to take share Post - separation, XPO expects RXO’s stock to trade at multiples at least as high as its most comparable peer due to its demonstrated ability to outperform the truck brokerage transportation industry RXO will be a tech - enabled brokerage leader BEST - IN - CLASS TRUCK BROKER WITH TRACK RECORD OF OUTPERFORMING THE INDUSTRY KEY PLATFORM METRICS 1 2021 r evenue $4.8 billion 2021 o perating income $226 million 2021 adjusted EBITDA $305 million Employees ~5,600 Customers ~10,000 2021 YoY revenue growth 63% 2013 - 2021 revenue CAGR 27% 2021 YoY total volume growth / 29% volume growth from top 20 customers 35% TRUCK BROKERAGE GROWTH METRICS 1 Includes the company’s North American truck brokerage, managed transportation, last mile and global forwarding operations; employee and customer data as of June 30, 2022 Refer to the “Non - GAAP Financial Measures” section on page 2 and Supplemental Materials for related information

Investor Presentation August 2022 11 Long track record of significant shareholder value creation Refer to the “Non - GAAP Financial Measures” section on page 2 and Supplemental Materials for related information GXO Logistics spin - off was the best - performing stock of all fully divested spin - offs in 2021 ▪ XPO was the 7th best - performing stock of the last decade on the Fortune 500, based on Bloomberg market data ▪ 38% return on invested capital (ROIC) for the trailing twelve months ended June 30, 2022 ▪ Spent more than $3 billion on technology on all operations over the past 11 years, including truck brokerage digitization and LTL optimization ▪ Drove 1,290 bps of improvement in North American LTL adjusted operating ratio, excluding gains from sales of real estate, since acquiring the business in Q4 2015 ▪ Delivered 27% revenue CAGR in North American truck brokerage 2013 – 2021, at 3x the industry growth rate ▪ Sold intermodal operation in March 2022 ▪ Robust adjusted EBITDA growth and free cash flow support continued deleveraging DRIVING SUPERIOR RESULTS THROUGH SKILLED CAPITAL ALLOCATION AND COMPANY - SPECIFIC LEVERS

Investor Presentation August 2022 12 ▪ Chief diversity officer leading DE&I; steering committees furthering diversity, inclusion and sustainability ▪ Executive compensation tied to ESG targets ▪ Core DE&I objectives relate to recruitment and retention ▪ Working to significantly increase the diversity by collaborating with historically Black colleges and universities (HBCUs) and others ▪ Promoting women and minority employees to middle and senior management roles ▪ Communicating culture of belonging to a range of underrepresented groups, replicating success with hiring LGBTQ+ community members and veterans ▪ Taking steps to align climate - related disclosures to TCFD, building on SASB and GRI reporting ▪ Post - spin - off, each standalone company will have a robust environmental, social and governance framework from day one of the separation Recent climate actions: Piloting all - electric trucks, deploying cleaner fuels, testing duo - trailers for fuel efficiency; and providing brokerage carriers with resources to help them in the adoption of sustainable technologies Strong ESG culture ESG SCORECARD CATEGORIES Workforce and Talent Information Security Employee and Community Safety Environmental and Sustainability Diversity, Equity and Inclusion Governance

Key financial results and guidance

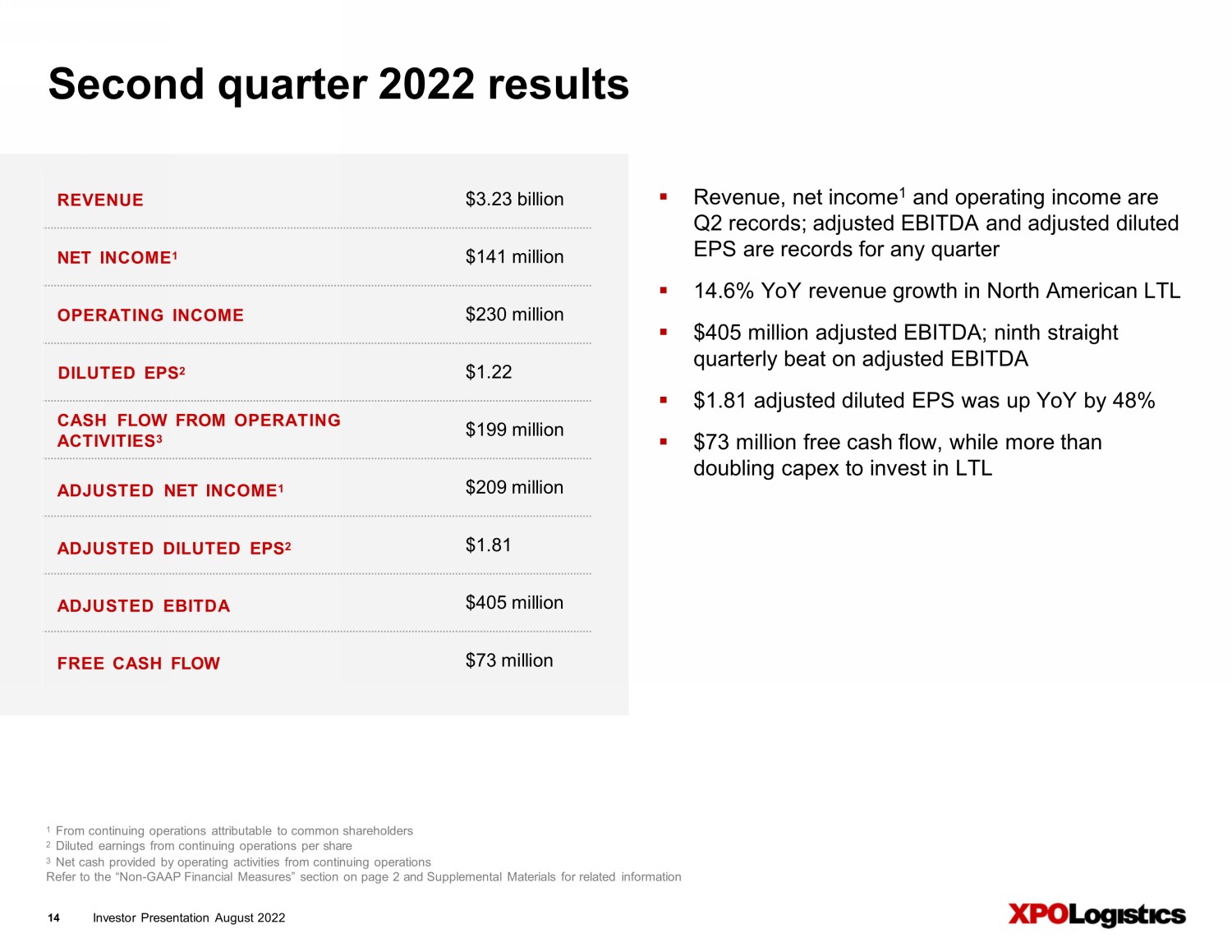

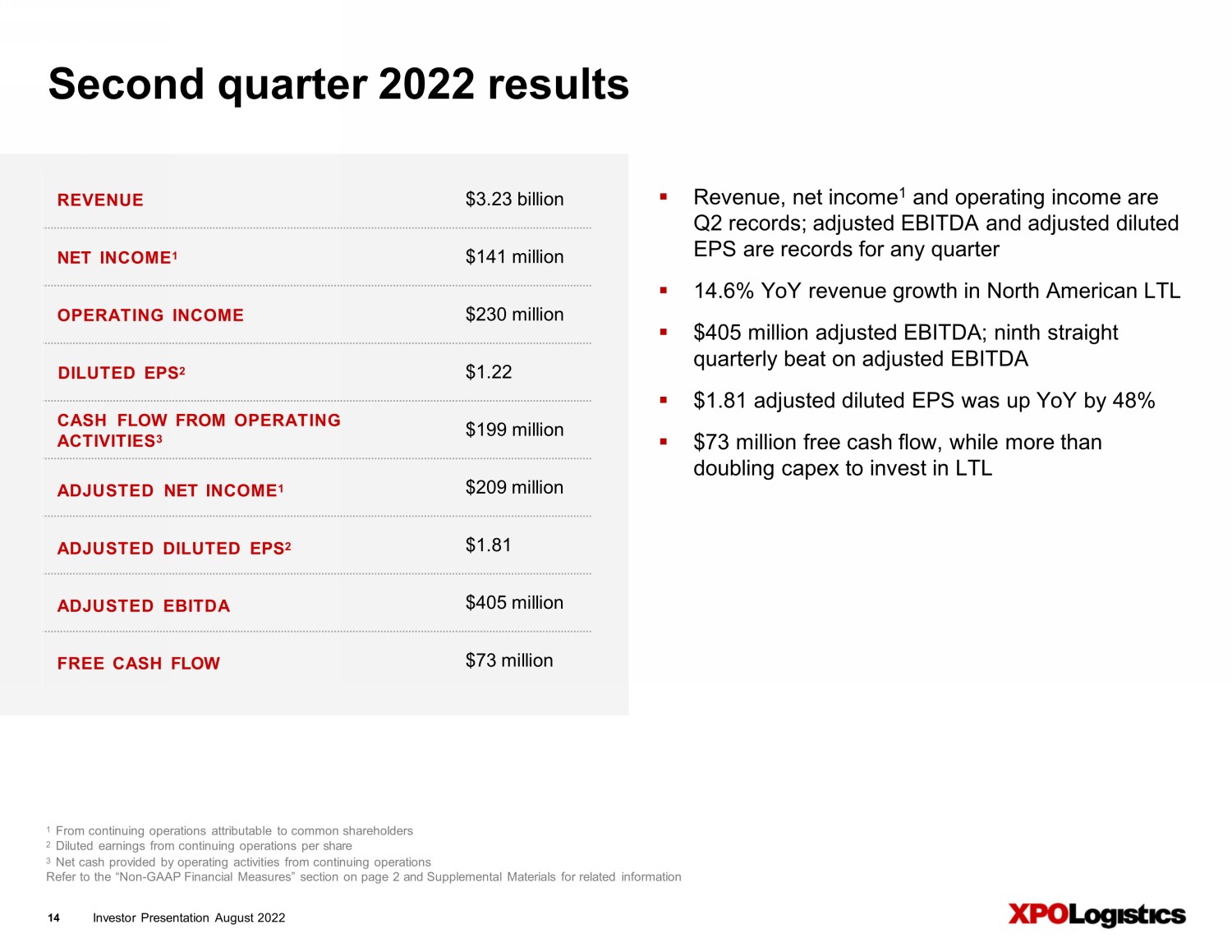

Investor Presentation August 2022 14 ▪ Revenue, net income 1 and operating income are Q2 records; adjusted EBITDA and adjusted diluted EPS are records for any quarter ▪ 14.6% YoY revenue growth in North American LTL ▪ $405 million adjusted EBITDA; ninth straight quarterly beat on adjusted EBITDA ▪ $1.81 adjusted diluted EPS was up YoY by 48% ▪ $73 million free cash flow, while more than doubling capex to invest in LTL Second quarter 2022 results REVENUE $3.23 billion NET INCOME 1 $141 million OPERATING INCOME $230 million DILUTED EPS 2 $1.22 CASH FLOW FROM OPERATING ACTIVITIES 3 $199 million ADJUSTED NET INCOME 1 $ 209 million ADJUSTED DILUTED EPS 2 $1. 81 ADJUSTED EBITDA $ 405 million FREE CASH FLOW $ 73 million 1 From continuing operations attributable to common shareholders 2 Diluted earnings from continuing operations per share 3 Net cash provided by operating activities from continuing operations Refer to the “Non - GAAP Financial Measures” section on page 2 and Supplemental Materials for related information

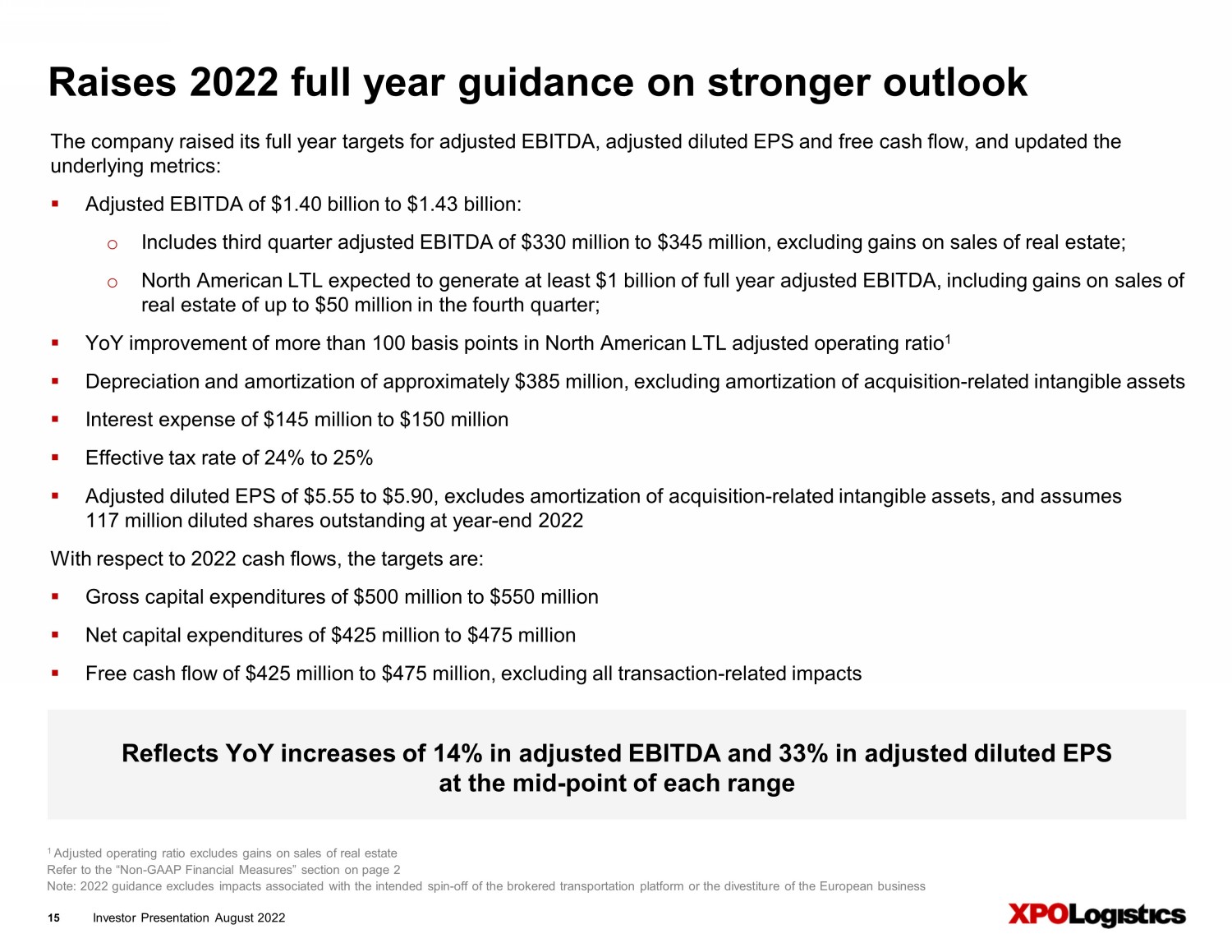

Investor Presentation August 2022 15 Raises 2022 full year guidance on stronger outlook 1 Adjusted operating ratio excludes gains on sales of real estate Refer to the “Non - GAAP Financial Measures” section on page 2 Note: 2022 guidance excludes impacts associated with the intended spin - off of the brokered transportation platform or the divest iture of the European business The company raised its full year targets for adjusted EBITDA, adjusted diluted EPS and free cash flow, and updated the underlying metrics: ▪ Adjusted EBITDA of $1.40 billion to $1.43 billion: o Includes third quarter adjusted EBITDA of $330 million to $345 million , excluding gains on sales of real estate; o North American LTL expected to generate at least $1 billion of full year adjusted EBITDA, including gains on sales of real estate of up to $50 million in the fourth quarter; ▪ YoY improvement of more than 100 basis points in North American LTL adjusted operating ratio 1 ▪ Depreciation and amortization of approximately $385 million, excluding amortization of acquisition - related intangible assets ▪ Interest expense of $145 million to $150 million ▪ Effective tax rate of 24% to 25% ▪ Adjusted diluted EPS of $5.55 to $5.90, excludes amortization of acquisition - related intangible assets, and assumes 117 million diluted shares outstanding at year - end 2022 With respect to 2022 cash flows, the targets are: ▪ Gross capital expenditures of $500 million to $550 million ▪ Net capital expenditures of $425 million to $475 million ▪ Free cash flow of $425 million to $475 million, excluding all transaction - related impacts Reflects YoY increases of 14% in adjusted EBITDA and 33% in adjusted diluted EPS at the mid - point of each range

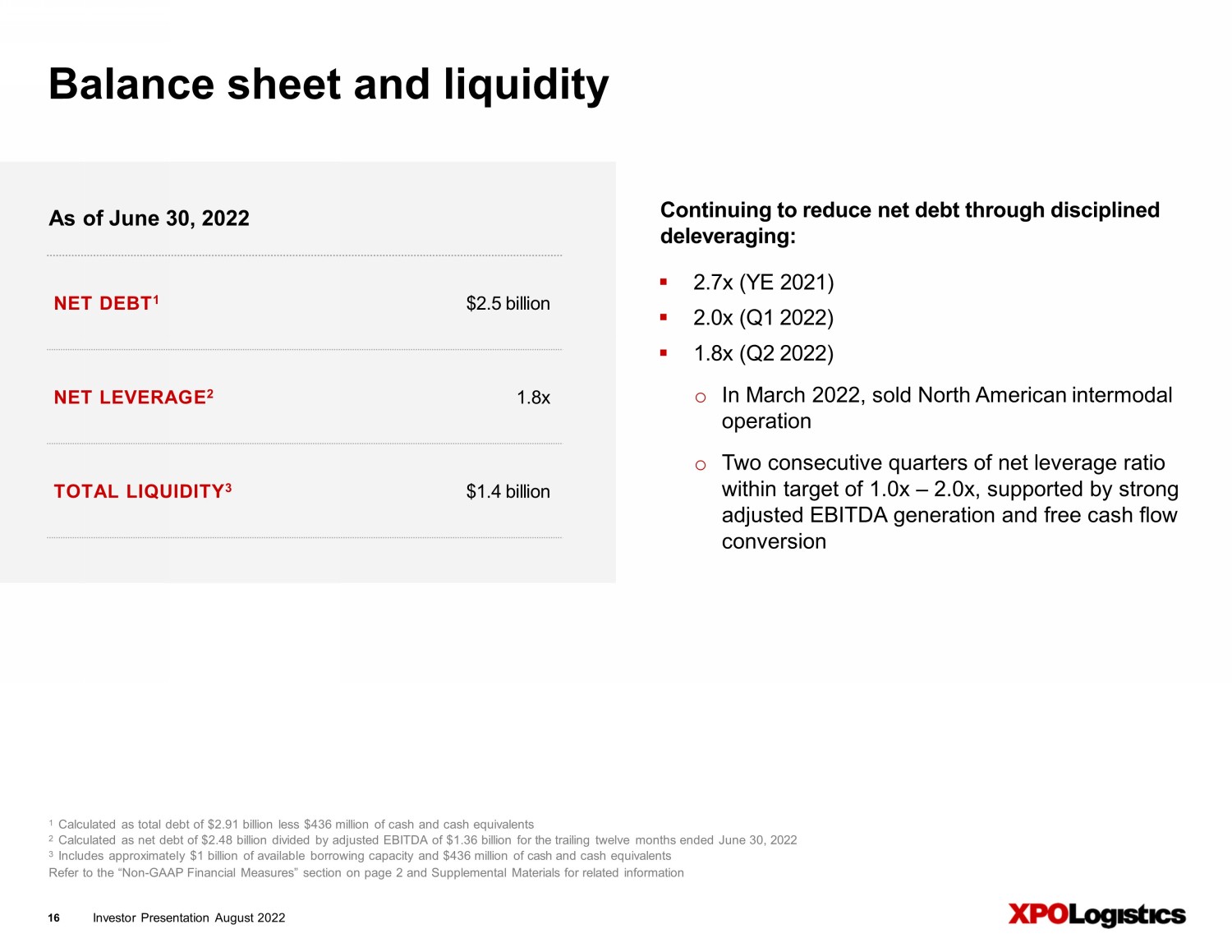

Investor Presentation August 2022 16 Balance sheet and liquidity 1 Calculated as total debt of $2.91 billion less $436 million of cash and cash equivalents 2 Calculated as net debt of $2.48 billion divided by adjusted EBITDA of $1.36 billion for the trailing twelve months ended June 30, 2022 3 Includes approximately $1 billion of available borrowing capacity and $436 million of cash and cash equivalents Refer to the “Non - GAAP Financial Measures” section on page 2 and Supplemental Materials for related information Continuing to reduce net debt through disciplined deleveraging: ▪ 2.7x (YE 2021) ▪ 2.0x (Q1 2022) ▪ 1.8x (Q2 2022) o In March 2022, sold North American intermodal operation o Two consecutive quarters of net leverage ratio within target of 1.0x – 2.0x, supported by strong adjusted EBITDA generation and free cash flow conversion As of June 30, 2022 NET DEBT 1 $2.5 billion NET LEVERAGE 2 1.8x TOTAL LIQUIDITY 3 $1.4 billion

