QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)September 13, 2004

MARKWEST ENERGY PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

| Delaware | | 1-31239 | | 27-0005456 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

155 Inverness Drive West, Suite 200, Englewood, CO 80112-5000

(Address of principal executive offices)

Registrant's telephone number, including area code303-290-8700

Not Applicable.

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

- o

- Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

- o

- Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

- o

- Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

- o

- Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

On September 13, 2004, MarkWest Energy Partners, L.P. (the "Partnership") filed with the Securities and Exchange Commission a preliminary prospectus supplement that is subject to completion dated September 13, 2004 (the "Prospectus Supplement") relating to an underwritten offering by the Partnership of 2,000,000 of its common units and 159,138 common units to be sold by certain selling unitholders. The information included under Item 8.01 of this Current Report reflects a series of excerpts from the Prospectus Supplement. The excerpts retain the pagination of the Prospectus Supplement to allow for accurate cross references to other sections of the Prospectus Supplement. References in the following excerpts to "the offering" or "this offering" refer to such underwritten offering of common units.

2

Item 8.01 Other Events

SUMMARY

This summary highlights information contained elsewhere in this prospectus supplement and the accompanying prospectus. It does not contain all of the information that you should consider before making an investment decision. You should read the entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference for a more complete understanding of this offering. Please read "Risk Factors" beginning on page S-17 of this prospectus supplement and page 1 of the accompanying prospectus for more information about important risks that you should consider before buying our common units. Unless the context otherwise indicates, the information included in this prospectus supplement assumes that the underwriters do not exercise their over-allotment option.

References to the "MarkWest Hydrocarbon Midstream Business" refer to the assets of the MarkWest Hydrocarbon Midstream Business that were contributed to us in connection with our initial public offering, which represented substantially all of MarkWest Hydrocarbon's natural gas gathering and processing and NGL transportation, fractionation and storage businesses. References to "the Partnership," "we," "our," "us," or like terms refer to MarkWest Energy Partners, L.P. and its operating subsidiaries. References to "MarkWest Hydrocarbon" refer to MarkWest Hydrocarbon, Inc. and its direct and indirect consolidated subsidiaries. We refer to natural gas liquids, such as propane, butanes and natural gasoline, as "NGLs."

MARKWEST ENERGY PARTNERS, L.P.

Overview

We are a rapidly growing, independent midstream energy limited partnership engaged in the gathering, processing and transmission of natural gas, the transportation, fractionation and storage of NGLs and the gathering and transportation of crude oil. A substantial portion of our revenues and cash flows are generated from providing fee-based services to our customers, which limits our commodity price exposure and provides us with a relatively stable base of cash flows.

Since our initial public offering in May 2002, we have completed six acquisitions for an aggregate purchase price of approximately $352 million. On July 30, 2004, we acquired the Carthage gathering system and natural gas processing assets located in East Texas, which we refer to as our East Texas System, from American Central Eastern Texas Gas Company, Limited Partnership for approximately $240 million. Through recent acquisitions, including the East Texas System acquisition, we have significantly expanded our natural gas gathering, processing and transmission operations in the southwestern United States. We are also the largest processor of natural gas in the Appalachian Basin and the primary intrastate pipeline transporter of crude oil in Michigan. Since our initial public offering, we have increased our quarterly cash distribution per unit in six out of eight quarters, resulting in an aggregate increase of 48%, from $0.50 per unit for our quarterly distribution for our first full quarter ended September 30, 2002 to $0.74 per unit for the quarter ended June 30, 2004.

We operate primarily in three geographic areas:

- •

- Southwest. We own 19 natural gas gathering systems in Texas, Oklahoma, Louisiana, Mississippi and New Mexico. We also own a natural gas processing plant in Oklahoma and expect to complete construction of a natural gas processing plant in East Texas by the end of 2005. We currently operate five intrastate natural gas transmission pipelines in Texas and New Mexico that transport natural gas to power plants, municipalities and other large industrial end users. On a pro forma basis for the six months ended June 30, 2004, as adjusted for the East Texas System acquisition, our operations in the Southwest area

S-1

accounted for 58% of our total gross margin, of which 31% was attributable to the East Texas System.

- •

- Appalachia. We are the largest processor of natural gas in the Appalachian Basin, one of the country's oldest natural gas producing regions, with fully integrated processing, fractionation, storage and marketing operations. Our Appalachian assets include five natural gas processing plants, 136 miles of NGL pipeline, an NGL fractionation plant and an 11-million-gallon NGL storage facility. On a pro forma basis for the six months ended June 30, 2004, as adjusted for the East Texas System acquisition, our operations in Appalachia accounted for 31% of our total gross margin.

- •

- Michigan. We own a 90-mile natural gas gathering pipeline and a natural gas processing plant in Michigan. We also own approximately 250 miles of intrastate crude oil gathering pipeline, which we refer to as the Michigan Crude Pipeline, the primary intrastate crude oil pipeline in Michigan. On a pro forma basis for the six months ended June 30, 2004, as adjusted for the East Texas System acquisition, our operations in Michigan accounted for 11% of our total gross margin.

We provide midstream services to our customers under four types of contracts. On a pro forma basis for the six months ended June 30, 2004, as adjusted for the East Texas System acquisition, we generated approximately 60% of our gross margin (revenues less purchased products costs) from contracts under which we charge fees for providing midstream services. Gross margin from these fee-based services largely depends on throughput volume and is typically less affected by short-term changes in commodity prices. On a pro forma basis for the six months ended June 30, 2004, as adjusted for the East Texas System acquisition, our remaining gross margin was generated pursuant to percent-of-index (19%), percent-of-proceeds (15%) and keep-whole contracts (6%). Under percent-of-index contracts, we purchase natural gas at a percentage discount to a specified index price and then deliver the natural gas to pipelines, where we resell the natural gas at the index price or at a different percentage discount to the index price. Under percent-of-proceeds arrangements, we gather and process natural gas on behalf of producers, sell the resulting residue natural gas and NGL volumes at market prices and remit to the producers an agreed-upon percentage of the proceeds based on an index price. Under keep-whole arrangements, we gather natural gas from the producer, process the natural gas and sell the resulting NGLs to third parties at market prices. The extraction of the NGLs from the natural gas during processing reduces the Btu content of the natural gas. Therefore, we must replace these Btus by either purchasing natural gas at market prices for return to producers or making a cash payment to the producers equal to the value of this natural gas.

Our net income was $6.6 million for the six months ended June 30, 2004. On a pro forma basis, as adjusted for our East Texas System acquisition, our net income for the six months ended June 30, 2004 would have been $6.5 million. Our earnings before income taxes, plus depreciation and amortization expense and interest expense, or EBITDA, was $16.0 million for the six months ended June 30, 2004. On a pro forma basis, as adjusted for our East Texas System acquisition, our EBITDA for the six months ended June 30, 2004 would have been $25.7 million. For a discussion of EBITDA and a reconciliation of EBITDA to net income, please read footnote (2) to "Summary Historical and Pro Forma Financial and Operating Data."

On a pro forma basis for the six months ended June 30, 2004, as adjusted for the East Texas System acquisition, our gathering, processing, and fractionation and storage activities accounted for 55%, 36% and 9%, respectively, of our gross margin.

