Exhibit 99.1

Management Presentation

April 2014

Forward-Looking Statements Disclaimer

This document includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including XPO’s full year 2014 and full year 2017 financial targets. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include, but are not limited to, those discussed in XPO’s filings with the SEC and the following: economic conditions generally; competition; XPO’s ability to find suitable acquisition candidates and execute its acquisition strategy; the expected impact of acquisitions, including the expected impact on XPO’s results of operations; XPO’s ability to raise debt and equity capital; XPO’s ability to attract and retain key employees to execute its growth strategy; litigation, including litigation related to alleged misclassification of independent contractors; the ability to develop and implement a suitable information technology system; the ability to maintain positive relationships with XPO’s networks of third-party transportation providers; the ability to retain XPO’s and acquired businesses’ largest customers; XPO’s ability to successfully integrate acquired businesses and realize anticipated synergies and cost savings; and governmental regulation. All forward-looking statements set forth in this document are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, XPO or its businesses or operations. Forward-looking statements set forth in this document speak only as of the date hereof, and XPO undertakes no obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events except to the extent required by law.

2

One of the Largest 3PLs in North America

We facilitate over 22,000 deliveries per day

#4 freight brokerage firm and Top 50 logistics company #3 provider of intermodal services #1 provider of cross-border Mexico intermodal #1 manager of expedited shipments #1 provider of last-mile logistics for heavy goods

International and domestic freight forwarder

Growing presence in managed transportation and LTL

Sources for rankings: Transport Topics, Journal of Commerce and company data

3

Clearly Defined Strategy for Value Creation

Acquire companies that bring value and are highly scalable Significantly scale up and optimize existing operations Open cold-starts where sales recruitment can drive revenue

We are on track or ahead of plan with all three legs of our growth strategy

4

Precise Execution of Growth Plan

Completed 11 strategic acquisitions and established 24 cold-starts in two years

Created leading edge recruiting and training programs

Introduced scalable IT platform

Added national operations centers for shared services, carrier procurement and last-mile operations

Stratified customers, assigned a single point of contact to each

Created a culture of passionate on-time performance

Disciplined focus on operational excellence

5

Massive Commitment to Shipper Satisfaction

Built integrated network across North America in two years

Over 3,000 employees at 120 locations in the U.S. and Canada

12,000 customers in the manufacturing, industrial, retail, food and beverage, commercial, life sciences and government sectors

Over 24,000 active, vetted carriers

Approximately 400 additional trucks under exclusive contract

6

Acquired Pacer in March 2014

Provides instant scale in the $15 billion intermodal sector, the fastest-growing freight mode in North America

– Third largest provider of intermodal services

– Largest provider of cross-border Mexico intermodal

Creates company-wide cross-selling opportunities in every area of XPO service

Establishes strong platform for organic growth and M&A

Enhances XPO’s value proposition as a large, single-source supply chain partner with deep capacity

Sources: SJ Consulting Group, Inc., American Trucking Associations and company data