XPO: L e s s - th a n - t r u ckl o a d

Investor Presentation August 2022 18 XPO is one of the largest providers of less - than - truckload transportation in North America LTL is the transportation of a quantity of freight that is larger than a parcel but too small to require an entire truck, often shipped on pallets ; f reight for different customers is consolidated in the same trailer. ▪ Significant competitive advantages in the US as one of only a few national LTL networks: ~25,000 accounts served and numerous long - standing customer relationships ▪ Favorable industry dynamics, including a firm pricing environment ▪ Large opportunity to enhance profitability through numerous XPO - specific initiatives, many independent of the macro, including: o Growing driver base and fleet, with plan to reduce use of third - party linehaul providers, saving 30% to 40% cost per mile o Optimizing dock and pickup - and - delivery operations through proprietary technology for routing, load - building and labor productivity; and advanced pricing algorithms o Expanding network capacity (doors, tractors and trailers) and in - house trailer manufacturing o Strong sales pipeline management: Q2 2022 was a company record for new business won ▪ ~13,000 professional truck drivers, with the advantage of training commercial drivers at 130 company locations ▪ High ROIC from capital allocated to grow network density, expand fleet and talent base, and enhance technology REVENUE AND MARGIN GROWTH LEVERS IN LTL

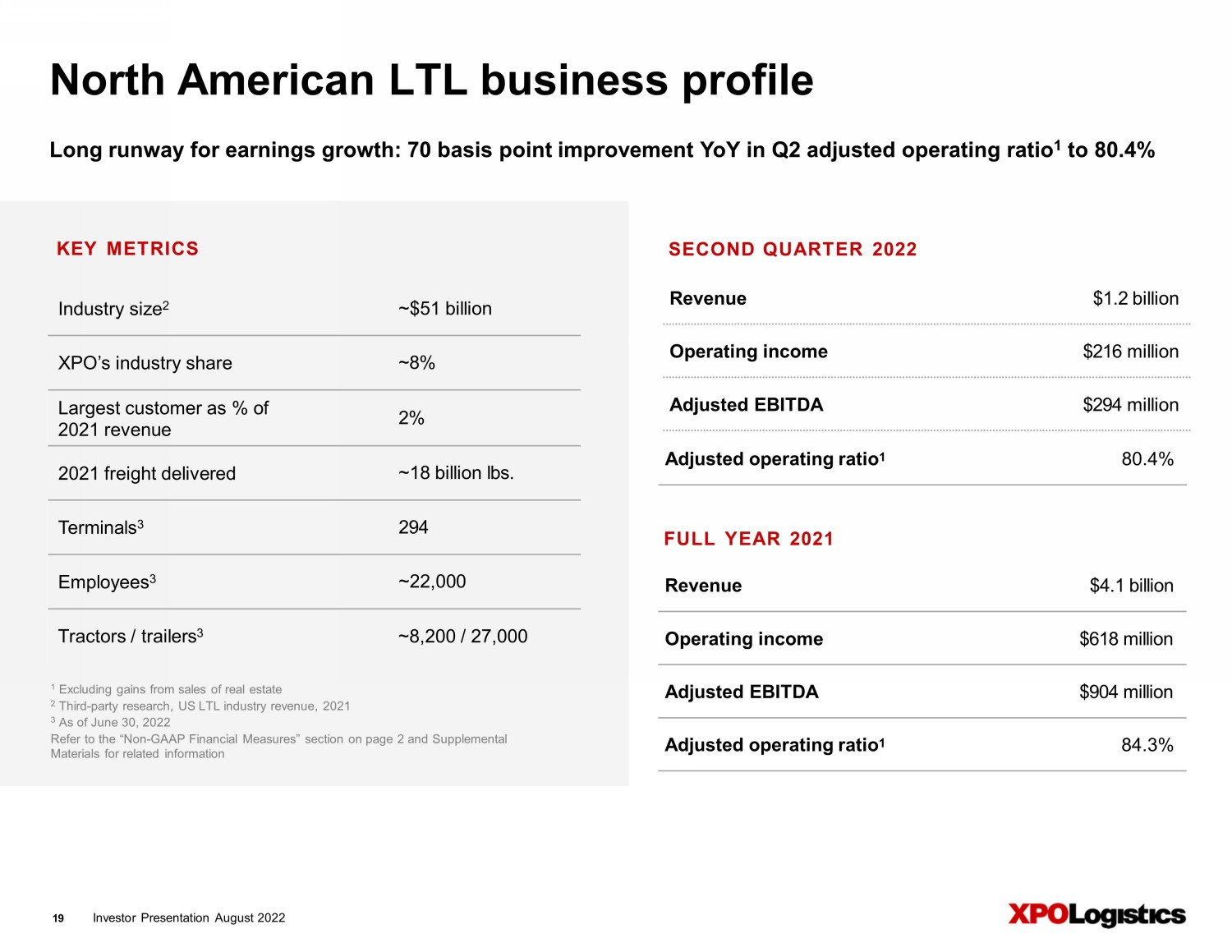

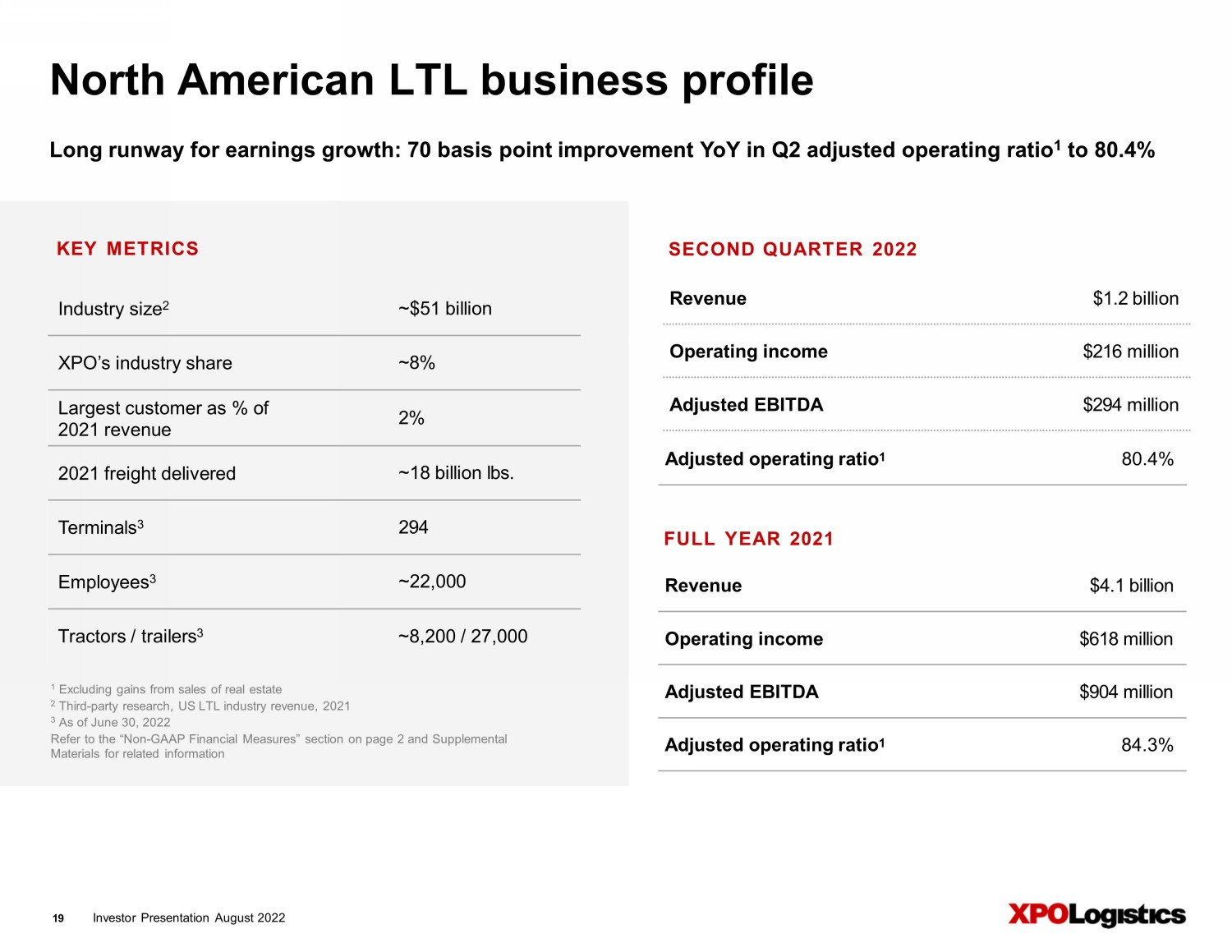

Investor Presentation August 2022 Long runway for earnings growth : 70 basis point improvement YoY in Q2 adjusted operating ratio 1 to 80.4% North American LTL business profile Industry size 2 ~$51 billion XPO’s industry share ~8% Largest customer as % of 2021 revenue 2% 2021 freight delivered ~18 billion lbs. Terminals 3 29 4 Employees 3 ~2 2 ,000 Tractors / trailers 3 ~8, 2 00 / 2 7 ,000 1 Excluding gains from sales of real estate 2 Third - party research, US LTL industry revenue, 2021 3 As of June 30, 2022 Refer to the “Non - GAAP Financial Measures” section on page 2 and Supplemental Materials for related information KEY METRICS SECOND QUARTER 2022 Revenue $1. 2 billion Operating income $ 216 million Adjusted EBITDA $2 94 million Adjusted operating ratio 1 80 . 4 % Revenue 19 $4.1 billion Operating income $618 million Adjusted EBITDA $904 million Adjusted operating ratio 1 84.3% FULL YEAR 2021

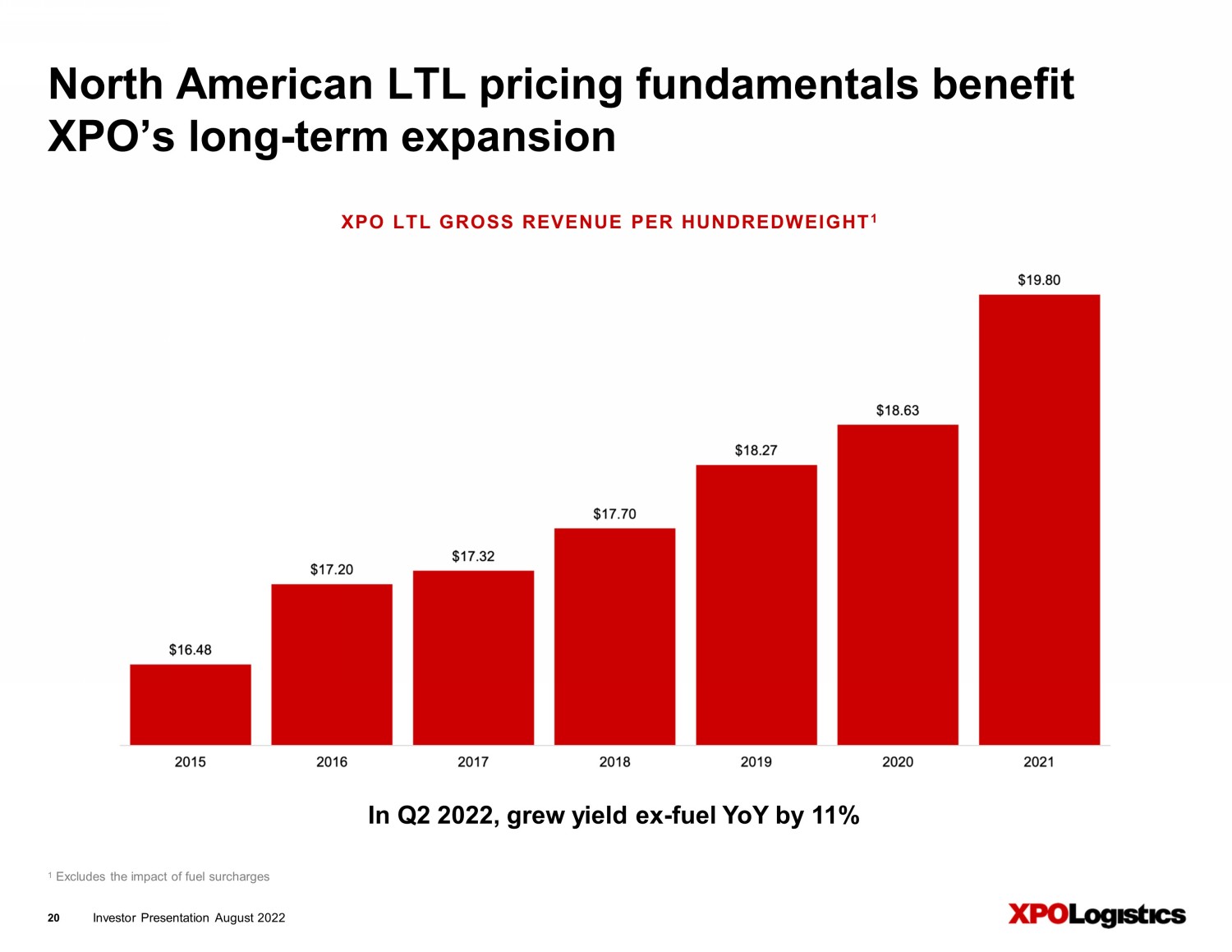

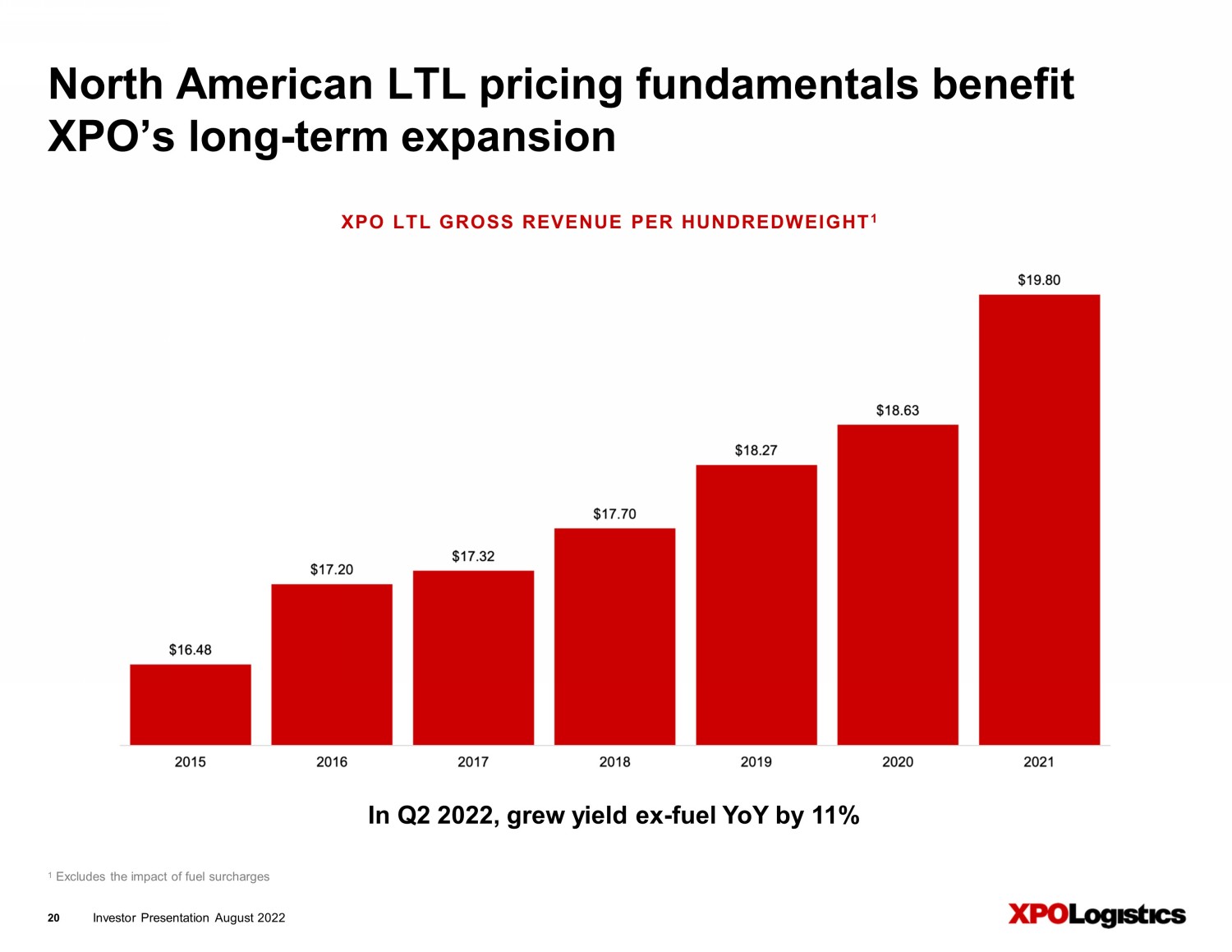

Investor Presentation August 2022 20 North American LTL pricing fundamentals benefit XPO’s long - term expansion 1 Excludes the impact of fuel surcharges XPO LTL GROSS REVENUE PER HUNDREDWEIGHT 1 In Q2 2022, grew yield ex - fuel YoY by 11%

Investor Presentation August 2022 21 Significant opportunity to drive further productivity gains with XPO’s technology Roadmap includes piece - level tracking, further optimization of linehaul and pick - up and delivery service, and dock productivity PRICING ▪ Data - driven pricing tools optimize LTL rates for local and regional accounts, while improving efficiency ▪ Elasticity tools help to determine best pricing for large, contractual customer relationships ▪ New pricing platform enables lead generation by mining historical pricing histories LINEHAUL AND NETWORK ▪ Opportunity to optimize annual linehaul spend of ~$1.1 billion ex - fuel by enhancing network tools ▪ Automated load - building increases trailer utilization while improving network fluidity PICKUP - AND - DELIVERY ROUTING ▪ Ongoing roll - out of new dispatch tools in 2022 ▪ Deployed new planning tools in 2021 CUSTOMER SERVICE ▪ Launched new online digital dashboard with self - service tools in Q1 2022 to enhance the customer experience

Investor Presentation August 2022 22 Company - specific levers for LTL network efficiency and growth Launched in Q2 2022: National initiative to further improve quality of trailer loading and on - time delivery, and engaging with customers on best practices to package freight IMPROVING NETWORK FLOW ▪ Network fluidity substantially improved over last nine months ▪ Generated significantly stronger service metrics in key areas, such as on - time transit and freight handling DRIVING PRICING: ▪ Launched new pricing technology to improve pricing on contract renewals o In Q2, increased yield on contract renewals by 12% o Instituted accessorial charges for detained trailers, oversized freight and special handling ▪ Actions contributed to Q2 record YoY increase in yield ex - fuel of 11% EXPANDING DRIVER BASE: ▪ 130 in - house commercial driver schools attract trainees in every US region ▪ Targeting to train twice as many drivers in 2022 as in 2021 Continued on next page