S-2

Recent Developments

East Texas System Acquisition. On July 30, 2004, we completed the acquisition of American Central Eastern Texas Gas Company, Limited Partnership's Carthage gathering system and natural gas processing assets located in East Texas for approximately $240 million. The acquired assets include 185 miles of existing natural gas gathering system pipelines connected to 1,730 wells with approximately 78 miles of additional pipeline under construction. The natural gas gathering system includes 14 centralized compressor stations with a throughput capacity of 350 MMcf/d. Average throughput volume for August 2004 was 245 MMcf/d. See "Overview of the East Texas System Acquisition."

We believe that the East Texas System complements our existing operations and provides us with growth opportunities through its attractive characteristics, including the following:

- •

- majority of cash flows generated from long-term contracts;

- •

- relatively newer assets than our major competitors in the area;

- •

- operations in fields characterized by long-lived reserves and recently increased drilling permit activity; and

- •

- platform for vertically integrating operations by adding processing and other midstream services.

Financing of East Texas System Acquisition. Concurrently with the closing of the East Texas System acquisition, we completed a private placement of approximately 1.3 million of our common units and amended and restated our existing credit facility to provide for additional short term-borrowings. We used total net proceeds of $45.1 million from our private placement and borrowings under our amended and restated credit facility to finance the East Texas System acquisition. We intend to apply the net proceeds from this offering to repay a portion of amounts outstanding under our credit facility. Following completion of this offering, we anticipate repaying substantially all of the then-remaining outstanding indebtedness under our credit facility through the issuance of senior notes or other long-term financing. Our ability to complete, and the timing of, these long-term financing transactions will depend on market conditions and other factors. See "Risk Factors."

Distribution Increase. On August 13, 2004, we paid a quarterly cash distribution of $0.74 per unit, or $2.96 per unit on an annualized basis, for the quarter ended June 30, 2004. Our 2004 second quarter distribution represents a 7.2% increase over our 2004 first quarter distribution of $0.69 per unit.

Competitive Strengths

Our competitive strengths include:

- •

- Strategic position and growing presence in the Southwest. Our East Texas System, Pinnacle, Lubbock and western Oklahoma acquisitions have allowed us to expand our presence in long-lived natural gas basins in the Southwest, particularly in Texas and Oklahoma. The East Texas System and Pinnacle gathering systems are strategically located in the East Texas and Permian Basins in Texas and the western Oklahoma assets are located in the Anadarko Basin in Oklahoma. Each of these areas is experiencing significant development and exploration activities and provides us with an opportunity to capture additional supplies of natural gas. We believe we can use our proven acquisition experience to further develop and expand our presence in the Southwest.

S-3

- •

- Strategic positions in the Appalachian Basin and Michigan. We are the largest processor of natural gas in Appalachia, and we believe our significant presence and asset base there provide us with a competitive advantage in capturing new supplies of natural gas. The Appalachian Basin is a large natural gas-producing region characterized by long-lived reserves, modest decline rates and natural gas with high NGL content, generating a stable supply of natural gas for our processing plants and our Siloam NGL fractionation facility. Our concentrated infrastructure and available land and storage assets in Appalachia provide us with a platform for additional cost-effective expansion. Our December 2003 acquisition of the Michigan Crude Pipeline allowed us to enter the Michigan crude oil transportation business, where we are now the primary intrastate pipeline transporter of crude oil. We enjoy a competitive advantage over higher cost crude oil transportation alternatives such as trucking. In addition, we own a 90-mile natural gas gathering pipeline and a natural gas processing plant in Michigan. The Niagaran Reef Trend, the area from which most of our natural gas and crude oil in the state is produced, is generally characterized by long-lived natural gas and crude oil reserves.

- •

- Proven acquisition and integration expertise. Since our initial public offering in May 2002, we have completed six acquisitions for an aggregate purchase price of approximately $352 million. We intend to continue to use our experience in acquiring assets to grow through accretive acquisitions with a focus on opportunities through which we can increase throughput volumes and cash flow.

- •

- Stable cash flows. On a pro forma basis for the six months ended June 30, 2004, as adjusted for the East Texas System acquisition, we generated 60% of our gross margin from fee-based contracts relating to natural gas gathering, processing and transmission services, NGL transportation, fractionation and storage services and crude oil gathering and transportation services. These fee-based services depend on throughput volume but are typically not affected by short-term changes in commodity prices. In addition, our five lateral pipelines in the Southwest typically generate firm transportation fees independent of the volumes transported. We believe that the fee-based nature of a significant portion of our business and the long-term nature of many of our contracts provide us with a relatively stable base of cash flows.

- •

- Long-term contracts. In the Southwest, approximately 74% of our current East Texas System gathering volumes are under contract until 2010. Our Pinnacle assets have two significant, fixed-fee contracts for the transmission of natural gas that expire in approximately 19 and 29 years. Approximately 90% of our daily throughput in the Foss Lake gathering system in western Oklahoma is pursuant to contracts with remaining terms of five years or more. In Appalachia, we have natural gas processing and NGL fractionation contracts, which have remaining terms of up to 11 years. In Michigan, our natural gas transportation, treating and processing agreements have terms for the life of the connected wells.

- •

- Experienced management with operational and technical expertise. Each member of our executive management team has at least 15 years of experience in the energy industry and our facility managers have extensive experience operating our facilities. Our operational and technical expertise has enabled us to upgrade existing facilities and to design and build new facilities. In addition, the ownership of interests in us and our general partner by members of our management, as well as our compensation and incentive plans, helps align the interests of our management team with the interests of our common unitholders.

S-4

- •

- Financial flexibility. Following the repayment of substantially all of the outstanding indebtedness under our existing credit facility through proceeds from this offering and our anticipated senior notes or other long-term debt financing, we expect to replace our existing credit facility with a new $200 million, multi-year credit facility. Under the terms of this new credit facility, which we expect will be largely undrawn, we expect to be able to finance future acquisitions, expansions and working capital projects. Our ability to complete, and the timing of, these long-term financing transactions will depend on market conditions and other factors.

Business Strategies

Our primary strategy is to increase distributable cash flow per unit by:

- •

- Expanding operations through acquisitions. We intend to continue to pursue strategic acquisitions of assets and businesses in our existing areas of operation in order to expand our current asset base, personnel and customer relationships. For example, our East Texas System, Pinnacle, Lubbock and western Oklahoma acquisitions have enabled us to establish and develop a new primary area of operation in the Southwest. In addition, we seek to acquire assets outside of our current areas of operation with a view towards creating new operating areas.

- •

- Increasing utilization of our facilities. We seek to capture additional natural gas and crude oil supplies from existing customers and to provide services to other natural gas and crude oil producers in our areas of operation. With our current excess capacity, we can increase throughput at our facilities with minimal incremental costs.

- •

- Expanding operations through new construction. By expanding our existing infrastructure and customer relationships, we intend to continue growing our asset base in our primary areas of operation to meet the anticipated need for additional midstream services. In connection with the East Texas System acquisition, we have 78 miles of natural gas gathering pipeline under construction and expect to complete a new processing plant by December 2005. In addition, drilling in the fields associated with our Appleby gathering system in East Texas and our Foss Lake gathering system in western Oklahoma has significantly increased throughput volumes over the past several years. We expect to complete a new, more efficient processing plant to replace our Cobb processing plant in Appalachia by the end of 2004.

