Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

J.P. Morgan High Yield

Investor Conference

MarkWest Energy Partners

February 2005

Jim Ivey

Chief Financial Officer

This discussion will contain some forward-looking statements. Although MarkWest believes that the expectations reflected in the forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. The forward-looking statements involve risks and uncertainties that affect our operations, financial performance and other factors as discussed in our filings with the Securities and Exchange Commission.

| Contact: | Frank Semple, President and CEO |

| | Jim Ivey, Senior VP and CFO |

| | Andy Schroeder, VP Finance and Treasurer |

| Phone: | 303.290.8700 |

| Website: | www.markwest.com |

[LOGO]

1

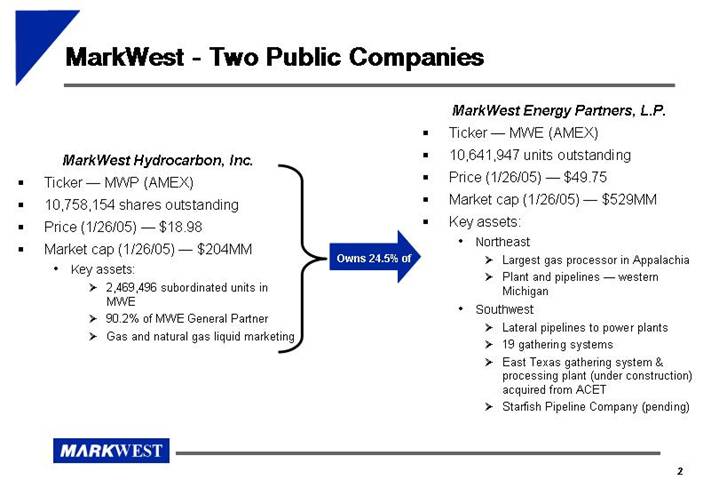

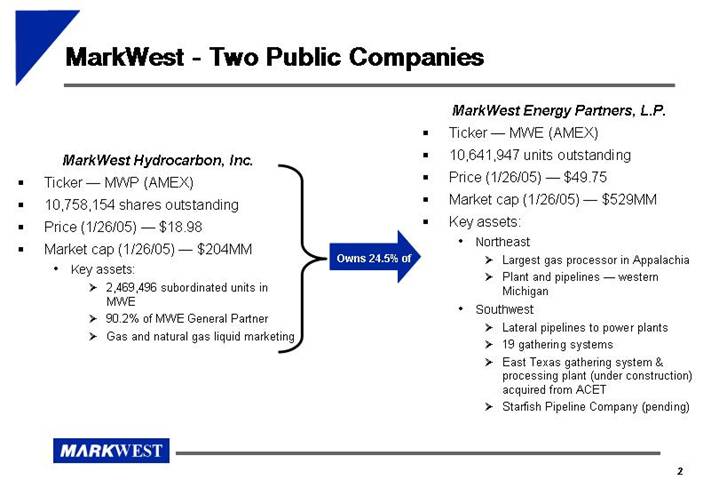

MarkWest - Two Public Companies

MarkWest Hydrocarbon, Inc. • Ticker — MWP (AMEX) • 10,758,154 shares outstanding • Price (1/26/05) — $18.98 • Market cap (1/26/05) — $204MM • Key assets: • 2,469,496 subordinated units in MWE • 90.2% of MWE General Partner • Gas and natural gas liquid marketing | | Owns 24.5% of | | MarkWest Energy Partners, L.P. |

| | • Ticker — MWE (AMEX) |

| | • 10,641,947 units outstanding |

| | • Price (1/26/05) — $49.75 |

| | • Market cap (1/26/05) — $529MM |

| | • Key assets: |

| | • Northeast |

| | • Largest gas processor in Appalachia |

| | • Plant and pipelines — western Michigan |

| | • Southwest |

| | • Lateral pipelines to power plants |

| | • 19 gathering systems |

| | • East Texas gathering system & processing plant (under construction) acquired from ACET |

| | • Starfish Pipeline Company (pending) |

2

MWE Investment Highlights

• Rapidly-growing independent midstream energy limited partnership

• Strong and growing presence in the natural gas-rich Southwest (onshore and offshore)

