Exhibit 99.1

Management Presentation

August 2013

Disclaimer

This presentation contains, and XPO Logistics, Inc. (the “Company”) may from time to time make, written or oral “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, made in this presentation that address activities, events or developments that the Company expects or anticipates will or may occur in the future, including such things as financial goals and projections, expansion and growth of the Company’s business and operations (including projected headcount increases), the expected impact of theacquisition of 3PD Holding, Inc. (“3PD”) and 3PD’s anticipated growth, the expected ability to integrate the Company’s and 3PD’s operations and technology platforms, finding other suitable merger or acquisition candidates, future technology improvements (including the timing and nature thereof) and other such matters, are forward-looking statements. These statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments as well as other factors it believes are appropriate in the circumstances. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “may,”“will,”“should,”“expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other comparable terms. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements. Factors that could adversely affect actual results and performance include: economic conditions generally; competition; the Company’s ability to find suitable acquisition candidates and execute its acquisition strategy;the expected impact of the 3PD acquisition, including the expected impact on the Company’s results of operations and EBITDA; the Company’s ability to raise debt and equity capital; the Company’s ability to attract and retain key employees to execute its growth strategy, including retention of 3PD’s management team; litigation, including litigation related to misclassification of independent contractors; the Company’s ability to develop and implement a suitable information technology system; the Company’s ability to maintain positive relationships with its network of third-party transportation providers; the Company’s ability to retain its and 3PD’s largest customers; the Company’s ability to successfully integrate 3PD and other acquired businesses; and governmental regulation. These factors, and additional factors that could cause actual results to differ materially from those projected in the forward-looking statements, are discussed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012, and in the Company’s other filings with the Securities and Exchange Commission (the “SEC”). These materials should be read in conjunction with the Company’s filings with the SEC, which are available to the public over the Internet at www.sec.gov and the Company’s website, www.xpologistics.com. All forward-looking statements made in these materials speak only as of the date of these materials. All forward-looking statements made in these materials are qualified by these cautionary statements and there can be no assurance thatthe actualresults or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence to or effects on the Company or its business or operations. The Company assumes no obligation to update any such forward-looking statements, except to the extent required by law.

2

Clearly Defined Strategy for Growth

Build XPO into a multi-billion dollar logistics company:

ƒ Significantly scale up and optimize existing operations

ƒ Acquire companies that are highly scalable

ƒ Open cold-starts in prime recruitment areas

On track to create dramatic shareholder value

3

Major Accomplishments in 20 Months

ƒ Completed eight strategic acquisitions

ƒ Opened 18 cold-starts, eight of them in freight brokerage

ƒ Established national operations center to drive efficiencies

ƒ Increased overall headcount from 208 to more than 1,800

– Grew freight brokerage sales headcount from 40 to 788

Grew footprint to 89 locations

4

Major Accomplishments in 20 Months

ƒ Implemented leading edge training programs

ƒ Introduced scalable IT platform and three major upgrades

ƒ Established professional sales and marketing team

ƒ Raised $543 million in common stock and convertible debt

ƒ Dynamic team culture, hungry for growth

Foundation in place for a much larger company

5

Strategy Part 1: Scale and Optimization

ƒ Rapidly grow sales force with aggressive recruiting and training

ƒ Expand branches capable of mega-growth

– Charlotte, North Carolina

– Chicago, Illinois

– Gainesville, Georgia

– Salt Lake City, Utah

ƒ Drive operational efficiency through shared services

6

Accelerate Sales and Marketing

ƒ Differentiate XPO by providing world-class customer service

ƒ Single point of contact for each customer

– Strategic accounts team marketing to largest 1,200 shippers

– National accounts team focused on next largest 5,000 companies

– Branch network expands our reach to hundreds of thousands of small and medium-sized shippers

ƒ Capitalize on significant less-than-truckload (LTL) opportunity

ƒ Cross-sell all services to new and existing customers

7

Scalable Technology Platform

ƒ Capitalize on XPO’s superior technology

ƒ Purchase transportation more efficiently as data pool grows

ƒ Proprietary freight optimizer tools for pricing and load-covering put in place in 2012

ƒ Enhancements delivered to date include carrier rating engine and LTL upgrades

ƒ New customer and carrier portals expected to go live in 2013

8

Strategy Part 2: Acquisitions

ƒ Acquire attractive, highly scalable companies

ƒ Gain capabilities, customers, carriers, lane and pricing histories with each acquisition

