Investor Presentation February 2019 Exhibit 99.2

Disclaimers Non-GAAP Financial Measures. As required by the rules of the Securities and Exchange Commission ("SEC"), we provide reconciliations of the non-GAAP financial measures contained in this presentation to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this document. This document contains the following non-GAAP financial measures: earnings before interest, taxes, depreciation and amortization (“EBITDA”) and adjusted EBITDA for the three-month periods ended December 31, 2018 and 2017; EBITDA, adjusted EBITDA and adjusted EBITDA excluding truckload for the twelve-month periods ended December 31, 2018, 2017 and 2016; free cash flow for the three-month periods ended December 31, 2018 and 2017, and the twelve-month periods ended December 31, 2018, 2017 and 2016; adjusted net income attributable to common shareholders and adjusted earnings per share (basic and diluted) (“adjusted EPS”) for the three and twelve-month periods ended December 31, 2018 and 2017; adjusted operating income and adjusted operating ratio for our North American less-than-truckload business for the three and twelve-month periods ended December 31, 2018, 2017 and 2015; and organic revenue growth for the three-month periods ended December 31, 2018 and 2017, on a consolidated basis. We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business segments' core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our operating performance. Adjusted EBITDA, adjusted net income attributable to common shareholders and adjusted EPS include adjustments for acquisition costs and related integration, transformation and rebranding initiatives as well as adjustments for restructuring costs, litigation costs for independent contractor matters and the gain on sale of an equity investment. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition and include transaction costs, acquisition and integration consulting fees, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems. Rebranding adjustments primarily relate to the rebranding of the XPO Logistics name on our truck fleet and buildings. Restructuring costs primarily relate to severance costs associated with business optimization initiatives. Litigation costs refer to settlement and related costs associated with classification claims in our last mile business. The gain on sale of an equity investment relates to the sale of a non-strategic equity ownership interest in a private company. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating XPO's and each business segment's ongoing performance. We believe that free cash flow is an important measure of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We believe that EBITDA, adjusted EBITDA and adjusted EBITDA excluding truckload improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of normalized operating activities and thereby assist investors with assessing trends in our underlying businesses. We believe that adjusted net income attributable to common shareholders and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains that management has determined are not reflective of our core operating activities. We believe that adjusted operating income for our North American less-than-truckload business improves the comparability of our operating results from period to period by (i) removing the impact of certain transaction, integration, restructuring and rebranding costs and amortization expenses and, (ii) including the impact of pension income incurred in the reporting period as set out in the attached tables. We believe that organic revenue is an important measure because it excludes the impact of the following items: foreign currency exchange rate fluctuations and fuel surcharges. With respect to our 2019 financial target for adjusted EBITDA and free cash flow, each of which is a non-GAAP measure, a reconciliation of the non-GAAP measure to the corresponding GAAP measure is not available without unreasonable effort due to the variability and complexity of the reconciling items described below that we exclude from the non-GAAP target measure. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP that would be required to produce such a reconciliation. Forward-looking Statements. This document includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including our financial targets for our consolidated adjusted EBITDA and free cash flow and our expected future growth prospects. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as "anticipate," "estimate," "believe," "continue," "could," "intend," "may," "plan," "potential," "predict," "should," "will," "expect," "objective," "projection," "forecast," "goal," "guidance," "outlook," "effort," "target," "trajectory" or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC and the following: economic conditions generally; competition and pricing pressures; our ability to align our investments in capital assets, including equipment, service centers and warehouses, to our customers' demands; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our substantial indebtedness; our ability to raise debt and equity capital; our ability to maintain positive relationships with our network of third-party transportation providers; our ability to attract and retain qualified drivers; litigation, including litigation related to alleged misclassification of independent contractors and securities class actions; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers and efforts by labor organizations to organize our employees; risks associated with our self-insured claims; risks associated with defined benefit plans for our current and former employees; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; fuel price and fuel surcharge changes; issues related to our intellectual property rights; governmental regulation, including trade compliance laws; and governmental or political actions, including the United Kingdom's likely exit from the European Union. All forward-looking statements set forth in this document are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this document speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law. Investor Presentation February 2019

Key Factors Driving Growth and Returns Leading positions in fast-growing areas of transportation and logistics $1 trillion addressable opportunity, with less than 2% market share Ability to provide a broad range of integrated solutions to customers with complex supply chains Differentiation through cutting-edge technology in every line of business Strong, multimodal presence in the e-commerce sector Significant advantages of scale: operating leverage, purchasing power, cross-selling and capacity to innovate Diverse talent base sharing best practices World-class operators who are also XPO shareholders Investor Presentation February 2019 Delivered year-over-year organic revenue growth of 9.3% for 2018 Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document

Note: Revenue data, excluding intersegment elimination, as reported for FY 2018 Move all types of freight using optimal mode or combination of modes Full truckload via brokered, contracted and owned truck and trailer capacity Less-than-truckload Last mile delivery, assembly and installation of heavy goods via contracted capacity Intermodal rail LOGISTICS 35% of Revenue TRANSPORTATION 65% of Revenue Solve complex supply chain requirements for all types of goods High-value-add warehousing, fulfillment, distribution and inventory management Innovative solutions using advanced automation, proprietary analytics and other XPO technology E-commerce and omnichannel specialization Returns management (reverse logistics) Top 10 Global Provider of Supply Chain Services We use our highly integrated network of people, technology and assets to help customers manage their goods most efficiently through their supply chains 4 Investor Presentation February 2019 Fortune named XPO one of the World’s Most Admired Companies for the second consecutive year in 2019

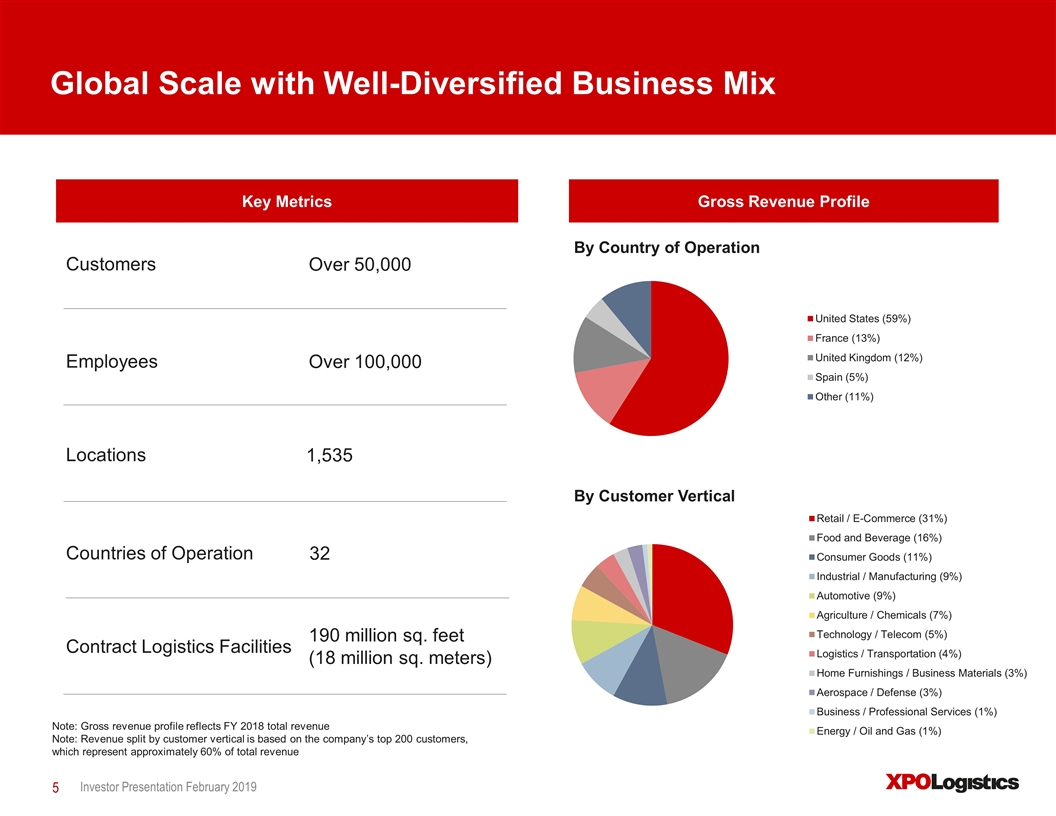

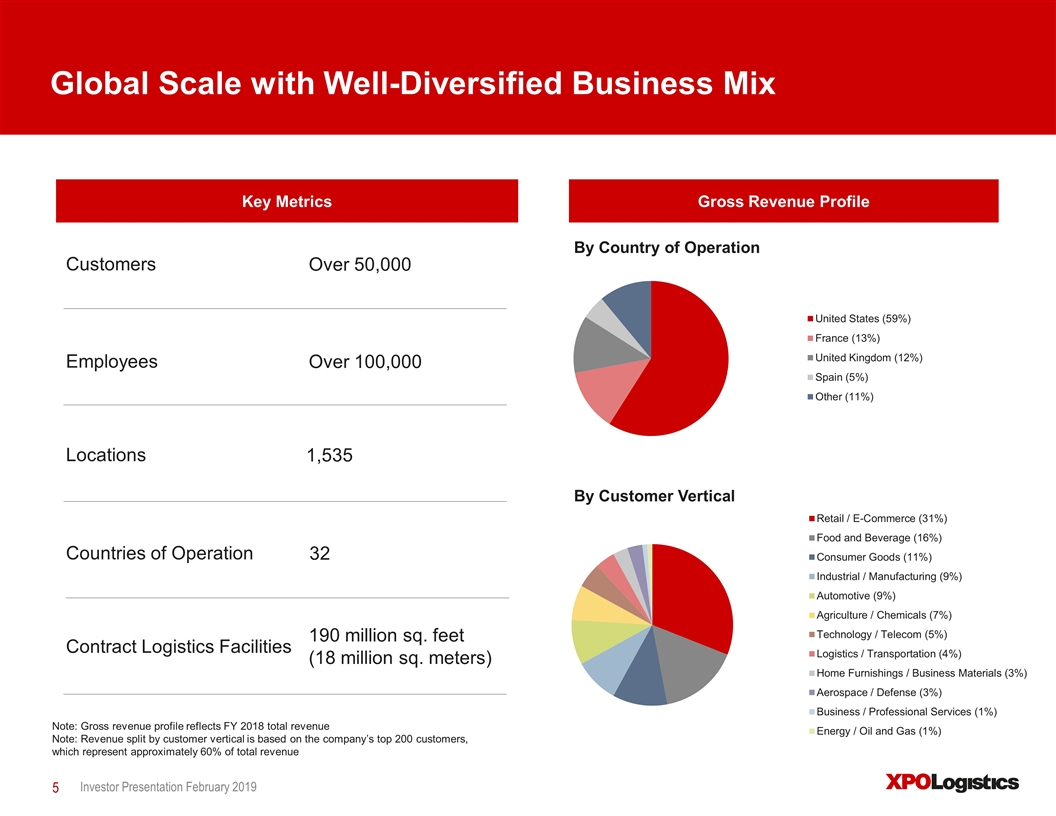

By Country of Operation By Customer Vertical Global Scale with Well-Diversified Business Mix Customers Over 50,000 Employees Over 100,000 Locations 1,535 Countries of Operation 32 Contract Logistics Facilities 190 million sq. feet (18 million sq. meters) Key Metrics Gross Revenue Profile Investor Presentation February 2019 Note: Gross revenue profile reflects FY 2018 total revenue Note: Revenue split by customer vertical is based on the company’s top 200 customers, which represent approximately 60% of total revenue

