UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14A-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant ☐ | Filed by a Party other than the Registrant ☒ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Pursuant to §240.14a-12 |

VERSO CORPORATION

(Name of Registrant as Specified In Its Charter)

BillerudKorsnas AB

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Press release

00:15 CET, 20 December 2021, Solna

BillerudKorsnäs to acquire Verso to ignite growth in North America

Creates one of the largest providers of virgin fiber paper and packaging with a cost and quality advantage

BillerudKorsnäs has entered into a merger agreement with Verso Corporation (Verso) under which BillerudKorsnäs has agreed to acquire Verso, a leading producer of coated papers in North America, for a purchase price of approximately USD 825 million in cash. Verso’s Board of Directors, acting upon the recommendation of a special committee, has unanimously approved, and resolved to recommend the transaction to Verso’s shareholders. The transaction is expected to close in the second quarter of 2022.

| • | BillerudKorsnäs has entered into an agreement to acquire Verso for a purchase price of approximately USD 825 million in cash, corresponding to USD 27.00 per share. |

| • | Verso is a leading producer of coated papers in North America with reported net sales for the last twelve months ended 30 September 2021 of USD 1 264 million and adjusted EBITDA of USD 158 million. |

| • | The purchase price corresponds to an enterprise value / adjusted EBITDA multiple of approximately 6x for the last twelve months ended 30 September 2021. The acquisition will immediately be accretive to earnings per share and create significant shareholder value over time with a more profitable product mix. |

| • | BillerudKorsnäs will build one of the most cost-efficient and sustainable paperboard platforms in North America by converting some of Verso’s assets into paperboard machines with an estimated capex of up to SEK 9 billion. |

| • | The acquisition and transformation will be financed through a combination of a rights issue of up to SEK 3.5 billion, additional debt and operating cash flow. |

| • | The acquisition is expected to close in the second quarter of 2022, subject to the approval of Verso’s shareholders as well as the receipt of applicable regulatory approvals and satisfaction of other customary closing conditions. |

Strategic rationale: Profitable and sustainable revenue growth

The acquisition of Verso is fully in line with BillerudKorsnäs’ strategy to drive profitable growth in paperboard, and the ambition to expand into North America. BillerudKorsnäs aims to build one of the most cost-efficient and sustainable paperboard platforms in North America by converting several of Verso’s assets into paperboard machines while maintaining its position as quality and cost leader in speciality and coated woodfree paper.

BillerudKorsnäs provides packaging materials and solutions that challenge conventional packaging for a sustainable future. We are a world leading provider of primary fibre based packaging materials and have customers in over 100 countries. The company has 7 production units in Sweden and Finland, and about 4,400 employees in over 13 countries. BillerudKorsnäs has an annual turnover of approximately

SEK 24 billion and is listed on Nasdaq Stockholm. www.billerudkorsnas.com

SEK 24 billion and is listed on Nasdaq Stockholm. www.billerudkorsnas.com

1 (6)

Verso’s strategic assets are positioned in a region with abundant and cost-effective fibre supply suitable for production of premium packaging materials. Verso’s location also presents favourable export opportunities to both Asia and Europe. Verso will become the platform for BillerudKorsnäs’ future expansion in North America and is expected to provide continuous growth opportunities over the next ten years and beyond. The combined company will be one of the largest providers of virgin fibre paper and packaging with a cost and quality advantage.

“The combination of BillerudKorsnäs’ expertise in high-quality virgin fibre packaging materials and Verso’s attractive assets creates an excellent platform for long-term profitable growth. We will obtain cost-effective production of coated virgin fibre material in the Midwestern United States. We also plan to sequentially transform part of the business into paperboard production while continuing to serve the U.S. customers. Our investments will create new US-based jobs in a growing market and accelerate the transition from plastic-based packaging materials to renewable sources,” said Christoph Michalski, President and CEO of BillerudKorsnäs.