• Strategic positions in the Appalachian Basin and Michigan

• Proven acquisition and integration expertise

• Stable and diverse cash flows from fee-based, long-term contracts

• Top tier distribution coverage ratio and commitment to a strong balance sheet

• Experienced management team with proven track record of growth and operating expertise

[GRAPHIC]

3

Significant Achievements Since MWE IPO

[GRAPHIC]

• Completed six acquisitions for $352 million

• Seventh announced for $42 million

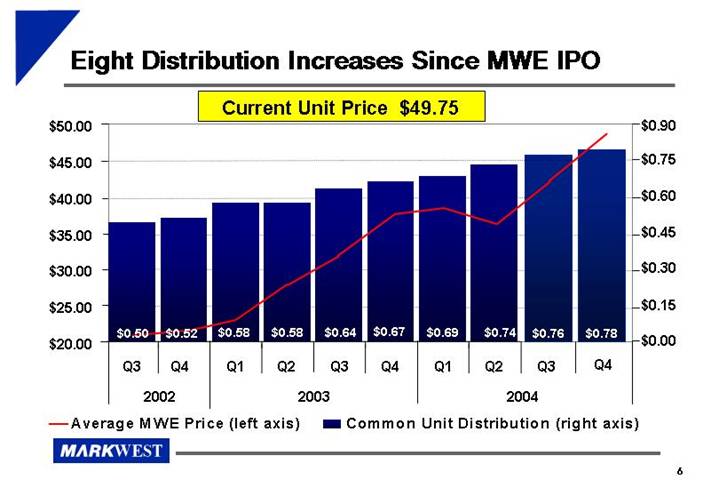

• Raised distribution eight times, or 56%

• Generated total investor returns of 175%

• Established extensive core area in the Southwest

• Enhanced alliance with General Partner

4

Proven Results Since MWE IPO

| | IPO | | | | Present | |

| | | | | | | |

Unit Price | | $ | 20.50 | | +143 | % | $ | 49.75 | |

| | | | | | | |

Annualized Distribution | | $ | 2.00 | | +56 | % | $ | 3.12 | |

| | | | | | | |

EBITDA (1)(2) | | $ | 11.0 | million | +236 | % | $ | 37.0 | million |

| | | | | | | |

Total Assets | | $ | 85.9 | million | +441 | % | $ | 464.6 | million |

(1) For a discussion of EBITDA and a reconciliation of EBITDA to net income, please read footnote (2) to “Summary Historical and Pro Forma Financial and Operating Data” in the Prospectus Supplement dated September 16, 2004.

(2) From year ended December 31, 2002 to year ended December 31, 2003, pro forma for East Texas acquisition.

5

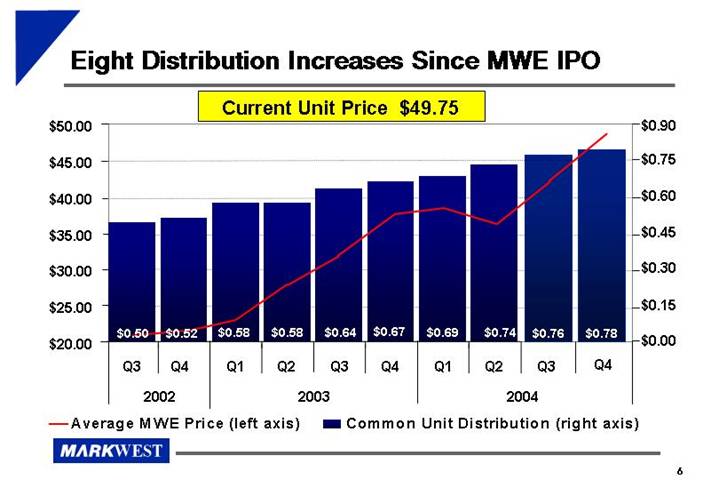

Eight Distribution Increases Since MWE IPO

Current Unit Price $49.75

[CHART]

