Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2016

Commission File Number: 001-31221

Total number of pages: 54

NTT DOCOMO, INC.

(Translation of registrant’s name into English)

Sanno Park Tower 11-1, Nagata-cho 2-chome

Chiyoda-ku, Tokyo 100-6150

Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NTT DOCOMO, INC. | ||||||

| Date: July 29, 2016 | By: | /s/ KATSUYUKI TAKAGI | ||||

Katsuyuki Takagi Head of Investor Relations | ||||||

Information furnished in this form:

| 1. |

| 2. | Results presentation for the first three months of the fiscal year ending March 31, 2017 |

Table of Contents

|  | |||

Earnings Release | July 29, 2016 | |||

| For the Three Months Ended June 30, 2016 | [U.S. GAAP] |

| Name of registrant: | NTT DOCOMO, INC.(URL https://www.nttdocomo.co.jp/) | |

| Code No.: | 9437 | |

| Stock exchange on which the Company’s shares are listed: | Tokyo Stock Exchange-First Section | |

| Representative: | Kazuhiro Yoshizawa, Representative Director, President and Chief Executive Officer | |

| Contact: | Koji Otsuki, Senior Manager, General Affairs Department / TEL +81-3-5156-1111 | |

| Scheduled date for filing of quarterly report: | August 4, 2016 | |

| Scheduled date for dividend payment: | — | |

| Supplemental material on quarterly results: | Yes | |

| Presentation on quarterly results: | Yes (for institutional investors and analysts) |

(Amounts are rounded off to the nearest 1 million yen.)

1. Consolidated Financial Results for the Three Months Ended June 30, 2016 (April 1, 2016 - June 30, 2016)

(1) Consolidated Results of Operations

(Millions of yen, except per share amounts)

| Operating Revenues | Operating Income | Income Before Income Taxes and Equity in Net Income (Losses) of Affiliates | Net Income Attributable to NTT DOCOMO, INC. | |||||||||||||||||||||||||||||

Three months ended June 30, 2016 | 1,108,670 | 3.0 | % | 299,291 | 27.1 | % | 295,292 | 22.7 | % | 206,854 | 22.6 | % | ||||||||||||||||||||

Three months ended June 30, 2015 | 1,076,864 | 0.1 | % | 235,395 | 12.3 | % | 240,611 | 13.2 | % | 168,784 | 23.8 | % | ||||||||||||||||||||

(Percentages above represent changes compared to the corresponding period of the previous year)

| (Note) | Comprehensive income attributable to | For the three months ended June 30, 2016: | 187,202 million yen | 14.3 | % | |||||

| NTT DOCOMO, INC.: | For the three months ended June 30, 2015: | 163,718 million yen | 22.4 | % |

| Basic Earnings per Share Attributable to NTT DOCOMO, INC. | Diluted Earnings per Share Attributable to NTT DOCOMO, INC. | |||||||

Three months ended June 30, 2016 | 55.10 (yen) | — | ||||||

Three months ended June 30, 2015 | 43.48 (yen) | — | ||||||

(2) Consolidated Financial Position

(Millions of yen, except per share amounts)

| Total Assets | Total Equity (Net Assets) | NTT DOCOMO, INC. Shareholders’ Equity | Shareholders’ Equity Ratio | NTT DOCOMO, INC. Shareholders’ Equity per Share | ||||||||||||

June 30, 2016 | 6,933,236 | 5,339,100 | 5,302,608 | 76.5% | 1,417.61 (yen) | |||||||||||

March 31, 2016 | 7,214,114 | 5,343,105 | 5,302,248 | 73.5% | 1,409.94 (yen) | |||||||||||

2. Dividends

| Cash Dividends per Share (yen) | ||||||||||||||||||||

| End of the First Quarter | End of the Second Quarter | End of the Third Quarter | Year End | Total | ||||||||||||||||

Year ended March 31, 2016 | — | 35.00 | — | 35.00 | 70.00 | |||||||||||||||

Year ending March 31, 2017 | — | |||||||||||||||||||

Year ending March 31, 2017 (Forecasts) | 40.00 | — | 40.00 | 80.00 | ||||||||||||||||

(Note) Revisions to the forecasts of dividends: None

3. Forecasts of Consolidated Financial Results for the Fiscal Year Ending March 31, 2017 (April 1, 2016 - March 31, 2017)

(Millions of yen, except per share amounts)

| Operating Revenues | Operating Income | Income Before Income Taxes and Equity in Net Income (Losses) of Affiliates | Net Income Attributable to NTT DOCOMO, INC. | Basic Earnings per Share Attributable to NTT DOCOMO, INC. | ||||||||||||||||||||||||||||||||

Six months ending September 30, 2016 | — | — | % | — | — | % | — | — | % | — | — | % | — (yen) | |||||||||||||||||||||||

Year ending | 4,620,000 | 2.1 | % | 910,000 | 16.2 | % | 914,000 | 17.5 | % | 640,000 | 16.7 | % | 173.22 (yen) | |||||||||||||||||||||||

(Percentages above represent changes compared to the corresponding previous year)

(Note) Revisions to the forecasts of consolidated financial results: None

Table of Contents

* Notes:

(1) Changes in significant subsidiaries: | None | |

(Changes in significant subsidiaries for the three months ended June 30, 2016 which resulted in changes in scope of consolidation) |

(2) Application of simplified or exceptional accounting: | None | |

(3) Changes in accounting policies | ||

i. Changes due to revision of accounting standards and other regulations: | None | |

ii. Others: | Yes | |

(Refer to “2. (3) Changes in Accounting Policies” on page 13.) | ||

(4) Number of issued shares (common stock) | ||

i. Number of issued shares (inclusive of treasury stock): | As of June 30, 2016: | 3,958,543,000 shares | ||

| As of March 31, 2016: | 3,958,543,000 shares | |||

ii. Number of treasury stock: | As of June 30, 2016: | 218,014,850 shares | ||

| As of March 31, 2016: | 197,926,250 shares | |||

iii. Number of weighted average common shares outstanding: | For the three months ended June 30, 2016: | 3,754,094,845 shares | ||

| For the three months ended June 30, 2015: | 3,881,483,829 shares | |||

* Presentation on the status of quarterly review procedure:

This earnings release is not subject to the quarterly review procedure as required by the Financial Instruments and Exchange Act of Japan. As of the date when this earnings release was issued, the quarterly review procedure on financial statements as required by the Financial Instruments and Exchange Act of Japan had not been finalized.

* Explanation for forecasts of operations and other notes:

| 1. | Forecast of results |

Forward-looking statements in this earnings release, such as forecasts of results of operations, are based on the information currently available and certain assumptions that we regard as reasonable, and therefore actual results may differ materially from those contained in, or suggested by, any forward-looking statements. With regard to the assumptions and other related matters concerning forecasts for the fiscal year ending March 31, 2017, refer to “1. (3) Prospects for the Fiscal Year Ending March 31, 2017” on page 12 and “5. Special Note Regarding Forward-Looking Statements” on page 20, contained in the attachment.

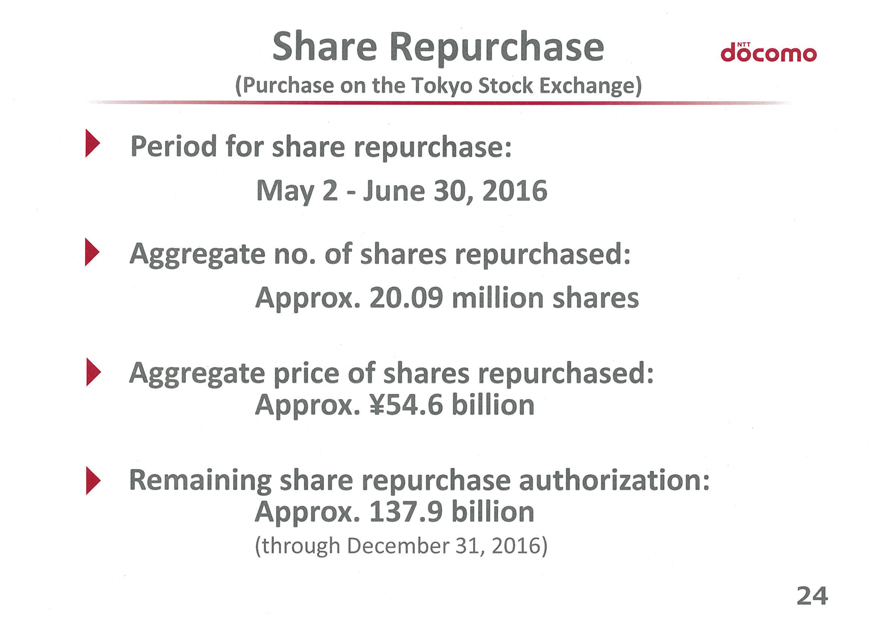

| 2. | Resolution of share repurchase up to prescribed maximum limit |

The forecasts of “Basic Earnings per Share Attributable to NTT DOCOMO, INC.” for the fiscal year ending March 31, 2017 are based on the assumption that DOCOMO will repurchase up to 220,000,000 shares for an amount in total not to exceed ¥500,000 million, as resolved at the board of directors’ meeting held on January 29, 2016.

Table of Contents

| page | ||

Contents of the Attachment | 1 | |

| 2-12 | ||

| 2-10 | ||

| 11 | ||

| 12 | ||

| 13 | ||

| 13 | ||

| 13 | ||

| 13 | ||

| 14-18 | ||

| 14 | ||

(2) Consolidated Statements of Income and Consolidated Statements of Comprehensive Income | 15 | |

| 16 | ||

| 17-18 | ||

| 19 | ||

| 19 | ||

| 20 | ||

1

Table of Contents

Earnings Release for the Three Months Ended June 30, 2016

1. Information on Consolidated Results

i. Business Overview

The environment surrounding our business has changed significantly. In the Japan’s telecommunications market, competition has intensified due to the government’s pro-competition policy, market entry by Mobile Virtual Network Operators (MVNOs) and other factors. In addition, technical advancements in the areas of cloud services, IoT*, big data and artificial intelligence (AI), etc., and new policy developments such as the full liberalization of the electricity retail market, brought about active competition and collaboration with new players from other industries, accelerating competition in new markets that transcend the conventional boundaries of telecommunications business.

Amid these changes in the market environment, positioning the current fiscal year ending March 31, 2017 (FY2016) as the year in which we intend to make “a vibrant leap toward further growth” beyond income recovery, we aim to achieve the various medium-term target indicators we announced for the fiscal year ending March 31, 2018 (FY2017) one year ahead of the schedule. In our business management, we are promoting the two pillars of “reinforcement of telecommunications business” and “expansion of smart life business and other businesses” centered on our “+d” value co-creation strategy, in which we pursue the creation of new values by evolving our collaborative activities with a wide range of external partners.

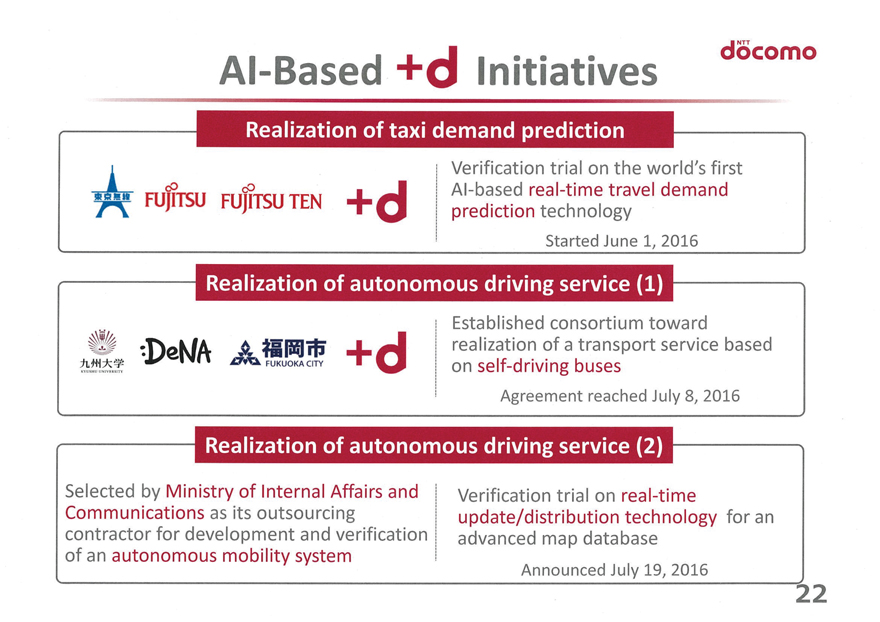

In the three months ended June 30, 2016, we further enriched our “Kake-hodai & Pake-aeru” billing scheme to ensure users worry-free usage for a long period time. As part of our “+d” initiatives, in collaboration with our partners, we took actions aimed for “co-creation of social values” in view of the future, including the introduction of “docomo smart parking system” that significantly reduces the initial investment required for starting up a metered parking business, and the commencement of a verification trial on “mobile demand forecast technology,” which predicts the demand for taxi use in real time.

For the three months ended June 30, 2016, despite a decrease in equipment sales revenues, operating revenues increased by ¥31.8 billion from the same period of the previous fiscal year to ¥1,108.7 billion, mainly due to the recovery of telecommunications services revenues as a result of the expansion of smartphone use and the demand for tablets and other products purchased as a second mobile device for individual use, the growth of the packet consumption of our “Kake-hodai & Pake-aeru” billing plan subscribers, and growth of the “docomo Hikari” users, as well as the growth of our smart life business and other businesses such as “dmarket” and other content services.