Converting assets into board production

The plan is to convert Verso’s largest facility, its Escanaba mill, into a world-class, sustainable, fully integrated paperboard production site. One machine is estimated to be converted by 2025, a second machine by 2029, to a total capacity of around 1 100 ktonnes. BillerudKorsnäs estimates that the investment for the conversion project will be up to SEK 9 billion, whereof around two thirds to be invested up to 2025 and the remainder up to 2029. The increased net capacity of around 400 ktonnes compared to today together with a more profitable product mix will create significant shareholder value over time.

In addition to continued paper production in Escanaba during the conversion, BillerudKorsnäs plans to continue operating the Quinnesec mill. It has an annual capacity of around 400 ktonnes of paper and 200 ktonnes of market pulp and is a cost and quality leader in graphical paper, specifically in coated woodfree and specialty papers. BillerudKorsnäs is committed to continuing to serve Verso’s existing customers.

The acquisition

The acquisition will be effected pursuant to a merger agreement under which Verso will merge with a wholly-owned subsidiary of BillerudKorsnäs. BillerudKorsnäs will pay holders of Verso’s issued and outstanding shares of common stock, subject to certain exceptions, an all-cash price of USD 27.00 per share, corresponding to an enterprise value of approximately USD 970 million (approximately SEK 8 770 million1) inclusive of Verso’s cash, net debt and other debt-like items as of 30 September, 2021.

The consideration corresponds to a premium of 26% compared to Verso’s volume-weighted average share price during the last 30 trading days and a premium of 35% compared to the closing price of Verso’s shares on 17 December 2021.

1 Calculation based on USD/SEK exchange rate 9.04 (The Riksbank 17 December 2021), which may change until the closing of the transaction.

2 (6)

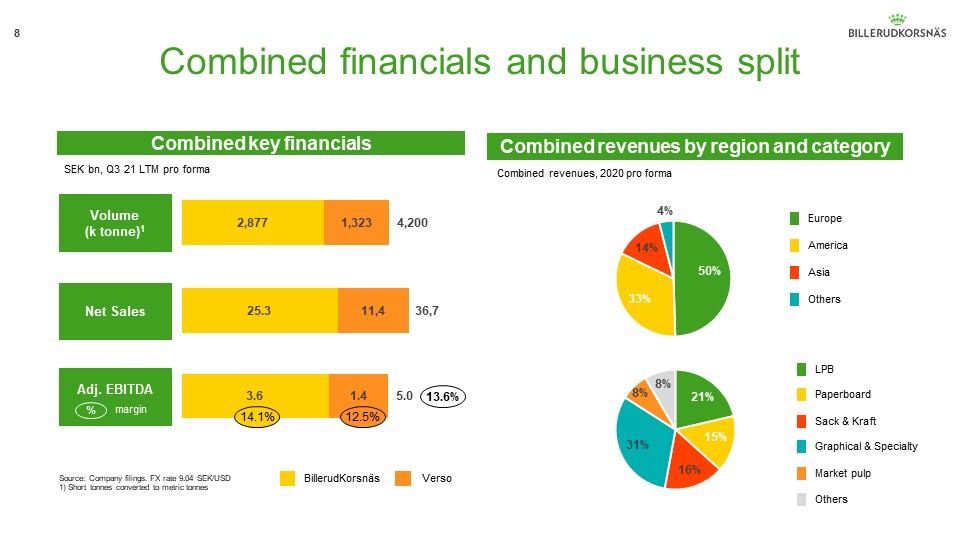

Combined net sales for BillerudKorsnäs and Verso for the twelve months ended 30 September 2021 amount to approximately SEK 36.7 billion and combined adjusted EBITDA for the same period is approximately SEK 5.0 billion (pro forma, 1 October 2020–30 September 20212).

A special meeting of Verso’s shareholders is expected to be convened following the mailing to Verso’s shareholders of a proxy statement for the transaction. Verso’s Board of Directors, acting upon the recommendation of a special committee, has unanimously approved and resolved to recommend the transaction to Verso’s shareholders.

