Exhibit 99.1

XPO Investor Presentation and Transcript

August 2015

Disclaimers

Forward-Looking Statements

This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including the company’s full year 2019 financial targets. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include those discussed in XPO’s filings with the SEC and the following: economic conditions generally; competition; XPO’s ability to find suitable acquisition candidates and execute its acquisition strategy; the expected impact of the Norbert Dentressangle acquisition and other acquisitions, including the expected impact on XPO’s results of operations; the ability to successfully integrate and realize anticipated synergies and cost savings with respect to Norbert Dentressangle and other acquired companies; XPO’s ability to raise debt and equity capital; XPO’s ability to attract and retain key employees to execute its growth strategy, including retention of Norbert Dentressangle’s and other acquired companies’ management teams; litigation, including litigation related to alleged misclassification of independent contractors; the ability to develop and implement a suitable information technology system; the ability to maintain positive relationships with XPO’s, Norbert Dentressangle’s and other acquired companies’ networks of third-party transportation providers; the ability to retain XPO’s, Norbert Dentressangle’s and other acquired companies’ largest customers; rail and other network changes; weather and other service disruptions; and governmental regulation. All forward-looking statements set forth in this presentation are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, XPO or its businesses or operations. Forward-looking statements set forth in this document speak only as of the date hereof, and XPO undertakes no obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events except to the extent required by law.

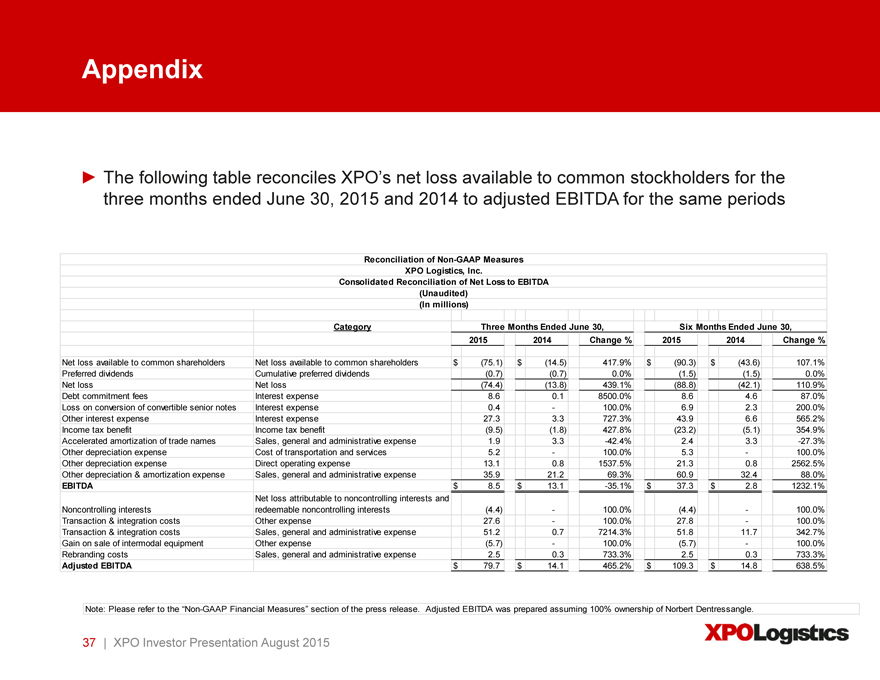

Non-GAAP Financial Measures

This presentation contains certain non-GAAP financial measures as defined under Securities and Exchange Commission (“SEC”) rules, such as adjusted earnings (loss) before interest, taxes, depreciation and amortization (“adjusted EBITDA”) for the quarters ended June 30, 2015 and 2014. As required by SEC rules, we provide reconciliations of these measures to the most directly comparable measures under United States generally accepted accounting principles (“GAAP”), which are set forth in the attachments to this presentation. We believe that adjusted EBITDA improves comparability from period to period by removing the impact of our capital structure (interest expense from our outstanding debt), asset base (depreciation and amortization) and tax consequences, in addition to other specified nonrecurring expense items, including acquisition-related transaction and integration costs; debt commitment fees; costs related to the rebranding to XPO Logistics (including accelerated amortization of trade names); loss on the conversion of the company’s convertible senior notes; impact of non-controlling interests; and gain on sale of intermodal equipment. In addition to its use by management, we believe that EBITDA is a measure widely used by securities analysts, investors and others to evaluate the financial performance of companies in our industry. Other companies may calculate EBITDA differently, and therefore our measure may not be comparable to similarly titled measures of other companies. EBITDA is not a measure of financial performance or liquidity under GAAP and should not be considered in isolation or as an alternative to net income, cash flows from operating activities and other measures determined in accordance with GAAP. Items excluded from EBITDA are significant and necessary components of the operations of our business, and, therefore, EBITDA should only be used as a supplemental measure of our operating performance.

XPO Investor Presentation August 2015

A Global Top Ten Transportation and Logistics Provider

Many robust avenues for growth

One of the world’s largest contract logistics companies

#1 last mile logistics provider for heavy goods in North America #1 manager of expedited shipments in North America #2 global freight brokerage firm by net revenue

#3 provider of intermodal services in North America, and leader in cross-border Mexico Largest owned fleet in Europe Growing presence in global freight forwarding Largest European platform for outsourced e-fulfillment

An increasing number of large customers want to consolidate their 3PL relationships with multi-modal providers

Source: Industry publications and company filings

XPO Investor Presentation August 2015

Highly Efficient and Customer Focused Organization

887 locations globally across 27 countries

54,000 employees serving over 30,000 customers

Access to network of over 700,000 trucks in North America and Europe 129 million square feet (12 million square meters) of logistics facilities Over 45,000 deliveries a day facilitated by XPO businesses in North America Over 2 billion inventory units are tracked by XPO’s contract logistics technology