Operating expenses decreased by ¥32.1 billion from the same period of the previous fiscal year to ¥809.4 billion owing primarily to a decline of depreciation expenses as a result of our change in depreciation method used, a decrease in cost of equipment sold and initiatives to pursue further cost efficiency, despite an increase in expenses associated with the growth of revenues from smart life business and other businesses and the expansion of “docomo Hikari” revenues.

As a result, operating income increased by ¥63.9 billion from the same period of the previous fiscal year to ¥299.3 billion for the three months ended June 30, 2016.

Income before income taxes and equity in net income (losses) of affiliates was ¥295.3 billion, and net income attributable to NTT DOCOMO, INC. increased by ¥38.1 billion from the same period of the previous fiscal year to ¥206.9 billion for the three months ended June 30, 2016.

| * | Abbreviation for Internet of Things. A concept that describes a world in which everything is connected to the Internet, enabling remote control and management of devices, etc. |

2

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

Consolidated results of operations for the three months ended June 30, 2015 and 2016 were as follows:

<Results of operations>

| Billions of yen | ||||||||||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | Increase (Decrease) | ||||||||||||||

Operating revenues | ¥ | 1,076.9 | ¥ | 1,108.7 | ¥ | 31.8 | 3.0 | % | ||||||||

Operating expenses | 841.5 | 809.4 | (32.1 | ) | (3.8 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Operating income | 235.4 | 299.3 | 63.9 | 27.1 | ||||||||||||

Other income (expense) | 5.2 | (4.0 | ) | (9.2 | ) | — | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Income before income taxes and equity in net income (losses) of affiliates | 240.6 | 295.3 | 54.7 | 22.7 | ||||||||||||

Income taxes | 72.6 | 89.6 | 17.0 | 23.4 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Income before equity in net income (losses) of affiliates | 168.0 | 205.6 | 37.7 | 22.4 | ||||||||||||

Equity in net income (losses) of affiliates | 1.6 | 1.0 | (0.6 | ) | (38.7 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Net income | 169.6 | 206.6 | 37.0 | 21.8 | ||||||||||||

Less: Net (income) loss attributable to noncontrolling interests | (0.8 | ) | 0.2 | 1.0 | — | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Net income attributable to NTT DOCOMO, INC. | ¥ | 168.8 | ¥ | 206.9 | ¥ | 38.1 | 22.6 | |||||||||

|

|

|

|

|

|

|

| |||||||||

EBITDA margin* | 36.0 | % | 37.2 | % | 1.2 point | — | ||||||||||

|

|

|

|

|

|

|

| |||||||||

ROE* | 3.1 | % | 3.9 | % | 0.8 point | — | ||||||||||

|

|

|

|

|

|

|

| |||||||||

| * | EBITDA and EBITDA margin, as we use them in this earnings release, are different from EBITDA as used in Item 10(e) of Regulation S-K and may not be comparable to similarly titled measures used by other companies. For an explanation of our definitions of EBITDA, EBITDA margin, ROE, see “4. Reconciliations of the Disclosed Non-GAAP Financial Measures to the Most Directly Comparable GAAP Financial Measures” on page 19. |

<Operating revenues>

| Billions of yen | ||||||||||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | Increase (Decrease) | ||||||||||||||

Telecommunications services | ¥ | 675.3 | ¥ | 729.7 | ¥ | 54.5 | 8.1 | % | ||||||||

Mobile communications services revenues | 669.4 | 704.2 | 34.8 | 5.2 | ||||||||||||

Voice revenues | 196.6 | 215.9 | 19.2 | 9.8 | ||||||||||||

Packet communications revenues | 472.7 | 488.3 | 15.5 | 3.3 | ||||||||||||

Optical-fiber broadband service and other telecommunications services revenues | 5.9 | 25.5 | 19.7 | 335.7 | ||||||||||||

Equipment sales | 201.3 | 165.8 | (35.6 | ) | (17.7 | ) | ||||||||||

Other operating revenues | 200.3 | 213.2 | 12.9 | 6.5 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total operating revenues | ¥ | 1,076.9 | ¥ | 1,108.7 | ¥ | 31.8 | 3.0 | % | ||||||||

|

|

|

|

|

|

|

| |||||||||

Note: | Voice revenues include data communications revenues through circuit switching systems. |

<Operating expenses>

| Billions of yen | ||||||||||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | Increase (Decrease) | ||||||||||||||

Personnel expenses | ¥ | 72.3 | ¥ | 72.3 | ¥ | 0.0 | 0.0 | % | ||||||||

Non-personnel expenses | 537.5 | 531.5 | (6.0 | ) | (1.1 | ) | ||||||||||

Depreciation and amortization | 145.6 | 109.7 | (35.9 | ) | (24.6 | ) | ||||||||||

Loss on disposal of property, plant and equipment and intangible assets | 11.3 | 7.9 | (3.4 | ) | (29.9 | ) | ||||||||||

Communication network charges | 64.6 | 76.7 | 12.1 | 18.7 | ||||||||||||

Taxes and public dues | 10.3 | 11.2 | 1.0 | 9.5 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total operating expenses | ¥ | 841.5 | ¥ | 809.4 | ¥ | (32.1 | ) | (3.8 | )% | |||||||

|

|

|

|

|

|

|

| |||||||||

3

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

ii. Segment Results

Telecommunications Business—

<Results of operations>

| Billions of yen | ||||||||||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | Increase (Decrease) | ||||||||||||||

Operating revenues from telecommunications business | ¥ | 878.6 | ¥ | 894.9 | ¥ | 16.3 | 1.9 | % | ||||||||

Operating income (loss) from telecommunications business | 212.4 | 270.4 | 58.0 | 27.3 | ||||||||||||

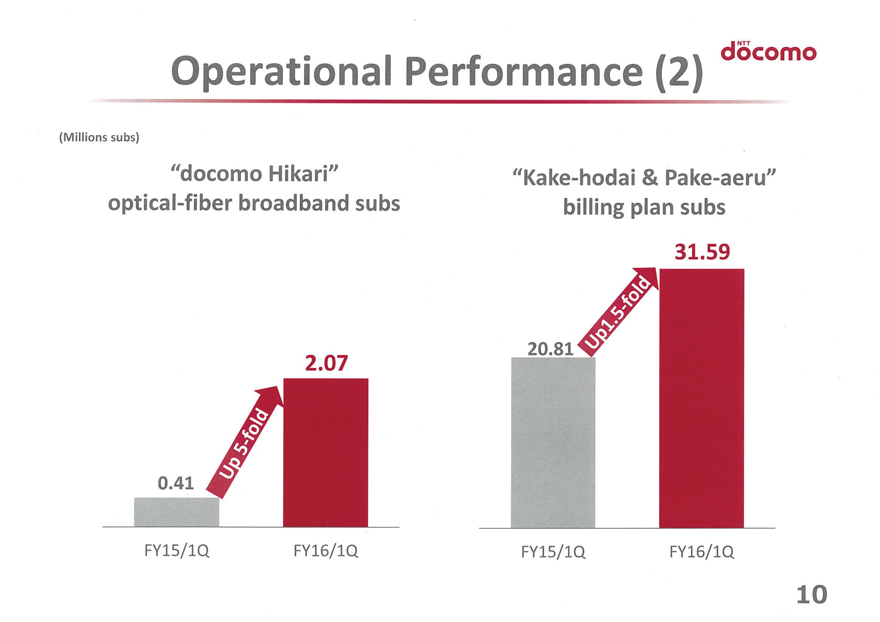

Despite a decrease in equipment sales revenues, operating revenues from telecommunications business for the three months ended June 30, 2016 increased by ¥16.3 billion, or 1.9%, from ¥878.6 billion for the same period of the previous fiscal year to ¥894.9 billion, as a result of the expansion of smartphone use and the demand for tablets and other products purchased as a second mobile device for individual use, the growth of the packet consumption of our “Kake-hodai & Pake-aeru” billing plan subscribers, and growth in the number of “docomo Hikari” users, which amounted to 2.07 million as of June 30, 2016.

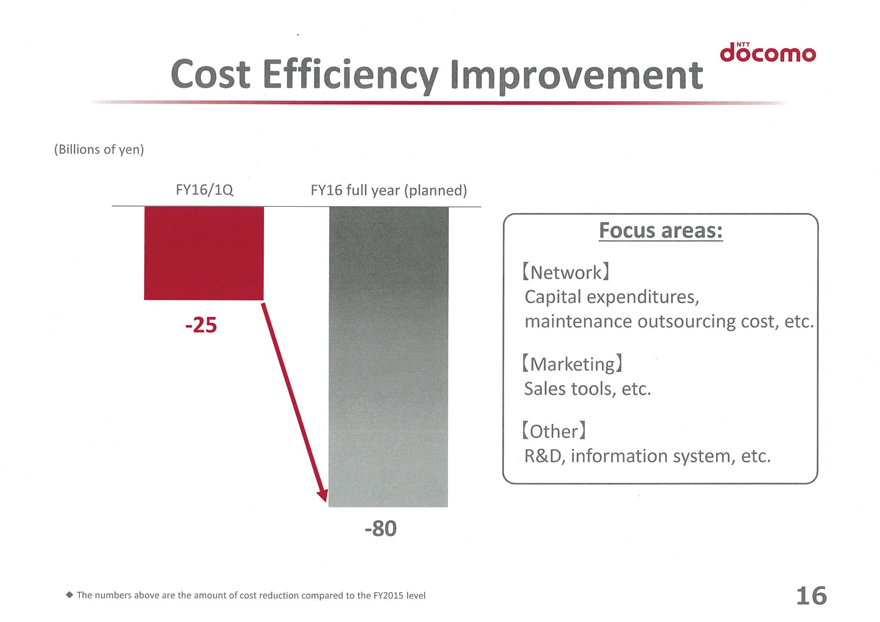

Operating expenses from telecommunications business decreased by ¥41.7 billion, or 6.3%, from ¥666.2 billion for the same period of the previous fiscal year to ¥624.5 billion due primarily to a decrease in depreciation expenses as a result of our change in depreciation method used, a decrease in cost of equipment sold and initiatives to pursue further cost efficiency, despite the increase in expenses associated with “docomo Hikari” revenues.

Consequently, operating income from telecommunications business was ¥270.4 billion, an increase of ¥58.0 billion, or 27.3%, from ¥212.4 billion for the same period of the previous fiscal year.

<<Key Topics>>

| • | In May 2016, we unveiled seven new models of devices, including smartphones that carry new features such as “Suguden,” which allows users to place and receive calls and perform other basic operations without having to touch the screen, in a bid to offer products and features that can respond to the diverse requirements of customers. The total number of subscriptions using smartphones and tablets amounted to 33.44 million as of June 30, 2016. |

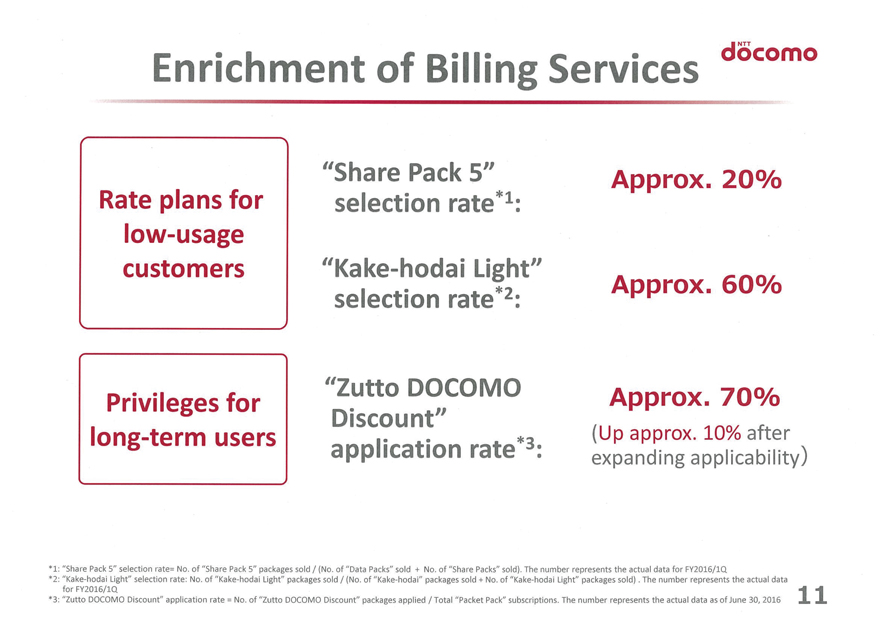

| • | In June 2016, we added two new options, the “Free Course” and the “Zutto DOCOMO Discount Course,” which allow customers to choose subscriptions with or without cancellation fees, to our “Kake-hodai & Pake-aeru” billing scheme. In addition, in order to allow customers to use our services for a long time at affordable rates, for customers who choose the “Zutto DOCOMO Discount Course,” we expanded the discounts offered under the “Zutto DOCOMO Discount” scheme and started offering reward points for customers renewing two-year contracts. As a result of the foregoing, as well as reinforced promotional activities, the number of “Kake-hodai & Pake-aeru” subscriptions as of June 30, 2016 totaled 31.59 million, recording an increase of 10.77 million from June 30, 2015. |