7

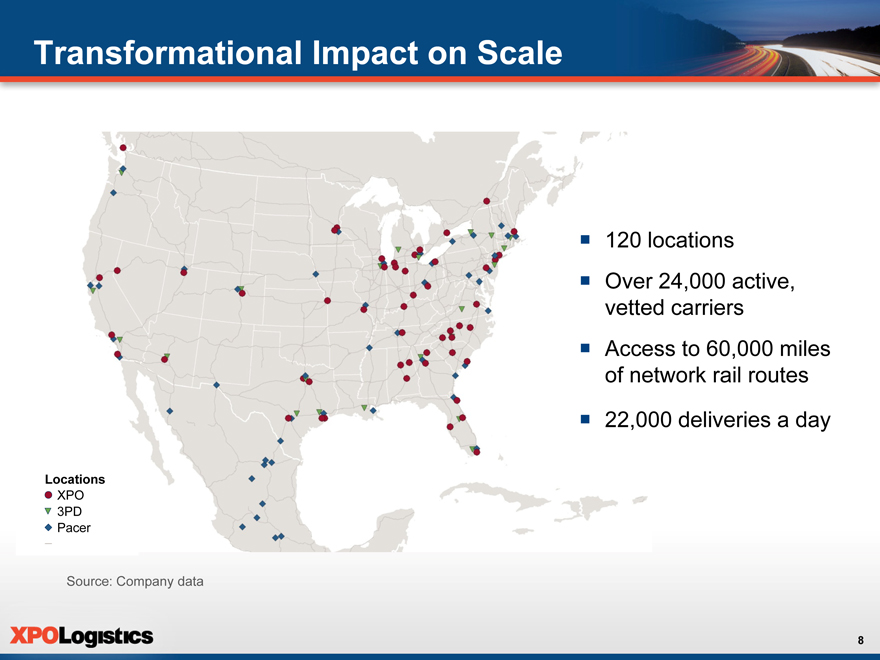

Transformational Impact on Scale

120 locations

Over 24,000 active, vetted carriers Access to 60,000 miles of network rail routes

22,000 deliveries a day

Locations

XPO 3PD Pacer

Source: Company data

8

Acquired 3PD in August 2013

Largest provider of heavy goods, last-mile logistics in North America

High value, high margin business, rapidly growing due to e-commerce and outsourcing

Strengthens XPO’s position with shippers as a large, single-source provider

Industry-leading customer experience IT can be used by XPO

Acquired Optima Service Solutions in November 2013

– Highly scalable supplier to 3PD, leader in last-mile delivery of large appliances and electronics

9

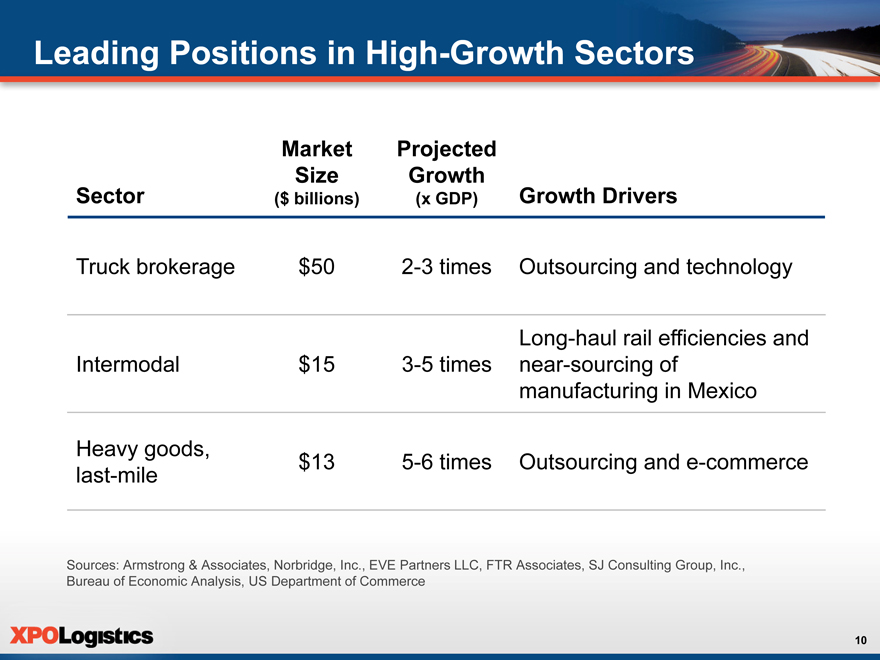

Leading Positions in High-Growth Sectors

Market Projected Size Growth

Sector ($ billions) (x GDP) Growth Drivers

Truck brokerage $50 2-3 times Outsourcing and technology

Long-haul rail efficiencies and Intermodal $15 3-5 times near-sourcing of manufacturing in Mexico

Heavy goods,

$13 5-6 times Outsourcing and e-commerce last-mile

Sources: Armstrong & Associates, Norbridge, Inc., EVE Partners LLC, FTR Associates, SJ Consulting Group, Inc., Bureau of Economic Analysis, US Department of Commerce

10

Acquired NLM in December 2013

Makes XPO the largest manager of expedited shipments in North America

#1 provider of web-based transportation management for expedited, through XPO NLM portal

XPO NLM manages more than $600 million of annual gross transportation spend

– Proprietary online auction system allows carriers to bid on loads that are then awarded electronically

Capitalizes on trend toward just-in-time inventories

11

Significant Growth Embedded in XPO’s Model

Strategic accounts: market to large shippers

Cold-starts: expand footprint in markets with best access to sales talent

Scale and productivity: recruit sales reps and provide state-of-the-art training and IT

