Use these links to rapidly review the document

Table of Contents

ITEM 8. Financial Statements and Supplementary Data

Starfish Pipeline Company, LLC Index December 31, 2007 and 2006

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2007. |

| or |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| for the transition period from to . |

| Commission File Number 001-31239 |

MARKWEST ENERGY PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

| Delaware | | 27-0005456 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

1515 Arapahoe Street, Tower 2, Suite 700, Denver, CO 80202-2126

(Address of principal executive offices)

Registrant's telephone number, including area code:303-925-9200

Securities registered pursuant to Section 12(b) of the Act: Common units representing limited partner interests, New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and ""smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filerý | | Accelerated filero | | Non-accelerated filero

(Do not check if a smaller reporting company) | | Smaller reporting companyo |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of common units held by non-affiliates of the registrant on June 29, 2007 was approximately $1.1 billion.

As of February 28, 2008, the number of the registrant's common units were 50,876,295.

DOCUMENTS INCORPORATED BY REFERENCE:

The information required by Part III of this Report, to the extent not set forth herein, is incorporated herein by reference from the registrant's definitive proxy statement relating to the Annual Meeting of Shareholders to be held in 2008, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

MarkWest Energy Partners, L.P.

Form 10-K

Table of Contents

Throughout this document we make statements that are classified as "forward-looking." Please refer to the "Forward-Looking Statements" included later in this section for an explanation of these types of assertions. Also, in this document, unless the context requires otherwise, references to "we," "us," "our," "MarkWest Energy" or the "Partnership" are intended to mean MarkWest Energy Partners, L.P., and its consolidated subsidiaries owned as of December 31, 2007.

As explained further in Part I, Item 1. Business, on February 21, 2008, MarkWest Energy Partners, L.P. closed its plan of redemption and merger (the "Merger") with MarkWest Hydrocarbon, Inc. (the "Company") and MWEP, L.L.C., a wholly owned subsidiary of the Partnership, pursuant to which the Company was merged into the Partnership.

This Annual Report on Form 10-K reflects amounts and events related prior to the consummation of the Merger and includes only the historical consolidated financial results of MarkWest Energy Partners, L.P. on a stand alone basis. The references made to the entities herein refer to those entities as they existed prior to the consummation of the Merger on February 21, 2008. The Partnership refers to MarkWest Energy Partners, L.P., prior to the consummation of the Merger, except where specifically noted. The Company refers to MarkWest Hydrocarbon, Inc., except where specifically noted.

2

Glossary of Terms

In addition, the following is a list of certain acronyms and terms used throughout the document:

| Bbls | | barrels |

| Bbl/d | | barrels per day |

| Bcf | | one billion cubic feet of natural gas |

| Btu | | one British thermal unit, an energy measurement |

| Gal/d | | gallons per day |

| Mcf | | one thousand cubic feet of natural gas |

| Mcf/d | | one thousand cubic feet of natural gas per day |

| MMBtu | | one million British thermal units, an energy measurement |

| MMcf | | one million cubic feet of natural gas |

| MMcf/d | | one million cubic feet of natural gas per day |

| MTBE | | methyl tertieary butyl ether |

| Net operating margin (a non-GAAP financial measure) | | revenues less purchased product costs |

| NGLs | | natural gas liquids, such as propane, butanes and natural gasoline |

| NA | | not applicable |

Forward-Looking Statements

Statements included in this Annual Report on Form 10-K that are not historical facts are forward-looking statements. We use words such as "could," "may," "will," "predict", "should," "expect," "hope", "continue", "potential", "plan," "project," "anticipate," "believe," "estimate," "intend" and similar expressions to identify forward-looking statements.

These forward-looking statements are made based upon management's expectations, estimates, assumptions and beliefs concerning future events impacting us and therefore involve a number of risks and uncertainties. We caution that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements.

3

PART I

ITEM 1. Business

General

MarkWest Energy Partners, L.P. is a publicly traded Delaware limited partnership formed by MarkWest Hydrocarbon, Inc. on January 25, 2002, to acquire most of the assets, liabilities and operations of the MarkWest Hydrocarbon Midstream Business. We are a master limited partnership engaged in the gathering, transportation and processing of natural gas; the transportation, fractionation and storage of NGLs; and the gathering and transportation of crude oil. We conduct our operations in three geographical areas: the Southwest, the Northeast, and the Gulf Coast. For more information on these geographical areas, see the Business Strategy discussion below. Our common units are traded on the New York Stock Exchange under the symbol, "MWE." We are headquartered in Denver, Colorado, and more information about us can be found at our Internet website,www.markwest.com.

Recent Developments

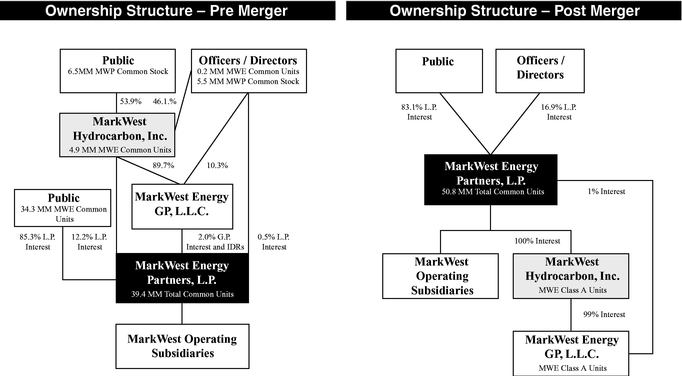

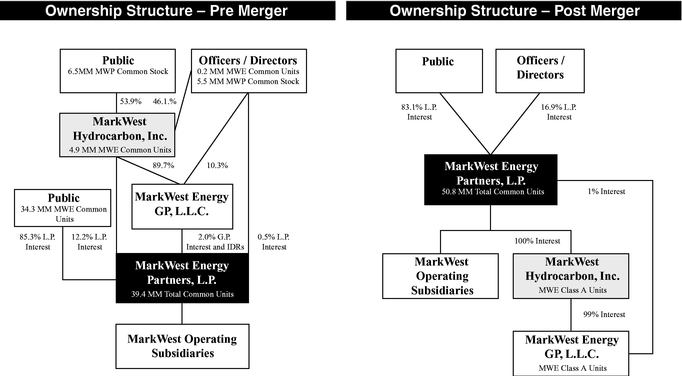

On February 21, 2008, the Partnership consummated the transactions contemplated by its plan of redemption and merger with the Company and MWEP, L.L.C., a wholly owned subsidiary of the Partnership. Pursuant to this agreement, the Company redeemed for cash approximately 3.9 million shares of its common stock, which we refer to as the "redemption," followed immediately by a merger, pursuant to which all remaining shares of the Company common stock were converted into Partnership common units, which we refer to as the "merger." As a result of the merger, the Company is a wholly owned subsidiary of the Partnership. In connection with the merger and redemption, the incentive distribution rights in the Partnership, the 2% economic interest in the Partnership of MarkWest Energy GP, L.L.C. (the "General Partner") and the Partnership common units owned by the Company were exchanged for Partnership Class A Units. Contemporaneously with the closing of the transactions contemplated by the merger, the Partnership separately acquired 100% of the Class B membership interests in the General Partner that had been held by current and former management and certain directors of the Company and the General Partner for approximately $21.0 million in cash and 0.9 million Partnership common units. The Company paid to its stockholders approximately $240.5 million in cash in the redemption and the Partnership issued to the Company's stockholders approximately 15.5 million Partnership common units in the merger. As a result of the merger and redemption, the Company owns approximately 31% of the Partnership. Please refer to Note 22 of the accompanying Notes to Consolidated Financial Statements included in Item 8 of this Form 10-K for further information about the merger and redemption and related subsequent events. The following

4

organization chart reflects the structure of the Partnership and Company both before and after the merger:

We expect the merger and redemption to offer the following advantages:

- •

- eliminates the incentive distribution rights in the Partnership (see Note 16 of the accompanying Notes to Consolidated Financial Statements included in Item 8 of this Form 10-K for information on the incentive distribution rights), which will substantially lower our cost of equity capital;

- •

- enhances the Partnership's ability to compete for new acquisitions;

- •

- improves the returns to the Partnership unitholders from the Partnership's expansion projects following the redemption and merger;

- •

- will be accretive to the Partnership's distributable cash flow per common unit; and

- •

- significantly reduces the costly duplication of services required to maintain two public companies.