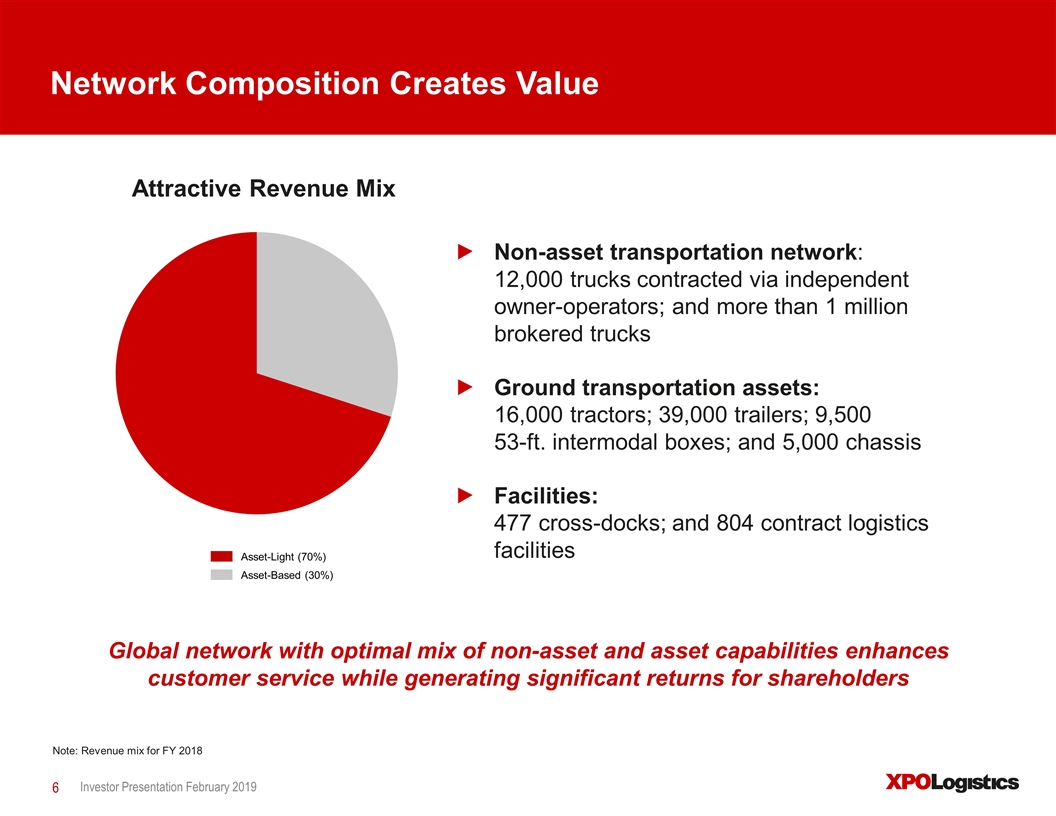

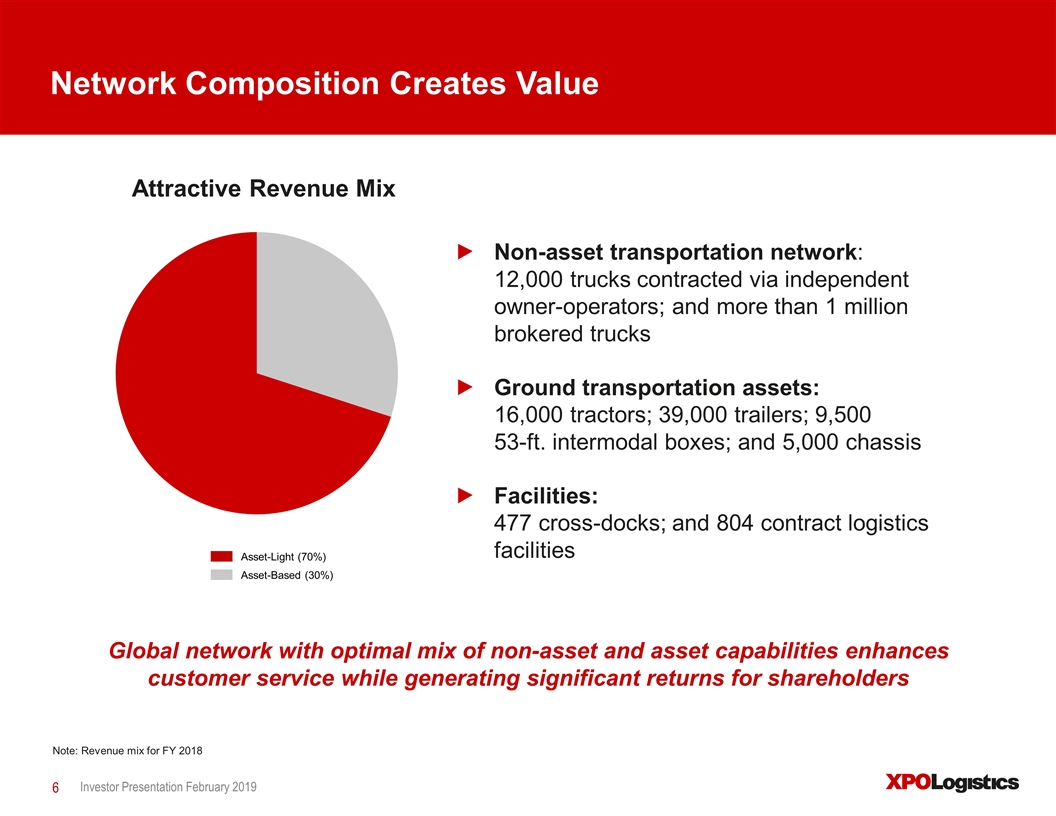

Note: Revenue mix for FY 2018 Network Composition Creates Value Non-asset transportation network: 12,000 trucks contracted via independent owner-operators; and more than 1 million brokered trucks Ground transportation assets: 16,000 tractors; 39,000 trailers; 9,500 53-ft. intermodal boxes; and 5,000 chassis Facilities: 477 cross-docks; and 804 contract logistics facilities Attractive Revenue Mix Global network with optimal mix of non-asset and asset capabilities enhances customer service while generating significant returns for shareholders Asset-Light (70%) Asset-Based (30%) Investor Presentation February 2019

$500 million annual investment in technology is a key competitive advantage Global technology team of ~1,700 professionals Over 100 data scientists focused on predictive analytics and machine learning XPO Connect digital freight marketplace gives shippers real-time visibility into supply and demand, automates load-matching with carriers through Drive XPO mobile app Last mile consumerization includes voice-activated tracking and augmented reality Launch of collaborative robots dramatically improves speed, accuracy and safe handling of logistics fulfillment; 5,000 robots planned Proprietary warehouse technology accelerates integration of automated solutions C3XPO security robots enhance facility safety and lower customer costs Fast Pace of Innovation Investor Presentation February 2019 Our technology is a major reason why customers trust us each day with approximately 160,000 ground shipments and more than 7 billion inventory units

Note: Partial list in alphabetical order Highly Skilled Management Team Bradley Jacobs Chief Executive Officer United Rentals, United Waste Josephine Berisha Senior Vice President, Global Compensation and Benefits Morgan Stanley Erik Caldwell Chief Operating Officer, Supply Chain–Americas and Asia Pacific Hudson's Bay, Luxottica Richard Cawston Managing Director, Supply Chain–Europe Asda, Norbert Dentressangle Michele Chapman Senior Vice President, Global Sales Operations Amazon Ashfaque Chowdhury President, Supply Chain–Americas and Asia Pacific New Breed Troy Cooper President United Rentals, United Waste Matthew Fassler Chief Strategy Officer Goldman Sachs Sarah Glickman Acting Chief Financial Officer; Senior Vice President, Corporate Finance Novartis, Honeywell, Bristol-Myers Squibb Luis Angel Gómez Managing Director, Transport–Europe Norbert Dentressangle Mario Harik Chief Information Officer Oakleaf Waste Management Tavio Headley Senior Director, Investor Relations Jefferies, American Trucking Associations Investor Presentation February 2019 Prior Experience

Note: Partial list in alphabetical order Highly Skilled Management Team (Cont’d) Meghan Henson Chief Human Resources Officer Chubb, PepsiCo Julie Katigan Senior Vice President, Human Resources, Supply Chain–North America Electrolux, Mead Johnson Nutrition Erin Kurtz Senior Vice President, Communications Thomson Reuters, AOL Katrina Liddell Senior Vice President, Transportation Sales–North America Johnson Controls International John Mitchell Chief Information Officer, Supply Chain–Americas and Asia Pacific New Breed, Pep Boys, Lowe’s Emily Phillips Senior Vice President, Advanced Solutions Home Depot, JDA Software Greg Ritter Chief Customer Officer Knight Transportation, C.H. Robinson Sanjib Sahoo Chief Information Officer, Transport Solutions tradeMONSTER Christopher Synek President, Transportation–North America Republic Services, Cintas Kenneth Wagers Chief Operating Officer; Interim President, LTL–North America Amazon, Dr Pepper Snapple, UPS Daniel Walsh President, Last Mile Brambles, CHEP Malcolm Wilson Chief Executive Officer, XPO Logistics Europe Norbert Dentressangle, NYK Logistics Investor Presentation February 2019 Prior Experience

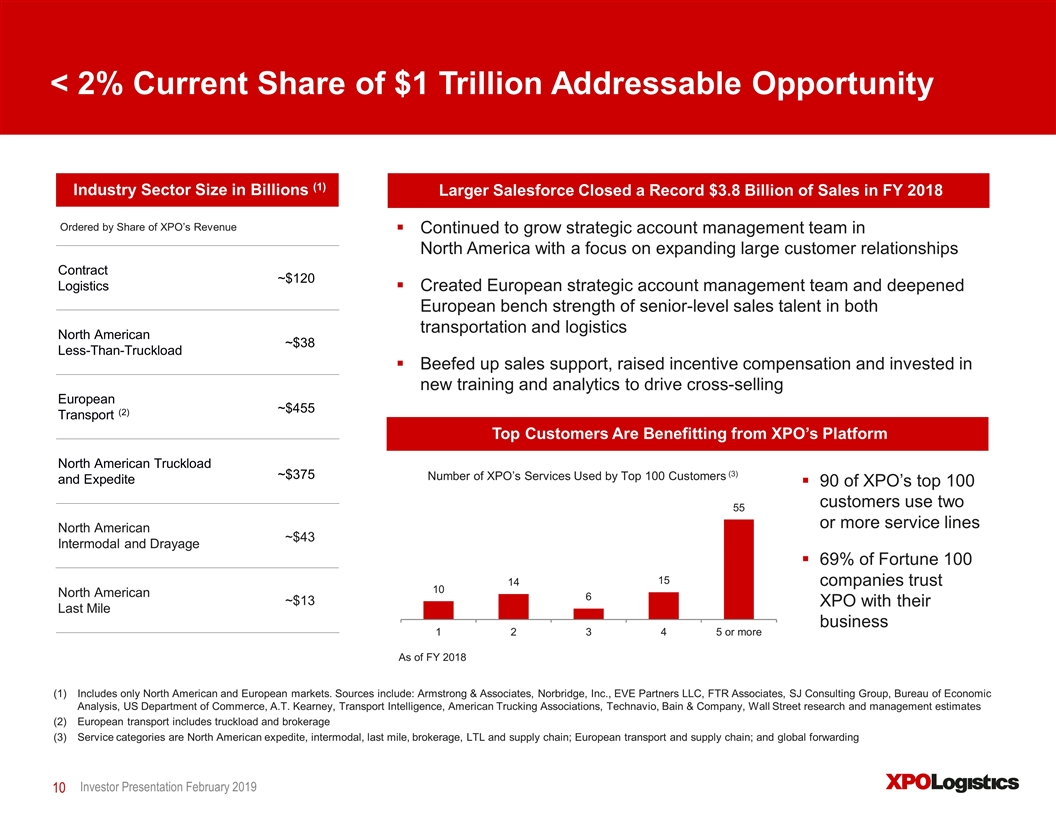

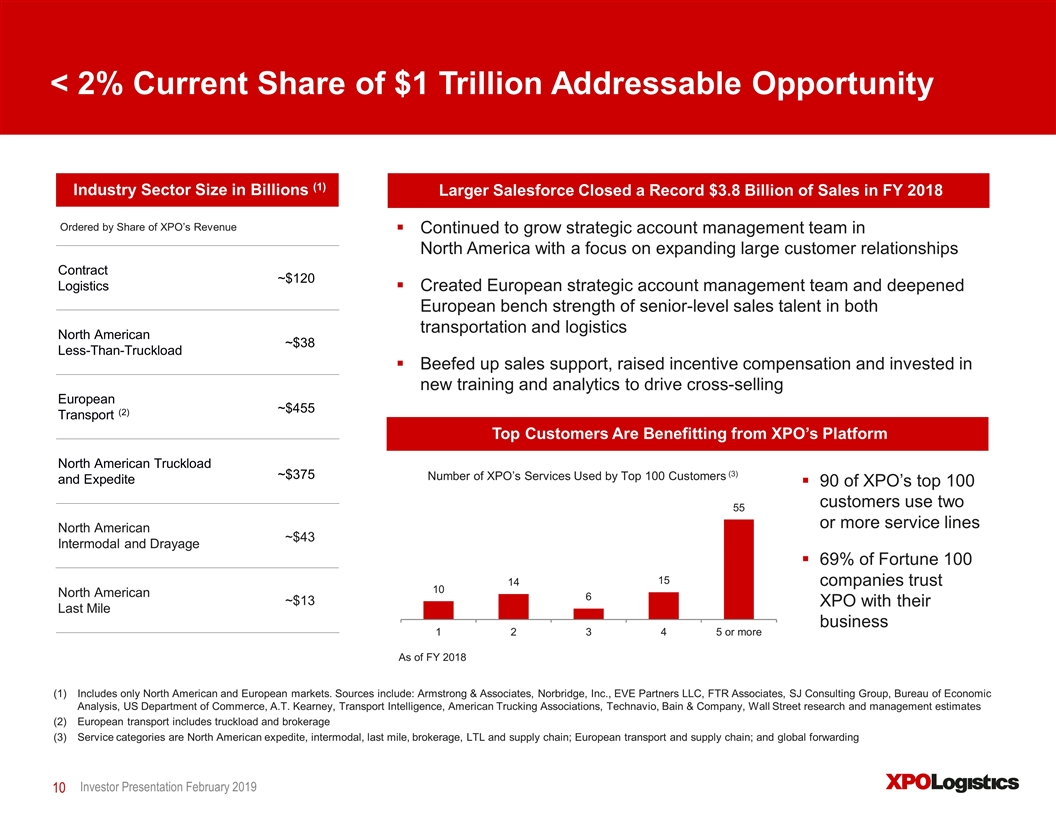

< 2% Current Share of $1 Trillion Addressable Opportunity Larger Salesforce Closed a Record $3.8 Billion of Sales in FY 2018 Continued to grow strategic account management team in North America with a focus on expanding large customer relationships Created European strategic account management team and deepened European bench strength of senior-level sales talent in both transportation and logistics Beefed up sales support, raised incentive compensation and invested in new training and analytics to drive cross-selling Industry Sector Size in Billions (1) Contract Logistics ~$120 North American Less-Than-Truckload ~$38 European Transport (2) ~$455 North American Truckload and Expedite ~$375 North American Intermodal and Drayage ~$43 North American Last Mile ~$13 Ordered by Share of XPO’s Revenue Top Customers Are Benefitting from XPO’s Platform Number of XPO’s Services Used by Top 100 Customers (3) 90 of XPO’s top 100 customers use two or more service lines 69% of Fortune 100 companies trust XPO with their business Investor Presentation February 2019 Includes only North American and European markets. Sources include: Armstrong & Associates, Norbridge, Inc., EVE Partners LLC, FTR Associates, SJ Consulting Group, Bureau of Economic Analysis, US Department of Commerce, A.T. Kearney, Transport Intelligence, American Trucking Associations, Technavio, Bain & Company, Wall Street research and management estimates European transport includes truckload and brokerage Service categories are North American expedite, intermodal, last mile, brokerage, LTL and supply chain; European transport and supply chain; and global forwarding As of FY 2018