The transaction is expected to close during the second quarter of 2022, subject to the approval of Verso’s shareholders, as well as receipt of applicable regulatory approvals and satisfaction of other customary closing conditions. Closing of the transaction is not subject to any financing condition.

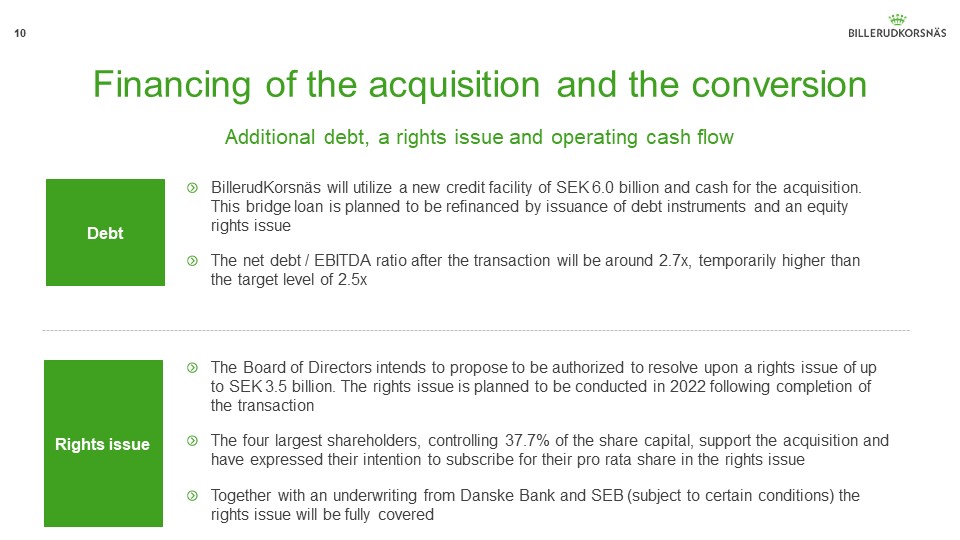

Financing of the acquisition and the conversion

The acquisition and transformation will be financed through a combination of rights issue, additional debt and operating cash flow.

BillerudKorsnäs has entered into a new credit facility of SEK 6,000 million, provided by Danske Bank and SEB, intended to be utilized for this purpose. This credit facility is planned to be refinanced by issuance of debt instruments and an equity rights issue.

After the completion of the transaction and prior to the rights issue, BillerudKorsnäs’ interest-bearing net debt to adjusted EBITDA ratio (pro forma twelve months ending 30 September 2021) is estimated to be around 2.7x, temporarily higher than its target level of below 2.5x.

BillerudKorsnäs’ Board of Directors intends to propose to a general meeting of BillerudKorsnäs’ shareholders that the Board of Directors be authorized to resolve upon a rights issue of up to SEK 3,500 million. The rights issue is planned to be carried out in 2022 following completion of the transaction. BillerudKorsnäs’ four largest shareholders, AMF Pension and Funds, FRAPAG Beteiligungsholding, Swedbank Robur Funds and The Fourth Swedish National Pension Fund, which together hold around 37.7% of BillerudKorsnäs’ share capital, support the acquisition and have expressed their intention to vote for the rights issue and subscribe for their pro rata share.

Danske Bank and SEB, acting as financial advisors to BillerudKorsnäs in relation to the rights issue, have confirmed their commitment, subject to customary conditions and subject to BillerudKorsnäs obtaining binding subscription commitments for at least 25% of the rights issue, to enter into an underwriting agreement in connection with the rights issue. The rights issue will, by way of the shareholder commitments and the underwriting by Danske Bank and SEB, be fully covered.