- •

- Securing additional long-term, fee-based contracts. We intend to continue to secure long-term, fee-based contracts both in our existing operations and through strategic acquisitions in order to minimize our exposure to short-term changes in commodity prices.

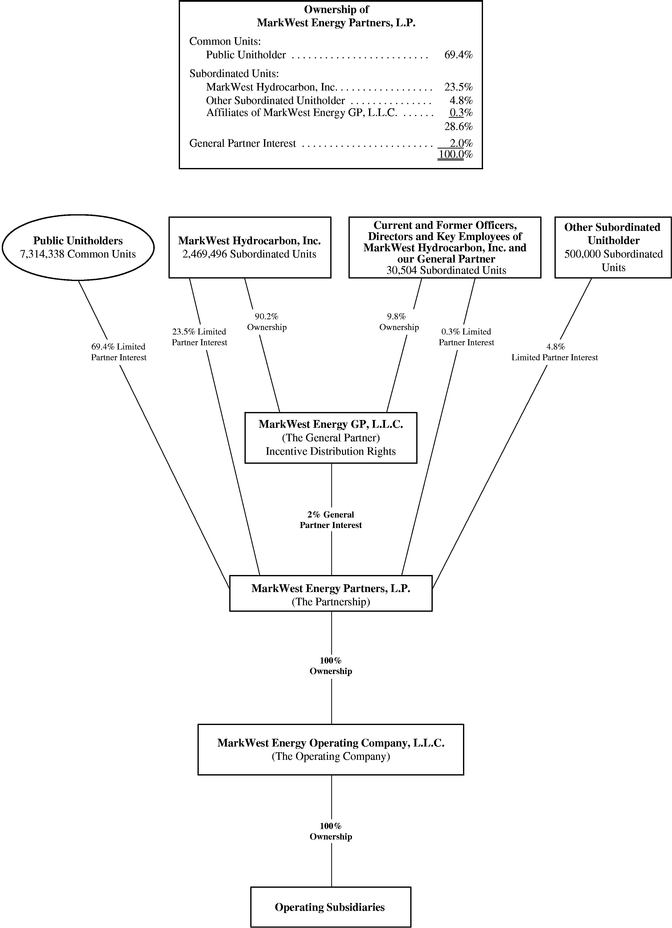

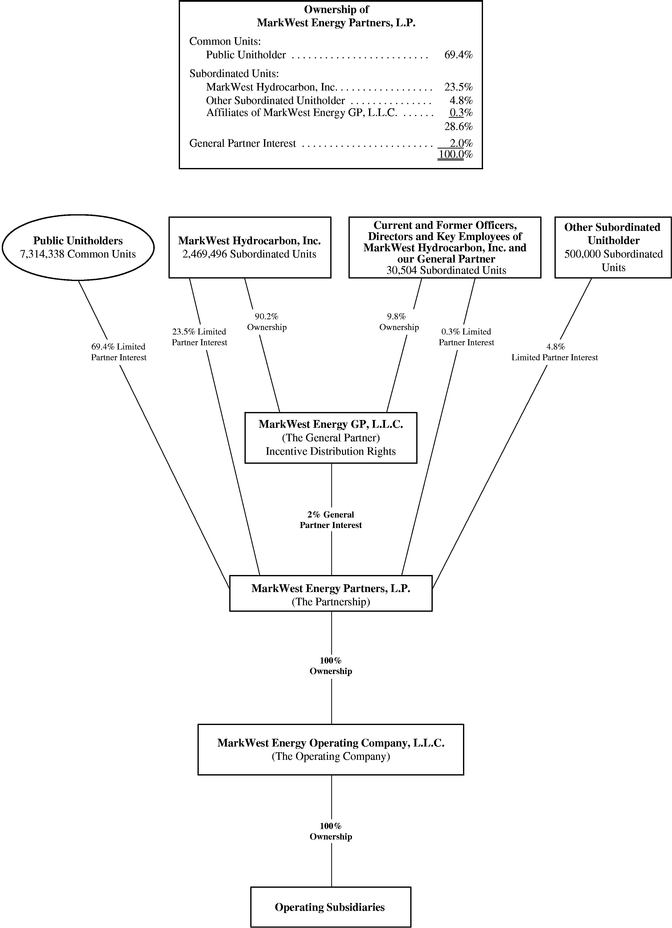

Partnership Structure and Management

Our operations are conducted through, and our operating assets are owned by, our subsidiaries. We own all of our subsidiaries through MarkWest Energy Operating Company, L.L.C. Upon completion of this offering:

- •

- The public unitholders will own a 69.4% limited partner interest in us, represented by 7,314,338 units.

- •

- MarkWest Hydrocarbon will own 2,469,496 subordinated units and current and former officers and directors of MarkWest Energy GP, L.L.C., our general partner, and current and former officers, directors and key employees of MarkWest Hydrocarbon will own an

S-5

Our general partner is entitled to distributions on its general partner interest and, if any, on its incentive distribution rights. Our general partner has sole responsibility for conducting our business and for managing our operations. Our general partner does not receive any management fee or other compensation in connection with its management of our business but is entitled to be reimbursed for all direct and indirect expenses incurred on our behalf.

The chart on the following page depicts the organization and ownership of MarkWest Energy Partners, L.P. and the operating company after giving effect to this offering.

S-6

S-7

Our Relationship with MarkWest Hydrocarbon, Inc.

We were formed by MarkWest Hydrocarbon to acquire most of its natural gas gathering and processing and NGL transportation, fractionation and storage assets. MarkWest Hydrocarbon is our largest customer, accounting for 42% of our revenues and 59% of our gross margin for the year ended December 31, 2003 and 22% of our revenues and 43% of our gross margin for the six months ended June 30, 2004. On a pro forma basis, as adjusted for our recent East Texas System acquisition, MarkWest Hydrocarbon accounted for 19% of our revenues and 30% of our gross margin for the six months ended June 30, 2004. We will continue for the foreseeable future to derive a significant portion of our revenues from the services we provide under our contracts with MarkWest Hydrocarbon. Upon completion of this offering, MarkWest Hydrocarbon and its affiliates will own a 23.8% limited partner interest in us and MarkWest Hydrocarbon will continue to direct our business operations through its ownership and control of our general partner. MarkWest Hydrocarbon employees are responsible for conducting our business and operating our assets on our behalf.

During 2003, MarkWest Hydrocarbon sold substantially all of its oil and natural gas properties. MarkWest Hydrocarbon's remaining business consists of its limited partnership interest in us, its ownership of a controlling interest in our general partner and the marketing of NGLs and natural gas. In 2003, MarkWest Hydrocarbon sold 177 million gallons of NGL products produced at our Siloam facility. In addition to its NGL product sales, MarkWest Hydrocarbon's marketing operations are also responsible for the purchase of natural gas delivered for the account of producers pursuant to its keep-whole processing contracts.

Our principal executive offices are located at 155 Inverness Drive West, Suite 200, Englewood, Colorado 80112, and our phone number is (303) 290-8700.

S-8

RISK FACTORS

You should read carefully the discussion of the material risks relating to our business under the caption "Risk Factors" beginning on page 1 of the accompanying prospectus, as well as those risks discussed in our Annual Report on Form 10-K/A for the year ended December 31, 2003, which are incorporated by reference into this prospectus supplement and the accompanying prospectus. If any of these risks were to occur, our business, financial condition or results of operations could be adversely affected. In that case, the trading price of our common units could decline and you could lose all or part of your investment.