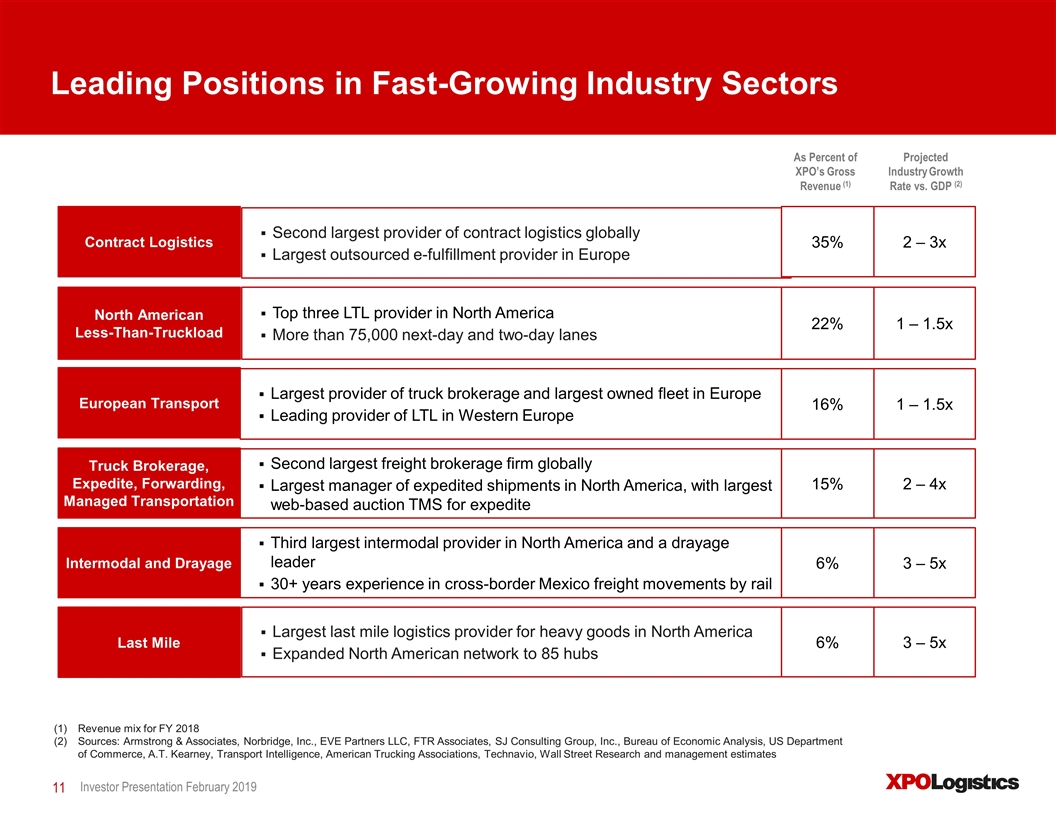

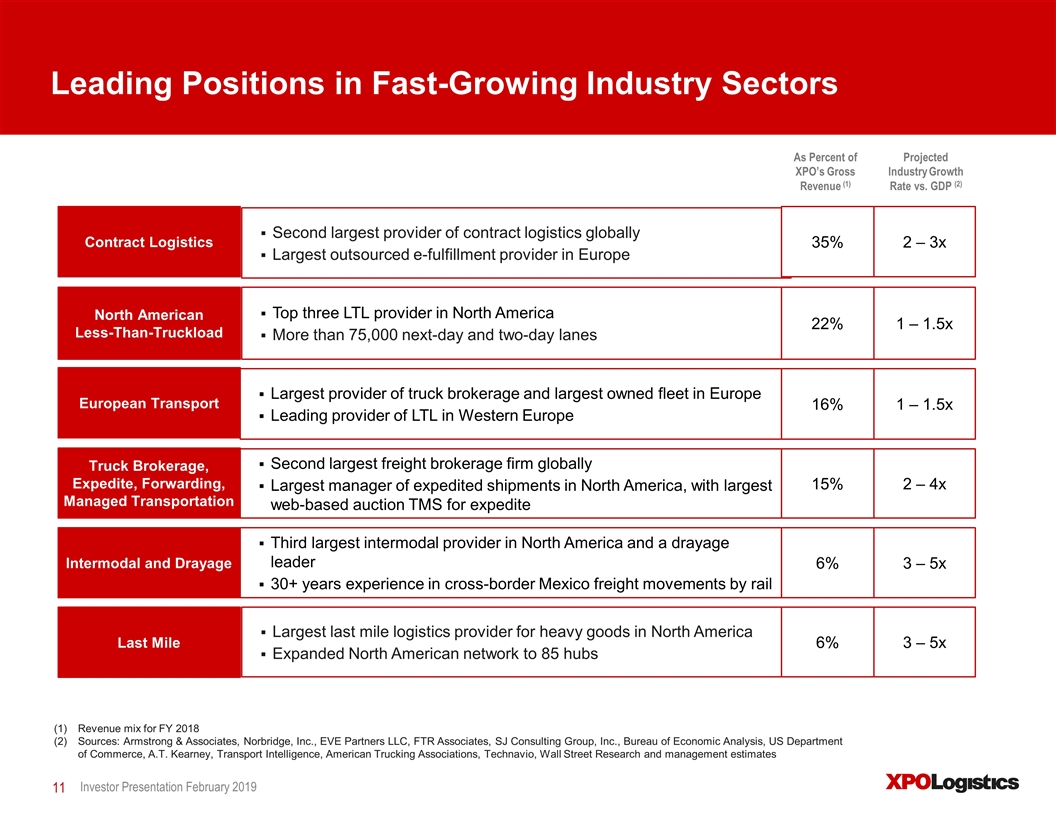

Revenue mix for FY 2018 Sources: Armstrong & Associates, Norbridge, Inc., EVE Partners LLC, FTR Associates, SJ Consulting Group, Inc., Bureau of Economic Analysis, US Department of Commerce, A.T. Kearney, Transport Intelligence, American Trucking Associations, Technavio, Wall Street Research and management estimates Leading Positions in Fast-Growing Industry Sectors As Percent of XPO’s Gross Revenue (1) Projected Industry Growth Rate vs. GDP (2) Second largest provider of contract logistics globally Largest outsourced e-fulfillment provider in Europe Contract Logistics 35% 2 – 3x Top three LTL provider in North America More than 75,000 next-day and two-day lanes North American Less-Than-Truckload 22% 1 – 1.5x Second largest freight brokerage firm globally Largest manager of expedited shipments in North America, with largest web-based auction TMS for expedite Truck Brokerage, Expedite, Forwarding, Managed Transportation 15% 2 – 4x Third largest intermodal provider in North America and a drayage leader 30+ years experience in cross-border Mexico freight movements by rail Intermodal and Drayage 6% 3 – 5x Largest last mile logistics provider for heavy goods in North America Expanded North American network to 85 hubs Last Mile 6% 3 – 5x Largest provider of truck brokerage and largest owned fleet in Europe Leading provider of LTL in Western Europe European Transport 16% 1 – 1.5x Investor Presentation February 2019

Major Player in the High-Growth E-Commerce Market Largest e-fulfillment 3PL in Europe, with a strong position in North America Omnichannel and reverse logistics (returns management) leader in North America Customers include pure-play e-commerce companies and retail giants Extensive experience with product returns, testing, refurbishment, warranty management, order personalization and other value-added services XPO Direct shared-space distribution network gives customers time-definite, fast and affordable order fulfillment Proprietary technology for advanced warehouse automation, robots, drones and other innovations enable customized logistics solutions Largest North American provider of last mile logistics for heavy goods, a growing category of online purchases, with service launched in Europe Industry-leading consumer satisfaction levels powered by scale and technology Investor Presentation February 2019

Company-Specific Growth Drivers Investor Presentation February 2019 2018 investments drive benefits going forward Expanded contract logistics infrastructure with warehouse management software, data-driven workforce planning tools and automated solutions Launched national operations of XPO Direct to serve omnichannel, e-commerce and manufacturing customers, with a network of over 90 sites LTL initiatives resulted in significant improvements in customer service, on-time delivery and overall customer satisfaction ratings Technology implemented for dynamic route optimization, advanced pricing algorithms and Al-based load-building Completed expansion of last mile footprint to 85 North American hubs, strategically located for pure-play last mile customers and XPO Direct distribution Deepened competitive moat of proprietary technology, with an emphasis on differentiation in e-commerce, consumerization and digitalization

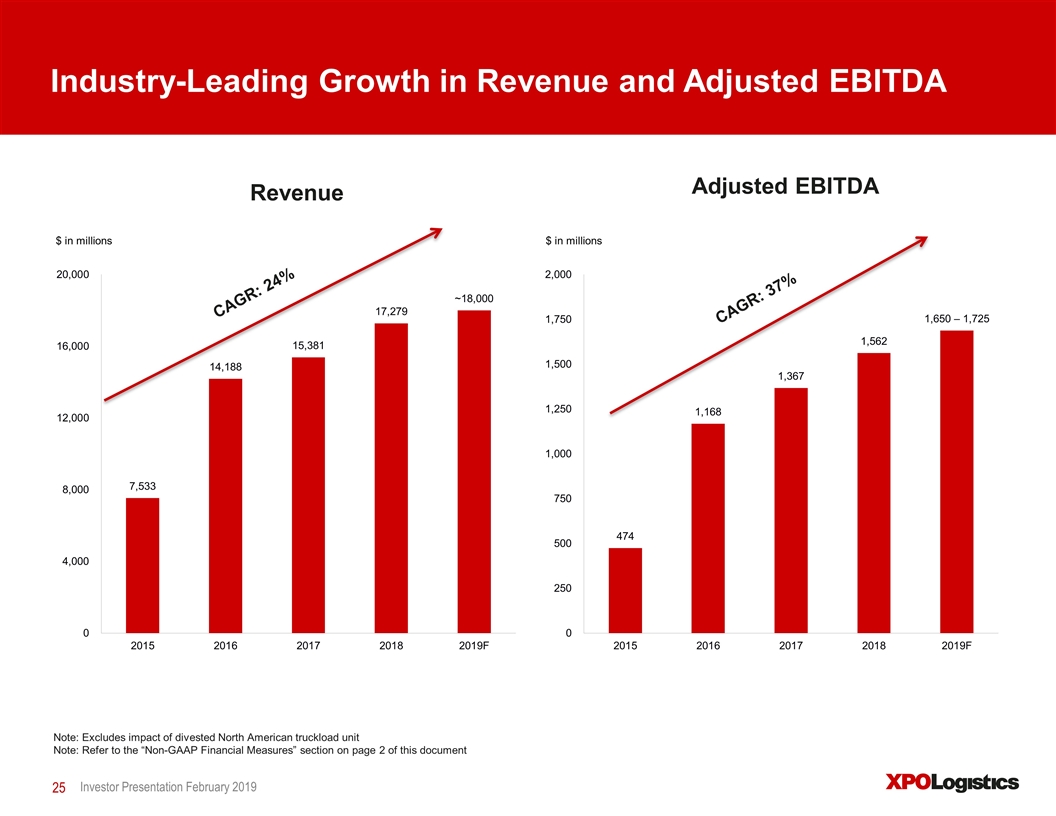

Grew Adjusted EBITDA by 14.3% in 2018, versus 2017 Investor Presentation February 2019 Delivered $1.562 billion of adjusted EBITDA for full year 2018 Investments in salesforce expansion and effectiveness Execution of pricing initiatives Implementation of process improvements, advanced robotics and other innovations Tech-enabled workforce planning for management of overtime and temporary labor Further improvement of LTL business mix and network efficiency Ongoing cross-fertilization of best practices Automation of select customer-related and carrier-facing operations Ongoing efficiencies in shared services such as HR, IT and Finance Centralized procurement and other economies of scale Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document

Key Lines of Business

Contract Logistics Competitive Position as Technology Leader Asset-light business characterized by long-term, recurring contractual relationships, low cyclicality and a high-value-add component that minimizes commoditization Deep expertise in high-growth sectors that trend toward outsourcing: retail, e-commerce, industrial, high tech, aerospace, telecom, food and beverage, healthcare and agriculture Largest provider of outsourced e-fulfillment in Europe Advanced warehouse robotics and automation Low maintenance capex requirements Five-year average contract tenure with a historical renewal rate of over 95% Organic revenue growth of 12.4% in Q4 2018 Investor Presentation February 2019 Global Footprint Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document

Truck Brokerage Broad Opportunity to Cross-Sell Massive Capacity Non-asset business that matches shippers’ freight with an established network of over 38,000 pre-qualified trucking carriers Continuously improving productivity through proprietary Freight Optimizer technology Drive XPO mobile app and XPO Connect network strengthen relationships with carriers Proprietary algorithms use machine learning to enhance pricing accuracy High free cash flow conversion and minimal capex Variable cost model performs well through cycles Fragmented market with opportunity to expand Outsourcing trends drive industry growth Global Footprint Investor Presentation February 2019

Last Mile Demand Propelled by E-Commerce and Omnichannel Investor Presentation February 2019 Asset-light business that arranges the final stage of heavy goods deliveries from distribution centers, cross-docks or retail stores to consumers’ homes Customers include nearly all of the top big-box retailers and e-tailers in the US Best-in-class customer experience facilitated by proprietary technology for tracking, delivery and in-home installation of goods Integrated with contract logistics and LTL in XPO Direct share distribution network to create a powerful value proposition for retail and e-commerce customers Arranged approximately 40,000 deliveries a day on average in 2018 Expanding last mile service in Europe Global Footprint

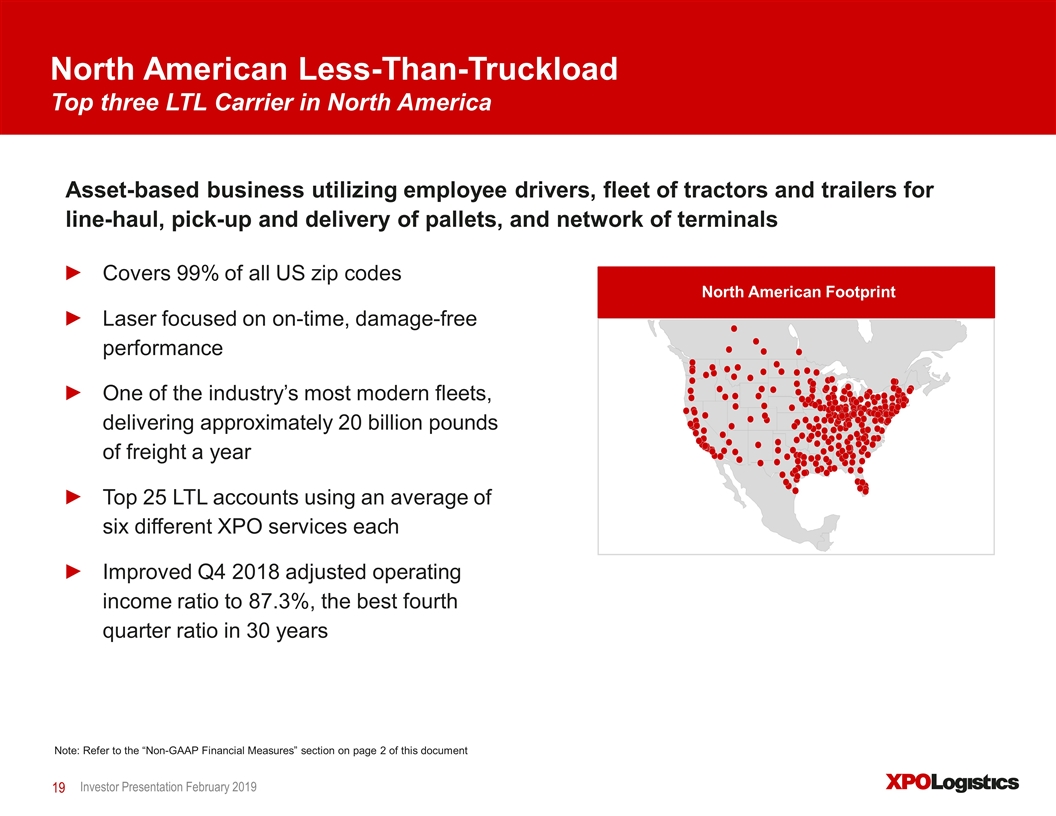

North American Less-Than-Truckload Top three LTL Carrier in North America Investor Presentation February 2019 Asset-based business utilizing employee drivers, fleet of tractors and trailers for line-haul, pick-up and delivery of pallets, and network of terminals Covers 99% of all US zip codes Laser focused on on-time, damage-free performance One of the industry’s most modern fleets, delivering approximately 20 billion pounds of freight a year Top 25 LTL accounts using an average of six different XPO services each Improved Q4 2018 adjusted operating income ratio to 87.3%, the best fourth quarter ratio in 30 years North American Footprint Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document

