© 2014 Verint Systems Inc. All Rights Reserved Worldwide. March 2014 Actionable Intelligence®

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Forward-Looking Statements This presentation contains "forward-looking statements," including statements regarding expectations, predictions, views, opportunities, plans, strategies, beliefs, and statements of similar effect relating to Verint Systems Inc. These forward-looking statements are not guarantees of future performance and they are based on management's expectations that involve a number of risks, uncertainties, and assumptions, any of which could cause actual results to differ materially from those expressed in or implied by the forward- looking statements. Important risks, uncertainties, assumptions, and other factors could cause actual results to differ materially from those expressed in or implied by the forward- looking statements. The forward-looking statements contained in this presentation are made as of the date of this presentation and, except as required by law, Verint assumes no obligation to update or revise them, or to provide reasons why actual results may differ. For a more detailed discussion of how these and other risks, uncertainties, and assumptions could cause Verint’s actual results to differ materially from those indicated in its forward-looking statements, see Verint’s prior filings with the Securities and Exchange Commission. 2

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Non-GAAP Financial Measures This presentation includes financial measures not prepared in accordance with generally accepted accounting principles (“GAAP”). For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the Appendix to this presentation, Verint’s earnings press releases, as well as the GAAP to non-GAAP reconciliation found under the Investor Relations tab on Verint’s website. 3

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Actionable Intelligence is a necessity in a dynamic world of massive information growth because it empowers organizations with crucial insights and enables decision makers to anticipate, respond, and take action. 4

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Big Data Collection The Actionable Intelligence Market Actionable Intelligence Applications Customer Engagement Optimization Fraud, Risk & Compliance Security Intelligence 5

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. More than 10,000 customers provide Verint the opportunity to deliver actionable intelligence solutions across multiple markets Market Leadership 6 Verint is a $1 billion Actionable Intelligence company with strong presence across global Fortune 500 companies Note: Percentage of 2013 Global Fortune 500 companies that are Verint customers. Pro forma for KANA, Verint FY14 revenue was more than $1 billion. Finance 90% Healthcare 70% Government Many countries around the world Retail 60% Communications 70% Insurance 75% Utilities 45%

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Enable organizations to aggregate, analyze, and act on big data across service channels to optimize the workforce, improve business processes and enrich customer interactions. 7 Customer centric organizations seek to optimize customer engagement. They need to respond to changing consumer expectations while maximizing revenue, minimizing costs, increasing customer loyalty and mitigating enterprise risk. Market Dynamics Our Solutions Customer Engagement Operations CRO Consumers CCO CIO Decision Makers Customer Engagement Optimization CMO Mobile Social Media Self-service Branch Chat Email Voice

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. A combined offering will allow organizations to align and optimize what happens in the service process with those that perform the work. This powerful combination makes a lot of sense. “ ” e D Creating a Category Leader Up to now, customer service vendors were purchasing point solutions to fill in gaps in their offering. “ ” The two companies together will become an even bigger player in the global market, and thus should benefit customers with better service and the opportunity to purchase products from a single vendor. “ ” Verint rocked the customer engagement landscape this week with the news that it will acquire KANA, an important and longstanding CRM vendor. This is the first time CRM and workforce optimization will be melded into a single suite at such a scale from one of the market's leading vendors. “ ” 8