Investor Presentation August 2022 23 Additional company - specific levers for network efficiency and growth INCREASING TRAILER PRODUCTION: ▪ Added second production line at Searcy, Arkansas trailer manufacturing facility ▪ Producing trailers at about double 2021 run rate through Q2 EXPANDING NETWORK FOOTPRINT: ▪ The company’s goal is to add 900 net new doors to its North American LTL network from October 2021 to YE 2023, increasing door count by ~6% ▪ Added 345 net new doors through Q2, with five terminals opened: o Chicago Heights, Illinois o Sheboygan, Wisconsin o Texarkana, Arkansas o San Bernardino, California o Atlanta, Georgia ▪ Opened new fleet maintenance shops in Ohio, Florida, New York and Nevada

RXO: T ru c k b r o kera ge

Investor Presentation August 2022 25 RXO will be the fourth largest US truck broker Truck brokerage is an asset - light business that facilitates the movement of full truckloads of freight, typically from a single shipper; a broker purchases truck capacity from independent carriers. ▪ Truck brokerage is a secular growth market, and RXO has a long history of generating best - in - class metrics that outpace industry growth ▪ Flexible, asset - light model with high ROIC, designed to grow volume and profits in any cycle ▪ Advantages of scale in a fragmented industry: massive capacity of ~98,000 independent carriers in North America ▪ First - mover technology advantage with cutting - edge brokerage automation developed ahead of the curve, starting in 2011, and enhanced for over a decade; difficult to replicate o Proprietary digital brokerage platform with soaring adoption rates and proven ability to drive margin growth by managing more volume at less cost ▪ Highly experienced leadership team has worked together for many years, bringing agility and expertise to the business ▪ Blue - chip customer base across diverse verticals REVENUE AND MARGIN GROWTH LEVERS IN TRUCK BROKERAGE

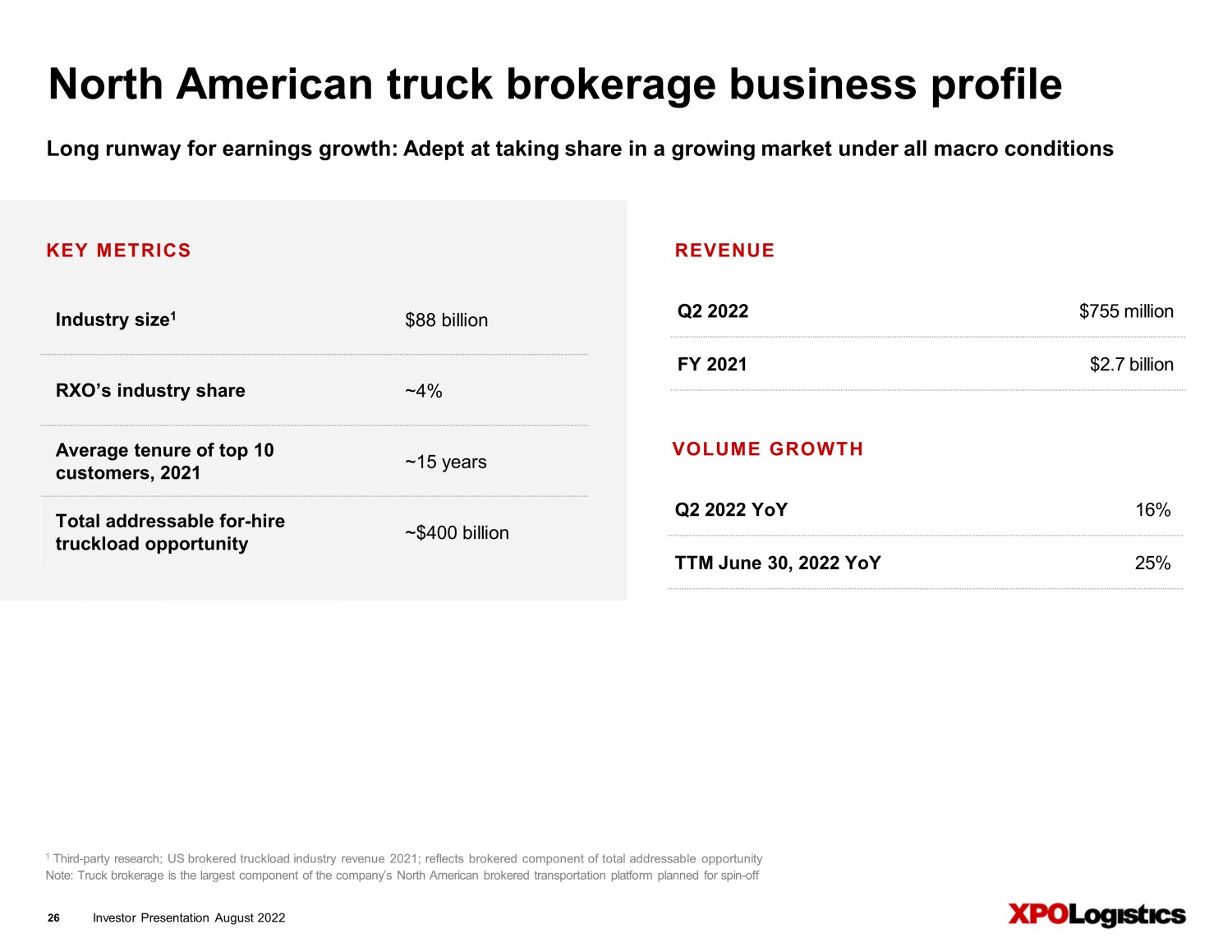

Investor Presentation August 2022 Long runway for earnings growth: Adept at taking share in a growing market under all macro conditions 26 North American truck brokerage business profile Industry size 1 $88 billion RXO’s industry share ~4% Average tenure of top 10 customers, 2021 ~15 years Total addressable for - hire truckload opportunity ~$400 billion 1 Third - party research ; US brokered truckload industry revenue 2021; reflects brokered component of t otal addressable opportunity Note: Truck brokerage is the largest component of the company’s North American brokered transportation platform planned for s pin - off KEY METRICS Q2 2022 $755 million FY 2021 $2.7 billion REVENUE Q2 2022 YoY 16% TTM June 30, 2022 YoY 25% VOLUME GROWTH

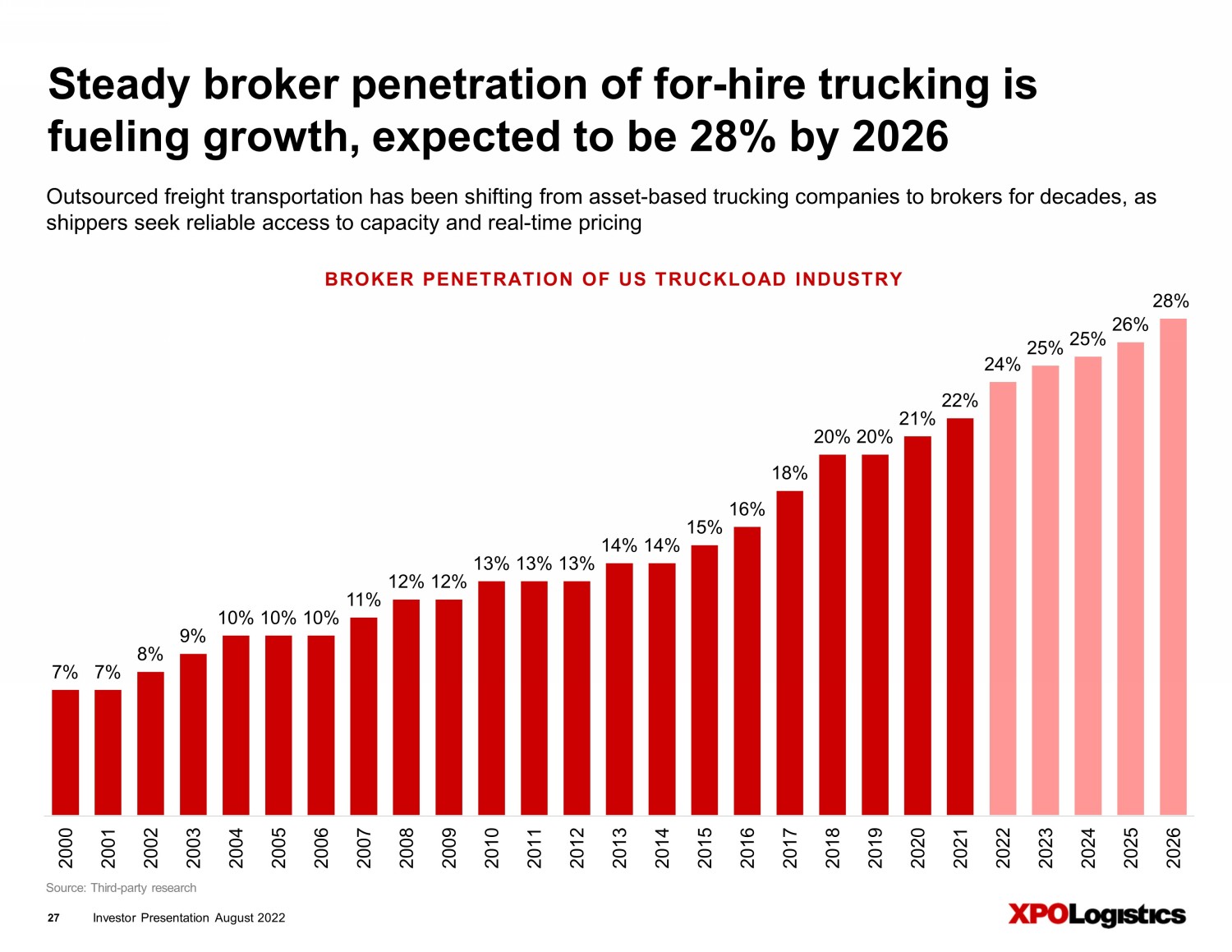

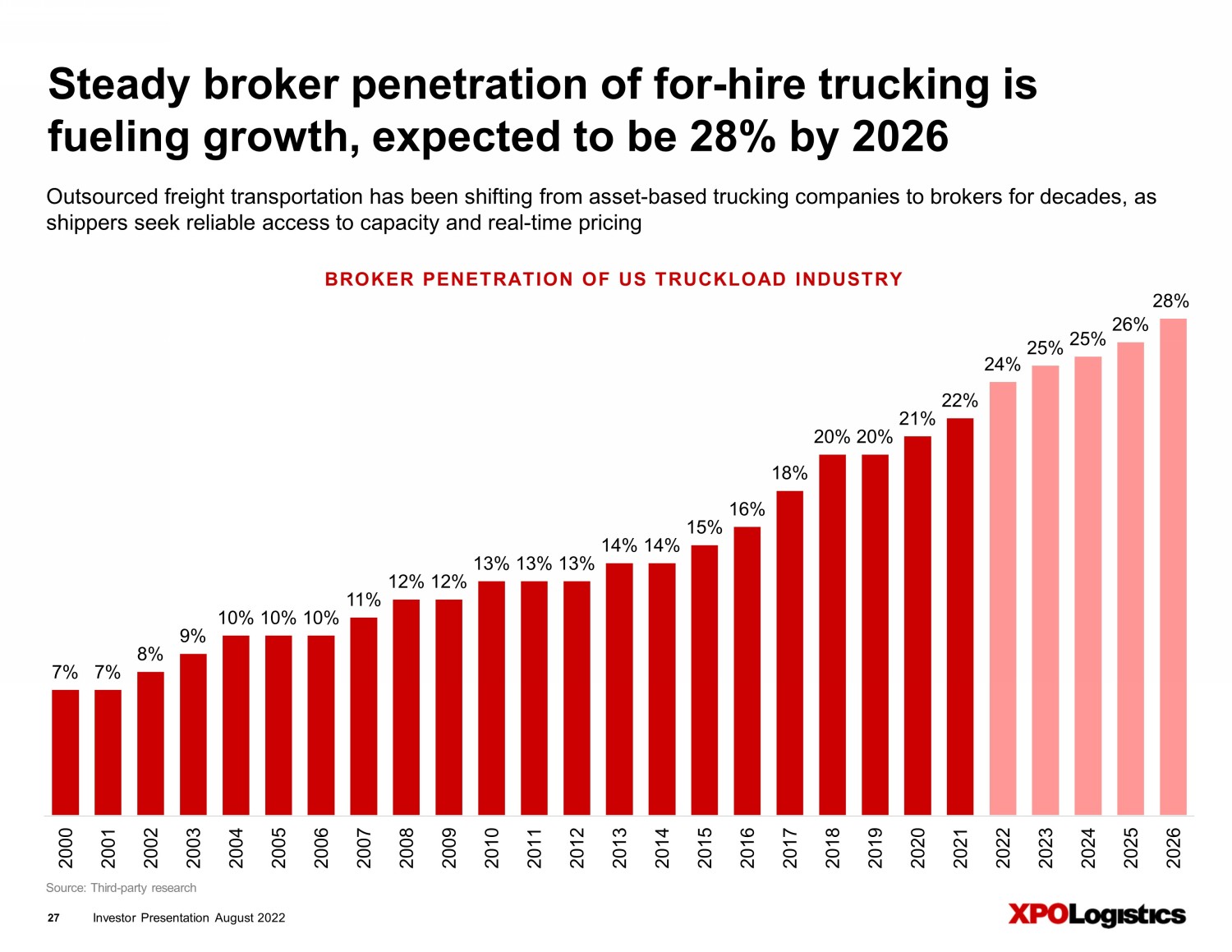

Investor Presentation August 2022 Source: Third - party research 27 Steady broker penetration of for - hire trucking is fueling growth, expected to be 28% by 2026 BROKER PENETRATION OF US TRUCKLOAD INDUSTRY Outsourced freight transportation has been shifting from asset - based trucking companies to brokers for decades, as shippers seek reliable access to capacity and real - time pricing 7% 7% 8% 9% 10% 10% 10% 11% 12% 12% 13% 13% 13% 14% 14% 15% 16% 18% 20% 20% 21% 22% 24% 25% 25% 26% 28% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

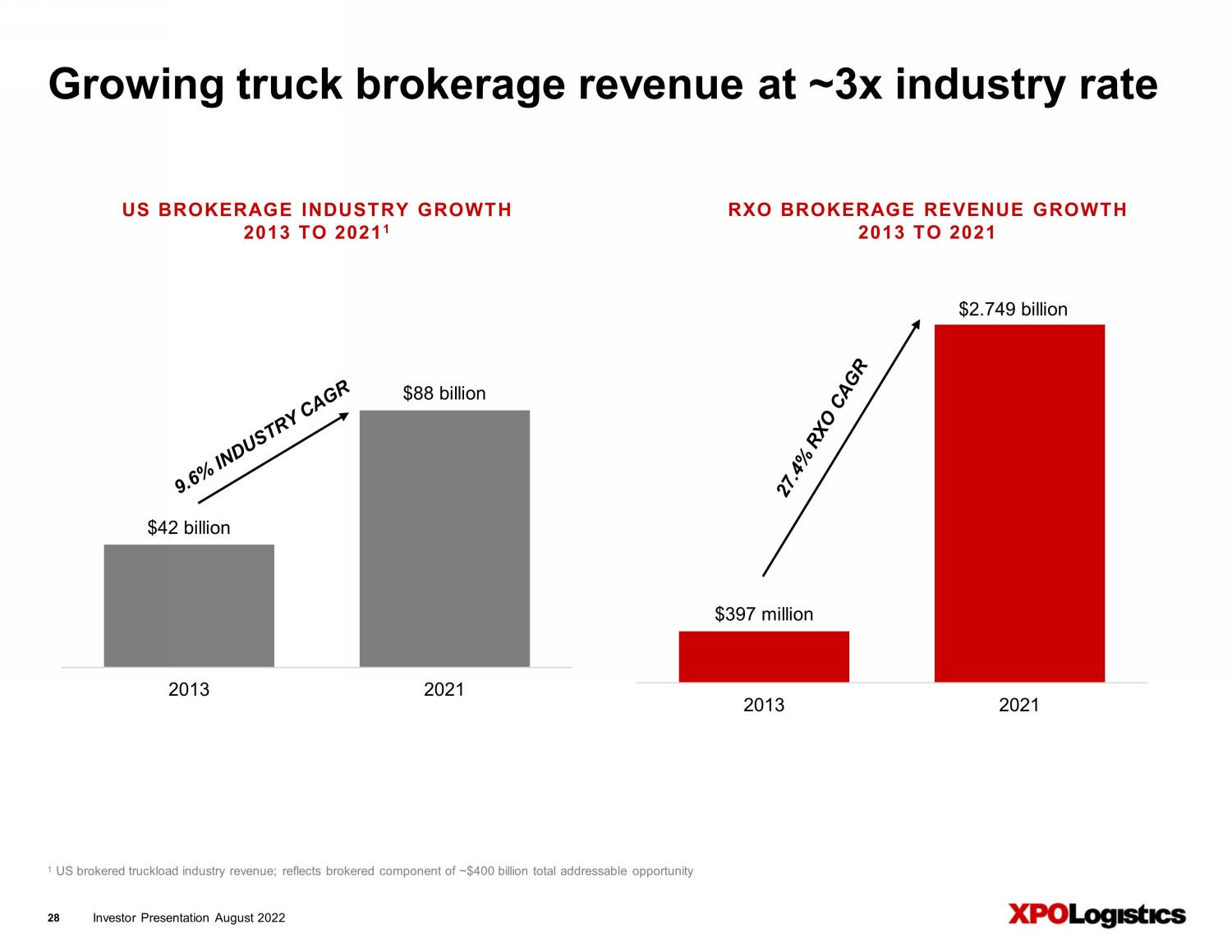

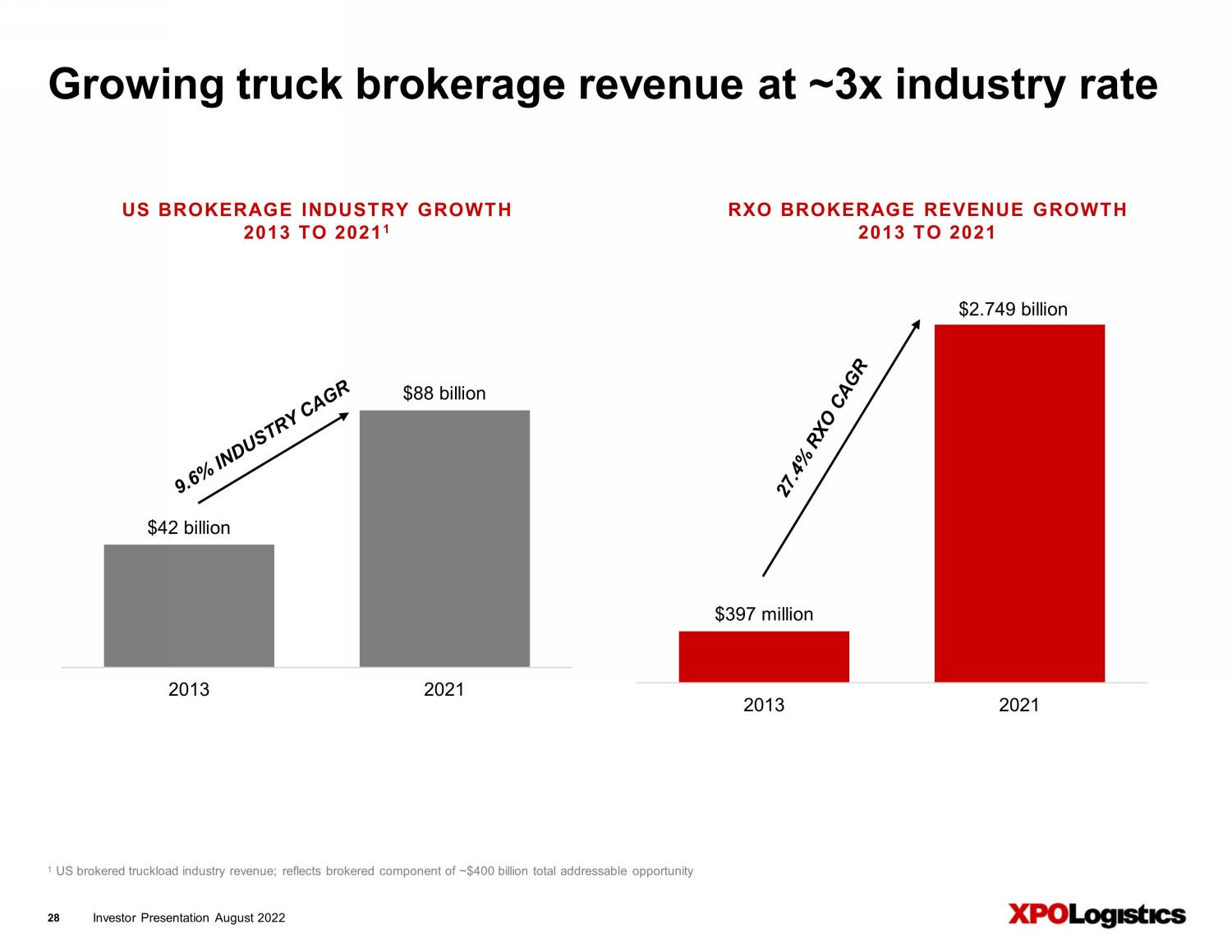

Investor Presentation August 2022 $42 billion $88 billion 2013 2021 $397 million $2.749 billion 2013 2021 28 Growing truck brokerage revenue at ~3x industry rate 1 US brokered truckload industry revenue; reflects brokered component of ~$400 billion total addressable opportunity US BROKERAGE INDUSTRY GROWTH 2013 TO 2021 1 RXO BROKERAGE REVENUE GROWTH 2013 TO 2021