Operating worldwide under the single brand of XPO Logistics

Source: Company information

XPO Investor Presentation August 2015

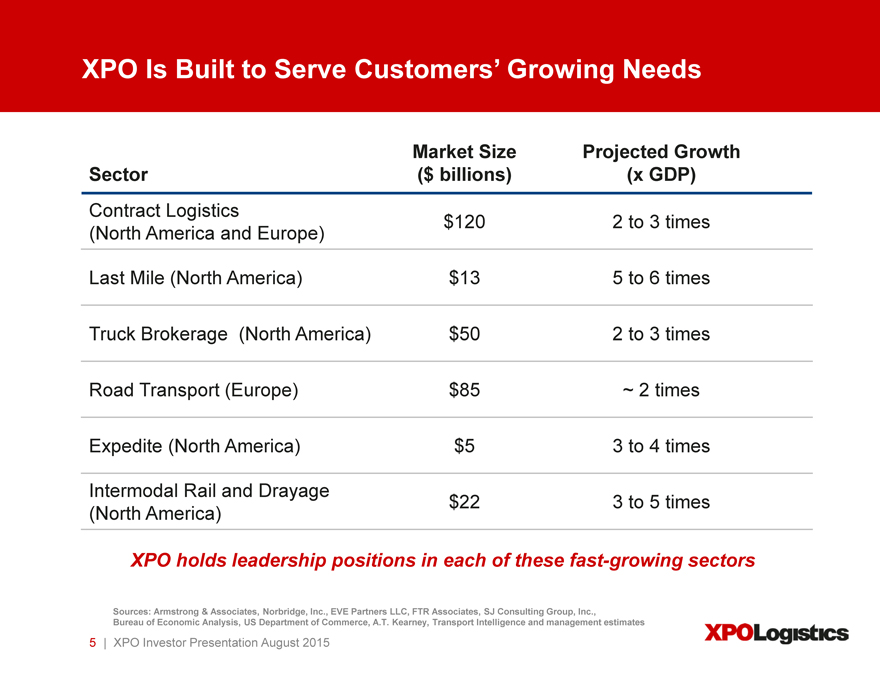

XPO Is Built to Serve Customers’ Growing Needs

Market Size Projected Growth

Sector ($ billions) (x GDP)

Contract Logistics $120 2 to 3 times

(North America and Europe)

Last Mile (North America) $13 5 to 6 times

Truck Brokerage (North America) $50 2 to 3 times

Road Transport (Europe) $85 ~ 2 times

Expedite (North America) $5 3 to 4 times

Intermodal Rail and Drayage $22 3 to 5 times

(North America)

XPO holds leadership positions in each of these fast-growing sectors

Sources: Armstrong & Associates, Norbridge, Inc., EVE Partners LLC, FTR Associates, SJ Consulting Group, Inc.,

Bureau of Economic Analysis, US Department of Commerce, A.T. Kearney, Transport Intelligence and management estimates

| XPO Investor Presentation August 2015

Contract Logistics: Long-term, Sticky Relationships

Significant barriers to entry Largely non-commoditized High value-add component

In Europe: Full range of retail logistics, and specialized services for cold chain, chemicals and e-commerce

In North America: Deep relationships in technology, wireless, e-commerce, aerospace, medical equipment, and select areas of manufacturing Low cyclicality

Average contractual agreement is five years

Average contract renewal rate of over 97% Source: Company information

XPO Investor Presentation August 2015

Major Player in E-Commerce

Leading e-commerce capabilities in high-growth e-fulfillment, reverse logistics and last mile

Worldwide e-commerce is projected to grow at a rate of 13% to 21% through at least 2018 North American market leader in last mile for heavy goods, with approximately 5% market share in an estimated $13 billion North American market

Untapped last mile opportunity in Europe

European market leader with approximately 5% market share in an estimated ¬5 billion e-fulfillment market

242 million revenue in e-commerce logistics in 2014

31% year-over-year organic growth in 2014

Sources: Company and industry information

XPO Investor Presentation August 2015

Blue Chip Customers

Any trademarks or logos used in this presentation are the property of their respective owners

XPO Investor Presentation August 2015

Blue Chip Customers

Any trademarks or logos used in this presentation are the property of their respective owners

XPO Investor Presentation August 2015

9

High Productivity through Technology

IT team of about 1,000 professionals

Over 200 IT projects launching in 2015

Proprietary technology delivers world-class service

Sophisticated contract logistics solutions for complex supply chain requirements Rigorous inventory management technology Freight Optimizer for cutting-edge pricing and load-covering Real-time customer experience management solutions Online bidding software Powerful suite of Rail Optimizer tools

Global IT budget of $225 million this year

XPO Investor Presentation August 2015

10

Disciplined Selection Process from M&A Pipeline

Acquisition prospects must meet strategic criteria

Provide services our customers highly value Highly scalable

Technology-oriented, with a willingness to embrace additional technology Operations that can be tightly integrated into XPO’s network Experienced management and enthusiastic employees Focus on world-class customer service that mirrors XPO’s culture

Two-pronged pipeline of complementary prospects in both North America and Europe

XPO Investor Presentation August 2015

11

Rock Solid Financial Position

$1.2 billion in cash, in addition to an undrawn $415 million asset-backed loan Positive and accelerating free cash flow Low maintenance capex, with total net capex of about 2% of revenue Global access to the highest caliber institutional investors Raised total of $2 billion of equity in two private offerings

September 2014: three leading global investors endorsed XPO’s growth strategy May 2015: same three investors expanded their positions, together with new institutional investors

XPO Investor Presentation August 2015

12

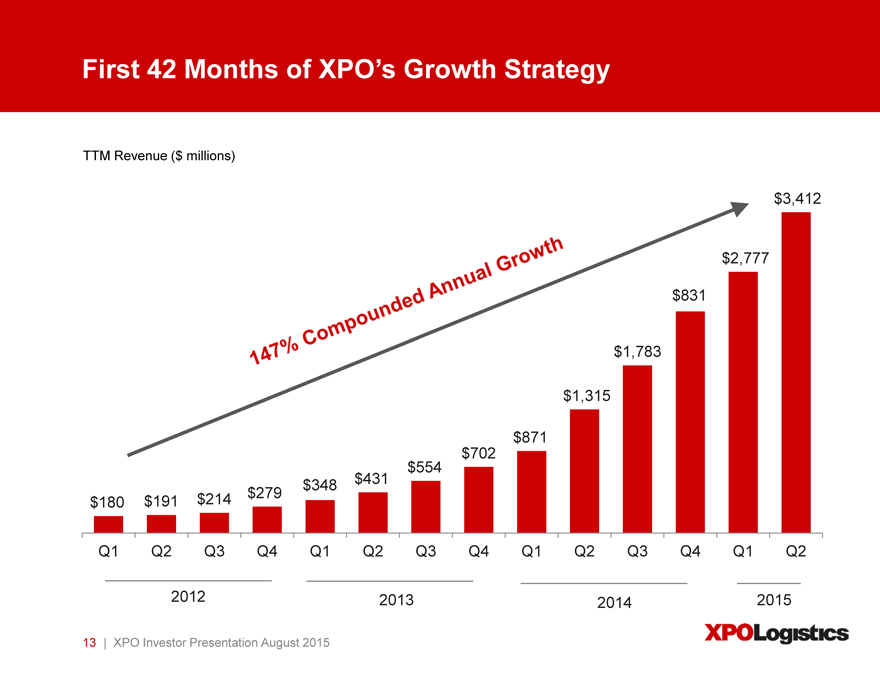

First 42 Months of XPO’s Growth Strategy

TTM Revenue ($ millions)