The elimination of the incentive distribution rights increases available cash to be distributed to common unitholders. Please refer to "Distributions of Available Cash" in Part II, Item 5 of this Form 10-K for further information. In addition, the Partnership will also be able to distribute available cash from the Company after the Company pays taxes on its portion of the earnings from its ownership of the Partnership Class A Units. Despite the additional interest expense from borrowings needed to consummate the merger and redemption, we expect the cash available to distribute to common unitholders to increase in total and on a per common unit basis.

5

Business Strategy

Our primary business strategy is to grow our business and increase distributable cash flow per unit and maintain our financial strength, flexibility and our ability to access capital to fund our growth. We plan to accomplish this through the following:

- •

- Expanding operations through internal growth projects. By expanding our existing infrastructure and customer relationships, we intend to continue growing in our primary areas of operation to meet the anticipated demand for additional midstream services. During 2007, we spent approximately $308.7 million of growth capital to expand several of our gathering and processing operations. Projects included the initial construction of the Woodford gathering system in the Arkoma Basin in eastern Oklahoma, ongoing compressor expansions in East Texas, and well connection expansion projects in the Southwest Business Unit.

- •

- Increasing utilization of our facilities. We hope to add to, or provide additional services to, our existing customers, and to provide services to other natural gas and crude oil producers in our areas of operation. Increased drilling activity in our core areas of operation, particularly within certain fields in the Southwest, should also produce increasing natural gas and crude oil supplies, and a corresponding increase in utilization of our transportation, gathering, processing and fractionation facilities. In the meantime, we continue to develop additional capacity at several of our facilities, which enables us to increase throughput with minimal incremental costs.

- •

- Expanding operations through strategic acquisitions. We intend to continue pursuing strategic acquisitions of assets and businesses in our existing areas of operation that leverage our current asset base, personnel and customer relationships. We will also seek to acquire assets in certain regions outside of our current areas of operation.

- •

- Maintain our financial strength and flexibility. As a publicly traded partnership, we have access to, and regularly utilize, both equity and debt capital markets as a source of financing, as well as that provided by our credit facility and the ability to use common units in connection with acquisitions. Our limited partnership structure also provides tax advantages to our unitholders.

- •

- Reducing the sensitivity of our cash flows to commodity price fluctuations. We intend to continue to secure long-term, fee-based contracts in both our existing operations and strategic acquisitions, in order to further minimize our exposure to short-term changes in commodity prices.

The Partnership engages in risk management activities in order to reduce the effect of commodity price volatility related to future sales of natural gas, ethane, propane, butanes, natural gasoline and crude oil. It may utilize a combination of fixed-price forward contracts, fixed-for-floating price swaps, options available in the over-the-counter market, and futures contracts traded on the New York Mercantile Exchange. The Partnership monitors these activities through enforcement of our risk management policy. Please refer to Item 7A. Quantitative and Qualitative Disclosures About Market Risk—Commodity Price Risk.

Historically, we have generated revenues by providing gathering, processing, transportation, fractionation, and storage services. We believe that the largely fee-based nature of our business and the relatively long-term nature of our contracts provide a relatively stable base of cash flows.

We conduct our operations in three geographical areas: the Southwest, the Northeast and the Gulf Coast. We also have six segments which are based on geographic area of operation. Our assets and operations in each of these areas are described below.

6

Southwest Business Unit

- •

- East Texas. We own the East Texas System, consisting of natural gas gathering system pipelines, centralized compressor stations, and a natural gas processing facility and NGL pipeline. The East Texas System is located in Panola, Harrison and Rusk Counties and services the Carthage Field, one of Texas' largest onshore natural gas fields. Producing formations in Panola County consist of the Cotton Valley, Pettit and Travis Peak formations, which together form one of the largest natural gas producing regions in the United States. For natural gas that is processed in this segment, we purchase the natural gas liquids from the producers primarily under percent-of-proceeds arrangements or fee-based arrangements. Approximately 90% of our natural gas volumes in the East Texas System result from contracts with five producers. The resulting NGLs and condensate make up approximately 85% of our revenues in the East Texas segment. We sell the purchased and retained NGLs to Targa Resources Partners, L.P. under a long-term contract. Such sales represent 31.8% of the Partnership's consolidated revenue in 2007.

- •

- Oklahoma. We own the Foss Lake gathering system and the Arapaho gas processing plant, located in Roger Mills, Custer and Ellis counties of western Oklahoma. The gathering portion consists of a pipeline system that is connected to natural gas wells and associated compression facilities. All of the gathered gas ultimately is compressed and delivered to the processing plant. We also own a gathering system in the Woodford Shale play in the Arkoma Basin of southeastern Oklahoma, and we own the Grimes gathering system, which is located in Roger Mills and Beckham counties in western Oklahoma. Approximately 80% of our volumes are derived from gathering contracts; 20% from purchase agreements. Approximately two-thirds of our volumes result from contracts with three producers. The Oklahoma segment has three customers to which we sell NGLs, condensate and natural gas which account for a significant portion of its segment revenue. ONEOK, accounting for 14.8% of consolidated revenue in 2007, was also significant to the Partnership's consolidated revenues.

- •

- Other Southwest. We own a number of natural gas-gathering systems located in Texas, Louisiana, Mississippi and New Mexico, including the Appleby gathering system in the City and County of Nacogdoches, Texas. We gather a significant portion of the gas produced from fields adjacent to our gathering systems. In many areas, we are the primary gatherer, and in some of the areas served by our smaller systems we are the sole gatherer. In addition, we own four lateral pipelines in Texas and New Mexico. The Other Southwest segment does not have any customers which we consider to be significant to this segment's revenues. A significant portion of the net operating margin (as defined inOur Contracts below) in 2007 for the Other Southwest results from contracts with five customers.

Northeast Business Unit

- •

- Appalachia. We are one of the largest processors of natural gas in the Appalachian Basin with fully integrated processing, fractionation, storage and marketing operations. The Appalachian Basin is a large natural gas producing region characterized by long-lived reserves and modest decline rates. Our Appalachian assets include the Kenova, Boldman, Cobb and Kermit natural gas-processing plants, an NGL pipeline, an NGL fractionation plant and two caverns for storing propane. The Appalachia segment has one customer which accounts for a significant portion of its segment revenue but does not account for a significant portion of the Partnership's consolidated revenue.

- •

- Michigan. We own and operate a crude oil pipeline in Michigan, which we refer to as the Michigan Crude Pipeline. The Michigan Crude Pipeline is subject to regulation by the Federal Energy Regulatory Commission ("FERC"). We also own a natural gas-gathering system and the Fisk processing plant in Manistee County, Michigan. The Michigan segment does not have any single customer which is considered to be significant to its segment revenue.

