UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 2007

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

COMMISSION FILE NUMBER000-50033

IRELAND INC.

(Exact name of registrant as specified in its charter)

| NEVADA | 91-2147049 |

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

| | |

| 2441 West Horizon Ridge Parkway, Suite 100 | |

| Henderson, Nevada | 89052 |

| (Address of principal executive offices) | (Zip Code) |

| | |

| Registrant’s telephone number, including area code | (702) 932-0353 |

| | |

| Securities registered pursuant to Section 12(b) of the Act: | NONE. |

| | |

| Securities registered pursuant to Section 12(g) of the Act: | Common Stock, $0.001 Par Value Per Share. |

Indicate by check mark if the registrant is a well-known seasoned issuer as defined by Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (s229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter:$42,467,800 based on a price of $2.05,being the average bid and asked price for the registrant’s common stock as quoted on the OTC Bulletin Board onJune 29, 2007.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.As of March 25, 2008, the registrant had 97,010,087 shares of common stock outstanding.

IRELAND INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2007

TABLE OF CONTENTS

2

PART I

Certain statements contained in this Annual Report on Form 10-K constitute "forward-looking statements.” These statements, identified by words such as “plan,” "anticipate,” "believe,” "estimate,” "should," "expect" and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include those set forth under the caption "Management's Discussion and Analysis or Plan of Operation" and elsewhere in this Annual Report. We advise you to carefully review the reports and documents we file from time to time with the Securities and Exchange Commission (the “SEC”), particularly our quarterly reports on Form 10-QSB and Form 10-Q and our current reports on Form 8-K.

As used in this Annual Report, the terms "we,” "us,” "our,” “Ireland,” and the “Company” mean Ireland Inc. and its subsidiaries, unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

ITEM 1. BUSINESS.

OVERVIEW

We were incorporated on February 20, 2001 under the laws of the State of Nevada under the name “Merritt Ventures Corp.” On December 19, 2005, we changed our name to “Ireland Inc.” On April 25, 2007, we effected a 4-for-1 stock split of our common stock. As a result, our authorized capital was increased from 100,000,000 shares of common stock, par value $0.001 per share, to 400,000,000 shares of common stock, par value $0.001 per share. Except as otherwise stated, all references to shares and prices per share have been adjusted to give retroactive effect to the stock split.

We are an exploration stage company engaged in the acquisition and exploration of mineral properties.

On February 20, 2008, we completed the acquisition of Columbus Brine Inc. (“CBI”). The acquisition of CBI was completed pursuant to the Agreement and Plan of Merger entered into by us, CBI Acquisition, Inc., our wholly owned subsidiary incorporated for the sole purpose of completing the acquisition, (“Ireland Sub”), CBI, and CBI’s directors and officers, John T. Arkoosh, William Maghan and Lawrence E. Chizmar, Jr. (collectively referred to as the “CBI Principals”) on December 14, 2007, and as amended on January 31, 2008 (the Agreement and Plan of Merger, as amended, is referred to as the “Merger Agreement”). The acquisition of CBI was completed by merging CBI into and with Ireland Sub, with Ireland Sub continuing as the surviving entity. In order to complete the acquisition, we issued to the former shareholders of CBI an aggregate of 10,440,087 shares of our common stock and an aggregate of 5,220,059 share purchase warrants. Each share purchase warrant entitles the holder to purchase one additional share of our common stock at a price of $2.39 per share until February 19, 2013. We may accelerate the expiration date of the share purchase warrants after August 19, 2010 if the average price of our common stock over any 20 consecutive trading days is greater than or equal to 150% of the exercise price. The share purchase warrants provide the holder with a cashless exercise right.

As a result of our acquisition of CBI, we now hold a 100% interest in a mineral project located in Esmeralda County, Nevada that we call the “Columbus Project.” In addition to the Columbus Project, we have an interest in a mineral project located in San Bernardino County and Kern County, California that we refer to as the Red Mountain Project. In addition, we own a 100% interest in a mineral claim located in Clark County, Nevada that we refer to as the Ireland Claim. A description of the Columbus Project, the Red Mountain Project and the Ireland Claim is set out below under the heading “Item 2 – Properties.”

RECENT CORPORATE DEVELOPMENTS

We have experienced the following corporate developments since our quarter ended September 30, 2007:

| 1. | On October 6, 2007, we received notice that Telford Sadovnick, P.L.L.C. had resigned as our auditors. Telford Sadovnick stated that their resignation was due to the fact that they had withdrawn their |

3

| registration with the Public Company Accountability Oversight Board (“PCAOB”) and were no longer able to audit US issuers. |

| | |

| 2. | On October 15, 2007, our Board of Directors appointed Brown Armstrong Paulden McCown Starbuck Thornburgh & Keeter Accountancy Corporation as our new independent registered public accounting firm following the resignation of Telford Sadovnick, P.L.L.C. |

| | |

| 3. | On October 19, 2007, we completed the fourth tranche for each of the foreign private placement offering (the “Foreign Offering”) and the U.S. private placement offering (the “U.S. Offering”) announced by us on April 25, 2007. We issued a total of 1,126,500 units (each a “Unit”) under the Foreign Offering to non- US persons as contemplated under Regulation S of the Securities Act of 1933 (the “Securities Act”) at a price of $0.65 per Unit for total gross proceeds of $732,225. We agreed to pay an aggregate of $37,993 in commissions and issue an aggregate of 25,050 Agent’s Warrants in connection with the sale of 835,000 of the Units sold in the fourth tranche of the Foreign Offering. We issued a total of 3,600,000 Units under the U.S. Offering to accredited investors pursuant to Rule 506 of Regulation D of the Securities Act also at a price of $0.65 per Unit for total gross proceeds of $2,340,000. We agreed to pay $4,550 in commissions and to issue an aggregate of 3,000 Agent’s Warrants in connection with the sale of 100,000 of the Units sold. A description of the Foreign Offering and the U.S. Offering is provided at “Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities: Recent Sales of Unregistered Securities.” |

| | |

| 4. | On November 5, 2007, we entered into an agreement (the “Consulting Agreement”) with RJ Falkner & Company, Inc. (“RJ Falkner”) whereby RJ Falkner agreed to provide us with various investor relations services for a nine month period ending on August 15, 2008. In consideration of these services, we agreed to pay a retainer fee of $3,000 per month to RJ Falkner and to grant R. Jerry Falkner an option to purchase 100,000 shares of our common stock at a price of $1.75. Unless we provide RJ Falkner with notice of our intent to cancel the Consulting Agreement by August 15, 2008, RJ Falkner will continue to act on a month-to-month basis until either party provides 60 days written notice of their intent to terminate the Consulting Agreement. In accordance with the terms of the Consulting Agreement, we granted an option to R. Jerry Falkner to purchase 100,000 shares of our common stock. The option granted is exercisable at a price of $1.75 per share and expires on August 15, 2017. |

| | |

| 5. | Effective December 14, 2007, we increased the size of our Board of Directors from one director to three directors and appointed Robert D. McDougal and Michael A. Steele to fill the vacancies created by the increase. Mr. McDougal has been acting as the Company’s Chief Financial Officer since March 30, 2007. |

| | |

| 6. | On February 20, 2008, we completed the acquisition of CBI. See “Overview” above. |

| | |

| 7. | Also on February 20, 2008, in connection with the acquisition of CBI, the size of our Board of Directors was increased to four and Lawrence E. Chizmar, Jr. was appointed to our Board of Directors. |

COMPETITION

We are a mineral resource exploration and development company. We compete with other mineral resource exploration and development companies for the acquisition of new mineral properties, the services of contractors, equipment and financing. Many of the mineral resource exploration and development companies with whom we compete may have greater access to a limited supply of qualified technical personnel and contractors and to specialized equipment needed in the exploration, development and operation of mineral properties. This could have an adverse effect on our ability to explore and develop our properties in a timely manner. In addition, because many of our competitors are more established and have a longer operating history than us, they may have greater access to promising mineral properties.