ƒ Continue to grow carrier network, currently at 22,000+

ƒ Eight acquisitions to date have added capabilities in LTL, last-mile, refrigerated and air charter

ƒ Turbo, Kelron and Covered brought strong relationships with

Fortune 500 customers

9

Acquisition of 3PD

ƒ Acquired on August 15, 2013

ƒ Largest provider of heavy goods, last-mile logistics in North America

ƒ Serves one of the fastest-growing segments of non-asset, third party logistics

ƒ Market leader facilitates over 4.5 million deliveries per year, more than twice its nearest competitor

ƒ Major milestone in XPO’s strategy, accelerates growth rate

10

3PD Is a Strong Strategic Fit

ƒ Serves a high-growth end market within XPO’s core competency of non-asset transportation logistics

ƒ Strengthens XPO’s position with shippers as a single-source provider

ƒ 3PD’s industry-leading technology can be used by XPO

ƒ Strong customer-centric culture built by experienced leaders

– All 3PD executives have joined XPO and will continue to grow the business

Scale up 3PD with organic growth and acquisitions

11

3PD Is High-Margin, High Cash Flow

ƒ Gross margin over 30% (1)

ƒ Free cash flow conversion of 80% to 90% (2)

ƒ Adjusted EBITDA margin of over 10% (1)

ƒ 36% YOY growth in adjusted EBITDA for 2013 YTD June

ƒ Total consideration of $365 million represents 10.1x LTM adjusted EBITDA

(1) Last twelve months ended June 30, 2013

(2) Defined as adjusted EBITDA less capital expenditure, divided by adjusted EBITDA. See slide 23 for a reconciliation of 3PD’s adjusted EBITDA, which is a non-GAAP financial measure

12

3PD’s Exciting Market Potential

ƒ $12 billion market for heavy goods, last-mile deliveries

ƒ Only 30% currently going through 3PLs

ƒ Two favorable trends: retailers outsourcing more deliveries, and e-commerce purchases of heavy goods on the rise

ƒ Highly fragmented with many small, regional providers

ƒ 3PD has major advantages of scale

– Cost efficiencies, productivity, access to trucks, quality control

– Leading software for workflow and customer experience management

Sources: Norbridge, Inc. and EVE Partners LLC

13

3PD Complements Current Offerings

ƒ All XPO customers have direct access to best-in-class heavy goods, last-mile logistics

– Historically offered by XPO’s freight forwarding division through 3PD and other providers

ƒ All 3PD customers have access to XPO freight brokerage, expedited and freight forwarding services

ƒ XPO’s expanded service offering capitalizes on shipper trend to use fewer, larger 3PLs

Build on 3PD’s tremendous momentum

14

Strategy Part 3: Cold-starts

ƒ Hire strong industry veterans as branch presidents

ƒ Position in prime recruitment areas

ƒ Rapidly scale up by adding salespeople

ƒ Low capital investment can deliver outsized returns

ƒ Opened 18 cold-starts to date

– Eight in freight brokerage, nine in freight forwarding, one in expedited

– Brokerage cold-starts on a combined annual revenue run rate of over $90 million

15

CEO Bradley S. Jacobs

Founded and led four highly successful companies

ƒ Amerex Oil Associates: Built one of world’s largest oil brokerage firms

ƒ Hamilton Resources: Grew global oil trading company to ~$1 billion

ƒ United Waste: Created fifth largest solid waste business in North America

ƒ United Rentals: Built world’s largest equipment rental company

United Waste stock outperformed S&P 500 by 5.6x from 1992 to 1997 United Rentals stock outperformed S&P 500 by 2.2x from 1997 to 2007