7

Gulf Coast Business Unit

- •

- Javelina. We own and operate the Javelina Processing Facility, a natural gas processing facility in Corpus Christi, Texas, which treats and processes off-gas from six local refineries. The facility processes approximately 125 to 130 MMcf/d of inlet gas out of its 142 MMcf/d capacity. The Gulf Coast segment has five customers which account for a significant portion of its segment revenue but do not account for a significant portion of the Partnership's consolidated revenue.

We own a 50% non-operating membership interest in Starfish, whose assets are located in the Gulf of Mexico and southwestern Louisiana. The Starfish interest is part of a joint venture with Enbridge Offshore Pipelines LLC, which is accounted for using the equity method; the financial results for Starfish are included in equity from earnings (losses) from unconsolidated affiliates and are not included in the Gulf Coast Business Unit results. Starfish owns the FERC-regulated Stingray natural gas pipeline, and the unregulated Triton natural gas gathering system and West Cameron dehydration facility. All of the assets are located in the Gulf of Mexico and southwestern Louisiana.

For further information, see Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations included in this Form 10-K, and Item 8. Financial Statements and Supplementary Data included in this Form 10-K.

The following summarizes the percentage of our revenue and net operating margin (a non-GAAP financial measure, seeOur Contracts discussion below) generated by our assets, by geographic region, for the year ended December 31, 2007:

| | East Texas

| | Oklahoma

| | Other Southwest

| | Appalachia

| | Michigan

| | Gulf Coast

| |

|---|

| Revenue | | 31 | % | 34 | % | 10 | % | 11 | % | 2 | % | 12 | % |

| Net operating margin | | 30 | % | 25 | % | 7 | % | 10 | % | 3 | % | 25 | % |

MarkWest Hydrocarbon was founded in 1988 as a partnership and later incorporated in Delaware. MarkWest Hydrocarbon is an energy company primarily focused on marketing NGLs. MarkWest Hydrocarbon's assets consist primarily of partnership interests in MarkWest Energy Partners and certain processing agreements in Appalachia.

Industry Overview, Competition

MarkWest Energy Partners provides services in most areas of the natural gas gathering, processing and fractionation industry. The following diagram illustrates the typical natural gas gathering, processing and fractionation process:

The natural gas gathering process begins with the drilling of wells into gas bearing rock formations. Once completed, the well is connected to a gathering system. Gathering systems typically consist of a

8

network of small diameter pipelines and, if necessary, compression systems, that collect natural gas from points near producing wells, and transport it to larger pipelines for further transmission.

Natural gas has a widely varying composition, depending on the field, the formation reservoir or facility from which it is produced. The principal constituents of natural gas are methane and ethane. Most natural gas also contains varying amounts of heavier components, such as propane, butane, natural gasoline and inert substances that may be removed by any number of processing methods.

Most natural gas produced at the wellhead is not suitable for long-haul pipeline transportation or commercial use. It must be gathered, compressed and transported via pipeline to a central facility, and then processed to remove the heavier hydrocarbon components and other contaminants that interfere with pipeline transportation or the end-use of the gas. Our business includes providing these services either for a fee or a percentage of the NGLs removed or gas units processed. The industry as a whole is characterized by regional competition, based on the proximity of gathering systems and processing plants to producing natural gas wells, or to facilities that produce natural gas as a byproduct of refining crude oil.

MarkWest Energy also provides processing and fractionation services to crude oil refineries in the Corpus Christi, Texas, area through its Javelina Gas Processing and Fractionation facility. While similar to the natural gas industry diagram outlined above, the following diagram illustrates the significant gas processing and fractionation processes at the Javelina Facility:

Natural gas processing and treating involves the separation of raw natural gas into pipeline-quality natural gas, principally methane, and NGLs, as well as the removal of contaminants. Raw natural gas from the wellhead is gathered at a processing plant, typically located near the production area, where it is dehydrated and treated, and then processed to recover a mixed NGL stream. In the case of our Javelina facilities, the natural gas delivered to our processing plant is a byproduct of the crude oil refining process.

The removal and separation of individual hydrocarbons by processing is possible because of differences in physical properties. Each component has a distinctive weight, boiling point, vapor pressure and other physical characteristics. Natural gas may also be diluted or contaminated by water, sulfur compounds, carbon dioxide, nitrogen, helium or other components. We also produce a high quality hydrogen stream that is delivered back to certain refinery customers.

After being separated from natural gas at the processing plant, the mixed NGL stream is typically transported to a centralized facility for fractionation. Fractionation is the process by which NGLs are further separated into individual, more marketable components, primarily ethane, propane, normal butane, isobutane and natural gasoline. Fractionation systems typically exist either as an integral part of a gas processing plant or as a "central fractionator," often located many miles from the primary production and processing facility. A central fractionator may receive mixed streams of NGLs from many processing plants.

9

Described below are the five basic NGL products and their typical uses:

- •

- Ethane is used primarily as feedstock in the production of ethylene, one of the basic building blocks for a wide range of plastics and other chemical products. Ethane is not produced at our Siloam fractionator, as there is little petrochemical demand for ethane in Appalachia. It remains, therefore, in the natural gas stream. Ethane, however, is produced and sold in our East Texas, Gulf Coast and Oklahoma operations.

- •

- Propane is used for heating, engine and industrial fuels, agricultural burning and drying, and as a petrochemical feedstock for the production of ethylene and propylene. Propane is principally used as a fuel in our operating areas.

- •

- Normal butane is principally used for gasoline blending, as a fuel gas, either alone or in a mixture with propane, and as a feedstock for the manufacture of ethylene and butadiene, a key ingredient of synthetic rubber.

- •

- Isobutane is principally used by refiners to enhance the octane content of motor gasoline.

- •

- Natural gasoline is principally used as a motor gasoline blend stock or petrochemical feedstock.

We face competition for natural gas and crude oil transportation and in obtaining natural gas supplies for our processing and related services operations; in obtaining unprocessed NGLs for fractionation; and in marketing our products and services. Competition for natural gas supplies is based primarily on the location of gas-gathering facilities and gas-processing plants, operating efficiency and reliability, and the ability to obtain a satisfactory price for products recovered. Competitive factors affecting our fractionation services include availability of capacity, proximity to supply and industry marketing centers, and cost efficiency and reliability of service. Competition for customers is based primarily on price, delivery capabilities, flexibility and maintenance of high-quality customer relationships.

Our competitors include:

- •

- other large natural gas gatherers that gather, process and market natural gas and NGLs;

- •

- major integrated oil companies;

- •

- medium and large sized independent exploration and production companies;

- •

- major interstate and intrastate pipelines; and

- •

- a large number of smaller gas gatherers of varying financial resources and experience.

Many of our competitors operate as master limited partnerships and enjoy a cost of capital comparable to and, in some cases, lower than ours. Other competitors, such as major oil and gas and pipeline companies, have capital resources and control supplies of natural gas substantially greater than ours. Smaller local distributors may enjoy a marketing advantage in their immediate service areas.

We believe our competitive strengths include:

- •

- Strategic and growing position with high-quality assets in the Southwest and the Gulf Coast. Our acquisitions and internal growth projects have allowed us to establish and expand our presence in several long-lived natural gas supply basins in the Southwest, particularly in Texas and Oklahoma. In late 2006, we began expanding this strategy through our Newfield agreement by building the largest gathering system to date in the newly emerging Woodford Shale play in southeastern Oklahoma. Our Gulf Coast assets provide high quality service to six strategically located gulf coast refineries that we believe will continue to play a key role in supporting US

10

Specifically, our East Texas and Appleby gathering systems are located in the East Texas basin producing from both the Cotton Valley and Travis Peak reservoirs. Our Foss Lake gathering system and the associated Arapaho gas processing plant are located in the Anadarko basin in Oklahoma. Additionally, as mentioned above, our Woodford gathering system is located in the rapidly growing Woodford shale reservoir. We refer to our Foss Lake gathering system, the Arapaho Plant and the Woodford gathering system as our Oklahoma assets. Finally, our Starfish asset gathers gas from multiple reservoirs in the Gulf of Mexico. Each of these basins are highly prolific with long lived reserves and significant growth potential. Our gathering systems are relatively new and provide producers with low-pressure and fuel-efficient service, a significant competitive advantage for us over many competing gathering systems in those areas. We believe this competitive advantage is evidenced by our growing throughput volumes in our East Texas, Appleby, and Oklahoma operations.