In addition, many of our competitors have greater financial resources than us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This may make our competitors more

4

attractive to potential investors and could adversely impact our ability to obtain additional financing if and when needed.

GOVERNMENT REGULATIONS

The mining industry in the United States is highly regulated. We intend to secure all necessary permits for the exploration of the Columbus Project, the Red Mountain Project and Ireland Claim and, if development is warranted on the properties, will file final plans of operation prior to starting any mining operations. The consulting geologists that we hire are experienced in conducting mineral exploration activities and are familiar with the necessary governmental regulations and permits required to conduct such activities. As such, we expect that our consulting geologists will inform us of any government permits that we will be required to obtain prior to conducting any planned activities on the Columbus Project, the Red Mountain Project and the Ireland Claim. We are not able to estimate the full costs of complying with environmental laws at this time since the full nature and extent of our proposed mining activities cannot be determined until we complete our exploration program.

If we enter into the development or production stages of any mineral deposits found on the Columbus Project, the Red Mountain Project and the Ireland Claim, of which there are no assurances, the cost of complying with environment laws, regulations and permitting requirements will be substantially greater than in the exploration phases because the impact on the project area is greater. Permits and regulations will control all aspects of any mineral deposit development or production program if the project continues to those stages because of the potential impact on the environment. Examples of regulatory requirements include:

| - | Water discharge will have to meet water standards; |

| - | Dust generation will have to be minimal or otherwise re-mediated; |

| - | Dumping of material on the surface will have to be re-contoured and re-vegetated; |

| - | An assessment of all material to be left on the surface will need to be environmentally benign; |

| - | Ground water will have to be monitored for any potential contaminants; |

| - | The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and, |

| - | There will have to be an impact report of the work on the local fauna and flora. |

EMPLOYEES

As of the date of this Annual Report on Form 10-K, other than our officers and directors, we have one full-time employee. We do not have any part-time employees.

RESEARCH AND DEVELOPMENT EXPENDITURES

We have not incurred any research or development expenditures since our incorporation.

PATENTS AND TRADEMARKS

We do not own, either legally or beneficially, any patents or trademarks.

ITEM 1A. RISK FACTORS.

The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in our forward-looking statements. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, financial condition or results of operation

5

Although we intend to implement a pilot production module for the Columbus Project, there is no assurance that this project is commercially feasible.

We intend to begin our pilot production operations on the Columbus Project in 2008. This pilot production module is designed to evaluate the economic feasibility of the Columbus Project. However, we have not yet established any probable or proven reserves and our activities continue to be exploratory in nature. We can not provide any assurances that the Columbus Project will turn out to be commercially viable.

If we do not obtain additional financing, we may not be able to complete our exploration and development programs for our mineral projects.

Although we have obtained sufficient proceeds from our Foreign and US Offerings to meet the anticipated costs of our exploration and development programs during the next twelve months, the actual costs of completing those programs may be greater than anticipated. If the actual costs are significantly greater than anticipated or if we proceed with our exploration and development programs beyond what we currently have planned for the next twelve months, we will need to obtain additional financing. There are no assurances that we will be able to obtain additional financing in an amount sufficient to meet our needs or on terms that are acceptable to us.

Our ability to obtain additional financing will be subject to a number of factors, including the variability of market prices for gold and silver, investor interest in our mineral projects, and the performance of equity markets in general. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

If we complete additional financings through the sale of shares of our common stock, our existing stockholders will experience dilution.

The most likely source of future financing presently available to us is through the issuance of our common stock. The only other anticipated alternative for the financing of further exploration would be the offering by us of an interest in our properties to be earned by another party or parties carrying out further exploration thereof, which is not presently contemplated. In addition, if our management decides to exercise the right to acquire a 100% interest in the Red Mountain Project, we will be required to issue significantly more shares of our common stock. Issuing shares of our common stock, for financing purposes or otherwise, will dilute the interests of our existing stockholders.

In order to maintain our rights to the Columbus Project, Red Mountain Project and Ireland Claim, we will be required to make annual filings with federal and state regulatory agencies and/or be required to complete assessment work on those properties.

In order to maintain our rights to the Columbus Project, Red Mountain Project and Ireland Claim, we will be required to make annual filings with federal and state regulatory authorities. Currently the amount of these fees is nominal; however, these maintenance fees are subject to adjustment. In addition, we may be required by federal and/or state legislation or regulations to complete minimum annual amounts of mineral exploration work on the Columbus Project, Red Mountain Project and Ireland Claim. A failure by us to meet the annual maintenance requirements under federal and state laws could cause our rights to the Columbus Project, Red Mountain Project and Ireland Claim to lapse.

Because we are an exploration stage company, we face a high risk of business failure.

To date, our primary business activities have involved the acquisition of mineral claims and the exploration and development on these claims. We have not earned any revenues as of the date of this Annual Report. Potential investors should be aware of the difficulties normally encountered by exploration stage companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

6

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims and the production of minerals thereon, if any, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to ever generate any operating revenues or achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our business will fail.

The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves of gold or silver on our mineral claims. Exploration for minerals is a speculative venture, necessarily involving substantial risk. The expenditures to be made by us in the upcoming exploration of our mineral projects may not result in the discovery of commercial quantities of ore. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages if and when we conduct mineral exploration activities.

The search for valuable minerals involves numerous hazards. As a result, if and when we conduct exploration activities we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

Even if we discover commercial reserves of precious metals on our optioned mineral claims, we may not be able to successfully obtain commercial production.

Our optioned mineral claims do not contain any known bodies of ore. If our exploration programs are successful in discovering ore of commercial tonnage and grade, we will require additional funds in order to place those mineral claims into commercial production. At this time, there is a risk that we will not be able to obtain such financing as and when needed.

If we are unable to hire and retain key personnel, we may not be able to implement our business plan and our business will fail.

Our success will largely depend on our ability to hire highly qualified personnel with experience in geological exploration. These individuals may be in high demand and we may not be able to attract the staff we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, or may lose such employees after they are hired. Currently, we have not hired any key personnel. An inability to hire key personnel when needed could have a significant negative effect on our business.

Because our executive officers do not have formal training specific to the technicalities of mineral exploration, there is a higher risk our business will fail.

Our executive officers and directors do not have formal training as geologists or in the technical aspects of management of a mineral exploration company. Accordingly, we will have to rely on the technical services of others trained in appropriate areas. If we are unable to contract for the services of such individuals, it will make it difficult and maybe impossible to pursue our business plan.

As we undertake exploration of our optioned mineral claims, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program.

7

There are several government regulations that materially restrict the exploration of minerals. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program.

Certain work to be performed on our mineral projects may require us to apply for permits from federal, state or local regulatory bodies.

If our applications for permits from the relevant regulatory bodies are denied, we may not be able to proceed with our exploration and development programs as disclosed above, which could have a negative affect on our business.

If we receive positive results from our exploration program and we decide to pursue commercial production, we may be subject to an environmental review process that may delay or prohibit commercial production.

If the results of our geological exploration program indicate commercially exploitable reserves, and we decide to pursue commercial production of our mineral claims, we may be subject to an environmental review process under environmental assessment legislation. Compliance with an environmental review process may be costly and may delay commercial production. Furthermore, there is the possibility that we would not be able to proceed with commercial production upon completion of the environmental review process if government authorities did not approve our mine or if the costs of compliance with government regulation adversely affected the commercial viability of the proposed mine.

The market for our common stock is limited and investors may have difficulty selling their stock.

Our shares are currently traded on the over the counter market, with quotations entered for our common stock on the OTC Bulleting Board under the symbol “IRLD.” However, the volume of trading in our common stock is currently very limited. As a result, holders of our common stock may have difficulty selling their shares.

