| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

Form 10-K

| [X] | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | For the fiscal year ended December 31, 2007 |

| | or |

| [ ] | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | For the transition period from__________ to__________ |

Commission File Number 001-31898

PINNACLE AIRLINES CORP.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 03-0376558 (I.R.S. Employer Identification No.) |

| | |

1689 Nonconnah Blvd, Suite 111 Memphis, Tennessee (Address of principal executive offices) | 38132 (Zip Code) |

901-348-4100

(Registrant's telephone number, including area code)

| Securities registered pursuant to Section 12(b) of the Act: |

| |

| Title of each class: | Name of each exchange on which registered: |

| Common Stock, $.01 par value | Nasdaq National Market |

Securities registered pursuant to section 12 (g) of the Act: None |

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] | Accelerated filer [ X ] | Non-accelerated filer [ ] | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The aggregate market value of the voting and non-voting common equity stock held by non-affiliates of the registrant was $377 million as of June 30, 2007.

As of March 14, 2008, 17,952,907 shares of common stock were outstanding.

Documents Incorporated by Reference

Certain information called for by Part III of Form 10-K is incorporated by reference to the Proxy Statement for our 2008 Annual Meeting of Stockholders to be filed with the Commission within 120 days after December 31, 2007.

Table of Contents

(continued)

Pinnacle Airlines Corp. and its wholly owned subsidiaries, Pinnacle Airlines, Inc. and Colgan Air, Inc., are collectively referred to in this report as the “Company,” “we”, and “us” except as otherwise noted. Pinnacle Airlines Corp. will be referred to as “PNCL.” Our subsidiaries will be referred to as “Pinnacle” for Pinnacle Airlines, Inc. and “Colgan” for Colgan Air, Inc., and collectively as “our subsidiaries.” Northwest Airlines Corporation and its subsidiaries are collectively referred to as “Northwest.” US Airways Group, Inc. and its subsidiaries are collectively referred to as “US Airways.” Continental Airlines, Inc. and its subsidiaries are collectively referred to as “Continental.” United Air Lines, Inc. and its subsidiaries are collectively referred to as “United.” Delta Air Lines, Inc. and its subsidiaries are collectively referred to as “Delta.”

PNCL, a Delaware corporation, is a holding company that operates two independent, wholly owned subsidiaries, Pinnacle Airlines, Inc. and Colgan Air, Inc. As of December 31, 2007, we had two reportable segments consisting of Pinnacle Airlines, Inc. and Pinnacle Airlines Corp. (the “Pinnacle Segment”) and Colgan Air, Inc. (the “Colgan Segment”).

Pinnacle operates an all-regional jet fleet providing regional airline capacity to Northwest as a Northwest Airlink carrier at its hub airports in Detroit, Minneapolis/St. Paul and Memphis, and to Delta as a Delta Connection carrier at its hub airport in Atlanta. At December 31, 2007, Pinnacle operated a jet fleet of 137 Canadair Regional Jet (‘‘CRJ’’)-200 aircraft as a Northwest Airlink carrier with approximately 770 daily departures to 115 cities in 36 states and four Canadian provinces. Pinnacle operated one CRJ-900 aircraft as a Delta Connection carrier with approximately six daily departures to four cities in four states.

Colgan operates an all turboprop fleet under revenue pro-rate agreements with Continental, United and US Airways, and also provides regional airline capacity to Continental under a capacity purchase agreement. Colgan’s operations are focused primarily in the northeastern United States and in Texas. As of December 31, 2007, Colgan offered approximately 270 daily departures and operated 11 Saab 340 aircraft as Continental Connection from Continental’s hub airport in Houston, six Saab 340 aircraft as United Express at Washington-Dulles, and six Beech 1900 aircraft and 20 Saab 340 aircraft as US Airways Express, with hub locations at New York–LaGuardia, Pittsburgh and Washington–National.

Pinnacle serves as our platform for regional jet operations. Historically, we have operated CRJ-200 aircraft as Northwest Airlink, providing Northwest with cost-efficient, highly reliable operations. During 2007, we entered into an agreement with Delta to operate 16 CRJ-900 aircraft as a Delta Connection carrier. We began these operations December 1, 2007 and will continue taking delivery of CRJ-900s throughout 2008 and early 2009. Pinnacle’s unit cost continues to be one of the most competitive in the regional airline industry.

PNCL acquired Colgan in January 2007, which now serves as our platform for turboprop operations. Colgan has traditionally operated as US Airways, United and Continental under revenue pro-rate agreements, and utilized smaller turboprop aircraft such as the Saab 340 and Beech 1900. Shortly after acquiring Colgan, we entered into a capacity purchase agreement with Continental to begin flying the next generation Q400 turboprop aircraft as Continental Connection out of Continental’s global gateway hub at Newark Liberty International Airport. The Q400 offers superior operating performance while operating more efficiently than most regional jets. Colgan began Q400 operations in February 2008.

Our operating contracts fall under two categories: capacity purchase agreements (“CPA”) and revenue pro-rate agreements. The following represents the percentage of our regional airline services revenue for the year ended December 31, 2007 derived under each contract type and by code-share partner:

| | | Percentage of Regional Airline Services Revenue |

| Code-Share Partner | | Capacity Purchase Agreements | | Pro-Rate Agreements | | Total |

| Northwest Airlines | | 75.1% | | - | | 75.1% |

| US Airways | | - | | 12.3% | | 12.3% |

| Continental Airlines | | - | | 6.8% | | 6.8% |

| United Air Lines | | - | | 3.8% | | 3.8% |

| Delta Air Lines | | 0.2% | | - | | 0.2% |

| Essential Air Services | | - | | 1.8% | | 1.8% |

| Total | | 75.3% | | 24.7% | | 100.0% |

Capacity Purchase Agreements. Our preferred contractual relationships with major airlines are structured as capacity purchase arrangements. Under capacity purchase agreements, our major airline partners purchase our flying capacity by paying pre-determined rates for specified flying, regardless of the number of passengers on board or the amount of revenue collected. These arrangements typically include incentive payments that are paid if we meet certain operational performance measures. Additionally, certain operating costs such as fuel, insurance premiums, ground handling and others are reimbursed or provided directly by the partner, which eliminates our risk associated with a change in the price of these goods or services. We believe the capacity purchase model reduces our financial risk and enables us to focus on operating our business with the highest standards, while maximizing the efficiencies of the business that we provide to our partners. Therefore, we plan to grow the percentage of our revenue derived from these types of agreements by working to structure new business with capacity purchase terms.

Pinnacle’s Amended and Restated Airline Services Agreement with Northwest (the “ASA”) and its Delta Connection Agreement (the “DCA”) are both structured as capacity purchase agreements. In addition, Colgan’s Q400 operations for Continental are under a capacity purchase agreement (the “Continental CPA”).

Under our CPA’s, most costs we incur are classified as one of the following:

| · | Reimbursed – Those costs that are reimbursed to the full extent of the actual cost, plus any applicable margin. |

| · | Rate-based – We receive payments for each block hour and departure we provide. These payments are designed to cover all of our expenses incurred with respect to the CPA that are not covered by the reimbursement payments, including overhead costs. |

| · | Excluded – Services that are provided by or paid for directly by the code-share partner. These costs do not appear on our financial statements. |

The following is a summary of the treatment of certain costs under the three CPA’s.

| | Continental CPA | | Delta DCA | | Northwest ASA |

| Labor costs | Rate-Based | | Rate-Based | | Rate-Based |

| Line maintenance | Rate-Based | | Rate-Based | | Rate-Based |

| Heavy maintenance | Rate-Based | | Reimbursed(2) | | Reimbursed |

| Landing fees / station costs | Reimbursed | | Reimbursed | | Rate-Based |

| Other (G&A and training) | Rate-Based | | Rate-Based | | Rate-Based |

| Non-aircraft depreciation | Rate-Based | | Rate-Based | | Rate-Based |

| Property taxes | Rate-Based | | Reimbursed | | Reimbursed |

| Fuel | Excluded | | Excluded | | Excluded |

| Facility rentals | Excluded(1) | | Excluded(1) | | Rate-Based |

| Ground handling | Excluded(1) | | Excluded(1) | | Rate-Based |

| Aircraft ownership | Rate-Based | | Reimbursed(2) | | Reimbursed |

| Aviation insurance | Reimbursed | | Reimbursed | | Reimbursed |

(1) | Ground handling and airport facilities are provided free of charge unless Delta or Northwest asks us to perform ground handling in a station. In these instances, we are compensated based upon negotiated ground handling rates. |