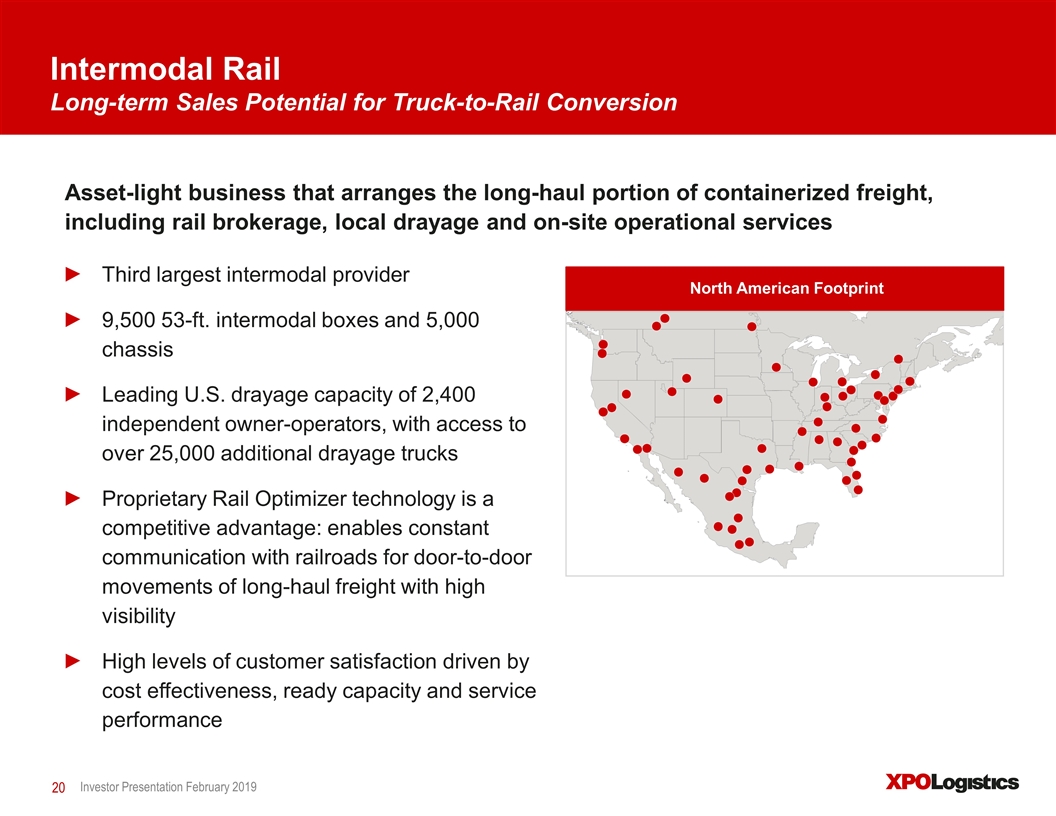

Intermodal Rail Long-term Sales Potential for Truck-to-Rail Conversion Investor Presentation February 2019 Asset-light business that arranges the long-haul portion of containerized freight, including rail brokerage, local drayage and on-site operational services Third largest intermodal provider 9,500 53-ft. intermodal boxes and 5,000 chassis Leading U.S. drayage capacity of 2,400 independent owner-operators, with access to over 25,000 additional drayage trucks Proprietary Rail Optimizer technology is a competitive advantage: enables constant communication with railroads for door-to-door movements of long-haul freight with high visibility High levels of customer satisfaction driven by cost effectiveness, ready capacity and service performance North American Footprint

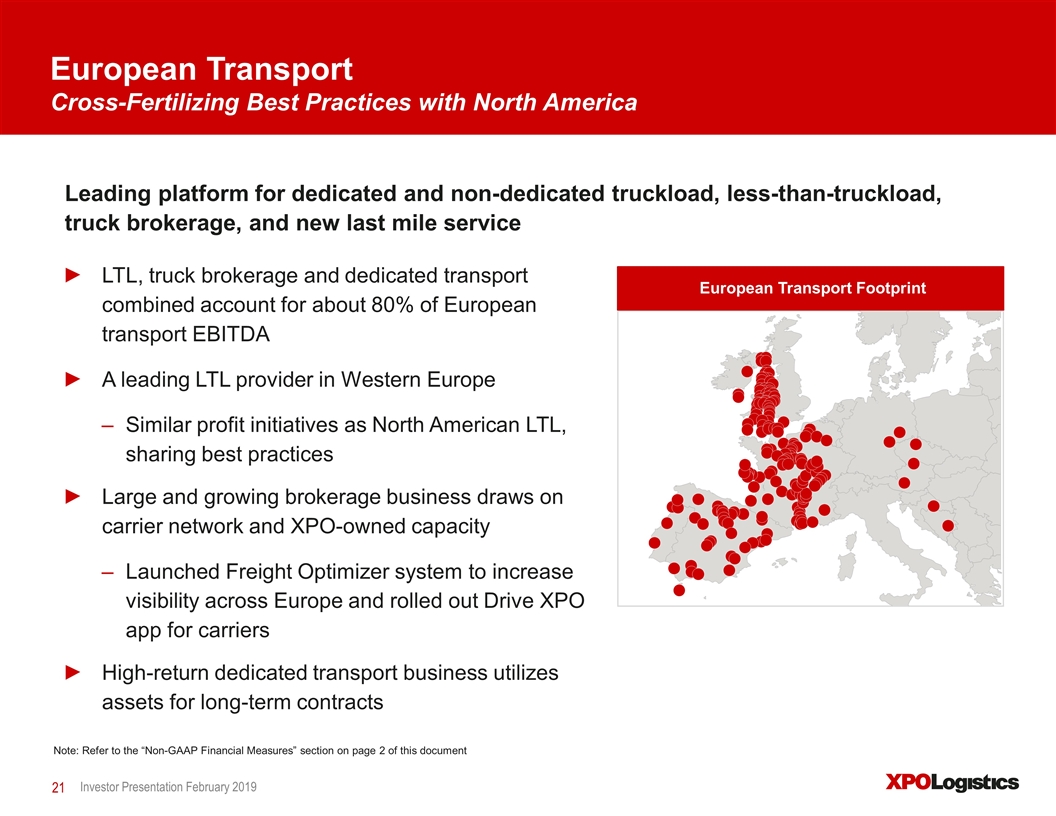

European Transport Cross-Fertilizing Best Practices with North America Investor Presentation February 2019 Leading platform for dedicated and non-dedicated truckload, less-than-truckload, truck brokerage, and new last mile service LTL, truck brokerage and dedicated transport combined account for about 80% of European transport EBITDA A leading LTL provider in Western Europe Similar profit initiatives as North American LTL, sharing best practices Large and growing brokerage business draws on carrier network and XPO-owned capacity Launched Freight Optimizer system to increase visibility across Europe and rolled out Drive XPO app for carriers High-return dedicated transport business utilizes assets for long-term contracts European Transport Footprint Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document

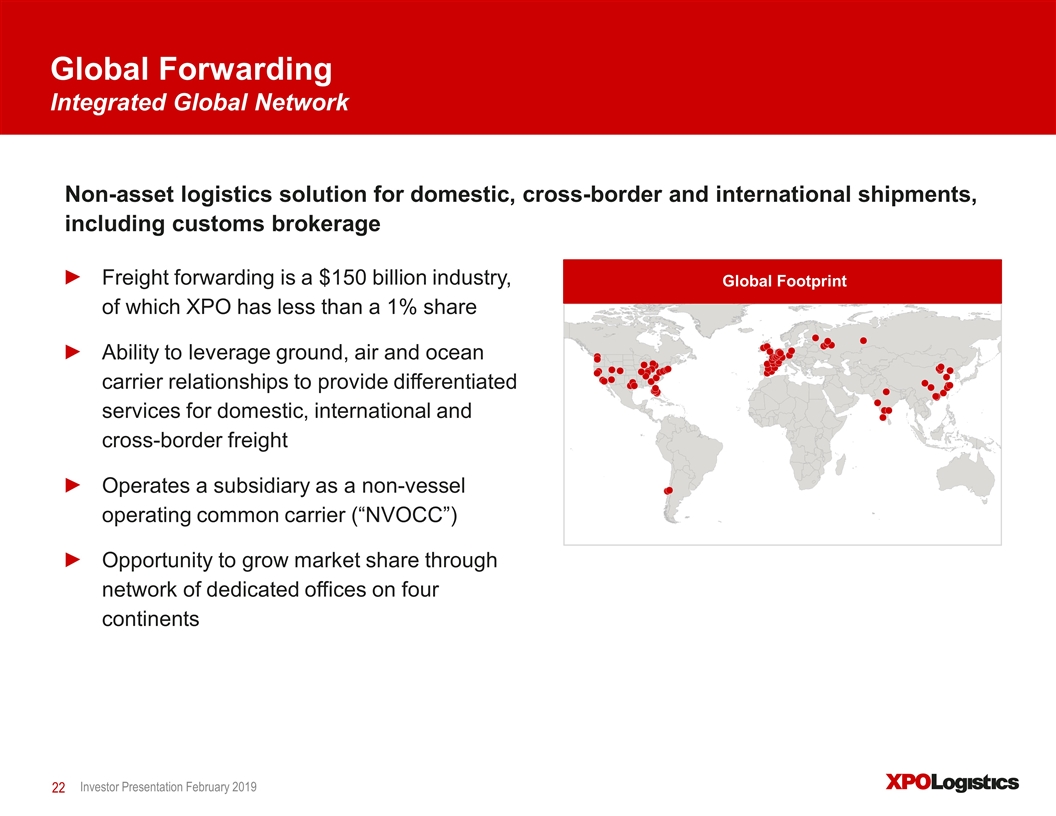

Global Forwarding Integrated Global Network Investor Presentation February 2019 Non-asset logistics solution for domestic, cross-border and international shipments, including customs brokerage Freight forwarding is a $150 billion industry, of which XPO has less than a 1% share Ability to leverage ground, air and ocean carrier relationships to provide differentiated services for domestic, international and cross-border freight Operates a subsidiary as a non-vessel operating common carrier (“NVOCC”) Opportunity to grow market share through network of dedicated offices on four continents Global Footprint

Financial Highlights

Share Repurchase Programs On February 4, 2019, the company completed the share repurchase program announced in December 2018: A total of 18 million shares of XPO common stock were retired for approximately $1 billion $56.09 average share price On February 13, 2019, the company’s board of directors authorized a new share repurchase of up to $1.5 billion of XPO common stock: The company intends to fund the program with existing cash, borrowings on its credit facility and other financing sources The company is not obligated to repurchase any specific number of shares, and may suspend or discontinue the program at any time Investor Presentation February 2019

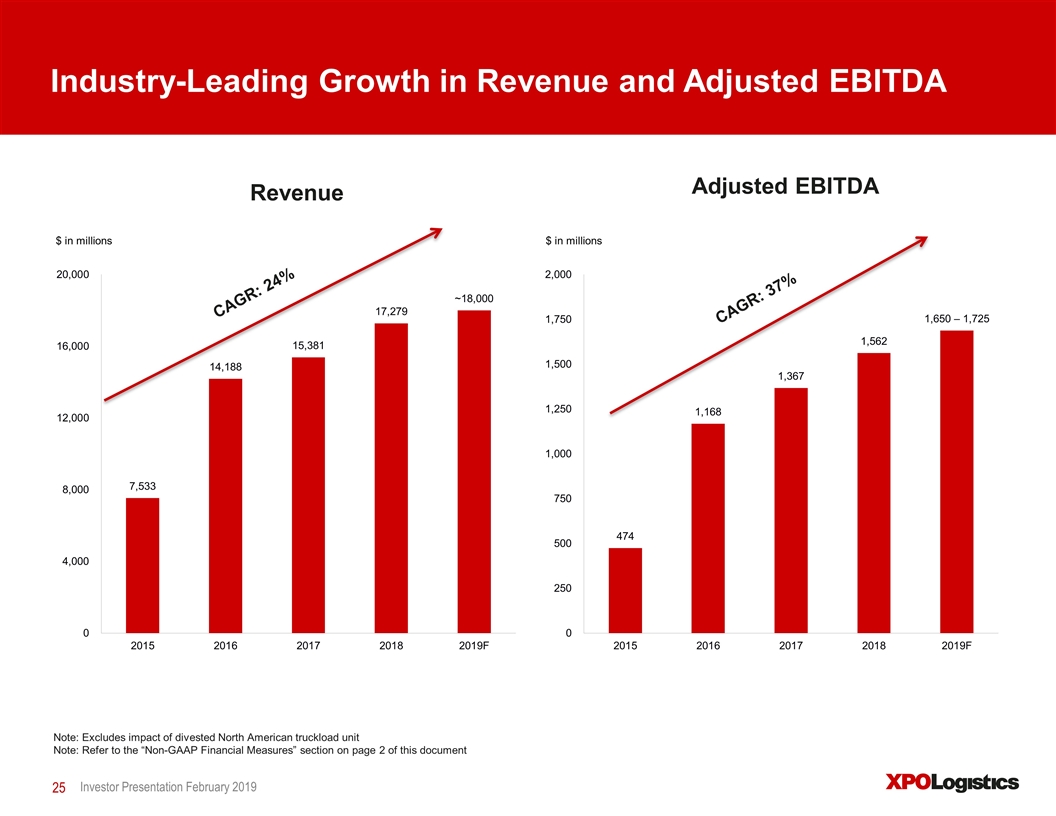

Industry-Leading Growth in Revenue and Adjusted EBITDA Note: Excludes impact of divested North American truckload unit Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document Investor Presentation February 2019 Revenue Adjusted EBITDA $ in millions $ in millions CAGR: 24% CAGR: 37%

