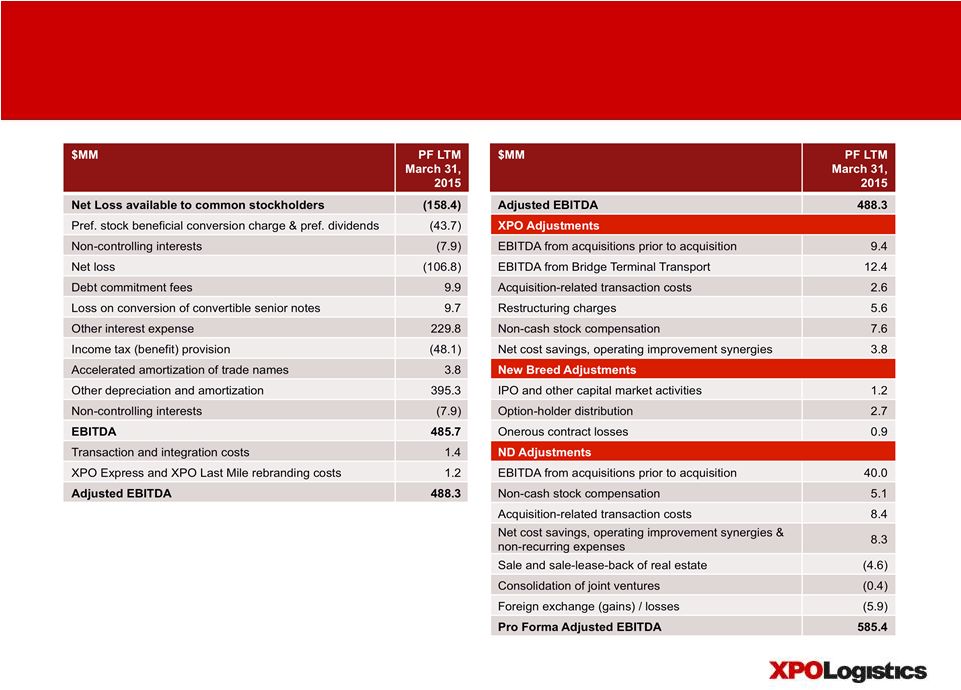

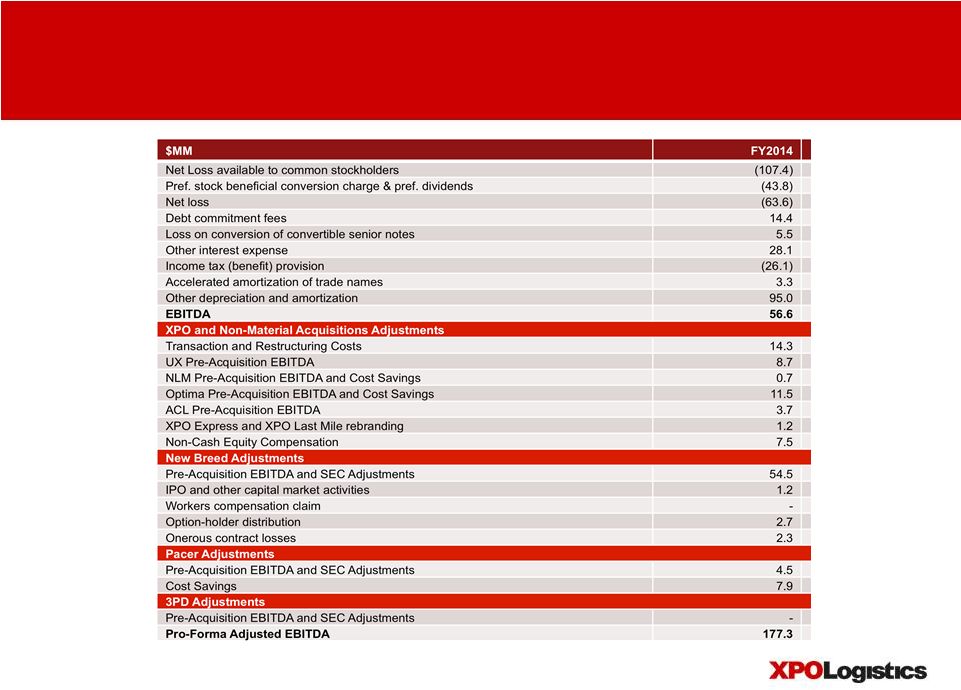

Disclaimers 2 | XPO Investor Presentation July 2015 Forward-Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including XPO Logistics, Inc.’s 2015 year-end run-rate performance targets, projected growth rates of industry sectors, modes and geographies in which XPO operates, the expected impact of the acquisitions of Norbert Dentressangle SA (ND) and Bridge Terminal Transport Services, Inc. (BTT), and the related financing, including the expected impact on XPO‘s results of operations and EBITDA, the expected ability to integrate operations and technology platforms and to cross-sell services, and the expected ability to retain acquired companies’ businesses and to grow XPO’s and the acquired companies’ businesses. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward- looking statements can be identified by the use of forward-looking terms such as "anticipate," "estimate," "believe," "continue," "could," "intend," "may," "plan," "potential," "predict," "should," "will," "expect," "objective," "projection," "forecast," "goal," "guidance," "outlook," "effort," "target" or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include those discussed in XPO’s filings with the SEC and the following: economic conditions generally; competition; XPO’s ability to find suitable acquisition candidates and execute its acquisition strategy; the expected impact of the Norbert Dentressangle and BTT acquisitions, including the expected impact on XPO's results of operations; XPO’s ability to successfully complete the tender offer of Norbert Dentressangle’s publicly held shares; the ability to successfully integrate and realize anticipated synergies and cost savings with respect to Norbert Dentressangle, BTT and other acquired companies; XPO’s ability to raise debt and equity capital; XPO’s ability to attract and retain key employees to execute its growth strategy, including retention of Norbert Dentressangle’s and BTT’s management teams; litigation, including litigation related to alleged misclassification of independent contractors; the ability to develop and implement a suitable information technology system; the ability to maintain positive relationships with XPO’s, Norbert Dentressangle’s and BTT’s networks of third-party transportation providers; the ability to retain XPO’s, Norbert Dentressangle’s, BTT’s and other acquired companies’ largest customers; rail and other network changes; weather and other service disruptions; and governmental