(2) | These costs are both subject to a cap and adjusted downward should actual expenses incurred be less than the rate–based payments received. Aircraft ownership cost include principal and interest payments on debt. |

Revenue Pro-rate Agreements. When PNCL purchased Colgan in January 2007, its existing contracts were structured as revenue pro-rate code-share agreements, which allowed for Colgan to market its operations under its partners’ brands. Under these agreements, Colgan generally manages its own inventory of unsold capacity and sets fare levels in the local markets that it services. Colgan retains all of the revenue for passenger flying within Colgan’s local markets and not connecting to its partners’ flights. For connecting passengers, the passenger fare is pro-rated between Colgan and its major airline partner, generally based on the distance traveled by the passenger on each segment of the passenger’s trip. Under these agreements, Colgan bears the risk associated with fares, passenger demand, and competition within its markets. Colgan incurs all of the costs associated with operating these flights, including those costs typically reimbursed or paid directly by the major airline under a capacity purchase agreement. In some instances, Colgan has the ability to earn incentive-based revenue should it achieve specified performance metrics.

Colgan’s revenue pro-rate agreement with Continental also contains a connecting passenger incentive designed to maintain a base level of profitability in the Houston markets that Colgan serves. The connect incentive can be a payment from or a payment to Continental, depending on load factors, and is designed to create a more stable income level in these markets that could otherwise not be supported under a traditional revenue pro-rate agreement. The connect incentives are adjusted twice a year for changes in fuel prices and station/passenger related costs.

In addition to operating its flights under revenue pro-rate code-share agreements, Colgan also operates some flights within its United Express and US Airways Express networks under its Essential Air Service (“EAS”) contracts with the Department of Transportation (“DOT”). The EAS program provides a federal government subsidy within certain small markets that could not otherwise sustain commercial air service because of limited passenger demand.

Northwest Airlink Airline Services Agreement

Pinnacle provides regional jet service to Northwest as a Northwest Airlink carrier under the ASA. The ASA was amended and restated effective January 1, 2007 and expires in December 2017. At the end of its term in 2017, the ASA automatically extends for additional five-year periods unless Northwest provides notice to us two years prior to the termination date that it does not plan to extend the term.

Our ASA with Northwest provides for the following payments:

Reimbursement payments: We receive monthly reimbursements for all expenses relating to: basic aircraft and engine rentals; aviation liability, war risk and hull insurance; third-party deicing services; CRJ third-party engine and airframe maintenance; hub and maintenance facility rentals; passenger security costs; ground handling in cities where Northwest has ground handling operations; Detroit landing fees and property taxes. Other than credit risk with respect to Northwest’s reimbursement of these costs, we have no financial risk associated with cost fluctuations in these items.

Payments based on pre-set rates: We are entitled to receive semi-monthly payments for each block hour and departure we provide to Northwest and a monthly fixed cost payment based on the size of Pinnacle’s fleet under the ASA. The term “block hours” refers to the elapsed time between an aircraft leaving a gate and arriving at a gate. These payments are designed to cover all of our expenses incurred with respect to the ASA that are not covered by the reimbursement payments, including overhead costs. The substantial majority of these expenses relate to labor costs, ground handling costs in cities where Northwest does not have ground handling operations, landing fees in cities other than Detroit, overhead and depreciation. These rates will be in effect (subject to indexed annual inflation adjustments) until 2013, when the rates will be reset.

Margin payments: We receive a monthly margin payment based on the revenues described above calculated to achieve a target operating margin. The target operating margin is 8% for 2007 and future years, and was 10% for 2006 and 2005. Our margin payments for 2007, 2006, and 2005 were subject to a ceiling and a floor. Beginning January 1, 2008, Northwest will not guarantee Pinnacle’s minimum operating margin, although we will still be subject to a margin ceiling above the revised target operating margin. If Pinnacle’s actual operating margin for any year beginning with 2008 exceeds the 8% target operating margin but is less than 13%, Pinnacle will make a year-end adjustment payment to Northwest in an amount equal to half of the excess above 8%. If Pinnacle’s actual operating margin for any year beginning with 2008 exceeds 13%, Pinnacle will pay Northwest all of the excess above 13%.

The ASA provides that we will be required to allocate our overhead to the extent that we establish operations with another major airline. Upon reaching a certain level of operations outside of our ASA, and to the extent that we have realized a cost savings benefit from combining overhead in such outside operations, we will negotiate an overhead sharing rate reduction The method of allocation, timing and extent of Northwest’s rate reduction have not yet been determined. To the extent that we cannot agree on the amount of a rate reduction with Northwest to share any overhead, the parties have agreed to pursue binding arbitration to determine the rate reduction.

To the extent that Pinnacle operates regional jets on behalf of another major airline, Northwest may remove one aircraft for every two aircraft that Pinnacle operates for another partner above an initial base of 20 regional jets. Northwest may remove no more than 20 aircraft subject to this option and no more than five aircraft in any 12-month period. Northwest may only exercise this option if the removed aircraft are not operated by or on behalf of Northwest after their removal.

Northwest may terminate the ASA at any time for cause, which is defined as:

| · | our failure to make any payment under any aircraft lease or sublease with Northwest; |

| · | an event of default by us under any aircraft lease or sublease with Northwest; |

| · | an event of default under any of our other agreements with Northwest; |

| · | our failure to maintain required insurance coverages; |

| · | our failure to comply with Northwest’s inspection requirements; |

| · | suspension or revocation of our authority to operate as an airline by the FAA or the DOT; |

| · | our failure to operate more than 50% of our aircraft for more than seven consecutive days or our failure to operate more than 25% of our aircraft for more than 21 consecutive days, other than as a result of: |

| 1) | an FAA order grounding all commercial flights or all air carriers or grounding a specific aircraft type of all carriers, |

| 2) | a scheduling action by Northwest or |

| 3) | Northwest’s inability to perform its obligations under the ASA as a result of a strike by Northwest employees. |

Northwest may also terminate the agreement at any time upon our bankruptcy or for any breach of the agreement by us that continues uncured for more than 30 days after we receive notice of the breach. Provided that in the case of a non-monetary default, Northwest may not terminate the agreement if the default would take more than 30 days to cure and we are diligently attempting to cure the default. In addition, both Northwest and we are entitled to seek an injunction and specific performance for a breach of the agreement. In addition, in the case of any other termination of the ASA, Northwest will have the right to require us:

| · | to terminate all leases, subleases and agreements with Northwest; |

| · | to assign, or use our best efforts to assign to Northwest, subject to some exceptions, any leases with third parties for facilities at airports to which we primarily fly scheduled flights on behalf of Northwest; |

| · | to sell or assign to Northwest facilities and inventory then owned or leased by us and used primarily for the services we provide to Northwest for an amount equal to the lesser of fair market value or depreciated book value of those assets. |

In general, we have agreed to indemnify Northwest and Northwest has agreed to indemnify us for any damages caused by any breaches of our respective obligations under the ASA or caused by our respective actions or inaction under the ASA.

Delta Connection Agreement

On April 27, 2007, we entered into the DCA, a ten-year capacity purchase agreement with Delta Air Lines to operate 16 CRJ-900 aircraft as a Delta Connection Carrier. The first aircraft was delivered in October 2007 and scheduled service began December 1, 2007. We currently operate five CRJ-900 aircraft under the DCA. The remaining CRJ-900 aircraft will continue to be delivered through January 2009. The DCA allows Delta to have the option to add an additional seven CRJ-900 aircraft to the fleet.

The DCA provides for Delta to pay pre-set rates based on the capacity we provide to Delta. We are responsible for the costs of flight crews, maintenance, dispatch, aircraft ownership and general and administrative costs. In addition, Delta reimburses us for certain pass-through costs, including landing fees, most station-related costs and aircraft hull and general liability insurance. In most instances, Delta will provide fuel and ground handling services free of charge. We earn incentive payments (calculated as a percentage of the payments received from Delta) if we meet certain performance targets. The DCA also provides for reimbursements to Delta annually to the extent that our actual pre-tax margin on our Delta Connection operations exceeds certain thresholds.