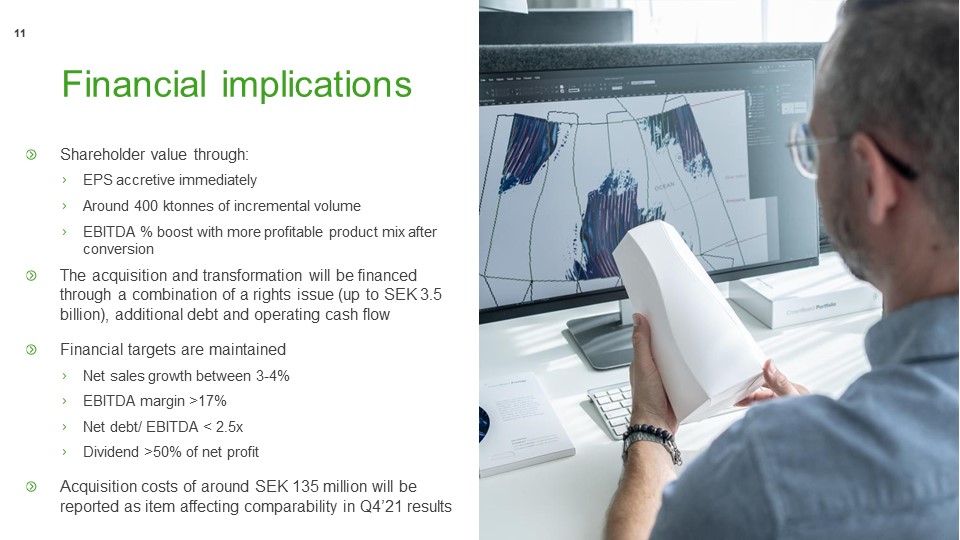

Financial targets remain

BillerudKorsnäs will maintain its financial targets as communicated at the Capital Market Day in November 2021. The long-term targets are: Net sales growth of 3-4% per year, EBITDA margin >17%, Net debt / EBITDA <2.5x and Dividend >50% of net profit.

3 (6)

Acquisition-related costs of around SEK 135 million will be reported in the fourth quarter results of 2021 as an item affecting comparability.

Advisors

BofA Securities serves as exclusive financial advisor to BillerudKorsnäs. Skadden, Arps, Slate, Meagher & Flom LLP serves as U.S. legal counsel and Cederquist serves as Swedish legal counsel to BillerudKorsnäs. Rothschild & Co serves as exclusive financial advisor and Kirkland & Ellis LLP serves as legal counsel to Verso.

Press and analyst conference

A conference call will be held on Monday 20 December at 11:00 CET, during which BillerudKorsnäs’ President and CEO, Christoph Michalski, and CFO, Ivar Vatne, will review the acquisition and answer questions. The conference can be followed via https://edge.media-server.com/mmc/p/5jeimdf2. To participate via telephone and thereby be able to ask questions, please use any of the following telephone numbers and pin code 46795865#.

Swedish number: +46 8 566 42 651

UK number: +44 333 300 0804

US number: +1 631 913 1422

About Verso Corporation

Verso Corporation (Verso) is a leading American producer of graphic, specialty and packaging paper and market pulp, with a long-standing reputation for quality and reliability. Verso is headquartered in Miamisburg, Ohio, and have two paper mills in Michigan, a roll to sheet converting facility in Wisconsin (paper production idled), and two distribution centres in Sauk Village, Illinois and Bedford, Pennsylvania. Verso’s product portfolio includes graphic paper, speciality paper, packaging paper and market pulp. The production facilities are strategically located within close proximity to major customers, and the annual production capacity totals around 1.1 million tonnes of paper. Verso has around 1,700 employees. For the twelve months ended 30 September 2021, Verso’s net sales amounted to USD 1 264 million. Verso is listed on the New York Stock Exchange. For more information, see www.versoco.com

For more information, please contact:

Christoph Michalski, President and CEO, +46 703 553 098

Ivar Vatne, CFO, +46 8 553 335 07

This information constituted inside information prior to publication. This is information that BillerudKorsnäs AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 00:15 CET on 20 December 2021.

4 (6)

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, any securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration, qualification or exemption under the securities laws of any such jurisdiction.