6

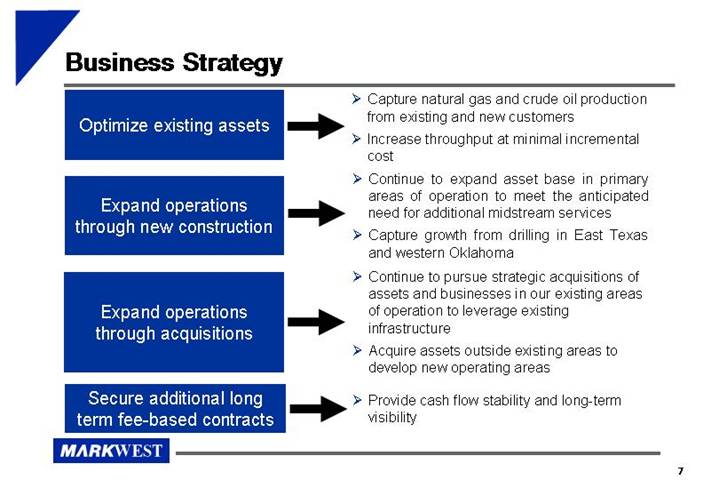

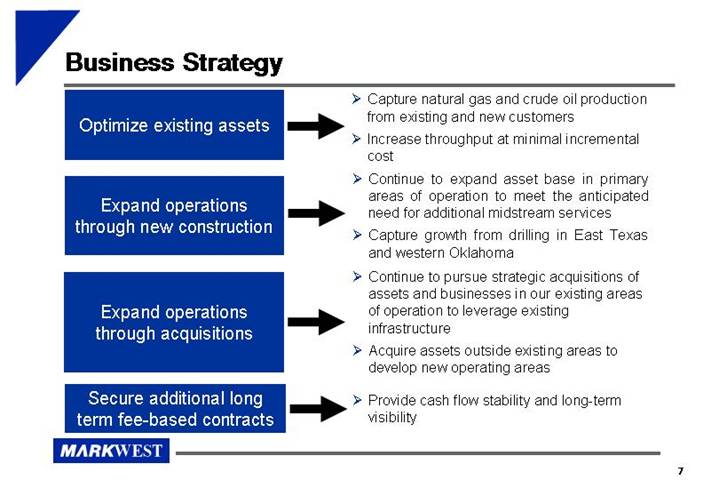

Business Strategy

Optimize existing assets | • Capture natural gas and crude oil production from existing and new customers • Increase throughput at minimal incremental cost |

| |

Expand operations

through new construction | • Continue to expand asset base in primary areas of operation to meet the anticipated need for additional midstream services • Capture growth from drilling in East Texas and western Oklahoma |

| |

Expand operations

through acquisitions | • Continue to pursue strategic acquisitions of assets and businesses in our existing areas of operation to leverage existing infrastructure • Acquire assets outside existing areas to develop new operating areas |

| |

Secure additional long

term fee-based contracts | • Provide cash flow stability and long-term visibility |

