Corporate Presentation

June 2008

Confidential

Forcompleteinformation onIreland Inc, itsprojects and riskfactors, please reviewIreland Inc.’s SEC filings athttp://www.sec.gov.

Forward Looking Statements

ThisPresentation maycontain, inaddition tohistoricalinformation,forward-lookingstatements.Statements in thisPresentation that areforward-lookingstatements aresubject tovarious risks anduncertaintiesconcerning thespecificfactorsdisclosed under theheading "RiskFactors”andelsewhere in theCompany'speriodic filings with the U.S.Securities andExchangeCommission. When used in thisPresentation, the words such as"could,""plan","estimate","expect","intend","may","potential“,"should", andsimilarexpressions, areforward-lookingstatements. The riskfactors that could cause actualresults to differ from theseforward-lookingstatementsinclude, but are notrestricted to theCompany‘slimitedoperatinghistory,uncertainties about theavailability ofadditionalfinancing,geological ormechanicaldifficultiesaffecting theCompany'splannedgeological workprograms,uncertainty ofestimates ofmineralizedmaterial,operational risk,environmental risk,financial risk,currency risk, and otherstatements that are nothistorical facts asdisclosed under theheading "RiskFactors" in theCompany'sAnnualReport on Form 10-K filing with the SEC andelsewhere in theCompany'speriodic filings withsecuritiesregulators in theUnitedStates.Copies of theCompany'speriodicreports areavailable on the SEC'swebsite athttp://www.sec.gov.

Company Vision

| | Build Ireland (IRLD) into a significant mid-tier mining company |

| | | |

| | • | IRLD has two precious metal projects with significant potential |

| | | | |

| | | • | Columbus Project- Acquired 100% Gold / Silver / Calcium Carbonate |

| | | | |

| | | • | Red Mountain Project – Option to buy 100% Gold / Tungsten / Silver |

| | | | |

| | • | Develop culture of managing expectations and over-delivering |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Company Goals

Todevelop theColumbusProject as the leadprojectfollowed by the RedMountainProject

ColumbusProject

- Determine Project Feasibility with Pilot Plant Testing

- Determine Project Resources with an exploratory Drill Program

Red MountainProject

- Determine Project Resources with a sampling and drill program

Columbus Project

Overview

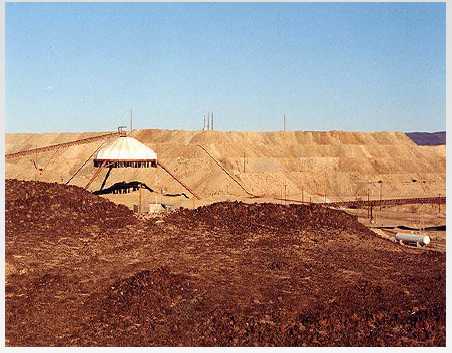

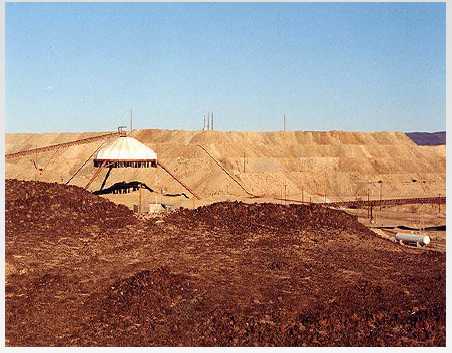

Columbus Project Mill-site Facility | | Columbus Project Gold, Silver and Calcium Carbonate Project At surface of a dry lake bed Mine Site Production permit has been granted Short Production Horizon