16

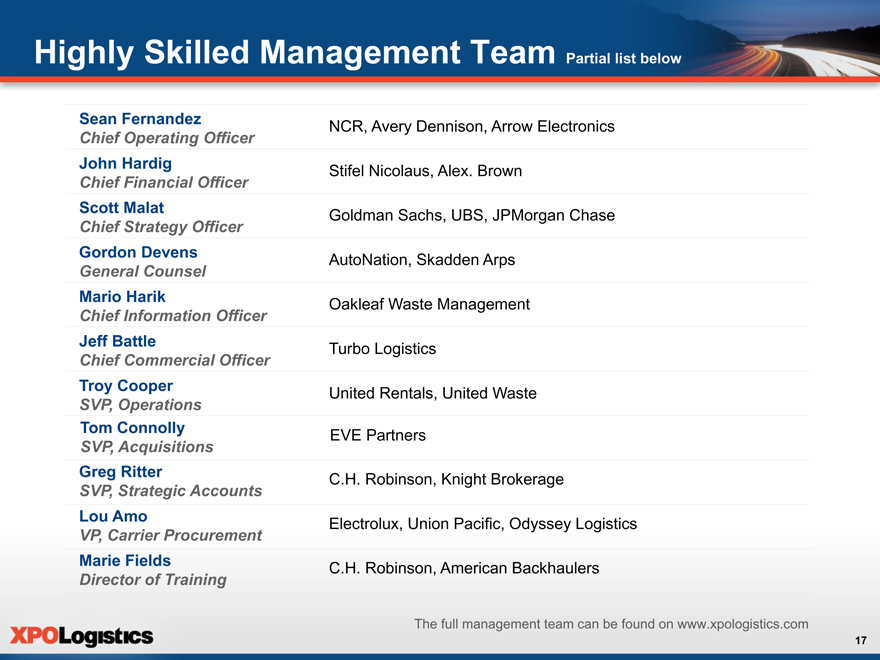

Highly Skilled Management Team Partial list below

Sean Fernandez

Chief Operating Officer

John Hardig

Chief Financial Officer

Scott Malat

Chief Strategy Officer

Gordon Devens

General Counsel

Mario Harik

Chief Information Officer

Jeff Battle

Chief Commercial Officer

Troy Cooper

SVP, Operations

Tom Connolly

SVP, Acquisitions

Greg Ritter

SVP, Strategic Accounts

Lou Amo

VP, Carrier Procurement

Marie Fields

Director of Training

NCR, Avery Dennison, Arrow Electronics Stifel Nicolaus, Alex. Brown Goldman Sachs, UBS, JPMorgan Chase AutoNation, Skadden Arps Oakleaf Waste Management Turbo Logistics

United Rentals, United Waste

EVE Partners

C.H. Robinson, Knight Brokerage

Electrolux, Union Pacific, Odyssey Logistics

C.H. Robinson, American Backhaulers

The full management team can be found on www.xpologistics.com

17

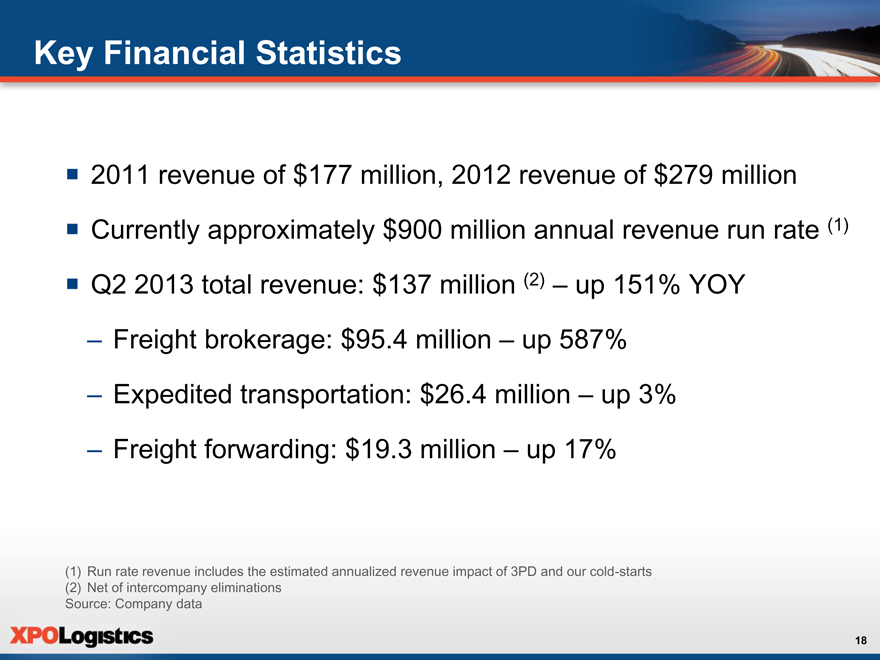

Key Financial Statistics

ƒ 2011 revenue of $177 million, 2012 revenue of $279 million

ƒ Currently approximately $900 million annual revenue run rate (1)