7

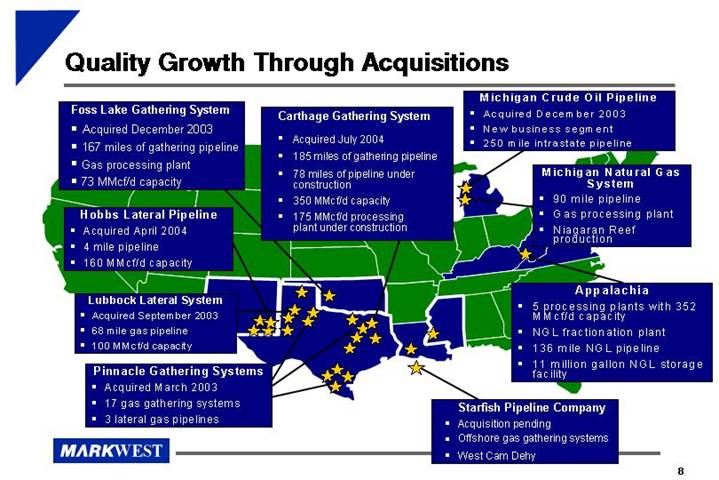

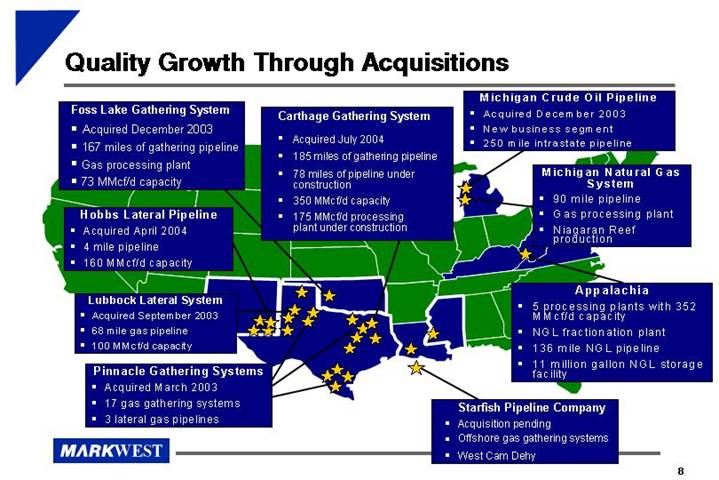

Quality Growth Through Acquisitions

[GRAPHIC]

Foss Lake Gathering System

• Acquired December 2003

• 167 miles of gathering pipeline

• Gas processing plant

• 73 MMcf/d capacity

Hobbs Lateral Pipeline

• Acquired April 2004

• 4 mile pipeline

• 160 MMcf/d capacity

Lubbock Lateral System

• Acquired September 2003

• 68 mile gas pipeline

• 100 MMcf/d capacity

Pinnacle Gathering Systems

• Acquired March 2003

• 17 gas gathering systems

• 3 lateral gas pipelines

Carthage Gathering System

• Acquired July 2004

• 185 miles of gathering pipeline

• 78 miles of pipeline under construction

• 350 MMcf/d capacity

• 175 MMcf/d processing plant under construction

Michigan Crude Oil Pipeline

• Acquired December 2003

• New business segment

• 250 mile intrastate pipeline

Michigan Natural Gas System

• 90 mile pipeline

• Gas processing plant

• Niagaran Reef production

Appalachia

• 5 processing plants with 352 MMcf/d capacity

• NGL fractionation plant

• 136 mile NGL pipeline

• 11 million gallon NGL storage facility

Starfish Pipeline Company

• Acquisition pending

• Offshore gas gathering systems

• West Cam Dehy

8

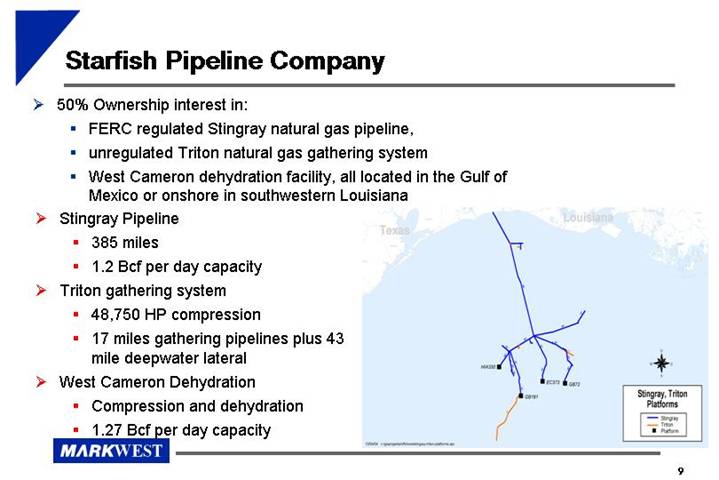

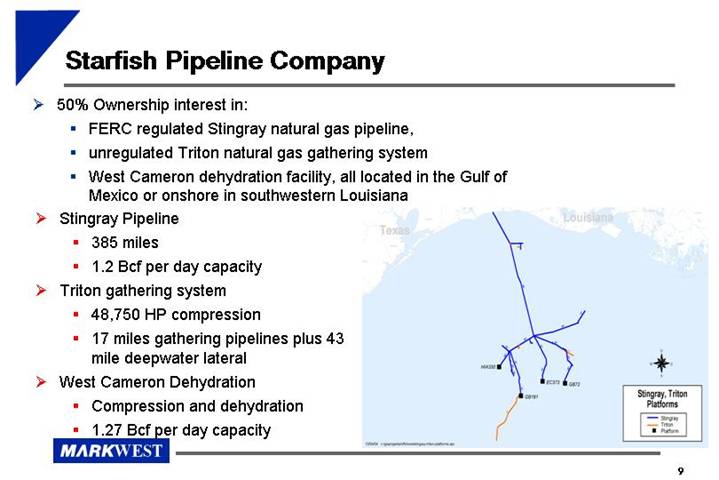

Starfish Pipeline Company

• 50% Ownership interest in:

• FERC regulated Stingray natural gas pipeline,

• nregulated Triton natural gas gathering system

• West Cameron dehydration facility, all located in the Gulf of Mexico or onshore in southwestern Louisiana

• Stingray Pipeline

• 385 miles

• 1.2 Bcf per day capacity

• Triton gathering system

• 48,750 HP compression

• 17 miles gathering pipelines plus 43 mile deepwater lateral

• West Cameron Dehydration

• Compression and dehydration

• 1.27 Bcf per day capacity

[GRAPHIC]

9

Significant Customers

• Strong relationships with major producers in all operating areas

• East Texas and Appalachia contracts extend up to 11 years

[LOGO]

10

MWE Geographic and Operating Diversity

Nine Months Ended 9/30/04 Pro Forma Gross Margin

By Geographic Region

[CHART]

By Operating Activity

[CHART]

11

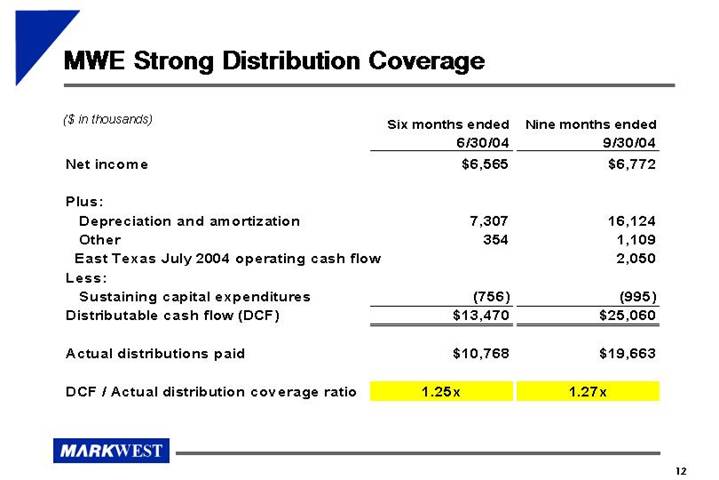

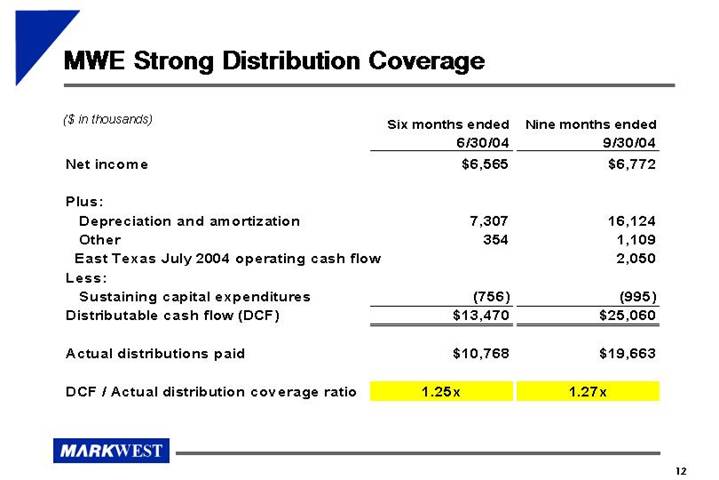

MWE Strong Distribution Coverage

