Investor Presentation Actionable Intelligence® June 2018 Confidential and proprietary information of Verint© 2014 Systems Verint Inc. Systems © 2018 Inc. Verint All RightsSystems Reserved Inc. All RightsWorldwide. Reserved Worldwide.

Disclaimers Forward Looking Statements This presentation contains "forward-looking statements," including statements regarding expectations, predictions, views, opportunities, plans, strategies, beliefs, and statements of similar effect relating to Verint Systems Inc. These forward- looking statements are not guarantees of future performance and they are based on management's expectations that involve a number of known and unknown risks, uncertainties, assumptions, and other important factors, any of which could cause our actual results to differ materially from those expressed in or implied by the forward-looking statements. The forward-looking statements contained in this presentation are made as of the date of this presentation and, except as required by law, Verint assumes no obligation to update or revise them, or to provide reasons why actual results may differ. For a more detailed discussion of how these and other risks, uncertainties, and assumptions could cause Verint’s actual results to differ materially from those indicated in its forward-looking statements, see Verint’s prior filings with the Securities and Exchange Commission. Non-GAAP Financial Measures This presentation includes financial measures which are not prepared in accordance with generally accepted accounting principles (“GAAP”), including certain constant currency measures. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the appendices to this presentation, Verint’s earnings press releases, as well as the GAAP to non-GAAP reconciliation found under the Investor Relations tab on Verint’s website www.verint.com. 2

Verint Market And Strategy ACTIONABLE CUSTOMER ENGAGEMENT POSITIVE MARKET INTELLIGENCE CYBER INTELLIGENCE GROWTH TRENDS One Vision Two Segments Improved Agility 3

Verint Financial Model Accelerating Expanding Double Digit Revenue Margins Earnings Growth Growth Rate 4

Visionary Organizations Leverage The Customer Customer Engagement as a Differentiator Engagement Company Confidential and proprietary information of Verint© 2014 Systems Verint Inc. Systems © 2017 Inc. Verint All RightsSystems Reserved Inc. All RightsWorldwide. Reserved Worldwide. 5

Our Market - Customer Engagement Customer Engagement (Enables Exceptional Customer Experiences while Lowering Cost) Adjacent Markets Unified Communications CRM (Enterprise-wide Telephony and (Systems of Record for Collaboration Tools) Sales, Marketing and Service) 6

Customer Engagement Market Leader $ in millions Non-GAAP Revenue $850 ~$800 $755 $750 $716 $650 10,000 + 85% of the $550 $450 Customers Fortune 100 FYE17A FYE18A FYE19F Non-GAAP Fully Allocated Operating Income $225 ~$200 $200 $183 $175 $169 3,000 + Innovation $150 $125 Employees Leadership $100 FYE17A FYE18A FYE19F Note: FYE19F based on June 7, 2018 guidance. 7

Market Growth Trends Across the Unified Cloud Automation Enterprise Communications Disruption 8

Trend #1: Across the Enterprise Customer Engagement has Become An Enterprise Initiative Across the Enterprise Our Broad Portfolio Connects Customer Engagement Across Contact Center • Back Office • the Enterprise Branch • Self Service • Marketing • Customer Experience • Compliance • IT 9

Trend #2: Cloud Organizations Choose to Adopt Cloud Technologies In a Variety of Models Cloud Helping Organizations Evolve at Their Own Pace While Private, Public, and Hybrid Models Preserving Prior Investments 10

Trend #3: Automation Automation Drives Significant ROI Automation Verint Infuses Automation Throughout Its Broad Customer Engagement Reduce Cost • Portfolio Elevate Customer Experience 11

Trend #4: Unified Communications Disruption Organizations Have Many Choices for Unified Communications Infrastructure Unified Communications Verint’s Solutions Are Open And Decoupled, Helping Disruption Organizations To Modernize Customer Engagements Legacy • New Entrants • New Models 12

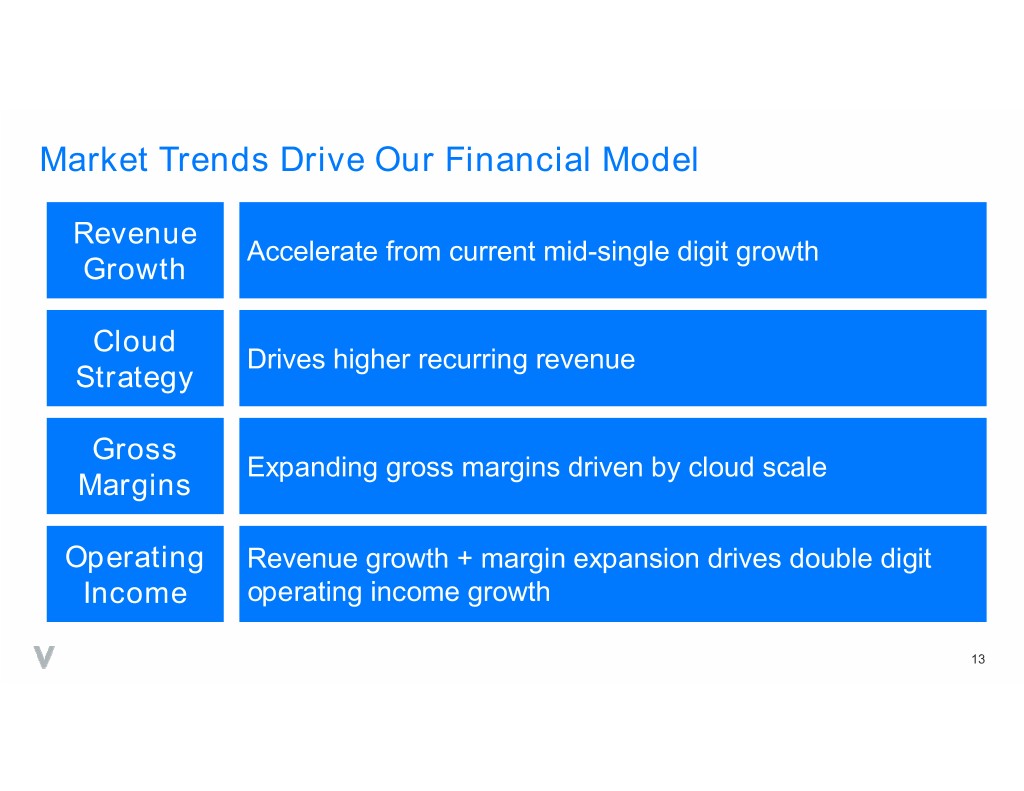

Market Trends Drive Our Financial Model Revenue Accelerate from current mid-single digit growth Growth Cloud Drives higher recurring revenue Strategy Gross Expanding gross margins driven by cloud scale Margins Operating Revenue growth + margin expansion drives double digit Income operating income growth 13

Security and Intelligence Intelligence Powered Security Data Mining Software Confidential and proprietary information of Verint© 2014 Systems Verint Inc. Systems © 2017 Inc. Verint All RightsSystems Reserved Inc. All RightsWorldwide. Reserved Worldwide.14

Our Market – Cyber Intelligence Data Mining Software (Driving “Intelligence Powered Security”) Sub Markets Law National National Critical Enterprise Enforcement Security Intelligence Infrastructure 15

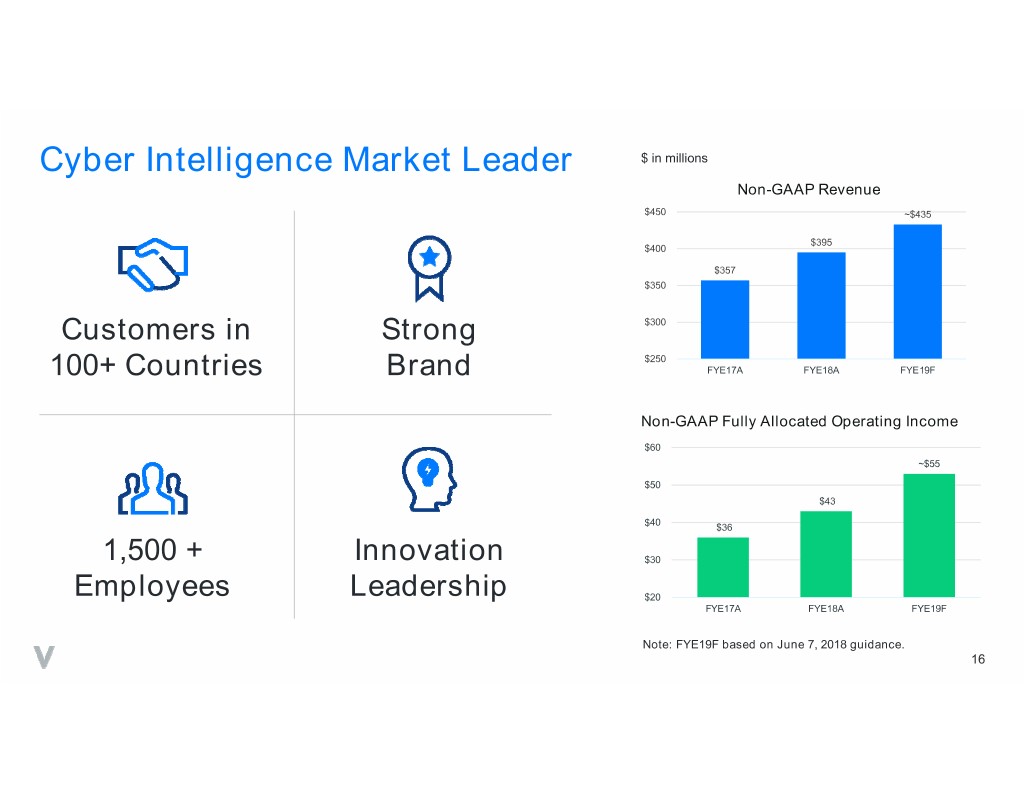

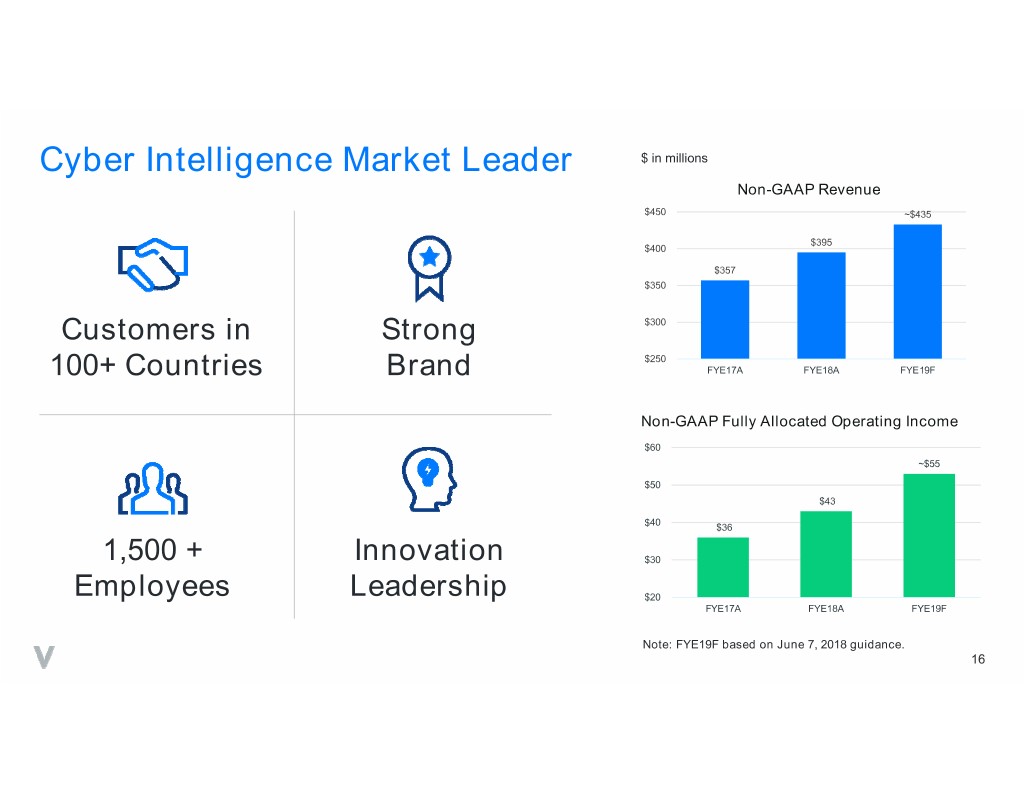

Cyber Intelligence Market Leader $ in millions Non-GAAP Revenue $450 ~$435 $395 $400 $357 $350 Customers in Strong $300 $250 100+ Countries Brand FYE17A FYE18A FYE19F Non-GAAP Fully Allocated Operating Income $60 ~$55 $50 $43 $40 $36 1,500 + Innovation $30 Employees Leadership $20 FYE17A FYE18A FYE19F Note: FYE19F based on June 7, 2018 guidance. 16

Market Growth Trends Threats More Shortage of Predictive Software Complex Analysts Intelligence Model 17

Predictive Intelligence as a Force Multiplier Predictive Intelligence Correlate Disparate Sources • Uncover Unknown Connections • Predictive Future Events 18