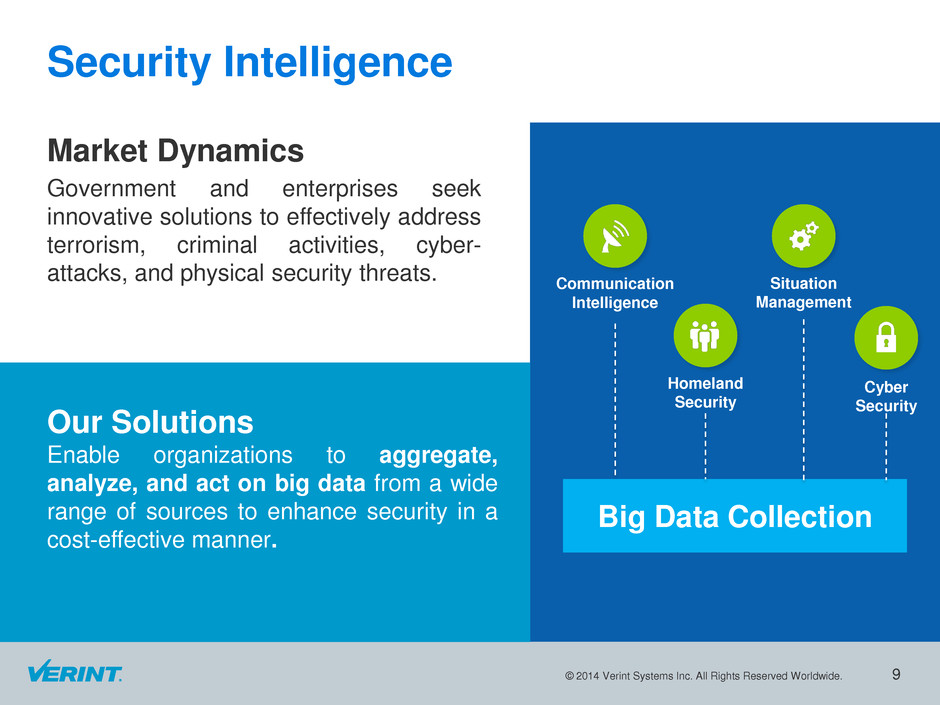

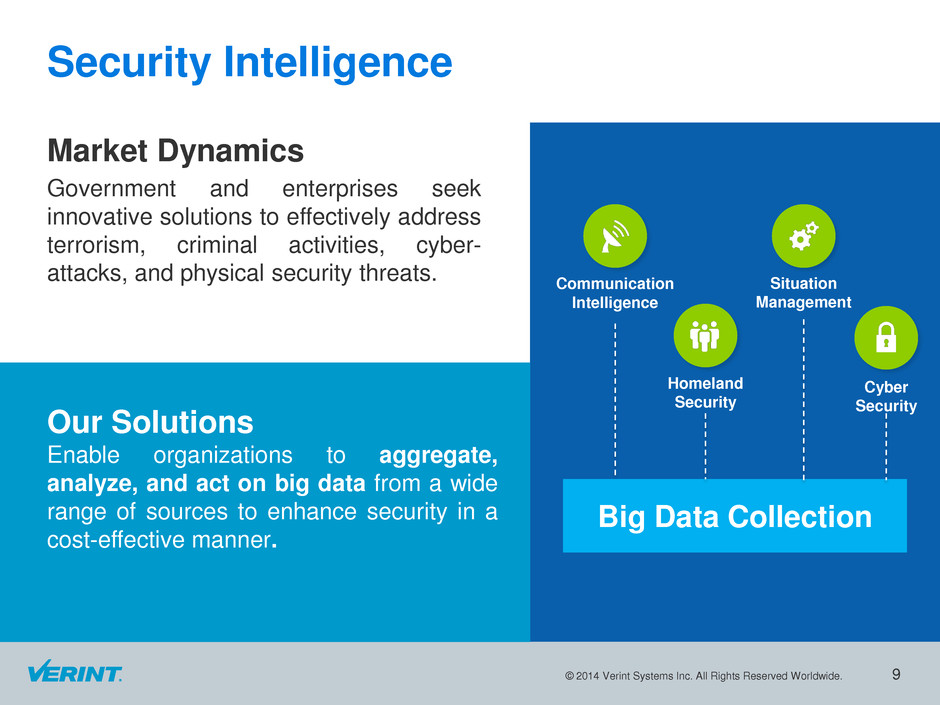

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Our Solutions Enable organizations to aggregate, analyze, and act on big data from a wide range of sources to enhance security in a cost-effective manner. 9 Government and enterprises seek innovative solutions to effectively address terrorism, criminal activities, cyber- attacks, and physical security threats. Market Dynamics Security Intelligence Communication Intelligence Situation Management Cyber Security Homeland Security Big Data Collection Solution

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Enable organizations to aggregate, analyze, and act on big data to identify and prevent fraud and help mitigate enterprise risk, helping to ensure compliance with legal, regulatory, and internal requirements. Organizations must address ongoing fraud intensified by new vulnerabilities and sophisticated cyber crimes as well as evolving compliance requirements across many industries. Market Dynamics Our Solutions Fraud, Risk & Compliance 10 Call Center Fraud and Compliance Financial Service Fraud and Compliance Retail Fraud Big Data Collection