$3,412

$2,777

$831

$1,783

$1,315

$871 $554 $702 $279 $348 $431 $180 $191 $214

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2012 2013 2014 2015

XPO Investor Presentation August 2015

13

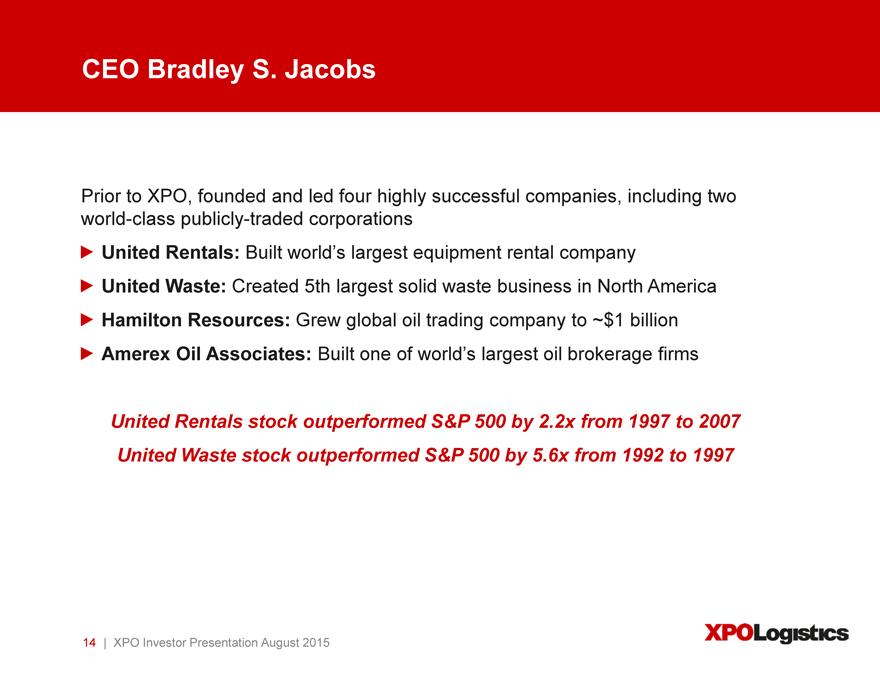

CEO Bradley S. Jacobs

Prior to XPO, founded and led four highly successful companies, including two world-class publicly-traded corporations

United Rentals: Built world’s largest equipment rental company

United Waste: Created 5th largest solid waste business in North America Hamilton Resources: Grew global oil trading company to ~$1 billion Amerex Oil Associates: Built one of world’s largest oil brokerage firms

United Rentals stock outperformed S&P 500 by 2.2x from 1997 to 2007 United Waste stock outperformed S&P 500 by 5.6x from 1992 to 1997

XPO Investor Presentation August 2015

14

Highly Skilled Management Team

Ashfaque Chowdhury

CIO, Contract Logistics, Americas New Breed

Troy Cooper

Chief Operating Officer United Rentals, United Waste

Louis DeJoy New Breed

CEO, Contract Logistics, Americas

Gordon Devens AutoNation, Skadden Arps

General Counsel

Bill Fraine

COO, Contract Logistics, Americas New Breed, FedEx

Luis Angel Gómez Norbert Dentressangle, Christian Salveson

Managing Director, Transport, Europe

John Hardig Stifel Nicolaus, Alex. Brown

Chief Financial Officer

Mario Harik Oakleaf Waste Management

Chief Information Officer

Angela Kirkby

Senior Vice President, Human Resources Belk, Bank of America, Accenture

Julie Luna

Chief Commercial Officer Pacer, Union Pacific

Partial list

XPO Investor Presentation August 2015

15

Highly Skilled Management Team (Cont’d)

Scott Malat

Chief Strategy Officer Goldman Sachs, UBS, JPMorgan Chase

Karl Meyer

Chief Executive Officer, Last Mile 3PD, Home Depot

Hervé Montjotin

Chief Executive Officer, Europe Norbert Dentressangle

Dominick Muzi

President, Global Forwarding Priority Solutions, AIT Worldwide

Michael O’Donnell

Executive VP, Expedite Managed Transportation Landstar, Penske, TNT

Will O’Shea

Chief Sales and Marketing Officer, Last Mile 3PD, Ryder, Cardinal Logistics

Ludovic Oster

Senior Vice President, Human Resources, Europe Norbert Dentressangle, Delphi, Valeo

Greg Ritter

Senior Vice President, Strategic Accounts Knight Transportation, C.H. Robinson

Paul Smith

President, Intermodal Pacer

Malcolm Wilson

Managing Director, Logistics, Europe Norbert Dentressangle, NYK Logistics

Partial list

XPO Investor Presentation August 2015

16

Second Quarter 2015 Financial Results

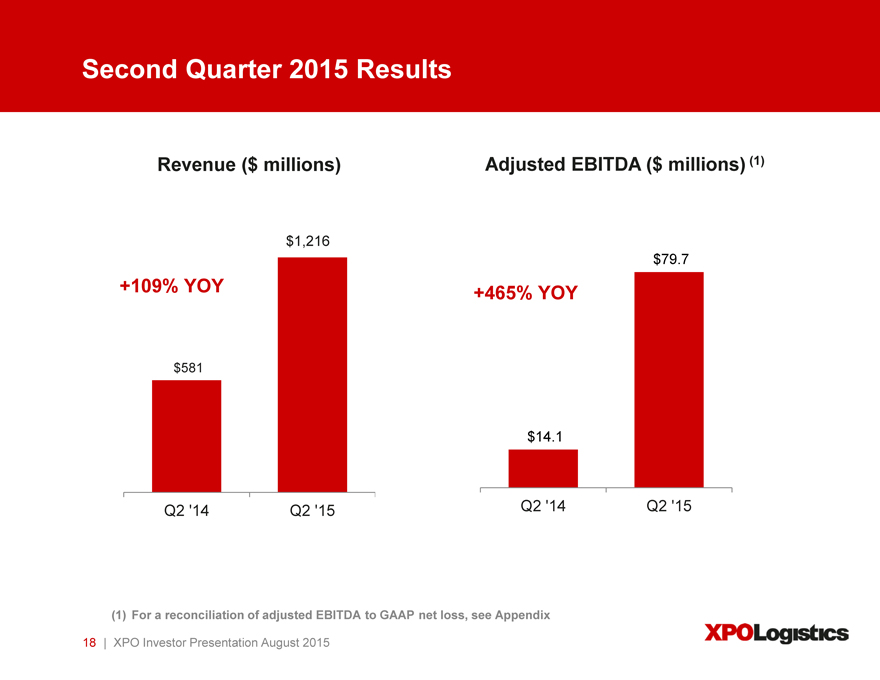

Second Quarter 2015 Results

Revenue ($ millions) Adjusted EBITDA ($ millions) (1)