Use of Non-GAAP and Non-IFRS Financial Metrics

This press release includes certain non-GAAP and non-IFRS financial measures. These non-GAAP and non-IFRS measures are an addition, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP or IFRS, as applicable, and should not be considered as an alternative to performance measures derived in accordance with GAAP or IFRS, as applicable. There are a number of limitations related to the use of these non-GAAP and non-IFRS measures. In addition, other companies may calculate non-GAAP and non-IFRS measures differently, or may use other measures to calculate their financial performance, and therefore, the non-GAAP and non-IFRS measures set forth in this press release may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward-looking non-GAAP and non-IFRS financial measures are provided, they are presented on a non-GAAP and non-IFRS basis without reconciliations of such forward-looking non-GAAP and non-IFRS measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations.

Forward-looking statements

This press release contains forward-looking statements that reflect BillerudKorsnäs’ current expectations and views of future events and developments. Some of these forward-looking statements can be identified by terms and phrases such as “may”, “expects”, “intends”, “anticipates”, “plans”, “projects”, “estimates” and the negatives thereof and analogues or similar expressions. The forward-looking statements include statements relating to the expected characteristics and financial results of the combined company; expected growth of our paperboard business; expected financing; expected benefits of the proposed transaction; expected EBITDA of the combined entity; BillerudKorsnäs’ plans with respect to Verso; its assets, including the timing and cost of the conversion; and expected timing of closing of the proposed transaction and satisfaction of closing conditions, including receipt of applicable regulatory approvals. The forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from such statements. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us. The forward-looking statements are only predictions based upon our current expectations and views of future events and developments and are subject to risks and uncertainties that are difficult to predict because they relate to events and depend on circumstances that will occur in the future. Risks and uncertainties include the ability of the parties to obtain the necessary regulatory approvals and consummate the pending transaction.

The forward-looking statements should be read in conjunction with the other cautionary statements that are included elsewhere, including BillerudKorsnäs’ most recent annual and quarterly reports available at www.billerudkorsnas.com and Verso’s most recent annual report on Form 10-K, quarterly report filed on Form 10-Q, and reports filed on Form 8-K, and any other documents that BillerudKorsnäs or Verso has made publicly available or Verso has filed with the SEC, respectively. Any forward-looking statements made in this release are qualified in their entirety by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realised or, even if substantially realised, that they will have the expected consequences to, or effects on, us or our business or operations. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

IMPORTANT ADDITIONAL INFORMATION

In connection with the proposed transaction, Verso expects to file with the SEC and furnish to its stockholders a proxy statement on Schedule 14A, as well as other relevant documents regarding the proposed transaction. Promptly after filing its definitive proxy statement with the SEC, Verso will mail its definitive proxy statement and a proxy card to Verso’s stockholders entitled to vote at a special meeting relating to the proposed transaction, seeking their approval of the respective transaction-related proposals. The proxy statement will contain important information about the proposed transaction and related matters. STOCKHOLDERS AND SECURITY HOLDERS OF VERSO ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT VERSO OR BILLERUDKORSNAS WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT VERSO, THE TRANSACTION AND THE OTHER TRANSACTIONS CONTEMPLATED BY THE MERGER AGREEMENT THAT HOLDERS OF VERSO’S SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING VOTING. This press release is not a substitute for the proxy statement or for any other document that Verso or BillerudKorsnäs may file with the SEC and send to Verso’s stockholders in connection with the proposed transaction. The proposed transaction will be submitted to Verso’s stockholders for their consideration.

5 (6)

Investors and security holders may obtain copies of these documents and any other documents filed with or furnished to the SEC by Verso or BillerudKorsnäs free of charge through the website maintained by the SEC at www.sec.gov, or on Verso’s investor website, https://investor.versoco.com/.

Participants in the Solicitation

BillerudKorsnäs and its directors and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. These documents will be available free of charge from the sources indicated above, and from Verso by going to its investor relations page on its corporate website at https://investor.versoco.com/.

Investors should read the proxy statement carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Verso using the sources indicated above.