Supply chain offering: build leadership positions in the fastest-growing areas of logistics

Performance: become the logistics partner of choice due to our relentless focus on on-time pickup and delivery

M&A program: focus on the top 100 pipeline prospects

12

Focused Sales and Marketing Effort

Differentiate XPO by providing a passionate commitment to customer satisfaction across a range of services

Single point of contact for each customer

– Strategic accounts team marketing to largest 1,200 shippers

– National accounts team focused on next largest 5,000 companies

– Branch network expands our reach to hundreds of thousands of small and medium-sized shippers

Capture more of the $32 billion less-than-truckload opportunity

Source: SJ Consulting Group, Inc.

13

Increasing Productivity through Technology

One common IT platform for freight brokerage in all cold-starts and acquired companies

Proprietary freight optimizer tools for pricing and load-covering put in place in 2012

Highly scalable load execution and tendering via automated load-to-carrier matching

Total IT budget of more than $70 million for 2014 (1)

(1) Includes IT budget for Pacer

14

Growth through Cold-starts

Hire strong industry veterans as branch presidents Position in prime recruitment areas Rapidly scale up by adding salespeople Low capital investment can deliver outsized returns 24 cold-starts

– 11 in freight brokerage, 12 in freight forwarding, one in expedited

– Brokerage cold-starts on a combined annual revenue run rate of more than $150 million

