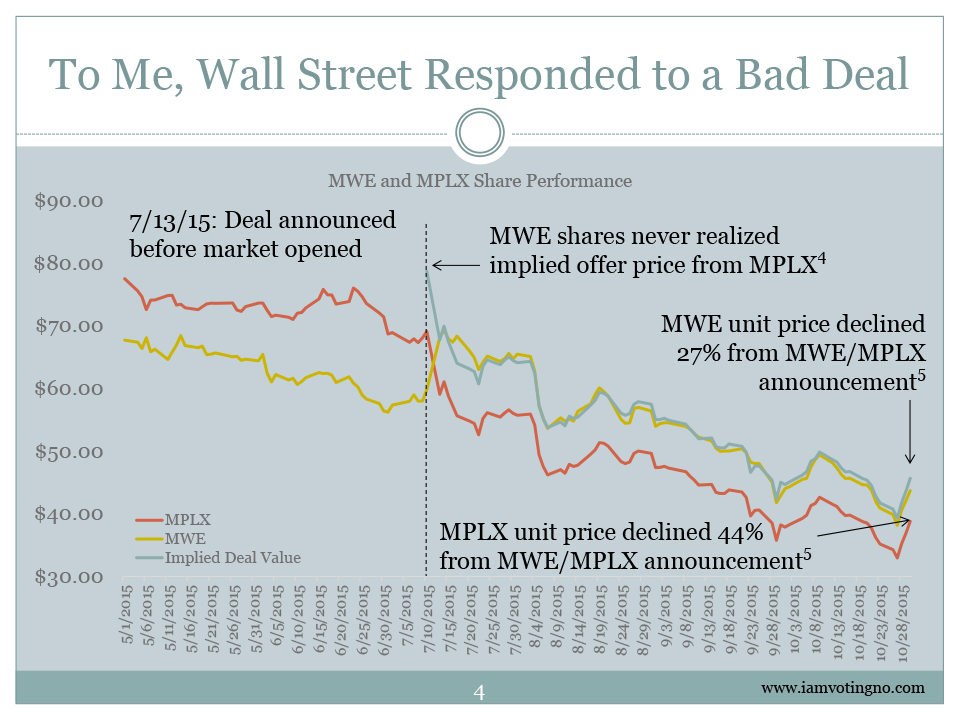

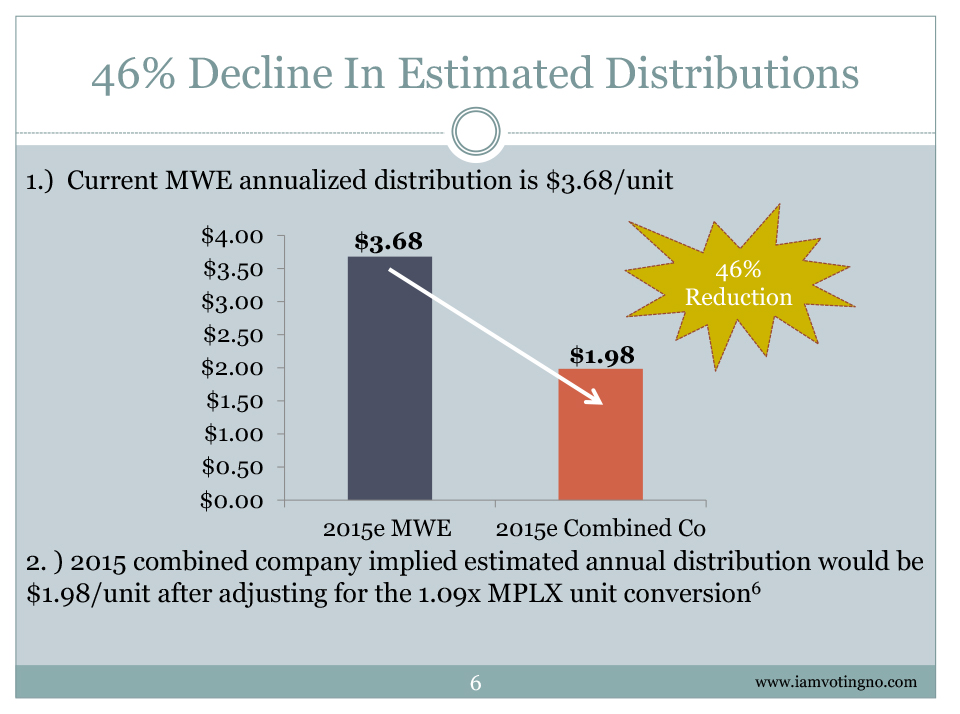

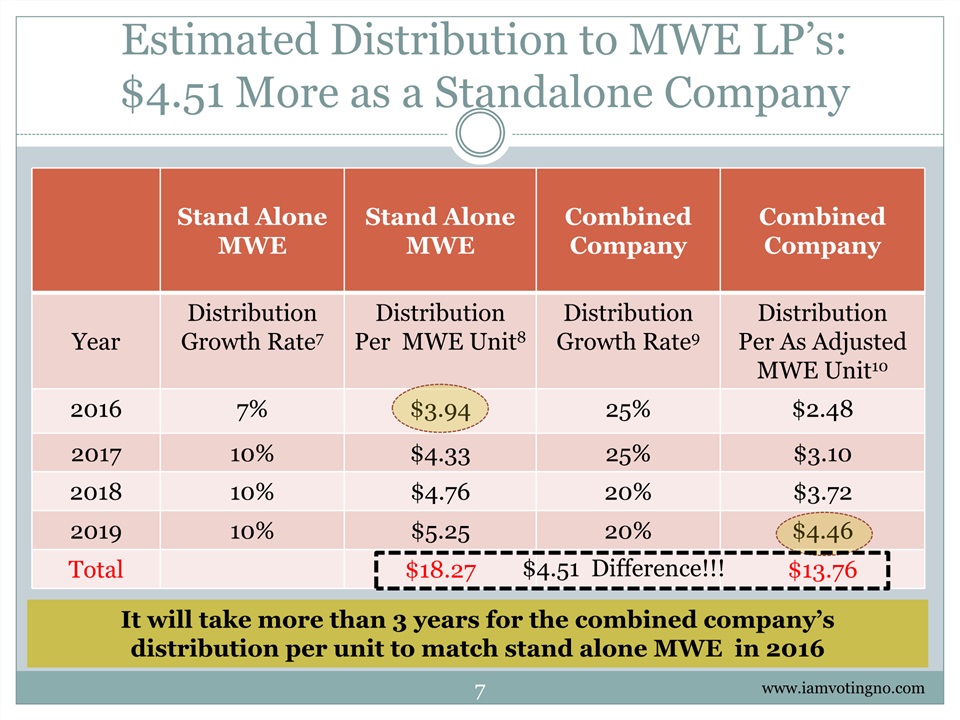

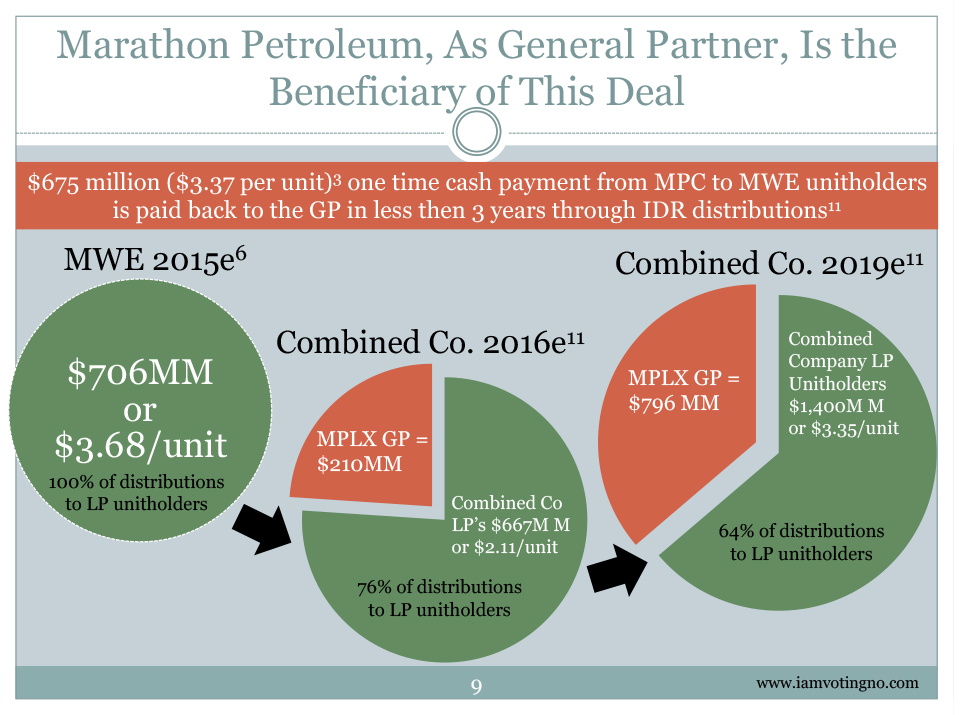

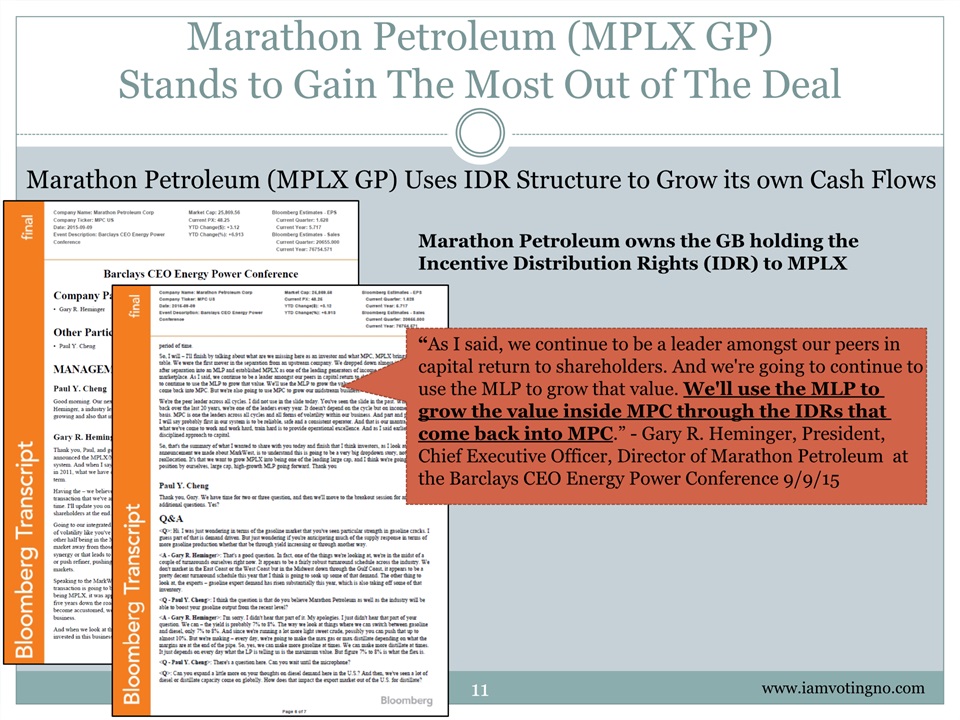

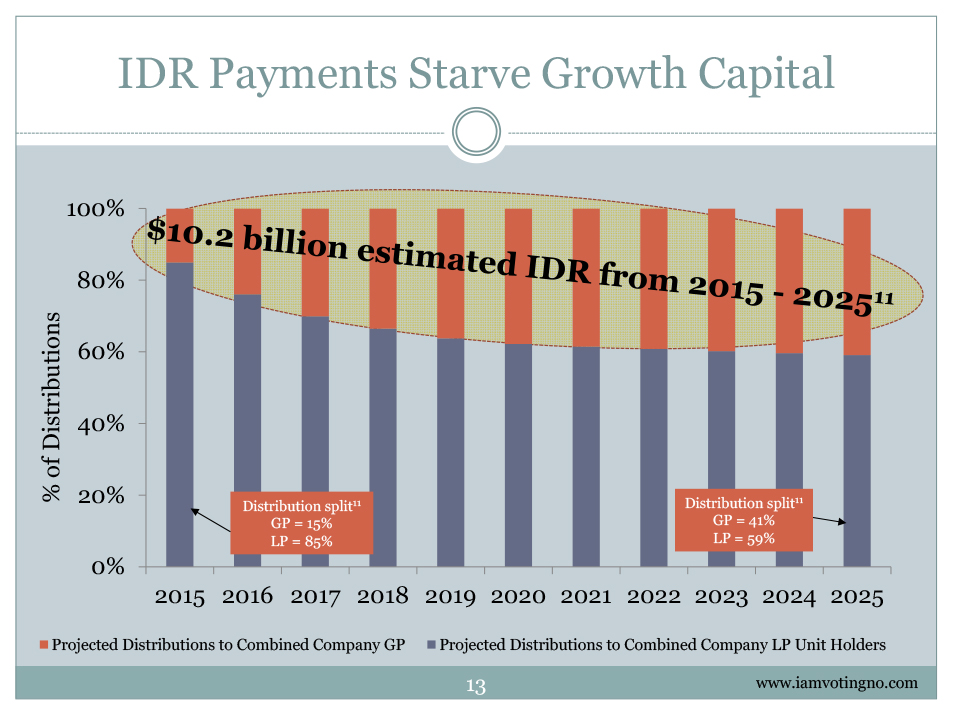

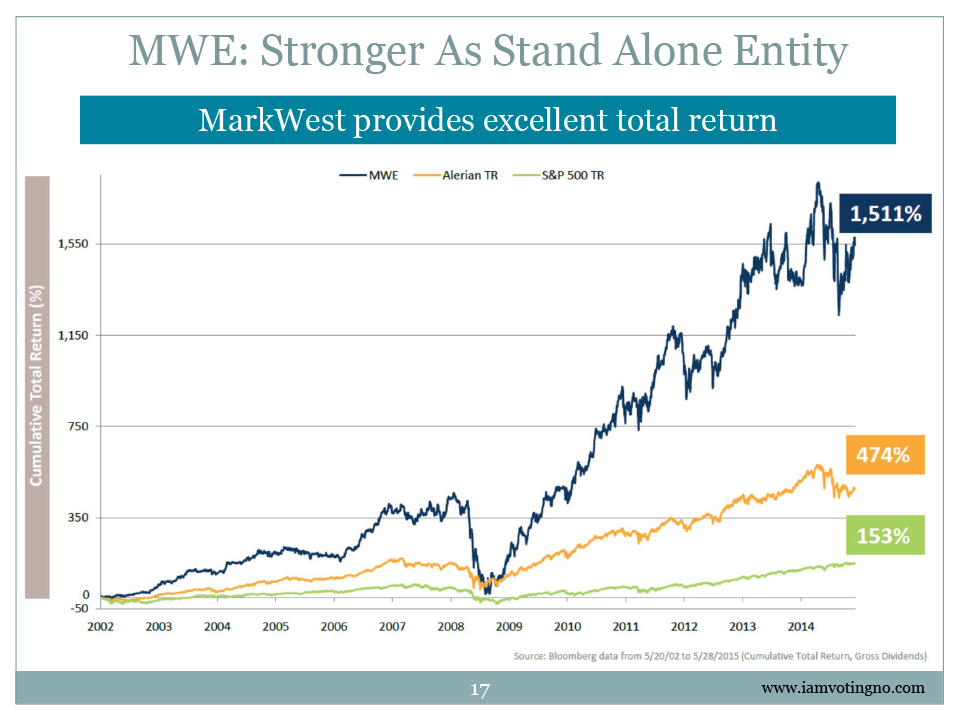

Endnotes Bio sourced to MWE News Release dated October 22, 2008; http://investor.markwest.com/phoenix.zhtml?c=135034&p=irol-newsArticle&ID=1543968 Represents ownership by John Fox and the Fox Family Foundation as of [XXX].Terms of the merger are as reported by MPLX LP in a July 13, 2015 press release. http://phx.corporate-ir.net/phoenix.zhtml?c=251401&p=irol-newsArticle&ID=2067108 