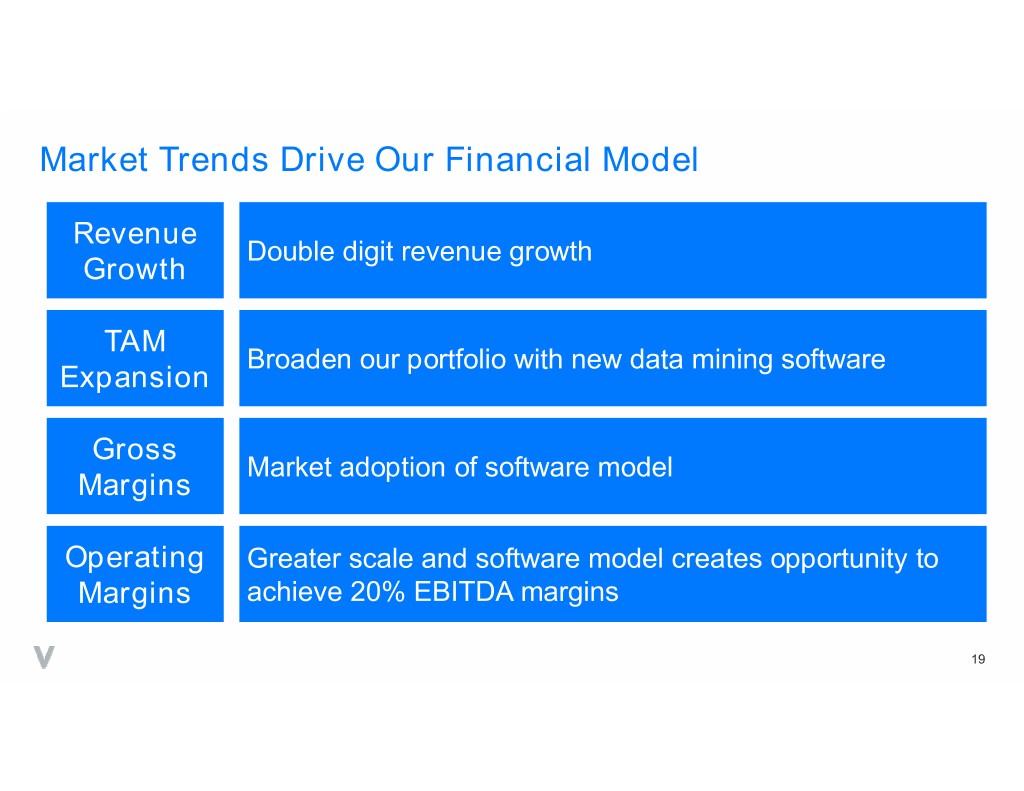

Market Trends Drive Our Financial Model Revenue Double digit revenue growth Growth TAM Broaden our portfolio with new data mining software Expansion Gross Market adoption of software model Margins Operating Greater scale and software model creates opportunity to Margins achieve 20% EBITDA margins 19

Financial Review 20

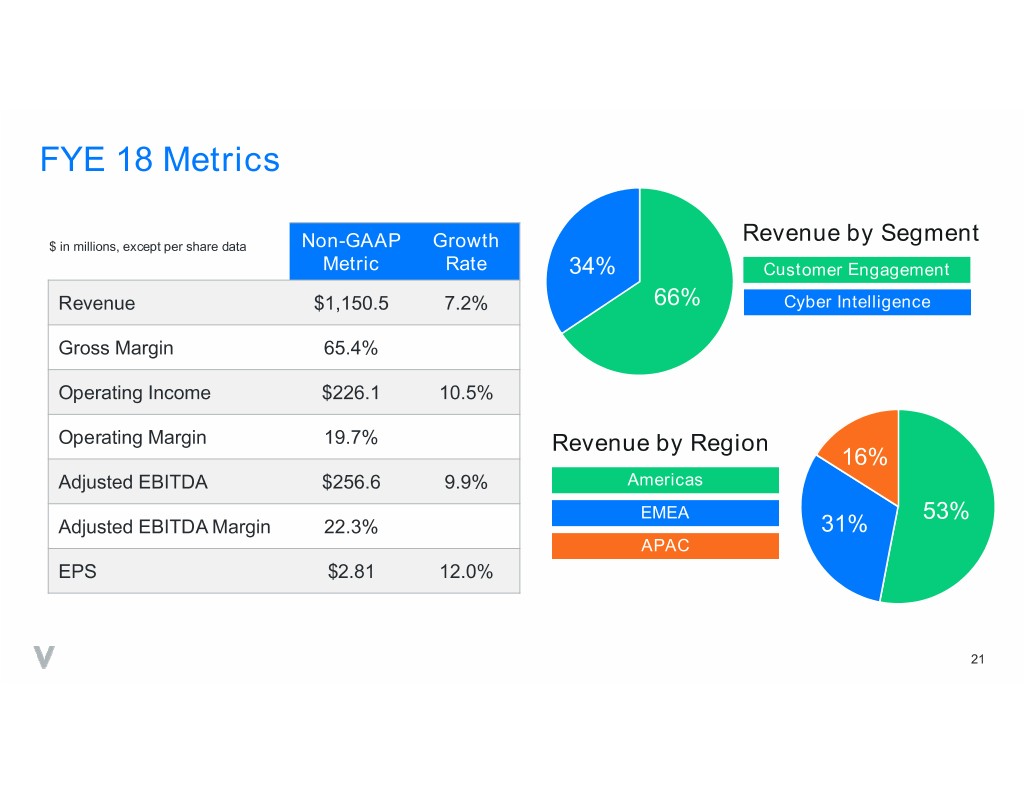

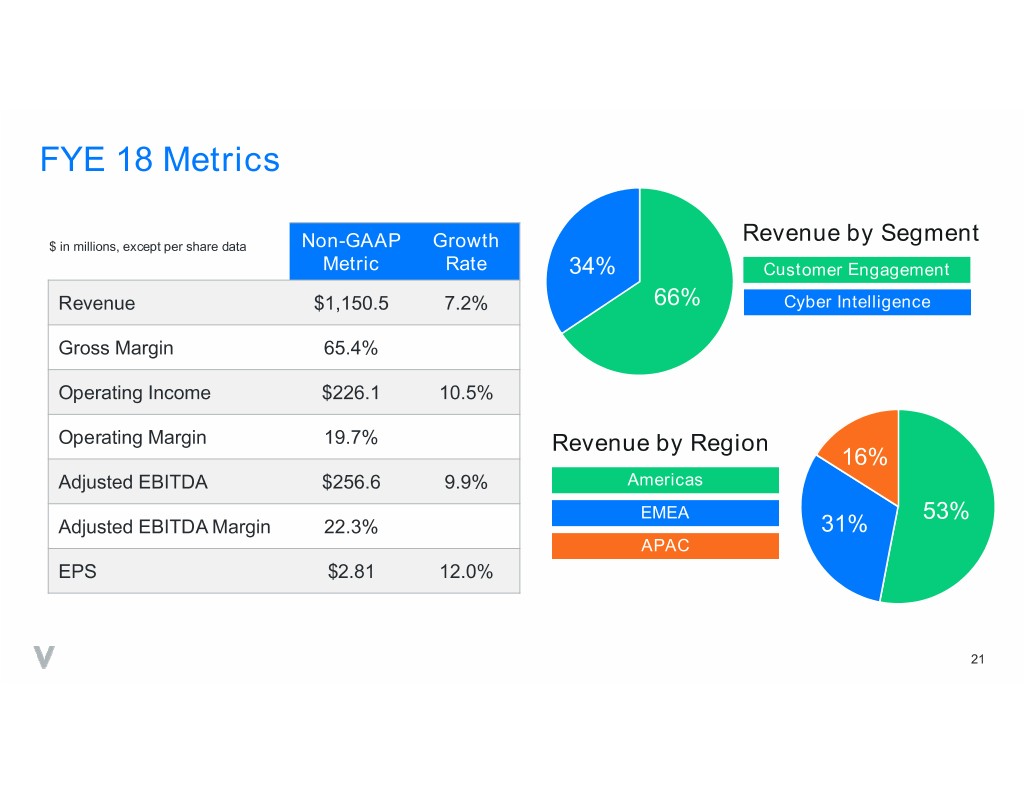

FYE 18 Metrics Revenue by Segment $ in millions, except per share data Non-GAAP Growth Metric Rate 34% Customer Engagement Revenue $1,150.5 7.2% 66% Cyber Intelligence Gross Margin 65.4% Operating Income $226.1 10.5% Operating Margin 19.7% Revenue by Region 16% Adjusted EBITDA $256.6 9.9% Americas EMEA 53% Adjusted EBITDA Margin 22.3% 31% APAC EPS $2.81 12.0% 21

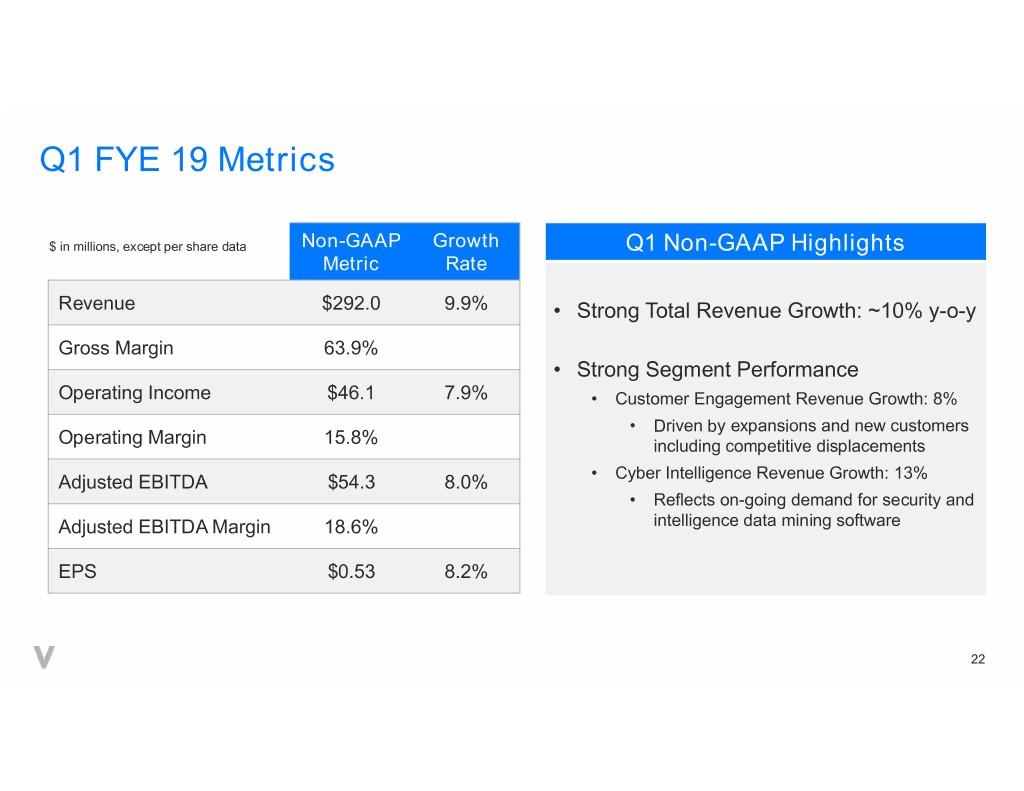

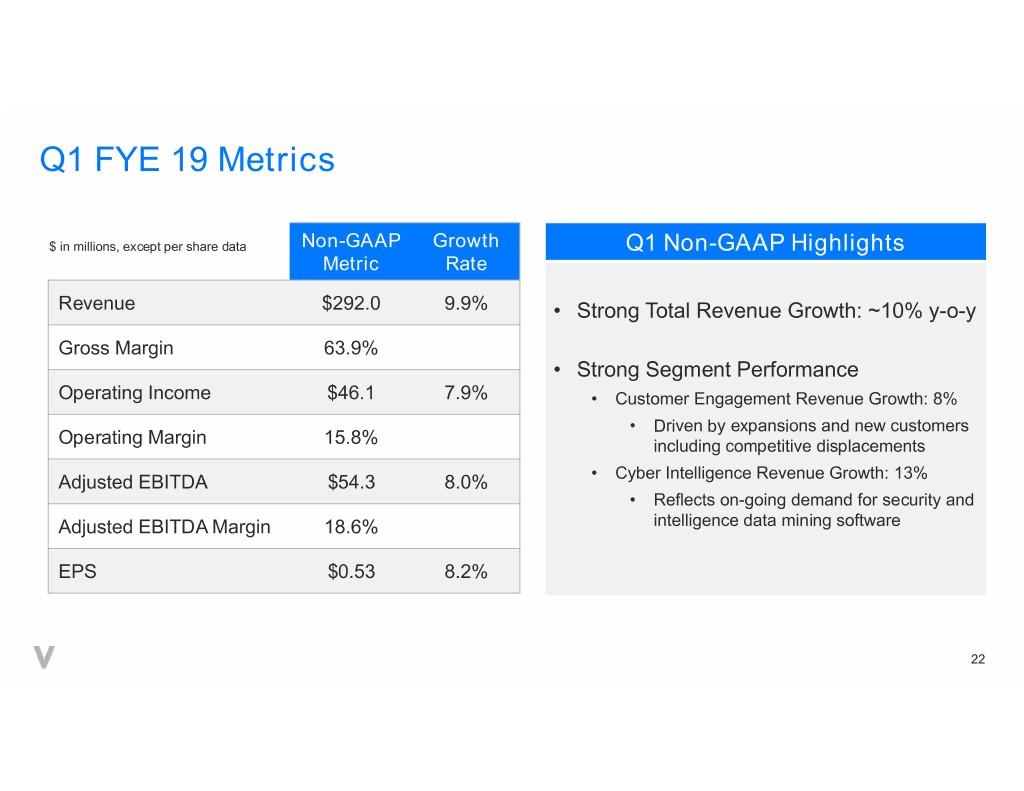

Q1 FYE 19 Metrics $ in millions, except per share data Non-GAAP Growth Q1 Non-GAAP Highlights Metric Rate Revenue $292.0 9.9% • Strong Total Revenue Growth: ~10% y-o-y Gross Margin 63.9% • Strong Segment Performance Operating Income $46.1 7.9% • Customer Engagement Revenue Growth: 8% • Driven by expansions and new customers Operating Margin 15.8% including competitive displacements Adjusted EBITDA $54.3 8.0% • Cyber Intelligence Revenue Growth: 13% • Reflects on-going demand for security and Adjusted EBITDA Margin 18.6% intelligence data mining software EPS $0.53 8.2% 22