15

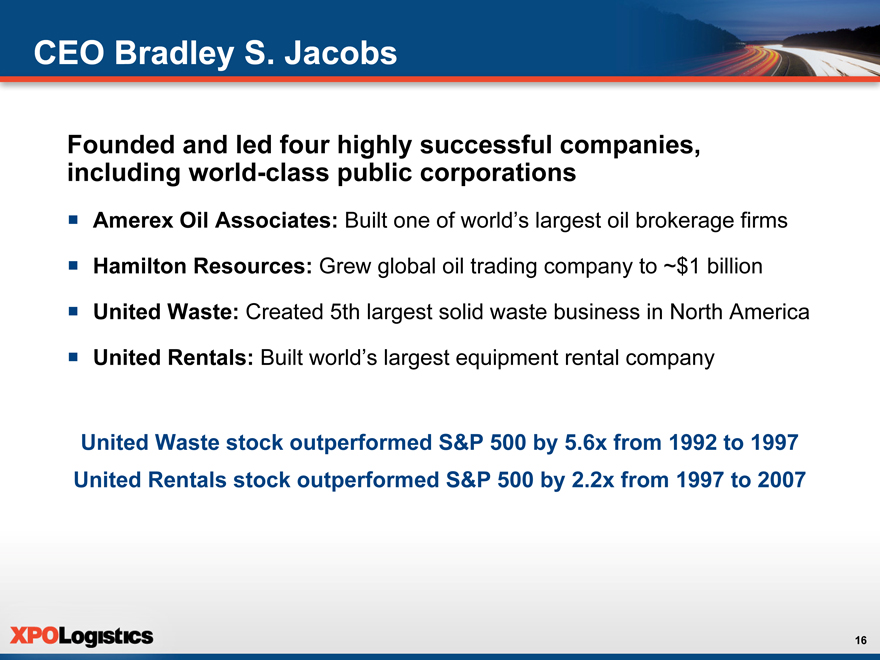

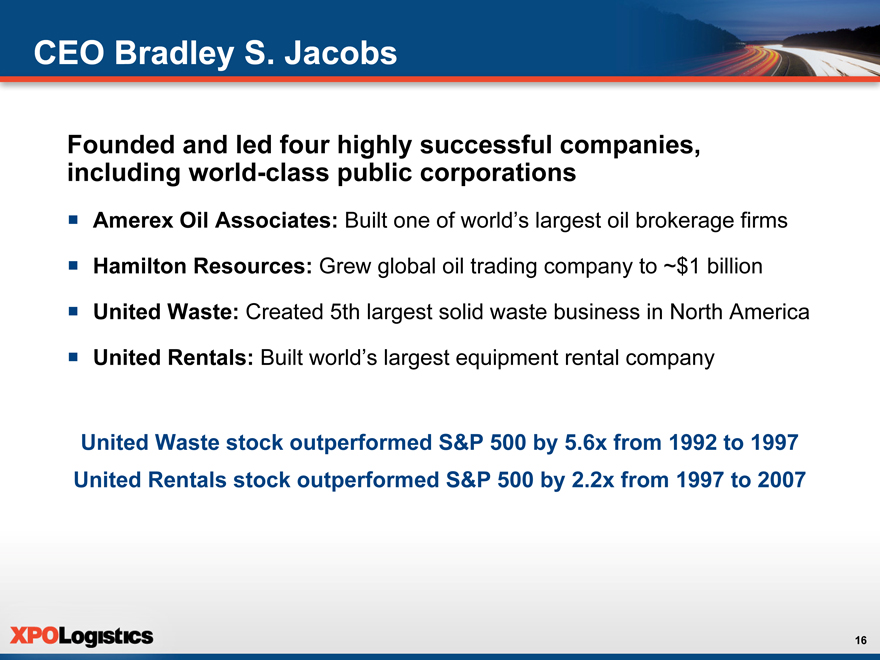

CEO Bradley S. Jacobs

Founded and led four highly successful companies, including world-class public corporations

Amerex Oil Associates: Built one of world’s largest oil brokerage firms Hamilton Resources: Grew global oil trading company to ~$1 billion United Waste: Created 5th largest solid waste business in North America United Rentals: Built world’s largest equipment rental company

United Waste stock outperformed S&P 500 by 5.6x from 1992 to 1997 United Rentals stock outperformed S&P 500 by 2.2x from 1997 to 2007