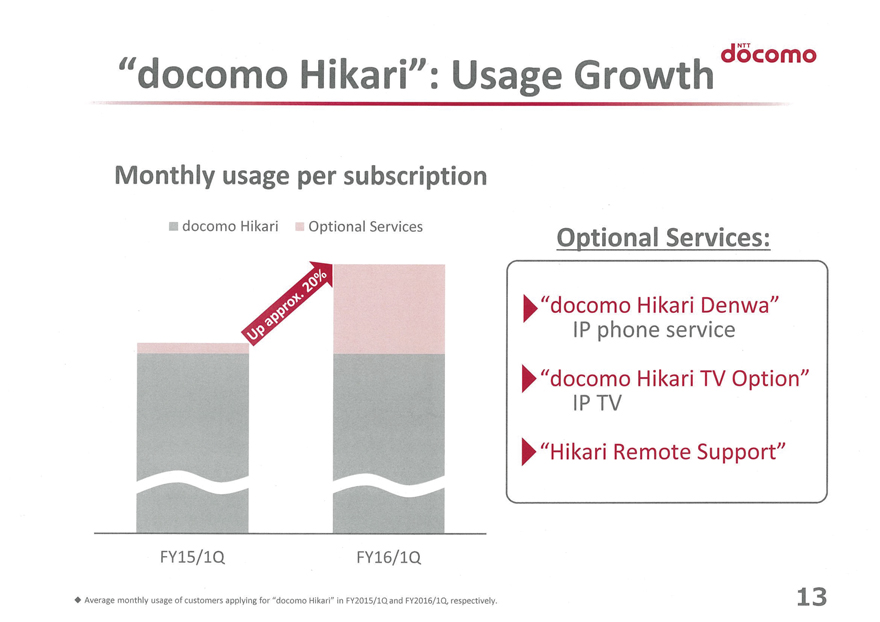

| • | To provide users with improved services and convenience, in April 2016 we launched “docomo Hikari Denwa” (IP telephone) and “docomo Hikari TV Option” (IP TV) services as part of our “docomo Hikari” optical-fiber broadband offerings. In May 2016, we introduced the “Hikari Multiple Discount” package which allows families or enterprises subscribing to two or more “docomo Hikari” lines for the same group of people to share to receive discounts on monthly charges for the second and all subsequent lines. Thanks to these measures and reinforced promotional activities, the total “docomo Hikari” subscriptions grew to over 2 million in June 2016 and reached 2.07 million as of June 30, 2016. |

4

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

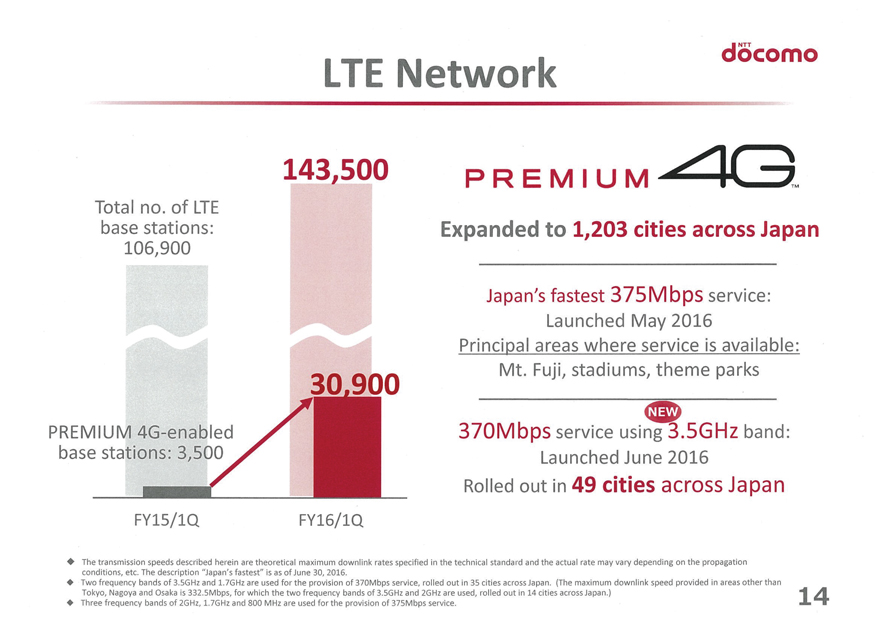

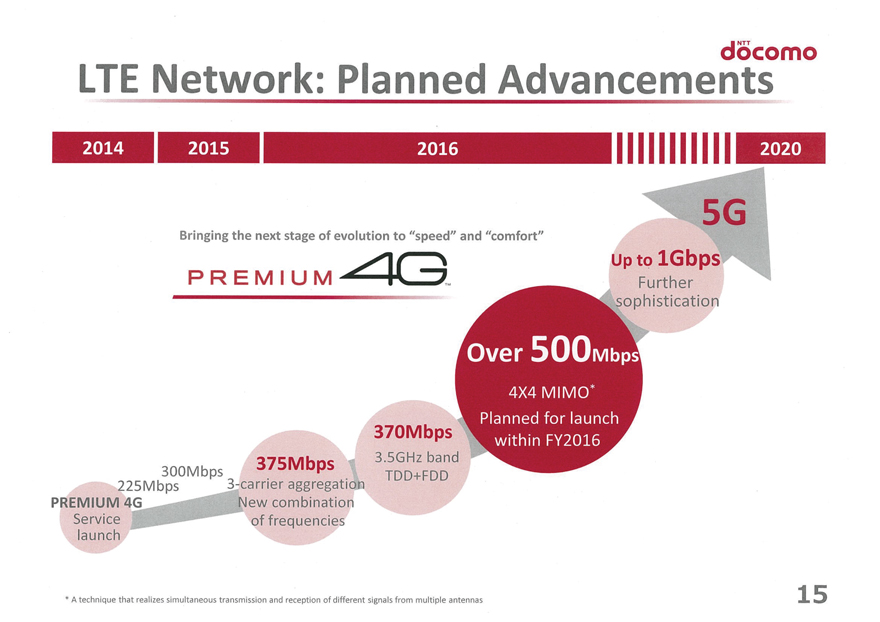

| • | To promote construction of a more convenient mobile telecommunications network, we expanded the coverage of our “PREMIUM 4G” service to 1,203 cities across Japan and 30,900 base stations as of June 30, 2016. Furthermore, from June 2016, we added a new carrier, 3.5GHz, to our service compatible with carrier aggregation*technologies, which allows us to offer a higher quality network service to our customers. Toward the goal of further expanding the coverage of our LTE service, we increased the total number of LTE-enabled base stations to 143,500 stations nationwide. |

| * | Technology that achieves improvement of data transmission speed by aggregating multiple carriers. |

Number of subscriptions by services and other operating data are as follows:

<Number of subscriptions by services>

| Thousand subscriptions | ||||||||||||||||

| June 30, 2015 | June 30, 2016 | Increase (Decrease) | ||||||||||||||

Mobile telecommunications services | 67,532 | 71,614 | 4,082 | 6.0 | % | |||||||||||

Including: “Kake-hodai & Pake-aeru” billing plan | 20,812 | 31,586 | 10,774 | 51.8 | ||||||||||||

Mobile telecommunications services (LTE(Xi)) | 32,609 | 39,893 | 7,284 | 22.3 | ||||||||||||

Mobile telecommunications services (FOMA) | 34,923 | 31,721 | (3,202 | ) | (9.2 | ) | ||||||||||

Note: | Number of subscriptions to Mobile telecommunications services, Mobile telecommunications services (LTE(Xi)) and Mobile telecommunications services (FOMA) includes Communication Module services subscriptions. |

<Number of handsets sold>

| Thousand units | ||||||||||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | Increase (Decrease) | ||||||||||||||

Number of handsets sold | 5,766 | 6,165 | 399 | 6.9 | % | |||||||||||

Mobile telecommunications services (LTE(Xi)) | ||||||||||||||||

New LTE(Xi) subscription | 1,898 | 2,446 | 548 | 28.9 | ||||||||||||

Change of subscription from FOMA | 896 | 577 | (318 | ) | (35.5 | ) | ||||||||||

LTE(Xi) handset upgrade by LTE(Xi) subscribers | 1,599 | 1,883 | 283 | 17.7 | ||||||||||||

Mobile telecommunications services (FOMA) | ||||||||||||||||

New FOMA subscription | 622 | 646 | 24 | 3.9 | ||||||||||||

Change of subscription from LTE(Xi) | 26 | 19 | (7 | ) | (26.6 | ) | ||||||||||

FOMA handset upgrade by FOMA subscribers | 725 | 593 | (132 | ) | (18.2 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Churn rate* | 0.59 | % | 0.62 | % | 0.03point | — | ||||||||||

| * | “Churn rate” is calculated excluding the subscriptions and cancellations of subscriptions of Mobile Virtual Network Operators (MVNOs). |

<Trend of ARPU and MOU>

| Yen | ||||||||||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | Increase (Decrease) | ||||||||||||||

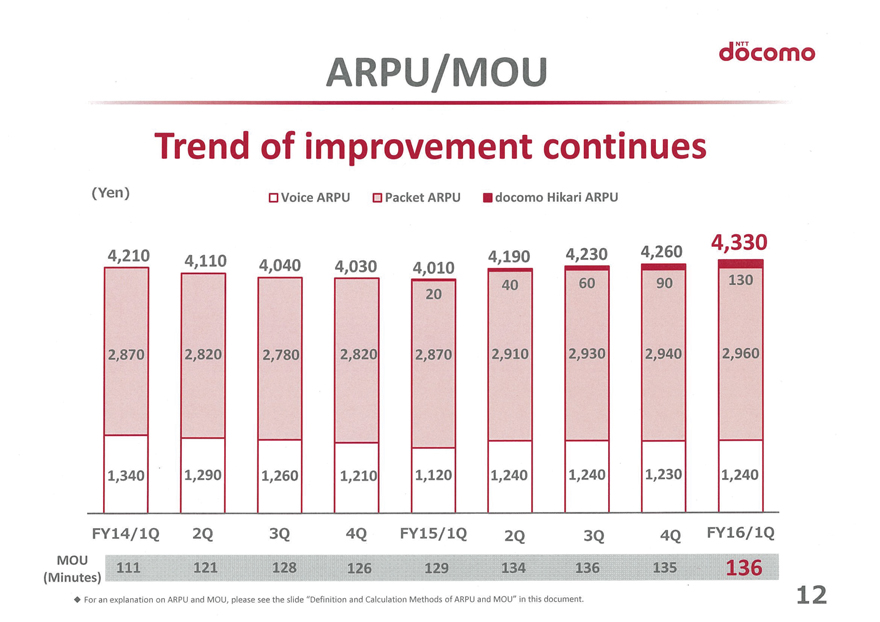

Aggregate ARPU | ¥ | 4,010 | ¥ | 4,330 | ¥ | 320 | 8.0 | % | ||||||||

Voice ARPU | 1,120 | 1,240 | 120 | 10.7 | ||||||||||||

Data ARPU | 2,890 | 3,090 | 200 | 6.9 | ||||||||||||

Packet ARPU | 2,870 | 2,960 | 90 | 3.1 | ||||||||||||

“docomo Hikari” ARPU | 20 | 130 | 110 | 550.0 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

MOU (minutes) | 129 | 136 | 7 | 5.4 | % | |||||||||||

Notes:

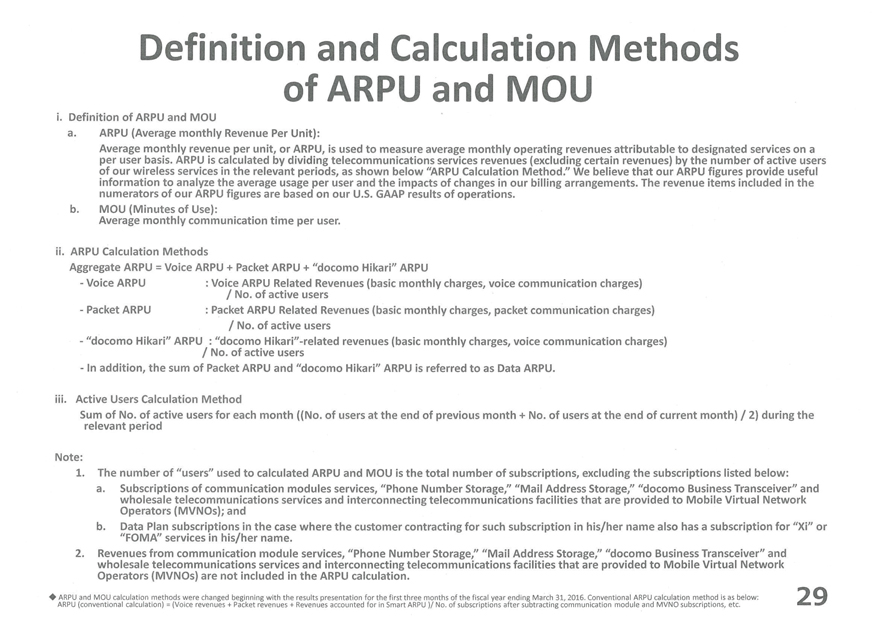

| 1. | Definition of ARPU and MOU |

| a. | ARPU (Average monthly Revenue Per Unit): |

Average monthly revenue per unit, or ARPU, is used to measure average monthly operating revenues attributable to designated services on a per user basis. ARPU is calculated by dividing telecommunications services revenues (excluding certain revenues) by the number of active users to our wireless services in the relevant periods, as shown below under “ARPU Calculation Method.” We believe that our ARPU figures provide useful information to analyze the average usage per user and the impacts of changes in our billing arrangements. The revenue items included in the numerators of our ARPU figures are based on our U.S. GAAP results of operations.

| b. | MOU (Minutes of Use): |

Average monthly communication time per user.