Investor Presentation August 2022 29 Breakthrough, proprietary digital brokerage platform RXO Connect has first - mover advantage in helping shippers and carriers make informed decisions by providing real - time information about supply and demand for truckload capacity. ▪ Demand for RXO Connect is outpacing the industry’s secular shift to digital truck brokerage, driving share gains ▪ Optimizes transportation procurement by providing deep visibility into available capacity and market conditions ▪ Proprietary pricing engine provides customers with dynamic analysis of carrier bids ▪ Improves productivity of company’s customer and carrier reps, while giving shippers and carriers the ability to interact directly when tendering loads for maximum efficiency ▪ Creates shipper loyalty by sourcing the best carrier for each load profile and providing shipment tracking in real time ▪ Integrates with customer TMS systems and provides real - time pricing backed by service quality and capacity ▪ Equips truck drivers to locate, win and book loads, negotiate rates and locate backhauls to reduce empty miles using the platform’s mobile app RXO WILL SPIN OFF WITH A WIDELY ADOPTED DIGITAL PLATFORM THAT’S GROWING HYPER - FAST

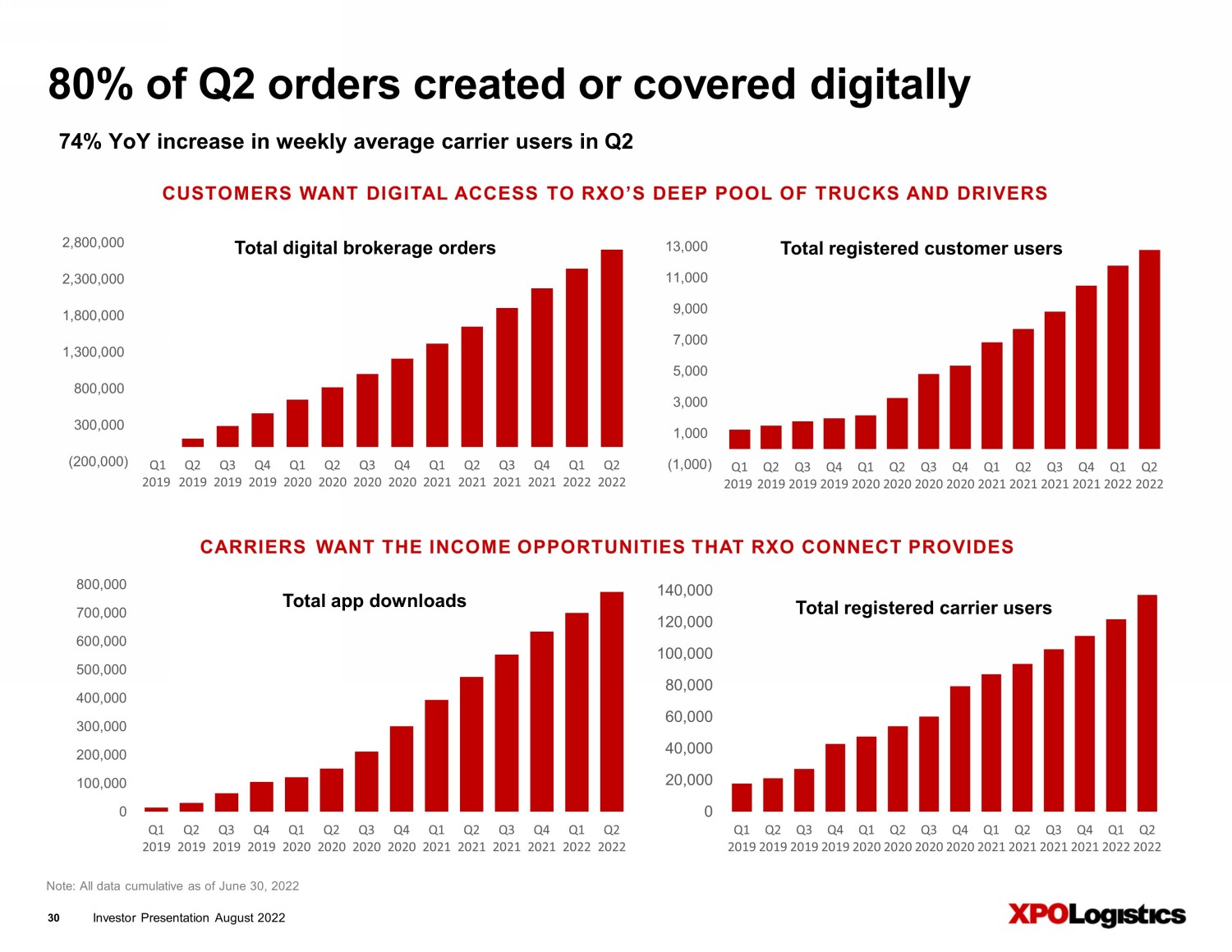

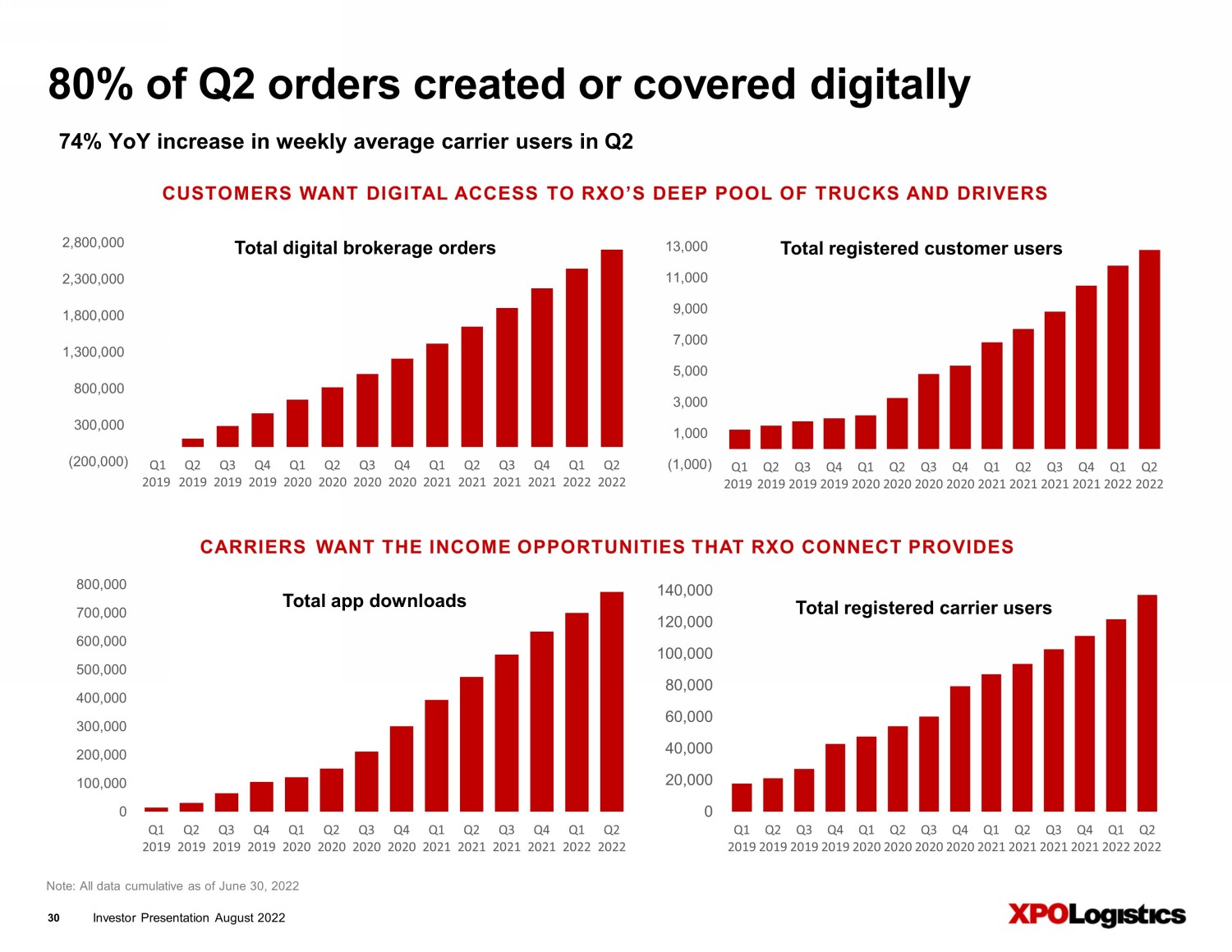

Investor Presentation August 2022 (1,000) 1,000 3,000 5,000 7,000 9,000 11,000 13,000 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Total registered customer users 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Total app downloads (200,000) 300,000 800,000 1,300,000 1,800,000 2,300,000 2,800,000 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Total digital brokerage orders Note: All data cumulative as of June 30 , 202 2 30 80% of Q2 orders created or covered digitally CUSTOMERS WANT DIGITAL ACCESS TO RXO’S DEEP POOL OF TRUCKS AND DRIVERS 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Total registered carrier users CARRIERS WANT THE INCOME OPPORTUNITIES THAT RXO CONNECT PROVIDES 74% YoY increase in weekly average carrier users in Q2

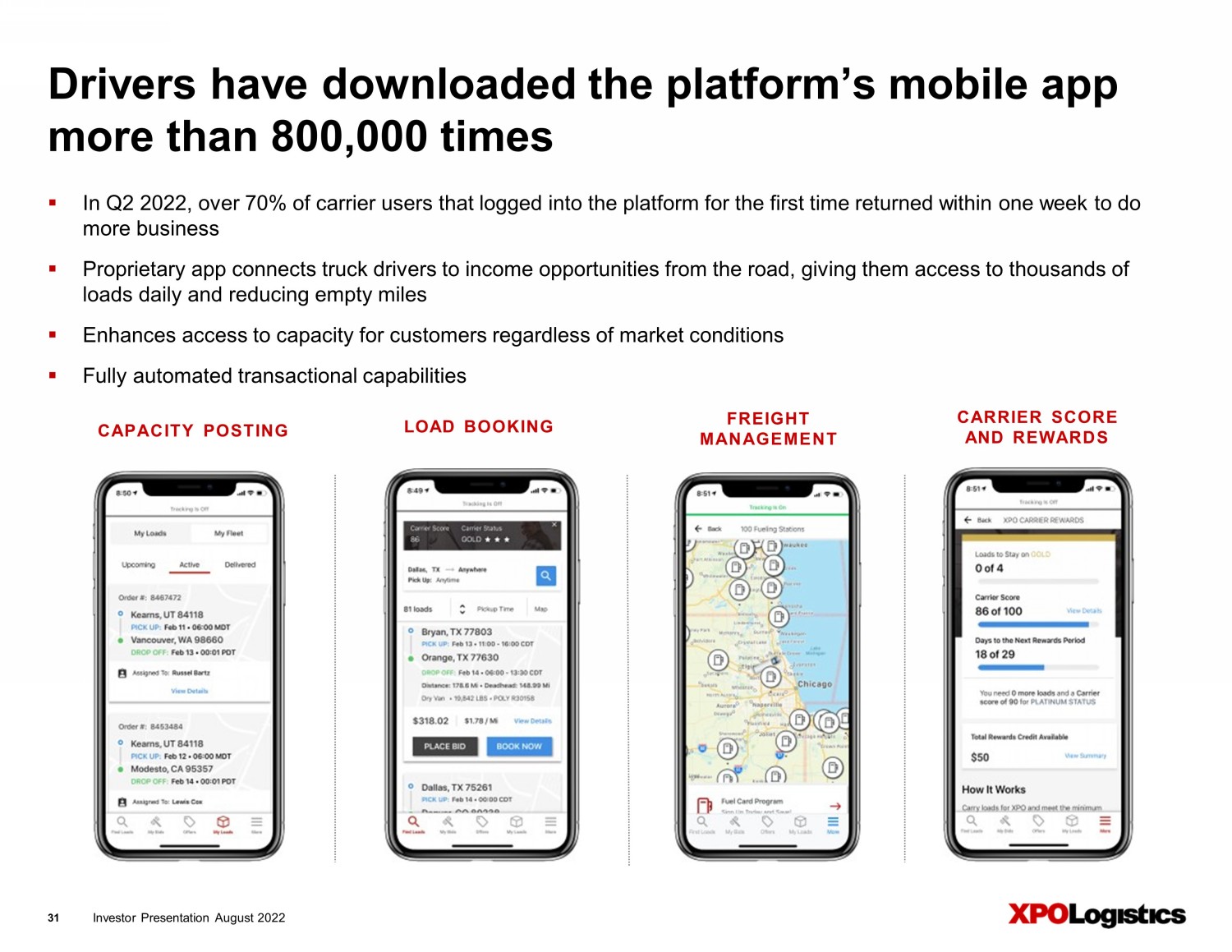

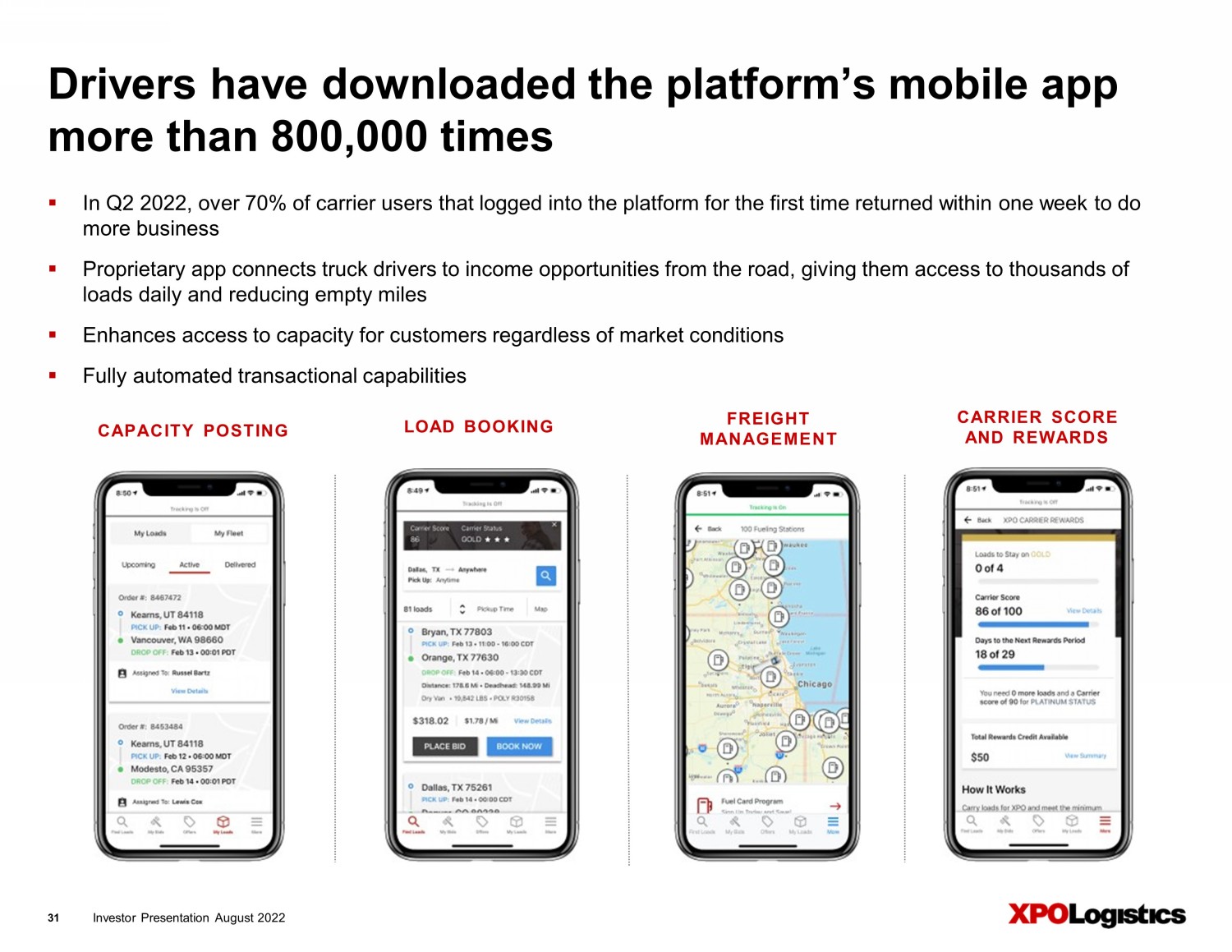

Investor Presentation August 2022 FREIGHT M ANA G E M E N T CARRIER SCORE AND REWARDS CAPACITY POSTING LOAD BOOKING 31 Drivers have downloaded the platform’s mobile app more than 800,000 times ▪ In Q2 2022, over 70% of carrier users that logged into the platform for the first time returned within one week to do more business ▪ Proprietary app connects truck drivers to income opportunities from the road, giving them access to thousands of loads daily and reducing empty miles ▪ Enhances access to capacity for customers regardless of market conditions ▪ Fully automated transactional capabilities

Investor Presentation August 2022 32 In 2021, over 80% of the operating income generated by the planned spin - off operations was generated by truck brokerage. The balance of the spin - off platform will be comprised of three additional brokered transportation services. Spin - off to include complementary asset - light services Provides asset - light, scalable solutions for shippers who choose to outsource their freight transportation requirements to gain reliability, visibility and cost savings. RXO’s managed transportation service uses proprietary technology to enhance revenue synergies and carrier management, with cross - selling to truck brokerage and global forwarding. MANAGED TRANSPORTATION An asset - light service that facilitates deliveries to consumers performed by third - party contractors. The company is the largest provider of outsourced last mile for heavy goods in North America, positioned within 125 miles of the vast majority of the US population, and serving a base of omnichannel and e - commerce retailers and direct - to - consumer manufacturers. LAST MILE A scalable, asset - light service managed with advanced technology that facilitates ocean, road and air transportation and assists shippers with customs brokerage processes. The company is a global freight forwarder with a network of company - owned and partner - owned locations and coverage of key trade lanes that reach 190 countries. GLOBAL FORWARDING