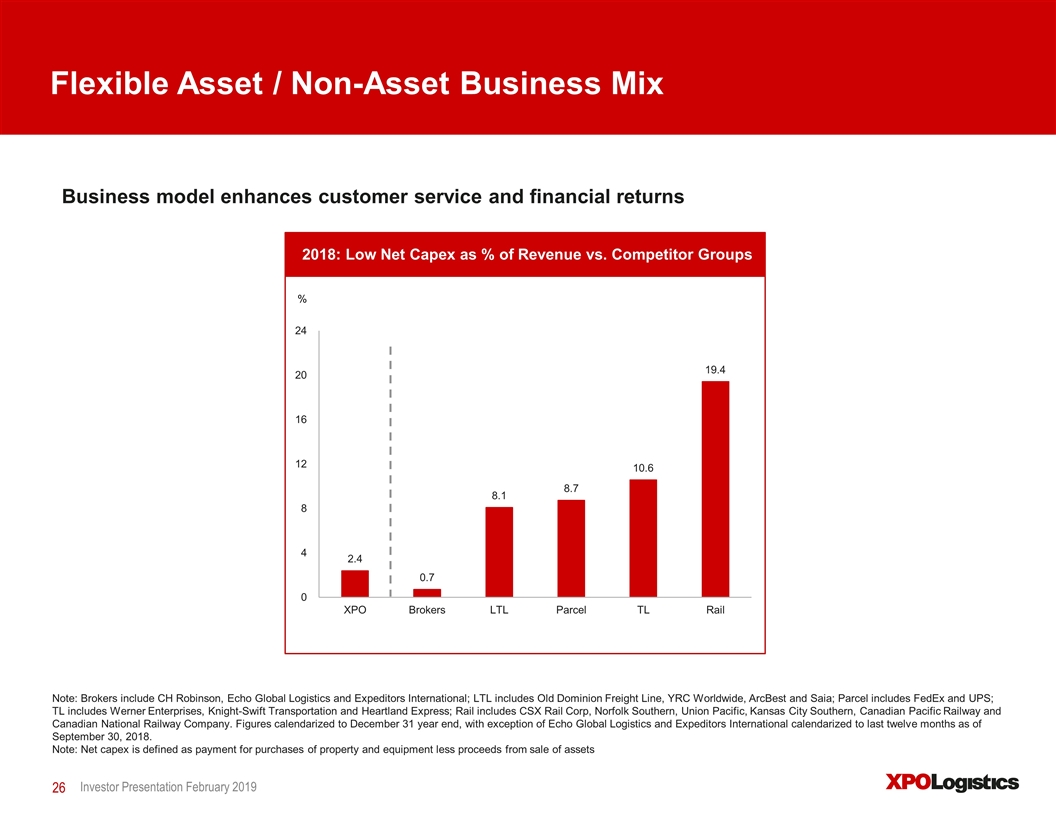

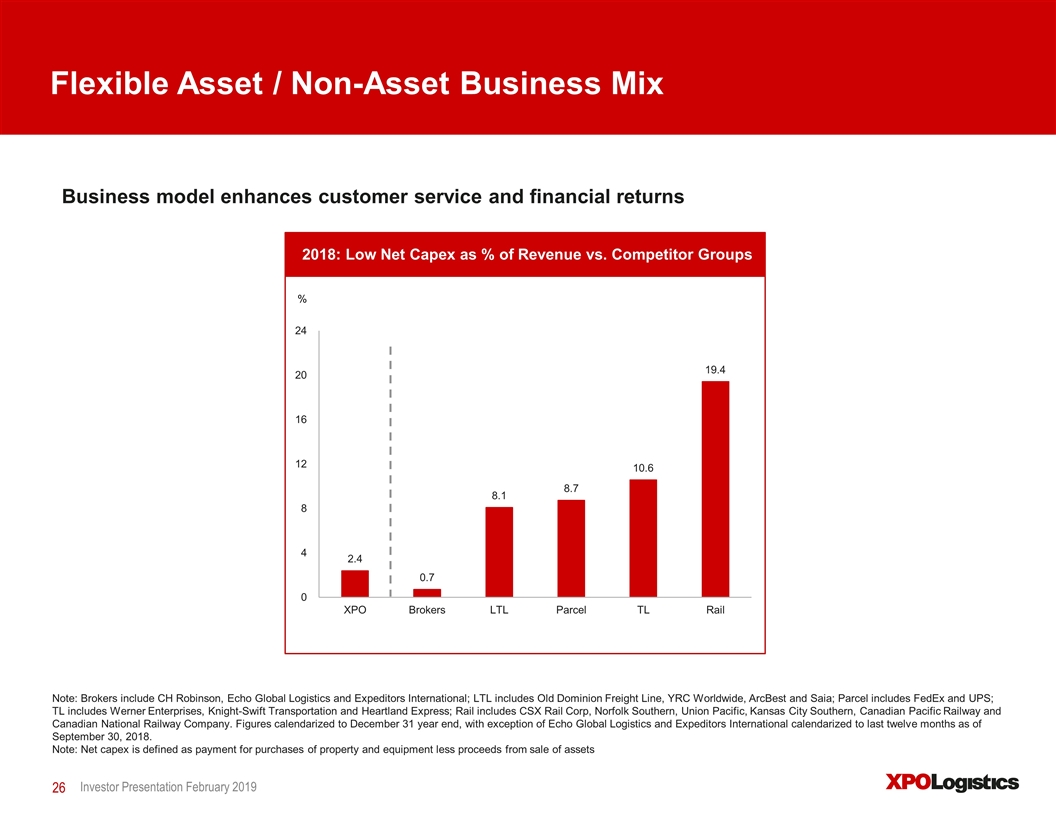

Flexible Asset / Non-Asset Business Mix Business model enhances customer service and financial returns % Investor Presentation February 2019 Note: Brokers include CH Robinson, Echo Global Logistics and Expeditors International; LTL includes Old Dominion Freight Line, YRC Worldwide, ArcBest and Saia; Parcel includes FedEx and UPS; TL includes Werner Enterprises, Knight-Swift Transportation and Heartland Express; Rail includes CSX Rail Corp, Norfolk Southern, Union Pacific, Kansas City Southern, Canadian Pacific Railway and Canadian National Railway Company. Figures calendarized to December 31 year end, with exception of Echo Global Logistics and Expeditors International calendarized to last twelve months as of September 30, 2018. Note: Net capex is defined as payment for purchases of property and equipment less proceeds from sale of assets 2018: Low Net Capex as % of Revenue vs. Competitor Groups

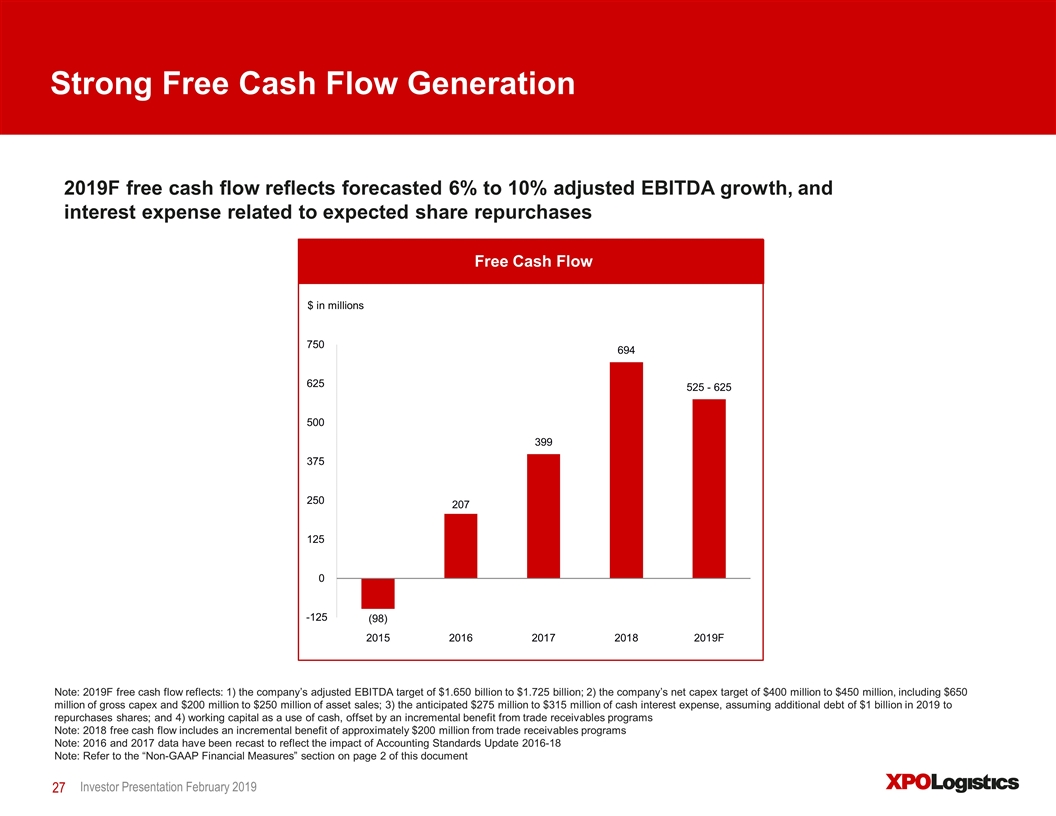

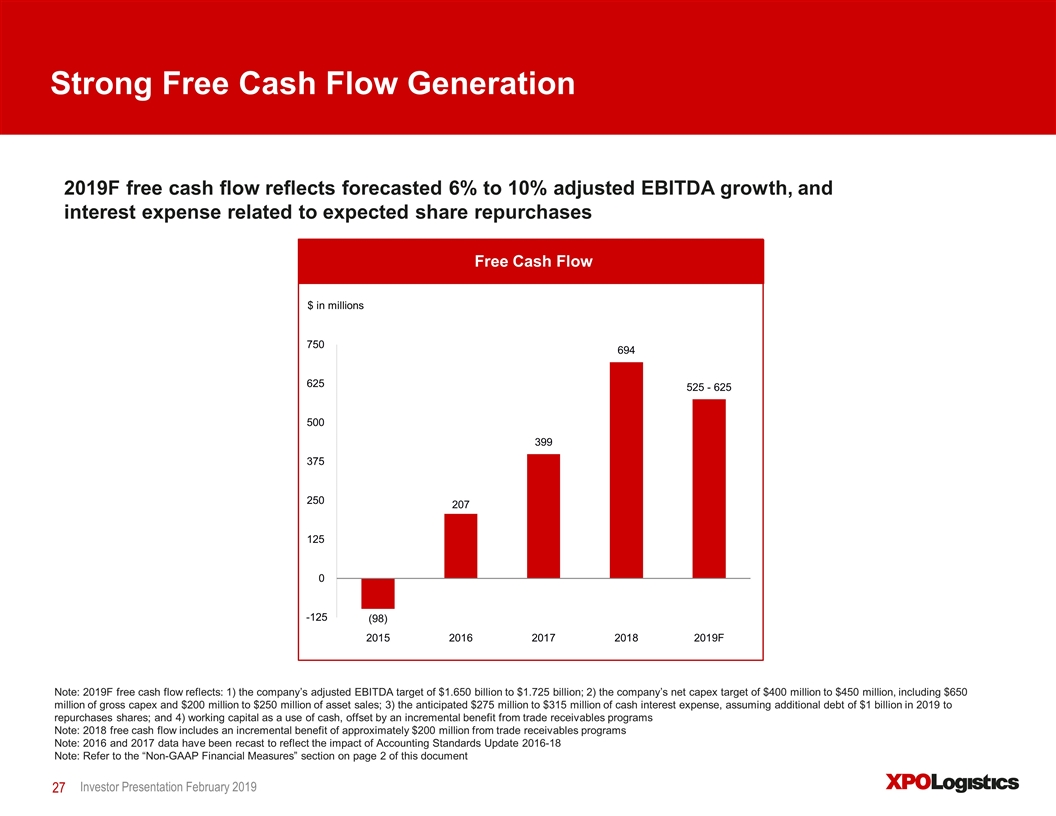

Strong Free Cash Flow Generation 2019F free cash flow reflects forecasted 6% to 10% adjusted EBITDA growth, and interest expense related to expected share repurchases Investor Presentation February 2019 Note: 2019F free cash flow reflects: 1) the company’s adjusted EBITDA target of $1.650 billion to $1.725 billion; 2) the company’s net capex target of $400 million to $450 million, including $650 million of gross capex and $200 million to $250 million of asset sales; 3) the anticipated $275 million to $315 million of cash interest expense, assuming additional debt of $1 billion in 2019 to repurchases shares; and 4) working capital as a use of cash, offset by an incremental benefit from trade receivables programs Note: 2018 free cash flow includes an incremental benefit of approximately $200 million from trade receivables programs Note: 2016 and 2017 data have been recast to reflect the impact of Accounting Standards Update 2016-18 Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document Free Cash Flow $ in millions

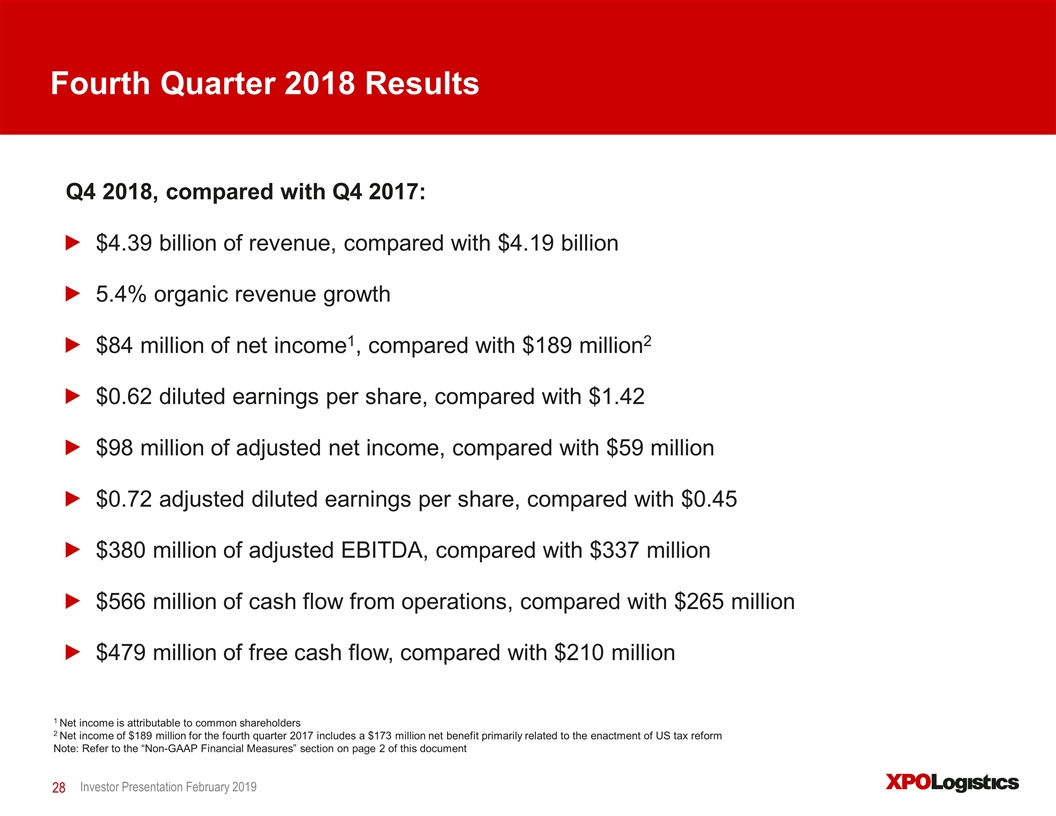

Fourth Quarter 2018 Results Investor Presentation February 2019 Q4 2018, compared with Q4 2017: $4.39 billion of revenue, compared with $4.19 billion 5.4% organic revenue growth $84 million of net income1, compared with $189 million2 $0.62 diluted earnings per share, compared with $1.42 $98 million of adjusted net income, compared with $59 million $0.72 adjusted diluted earnings per share, compared with $0.45 $380 million of adjusted EBITDA, compared with $337 million $566 million of cash flow from operations, compared with $265 million $479 million of free cash flow, compared with $210 million 1 Net income is attributable to common shareholders 2 Net income of $189 million for the fourth quarter 2017 includes a $173 million net benefit primarily related to the enactment of US tax reform Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document