Because our common stock is a penny stock, stockholders may be further limited in their ability to sell their shares.

Our shares constitute a penny stock under the Securities Exchange Act of 1934 (the “Exchange Act”) and are expected to remain classified as a penny stock for the foreseeable future. Classification as a penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares will be subject to Rules 15g-2 through 15g-9 of the Exchange Act. Rather than having to comply with these rules, some broker-dealers will refuse to attempt to sell a penny stock.

No Assurance That Forward Looking Assessments Will Be Realized.

Our ability to accomplish our objectives and whether or not we are financially successful is dependent upon numerous factors, each of which could have a material effect on the results obtained. Some of these factors are in the discretion and control of management and others are beyond management’s control. The assumptions and hypothesis used in preparing any forward-looking assessments contained herein are considered reasonable by management. There can be no assurance, however, that any projections or assessments contained herein or otherwise made by management will be realized or achieved at any level.

FOR ALL OF THE AFORESAID REASONS AND OTHERS SET-FORTH AND NOT SET-FORTH HEREIN, AN INVESTMENT IN OUR SECURITIES INVOLVES A CERTAIN DEGREE OF RISK. ANY PERSON CONSIDERING TO INVEST IN OUR SECURITIES SHOULD BE AWARE OF THESE AND OTHER FACTORS SET-FORTH IN THIS ANNUAL REPORT ON FORM 10-K AND SHOULD CONSULT WITH HIS/HER LEGAL, TAX AND FINANCIAL ADVISORS PRIOR TO MAKING AN INVESTMENT IN OUR SECURITIES. AN INVESTMENT IN OUR SECURITIES SHOULD ONLY BE ACQUIRED BY PERSONS WHO CAN AFFORD TO LOSE THEIR TOTAL INVESTMENT.

8

ITEM 2. PROPERTIES.

We currently lease office space located at Suite 100, 2441 W. Horizon Ridge Parkway, Henderson, NV 89052 at a rate of $2,200 per month. The lease is for a term of one year and expires on August 31, 2008.

We currently own an interest in three mineral projects that we refer to as the Columbus Project, the Red Mountain Project and the Ireland Claim.

THE COLUMBUS PROJECT

Description of the Columbus Project

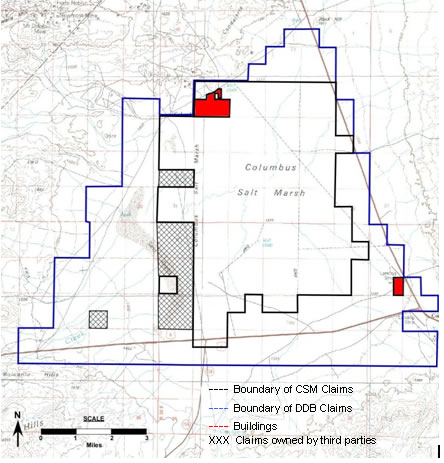

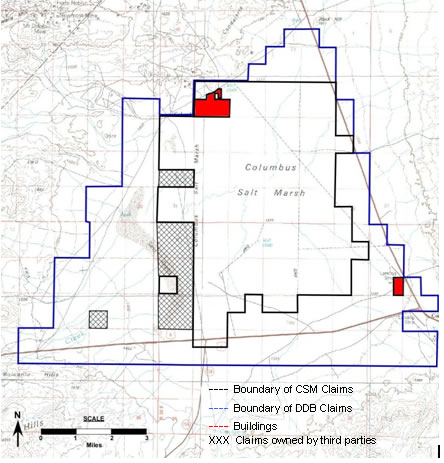

The Columbus Project is a potential gold, silver and calcium carbonate project that is currently made up of 128 mineral and millsite claims that we refer to as the “CSM Claims” and an option for an additional 147 mineral claims that we refer to as the “DDB Claims.”

Location

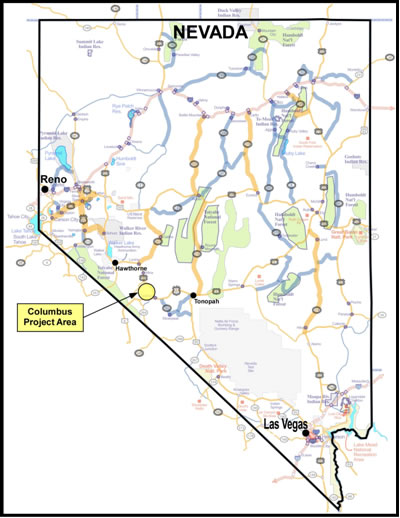

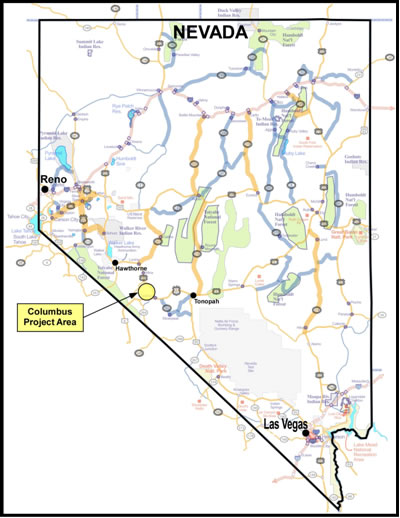

The mineral claims that make up the Columbus Project are located in the Columbus Salt Marsh, in Esmeralda County, Nevada, approximately 41 miles west of Tonopah, halfway between Las Vegas and Reno. The Columbus Salt Marsh is an enclosed basin and is a dry lake bed for the majority of the year. All surface drainage from the surrounding 300 square mile area flows into the Columbus Salt Marsh.

Figure 1. Location of Columbus Project

9

Title and Ownership Rights to the CSM Claims and the DDB Claims

The CSM Claims are wholly owned by Columbus S.M., LLC (“CSM”). CSM was a wholly owned subsidiary of CBI, and is now our wholly owned subsidiary. The DDB Claims are wholly owned by a mining syndicate known as the DDB Syndicate. Each of Douglas D.G. Birnie, our President and Chief Executive Officer, and a member of our Board of Directors, and Lawrence E. Chizmar Jr., currently a member of our Board of Directors (and a former director of CBI), is the owner of a 1/8 interest in the DDB Syndicate. The remaining members of the DDB Syndicate are made up of the former officers and directors of CBI, the brother of a former officer and director of CBI, Nanominerals Corp. (“Nanominerals”) and certain affiliates of Nanominerals. Nanominerals is a significant shareholder in our Company. The DDB Claims were located by the DDB Syndicate in February, 2007, prior to Mr. Birnie’s, Nanominerals’ or Mr. Chizmar’s involvement with Ireland.

Figure 2. Location of the CSM Claims and the DDB Claims

We acquired our interest in the CSM Claims and the DDB Claims under the terms of a letter agreement (the “Columbus Letter Agreement”) initially entered into by CBI, CSM and Nanominerals in July, 2006. In March, 2007, we entered into an assignment agreement (the “Nano Agreement”) with Nanominerals, pursuant to which Nanominerals agreed to assign to us all of its rights and interests under the Columbus Letter Agreement, and a letter agreement entered into by it with the owners of the Red Mountain Project (the “Red Mountain Letter Agreement”). On August 14, 2007, Nanominerals completed the assignment of its rights and interests under the Columbus Letter Agreement and the Red Mountain Letter Agreement to us, in consideration for which we:

| | (a) | issued an aggregate of 30,000,000 shares of our common stock to Nanominerals and certain business associates of Nanominerals (including 1,200,000 shares to Robert D. McDougal, our current Chief Financial Officer, Treasurer and a member of our Board of Directors); |

10

| | (b) | granted Nanominerals a 5% royalty on any net smelter returns from either of the Columbus Project or the Red Mountain Project, or any other mineral projects that Nanominerals may assign or transfer to us in the future; |

| | | |

| | (c) | assumed all of Nanominerals obligations under the Columbus Letter Agreement and the Red Mountain Letter Agreement; and |

| | | |

| | (d) | agreed to reimburse Nanominerals for any properly documented expenditures made by it on either the Columbus Project or the Red Mountain Project. |

In addition to the consideration paid by us, Lorrie Ann Archibald, then our Chief Executive Officer, Treasurer and sole director, and our principal shareholder, sold to Nanominerals 18,200,000 shares of our common stock, being all of the shares of our common stock owned by Ms. Archibald at that time, for an aggregate of $45,500. Mr. Birnie was appointed as our Chief Executive Officer, President and Secretary, and Mr. McDougal was appointed as our Chief Financial Officer pursuant to the terms of the Nano Agreement.