Continental Connection Capacity Purchase Agreement

On February 5, 2007, we entered into the Continental CPA under which Colgan will operate 15 Q400 turboprop aircraft predominantly out of Continental’s hub at Newark Liberty International Airport. The Q400 is configured with 74 passenger seats. We began operations on February 4, 2008, and currently operate four Q400 aircraft under the Continental CPA. We will take delivery of the remaining Q400 aircraft through June 2008. Continental also has the option to elect by April 1, 2008 to cause us to purchase 15 additional Q400 aircraft to be operated under the Continental CPA at a future date. The term of the Continental CPA is ten years.

The Continental CPA provides that we are compensated at pre-set rates for the capacity that we provide to Continental. We are responsible for our own expenses associated with flight crews, maintenance, dispatch, aircraft ownership and general and administrative costs. In addition, Continental reimburses us without a markup for certain reconciled costs, such as landing fees, most other station-related costs, aircraft hull and passenger liability insurance (provided that our insurance rates do not exceed those typically found at other Continental regional airline partners) and passenger related costs. Continental will also provide fuel and ground handling services at its stations to us at no charge. Continental may request that we provide ground handling for our flights at certain stations; in this event we will be compensated at a predetermined rate for these ground handling services. The Continental CPA also provides for the ability to earn additional incentive-based revenue based upon achieving operational and financial performance targets.

The Continental CPA provides for a rate reduction to Continental to the extent that we begin operating Q400 aircraft for another major airline. The rate reduction is designed to share the overhead burden associated with the Q400 aircraft across all of our potential Q400 operations and is only applicable for the first 15 aircraft that we add with another airline.

Continental Connection Pro-Rate Agreement

We operate 11 Saab 340 aircraft based in Houston, Texas under a code-share agreement with Continental (the “Continental Agreement”). Colgan entered into the Continental Agreement in January 2005 for a term of five years. The Continental Agreement is structured as a pro-rate agreement for which we receive all of the fares associated with local passengers and an allocated portion of the connecting passengers’ fares. We pay all of the costs of operating the flights, including sales and distribution costs. However, we also receive connect incentive payments from Continental for passengers connecting from Colgan operated flights to any flights operated by Continental or its other code-share partners at Houston/George Bush Intercontinental Airport. The connect incentive payments are designed to maintain a base level of profitability in the markets that we fly out of Houston, and can result in a payment to us or from us depending on our passenger load factor in these markets. The connect incentives are modified every six months to adjust for prospective modifications in fuel price and certain station expenses.

US Airways Express Agreement

We operate 20 Saab 340 aircraft and six Beech 1900D aircraft under a code-share agreement with US Airways (the “US Airways Agreement”). Colgan entered into the US Airways Agreement in 1999 to provide passenger service and cargo service under the name “US Airways Express.” The US Airways Agreement provides us use of the US Airways flight designator code to identify flights and fares in computer reservations systems, permits use of logos, service marks, aircraft paint schemes, and uniforms similar to US Airways and coordinated scheduling and joint advertising. The US Airways Agreement is structured as a revenue pro-rate agreement for which we receive all of the fares associated with our local passengers and an allocated portion of connecting passengers’ fares. We pay all of the costs of operating the flights, including sales and distribution costs. We control all scheduling, inventory and pricing for each local market we serve. The current US Airways Agreement became effective on October 1, 2005 under terms similar to the 1999 agreement and has a three-year term.

The US Airways Agreement provides US Airways first right of initial refusal should the Company receive an offer to purchase or lease slots at Ronald Reagan National Airport in Washington, D.C. or LaGuardia International Airport in New York, New York or an offer to purchase any portion of an equity interest in Colgan, except for stock sale or transfer between former Colgan shareholders and their families. US Airways waived its right of first refusal to purchase Colgan prior to PNCL’s acquisition of Colgan.

United Express Agreement

In October 2003, Colgan entered into a code-share agreement with United Air Lines to include the United Air Lines flight designator code on all United flights operated by Colgan. In October 2005, Colgan entered into a separate code-share agreement with United to provide services as a United Express carrier (the “United Agreement”). Colgan currently operates six Saab 340 aircraft under the name “United Express.” We are in the process of transitioning nine markets currently operated from Pittsburgh under our US Airways agreement to markets originating from Washington/Dulles under the United Agreement. The United Agreement expires on December 31, 2008 and is structured as a pro-rate agreement for which we receive all of the fares associated with local passengers and an allocated portion of the connecting passengers’ fares. We pay all of the costs of operating the flights, including sales and distribution costs. We control all scheduling, inventory and pricing for each local market we serve.

As of December 31, 2007, PNCL, Pinnacle and Colgan had 106, 4,008 and 1,202 employees, respectively. Flight attendants and ground operations agents included 203 and 941 part-time employees, respectively. The part-time employees work varying amounts of time, but typically are half-time or less employees. The follow table details the number of employees by group:

| Employee Group | | Pinnacle Airlines Corp. | | Pinnacle Airlines, Inc. | | Colgan Air, Inc. | | Total |

| Pilots | | - | | 1,197 | | 397 | | 1,594 |

| Flight attendants | | - | | 697 | | 193 | | 890 |

| Ground operations personnel | | - | | 1,412 | | 268 | | 1,680 |

| Mechanics and other maintenance personnel | | - | | 430 | | 212 | | 642 |

| Dispatchers and crew resource personnel | | - | | 90 | | 29 | | 119 |

| Management and support personnel | | 106 | | 182 | | 103 | | 391 |

| Total | | 106 | | 4,008 | | 1,202 | | 5,316 |

Labor costs are a significant component of airline expenses and can substantially affect our results, though we believe we generally have high labor productivity. Approximately 77% and 16% of Pinnacle Airlines, Inc. and Colgan Air, Inc. employees, respectively, are represented by unions.

The following table reflects our principal collective bargaining agreements and their respective amendable dates:

| Employee Group | | Employees Represented | | Representing Union | | Contract Amendable Date |

| Pinnacle’s pilots | | 1,197 | | Air Line Pilots Association | | April 30, 2005 |

| Pinnacle’s flight attendants | | 697 | | United Steel Workers of America | | February 1, 2011 |

| Pinnacle’s ground operations agents | | 1,254 | | United Steel Workers of America | | March 19, 2010 |

| Pinnacle’s flight dispatchers | | 37 | | Transport Workers Union of America | | December 31, 2013 |

| Colgan’s flight attendants | | 193 | | United Steel Workers of America | | Initial contract currently being negotiated |

The Railway Labor Act, which governs labor relations for unions representing airline employees, contains detailed provisions that must be exhausted before work stoppage can occur once a collective bargaining agreement becomes amendable.

The collective bargaining agreement between Pinnacle and the Air Line Pilots Association (“ALPA”) became amendable in April 2005. Pinnacle has been actively negotiating with ALPA since that time. In August 2006, Pinnacle filed for mediation with the National Mediation Board. Since then, Pinnacle has met with the mediator assigned to its case and with ALPA, but has not reached resolution on an amended collective bargaining agreement.

On November 5, 2007, ALPA filed suit in the U.S. District Court in Minneapolis, Minnesota against Pinnacle. The suit seeks an injunction prohibiting Pinnacle from paying certain bonuses to its pilots, asserting that such an action would violate the Railway Labor Act. Pinnacle believes that the lawsuit lacks merit, and accordingly, Pinnacle will vigorously defend its position in this case. Pinnacle does not believe that it will incur any material loss with respect to this lawsuit. On January 8, 2008, Pinnacle filed suit in the U.S. District Court for the Western District of Tennessee against ALPA, alleging bad faith bargaining. The primary intent of this lawsuit is to encourage ALPA to negotiate in good faith so that Pinnacle can reach agreement for an amended collective bargaining agreement as soon as possible. Pinnacle’s pilots are currently paid at rates less than the industry average for similarly sized aircraft, and an amended agreement is expected to contain higher rates of pay for Pinnacle’s pilots.