($ in thousands) | | Six months ended

6/30/04 | | Nine months ended

9/30/04 | |

| | | | | |

Net income | | $ | 6,565 | | $ | 6,772 | |

| | | | | |

Plus: | | | | | |

Depreciation and amortization | | 7,307 | | 16,124 | |

Other | | 354 | | 1,109 | |

East Texas July 2004 operating cash flow | | | | 2,050 | |

Less: | | | | | |

Sustaining capital expenditures | | (756 | ) | (995 | ) |

Distributable cash flow (DCF) | | $ | 13,470 | | $ | 25,060 | |

| | | | | |

Actual distributions paid | | $ | 10,768 | | $ | 19,663 | |

| | | | | |

DCF / Actual distribution coverage ratio | | 1.25 | x | 1.27 | x |

12

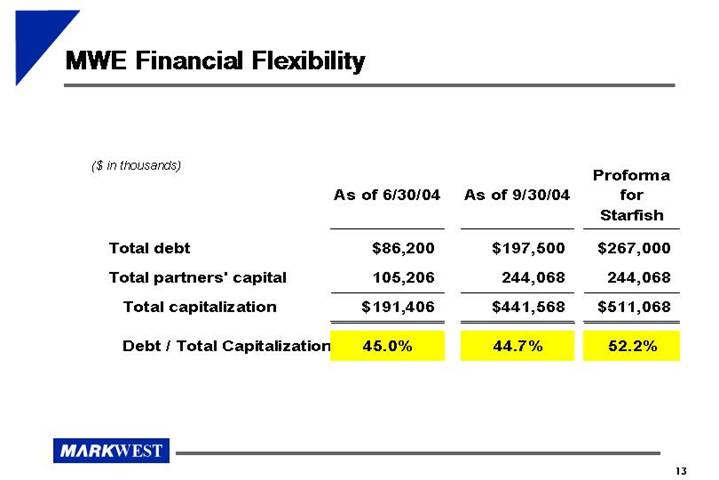

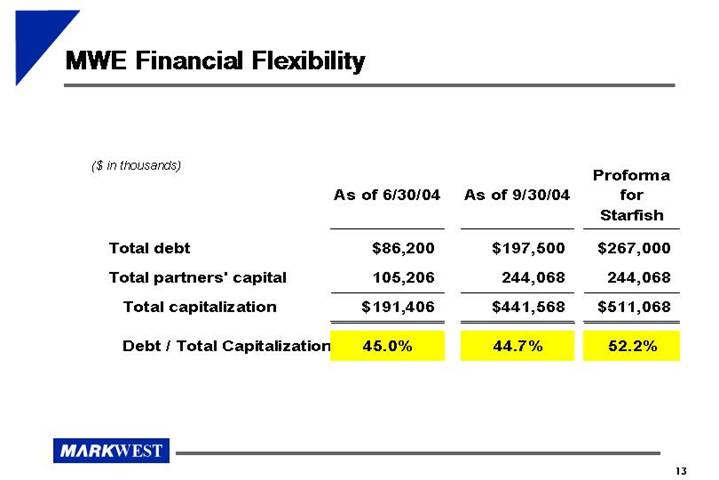

MWE Financial Flexibility

($ in thousands) | | As of 6/30/04 | | As of 9/30/04 | | Proforma

for

Starfish |

|

| | | | | | | |

Total debt | | $ | 86,200 | | $ | 197,500 | | $ | 267,000 | |

Total partners’ capital | | 105,206 | | 244,068 | | 244,068 | |