$1,216 $79.7

+109% YOY

+465% YOY

$581

$14.1

Q2 ‘14 Q2 ‘15 Q2 ‘14 Q2 ‘15

(1) | | For a reconciliation of adjusted EBITDA to GAAP net loss, see Appendix |

XPO Investor Presentation August 2015

18

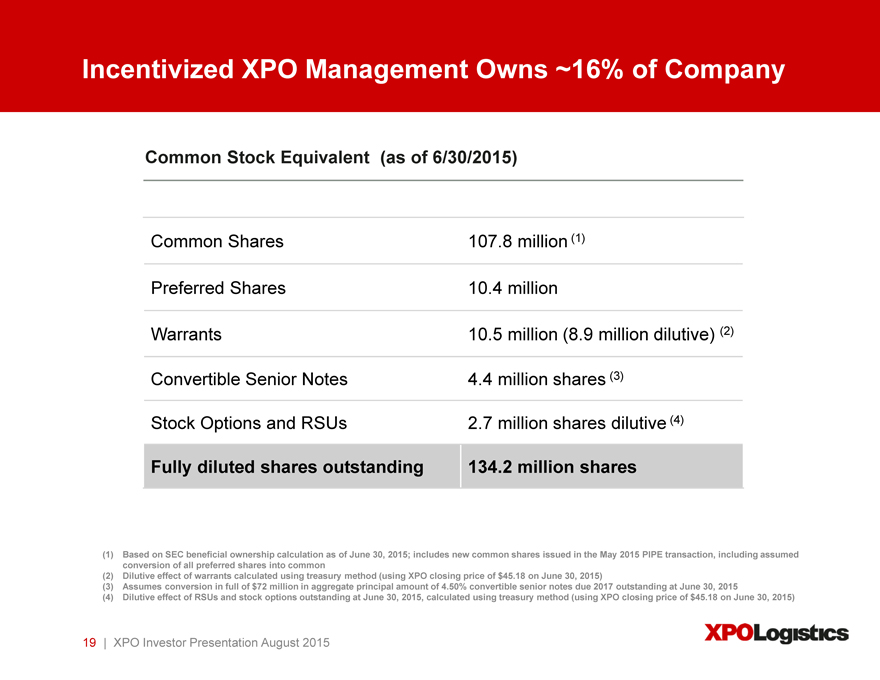

Incentivized XPO Management Owns ~16% of Company

Common Stock Equivalent (as of 6/30/2015)

Common Shares 107.8 million (1)

Preferred Shares 10.4 million

Warrants 10.5 million (8.9 million dilutive) (2)

Convertible Senior Notes 4.4 million shares (3)

Stock Options and RSUs 2.7 million shares dilutive (4)

Fully diluted shares outstanding 134.2 million shares

(1) Based on SEC beneficial ownership calculation as of June 30, 2015; includes new common shares issued in the May 2015 PIPE transaction, including assumed conversion of all preferred shares into common (2) Dilutive effect of warrants calculated using treasury method (using XPO closing price of $45.18 on June 30, 2015) (3) Assumes conversion in full of $72 million in aggregate principal amount of 4.50% convertible senior notes due 2017 outstanding at June 30, 2015 (4) Dilutive effect of RSUs and stock options outstanding at June 30, 2015, calculated using treasury method (using XPO closing price of $45.18 on June 30, 2015)

XPO Investor Presentation August 2015

19

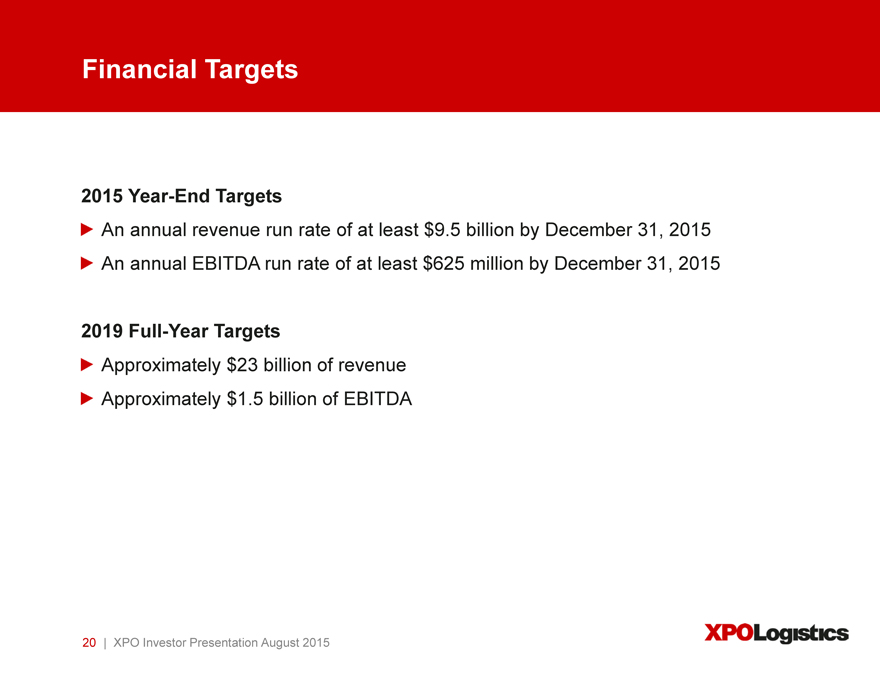

Financial Targets

2015 Year-End Targets

An annual revenue run rate of at least $9.5 billion by December 31, 2015 An annual EBITDA run rate of at least $625 million by December 31, 2015