2019 Financial Targets The company updated its full-year 2019 targets on February 14, 2019: Revenue growth of 3% to 5%, which corresponds to organic revenue growth of 4% to 6% year-over-year; Adjusted EBITDA in the range of $1.650 billion to $1.725 billion, an increase of 6% to 10% year-over-year, versus the prior target of 12% to 15%; Free cash flow in the range of $525 million to $625 million, versus the prior target of approximately $650 million; Net capital expenditures in the range of $400 million to $450 million; Depreciation and amortization in the range of $765 million to $785 million; Effective tax rate in the range of 26% to 29%; and Cash taxes in the range of $165 million to $190 million. The company’s 2019 targets for free cash flow and cash taxes assume a cash interest expense of $275 million to $315 million, based on additional debt of $1 billion in 2019 to repurchases shares. The company expects working capital to be a use of cash in 2019 as it funds its revenue growth, offset in part by incremental year-over-year proceeds of $125 million to $150 million from trade receivables programs. Investor Presentation February 2019 Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document

Well-Positioned to Create Meaningful Shareholder Value Leading positions in fast-growing areas of transportation and logistics Highly skilled at capital allocation Differentiated solutions that help customers manage their supply chains most efficiently Leading-edge technology for operations, customers and carriers Strong position in rapidly expanding e-commerce sector EBITDA growing faster than revenue Robust cash generation Insiders own 16% of diluted outstanding XPO shares Interests are strongly aligned with public shareholders Investor Presentation February 2019

Supplemental Materials

XPO Is Widely Recognized for Performance and Culture Named one of the World’s Most Admired Companies by Fortune, 2018 and 2019 Named to the Fortune Future 50 list of US companies best positioned for breakout growth by Fortune, 2018 Ranked #7 of the Glassdoor Top 20 UK companies with the best leadership and culture at work, 2018 Ranked #67 of Largest US Employers by Fortune, 2018 CEO Jacobs ranked #10 on Barron's list of World's Best CEOs, 2018 Awarded Company of the Year for innovation by Assologistica (Italy), 2017 and 2018 Recognized by Nissan (Europe) for logistics excellence, 2015, 2016, 2017, 2018 Named a top-performing US company on the Global 2000 by Forbes, 2017 Named one of America’s Best Employers by Forbes, 2017 Named a Worldwide Leader in the Magic Quadrant for Third-Party Logistics Providers by Gartner, 2018 Investor Presentation February 2019

Strongly Committed to Sustainability Transportation Named a Top 75 Green Supply Chain Partner by Inbound Logistics for 2016, 2017, 2018 Honored for excellence in environmental improvement by SmartWay® Awarded the label “Objectif CO2” for outstanding environmental performance of transport operations by the French Ministry of the Environment and the French Environment and Energy Agency Large capex investment in fuel-efficient Freightliner Cascadia tractors in North America (EPA 2013-compliant and GHG14-compliant SCR technology) One of the most modern fleets in Europe: 98% compliant with Euro V, EEV and Euro VI standards, with an average truck age of 2.5 years in 2018 Large fleet of natural gas trucks in Europe, pioneered LNG-powered tractors in the Paris suburban area Government-approved mega-trucks in Spain reduce road miles, CO2 emissions Investor Presentation February 2019

Strongly Committed to Sustainability (Cont’d) North American LTL operations have energy-saving policies in place and are implementing a phased upgrade to LED lighting Drivers train in responsible eco-driving and fuel usage reduction techniques Waste mitigation measures are instilled in daily operations to reduce paper, such as electronic waybills and documentation, and other waste products Experimenting with diesel alternatives such as diesel-electric hybrids Logistics Numerous XPO facilities are ISO14001-certified to high standards for environmental management Nestlé’s warehouse of the future in the UK will be sited on man-made plateaus, with environmentally friendly ammonia refrigeration systems, LED lighting, air-source heat pumps for administration areas and rainwater harvesting Investor Presentation February 2019

Strongly Committed to Sustainability (Cont’d) Energy efficiency evaluations are performed prior to selecting warehouses to lease, and energy efficient equipment is purchased when feasible Fuel emissions from forklifts are monitored at logistics sites, with protocols in place to take immediate corrective action if needed Millions of electronic components and batteries are recycled annually as a byproduct of reverse logistics operations Packaging engineers ensure that the optimal carton size is used for each product slated for distribution Recycled packaging is purchased when feasible Reusable kitting tools are utilized for the installation of parts in customer operations, manufactured by XPO We are focused on operating our business in a way that demonstrates a high regard for the environment and all our stakeholders Investor Presentation February 2019

Business Glossary Contract Logistics: An asset-light, technology-enabled business characterized by long-term contractual relationships with high renewal rates, low cyclicality and a high-value-add component that minimizes commoditization. Contracts are typically structured as either fixed-variable, cost-plus or gain-share. XPO services include highly engineered solutions, e-fulfillment, reverse logistics, packaging, factory support, aftermarket support, warehousing and distribution for customers in aerospace, manufacturing, retail, life sciences, chemicals, food and beverage, and cold chain. Reverse logistics, also known as returns management, refers to processes associated with managing the flow of returned goods back through contract logistics facilities: for example, unwanted e-commerce purchases, food transport equipment or defective goods. Reverse logistics services can include cleaning, inspection, refurbishment, restocking, warranty processing and other lifecycle services. Expedite: A non-asset business that facilitates time-critical, high-value or high-security shipments, usually on very short notice. Revenue is either contractual or transactional, primarily driven by unforeseen supply chain disruptions or just-in-time inventory demand for raw materials, parts or goods. XPO provides three types of expedite service: ground transportation via a network of independent contract carriers; air charter transportation facilitated by proprietary, a web-based technology that solicits bids and assigns loads to aircraft; and a transportation management system (TMS) network that is the largest web-based expedite management system in North America. Freight Brokerage: A variable cost business that facilitates the trucking of freight by procuring carriers through the use of proprietary technology. Freight brokerage net revenue is the spread between the price to the shipper and the cost of purchased transportation. In North America, XPO has a non-asset freight brokerage business, with a network of 38,000 independent carriers. In Europe, XPO generates over €1 billion in freight brokerage revenue annually, with capacity provided by an asset-light mix of owned fleet and independent carriers. Global Forwarding: A non-asset business that facilitates freight shipments by ground, air and ocean. Shipments may have origins and destinations within North America, to or from North America, or between foreign locations. Services are provided through a network of market experts who provide local oversight in thousands of key trade areas worldwide. XPO’s global forwarding service can arrange shipments with no restrictions as to size, weight or mode, and is OTI and NVOCC licensed. Investor Presentation February 2019

Business Glossary (Cont’d) Intermodal: An asset-light business that facilitates the movement of long-haul, containerized freight by rail, often with a drayage (trucking) component at either end. Intermodal is a variable cost business, with revenue generated by a mix of contractual and spot market transactions. Net revenue equates to the spread between the price to the shipper and the cost of purchasing rail and truck transportation. Two factors are driving growth in intermodal in North America: rail transportation is less expensive and more fuel efficient per mile than long-haul trucking, and rail is a key mode of transportation in and out of Mexico, where the manufacturing base is booming due to a trend toward near-shoring. Last Mile: An asset-light business that facilitates the delivery of goods to their final destination, most often to consumer households. XPO specializes in two areas of last mile service: arranging the delivery and installation of heavy goods such as appliances, furniture and electronics, often with a white glove component; and providing logistics solutions to retailers and distributors to support their e-commerce supply chains and omnichannel distribution strategies. Capacity is sourced from a network of independent contract carriers and technicians. Less-Than-Truckload (LTL): The transportation of a quantity of freight that is larger than a parcel, but too small to require an entire truck, and is often shipped on a pallet. LTL shipments are priced according to the weight of the freight, its commodity class (which is generally determined by its cube/weight ratio and the description of the product), and mileage within designated lanes. An LTL carrier typically operates a hub-and-spoke network that allows for the consolidation of multiple shipments for different customers in single trucks. Managed Transportation: A service provided to shippers who want to outsource some or all of their transportation modes, together with associated activities. This can include freight handling such as consolidation and deconsolidation, labor planning, inbound and outbound shipment facilitation, documentation and customs management, claims processing, and 3PL supplier management, among other things. Truckload: The ground transportation of cargo provided by a single shipper in an amount that requires the full limit of the trailer, either by dimension or weight. Cargo typically remains on a single vehicle from the point of origin to the destination, and is not handled en route. See Freight Brokerage on the prior page for additional details. Investor Presentation February 2019

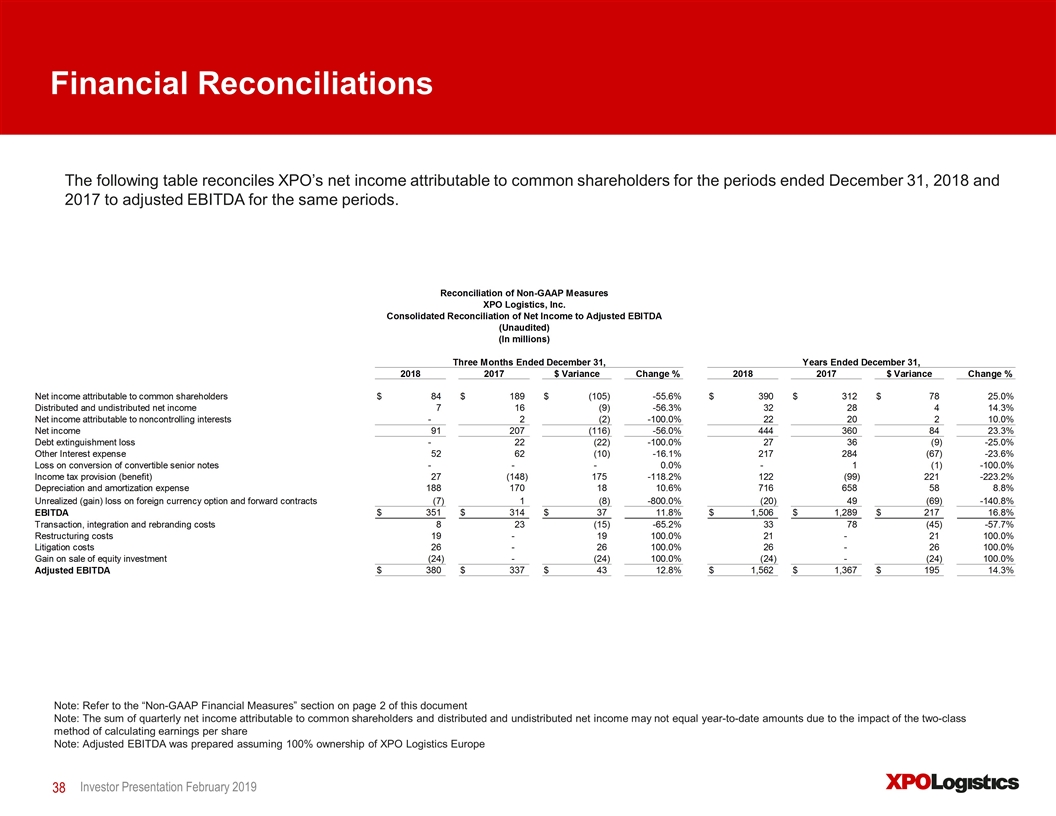

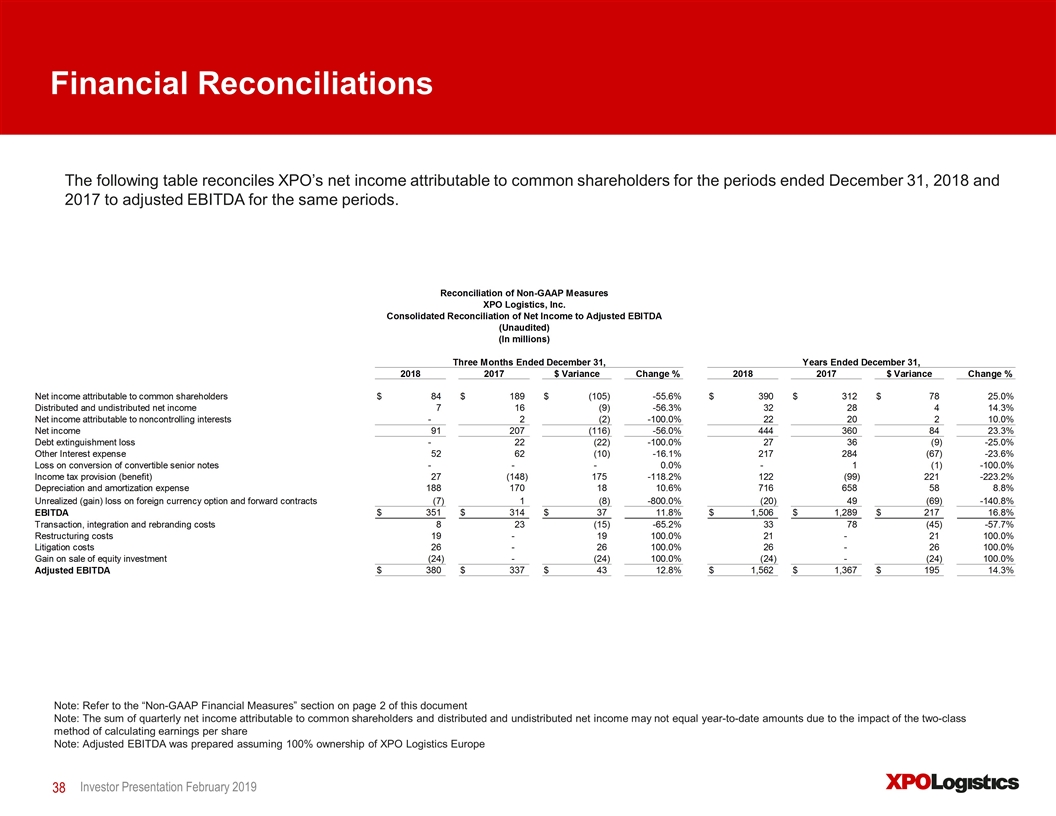

Financial Reconciliations The following table reconciles XPO’s net income attributable to common shareholders for the periods ended December 31, 2018 and 2017 to adjusted EBITDA for the same periods. Investor Presentation February 2019 Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document Note: The sum of quarterly net income attributable to common shareholders and distributed and undistributed net income may not equal year-to-date amounts due to the impact of the two-class method of calculating earnings per share Note: Adjusted EBITDA was prepared assuming 100% ownership of XPO Logistics Europe