We may be unable to successfully integrate the East Texas System acquisition with our operations or realize all of the anticipated benefits of the East Texas System acquisition.

Integration of the East Texas System business and operations with our existing business and operations will be a complex, time-consuming and costly process. Failure to successfully integrate the East Texas System business and operations with our existing business and operations in a timely manner may have a material adverse effect on our business, financial condition, results of operations and cash flows. The difficulties of combining the operations include, among other things:

- •

- operating a significantly larger combined organization and integrating additional midstream operations to our existing operations;

- •

- coordinating geographically disparate organizations, systems and facilities;

- •

- integrating personnel from diverse business backgrounds and organizational cultures; and

- •

- consolidating corporate and administrative functions.

In addition, we may not realize all of the anticipated benefits from our acquisition of the East Texas System. In particular, we may not achieve the potential cost savings and revenue enhancements described in "Overview of the East Texas System Acquisition" due to a number of potential factors including difficulties integrating operations, higher costs and fluctuations in markets.

We will also be exposed to risks that are commonly associated with transactions similar to this acquisition, such as unanticipated liabilities and costs, some of which may be material, and diversion of management's attention. Moreover, these new assets are subject to the same stringent environmental laws and regulations relating to releases of pollutants into the environment and environmental protection as are our existing plants, pipelines and facilities, and thus our operation of these new assets could cause us to incur increased costs to maintain compliance with such laws and regulations. As a result, the anticipated benefits of the acquisition may not be fully realized, if at all.

We may not be able to repay or refinance the short-term debt we incurred in connection with the East Texas System acquisition.

In connection with our acquisition of the East Texas System, we borrowed approximately $200.8 million of indebtedness under our amended and restated credit facility. Of that amount, $50.0 million is due in December 2004 and the remainder of that debt is due in May 2005. We intend to apply the net proceeds of this offering to retire the debt due in December 2004 and a portion of the debt due in May 2005. Following the completion of this offering, we anticipate repaying substantially all of the remaining outstanding indebtedness due in May 2005 through the

S-17

issuance of senior notes or other long-term debt financing. Our ability to complete, and the timing of, these or other long-term financing transactions will depend on market conditions, operating performance and other factors. If we are unable to successfully complete any or all of the transactions in connection with our long-term financing plan in a timely manner, or on attractive terms, our business, financial condition, results of operations and cash flows may be materially adversely affected.

We depend on third parties for the raw natural gas we transport through our East Texas System facilities, and any reduction in these quantities could reduce our ability to make distributions to our unitholders.

We depend on numerous suppliers, including Devon Energy, to provide a significant portion of the raw natural gas for our transportation through the East Texas System. For the six months ended June 30, 2004, Devon Energy accounted for 42% of the throughput volume on the East Texas System. If Devon Energy, or a significant number of other producers, were to decrease materially the supply of raw natural gas to our East Texas System facilities for any reason, we could experience difficulty in replacing those lost volumes. Because our operating costs are primarily fixed, a reduction in the volumes of raw natural gas delivered to us would result not only in a reduction of revenues but also a decline in net income and cash flow of similar or greater magnitude, which would reduce our ability to make distributions to our unitholders.

Transportation on our Michigan Crude Pipeline could become subject to the jurisdiction of the Federal Energy Regulatory Commission.

The Michigan Crude Pipeline is not currently subject to the jurisdiction of the Federal Energy Regulatory Commission, or FERC. If a shipper sought to challenge the jurisdictional status of this pipeline, however, FERC could determine that transportation on this pipeline is within its jurisdiction under the Interstate Commerce Act, thereby requiring us to file a tariff and cost-based rates for such transportation with FERC. While no shipper has filed a formal complaint, one shipper on the Michigan Crude Pipeline has contacted FERC to complain about the transportation rates and question the jurisdictional status of the pipeline. FERC requested that we and the shipper resolve the dispute. If we are unable to successfully resolve this dispute or any future dispute over the jurisdictional status of the Michigan Crude Pipeline, it could become subject to FERC regulation, and the cost of compliance with that regulation could adversely affect our profitability.

S-18

OVERVIEW OF THE EAST TEXAS SYSTEM ACQUISITION

On July 30, 2004, we acquired certain natural gas gathering assets located in East Texas from American Central Eastern Texas Gas Company, Limited Partnership for $240 million. The acquired assets, which we refer to as our East Texas System, are located in Panola County, Texas and consist of:

- •

- approximately 185 miles of natural gas gathering system pipelines;

- •

- approximately 78 miles of additional natural gas gathering system pipelines currently under construction; and

- •

- 14 centralized compressor stations representing approximately 61,500 horsepower of compression (with an additional 23,900 horsepower currently being installed as gathering system compression and processing plant recompression).

The gathering system currently serves approximately 20 producers in the Carthage Field through central receipt points sourced by natural gas production from approximately 1,730 upstream well connections. The gathering system has a throughput capacity of approximately 350 MMcf/d and had average throughput volumes of 245 MMcf/d in August 2004. In addition, we anticipate increasing our throughput volumes to over 300 MMcf/d by the end of 2004 by connecting additional volumes currently under contract. We recently secured gathering and processing contractual commitments from ChevronTexaco and TotalFinaElf for the connection of additional natural gas production of approximately 95 MMcf/d for January 2005. We intend to seek additional gathering and processing contracts with producers not currently served by the gathering system and to add incremental volumes through system expansion into the Bethany and Beckville areas of the Carthage field that will be accessible upon completion of the system expansion.

To increase our midstream services available to producers connected to our gathering system, provide natural gas processing required to meet downstream pipeline quality specifications and expand the existing system footprint to receive new natural gas dedicated to the system, we are currently constructing gathering pipeline additions, compression additions and a new processing facility and planning the construction of an NGL pipeline at an aggregate total projected cost of approximately $55 million, which we expect to complete by December 2005. Once the pipeline and compression additions are operational, we will be positioned to pursue future expansion into surrounding natural gas supply areas, particularly the Beckville and Bethany areas. We expect that the new processing plant will have a capacity of 175 MMcf/d. We are pursuing dedication of additional processing volumes that are gathered on the system and are considering expanding the plant as contractually committed processing volumes increase.

During plant construction, we are processing natural gas at the Duke Energy Field Services East Texas plant under an existing processing agreement that expires on December 31, 2005. Under the terms of this contract, we expect to receive processing income of less than $1.5 million in 2005.

S-22

Rationale for the Acquisition

We believe that the East Texas System complements our existing businesses in several ways and provides us with a number of growth opportunities through its attractive characteristics, including the following:

- •

- The majority of the East Texas System's cash flow is generated from its natural gas gathering operations, which are tied to contracts generally ranging in length from five to 10 years.

- •

- The East Texas System features natural gas pipelines with centralized receipt points connected to common suction or common discharge gathering pipelines. This configuration provides a high degree of reliability and enables us to offer both low and high-pressure service to our customers. The system benefits from low fuel and operating costs because of its design, age and large, efficient, standardized compressor stations.