- •

- Leading position in the Appalachian Basin. We are one of the largest processors of natural gas in Appalachia. We believe our significant presence and asset base provide us with a competitive advantage in capturing and contracting for new supplies of natural gas. The Appalachian Basin is a large natural gas-producing region characterized by long-lived reserves with modest decline rates and natural gas with high NGL content. These reserves provide a stable supply of natural gas for our processing plants and our Siloam NGL fractionation facility. Our concentrated infrastructure, and available land, storage assets and expansion plans in Appalachia should continue to provide us with a platform for additional cost-effective expansion. In November 2007, the Partnership announced a plan to invest approximately $60.0 million to significantly expand nearly all of its plants in the Appalachia region. The Partnership expects to complete the Kenova upgrade in early 2008, the expansion of the Siloam facility in the third quarter of 2008, and the Boldman and Cobb expansions in early 2009.

- •

- Stable cash flows. We believe our numerous fee-based contracts and our active commodity risk management program provide us with stable cash flows. For the year ended December 31, 2007, we generated approximately 32% of our net operating margin (a non-GAAP financial measure, seeOur Contracts discussion below) from fee-based services. In addition, a portion of our fee-based business is generated by our four lateral pipelines in the Southwest, which typically provide fixed transportation fees independent of the volumes transported. We also believe that an active commodity risk management program is a significant component of providing stable cash flows as our commodity exposure grows with our expanding operations.

- •

- Long-term Contracts. We believe our long-term contracts, which we define as contracts with remaining terms of four years or more, lend greater stability to our cash-flow profile. In East Texas, approximately 77% of our current gathering volumes as of December 31, 2007, are under contract for longer than four years. Two of our Pinnacle lateral pipelines operate under fixed-fee contracts for the transmission of natural gas that expire in approximately 15 and 23 years, respectively. Approximately 20% of our daily throughput in the Foss Lake gathering system and Arapaho processing plant in western Oklahoma is subject to contracts with remaining terms of

11

four years or more. The majority of our throughput in the Woodford gathering system is subject to contracts with remaining terms of more than 12 years. In Appalachia, we have natural gas processing and NGL fractionation contracts with remaining terms from 4 to 6 years. In Michigan, our natural gas transportation, treating and processing agreements have remaining terms of 9 to 21 years.

- •

- Experienced management with operational, technical and acquisition expertise. Each member of our executive management team has substantial experience in the energy industry. Our facility managers have extensive experience operating our facilities. Our operational and technical expertise has enabled us to upgrade our existing facilities, as well as to design and build new ones. Since our initial public offering in May 2002, our management team has utilized a disciplined approach to analyze and evaluate numerous acquisition opportunities, and has completed nine acquisitions. We intend to continue to use our management's experience and disciplined approach in evaluating and acquiring assets to grow through accretive acquisitions—those acquisitions expected to increase our throughput volumes and cash flow distributable to our unitholders.

- •

- Financial strength and flexibility. During 2007, we issued approximately $229.6 million of equity. Our goal is to maintain a capital structure with approximately equal amounts of debt and equity on a long-term basis. We expect the merger and redemption will substantially lower our cost of equity capital.

As of February 25, 2008, we have available borrowing capacity of approximately $258.5 million under our new $350.0 million revolving credit facility. See further discussion of our new credit facility in Note 22 of the accompanying Notes to Consolidated Financial Statements included in Item 8 of this Form 10-K. The borrowing capacity is determined on a quarterly basis and is further adjusted to take into consideration the cash flow contribution of an acquisition at the time of its closing. The credit facility, together with our ability to issue additional partnership units for financing and acquisition purposes, should provide us with a flexible financial structure that will facilitate the execution of our business strategy.

To better understand our business and the results of operations discussed in Item 6. Selected Financial Data and Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation, the following two factors are important to consider:

- •

- the nature of the contracts from which we derive our revenues; and

- •

- the difficulty in comparing our results of operations across periods because of our acquisition activity.

Our Contracts

We generate the majority of our revenues and net operating margin (a non-GAAP measure, see below for discussion and reconciliation of net operating margin) from natural gas gathering, processing and transmission; NGL transportation, fractionation and storage; and crude oil gathering and transportation. We enter into a variety of contract types. In many cases, we provide services under contracts that contain a combination of more than one of the arrangements described below. We provide services under the following different types of arrangements (all of which constitute midstream energy operations):

- •

- Fee-based arrangements: Under fee-based arrangements, we receive a fee or fees for one or more of the following services: gathering, processing and transmission of natural gas; transportation, fractionation and storage of NGLs; and gathering and transportation of crude oil. The revenue we earn from these arrangements is directly related to the volume of natural gas, NGLs or crude oil that flows through our systems and facilities and is not directly dependent on commodity

12

prices. In certain cases, our arrangements provide for minimum annual payments or fixed demand charges. If a sustained decline in commodity prices were to result in a decline in volumes, however, our revenues from these arrangements would be reduced.

- •

- Percent-of-proceeds arrangements: Under percent-of-proceeds arrangements, we gather and process natural gas on behalf of producers, sell the resulting residue gas, condensate and NGLs at market prices and remit to producers an agreed-upon percentage of the proceeds based on an index price. In other cases, instead of remitting cash payments to the producer, we deliver an agreed-upon percentage of the residue gas and NGLs to the producer and sell the volumes we keep to third parties at market prices. Generally, under these types of arrangements our revenues and gross margins increase as natural gas, condensate and NGL prices increase, and our revenues and net operating margins decrease as natural gas, condensate and NGL prices decrease.

- •

- Percent-of-index arrangements: Under percent-of-index arrangements, we purchase natural gas at either (1) a percentage discount to a specified index price, (2) a specified index price less a fixed amount or (3) a percentage discount to a specified index price less an additional fixed amount. We then gather and deliver the natural gas to pipelines where we resell the natural gas at the index price, or at a different percentage discount to the index price. With respect to (1) and (3) above, the net operating margins we realize under the arrangements decrease in periods of low natural gas prices because these net operating margins are based on a percentage of the index price. Conversely, our net operating margins increase during periods of high natural gas prices.

- •

- Keep-whole arrangements: Under keep-whole arrangements, we gather natural gas from the producer, process the natural gas and sell the resulting condensate and NGLs to third parties at market prices. Because the extraction of the condensate and NGLs from the natural gas during processing reduces the Btu content of the natural gas, we must either purchase natural gas at market prices for return to producers or make cash payment to the producers equal to the energy content of this natural gas. Accordingly, under these arrangements our revenues and net operating margins increase as the price of condensate and NGLs increases relative to the price of natural gas, and decrease as the price of natural gas increases relative to the price of condensate and NGLs.

- •

- Settlement margin: Typically, we are allowed to retain a fixed percentage of the volume gathered to cover the compression fuel charges and deemed-line losses. To the extent our gathering systems are operated more efficiently than specified per contract allowance, we are entitled to retain the difference for our own account.

