2007 Analyst Meeting Exhibit 99.1 |

Mike Ullman Chairman and Chief Executive Officer 2007 – 2011 Long Range Plan Accelerated Growth . . . Industry Leadership . . . |

2005 – 2009 Long Range Plan • Vision: • To be the preferred shopping choice for Middle America • Constituencies: • Customers, Associates, Investors • Strategies: • Make an emotional connection with customers • Be an easy and exciting place to shop • Be a great place to work • Be in the top quartile of financial performance |

Strong Leadership team Focused on consistent execution Aggressively competing to win the customer, take market share So where are we on the 5 year plan? |

• In 2006 . . . Exceeded 2007 sales plan at $19.9 billion • In 2006 . . . Exceeded 2008 income plan at $1.9 billion • In 2006 . . . Exceeded 2009 profitability plan at 9.7% 2006 was a very busy and successful year! |

Customer Value Proposition . . . Style and Quality at Smart Prices |

Major Competitive Advantage . . . 3 Unique “Pairings” • 600+ mall stores . . . 400+ off-mall stores • 45% private brands . . . national brands • 1,000+ stores . . . website, catalogs |

Building on strength and progress last two years . . . • Set higher expectations for ourselves • Team has developed a new 5 year plan |

2007 – 2011 Long Range Plan Accelerated Growth Vision: To be the preferred shopping choice for Middle America |

Constituencies: Customers: deeper, more enduring Associates: invest in careers Shareholders: industry leading performance 2007 – 2011 Long Range Plan Accelerated Growth |

1. “Know our customer” 2. “Communicate with our customer” 3. “Serve our customer” 2007 – 2011 Long Range Plan Accelerated Growth Strategies: Develop an emotional connection with our customers that is strong and enduring |

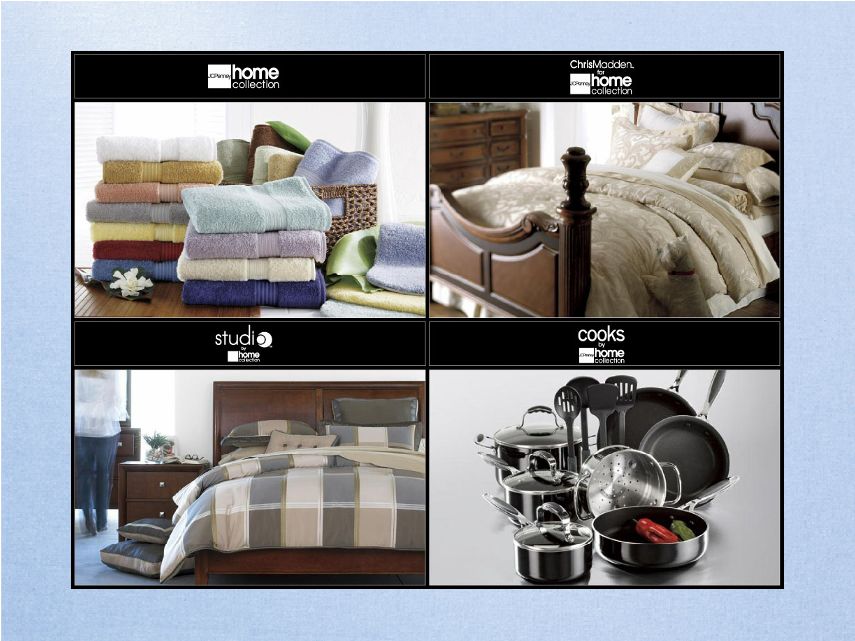

4. Lead in delivering style, quality at a smart price 5. Improve merchandise relevancy 2007 – 2011 Long Range Plan Accelerated Growth Strategies: Inspire our customers with our merchandise and services |

6. Build a “WINNING TOGETHER” culture 7. Retain, attract and develop the best people in retail, reflecting the diversity of our customers 2007 – 2011 Long Range Plan Accelerated Growth Strategies: Become the preferred choice for a retail career |

8. Optimize growth in our core business 9. Execute new growth opportunities that leverage our core strengths 2007 – 2011 Long Range Plan Accelerated Growth Strategies: Establish JCP as the growth leader in the retail industry |

• Accelerated growth • Excellence in execution • Industry leadership 2007 – 2011 Long Range Plan |

Retailing is a “contact sport” . . . it’s about WINNING . . . Being the preferred choice Retailing is a “team sport” . . . it’s’ about working TOGETHER as a team 2007 – 2011 Long Range Plan Accelerated Growth |

2007 Analyst Meeting Agenda Tuesday Afternoon: “Every Day Matters” Mike Boylson Merchandising Growth Ken Hicks, Peter McGrath, Ambrielle – Brand Laurie Van Brunt Development Process jcp.com Growth Bernie Feiwus, Steve Lawrence, Tom Nealon Store Initiatives Mike Taxter Questions & Answers Store Tour/Reception |

2007 Analyst Meeting Agenda Wednesday Morning: Store Growth, Store Environment Michael Dastugue Improved Inventory Flow Peter McGrath, Clarence Kelley Winning Together Mike Theilmann Financial Growth Bob Cavanaugh Questions & Answers |

2006: Major Accomplishments • Sales up 6% • jcp.com increase to almost $1.3B • Operating Income up 100 bp to 9.7% • “Every Day Matters” • “Sephora inside JCPenney” • American Living launch – biggest ever • Private Brands – a.n.a, Ambrielle, East 5th • Exclusive – liz & co., Concepts by Claiborne • Opened 28 new stores; 20 on October 6th |

• Associate Engagement up 7 pts to 73% • $750 million share repurchase • 44% dividend increase • Achieved investment grade rating • EPS increased to $4.88; up 122% in 2 years • $5.8 billion increase in market cap in 2006 • Moved up to Fortune 3 rd “Most Admired” • 70% of 5-year execution points complete in first 2 years 2006: Major Accomplishments |

Mike Boylson Executive Vice President Chief Marketing Officer Develop An Emotional Connection with Our Customers |

I. Develop an emotional connection with our customers that is strong and enduring II. Inspire our customers with our merchandise and services III. Become the preferred choice for a retail career IV. Establish JCPenney as the growth leader in the retail industry 2007 – 2011 Long Range Plan |

1. Know Our Customer 2. Communicate With Our Customer 3. Serve Our Customer Develop An Emotional Connection With Our Customers |

A. Understand style preferences, needs, wants, aspirations Know Our Customer |

Know Our Customer A. Understand style preferences, needs, wants, aspirations B. Continuous Customer Feedback (scorecards, surveys, purchase history) |

A. Understand style preferences, needs, wants, aspirations B. Continuous Customer Feedback (scorecards, surveys, purchase history) C. New Customer Acquisition Know Our Customer |

A. Understand style preferences, needs, wants, aspirations B. Continuous Customer Feedback (scorecards, surveys, purchase history) C. New Customer Acquisition D. Existing Customers – frequency, conversion, cross-shopping, share of wallet, profitability Know Our Customer |

A. Understand style preferences, needs, wants, aspirations B. Continuous Customer Feedback (scorecards, surveys, purchase history) C. New Customer Acquisition D. Existing Customers – frequency, conversion, cross-shopping, share of wallet, profitability E. Corporate Social Responsibility Agenda Know Our Customer |

Communicate with Our Customer A. Establish / Execute Brand Position |

A. Establish / Execute Brand Position B. Messaging = Leadership, Differentiation, Inspiration Communicate with Our Customer |

A. Establish / Execute Brand Position B. Messaging = Leadership, Differentiation, Inspiration C. Maintain Promotional Intensity Communicate with Our Customer |

Marketing Takeaways 1. Customer Intelligence • Strategic Advantage |

Marketing Takeaways 1. Customer Intelligence • Strategic Advantage 2. Every Day Matters • Unique Brand Position |

1. Customer Intelligence • Strategic Advantage 2. Every Day Matters • Unique Brand Position 3. Elevating Our Message Marketing Takeaways |

Our Vision • Preferred Shopping Choice – Sales and Market Share – Customer Feedback – Customer Scorecards • Target Customer – Age 35-54 – Income: $40K - $100K |

Customer Tracking Tools • Store Scorecard • Internet Scorecard • Customer Satisfaction Survey • Customer File Management • Brand Research |

Store Scorecard Image Apparel and Home Merchandise Price Sales/Promotion Store Environment Customer Service |

Internet Scorecard Measures general Internet shoppers Compares to on-line competition Reported quarterly |

Customer Satisfaction Survey Measures JCPenney store Customers’ satisfaction with last visit 1.6 million completed surveys since July 2006 Granular data reported down to the store/department level |

Brand Research • Brand imagery • Brand personality • Involvement • Commitment • Loyalty |

JCPenney Household Capture • 111 million U.S. Households • 44 million Known Customers • 20 million Estimated Unknown Customers |

Customer File • 44 million Known Customers • $12 billion / $195 billion • 6.1% Wallet Share • Growth Opportunity |

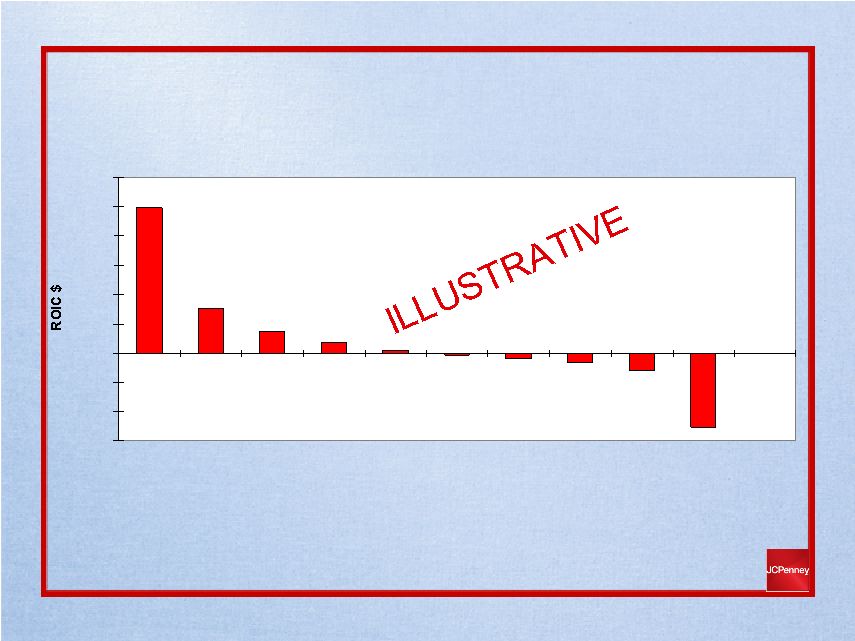

Customer ROIC -$60 -$40 -$20 $0 $20 $40 $60 $80 $100 $120 1 7 6 5 4 3 2 8 9 10 DECILE |