Total capitalization | | $ | 191,406 | | $ | 441,568 | | $ | 511,068 | |

| | | | | | | |

Debt / Total Capitalization | | 45.0 | % | 44.7 | % | 52.2 | % |

13

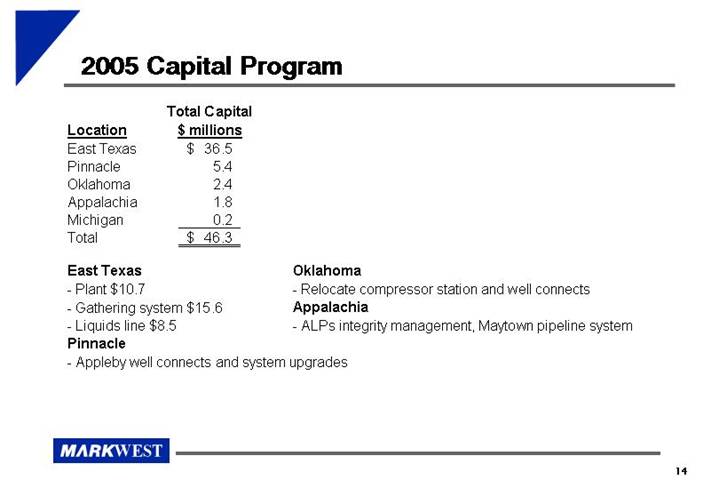

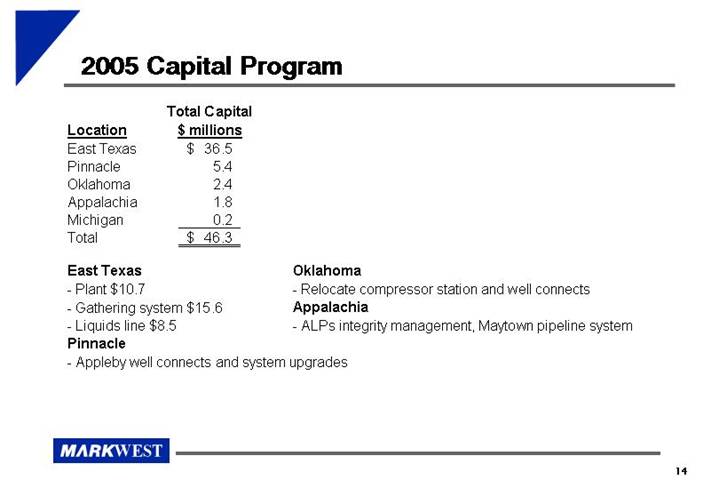

2005 Capital Program

Location | | Total Capital

$ millions | |

East Texas | | $ | 36.5 | |

Pinnacle | | 5.4 | |

Oklahoma | | 2.4 | |

Appalachia | | 1.8 | |

Michigan | | 0.2 | |

Total | | $ | 46.3 | |

East Texas

• Plant $10.7

• Gathering system $15.6

• Liquids line $8.5

Pinnacle

• Appleby well connects and system upgrades

Oklahoma

• Relocate compressor station and well connects

Appalachia

• ALPs integrity management, Maytown pipeline system

14

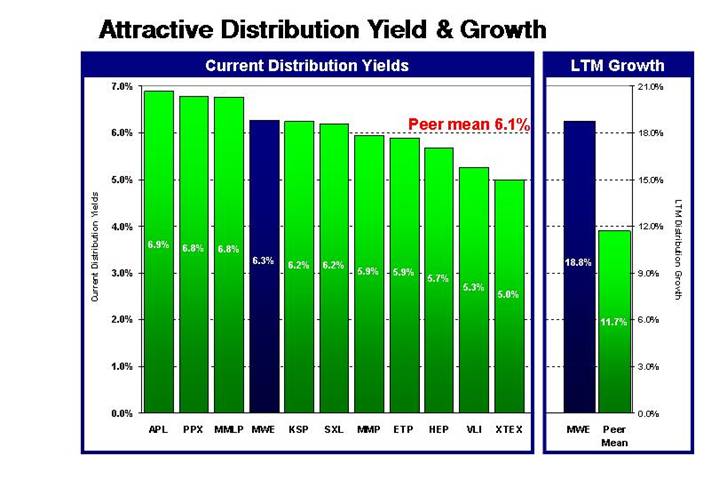

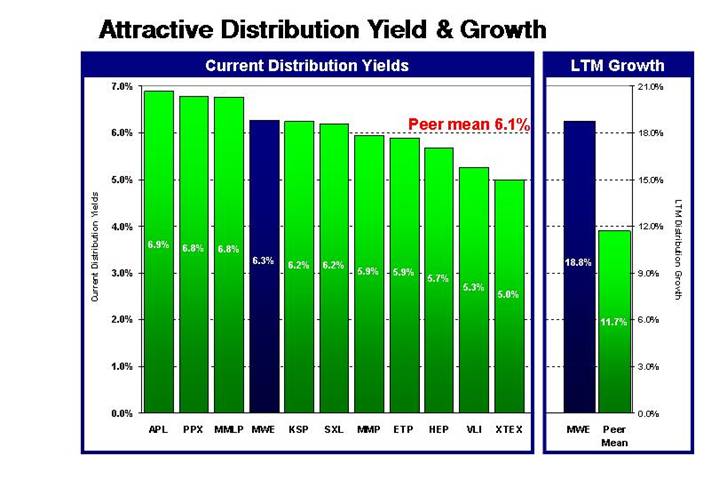

Attractive Distribution Yield & Growth

Current Distribution Yields

[CHART]

LTM Growth

[CHART]

MarkWest Energy Partners

Presentation

February 2005