- •

- We believe that the Carthage Field served by the East Texas System is an attractive operating area for us because it has long-lived reserves and significant development potential. To date, more than 12 trillion cubic feet, or Tcf, of natural gas has been produced from the the Carthage Field. The level of drilling permit activity in Panola County has increased from 2003 to 2004 due to a combination of higher natural gas prices and improved technology.

- •

- The East Texas System provides us with a platform on which to vertically integrate our operations through the planned construction of a 175 MMcf/d natural gas processing facility. We have already obtained contractual commitments that will fill the plant's capacity.

Overview of the East Texas System

Geographic Market. The East Texas System is strategically located in Panola County, which encompasses the Carthage Field, one of Texas' largest onshore natural gas fields. Panola County consists of the Cotton Valley, Pettit and Travis Peak formations and is one of the largest natural gas producing regions in the United States. The Carthage Field has approximately 18 Tcf of estimated ultimate reserves and cumulative historical production in excess of 12 Tcf. According to industry sources, there were 4,158 active wells in the field during May 2004, 1,730 of which were connected to the East Texas System.

Gathering Operations. The East Texas System is a regional gathering system designed to provide relatively low-cost gathering service at consistent operating pressures over a broad geographic area. Substantially all of the system was constructed within the last 10 years, which makes our natural gas pipelines generally newer than competing gathering systems in the area. The low-pressure system design allows for natural gas production to be distributed or balanced across 14 centralized compressor stations with an aggregate of approximately 61,500 horsepower, with an additional 23,900 of new compression currently being planned. These stations are designed to operate in unison, to respond to gathering system dynamics and to automatically load and unload the compressors based on operating pressures and volumes.

Automation technology allows the gathering system to be balanced daily on an MMcf/d and on an MMbtu/d basis. All system inlets are compared to system outlets (natural gas redeliveries, fuel, NGLs, and condensates) to accurately manage the system and minimize system losses. Monitoring technology also is used to compare producers' nominations to actual flows to minimize end-of-the-month pipeline imbalances.

S-23

The gathering system was designed and constructed to operate as a closed system, which means hydrocarbons are not released or vented into the atmosphere during normal operations. Specifically, all hydrocarbon liquids that condense in the pipeline system are collected and transported to the liquid handling and vapor recovery facility. The high-pressure hydrocarbon liquids are then stabilized into condensate, which is trucked and sold. The hydrocarbon vapors from the high-pressure liquids are compressed to 1,050 per square inch for delivery to the processing plant, where they are converted into NGL products. During 2003, the East Texas System gathered 204 MMcf/d of natural gas, and hydrocarbon liquid production was 1,016 Bbls/d.

Gathering Fee Arrangements. The East Texas System gathering revenues are derived from the following three fee-arrangements:

- •

- Fixed gathering and compression fees. Fixed gathering and compression fees accounted for 39% of the East Texas System's total gathering margin for the six months ended June 30, 2004. Typically, gathering and compression fees are comprised of a fixed fee portion in which producers pay a fixed rate per unit to transport their natural gas through the gathering system. Under the majority of these contracts, fees are escalated annually based on the Consumer Price Index.

- •

- Settlement margin. Settlement margin accounted for 37% of the East Texas System's total gathering margin for the six months ended June 30, 2004. Typically, the terms of these contracts specify that we are allowed to retain a fixed percentage of the volume gathered to cover the compression fuel charges and deemed line losses. To the extent the East Texas System is operated more efficiently than provided for by contracted allowances, we are entitled to retain the difference for our own account.

- •

- Condensate sales. Condensate sales (otherwise known as pipeline drip) accounted for 24% of the East Texas System's total gathering margin for the six months ended June 30, 2004. During the gathering process, thermodynamic forces contribute to changes in operating conditions of the natural gas flowing through the pipeline infrastructure. As a result, hydrocarbon dew points are reached, causing condensation of hydrocarbons in the high- pressure pipelines. The East Texas System retains 100% of condensate collected in the system and sells the condensate at a monthly crude-oil based price.

In July 2004, Devon Energy, ConocoPhillips, BP Amoco, Samson, XTO Energy, EOG Resources, Anadarko, ExxonMobil, ChevronTexaco and TotalFinaElf were the East Texas System's largest customers based on system throughput, collectively accounting for approximately 95% of total system throughput.

Processing Plant and NGL Transportation. We are currently constructing a 175 MMcf/d skid-mounted cryogenic processing plant designed to recover ethane and heavier hydrocarbons. The plant will be able to operate efficiently in an ethane recovery or rejection mode. A plant expansion is already under consideration based on the availability of additional processable natural gas currently gathered on the system. Plant residue natural gas will be delivered to both the Natural Gas Pipeline Company of America and the Carthage Hub. We also expect to construct an NGL pipeline to effect eventual delivery of the recovered plant products to Mount Belvieu for fractionation and sale. The plant and related pipeline are scheduled for completion by December 2005.

Regulation. The East Texas System is subject to the Texas Utilities Code, as implemented by the Texas Railroad Commission, or TRRC. Generally, the TRRC has authority to ensure that rates and/or operations and services of gas utilities, intrastate pipelines and gathering systems are just and reasonable and not discriminatory. Rates are deemed just and reasonable unless challenged in a complaint. We cannot predict whether such a complaint will be filed against us or whether the TRRC will change its regulations of gas utilities, intrastate pipelines and gathering systems.

S-24

MANAGEMENT

The following table shows information for the directors and executive officers of MarkWest Energy GP, L.L.C., our general partner. Executive officers are appointed and directors are elected by the owners of our general partner for one-year terms.

Name

| | Age

| | Position with our General Partner

|

|---|

| John M. Fox | | 64 | | Chairman of the Board of Directors |

Frank M. Semple |

|

52 |

|

President, Chief Executive Officer and Director |

Charles K. Dempster |

|

62 |

|

Director |

Donald C. Heppermann |

|

61 |

|

Director |

William A. Kellstrom |

|

63 |

|

Director |

William P. Nicoletti |

|

59 |

|

Director |

James G. Ivey |

|

53 |

|

Senior Vice President and Chief Financial Officer |

John C. Mollenkopf |

|

43 |

|

Senior Vice President, Southwest Business Unit |

Randy S. Nickerson |

|

43 |

|

Senior Vice President, Corporate Development |

Andrew L. Schroeder |

|

45 |

|

Vice President, Finance, Treasurer and Secretary |

Ted S. Smith |

|

54 |

|

Vice President and Chief Accounting Officer |

David L. Young |

|

44 |

|

Senior Vice President, Northeast Business Unit |

John M. Fox has served as Chairman of the Board of Directors of our general partner since May 2002 and has served in the same capacity with MarkWest Hydrocarbon since its inception in April 1988. Mr. Fox also served as President and Chief Executive Officer of our general partner and of MarkWest Hydrocarbon from April 1988 until his retirement as President on November 1, 2003 and his retirement as Chief Executive Officer effective December 31, 2003. Mr. Fox was a founder of Western Gas Resources, Inc. and was its Executive Vice President and Chief Operating Officer from 1972 to 1986. Mr. Fox holds a bachelor's degree in engineering from the United States Air Force Academy and a master of business administration degree from the University of Denver.

