XPO Investor Presentation August 2017 Exhibit 99.1

Disclaimers Non-GAAP Financial Measures This document contains certain non-GAAP financial measures as defined under the rules of the Securities and Exchange Commission ("SEC"), including earnings before interest, taxes, depreciation and amortization (“EBITDA”) and adjusted EBITDA for the three and six-month periods ended June 30, 2016, and June 30, 2017, on a consolidated basis; free cash flow for the three and six-month periods ended June 30, 2016, June 30, 2017 and the full-year period ended December 31, 2016; adjusted net income attributable to common shareholders and adjusted earnings per share (basic and diluted) (“adjusted EPS”) for the three and six-month periods ended June 30, 2016, and June 30, 2017; adjusted operating income for our North American less-than-truckload business for the three and six-month periods ended June 30, 2016 and June 30, 2017; and total organic revenue for the three-month periods ended June 30, 2016 and June 30, 2017. We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business segments’ core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. In particular, adjusted EBITDA, adjusted net income and adjusted EPS include adjustments for acquisition costs and related integration, transformation and rebranding initiatives as well as other adjustments that management has determined are not reflective of its business segments’ core operating activities. Transaction and integration adjustments are generally incremental costs that result from an acquisition and include transaction costs, restructuring costs, acquisition and integration consulting fees, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems. Rebranding adjustments relate primarily to the rebranding of the XPO Logistics name on our truck fleet and buildings. These adjustments are consistent with how management views our businesses. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating XPO’s and each business segment’s ongoing performance. Accordingly, we believe that free cash flow is an important measure of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We believe that EBITDA and adjusted EBITDA improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of normalized operating activities. We believe that adjusted net income attributable to common shareholders and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains that management has determined are not reflective of our core operating activities. We believe that adjusted operating income for our North American less-than-truckload business improves the comparability of our operating results from period to period by removing the impact of certain transaction, integration and rebranding costs and amortization and depreciation expenses incurred in the reporting period as set out in the attached tables. We believe that total organic revenue is an important measure because it excludes the impact of the following items: foreign currency exchange rate fluctuations, acquisitions and divestitures, and fuel surcharges. Specifically, our total organic revenue reflects adjustments to (i) exclude revenue from our North American truckload operations, which were sold in October 2016, (ii) exclude the estimated revenue attributable to fuel, and (iii) apply a constant foreign exchange rate to both periods (based on average rates during the monthly periods) as set out in the attached tables. Other companies may calculate EBITDA and adjusted EBITDA differently, and therefore our measure may not be comparable to similarly titled measures of other companies. Free cash flow, EBITDA, adjusted EBITDA, adjusted net income attributable to common shareholders, adjusted EPS, adjusted operating income for our North American less-than-truckload business and total organic revenue are not measures of financial performance or liquidity under GAAP and should not be considered in isolation or as an alternative to revenue, net income, operating income for our North American less-than-truckload business, cash flows provided (used) by operating activities and other measures determined in accordance with GAAP. Items excluded from EBITDA and adjusted EBITDA are significant and necessary components of the operations of our business, and, therefore, EBITDA and adjusted EBITDA should only be used as a supplemental measure of our operating performance. As required by SEC rules, we provide reconciliations of these historical measures to the most directly comparable measure under United States generally accepted accounting principles ("GAAP"), which are set forth in the financial tables attached to this document. With respect to our 2017 and 2018 financial targets of adjusted EBITDA and our 2017 and 2017-2018 cumulative targets for free cash flow, each of which is a non-GAAP measure, a reconciliation of the non-GAAP measure to the corresponding GAAP measure is not available without unreasonable effort due to the variability and complexity of the reconciling items described below that we exclude from the non-GAAP target measure. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP that would be required to produce such a reconciliation. Forward-looking Statements This document includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including our financial targets. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as "anticipate," "estimate," "believe," "continue," "could," "intend," "may," "plan," "potential," "predict," "should," "will," "expect," "objective," "projection," "forecast," "goal," "guidance," "outlook," "effort," "target," “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC and the following: economic conditions generally; competition and pricing pressures; our ability to align our investments in capital assets, including equipment, service centers and warehouses, to our customers’ demands; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our substantial indebtedness; our ability to raise debt and equity capital; our ability to maintain positive relationships with our network of third-party transportation providers; our ability to attract and retain qualified drivers; litigation, including litigation related to alleged misclassification of independent contractors; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers and efforts by labor organizations to organize our employees; risks associated with our self-insured claims; risks associated with defined benefit plans for our current and former employees; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; our ability to execute our growth strategy through acquisitions; fuel price and fuel surcharge changes; issues related to our intellectual property rights; governmental regulation, including trade compliance laws; and governmental or political actions, including the United Kingdom's likely exit from the European Union. All forward-looking statements set forth in this document are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this document speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law. | Investor Presentation August 2017

Key Factors Driving High Growth and Returns Solid organic revenue growth supported by numerous tailwinds Leadership positions in fast-growing areas of transportation and logistics $1 trillion addressable opportunity, of which we hold less than 1.5% market share Strong presence in high-growth e-commerce sector Cutting-edge technology differentiates XPO Numerous company-specific margin improvement initiatives Low maintenance capex requirements World-class operators who are laser-focused on driving results Organizational track record of creating value through M&A integrations | Investor Presentation August 2017

63% of Revenue Truckload, Brokerage and Expedite Less-Than-Truckload Last Mile Intermodal and Drayage Global Forwarding LOGISTICS High-Value-Add Services TRANSPORTATION Freight Is Moved Using Optimal Mode 37% of Revenue Omni-Channel and E-Commerce Fulfillment Reverse Logistics Technology-Enabled Managed Transportation Customized Warehousing and Distribution Supply Chain Optimization 63% of Fortune 100 companies trust XPO with their business Largest logistics provider in North America Top 10 Global Leader We use our highly integrated network of people, technology and assets to help customers manage their goods more efficiently throughout their supply chains | Investor Presentation August 2017

By Country of Operation By Customer Vertical Global Scale with Well-Diversified Business Mix Customers Over 50,000 Employees 90,000 Locations 1,435 Countries of Operation 31 Contract Logistics Facilities 162 million sq. feet (15.1 million sq. meters) Key Metrics Gross Revenue Profile | Investor Presentation August 2017 Note: Gross revenue profile reflects FY2016 total revenue, excluding North American truckload business divested in 2016

XPO’s Global Transportation and Logistics Platform | Investor Presentation August 2017 #2 largest contract logistics provider worldwide #2 freight brokerage firm worldwide #1 last mile logistics provider for heavy goods in North America #2 largest less-than-truckload provider in North America, covering 99% of U.S. zip codes #1 outsourced e-fulfillment provider in Europe #1 manager of expedited shipments in North America #3 intermodal provider in North America, with leading drayage network Leading provider of less-than-truckload in Western Europe Top five global managed transportation provider Growing position in global freight forwarding Fortune 500’s fastest-growing transportation company Named by Forbes as an innovative growth company and one of America's best employers

Comprehensive Network for Customers Meticulously built to add value to customers and generate high returns for shareholders: Talent: Top operators with highly engaged employees Technology: Best-in-class, proprietary applications integrated on cloud-based platform Ground transportation assets: 16,000 owned tractors; 39,000 trailers; 10,000 53-ft. intermodal boxes; and 5,400 chassis Non-asset transportation network: 11,000 trucks contracted via independent owner-operators; and more than 1 million brokered trucks Facility assets: 438 cross-docks; and 758 contract logistics facilities | Investor Presentation August 2017 Note: Revenue mix for FY 2016, excluding divested North American truckload unit Attractive Revenue Mix Asset-Light (68%) Asset-Based (32%)

| Investor Presentation August 2017 XPO Leads the Industry in Rapid Technology Development Leading-edge software driven by $425 million of annual IT spend in 2016 Global IT team of more than 1,600 professionals, including over 100 data scientists Cloud-based platform supports agile product development Collaborating with blue chip customer to build next-generation logistics facility XPO’s ongoing innovations include: Advanced robotics Harnessing big data for predictive analytics Proprietary Freight Optimizer for truck and intermodal systems Drones for inventory management Patented last mile applications Our proprietary IT is a major reason why customers trust us each day with 160,000 ground shipments and more than 7 billion inventory units