Supplemen t al materials

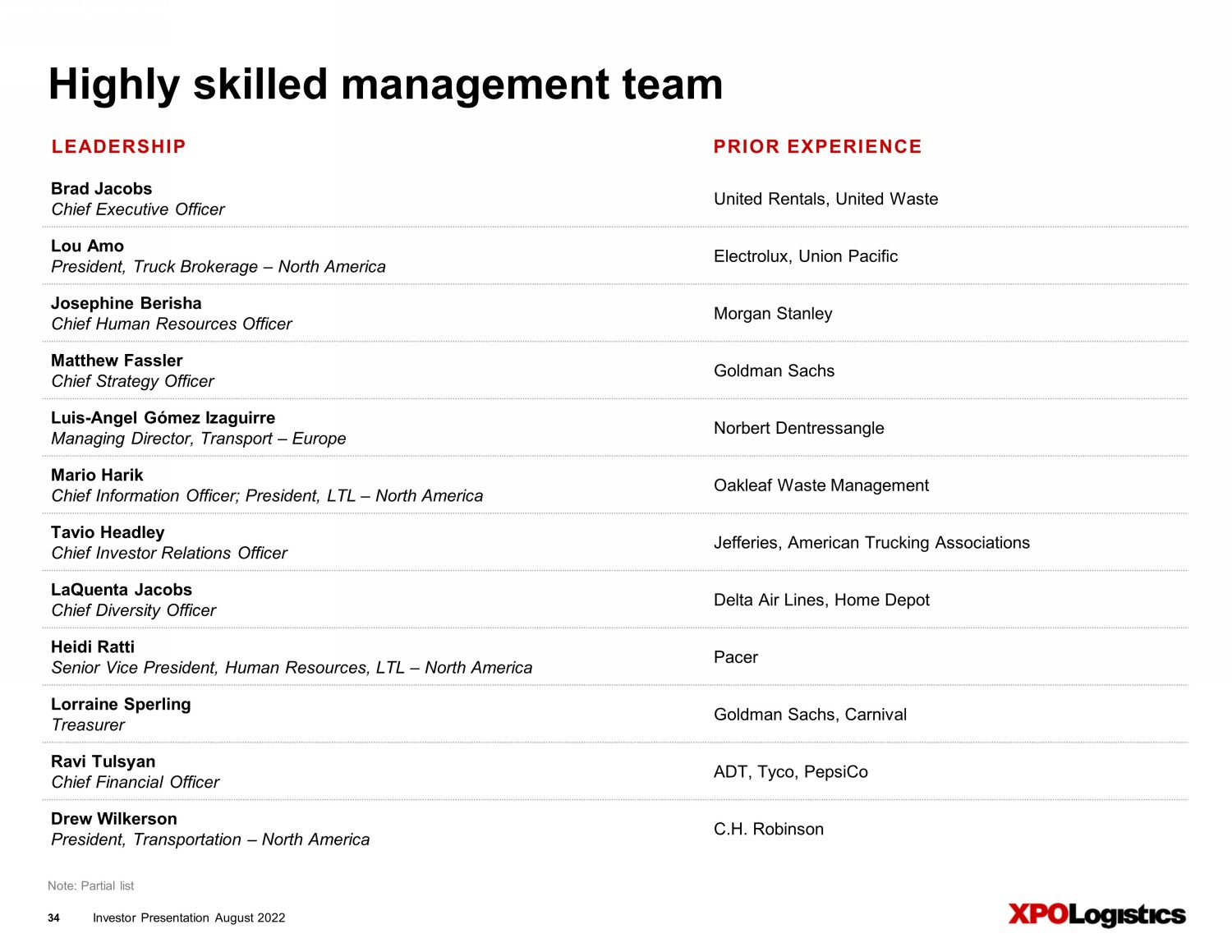

Investor Presentation August 2022 Brad Jacobs Chief Executive Officer United Rentals, United Waste Lou Amo President, Truck Brokerage – North America Electrolux, Union Pacific Josephine Berisha Chief Human Resources Officer Morgan Stanley Matthew Fassler Chief Strategy Officer Goldman Sachs Luis - Angel Gómez Izaguirre Managing Director, Transport – Europe Norbert Dentressangle Mario Harik Chief Information Officer; President, LTL – North America Oakleaf Waste Management Tavio Headley Chief Investor Relations Officer Jefferies, American Trucking Associations LaQuenta Jacobs Chief Diversity Officer Delta Air Lines, Home Depot Heidi Ratti Senior Vice President, Human Resources, LTL – North America Pacer Lorraine Sperling Treasurer Goldman Sachs, Carnival Ravi Tulsyan Chief Financial Officer ADT, Tyco, PepsiCo Drew Wilkerson President, Transportation – North America C.H. Robinson LEADERSHIP Note: Partial list PRIOR EXPERIENCE 34 Highly skilled management team

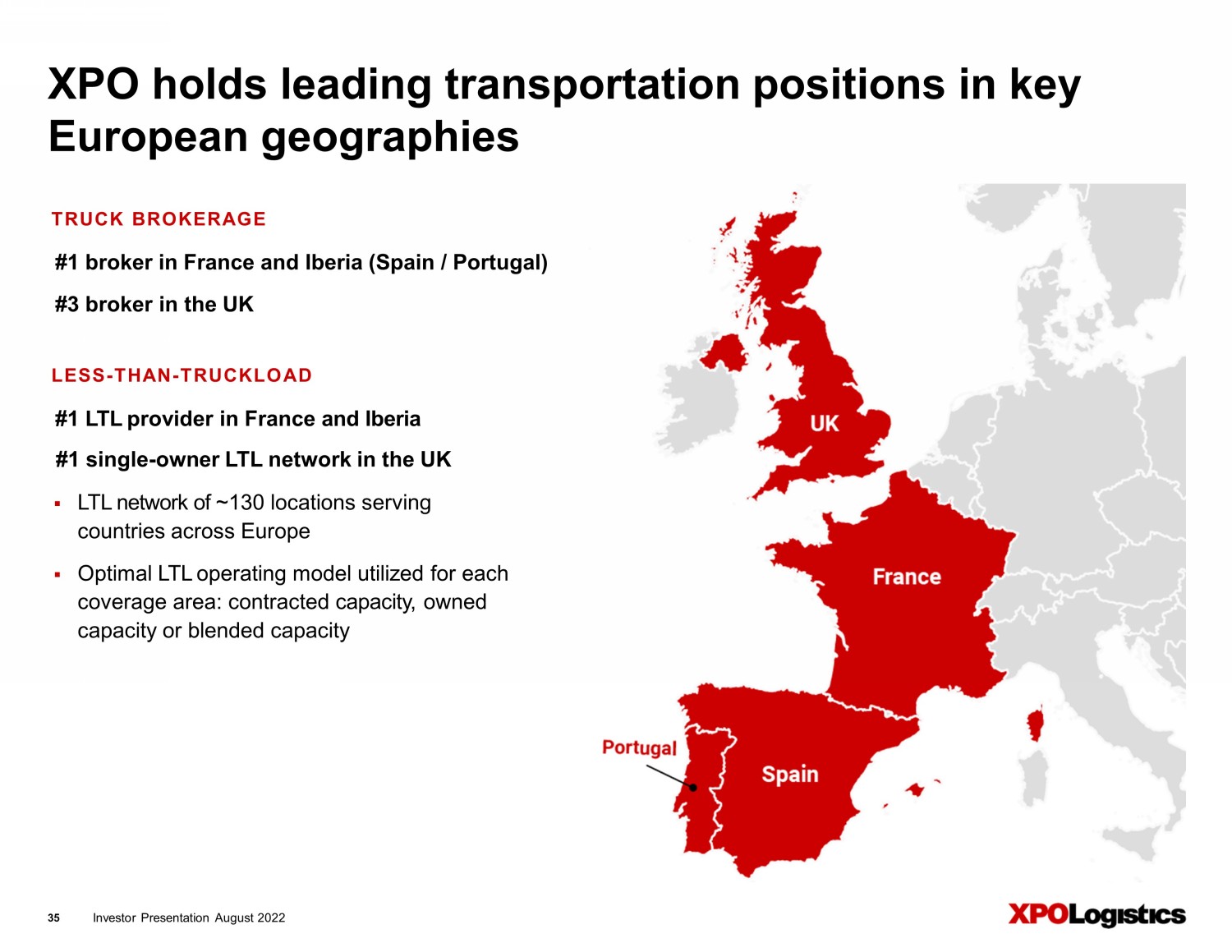

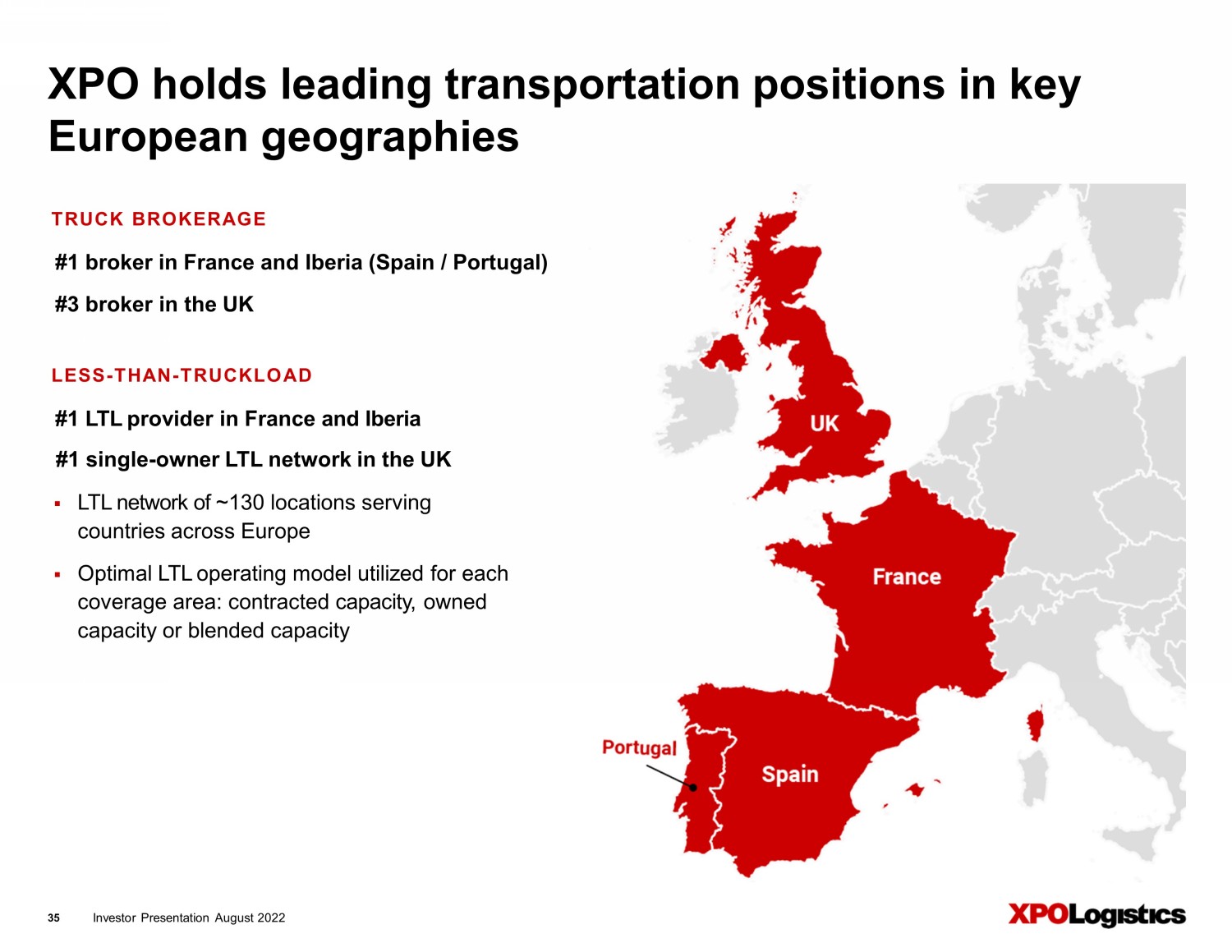

Investor Presentation August 2022 35 XPO holds leading transportation positions in key European geographies TRUCK BROKERAGE #1 LTL provider in France and Iberia #1 single - owner LTL network in the UK ▪ LTL network of ~ 130 locations serving countries across Europe ▪ Optimal LTL operating model utilized for each coverage area: contracted capacity, owned capacity or blended capacity LESS - THAN - TRUCKLOAD #1 broker in France and Iberia ( Spain / Portugal) #3 broker in the UK

Investor Presentation August 2022 36 XPO is widely recognized for performance and culture ▪ Recognized as one of America’s Best Large Employers by Forbes, 2022 ▪ Named one of the World’s Most Admired Companies by Fortune, 2018, 2019, 2020, 2021 ▪ Ranked #1 in the Fortune 500 category of Transportation and Logistics, 2017, 2018, 2019, 2020, 2021 ▪ Named a Top Company for Women to Work for in Transportation by Women in Trucking Association, 2021 ▪ Named one of America's Most Responsible Companies by Newsweek, 2020, 2022 ▪ Named one of Spain’s Best Companies to Work For by Forbes, 2019, 2020, 2021 , 2022 ▪ Named a Leader in the Magic Quadrant for 3PL Providers by Gartner, 2017, 2018, 2019, 2020, 2021 ▪ Received first - place ranking in all categories of 2022 Institutional Investor All - America Executive Team; voted Brad Jacobs best CEO in transportation space ▪ Received Intel’s Supplier Achievement Award for COVID response, 2021 ▪ Recognized by General Motors with Supplier of the Year Award for aftermarket distribution 2019, managed transportation 2020, 2021 ▪ Received Ulta Beauty’s “Improve Always” Award, 2021 ▪ Named a Top 100 3PL by Inbound Logistics, 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021 , 2022 ▪ Named one of Best Leadership Teams and Best CEOs for Diversity by Comparably, 2021 ▪ Winner of Dow Chemical’s Sustainability Award for road transportation, 2021 ▪ Named LTL Collaborator of the Year by GlobalTranz, 2020, 2021 ▪ Named a Top 100 Trucker by Inbound Logistics, 2016, 2017, 2018, 2019, 2020, 2021 ▪ Named a Freight.Tech Disruptive Technology Leader by FreightWaves , 2018, 2019, 2020, 2021, 2022 ▪ Recognized by Ford Motor Company with World Excellence Awards, 2019, 2020, 2021 ▪ Awarded BRC certification for food safety in transport operations for Arla Foods distribution, 2021 ▪ Honored with Whirlpool Corporation Intermodal Carrier of the Year Award and Maytag Dependability Award, 2020 ▪ Ranked #7 of the Top 20 UK Companies for Quality of Workplace Culture by the Chartered Management Institute, 2020 ▪ Recognized by Owens Corning as Supplier of the Year Award, 2020 ▪ Recognized by Raytheon Company with EPIC Supplier Excellence Award for on - time delivery, 2019 ▪ Named a European Diversity Leader by the Financial Times, 2019 ▪ Named a Winning “W” Company by 2020 Women on Boards for gender diversity of the board of directors, 2019 ▪ Recognized by Nissan Manufacturing UK for excellence at Operational Logistics Awards, 2014, 2015, 2016, 2017, 2018, 2019 ▪ CEO Jacobs ranked #10 on Barron's readers list of World's Best CEOs, 2018 ▪ Named to Fortune Future 50 list of US companies best positioned for breakout growth, 2018

Investor Presentation August 2022 37 Selected highlights of XPO’s people - first culture ▪ Appointed a Chief Diversity Officer and launched a Diversity and Inclusion Council , 2020 ▪ Launched a global Diversity and Inclusion Steering Committee, 2021 , and a global Sustainability Steering Committee, 2022 ▪ Named transportation partner of 3 - Day Walks ® for Susan G. Komen Foundation in fight against breast cancer through 2022 ▪ Partnered with Hispanic Association of Colleges and Universities to provide financial support for HACU’s objectives ▪ Partnered with Truckers Against Trafficking to help combat human trafficking ▪ Recognized by Human Rights Campaign on the Corporate Equality Index (CEI) for LGBTQ+ inclusion, 2020, 2021 , 2022 ▪ Recognized by Disability:IN and American Association of People with Disabilities on the Disability Equality Index, 2021 , 2022 ▪ Donated services and shoe collections to Soles4Souls, a non - profit committed to disrupting the cycle of poverty ▪ Provides employees with t uition reimburse ment of up to $5,250 annually for pursuing continuing education ▪ Robust recruitment initiatives emphasize diversity hiring; awarded Viqtory’s bronze - level Military - Friendly Employer ® ▪ Awarded VETS Indexes Recognized Employer status, 2022 ▪ Company celebrates Black History, Women’s History, Hispanic Heritage, Asian American and Pacific Islander Heritage, LGBTQ+ Pride and Military Appreciation months ▪ Honored by Women’s Forum of New York for having 35% or more female representation on the XPO board of directors, 2021 ▪ Signed national Diversity Charters in Spain and France, committing to diversity and inclusion in the workplace Progressive Pregnancy Care and Family Bonding benefits ▪ Any XPO employee, male or female, receives up to six weeks of 100% paid postnatal leave as primary caregiver , or up to two paid weeks as a secondary caregiver ▪ W omen receive up to 20 days or 160 hours of 100% paid prenatal leave for health and wellness ▪ “Automatic yes" pregnancy accommodations granted on request; more extensive accommodations easily arranged ▪ XPO guarantees that a woman will continue to be paid her regular base wage rate, and remain eligible for wage increases, while her pregnancy accommodations are in effect

Investor Presentation August 2022 38 Strongly committed to sustainability ▪ CarbonNET, XPO’s proprietary, cloud - based calculator, helps document emission sources, activity data and CO 2 calculations ▪ Awarded Silver Status for ESG Performance by EcoVadis in Europe, 2022 ▪ Named a Top 75 Green Supply Chain Partner by Inbound Logistics for 2016, 2017, 2018, 2019, 2020, 2021 ▪ Joined Lean & Green National Project in Spain as part of pan - European initiative to cut greenhouse gas emissions in supply chain s ▪ Awarded Trophées EVE 2020 for implementing an “urban river” solution to reduce CO 2 emissions during inner - city deliveries in Paris, in cooperation with the Ports of Paris, City of Paris, Île - de - France region and Voies Navigables de France ▪ Renewed three - year commitment to the CO 2 Charter in France, extending 10 - year commitment to sustainability ▪ Expanded fleet with 80 liquified natural gas (LNG) trucks in Europe in 2020; now over 250 natural gas trucks in Europe ▪ In partnership with Irish Rail, created a multimodal solution that can significantly decrease road congestion and emissions p er freight unit ▪ Piloted the first fully electric trucks in XPO fleets in Spain and France ▪ Partnered with Daimler Trucks North America to conduct a nine - month pilot of Daimler’s battery - electric commercial trucks ▪ Invested in fuel - efficient Freightliner Cascadia tractors in North America (EPA - compliant and GHG14 - compliant technology), and Stralis Natural Power Euro VI tractors in Europe ▪ European fleet has reduced fuel consumption by 10% since 2015 ▪ Official transport partner of Tour de France for 42 years; used biofuel at 2022 Tour and reduced CO2 emissions in 18 trucks by 8 5% ▪ Partnered with ENGIE Solutions, a leading provider of sustainable mobility, to transport natural gas in cryogenic tanks capable of maintaining extremely low temperatures ▪ XPO mega - trucks in Spain can reduce CO 2 emissions by up to 20% by transporting more freight per trip ▪ XPO drivers train in responsible eco - driving and fuel usage reduction techniques ▪ North American LTL locations implementing phased upgrades to LED lighting ▪ Experimenting in Europe with diesel - electric hybrids and zero - emission electric vans for last mile service ▪ Utilizing electronic waybills and documentation in global operations to reduce paper and other waste XPO ’s Sustainability Report is available online at sustainability.xpo.com

Investor Presentation August 2022 39 Glossary XPO SERVICES ▪ Less - than - truckload (LTL): LTL is the transportation of a quantity of freight that is larger than a parcel but doesn’t require an entire truck, and is often shipped on a pallet. LTL shipments are priced according to the weight of the freight, its commodity class (generally determined by cube/weight ratio and type of product), and mileage within designated lanes. An LTL carrier typically operates a hub - and - spoke network that allows for the consolidation of multiple shipments for different customers in single trucks. XPO is the fourth largest LTL provider in North America, with a national network that provides customers with geographic density and day - definite regional, inter - regional and transcontinental LTL freight services, including cross - border US service to and from Mexico and Canada, and intra - Canada service. After the planned RXO spin - off, XPO will be the third largest LTL pure - play in North America. The company also has one of the largest LTL networks in Western Europe. ▪ Truck brokerage: Truck brokerage is a variable - cost business that facilitates the trucking of freight by procuring carriers through the use of technology, typically referred to as a transportation management system (TMS). Brokerage margin is the spread between the price to the shipper and the cost of purchased transportation. The vast majority of truck brokerage shipments are full truckload; cargo is provided by a single shipper in an amount that requires the full capacity of the trailer, either by dimension or weight. Truck brokers have steadily increased share of the for - hire trucking market throughout cycles, and shippers and carriers increasingly value automation, making digital truck brokerage one of the strongest trends in the freight transportation industry. The RXO spin - off will be the fourth largest truck broker in the US, and is differentiated by its technology (see below). XPO’s truck brokerage business will be the largest component of its planned 2022 spin - off of RXO, which also includes complementary, asset - light brokered services for mana ged transportation, last mile and global forwarding. TECHNOLOGY ▪ XPO Connect ® (RXO Connect): The company’s proprietary, fully automated, self - learning digital freight marketplace connects shippers and carriers directly, as well as through company operations. The platform gives shippers comprehensive visibility into current market conditions, including fluctuations in capacity, spot rates by geography and digital negotiating through an automated counteroffer feature. Carriers can post available truck capacity and bid on loads, and shippers can tender loads and track their freight in real time. Truck drivers use the company’s proprietary app for mobile access from the road. Approximately 80% of the company’s truck brokerage loads are created or covered digitally, and the company expects that number to climb to 95% or more through ongoing industry adoption of its technology platform. ▪ XPO Smart ® : XPO’s proprietary labor optimization tools use machine learning to improve productivity in dock operations at the company’s LTL network terminals.