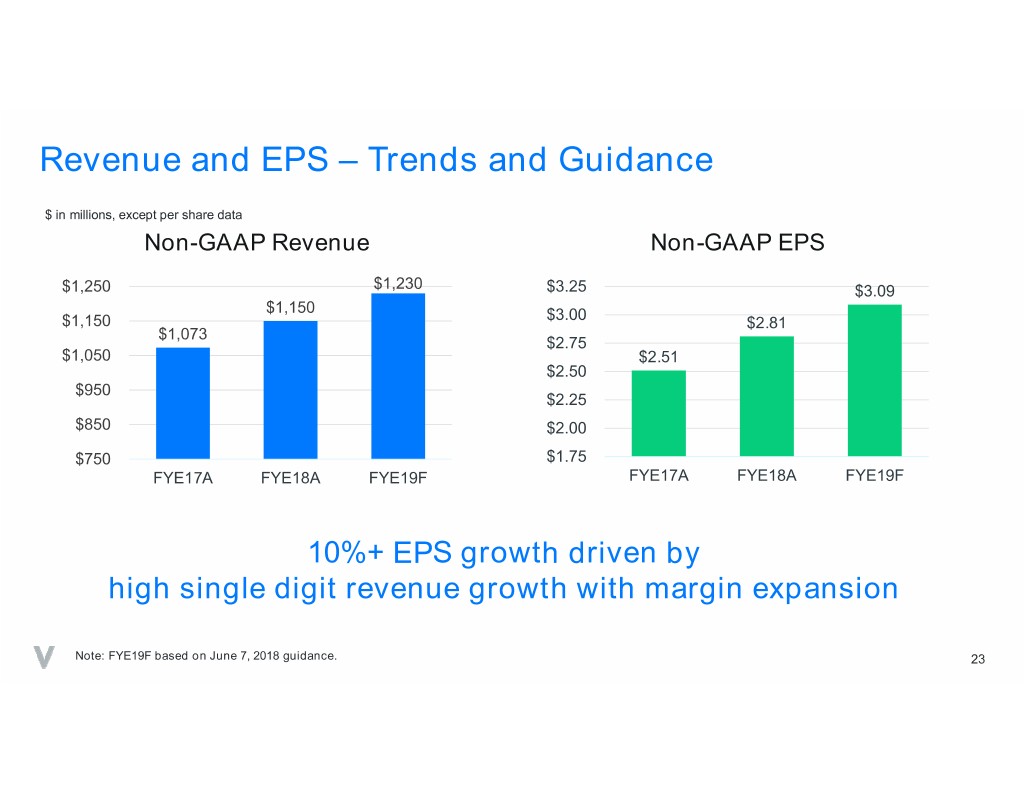

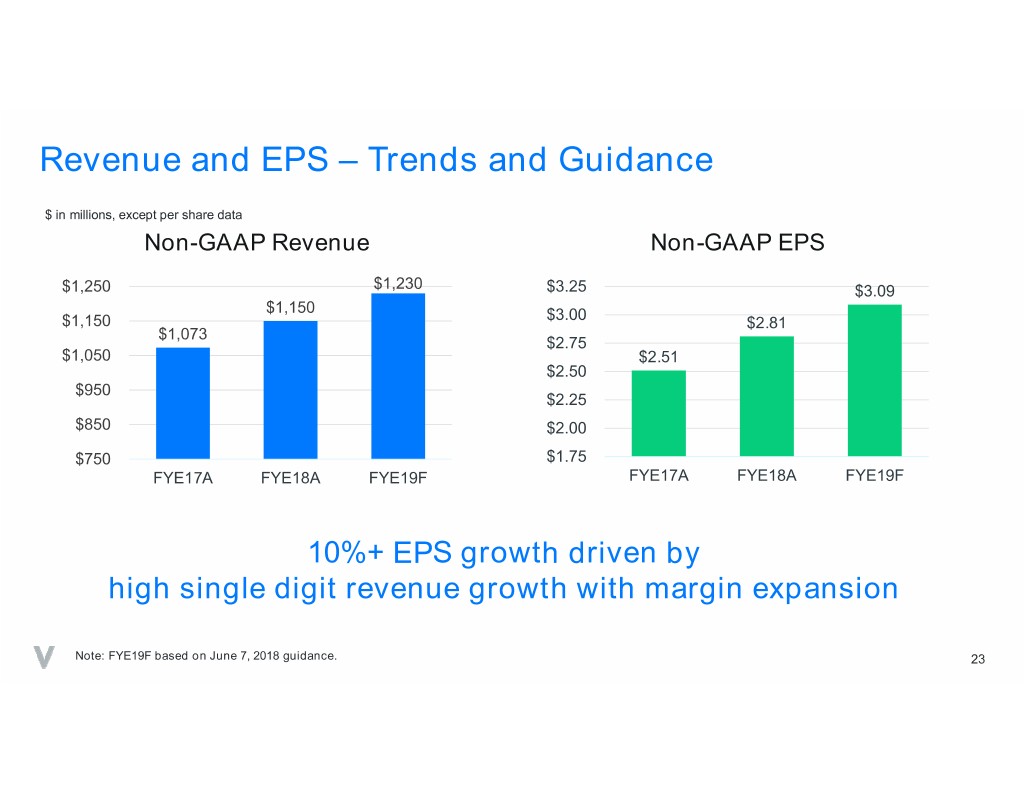

Revenue and EPS – Trends and Guidance $ in millions, except per share data Non-GAAP Revenue Non-GAAP EPS $1,250 $1,230 $3.25 $3.09 $1,150 $3.00 $1,150 $2.81 $1,073 $2.75 $1,050 $2.51 $2.50 $950 $2.25 $850 $2.00 $750 $1.75 FYE17A FYE18A FYE19F FYE17A FYE18A FYE19F 10%+ EPS growth driven by high single digit revenue growth with margin expansion Note: FYE19F based on June 7, 2018 guidance. 23

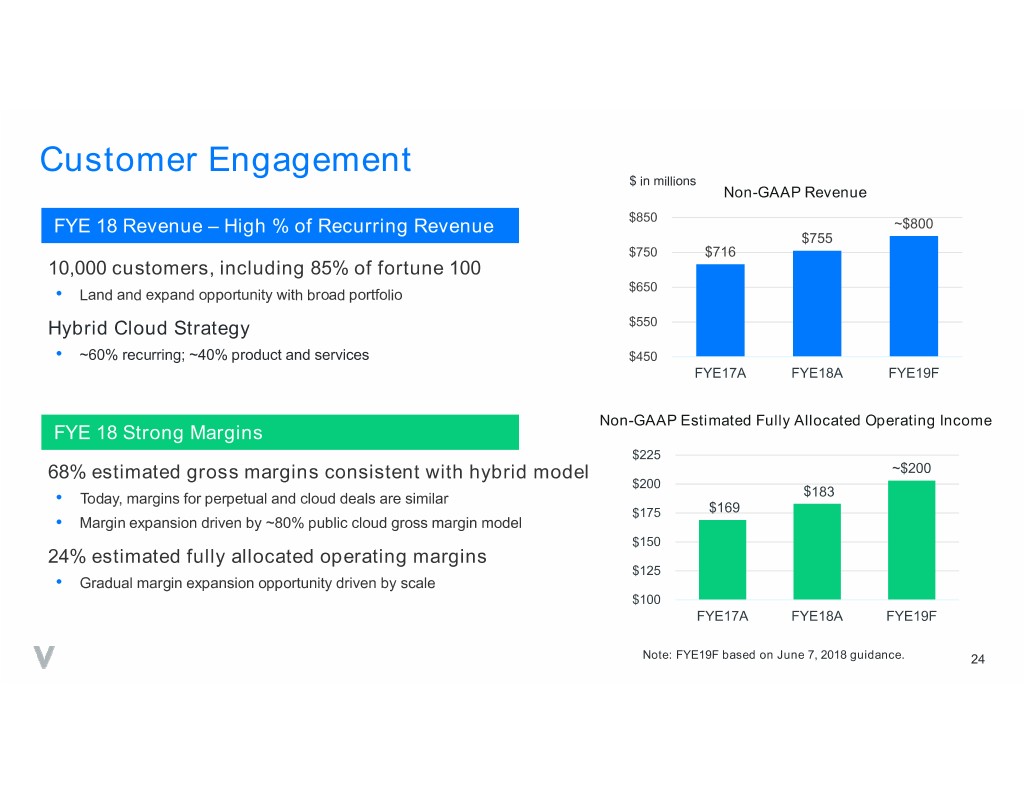

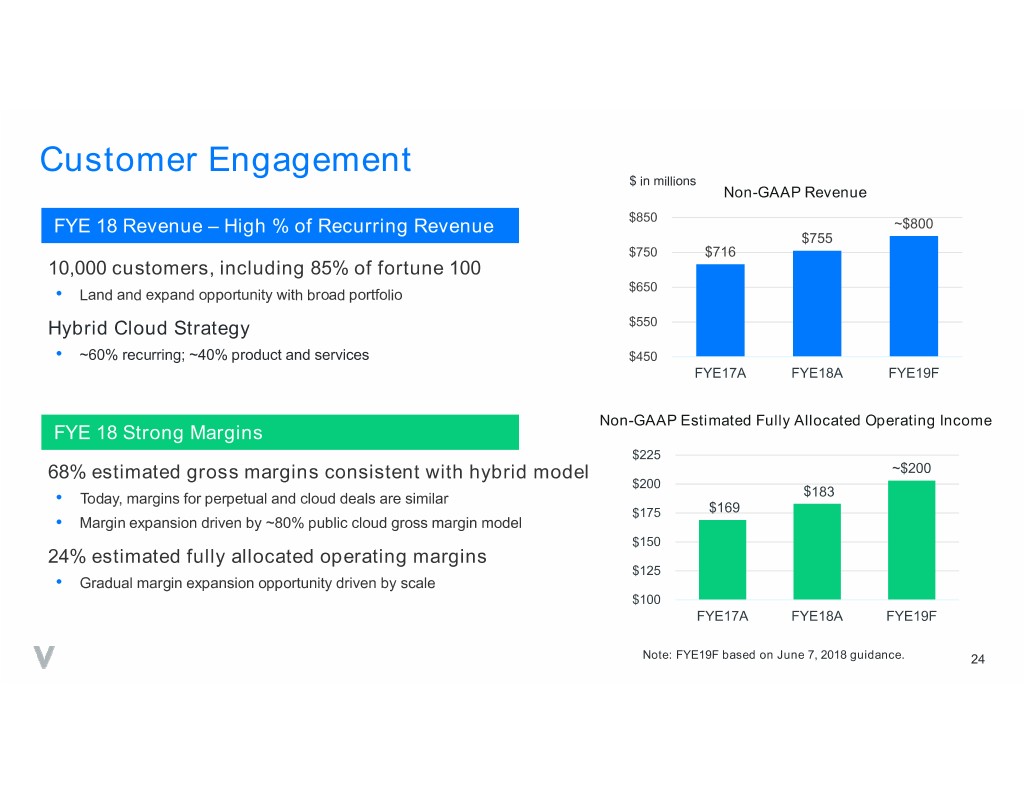

Customer Engagement $ in millions Non-GAAP Revenue FYE 18 Revenue – High % of Recurring Revenue $850 ~$800 $755 $750 $716 10,000 customers, including 85% of fortune 100 $650 • Land and expand opportunity with broad portfolio Hybrid Cloud Strategy $550 • ~60% recurring; ~40% product and services $450 FYE17A FYE18A FYE19F Non-GAAP Estimated Fully Allocated Operating Income FYE 18 Strong Margins $225 68% estimated gross margins consistent with hybrid model ~$200 $200 • Today, margins for perpetual and cloud deals are similar $183 $175 $169 • Margin expansion driven by ~80% public cloud gross margin model $150 24% estimated fully allocated operating margins $125 • Gradual margin expansion opportunity driven by scale $100 FYE17A FYE18A FYE19F Note: FYE19F based on June 7, 2018 guidance. 24