5

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

| 2. | ARPU Calculation Methods |

Aggregate ARPU= Voice ARPU + Packet ARPU + “docomo Hikari” ARPU | ||

- Voice ARPU | : Voice ARPU Related Revenues (basic monthly charges, voice communication charges) / Number of active users | |

- Packet ARPU | : Packet ARPU Related Revenues (basic monthly charges, packet communication charges) / Number of active users | |

-“docomo Hikari” ARPU | : A part of other operating revenues (basic monthly charges, voice communication changes) /Number of active users | |

| 3. | Active Users Calculation Method |

Sum of number of active users for each month ((number of users at the end of previous month + number of users at the end of current month) /2) during the relevant period

| 4. | The number of “users” used to calculate ARPU and MOU is the total number of subscriptions, excluding the subscriptions listed below: |

| a. | Subscriptions of communication module services, “Phone Number Storage,” “Mail Address Storage,” “docomo Business Transceiver” and wholesale telecommunication services and interconnecting telecommunications facilities that are provided to Mobile Virtual Network Operators (MVNOs); and |

| b. | Data Plan subscriptions in the case where the customer contracting for such subscription in his/her name also has a subscription for “Xi” or “FOMA” services in his/her name |

Revenues from communication module services, “Phone Number Storage,” “Mail Address Storage,” “docomo Business Transceiver” and wholesale telecommunications services and interconnecting telecommunications facilities that are provided to Mobile Virtual Network Operators (MVNOs) are not included in the ARPU calculation.

6

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

Smart life business—

<Results of operations>

| Billions of yen | ||||||||||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | Increase (Decrease) | ||||||||||||||

Operating revenues from smart life business | ¥ | 118.4 | ¥ | 125.2 | ¥ | 6.9 | 5.8 | % | ||||||||

Operating income (loss) from smart life business | 16.9 | 17.2 | 0.3 | 1.9 | ||||||||||||

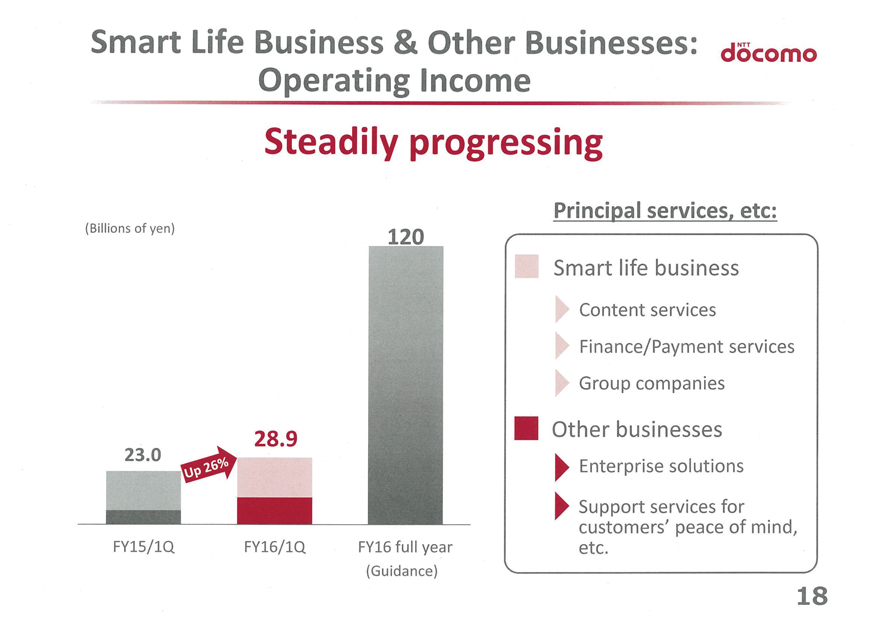

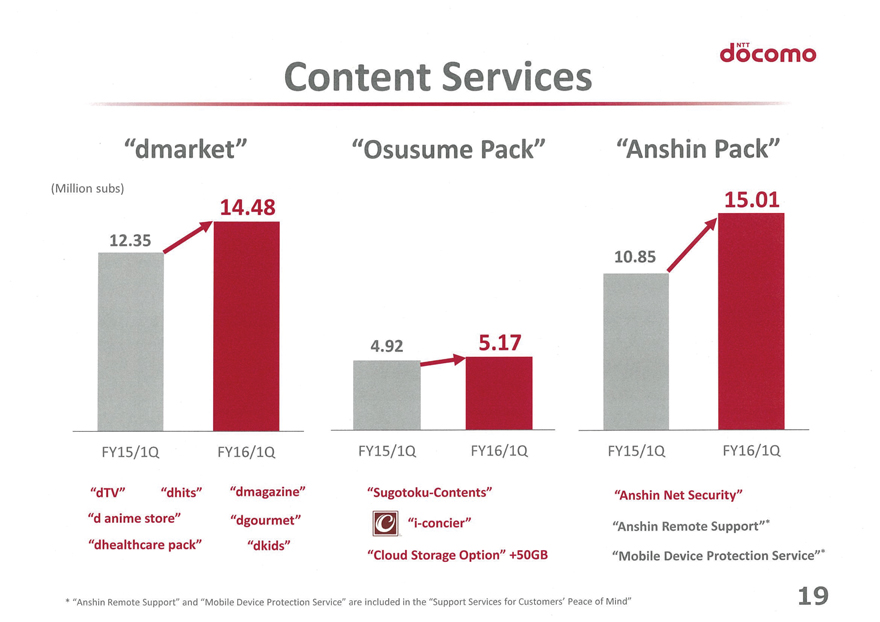

Operating revenues from smart life business for the three months ended June 30, 2016 were ¥125.2 billion, an increase of ¥6.9 billion, or 5.8%, from ¥118.4 billion for the same period of the previous fiscal year, due mainly to an expansion of content services revenues such as “dmarket” and other content services.

Operating expenses from smart life business were ¥108.0 billion, an increase of ¥6.5 billion, or 6.4%, from ¥101.5 billion for the same period of the previous fiscal year, driven primarily by an increase in expenses associated with the growth in content services revenues such as “dmarket” and other content services.

As a consequence, operating income from smart life business was ¥17.2 billion, an increase of ¥0.3 billion, or 1.9%, from ¥16.9 billion for the same period of the previous fiscal year.

<<Key Topics>>

| • | From April 2016, with the aim of providing customers with comprehensive health support, we started marketing “dhealthcare pack,” a package of health-related services which includes the new “Aruiteotoku” service that allows users to earn “d POINTs” simply by walking with smartphones. |

| • | The combined “dmarket” subscriptions* as of June 30, 2016 reached 14.48 million, an increase of by 2.13 million from June 30, 2015. Among the various “dmarket” services, “dmagazine” has been recording brisk sales with its total subscriptions growing to 3.06 million, an increase of 1.01 million from June 30, 2015. |

| • | Toward the goal of enhancing the convenience and service quality of “d POINT CARD” (a loyalty point card), starting from June 2016 we made it compatible with our “Osaifu-Keitai” electronic wallet service, allowing users to earn and use points just by waving their smartphones close to the reader machine at our “d POINT” partner stores handling “Osaifu-Keitai” payments. |

| * | The total number of users using “dTV,” “danime store,” “dhits,” “dkids,” “dmagazine,” “dgourmet” and “dhealthcare pack” services under a monthly subscription arrangement. |

7

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

Other businesses—

<Results of operations>

| Billions of yen | ||||||||||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | Increase (Decrease) | ||||||||||||||

Operating revenues from other businesses | ¥ | 85.9 | ¥ | 94.8 | ¥ | 8.9 | 10.4 | % | ||||||||

Operating income (loss) from other businesses | 6.1 | 11.7 | 5.6 | 91.5 | ||||||||||||

Operating revenues from other businesses for the three months ended June 30, 2016 amounted to ¥94.8 billion, an increase of ¥8.9 billion, or 10.4%, from ¥85.9 billion for the same period of the previous fiscal year, driven mainly by an increase number of subscriptions for our “Mobile Device Protection Service” and the growth of revenues relating to IoT businesses.

Operating expenses from other businesses were ¥83.1 billion, an increase of ¥3.4 billion, or 4.2%, from ¥79.8 billion for the same period of the previous fiscal year, as a result of rises in expenses associated with the expansion of revenues from our “Mobile Device Protection Service” and other services.

Consequently, operating income from other businesses was ¥11.7 billion, an increase of ¥5.6 billion, or 91.5%, from ¥6.1 billion for the same period of the previous fiscal year.

<<Key Topics>>

| • | To allow customers to utilize LTE connections in IoT solutions that involve high-speed transmission of large-capacity content, we started marketing our first embedded LTE ubiquitous module, “UMO4-KO.” The module can be used for a wide range of applications when combined with our rate option “LTE ubiquitous plan” as it allows use over high-speed connections as well as use with reduced power consumption during low-speed access. |

| • | From April 2016, as part of our undertakings to promote the adoption of ICT in agriculture, we started marketing equipments for “PaddyWatch,” a water management support system for rice production developed by vegitalia, inc., embedded with our communication module. At the same time, we also commenced the sales of “Agri-note,” a service developed by Water Cell, Inc. that allows producers to record their daily farm activities on the screens of smartphones and other devices utilizing the aerial photographs of farmlands, by making it available through our “Business Plus” service menu for enterprise clients. |

8

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

iii. CSR Activities

We aspire to help build a society in which everyone can share in a prosperous life of safety and security, beyond borders and across generations. We believe it is our corporate social responsibility (“CSR”) to fulfill the two aspects of (i) “Innovative docomo,” to solve various social issues in the fields of IoT, medicine, healthcare, education and agriculture through the “co-creation of social values,” an initiative that we plan to pursue together with various partners to create new services and businesses, and (ii) “Responsible docomo,” to thoroughly ensure fair, transparent and ethical business operations as a foundation for the creation of such values. Accordingly, we will strive realize a sustainable society while expanding our own businesses.

The principal CSR actions undertaken during the three months ended June 30, 2016 are summarized below:

<Innovative docomo>

| • | In April 2016, we entered into a “business collaboration agreement for the use of ICT and data” with Kobe City for the purpose of solving various social issues in the regional community, such as the monitoring of the safety of children and the elderly and the development of human resources proficient in ICT, by fostering collaboration in the fields of ICT and data utilization. |

<Responsible docomo >

| • | The power outages and transmission line disruptions caused by the 2016 Kumamoto Earthquakes forced us to temporarily suspend services in a part of coverage area of our mobile communications services, but we have been able to continue to offer services in all areas around municipality offices in Kumamoto and Oita prefectures owing to our constant preparation for disaster. As a result of establishing a disaster response office without delay and devoting utmost effort to secure communications and restore services as quickly as possible, we successfully restored the services in all areas around the evacuation shelters by April 18, 2016, the second day after the main tremor, and restored coverage to pre-disaster levels by April 20, 2016, the fourth day after the main tremor, except for certain areas where access was restricted by the government. We also extended a broad range of assistance to the disaster victims, including the provision of free battery charging services and Wi-Fi spots at evacuation shelters and free-of-charge rental of mobile phones and others to administrative organizations. |

| • | We set up a charity website in the aftermath of the earthquakes that struck Kumamoto, Japan and Ecuador in 2016, and collected donations from a large number of people. We also provided relief funds for the 2016 Kumamoto Earthquakes to help support the people and regions affected by the disaster. |

| • | We held a total of approximately 2,200 sessions of “Smartphone and Mobile Phone Safety Class” garnering a cumulative participation of approximately 0.49 million people during the three months ended June 30, 2016. The classes enlighten participants on rules and manners of using smartphones and mobile phones, and inform them as to how to respond to troubles that may arise with their use. In April 2016, we launched a new initiative convening the class in conjunction with the crime prevention seminar hosted by the Hiroshima Prefectural Police. |

9

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

iv. Trend of Capital Expenditures

<Capital expenditures>

| Billions of yen | ||||||||||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | Increase (Decrease) | ||||||||||||||

Total capital expenditures | ¥ | 93.1 | ¥ | 97.1 | ¥ | 4.0 | 4.3 | % | ||||||||

Telecommunications business | 89.1 | 93.8 | 4.8 | 5.4 | ||||||||||||

Smart life business | 2.6 | 2.2 | (0.4 | ) | (14.8 | ) | ||||||||||

Other businesses | 1.5 | 1.1 | (0.4 | ) | (27.4 | ) | ||||||||||

We pursued more efficient use of capital expenditures and further cost reduction, and expanded the coverage of our “PREMIUM 4G” service to construct a more convenient mobile telecommunications network. Furthermore, we added a new carrier, 3.5GHz, to our service compatible with carrier aggregation technologies.

As a result, the total amount of capital expenditures we made increased by 4.3% from the same period of the previous fiscal year to ¥97.1 billion for the three months ended June 30, 2016.