2019 Full-Year Targets

Approximately $23 billion of revenue Approximately $1.5 billion of EBITDA

XPO Investor Presentation August 2015

20

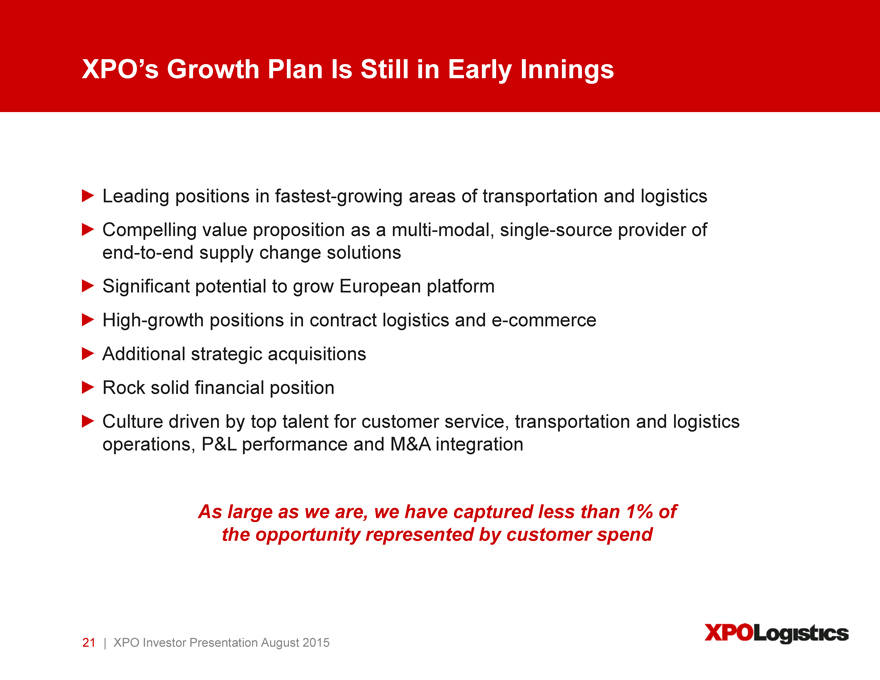

XPO’s Growth Plan Is Still in Early Innings

Leading positions in fastest-growing areas of transportation and logistics Compelling value proposition as a multi-modal, single-source provider of end-to-end supply change solutions Significant potential to grow European platform High-growth positions in contract logistics and e-commerce Additional strategic acquisitions Rock solid financial position Culture driven by top talent for customer service, transportation and logistics operations, P&L performance and M&A integration

As large as we are, we have captured less than 1% of the opportunity represented by customer spend

XPO Investor Presentation August 2015

21

Acquired Norbert Dentressangle(ND)

June 8, 2015

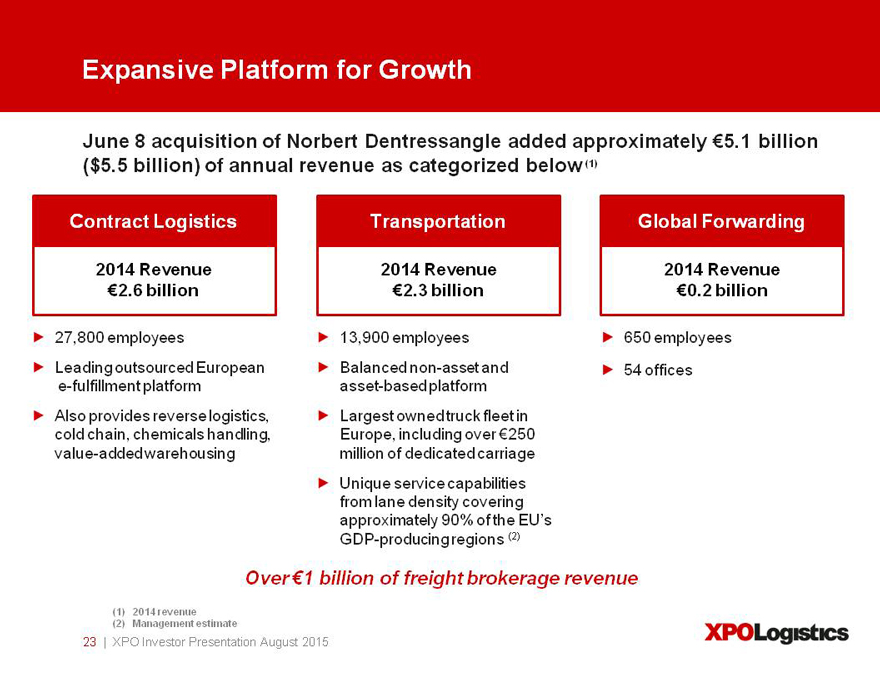

Expansive Platform for Growth

June 8 acquisition of Norbert Dentressangle added approximately €5.1 billion

($5.5 billion) of annual revenue as categorized below (1)

Contract Logistics Transportation Global Forwarding

2014 Revenue 2014 Revenue 2014 Revenue €2.6 billion €2.3 billion €0.2 billion

27,800 employees

Leading outsourced European e-fulfillment platform Also provides reverse logistics, cold chain, chemicals handling, value-added warehousing

13,900 employees Balanced non-asset and asset-based platform Largest owned truck fleet in Europe, including over ¬250 million of dedicated carriage Unique service capabilities from lane density covering approximately 90% of the EU’s GDP-producing regions (2)

employees

offices

Over €1 billion of freight brokerage revenue

XPO Investor Presentation August 2015

23

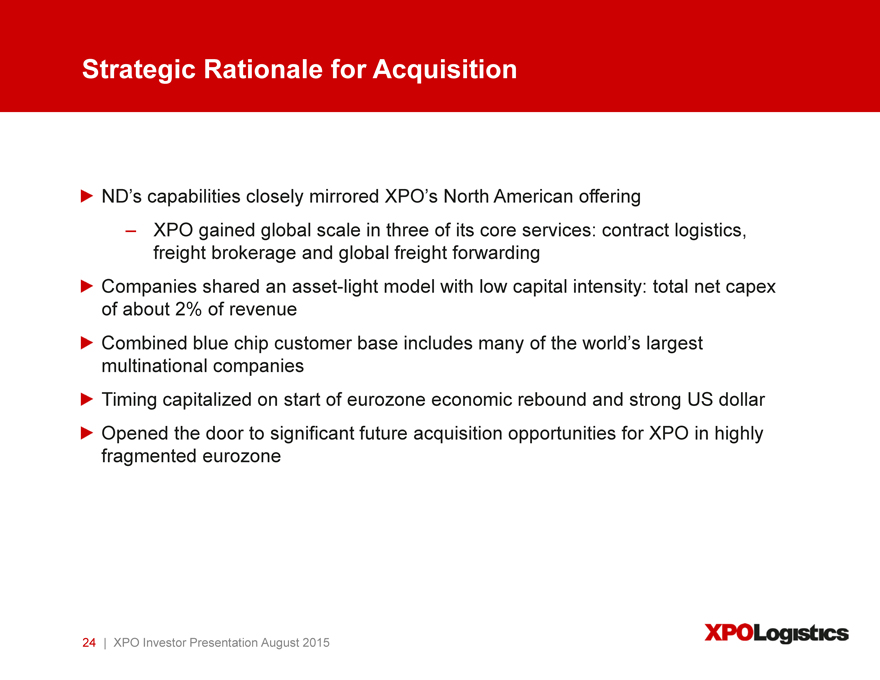

Strategic Rationale for Acquisition

ND’s capabilities closely mirrored XPO’s North American offering

XPO gained global scale in three of its core services: contract logistics, freight brokerage and global freight forwarding Companies shared an asset-light model with low capital intensity: total net capex of about 2% of revenue Combined blue chip customer base includes many of the world’s largest multinational companies Timing capitalized on start of eurozone economic rebound and strong US dollar Opened the door to significant future acquisition opportunities for XPO in highly fragmented eurozone