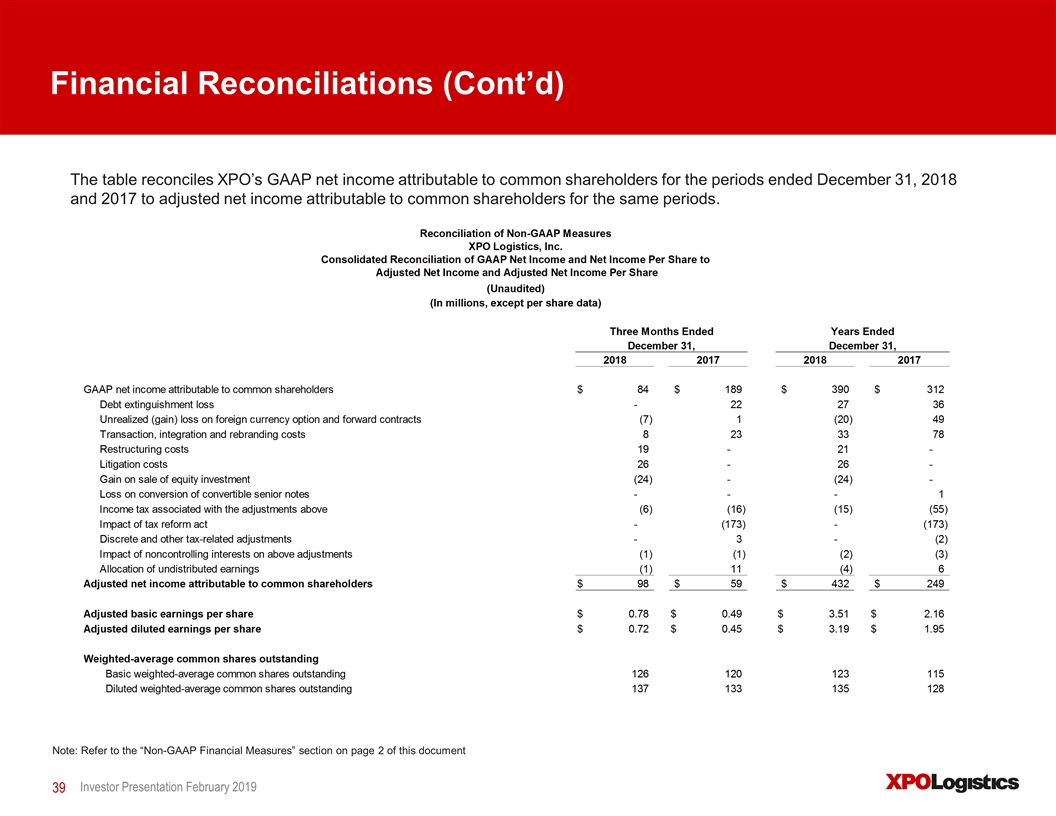

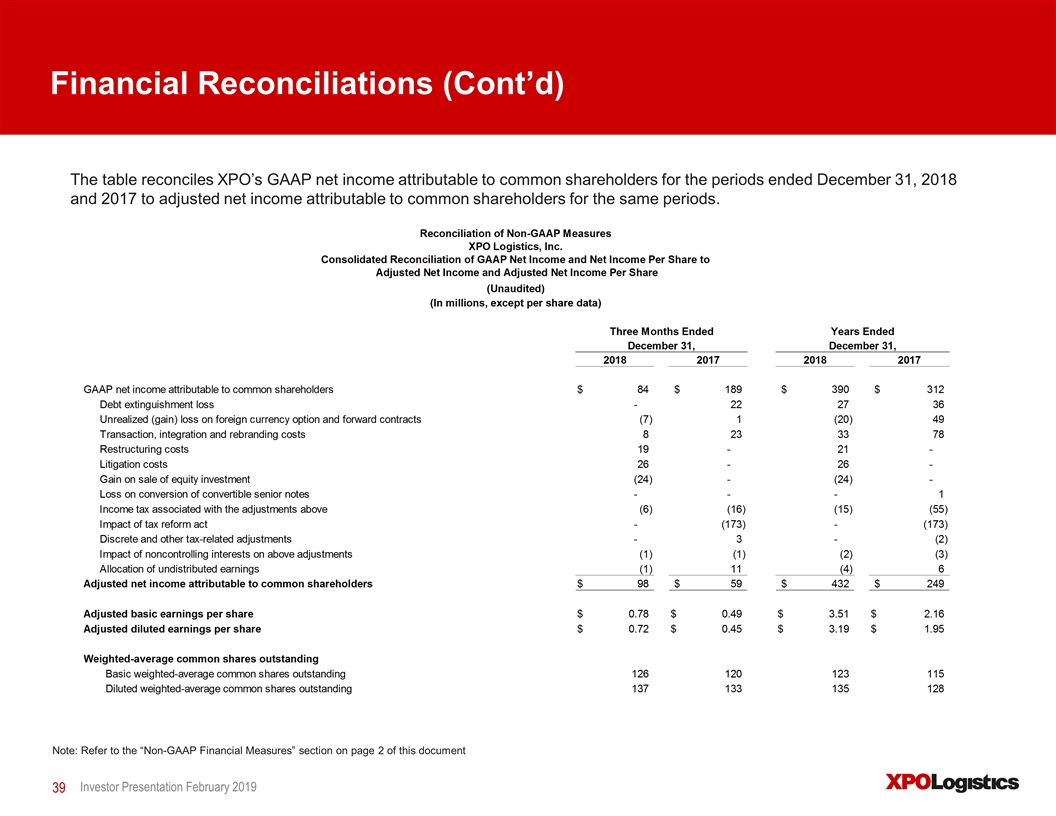

Financial Reconciliations (Cont’d) Investor Presentation February 2019 The table reconciles XPO’s GAAP net income attributable to common shareholders for the periods ended December 31, 2018 and 2017 to adjusted net income attributable to common shareholders for the same periods. Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document

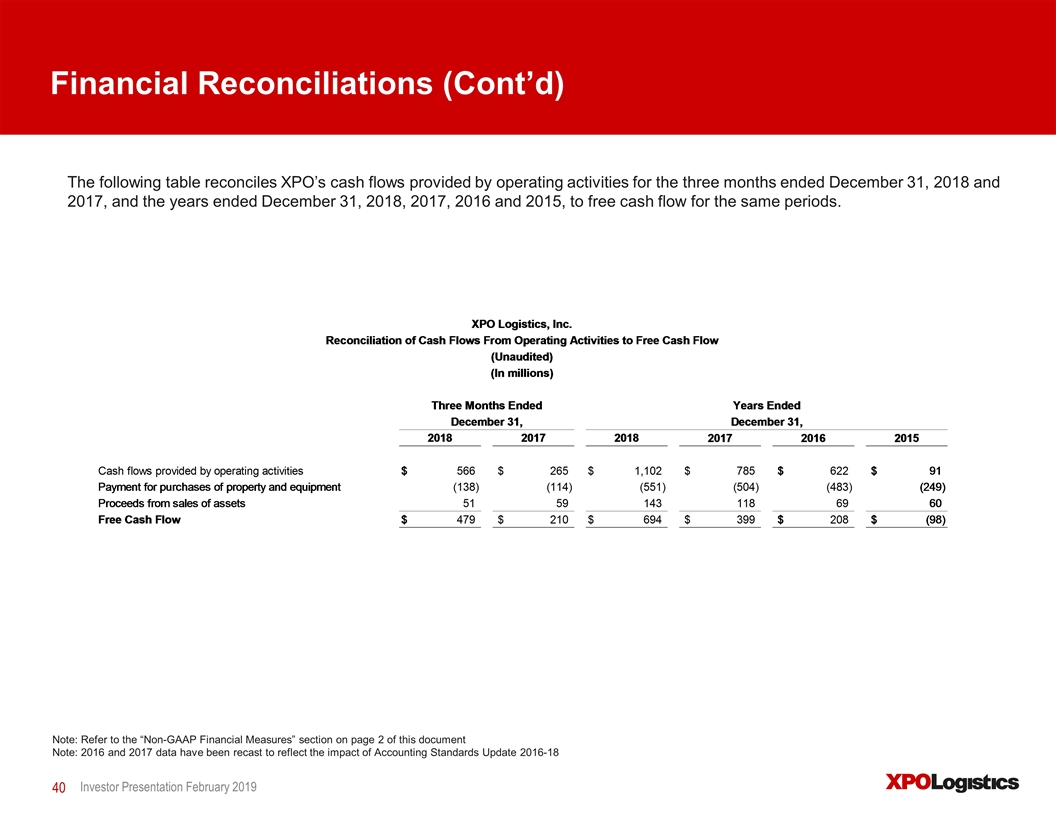

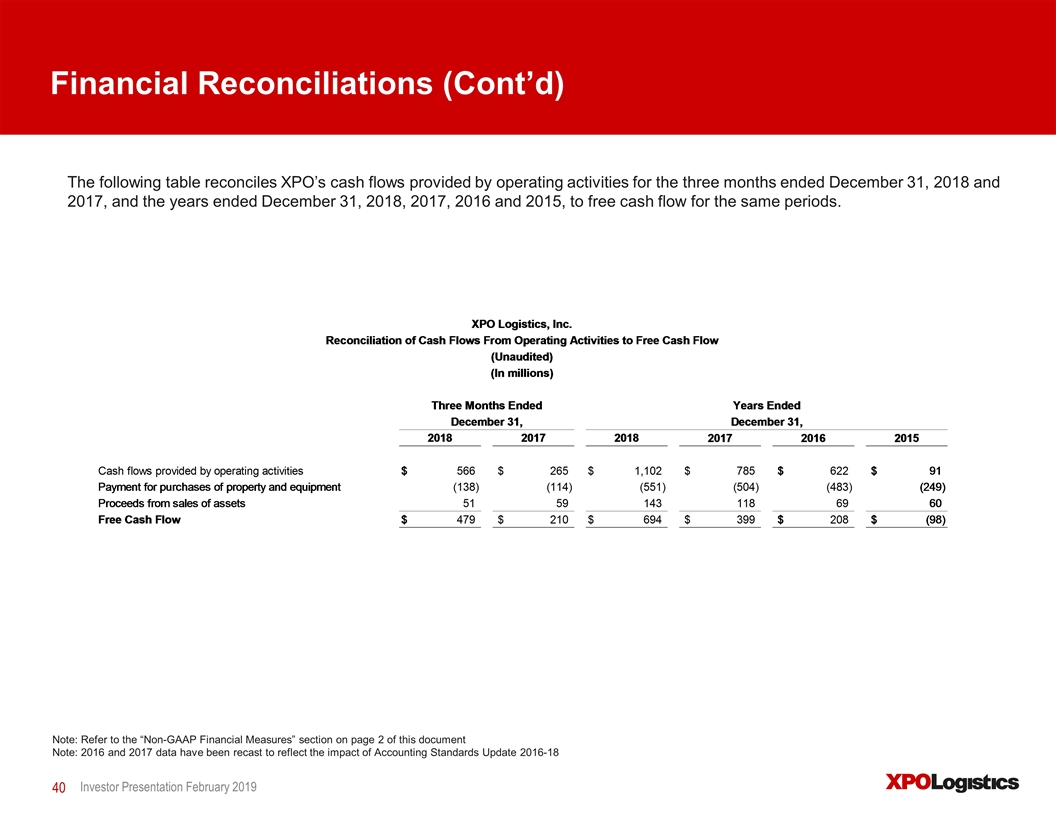

Financial Reconciliations (Cont’d) Investor Presentation February 2019 Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document Note: 2016 and 2017 data have been recast to reflect the impact of Accounting Standards Update 2016-18 The following table reconciles XPO’s cash flows provided by operating activities for the three months ended December 31, 2018 and 2017, and the years ended December 31, 2018, 2017, 2016 and 2015, to free cash flow for the same periods.