regulation. All forward-looking statements set forth in this presentation are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, XPO or its businesses or operations. Forward-looking statements set forth in this document speak only as of the date hereof, and XPO undertakes no obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events except to the extent required by law. XPO Logistics France has obtained the visa of the French Autorité des marchés financiers on the simplified tender offer launched by XPO Logistics France on the shares of ND at a price of 217.50 euros per share (the “Offer”). The information memorandum prepared by XPO Logistics France received visa n° 15-290 of the AMF, dated June 23, 2015, further to the conformity decision rendered on the same date. Non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures as defined under Securities and Exchange Commission ("SEC") rules, such as pro forma adjusted earnings (loss) before interest, taxes, depreciation and amortization (“pro forma adjusted EBITDA“) for the 12-month periods ended December 31, 2014 and March 31, 2015. As required by SEC rules, we provide reconciliations of these measure to the most directly comparable measures under United States generally accepted accounting principles ("GAAP"), which are set forth in the attachments to this presentation. We believe that pro forma adjusted EBITDA improves comparability from period to period by removing the impact of our capital structure (interest expense from our outstanding debt), asset base (depreciation and amortization) and tax consequences, in addition to reflecting anticipated pro forma adjustments relating to recent acquisitions as permitted by the instruments governing our credit facility and senior notes. In addition to its use by management, we believe that EBITDA is a measure widely used by securities analysts, investors and others to evaluate the financial performance of companies in our industry. Other companies may calculate EBITDA differently, and therefore our measure may not be comparable to similarly titled measures of other companies. EBITDA is not a measure of financial performance or liquidity under GAAP and should not be considered in isolation or as an alternative to net income, cash flows from operating activities and other measures determined in accordance with GAAP. Items excluded from EBITDA are significant and necessary components of the operations of our business, and, therefore, EBITDA should only be used as a supplemental measure of our operating performance. |