This press release does not constitute an offer of rights to subscribe for shares of BillerudKorsnäs for sale or a solicitation of an offer to purchase the rights described in this press release in the United States. The rights of BillerudKorsnäs referred to in this press release have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) or with any securities regulatory authority of any state of the United States for offer or sale as part of their distribution and may not be offered or sold within the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in compliance with any applicable securities laws of any state or other jurisdiction of the United States. There will be no public offering of rights in the United States.

6 (6)

Acquisition of Verso Christoph Michalski, President and CEOIvar Vatne, CFO20 December 2021

Securing BillerudKorsnäs profitable and sustainable growth Verso will be the cornerstone of our expansion in North America and provide sustainable capacity opportunity for 10 years and beyond for BillerudKorsnäsMarket proximity to one of the largest and growing markets in primary fibre containerboard and cartonboardWorld-class cost base: lowest cost producer in US and in top quintile cost base for export to Europe or AsiaTwo state-of-the-art Paperboard machines with fully integrated pulp supply situated in North Americas’ prime quality abundant and cost competitive wood basketThe acquisition will immediately be accretive to EPS and create significant shareholder value over time with a more profitable product mix 2

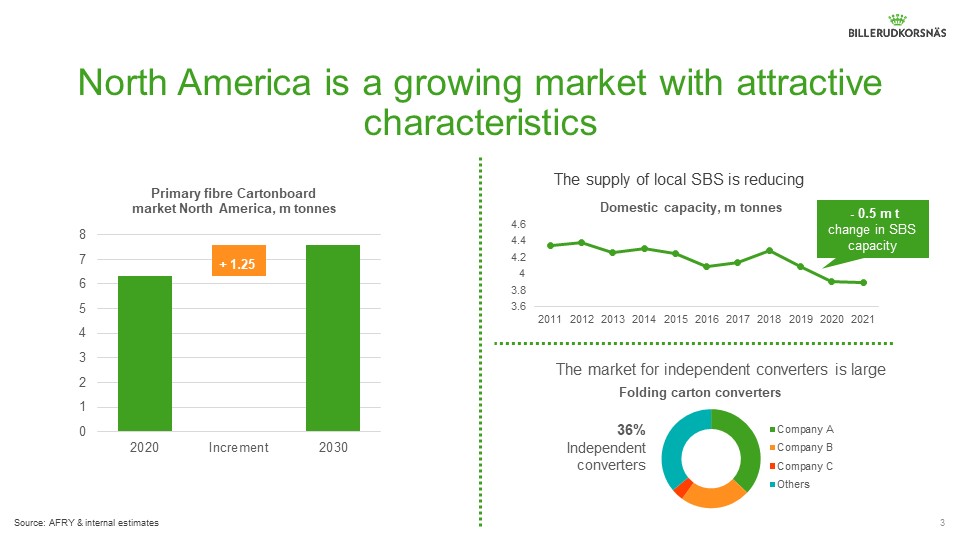

North America is a growing market with attractive characteristics + 1.25 The market for independent converters is large 36%Independent converters - 0.5 m t change in SBS capacity The supply of local SBS is reducing Source: AFRY & internal estimates 3

Verso has large surplus of low-cost fibre with excellent properties 4 Pulpwood Delivered Cost (2020) – Verso vs BK Michigan Upper Peninsula & WI Northeast Net Annual Increment (NAI), Removal and Surplus HW pulpwood SW pulpwood -29% -30%

Overview of Verso Leading American producer of graphic and speciality paper and market pulpWell positioned production facilities in close proximity to wood supply and customersCost and quality leader with streamlined operations100% pulp integration and procures wood only from sustainable managed forests 5 Net sales Q3 ‘21 LTMUSD 1 264 m Adj. EBITDA margin Q3 ‘21 LTM12.5% Key figures Facility overview Key highlights Quinnesec millOne paper machine with annual capacity of ~400 ktonnes of paper and one pulp dryer with annual capacity of ~200 ktonnes of market pulpGraphic, speciality paper and market pulp~420 employees Escanaba millThree paper machines with annual capacity of ~700 ktonnes paperGraphic, speciality paper and packaging~830 employees In addition, Wisconsin Rapids converting facility (paper production idled) where own manufactured rolls are converted to sheets, and a hydroelectric power company 2020 revenues by product area Graphic paper Specialty paper Pulp and others