16

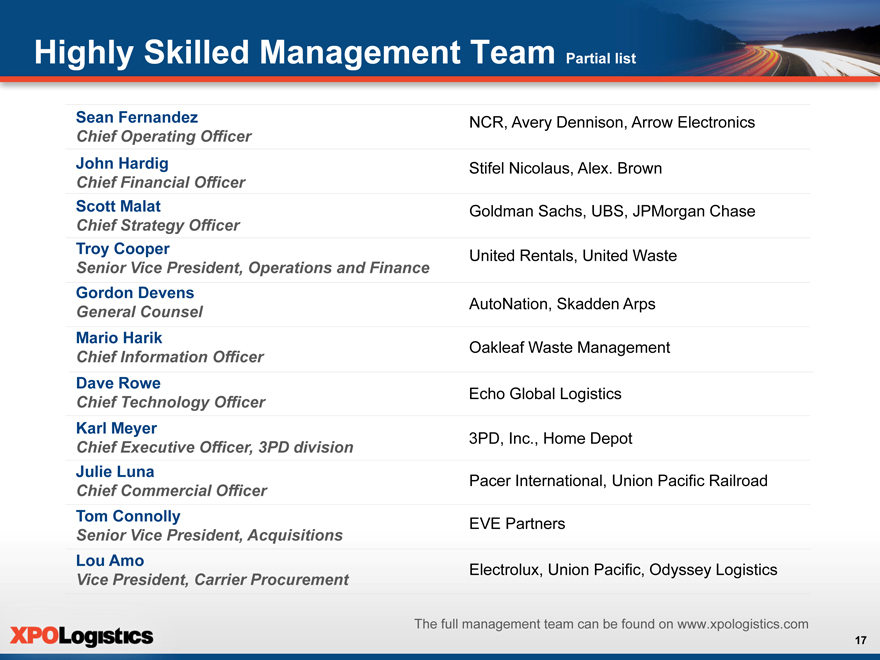

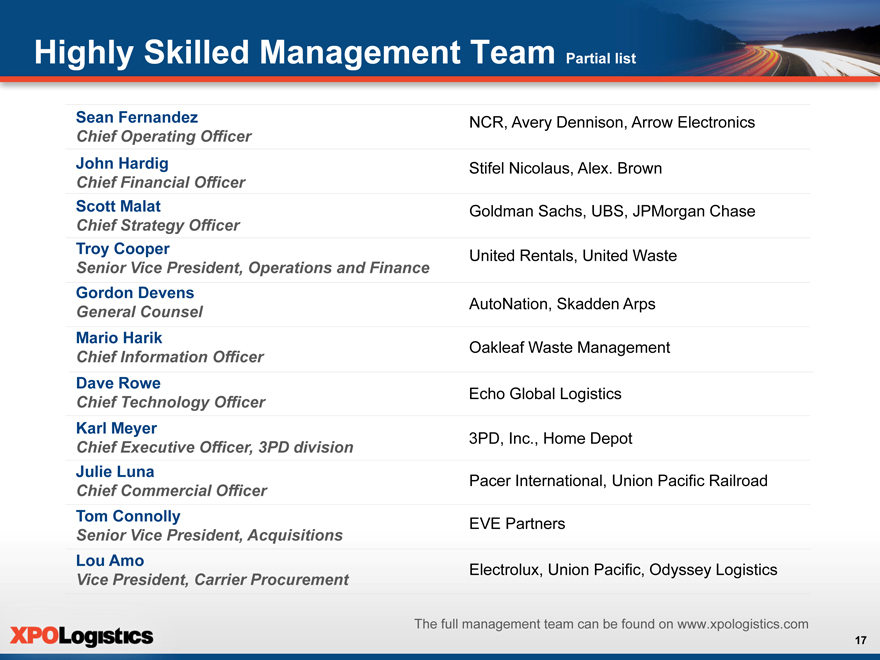

Highly Skilled Management Team Partial list

Sean Fernandez NCR, Avery Dennison, Arrow Electronics

Chief Operating Officer

John Hardig Stifel Nicolaus, Alex. Brown

Chief Financial Officer

Scott Malat Goldman Sachs, UBS, JPMorgan Chase

Chief Strategy Officer

Troy Cooper United Rentals, United Waste

Senior Vice President, Operations and Finance

Gordon Devens

AutoNation, Skadden Arps

General Counsel

Mario Harik

Oakleaf Waste Management

Chief Information Officer

Dave Rowe

Echo Global Logistics

Chief Technology Officer

Karl Meyer

3PD, Inc., Home Depot

Chief Executive Officer, 3PD division

Julie Luna

Pacer International, Union Pacific Railroad

Chief Commercial Officer

Tom Connolly

EVE Partners

Senior Vice President, Acquisitions

Lou Amo

Electrolux, Union Pacific, Odyssey Logistics

Vice President, Carrier Procurement

The full management team can be found on www.xpologistics.com

17

Deep Bench of Industry Experience Partial list

Chris Healy

Boyd Brothers, Caliber Logistics, Roberts Express

President, Expedited Transportation

Will O’Shea

Ryder Integrated Logistics, Cardinal Logistics

Chief Sales and Marketing Officer, 3PD division

Gregory Ritter

Knight, C.H. Robinson

Senior Vice President, Strategic Accounts

Jake Schnell

C.H. Robinson

Sr. Operational Process and Integration Manager

Jenna Sargent

OHL, Schneider Logistics

Regional Sales and Operation Manager

Marie Fields

C.H. Robinson, American Backhaulers

Director of Training

Kip Douglass

Crowley Maritime, Coyote

Regional Vice President

Drew Wilkerson

C.H. Robinson

Branch President, Charlotte

Doug George

AFN, Ryder Integrated Logistics

Branch President, Dallas

Evan Laskaris AFN, CEVA Logistics, Menlo

Director of Operations, Chicago

Andrew Armstrong

Livingston International, Echo Global Logistics

Sales and Operations Manager

18

First 24 Months of Growth Strategy

Revenue ($ millions)