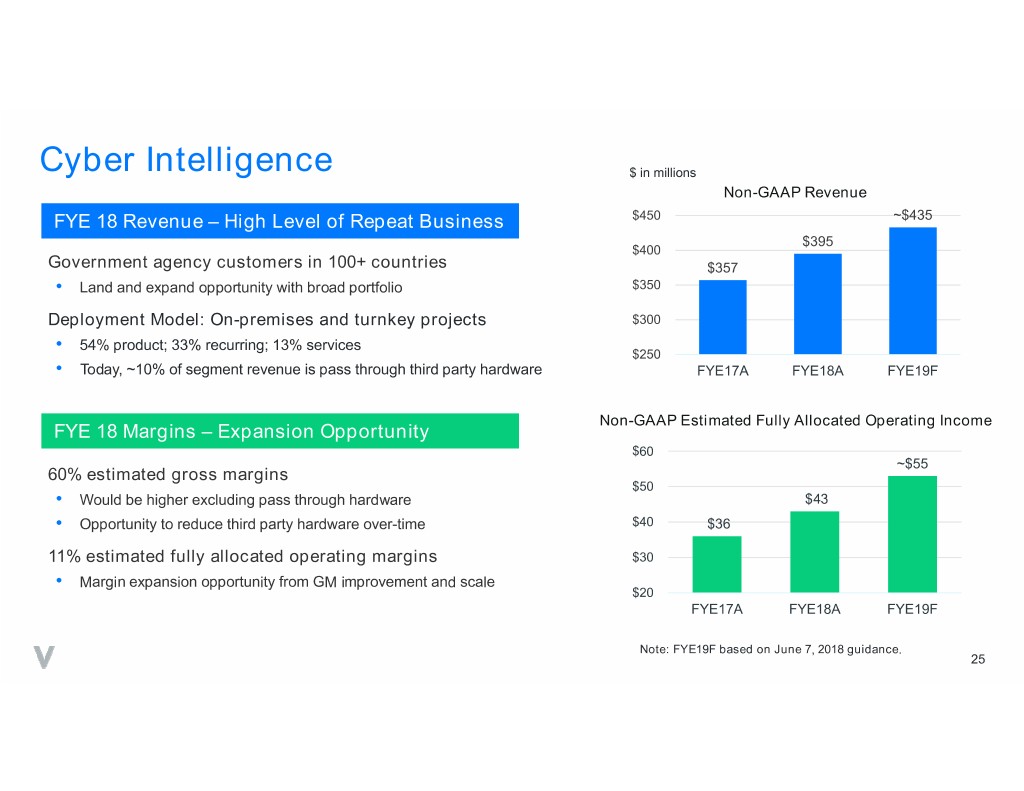

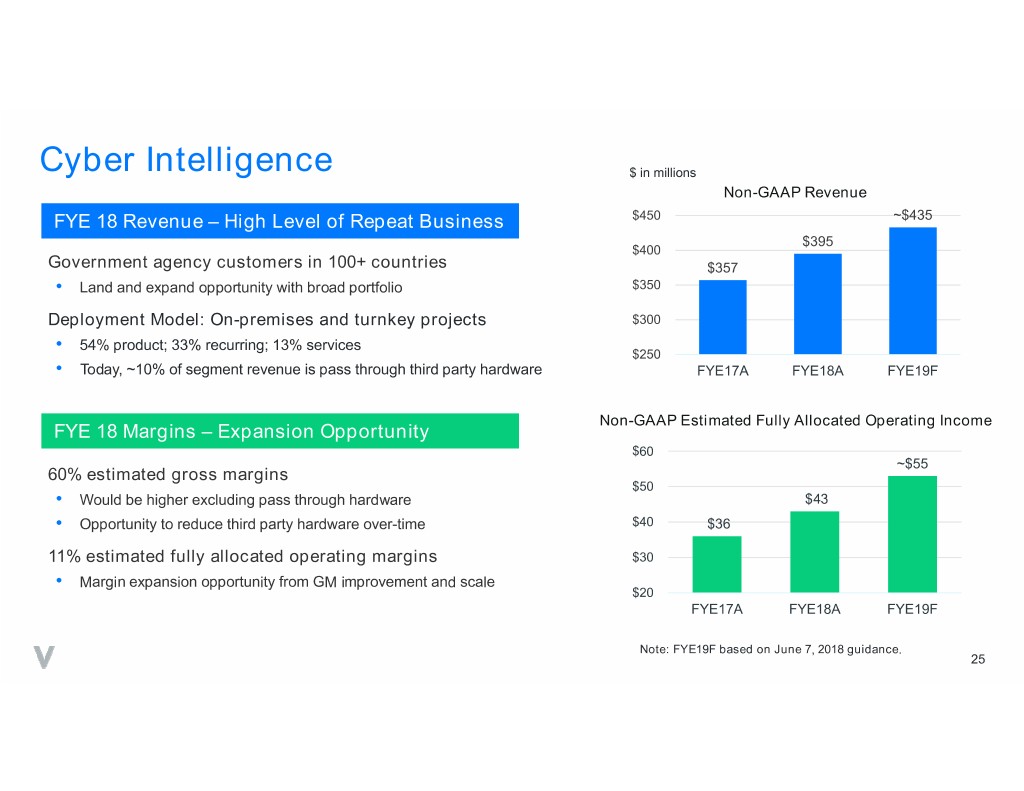

Cyber Intelligence $ in millions Non-GAAP Revenue FYE 18 Revenue – High Level of Repeat Business $450 ~$435 $395 $400 Government agency customers in 100+ countries $357 • Land and expand opportunity with broad portfolio $350 Deployment Model: On-premises and turnkey projects $300 • 54% product; 33% recurring; 13% services $250 • Today, ~10% of segment revenue is pass through third party hardware FYE17A FYE18A FYE19F Non-GAAP Estimated Fully Allocated Operating Income FYE 18 Margins – Expansion Opportunity $60 ~$55 60% estimated gross margins $50 • Would be higher excluding pass through hardware $43 • Opportunity to reduce third party hardware over-time $40 $36 11% estimated fully allocated operating margins $30 • Margin expansion opportunity from GM improvement and scale $20 FYE17A FYE18A FYE19F Note: FYE19F based on June 7, 2018 guidance. 25

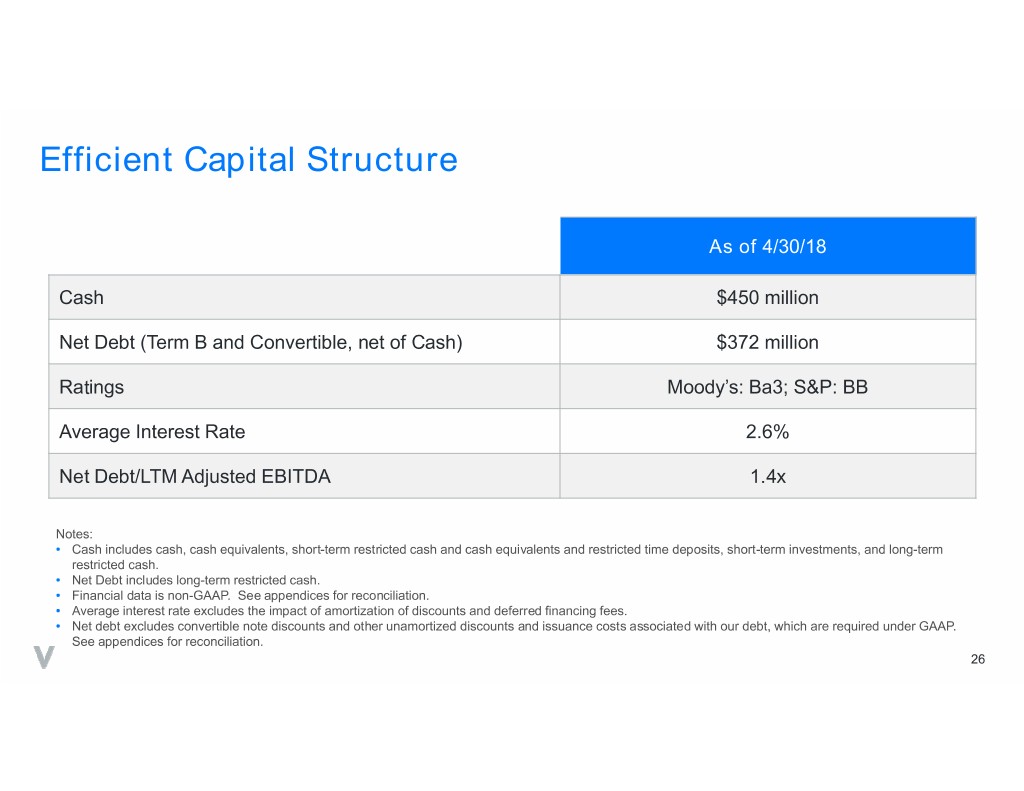

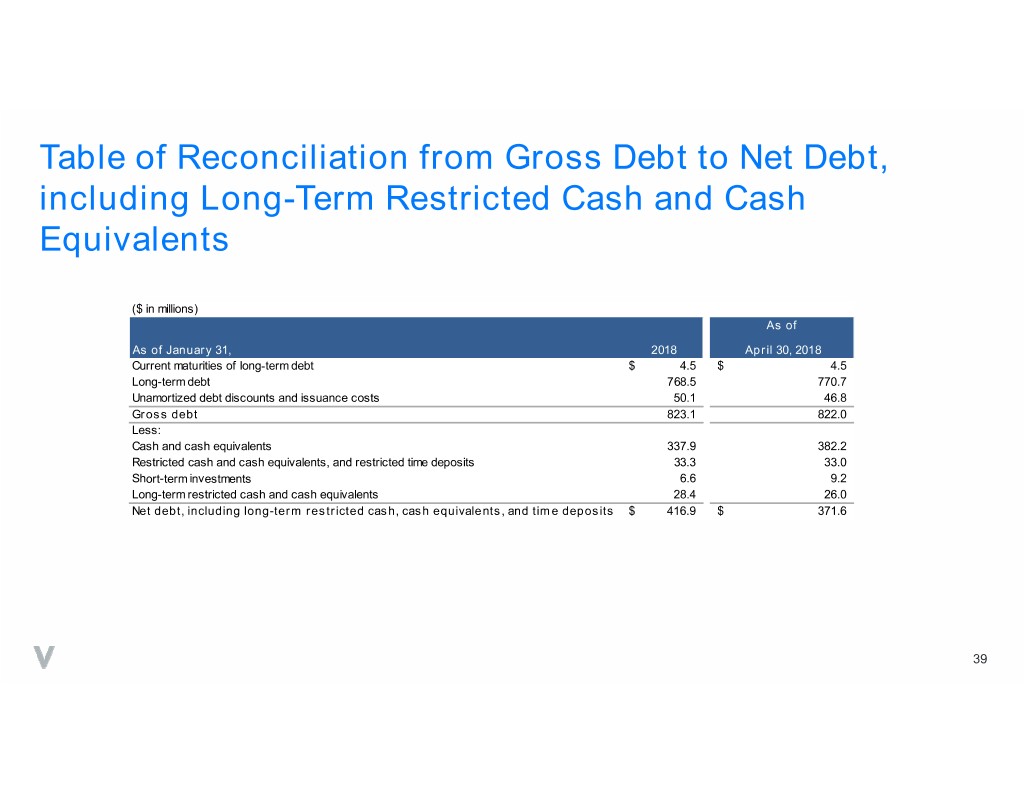

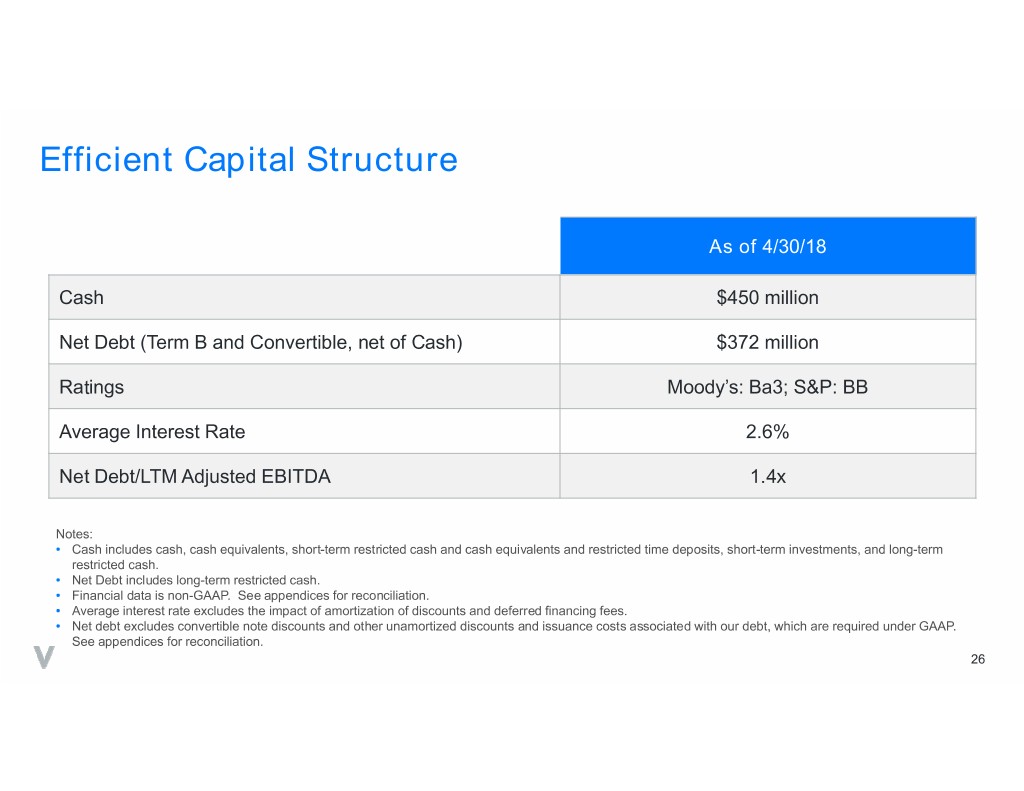

Efficient Capital Structure As of 4/30/18 Cash $450 million Net Debt (Term B and Convertible, net of Cash) $372 million Ratings Moody’s: Ba3; S&P: BB Average Interest Rate 2.6% Net Debt/LTM Adjusted EBITDA 1.4x Notes: • Cash includes cash, cash equivalents, short-term restricted cash and cash equivalents and restricted time deposits, short-term investments, and long-term restricted cash. • Net Debt includes long-term restricted cash. • Financial data is non-GAAP. See appendices for reconciliation. • Average interest rate excludes the impact of amortization of discounts and deferred financing fees. • Net debt excludes convertible note discounts and other unamortized discounts and issuance costs associated with our debt, which are required under GAAP. See appendices for reconciliation. 26

Thank You © 2018 Verint Systems Inc. All Rights Reserved Worldwide.