Under the terms of the Columbus Letter Agreement, we had the right to earn up to a 15% operating interest in the CSM Claims by:

| | (a) | paying $10,000 per month to CSM until December 31, 2007; |

| | | |

| | (b) | spending a total of $3,000,000 on examining, testing, exploring or developing the Columbus Project before December 31, 2007 (the “CP Expenditures”); and |

| | | |

| | (c) | paying $7,000 per month in consulting fees to each of John T. Arkoosh (the former President, and a former director of, CBI) and William Maghan (a former director of CBI). |

By December, 2007, we had earned our 15% operating interest under the terms of the Columbus Letter Agreement. As a result of completing the acquisition of CBI on February 20, 2008, we now own 100% of the CSM Claims. See “Item 1. – Business: Overview” for a description of our acquisition of CBI.

On November 30, 2007, CBI increased the size of the Columbus Project by entering into a mining lease agreement with the DDB Syndicate (the “DDB Agreement”). The DDB Agreement provided CSM with a 5 year lease on the DDB Claims, ending on November 29, 2012, with an option to purchase the DDB Claims at anytime during the lease period. In order to maintain its lease rights, CSM must pay the DDB Syndicate $130,000 by June 30, 2008, with annual rental payments thereafter of $30,000 per year, payable on June 30, 2009, 2010 and 2011 respectively. Under the option rights provided under the DDB Agreement, CSM may purchase the DDB Claims by either:

| | (a) | paying the DDB Syndicate the purchase price of $400,000, less any rental payments made by CSM prior to exercise of the option right; or |

| | | |

| | (b) | paying the DDB Syndicate $10, plus granting the DDB Syndicate a royalty of 2% of net smelter returns on the DDB Claims. |

Access and Infrastructure

The Columbus Project contains an existing mill site with power generator sets and an onsite fresh water well. Water used for processing is available from existing wells located on the surrounding basin (the “Columbus Basin”), one of which is an artesian well. An artesian well is a confined aquifer containing groundwater that flows upwards without the need for pumping. There is also a high voltage grid located at the Candelaria Mines, approximately three miles from the Columbus Project.

Permits have been obtained for the production of calcium carbonate and the extraction of precious metals from an area of interest consisting of approximately 380 acres, including millsite, roads and mineable acreage.

11

History

The Columbus Project is located in an area that has historically been known as a well mineralized region. A gold and silver mining operation known as the Candelaria Mine is located approximately three miles northwest of the Columbus Project. The Clayton Valley Brine Project, a lithium extraction project, is located approximately 25 miles southeast of the Columbus Project.

The history of the area dates back to the 1860s upon the discovery of significant deposits of silver. During this period, the Candelaria Mine was established. To date, the Candelaria Mine has produced approximately 68 million ounces of silver.

The Clayton Valley Brine Project was established in the 1960’s and uses a brine aquifer to extract minerals. Clayton Valley has historically been one of the largest sources of lithium in the United States.

Geology

The Columbus Basin is an enclosed basin that appears to be a sediment-filled collapsed caldera of a volcano or a rift basin. A caldera is a volcanic feature formed by the collapse of land following a volcanic eruption. Surveys conducted on the area indicate that there appears to be a two mile wide fault structure in the northwest section of the Columbus Basin. The subsurface of the Columbus Basin contains an ash layer approximately 150 feet thick, located at a depth of approximately 400 feet. This ash layer hosts a large brine aquifer.

Sampling Results on the Columbus Project

In August, 2006, Nanominerals commissioned Arrakis, Inc., an independent mining and metallurgical consulting engineering firm, to conduct surface sampling studies on the Columbus Project. Fifty-nine surface samples were taken by Arrakis and were processed at Arrakis’ laboratory in Englewood, Colorado. The results from these samples indicated an anomaly containing an average in-situ area wide grade of 0.078 ounces per ton (o.p.t.) of gold. Readers are cautioned that these results are from surface samples only and are not necessarily indicative of the mineralization found at depth.

In December, 2006, Arrakis returned to the Columbus Project and took five additional surface samples, four borings and a two thousand pound bulk sample. One boring went down to a depth of 10 feet, two borings went down to a depth of 15 feet and the final boring when down to a depth of 20 feet. The results of these additional samples fit the trend shown by the original surface samples, with no significant variations at depth.

The bulk sample taken by Arrakis was used to conduct gravity concentration tests. Most of the gold contained in the samples appear to be less than 50 microns. Arrakis noted that the gravity concentration tests indicated that more than 90% of the ore was made up of a clay matrix that would need to be carefully de-agglomerated and diluted prior to effective gravity concentration. A high grade calcium carbonate product is expected to be producible from these clay tailings.

In the fourth quarter of 2007, a drill program was conducted by Arrakis within the 320-acre permitted area of the Columbus Project. The program consisted of 18 holes drilled to a maximum of 100 feet in depth. Independent analyses of the 18 holes indicate an average gold grade as follows:

154 sample average = 0.074 opt Au

18 drill hole average = 0.070 opt Au

The drill program and sample analyses were completed under chain-of-custody (COC) parameters by Arrakis. The samples were analyzed using total acid digestion and graphite furnace atomic absorption.

Drilling was completed by using a split auger to collect 2-foot composite samples every 10 feet down each hole. Holes were drilled to a maximum depth of 100 feet, with some holes being shallower due to bedrock or drilling conditions The drill program covered the 320-acre permitted mine site with 18 drill holes in a 6-hole by 3-hole evenly spaced grid.