|

Location

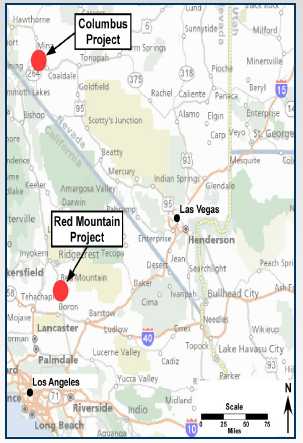

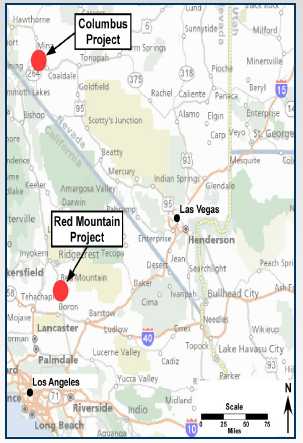

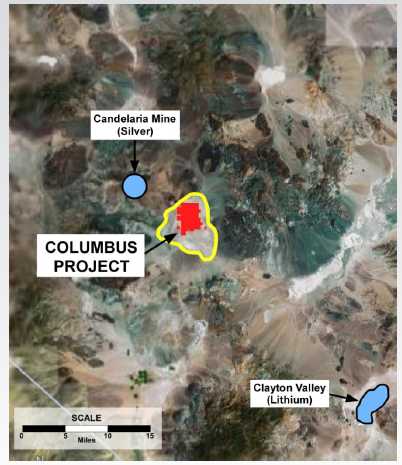

TheColumbus Projectislocated ~halfwaybetween Las Vegas and Reno, ~52 miles west ofTonopah,Nevada, USA.

TheProject isspecificallylocatedover theColumbus Salt Marsh inEsmeraldaCounty,Nevada.

Regional History

| | Columbus Project is in a mineralized area : |

| | |

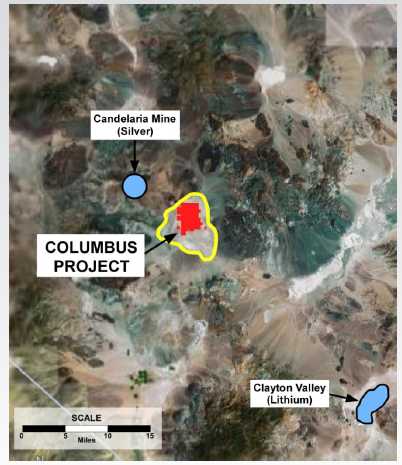

• | Candelaria Mine (Silver)* |

| | | |

| • | Original Claims in 1860’s |

| | | |

| • | 151 M oz of Silver identified |

| | | |

| • | 68 M oz of Silver mined |

| | | |

| • | ~ 5 miles from Columbus Project |

| | | |

• | Clayton Valley (Lithium) |

| | | |

| • | Lithium salts in Aquifer |

| | | |

| • | Production since 1950’s |

| | | |

| • | Aquifer type similar to Columbus |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

* - data frompublishedreports

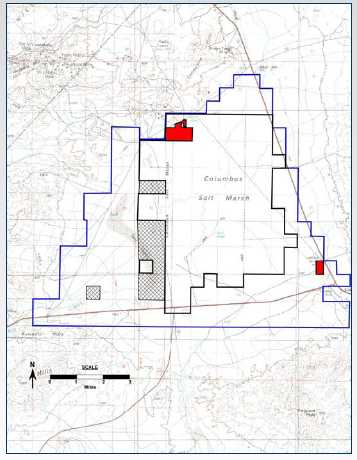

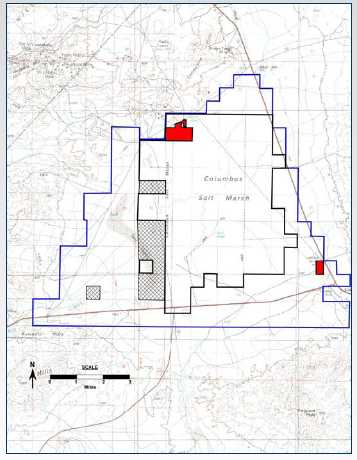

Project Assets

| | The Columbus Project consists of : •~ 19,300 acres of mineral claims on federal land administered by the BLM, with an option for an additional ~23,000 acres. • 380 acres permitted for productionof CalciumCarbonate(CaCO3) and precious mineral extraction (the PermittedArea)

- 270 acre mine site

- 60 acre mill sites

- 50 acres of road access

- 15,000sq ft mill building • 80 acres of private land • Water usage rights of aquifers in basin |

Technical Team

Retained two independent engineering firms:

Arrakis Inc. – based in Denver, CO.