XPO Investor Presentation August 2015

24

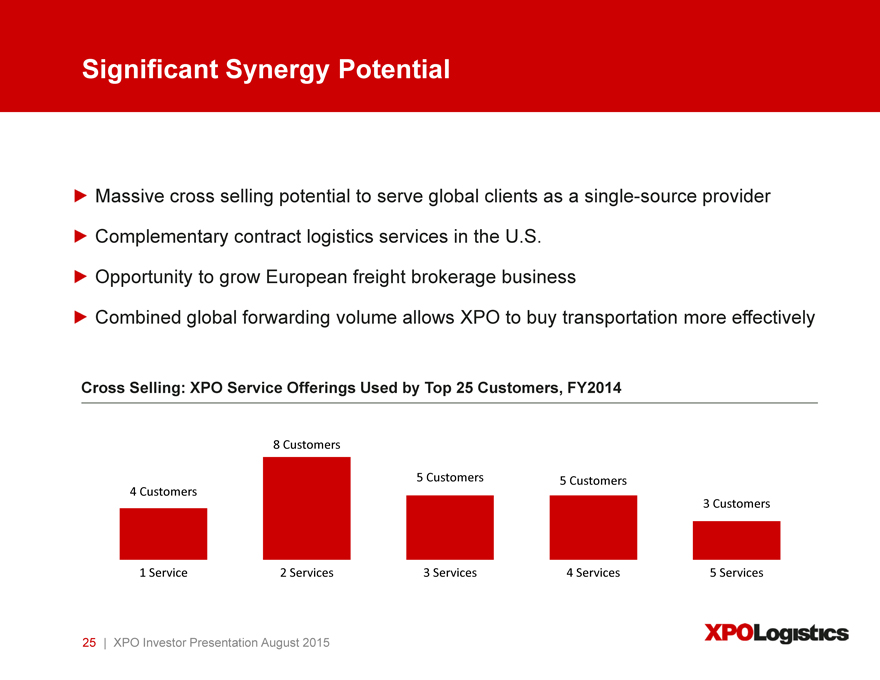

Significant Synergy Potential

Massive cross selling potential to serve global clients as a single-source provider

Complementary contract logistics services in the U.S.

Opportunity to grow European freight brokerage business

Combined global forwarding volume allows XPO to buy transportation more effectively

Cross Selling: XPO Service Offerings Used by Top 25 Customers, FY2014

1 | | Service 2 Services 3 Services 4 Services 5 Services |

XPO Investor Presentation August 2015

25

XPO Gained Leadership in European E-Fulfillment

Favorable historical performance and future growth opportunities

242 million revenue in e-commerce logistics in 2014

31% organic growth compared to 2013

Business focused in the UK, Spain and France

Strong growth potential with approximately 5% market share in estimated 5 billion European e-fulfillment market

Expected to increase at 9% to 10% CAGR over the next several years Increasingly complex supply chains and customer requirements demand scale, which XPO has and few others can match

Serves both B2B and B2C customers

Leading capabilities in high-growth reverse logistics

Source: Company information

XPO Investor Presentation August 2015

26

Preeminent European Transportation Network

36-year history as global partner to blue chip customers Combines non-asset, asset-light and asset-based operations

Rapid growth in freight brokerage, asset-light palletized service and dedicated carriage Unique service capabilities from lane density covering approximately 90% of the EU’s GDP-producing regions Ground transportation in primary markets of the UK, Spain and France is an estimated ¬95 billion market

Source: Company information

XPO Investor Presentation August 2015

27

Combination is a Growth Accelerator

Deploy cutting-edge technology to turbocharge growth in freight brokerage

Pricing and truck matching algorithms to accelerate growth and margins

Combined annual technology spend is among the highest in the industry Combine leading businesses in fast growth e-commerce

Top outsourced e-fulfillment provider in Europe, handling over 200 million units per year

Leading capabilities in reverse logistics

Expand leadership position in last mile logistics for heavy goods to Europe

Sharing best practices and capabilities across new global platform

XPO Investor Presentation August 2015

28

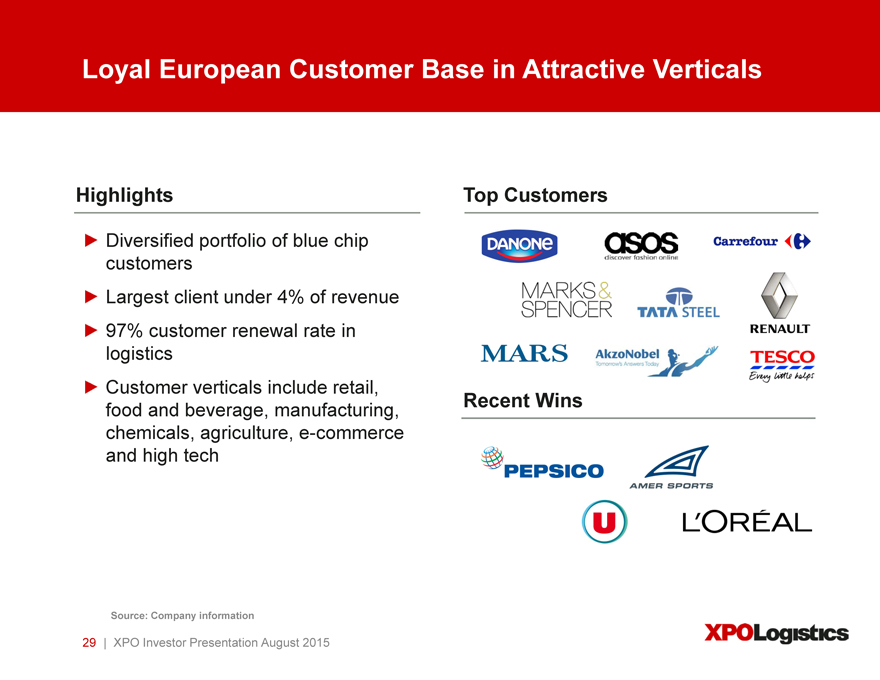

Loyal European Customer Base in Attractive Verticals

Highlights Top Customers

Diversified portfolio of blue chip customers Largest client under 4% of revenue 97% customer renewal rate in logistics Customer verticals include retail, food and beverage, manufacturing, chemicals, agriculture, e-commerce and high tech