On March 1, 2007, we announced that Pinnacle had entered into a new four-year contract with the United Steel Workers (“USW”), the union that represents Pinnacle’s flight attendants. Pinnacle had been in negotiations with the USW since July 2006, when its most recent contract with its flight attendants expired. In September 2007, Colgan recognized the United Steel Workers of America (“USW”) to represent its flight attendants. Negotiations will begin shortly for a flight attendant collective bargaining agreement with the United Steel Workers. The Company does not expect this new collective bargaining agreement to have a material impact on its financial results, as Colgan’s flight attendants are currently compensated at rates approximating industry average.

In August 2005, Pinnacle’s flight dispatchers elected representation by the Transport Workers Union of America AFL-CIO, Air Transport Division (“TWU”). In December 2007, an agreement was negotiated and ratified by the TWU membership and Pinnacle.

Using a combination of FAA-certified maintenance vendors and our own personnel and facilities, we maintain our aircraft on a scheduled and ‘‘as-needed’’ basis. We perform preventive maintenance and inspect our engines and airframes in accordance with our FAA-approved preventive maintenance policies and procedures.

The maintenance performed on our aircraft can be divided into three general categories: line maintenance, heavy maintenance checks, and engine and component overhaul and repair. Line maintenance consists of routine daily and weekly scheduled maintenance checks on our aircraft, including pre-flight, daily, weekly and overnight checks and any diagnostic and routine repairs.

Pinnacle contracts with an affiliate of the original equipment manufacturer of its CRJ-200s to perform certain routine heavy maintenance checks on its aircraft. Pinnacle also contracts with a third-party to perform engine overhauls on its CRJ-200 fleet. These maintenance checks are regularly performed on a schedule approved by the manufacturer and the FAA. The average age of the CRJ-200 regional jets in our fleet is approximately 4.5 years. In general, both the CRJ-200 and CRJ-900 aircraft do not require their first heavy maintenance checks until they have flown approximately 8,000 hours. Therefore, we do not expect our CRJ-900s to require such heavy maintenance checks for several years.

Colgan performs its own heavy maintenance airframe checks for its Saab fleet at its maintenance facility in Houston, Texas. Colgan contracts with third parties to perform engine overhauls and propeller maintenance on its Saab fleet, and utilizes a combination of internal and third-party resources to perform heavy maintenance on its Beech 1900 fleet. Colgan also plans to use a combination of internal and third-party resources to complete heavy maintenance requirements on its Q400 fleet.

Component overhaul and repair involves sending parts, such as engines, landing gear and avionics to a third-party, FAA-approved maintenance facility. We are party to maintenance agreements with various vendors covering our aircraft engines, avionics, auxiliary power units and brakes.

Pinnacle performs the majority of its flight personnel training in Memphis, Tennessee both at its Corporate Education Center and the simulator center operated by FlightSafety International. FlightSafety International, at Pinnacle’s request, provides some overflow training at various other simulator centers throughout the U.S. The Memphis simulator center currently includes three CRJ full-motion simulators. Under Pinnacle’s agreement with FlightSafety International, Pinnacle has first priority on all of the simulator time available in the Memphis center. Instructors used in the Memphis center are typically Pinnacle employees who are either professional instructors or trained line pilot instructors.

Colgan’s flight personnel are trained at various simulator centers throughout the U.S. under a contract with FlightSafety International. Non-simulator training is conducted near its corporate headquarters in Manassas, Virginia.

We provide both in-house and outside training for our maintenance personnel. To control costs and to ensure our employees receive the best training, we take advantage of manufacturers’ training programs offered, particularly when acquiring new aircraft. We employ professional instructors to conduct training of mechanics, flight attendants and ground operations personnel in Memphis and Manassas.

We are committed to the safety and security of our passengers and employees. Since the September 11, 2001 terrorist attacks, Pinnacle and Colgan have taken many steps to increase the safety and security of their operations. Some of the safety and security measures we have taken, along with our code-share partners, include: aircraft security and surveillance, positive bag matching procedures, enhanced passenger and baggage screening and search procedures, and securing of cockpit doors. We will continue to comply with future safety and security requirements.

As required by our code-share agreements, we currently maintain insurance policies with necessary coverage levels for: aviation liability, which covers public liability, passenger liability, hangar keepers’ liability, baggage and cargo liability and property damage; war risk, which covers losses arising from acts of war, terrorism or confiscation; hull insurance, which covers loss or damage to our flight equipment; directors’ and officers’ insurance; property and casualty insurance for our facilities and ground equipment; and workers’ compensation insurance. Our code-share agreements require that we maintain specified coverage levels for these types of policies.

Our aviation liability and hull insurance coverage is obtained through a combined placement with five other airlines. We are reimbursed in full, along with margin, for aviation insurance under our three CPAs.

We were given the option under the Air Transportation Safety and Stabilization Act, signed into law on September 22, 2001, to purchase certain third-party war risk liability insurance from the U.S. government on an interim basis at rates that are more favorable than those available from the private market. As provided under this Act, we have purchased from the Federal Aviation Administration (“FAA”) this war risk liability insurance, which is currently set to expire on March 30, 2008.

Our subsidiaries operate under air carrier certificates issued by the FAA and certificates of convenience and necessity issued by the DOT. The DOT may alter, amend, modify or suspend these authorizations if the DOT determines that we are no longer fit to continue operations. The FAA may suspend or revoke the air carrier certificates if our subsidiaries fail to comply with the terms and conditions of the certificates. The DOT has established regulations affecting the operations and service of the airlines in many areas, including consumer protection, non-discrimination against disabled passengers, minimum insurance levels and others. Failure to comply with FAA or DOT regulations can result in civil penalties, revocation of the right to operate or criminal sanctions. FAA regulations are primarily in the areas of flight operations, maintenance, ground facilities, security, transportation of hazardous materials and other technical matters. The FAA requires each airline to obtain an operating certificate authorizing the airline to operate at specific airports using specified equipment. Under FAA regulations, our subsidiaries have established, and the FAA has approved, a maintenance program for each type of aircraft they operate that provides for the ongoing maintenance of these aircraft, ranging from frequent routine inspections to major overhauls.

As previously discussed, the majority of our business is conducted under capacity purchase agreements. Therefore, our markets and routes are chosen by the major airlines with whom we partner. As of December 31, 2007, Pinnacle operated 137 CRJ-200s and one CRJ-900 serving 115 cities in 36 states and four Canadian provinces out of Northwest’s three hubs and out of Delta’s Atlanta hub. Colgan operated 42 Saab 340s and six Beech 1900 aircraft serving 53 cities in 12 states. Our route network primarily spans the entire eastern half of the United States. Our aircraft fly as far west as Salt Lake City, Utah, as far east as Bangor, Maine, as far north as Regina, Saskatchewan and as far south as Fort Lauderdale, Florida.

The airline industry is highly competitive. Major airlines award contract flying to regional airlines based upon three main areas of competition: costs, customer service, and operational reliability. We compete not only with other regional airlines, but also with regional carriers that are wholly owned subsidiaries of major airline holding companies.

In addition, we face competition from other airlines within the markets that we service under revenue pro-rate code-share agreements. These markets are served with our Saab 340 fleet by our Colgan subsidiary, and are primarily concentrated in New England, the mid-Atlantic, and Texas.

As with most airlines, we are subject to seasonality, though seasonality has historically had a lesser effect on our capacity purchase operations than it has on our pro-rate operations. Mainline carriers use capacity purchase agreements because these arrangements allow them to expand their operations at lower fixed costs by using regional’s lower cost structure for operating aircraft. Because regional aircraft are more fuel efficient and economical to operate than larger aircraft, mainline carriers tend to maintain regional aircraft utilization during seasons of reduced demand. Conversely, our financial results can be materially affected by the level of passenger demand for our services operated under pro-rate agreements under which we more directly bear the risk of decreased demand for our services. Our results can materially vary due to seasonality and cyclicality. For example, Colgan has historically reported significant losses or significantly lower income during the first and fourth quarters of each year, when demand for air travel is generally lower, and higher income during the second and third quarters of each year when demand for air travel increases.