BillerudKorsnäs will be #2 in virgin fibre products with a quality and cost advantage 6 m tonnes, selected primary fibre products Company 1-10 Others Conversion 7% Source: AFRY & internal estimates Market share Capacity

Sequential conversion of Escanaba facility to paperboard production BillerudKorsnäs plans to convert the Escanaba mill into a world-class, sustainable, integrated paperboard production facility by 2029The conversion will involve rebuilding two paper machines. The 1st machine is planned to be converted by 2025 and the 2nd machine by 2029. Conversions will yield around 400K tons of incremental volume BillerudKorsnäs estimates that the investment for the conversion project will be up to SEK 9 billion, whereof around two thirds to be invested up to 2025 and the remainder up to 2029 7 Acquisition of Verso 2022 Conversion of Escanaba PM4 2023-2025 Conversion of Escanaba PM3 2026-2029 2022 2035 2025 Estimated total conversion capexSEK 9 bn

Combined financials and business split 8 Europe America Asia Others Volume (k tonne)1 Net Sales Adj. EBITDA Source: Company filings. FX rate 9.04 SEK/USD1) Short tonnes converted to metric tonnes BillerudKorsnäs Verso 14.1% 12.5% 13.6% Combined revenues by region and category Combined key financials SEK bn, Q3 21 LTM pro forma Combined revenues, 2020 pro forma % margin LPB Paperboard Sack & Kraft Graphical & Specialty Market pulp Others

Transaction details 9 The acquisition will be effected pursuant to a merger agreement under which Verso will merge with a wholly-owned subsidiary of BillerudKorsnäsBillerudKorsnäs will acquire Verso for a purchase price of approximately USD 825 million in cash, corresponding to USD 27.00 per shareThe consideration corresponds to a premium of 35% compared to the closing price of Verso’s share on 17 December Enterprise value of approximately USD 970 million inclusive of Verso’s cash, net debt and other debt-like items as of 30 September 2021Enterprise value / adjusted EBITDA for LTM Q3’21 multiple of approx. 6x Verso’s Board of Directors, acting upon the recommendation of a special Board committee, has unanimously approved and resolved to recommend the transaction to Verso’s shareholders The completion of the transaction is subject to shareholder approval in Verso, as well as customary regulatory approvals from competition and energy authorities Agreement and consideration Shareholder and regulatory approval

Financing of the acquisition and the conversion Additional debt, a rights issue and operating cash flow 10 BillerudKorsnäs will utilize a new credit facility of SEK 6.0 billion and cash for the acquisition. This bridge loan is planned to be refinanced by issuance of debt instruments and an equity rights issueThe net debt / EBITDA ratio after the transaction will be around 2.7x, temporarily higher than the target level of 2.5x Debt Rights issue The Board of Directors intends to propose to be authorized to resolve upon a rights issue of up to SEK 3.5 billion. The rights issue is planned to be conducted in 2022 following completion of the transactionThe four largest shareholders, controlling 37.7% of the share capital, support the acquisition and have expressed their intention to subscribe for their pro rata share in the rights issueTogether with an underwriting from Danske Bank and SEB (subject to certain conditions) the rights issue will be fully covered

Shareholder value through:EPS accretive immediately Around 400 ktonnes of incremental volume EBITDA % boost with more profitable product mix after conversionThe acquisition and transformation will be financed through a combination of a rights issue (up to SEK 3.5 billion), additional debt and operating cash flow Financial targets are maintainedNet sales growth between 3-4% EBITDA margin >17%Net debt/ EBITDA < 2.5xDividend >50% of net profitAcquisition costs of around SEK 135 million will be reported as item affecting comparability in Q4’21 results 11 Financial implications