Source: Company information

XPO Investor Presentation August 2015

29

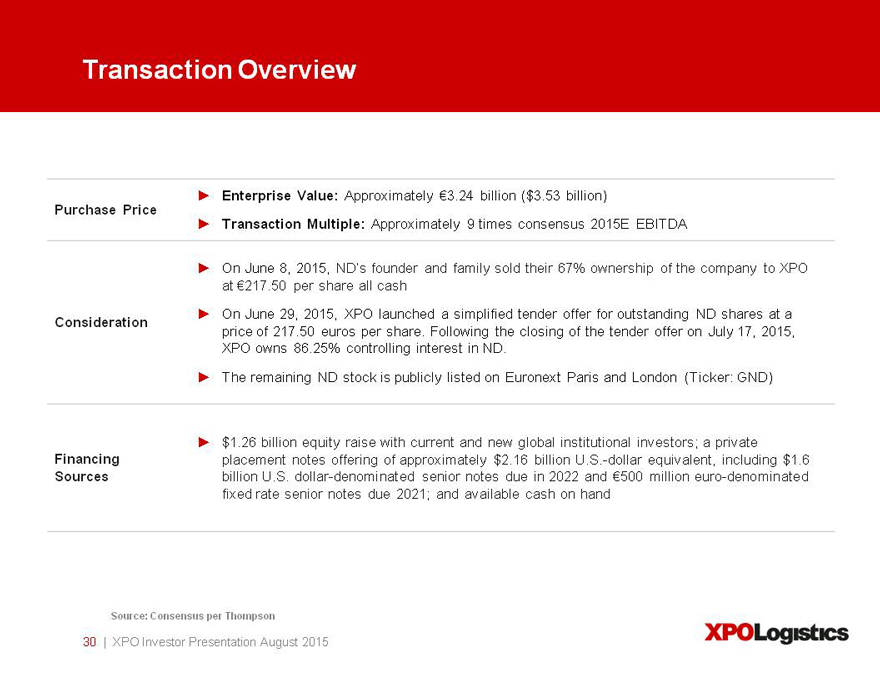

Purchase Price

Consideration

Financing Sources

Enterprise Value: Approximately ¬3.24 billion ($3.53 billion)

Transaction Multiple: Approximately 9 times consensus 2015E EBITDA

On June 8, 2015, ND’s founder and family sold their 67% ownership of the company to XPO at ¬217.50 per share all cash On June 29, 2015, XPO launched a simplified tender offer for outstanding ND shares at a price of 217.50 euros per share. Following the closing of the tender offer on July 17, 2015, XPO owns 86.25% controlling interest in ND.

The remaining ND stock is publicly listed on Euronext Paris and London (Ticker: GND)

$1.26 billion equity raise with current and new global institutional investors; a private placement notes offering of approximately $2.16 billion U.S.-dollar equivalent, including $1.6 billion U.S. dollar-denominated senior notes due in 2022 and ¬500 million euro-denominated fixed rate senior notes due 2021; and available cash on hand

Source: Consensus per Thompson

XPO Investor Presentation August 2015

30

Acquired Bridge Terminal Transport (BTT)

June 1, 2015

Acquired Bridge Terminal Transport (BTT)

One of the largest asset-light drayage providers in the United States

Approximately 1,800 customers, including many longstanding, blue chip customer relationships Revenue of $232 million and EBITDA of $12.4 million for the trailing 12 months ended March 31, 2015 Purchase price was $100 million, excluding any working capital adjustments, with no assumption of debt

Represents a consideration of 8.1 times EBITDA of $12.4 million Operations are being rebranded and integrated as XPO Logistics

XPO Investor Presentation August 2015

32

Strategic Rationale and Synergies

XPO gained 1,300 independent owner operators and 28 terminals

Increased XPO’s total capacity under contract to its drayage, last mile and expedite businesses to more than 6,400 independent owner operators

Strengthened XPO’s drayage footprint on the East Coast

XPO can take on more freight in tight markets when drayage capacity is scarce

More cost effective and more reliable to use contracted owner operators, rather than unaffiliated third-party carriers Well-run operations can be seamlessly integrated into XPO’s network

XPO Investor Presentation August 2015

33

Supplemental Materials

XPO Business Glossary

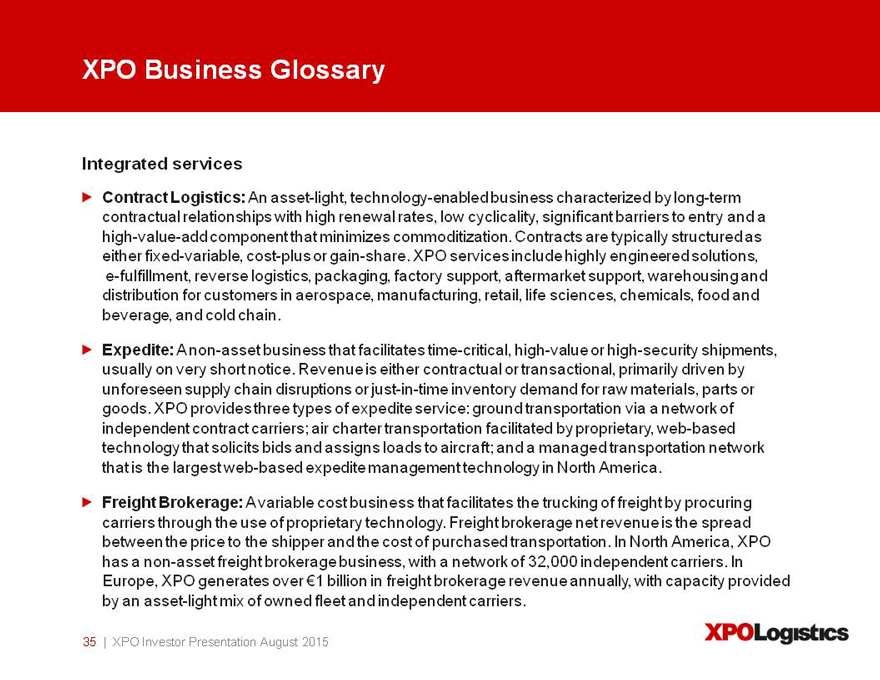

Integrated services

Contract Logistics: An asset-light, technology-enabled business characterized by long-term contractual relationships with high renewal rates, low cyclicality, significant barriers to entry and a high-value-add component that minimizes commoditization. Contracts are typically structured as either fixed-variable, cost-plus or gain-share. XPO services include highly engineered solutions, e-fulfillment, reverse logistics, packaging, factory support, aftermarket support, warehousing and distribution for customers in aerospace, manufacturing, retail, life sciences, chemicals, food and beverage, and cold chain.