12

Composite

Depth | Hole A1

(Au opt) | Hole A2

(Au opt) | Hole A3

(Au opt) | Hole A4

(Au opt) | Hole A5

(Au opt) | Hole A6

(Au opt) |

| 10’ – 12’ | 0.082 | 0.083 | 0.087 | 0.107 | 0.129 | 0.070 |

| 20’ – 22’ | 0.089 | 0.071 | 0.062 | 0.086 | 0.094 | 0.064 |

| 30’ – 32’ | 0.080 | 0.072 | 0.081 | 0.067 | 0.080 | 0.066 |

| 40’ – 42’ | 0.079 | 0.070 | 0.095 | 0.096 | 0.073 | 0.064 |

| 50’ – 52’ | 0.089 | 0.078 | 0.083 | 0.108 | 0.088 | 0.064 |

| 60’ – 62’ | 0.086 | 0.069 | 0.092 | 0.097 | 0.076 | 0.060 |

| 70’ – 72’ | 0.074 | 0.085 | 0.089 | 0.092 | 0.072 | 0.060 |

| 80’ – 82’ | 0.082 | 0.047 | 0.063 | 0.092 | 0.074 | 0.054 |

| 90’ – 92’ | 0.086 | 0.067 | 0.074 | 0.065 | 0.071 | 0.053 |

| 100’ – 102’ | 0.039 | | 0.063 | 0.083 | 0.060 | 0.060 |

| | | | | | | |

| Average | 0.079 | 0.071 | 0.079 | 0.089 | 0.082 | 0.062 |

Composite

Depth | Hole A7

(Au opt) | Hole A8

(Au opt) | Hole A9

(Au opt) | Hole A10

(Au opt) | Hole A11

(Au opt) | Hole A12

(Au opt) |

| 10’ – 12’ | 0.062 | 0.063 | 0.086 | 0.128 | 0.116 | 0.103 |

| 20’ – 22’ | 0.054 | 0.044 | 0.057 | 0.089 | 0.095 | 0.085 |

| 30’ – 32’ | 0.077 | 0.068 | 0.078 | 0.085 | 0.053 | 0.077 |

| 40’ – 42’ | 0.062 | 0.062 | 0.076 | 0.110 | 0.076 | 0.070 |

| 50’ – 52’ | 0.054 | 0.066 | 0.077 | 0.117 | 0.108 | 0.104 |

| 60’ – 62’ | 0.076 | 0.065 | 0.081 | 0.109 | 0.102 | 0.089 |

| 70’ – 72’ | | 0.069 | 0.079 | 0.100 | 0.109 | 0.104 |

| 80’ – 82’ | | 0.061 | 0.081 | 0.089 | 0.102 | 0.109 |

| 90’ – 92’ | | | 0.068 | 0.091 | 0.078 | 0.105 |

| 100’ – 102’ | | | 0.085 | 0.095 | 0.086 | 0.101 |

| | | | | | | |

| Average | 0.064 | 0.062 | 0.077 | 0.101 | 0.092 | 0.095 |

Composite

Depth | Hole A13

(Au opt) | Hole A14

(Au opt) | Hole A15

(Au opt) | Hole A16

(Au opt) | Hole A17

(Au opt) | Hole A18

(Au opt) |

| 10’ – 12’ | 0.009 | 0.076 | 0.089 | 0.092 | 0.055 | 0.079 |

| 20’ – 22’ | 0.035 | 0.046 | 0.063 | 0.029 | 0.047 | 0.059 |

| 30’ – 32’ | 0.034 | 0.100 | 0.113 | 0.093 | 0.028 | 0.049 |

| 40’ – 42’ | | 0.058 | 0.093 | 0.085 | | 0.072 |

| 50’ – 52’ | | 0.007 | 0.066 | 0.069 | | 0.064 |

| 60’ – 62’ | | | 0.047 | 0.081 | | 0.059 |

| 70’ – 72’ | | | 0.029 | 0.028 | | 0.061 |

| 80’ – 82’ | | | 0.035 | 0.029 | | 0.052 |

| 90’ – 92’ | | | | 0.021 | | 0.031 |

| 100’ – 102’ | | | | 0.025 | | 0.043 |

| | | | | | | |

| Average | 0.026 | 0.057 | 0.067 | 0.055 | 0.044 | 0.057 |

Based on the test results on the samples taken from the Columbus Project, Arrakis has recommended proceeding with (1) a pilot processing installation at the existing mill site located on the property; and (2) exploration drilling of an anomalous zone indicated by the samples in an effort to determine the economic viability of the project.Readers are cautioned that, although we believe that the results of our exploration activities to date are sufficiently positive to proceed with the installation of a pilot processing facility at the Columbus Project millsite, we have not yet established any probable or proven reserves and our activities continue to be exploratory in nature. There are no assurances that we will be able to establish any commercially extractable ore reserves on the Columbus Project.

13

Current Exploration and Development Program for the Columbus Project

In early 2008, we completed the upgrade of the existing mill facilities located on the Columbus Project. The upgrade of the mill facilities consisted of bringing in the necessary equipment and other infrastructure required to implement our pilot operations. As a result of the upgrade, our mill facility is ready for installation of pilot production module.

Our exploration and development program for the Columbus Project currently consists of the following:

| 1. | Pilot Production Module: We plan to implement a pilot production module on the Columbus Project in order to evaluate the economic feasibility of the project. The pilot production module will consist of a full scale production and processing cycle that we will use to test the commercial viability of the project. If the operation of this pilot production module proves to our satisfaction that the Columbus Project is economically viable, we will seek to construct additional production modules of the mill site. The production model for the Columbus Project is anticipated to be a low grade, low cost, high volume mining operation. |

| | |

| We have obtained a production permit from the Bureau of Land Management (“BLM”). The production permit allows us to commence calcium carbonate production and precious mineral extraction on the 270 acre mine site and 60 acre mill sites located at the Columbus Project at a mine rate of up to 78,000 tons per year. In addition, the production permit allows us to use 50 acres of the Columbus Project for road access. |

| | |

| We plan to use an open pit mining method to extract minerals from the Columbus Project. The material will be mined and transported by truck to the project facility. Water will then be added to the extracted material to make a slurry. Once the material has been slurried, we will use a gravity and spiral concentration process to filter the minerals from the material. The final extraction method will involve acid leaching to recover the minerals from the materials. |

| | |

| Once we commence production, we anticipate that we will continue our production with the pilot production module as long as the Columbus Project produces commercial minerals. |

| | |

| 2. | Drilling Exploration Program: We plan to commence a drilling program on the Columbus Project in order to determine whether there are sufficient reserves on the Columbus Project for economic viability. We have applied for the required permit applications in connection with the next phase of our drilling exploration program on the Columbus Project. If we receive the necessary approvals from the BLM, of which there are no assurances, we expect to commence drilling in the second quarter of 2008. We anticipate that our total drilling program will take up to two years to complete. |

We anticipate spending approximately $4,176,975 on the above exploration and development program for the Columbus Project in 2008.

THE RED MOUNTAIN PROJECT

The Red Mountain Project is a potential gold, silver and tungsten project that consists of 60 mineral claims covering approximately 7,500 acres, all located in San Bernardino County and Kern County, California. Title to these mineral claims is currently recorded in the names of a number of individuals who, together, make up a mining syndicate known as Red Mountain Mining (“RMM”). We have been notified that some of the claims making up the Red Mountain Project may conflict with other existing mineral claims and other property rights covering the location of the project. We intend to work with RMM to in order to resolve these issues.

Description of the Red Mountain Project

Rights to the Red Mountain Project

We acquired our rights to the Red Mountain Project on August 14, 2007, pursuant to an assignment to us by Nanominerals of its rights and interests under the Red Mountain Letter Agreement between it and RMM. For a description of the consideration paid by us to Nanominerals in exchange for the assignment of its rights under

14

the Red Mountain Letter Agreement, as well as its rights under the Columbus Letter Agreement, please see our description of the Columbus Project, provided above, and below at “Item 13. Certain Relationships and Related Transactions, and Director Independence.”

The Red Mountain Letter Agreement provides that we are to:

| | (a) | pay $5,000 per month to RMM until December 31, 2011; |

| | | |

| | (b) | spend a total of $200,000 by December 31, 2008 on examining, testing, exploring or developing the Red Mountain Project (the “RMP Phase 1 Expenditures”); and |

| | | |

| | (c) | spend a total of $1,000,000 by December 31, 2011 on examining, testing, exploring or developing the Red Mountain Project (the “RMP Phase 2 Expenditures”). |

For each $100,000 spent by us on the RMP Phase 1 or RMP Phase 2 Expenditures, we will earn a 5% interest in the Red Mountain Project (or a proportionate fractional interest for expenditures in denominations of less than $100,000). We will earn a maximum 60% interest in the Red Mountain Project if we spend the full $1,200,000 of the RMP Phase 1 and RMP Phase 2 Expenditures by the deadlines set out above.