PNCL’s website address is www.pncl.com. All of our filings with the U.S. Securities and Exchange Commission (“SEC”) are available free of charge through our website on the same day, or as soon as reasonably practicable after we file them with, or furnish them to, the SEC. Printed copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K may be obtained by submitting a request at PNCL’s website. PNCL’s website also contains our Code of Conduct, which contains the code of business conduct and ethics applicable to all of our directors and employees. Any amendments made in the future to the code of business conduct will be promptly posted to our website.

Our ASA with Northwest generated approximately 77% of our consolidated 2007 revenues. Termination by Northwest of our ASA would result in material declines in our revenues and earnings, and the size of our regional jet fleet.

If Northwest terminates the ASA for cause, it will have the right to terminate our regional jet aircraft leases covered by the agreement and take possession of these aircraft. As a result, we would lose our most significant source of revenue and earnings, and likely would not have an immediate source of revenue or earnings to offset such a loss. Northwest may also terminate the agreement at any time upon our bankruptcy or for any breach of the agreement by us that continues uncured for more than 30 days after we receive notice of the breach. A termination of our ASA would have a material adverse effect on our financial condition, operating revenues, and net income unless we are able to enter into satisfactory substitute arrangements whereby we would acquire aircraft to operate in conjunction with a regional airline service agreement with another major airline. In addition, we would be required to obtain the necessary airport facilities and gates, and provided the same variety of third-party services presently provided by Northwest, or alternatively, take the necessary steps to operate as an independent airline. We may not be able to enter into substitute code-share arrangements, and any such arrangements we might secure may not be as favorable to us as our current agreements. Operating this airline independently from major partners would be a significant departure from our business plan, and would require significant time and resources, which may not be available to us at such time.

Reduced utilization levels of our aircraft under our capacity purchase code-share agreements would reduce our revenues and earnings.

A significant portion of the revenues from our capacity purchase code-share agreements are derived from block hours, departures and certain reimbursable expenses that we incur only when we fly. During 2007, approximately 40% of our regional airline services revenue stemmed from these activities. If our code-share partners reduce the utilization of our fleet or decrease the size of our fleet, our revenues and profits would decrease.

Under our capacity purchase agreements, our code-share partners are solely responsible for scheduling our flights, but these agreements do not require the code-share partner to meet any minimum utilization levels for our aircraft. Our code-share partners could decide to significantly reduce the utilization levels of our fleet in the future. For example after September 11, 2001, Northwest reduced Pinnacle’s scheduled capacity by approximately 20% on an available seat mile basis for a short period of time. More recently, during construction delays at the Minneapolis/St. Paul airport, Northwest cancelled numerous Pinnacle flights to allow its own aircraft to utilize the available airport and runway capacity during the construction period. Additionally, any disruption in the operations of one of our code-share partners, such as may be caused by threatened strike by any of our code-share partners’ employee groups, could adversely affect our fleet utilization, and thus reduce our revenue and profits.

We are engaged in discussions with Northwest, our largest customer, regarding disputes over the interpretation of various aspects of our ASA, and we may encounter additional ASA interpretation disputes as our business expands to include other partners. We may pursue binding arbitration, which could yield a ruling that negatively affects our future earnings.

We are currently engaged in discussions with Northwest involving various disputed items under the ASA that could impact the rates that we are compensated for our regional airline services. Some of these items relate to the period prior to the execution of the ASA in January 2007. Two of these items could affect our operating income in future periods. The first item relates to a 2006 adjustment to Pinnacle’s block hour, departure and fixed cost rates. Our annual operating income could increase or decrease by approximately $2.8 million per year based upon differing interpretations of the relevant ASA terms. The second issue involves the reclassification of certain airport and ground handling costs and related ASA revenue in a manner that could reduce our operating income in future periods by up to approximately $2.0 million per year. Also, as our business expands to include other partners, interpreting certain provisions of our ASA becomes more complex and subject to different interpretations of various terms. Additional disputes with Northwest could develop if we arrive at differing interpretations of key terms.

If we are unable to resolve these issues directly with Northwest, we may enter into a binding arbitration process or other form of legal dispute resolution. Adverse determinations in these matters could result in a loss of up to $7.2 million for disputed amounts through December 31, 2007. We may not be successful in resolving these disputes without reducing our future income, or without paying Northwest for some or all of the amount noted above. We cannot currently predict the timing of the resolution of these matters.

Increases in our labor costs, which constitute a substantial portion of our total operating costs, may directly affect our earnings.

Labor costs are not directly reimbursed by any of our code-share partners. Rather, these costs are intended to be included in the payments based on pre-set rates for block hours, departures and fixed costs. Labor costs constitute a significant portion, ranging from 26% to 28%, of our total operating costs. Pressure to increase these costs beyond standard industry wages, and therefore beyond the limits intended to be covered by the fixed payments we receive from our code-share partners, is increased by the high degree of unionization of our workforce (64% unionized at December 31, 2007) and the ongoing negotiations between Pinnacle and ALPA for a revised collective bargaining agreement. An increase in our labor costs over standard industry wages could result in a material reduction to our earnings, and could affect our future prospects for additional business opportunities.

Strikes or labor disputes with our employees may adversely affect our ability to conduct our business and could result in the termination, or a significant reduction of the benefit, of our code-share agreements. In December 2007, Pinnacle’s pilots voted to authorize a strike.

If we are unable to reach an agreement with any of our unionized work groups on the terms of their collective bargaining agreements, we may be subject to work interruptions, work stoppages, or a fleet size reduction. Work stoppages may adversely affect our ability to conduct our operations and fulfill our obligations under our code-share agreements.

Pinnacle’s bargaining agreement with its pilots became amendable on April 30, 2005, and Pinnacle is currently engaged in discussions with ALPA representatives. Both the union and management continue to engage in labor talks that are governed by the National Mediation Board, and the parties have not been released from these talks. While a strike deadline has not been set and Pinnacle’s pilots are not legally authorized to strike, Pinnacle’s pilot workforce recently voted affirmatively to authorize a strike. Any strike would take place only after a thirty-day cooling-off period that begins when the parties are released from their talks by the National Mediation Board. Under the ASA, adverse consequences could result from a strike or a work stoppage, including a significant fleet reduction or possible termination of the ASA.

We are increasingly dependent on technology in our operations, and if our technology fails, our business may be adversely affected.

Our subsidiaries’ systems operations control centers, which oversee daily flight operations, are dependent on a number of technology systems to operate effectively. Large scale interruption in technology infrastructure that we depend on, such as power, telecommunications or the internet, could cause a substantial disruption in our operations.

For example, in December 2004, Pinnacle’s operations were significantly affected when adverse weather conditions closed or reduced operations at over 60% of the airports we serve. The severe weather strained Pinnacle’s operational systems, and its ability to recover quickly to normal reliability levels was impaired. The December 2004 operational conditions were a factor in Pinnacle’s failure to meet certain operational performance levels under the 2002 ASA for the second half of 2004, and consequently Pinnacle failed to earn $1.4 million of incentive revenue from Northwest.

In addition, we are transitioning during 2008 to new software for our accounting, maintenance, inventory and flight statistics functions. If there are problems with this integration, our ability to capture critical data could be affected.

If we are unable to attract and retain key employees, our business could be harmed.

We compete against the other major and regional U.S. airlines for pilots, some of which offer wage and benefit packages that exceed ours. We may be required to increase wages and/or benefits in order to attract and retain qualified pilots or risk considerable turnover. As we grow and add additional aircraft types to our operating fleets, our need for pilots increases. We believe that in the current environment where many of the major U.S. airlines are emerging from bankruptcy and/or growing their own operations, it may be increasingly challenging to continue to hire and retain qualified pilots.

Further complicating our ability to both attract and retain pilots is Pinnacle’s ongoing dispute with ALPA, against which Pinnacle filed a bad faith lawsuit during January 2008, and Pinnacle’s inability to reach a new pilot agreement whereby, in an effort to remain competitive within the industry, Pinnacle could increase its pilot salaries to the industry average.

If we are unable to hire, train and retain qualified pilots we would be unable to efficiently run our operations and our competitive ability would be impaired. Our business could be harmed and revenue reduced if, due to the shortage of pilots, we are forced to cancel flights and forego earning incentive-based revenue under our code-share agreements. For example, during the first half of 2007 we failed to earn $2.9 million of incentive-based revenue under our ASA primarily due to a pilot shortage.