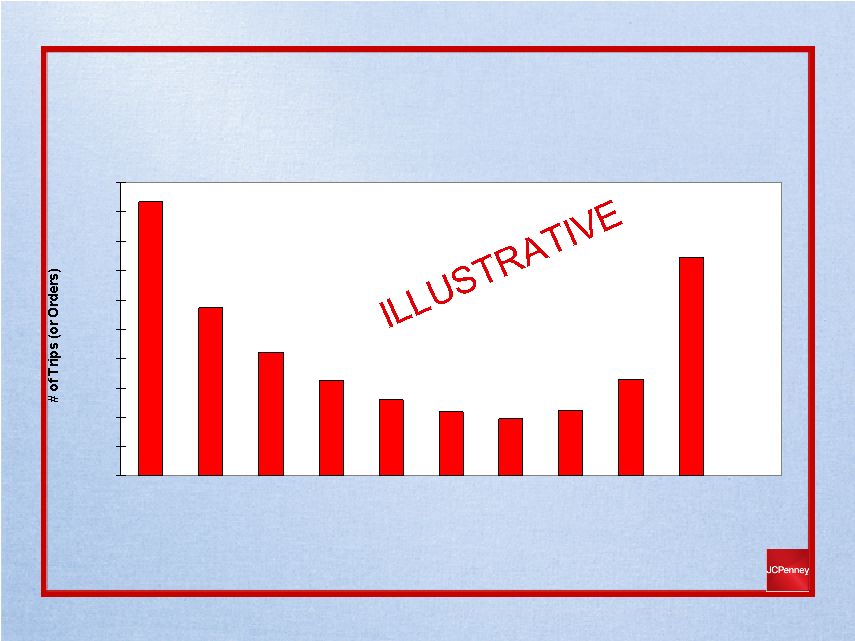

Shopping Trips - 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 1 7 6 5 4 3 2 8 9 10 DECILE |

Compare Decile 1 to 10 Decile 1 • Shop earlier in season • Style is equally important to price • JCPenney their number one choice Decile 10 • Shop only on sale at deep discounts • Price is most important • JCPenney is one of many favorites |

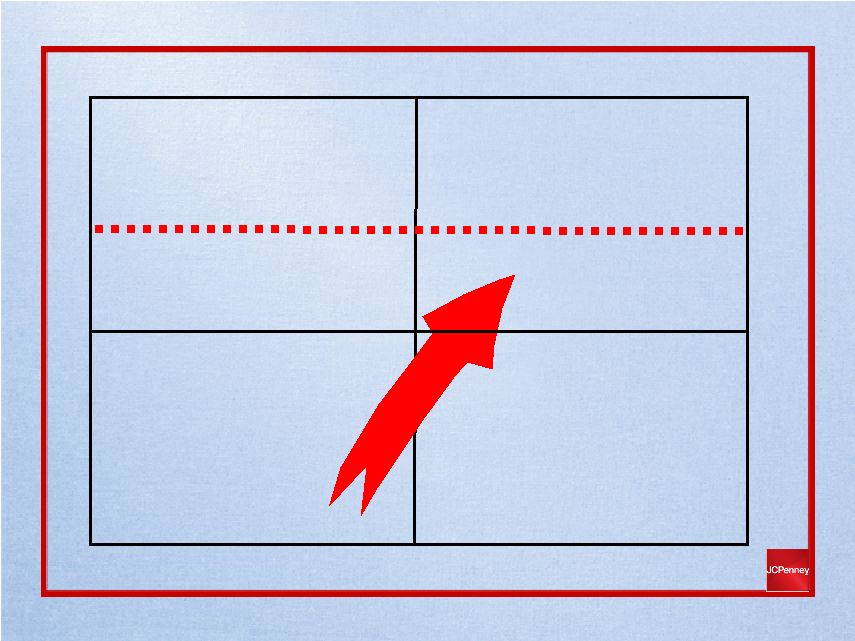

0 1 2 3 4 5 6 7 8 9 10 Decile 1 Decile 2 Decile 3 Decile 4 Decile 5 Decile 6 Decile 7 Decile 8 Decile 9 Decile 10 Frequency Shopped Loyalty Brand Advocate Frequency Share of Wallet Manage Expenses Customer Value Analysis |

Customer Value Analysis • Historically – response model • Today – modeling for profit • Test Results Positive – Higher Sales – Better Margins |

Brand Position Challenge jcp.com |

Saatchi and Saatchi • Senior Leadership Team • Creative Differentiation • Consumer Research Approach • New Brand Position |

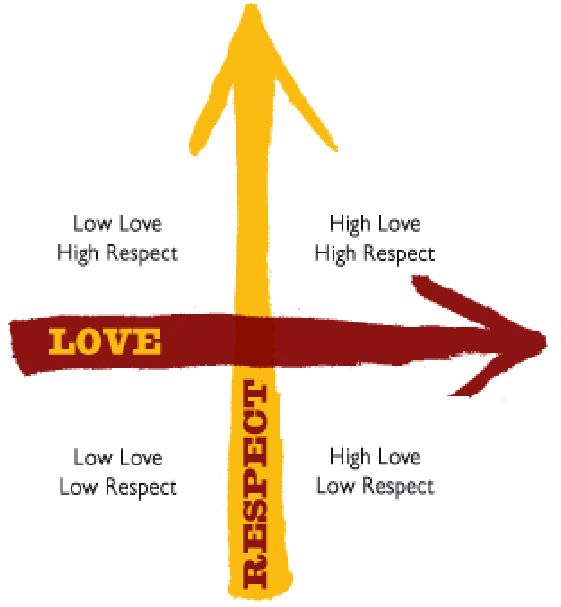

Lovemarks Brands Commodities Fads |

Our Objective ENGAGE CUSTOMERS |

FAD FAD BRAND BRAND Known Known for something I care about A brand I identify with Unknown Known for something Known for something good or different LOVEMARK LOVEMARK COMMODITY COMMODITY |

They Shop Because It Inspires Them |

An Experience That . . . Offers Encouragement Provides Ideas Stimulates Them Active |

Value Proposition JCPenney inspires our customers every day through all the little things that matter to them |

Taking Us From Functional Emotional Transactional Inspirational Department Preferred Store Shopping Experience |

Online Experience Store Experience Merchandise Social Responsibility Associates Marketing Message |

Marketing Takeaways 1. Customer Intelligence • Strategic Advantage 2. Brand Positioning • “Every Day Matters” 3. Elevating Our Message |

Ken Hicks President & Chief Merchandising Officer Merchandise Inspiration |

Making An Emotional Connection . . . Through Inspiring Merchandise Life and Style Pricing Strategy Brand Positioning |