$257

$194

$137 $109 $114 $71 $55 $45

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2012 2013

28% quarter-over-quarter CAGR

Source: Company data

19

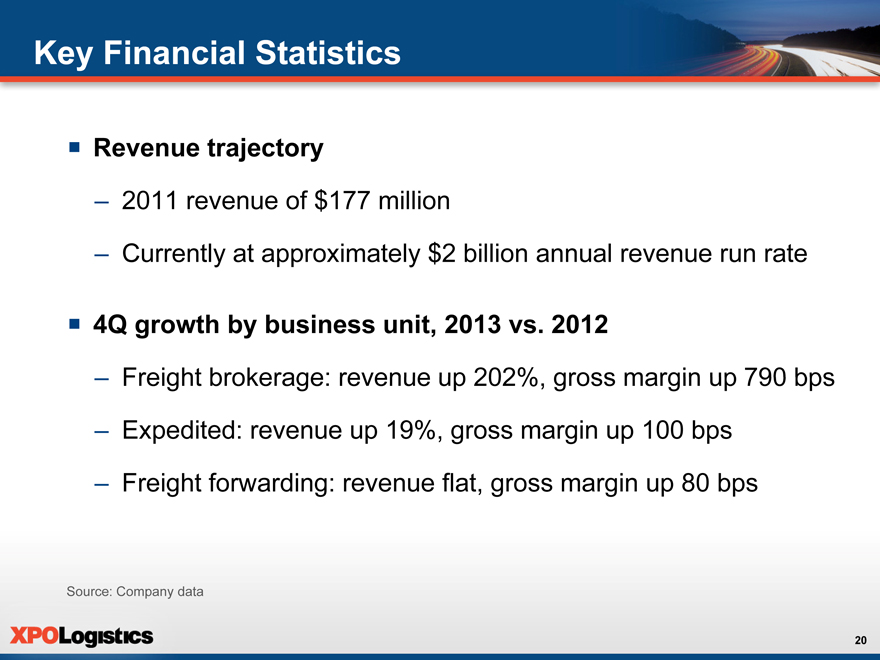

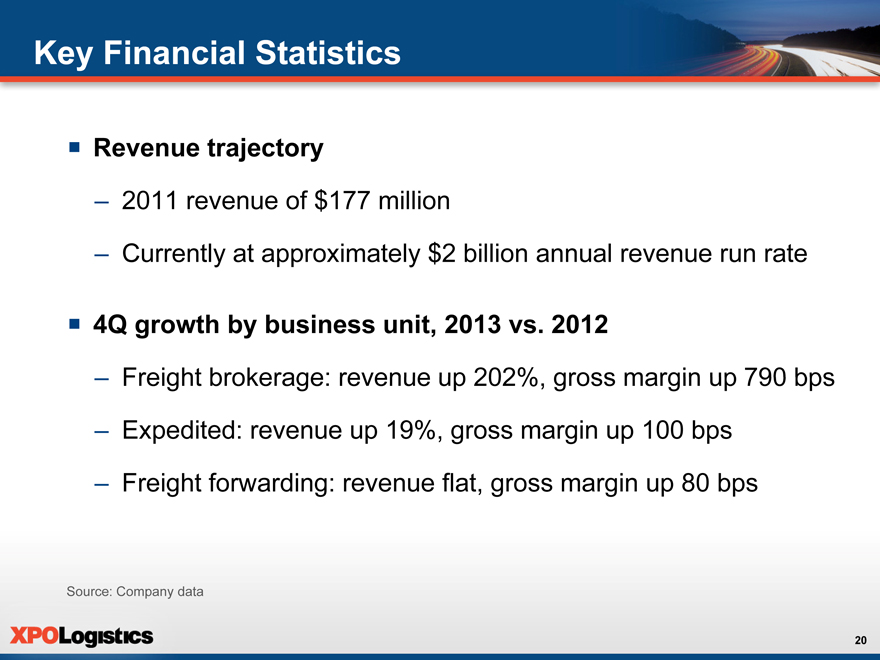

Key Financial Statistics

Revenue trajectory

– 2011 revenue of $177 million

– Currently at approximately $2 billion annual revenue run rate

4Q growth by business unit, 2013 vs. 2012

– Freight brokerage: revenue up 202%, gross margin up 790 bps