The terms of our contracts vary based on gas quality conditions, the competitive environment when the contracts are signed and customer requirements. Our contract mix and, accordingly, our exposure to natural gas and NGL prices, may change as a result of changes in producer preferences, our expansion in regions where some types of contracts are more common and other market factors. Any change in mix will influence our financial results.

As of December 31, 2007, our primary exposure to keep-whole contracts was limited to our Arapaho (Oklahoma) processing plant and our East Texas processing contracts. At the Arapaho plant inlet, the Btu content of the natural gas meets the downstream pipeline specification; however, we have the option of extracting NGLs when the processing margin environment is favorable. Due to our ability to operate the Arapaho plant in several recovery modes, our overall keep-whole contract exposure is limited to a small portion of the operating costs of the plant.

Approximately 11% of the gas processed in East Texas for producers was processed under keep-whole terms. Our keep-whole exposure in this area was offset to a great extent because the East

13

Texas agreements provide for the retention of natural gas as a part of the gathering and compression arrangements with all producers on the system. This excess gas helps offset the amount of replacement natural gas purchases required to keep our producers whole on an MMbtu basis, thereby creating a partial natural hedge. The net result is a significant reduction in volatility for these changes in natural gas prices. The remaining volatility for these contracts results from changes in NGL prices. We have an active commodity risk management program in place to reduce the impacts of changing NGL prices.

Management evaluates contract performance on the basis of net operating margin (a non-GAAP financial measure), which is defined as income (loss) from operations, excluding facility expense, selling, general and administrative expense, depreciation, amortization, impairments and accretion of asset retirement obligations. These charges have been excluded for the purpose of enhancing the understanding by both management and investors of the underlying baseline operating performance of our contractual arrangements, which management uses to evaluate our financial performance for purposes of planning and forecasting. Net operating margin does not have any standardized definition and therefore is unlikely to be comparable to similar measures presented by other reporting companies. Net operating margin results should not be evaluated in isolation of, or as a substitute for our financial results prepared in accordance with GAAP. Our usage of net operating margin and the underlying methodology in excluding certain charges is not necessarily an indication of the results of operations expected in the future, or that we will not, in fact, incur such charges in future periods.

The following is a reconciliation to income from operations, the most comparable GAAP financial measure of this non-GAAP financial measure (in thousands):

| | Year ended December 31,

| |

|---|

| | 2007

| | 2006

| | 2005

| |

|---|

| Revenues | | $ | 602,879 | | $ | 629,911 | | $ | 541,090 | |

| Purchased product costs | | | 358,720 | | | 376,237 | | | 408,884 | |

| | |

| |

| |

| |

| Net operating margin | | | 244,159 | | | 253,674 | | | 132,206 | |

| | |

| |

| |

| |

| | Facility expenses | | | 75,036 | | | 60,112 | | | 47,972 | |

| | Selling, general and administrative | | | 51,334 | | | 44,377 | | | 21,597 | |

| | Depreciation | | | 40,171 | | | 29,993 | | | 19,534 | |

| | Amortization of intangible | | | 16,672 | | | 16,047 | | | 9,656 | |

| | Loss (gain) on disposal of property, plant and equipment | | | 7,564 | | | (192 | ) | | (24 | ) |

| | Accretion of asset retirement obligation | | | 114 | | | 102 | | | 159 | |

| | Impairments | | | 356 | | | — | | | — | |

| | |

| |

| |

| |

| Income from operations | | $ | 52,912 | | $ | 103,235 | | $ | 33,312 | |

| | |

| |

| |

| |

For the year ended December 31, 2007, we calculated the following approximate percentages of our revenues and net operating margin from the following types of contracts:

| | Fee-Based

| | Percent-of-Proceeds(1)

| | Percent-of-Index(2)

| | Keep-Whole(3)

| |

|---|

| Revenue | | 15 | % | 38 | % | 28 | % | 19 | % |

| Net operating margin | | 32 | % | 41 | % | 7 | % | 20 | % |

- (1)

- Includes other types of arrangements tied to NGL prices.

- (2)

- Includes settlement margin, condensate sales and other types of arrangements tied to natural gas prices.

- (3)

- Includes settlement margin, condensate sales and other types of arrangements tied to both NGL and natural gas prices.

14

Our short natural gas positions under our keep-whole contracts are largely offset by our long positions in our other operating areas. As a result, our net exposure to natural gas price volatility is not significant prior to the merger. While the percentages in the table above accurately reflect the percentages by contract type, we manage our business by taking into account the offset described above, required levels of operational flexibility and the fact that our hedge plan is implemented on this basis. When considered on this basis, the calculated percentages for the net operating margin in the table above for Percent-of-Proceeds, Percent-of-Index and Keep-Whole contracts change to 61%, 0% and 7%, respectively. As a result of our acquisition of MarkWest Hydrocarbon and its NGL marketing business, our exposure to keep-whole contracts will increase and as a result our exposure to natural gas volatility will increase as well. For further information on our natural gas volatility, please read Item 7A. Quantitative and Qualitative Disclosures About Market Risk—Commodity Price Riskas set forth in this report.

Acquisitions

A significant part of our business strategy includes acquiring additional businesses and assets that will allow us to increase distributions to our unitholders. We regularly consider and enter into discussions regarding potential acquisitions. These transactions may be effectuated quickly, may occur at any time and may be significant in size relative to our existing assets and operations.

Since our initial public offering, we have completed nine acquisitions for an aggregate purchase price of approximately $810 million, net of working capital. The acquisitions were individually accounted for as a business combination. Summary information regarding each of these acquisitions is presented below (consideration in millions):

Name

| | Assets

| | Location

| | Consideration

| | Closing Date

|

|---|

| Santa Fe | | Gathering system | | Oklahoma | | $ | 15.0 | | December 29, 2006 |

Javelina(1) |

|

Gas processing and fractionation facility |

|

Corpus Christi, TX |

|

|

398.8 |

|

November 1, 2005 |

Starfish(2) |

|

Natural gas pipeline, gathering system and dehydration facility |

|

Gulf of Mexico/ Southern Louisiana |

|

|

41.7 |

|

March 31, 2005 |

East Texas |

|

Gathering system and gas processing assets |

|

East Texas |

|

|

240.7 |

|

July 30, 2004 |

Hobbs |

|

Natural gas pipeline |

|

New Mexico |

|

|

2.3 |

|

April 1, 2004 |

Michigan Crude Pipeline |

|

Common carrier crude oil pipeline |

|

Michigan |

|

|

21.3 |

|

December 18, 2003 |

Western Oklahoma |

|

Gathering system |

|

Western Oklahoma |

|

|

38.0 |

|

December 1, 2003 |

Lubbock Pipeline |

|

Natural gas pipeline |

|

West Texas |

|

|

12.2 |

|

September 2, 2003 |

Pinnacle |

|

Natural gas pipelines and gathering systems |

|

East Texas |

|

|

39.9 |

|

March 28, 2003 |

- (1)

- Consideration includes $35.5 million in cash.

- (2)

- Represents a 50% non-controlling interest.

Regulatory Matters

Our operations are subject to extensive regulations. The failure to comply with applicable laws and regulations can result in substantial penalties. The regulatory burden on our operations increases our

15

cost of doing business and, consequently, affects our profitability. However, we do not believe that we are affected in a significantly different manner by these laws and regulations than are our competitors. Due to the myriad of complex federal, state, provincial and local regulations that may affect us, directly or indirectly, reliance on the following discussion of certain laws and regulations should not be considered an exhaustive review of all regulatory considerations affecting our operations.