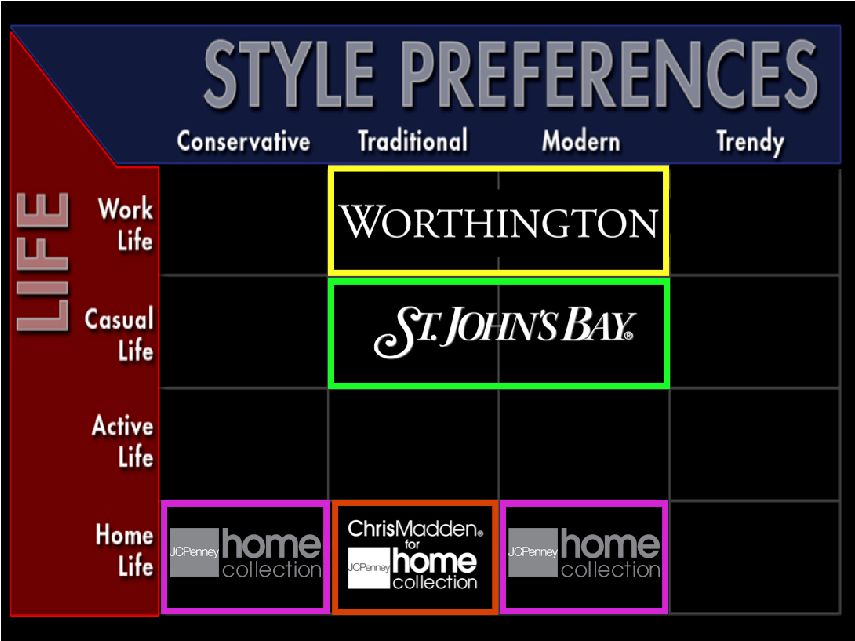

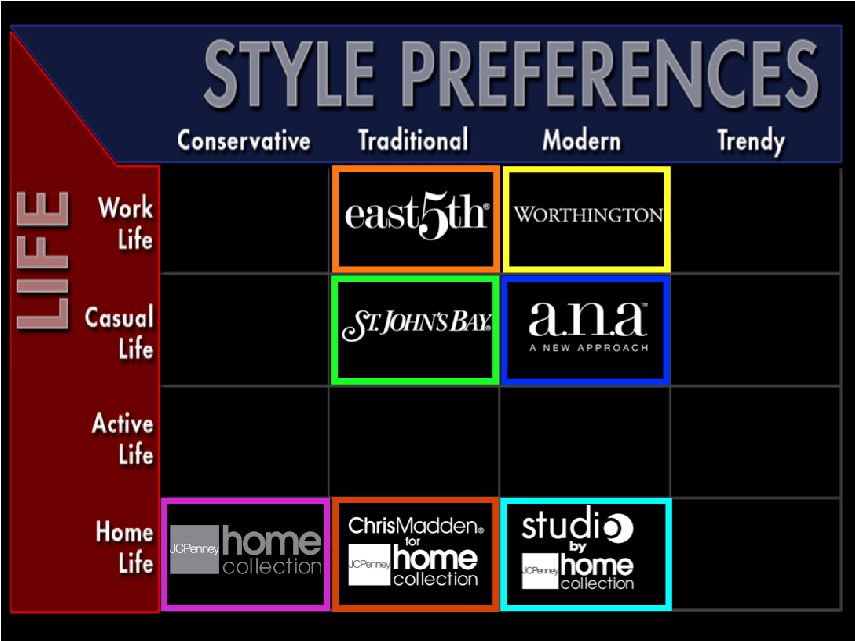

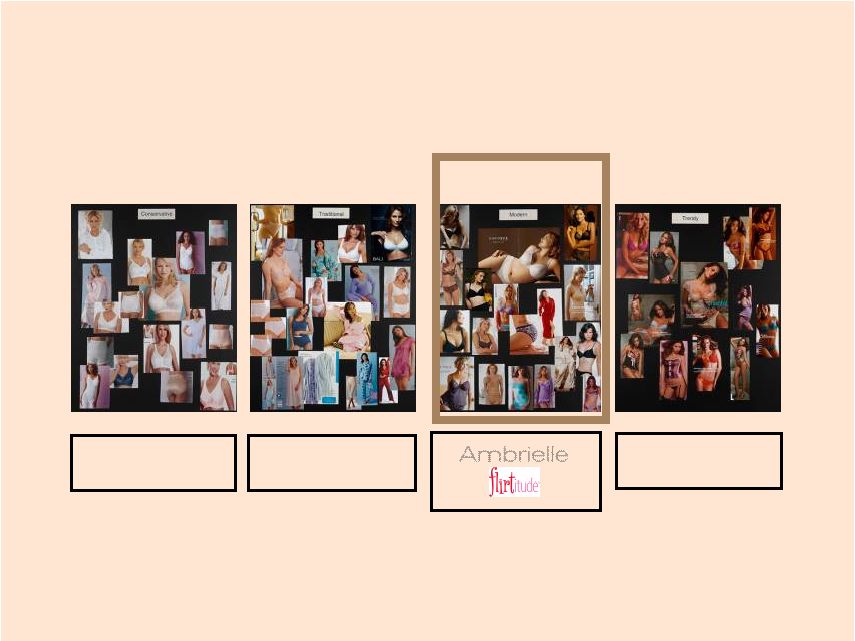

Lifestyles That Resonate Conservative Traditional Modern Trendy |

Our Value Proposition . . . Style and Quality at Smart Prices |

Pricing Strategy Good = Most Promotional Better = Core Best = Aspirational |

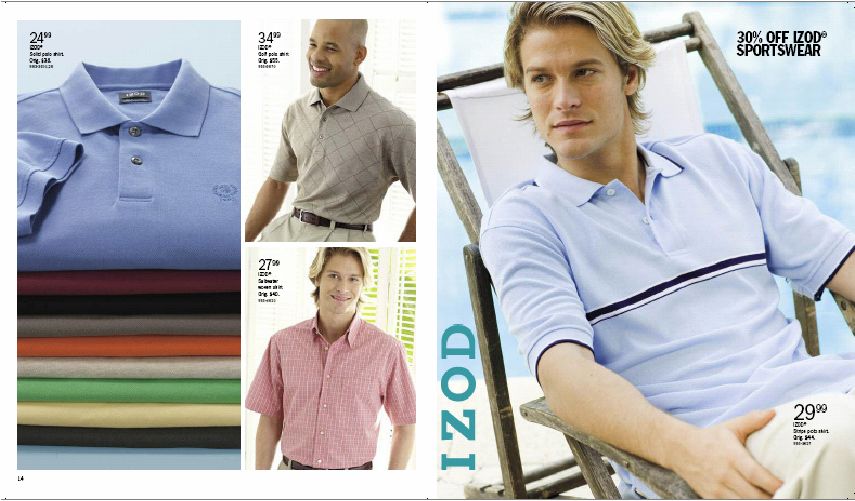

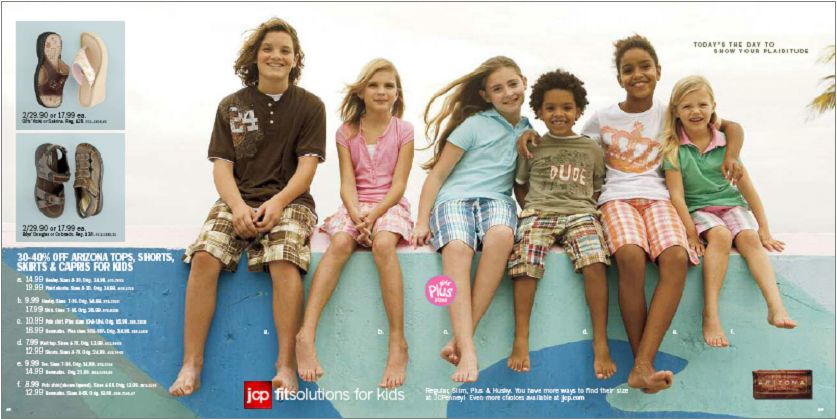

Pricing Strategy Arizona Private Brand Pricing Strategy: Most Promotional |

Levi’s National Brand Pricing Strategy: Core Pricing Strategy |

Pricing Strategy C7P…A Chip & Pepper Production Exclusive Brand Pricing Strategy: Aspirational |

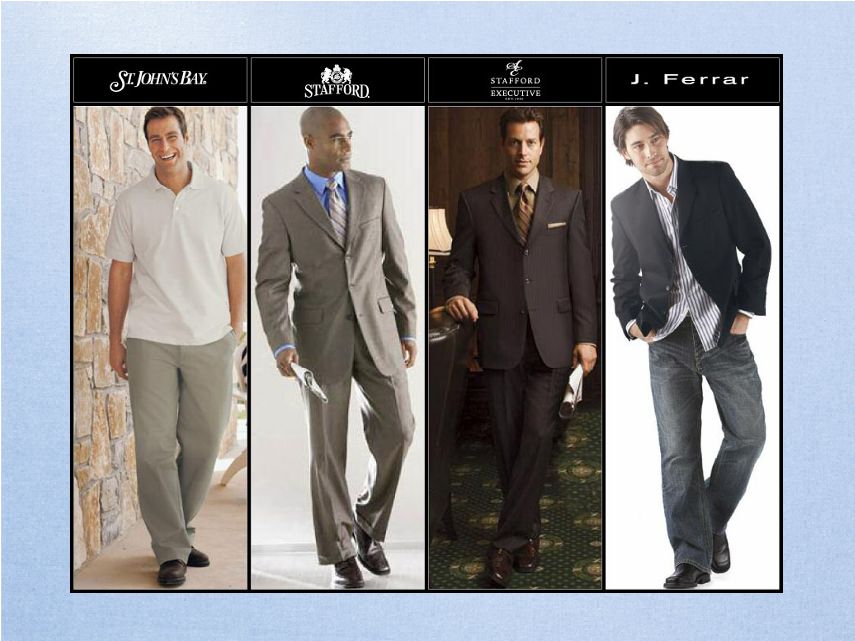

Destination Brands Power Brands Concepts Brand Positioning |

Destination Brands Lifestyle brands that solidify JCPenney as the preferred shopping destination JCPenney National Exclusive |

National Destination Brands |

Exclusive Destination Brands |

Exclusive Destination Brands |

Power Brands Nationally recognized lifestyle brands that generate strong customer loyalty |

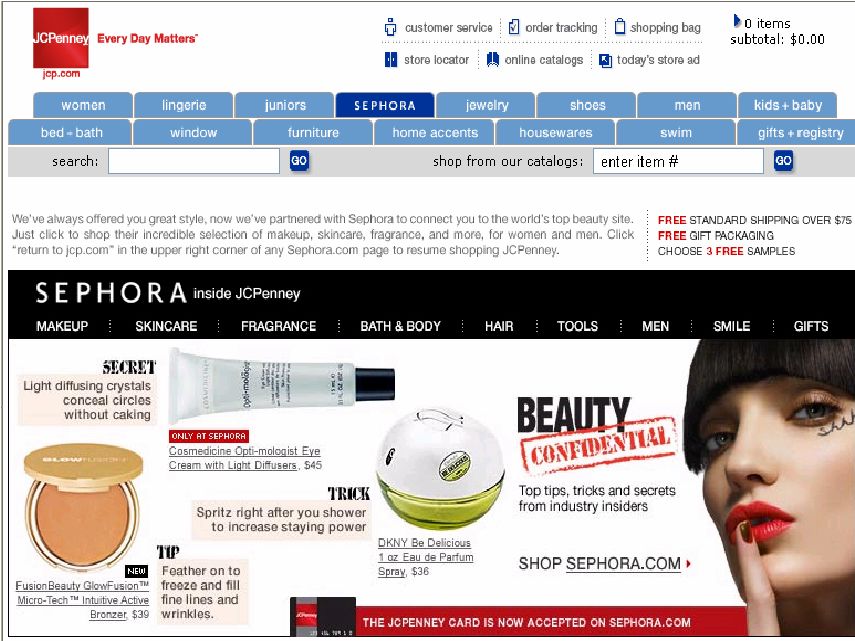

New merchandise concepts that go beyond lifestyle . . . Sephora inside JCPenney American Living Concepts |

American Living Largest launch in our Company’s history Aspirational price points Impactful marketing statement |

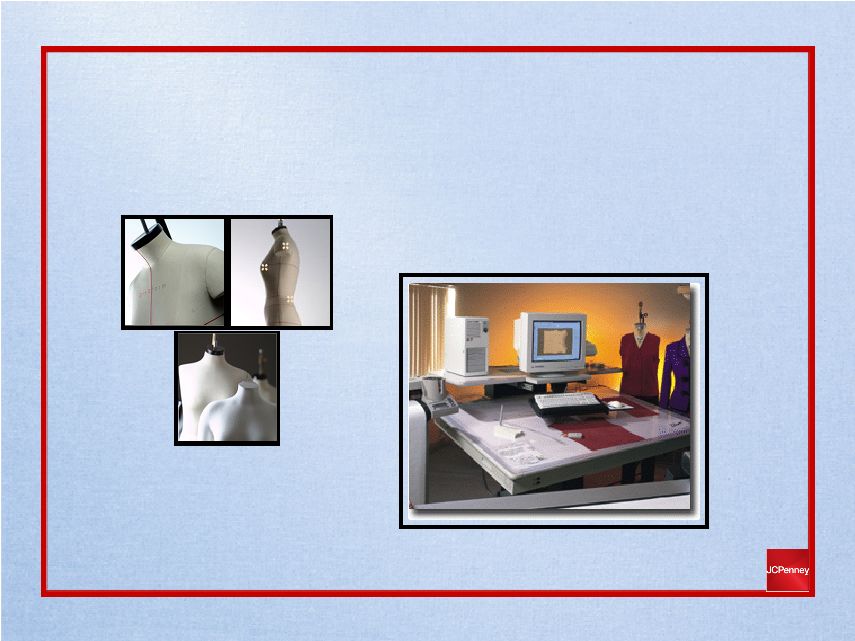

Peter McGrath Executive Vice President Product Development and Sourcing Brand Development Process |

Private label • Fills a Need • Unfocused • Lackluster • Multi-LifeStyle Power Brand VS. |

Characteristics of a Power Brand • Customer-Centric |

Characteristics of a Power Brand • Customer-Centric • Single Point of View |

Characteristics of a Power Brand • Customer-Centric • Single Point of View • Authoritative |

Laurie Van Brunt Vice President Brand Management Brand Development Process |

Intimate Apparel Market Share FY 2005 $14.7 Billion 4.5% 2-year CAGR 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% Victoria's Secret Wal-Mart Target Macy's JCPenney Kohl's Lane Bryant (Cacique) 16.8% share 15.2% share 6.1% share 7.3% share 5.5% share 6.6% share 1.4% share |

Soma Price (Low) Fashion Fashion (High) (Low) Wal-Mart Luxury Department Stores National Brands European Brands Victoria’s Secret Cacique Gap Body Benchmarking: Competitors Brand Matrix Price (High) White Space for JCPenney Modern Brand A Delicates & National Brands JCPenney, Kohl’s, Macy’s, Sears, Mervyns |

WHY ? Customers were not connecting to Delicates • Only 1% of women knew the Delicates Brand • 65% of JCPenney women shoppers didn’t buy JCP lingerie the CHANGE |

How is sensual different from sexy? Sexy Sensual Overt Raw Singular Exterior Contrived Active Bold Not Every Day Subtle Intimate All Senses Interior Alluring Calm Confident Every Day © 2005 Interbrand Consumer Research |

Consumer Research: Intimates Department Store Shopping Experience • Confusing and frustrating • Bras are highest brand loyalty category & a pain to shop for “When I go shopping for bras and underwear, I don’t want it to be a chore.” |

Conservative Traditional Modern Trendy Underscore & National Brands Adonna & National Brands Bisou Bisou & National Brands Intimate LifeStyle Alignment |