Implied offer price calculated as 1.09 x $69.05 (the closing share price of MPLX on 7/10/15) plus $3.37 per unit in cash.Price decline calculated at the change from market closing price on 7/10/15 to market closing price on 10/30/15.Distribution decline calculated as a percentage change from MWE annualized distribution of $3.68 based on July 20, 2015 MWE news release (http://investor.markwest.com/phoenix.zhtml?c=135034&p=irol-newsArticle&ID=2069328) to Bloomberg best analyst estimate for MPLX 2015e distributions as of October 2, 2015 of $1.82 per unit then multiplied by 1.09x to convert to MWE interest.MWE guidance based on the MarkWest Analyst Day presentation dated 6/3/15Starting distribution based on annualized distribution of $3.68 based on July 20, 2015 MWE news release (http://investor.markwest.com/phoenix.zhtml?c=135034&p=irol-newsArticle&ID=2069328) and carried forward at estimated growth rates (see note 7 above).Combined Company distribution growth rates based on the MPLX and MarkWest Strategic Combination presentation dated July 20, 2015. Starting distribution based on Bloomberg best analyst estimate for MPLX 2015e distributions as of October 2, 2015 of $1.82 per unit then multiplied by 1.09x to convert to MWE interest. Distributions were carried forward at estimated growth rates (see note 9 above)Estimates sourced from Bank of America Merrill Lynch Report 7/22/2015Quotes sourced to MWE News Release dated September 5, 2007; http://investor.markwest.com/phoenix.zhtml?c=135034&p=irol-newsArticle&ID=1542723 Compounded annual growth rated sourced to MPLX and MarkWest Strategic Combination presentation dated July 20, 2015. All quotes and data points on slides 15, 16 and 17 of this document are sourced from MWE analyst day presentation dated 6/3/15 unless noted otherwise.Equity capital raised is sourced from MWE 2014 10-K and Q2’15 10-Q SEC filings.MWE Q2’15 earnings presentation dated 8/5/15 19 www.iamvotingno.com