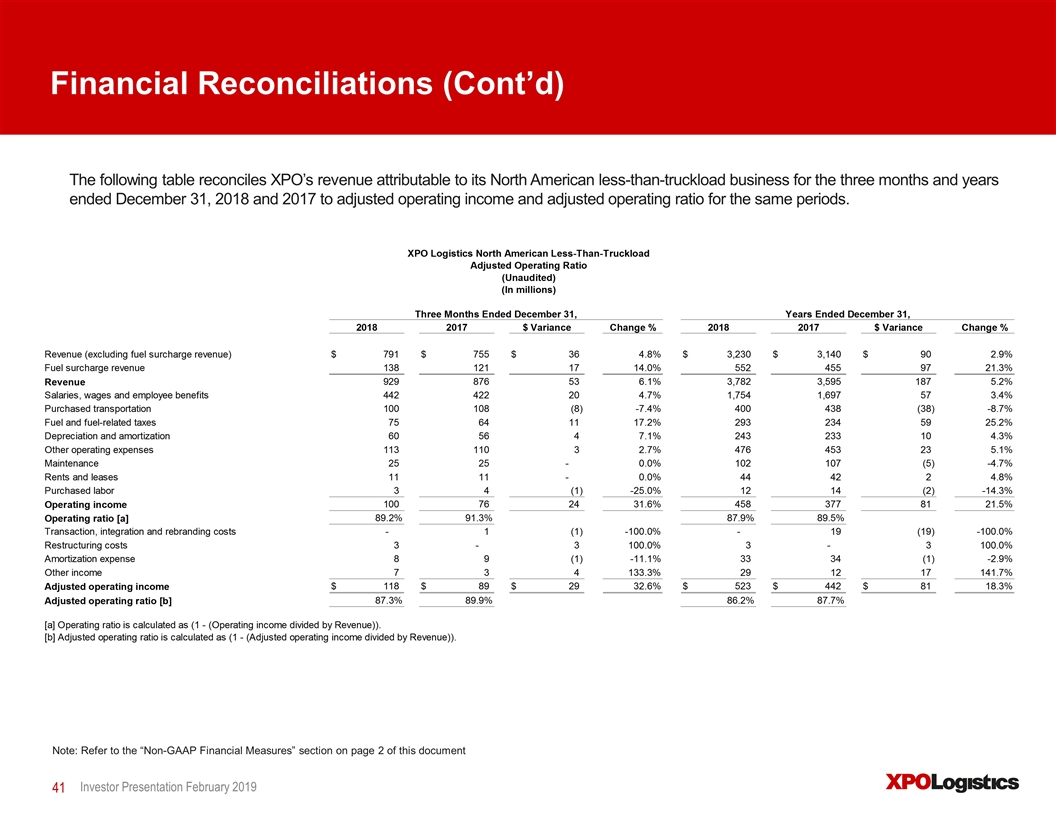

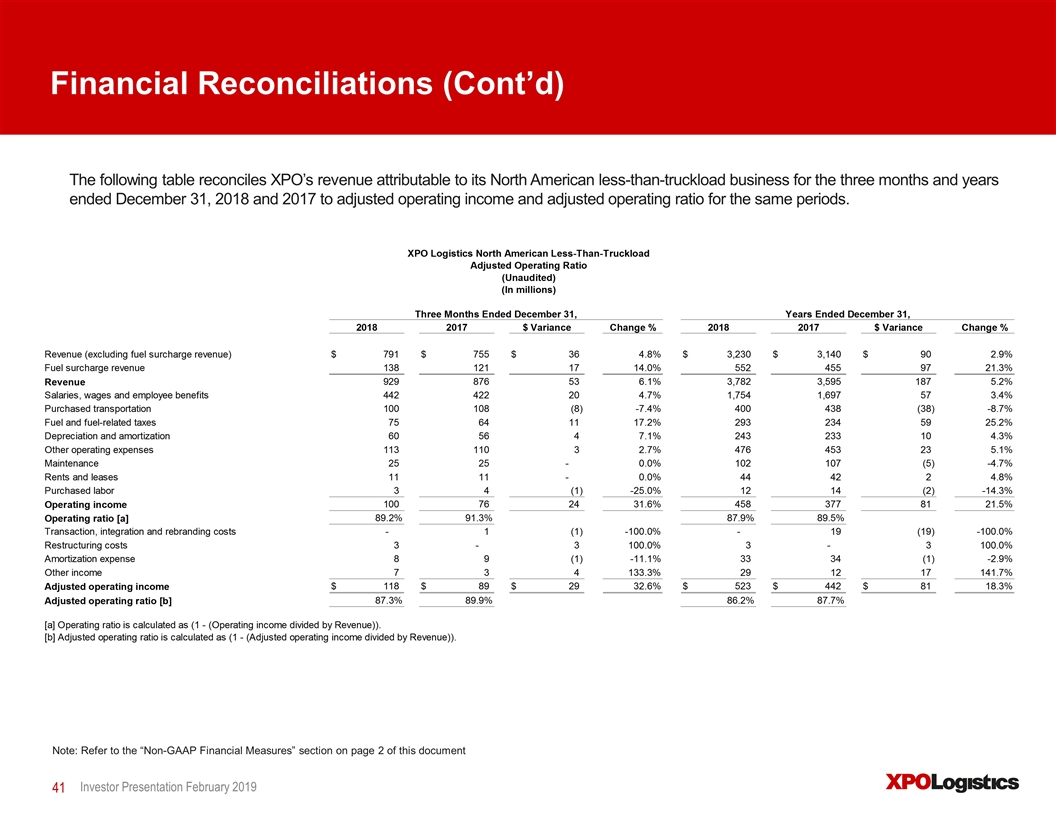

Financial Reconciliations (Cont’d) Investor Presentation February 2019 The following table reconciles XPO’s revenue attributable to its North American less-than-truckload business for the three months and years ended December 31, 2018 and 2017 to adjusted operating income and adjusted operating ratio for the same periods. Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document

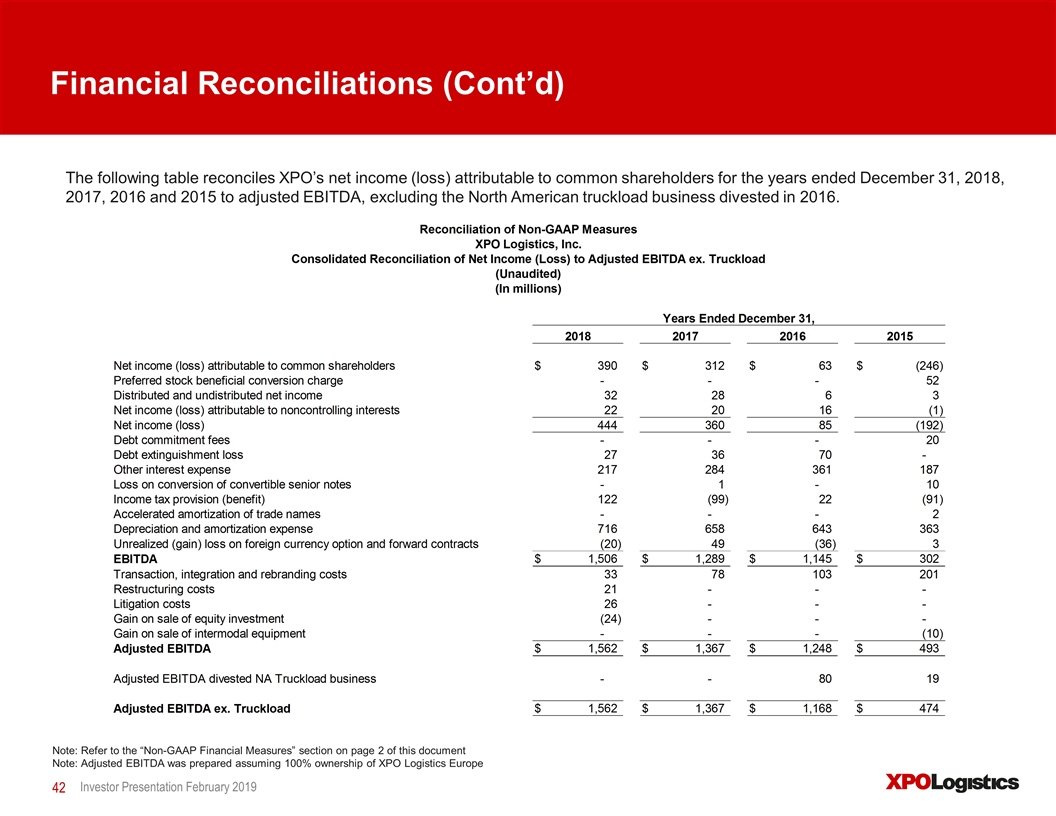

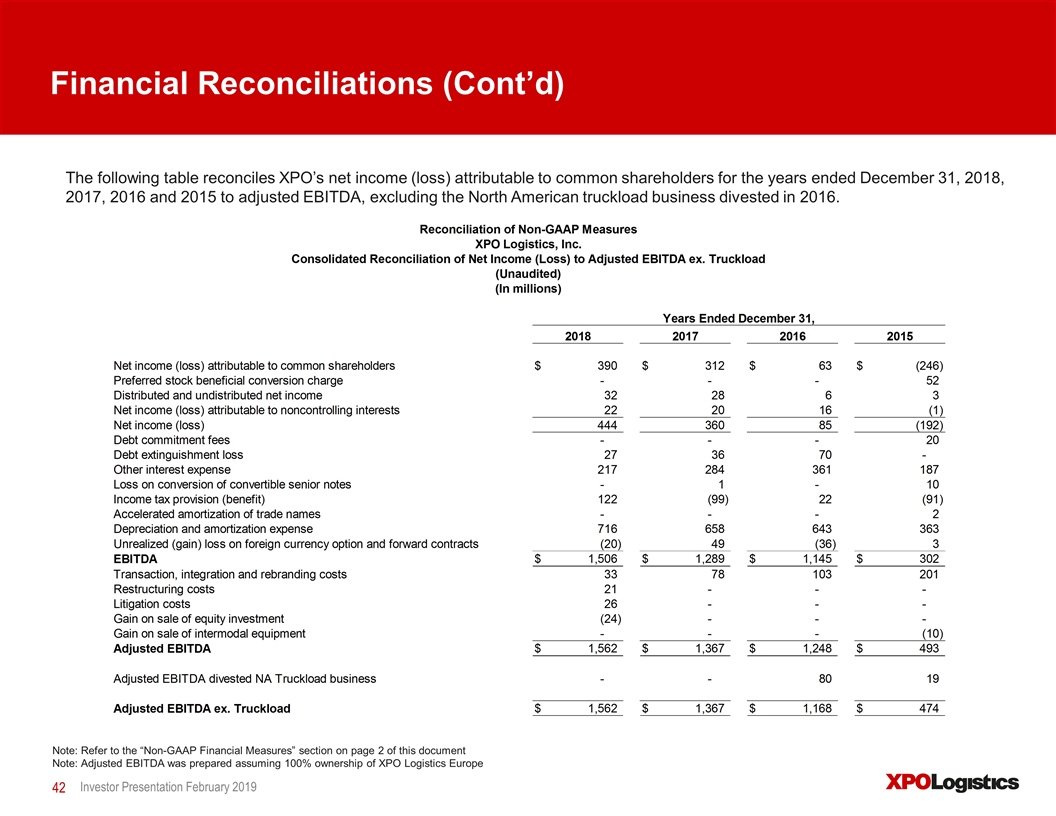

Financial Reconciliations (Cont’d) Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document Note: Adjusted EBITDA was prepared assuming 100% ownership of XPO Logistics Europe Investor Presentation February 2019 The following table reconciles XPO’s net income (loss) attributable to common shareholders for the years ended December 31, 2018, 2017, 2016 and 2015 to adjusted EBITDA, excluding the North American truckload business divested in 2016.

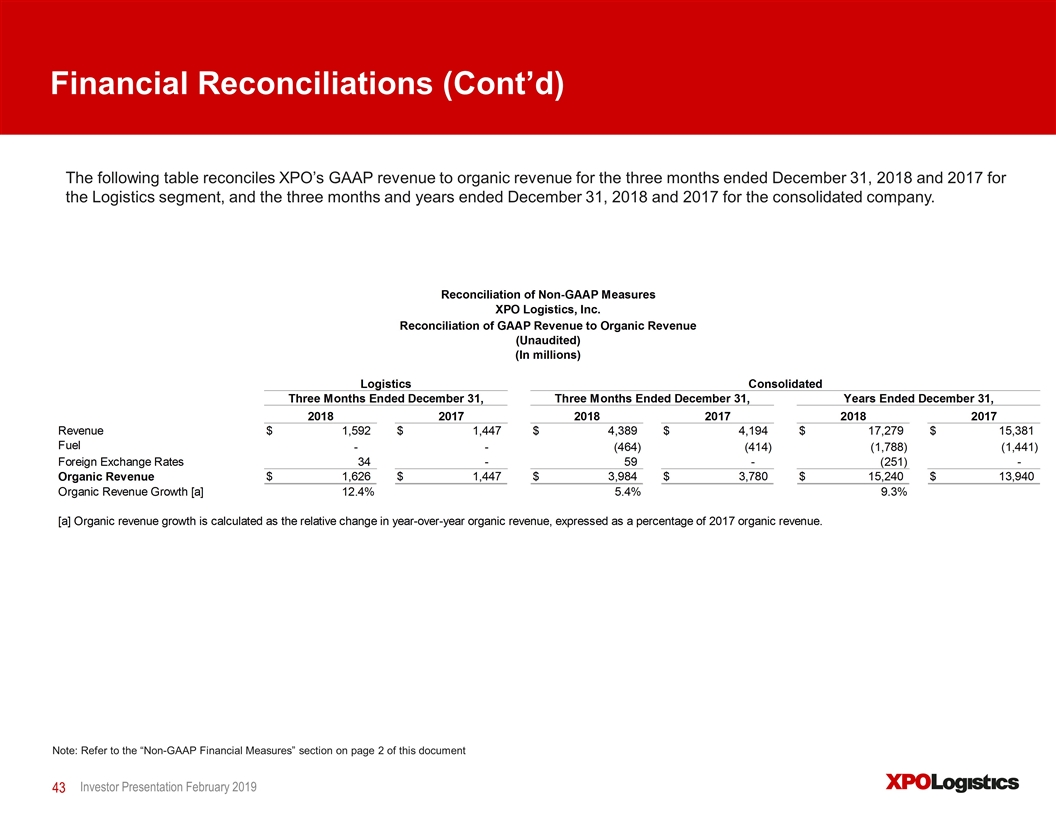

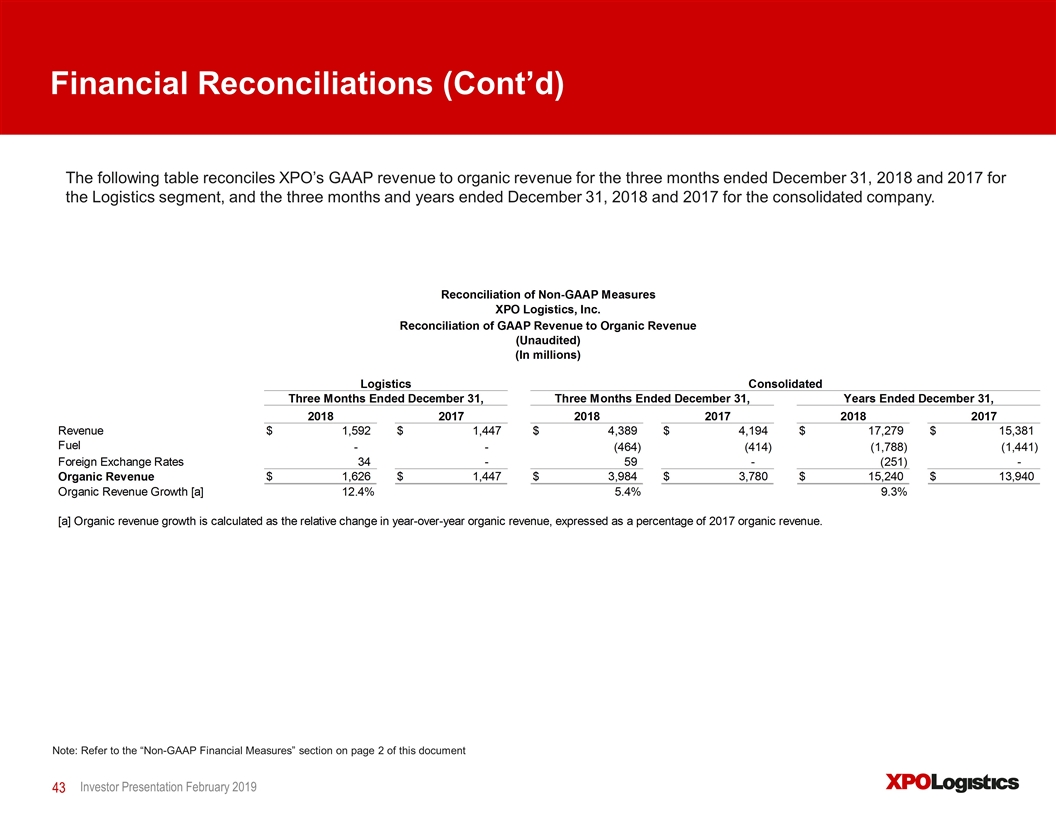

Financial Reconciliations (Cont’d) Investor Presentation February 2019 The following table reconciles XPO’s GAAP revenue to organic revenue for the three months ended December 31, 2018 and 2017 for the Logistics segment, and the three months and years ended December 31, 2018 and 2017 for the consolidated company. Note: Refer to the “Non-GAAP Financial Measures” section on page 2 of this document