10

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

i. Financial Position

| Billions of yen | ||||||||||||||||||||

| June 30, 2015 | June 30, 2016 | Increase (Decrease) | (Reference) March 31, 2016 | |||||||||||||||||

Total assets | ¥ | 7,072.7 | ¥ | 6,933.2 | ¥ | (139.4 | ) | (2.0 | )% | ¥ | 7,214.1 | |||||||||

NTT DOCOMO, INC. shareholders’ equity | 5,407.9 | 5,302.6 | (105.3 | ) | (1.9 | ) | 5,302.2 | |||||||||||||

Liabilities | 1,628.9 | 1,577.7 | (51.2 | ) | (3.1 | ) | 1,854.8 | |||||||||||||

Including: Interest bearing liabilities | 316.1 | 222.1 | (94.0 | ) | (29.7 | ) | 222.2 | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Shareholders’ equity ratio (1) (%) | 76.5 | % | 76.5 | % | 0.0point | — | 73.5 | % | ||||||||||||

Debt to Equity ratio (2) (multiple) | 0.058 | 0.042 | (0.016 | ) | — | 0.042 | ||||||||||||||

Notes: | (1) | Shareholders’ equity ratio = NTT DOCOMO, INC. shareholders’ equity / Total assets | ||

(2) | Debt to Equity ratio = Interest bearing liabilities / NTT DOCOMO, INC. shareholders’ equity |

ii. Cash Flow Conditions

| Billions of yen | ||||||||||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | Increase (Decrease) | ||||||||||||||

Net cash provided by operating activities | ¥ | 273.8 | ¥ | 243.8 | ¥ | (30.0 | ) | (11.0 | )% | |||||||

Net cash used in investing activities | (208.4 | ) | (208.8 | ) | (0.4 | ) | (0.2 | ) | ||||||||

Net cash provided by (used in) financing activities | (43.8 | ) | (190.0 | ) | (146.1 | ) | (333.3 | ) | ||||||||

Free cash flows (1) | 65.4 | 35.0 | (30.4 | ) | (46.5 | ) | ||||||||||

Free cash flows excluding changes in investments for cash management purposes (2)* | 65.4 | 34.9 | (30.5 | ) | (46.7 | ) | ||||||||||

Notes: | (1) | Free cash flows = Net cash provided by operating activities + Net cash used in investing activities | ||

(2) | Changes in investments for cash management purposes = Changes by purchases, redemption at maturity and disposals of financial instruments held for cash management purposes with original maturities of longer than three months |

| * | See “4. Reconciliations of the Disclosed Non-GAAP Financial Measures to the Most Directly Comparable GAAP Financial Measures” on page 19. |

For the three months ended June 30, 2016, net cash provided by operating activities was ¥243.8 billion, a decrease of ¥30.0 billion, or 11.0%, from the same period of the previous fiscal year. This was due mainly to an increase in cash outflows for the payments of income taxes, despite an increase in cash inflows from customers in relation to collections of installment receivables for customers’ handset purchases, which are included in decrease in receivables for sale.

Net cash used in investing activities was ¥208.8 billion, an increase of ¥0.4 billion, or 0.2%, from the same period of the previous fiscal year. This was due mainly to an increase in cash outflows for purchases of property, plant and equipment.

Net cash used in financing activities was ¥190.0 billion, an increase of ¥146.1 billion, or 333.3%, from the same period of the previous fiscal year. This was due mainly to a decrease in cash inflows from proceeds from short-term borrowings and an increase in cash outflows for payments to acquire treasury stock.

As a result of the foregoing, the balance of cash and cash equivalents was ¥198.6 billion as of June 30, 2016, a decrease of ¥155.9 billion, or 44.0%, from the previous fiscal year end.

11

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

(3) Prospects for the Fiscal Year Ending March 31, 2017

Japan’s telecommunications market has seen a dramatic change due to the entry of a wide range of players into the market, which has resulted in severe and continuous competition among them, as well as the government’s adoption of a pro-competition policy. Under such market conditions, we will continue our efforts to strengthen competitiveness of our telecommunications business by using driving forces, such as the proliferation of our billing plan “Kake-hodai & Pake-aeru” launched in June 2014, as well as the “docomo Hikari” optical-fiber broadband service and the “docomo Hikari Pack” bundle discount packages launched in March 2015. In addition, we will continue our “+d” value co-creation initiatives, aiming to deliver new values by making available the business assets that we have accumulated through our operations, such as our payment platform and loyalty program. Through these endeavors, we expect to post an increase in both operating revenues and operating income for the fiscal year ending March 31, 2017.

Although we expect a decline in revenues from equipment sales, we estimate that operating revenues for the fiscal year ending March 31, 2017 will increase by ¥92.9 billion from the previous fiscal year to ¥4,620.0 billion, driven by an increase in mobile communications services revenues as a result of the rise in smartphone use, the strong demand for tablets and other products purchased as a second mobile device for individual use, and initiatives aimed at boosting the packet consumption of our “Kake-hodai & Pake-aeru” billing plan subscribers, an increase in optical-fiber broadband service and other telecommunications services revenues due to the projected growth of “docomo Hikari” users, and an increase in revenues from smart life business and other businesses. On the expenses side, although we project an increase in expenses associated with the growth of revenues from smart life business and other businesses and the expansion of “docomo Hikari” revenues, operating expenses are expected to decrease by ¥34.1 billion to ¥3,710.0 billion, owing primarily to a decline of depreciation expenses as a result of our change in depreciation method used from the declining-balance method to the straight-line method, as well as a decrease in cost of equipment sold and initiatives to pursue further cost efficiency. Accordingly, operating income for the fiscal year ending March 31, 2017 is estimated to be ¥910.0 billion, an increase of ¥127.0 billion from the previous fiscal year.

As we are not currently aware of any factor that may have a material impact on our projected results of operations, we have not revised our forecasts announced on April 28, 2016.

12

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

(1) Changes in Significant Subsidiaries

None

(2) Application of Simplified or Exceptional Accounting

None

(3) Change in Accounting Policies

Change in depreciation method

Previously, DOCOMO principally used the declining-balance method for calculating depreciation of property, plant, and equipment. Effective April 1, 2016, DOCOMO adopted the straight-line method of depreciation. Data traffic has recently grown due to increased use of smartphones. As a way of addressing the rising data traffic, DOCOMO provides LTE-Advanced services, using the carrier aggregation technology which enables higher speeds and capacities for the LTE services. With the introduction of the carrier aggregation technology, DOCOMO is able to use its frequencies more efficiently, bringing stability to DOCOMO’s operation of its wireless telecommunications equipment. As a result, DOCOMO believes that the straight-line depreciation method better reflects the pattern of consumption of the future benefits to be derived from those assets being depreciated. The effect of the change in the depreciation method is recognized prospectively as a change in the accounting estimate pursuant to the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 250, “Accounting Changes and Error Corrections.”

The change in depreciation method caused a decrease in “Depreciation and amortization” by ¥33,381 million for the three months ended June 30, 2016. “Net income attributable to NTT DOCOMO, INC.” and “Basic and Diluted earnings per share attributable to NTT DOCOMO, INC.” increased by ¥22,833 million and ¥6.08, respectively, for the three months ended June 30, 2016.

13

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

3. Consolidated Financial Statements

(1) Consolidated Balance Sheets

| Millions of yen | ||||||||

| March 31, 2016 | June 30, 2016 | |||||||

ASSETS | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | ¥ | 354,437 | ¥ | 198,583 | ||||

Short-term investments | 5,872 | 5,726 | ||||||

Accounts receivable | 237,040 | 157,916 | ||||||

Receivables held for sale | 972,851 | 956,863 | ||||||

Credit card receivables | 276,492 | 296,226 | ||||||

Other receivables | 381,096 | 383,209 | ||||||

Allowance for doubtful accounts | (17,427 | ) | (19,191 | ) | ||||

Inventories | 153,876 | 171,059 | ||||||

Deferred tax assets | 107,058 | 98,023 | ||||||

Prepaid expenses and other current assets | 108,898 | 125,794 | ||||||

|

|

|

| |||||

Total current assets | 2,580,193 | 2,374,208 | ||||||

|

|

|

| |||||

Property, plant and equipment: | ||||||||

Wireless telecommunications equipment | 5,084,416 | 5,099,923 | ||||||

Buildings and structures | 896,815 | 898,212 | ||||||

Tools, furniture and fixtures | 468,800 | 470,524 | ||||||

Land | 199,054 | 199,141 | ||||||

Construction in progress | 190,261 | 183,691 | ||||||

Accumulated depreciation and amortization | (4,398,970 | ) | (4,423,596 | ) | ||||

|

|

|

| |||||

Total property, plant and equipment, net | 2,440,376 | 2,427,895 | ||||||

|

|

|

| |||||

Non-current investments and other assets: | ||||||||

Investments in affiliates | 411,395 | 395,231 | ||||||

Marketable securities and other investments | 182,905 | 167,881 | ||||||

Intangible assets, net | 615,013 | 604,504 | ||||||

Goodwill | 243,695 | 241,692 | ||||||

Other assets | 479,103 | 465,138 | ||||||

Deferred tax assets | 261,434 | 256,687 | ||||||

|

|

|

| |||||

Total non-current investments and other assets | 2,193,545 | 2,131,133 | ||||||

|

|

|

| |||||

Total assets | ¥ | 7,214,114 | ¥ | 6,933,236 | ||||

|

|

|

| |||||

LIABILITIES AND EQUITY | ||||||||

Current liabilities: | ||||||||

Current portion of long-term debt | ¥ | 200 | ¥ | 200 | ||||

Short-term borrowings | 1,764 | 1,755 | ||||||

Accounts payable, trade | 793,084 | 600,810 | ||||||

Accrued payroll | 53,837 | 40,688 | ||||||

Accrued income taxes | 165,332 | 66,573 | ||||||

Other current liabilities | 205,602 | 236,160 | ||||||

|

|

|

| |||||

Total current liabilities | 1,219,819 | 946,186 | ||||||

|

|

|

| |||||

Long-term liabilities: | ||||||||

Long-term debt (exclusive of current portion) | 220,200 | 220,170 | ||||||

Accrued liabilities for point programs | 75,182 | 67,655 | ||||||

Liability for employees’ retirement benefits | 201,604 | 203,504 | ||||||

Other long-term liabilities | 137,983 | 140,209 | ||||||

|

|

|

| |||||

Total long-term liabilities | 634,969 | 631,538 | ||||||

|

|

|

| |||||

Total liabilities | 1,854,788 | 1,577,724 | ||||||

|

|

|

| |||||

Redeemable noncontrolling interests | 16,221 | 16,412 | ||||||

|

|

|

| |||||

Equity: | ||||||||

NTT DOCOMO, INC. shareholders’ equity | ||||||||

Common stock | 949,680 | 949,680 | ||||||

Additional paid-in capital | 330,482 | 329,903 | ||||||

Retained earnings | 4,413,030 | 4,488,262 | ||||||

Accumulated other comprehensive income (loss) | 14,888 | (4,764 | ) | |||||

Treasury stock | (405,832 | ) | (460,473 | ) | ||||

Total NTT DOCOMO, INC. shareholders’ equity | 5,302,248 | 5,302,608 | ||||||

Noncontrolling interests | 40,857 | 36,492 | ||||||

|

|

|

| |||||

Total equity | 5,343,105 | 5,339,100 | ||||||

|

|

|

| |||||

Total liabilities and equity | ¥ | 7,214,114 | ¥ | 6,933,236 | ||||

|

|

|

| |||||

14

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

(2) Consolidated Statements of Income and Consolidated Statements of Comprehensive Income

Consolidated Statements of Income

| Millions of yen | ||||||||

| Three Months Ended June 30, 2015 | Three Months Ended June 30, 2016 | |||||||

Operating revenues: | ||||||||

Telecommunications services | ¥ | 675,255 | ¥ | 729,708 | ||||

Equipment sales | 201,345 | 165,753 | ||||||

Other operating revenues | 200,264 | 213,209 | ||||||

|

|

|

| |||||

Total operating revenues | 1,076,864 | 1,108,670 | ||||||

|

|

|

| |||||

Operating expenses: | ||||||||

Cost of services (exclusive of items shown separately below) | 288,904 | 304,479 | ||||||

Cost of equipment sold (exclusive of items shown separately below) | 175,531 | 154,977 | ||||||

Depreciation and amortization | 145,572 | 109,715 | ||||||

Selling, general and administrative | 231,462 | 240,208 | ||||||

|

|

|

| |||||

Total operating expenses | 841,469 | 809,379 | ||||||

|

|

|

| |||||

Operating income | 235,395 | 299,291 | ||||||

|

|

|

| |||||

Other income (expense): | ||||||||

Interest expense | (312 | ) | (240 | ) | ||||

Interest income | 179 | 155 | ||||||

Other, net | 5,349 | (3,914 | ) | |||||

|

|

|

| |||||

Total other income (expense) | 5,216 | (3,999 | ) | |||||

|

|

|

| |||||

Income before income taxes and equity in net income (losses) of affiliates | 240,611 | 295,292 | ||||||

|

|

|

| |||||

Income taxes: | ||||||||

Current | 70,293 | 69,256 | ||||||

Deferred | 2,328 | 20,392 | ||||||

|

|

|

| |||||

Total income taxes | 72,621 | 89,648 | ||||||

|

|

|

| |||||

Income before equity in net income (losses) of affiliates | 167,990 | 205,644 | ||||||

|

|

|

| |||||

Equity in net income (losses) of affiliates (including impairment charges of investments in affiliates) | 1,619 | 992 | ||||||

|

|

|

| |||||

Net income | 169,609 | 206,636 | ||||||

|

|

|

| |||||

Less: Net (income) loss attributable to noncontrolling interests | (825 | ) | 218 | |||||

|

|

|

| |||||

Net income attributable to NTT DOCOMO, INC. | ¥ | 168,784 | ¥ | 206,854 | ||||

|

|

|

| |||||

Per Share Data | ||||||||

Weighted average common shares outstanding – Basic and Diluted | 3,881,483,829 | 3,754,094,845 | ||||||

|

|

|

| |||||

Basic and Diluted earnings per share attributable to NTT DOCOMO, INC. | ¥ | 43.48 | ¥ | 55.10 | ||||

|

|

|

| |||||

Consolidated Statements of Comprehensive Income |

| |||||||

| Millions of yen | ||||||||

| Three Months Ended June 30, 2015 | Three Months Ended June 30, 2016 | |||||||

Net income | ¥ | 169,609 | ¥ | 206,636 | ||||

Other comprehensive income (loss): | ||||||||

Unrealized holding gains (losses) on available-for-sale securities, net of applicable taxes | 1,730 | (11,821 | ) | |||||

Unrealized gains (losses) on cash flow hedges, net of applicable taxes | (23 | ) | (72 | ) | ||||

Foreign currency translation adjustment, net of applicable taxes | (6,716 | ) | (8,105 | ) | ||||