Last Mile Patented technology enables real-time delivery performance management Online order creation and management Facilitates complex in-home installations European Transport U.S. IT best practices application lowers costs and offers enhanced data analytics IT-enabled improvements to pricing, workforce planning and business intelligence Truck Brokerage / Expedite Freight Optimizer offers powerful tools to source optimal capacity and pricing for each load using advanced algorithms Largest web-based auction TMS for expedite in North America Intermodal / Drayage Rail Optimizer facilitates seamless, door-to-door movements of long haul freight, lowers operating costs, increases visibility Constant communication with railroads and real-time delivery updates to customers Less-Than-Truckload Proprietary pricing systems, handhelds for dock workers, drivers, weights/inspections Rolling out IT for line-haul, engineered standards, pickup and delivery optimization Contract Logistics Proprietary systems handle complete logistics processes: packaging, e-fulfilment, warehousing, distribution, reverse logistics, omni-channel, aftermarket, etc. Integrates with advanced automation, robotics | Investor Presentation August 2017 “One XPO” United by IT and Integrated Across Service Lines One XPO achieved by deploying global collaboration and communication tools for all employees

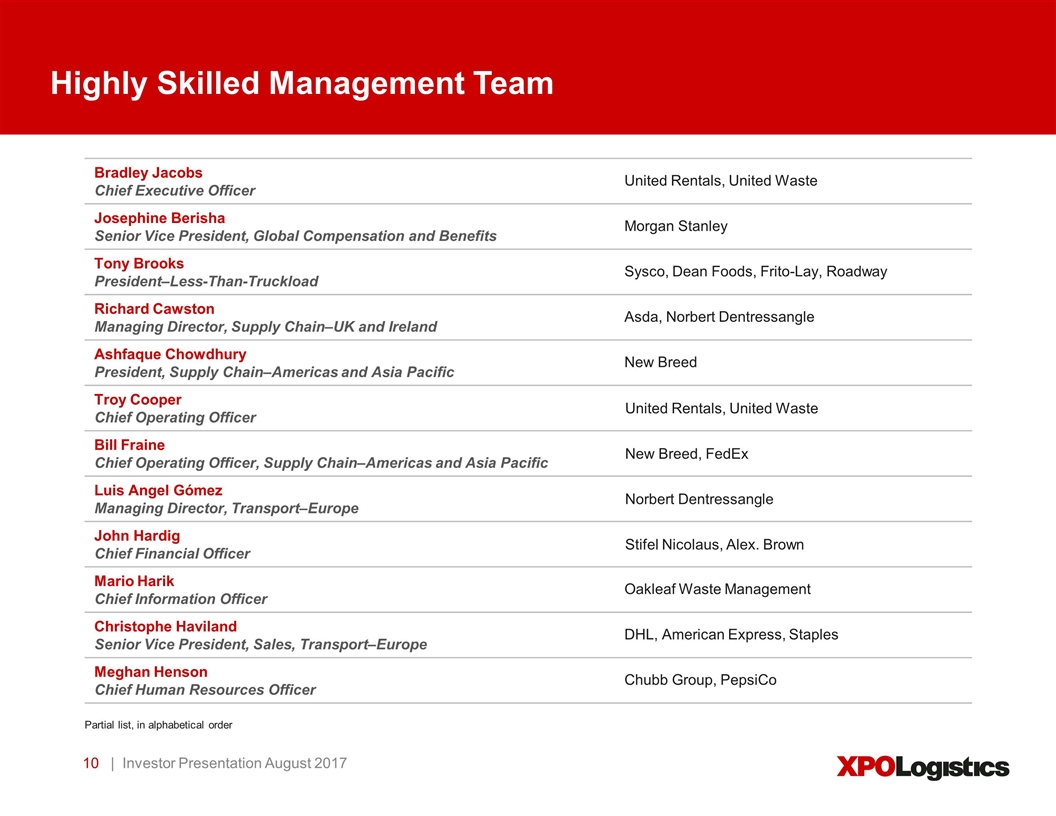

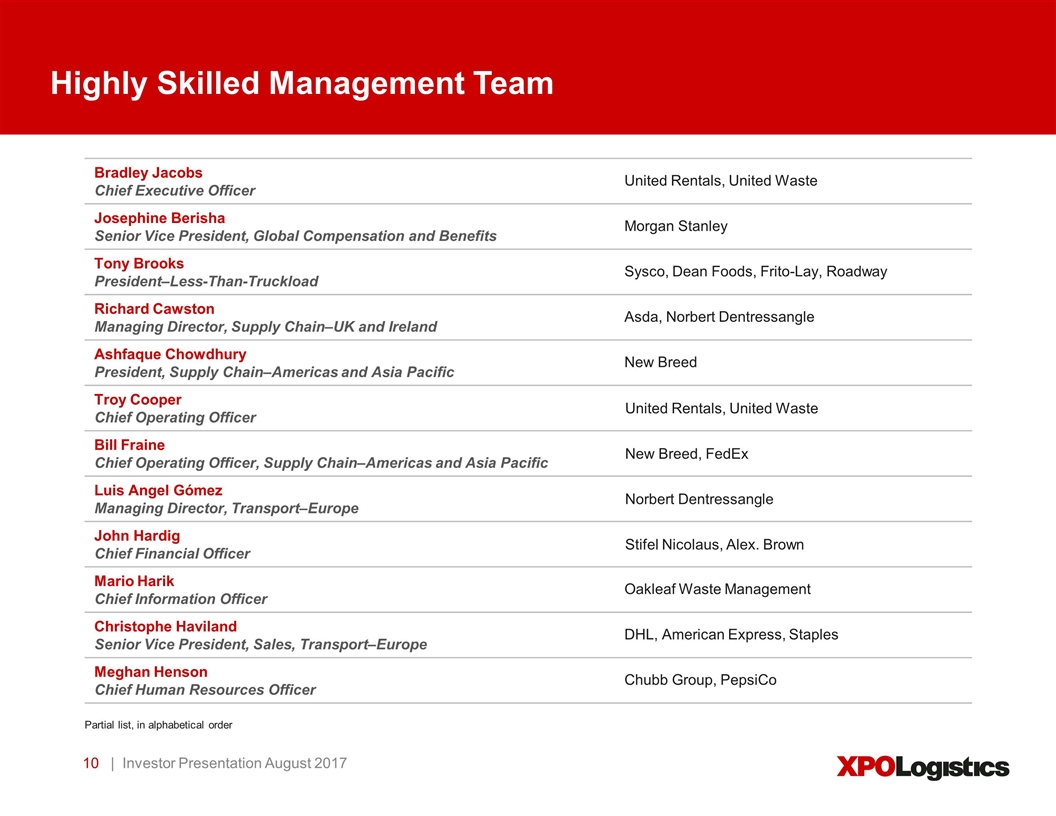

Highly Skilled Management Team | Investor Presentation August 2017 Partial list, in alphabetical order Bradley Jacobs Chief Executive Officer United Rentals, United Waste Josephine Berisha Senior Vice President, Global Compensation and Benefits Morgan Stanley Tony Brooks President–Less-Than-Truckload Sysco, Dean Foods, Frito-Lay, Roadway Richard Cawston Managing Director, Supply Chain–UK and Ireland Asda, Norbert Dentressangle Ashfaque Chowdhury President, Supply Chain–Americas and Asia Pacific New Breed Troy Cooper Chief Operating Officer United Rentals, United Waste Bill Fraine Chief Operating Officer, Supply Chain–Americas and Asia Pacific New Breed, FedEx Luis Angel Gómez Managing Director, Transport–Europe Norbert Dentressangle John Hardig Chief Financial Officer Stifel Nicolaus, Alex. Brown Mario Harik Chief Information Officer Oakleaf Waste Management Christophe Haviland Senior Vice President, Sales, Transport–Europe DHL, American Express, Staples Meghan Henson Chief Human Resources Officer Chubb Group, PepsiCo