Under certain circumstances, we may be required to pay cash or a combination of cash and our common stock to holders of our 3.25% senior convertible notes due 2025 at their option prior to the maturity date. However, due to our significant investment in purchasing additional aircraft for our operating fleet, our liquidity is reduced.

Holders of our $121.0 million principal amount senior convertible notes (the “Notes”) may require us to purchase all or a portion of their Notes for cash on February 15, 2010, February 15, 2015 and February 15, 2020 at a purchase price equal to 100% of the principal amount of the Notes to be repurchased plus accrued and unpaid interest, if any, to the purchase date. In addition, under certain circumstances, holders of the Notes may convert the Notes into the equivalent value of our common stock. Upon conversion, we will pay the portion of the conversion value up to the principal amount of each Note in cash, and any excess conversion value in cash or our common stock at our election. However, due to our significant investment in the purchase of our CRJ-900 and Q400 aircraft, our financial leverage has significantly increased and our liquidity has been reduced. We may find it difficult to obtain the cash necessary to redeem the notes should holders choose to convert the notes into cash and stock or should holders choose to redeem the notes at the optional redemption date in February 2010. For further discussion of the Notes, please refer to Note 7, Debt, in Item 8 of this Form 10-K.

We are currently under audit by the Internal Revenue Service, and the results of the audit could materially affect our financial statements and liquid assets.

The Internal Revenue Service (“IRS”) is currently examining our federal income tax returns for years 2003 through 2005. The IRS has focused on several key transactions that we undertook during those periods and the IRS has proposed adjustments. Should the IRS prevail on any proposed adjustment, the impact on the Company could be significant. While we believe that we have recorded reserves that are appropriate for each identified issue, our liquid assets and our net earnings could be significantly reduced if the IRS examination ultimately overturns our positions.

Our short-term investment portfolio is primarily composed of Auction Rate Securities (“ARS”), which have recently become illiquid and may become impaired.

We require liquidity to make our investment in new aircraft. In order to fund the non-financed portion of future aircraft deliveries and due to the existence of certain short-term financing debt covenants, we may be forced to sell some of our ARS portfolio under distressed, illiquid market conditions, which would result in our recognizing a loss on such sales. In addition, we may record an impairment charge in future periods if we determine that the decline in value of our ARS portfolio is other-than-temporary or will not recover before we sell the investment.

We may be adversely affected by increases in fuel prices, and we would be adversely affected by disruptions in the supply of fuel.

Colgan’s pro-rate agreements provide that Colgan pays for its own fuel. Fuel prices have recently increased significantly and remain high. For example, the average price paid per gallon increased 29% from the first quarter of 2007 to the fourth quarter of the same year. Due to the competitive nature of the airline industry, we may not be able to pass on increased fuel prices to customers by increasing fares. If fuel prices decline in the future, increased fare competition and lower revenues may offset any potential benefit of lower fuel prices.

Our results could be negatively affected by Colgan’s pro-rate agreements.

Colgan has revenue-sharing agreements with United, Continental and US Airways. We are now exposed to the fluctuations associated with revenue-sharing agreements for fare competition and passenger volumes. The rise and fall of profits can correspond to seasonality, and operations can be adversely affected by severe weather, levels of travel demand and competition in Colgan’s markets. We will realize increased profits as ticket prices and passenger load factors increase or fuel prices decrease and, correspondingly, realize decreased profits as ticket prices and passenger load factors decrease or fuel prices increase.

We may not achieve the potential benefits of the Colgan acquisition.

Our achievement of the potential benefits of the Colgan acquisition will depend on our ability to successfully implement our business strategy, including improving the pro-rate route profitability, improving the utilization of equipment and facilities, increasing employee productivity and allocating overhead and administrative expenses over a larger platform as we grow Colgan’s fleet with the additional Q400 aircraft. Our initiatives to improve and grow Colgan’s operations may be costly, complex and time-consuming.

The Colgan acquisition diversifies our fleet mix with the addition of Colgan's existing turboprop and new Q400 aircraft. This fleet diversification increases the complexity of managing our business. If we are not able to successfully achieve our objectives and manage the diverse fleet, the potential benefits of the Colgan acquisition may not be realized fully or at all, or they may take longer to realize than expected. We cannot be certain that the Colgan acquisition will result in combined results of operations and financial condition consistent with our expectations or superior to what Pinnacle or Colgan could have achieved independently.

Our capacity purchase agreements with Delta and Continental may not be profitable.

During 2007, we entered into new ten-year capacity purchase agreements with Delta and Continental to operate CRJ-900 and Q400 aircraft, respectively. As part of the bidding process to win these contracts, we utilized complex financial models, which included assumptions as to numerous variables. Adding to the complexity is that the agreements required that we purchase the aircraft to be utilized under these agreements. We lack experience managing aircraft ownership, and our assumptions may not be accurate. Consequently, should our actual experience differ from the assumptions we used when modeling the business, the contracts may not be profitable.

Our current growth plans include fleet diversification, which increases the complexity of our business and exposes us to risks that could reduce our profitability.

We are in the process of acquiring 16 CRJ-900 and 15 Q400 aircraft. Currently, we have agreements to operate all purchased aircraft for Delta and Continental, respectively. If we are incorrect in our assessment of the profitability and feasibility of our growth plans, or if circumstances change in a way that was unforeseen by us, our growth may not be profitable. With the addition of these aircraft, Pinnacle is no longer operating a single fleet type. Since 2003, Pinnacle has operated only CRJ-200 aircraft to take advantage of the efficiencies in employee training, aircraft maintenance, lower spare parts inventory requirements, and simplified aircraft scheduling. Similarly, Colgan has historically operated only Saab and Beech aircraft. As we expand our operations to include additional aircraft types, some of these efficiencies may no longer be realized, which could reduce our profitability.

All staff comments received from the Securities and Exchange Commission were resolved as of the date of this filing.

As shown in the following table, the Company’s aircraft fleet consisted of 140 Canadair regional jets (“CRJs”) and 48 turboprop aircraft at December 31, 2007.

| Aircraft Type | | Number of Aircraft Leased | | Number of Aircraft Owned | | Standard Seating Configuration | | Average Age (in years) |

| CRJ-200 | | 137 | | - | | 50 | | 4.5 |

CRJ-900(1) | | - | | 3 | | 76 | | 0.1 |

| Saab 340 | | 17 | | 25 | | 34/30 | | 16.2 |

| Beech 1900D | | 5 | | 1 | | 19 | | 14.6 |

| Total | | 159 | | 29 | | | | |

(1) Of the three CRJ-900 aircraft, only one was operated as of December 31, 2007.

The following table outlines the number of firm orders and options to purchase aircraft as of December 31, 2007:

| | | Firm Noncancelable | | Firm Cancelable | | Options | | Total |

| Q400 | | | | | | | | |

| 2008 | | 15 | | - | | - | | 15 |

| 2009 | | - | | 8 | | 8 | | 16 |

| 2010 | | - | | 2 | | 12 | | 14 |

| Total Q400 | | 15 | | 10 | | 20 | | 45 |

| | | | | | | | | |

| CRJ-900 | | | | | | | | |

| 2008 | | 12 | | - | | - | | 12 |

| 2009 | | 1 | | - | | - | | 1 |

| Total CRJ-900 | | 13 | | - | | - | | 13 |

| | | | | | | | | |

| Total | | 28 | | 10 | | 20 | | 58 |

The Company had the following significant dedicated facilities as of December 31, 2007:

| Location | | Description | | Square Footage | | Lease Expiration Date |

| Memphis, TN | | Pinnacle Airlines, Inc. Headquarters and Corporate Education Center | | | 59,100 | | August 2011 |

| | | | | | | | |

| Memphis, TN | | Pinnacle Airlines Corp. Headquarters | | | 12,300 | | July 2009 |

| | | | | | | | |

| Memphis, TN | | Hangar and Maintenance Facility | | | 51,250 | | December 2016 |

| | | | | | | | |

| Knoxville, TN | | Hangar and Maintenance Facility | | | 55,000 | | Termination of the ASA |

| | | | | | | | |

| Manassas, VA | | Colgan Air, Inc. Hangars and Maintenance Facility and Corporate Headquarters | | | 63,060 | | December 2008/ December 2025 |

Our significant maintenance facilities are positioned in spoke cities based on market size, frequency, and location. These facilities are used for overnight maintenance; however, Memphis and Manassas are also used during the day. We have additional smaller maintenance facilities in Fort Wayne, Indiana, South Bend, Indiana, Houston, Texas, Latham, New York and Hyannis, Massachusetts. The facilities are highly utilized with an average turn around time of seven to ten hours. We also expect to relocate the maintenance base from Manassas to Washington Dulles airport to lower operating costs. We believe that our existing facilities are adequate for the foreseeable needs of our business.