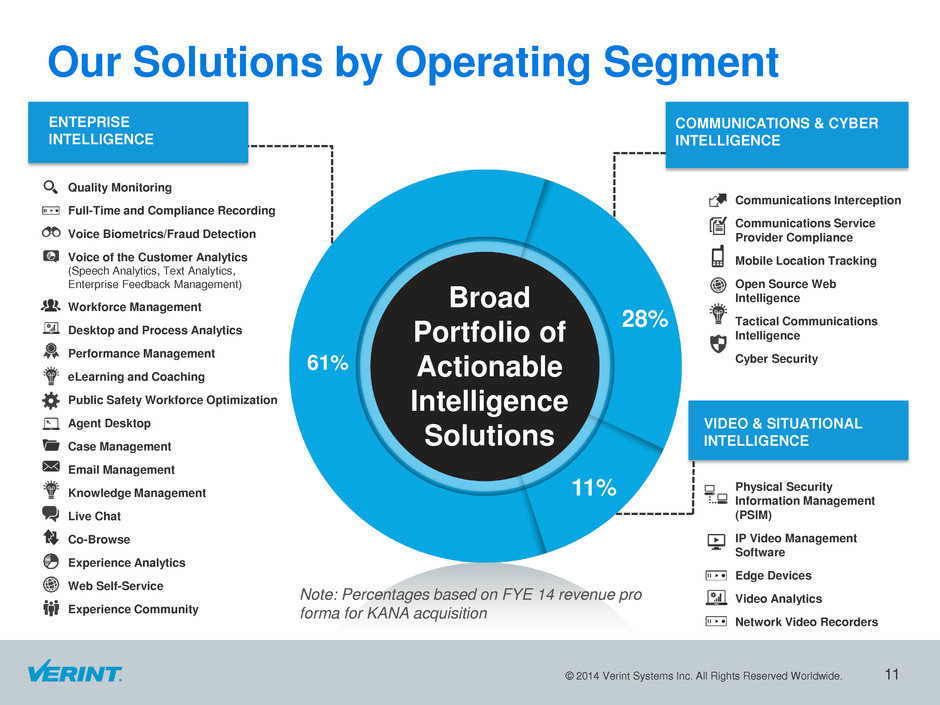

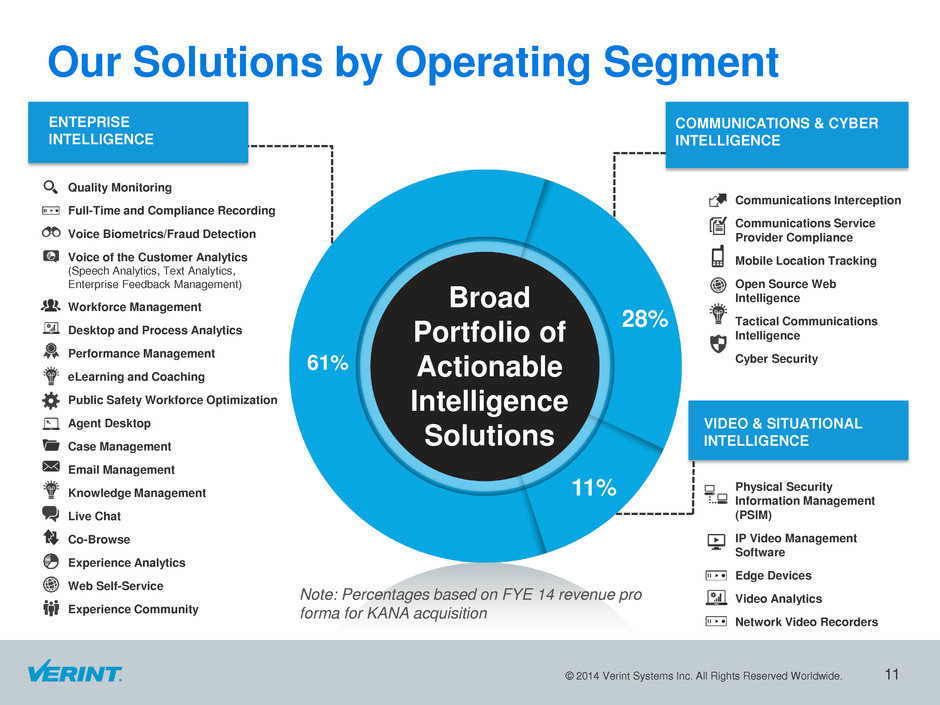

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Our Solutions by Operating Segment COMMUNICATIONS & CYBER INTELLIGENCE Quality Monitoring Full-Time and Compliance Recording Voice Biometrics/Fraud Detection Voice of the Customer Analytics (Speech Analytics, Text Analytics, Enterprise Feedback Management) Workforce Management Desktop and Process Analytics Performance Management eLearning and Coaching Public Safety Workforce Optimization Agent Desktop Case Management Email Management Knowledge Management Live Chat Co-Browse Experience Analytics Web Self-Service Experience Community Physical Security Information Management (PSIM) IP Video Management Software Edge Devices Video Analytics Network Video Recorders Broad Portfolio of Actionable Intelligence Solutions Communications Interception Communications Service Provider Compliance Mobile Location Tracking Open Source Web Intelligence Tactical Communications Intelligence Cyber Security VIDEO & SITUATIONAL INTELLIGENCE ENTEPRISE INTELLIGENCE 11 61% 28% 11% Note: Percentages based on FYE 14 revenue pro forma for KANA acquisition.

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Direct Salesforce • Verticalized direct sales force with subject matter expertise o 900 professionals in sales and marketing 12 Our Go-to-Market Strategy Partner Strategy • 50% of business through channel partners o OEMs, systems integrators and regional resellers Flexible Deployment Options • Perpetual, software-as-a-service, managed service • Business models reflect customer preferences

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Financial Highlights 13

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Revenue Trends FYE Jan 2005 FYE Jan 2006 FYE Jan 2007 FYE Jan 2008 FYE Jan 2009 FYE Jan 2010 FYE Jan 2011 FYE Jan 2012 FYE Jan 2013 FYE Jan 2014 APAC EMEA Americas $214 $279 $369 $572 $675 $704 $727 $796 56% Americas, 21% EMEA and 23% APAC Note: Financial data is non-GAAP. Percentage of total based on revenue in FYE January 31, 2014. ($ in millions) $848 $910 14