12 Estimated time schedule Early March 2022 Approval of Verso’s shareholders at a special shareholder meeting Q1-Q2 2022 Receipt of regulatory approvals Q2 2022 General meeting in BillerudKorsnäs to resolve on rights issue Q2 2022 Acquisition expected to be completed Q2-Q3 2022 Rights issue expected to be completed

Securing BillerudKorsnäs profitable and sustainable growth Verso will be the cornerstone of our expansion in North America and provide sustainable capacity opportunity for 10 years and beyond for BillerudKorsnäsMarket proximity to one of the largest and growing markets in primary fibre containerboard and cartonboardWorld-class cost base: lowest cost producer in US and in top quintile cost base for export to Europe or AsiaTwo state-of-the-art Paperboard machines with fully integrated pulp supply situated in North Americas’ prime quality abundant and cost competitive wood basketThe acquisition will immediately be accretive to EPS and create significant shareholder value over time with a more profitable product mix 13

Q&A

15 Use of Non-IFRS Financial MetricsThis presentation includes certain non-IFRS financial measures. These non-IFRS measures are an addition, and not a substitute for or superior to, measures of financial performance prepared in accordance with IFRS and should not be considered as an alternative to performance measures derived in accordance with. Forward-looking statementsThis presentation contains forward-looking statements that reflect BillerudKorsnäs’ current expectations and views of future events and developments. Some of these forward-looking statements can be identified by terms and phrases such as “may”, “expects”, “anticipates”, “plans”, “projects”, “estimates” and the negatives thereof and analogues or similar expressions. The forward-looking statements include statements relating to the expected characteristics and financial results of the combined company; expected growth of our paperboard business; expected financing; expected benefits of the proposed transaction; expected EBITDA of the combined entity; BillerudKorsnäs’ plans with respect to Verso; its assets, including the timing and cost of the conversion; and expected timing of closing of the proposed transaction and satisfaction of closing conditions, including receipt of applicable regulatory approvals. The forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from such statements. IMPORTANT ADDITIONAL INFORMATIONIn connection with the proposed transaction, Verso expects to file with the SEC and furnish to its stockholders a proxy statement on Schedule 14A, as well as other relevant documents regarding the proposed transaction. Promptly after filing its definitive proxy statement with the SEC, Verso will mail its definitive proxy statement and a proxy card to Verso’s stockholders entitled to vote at a special meeting relating to the proposed transaction, seeking their approval of the respective transaction-related proposals. The proxy statement will contain important information about the proposed transaction and related matters. STOCKHOLDERS AND SECURITY HOLDERS OF VERSO ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT VERSO OR BILLERUDKORSNAS WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT VERSO, THE TRANSACTION AND THE OTHER TRANSACTIONS CONTEMPLATED BY THE MERGER AGREEMENT THAT HOLDERS OF VERSO’S SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING VOTING. This presentation is not a substitute for the proxy statement or for any other document that Verso or BillerudKorsnäs may file with the SEC and send to Verso’s stockholders in connection with the proposed transaction. The proposed transaction will be submitted to Verso’s stockholders for their consideration. Investors and security holders may obtain copies of these documents and any other documents filed with or furnished to the SEC by Verso or BillerudKorsnäs free of charge through the website maintained by the SEC at www.sec.gov, or on Verso’s investor website, https://investor.versoco.com/. BillerudKorsnäs and its directors and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. Investors should read the proxy statement carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Verso using the sources indicated above.This presentation does not constitute an offer of rights to subscribe for shares of BillerudKorsnäs for sale or a solicitation of an offer to purchase the rights described in this presentation in the United States. The rights of BillerudKorsnäs referred to in this presentation have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) or with any securities regulatory authority of any state of the United States for offer or sale as part of their distribution and may not be offered or sold within the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in compliance with any applicable securities laws of any state or other jurisdiction of the United States. There will be no public offering of rights in the United States.