In addition, at anytime, we may acquire a 100% interest in the Red Mountain Project (the “RM Acquisition Rights”) by:

| | (a) | paying and issuing to RMM the following consideration: |

| | | | |

| | | (i) | $100,000 in cash; |

| | | | |

| | | (ii) | between 280,000 and 5,600,000 shares of our common stock, with the actual number of shares to be issued to be determined by dividing $1,400,000 by the Acquisition Price (defined below); |

| | | | |

| | | (iii) | for every 4 shares issued under (a)(ii), we will be required to issue one share purchase warrant to acquire one additional share of our common stock at a price per share equal to 125% of the Acquisition Price, for a period of two years; and |

| | | | |

| | (b) | if the Red Mountain Project achieves commercial production, paying and issuing to RMM the following additional consideration: |

| | | | |

| | | (i) | an additional $100,000 in cash; |

| | | | |

| | | (ii) | between 480,000 and 9,600,000 additional shares of our common stock, with the actual number of additional shares to be issued to be determined by dividing $2,400,000 by the Acquisition Price; and |

| | | | |

| | | (iii) | for every 4 additional shares issued under (b)(ii), we will be required to issue one additional share purchase warrant to acquire one additional share of our common stock at a price per share equal to 125% of the Acquisition Price, for a period of two years. |

The Acquisition Price to be used to calculate the aggregate number of shares and share purchase warrants to be issued to RMM under the terms of the Red Mountain Letter Agreement will be the average closing price of our common stock during the 60 days prior to the acquisition date, provided, however, that the Acquisition Price shall not be lower than $0.25 and shall not be greater than $5.00.

As of December 31, 2007, the date of our most recently available financial statements, we had spent $233,400 on the Red Mountain Project, meaning that, as of December 31, 2007, we owned an 11.6% interest in the project.

15

Location and Access

The Red Mountain Project is located at the base of Red Mountain, which is 27 miles south of Ridgecrest in San Bernardino County and Kern County, California, approximately 75 miles northeast of Los Angeles. The Red Mountain Project can be accessed by using a gravel road that bisects the project from northwest to southeast.

The Red Mountain Project does not contain any useable infrastructure other than a water well.

Figure 3. Location of the Red Mountain Project

History

The Red Mountain Project is east of and adjacent to the Rand Mining District, initially discovered in 1894. The Rand Mining District was mined off and on until just recently for gold, silver and tungsten. The majority of the mines in the area consisted of small independent operations. There is currently no commercial mining occurring on the Red Mountain Project site.

Geology

The area surrounding the Red Mountain Project is highly mineralized with recorded production of gold, silver and tungsten.

Nanominerals had Arrakis review the Red Mountain Project, including the existing reports on work previously done by RMM. RMM has excavated over 100 test pits at the project site and has gravity concentrated the bulk samples taken from these pits. The results of RMM’s tests show values ranging from less than 0.01 troy ounces of gold per ton to over 1.00 troy ounces of gold per ton. Those test results reportedly show an average of 0.06 o.p.t. Arrakis reported that the grades were similar to other grades that have been reported in the area on similar mine sites.

Based on their review of the existing reports and a field visit to the Red Mountain Project site, Arrakis has recommended that we proceed with an exploration program to verify the reported gold grades in RMM’s studies and to test the recoverability in order to assess the economic viability of the Red Mountain Project.

16

Current Exploration

Our exploration and development program for the Red Mountain Project currently consists of the following:

| 1. | Comprehensive Project Report: We are currently in the process of having a comprehensive project report prepared by an independent geological consultant on the Red Mountain Project. This report is expected to include a review and summary of the mining history of the area and previous work done on the project area. We expect to receive a final draft of this report early in our second fiscal quarter of 2008. |

| | |

| 2. | Sampling and Drilling Program: We have initiated a surface sampling program on the Red Mountain Project and we are planning to initiate a drilling program on the Red Mountain Project sometime in 2008. We hope to submit our initial drill permit application in 2008. The drill locations will be determined by further analysis of the project data, which is currently underway. |

We anticipate that we will spend approximately $1,645,600 on our exploration program for the Red Mountain Project in 2008.

THE IRELAND CLAIM

Location and Access to the Ireland Claim

The Ireland Claim consists of one unpatented mineral lode claim situated in the Yellow Pine Mining District in Clark County, Nevada, Section 24 of Township 25 south, range 58 east.

The Ireland Claim is located approximately 30 miles southwest of Las Vegas, Nevada, and approximately 4 miles south of Goodsprings, Nevada on the eastern slope of the Spring Mountains. Access to the Ireland Claim may be obtained by traveling southwest along Interstate Highway No. 15 from Las Vegas to the town of Jean, Nevada. Goodsprings is accessible from Jean by paved road at a distance of approximately seven miles to the northeast. The Ireland Claim is approximately four miles south of Goodsprings and may be accessed from Goodsprings by gravel road.

Ownership Interest

We acquired ownership of the Ireland Claim from Multi Metal Mining Corp. effective as of November 30, 2004 in exchange for the sum of $6,000. The full purchase price has been paid to Multi Metal Mining Corp. and, as such, we are the sole legal and beneficial owners of the Ireland Claim. A copy of the purchase agreement was filed as an exhibit to our Annual Report for the fiscal year ended December 31, 2004.

Geology of the Ireland Claim

The regional geography of the Spring Mountain Range consists primarily of Paleozoic sediments that have undergone intense folding accompanied by faulting. The Yellow Pine Mining District is underlain by a series of Carboniferous sediments (i.e. relating to the Carboniferous Period) consisting of limestone, pure crystalline limestone, and dolomite, with occasional intercalated beds of fine-grained sandstone. These strata have a general west to southwest dip from 15 to 45 degrees occasionally disturbed by local folds. Igneous rocks (i.e. rocks formed by solidified magma) are scarce in this region and are represented chiefly by quartz-monzonite porphyry dikes and sills.

History and Previous Operations on the Ireland Claim

The Ireland Claim is situated in an area that has historically been known as a well mineralized region.

The history of the area surrounding the Ireland Claim dates back to 1856 following the investigation of lead ore by Mormon missionaries. The first ore was smelted in 1857 and a mill was built north of Goodsprings in 1898. The completion of the San Pedro, Los Angeles and Salt Lake railroad in 1905 and the recognition of oxidized zinc minerals in the ore found around this location stimulated the development of mines in this region. The region was the subject of intermittent mining activity up to around 1964. The area has remained primarily

17

dormant since 1964. A report on the area from 1931 indicated that several cars of copper-bearing lead ore had been previously mined from the area. To our knowledge, no recent work has been recorded on the Ireland Claim.

The Yellow Pine Mining District has been mined primarily for lead, zinc and silver. However, an estimated 91,000 ounces of gold has also been recovered in the region.

Current State of Exploration on the Ireland Claim

Our exploration program for the Ireland Claim consists of the following:

| 1. | Phase I: Phase I of the exploration program involves conducting a VLF electromagnetic survey that traces geological fracture and breccia zones. VLF electromagnetic surveying employs electromagnetic waves that are generated at the surface and directed into the earth. When these waves encounter electrically conductive mineral formations or ore bodies located underground, they induce currents in the conducting minerals which generate new electromagnetic waves that are then detected by instruments located at the surface. Using this method, we can detect the presence of underground mineral formations and ore bodies. |

| | |

| 2. | Phase II: Phase II of the exploration program, which has been completed, involved conducting a trench sampling survey of the Ireland Claim. Trench sampling involves dragging a shovel along the surface in a single direction to create a channel. Material for the sample is then taken at regular intervals along the channel. This procedure is repeated with several other channels in different directions until a suitable sample size has been procured. The cost of completing Phase II was $8,500. |

| | |

| 3. | Phase III: Phase III of our exploration program will involve conducting a detailed geological mapping program of the Ireland Claim. The purpose of this phase of the exploration program would be to identify the geological environment underlying the mineral claims and to produce a detailed mineralization map. |

| | |

| 4. | Phase IV: Phase IV of the exploration program will involve diamond drilling the Ireland Claim in order to obtain core samples of the underground mineralization. |

Phase II of our exploration program was completed before Phase I due to the unavailability of the equipment necessary to conduct a VLF electromagnetic survey. Based upon the results of Phase II, our consulting geologist has recommended that we proceed with the VLF electromagnetic survey that was originally recommended for Phase I. We were not able to complete Phase I of our exploration program on the Ireland Claim during 2006 due to the unavailability of the necessary equipment and consultants. Phase I of our exploration program for the Ireland Claim is expected to cost approximately $5,500. The remainder of our exploration program is expected to cost approximately $101,200 to complete.