Interstate Gas Pipelines. Our natural gas pipeline operations are subject to federal, state and local regulatory authorities. Specifically, our Hobbs, New Mexico natural gas pipeline, our proposed Arkoma Connector natural gas pipeline in Oklahoma, and our Michigan crude oil pipeline facilities and related assets are subject to regulation by the FERC. In addition, the Midcontinent Express Pipeline connecting Bennington, Oklahoma, and Perryville, Louisiana, in which we have an option to acquire a 10% interest, will also be subject to regulation by the FERC. Federal regulation extends to such matters as:

- •

- rate structures;

- •

- return on equity;

- •

- recovery of costs;

- •

- the services that our regulated assets are permitted to perform;

- •

- the acquisition, construction and disposition of assets; and

- •

- to an extent, the level of competition in that regulated industry.

Under the Natural Gas Act ("NGA"), FERC has authority to regulate natural gas companies that provide natural gas pipeline transportation services in interstate commerce. Its authority to regulate those services includes the rates charged for the services, terms and conditions of service, certification and construction of new facilities, the extension or abandonment of services and facilities, the maintenance of accounts and records, the acquisition and disposition of facilities, the initiation and discontinuation of services, and various other matters. Natural gas companies may not charge rates that have been determined not to be just and reasonable by FERC. In addition, FERC prohibits natural gas companies from unduly preferring or unreasonably discriminating against any person with respect to pipeline rates or terms and conditions of service. The rates and terms and conditions for our service will be found in FERC-approved tariffs. Pursuant to FERC's jurisdiction over rates, existing rates may be challenged by complaint and proposed rate increases may be challenged by protest. We cannot assure you that FERC will continue to pursue its approach of procompetitive policies as it considers matters such as pipeline rates and rules and policies that may affect rights of access to natural gas transportation capacity, and transportation facilities. Any successful complaint or protest against our rates, or loss of market-based rate authority by FERC could have an adverse impact on our revenues associated with providing interstate gas transportation services.

Energy Policy Act of 2005. On August 8, 2005, President Bush signed into law the Domenici-Barton Energy Policy Act of 2005 ("2005 EP Act"). Under the 2005 EP Act, FERC may impose civil penalties of up to $1,000,000 per day for each current violation of the NGA or the Natural Gas Policy Act of 1978. The 2005 EP Act also amends the NGA to add an anti-market manipulation provision, which makes it unlawful for any entity to engage in prohibited behavior in contravention of rules and regulations to be prescribed by FERC. FERC issued Order No. 670 to implement the anti-market manipulation provision of 2005 EP Act. This order makes it unlawful for gas pipelines and storage companies that provide interstate services to: (1) in connection with the purchase or sale of natural gas subject to the jurisdiction of FERC, or the purchase or sale of transportation services subject to the jurisdiction of FERC, for any entity, directly or indirectly, to use or employ any device, scheme or

16

artifice to defraud; (2) to make any untrue statement of material fact or omit to make any such statement necessary to make the statements made not misleading; or (3) to engage in any act or practice that operates as a fraud or deceit upon any person. The anti-market manipulation rule and enhanced civil penalty authority reflect an expansion of FERC's enforcement authority. Additional proposals and proceedings that might affect the natural gas industry are pending before Congress, FERC and the courts. We cannot assure you that present policies pursued by FERC and Congress will continue.

Affiliate Relationships. Commencing in 2003, FERC issued a series of orders adopting rules for new Standards of Conduct for Transmission Providers (Order No. 2004) that applied to interstate natural gas pipelines and to certain natural gas storage companies, which provide storage services in interstate commerce. Among other matters, Order No. 2004 required interstate pipelines to operate independently from their energy affiliates, prohibited interstate pipelines from providing non-public transportation or shipper information to their energy affiliates, prohibited interstate pipelines from favoring their energy affiliates in providing service, and obligated interstate pipelines to post on their websites a number of items of information concerning the company, including its organizational structure, facilities shared with energy affiliates, discounts given for service and instances in which the company has agreed to waive discretionary terms of its tariff.

The United States Court of Appeals for the District of Columbia Circuit vacated and remanded Order No. 2004 in late 2006, as it relates to natural gas transportation providers. On January 9, 2007, and as clarified on March 21, 2007, FERC issued an interim rule re-promulgating on an interim basis the standards of conduct that were not challenged before the court. The interim rule makes the standards of conduct apply to the relationship between natural gas transportation providers and their marketing affiliates, but not to energy affiliates who are not also marketing affiliates. FERC has now issued a notice of proposed rulemaking ("NOPR") that proposes permanent standards of conduct which FERC states will avoid the aspects of the previous standards of conduct rejected by the court. We have no way to predict with certainty the scope of FERC's permanent rules on the standards of conduct.

Market Transparency Rulemakings. In 2007, FERC issued a NOPR on pipeline posting requirements and a final rule on annual natural gas transaction reporting (Order 704). Under Order No. 704, wholesale buyers and sellers of more than a minimum volume of natural gas are now required to report, on May 1 of each year, beginning in 2009, aggregate volumes of natural gas purchased or sold at wholesale in the prior calendar year. Order No. 704 also requires market participants to indicate whether they report prices to any index publishers, and if so, whether their reporting complies with the Commission's Policy Statement on price reporting. Several parties have filed requests for clarification or rehearing that are currently pending before FERC.

Under the NOPR on pipeline posting requirements, the Commission is proposing to require intrastate pipelines to post daily actual and scheduled flows on an Internet website. It is also proposing to require that interstate pipelines add actual daily volumes to their Internet websites. We cannot predict the ultimate impact of these regulatory changes to our natural gas operations. We do not believe we would be affected by any such FERC action materially different than any other natural gas company with which we compete.

17

Gathering and Intrastate Pipeline Regulation. Section 1(b) of the NGA exempts natural gas gathering facilities from the jurisdiction of FERC. We own a number of facilities that we believe meet the traditional tests FERC has used to establish a pipeline's status as a gatherer not subject to FERC jurisdiction. In the states in which we operate, regulation of gathering facilities and intrastate pipeline facilities generally includes various safety, environmental and, in some circumstances, open access, nondiscriminatory take requirement and complaint-based rate regulation. For example, some of our natural gas gathering facilities are subject to state ratable take and common purchaser statutes. Ratable take statutes generally require gatherers to take, without undue discrimination, natural gas production that may be tendered to the gatherer for handling. Similarly, common purchaser statutes generally require gatherers to purchase gas without undue discrimination as to source of supply or producer. These statutes are designed to prohibit discrimination in favor of one producer over another producer or one source of supply over another source of supply. These statutes have the effect of restricting our right as an owner of gathering facilities to decide with whom we contract to purchase or transport natural gas.

Natural gas gathering may receive greater regulatory scrutiny at both the state and federal levels now that FERC has taken a less stringent approach to regulation of the gathering activities of interstate pipeline transmission companies and a number of such companies have transferred gathering facilities to unregulated affiliates. Our gathering operations could be adversely affected should they be subject in the future to the application of state or federal regulation of rates and services. Our gathering operations also may be or become subject to safety and operational regulations relating to the design, installation, testing, construction, operation, replacement and management of gathering facilities. Additional rules and legislation pertaining to these matters are considered or adopted from time to time. We cannot predict what effect, if any, such changes might have on our operations, but the industry could be required to incur additional capital expenditures and increased costs depending on future legislative and regulatory changes.

Our intrastate gas pipeline facilities are subject to various state laws and regulation that affect the rates we charge and terms of service. Although state regulation is typically less onerous than at FERC, state regulation typically requires pipelines to charge just and reasonable rates and to provide service on a non-discriminatory basis. The rates and service of an intrastate pipeline generally are subject to challenge by complaint.