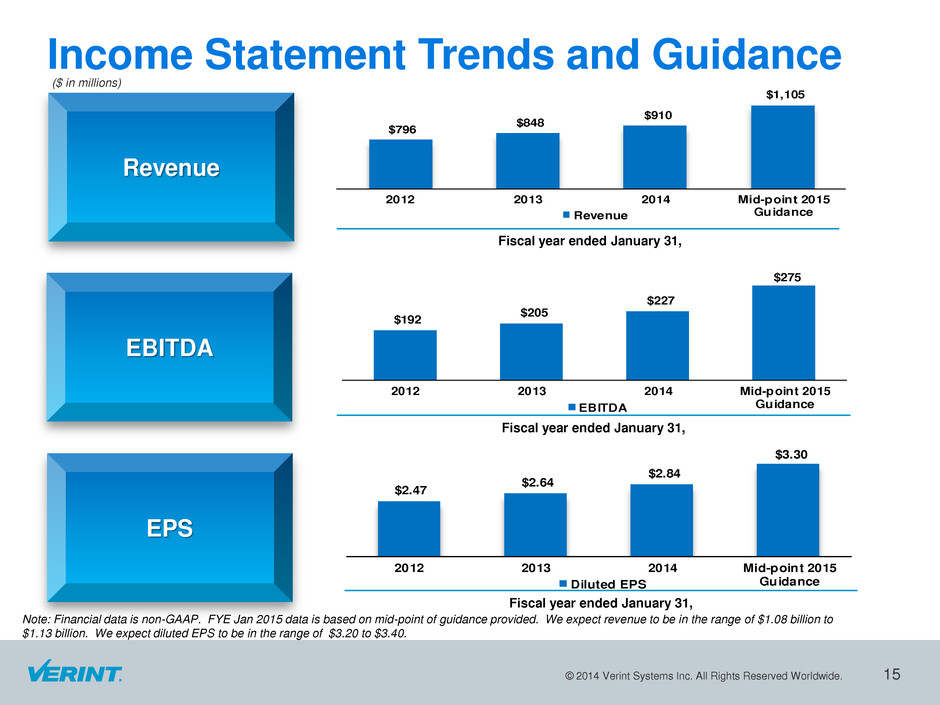

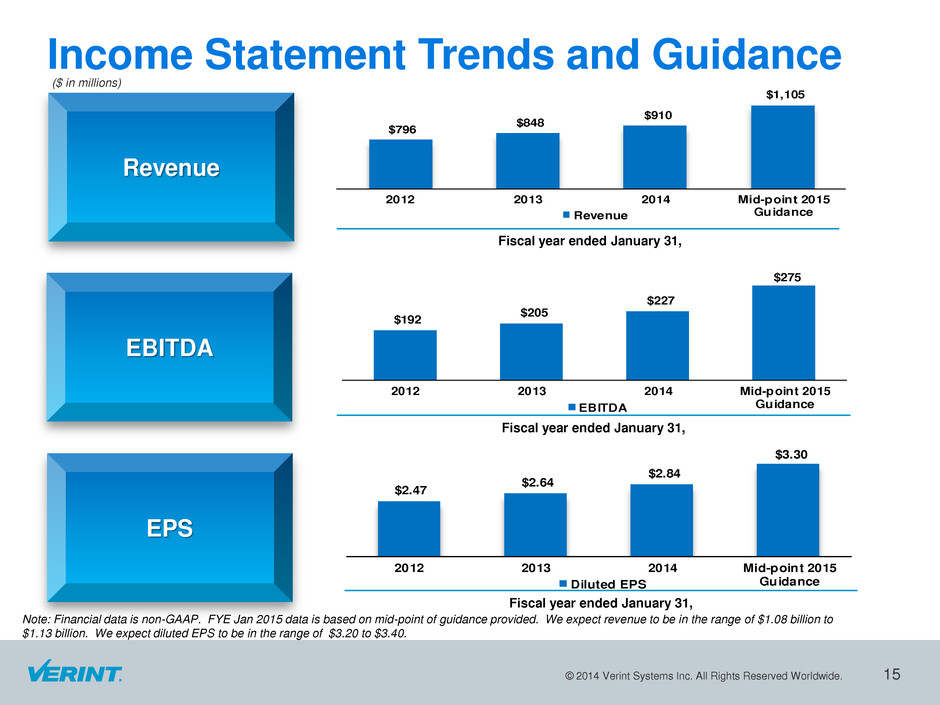

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Income Statement Trends and Guidance EBITDA Revenue Note: Financial data is non-GAAP. FYE Jan 2015 data is based on mid-point of guidance provided. We expect revenue to be in the range of $1.08 billion to $1.13 billion. We expect diluted EPS to be in the range of $3.20 to $3.40. ($ in millions) 15 EPS $796 $848 $910 $1,105 $500 2012 2013 2014 Mid-point 2015 GuidanceRevenue Fiscal year ended January 31, $192 $205 $227 $275 $100 $120 $140 $160 $180 $200 $220 $240 $260 $280 2012 2013 2014 Mid-point 2015 GuidanceEBITDA Fiscal year ended January 31, $2.47 $ .64 $2.84 $3.30 $1.25 $1.75 $2.25 $2.75 $3.25 2012 2013 2014 Mid-point 2015 GuidanceDiluted EPS Fiscal year ended January 31,