Our exploration program for the Ireland Claim has been deprioritized by our management based on the progress and potential of our Columbus and Red Mountain Projects. As a result, our exploration program for the Ireland Claim is expected to be delayed. We do not expect to make significant progress on exploration of the Ireland Claim in 2008. If Phase I is completed, our Board of Directors will make a determination whether to proceed with Phase III of the exploration program. Upon the completion of each phase of our exploration program, our Board of Directors will make an assessment to determine whether the results of that phase are sufficiently favorable to justify proceeding.

ITEM 3. LEGAL PROCEEDINGS.

We are not currently a party to any material legal proceedings and, to our knowledge, no such proceedings are threatened or contemplated.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

None.

18

PART II

ITEM 5. | MARKET FOR REGISTRANT’SCOMMON EQUITY, RELATED STOCKHOLDER MATTERSAND ISSUER PURCHASES OF EQUITY SECURITIES. |

Quotations for our common stock were entered on the OTC Bulletin Board under the symbol IREL beginning on May 8, 2006. Our symbol was changed to “IRLD” on April 25, 2007 upon completion of our 4-for-1 stock split. As our common stock did not become eligible for quotation on the OTCBB prior to May 8, 2006, no information is available for periods prior to that date. In addition, the OTC Bulletin Board did not report any trading activity on our common stock during the second, third or fourth quarters of 2006 and the high and low bid information for our common stock was not available from the OTC Bulletin Board for those quarters.

| | 2007 | 2006 |

| | High | Low | High | Low |

| First Quarter ended March 31 | $ 0.05 | $ 0.00 | $ N/A | $ N/A |

| Second Quarter ended June 30 | $ 2.30 | $ 0.00 | $ 0.00 | $ 0.00 |

| Third Quarter ended September 30 | $ 2.05 | $ 1.40 | $ 0.00 | $ 0.00 |

| Fourth Quarter ended December 31 | $ 2.10 | $ 1.60 | $ 0.00 | $ 0.00 |

The above quotations have been adjusted to reflect our 4-for-1 stock split effective April 25, 2007. Quotations entered on the OTC Bulletin Board reflect inter-dealer prices, without retail mark-up, markdown or commission and may not represent actual transactions.

Penny Stock Rules

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, which:

| | (a) | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| | (b) | contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of securities laws; |

| | (c) | contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| | (d) | contains a toll-free telephone number for inquiries on disciplinary actions; |

| | (e) | defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| | (f) | contains such other information and in such form as the SEC shall require by rule or regulation. |

The broker-dealer also must, prior to effecting any transaction in a penny stock, provide the customer with:

| | (a) | bid and offer quotations for the penny stock; |

| | (b) | the compensation of the broker-dealer and its salesperson in the transaction; |

| | (c) | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and |

| | (d) | monthly account statements showing the market value of each penny stock held in the customer's account. |

In addition, the penny stock rules require that, prior to a transaction in a penny stock that is not otherwise exempt from those rules, the broker-dealer must:

| | (a) | make a special written determination that the penny stock is a suitable investment for the purchaser; and |

19

| | (b) | receive from the purchaser his or her written acknowledgement of receipt of the determination and a written agreement to the transaction. |

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our common stock and therefore stockholders may have difficulty selling those securities.

Holders of Common Stock

As of March 25, 2008, there were 248 stockholders of record of our common stock. In addition, we believe that a number of stockholders hold shares of our common stock on deposit with their brokers or investment bankers and registered in the name of stock depositories.

Dividends

We have not declared any dividends on our common stock since our inception. There are no dividend restrictions that limit our ability to pay dividends on our common stock in our Articles of Incorporation or bylaws. Chapter 78 of the Nevada Revised Statutes (the “NRS”), does provide certain limitations on our ability to declare dividends. Section 78.288 of Chapter 78 of the NRS prohibits us from declaring dividends where, after giving effect to the distribution of the dividend:

| | (a) | we would not be able to pay our debts as they become due in the usual course of business; or |

| | | |

| | (b) | except as may be allowed by our Articles of Incorporation, our total assets would be less than the sum of our total liabilities plus the amount that would be needed, if we were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of stockholders who may have preferential rights and whose preferential rights are superior to those receiving the distribution. |

Recent Sales of Unregistered Securities

Foreign and US Private Placement Offerings

During the fiscal year ended December 31, 2007, we completed two private placement offerings, one made solely to “non-US persons” as contemplated under Regulation S of the Securities Act and another made solely to US “accredited investors” as defined in Regulation D of the Securities Act. As initially approved by our Board of Directors, each of the Foreign Offering and US Offering consisted of an offering of 10,000,000 units (each a “Unit”) each, at a price of $0.65 per Unit. Each Unit offered under the Foreign Offering and the US Offering consisted of one share of our common stock and one share purchase warrant entitling the holder to purchase one additional share of our common stock at a price of $1.00 per share for a period of two (2) years from the date of issuance. We may accelerate the expiry date for these warrants after one year from the date of issuance if our common stock trades at a weighted average price over $3.50 for twenty (20) consecutive trading days. If we choose to exercise these acceleration rights, the accelerated expiry date will be 30 days after we send notice of the acceleration.

The total number of Units sold under the Foreign Offering and the US Offering was 8,188,000 Units and 11,812,000 Units respectively. This represents an over allotment of 1,812,000 Units from the total number of Units originally approved by our Board of Directors for the US Offering. To account for the over allotment, we decreased the number of Units. The aggregate number of Units sold by us under both the Foreign Offering and the US Offering was 20,000,000 Units, for total gross proceeds of $13,000,000. We paid an aggregate of $243,653 in cash commissions and issued an aggregate of 160,650 Agent’s Warrants in connection with the sale of 5,355,000 Units under the US Offering and the Foreign Offering, collectively. The Agent’s Warrants contain the same rights and conditions as the other warrants issued in the Foreign Offering and the US Offering. Both the Foreign Offering and the US Offering have now been closed. The proceeds of the Foreign Offering and the U.S. Offering were used to fund our acquisition of CBI, exploration and development of our mineral properties and for general working capital purposes.

20

Acquisition of Columbus Brine Inc. (“CBI”)

In order to complete the acquisition of CBI, we issued an aggregate of 10,440,087 shares of our common stock and 5,220,059 share purchase warrants (the “CBI Warrants”) to the former shareholders of CBI. The shares and share purchase warrants issued to the former shareholders of CBI were issued in reliance upon Rule 506 of Regulation D promulgated under the Securities Act. We received representations that there were no more than 35 shareholders of CBI who did not qualify as “accredited investors” as that term is defined in Rule 502 of Regulation D. Each share purchase warrant entitles the holder to purchase one additional share of our common stock at a price of $2.39 per share until February 19, 2013. We may accelerate the expiration date of the share purchase warrants after August 19, 2010 if the average price of our common stock over any 20 consecutive trading days is greater than or equal to 150% of the exercise price. The share purchase warrants provide the holder with a cashless exercise right.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

PLAN OF OPERATION

During our 2008 fiscal year, we intend to proceed with our exploration and development programs for the Columbus Project and the Red Mountain Project. Although we currently intend to retain the Ireland Claim, our management has deprioritized our exploration program for the Ireland Claim based on the progress and potential of the Columbus and Red Mountain Projects. As a result, our exploration program for the Ireland Claim is expected to be delayed, and may be delayed indefinitely.