– Expedited: revenue up 19%, gross margin up 100 bps

– Freight forwarding: revenue flat, gross margin up 80 bps

Source: Company data

20

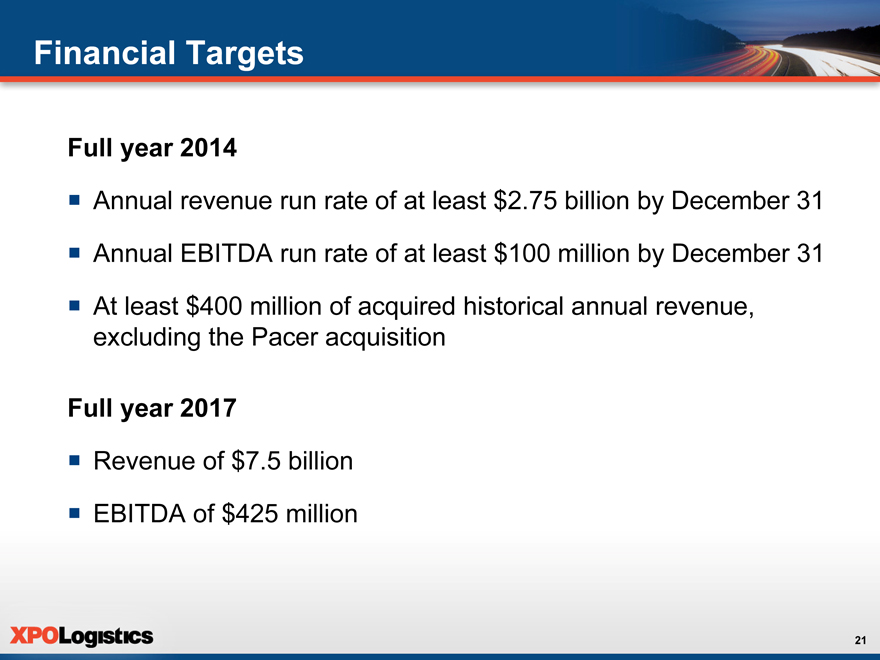

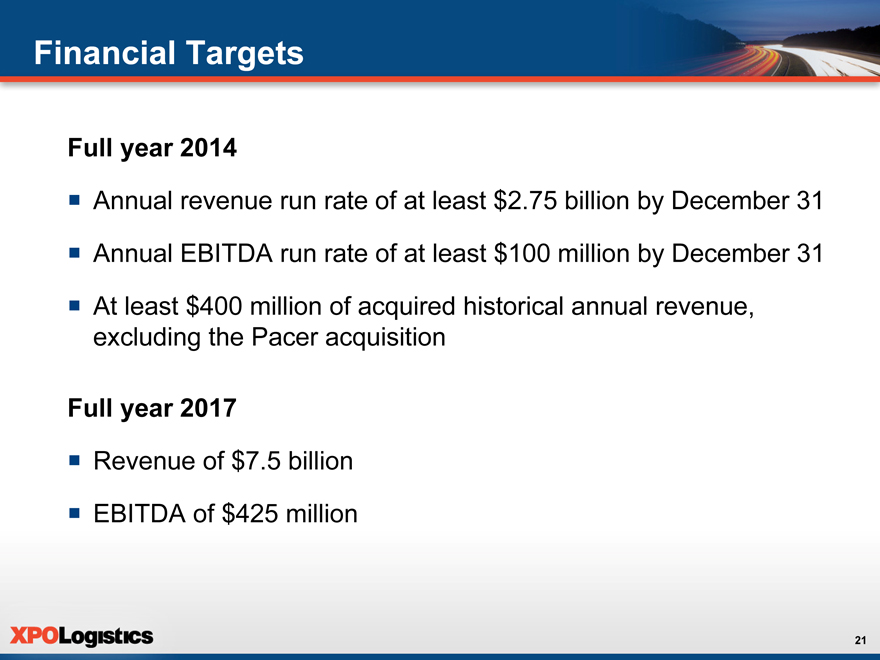

Financial Targets

Full year 2014

Annual revenue run rate of at least $2.75 billion by December 31

Annual EBITDA run rate of at least $100 million by December 31

At least $400 million of acquired historical annual revenue, excluding the Pacer acquisition