Pension liability adjustment, net of applicable taxes | (26 | ) | 141 | |||||

|

|

|

| |||||

Total other comprehensive income (loss) | (5,035 | ) | (19,857 | ) | ||||

|

|

|

| |||||

Comprehensive income | 164,574 | 186,779 | ||||||

|

|

|

| |||||

Less: Comprehensive (income) loss attributable to noncontrolling interests | (856 | ) | 423 | |||||

|

|

|

| |||||

Comprehensive income attributable to NTT DOCOMO, INC. | ¥ | 163,718 | ¥ | 187,202 | ||||

|

|

|

| |||||

15

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

(3) Consolidated Statements of Cash Flows

| Millions of yen | ||||||||

| Three Months Ended June 30, 2015 | Three Months Ended June 30, 2016 | |||||||

Cash flows from operating activities: | ||||||||

Net income | ¥ | 169,609 | ¥ | 206,636 | ||||

Adjustments to reconcile net income to net cash provided by operating activities– | ||||||||

Depreciation and amortization | 145,572 | 109,715 | ||||||

Deferred taxes | 2,328 | 20,392 | ||||||

Loss on sale or disposal of property, plant and equipment | 6,379 | 3,963 | ||||||

Inventory write-downs | 770 | 4,076 | ||||||

Impairment loss on marketable securities and other investments | — | 853 | ||||||

Equity in net (income) losses of affiliates (including impairment charges of investments in affiliates) | (1,619 | ) | (992 | ) | ||||

Dividends from affiliates | 4,160 | 4,837 | ||||||

Changes in assets and liabilities: | ||||||||

(Increase) / decrease in accounts receivable | 81,894 | 78,707 | ||||||

(Increase) / decrease in receivables held for sale | (5,708 | ) | 15,988 | |||||

(Increase) / decrease in credit card receivables | (6,224 | ) | (10,778 | ) | ||||

(Increase) / decrease in other receivables | (7,179 | ) | (3,384 | ) | ||||

Increase / (decrease) in allowance for doubtful accounts | 893 | 1,756 | ||||||

(Increase) / decrease in inventories | (24,058 | ) | (21,333 | ) | ||||

(Increase) / decrease in prepaid expenses and other current assets | (16,365 | ) | (17,549 | ) | ||||

(Increase) / decrease in non-current receivables held for sale | 3,278 | 21,618 | ||||||

Increase / (decrease) in accounts payable, trade | (85,782 | ) | (90,114 | ) | ||||

Increase / (decrease) in accrued income taxes | (307 | ) | (98,738 | ) | ||||

Increase / (decrease) in other current liabilities | 26,887 | 32,519 | ||||||

Increase / (decrease) in accrued liabilities for point programs | (8,169 | ) | (7,527 | ) | ||||

Increase / (decrease) in liability for employees’ retirement benefits | 1,865 | 1,905 | ||||||

Increase / (decrease) in other long-term liabilities | 679 | 3,782 | ||||||

Other, net | (15,105 | ) | (12,538 | ) | ||||

|

|

|

| |||||

Net cash provided by operating activities | 273,798 | 243,794 | ||||||

|

|

|

| |||||

Cash flows from investing activities: | ||||||||

Purchases of property, plant and equipment | (130,531 | ) | (125,769 | ) | ||||

Purchases of intangible and other assets | (72,028 | ) | (78,535 | ) | ||||

Purchases of non-current investments | (1,359 | ) | (743 | ) | ||||

Proceeds from sale of non-current investments | 1,054 | 1,611 | ||||||

Purchases of short-term investments | (1,684 | ) | (5,428 | ) | ||||

Redemption of short-term investments | 1,621 | 5,546 | ||||||

Other, net | (5,518 | ) | (5,480 | ) | ||||

|

|

|

| |||||

Net cash used in investing activities | (208,445 | ) | (208,798 | ) | ||||

|

|

|

| |||||

Cash flows from financing activities: | ||||||||

Proceeds from short-term borrowings | 143,798 | 5,754 | ||||||

Repayment of short-term borrowings | (50,146 | ) | (5,754 | ) | ||||

Principal payments under capital lease obligations | (379 | ) | (311 | ) | ||||

Payments to acquire treasury stock | (0 | ) | (54,641 | ) | ||||

Dividends paid | (134,332 | ) | (130,524 | ) | ||||

Cash distributions to noncontrolling interests | (2,310 | ) | (3,500 | ) | ||||

Other, net | (474 | ) | (990 | ) | ||||

|

|

|

| |||||

Net cash provided by (used in) financing activities | (43,843 | ) | (189,966 | ) | ||||

|

|

|

| |||||

Effect of exchange rate changes on cash and cash equivalents | (718 | ) | (884 | ) | ||||

|

|

|

| |||||

Net increase (decrease) in cash and cash equivalents | 20,792 | (155,854 | ) | |||||

Cash and cash equivalents as of beginning of period | 105,553 | 354,437 | ||||||

|

|

|

| |||||

Cash and cash equivalents as of end of period | ¥ | 126,345 | ¥ | 198,583 | ||||

|

|

|

| |||||

Supplemental disclosures of cash flow information: | ||||||||

Cash received during the period for: | ||||||||

Income tax refunds | ¥ | 653 | ¥ | 3 | ||||

Cash paid during the period for: | ||||||||

Interest, net of amount capitalized | 265 | 213 | ||||||

Income taxes | 74,492 | 167,075 | ||||||

|

|

|

| |||||

16

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

(4) Notes to Consolidated Financial Statements

i. Note to Going Concern Assumption

There is no corresponding item.

ii. Significant Changes in NTT DOCOMO, INC. Shareholders’ Equity

None

iii. Segment Information

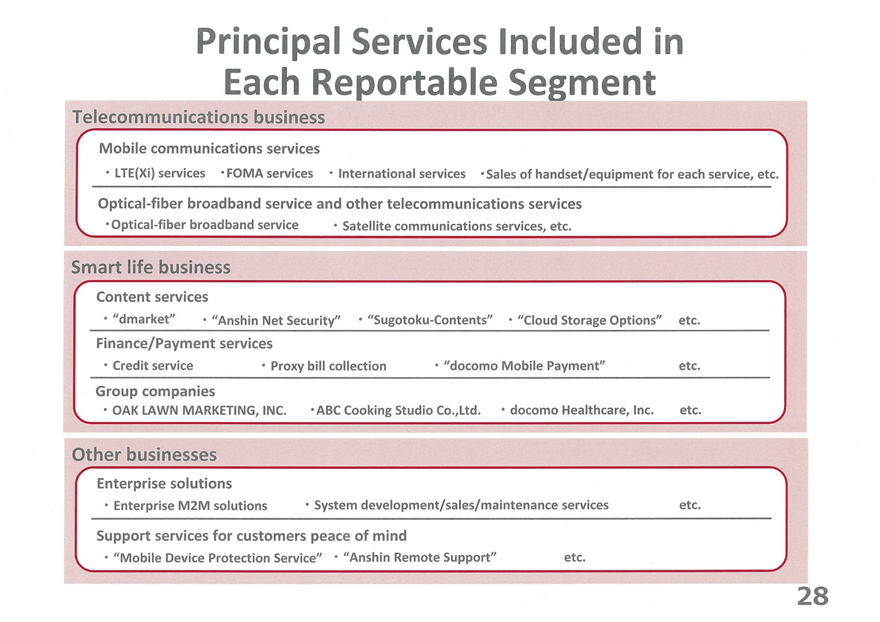

DOCOMO’s chief operating decision maker (the “CODM”) is its board of directors. The CODM evaluates the performance and makes resource allocations of its segments based on the information provided by DOCOMO’s internal management reports.

DOCOMO has three operating segments, which consist of telecommunications business, smart life business and other businesses.

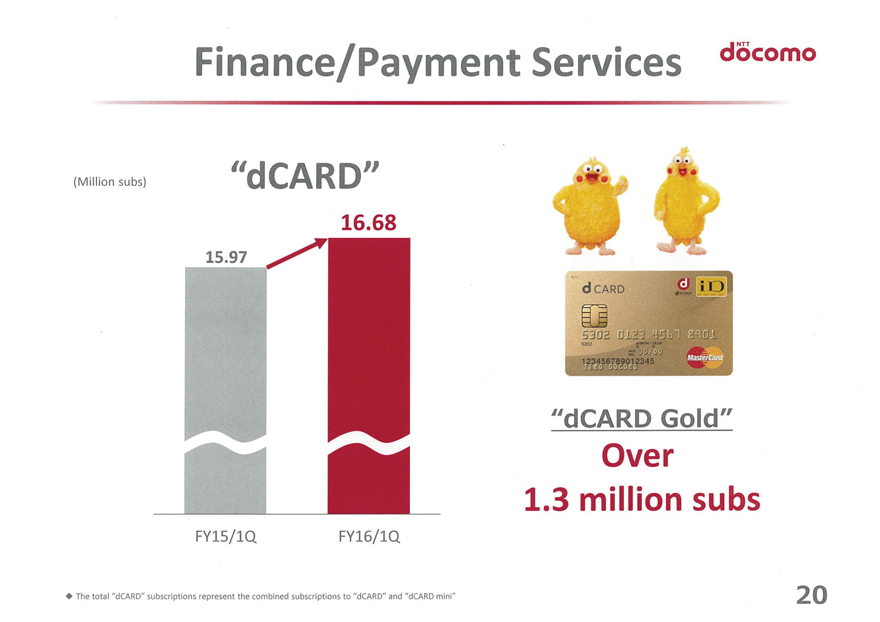

The telecommunications business includes mobile phone services (LTE(Xi) services and FOMA services), optical-fiber broadband service, satellite mobile communications services, international services and the equipment sales related to these services. The smart life business includes video and music distribution, electronic books and other services offered through DOCOMO’s “dmarket” portal, as well as finance/payment services, shopping services and various other services to support our customers’ daily lives. The other businesses primarily includes “Mobile Device Protection Service,” as well as development, sales and maintenance of IT systems.

Certain Machine-to-Machine (M2M) services for consumers that had been included in other businesses were reclassified to the smart life business from the second quarter of the fiscal year ended March 31, 2016 to reflect the change in its internal organizational structure effective as of July 1, 2015.

In connection with this realignment, segment information for the three months ended June 30, 2015 has been restated to conform, to the presentation for the three months ended June 30, 2016.

Accounting policies used to determine segment operating revenues and operating income (loss) are consistent with those used to prepare the consolidated financial statements in accordance with U.S. GAAP.

Segment operating revenues:

| Millions of yen | ||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | |||||||

Telecommunications business- | ||||||||

External customers | ¥ | 878,374 | ¥ | 894,659 | ||||

Intersegment | 250 | 265 | ||||||

|

|

|

| |||||

Subtotal | 878,624 | 894,924 | ||||||

Smart life business- | ||||||||

External customers | 115,515 | 122,161 | ||||||

Intersegment | 2,872 | 3,088 | ||||||

|

|

|

| |||||

Subtotal | 118,387 | 125,249 | ||||||

Other businesses- | ||||||||

External customers | 82,975 | 91,850 | ||||||

Intersegment | 2,901 | 2,961 | ||||||

|

|

|

| |||||

Subtotal | 85,876 | 94,811 | ||||||

|

|

|

| |||||

Segment total | 1,082,887 | 1,114,984 | ||||||

Elimination | (6,023 | ) | (6,314 | ) | ||||

|

|

|

| |||||

Consolidated | ¥ | 1,076,864 | ¥ | 1,108,670 | ||||

|

|

|

| |||||

17

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

Segment operating income (loss):

| Millions of yen | ||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | |||||||

Telecommunications business | ¥ | 212,420 | ¥ | 270,410 | ||||

Smart life business | 16,876 | 17,203 | ||||||

Other businesses | 6,099 | 11,678 | ||||||

|

|

|

| |||||

Consolidated | ¥ | 235,395 | ¥ | 299,291 | ||||

|

|

|

| |||||

Segment operating income (loss) is segment operating revenues less segment operating expenses.

As indicated in “2. (3) Changes in Accounting Policies,” previously, DOCOMO principally used the declining-balance method for calculating depreciation of property, plant, and equipment. Effective April 1, 2016, DOCOMO adopted the straight-line method of depreciation. As a result, compared with the depreciation method used prior to April 1, 2016, operating income for the Telecommunications business segment, Smart life business segment, and Other businesses segment for the three months ended June 30, 2016 increased by ¥33,350 million, ¥12 million and ¥19 million, respectively.

DOCOMO does not disclose geographical information because the amounts of operating revenues generated outside Japan are immaterial.