The table above includes two hangars in Manassas that we lease from one of the selling shareholders of Colgan. Subsequent to year end, we entered into a side agreement with the selling shareholder, authorizing the selling shareholder to market the two hangars to a third-party purchaser with a condition precedent that a third-party purchaser assume our leases with modifications that would reduce the lease term and permit early lease termination. We remain obligated under the original purchase agreement to purchase the hangars in the event that a sale to a third-party purchaser fails to occur.

In connection with the ASA, we entered into facilities use agreements under which we have the right to use Northwest terminal gates, parking positions and operations space at the Detroit, Minneapolis/St. Paul and Memphis airports. The DCA provides us with the right to use terminal gates, parking positions and operations space at Delta’s Atlanta hub.

In connection with our code-sharing partners, we maintain contract service agreements with Continental, United and US Airways allowing for the use of terminal gates, parking positions and operations space at the Houston, Washington Dulles, Boston, LaGuardia, and Pittsburgh airports. The addition of the Q400 aircraft to our fleet will require additional gate, parking and operational space, which is included in the Continental CPA.

We believe the use of the terminal gates, parking positions, and operations space for our code-share partners will be sufficient to meet the operational needs of our business.

Item 3. Legal Proceedings

Pinnacle and Colgan are defendants in various ordinary and routine lawsuits incidental to our business. While the outcome of these lawsuits and proceedings cannot be predicted with certainty, it is the opinion of our management, based on current information and legal advice, that the ultimate disposition of these suits will not have a material adverse effect on our financial statements as a whole. For further discussion, see Note 17, Commitments and Contingencies, in Item 8 of this Form 10-K.

On November 5, 2007, ALPA filed suit in the U.S. District Court in Minneapolis, Minnesota against Pinnacle. The suit seeks an injunction prohibiting Pinnacle from paying certain bonuses to its pilots, asserting that such an action would violate the Railway Labor Act. Pinnacle believes that the lawsuit lacks merit, and accordingly, Pinnacle will vigorously defend its position in this case. Pinnacle does not believe that it will incur any material loss with respect to this lawsuit. On January 8, 2008, Pinnacle filed suit in the U.S. District Court for the Western District of Tennessee against ALPA, alleging bad faith bargaining. The primary intent of the lawsuit is to encourage ALPA to negotiate in good faith so that Pinnacle can reach agreement for an amended collective bargaining agreement as soon as possible. Pinnacle’s pilots are currently paid at rates less than the industry average for similarly sized aircraft, and an amended agreement is expected to contain higher rates of pay for Pinnacle’s pilots. For further discussions, see Item 1 of this Form 10-K.

Colgan is a defendant in litigation resulting from the September 11, 2001 terrorist attacks. The Company believes that any adverse outcome from this litigation will be covered by insurance and will therefore have no material adverse effect on the Company’s financial position, results of operations and cash flows.

We are subject to regulation under various environmental laws and regulations, which are administered by numerous state and federal agencies, including the Clean Air Act, the Clean Water Act and the Comprehensive Environmental Response, Compensation and Liability Act of 1980. In addition, many state and local governments have adopted environmental laws and regulations to which our operations are subject. We are, and may from time to time become, involved in environmental matters, including the investigation and/or remediation of environmental conditions at properties used or previously used by us. We are not, however, currently subject to any environmental cleanup orders imposed by regulatory authorities, nor do we have any active investigations or remediations at this time.

Regulatory Matters

We are subject to regulation under various laws and regulations which are administered by numerous state and federal agencies, including but not limited to the FAA, TSA and DOT. We are involved in various matters with these agencies during the ordinary course of our business. While the outcome of these matters cannot be predicted with certainty, it is the opinion of our management, based on current information and past experience, that the ultimate disposition of these matters will not have a material adverse effect on our financial condition as a whole.

None.

Part II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The shares of PNCL’s common stock are quoted and traded on the Nasdaq National Market under the symbol “PNCL.” Our common stock began trading on November 25, 2003, following our initial public offering. Set forth below, for the applicable periods indicated, are the high and low closing sale prices per share of our common stock as reported by the Nasdaq National Market.

| 2006 | | High | | | Low |

| First Quarter | | $ | 8.14 | | | $ | 6.07 |

| Second Quarter | | $ | 7.59 | | | $ | 6.40 |

| Third Quarter | | $ | 7.59 | | | $ | 5.74 |

| Fourth Quarter | | $ | 17.05 | | | $ | 7.44 |

| 2007 | | High | | | Low |

| First Quarter | | $ | 19.88 | | | $ | 16.76 |

| Second Quarter | | $ | 19.29 | | | $ | 16.13 |

| Third Quarter | | $ | 19.68 | | | $ | 15.14 |

| Fourth Quarter | | $ | 16.75 | | | $ | 13.86 |

As of March 14, 2008, there were approximately 40 holders of record of our common stock. We have paid no cash dividends on our common stock and have no current intention of doing so in the future.

The follow table represents the Company’s purchase of its common stock made during the three months ended December 31, 2007:

| Period | | Total Number of Shares Purchased | | | Average Price Paid per Share (1) | | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | | Maximum Number (or Approximate Dollar Value) that May Yet Be Purchased Under the Plans or Programs | |

| Balance at October 1, 2007 | | | 1,958,032 | | | $ | 17.95 | | | | 1,958,032 | | | $ | 4,793,287 | |

| | | | | | | | | | | | | | | | | |

| October 1, 2007 – October 31, 2007 | | | - | | | | - | | | | - | | | | 4,793,287 | |

| | | | | | | | | | | | | | | | | |

| November 1, 2007 – November 30, 2007 | | | 2,492,060 | | | | 13.22 | (2) | | | 2,492,060 | | | | - | (2) |

| | | | | | | | | | | | | | | | | |

| December 1, 2007 – December 31, 2007 | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | |

| Total | | | 4,450,092 | | | $ | 15.30 | | | | 4,450,092 | | | $ | - | |

(1) Average price paid per share excludes any commissions paid. | |

(2) On November 21, 2007, the Board of Directors authorized a $28.1 million increase in the Company's existing share repurchase program to enable the Company to purchase the 2,492,060 shares of its common stock held by Northwest. The Company paid Northwest $32.9 million, or $13.22 per share, for the stock, which was a mutually agreed upon volume-based priced less than the then closing market price of $16.26. | |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The information under the caption “Securities Authorized for Issuance under Equity Compensation Plans,” appearing in the Proxy Statement for our 2008 Annual Meeting of Stockholders, anticipated to be filed with the Commission within the 120 days after December 31, 2007, is hereby incorporated by reference.

Our Certificate of Incorporation provides that no shares of capital stock may be voted by or at the direction of persons who are not United States citizens unless such shares are registered on a separate stock record. Our Bylaws further provide that no shares will be registered on such separate stock record if the amount so registered would exceed United States foreign ownership restrictions. United States law currently limits to 25% the voting power in our company (or any other U.S. airline) of persons who are not citizens of the United States.

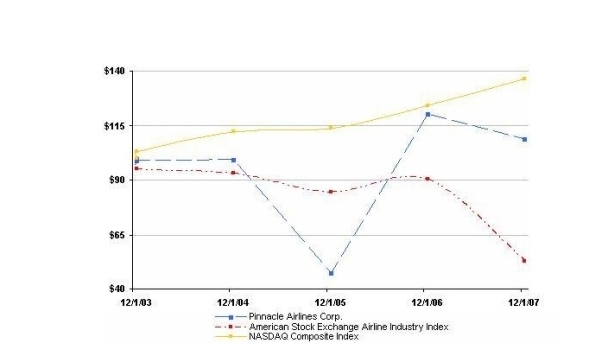

The following graph compares the cumulative total return on the Company’s common stock with the cumulative total returns (assuming reinvestment of dividends) on the American Stock Exchange Airline Industry Index and the NASDAQ Composite Index as if $100 were invested in our common stock and each of those indices on November 25, 2003, the date of the Company’s initial public offering.