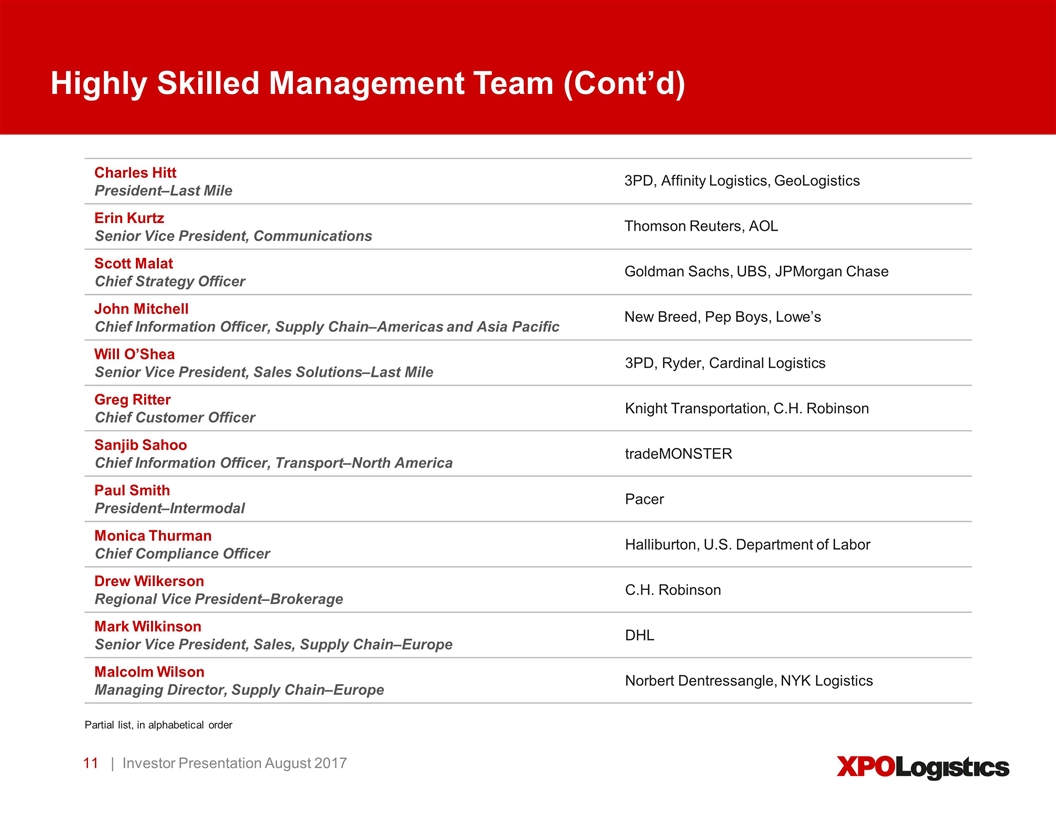

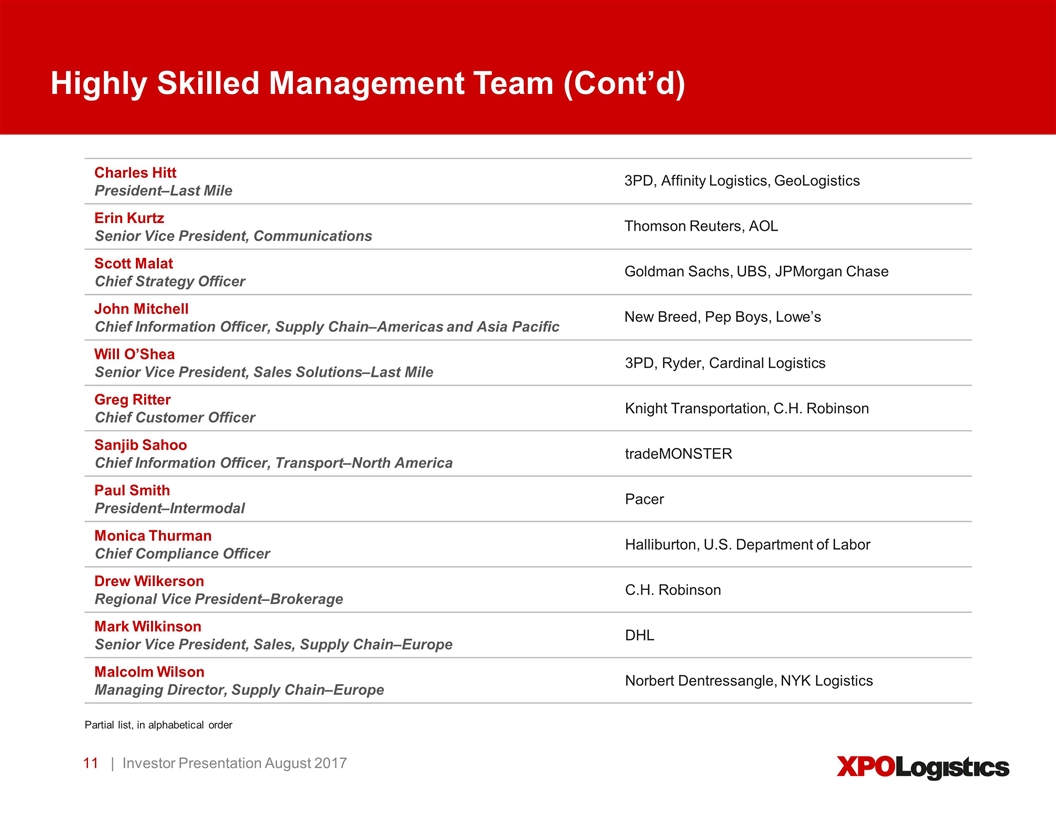

Highly Skilled Management Team (Cont’d) | Investor Presentation August 2017 Charles Hitt President–Last Mile 3PD, Affinity Logistics, GeoLogistics Erin Kurtz Senior Vice President, Communications Thomson Reuters, AOL Scott Malat Chief Strategy Officer Goldman Sachs, UBS, JPMorgan Chase John Mitchell Chief Information Officer, Supply Chain–Americas and Asia Pacific New Breed, Pep Boys, Lowe’s Will O’Shea Senior Vice President, Sales Solutions–Last Mile 3PD, Ryder, Cardinal Logistics Greg Ritter Chief Customer Officer Knight Transportation, C.H. Robinson Sanjib Sahoo Chief Information Officer, Transport–North America tradeMONSTER Paul Smith President–Intermodal Pacer Monica Thurman Chief Compliance Officer Halliburton, U.S. Department of Labor Drew Wilkerson Regional Vice President–Brokerage C.H. Robinson Mark Wilkinson Senior Vice President, Sales, Supply Chain–Europe DHL Malcolm Wilson Managing Director, Supply Chain–Europe Norbert Dentressangle, NYK Logistics Partial list, in alphabetical order