Our Appalachian pipeline carries NGLs across state lines. The primary shipper on the pipeline is MarkWest Hydrocarbon, which has entered into agreements with us providing for a fixed transportation charge for the term of the agreements. They expire on December 31, 2015. We are the only other shipper on the pipeline. We neither operate our Appalachian pipeline as a common carrier, nor hold it out for service to the public. Generally, there are currently no third-party shippers on this pipeline and the pipeline is, and will continue to be, operated as a proprietary facility. The likelihood of other entities seeking to utilize our Appalachian pipeline is remote, so it should not be subject to regulation by the FERC in the future. We cannot provide assurance, however, that FERC will not at some point determine that such transportation is within its jurisdiction, or that such an assertion would not adversely affect our results of operations. In such a case, we would be required to file a tariff with FERC and provide a cost justification for the transportation charge.

Crude Common Carrier Pipeline Operations. Our Michigan Crude Pipeline is a crude oil pipeline that is a common carrier and subject to regulation by the FERC under the October 1, 1977 version of the Interstate Commerce Act ("ICA") and the Energy Policy Act of 1992 ("EPAct 1992"). The ICA and its implementing regulations give the FERC authority to regulate the rates charged for service on the interstate common carrier liquids pipelines and generally require the rates and practices of interstate liquids pipelines to be just and reasonable and nondiscriminatory. The ICA also requires tariffs to be maintained on file with the FERC that set forth the rates it charges for providing transportation services on its interstate common carrier liquids pipelines as well as the rules and regulations governing

18

these services. EPAct 1992 and its implementing regulations allow interstate common carrier oil pipelines to annually index their rates up to a prescribed ceiling level. In addition, the FERC retains cost-of-service ratemaking, market-based rates and settlement rates as alternatives to the indexing approach.

With respect to our Michigan Crude Pipeline, we filed a tariff establishing a cost-of-service rate structure to be effective starting January 1, 2006, and pursuant to a FERC certified settlement with shippers on the pipeline, the rate structure is under a moratorium on rate changes or challenges for a three-year period, with limited exceptions.

Environmental Matters

Our processing and fractionation plants, pipelines, and associated facilities are subject to multiple obligations and potential liabilities under a variety of stringent and comprehensive federal, state and local laws and regulations governing discharges of materials into the environment or otherwise relating to environmental protection. Such laws and regulations affect many aspects of our present and future operations, such as requiring the acquisition of permits or other approvals to conduct regulated activities, restricting the manner in which we handle or dispose of our wastes, limiting or prohibiting activities in sensitive areas such as wetlands, ecologically-sensitive areas, or areas inhabited by endangered species, incurring capital costs to construct, maintain and upgrade equipment and facilities, and requiring remedial actions to mitigate pollution caused by our operations or attributable to former operations. Failure to comply with these stringent and comprehensive requirements may expose us to the assessment of administrative, civil and criminal penalties, the imposition of remedial requirements and the issuance of orders enjoining or limiting some or all of our operations.

We believe that our operations and facilities are in substantial compliance with applicable environmental laws and regulations, and that the cost of continued compliance with such laws and regulations will not have a material adverse effect on our results of operations or financial condition. We cannot ensure, however, that existing environmental laws and regulations will not be revised or that new laws and regulations will not be adopted or become applicable to us. The clear trend in environmental law is to place more restrictions and limitations on activities that may be perceived to affect the environment, and thus there can be no assurance as to the amount or timing of future expenditures for environmental-regulation compliance or remediation, and actual future expenditures may be different from the amounts we currently anticipate. Revised or additional environmental requirements that result in increased compliance costs or additional operating restrictions, particularly if those costs are not fully recoverable from our customers, could have material adverse effect on our business, financial condition, results of operations and cash flow. We may not be able to recover some or any of these costs from insurance.

To a large extent, the environmental laws and regulations affecting our operations relate to the release of hazardous substances or solid wastes into soils, groundwater, and surface water, and include measures to control environmental pollution of the environment. For instance, the Comprehensive Environmental Response, Compensation, and Liability Act, as amended, or CERCLA, also known as the "Superfund" law, and comparable state laws, impose liability without regard to fault or the legality of the original conduct, on certain classes of persons that contributed to a release of "hazardous substance" into the environment. These persons include current and prior owners or operators of a site where a release occurred and companies that disposed or arranged for the disposal of the hazardous substances found at the site. Under CERCLA, these persons may be subject to joint and several strict liability for the costs of removing or remediating hazardous substances that have been released into the environment, for restoration and damages to natural resources, and for the costs of certain health

19

studies. Additionally, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances or other pollutants released into the environment. While we generate materials in the course of our operations that are regulated as hazardous substances under CERCLA or similar state statutes, we have not received any notification that we may be potentially responsible for cleanup costs under such laws. We also may incur liability under the Resource Conservation and Recovery Act, as amended, or RCRA, and comparable state statutes, which impose requirements relating to the handling and disposal of hazardous wastes and nonhazardous solid wastes. We are not currently required to comply with a substantial portion of the RCRA requirements because our operations generate minimal quantities of hazardous wastes. However, it is possible that some wastes generated by us that are currently classified as nonhazardous may in the future be designated as "hazardous wastes," resulting in the wastes being subject to more rigorous and costly disposal requirements.

We currently own or lease, and have in the past owned or leased, properties that have been used over the years for natural gas gathering and processing, for NGL fractionation, transportation and storage or for the storage and gathering and transportation of crude oil. Although solid waste disposal practices within the NGL industry and other oil and natural gas related industries have improved over the years, a possibility exists that hydrocarbons and other solid wastes or hazardous wastes may have been disposed of on or under various properties owned or leased by us during the operating history of those facilities. In addition, a number of these properties may have been operated by third parties whose treatment and disposal or release of hydrocarbons or other wastes was not under our control. These properties and wastes disposed thereon may be subject to CERCLA, RCRA, and analogous state laws. Under these laws, we could be required to remove or remediate previously disposed wastes or property contamination, including groundwater contamination or to perform remedial operations to prevent future contamination. We do not believe that there presently exists significant surface and subsurface contamination of our properties by hydrocarbons or other solid wastes for which we are currently responsible. We do not believe that there presently exists significant surface and subsurface contamination of our properties by hydrocarbons or other solid wastes for which we are currently responsible.

The previous owner/operator of our Boldman and Cobb facilities has been, or is currently involved in, investigatory or remedial activities with respect to the real property underlying these facilities. These investigatory and remedial obligations arise out of a September 1994 "Administrative Order by Consent for Removal Actions" with EPA Regions II, III, IV, and V; and an "Agreed Order" entered into by the previous owner/operator with the Kentucky Natural Resources and Environmental Protection Cabinet in October 1994. The previous owner/operator has accepted sole liability and responsibility for, and indemnifies MarkWest Hydrocarbon against, any environmental liabilities associated with the EPA Administrative Order, the Kentucky Agreed Order or any other environmental condition related to the real property prior to the effective dates of MarkWest Hydrocarbon's lease or purchase of the real property. In addition, the previous owner/operator has agreed to perform all the required response actions at its expense in a manner that minimizes interference with MarkWest Hydrocarbon's use of the properties. On May 24, 2002, MarkWest Hydrocarbon assigned to us the benefit of this indemnity from the previous owner/operator. To date, the previous owner/operator has been performing all actions required under these agreements and, accordingly, we do not believe that the remediation obligation of these properties will have a material adverse impact on our financial condition or results of operations. To date, the previous owner/operator has been performing all actions required under these agreements and, accordingly, we do not believe that the remediation obligation of these properties will have a material adverse impact on our financial condition or results of operations.