ƒ Q2 2013 total revenue: $137 million (2)

up 151% YOY

– Freight brokerage: $95.4 million – up 587%

– Expedited transportation: $26.4 million – up 3%

– Freight forwarding: $19.3 million – up 17%

(1) Run rate revenue includes the estimated annualized revenue impact of 3PD and our cold-starts (2) Net of intercompany eliminations

Source: Company data

18

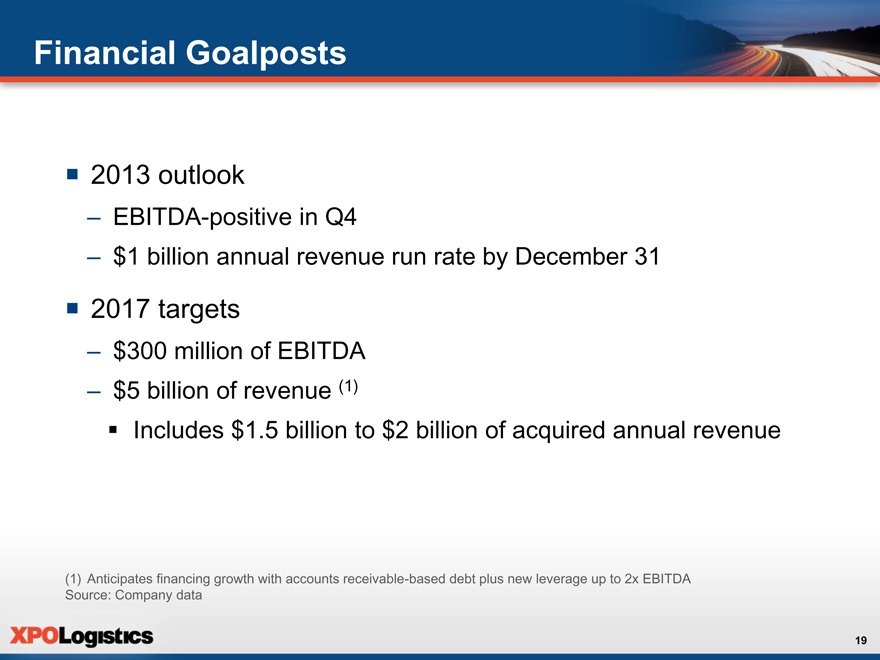

Financial Goalposts

ƒ 2013 outlook

– EBITDA-positive in Q4

– $1 billion annual revenue run rate by December 31

ƒ 2017 targets

– $300 million of EBITDA

– $5 billion of revenue (1)

??Includes $1.5 billion to $2 billion of acquired annual revenue

(1) Anticipates financing growth with accounts receivable-based debt plus new leverage up to 2x EBITDA Source: Company data

19

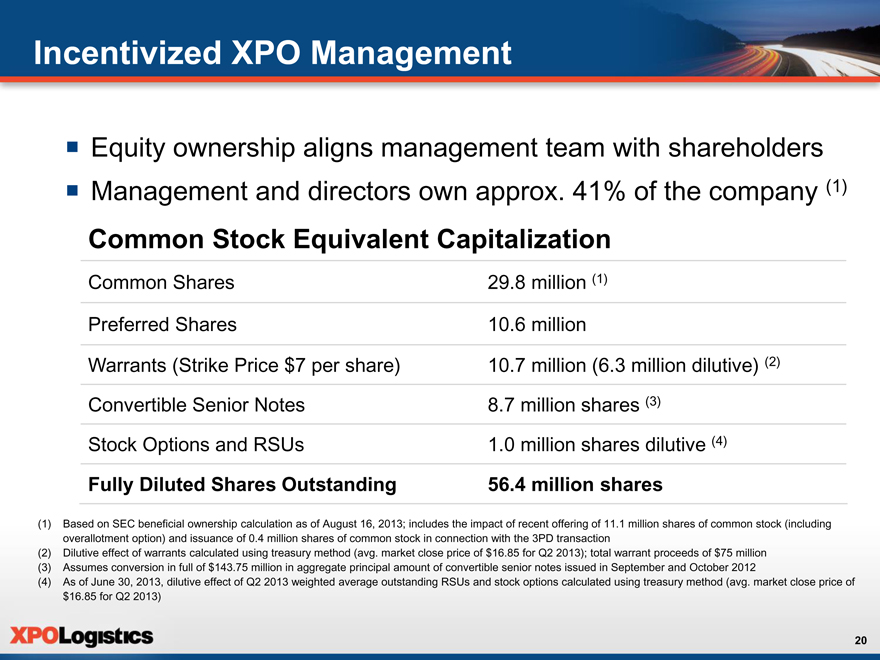

Incentivized XPO Management

ƒ Equity ownership aligns management team with shareholders

ƒ Management and directors own approx. 41% of the company (1)