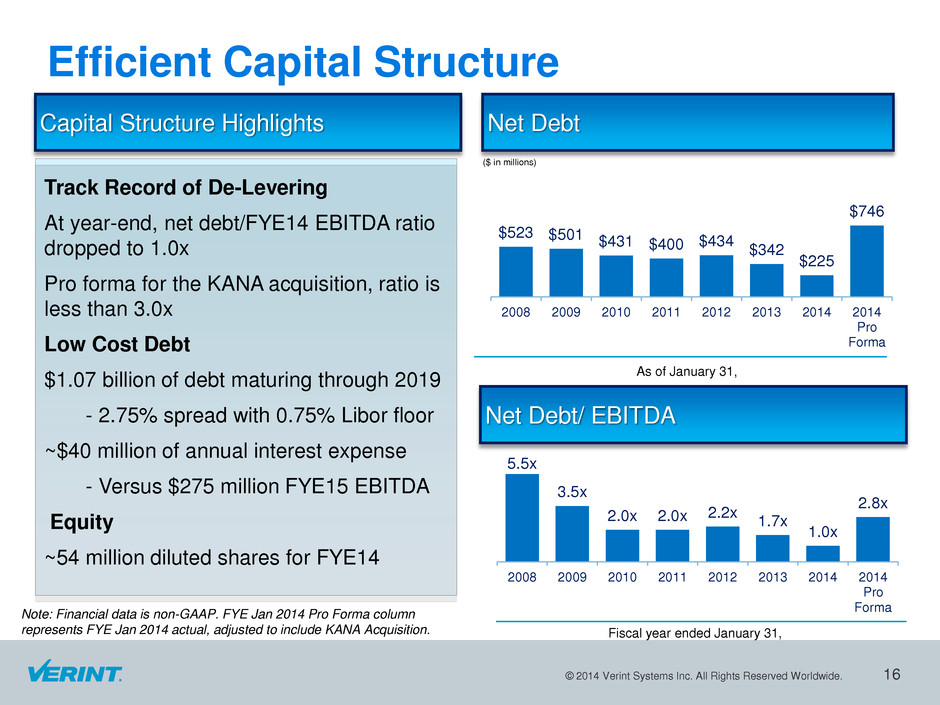

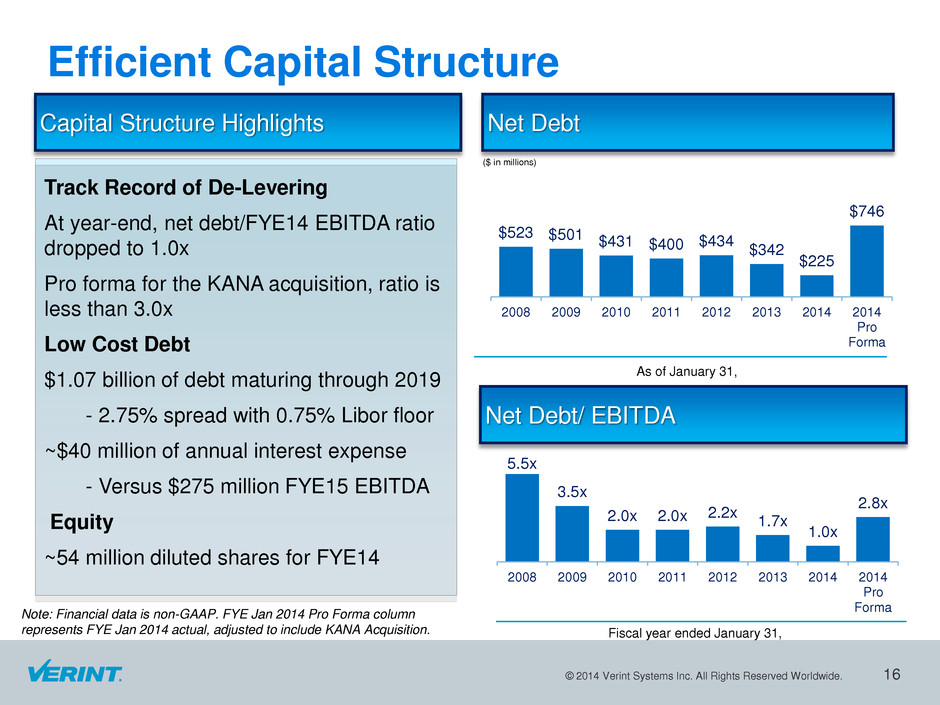

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Efficient Capital Structure ($ in millions) Net Debt Capital Structure Highlights Net Debt/ EBITDA As of January 31, Track Record of De-Levering At year-end, net debt/FYE14 EBITDA ratio dropped to 1.0x Pro forma for the KANA acquisition, ratio is less than 3.0x Low Cost Debt $1.07 billion of debt maturing through 2019 - 2.75% spread with 0.75% Libor floor ~$40 million of annual interest expense - Versus $275 million FYE15 EBITDA Equity ~54 million diluted shares for FYE14 Fiscal year ended January 31, Note: Financial data is non-GAAP. FYE Jan 2014 Pro Forma column represents FYE Jan 2014 actual, adjusted to include KANA Acquisition. 16 $523 $501 $431 $400 $434 $342 $225 $746 2008 2009 2010 2011 2012 2013 2014 2014 Pro Forma 5.5x 3.5x 2.0x 2.0x 2.2x 1.7x 1.0x 2.8x 2008 2009 2010 2011 2012 2013 2014 2014 Pro Forma

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Summary • Verint’s strong market presence in big data collection provides a solid foundation for delivering applications and growth • Large installed base provides stability and recurring revenue • Strong economy: Opportunity to accelerate adoption of applications • Weak economy: Maintenance stream, compliance and high value ROI • Track record of growth • Strong cash generation • Efficient capital structure • Long-term model • Opportunity to accelerate growth as addressable market continues to expand • Opportunity to expand margins with scale 17