The Columbus Project

Our exploration and development program for the Columbus Project currently consists of the following:

| 1. | Pilot Production Module: We plan to implement a pilot production module on the Columbus Project in order to evaluate the economic feasibility of the project. The pilot production module will consist of a full scale production and processing cycle that we will use to test the commercial viability of the project. If the operation of this pilot production module proves to our satisfaction that the Columbus Project is economically viable, we will seek to construct additional production modules of the mill site. The production model for the Columbus Project is anticipated to be a low grade, low cost, high volume mining operation. |

| | |

| We have obtained a production permit from the Bureau of Land Management (“BLM”). The production permit allows us to commence calcium carbonate production and precious mineral extraction on the 270 acre mine site and 60 acre mill sites located at the Columbus Project at a mine rate of up to 78,000 tons per year. In addition, the Production Permit allows us to use 50 acres of the Columbus Project for road access. |

| | |

| We plan to use an open pit mining method to extract minerals from the Columbus Project. The material will be mined and transported by truck to the project facility. Water will then be added to the extracted material to make a slurry. Once the material has been slurried, we will use a gravity and spiral concentration process to filter the minerals from the material. The final extraction method will involve acid leaching to recover the minerals from the materials. |

| | |

| Once we commence production, we anticipate that we will continue our production with the pilot production module as long as the Columbus Project produces commercial minerals.Readers are cautioned that, although we believe that the results of our exploration activities to date are sufficiently positive to proceed with the installation of a pilot production module for the Columbus Project, we have not yet established any probable or proven reserves. There is no assurance that we will be able to establish that any commercially extractable ore reserves exist on the Columbus Project. |

| | |

| 2. | Drilling Exploration Program: We plan to commence a drilling program on the Columbus Project in order to determine whether there are sufficient reserves on the Columbus Project for economic viability. |

21

During the fourth quarter of 2007, we applied for the required permit applications in connection with our drilling exploration program on the Columbus Project. If we receive the necessary approvals from the BLM, of which there are no assurances, we expect to commence drilling by the end of the first quarter of 2008. We anticipate that our drilling program will take up to two years to complete.

We anticipate spending approximately $4,176,975 on the above exploration and development program for the Columbus Project in 2008.

The Red Mountain Project

Our exploration and development program for the Red Mountain Project currently consists of the following:

| 1. | Comprehensive Project Report: We are currently in the process of having a comprehensive project report prepared by an independent geological consultant on the Red Mountain Project. This report is expected to include a review and summary of the mining history of the area and previous work done on the project area. We expect to receive a final draft of this report early in our second fiscal quarter of 2008. |

| | |

| 2. | Sampling and Drilling Program: We have initiated a surface sampling program on the Red Mountain Project and we are planning to initiate a drilling program on the Red Mountain Project sometime in 2008. We hope to submit our initial drill permit application in 2008. The drill locations will be determined by further analysis of the project data, which is currently underway. |

We anticipate that we will spend approximately $1,645,600 on our exploration program for the Red Mountain Project in 2008.

Cash Requirements

Our estimated expenses for 2008 are as follows:

| Columbus Project | |

| • Property Acquisition and Maintenance Costs | $210,000 |

| • Drilling Exploration Program and Obtaining Reserve Estimates | 626,000 |

| • Plant Facility Upgrades | 2,379,250 |

| • Plant Operation | 402,000 |

| • Permits | 180,000 |

| | 3,797,250 |

| • Contingency (@ 10%) | 379,725 |

| Total for Columbus Project | $4,176,975 |

| Red Mountain Project – Phase I | |

| • Property Acquisition and Maintenance Costs | $60,000 |

| • Permitting Costs | 350,000 |

| • Drilling/Sampling Exploration Program | 720,000 |

| • Operations | 366,000 |

| | 1,496,000 |

| • Contingency (@ 10%) | 149,600 |

| Total for Red Mountain Project | $1,645,600 |

| General and Administration | |

| • General and Administration | $1,316,400 |

| • Contingency (@ 10%) | 131,640 |

| | |

Total for General andAdministration | $1,448,040 |

| TOTAL | $7,270,615 |

22

As of December 31, 2007, we had cash in the amount of approximately $8,759,605 and a working capital surplus of $8,621,176. Although this amount is sufficient to meet our anticipated costs for our exploration and development programs during the next twelve months, the actual costs of completing those programs may be greater than anticipated. If the actual costs are significantly greater than anticipated or if we proceed with our exploration and development programs beyond what we currently have planned for the next twelve months, we will need to obtain additional financing. There are no assurances that we will be able to obtain additional financing in an amount sufficient to meet our needs or on terms that are acceptable to us.

RESULTS OF OPERATIONS

| Summary of Year End Results | | | |

| | | Year Ended December 31 | |

| | | | Percentage |

| | 2007 | 2006 | Increase / (Decrease) |

| Revenue | $ Nil | $ Nil | n/a |

| Operating Expenses | (2,363,460) | (95,279) | 2,380.6% |

| Interest Income | 120,189 | - | n/a |

| Net Loss | $(2,243,271) | $(95,279) | 2,254.4% |

Revenue

We have not earned any revenues since our inception and we do not anticipate earning revenues until such time as we have entered into commercial production of our mineral properties. We are currently in the exploration stage of our business and we can provide no assurances that we will discover commercially exploitable levels of mineral resources on our properties, or if such resources are discovered, that we will be able to enter into commercial production of our mineral properties.

Operating Expenses

The major components of our operating expenses are outlined in the table below:

| | | Year Ended December 31 | |

| | | | Percentage |

| | 2007 | 2006 | Increase / (Decrease) |

| Mineral exploration and evaluation expenses | $336,042 | - | n/a |

Mineral exploration and evaluation

expenses – related party | 976,314

| -

| n/a

|

| General and administrative | 485,932 | 95,279 | 410.0% |

| Depreciation | 672 | - | n/a |

| Mineral and property holding costs | 269,500 | - | n/a |

Mineral and property holding costs –

reimbursed to related party | 295,000

| -

| n/a

|

| Total Expenses | $2,363,460 | $95,279 | 2,380.6% |

Our operating expenses increased during the year ended December 31, 2007 primarily as a result of amounts spent by us on acquiring, exploring and evaluating the Columbus and Red Mountain Projects.

The amounts spent on mineral exploration and evaluation expenses in 2007 represents amounts spent by us on exploring and evaluating the Columbus and Red Mountain Projects. “Mineral exploration and evaluation expenses – related party” and “Mineral and property option payments – reimbursed to related party” represent amounts paid or reimbursed to Nanominerals. During the year ended December 31, 2007, we incurred fees payable to Nanominerals of $645,000 for technical services and financing related services relating primarily to

23

the Columbus and Red Mountain Projects. In addition, we reimbursed Nanominerals an aggregate of $626,314 for expenses related to the acquisition, exploration and evaluation of the Columbus and Red Mountain Projects.

The increase in general and administrative expenses is primarily attributable to: (i) increases in the amounts paid as executive compensation (see “Item 11. Executive Compensation”); and (ii) an increase in legal expenses incurred by us due to our acquisition of the Columbus Project and the assigning to us of Nanominerals’ rights under the Columbus Letter Agreement and the Red Mountain Letter Agreement.

We anticipate that our operating expenses will continue to increase significantly as we pursue our exploration and development programs for the Columbus Project, the Red Mountain Project and the Ireland Claim.

LIQUIDITY AND CAPITAL RESOURCES

| Working Capital | | | |

| | At December 31, | At December 31, | Percentage |

| | 2007 | 2006 | Increase / (Decrease) |

| Current Assets | $8,909,628 | $11,633 | 76,489.3% |

| Current Liabilities | (288,452) | (71,061) | 305.9% |

| Working Capital Surplus (Deficit) | $8,621,176 | $(59,428) | 14,406.9% |

| Cash Flows | | |

| | Year Ended December 31 |

| | 2007 | 2006 |

| Net Cash Used In Operating Activities | $(3,790,103) | $(51,609) |