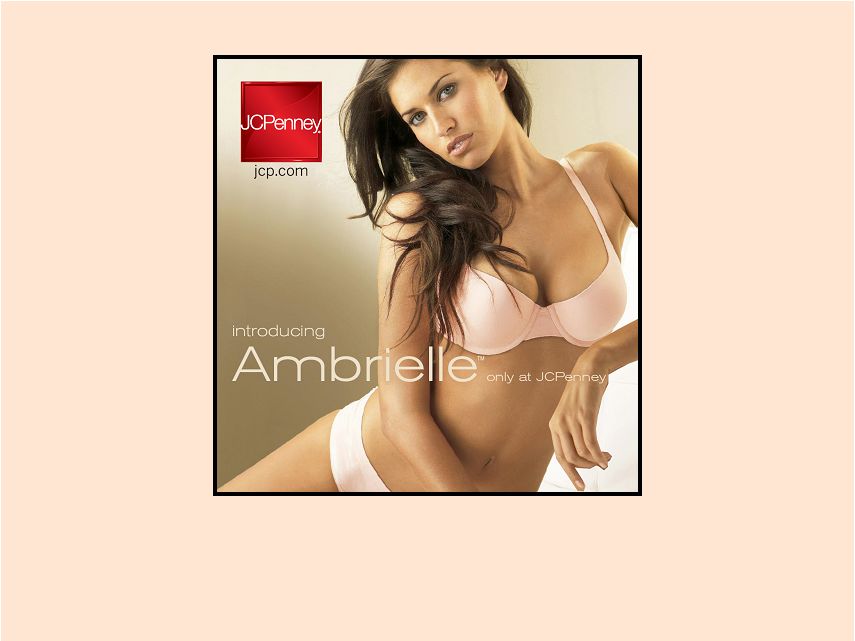

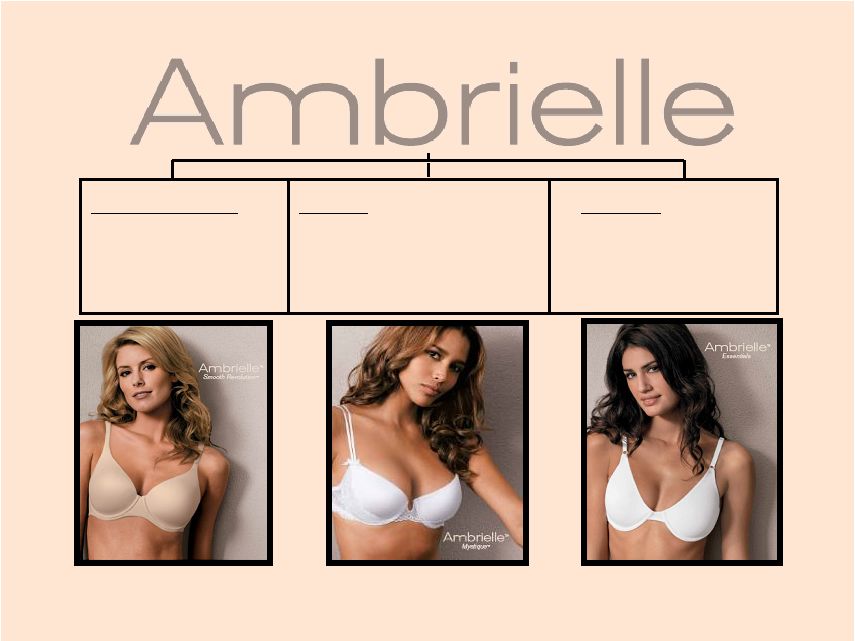

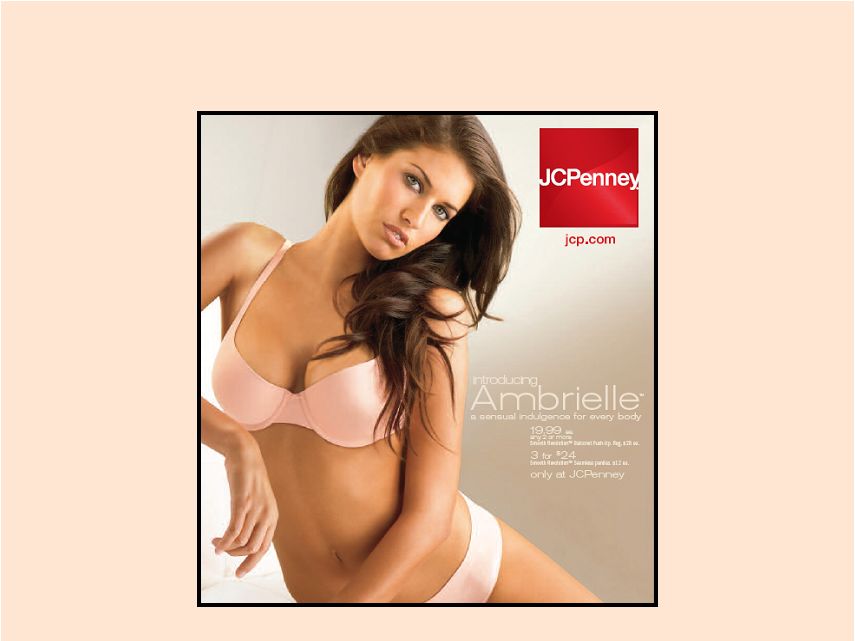

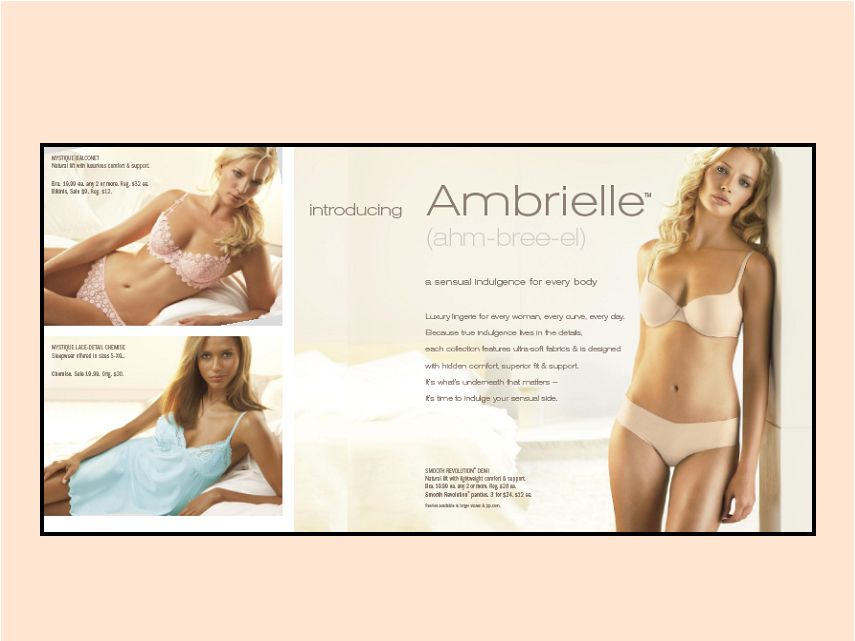

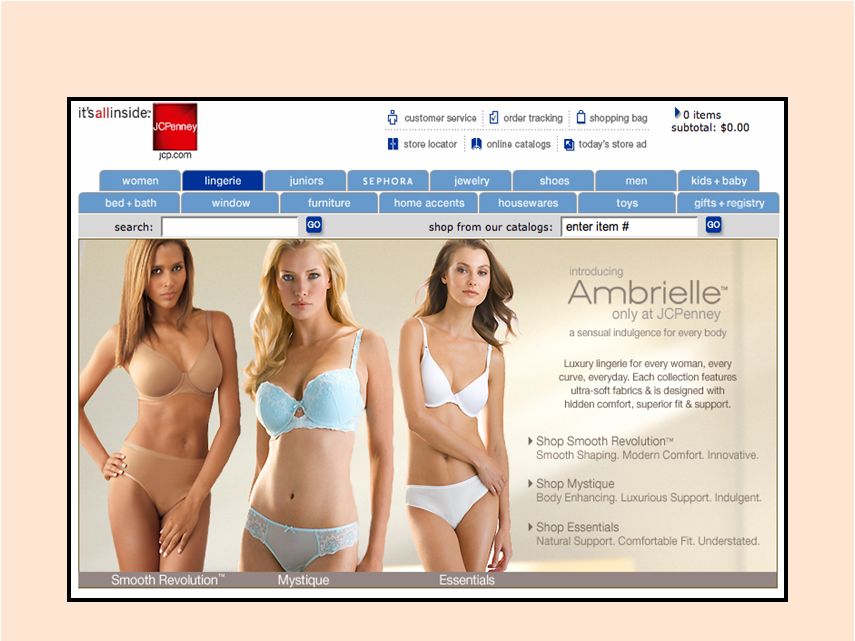

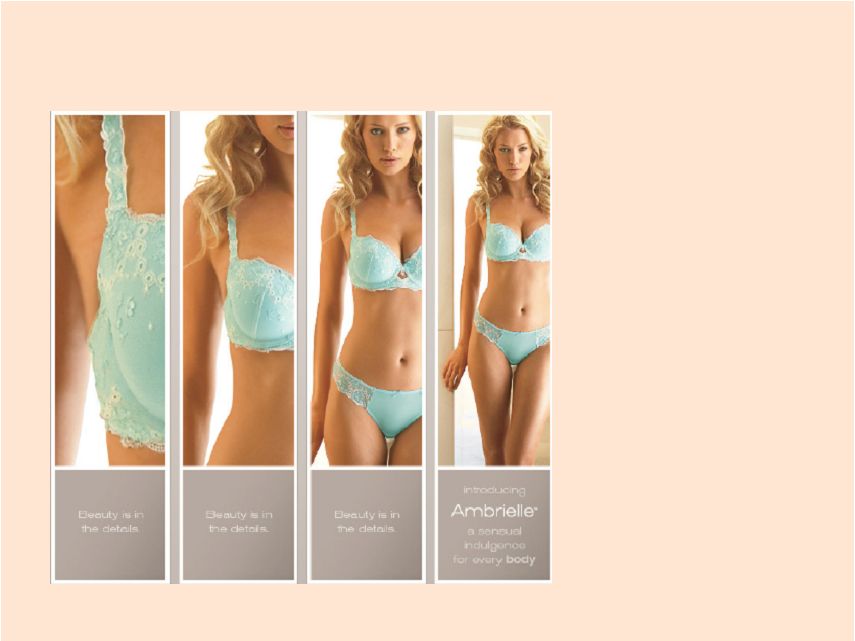

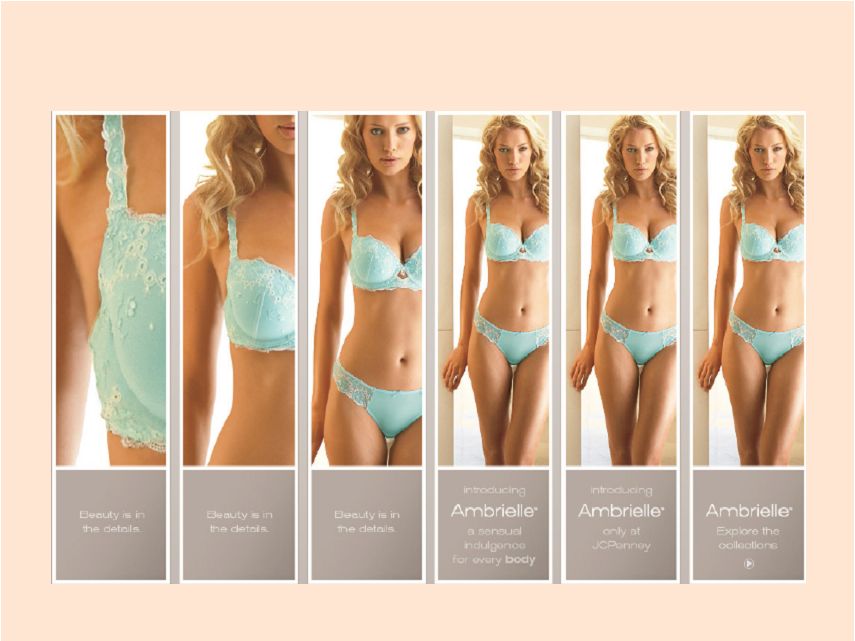

(ahm-bree-el) A sensual indulgence for every body |

Ambrielle: Brand Positioning • Modern sensual fashion |

Ambrielle: Brand Positioning • Modern sensual fashion • Smart pricing |

Intimates Pricing Comparison (Full Coverage Example) JCPenney Ambrielle Ticket $28.00 Sale $19.99 Specialty Store Ticket $45.00 Sale N/A Discount Store Ticket $14.99 Sale N/A National Brand Ticket $32.00 Sale $22.40 |