18

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

Reconciliations of the Disclosed Non-GAAP Financial Measures to the Most Directly Comparable GAAP Financial Measures

i. EBITDA and EBITDA margin

| Billions of yen | ||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | |||||||

a. EBITDA | ¥ | 387.3 | ¥ | 413.0 | ||||

|

|

|

| |||||

Depreciation and amortization | (145.6 | ) | (109.7 | ) | ||||

Loss on sale or disposal of property, plant and equipment | (6.4 | ) | (4.0 | ) | ||||

|

|

|

| |||||

Operating income | 235.4 | 299.3 | ||||||

|

|

|

| |||||

Other income (expense) | 5.2 | (4.0 | ) | |||||

Income taxes | (72.6 | ) | (89.6 | ) | ||||

Equity in net income (losses) of affiliates | 1.6 | 1.0 | ||||||

Less: Net (income) loss attributable to noncontrolling interests | (0.8 | ) | 0.2 | |||||

|

|

|

| |||||

b. Net income attributable to NTT DOCOMO, INC. | 168.8 | 206.9 | ||||||

|

|

|

| |||||

c. Operating revenues | 1,076.9 | 1,108.7 | ||||||

|

|

|

| |||||

EBITDA margin (=a/c) | 36.0 | % | 37.2 | % | ||||

Net income margin (=b/c) | 15.7 | % | 18.7 | % | ||||

|

|

|

| |||||

Note: | EBITDA and EBITDA margin, as we use them, are different from EBITDA as used in Item 10(e) of regulation S-K and may not be comparable to similarly titled measures used by other companies. |

ii. ROE

| Billions of yen | ||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | |||||||

a. Net income attributable to NTT DOCOMO, INC. | ¥ | 168.8 | ¥ | 206.9 | ||||

b. Shareholders’ equity | 5,394.0 | 5,302.4 | ||||||

|

|

|

| |||||

ROE (=a/b) | 3.1 | % | 3.9 | % | ||||

|

|

|

| |||||

Note: | Shareholders’ equity = The average of NTT DOCOMO, INC. shareholders’ equity, each as of March 31, 2016 (or 2015) and June 30, 2016 (or 2015). |

iii. Free cash flows excluding changes in investments for cash management purposes

| Billions of yen | ||||||||

| Three months ended June 30, 2015 | Three months ended June 30, 2016 | |||||||

Net cash provided by operating activities | ¥ | 273.8 | ¥ | 243.8 | ||||

Net cash used in investing activities | (208.4 | ) | (208.8 | ) | ||||

|

|

|

| |||||

Free cash flows | 65.4 | 35.0 | ||||||

|

|

|

| |||||

Changes in investments for cash management purposes | (0.1 | ) | 0.1 | |||||

|

|

|

| |||||

Free cash flows excluding changes in investments for cash management purposes | 65.4 | 34.9 | ||||||

|

|

|

| |||||

Note: | Changes in investments for cash management purposes were derived from purchases, redemption at maturity and disposals of financial instruments held for cash management purposes with original maturities of longer than three months. | |

Net cash used in investing activities includes changes in investments for cash management purposes. | ||

19

Table of Contents

| DOCOMO Earnings Release | Three Months Ended June 30, 2016 |

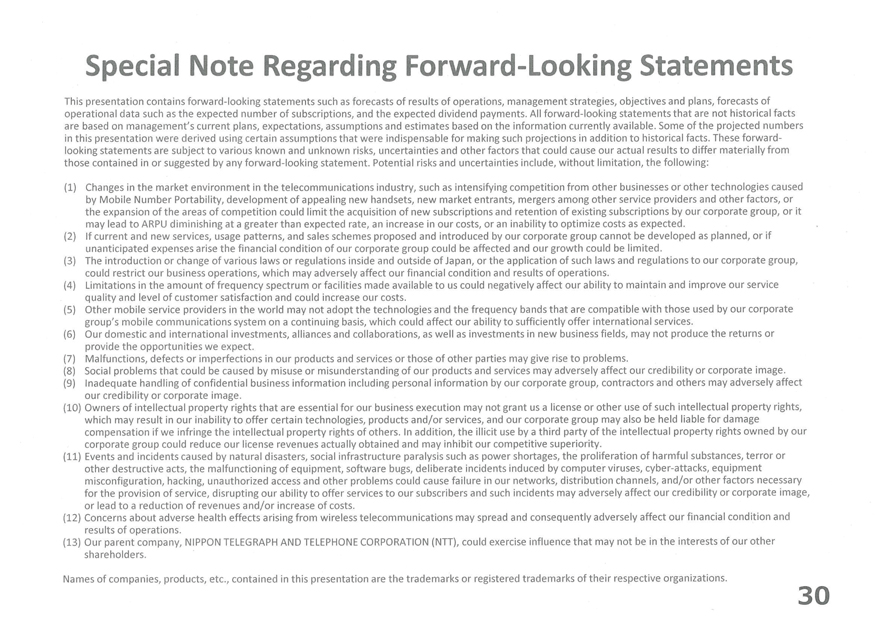

5. Special Note Regarding Forward-Looking Statements

This earning release contains forward-looking statements such as forecasts of results of operations, management strategies, objectives and plans, forecasts of operational data such as the expected number of subscriptions, and the expected dividend payments. All forward-looking statements that are not historical facts are based on management’s current plans, expectations, assumptions and estimates based on the information currently available. Some of the projected numbers in this report were derived using certain assumptions that were indispensable for making such projections in addition to historical facts. These forward-looking statements are subject to various known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from those contained in or suggested by any forward-looking statement. Potential risks and uncertainties include, without limitation, the following:

| (1) | Changes in the market environment in the telecommunications industry, such as intensifying competition from other businesses or other technologies caused by Mobile Number Portability, development of appealing new handsets, new market entrants, mergers among other service providers and other factors, or the expansion of the areas of competition could limit the acquisition of new subscriptions and retention of existing subscriptions by our corporate group, or it may lead to ARPU diminishing at a greater than expected rate, an increase in our costs, or an inability to optimize costs as expected. |

| (2) | If current and new services, usage patterns, and sales schemes proposed and introduced by our corporate group cannot be developed as planned, or if unanticipated expenses arise the financial condition of our corporate group could be affected and our growth could be limited. |

| (3) | The introduction or change of various laws or regulations inside and outside of Japan, or the application of such laws and regulations to our corporate group, could restrict our business operations, which may adversely affect our financial condition and results of operations. |

| (4) | Limitations in the amount of frequency spectrum or facilities made available to us could negatively affect our ability to maintain and improve our service quality and level of customer satisfaction and could increase our costs. |

| (5) | Other mobile service providers in the world may not adopt the technologies and the frequency bands that are compatible with those used by our corporate group’s mobile communications system on a continuing basis, which could affect our ability to sufficiently offer international services. |

| (6) | Our domestic and international investments, alliances and collaborations, as well as investments in new business fields, may not produce the returns or provide the opportunities we expect. |

| (7) | Malfunctions, defects or imperfections in our products and services or those of other parties may give rise to problems. |

| (8) | Social problems that could be caused by misuse or misunderstanding of our products and services may adversely affect our credibility or corporate image. |

| (9) | Inadequate handling of confidential business information including personal information by our corporate group, contractors and others may adversely affect our credibility or corporate image. |

| (10) | Owners of intellectual property rights that are essential for our business execution may not grant us a license or other use of such intellectual property rights, which may result in our inability to offer certain technologies, products and/or services, and our corporate group may also be held liable for damage compensation if we infringe the intellectual property rights of others. In addition, the illicit use by a third party of the intellectual property rights owned by our corporate group could reduce our license revenues actually obtained and may inhibit our competitive superiority. |

| (11) | Events and incidents caused by natural disasters, social infrastructure paralysis such as power shortages, the proliferation of harmful substances, terror or other destructive acts, the malfunctioning of equipment, software bugs, deliberate incidents induced by computer viruses, cyber-attacks, equipment misconfiguration, hacking, unauthorized access and other problems could cause failure in our networks, distribution channels, and/or other factors necessary for the provision of service, disrupting our ability to offer services to our subscribers and such incidents may adversely affect our credibility or corporate image, or lead to a reduction of revenues and/or increase of costs. |

| (12) | Concerns about adverse health effects arising from wireless telecommunications may spread and consequently adversely affect our financial condition and results of operations. |

| (13) | Our parent company, NIPPON TELEGRAPH AND TELEPHONE CORPORATION (NTT), could exercise influence that may not be in the interests of our other shareholders. |

| * | Names of companies, products, etc., contained in this release are the trademarks or registered trademarks of their respective organizations. |

20

Table of Contents

FY2016/1Q Results Presentation

NTT

docomo

July 29, 2016

Table of Contents

|

NTT

docomo

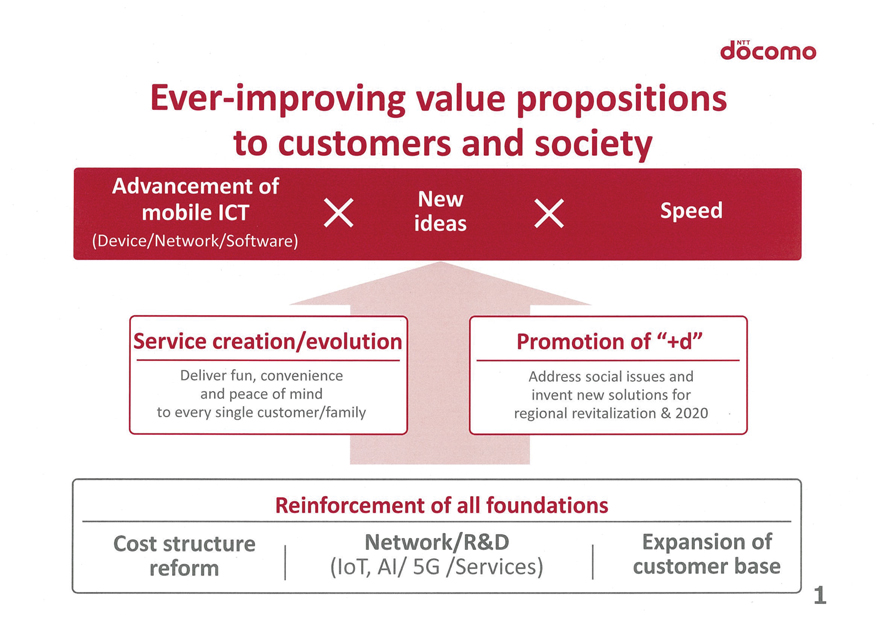

Ever-improving value propositions

to customers and society

Service creation/evolution

Deliver fun, convenience and peace of mind to every single customer/family

Promotion of “+d”

Address social issues and invent new solutions for regional revitalization & 2020

1 advancement of mobile ict (device/network/software) new ideas x x speed reinforcement of all foundations cost structure reform netwrok/r&d (iot,ai/5g/services) expansion of customer base

Table of Contents

|

docomo

Ever-improving value propositions to customers and society

(Shift to service co-creation)

x

Reinforce corporate governance

II

A healthy company that achieves both enhanced customer service and sustainable business growth

(Gain the confidence of customers, society, shareholders,

business partners and employees)

2

Table of Contents

|

NTT

docomo

1. Results Highlights

Key Financial Data, Segment Results

2. Telecommunications Business

? Operational Performance, ARPU

Network, Cost Efficiency Improvement

3. Smart Life Business & Other Businesses

Operating Income, Principal Services

Promotion of “+d”

4. Summary

Table of Contents

|

NTT

FY2016/1Q Results Snapshot docomo

U.S.

GAAP

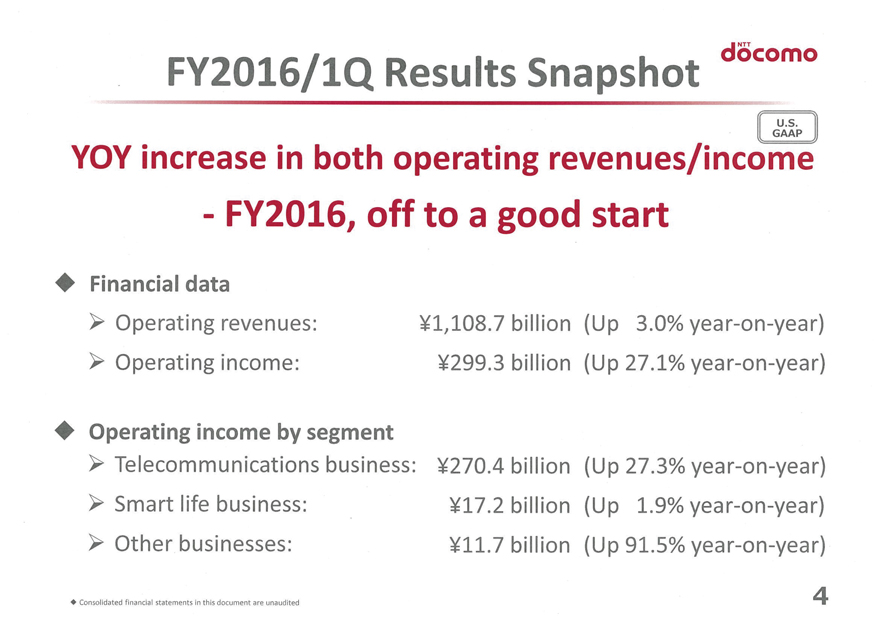

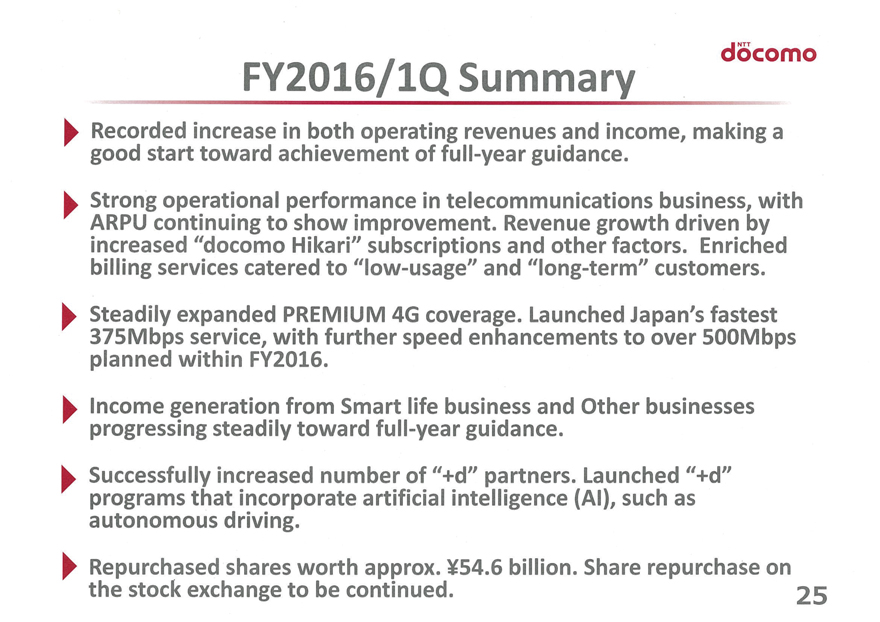

YOY increase in both operating revenues/income

- FY2016, off to a good start

Financial data

> Operating revenues: ¥1,108.7 billion (Up 3.0% year-on-year)