Expedite: A non-asset business that facilitates time-critical, high-value or high-security shipments, usually on very short notice. Revenue is either contractual or transactional, primarily driven by unforeseen supply chain disruptions or just-in-time inventory demand for raw materials, parts or goods. XPO provides three types of expedite service: ground transportation via a network of independent contract carriers; air charter transportation facilitated by proprietary, web-based technology that solicits bids and assigns loads to aircraft; and a managed transportation network that is the largest web-based expedite management technology in North America.

Freight Brokerage: A variable cost business that facilitates the trucking of freight by procuring carriers through the use of proprietary technology. Freight brokerage net revenue is the spread between the price to the shipper and the cost of purchased transportation. In North America, XPO has a non-asset freight brokerage business, with a network of 32,000 independent carriers. In Europe, XPO generates over ¬1 billion in freight brokerage revenue annually, with capacity provided by an asset-light mix of owned fleet and independent carriers.

XPO Investor Presentation August 2015

35

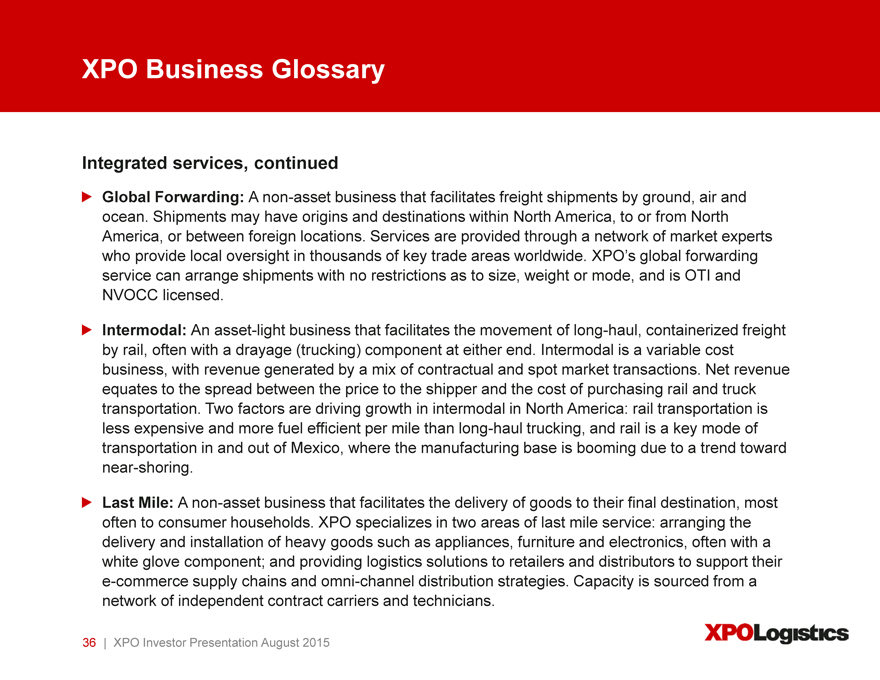

XPO Business Glossary

Integrated services, continued

Global Forwarding: A non-asset business that facilitates freight shipments by ground, air and ocean. Shipments may have origins and destinations within North America, to or from North America, or between foreign locations. Services are provided through a network of market experts who provide local oversight in thousands of key trade areas worldwide. XPO’s global forwarding service can arrange shipments with no restrictions as to size, weight or mode, and is OTI and NVOCC licensed.

Intermodal: An asset-light business that facilitates the movement of long-haul, containerized freight by rail, often with a drayage (trucking) component at either end. Intermodal is a variable cost business, with revenue generated by a mix of contractual and spot market transactions. Net revenue equates to the spread between the price to the shipper and the cost of purchasing rail and truck transportation. Two factors are driving growth in intermodal in North America: rail transportation is less expensive and more fuel efficient per mile than long-haul trucking, and rail is a key mode of transportation in and out of Mexico, where the manufacturing base is booming due to a trend toward near-shoring.

Last Mile: A non-asset business that facilitates the delivery of goods to their final destination, most often to consumer households. XPO specializes in two areas of last mile service: arranging the delivery and installation of heavy goods such as appliances, furniture and electronics, often with a white glove component; and providing logistics solutions to retailers and distributors to support their e-commerce supply chains and omni-channel distribution strategies. Capacity is sourced from a network of independent contract carriers and technicians.

XPO Investor Presentation August 2015

36

Appendix

Reconciliation of Non-GAAP Measures

XPO Logistics, Inc.

Consolidated Reconciliation of Net Loss to EBITDA

(Unaudited)

(In millions)

Category Three Months Ended June 30, Six Months Ended June 30,

2015 2014 Change % 2015 2014 Change %

Net loss available to common shareholders Net loss available to common shareholders $ (75.1) $ (14.5) 417.9% $ (90.3) $ (43.6) 107.1%

Preferred dividends Cumulative preferred dividends (0.7) (0.7) 0.0% (1.5) (1.5) 0.0%

Net loss Net loss (74.4) (13.8) 439.1% (88.8) (42.1) 110.9%

Debt commitment fees Interest expense 8.6 0.1 8500.0% 8.6 4.6 87.0%

Loss on conversion of convertible senior notes Interest expense 0.4 — 100.0% 6.9 2.3 200.0%

Other interest expense Interest expense 27.3 3.3 727.3% 43.9 6.6 565.2%

Income tax benefit Income tax benefit (9.5) (1.8) 427.8% (23.2) (5.1) 354.9%

Accelerated amortization of trade names Sales, general and administrative expense 1.9 3.3 -42.4% 2.4 3.3 -27.3%

Other depreciation expense Cost of transportation and services 5.2 — 100.0% 5.3 — 100.0%

Other depreciation expense Direct operating expense 13.1 0.8 1537.5% 21.3 0.8 2562.5%

Other depreciation & amortization expense Sales, general and administrative expense 35.9 21.2 69.3% 60.9 32.4 88.0%

EBITDA $ 8.5 $ 13.1 -35.1% $ 37.3 $ 2.8 1232.1%

Net loss attributable to noncontrolling interests and

Noncontrolling interests redeemable noncontrolling interests (4.4) — 100.0% (4.4) — 100.0%

Transaction & integration costs Other expense 27.6 — 100.0% 27.8 — 100.0%

Transaction & integration costs Sales, general and administrative expense 51.2 0.7 7214.3% 51.8 11.7 342.7%

Gain on sale of intermodal equipment Other expense (5.7) — 100.0% (5.7) — 100.0%

Rebranding costs Sales, general and administrative expense 2.5 0.3 733.3% 2.5 0.3 733.3%

Adjusted EBITDA $ 79.7 $ 14.1 465.2% $ 109.3 $ 14.8 638.5%

Note: Please refer to the “Non-GAAP Financial Measures” section of the press release. Adjusted EBITDA was prepared assuming 100% ownership of Norbert Dentressangle.

XPO Investor Presentation August 2015

37