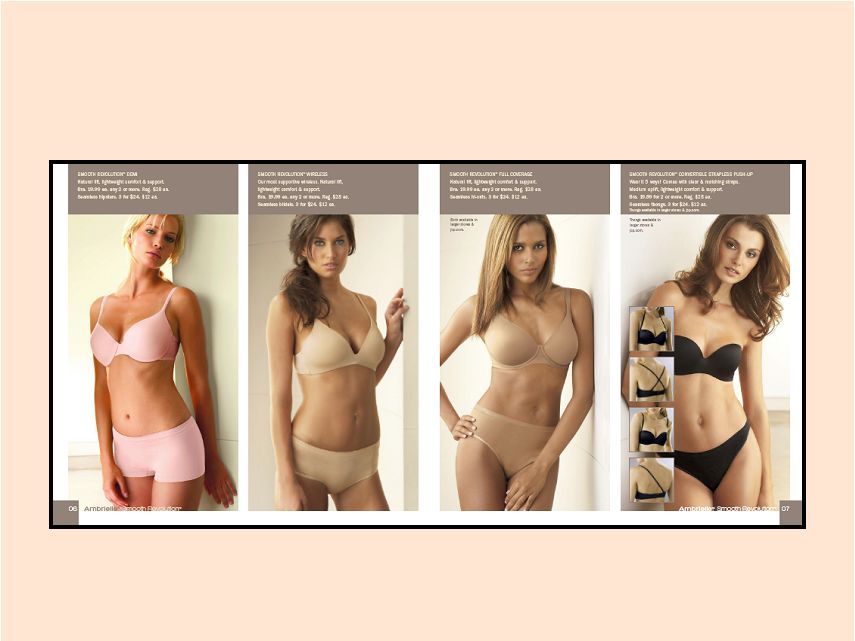

Smooth Revolution Smooth Support. Modern Comfort. Innovative. Mystique Body Enhancing. Luxurious Comfort. Indulgent. Essentials Natural Support. Comfortable Fit. Understated. |

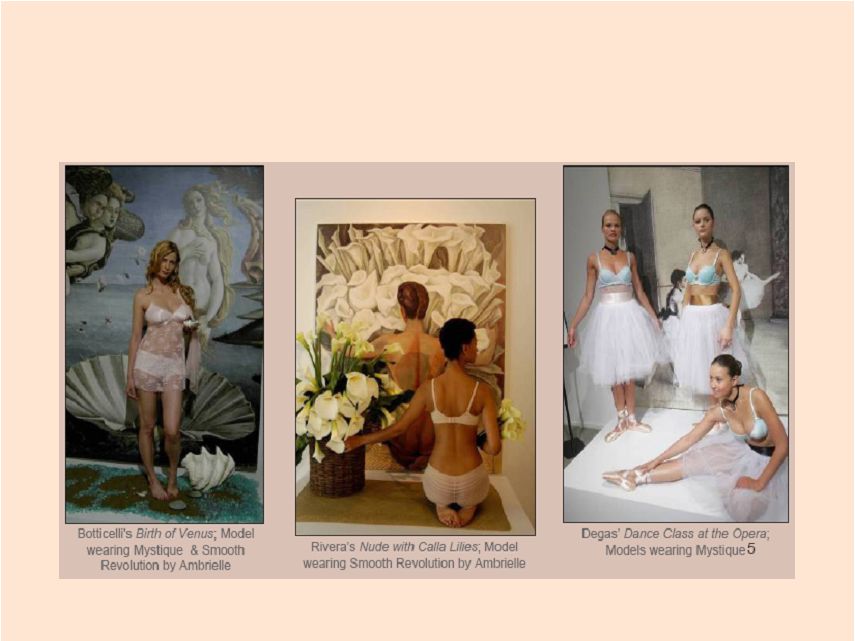

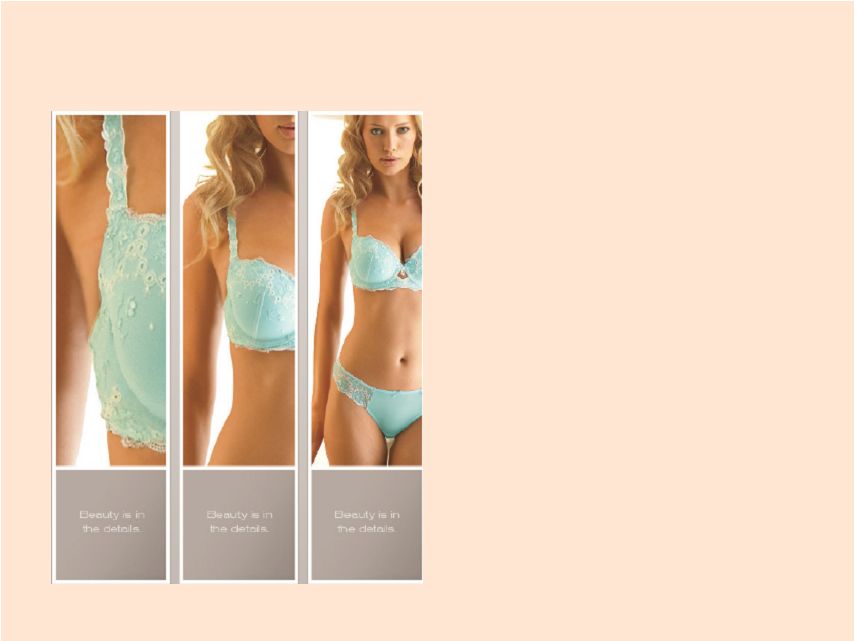

Ambrielle: Brand Positioning • Modern sensual fashion • Smart pricing • Consistent, exciting marketing |

Ambrielle Launch Event New York |

Ambrielle: Brand Positioning • Modern sensual fashion • Smart pricing • Consistent, exciting marketing • Multi-channel destination |

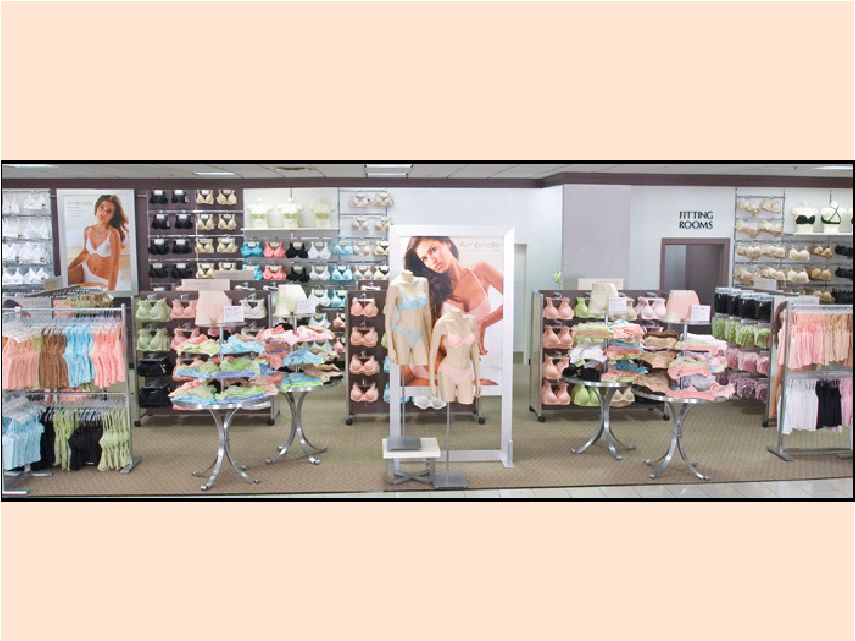

Store Environment - Ambrielle |

Spring and Summer Catalog |

HR Communication Training Brand Management Sourcing Product Development Marketing Certified Fit Specialists jcp.com Catalog Merchandising Store Environment Aesthetic Technical Design Consumer Research Planning & Allocation |

Brand Management Merchandising Design Sourcing PRODUCT DEVELOPMENT |

Building a Power Brand • Leverage deep resources • Integration across channels • Earn a higher AUR • Maximize cross-shopping • Expand our customer base • Change perception of JCPenney |

Bernie Feiwus SVP & Chief Operating Officer JCP Direct jcp.com: Leveraging technology to accelerate growth |

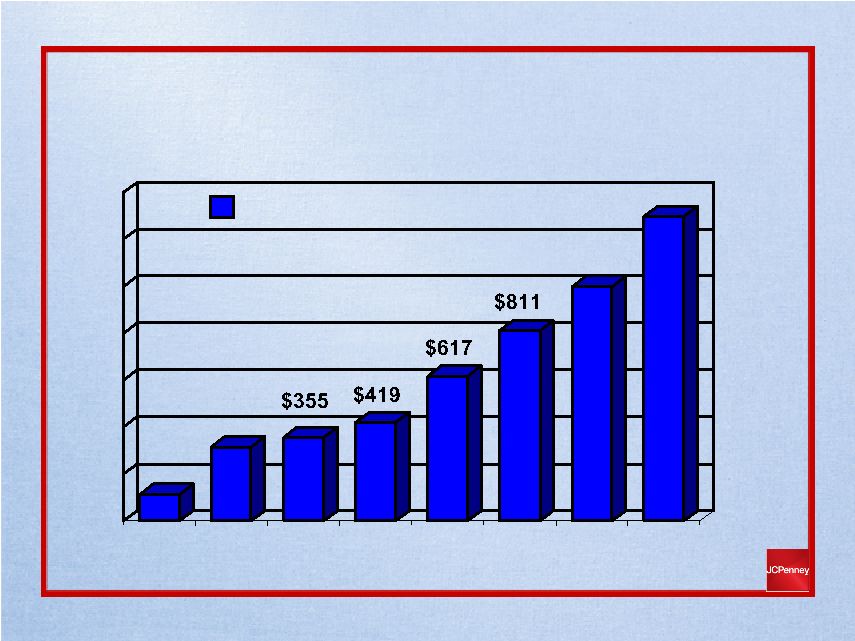

jcp.com Profitable Growth Strategy 1999 2000 2001 2002 2003 2004 2005 2006 $112 $315 $1 B $1.3 B Revenue in Millions |