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. Appendices 18

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. About Non-GAAP Financial Measures The following tables include a reconciliation of certain financial measures prepared in accordance with Generally Accepted Accounting Principles (“GAAP”) to the most directly comparable financial measures not prepared in accordance with GAAP (“non-GAAP”). Non- GAAP financial measures should not be considered in isolation or as a substitute for comparable GAAP financial measures. The non- GAAP financial measures we present in the following tables have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP, and these non-GAAP financial measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP financial measures. These non-GAAP financial measures do not represent discretionary cash available to us to invest in the growth of our business, and we may in the future incur expenses similar to the adjustments made in these non-GAAP financial measures. We believe that the non-GAAP financial measures we present in the following tables provide meaningful supplemental information regarding our operating results primarily because they exclude certain non-cash charges or items that we do not believe are reflective of our ongoing operating results when budgeting, planning and forecasting, determining compensation and when assessing the performance of our business with our individual operating segments or our senior management. We believe that these non-GAAP financial measures also facilitate the comparison by management and investors of results between periods and among our peer companies. However, those companies may calculate similar non-GAAP financial measures differently than we do, limiting their usefulness as comparative measures. Our non-GAAP financial measures reflect adjustments to the corresponding GAAP financial measure based on the items set forth below. The purpose of these adjustments is to give an indication of our performance exclusive of certain non-cash charges and other items that are considered by our senior management to be outside of our ongoing operating results. 19

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. About Non-GAAP Financial Measures • Revenue adjustments related to acquisitions. We exclude from our non-GAAP revenue the impact of fair value adjustments required under GAAP relating to acquired customer support contracts which would have otherwise been recognized on a standalone basis. We exclude these adjustments from our non-GAAP financial measures because these are not reflective of our ongoing operations. • Amortization of acquired intangible assets, including acquired technology. When we acquire an entity, we are required under GAAP to record the fair values of the intangible assets of the acquired entity and amortize those assets over their useful lives. We exclude the amortization of acquired intangible assets, including acquired technology, from our non-GAAP financial measures. These expenses are excluded from our non-GAAP financial measures because they are non-cash charges. In addition, these amounts are inconsistent in amount and frequency and are significantly impacted by the timing and size of acquisitions. Thus, we also exclude these amounts to provide better comparability of pre- and post-acquisition operating results. • Stock-based compensation expenses. We exclude stock-based compensation expenses related to stock options, restricted stock awards and units, stock bonus plans and phantom stock from our non-GAAP financial measures. These expenses are excluded from our non-GAAP financial measures because they are primarily non-cash charges. In prior periods, we also incurred (and excluded from our non-GAAP financial measures) significant cash-settled stock compensation expense due to our previous extended filing delay and restrictions on our ability to issue new shares of common stock to our employees. • M&A and other adjustments. We exclude from our non-GAAP financial measures legal, other professional fees and certain other expenses associated with acquisitions, whether or not consummated, and certain extraordinary transactions, including reorganizations, restructurings and expenses associated with our merger with CTI. Also excluded are changes in the fair value of contingent consideration liabilities associated with business combinations, and expenses related to our restatement of previously filed financial statements and our previous extended filing delay. These expenses are excluded from our non-GAAP financial measures because we believe that they are not reflective of our ongoing operations. 20

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. About Non-GAAP Financial Measures • Unrealized (gains) losses on derivatives, net. We exclude from our non-GAAP financial measures unrealized gains and losses on interest rate swaps and foreign currency derivatives not designated as hedges. These gains and losses are excluded from our non- GAAP financial measures because they are non-cash transactions which are highly variable from period to period and which we believe are not reflective of our ongoing operations. • Loss on extinguishment of debt. We exclude from our non-GAAP financial measures loss on extinguishment of debt attributable to refinancing of our debt because we believe it is not reflective of our ongoing operations. • Non-cash tax adjustments. We exclude from our non-GAAP financial measures non-cash tax adjustments, which represent the difference between the amount of taxes we expect to pay related to current year income and our GAAP tax provision on an annual basis. On a quarterly basis, this adjustment reflects our expected annual effective tax rate on a cash basis.. • Integration costs. We exclude from our non-GAAP financial measures expenses directly related to the integration of Witness. These expenses are excluded from our non-GAAP financial measures because they are not reflective of our ongoing operations. • In-process research and development. We exclude from our non-GAAP financial measures the fair value of incomplete in-process research and development projects that had not yet reached technological feasibility and have no known alternative future use as of the date of the acquisition. These expenses are excluded from our non-GAAP financial measures because they are non-cash charges that we do not believe are reflective of our ongoing operations. • Impairments of goodwill and other acquired intangible assets. Goodwill represents the excess of the purchase price in a business combination over the fair value of net tangible and identifiable intangible assets acquired. We exclude from our non-GAAP financial measures charges relating to impairment of goodwill and acquired identifiable intangible assets. These expenses are excluded from our non-GAAP financial measures because they are non-cash charges. 21

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. About Non-GAAP Financial Measures • Other legal expenses (recoveries). We exclude from our non-GAAP financial measures other legal fees and settlements associated with certain intellectual property litigations assumed in connection with the Witness acquisition. We excluded these items from our non-GAAP financial measures because they are not reflective of our ongoing operations. • Expenses related to our previous extended filing delay. We exclude from our non-GAAP financial measures expenses related to our restatement of previously filed financial statements and our extended filing delay. These expenses included professional fees and related expenses as well as expenses associated with a special cash retention program. These expenses are excluded from our non-GAAP financial measures because they are not reflective of our ongoing operations. • Restructuring costs. We exclude from our non-GAAP financial measures expense associated with the restructuring of our operations due to internal or external market factors. These expenses are excluded from our non-GAAP financial measures because we believe they are not reflective of our ongoing operations. • Settlement with OCS. In the year ended January 31, 2007, we recorded a charge related to our July 31, 2006 settlement with the Office of Chief Scientist in Israel (“OCS”), pursuant to which we exited a royalty-bearing program and the OCS accepted a settlement of our royalty obligations under this program. We exclude from our non-GAAP financial measures expenses associated with exiting this program because they are not reflective of our ongoing operations. • Gain on sale of land. We exclude from our non-GAAP financial measures the gain from the sale of a parcel of land. This gain is excluded from our non-GAAP financial measures because it is not reflective of our ongoing operations. 22