20

The Clean Air Act, as amended, and comparable state laws restrict the emission of air pollutants from many sources, including processing plants and compressor stations, and also impose various monitoring and reporting requirements. These laws and any implementing regulations may require us to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly increase air emissions, obtain and strictly comply with stringent air permit requirements, or utilize specific equipment or technologies to control emissions. As the result of changes to the Clean Air Act, we may be required to incur certain capital expenditures for air pollution control equipment in connection with maintaining or obtaining operating permits addressing other air emission-related issues. We do not believe, however, that such requirements will have a material adverse affect on our operations.

The Federal Water Pollution Control Act of 1972, as amended, also known as the "Clean Water Act," and analogous state laws impose restrictions and controls on the discharge of pollutants into federal and state waters. Such discharges are prohibited, except in accord with the terms of a permit issued by the EPA or the analogous state agency. Spill prevention, control and countermeasure requirements under federal law require appropriate containment berms and similar structures to help prevent the contamination of navigable waters in the event of a hydrocarbon tank spill, rupture or leak. In addition, the Clean Water Act and analogous state law require individual permits or coverage under general permits for discharges of stormwater from certain types of facilities. These permits may require us to monitor and sample the stormwater runoff. Any unpermitted release of pollutants, including oil, natural gas liquids or condensates, could result in penalties, as well as significant remedial obligations. We believe that we are in substantial compliance with the Clean Water Act.

Some scientific studies have suggested that emissions of certain gases, commonly referred to as "greenhouse gases" and including carbon dioxide and methane, may be contributing to warming of the Earth's atmosphere. In response to such studies, the U.S. Congress is actively considering legislation to reduce emissions of greenhouse gases, which may include the implementation of emissions allowances that could be traded or acquired in the open market. This legislation may be subject to debate and a possible vote by mid-year 2008. In addition, at least 17 states have already taken legal measures to reduce emissions of greenhouse gases, primarily through the planned development of greenhouse gas emission inventories and/or regional greenhouse gas cap and trade programs.

Our operations and the operations of the natural gas and oil industry in general may be subject to laws and regulations regarding the security of industrial facilities, including natural gas and oil facilities. The Department of Homeland Security Appropriations Act of 2007 required the Department of Homeland Security ("DHS"), to issue regulations establishing risk-based performance standards for the security of chemical and industrial facilities, including oil and gas facilities that are deemed to present "high levels of security risk." The DHS issued an interim final rule, known as the Chemical Facility Anti-Terrorism Standards interim rule, in April 2007 regarding risk-based performance standards to be attained pursuant to the act and on November 20, 2007 further issued an Appendix A to the interim rule that established the chemicals of interest and their respective threshold quantities that will trigger compliance with these interim rules. Covered facilities that are determined by DHS to pose a high level of security risk will be required to prepare and submit Security Vulnerability Assessments and Site Security Plans as well as comply with other regulatory requirements, including those regarding inspections, audits, recordkeeping, and protection of chemical-terrorism vulnerability information. In

21

January 2008, we prepared and submitted to the DHS initial screening surveys for facilities operated by us that possess regulated chemicals of interest in excess of the Appendix A threshold levels. Because we are currently awaiting a response from DHS on the extent to which some or all of our surveyed facilities may be determined to present a high level of security risk, the associated costs for complying with this interim rule has not been determined by us, and it is possible that such costs ultimately could be substantial.

Pipeline Safety Regulations

Our pipelines are subject to regulation by the U.S. Department of Transportation ("DOT") under the Natural Gas Pipeline Safety Act of 1986, as amended ("NGPSA"), with respect to natural gas and the Hazardous Pipeline Safety Act of 1979, as amended ("HLPSA"), with respect to crude oil, NGLs and condensates. The NGPSA and HLPSA govern the design, installation, testing, construction, operation, replacement and management of natural gas, oil and NGL pipeline facilities. The NGPSA and HLPSA require any entity that owns or operates pipeline facilities to comply with the regulations implemented under these acts, permit access to and allow copying of records, and to make certain reports and provide information as required by the Secretary of Transportation. We believe that our pipeline operations are in substantial compliance with applicable existing NGPSA and HLPSA requirements; however, due to the possibility of new or amended laws and regulations or re interpretation of existing laws and regulations, future compliance with the NGPSA and HLPSA could result in increased costs.

Our pipelines are also subject to regulation by the DOT under the Pipeline Safety Improvement Act of 2002, which was reauthorized and amended by the Pipeline Inspection, Protection, Enforcement and Safety Act of 2006. The DOT, through the Pipeline and Hazardous Materials Safety Administration ("PHMSA"), has established a series of rules under 49 C.F.R. Part 192 that require pipeline operators to develop and implement integrity management programs for gas transmission pipelines that, in the event of a failure, could affect high consequence areas. "High consequence areas" are currently defined to include high population areas, areas unusually sensitive to environmental damage and commercially navigable waterways. Similar rules are also in place under 49 C.F.R. Part 195 for operators of hazardous liquid pipelines including lines transporting NGLs and condensates. The DOT also is required by the Pipeline Inspections, Protection, Enforcement, and Safety Act of 2006 to issue new regulations that set forth safety standards and reporting requirements applicable to low stress pipelines and gathering lines transporting hazardous liquids, including oil, NGLs and condensate. A final rule addressing safety standards for hazardous liquid low-stress pipelines and gathering lines is anticipated to be issued by PHMSA in 2008. Such new hazardous liquid pipeline safety standards may include applicable integrity management program requirements. While we believe that our pipeline operations are in substantial compliance with applicable requirements, due to the possibility of new or amended laws and regulations, or reinterpretation of existing laws and regulations, there can be no assurance that future compliance with the requirements will not have a material adverse effect on our results of operations or financial position.

Employee Safety

The workplaces associated with the processing and storage facilities and the pipelines we operate are also subject to oversight pursuant to the federal Occupational Safety and Health Act, as amended, ("OSHA"), as well as comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA hazard-communication standard requires that we maintain information about hazardous materials used or produced in operations, and that this information be provided to employees, state and local government authorities, and citizens. We believe that we have conducted our operations in substantial compliance with OSHA requirements, including general industry standards, record-keeping requirements and monitoring of occupational exposure to regulated substances.

22

In general, we expect industry and regulatory safety standards to become stricter over time, resulting in increased compliance expenditures. While these expenditures cannot be accurately estimated at this time, we do not expect such expenditures will have a material adverse effect on our results of operations.

Employees

We employ through our subsidiary, MarkWest Hydrocarbon, Inc., 356 individuals to operate our facilities and provide general and administrative services. The Paper, Allied Industrial, Chemical and Energy Workers International Union Local 5-372 represents 15 employees at our Siloam fractionation facility in South Shore, Kentucky. The collective bargaining agreement with this union was renewed on July 11, 2005, for a term of three years. The agreement covers only hourly, non-supervisory employees. We consider labor relations to be satisfactory at this time.

Available Information

Our principal executive office is located at 1515 Arapahoe Street, Tower 2, Suite 700, Denver, Colorado 80202-2126. Our telephone number is 303-925-9200. Our common units trade on the New York Stock Exchange under the symbol "MWE." You can find more information about us at our Internet website,www.markwest.com. Our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and any amendments to those reports are available free of charge through our Internet website as soon as reasonably practicable after we electronically file or furnish such material with the Securities & Exchange Commission.

ITEM 1A. Risk Factors

In addition to the other information set forth elsewhere in this Form 10-K, you should carefully consider the following factors when evaluating MarkWest Energy Partners.