Appendices 28

About Non-GAAP Financial Measures The following tables include reconciliations of certain financial measures not prepared in accordance with Generally Accepted Accounting Principles, consisting of non- GAAP revenue, non GAAP gross profit and gross margin, non-GAAP operating income and operating margin, non-GAAP other income (expense), net, non-GAAP provision (benefit) for income taxes and non-GAAP effective income tax rate, non-GAAP net income attributable to Verint Systems Inc., non-GAAP net income per common share attributable to Verint Systems Inc., adjusted EBITDA, net debt, constant currency measures, and estimated non-GAAP fully allocated operating margins to the most directly comparable financial measures prepared in accordance with GAAP. We believe these non-GAAP financial measures, used in conjunction with the corresponding GAAP measures, provide investors with useful supplemental information about the financial performance of our business by: • facilitating the comparison of our financial results and business trends between periods, including by excluding certain items that either can vary significantly in amount and frequency, are based upon subjective assumptions, or in certain cases are unplanned for or difficult to forecast, • facilitating the comparison of our financial results and business trends with other technology companies who publish similar non-GAAP measures, and • allowing investors to see and understand key supplementary metrics used by our management to run our business, including for budgeting and forecasting, resource allocation, and compensation matters. We also make these non-GAAP financial measures available because a number of our investors have informed us that they find this supplemental information useful. Non-GAAP financial measures should not be considered in isolation as substitutes for, or superior to, comparable GAAP financial measures. The non-GAAP financial measures we present have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP, and these non-GAAP financial measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP financial measures. These non- GAAP financial measures do not represent discretionary cash available to us to invest in the growth of our business, and we may in the future incur expenses similar to or in addition to the adjustments made in these non-GAAP financial measures. Other companies may calculate similar non-GAAP financial measures differently than we do, limiting their usefulness as comparative measures. 29

About Non-GAAP Financial Measures Our non-GAAP financial measures are calculated by making the following adjustments to our GAAP financial measures: • Revenue adjustments related to acquisitions. We exclude from our non-GAAP revenue the impact of fair value adjustments required under GAAP relating to acquired customer support contracts, which would have otherwise been recognized on a stand-alone basis. We believe that it is useful for investors to understand the total amount of revenue that we and the acquired company would have recognized on a stand-alone basis under GAAP, absent the accounting adjustment associated with the business acquisition. Our non-GAAP revenue also reflects certain adjustments from aligning an acquired company’s revenue recognition policies to our policies. We believe that our non-GAAP revenue measure helps management and investors understand our revenue trends and serves as a useful measure of ongoing business performance. • Amortization of acquired technology and other acquired intangible assets. When we acquire an entity, we are required under GAAP to record the fair values of the intangible assets of the acquired entity and amortize those assets over their useful lives. We exclude the amortization of acquired intangible assets, including acquired technology, from our non-GAAP financial measures because they are inconsistent in amount and frequency and are significantly impacted by the timing and size of acquisitions. We also exclude these amounts to provide easier comparability of pre- and post-acquisition operating results. • Stock-based compensation expenses. We exclude stock-based compensation expenses related to restricted stock awards, stock bonus programs, bonus share programs, and other stock-based awards from our non-GAAP financial measures. We evaluate our performance both with and without these measures because stock- based compensation is typically a non-cash expense and can vary significantly over time based on the timing, size and nature of awards granted, and is influenced in part by certain factors which are generally beyond our control, such as the volatility of the price of our common stock. In addition, measurement of stock-based compensation is subject to varying valuation methodologies and subjective assumptions, and therefore we believe that excluding stock-based compensation from our non-GAAP financial measures allows for meaningful comparisons of our current operating results to our historical operating results and to other companies in our industry. • Unrealized gains and losses on certain derivatives, net. We exclude from our non-GAAP financial measures unrealized gains and losses on certain foreign currency derivatives which are not designated as hedges under accounting guidance. We exclude unrealized gains and losses on foreign currency derivatives that serve as economic hedges against variability in the cash flows of recognized assets or liabilities, or of forecasted transactions. These contracts, if designated as hedges under accounting guidance, would be considered “cash flow” hedges. These unrealized gains and losses are excluded from our non-GAAP financial measures because they are non-cash transactions which are highly variable from period to period. Upon settlement of these foreign currency derivatives, any realized gain or loss is included in our non-GAAP financial measures. 30

About Non-GAAP Financial Measures • Amortization of convertible note discount. Our non-GAAP financial measures exclude the amortization of the imputed discount on our convertible notes. Under GAAP, certain convertible debt instruments that may be settled in cash upon conversion are required to be bifurcated into separate liability (debt) and equity (conversion option) components in a manner that reflects the issuer’s assumed non-convertible debt borrowing rate. For GAAP purposes, we are required to recognize imputed interest expense on the difference between our assumed non-convertible debt borrowing rate and the coupon rate on our $400.0 million of 1.50% convertible notes. This difference is excluded from our non-GAAP financial measures because we believe that this expense is based upon subjective assumptions and does not reflect the cash cost of our convertible debt. • Losses and expenses on early retirements or modifications of debt. We exclude from our non-GAAP financial measures losses on early retirements of debt attributable to refinancing or repaying our debt, and expenses incurred to modify debt terms, because we believe they are not reflective of our ongoing operations. • Acquisition Expenses, net. In connection with acquisition activity (including with respect to acquisitions that are not consummated), we incur expenses, including legal, accounting, and other professional fees, integration costs, changes in the fair value of contingent consideration obligations, and other costs. Integration costs may consist of information technology expenses as systems are integrated across the combined entity, consulting expenses, marketing expenses, and professional fees, as well as non-cash charges to write-off or impair the value of redundant assets. We exclude these expenses from our non-GAAP financial measures because they are unpredictable, can vary based on the size and complexity of each transaction, and are unrelated to our continuing operations or to the continuing operations of the acquired businesses. • Restructuring Expenses. We exclude restructuring expenses from our non-GAAP financial measures, which include employee termination costs, facility exit costs, certain professional fees, asset impairment charges, and other costs directly associated with resource realignments incurred in reaction to changing strategies or business conditions. All of these costs can vary significantly in amount and frequency based on the nature of the actions as well as the changing needs of our business and we believe that excluding them provides easier comparability of pre- and post-restructuring operating results. • Impairment Charges and Other Adjustments. We exclude from our non-GAAP financial measures asset impairment charges (other than those associated with restructuring or acquisition activity), rent expense for redundant facilities, gains or losses on sales of property, and certain professional fees unrelated to our ongoing operations, all of which are unusual in nature and can vary significantly in amount and frequency. 31

About Non-GAAP Financial Measures • Non-GAAP income tax adjustments. We exclude our GAAP provision (benefit) for income taxes from our non-GAAP measures of net income attributable to Verint Systems Inc., and instead include a non-GAAP provision for income taxes, determined by applying a non-GAAP effective income tax rate to our income before provision for income taxes, as adjusted for the non-GAAP items described above. The non-GAAP effective income tax rate is generally based upon the income taxes we expect to pay in the reporting year. We adjust our non-GAAP effective income tax rate to exclude current-year tax payments or refunds associated with prior-year income tax returns and related amendments which were significantly delayed as a result of our previous extended filing delay. Our GAAP effective income tax rate can vary significantly from year to year as a result of tax law changes, settlements with tax authorities, changes in the geographic mix of earnings including acquisition activity, changes in the projected realizability of deferred tax assets, and other unusual or period-specific events, all of which can vary in size and frequency. We believe that our non-GAAP effective income tax rate removes much of this variability and facilitates meaningful comparisons of operating results across periods. Our non-GAAP effective income tax rates for the three months ended April 30, 2018 was currently approximately 11%, and was 11.5% for the year ended January 31, 2018. We evaluate our non-GAAP effective income tax rate on an ongoing basis and it can change from time to time. Our non-GAAP income tax rate can differ materially from our GAAP effective income tax rate. Adjusted EBITDA Adjusted EBITDA is a non-GAAP measure defined as net income (loss) before interest expense, interest income, income taxes, depreciation expense, amortization expense, revenue adjustments related to acquisitions, restructuring expenses, acquisition expenses, and other expenses excluded from our non-GAAP financial measures as described above. We believe that adjusted EBITDA is also commonly used by investors to evaluate operating performance between competitors because it helps reduce variability caused by differences in capital structures, income taxes, stock-based compensation accounting policies, and depreciation and amortization policies. Adjusted EBITDA is also used by credit rating agencies, lenders, and other parties to evaluate our creditworthiness. Net Debt Net Debt is a non-GAAP measure defined as the sum of long-term and short-term debt on our consolidated balance sheet, excluding unamortized discounts and issuance costs, less the sum of cash and cash equivalents, restricted cash, restricted cash equivalents, and restricted bank time deposits (including long-term portions), and short- term investments. We use this non-GAAP financial measure to help evaluate our capital structure, financial leverage, and our ability to reduce debt and to fund investing and financing activities, and believe that it provides useful information to investors. 32

Financial Outlook Our non-GAAP outlook for the year ending January 31, 2019 excludes the following GAAP measures which we are able to quantify with reasonable certainty: • Amortization of intangible assets of approximately $55 million. • Amortization of discount on convertible notes of approximately $12 million. Our non-GAAP outlook for the year ending January 31, 2019 excludes the following GAAP measures for which we are able to provide a range of probable significance: • Revenue adjustments related to completed acquisitions are expected to be between approximately $8 million and $9 million for the year ending January 31, 2019. • Stock-based compensation is expected to be between approximately $64 million and $69 million for the year ending January 31, 2019, assuming market prices for our common stock approximately consistent with current levels. Our non-GAAP outlook does not include the potential impact of any in-process business acquisitions that may close after the date hereof, and, unless otherwise specified, reflects foreign currency exchange rates approximately consistent with current rates. We are unable, without unreasonable efforts, to provide a reconciliation for other GAAP measures which are excluded from our non-GAAP outlook, including the impact of future business acquisitions or acquisition expenses, future restructuring expenses, and non-GAAP income tax adjustments due to the level of unpredictability and uncertainty associated with these items. For these same reasons, we are unable to assess the probable significance of these excluded items. While historical results may not be indicative of future results, actual amounts for the three months ended April 31, 2018 and year ended January 31, 2018 for the GAAP measures excluded from our non-GAAP outlook appear in the GAAP to Non-GAAP Reconciliation Tables contained in this presentation. 33