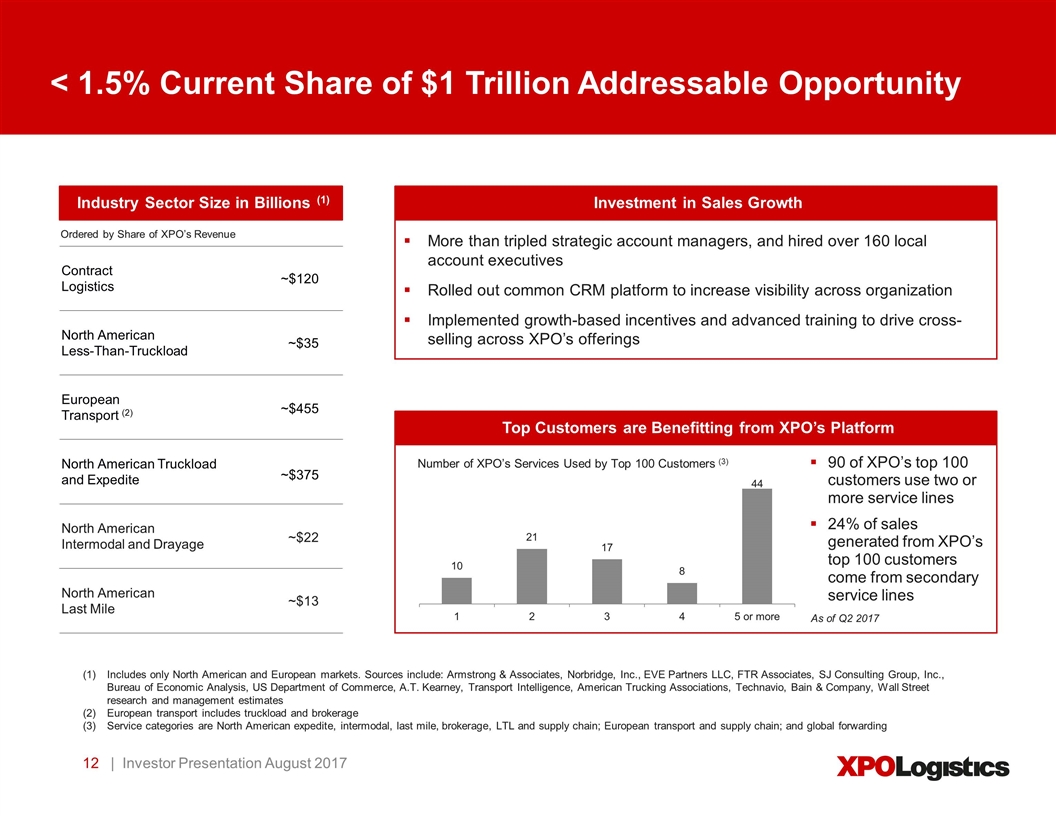

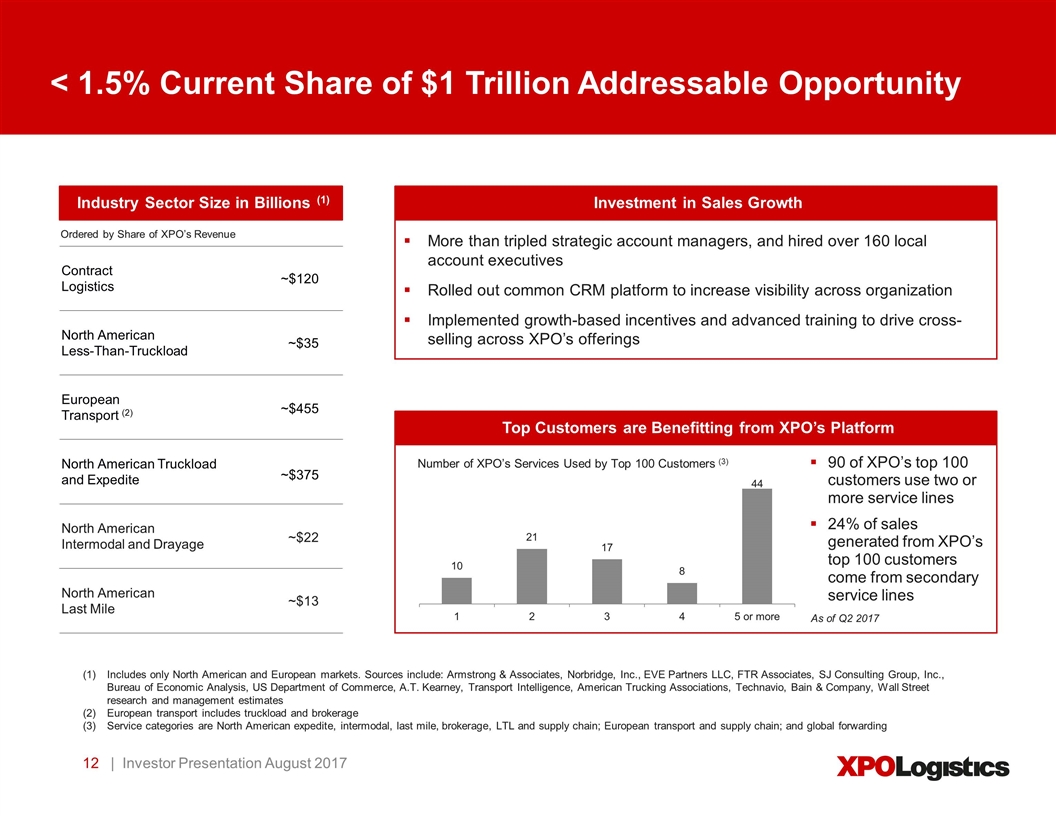

< 1.5% Current Share of $1 Trillion Addressable Opportunity | Investor Presentation August 2017 Investment in Sales Growth More than tripled strategic account managers, and hired over 160 local account executives Rolled out common CRM platform to increase visibility across organization Implemented growth-based incentives and advanced training to drive cross-selling across XPO’s offerings Industry Sector Size in Billions (1) Includes only North American and European markets. Sources include: Armstrong & Associates, Norbridge, Inc., EVE Partners LLC, FTR Associates, SJ Consulting Group, Inc., Bureau of Economic Analysis, US Department of Commerce, A.T. Kearney, Transport Intelligence, American Trucking Associations, Technavio, Bain & Company, Wall Street research and management estimates European transport includes truckload and brokerage Service categories are North American expedite, intermodal, last mile, brokerage, LTL and supply chain; European transport and supply chain; and global forwarding Contract Logistics ~$120 North American Less-Than-Truckload ~$35 European Transport (2) ~$455 North American Truckload and Expedite ~$375 North American Intermodal and Drayage ~$22 North American Last Mile ~$13 Ordered by Share of XPO’s Revenue Top Customers are Benefitting from XPO’s Platform Number of XPO’s Services Used by Top 100 Customers (3) 90 of XPO’s top 100 customers use two or more service lines 24% of sales generated from XPO’s top 100 customers come from secondary service lines As of Q2 2017