Top Apparel & Home E-retailers $205 * $350 * $805 * $900 * $960 * $1,292 2006 Revenues $45 * $90 * $225 * $150 * $260 * $254 $ Change vs. 2005 Kohls.com Macys.com Target.com Sears.com Walmart.com jcp.com Site *internal estimate |

jcp.com Site Metrics 22 million 13 million Page views 360,000 140,000 Searches 920,000 520,000 Unique visitors Holiday Off peak Per day Source: Coremetrics |

Source: Keynote 76.1% Retail Index average: 99.7% jcp.com average: 2006 Site Availability |

2006 Conversion Rates 2.8 % Macys.com 9.9 % jcp.com 2006 Average (Feb ’06 – Jan ’07) Conversion Rate 3.1 % Kohls.com 2.7 % Target.com 3.2 % Sears.com 3.9 % Walmart.com Source: internal estimate |

jcp.com Vision jcp.com will be the gateway for new and existing customers to experience the possibilities “inside” JCPenney, by offering compelling merchandise and relevant solutions for their lifestyle needs & aspirations |

5 Key Priorities • Ensure continued growth of e-commerce • Connect stores and store associates with jcp.com • Compete with the best specialists in targeted customer segments and product categories • Improve coordination, relevance, and clarity of communication with customers across and between channels • Keep our use and development of technology in pace with customer use and adaptation |

Steve Lawrence Senior Vice President & GMM Children’s Apparel jcp.com: Leveraging technology to accelerate growth |

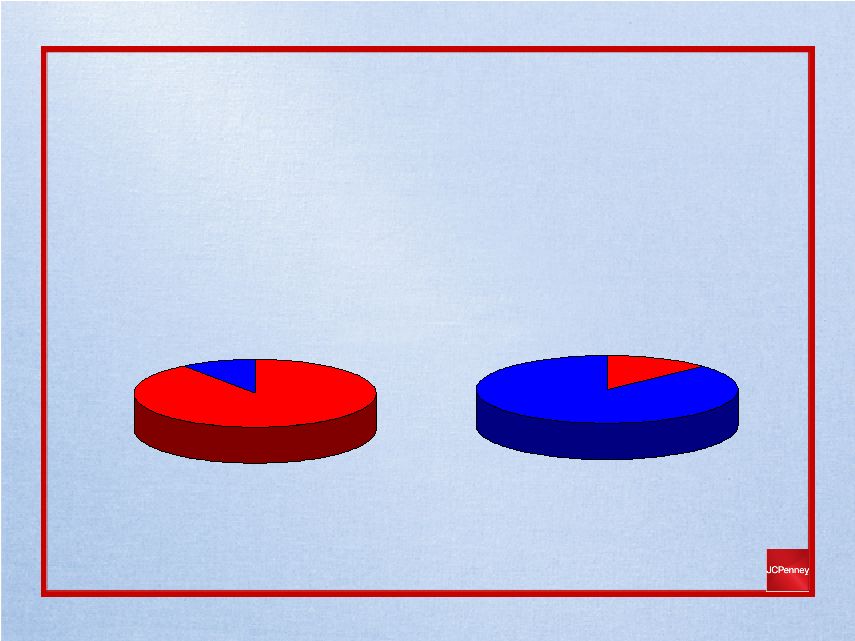

Newborn / Infants / Toddler Business 90% Apparel 10% Non-Apparel Stores Direct 87% Non-Apparel 13% Apparel |

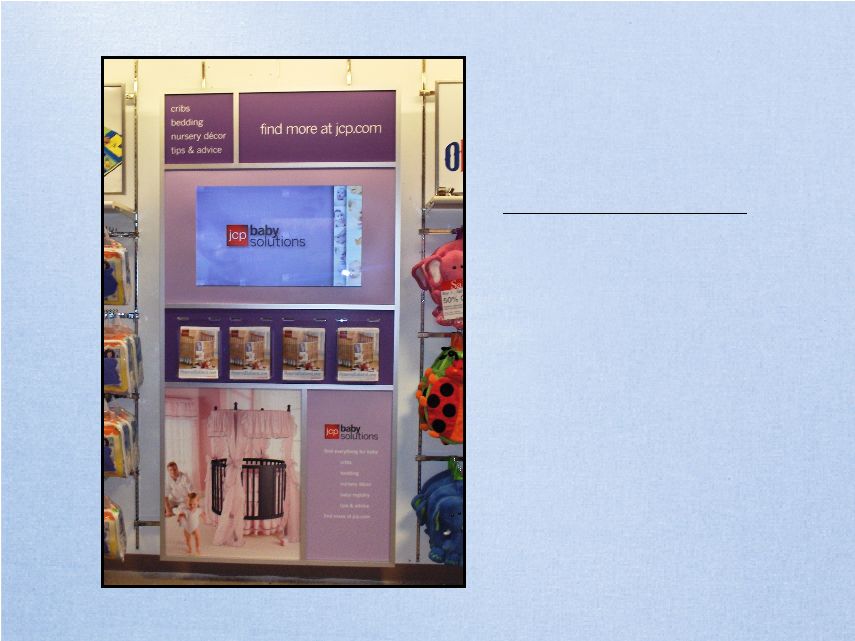

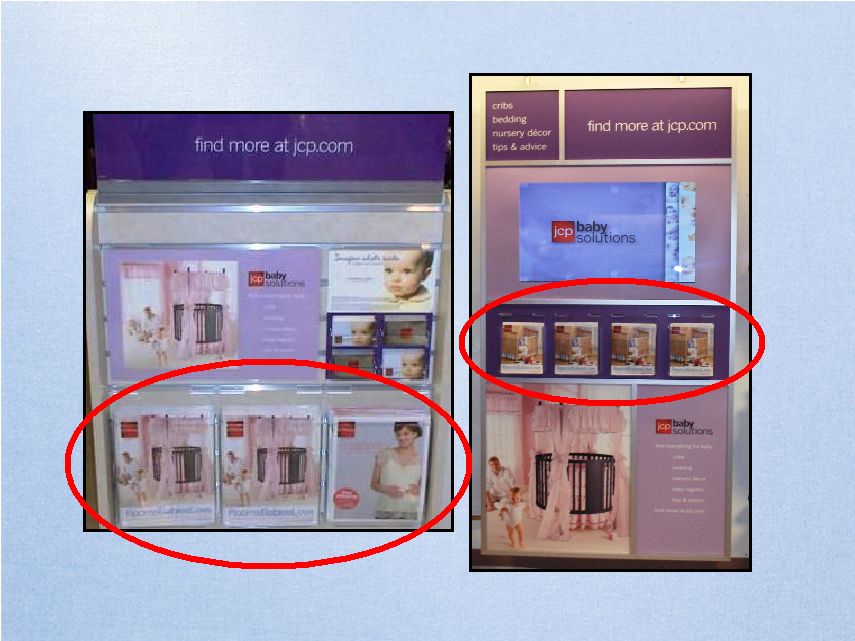

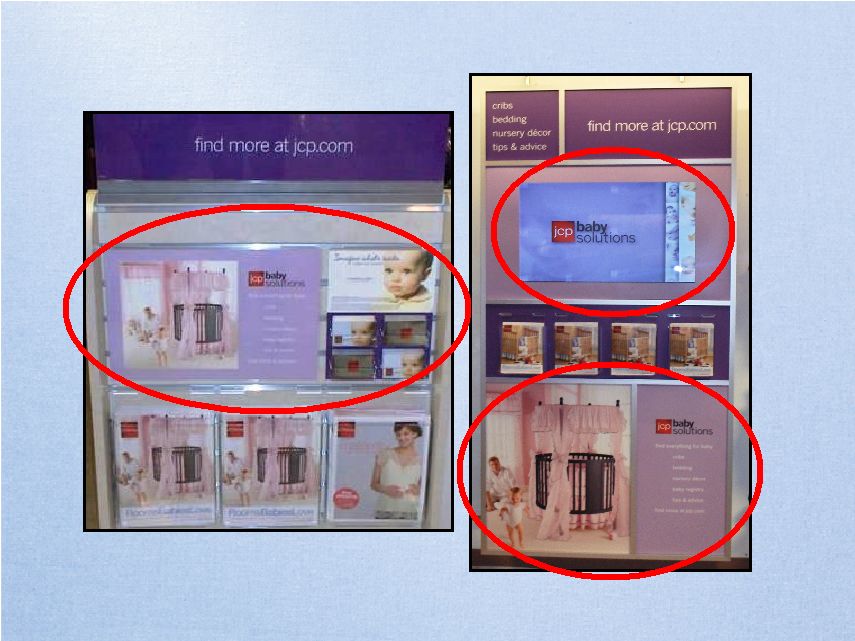

New concept: Bring online and catalog assortments to in-store customers |

School Uniforms 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 2004 2006 6.6% 9.3% • $1.1B US market • 12.5% year over year growth • 23.5% of school districts have uniforms JCPenney market share July/August |

Steve Lawrence Senior Vice President & GMM Children’s Apparel jcp.com: Leveraging technology to accelerate growth |

Tom Nealon Executive Vice President Chief Information Officer jcp.com: Leveraging technology to accelerate growth |

Building Long-Term Capability • Continued innovation on jcp.com • Richer functionality • Expand the opportunities for interaction |

Building Long-Term Capability • Continued innovation on jcp.com • Focus on the game-changing business processes • Assortment Planning • Ordering and Flow |

Building Long-Term Capability • Continued innovation on jcp.com • Focus on the game-changing business processes • Building a durable asset • Business model flexibility is a fundamental requirement |

Customer Experience Team Assortment Team Merchandise Flow Team Our Associates Team |

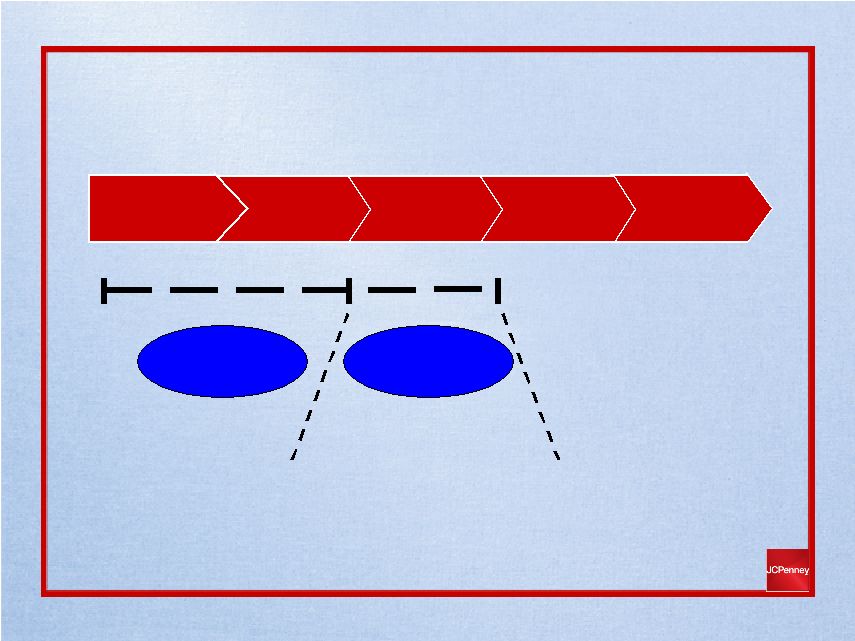

Merchandising Design & Source Product Flow of Goods Customer Environment & Experience Strengthen the Customer Relationship Conceptual Plan Consolidator Assortment Team |