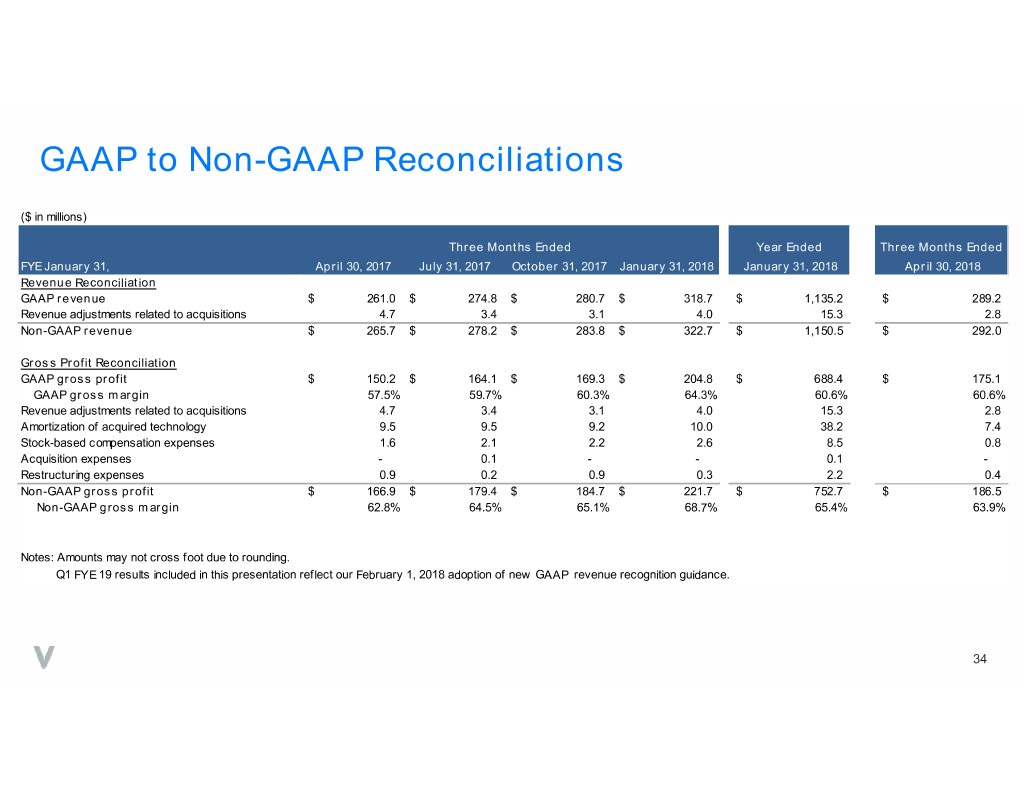

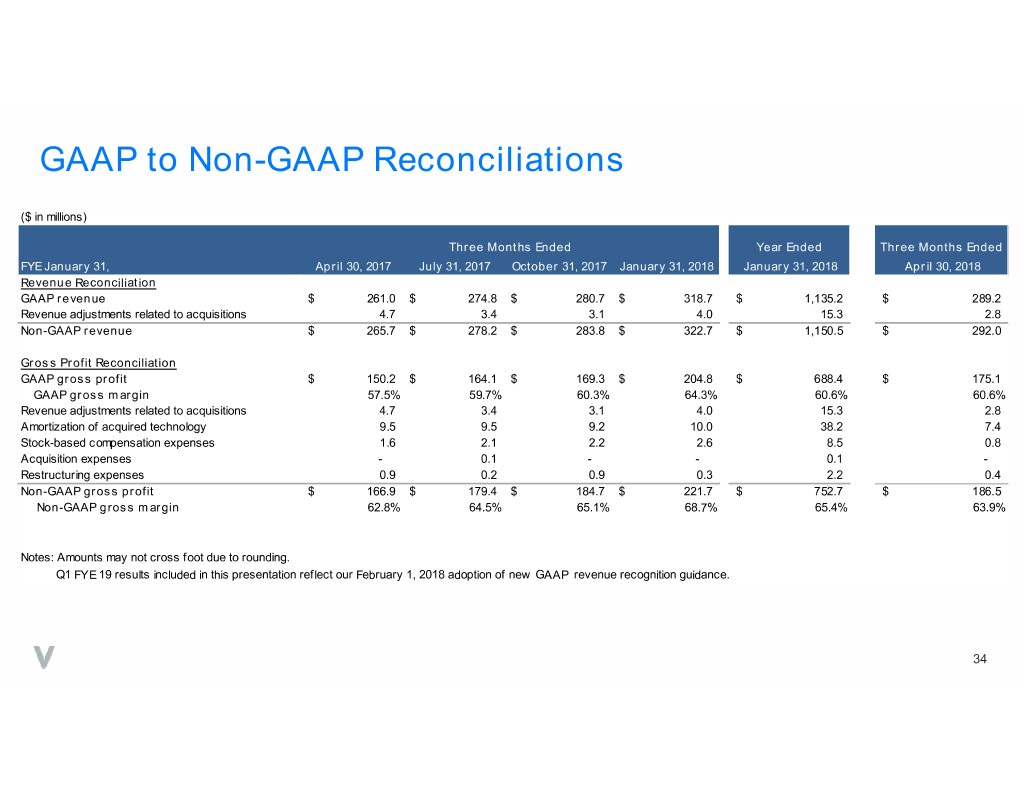

GAAP to Non-GAAP Reconciliations ($ in millions) Three Months Ended Year Ended Three Months Ended FYE January 31, April 30, 2017 July 31, 2017 October 31, 2017 January 31, 2018 January 31, 2018 April 30, 2018 Revenue Reconciliation GAAP revenue$ 261.0 $ 274.8 $ 280.7 $ 318.7 $ 1,135.2 $ 289.2 Revenue adjustments related to acquisitions 4.7 3.4 3.1 4.0 15.3 2.8 Non-GAAP revenue$ 265.7 $ 278.2 $ 283.8 $ 322.7 $ 1,150.5 $ 292.0 Gross Profit Reconciliation GAAP gross profit$ 150.2 $ 164.1 $ 169.3 $ 204.8 $ 688.4 $ 175.1 GAAP gross margin 57.5% 59.7% 60.3% 64.3% 60.6% 60.6% Revenue adjustments related to acquisitions 4.7 3.4 3.1 4.0 15.3 2.8 Amortization of acquired technology 9.5 9.5 9.2 10.0 38.2 7.4 Stock-based compensation expenses 1.6 2.1 2.2 2.6 8.5 0.8 Acquisition expenses - 0.1 - - 0.1 - Restructuring expenses 0.9 0.2 0.9 0.3 2.2 0.4 Non-GAAP gross profit$ 166.9 $ 179.4 $ 184.7 $ 221.7 $ 752.7 $ 186.5 Non-GAAP gross margin 62.8% 64.5% 65.1% 68.7% 65.4% 63.9% Notes: Amounts may not cross foot due to rounding. Q1 FYE 19 results included in this presentation reflect our February 1, 2018 adoption of new GAAP revenue recognition guidance. 34

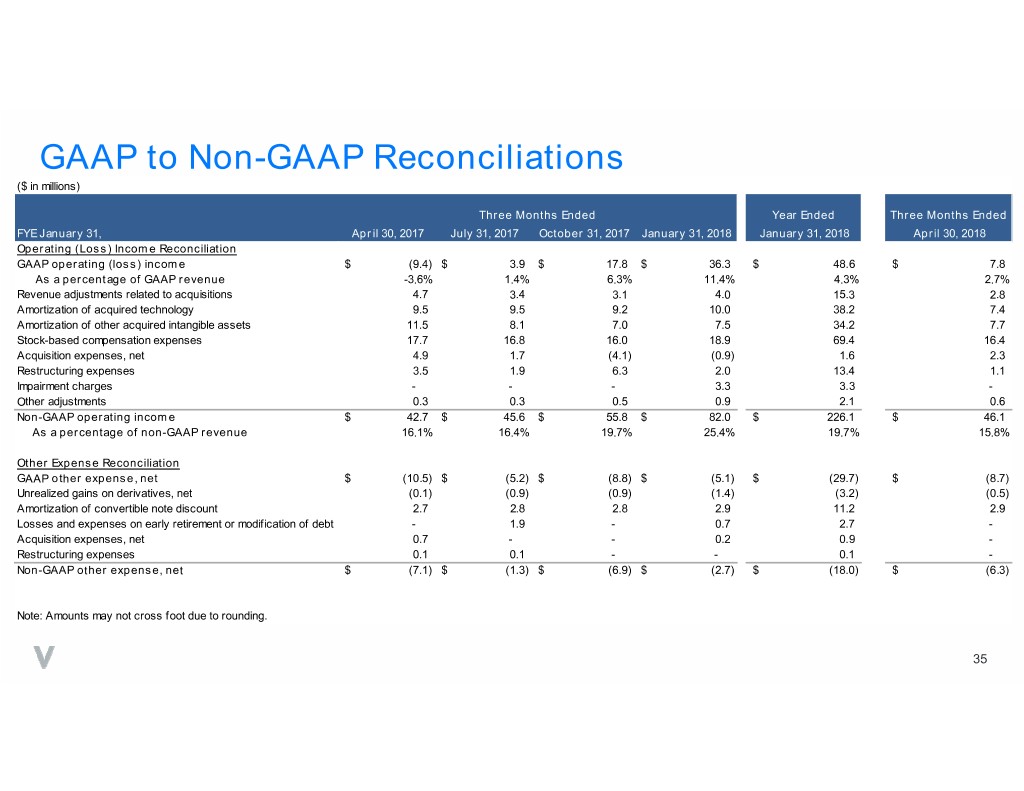

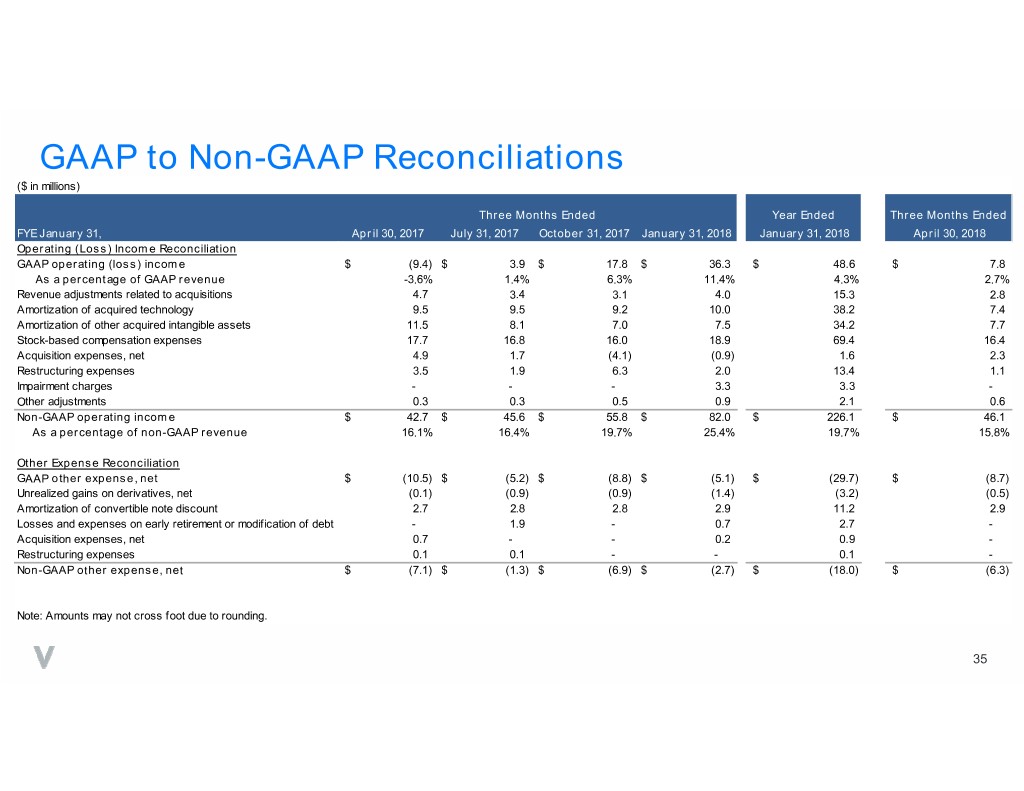

GAAP to Non-GAAP Reconciliations ($ in millions) Three Months Ended Year Ended Three Months Ended FYE January 31, April 30, 2017 July 31, 2017 October 31, 2017 January 31, 2018 January 31, 2018 April 30, 2018 Operating (Loss) Income Reconciliation GAAP operating (loss) income$ (9.4) $ 3.9 $ 17.8 $ 36.3 $ 48.6 $ 7.8 As a percentage of GAAP revenue -3.6% 1.4% 6.3% 11.4% 4.3% 2.7% Revenue adjustments related to acquisitions 4.7 3.4 3.1 4.0 15.3 2.8 Amortization of acquired technology 9.5 9.5 9.2 10.0 38.2 7.4 Amortization of other acquired intangible assets 11.5 8.1 7.0 7.5 34.2 7.7 Stock-based compensation expenses 17.7 16.8 16.0 18.9 69.4 16.4 Acquisition expenses, net 4.9 1.7 (4.1) (0.9) 1.6 2.3 Restructuring expenses 3.5 1.9 6.3 2.0 13.4 1.1 Impairment charges - - - 3.3 3.3 - Other adjustments 0.3 0.3 0.5 0.9 2.1 0.6 Non-GAAP operating income$ 42.7 $ 45.6 $ 55.8 $ 82.0 $ 226.1 $ 46.1 As a percentage of non-GAAP revenue 16.1% 16.4% 19.7% 25.4% 19.7% 15.8% Other Expense Reconciliation GAAP other expense, net$ (10.5) $ (5.2) $ (8.8) $ (5.1) $ (29.7) $ (8.7) Unrealized gains on derivatives, net (0.1) (0.9) (0.9) (1.4) (3.2) (0.5) Amortization of convertible note discount 2.7 2.8 2.8 2.9 11.2 2.9 Losses and expenses on early retirement or modification of debt - 1.9 - 0.7 2.7 - Acquisition expenses, net 0.7 - - 0.2 0.9 - Restructuring expenses 0.1 0.1 - - 0.1 - Non-GAAP other expense, net$ (7.1) $ (1.3) $ (6.9) $ (2.7) $ (18.0) $ (6.3) Note: Amounts may not cross foot due to rounding. 35