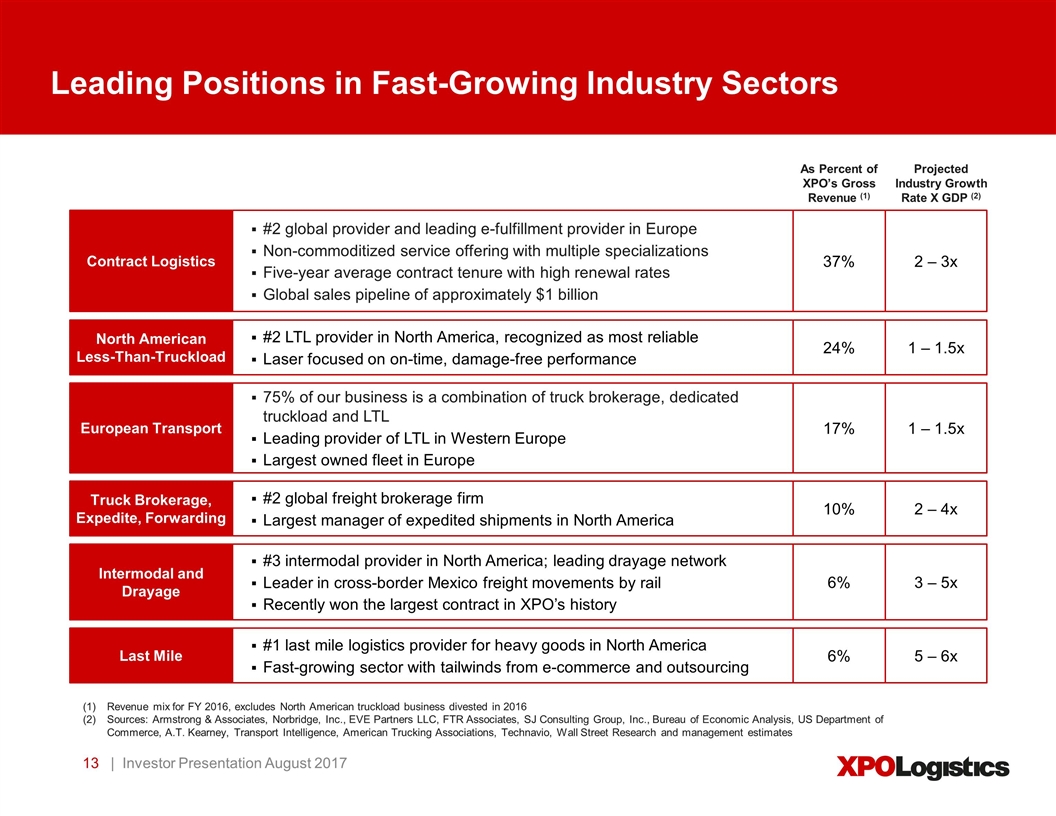

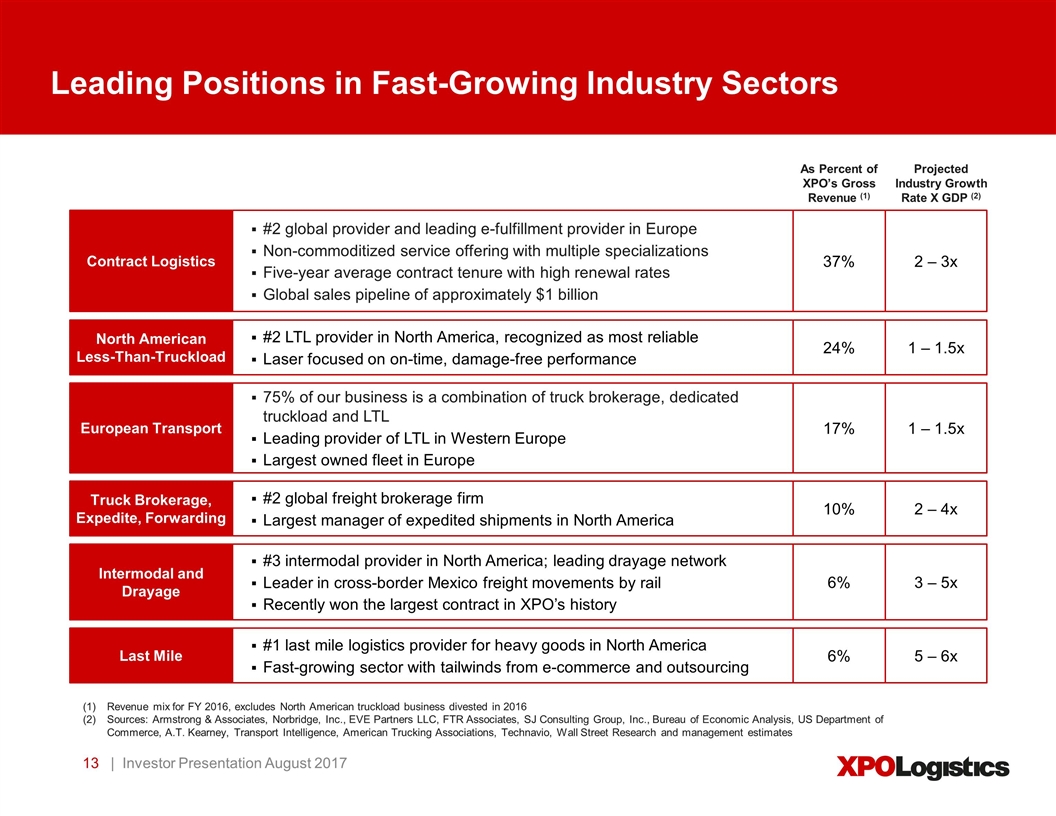

Leading Positions in Fast-Growing Industry Sectors | Investor Presentation August 2017 Revenue mix for FY 2016, excludes North American truckload business divested in 2016 Sources: Armstrong & Associates, Norbridge, Inc., EVE Partners LLC, FTR Associates, SJ Consulting Group, Inc., Bureau of Economic Analysis, US Department of Commerce, A.T. Kearney, Transport Intelligence, American Trucking Associations, Technavio, Wall Street Research and management estimates As Percent of XPO’s Gross Revenue (1) Projected Industry Growth Rate X GDP (2) #2 global provider and leading e-fulfillment provider in Europe Non-commoditized service offering with multiple specializations Five-year average contract tenure with high renewal rates Global sales pipeline of approximately $1 billion Contract Logistics 37% 2 – 3x #2 LTL provider in North America, recognized as most reliable Laser focused on on-time, damage-free performance North American Less-Than-Truckload 24% 1 – 1.5x #2 global freight brokerage firm Largest manager of expedited shipments in North America Truck Brokerage, Expedite, Forwarding 10% 2 – 4x #3 intermodal provider in North America; leading drayage network Leader in cross-border Mexico freight movements by rail Recently won the largest contract in XPO’s history Intermodal and Drayage 6% 3 – 5x #1 last mile logistics provider for heavy goods in North America Fast-growing sector with tailwinds from e-commerce and outsourcing Last Mile 6% 5 – 6x 75% of our business is a combination of truck brokerage, dedicated truckload and LTL Leading provider of LTL in Western Europe Largest owned fleet in Europe European Transport 17% 1 – 1.5x

| Investor Presentation August 2017 Global Player in High-Growth E-Commerce Sector Largest e-fulfillment provider in Europe and a leading provider in North America Omni-channel and reverse logistics / returns management leader in North America Last mile business propelled by e-commerce tailwinds Customers include largest e-tailers and retailers in the U.S. Rolling out service in the UK, Ireland and the Netherlands Grew second quarter 2017 revenue by 15% year-over-year Cutting-edge technology propels leadership position Proprietary technology enables best-in-class customer experience Demand forecasting optimizes fulfillment and returns Automated e-commerce sortation facilities

Clear Path to Targeted 200 Basis Point Margin Improvement | Investor Presentation August 2017 Comprehensive plan in progress to take out costs Includes approximately $190 million of savings already realized from the original LTL profit improvement plan Focused on $13 billion of spend across purchased services, shared services, technology infrastructure, labor and real estate Opportunities for improvement include: Centralization of procurement across global organization Consolidation of real estate and lease management Optimization of back office functions including HR, IT and finance Workforce planning and labor productivity through better management of overtime and temporary labor Cross-fertilization of best practices in warehouse operations and cross-dock facilities Increase line-haul trailer utilization

| Investor Presentation August 2017 Opportunity to Enhance Shareholder Value through M&A Disciplined process to find acquisitions that are strategically and financially compelling Primary focus on North America and Europe in existing or complementary lines of business Sensible valuation and terms Opportunities to apply expertise and improve profitability of acquired businesses through: Operational efficiencies through cost-out initiatives and best practices Cross-selling with existing businesses and customers Optimizing organizational structure Economies of scale, including global procurement Increasing productivity of capacity through technology Instilling a culture of accountability

| Investor Presentation August 2017 Track Record of Highly Accretive M&A Successful at acquiring, integrating and improving operations June 2015 acquisition of Norbert Dentressangle Delivering record revenue and profits in both segments Accelerating top-line growth through cross selling, investments in sales force and realignment of compensation structures Improved margins through cross-fertilization of best practices and addressing loss makers October 2015 acquisition of Con-way Grew LTL adjusted operating income by 85%, from FY 2015 to TTM June 30, 2017 Achieved best quarterly adjusted operating ratio in at least 20 years Completed over $190 million of cost improvements to date

Key Lines of Business

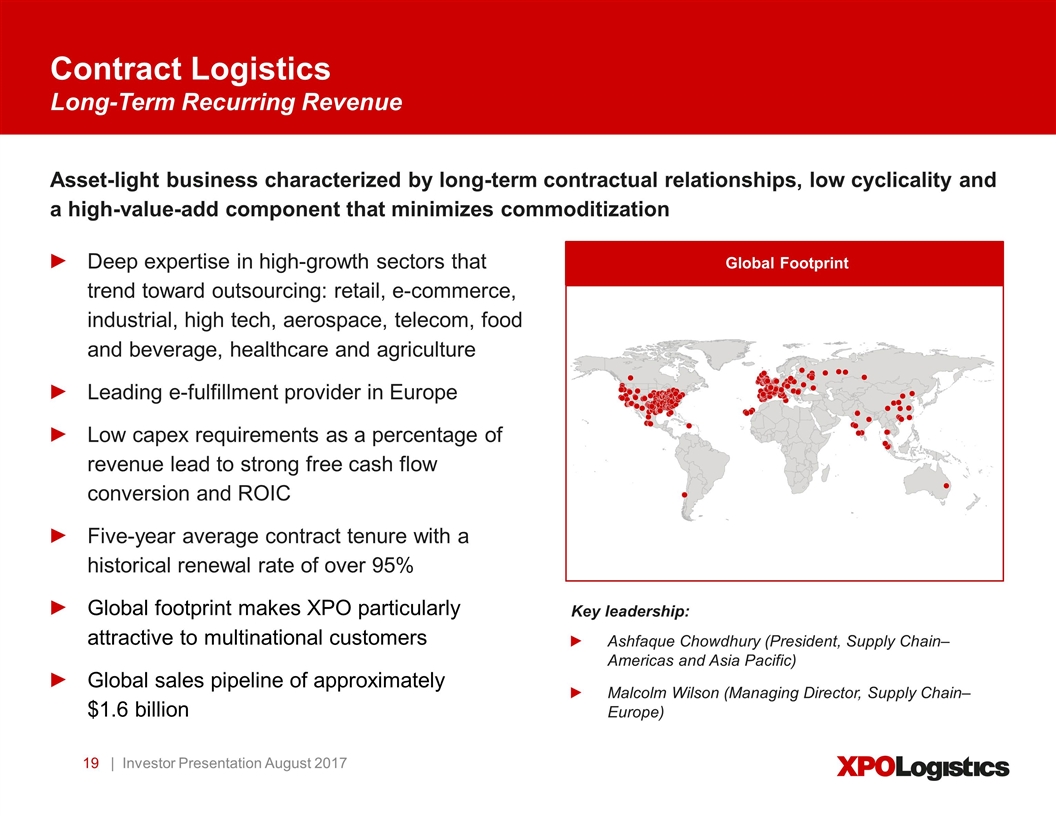

Contract Logistics Long-Term Recurring Revenue | Investor Presentation August 2017 Asset-light business characterized by long-term contractual relationships, low cyclicality and a high-value-add component that minimizes commoditization Deep expertise in high-growth sectors that trend toward outsourcing: retail, e-commerce, industrial, high tech, aerospace, telecom, food and beverage, healthcare and agriculture Leading e-fulfillment provider in Europe Low capex requirements as a percentage of revenue lead to strong free cash flow conversion and ROIC Five-year average contract tenure with a historical renewal rate of over 95% Global footprint makes XPO particularly attractive to multinational customers Global sales pipeline of approximately $1.6 billion Key leadership: Ashfaque Chowdhury (President, Supply Chain– Americas and Asia Pacific) Malcolm Wilson (Managing Director, Supply Chain– Europe) Global Footprint

Truck Brokerage Broad Cross-Selling Opportunity | Investor Presentation August 2017 Non-asset business that places shippers’ freight with qualified carriers through brokers that match capacity with shipper demand High free cash flow conversion and minimal capex Fragmented market with opportunity to expand Outsourcing trends drive industry growth Continuously improving productivity through technology and the tenure of the sales force Pricing accuracy enabled by XPO’s proprietary algorithms Variable cost model performs well through cycles Key leadership: Drew Wilkerson (Regional Vice President–Brokerage) Frederic Cuvelier (Brokerage Director–Europe) Lou Amo (President–Expedite) Global Footprint