Common Stock Equivalent Capitalization

Common Shares

Preferred Shares

Warrants (Strike Price $7 per share) Convertible Senior Notes Stock Options and RSUs

Fully Diluted Shares Outstanding

29.8 million (1)

10.6 million

10.7 million (6.3 million dilutive) (2)

8.7 million shares (3)

1.0 million shares dilutive (4)

56.4 million shares

(1) Based on SEC beneficial ownership calculation as of August 16, 2013; includes the impact of recent offering of 11.1 million shares of common stock (including overallotment option) and issuance of 0.4 million shares of common stock in connection with the 3PD transaction (2) Dilutive effect of warrants calculated using treasury method (avg. market close price of $16.85 for Q2 2013); total warrant proceeds of $75 million (3) Assumes conversion in full of $143.75 million in aggregate principal amount of convertible senior notes issued in September and October 2012 (4) As of June 30, 2013, dilutive effect of Q2 2013 weighted average outstanding RSUs and stock options calculated using treasury method (avg. market close price of

$16.85 for Q2 2013)

20

Clear Path for Significant Value Creation

ƒ Large, growing, fragmented logistics industry

ƒ Well-defined process to scale up operations

ƒ Robust acquisition pipeline

ƒ Significant growth potential through cold-starts

ƒ Highly skilled management team incentivized to create shareholder value

ƒ Passionate, world-class culture of customer service

21

Appendix

22

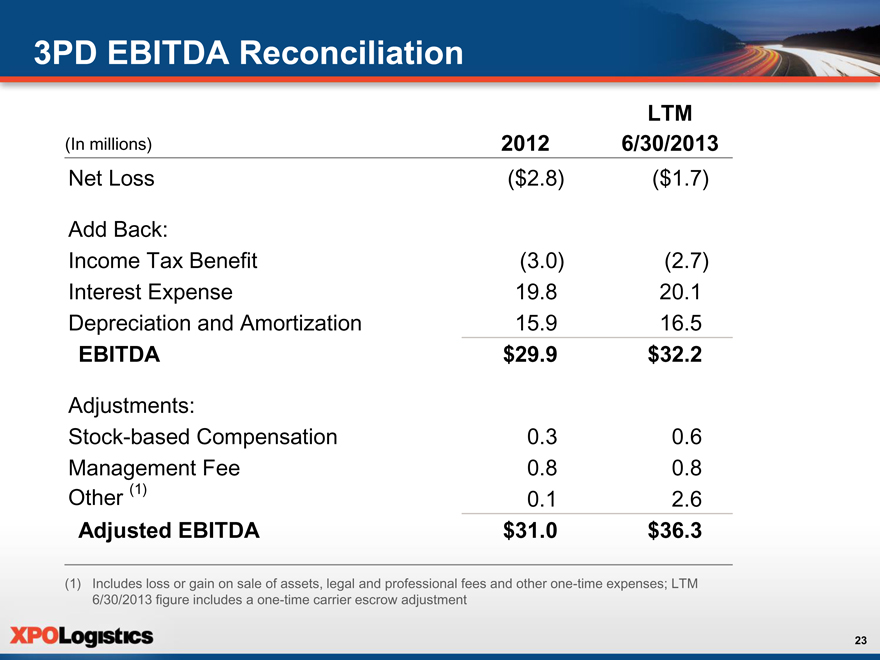

3PD EBITDA Reconciliation

LTM

(In millions) 2012 6/30/2013

Net Loss($2.8)($1.7)

Add Back:

Income Tax Benefit(3.0)(2.7)

Interest Expense 19.8 20.1

Depreciation and Amortization 15.9 16.5

EBITDA $29.9 $32.2

Adjustments:

Stock-based Compensation 0.3 0.6

Management Fee 0.8 0.8

Other (1) 0.1 2.6

Adjusted EBITDA $31.0 $36.3

(1) Includes loss or gain on sale of assets, legal and professional fees and other one-time expenses; LTM 6/30/2013 figure includes a one-time carrier escrow adjustment

23