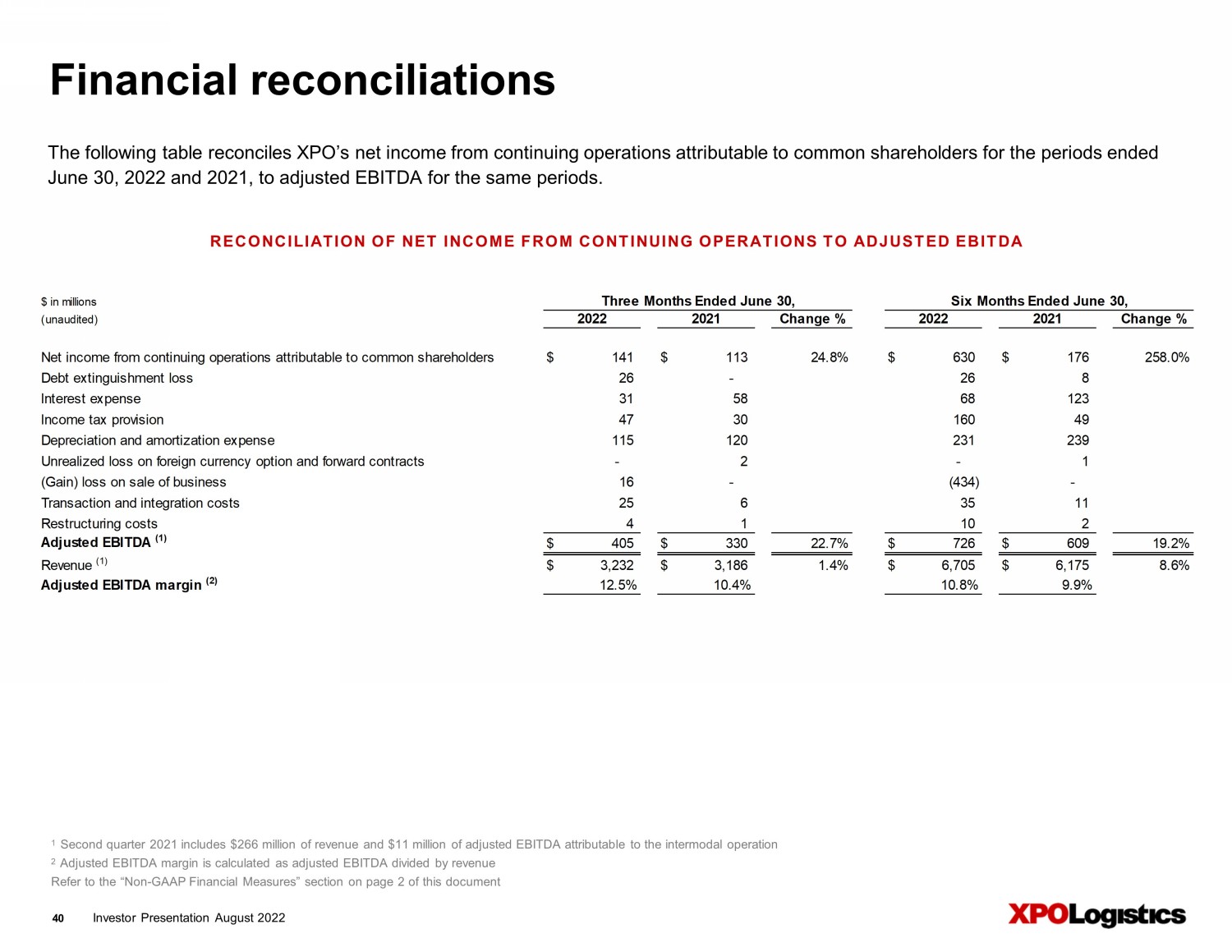

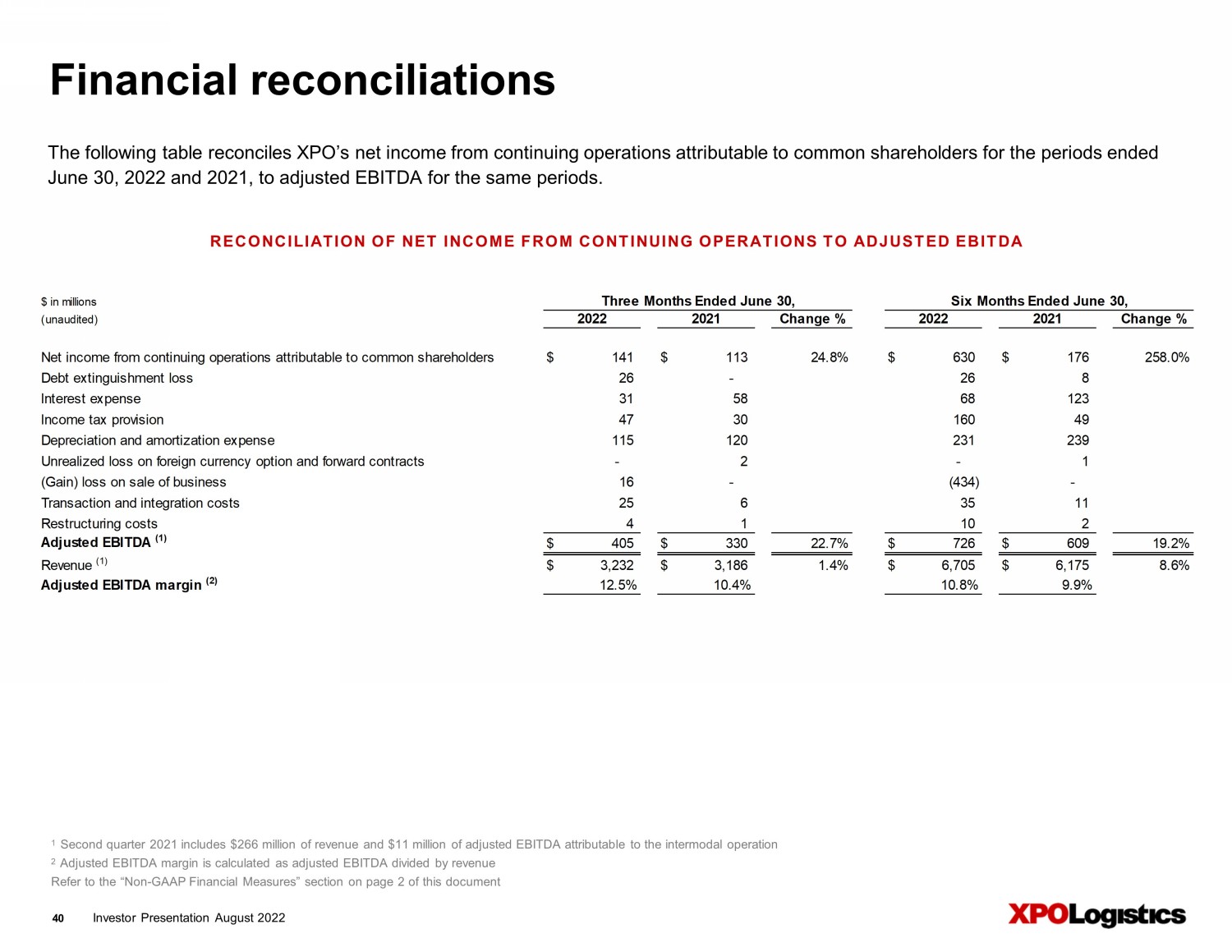

Investor Presentation August 2022 T he following table reconciles XPO’s net income from continuing operations attributable to common shareholders for the periods en ded June 30, 2022 and 2021, to adjusted EBITDA for the same periods. 40 Financial reconciliations RECONCILIATION OF NET INCOME FROM CONTINUING OPERATIONS TO ADJUSTED EBITDA $ in millions (unaudited) Change % Change % Net income from continuing operations attributable to common shareholders $ 141 $ 113 24.8% $ 630 $ 176 258.0% Debt extinguishment loss 26 - 26 8 Interest expense 31 58 68 123 Income tax provision 47 30 160 49 Depreciation and amortization expense 115 120 231 239 Unrealized loss on foreign currency option and forward contracts - 2 - 1 (Gain) loss on sale of business 16 - (434) - Transaction and integration costs 25 6 35 11 Restructuring costs 4 1 10 2 Adjusted EBITDA (1) $ 405 $ 330 22.7% $ 726 $ 609 19.2% Revenue (1) $ 3,232 $ 3,186 1.4% $ 6,705 $ 6,175 8.6% Adjusted EBITDA margin (2) 12.5% 10.4% 10.8% 9.9% Three Months Ended June 30, Six Months Ended June 30, 2022 2021 2022 2021 1 Second quarter 2021 includes $266 million of revenue and $11 million of adjusted EBITDA attributable to the intermodal operat ion 2 Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue Refer to the “Non - GAAP Financial Measures” section on page 2 of this document

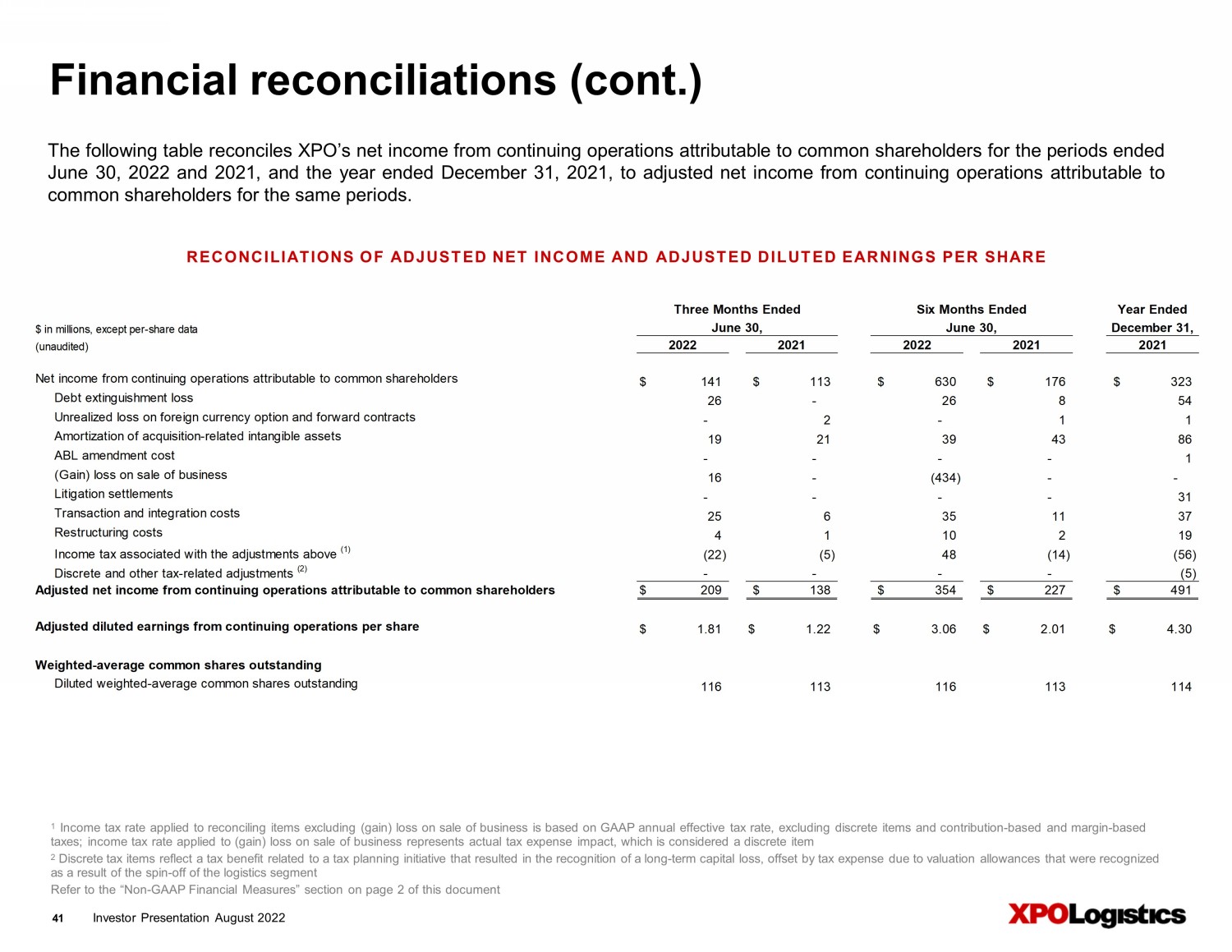

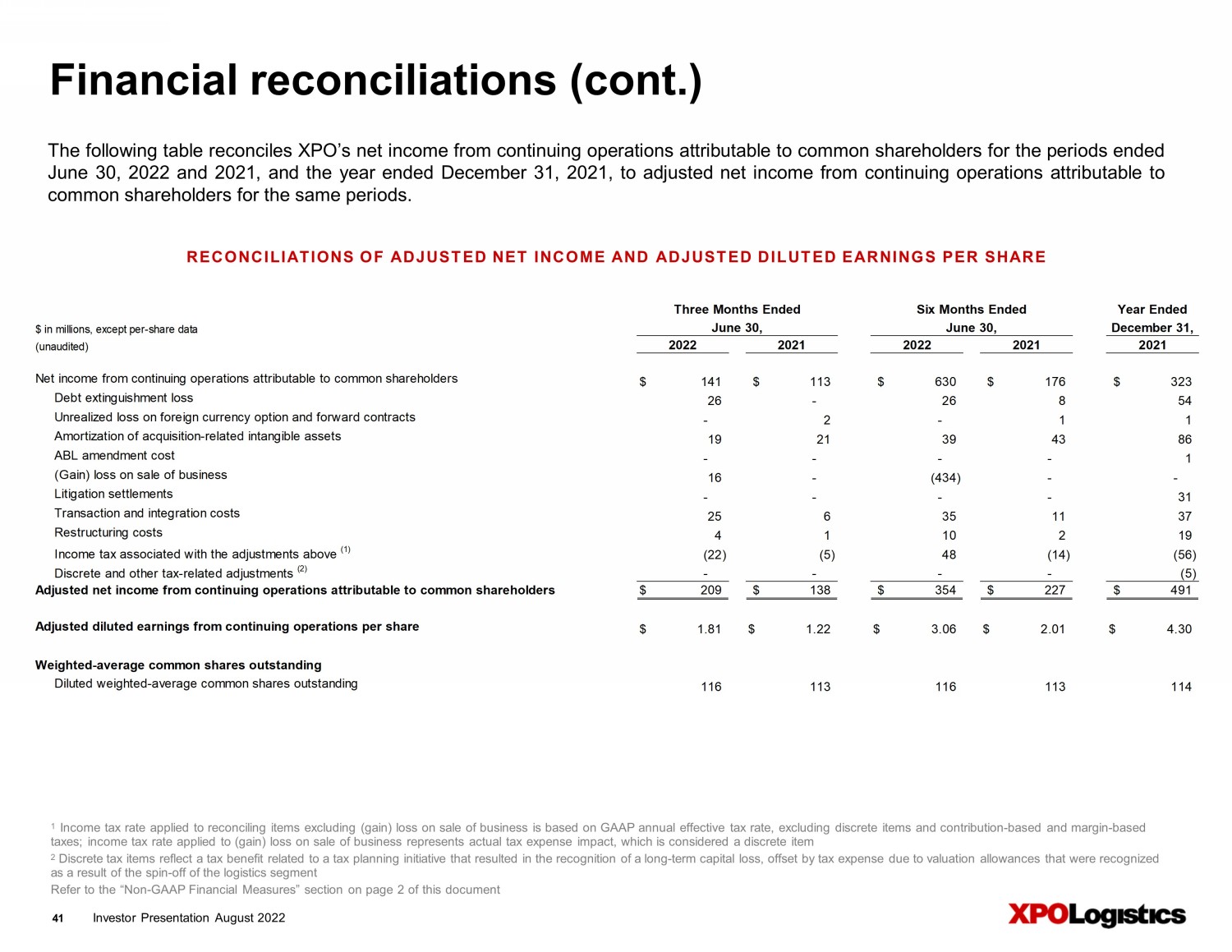

Investor Presentation August 2022 The following table reconciles XPO’s net income from continuing operations attributable to common shareholders for the periods ended June 30 , 2022 and 2021 , and the year ended December 31 , 2021 , to adjusted net income from continuing operations attributable to common shareholders for the same periods . Financial reconciliations (cont.) 1 Income tax rate applied to reconciling items excluding (gain) loss on sale of business is based on GAAP annual effective tax rat e, excluding discrete items and contribution - based and margin - based taxes ; income tax rate applied to (gain) loss on sale of business represents actual tax expense impact, which is considered a discre te item 2 Discrete tax items reflect a tax benefit related to a tax planning initiative that resulted in the recognition of a long - term capital loss, offset by tax expense due to valuation allowances that were recognized as a result of the spin - off of the logistics segment Refer to the “Non - GAAP Financial Measures” section on page 2 of this document 41 RECONCILIATION S OF ADJUSTED NET INCOME AND ADJUSTED DILUTED EARNINGS PER SHARE $ in millions, except per-share data (unaudited) Net income from continuing operations attributable to common shareholders $ 141 $ 113 $ 630 $ 176 $ 323 Debt extinguishment loss 26 - 26 8 54 Unrealized loss on foreign currency option and forward contracts - 2 - 1 1 Amortization of acquisition-related intangible assets 19 21 39 43 86 ABL amendment cost - - - - 1 (Gain) loss on sale of business 16 - (434) - - Litigation settlements - - - - 31 Transaction and integration costs 25 6 35 11 37 Restructuring costs 4 1 10 2 19 Income tax associated with the adjustments above (1) (22) (5) 48 (14) (56) Discrete and other tax-related adjustments (2) - - - - (5) Adjusted net income from continuing operations attributable to common shareholders $ 209 $ 138 $ 354 $ 227 $ 491 Adjusted diluted earnings from continuing operations per share $ 1.81 $ 1.22 $ 3.06 $ 2.01 $ 4.30 Weighted-average common shares outstanding Diluted weighted-average common shares outstanding 116 113 116 113 114 Three Months Ended 2022 2021 2022 2021 June 30, Six Months Ended June 30, Year Ended December 31, 2021