Item 6. Selected Financial Statements

You should read this selected consolidated financial data together with the audited consolidated financial statements and related notes contained in Item 8, Management’s Discussion and Analysis of Financial Condition and Results of Operation contained in Item 7 and Risk Factors in Item 1A of this Form 10-K.

| | | Years Ended December 31, | |

| | | 2007 (8) | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Statement of Operations Data: | | (in thousands, except per share data) | |

| Total operating revenues | | $ | 787,374 | | | $ | 824,623 | | | $ | 841,605 | | | $ | 635,448 | | | $ | 456,770 | |

Total operating expenses (1) | | | 735,286 | | | | 697,075 | | | | 814,676 | | | | 568,145 | | | | 392,601 | |

Operating income (1) | | | 52,088 | | | | 127,548 | | | | 26,929 | | | | 67,303 | | | | 64,169 | |

Operating income as a percentage of operating revenues (2) | | | 6.6 | % | | | 15.5 | % | | | 3.2 | % | | | 10.6 | % | | | 14.0 | % |

Nonoperating (expense) income(3) | | | (1,051 | ) | | | (2,948 | ) | | | 14,482 | | | | (4,178 | ) | | | (6,770 | ) |

Net income (1) | | | 34,637 | | | | 77,799 | | | | 25,698 | | | | 40,725 | | | | 35,067 | |

Basic earnings per share (1) | | $ | 1.66 | | | $ | 3.55 | | | $ | 1.17 | | | $ | 1.86 | | | $ | 1.60 | |

Diluted earnings per share (1) | | $ | 1.50 | | | $ | 3.54 | | | $ | 1.17 | | | $ | 1.86 | | | $ | 1.60 | |

| Shares used in computing basic earnings per share | | | 20,897 | | | | 21,945 | | | | 21,913 | | | | 21,892 | | | | 21,892 | |

| Shares used in computing diluted earnings per share | | | 23,116 | | | | 21,974 | | | | 21,932 | | | | 21,911 | | | | 21,892 | |

| | | As of December 31, | |

| | | 2007 (8) | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Balance Sheet Data: | | (in thousands) | |

Cash and cash equivalents (4) | | $ | 26,785 | | | $ | 705 | | | $ | 31,567 | | | $ | 34,912 | | | $ | 31,523 | |

| Short-term investments | | | 186,850 | | | | 72,700 | | | | 44,160 | | | | - | | | | - | |

| Property and equipment, net | | | 255,410 | | | | 40,985 | | | | 42,535 | | | | 39,416 | | | | 34,286 | |

| Total assets | | | 708,588 | | | | 301,273 | | | | 228,802 | | | | 165,960 | | | | 128,906 | |

| Long-term debt obligations, including capital leases | | | 196,480 | | | | 121,000 | | | | 121,000 | | | | 120,000 | | | | 120,000 | |

| Stockholders' equity (deficiency) | | | 57,822 | | | | 97,021 | | | | 18,618 | | | | (7,548 | ) | | | (42,382 | ) |

Item 6. Selected Financial Statements

| | Years Ended December 31, |

| | 2007 (8) | | 2006 | | 2005 | | 2004 | | 2003 |

| Other Data: | | | | | | | | | |

| Revenue passengers (in thousands) | 11,494 | | 8,988 | | 8,105 | | 6,340 | | 4,540 |

Revenue passenger miles (in thousands) (5) | 4,898,188 | | 4,288,551 | | 4,129,039 | | 2,894,776 | | 1,797,631 |

Available seat miles (“ASMs”) (in thousands) (6) | 6,604,082 | | 5,640,629 | | 5,732,773 | | 4,219,078 | | 2,678,000 |

Passenger load factor (7) | 74.2% | | 76.0% | | 72.0% | | 68.6% | | 67.1% |

Operating revenue per ASM (in cents) (2) | 11.92 | | 14.62 | | 14.68 | | 15.06 | | 17.06 |

Operating revenue per block hour (2) | $1,392 | | $1,987 | | $1,944 | | $1,962 | | $2,168 |

Operating costs per ASM (in cents) (1) | 11.13 | | 12.36 | | 14.21 | | 13.47 | | 14.66 |

Operating cost per block hour (1) | $1,300 | | $1,679 | | $1,882 | | $1,754 | | $1,864 |

| Block hours | | | | | | | | | |

| Regional jets | 438,988 | | 415,069 | | 432,900 | | 323,810 | | 210,646 |

| Turboprops | 126,675 | | - | | - | | - | | - |

| Departures | | | | | | | | | |

| Regional jets | 265,418 | | 251,091 | | 249,262 | | 201,816 | | 146,898 |

| Turboprops | 107,171 | | - | | - | | - | | - |

| Average daily utilization (in block hours) | | | | | | | | | |

| Regional jets | 8.73 | | 9.17 | | 9.07 | | 8.98 | | 8.83 |

| Turboprops | 7.32 | | - | | - | | - | | - |

| Average stage length (in miles) | 321 | | 470 | | 500 | | 450 | | 384 |

| Number of operating aircraft (end of period) | | | | | | | | | |

| Regional jets | 138 | | 124 | | 124 | | 117 | | 76 |

| Turboprops | 48 | | - | | - | | - | | - |

| Employees | 5,316 | | 3,860 | | 3,436 | | 3,056 | | 2,253 |

| (1) Results for the years ended December 31, 2006 and 2005 were affected by the Northwest and Mesaba bankruptcies. |

(2) As discussed in “Pinnacle’s Agreements with Major Airlines” in Item 1. Business, our target operating margin under the ASA was 10% from December 1, 2003 through December 31, 2006. Under the ASA, effective January 1, 2007, Pinnacle’s Northwest Airlink target operating margin was reduced to 8% and certain significant expenses such as fuel and aircraft rentals were eliminated or reduced. For further discussion of the target operating margin, refer to Note 4 Code-Share Agreements in Item 8 of this Form 10-K. |

| (3) Nonoperating income for the year ended December 31, 2005 includes a gain of $18.0 million related to the repurchase of our note payable to Northwest. |

| (4) Cash balance as of December 31, 2006 does not include the normal Northwest end-of-month payment of $31.9 million, which was received on January 2, 2007 as December 31, 2006 fell on a non-business day. |

| (5) Revenue passenger miles represent the number of miles flown by revenue passengers. |

| (6) Available seat miles represent the number of seats available for passengers multiplied by the number of miles the seats are flown. |

| (7) Passenger load factor equals revenue passenger miles divided by available seat miles. |

| (8) The date of acquisition for Colgan was January 18, 2007. The data for 2007 includes Colgan data and statistics from the date of acquisition through the end of the year, in addition to data for Pinnacle Airlines, Inc. and Pinnacle Airlines Corp. See Footnotes 3 and 18 in Item 8 of this Form 10-K for further discussion. |

Item 6. Selected Financial Statements

Certain Statistical Information:

The following tables present our operating expenses per block hour and operating expenses per available seat mile. While not relevant to our financial results, this data is used as an analytic in the airline industry. Please see Results of Operations in Item 7 of this Form 10-K for more information on our operating expenses.

| | | Years Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Operating expenses per block hour: | | | | | | | | | | | | | | | |

| Salaries, wages and benefits | | $ | 359 | | | $ | 342 | | | $ | 310 | | | $ | 325 | | | $ | 395 | |

Aircraft fuel(1) | | | 68 | | | | 263 | | | | 260 | | | | 258 | | | | 261 | |

| Aircraft maintenance, materials and repairs | | | 154 | | | | 85 | | | | 74 | | | | 73 | | | | 67 | |

Aircraft rentals(1) | | | 245 | | | | 636 | | | | 642 | | | | 645 | | | | 647 | |

| Other rentals and landing fees | | | 104 | | | | 104 | | | | 99 | | | | 114 | | | | 139 | |