Lumos & Associates – based in Reno, NV

All reported work to date has been completed andperformed under Chain of Custody (COC)

Technical Program

| | Gold (Au) Anomaly Identified |

| | |

| • | Over 60 surface samples and 5 large bulk samplestaken over an ~ 27,000-acre area at depths of 3’ to20’ analyzed by Arrakis Inc. |

| | |

| • | Results of sediment analysis identified an ~5,000-acre area with samples of Au values of > 0.075 oz/tin the NW section of the basin (the Gold Anomaly) |

| | |

| • | Gold values from surface samples are in-situgrades; tonnages have yet to be proven |

| | |

| • | Gold is fine and entombed in clays. The challengeof the project will be to separate the Gold fromthese clays |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

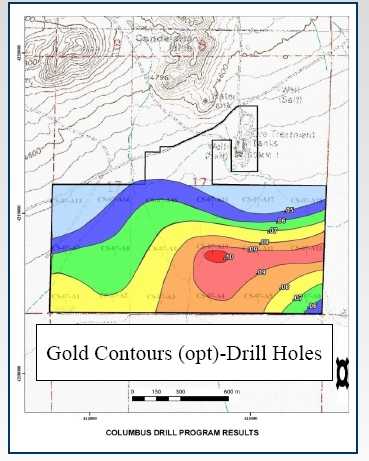

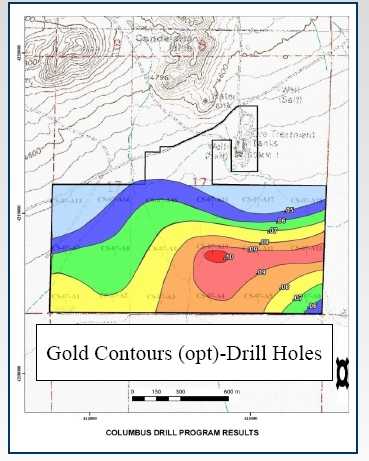

Drill Program Results

| | Drill ProgramDetails |

| | | |

| | • | 18 holes drilled to a maximumdepth of 100 ft* in 380-acreProduction Permitted Area |

| | • | 2 ft composite samples takenevery 10 ft |

| | | |

| | Gold Results |

| | | |

| | • | 154 Sample Av. = 0.074 opt Au |

| | • | 18 Drill Hole Av. = 0.070 opt Au |

| | | |

| | * Holes were drilled to 100 ft or shallower due to bed rock or drilling conditions |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

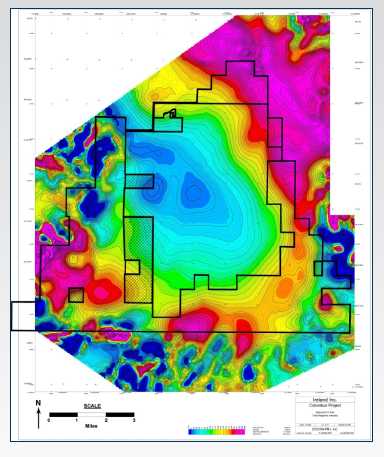

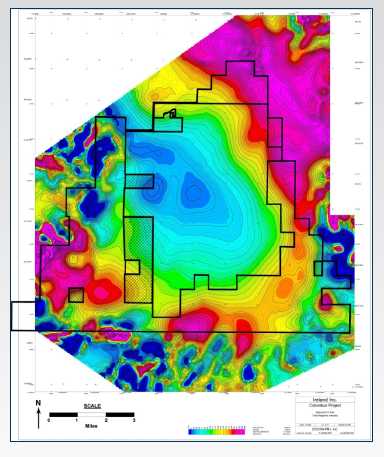

Geology

| | Aeromagnetic Survey |

| | | |

| | • | High resolution aeromagnetic surveycompleted October 2007 |

| | | |

| | • | Mag Highs= Volcanics surrounding basin |

| | | |

| | • | Mag Lows= Young Sediments in basin andolder sediments around basin |

| | | |

| | • | A large NW-SE fault structure enters basinfrom the NW and could be main aquifer feed tobasin |

| | | |

| | • | Basin could be collapsed caldera or rift basin |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Potential of Mineralized Area

Parameter

| Area

| Depth

| Tons of

Minable Material |

| Permitted Area | 320 Acres | 25 ft | 8.8 M |

Currently permitted to mine up to 790,000 tpy in a 320-acre area to a depth of 40 ft.(estimated mine life of over 17 years)

SRK Consulting, an independent engineering firm based in Reno estimated that themineable tonnage in the 320-acre permitted mine area, to a depth of 25 feet,approximates 8.8 million tons

The Drilling Program completed within the permitted area indicates that the minablematerial extends below the currently permitted depth of 25 feet.