Full year 2017

Revenue of $7.5 billion

EBITDA of $425 million

21

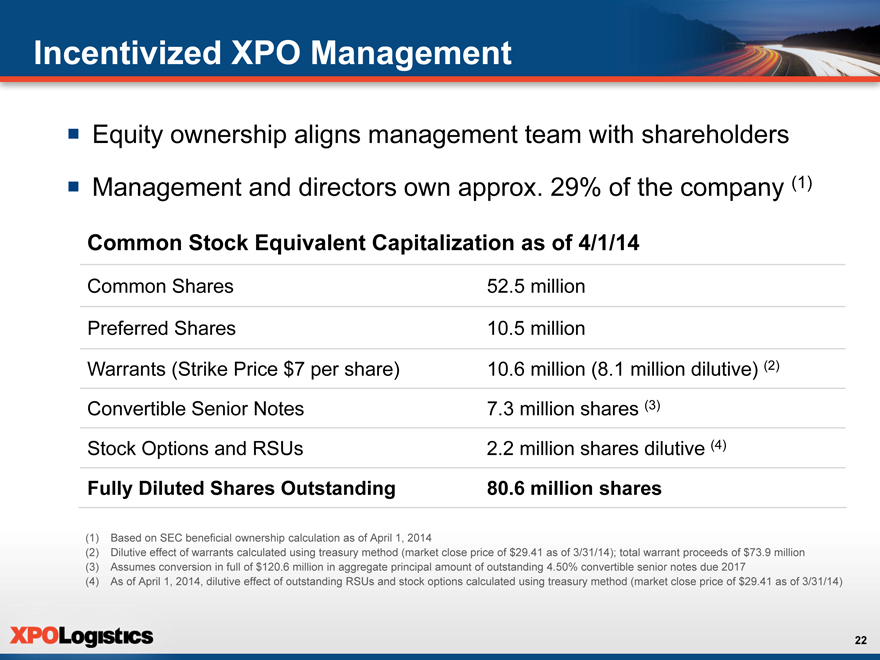

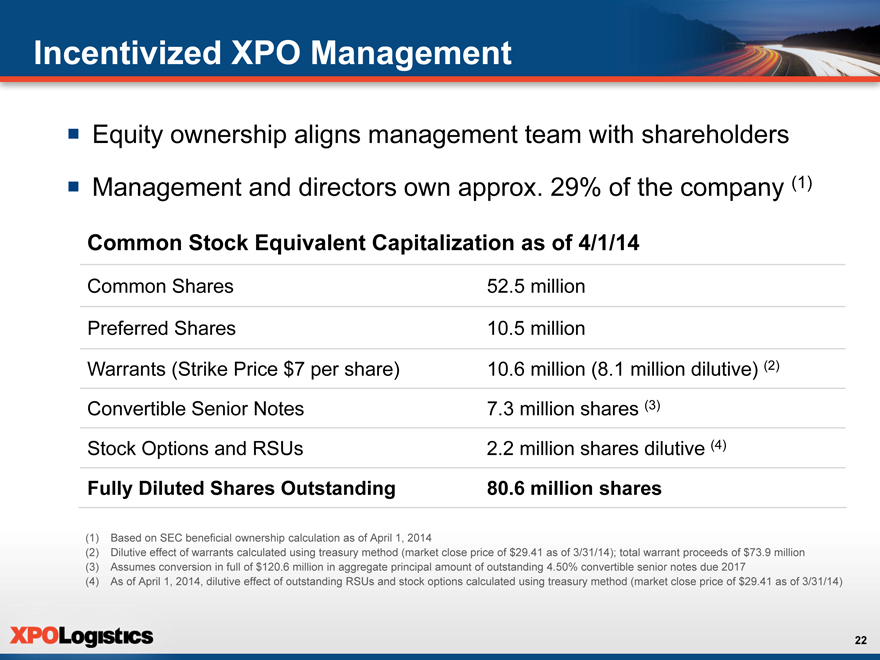

Incentivized XPO Management

Equity ownership aligns management team with shareholders

Management and directors own approx. 29% of the company (1)

Common Stock Equivalent Capitalization as of 4/1/14

Common Shares 52.5 million

Preferred Shares 10.5 million

Warrants (Strike Price $7 per share) 10.6 million (8.1 million dilutive) (2) Convertible Senior Notes 7.3 million shares (3) Stock Options and RSUs 2.2 million shares dilutive (4)

Fully Diluted Shares Outstanding 80.6 million shares

(1) Based on SEC beneficial ownership calculation as of April 1, 2014

(2) Dilutive effect of warrants calculated using treasury method (market close price of $29.41 as of 3/31/14); total warrant proceeds of $73.9 million (3) Assumes conversion in full of $120.6 million in aggregate principal amount of outstanding 4.50% convertible senior notes due 2017

(4) As of April 1, 2014, dilutive effect of outstanding RSUs and stock options calculated using treasury method (market close price of $29.41 as of 3/31/14)

22

Clear Path for Significant Value Creation

Assembled top management talent with skills uniquely suited to our growth strategy

Built a $177 million company into the 4th largest freight broker in North America in two years

Established leading positions in the fastest-growing areas of transportation logistics

Intent on making XPO an irreplaceable, single-source provider through a passionate culture of on-time performance

We’re making the best use of our resources to build our value to customers and drive profitable growth

23