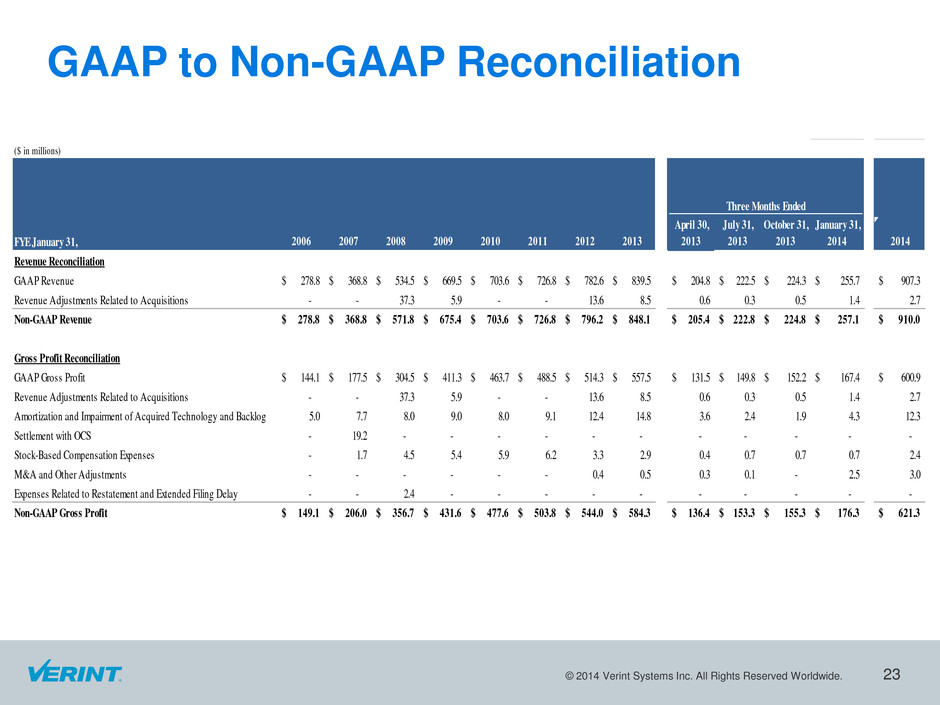

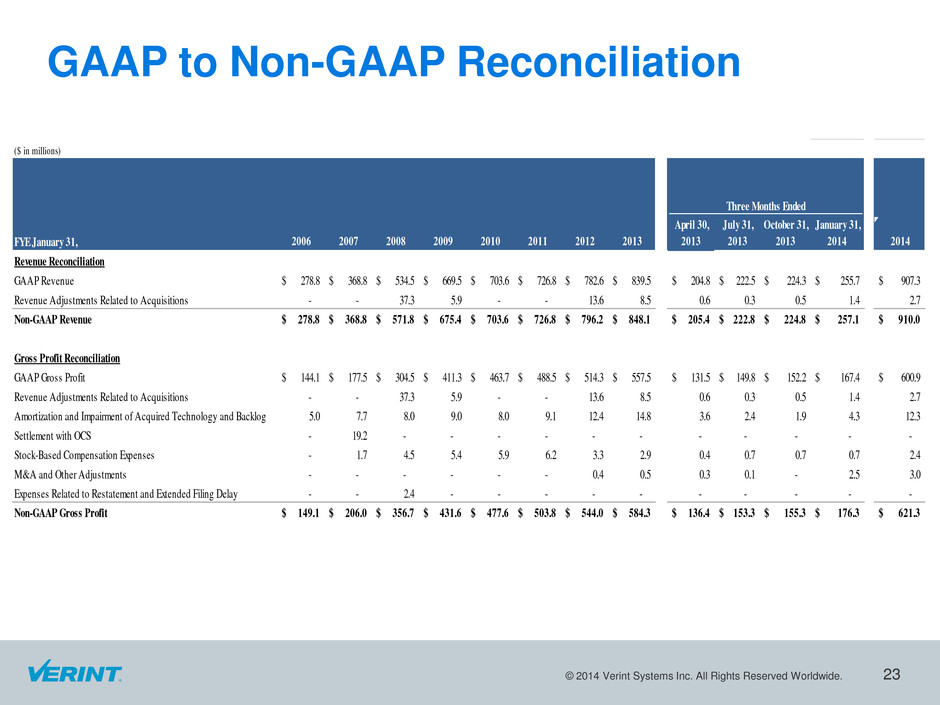

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. GAAP to Non-GAAP Reconciliation ($ in millions) FYE January 31, 2006 2007 2008 2009 2010 2011 2012 2013 April 30, 2013 July 31, 2013 October 31, 2013 January 31, 2014 2014 Revenue Reconciliation GAAP Revenue 278.8$ 368.8$ 534.5$ 669.5$ 703.6$ 726.8$ 782.6$ 839.5$ 204.8$ 222.5$ 224.3$ 255.7$ 907.3$ Revenue Adjustments Related to Acquisitions - - 37.3 5.9 - - 13.6 8.5 0.6 0.3 0.5 1.4 2.7 Non-GAAP Revenue 278.8$ 368.8$ 571.8$ 675.4$ 703.6$ 726.8$ 796.2$ 848.1$ 205.4$ 222.8$ 224.8$ 257.1$ 910.0$ Gross Profit Reconciliation GAAP Gross Profit 144.1$ 177.5$ 304.5$ 411.3$ 463.7$ 488.5$ 514.3$ 557.5$ 131.5$ 149.8$ 152.2$ 167.4$ 600.9$ Revenue Adjustments Related to Acquisitions - - 37.3 5.9 - - 13.6 8.5 0.6 0.3 0.5 1.4 2.7 Amortization and Impairment of Acquired Technology and Backlog 5.0 7.7 8.0 9.0 8.0 9.1 12.4 14.8 3.6 2.4 1.9 4.3 12.3 Settlement with OCS - 19.2 - - - - - - - - - - - Stock-Based Compensation Expenses - 1.7 4.5 5.4 5.9 6.2 3.3 2.9 0.4 0.7 0.7 0.7 2.4 M&A and Other Adjustments - - - - - - 0.4 0.5 0.3 0.1 - 2.5 3.0 Expenses Related to Restatement and Extended Filing Delay - - 2.4 - - - - - - - - - - Non-GAAP Gross Profit 149.1$ 206.0$ 356.7$ 431.6$ 477.6$ 503.8$ 544.0$ 584.3$ 136.4$ 153.3$ 155.3$ 176.3$ 621.3$ Three Months Ended 23

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. GAAP to Non-GAAP Reconciliation ($ in millions) FYE January 31, 2006 2007 2008 2009 2010 2011 2012 2013 April 30, 2013 July 31, 2013 October 31, 2013 January 31, 2014 2014 Operating Income (Loss) Reconciliation GAAP Operating Income (Loss) 4.1$ (47.3)$ (114.6)$ (15.0)$ 65.7$ 73.1$ 86.5$ 99.6$ 13.7$ 31.3$ 37.8$ 39.5$ 122.3$ Revenue Adjustments Related to Acquisitions - - 37.3 5.9 - - 13.6 8.5 0.6 0.3 0.5 1.4 2.7 Amortization and Impairment of Acquired Technology and Backlog 5.0 7.7 