Last Mile Demand Propelled by E-Commerce | Investor Presentation August 2017 Asset-light business that arranges the final stage of heavy goods delivery from distribution centers or retail stores to end consumers’ home or business Customers include nearly all of the top 30 big-box retailers and e-tailers in the U.S. Facilitated over 12 million deliveries in 2016 E-commerce and omni-channel are catalysts Best-in-class proprietary customer experience technology Integrated with contract logistics and LTL networks to create powerful value proposition for retail and e-commerce customers Rolling out last mile service in the UK, Ireland and the Netherlands Grew second quarter 2017 revenue by 15% year-over-year, propelled by e-commerce Global Footprint Key leadership: Charles Hitt (President–Last Mile) Fernando Rabel (Senior Vice President, Operations–Last Mile)

North American Less-Than-Truckload Major Success Story | Investor Presentation August 2017 Asset-based business utilizing employee drivers, a fleet of tractors and trailers for line-haul, pick-up and delivery of pallets, and a network of terminals Second largest LTL carrier, recognized as the most reliable in North America Laser focused on on-time, damage-free performance Largest single LTL network in the US, covering 99% of all zip codes One of the industry’s most modern fleets delivering nearly 60,000 shipments a day Already surpassed $190 million of profit improvement Nearly doubled adjusted operating income from $233 million in 2015 to $430 million in the trailing 12 months through June 2017 North American Footprint Key leadership: Tony Brooks (President–Less-Than-Truckload) Lori Blaney (Vice President, Sales and Customer Solutions–Less-Than-Truckload)

Intermodal and Drayage Long-term Sales Potential for Truck-to-Rail Conversion | Investor Presentation August 2017 Asset-light business that arranges the long-haul portion of containerized freight, including rail brokerage, local drayage and on-site operational services Third largest intermodal provider 10,000 53-ft. intermodal boxes and 5,400 chassis Leading U.S. drayage capacity of 2,200 independent owner-operators, with access to over 25,000 additional drayage trucks Proprietary Rail Optimizer IT is a competitive advantage and engine for growth Increasing customer satisfaction by achieving best-ever on-time performance Recently won the largest contract in XPO’s history North American Footprint Key leadership: Paul Smith (President–Intermodal) Don Ingersoll (Vice President−Transportation)

European Transport Cross-fertilizing Best Practices with North America | Investor Presentation August 2017 Leading platform for dedicated and non-dedicated truckload, less-than-truckload, truck brokerage, and new last mile service LTL, truck brokerage and dedicated transport combined account for about three-quarters of European transport EBITDA A leading LTL provider in Western Europe Similar profit improvement plan as North American LTL, sharing best practices Large and growing brokerage business draws on carrier network and XPO-owned capacity Launched Freight Optimizer software to increase visibility across Europe High-return dedicated transport business utilizes assets for long-term contracts Largest owned fleet in Europe Key leadership: Luis Gomez (Managing Director, Transport–Europe) Christophe Haviland (Senior Vice President, Sales, Transport–Europe) European Transport Footprint

Global Forwarding Integrated Global Network | Investor Presentation August 2017 Non-asset logistics solution for domestic, cross-border and international shipments, including customs brokerage Freight forwarding is a $150 billion industry, of which XPO has less than a 1% share 157,000 TEUs and 58,000 tons of freight moved for customers annually Leverages ground, air and ocean carrier relationships to provide differentiated service Operates a subsidiary as a non-vessel operating common carrier (“NVOCC”) Opportunity to grow market share through network of dedicated offices on four continents Key leadership: Dominick Muzi (President, Global Forwarding) Global Footprint

Financial Performance

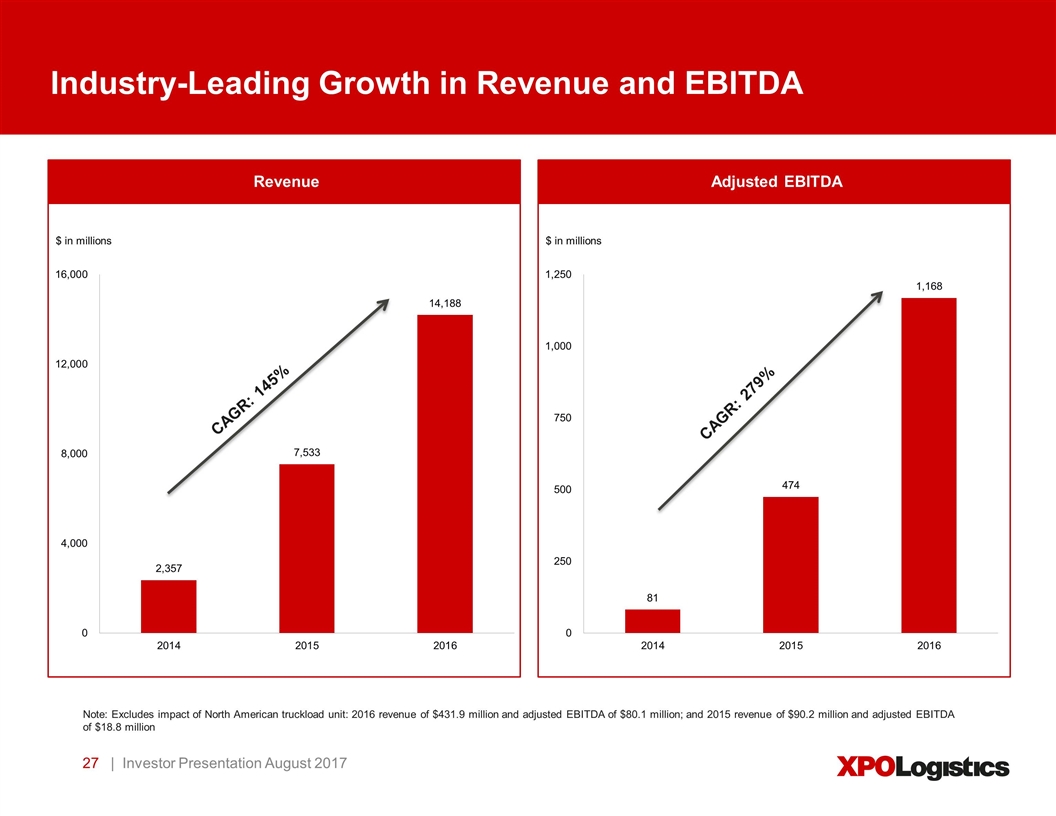

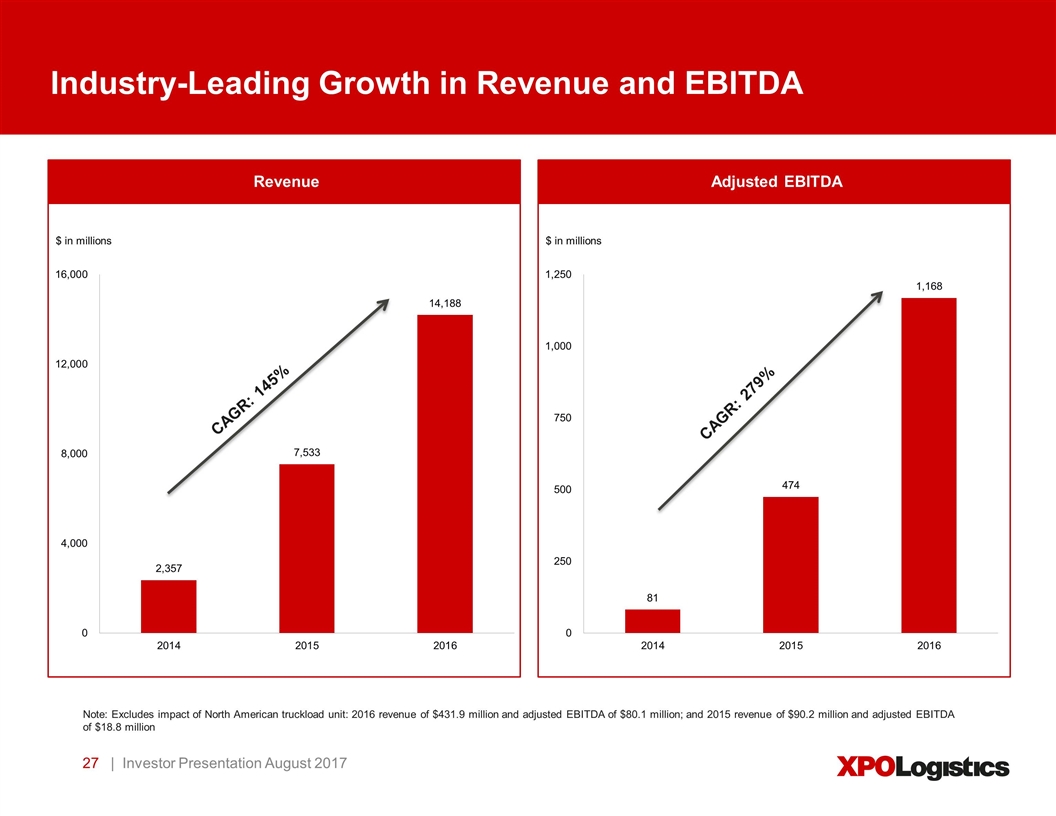

| Investor Presentation August 2017 Industry-Leading Growth in Revenue and EBITDA Revenue Adjusted EBITDA $ in millions $ in millions CAGR: 145% CAGR: 279% Note: Excludes impact of North American truckload unit: 2016 revenue of $431.9 million and adjusted EBITDA of $80.1 million; and 2015 revenue of $90.2 million and adjusted EBITDA of $18.8 million