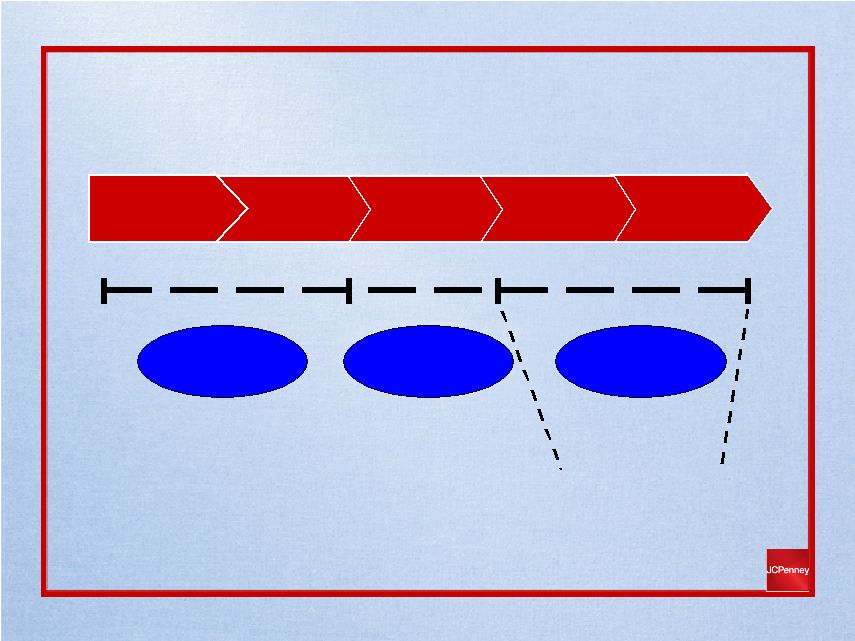

Merchandising Design & Source Product Flow of Goods Customer Environment & Experience Strengthen the Customer Relationship Consolidator Store Receipt Merch Flow Team Assortment Team |

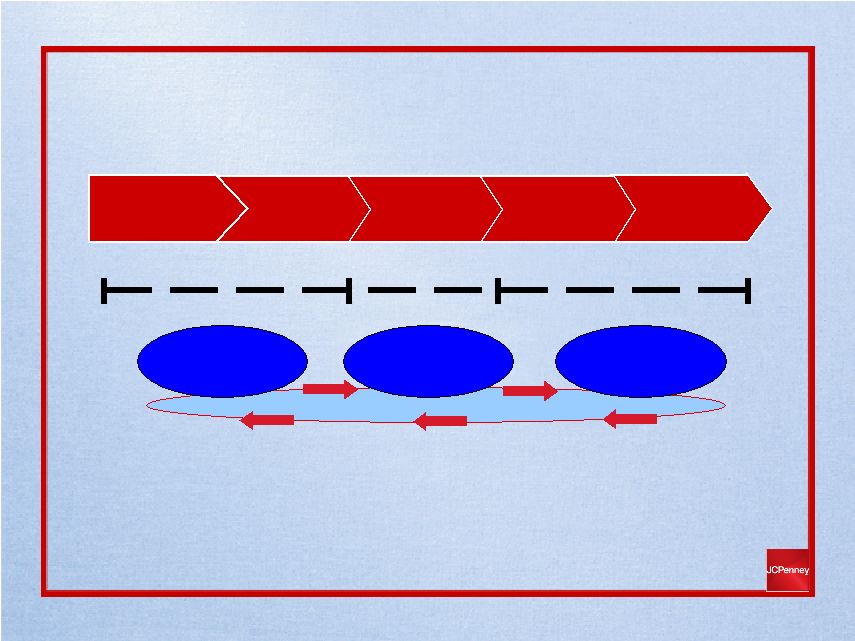

Merchandising Design & Source Product Flow of Goods Customer Environment & Experience Strengthen the Customer Relationship Store Receipt CRM Merch Flow Team Assortment Team Customer Experience Team |

Merch Flow Team Assortment Team Customer Experience Team Merchandising Design & Source Product Flow of Goods Customer Environment & Experience Strengthen the Customer Relationship |

• Clarence Kelley • John Irvin • Peter McGrath • Tom Nealon • Liz Sweney • Jeff Allison • Debra Glassburn • Jim LaBounty • Tom Nealon • Mike Boylson • Michael Dastugue • Bernie Feiwus • Tom Nealon • Mike Taxter Ownership & Alignment Across the Executive Team Merchandising Design & Source Product Flow of Goods Customer Environment & Experience Strengthen the Customer Relationship Merch Flow Team Customer Experience Team Assortment Team |

BILT Teams B usiness I nfrastructure L eadership Teams |

• Technology • Process • Organization • Discipline • Leading Change BILT Teams B usiness I nfrastructure L eadership Teams |

Bernie Feiwus SVP & Chief Operating Officer JCP Direct jcp.com: Leveraging technology to accelerate growth |

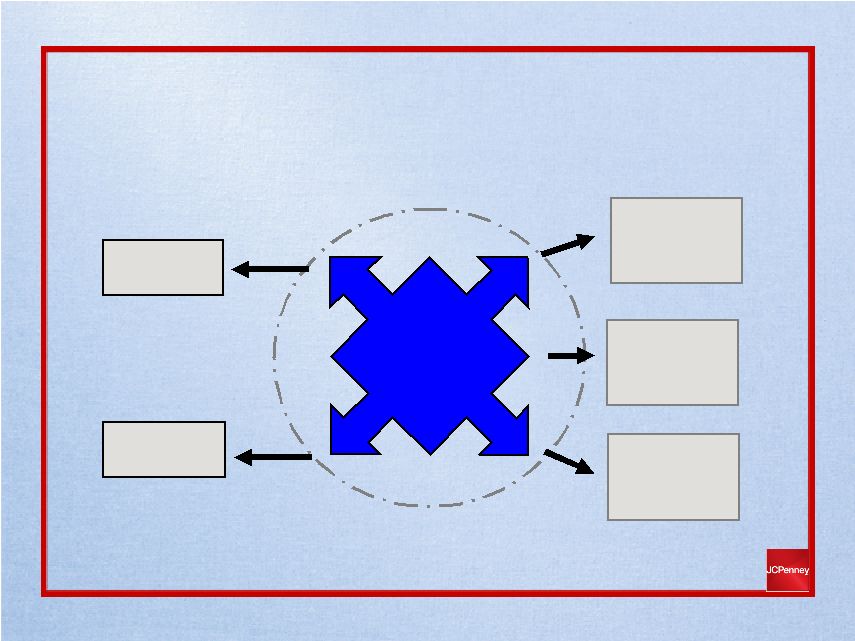

Sephora, American Living Arizona, Ambrielle jcp.com “hub” “Owned & Operated” “Strategic Alliances” Stores ECommerce Direct Mail Catalogs E-mail jcp.com – the Gateway |

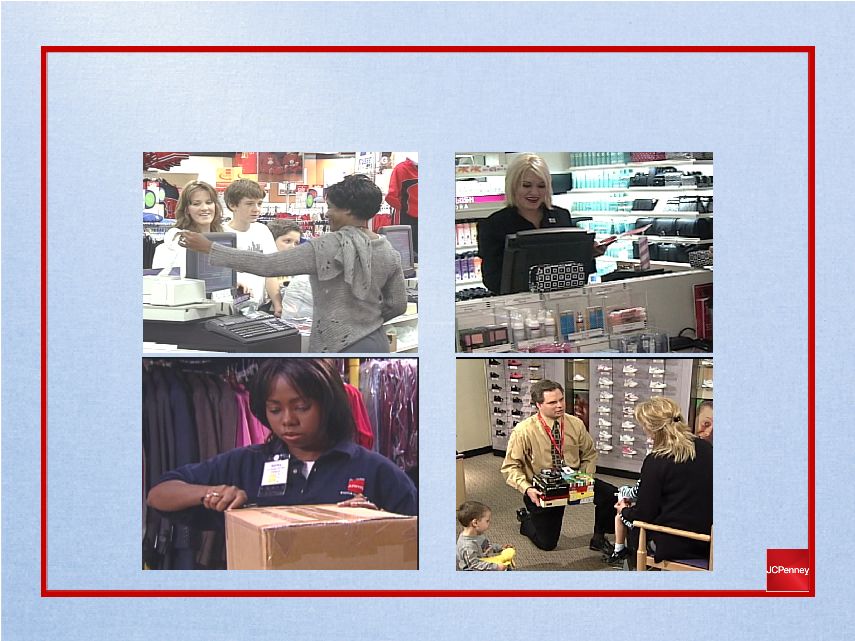

Mike Taxter Executive Vice President Director of Stores Develop An Emotional Connection With Our Customers |

Customer Focus Associate Engagement |

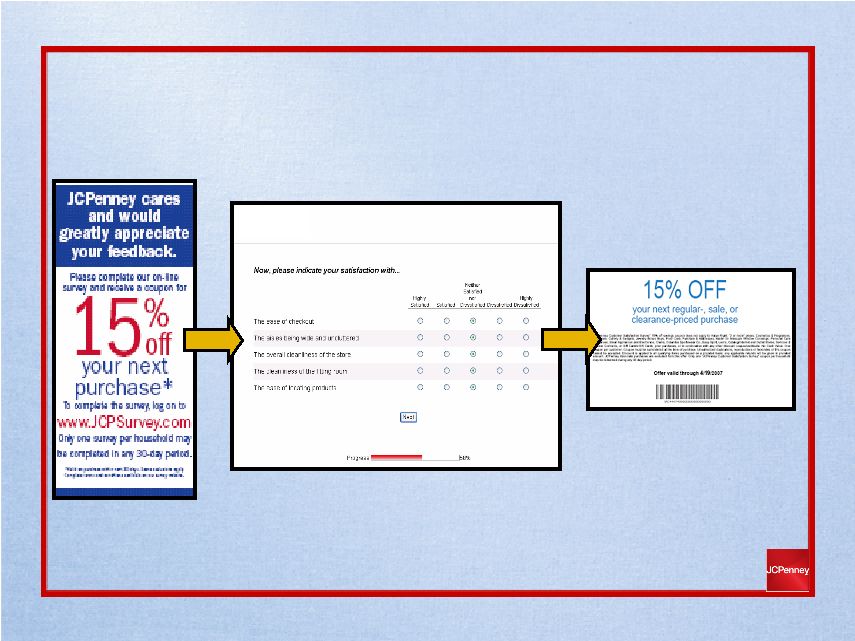

Customer Satisfaction Survey Survey Invitation Survey Coupon |

Five Point Satisfaction Scale • Highly Satisfied • Satisfied • Neither Satisfied nor Dissatisfied • Dissatisfied • Highly Dissatisfied |