Permitted Area lies on northern edge of the identified Gold Anomaly

If the geology is consistent from the permitted area to the Gold Anomaly, the ~5,000-acres would contain a potential minable tonnage of>150 million tonsin the top 25 feet.

Recent Milestones

January- June 2008

| • | Completed Acquisition of Columbus Project |

| | |

| • | Announced results of 18-hole drill program |

| | |

| • | Received permits for 28-hole drill program to test the mineralizationwithin the ~5,000 acre gold anomaly |

| | |

| • | Completed first phase of upgrades to 15,000 ft2processing building |

| | |

| • | Initiated construction of on-site pilot plant for Columbus Project |

| | |

| • | Received amended production permits to 790,000 tpy and to a depthof 40 feet. |

Next Steps

Project Development– 2008

| • | Install on-site pilot plant at Columbus Project |

| | |

| • | Completeinitial resource study and commence pilot plant testingfor pre-feasibility study |

| | |

| • | Continue drill testing for resources outside of the permitted area,within the 5,000-acre gold anomaly |

| | |

| • | Completeinitial mineral resource estimates |

| | |

| • | Completepre-feasibility study for gold, silver and calcium carbonateproduction at Columbus Project |

Exploration Budget

| January To December 31st2008 | |

| Feasibility Study and Testing | |

| Property Payments | $ 210,000 |

| Drilling and Analysis | $ 626,000 |

| Plant and Feasibility | $ 2,379,250 |

| Plant Operations | $ 402,000 |

| Permits | $ 180,000 |

| | $ 3,797,250 |

| Contingency (10%) | $ 379,725 |

| Estimated Costs | $ 4,176,975 |

Summary

| | The Columbus Project represents a solid exploration and production opportunity: |

| | |

| • | Full permit for the extraction of Gold andSilver and the production of CalciumCarbonate |

| | |

| • | “Big Box Store” of mining operations:high volume and low cost |

| | |

| • | Near term production horizon |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Red Mountain Project

Overview

Red Mountain, Ca | | Red Mountain Longer Term Exploration Project Gold, Tungsten and Silver Over 25 years of sampling and testing Option to acquire 100% by Dec 31, 2011

|

Location

| | The Red Mountain Project is located at the base of Red Mountain, 27 miles south of Ridgecrest, in San Bernardino County, California. |

History

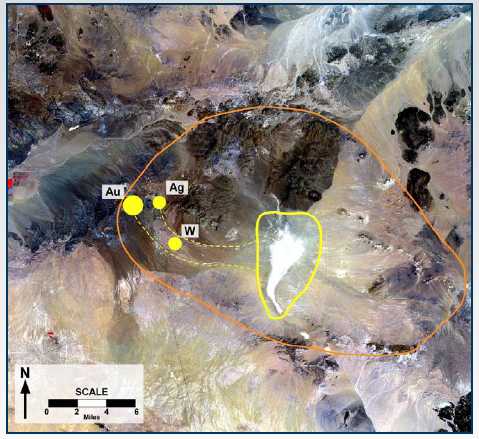

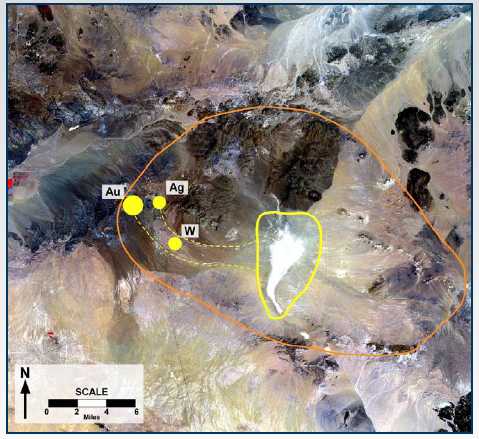

| | Satellite Image The Red Mountain Project is in a well known mineralized area. Proven Production in Region* - Gold (Au)** : ~+1.9M oz