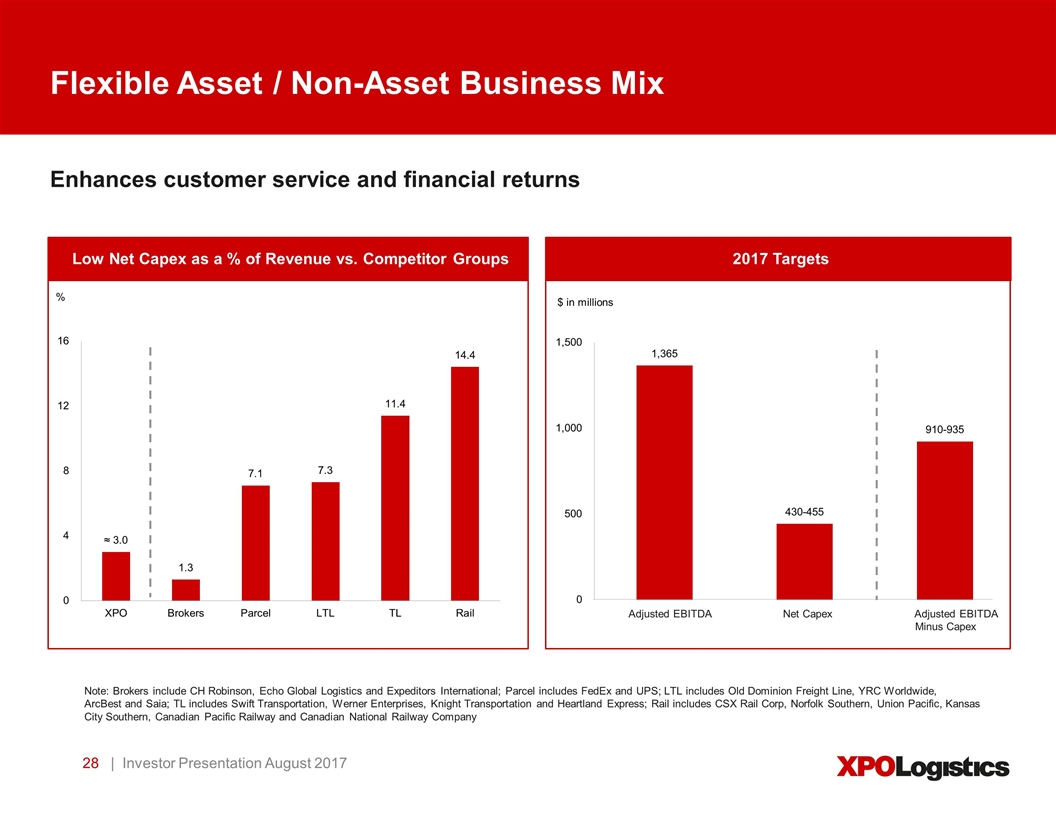

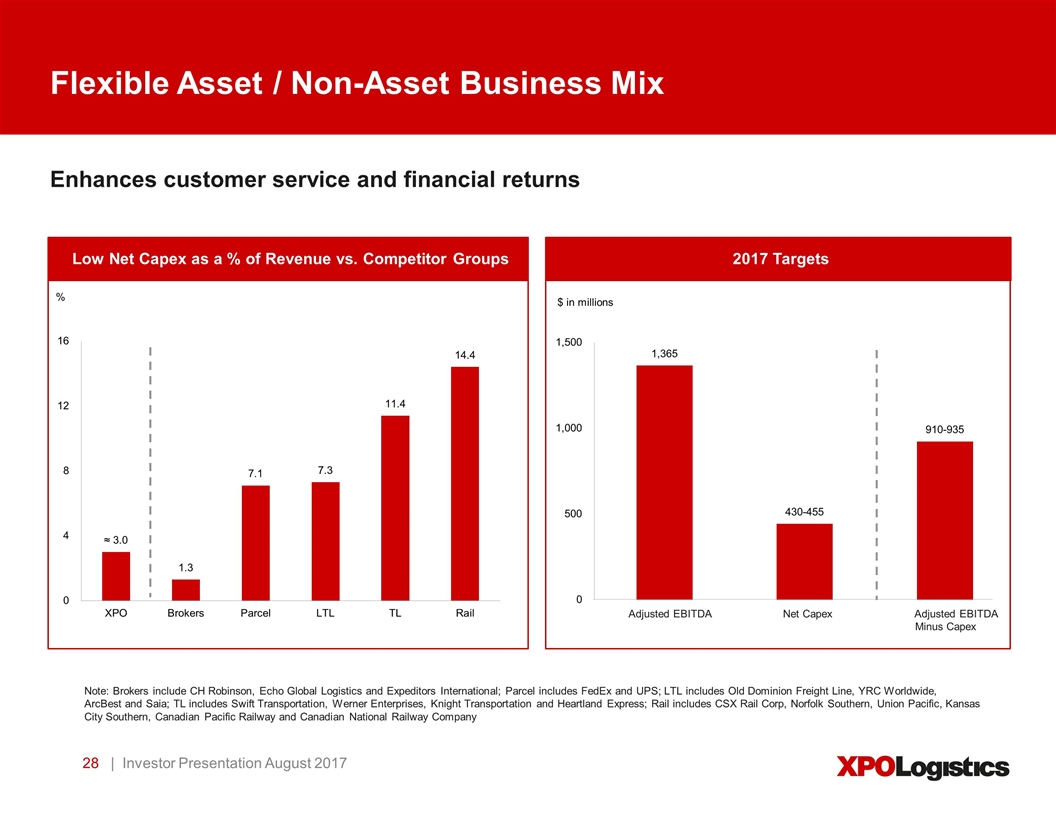

Flexible Asset / Non-Asset Business Mix | Investor Presentation August 2017 Enhances customer service and financial returns % Low Net Capex as a % of Revenue vs. Competitor Groups Note: Brokers include CH Robinson, Echo Global Logistics and Expeditors International; Parcel includes FedEx and UPS; LTL includes Old Dominion Freight Line, YRC Worldwide, ArcBest and Saia; TL includes Swift Transportation, Werner Enterprises, Knight Transportation and Heartland Express; Rail includes CSX Rail Corp, Norfolk Southern, Union Pacific, Kansas City Southern, Canadian Pacific Railway and Canadian National Railway Company 2017 Targets Adjusted EBITDA Net Capex Adjusted EBITDA Minus Capex $ in millions

$625 million of cash flow from operations and $211 million of free cash flow in 2016 Expect to grow free cash flow of existing business by over 2.5x in the medium term through: EBITDA growth Lower interest expense Lower transaction, integration and rebranding costs Annual net capex spend likely in $430 million to $455 million range | Investor Presentation August 2017 Accelerating Free Cash Flow Generation Note: See Supplemental Materials for reconciliation of free cash flow to cash flow from operations

Second Quarter 2017 Highlights | Investor Presentation August 2017 $3.76 billion of revenue $47.6 million of net income; $0.38 per diluted share $371 million of adjusted EBITDA $75 million of adjusted net income $216 million of cash flow from operations Free cash flow of $98.1 million Accelerated organic revenue growth to 7.5% and expanded margins in both transportation and logistics Note: Net capex is defined as payment for purchases of property and equipment less proceeds from sale of assets

Raised EBITDA Guidance | Investor Presentation August 2017 Financial targets updated August 2, 2017 2017: adjusted EBITDA of at least $1.365 billion 2018: adjusted EBITDA of at least $1.6 billion 2017–2018: cumulative free cash flow target of approximately $900 million Includes at least $350 million of free cash flow generated in 2017