Fully Staff and Train in Key Departments |

Additional Service Level Questions |

Survey Topics • Store execution • Associate interactions • Merchandise • Customer loyalty |

Store Trend Report • Specific targeted areas • Address concerns • Recognize outstanding performance |

} 94% Highly Satisfied Satisfied Neither Satisfied nor Dissatisfied Dissatisfied Highly Dissatisfied Customer Satisfaction Survey |

Highly Satisfied • 1.5 times likely to return • Twice as likely to recommend Satisfied Neither Satisfied nor Dissatisfied Dissatisfied Highly Dissatisfied |

Growth Opportunities Highly Satisfied Satisfied Neither Satisfied nor Dissatisfied Dissatisfied Highly Dissatisfied |

Growth Opportunities Highly Satisfied Satisfied Dissatisfied Neither Satisfied nor Dissatisfied Highly Dissatisfied |

300 basis point improvement in customer satisfaction |

Correlation Between Sales Growth and Customer Satisfaction |

Top Performing Stores • Satisfaction score is 500 basis points higher than company average |

Top Performing Stores • Satisfaction score is 500 basis points higher than company average • Sales results are 170 basis points higher than company average |

WINNING TOGETHER Store Engagement Scores 2005 2006 67 73 |

JCPenney ranks in the 80th percentile of Fortune 500 companies in Associate Engagement |

Stores that Score the Highest in Associate Engagement Have Twice the Average Sales Gain |

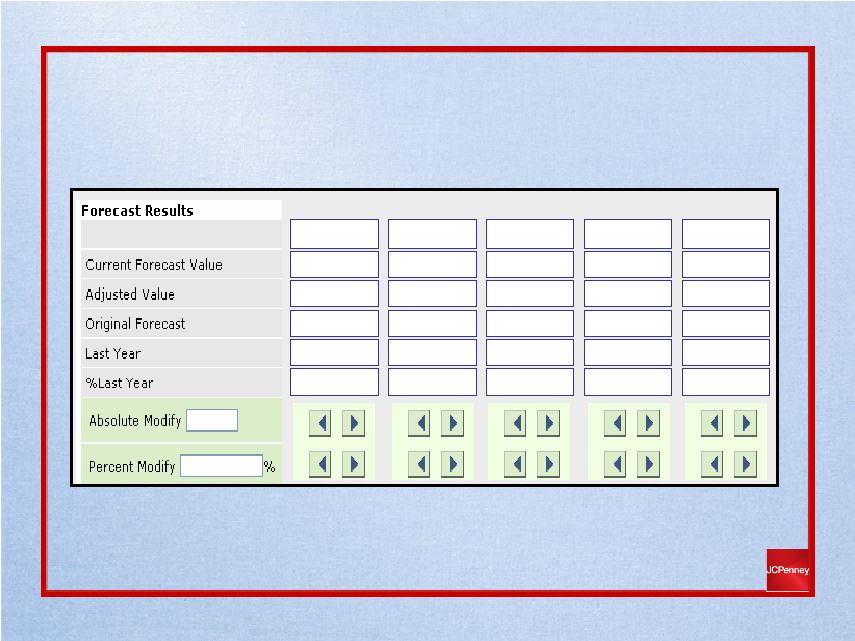

Centrally Driven • Sales curves • Marketing events • Calendar shifts • Extended store hours |

Store Specific • Individual store budgets |

Store Specific • Individual store budgets • Customer shopping patterns |

Store Specific • Individual store budgets • Customer shopping patterns • Sales opportunities |

Ability to Build Individual Store Staffing Plans |

Weekly Forecasting $136,501 $136,501 $126,639 $125,962 8.4% Total $21,187 $21,187 $20,973 $20,683 2.4% Sun 9/4 $12,145 $12,145 $12,659 $12,004 1.2% Mon 9/5 $13,400 $13,400 $12,942 $13,214 1.4% Tue 9/6 $15,065 $15,065 $15,702 $14,727 2.3% Wed 9/7 |

Store Specific Adjustments • Knowledge of their market • 8 week trend • Customer shopping patterns |

Workforce Management Provides Optimized Schedules |

Weekly Schedule Score Schedule Cost Original Score Schedule Score Budget: 50,814 Budget: 0.95 Budget: 1.00 Original: 48,681 Service: 0.88 Service: 0.96 Current: 50,681 Efficiency: 1.12 Efficiency: 1.04 |

Schedule Cost Original Score Schedule Score Budget: 50,814 Budget: 0.95 Budget: 1.00 Original: 48,681 Service: 0.88 Service: 0.96 Current: 50,681 Efficiency: 1.12 Efficiency: 1.04 Weekly Schedule Score |

Schedule Cost Original Score Schedule Score Budget: 50,814 Budget: 0.95 Budget: 1.00 Original: 48,681 Service: 0.88 Service: 0.96 Current: 50,681 Efficiency: 1.12 Efficiency: 1.04 Weekly Schedule Score |

Schedule Cost Original Score Schedule Score Budget: 50,814 Budget: 0.95 Budget: 1.00 Original: 48,681 Service: 0.88 Service: 0.96 Current: 50,681 Efficiency: 1.12 Efficiency: 1.04 Weekly Schedule Score |

Schedule Cost Original Score Schedule Score Budget: 50,814 Budget: 0.95 Budget: 1.00 Original: 48,681 Service: 0.88 Service: 0.96 Current: 50,681 Efficiency: 1.12 Efficiency: 1.04 Weekly Schedule Score |

Weekly Schedule Score Schedule Cost Original Score Schedule Score Budget: 50,814 Budget: 0.95 Budget: 1.00 Original: 48,681 Service: 0.88 Service: 0.96 Current: 50,681 Efficiency: 1.12 Efficiency: 1.04 |

Schedule Cost Original Score Schedule Score Budget: 50,814 Budget: 0.95 Budget: 1.00 Original: 48,681 Service: 0.88 Service: 0.96 Current: 50,681 Efficiency: 1.12 Efficiency: 1.04 Weekly Schedule Score |

Benefits of Workforce Management • Optimal coverage • Shopping experience • Maximize sales and profits |

Store Managers Utilize the Tool to Optimize Staffing |

Input associate availability |

Input associate availability Balance work and family life |

Input associate availability Balance work and family life Schedules two weeks out |

Drive Profitable Sales Growth |

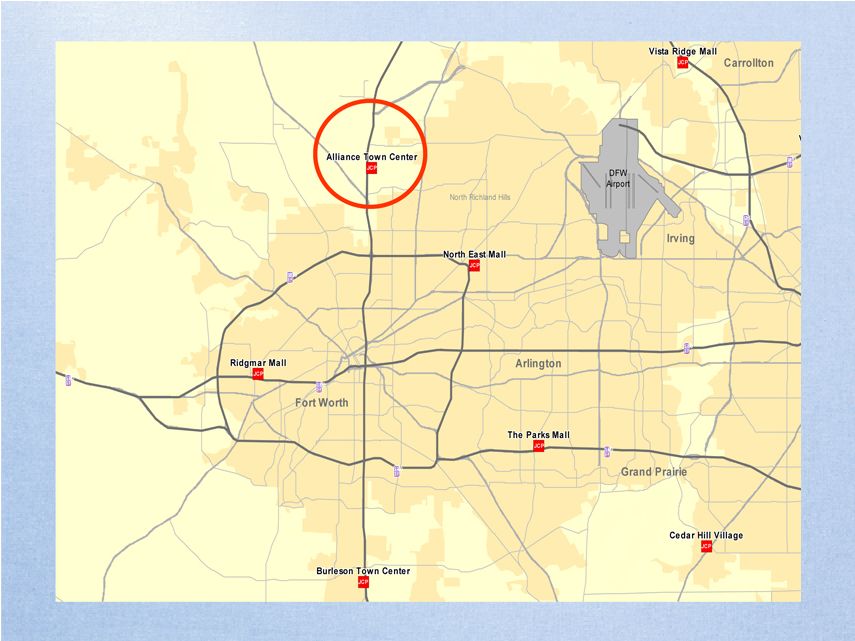

Alliance Town Center • Off-mall format • 104,000 gross square feet • 87,000 net sell square feet |

Trade Area • Population growth 4.5% • Median household income $71,600 • New homes and families with children |

Store Tour • Sephora • Liz & Co. and a.n.a • Concepts by Claiborne • Cooks • Ambrielle • The Kid’s Store • Special Sizes • Fine Jewelry |

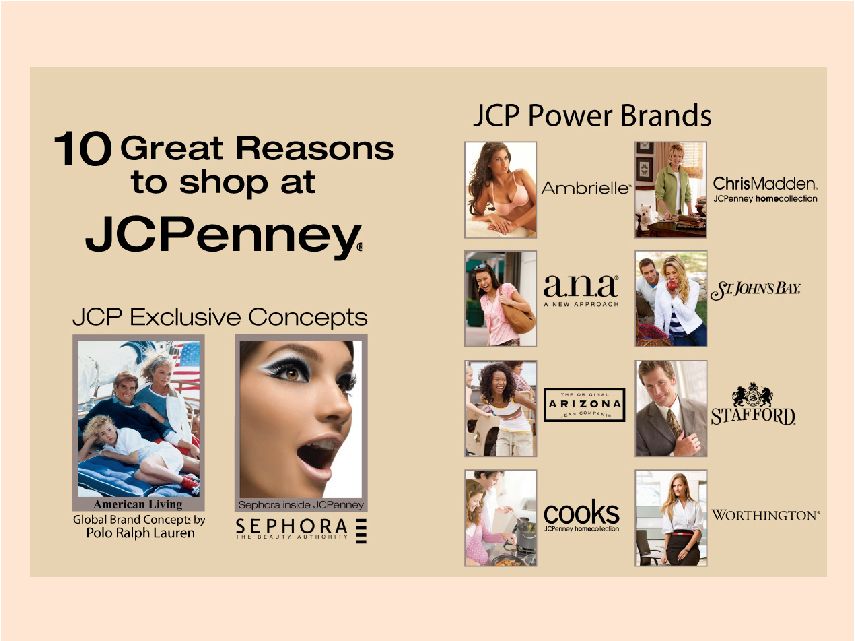

10 Great Reasons to shop at

JCPenney®

JCP Exclusive Concepts

Global Brand Concepts by Polo Ralph Lauren

JCP Power Brands

Building a Power Brand at JCPenney®

AmbrielleTM Brand Development Process

| | | | | | | | | | |

| Listen | | Conceive | | Design | | Source | | Market | | Sell |

| | | | | |

| Assess Opportunity | | Brand Definition | | Concept/Design | | Production | | Messaging | | Brand Experience |

| | | | | |

• consumer research | | • lifestyle alignment | | • collection | | • placement | | • imaging | | • store environment |

| | | | | |

• competitive review | | • assortment plan | | • silhouette | | • quality assurance | | • print/media | | • associate training |

| | | | | |

• “white space” | | • pricing/promotion | | • fabrication | | • shipping | | • promotion | | • jcp.com execution |

| | | | | |

| | | | • flow strategy | | | | | | |