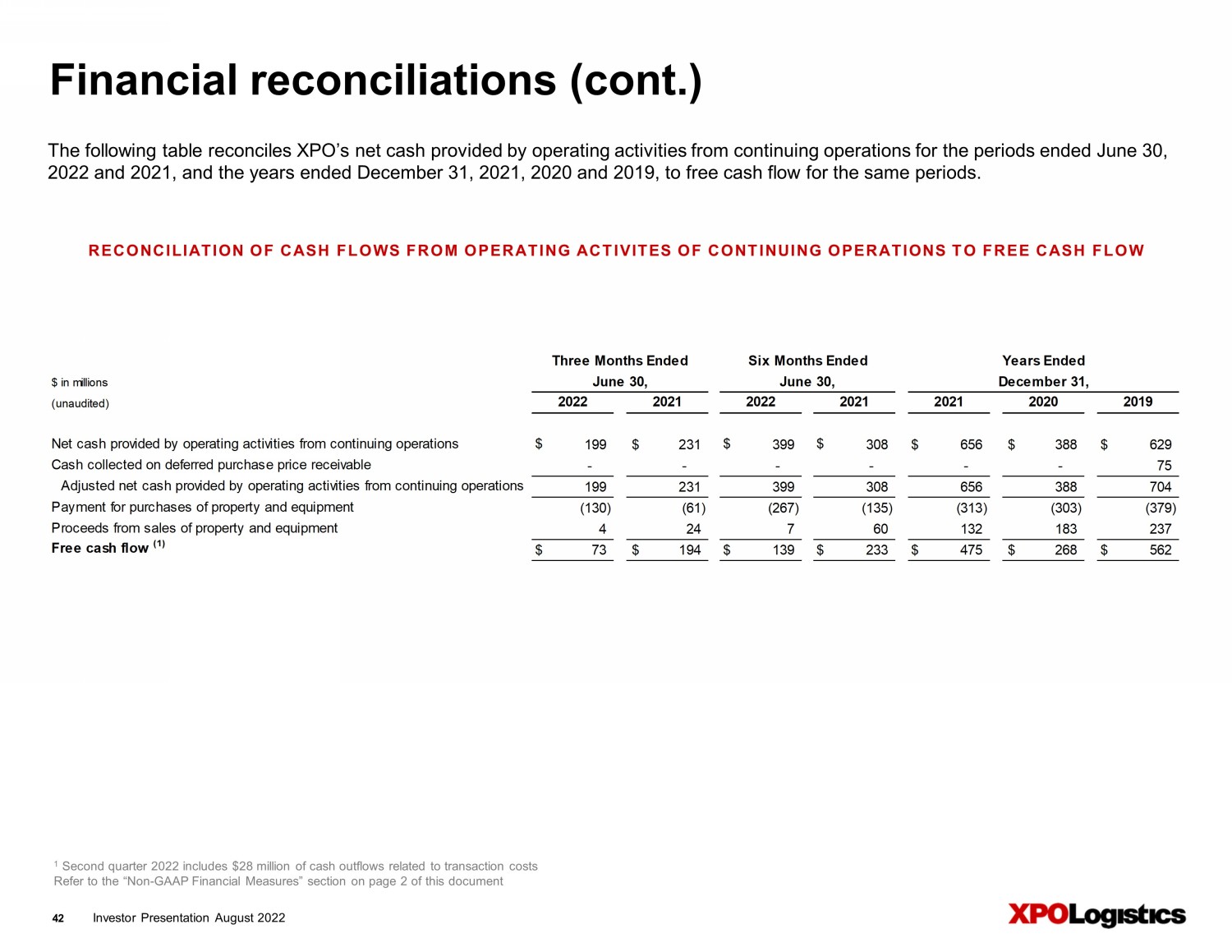

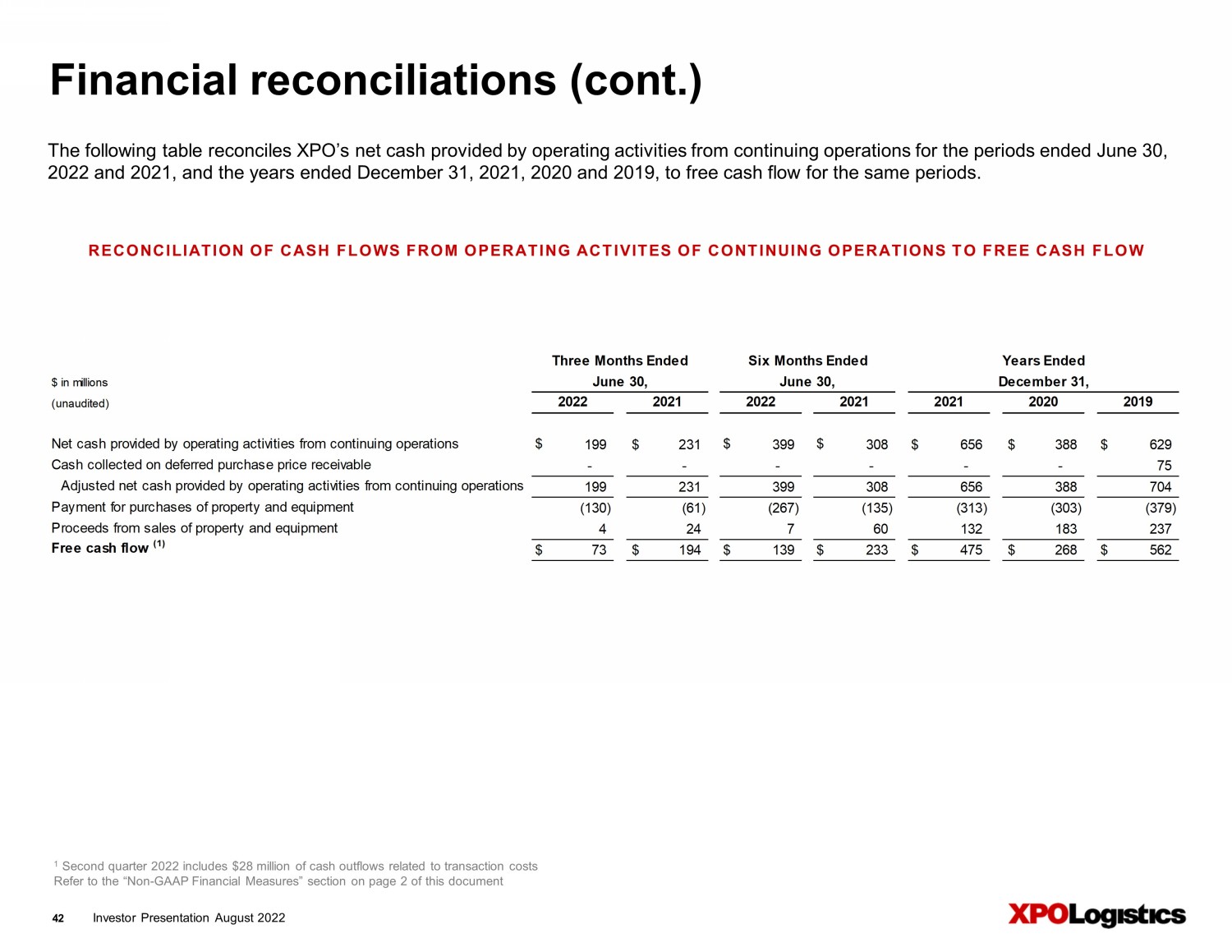

Investor Presentation August 2022 The following table reconciles XPO’s net cash provided by operating activities from continuing operations for the periods end ed June 30, 2022 and 2021, and the years ended December 31, 2021, 2020 and 2019, to free cash flow for the same periods. Financial reconciliations (cont.) 42 RECONCILIATION OF CASH FLOWS FROM OPERATING ACTIVITES OF CONTINUING OPERATIONS TO FREE CASH FLOW $ in millions (unaudited) Net cash provided by operating activities from continuing operations $ 199 $ 231 $ 399 $ 308 $ 656 $ 388 $ 629 Cash collected on deferred purchase price receivable - - - - - - 75 Adjusted net cash provided by operating activities from continuing operations 199 231 399 308 656 388 704 Payment for purchases of property and equipment (130) (61) (267) (135) (313) (303) (379) Proceeds from sales of property and equipment 4 24 7 60 132 183 237 Free cash flow (1) $ 73 $ 194 $ 139 $ 233 $ 475 $ 268 $ 562 Years Ended December 31, 2021 2020 June 30, 20212022 2019 Three Months Ended Six Months Ended June 30, 2022 2021 1 S econd quarter 2022 includes $28 million of cash outflows related to transaction costs Refer to the “Non - GAAP Financial Measures” section on page 2 of this document

Investor Presentation August 2022 The following table reconciles XPO’s operating income attributable to its North American less - than - truckload business to adjuste d operating income, adjusted operating ratio, adjusted EBITDA and net cash for the respective periods shown in the table below. Financial reconciliations (cont.) RECONCILIATIONS OF NORTH AMERICAN LESS - THAN - TRUCKLOAD ADJUSTED OPERATING RATIO, ADJUSTED EBITDA AND NET CASH 43 1 Operating income, adjusted operating income and adjusted EBITDA include real estate gains of $ - million and $5 million for the t hree months ended June 30, 2022 and 2021, respectively, and $ - million and $22 million for the six months ended June 30, 2022 and 2021, respectively 2 Operating ratio is calculated as (1 – (operating income divided by revenue)) 3 Other income primarily consists of pension income 4 Adjusted operating ratio is calculated as (1 – (adjusted operating income divided by revenue)); adjusted operating margin is the inverse of adjusted operating ratio 5 Adjusted EBITDA is used by our chief operating decision maker to evaluate segment profit (loss) in accordance with ASC 280 6 Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue 7 Net cash generated from operating income is calculated as operating income less payments for purchases of property and equipment 8 Net cash generated from adjusted EBITDA is calculated as adjusted EBITDA, excluding gains on real estate transactions, less payments for purchases of property and equipment; we also refer to this measure as net cash from LTL 9 The c ompany acquired North American LTL in Q4 2015 Note: Refer to the “Non - GAAP Financial Measures” section on page 2 of this document $ in millions (unaudited) Revenue (excluding fuel surcharge revenue) $ 948 $ 917 $ 1,846 $ 1,744 $ 3,486 $ 3,106 $ 3,259 $ 3,230 $ 3,140 $ 3,035 $ 753 Fuel surcharge revenue 291 164 498 299 632 433 532 552 455 370 98 Revenue 1,239 1,081 2,344 2,043 4,118 3,539 3,791 3,782 3,595 3,405 851 Salaries, wages and employee benefits 524 486 1,019 939 1,907 1,740 1,783 1,751 1,697 1,676 434 Purchased transportation 134 116 270 210 452 334 397 400 438 438 119 Fuel and fuel-related taxes 121 71 215 134 282 186 264 293 234 191 48 Other operating expenses 159 145 327 279 553 494 471 590 555 514 139 Depreciation and amortization 60 57 115 112 226 224 227 243 233 203 53 Rents and leases 23 19 45 37 79 65 49 44 42 41 11 Transaction, integration and rebranding costs 2 - 2 - 1 5 - - 19 24 21 Restructuring costs - - 3 - - 4 3 3 - - - Operating income (1) 216 187 348 332 618 487 597 458 377 318 26 Operating ratio (2) 82.5% 82.7% 85.1% 83.7% 85.0% 86.2% 84.3% 87.9% 89.5% 90.7% 96.9% Other income (3) 15 14 30 28 58 43 22 29 12 - - Amortization expense 9 9 17 17 33 34 34 33 34 34 10 Transaction, integration and rebranding costs 2 - 2 - 1 5 - - 19 24 21 Restructuring costs - - 3 - - 4 3 3 - - - Depreciation adjustment from updated purchase price allocation of acquired assets - - - - - - - - - (2) - Adjusted operating income (1) $ 242 $ 210 $ 400 $ 377 $ 710 $ 573 $ 656 $ 523 $ 442 $ 374 $ 57 Adjusted operating ratio (4) 80.4% 80.6% 82.9% 81.5% 82.7% 83.8% 82.7% 86.2% 87.7% 89.0% 93.3% Depreciation expense 51 48 98 95 193 190 193 210 199 169 Other 1 - 1 - 1 1 2 - 6 4 Adjusted EBITDA (1) (5) $ 294 $ 258 $ 499 $ 472 $ 904 $ 764 $ 851 $ 733 $ 647 $ 547 Adjusted EBITDA Margin (6) 23.7% 23.9% 21.3% 23.1% 21.9% 21.6% Gains on real estate transactions - (5) - (22) (62) (77) (88) (2) (5) - - Adjusted EBITDA, excluding gains on real estate transactions $ 294 $ 253 $ 499 $ 450 $ 842 $ 687 $ 763 $ 731 $ 642 $ 547 Adjusted operating income, excluding gains on real estate transactions $ 242 $ 205 $ 400 $ 355 $ 648 $ 496 $ 57 Adjusted operating ratio, excluding gains on real estate transactions (4) 80.4% 81.1% 82.9% 82.6% 84.3% 86.0% 93.3% Payment for purchases of property and equipment (165) $ (155) $ (102) $ (153) $ (112) $ (88) $ (130) Net cash generated from operating income (7) 183 463 385 444 346 289 188 Net cash generated from adjusted EBITDA (8) 334 687 585 610 619 554 417 Three Months Ended June 30, Six Months Ended June 30, 2022 2021 Years Ended December 31, December 31, Three Months Ended 2016 2015 (9) 2022 2021 2021 2020 2019 2018 2017

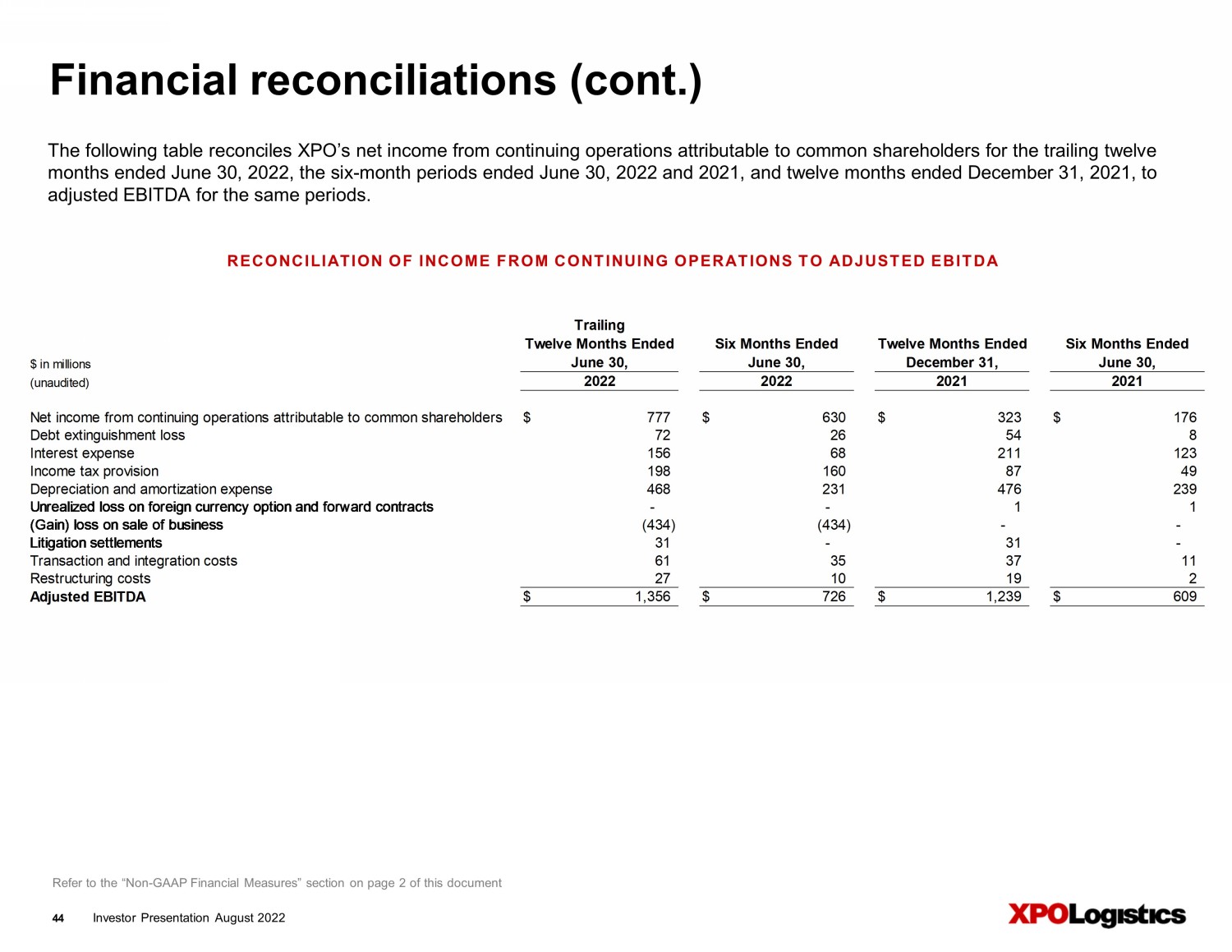

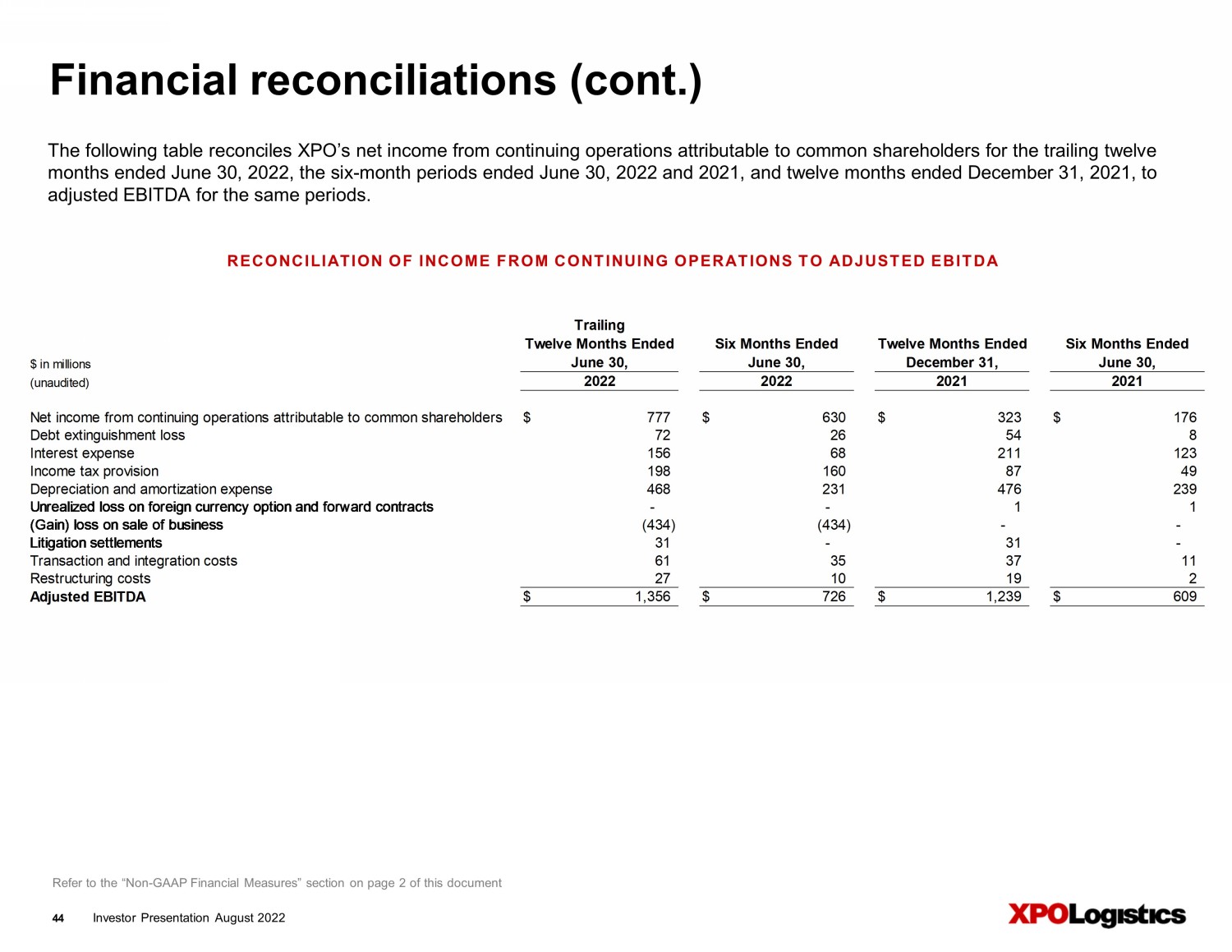

Investor Presentation August 2022 RECONCILIATION OF INCOME FROM CONTINUING OPERATIONS TO ADJUSTED EBITDA The following table reconciles XPO’s net income from continuing operations attributable to common shareholders for the trailing twelve months ended June 30 , 2022 , the six - month periods ended June 30 , 2022 and 2021 , and twelve months ended December 31 , 2021 , to adjusted EBITDA for the same periods . Financial reconciliations (cont.) Refer to the “Non - GAAP Financial Measures” section on page 2 of this document 44 $ in millions (unaudited) Net income from continuing operations attributable to common shareholders $ 777 $ 630 $ 323 $ 176 Debt extinguishment loss 72 26 54 8 Interest expense 156 68 211 123 Income tax provision 198 160 87 49 Depreciation and amortization expense 468 231 476 239 Unrealized loss on foreign currency option and forward contracts - - 1 1 (Gain) loss on sale of business (434) (434) - - Litigation settlements 31 - 31 - Transaction and integration costs 61 35 37 11 Restructuring costs 27 10 19 2 Adjusted EBITDA $ 1,356 $ 726 $ 1,239 $ 609 June 30, June 30, December 31, June 30, Twelve Months Ended Six Months Ended Twelve Months Ended Six Months Ended Trailing 2022 2022 2021 2021