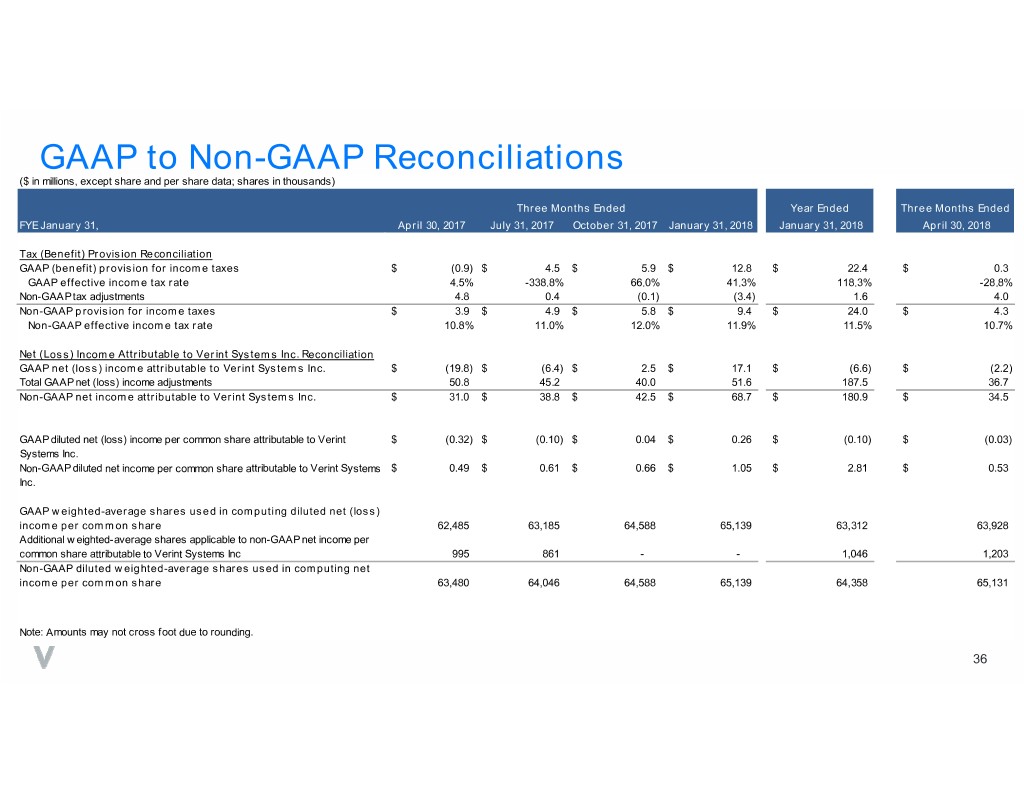

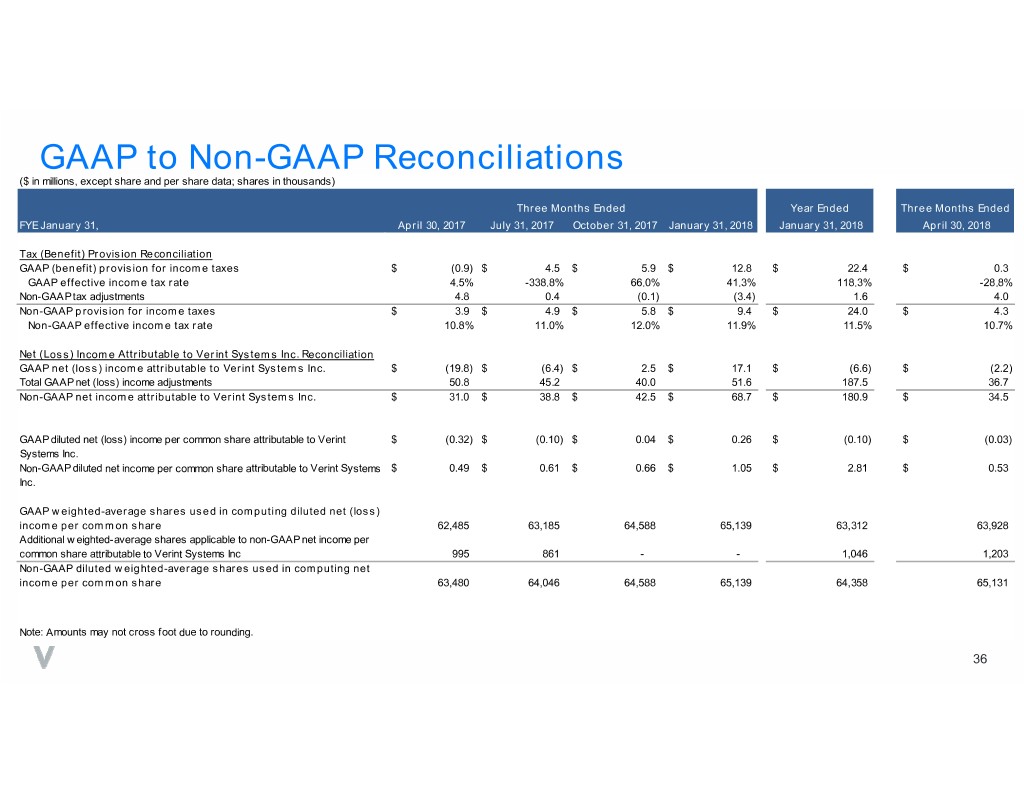

GAAP to Non-GAAP Reconciliations ($ in millions, except share and per share data; shares in thousands) Three Months Ended Year Ended Three Months Ended FYE January 31, April 30, 2017 July 31, 2017 October 31, 2017 January 31, 2018 January 31, 2018 April 30, 2018 Tax (Benefit) Provision Reconciliation GAAP (benefit) provision for income taxes$ (0.9) $ 4.5 $ 5.9 $ 12.8 $ 22.4 $ 0.3 GAAP effective income tax rate 4.5% -338.8% 66.0% 41.3% 118.3% -28.8% Non-GAAP tax adjustments 4.8 0.4 (0.1) (3.4) 1.6 4.0 Non-GAAP provision for income taxes$ 3.9 $ 4.9 $ 5.8 $ 9.4 $ 24.0 $ 4.3 Non-GAAP effective income tax rate 10.8% 11.0% 12.0% 11.9% 11.5% 10.7% Net (Loss) Income Attributable to Verint Systems Inc. Reconciliation GAAP net (loss) income attributable to Verint Systems Inc.$ (19.8) $ (6.4) $ 2.5 $ 17.1 $ (6.6) $ (2.2) Total GAAP net (loss) income adjustments 50.8 45.2 40.0 51.6 187.5 36.7 Non-GAAP net income attributable to Verint Systems Inc.$ 31.0 $ 38.8 $ 42.5 $ 68.7 $ 180.9 $ 34.5 GAAP diluted net (loss) income per common share attributable to Verint $ (0.32) $ (0.10) $ 0.04 $ 0.26 $ (0.10) $ (0.03) Systems Inc. Non-GAAP diluted net income per common share attributable to Verint Systems $ 0.49 $ 0.61 $ 0.66 $ 1.05 $ 2.81 $ 0.53 Inc . GAAP weighted-average shares used in computing diluted net (loss) income per common share 62,485 63,185 64,588 65,139 63,312 63,928 Additional w eighted-average shares applicable to non-GAAP net income per common share attributable to Verint Systems Inc 995 861 - - 1,046 1,203 Non-GAAP diluted weighted-average shares used in computing net income per common share 63,480 64,046 64,588 65,139 64,358 65,131 Note: Amounts may not cross foot due to rounding. 36

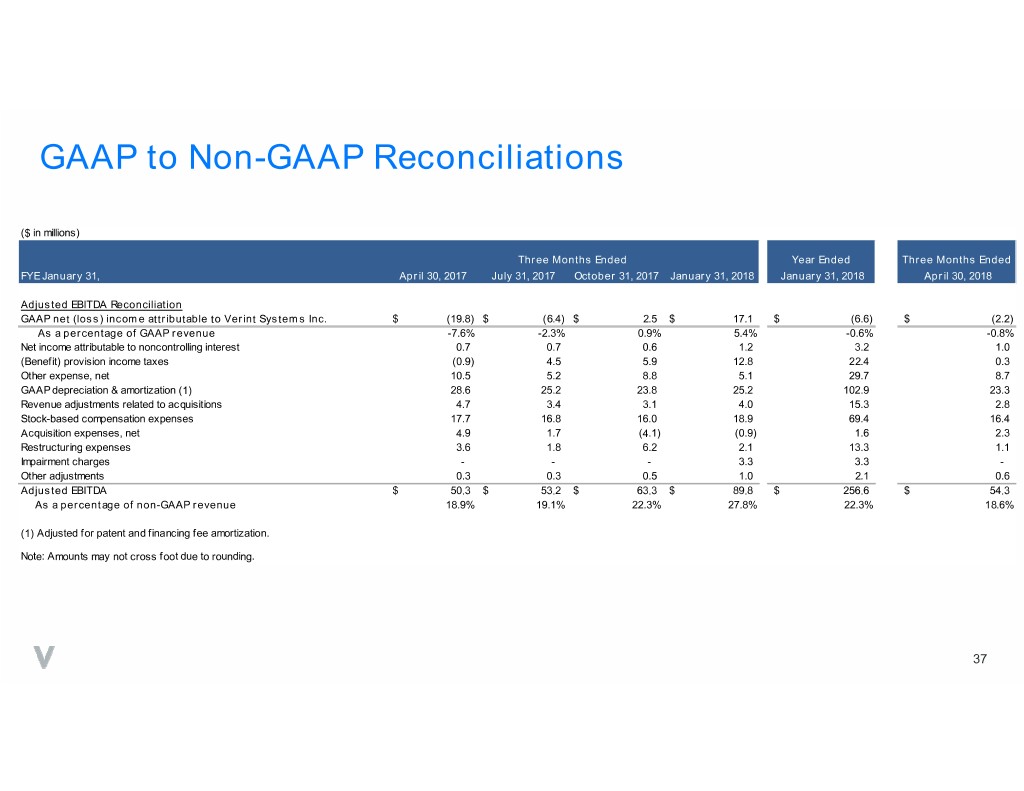

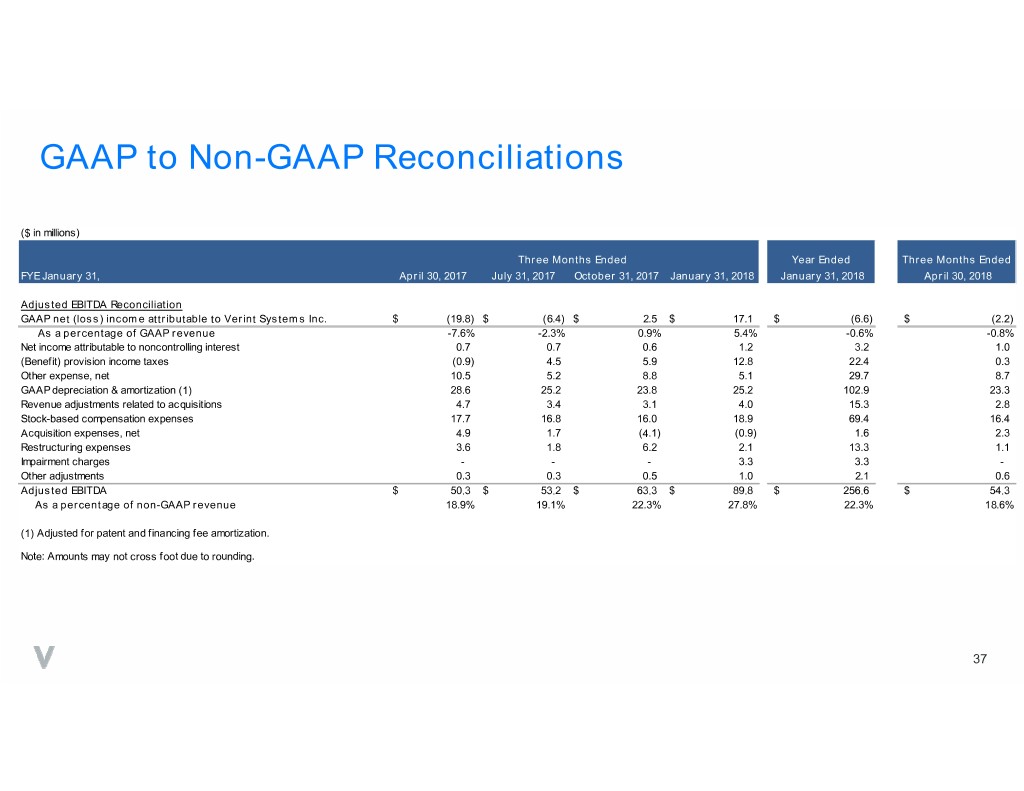

GAAP to Non-GAAP Reconciliations ($ in millions) Three Months Ended Year Ended Three Months Ended FYE January 31, April 30, 2017 July 31, 2017 October 31, 2017 January 31, 2018 January 31, 2018 April 30, 2018 Adjusted EBITDA Reconciliation GAAP net (loss) income attributable to Verint Systems Inc.$ (19.8) $ (6.4) $ 2.5 $ 17.1 $ (6.6) $ (2.2) As a percentage of GAAP revenue -7.6% -2.3% 0.9% 5.4% -0.6% -0.8% Net income attributable to noncontrolling interest 0.7 0.7 0.6 1.2 3.2 1.0 (Benefit) provision income taxes (0.9) 4.5 5.9 12.8 22.4 0.3 Other expense, net 10.5 5.2 8.8 5.1 29.7 8.7 GAAP depreciation & amortization (1) 28.6 25.2 23.8 25.2 102.9 23.3 Revenue adjustments related to acquisitions 4.7 3.4 3.1 4.0 15.3 2.8 Stock-based compensation expenses 17.7 16.8 16.0 18.9 69.4 16.4 Acquisition expenses, net 4.9 1.7 (4.1) (0.9) 1.6 2.3 Restructuring expenses 3.6 1.8 6.2 2.1 13.3 1.1 Impairment charges - - - 3.3 3.3 - Other adjustments 0.3 0.3 0.5 1.0 2.1 0.6 Adjusted EBITDA $ 50.3 $ 53.2 $ 63.3 $ 89.8 $ 256.6 $ 54.3 As a percentage of non-GAAP revenue 18.9% 19.1% 22.3% 27.8% 22.3% 18.6% (1) Adjusted for patent and financing fee amortization. Note: Amounts may not cross foot due to rounding. 37