- Silver (Ag) : ~+16M oz

- Tungsten (W) : ~+20M lbs of WO3

* Based on Published Reports

** Site of Glamis Gold project at Randsburg |

Similar Projects in California

| | Mesquite Project near Glamis, Imperial County, CA Similar metallurgy to Red Mountain Common Cyanide Heap Leach Process Recently raised ~$100M to re-start production On Schedule for full production in Jan ‘08 of 160,000 – 170,000 oz Au /yr |

Technical Team

| • | Retained an independent engineering firm to workwith Nanominerals Corp. on technical program: |

| | | |

| | • | McEwen Geological – based in Denver, CO. |

| | | |

| • | All reported work to be completed and performedunder Chain of Custody (COC) |

Project Assets

| | The Red Mountain Project consists of : ~ 7,500 acres of mineralclaimsand mill sites on federal land administered by the BLM. |

Geology

| • | Miocene mineralization:General area of interest(orange) |

| | |

| • | Major mines: (yellow)gold, tungsten, silver |

| | |

| • | ‘Project Area’: (yellow)Erosion zone from the majormines east to original lakesite |

| | |

| • | The erosion zone is ~ 2 mileswide and 8 miles long |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Technical Program

Summary of Previous Work:

+25 years of sampling and metallurgical testing

+2,000 assays taken from +20 bulk sample sites and +100 backhoepits has proven alarge tonnage potential for Au, W and Ag

Work proved erosion of Au/W/Ag deposits on west, easterly intomineralized alluvial fan some 2 miles wide x 8 miles long

Based on work completed, potential commercially viableproduction flow sheets have been drafted

Completed Aeromagnetic Survey of Region

Compiled geological/geophysical/metallurgical data

Next Steps

Project Development 2008

| • Initiate Surface Sampling /Drilling Program to determineproject resources |  |

Exploration Budget

| January To December 31st2008 | |

| Testing Program | |

| Property Payments | $ 60,000 |

| Permitting | $ 350,000 |

| Drilling Program | $ 720,000 |

| Operations | $ 366,000 |

| | $ 1,496,000 |

| Contingency (10%) | $ 149,600 |

| Estimated Costs | $ 1,645,600 |

Summary

The RedMountainProjectrepresents asolid exploration and production opportunity for Au/W/Ag.

The RedMountainproject is veryappealing due to itslocation in ahistoricalminingdistrict, theproject’s size andeconomicpotential and the lack ofcomplexity in theproposeddevelopment plan.

Previous workindicates the RedMountainProject and theColumbusProject havecomparablemetallurgicalextractionmethods.

Financial Information

Capitalization and Finances

| Capitalization | |

| Issued and Outstanding | 97,010,087 |

| Float | ~13,500,000 |

| Total Fully Diluted | 116,365,796 |

| Market Capitalization | ~$85 M |

| Finances | |

| Cash (03/31/08) | $7,662,452 |

| Long-Term Debt | $0 |

| Stockholders Equity (12/31/07) | $31,708,558 |

| Burn Rate | ~ $500K / Month* |

*General &AdministrationExpenses < 20%

Finances

| Cash Position | |

| Cash Position at (12/31/07) | $8,759,605 |

| Budgets (01/01/08 – 12/31/08) | |

| Columbus Project | 4,176,975 |

| Red Mountain Project | 1,645,600 |

| General and Admin. | 1,448,040 |

| Total Budget | $7,270,615 |

| | |

| Cash Position at (12/31/08) | $1,488,990 |

| Burn Rate | ~ $500K / Month* |

*General &AdministrationExpenses < 20%

Ireland Inc

Overall Summary

• | Exploration company with goal of production |

| | | |

• | Two projects with significant potential |

| | | |

| • | Columbus:Gold/Silver/Calcium Carbonate |

| • | Red Mountain:Gold/Tungsten/Silver |

| | | |

• | Good Fundamentals |

| | | |

• | Assembled Talented Technical Team |

| | | |

• | Well Financed |

| | | |

• | Strong Mineral / Metal Prices |

Ireland Inc

Corporate Office:

2441 WestHorizon RidgeParkway, Suite 100

Henderson, NV, 89044

(702) 932-0353

info@irelandminerals.com

http://www.irelandminerals.com

Investor Relations Contact:

R. JerryFalkner, CFA

RJFalkner &Company, Inc.

125 Piper Lane

Spicewood, TX, 78669

Tel: 800-377-9893