> Operating income: ¥299.3 billion (Up 27.1% year-on-year)

Operating income by segment

> Telecommunications business: ¥270.4 billion (Up 27.3% year-on-year)

> Smart life business: ¥17.2 billion (Up 1.9% year-on-year)

> Other businesses: ¥11.7 billion (Up 91.5% year-on-year)

Consolidated financial statements in this document are unaudited

4

Table of Contents

|

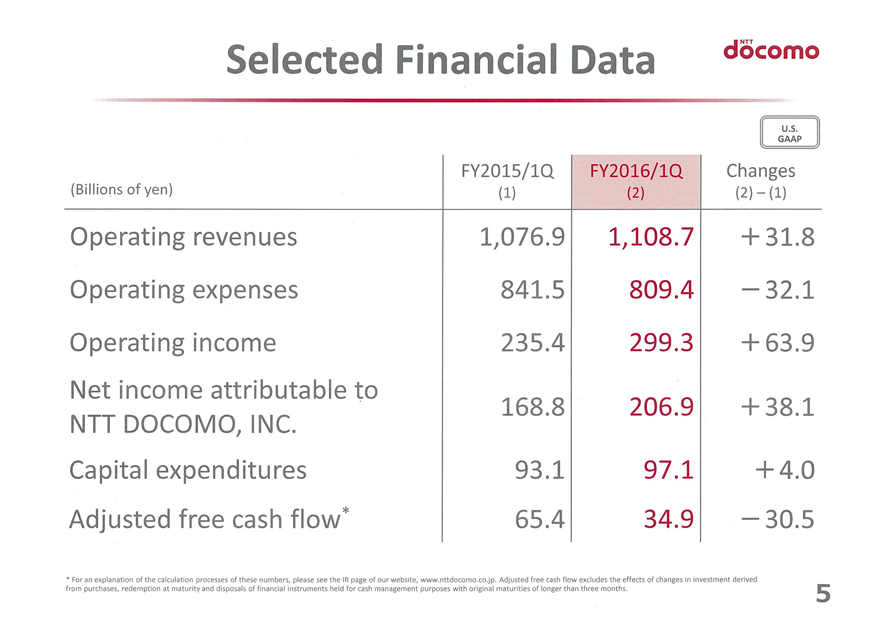

Selected Financial Data docomo NTT

U.S.

GAAP

(Billions of yen) FY2015/1Q

(1) FY2016/1Q

(2) Changes (2) – (1)

Operating revenues 1,076.9 1,108.7 + 31.8

Operating expenses 841.5 809.4 -32.1

Operating income 235.4 299.3 + 63.9

Net income attributable to NTT DOCOMO, INC. 168.8 206.9 + 38.1

Capital expenditures 93.1 97.1 +4.0

Adjusted free cash flow* 65.4 34.9 -30.5

* For an explanation of the calculation processes of these numbers, please see the IR page of our website, www.nttdocomo.co.jp. Adjusted free cash flow excludes the effects of changes in investment derived from purchases, redemption at maturity and disposals of financial instruments held for cash management purposes with original maturities of longer than three months.

5

Table of Contents

|

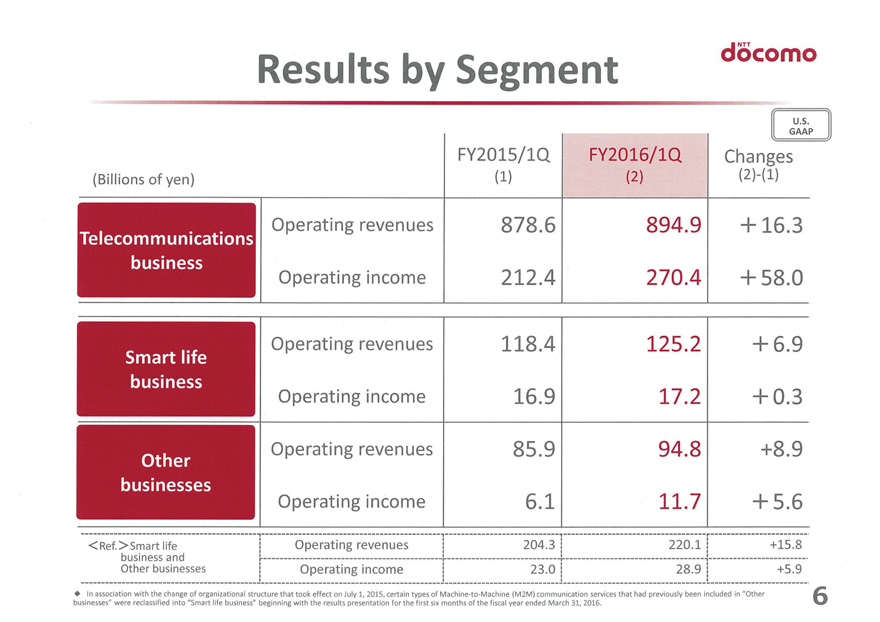

Results by Segment NTT docomo

U.S.

GAAP

(Billions of yen)

FY2015/1Q*1

(1)

FY2016/1Q

(2)

Changes

(2)-(l)

Telecommunications

Operating revenues

878.6

894.9

+16.3

business

Operating income

212.4

270.4

+58.0

Smart life Operating revenues 118.4 125.2 + 6.9

business Operating income 16.9 17.2 + 0.3

Other Operating revenues 85.9 94.8 +8.9

businesses Operating income 6.1 11.7 + 5.6

<Ref.>Smart life business and Other businesses Operating revenues 204.3 220.1 +15.8

Operating income 23.0 28.9 +5.9

In association with the change of organizational structure that took effect on July 1, 2015, certain types of Machine-to-Machine (M2M) communication services that had previously been included in “Other businesses” were reclassified into “Smart life business” beginning with the results presentation for the first six months of the fiscal year ended March 31, 2016.

6

Table of Contents

|

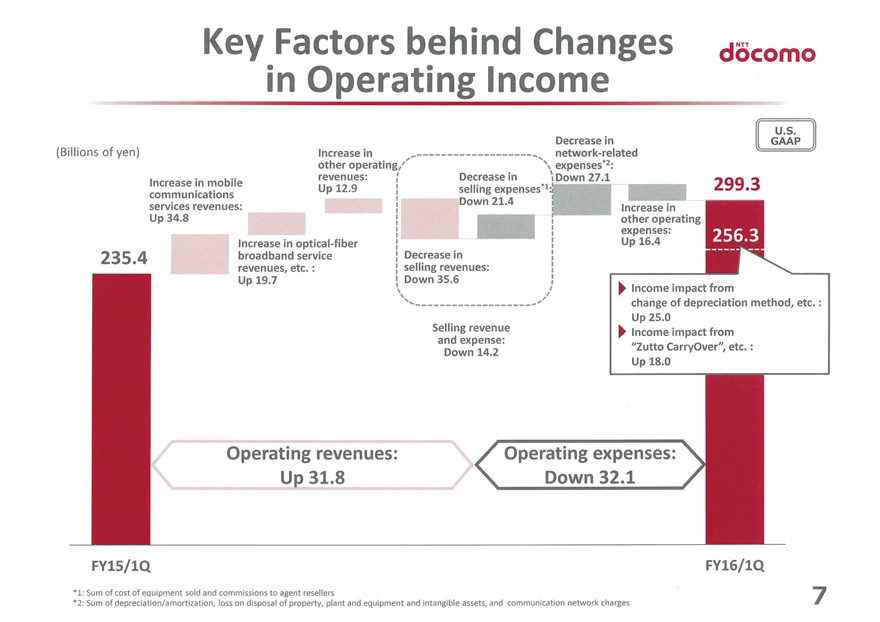

Key Factors behind Changes docomo in Operating Income ntt

(Billions of yen)

Increase in mobile communications services revenues: Up 34.8

Increase in other operating’ revenues:

Up 12.9

235.4

Increase in optical-fiber broadband service revenues, etc.:

Up 19.7*1

Decrease in selling expenses

Decrease in network-related expenses*2:

U.S.

GAAP

Down 27.1

Down 21.4

299.3

Decrease in selling revenues: Down 35.6

Increase in other operating expenses:

Up 16.4

Selling revenue and expense: Down 14.2

Income impact from

change of depreciation method, etc.

Up 25.0

Income impact from “Zutto Carryover”, etc.:

Up 18.0

Operating revenues: Up 31.8

Operating expenses: Down 32.1

FY15/1Q

FY16/1Q

*1: Sum of cost of equipment sold and commissions to agent resellers

*2: Sum of depreciation/amortization, loss on disposal of property, plant and equipment and intangible assets, and communication network charges 7

Table of Contents

|

NTT

docomo

1. Results Highlights

Key Financial Data, Segment Results

2. Telecommunications Business

Operational Performance, ARPU

Network, Cost Efficiency Improvement

3. Smart Life Business & Other Businesses

Operating Income, Principal Services

Promotion of “+d”

4. Summary

Table of Contents

|

NTT

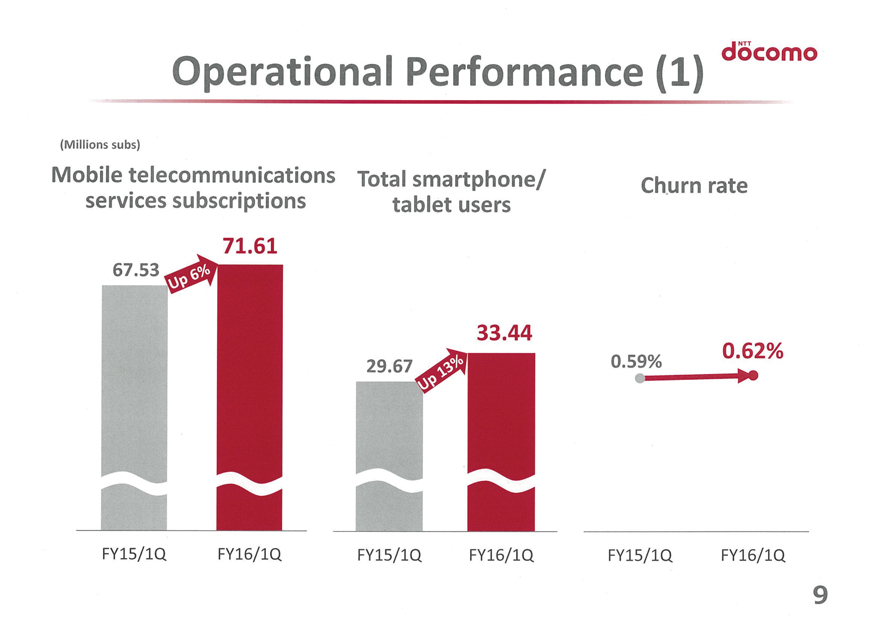

Operational Performance (1) docomo

(Millions subs)

Mobile telecommunications services subscriptions

71.61

Total smartphone churn rate

tablet users

33.44

FY15/1Q FY16/1Q FY15/1Q FY16/1Q FY15/1Q FY16/1Q

9 67.53 up 6% 29.67 up 13% 0.59% 0.62% up 5-fold 20.81 up 1.5-fold

Table of Contents

|

NTT

Operational Performance (2) docomo

(Millions subs)

“docomo Hikari” optical-fiber broadband subs

2.07

[GRAPHIC APPEARS HERE]

FY15/1Q FY16/1Q

“Kake-hodai & Pake-aeru” billing plan subs

31.59

[GRAPHIC APPEARS HERE]

FY15/1Q FY16/1Q

10

0.41 up5 20.81 up 1.5

Table of Contents

|

ntt Enrichment of Billing Services docomo

Rate plans for low-usage customers

“Share Pack 5” selection rate*1:

Approx. 20%

“Kake-hodai Light” selection rate*2:

Approx. 60%

Privileges for long-term users

“Zutto DOCOMO Discount” application rate*3:

Approx. 70%

(Up approx. 10% after expanding applicability)

*1: “Share Pack 5” selection rate= No. of “Share Pack 5” packages sold / (No. of “Data Packs” sold + No. of “Share Packs” sold). The number represents the actual data for FY2016/1Q *2: “Kake-hodai Light” selection rate: No. of “Kake-hodai Light” packages sold / (No. of “Kake-hodai” packages sold + No. of “Kake-hodai Light” packages sold). The number represents the actual data for FY2016/1Q

*3: “Zutto DOCOMO Discount” application rate = No. of “Zutto DOCOMO Discount” packages applied / Total “Packet Pack” subscriptions. The number represents the actual data as of June 30, 2016 11 2,780 2,870

Table of Contents

|

ARPU/MOU

NTT

docomo

(Yen)

Trend of improvement continues

Voice ARPU Packet ARPU ? docomo Hikari ARPU

4,110 4040 4,030 4,010

4,190

4,230 4,260 4,330

MOU

FY14/1Q 2Q 3Q 4Q FY15/1Q 2Q 3Q 4Q FY16/1Q

(Minutes) 111 121 128 126 129 134 136 135 136

For an explanation on ARPU and MOU, please see the slide “Definition and Calculation Methods of ARPU and MOU” in this document.

12 20 40 60 90 130 2,870 2,820 2,2870 2,910 2,930 2,940 2,960 1,340 1,290 1,260 1,210 1,120 1,240 1,240 1,230 1,240 4, 210