Frank M. Semple was appointed as President of both our general partner and MarkWest Hydrocarbon on November 1, 2003. Mr. Semple also became Chief Executive Officer of both our general partner and MarkWest Hydrocarbon on January 1, 2004 and also became a director of our general partner and MarkWest Hydrocarbon in January 2004. Prior to his appointment, Mr. Semple served in various capacities, lastly as Chief Operating Officer, with WilTel Communications, formerly Williams Communications from 1997 to 2003. Prior to his tenure at WilTel Communications, he was the Senior Vice President/General Manager of Williams Natural Gas from 1995 to 1997 as well as Vice President of Marketing and Vice President of Operations and Engineering for Northwest Pipeline and Director of Product Movements and Division

S-25

Manager for Williams Pipeline during his 22-year career with the Williams Companies. During his tenure at Williams Communications, he served on the board of directors for PowerTel Communications and the Competitive Telecommunications Association (Comptel). He currently serves on the board of directors for the Tulsa Zoo and the Children's Medical Center. Mr. Semple holds a bachelor's degree in mechanical engineering from the United States Naval Academy.

Charles K. Dempster has served as a member of the board of directors of our general partner since December 2002. Mr. Dempster has more than 30 years of experience in the natural gas and power industry. He held various management and executive positions with Enron Corporation and its predecessors between 1969 and 1986, focusing on natural gas supply, transmission and distribution. From 1986 through 1992 Mr. Dempster served as President of Reliance Pipeline Company and Executive Vice President of Nicor Oil and Gas Corporation, which were oil and natural gas midstream and exploration subsidiaries of Nicor Inc. in Chicago. He was appointed President of Aquila Energy Corporation in 1993, a wholly owned midstream, pipeline and energy-trading subsidiary of Utilicorp, Inc. Mr. Dempster retired in 2000 as Chairman and CEO of Aquila Energy Company. Mr. Dempster holds a bachelor's degree in civil engineering from the University of Houston and attended graduate business school at the University of Nebraska.

Donald C. Heppermann has served on our general partner's board of directors since its inception in May 2002 and will continue to serve as Chairman of the Finance Committee. Mr. Heppermann previously served as Executive Vice President, Chief Financial Officer and Secretary of our general partner from October 2003 until his retirement in March 2004. He joined our general partner and MarkWest Hydrocarbon in November 2002 as Senior Vice President and Chief Financial Officer and served as Senior Executive Vice President beginning in January 2003. Prior to joining our general partner and MarkWest Hydrocarbon, Mr. Heppermann was a private investor and a career executive in the energy industry with major responsibilities in operations, finance, business development and strategic planning. From 1990 to 1997 he served as President and Chief Operating Officer for InterCoast Energy Company, an unregulated subsidiary of Mid American Energy Company. From 1987 to 1990 Mr. Heppermann was employed by Pinnacle West Capital Corporation, the holding company for Arizona Public Service Company, where he was Vice President of Finance. From 1965 to 1987, Enron Corporation and its predecessors employed Mr. Heppermann in a variety of positions, including Executive Vice President, Gas Pipeline Group. Mr. Heppermann holds a bachelor's degree in accounting from the University of Missouri and a master of business degree from Creighton University.

William A. Kellstrom has served as a member of the Board of Directors of our general partner since its inception in May 2002 and has served as a director of MarkWest Hydrocarbon since May 2000. Mr. Kellstrom has held a variety of managerial positions in the natural gas industry since 1968. They include distribution, pipelines and marketing. He held various management and executive positions with Enron Corp., including Executive Vice President, Pipeline Marketing and Senior Vice President, Interstate Pipelines. In 1989, he created and was President of Tenaska Marketing Ventures, a natural gas marketing company for the Tenaska Power Group. From 1992 until 1997 he was with NorAm Energy Corporation (which later merged with Reliant Energy, Incorporated) where he was President of the Energy Marketing Company and Senior Vice President, Corporate Development. Mr. Kellstrom holds an engineering degree from Iowa State University and a master of business administration degree from the University of Illinois. He retired in 1997 and is periodically engaged as a consultant to energy companies.

William P. Nicoletti has served as a member of the Board of Directors of our general partner since its inception in May 2002. Mr. Nicoletti is Managing Director of Nicoletti & Company Inc., a private banking firm serving clients in the energy and transportation industries. In addition,

S-26

Mr. Nicoletti has served as a Senior Advisor to the Energy Investment Banking Group of McDonald Investments Inc. From March 1998 until July 1999, Mr. Nicoletti was a Managing Director and co-head of Energy Investment Banking for McDonald Investments Inc. Prior to forming Nicoletti & Company Inc. in 1991, Mr. Nicoletti was a Managing Director and head of Energy Investment Banking for PaineWebber Incorporated. Previously, he held a similar position at E.F. Hutton & Company Inc. Mr. Nicoletti is a director and Chairman of the Audit Committee of Star Gas LLC, the general partner of Star Gas Partners, L.P, a retail propane and heating oil master limited partnership. He is also a director of Southwest Royalties, Inc., an oil and natural gas exploration and production company and Russell-Stanley Holdings, Inc., a manufacturer and marketer of steel and plastic industrial containers. Mr. Nicoletti is a graduate of Seton Hall University and received an MBA degree from Columbia University Graduate School of Business.

James G. Ivey has served as Chief Financial Officer of MarkWest Hydrocarbon and our general partner since June 2004. Prior to joining MarkWest, Mr. Ivey served as Treasurer of The Williams Companies from 1999 to April 30, 2004 and as acting Chief Financial Officer from mid-2002 to mid-2003. Prior to joining Williams, Mr. Ivey held similar positions with Tenneco Gas and NORAM Energy. Prior to that, he held various engineering positions with Conoco and Fluor Corp. He currently serves on the board of directors for MACH Gen LLC and the Tulsa Boys Home. Mr. Ivey is a graduate of Texas A&M University with a B.S. in Building Construction, the University of Houston with a MBA, the Army Command and General Staff College and the Duke University Advanced Management Program. Mr. Ivey retired in early 2004 from the Army Reserve with the rank of Colonel.

John C. Mollenkopf was appointed Senior Vice President, Southwest Business Unit of our general partner in January 2004 and previously served as Vice President, Business Development since January 2003. Prior to that, he served as Vice President-Michigan Business Unit of our general partner since its inception in May 2002 and in the same capacity with MarkWest Hydrocarbon since December 2001. Prior to that, Mr. Mollenkopf was General Manager of the Michigan Business Unit of MarkWest Hydrocarbon since 1997. He joined MarkWest Hydrocarbon in 1996 as Manager, New Projects. From 1983 to 1996, Mr. Mollenkopf worked for ARCO Oil and Gas Company, holding various positions in process and project engineering, as well as operations supervision. Mr. Mollenkopf holds a bachelor's degree in mechanical engineering from the University of Colorado at Boulder.

Randy S. Nickerson has served as Senior Vice President, Corporate Development of our general partner since October 2003. Prior to that, Mr. Nickerson served as Executive Vice President, Corporate Development of our general partner from January 2003 and as Senior Vice President of our general partner since its inception in May 2002 and has served in the same capacity with MarkWest Hydrocarbon since December 2001. Prior to that, Mr. Nickerson served as MarkWest Hydrocarbon's Vice President and the General Manager of the Appalachia Business Unit from June 1997. Mr. Nickerson joined MarkWest Hydrocarbon in July 1995 as Manager, New Projects and served as General Manager of the Michigan Business Unit from June 1996 until June 1997. From 1990 to 1995, Mr. Nickerson was a Senior Project Manager and Regional Engineering Manager for Western Gas Resources, Inc. From 1984 to 1990, Mr. Nickerson worked for Chevron USA and Meridian Oil Inc. in various process and project engineering positions. Mr. Nickerson holds a bachelor's degree in chemical engineering from Colorado State University.