8.0 9.0 8.0 9.1 12.4 14.8 3.6 2.4 1.9 4.3 12.3 Amortization of Other Acquired Intangible Assets 1.3 3.2 19.7 25.2 22.3 21.5 22.9 24.4 6.0 6.0 6.2 6.5 24.7 Settlement with OCS - 19.2 - - - - - - - - - - - Impairments of Goodwill and Other Acquired Intangible Assets - 21.1 22.9 26.0 - - - - - - - - - In-process Research and Development 2.9 - 6.7 - - - - - - - - - - Integration Costs - - 11.0 3.3 - - - - - - - - - Restructuring Costs - - 3.3 5.7 0.1 - - - - - - - - Other Legal Expenses (Recoveries) 2.6 - 8.7 (4.3) - - - - - - - - - Stock-Based Compensation Expenses 1.2 18.8 31.1 36.0 44.2 46.8 27.9 25.2 6.2 9.2 9.7 9.8 35.0 Expenses Related to Restatement and Extended Filing Delay - 3.7 41.4 28.7 54.5 28.9 1.0 - - - - - - Gain on Sale of Land - (0.8) - - - - - - - - - - - M&A and Other Adjustments - - - - 0.8 5.2 12.3 16.6 6.5 2.2 0.3 4.0 13.0 Non-GAAP Operating Income 17.1$ 25.5$ 75.4$ 120.4$ 195.6$ 184.6$ 176.6$ 189.2$ 36.7$ 51.4$ 56.4$ 65.5$ 210.0$ EBITDA Reconciliation Non-GAAP Operating Income 17.1$ 25.5$ 75.4$ 120.4$ 195.6$ 184.6$ 176.6$ 189.2$ 36.7$ 51.4$ 56.4$ 65.5$ 210.0$ GAAP Depreciation & Amortization (1) 17.8 19.3 45.3 53.5 47.8 46.8 51.0 54.9 13.9 12.3 12.4 15.2 53.8 Amortization and Impairment of Acquired Technology and Backlog (5.0) (7.7) (8.0) (9.0) (8.0) (9.1) (12.4) (14.8) (3.6) (2.4) (1.9) (4.3) (12.3) Amortization of Other Acquired Intangible Assets (1.3) (3.2) (19.7) (25.2) (22.3) (21.5) (22.9) (24.4) (6.0) (6.0) (6.2) (6.5) (24.7) M&A and Other Adjustments - - - (0.2) - (0.8) (0.2) (0.1) - - - - - Non-GAAP Depreciation & Amortization 11.5 8.4 17.6 19.0 17.5 15.4 15.4 15.6 4.2 3.9 4.3 4.4 16.8 Non-GAAP EBITDA 28.5$ 34.0$ 93.0$ 139.5$ 213.2$ 200.0$ 192.0$ 204.8$ 40.9$ 55.3$ 60.7$ 69.9$ 226.8$ (1) Adjusted for patent and financing fee amortization. Three Months Ended 24

© 2014 Verint Systems Inc. All Rights Reserved Worldwide. © 2014 Verint Systems Inc. All Rights Reserved Worldwide. Thank You