Results Matter: Proven Credentials for Value Creation | Investor Presentation August 2017 Leading global positions in the fastest-growing areas of transportation and logistics Differentiated, end-to-end range of supply chain services Accelerating top-line growth Approximately 26% of revenue comes from retail and e-commerce Robust free cash flow growth Industry-leading commitment to technology innovation Highly integrated organization with culture of accountability Management team laser-focused on creating shareholder value Upside from future acquisitions

Supplemental Materials

A Strong and Global Commitment to Sustainability | Investor Presentation August 2017 Owns one of the most modern and environmental-friendly fleets in Europe 97% compliant with Euro V, EEV and Euro VI standards, with average truck age of 2.5 years Owns the largest natural gas truck fleet in Europe Introduced the first LNG-powered tractors in Europe in 2015 Will lower the carbon footprint of trucking in Paris this year by using natural gas trucks for the road transport portion of France's first intermodal urban rail shuttle Launched government-approved mega-trucks in Spain, expected to reduce CO2 emissions by over 25% Honored for excellence in environmental improvement by SmartWay® Named a Top 75 Green Supply Chain Partner by Inbound Logistics

XPO Is a Leader in Sustainability (Cont’d) | Investor Presentation August 2017 Awarded the label “Objectif CO2” for outstanding environmental performance of transport operations in Europe by the French Ministry of the Environment and the French Environment and Energy Agency Large capex investment in 2017 in fuel-efficient Freightliner Cascadia tractors in North America (EPA 2013-compliant and GHG14-compliant SCR technology), and Euro 6-compliant tractors in Europe ISO14001-certified logistics facilities ensure environmental compliance Fuel emissions from forklifts monitored in supply chain sites, and systems in place to take immediate corrective action if needed Reverse logistics operations in supply chain sites recycle millions of electronic components and batteries each year Energy efficiency evaluations performed on all warehouses prior to selecting sites to lease, and energy efficient equipment purchased when feasible

XPO Is a Leader in Sustainability (Cont’d) | Investor Presentation August 2017 Packaging engineers ensure that the optimal carton size is used for each product slated for distribution Recycled packaging purchased when feasible Reusable kitting tools utilized for the installation of parts in customer operations, manufactured by XPO Measures instilled in daily operations to reduce paper, such as electronic waybills and documentation, and waste mitigation policies Drivers trained in responsible eco-driving and fuel usage reduction techniques Experimenting with diesel alternatives such as diesel-electric hybrids Reports annually on European compliance with the United Nations Global Compact We are committed to operating our business in a way that demonstrates a high regard for the environment and all our stakeholders

Business Glossary | Investor Presentation August 2017 Contract Logistics: An asset-light, technology-enabled business characterized by long-term contractual relationships with high renewal rates, low cyclicality and a high-value-add component that minimizes commoditization. Contracts are typically structured as either fixed-variable, cost-plus or gain-share. XPO services include highly engineered solutions, e-fulfillment, reverse logistics, packaging, factory support, aftermarket support, warehousing and distribution for customers in aerospace, manufacturing, retail, life sciences, chemicals, food and beverage, and cold chain. Expedite: A non-asset business that facilitates time-critical, high-value or high-security shipments, usually on very short notice. Revenue is either contractual or transactional, primarily driven by unforeseen supply chain disruptions or just-in-time inventory demand for raw materials, parts or goods. XPO provides three types of expedite service: ground transportation via a network of independent contract carriers; air charter transportation facilitated by proprietary, web-based technology that solicits bids and assigns loads to aircraft; and a managed transportation network that is the largest web-based expedite management technology in North America. Freight Brokerage: A variable cost business that facilitates the trucking of freight by procuring carriers through the use of proprietary technology. Freight brokerage net revenue is the spread between the price to the shipper and the cost of purchased transportation. In North America, XPO has a non-asset freight brokerage business, with a network of 38,000 independent carriers. In Europe, XPO generates over €1 billion in freight brokerage revenue annually, with capacity provided by an asset-light mix of owned fleet and independent carriers. Global Forwarding: A non-asset business that facilitates freight shipments by ground, air and ocean. Shipments may have origins and destinations within North America, to or from North America, or between foreign locations. Services are provided through a network of market experts who provide local oversight in thousands of key trade areas worldwide. XPO’s global forwarding service can arrange shipments with no restrictions as to size, weight or mode, and is OTI and NVOCC licensed.

Business Glossary (Cont’d) Intermodal: An asset-light business that facilitates the movement of long-haul, containerized freight by rail, often with a drayage (trucking) component at either end. Intermodal is a variable cost business, with revenue generated by a mix of contractual and spot market transactions. Net revenue equates to the spread between the price to the shipper and the cost of purchasing rail and truck transportation. Two factors are driving growth in intermodal in North America: rail transportation is less expensive and more fuel efficient per mile than long-haul trucking, and rail is a key mode of transportation in and out of Mexico, where the manufacturing base is booming due to a trend toward near-shoring. Last Mile: A non-asset business that facilitates the delivery of goods to their final destination, most often to consumer households. XPO specializes in two areas of last mile service: arranging the delivery and installation of heavy goods such as appliances, furniture and electronics, often with a white glove component; and providing logistics solutions to retailers and distributors to support their e-commerce supply chains and omni-channel distribution strategies. Capacity is sourced from a network of independent contract carriers and technicians. Less-Than-Truckload (LTL): The transportation of a quantity of freight that is larger than a parcel, but too small to require an entire truck, and is often shipped on a pallet. LTL shipments are priced according to the weight of the freight, its commodity class (which is generally determined by its cube/weight ratio and the description of the product), and mileage within designated lanes. An LTL carrier typically operates a hub-and-spoke network that allows for the consolidation of multiple shipments for different customers in single trucks. Managed Transportation: A service provided to shippers who want to outsource some or all of their transportation modes, together with associated activities. This can include freight handling such as consolidation and deconsolidation, labor planning, inbound and outbound shipment facilitation, documentation and customs management, claims processing, and 3PL supplier management, among other things. Truckload: The ground transportation of cargo provided by a single shipper in an amount that requires the full limit of the trailer, either by dimension or weight. Cargo typically remains on a single vehicle from the point of origin to the destination, and is not handled en route. See Freight Brokerage on the prior page for additional details. | Investor Presentation August 2017

Financial Reconciliations The following table reconciles XPO’s net income (loss) attributable to common shareholders for the periods ended June 30, 2017 and 2016 to adjusted EBITDA for the same periods. Refer to the “Non-GAAP Financial Measures” section on page 2 of this document. Adjusted EBITDA was prepared assuming 100% ownership of XPO Logistics Europe. | Investor Presentation August 2017 [1] The sum of quarterly net income attributable to common shareholders and distributed and undistributed net income may not equal year-to-date amounts due to the impact of the two-class method of calculating earnings per share.

Financial Reconciliations (Cont’d) The following table reconciles XPO’s GAAP net income attributable to common shareholders for the periods ended June 30, 2017 and 2016 to adjusted net income attributable to common shareholders for the same periods. | Investor Presentation August 2017 Refer to the “Non-GAAP Financial Measures” section on page 2 of this document.

Financial Reconciliations (Cont’d) Refer to the “Non-GAAP Financial Measures” section on page 2 of this document. Free cash flow was prepared assuming 100% ownership of XPO Logistics Europe. The following table reconciles XPO’s cash flows provided by operating activities for the periods ended December 31, 2016 and 2015 to free cash flow for the same periods. | Investor Presentation August 2017

Financial Reconciliations (Cont’d) The following table reconciles XPO’s cash flows provided by operating activities for the periods ended June 30, 2017 and 2016 to free cash flow for the same periods. | Investor Presentation August 2017 Refer to the “Non-GAAP Financial Measures” section on page 2 of this document. Free cash flow was prepared assuming 100% ownership of XPO Logistics Europe.

Financial Reconciliations (Cont’d) The following table reconciles XPO’s revenue attributable to its North American less-than-truckload business for the periods ended June 30, 2017 and 2016 to adjusted operating ratio for the same periods. | Investor Presentation August 2017 Refer to the “Non-GAAP Financial Measures” section on page 2 of this document.

Financial Reconciliations (Cont’d) | Investor Presentation August 2017 XPO Logistics, Inc. Organic Revenue (Unaudited) (In millions) Three Months Ended June 30, 2017 2016 Total Revenue $ 3,760.3 $ 3,683.3 North American Truckload - (133.4) Fuel (334.6) (296.5) Foreign Exchange Rates 73.1 - Total Organic Revenue $ 3,498.7 $ 3,253.4 Organic Revenue Growth 7.5% The following table reconciles XPO’s total revenue for the periods ended June 30, 2017 and 2016 to total organic revenue for the same periods. Refer to the “Non-GAAP Financial Measures” section on page 2 of this document.