Andrew L. Schroeder currently serves as Vice President, Finance, Treasurer and Secretary for our general partner and has been employed by our general partner since February 2003. Prior to his appointment, he was Director of Finance/Business Development at Crestone Energy Ventures from 2001 through 2002. Prior to that Mr. Schroeder worked at Xcel Energy for two years as

S-27

Director of Corporate Financial Analysis. Prior to that, he spent seven years working with various energy companies. He began his career with Touche, Ross & Co. and spent eight years in public accounting. Mr. Schroeder holds a master's of taxation from the University of Denver and a bachelor's degree in business from the University of Colorado. He is a Certified Public Accountant licensed in the state of Colorado.

Ted S. Smith was appointed as Vice President and Chief Accounting Officer of our general partner in March 2004. Prior to that, he served as a Vice President of our general partner beginning on his arrival in March 2003, via the Pinnacle Natural Gas Company merger. Prior to that time, Mr. Smith had been Senior Vice President and Chief Financial Officer for Pinnacle Natural Gas Corporation from 1999. From 1994 through 1999 he was Chief Financial Officer for Total Safety Inc., and from 1987 to 1994 Mr. Smith served as Assistant Treasurer and Director of Management Information Systems at American Oil and Gas Corporation in Houston, Texas. Prior to that, Mr. Smith held various senior executive finance and accounting positions with several energy services organizations. Mr. Smith holds a bachelor's degree in finance from Texas A&M University and is a Certified Public Accountant licensed in the state of Texas.

David L. Young was appointed Senior Vice President, Northeast Business Unit of our general partner effective February 1, 2004. Prior to joining MarkWest, Mr. Young spent eighteen years at the Williams Companies in Tulsa, Oklahoma, having served most recently as Vice President and General Manager for WilTel Communications' video services business from 2001 to 2004. Prior to that, Mr. Young's management positions at the Williams Companies included serving as Senior Vice President and General Manager for Texas Gas Pipeline and Williams Central Pipeline Company. Mr. Young holds a bachelor's degree in petroleum engineering from the Colorado School of Mines.

S-28

SELLING UNITHOLDERS

The following table shows the beneficial ownership of common units held by the selling unitholders as of September 9, 2004 and to be held following the offering. Each of the selling unitholders acquired its common units in connection with the June 2003 private placement.

We and the selling unitholders are parties to a registration rights agreement. This registration rights agreement gives the holders of the securities covered under the agreement rights to request registration of their common units and to participate in any registration by us of any of our common units for sale to the public pursuant to the Securities Act (other than in connection with mergers, acquisitions, exchange offers, options or other employee benefit plans). We are required to pay all registration expenses if these registration rights are exercised, other than underwriting discounts and selling commissions.

| | Common Units

Beneficially

Owned Prior to

this Offering

| | Common Units

Beneficially

Owned Following

this Offering

|

|---|

Name of Selling Unitholder

| | Number

| | Percentage

Owned

| | Units

Offered in

this Offering

| | Number

| | Percentage

Owned

|

|---|

JAS Trust, Country Club Bank N.A. Trustee

414 Nichols Road

P.O. Box 410889

Kansas City, MO 64141 | | 19,062 | | * | | 19,062 | | 0 | | — |

Jeane Marie Swalm

405 Merry-Go-Round Rock Road

Sedona, AZ 86341 | | 19,062 | | * | | 14,515 | | 4,547 | | * |

Robert A. Tucci and Cynthia L. Tucci, JTWROS

8631 Cedar Dr.

Prairie Village, KS 66207 | | 19,062 | | * | | 5,800 | | 13,262 | | * |

Elkan, L.L.C.

4200 Somerset Drive, Suite 200

Prairie Village, KS 66208 | | 9,531 | | * | | 9,531 | | 0 | | — |

Curtis A. Krizek Revocable Trust UTA dated 12/17/98, Curtis A. Krizek, Trustee

4200 Somerset Drive, Suite 200

Prairie Village, KS 66208 | | 11,437 | | * | | 11,437 | | 0 | | — |

Jonathan E. Baum Revocable Trust U/A dated 1/29/92, Jonathan E. Baum, Trustee

3600 W. 64th Street

Mission Hills, KS 66208 | | 4,765 | | * | | 4,765 | | 0 | | — |

Timothy S. Webster Revocable Trust dated 4/10/00, Timothy S. Webster, Trustee

3700 W. 65th Street

Mission Hills, KS 66208 | | 9,531 | | * | | 9,531 | | 0 | | — |

| | | | | | | | | | | |

S-29

Richard B. Klein Revocable Trust Richard B. Klein and Lynn M. Klein, Trustees

8104 W. 99th St.

Overland Park, KS 66212 | | 9,531 | | * | | 3,500 | | 6,031 | | * |

Michael G. Smith

221 N. Adams

Hinsdale, IL 60521 | | 9,531 | | * | | 9,531 | | 0 | | — |

Sally S. Hikene Revocable Trust dated 8/30/2002, Sally S. Hikene Trustee

2700 Verona Road

Shawnee Mission, KS 66208 | | 3,812 | | * | | 3,812 | | 0 | | — |

Frederick M. Solberg, Jr. and Elizabeth T. Solberg, Tenants by the Entirety

850 W. 52nd Street

Kansas City, MO 64112 | | 3,812 | | * | | 3,812 | | 0 | | — |

Edward D. Durwood

3001 W. 68th Street

Shawnee Mission, KS 66208 | | 5,718 | | * | | 5,718 | | 0 | | — |

Bradford M. Epsten

1030 W. 66th Terrace

Kansas City, MO 64112 | | 5,718 | | * | | 5,718 | | 0 | | — |

Laura Marcia Wolff Greenbaum Trust dated 9/20/78, Laura Wolff Greenbaum Trustee

6035 High Drive

Shawnee Mission, KS 66208 | | 5,718 | | * | | 3,450 | | 2,268 | | * |

Brian N. Kaufman and Susan C. Kaufman JTWROS

4972 W. 88th Street

Prairie Village, KS 66207 | | 4,765 | | * | | 4,765 | | 0 | | — |

A. Scott Ritchie III

8831 Clubside Ct.

Wichita, KS 67206 | | 4,000 | | * | | 4,000 | | 0 | | — |

Frank J. Cucchiara and Jo Marie Cucchiara JTWROS

26724 W. Greentree Ct.

Olathe, KS 66061 | | 3,812 | | * | | 3,812 | | 0 | | — |

The Lewis White Trust U/D/T dated 12/29/86, as amended

8900 State Line Road, Suite 333

Leawood, KS 66206 | | 3,812 | | * | | 3,812 | | 0 | | — |

| | | | | | | | | | | |

S-30

Dolores Arn Underhill Trust, Dolores Arn Underhill Trustee

4 N. Encino

Laguna Beach, CA 92651 | | 3,812 | | * | | 3,812 | | 0 | | * |

John D. Starr Trust dated 11/10/93, John D. Starr Trustee

833 West 51st Street

Kansas City, MO 64112 | | 3,049 | | * | | 3,049 | | 0 | | * |

Jeffrey C. Reene Revocable Trust dated 10/20/99, Jeffrey C. Reene Trustee

9808 High Drive

Leawood, KS 66206 | | 2,859 | | * | | 2,859 | | 0 | | * |

Jason Talley and Amarilis Talley, Tenants by the Entirety

300 Loch Lloyd Parkway

Belton, MO 64012 | | 2,287 | | * | | 2,287 | | 0 | | * |

George D. and Lisa M. Shadid, Trustees u/t/a dated 07/03/00, George D. Shadid, donor