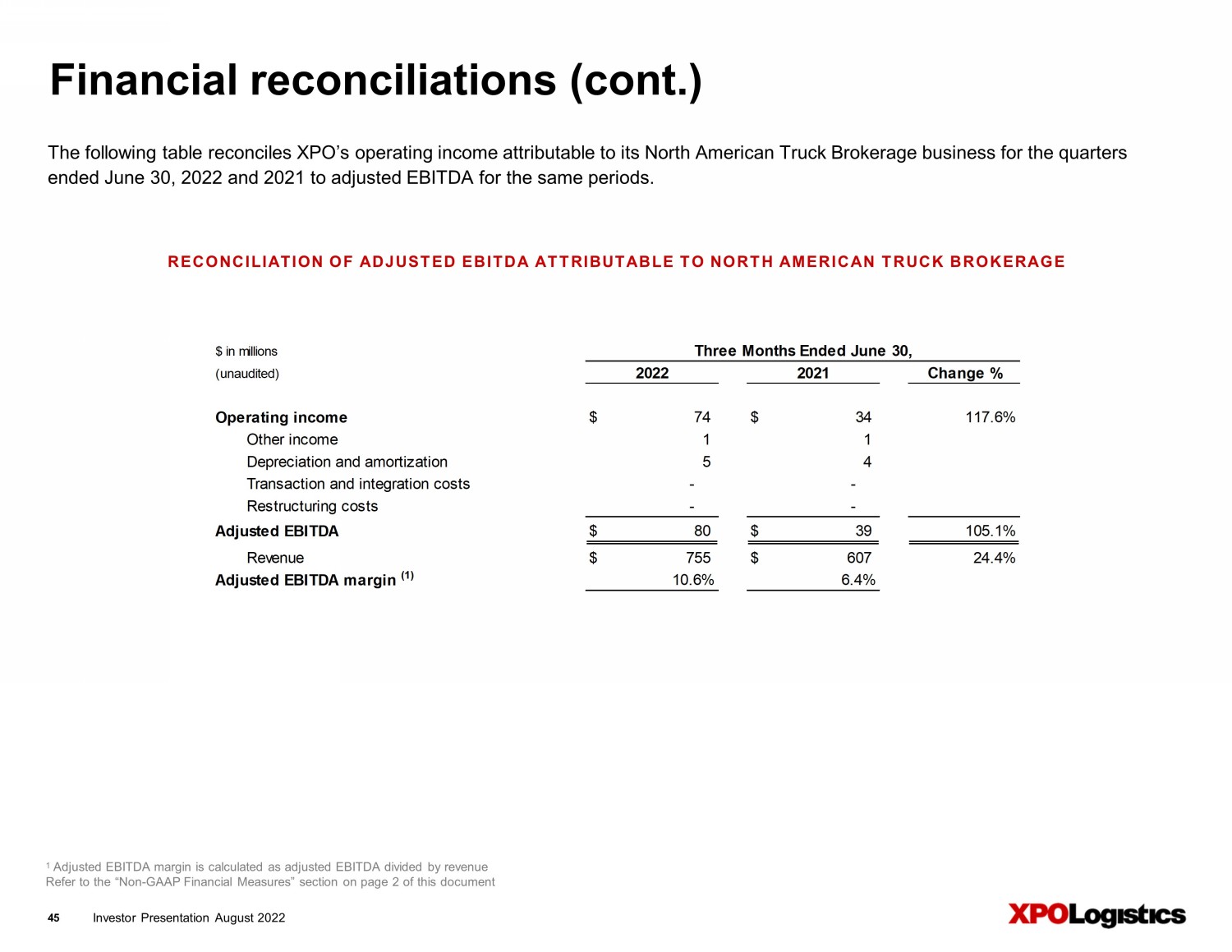

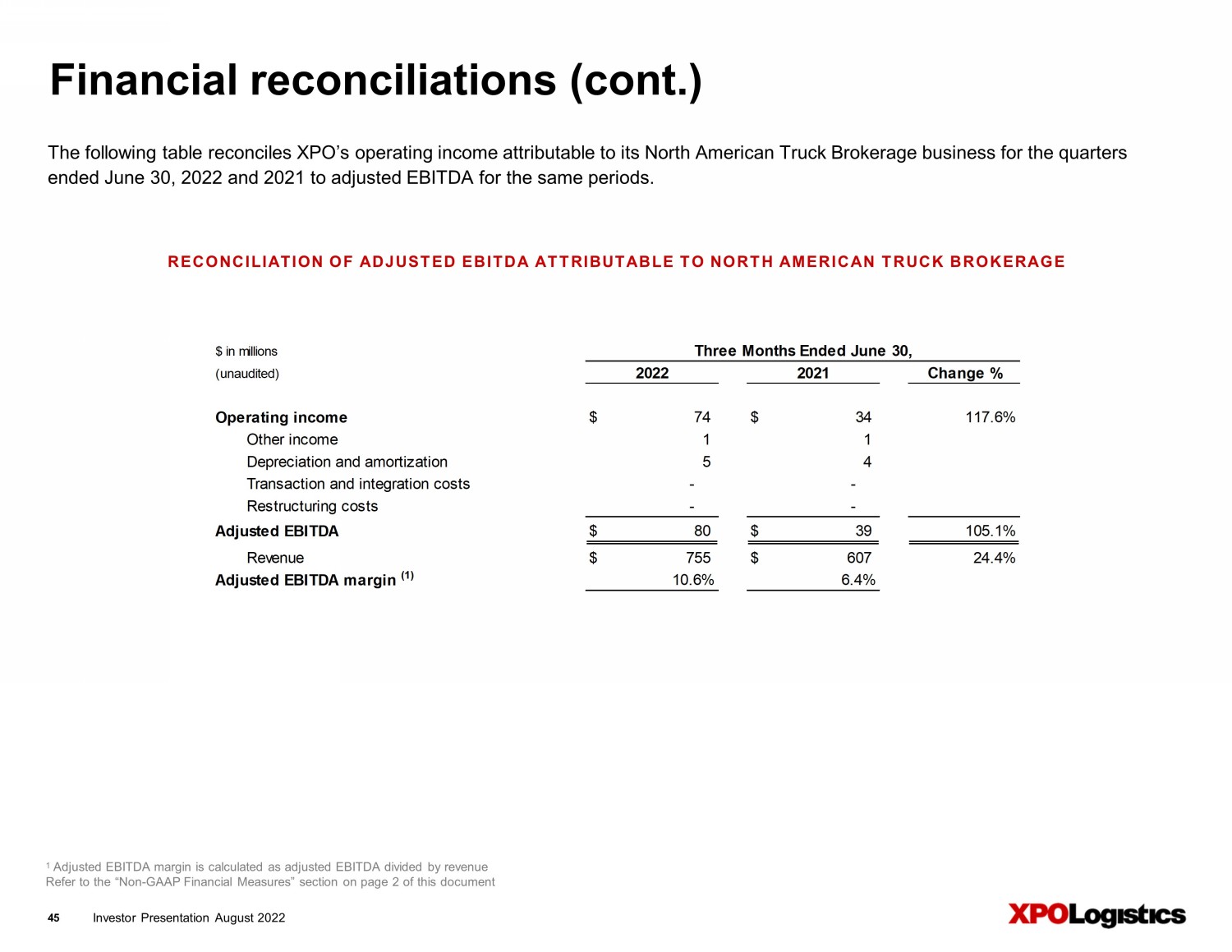

Investor Presentation August 2022 The following table reconciles XPO’s operating income attributable to its North American Truck Brokerage business for the qua rte rs ended June 30, 2022 and 2021 to adjusted EBITDA for the same periods. Financial reconciliations (cont.) 1 Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue Refer to the “Non - GAAP Financial Measures” section on page 2 of this document 45 RECONCILIATION OF ADJUSTED EBITDA ATTRIBUTABLE TO NORTH AMERICAN TRUCK BROKERAGE $ in millions (unaudited) Change % Operating income $ 74 $ 34 117.6% Other income 1 1 Depreciation and amortization 5 4 Transaction and integration costs - - Restructuring costs - - Adjusted EBITDA $ 80 $ 39 105.1% Revenue $ 755 $ 607 24.4% Adjusted EBITDA margin (1) 10.6% 6.4% 2022 2021 Three Months Ended June 30,

Investor Presentation August 2022 The following table reconciles XPO’s operating income attributable to the planned spin - off operations (1) for the year ended December 31, 2021 to adjusted EBITDA for the same period. Financial reconciliations (cont.) 1 The planned spin - off is expected to include the company's truck brokerage, managed transportation, last mile and global forwardi ng operations 2 Excludes unallocated corporate costs Refer to the “Non - GAAP Financial Measures” section on page 2 of this document 46 RECONCILIATION OF ADJUSTED EBITDA ATTRIBUTABLE TO RXO (PLANNED SPIN - OFF) $ in millions (unaudited) Spin-off operations Operating income $ 226 Other expense (2) Depreciation and amortization 79 Transaction and integration costs 2 Adjusted EBITDA (2) $ 305 Year Ended December 31, 2021

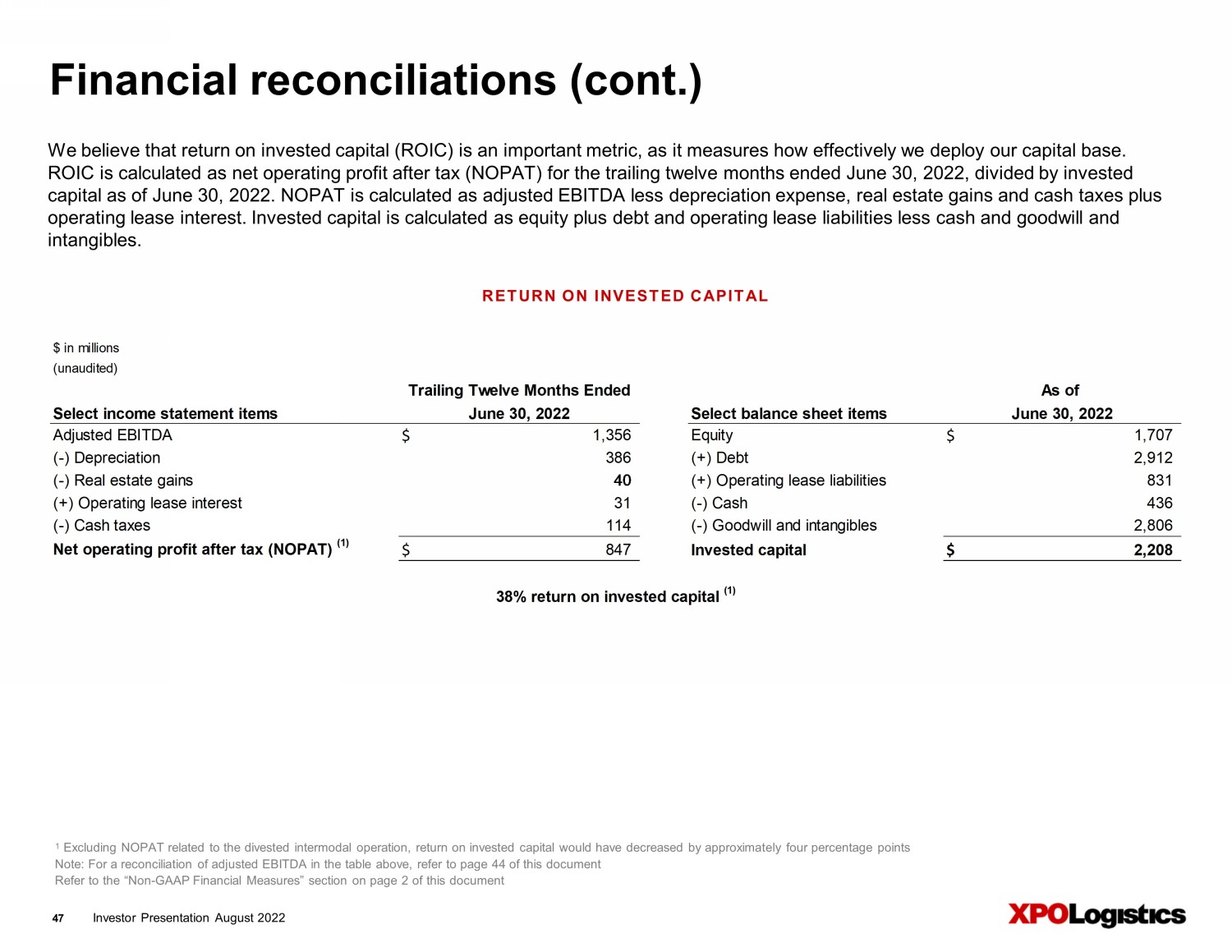

Investor Presentation August 2022 We believe that return on invested capital (ROIC) is an important metric, as it measures how effectively we deploy our capita l b ase. ROIC is calculated as net operating profit after tax (NOPAT) for the trailing twelve months ended June 30, 2022, divided by i nve sted capital as of June 30, 2022. NOPAT is calculated as adjusted EBITDA less depreciation expense, real estate gains and cash tax es plus operating lease interest. Invested capital is calculated as equity plus debt and operating lease liabilities less cash and go odw ill and intangibles. Financial reconciliations (cont.) 1 Excluding NOPAT related to the divested intermodal operation, return on invested capital would have decreased by approximately four percentage points Note: For a reconciliation of adjusted EBITDA in the table above, refer to page 44 of this document Refer to the “Non - GAAP Financial Measures” section on page 2 of this document RETURN ON INVESTED CAPITAL 47 $ in millions (unaudited) Select income statement items Select balance sheet items Adjusted EBITDA $ 1,356 Equity $ 1,707 (-) Depreciation 386 (+) Debt 2,912 (-) Real estate gains 40 (+) Operating lease liabilities 831 (+) Operating lease interest 31 (-) Cash 436 (-) Cash taxes 114 (-) Goodwill and intangibles 2,806 Net operating profit after tax (NOPAT) (1) $ 847 Invested capital $ 2,208 38% return on invested capital (1) Trailing Twelve Months Ended As of June 30, 2022 June 30, 2022

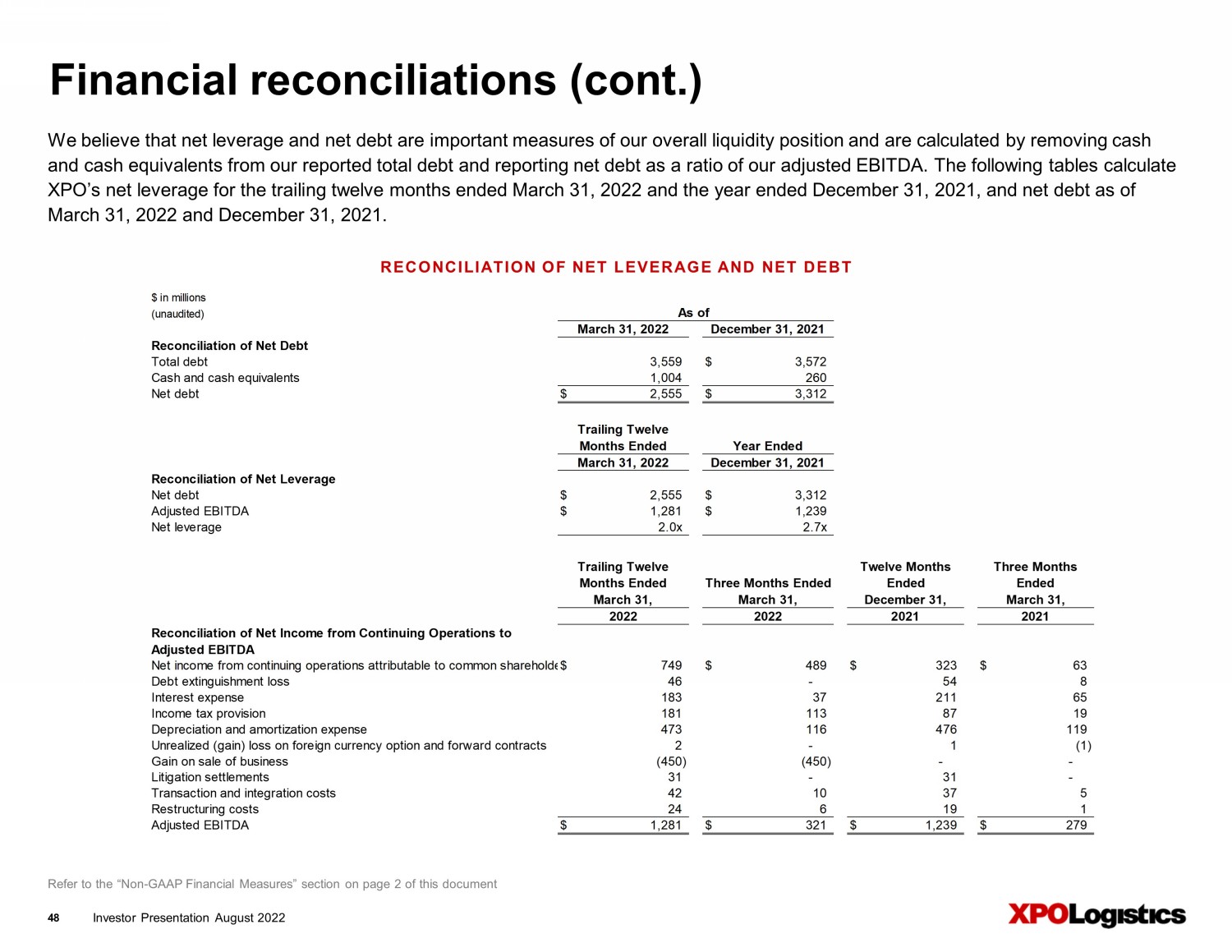

Investor Presentation August 2022 W e believe that net leverage and net debt are important measures of our overall liquidity position and are calculated by remov ing cash and cash equivalents from our reported total debt and reporting net debt as a ratio of our adjusted EBITDA. The following tab les calculate XPO’s net leverage for the trailing twelve months ended March 31, 2022 and the year ended December 31, 2021, and net debt as of March 31, 2022 and December 31, 2021. Financial reconciliations (cont.) RECONCILIATION OF NET LEVERAGE AND NET DEBT 48 $ in millions (unaudited) Reconciliation of Net Debt Total debt 3,559 $ 3,572 Cash and cash equivalents 1,004 260 Net debt $ 2,555 $ 3,312 Reconciliation of Net Leverage Net debt $ 2,555 $ 3,312 Adjusted EBITDA $ 1,281 $ 1,239 Net leverage 2.0x 2.7x Reconciliation of Net Income from Continuing Operations to Adjusted EBITDA Net income from continuing operations attributable to common shareholders$ 749 $ 489 $ 323 $ 63 Debt extinguishment loss 46 - 54 8 Interest expense 183 37 211 65 Income tax provision 181 113 87 19 Depreciation and amortization expense 473 116 476 119 Unrealized (gain) loss on foreign currency option and forward contracts 2 - 1 (1) Gain on sale of business (450) (450) - - Litigation settlements 31 - 31 - Transaction and integration costs 42 10 37 5 Restructuring costs 24 6 19 1 Adjusted EBITDA $ 1,281 $ 321 $ 1,239 $ 279 Trailing Twelve Months Ended Year Ended December 31, 2021 Trailing Twelve Months Ended Three Months Ended Twelve Months Ended Three Months Ended March 31, March 31, December 31, March 31, As of March 31, 2022 December 31, 2021 March 31, 2022 2022 2022 2021 2021 Refer to the “Non - GAAP Financial Measures” section on page 2 of this document