801 W. 58th Terrace

Kansas City, MO 64113 | | 2,859 | | * | | 715 | | 2,144 | | * |

Theresa K. Freilich Revocable Trust dated 3/28/2003, Theresa K. Freilich Trustee

5252 Sunset Drive

Kansas City, MO 64113 | | 1,906 | | * | | 1,906 | | 0 | | * |

Peter P. Dreher and Nancy D. Dreher, JTWROS

5129 Woodland Avenue

Western Springs, IL 60302 | | 1,906 | | * | | 906 | | 1,000 | | * |

Robyn R. Schneider Revocable Trust, Robyn R. Schneider Trustee

20 E. 3rd Street

Hinsdale, IL 60521 | | 1,906 | | * | | 906 | | 1,000 | | * |

James S. Gerson Revocable Trust Dtd 04/94, James S. Gerson Trustee

6516 Overbrook Road

Mission Hills, KS 66208 | | 1,524 | | * | | 1,524 | | 0 | | * |

Midwest Venture Capital, LLC

1100 Main Street, Suite 350

Kansas City, MO 64105 | | 12,000 | | * | | 6,000 | | 6,000 | | * |

| | | | | | | | | | | |

S-31

Roger Brent Stover

6841 Linden

Prairie Village, KS 66208 | | 2,860 | | * | | 2,860 | | 0 | | * |

Kansas City Equity Partners, LC

233 West 47th Street

Kansas City, MO 64112 | | 2,028 | | * | | 2,028 | | 0 | | * |

Gerald W. Buetow, Jr.

1705 Owensfield Drive

Charlottesville, VA 22901 | | 1,000 | | * | | 1,000 | | 0 | | * |

Brian K. Smith Trust

5744 Sheridan Drive

Fairway, KS 66205 | | 1,000 | | * | | 1,000 | | 0 | | * |

Larry H. Powell

5620 Mission Drive

Mission Hills, KS 66208 | | 953 | | * | | 953 | | 0 | | * |

IMREX, L.P.

400 W. 2nd

Washington, KS 66968 | | 762 | | * | | 762 | | 0 | | * |

*Less than 1%

S-32

FORWARD-LOOKING STATEMENTS

Statements included in this prospectus supplement and the accompanying prospectus and any documents we incorporate by reference that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. We use words such as "may," "believe," "estimate," "expect," "plan," "intend," "project," "anticipate," and similar expressions to identify forward-looking statements.

These forward-looking statements are based on management's current plans, expectations, estimates, assumptions and beliefs concerning future events impacting us and therefore involve a number of risks and uncertainties. We caution that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements.

Important factors that could cause our actual results of operations or our actual financial condition to differ include, but are not necessarily limited to:

- •

- The availability of raw natural gas supply for our gathering and processing services;

S-37

- •

- The availability of NGLs for our transportation, fractionation and storage services;

- •

- Our dependence on certain significant customers, producers, gatherers, treaters, and transporters of natural gas, including MarkWest Hydrocarbon;

- •

- The risks that third-party oil and natural gas exploration and production activities will not occur or be successful;

- •

- Prices of NGL products and crude oil, including the effectiveness of any hedging activities, and indirectly by natural gas prices;

- •

- Competition from other NGL processors, including major energy companies;

- •

- Changes in general economic conditions in regions in which our products are located; and

- •

- Our ability to identify and consummate grass roots projects or acquisitions complementary to our business.

These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on future results. We do not update publicly any forward-looking statement. We caution you not to put undue reliance on forward-looking statements. You should read "Risk Factors" included on page S-17 of this prospectus supplement and page 1 of the accompanying prospectus, as well as those risks discussed in our Annual Report on Form 10-K/A for the year ended December 31, 2003, for further information.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement with the Securities and Exchange Commission, or SEC, under the Securities Act that registers the common units offered by this prospectus supplement. The registration statement, including the attached exhibits, contains additional relevant information about us. In addition, we file annual, quarterly and other reports and other information with the SEC. You may read and copy any document we file at the SEC's public reference room at 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at 1-800-732-0330 for further information on their public reference room. Our SEC filings are also available at the SEC's web site atwww.sec.gov. You can also obtain information about us at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005.

The SEC allows us to "incorporate by reference" the information we have filed with the SEC. This means that we can disclose important information to you without actually including the specific information in this prospectus supplement or the accompanying prospectus by referring you to those documents. The information incorporated by reference is an important part of this prospectus supplement and the accompanying prospectus. Information that we file later with the SEC and that is deemed to be "filed" with the SEC will automatically update and may replace information in this prospectus supplement and the accompanying prospectus and information previously filed with the SEC.

In addition to the documents listed in "Where You Can Find More Information" on page ii of the accompanying prospectus, we incorporate the documents listed below and any future filings made with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, other than

S-38

information under Item 9 or Item 12 of any Current Report on Form 8-K. These reports contain important information about us, our financial condition and results of operations.

- •

- Our Amendment No. 1 to Annual Report on Form 10-K/A for the year ended December 31, 2003;

- •

- Our Quarterly Reports on Form 10-Q for the periods ended March 31, 2004 and June 30, 2004;

- •

- Our Current Reports on Forms 8-K and 8-K/A filed March 1, 2004; March 22, 2004; April 16, 2004; August 13, 2004; September 9, 2004; and September 13, 2004; and

- •

- The description of our common units contained in our registration statement on Form 8-A filed February 14, 2002 and any amendment thereto filed for the purpose of updating such description.

We make available free of charge on or through our Internet website,www.markwest.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Information contained on our Internet website is not part of this prospectus supplement or the accompanying prospectus and you should not consider information contained on our Internet website as part of this prospectus supplement or the accompanying prospectus.

You may request a copy of any document incorporated by reference in this prospectus, at no cost, by writing or calling us at the following address:

MarkWest Energy Partners, L.P.

155 Inverness Drive West, Suite 200

Englewood, CO 80112-5000

Attention: Andrew L. Schroeder

(303) 290-8700

S-39

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MARKWEST ENERGY PARTNERS, L.P.

(Registrant) |

|

|

By: |

|

MarkWest Energy GP, L.L.C., Its General Partner |

Date: September 13, 2004 |

|

By: |

|

/s/ JAMES G. IVEY

James G. Ivey

Chief Financial Officer

|

3

QuickLinks

EXPLANATORY NOTESUMMARYRISK FACTORSOVERVIEW OF THE EAST TEXAS SYSTEM ACQUISITIONMANAGEMENTSELLING UNITHOLDERSFORWARD-LOOKING STATEMENTSWHERE YOU CAN FIND MORE INFORMATIONSIGNATURES