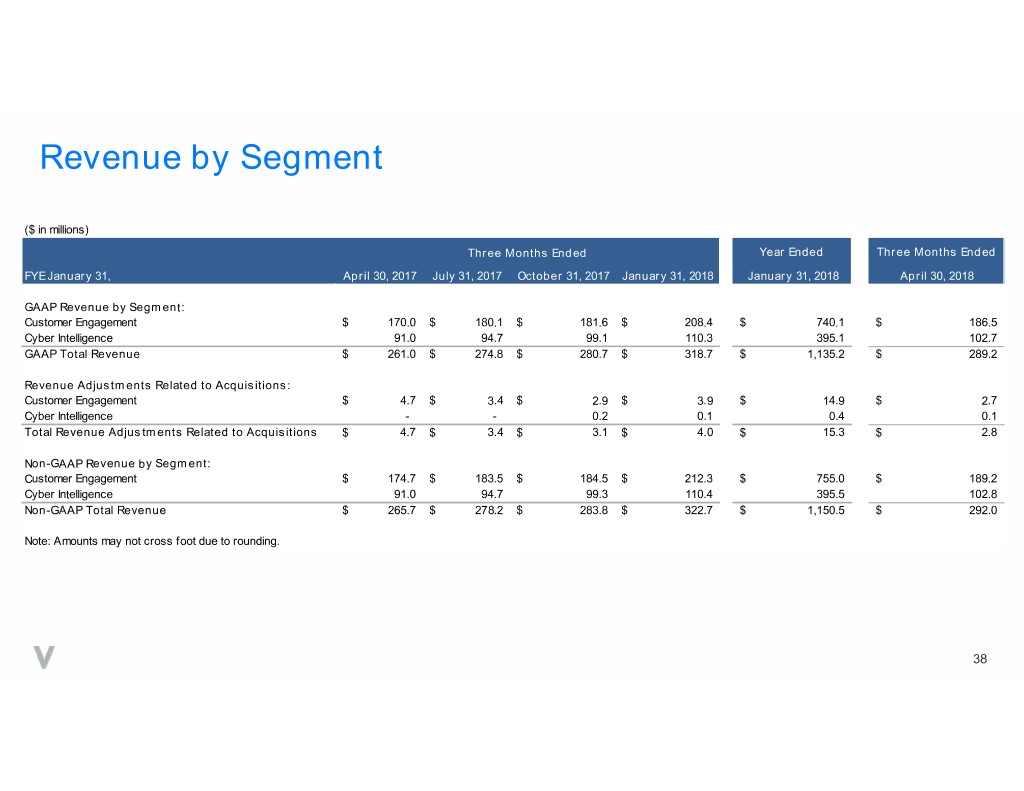

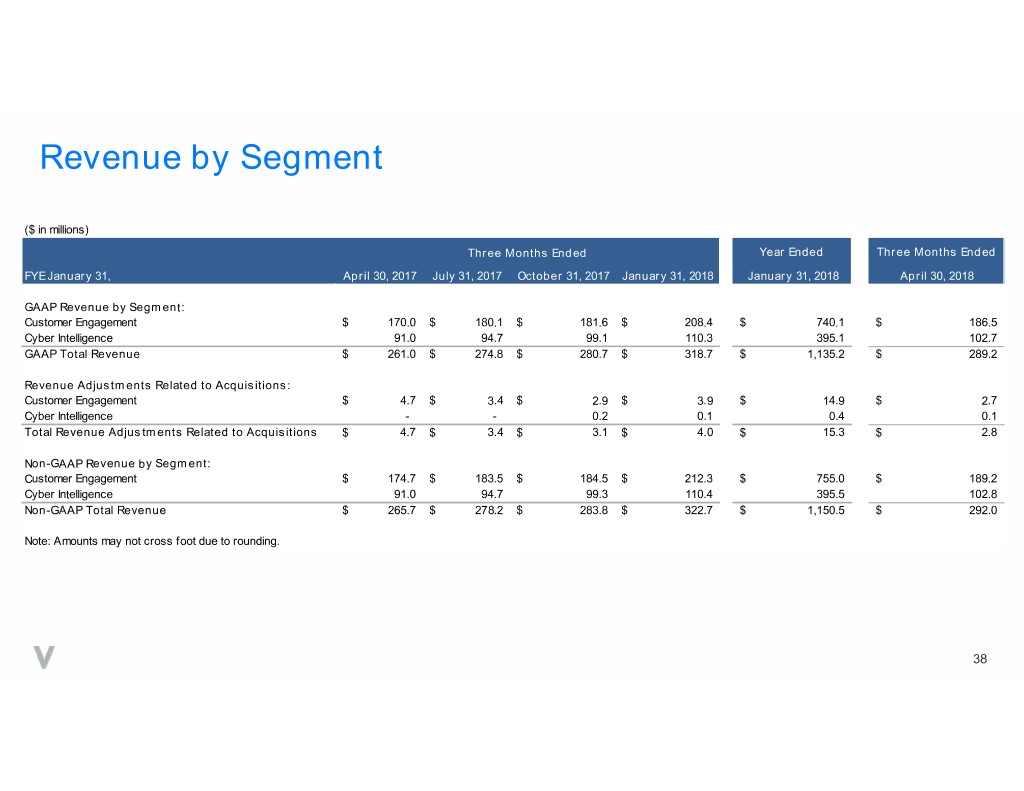

Revenue by Segment ($ in millions) Three Months Ended Year Ended Three Months Ended FYE January 31, April 30, 2017 July 31, 2017 October 31, 2017 January 31, 2018 January 31, 2018 April 30, 2018 GAAP Revenue by Segment: Customer Engagement$ 170.0 $ 180.1 $ 181.6 $ 208.4 $ 740.1 $ 186.5 Cyber Intelligence 91.0 94.7 99.1 110.3 395.1 102.7 GAAP Total Revenue$ 261.0 $ 274.8 $ 280.7 $ 318.7 $ 1,135.2 $ 289.2 Revenue Adjustments Related to Acquisitions: Customer Engagement$ 4.7 $ 3.4 $ 2.9 $ 3.9 $ 14.9 $ 2.7 Cyber Intelligence - - 0.2 0.1 0.4 0.1 Total Revenue Adjustments Related to Acquisitions$ 4.7 $ 3.4 $ 3.1 $ 4.0 $ 15.3 $ 2.8 Non-GAAP Revenue by Segment: Customer Engagement$ 174.7 $ 183.5 $ 184.5 $ 212.3 $ 755.0 $ 189.2 Cyber Intelligence 91.0 94.7 99.3 110.4 395.5 102.8 Non-GAAP Total Revenue$ 265.7 $ 278.2 $ 283.8 $ 322.7 $ 1,150.5 $ 292.0 Note: Amounts may not cross foot due to rounding. 38

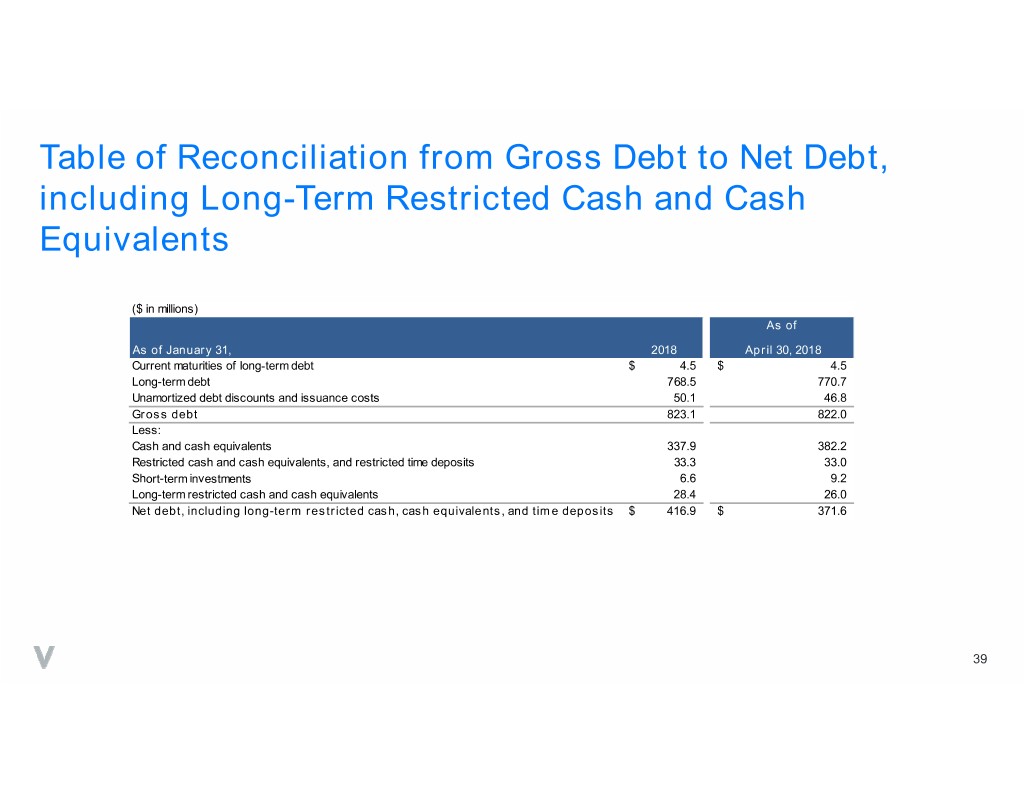

Table of Reconciliation from Gross Debt to Net Debt, including Long-Term Restricted Cash and Cash Equivalents ($ in millions) As of As of January 31, 2018 April 30, 2018 Current maturities of long-term debt$ 4.5 $ 4.5 Long-term debt 768.5 770.7 Unamortized debt discounts and issuance costs 50.1 46.8 Gross debt 823.1 822.0 Less: Cash and cash equivalents 337.9 382.2 Restricted cash and cash equivalents, and restricted time deposits 33.3 33.0 Short-term investments 6.6 9.2 Long-term restricted cash and cash equivalents 28.4 26.0 Net debt, including long-term restricted cash, cash equivalents, and time deposits$ 416.9 $ 371.6 39

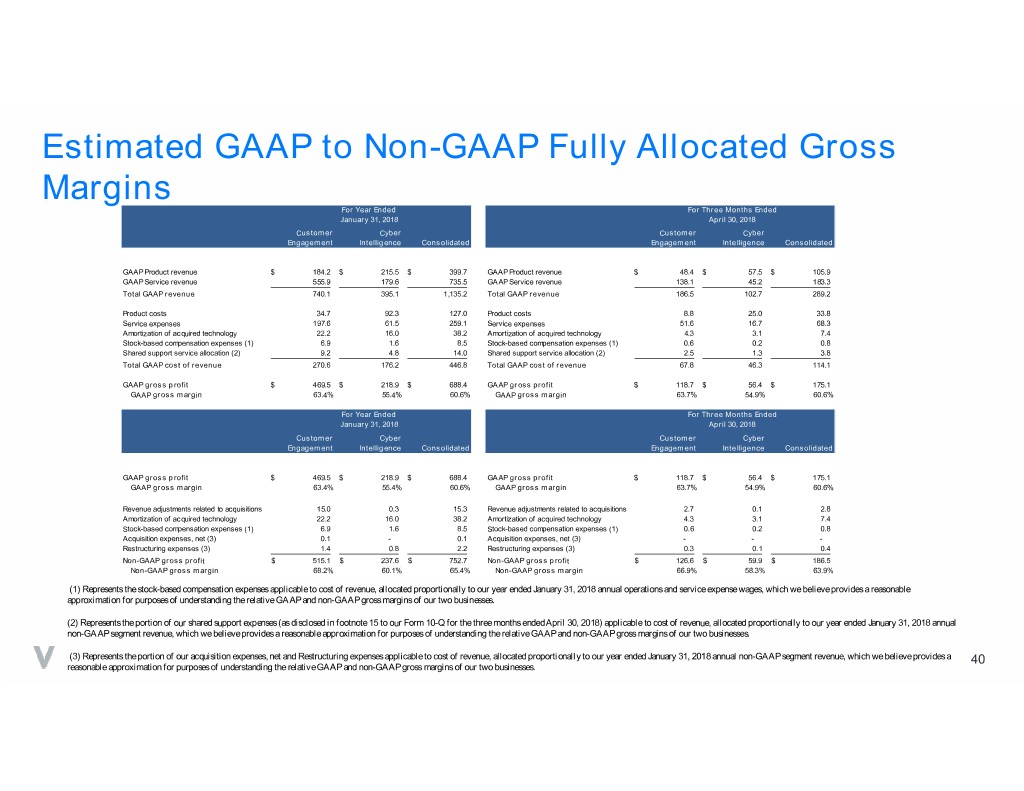

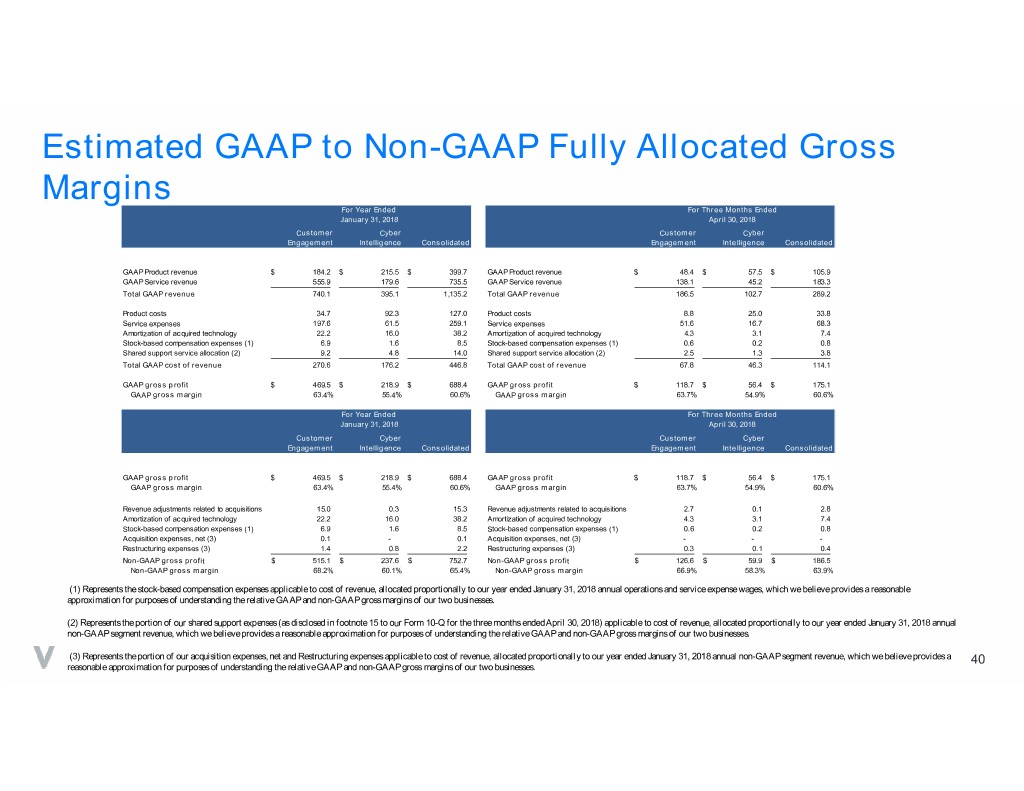

Estimated GAAP to Non-GAAP Fully Allocated Gross Margins For Ye ar Ende d For Three Months Ended January 31, 2018 April 30, 2018 Customer Cyber Customer Cyber Engagement Intelligence Consolidated Engagement Intelligence Consolidated GAAP Product revenue$ 184.2 $ 215.5 $ 399.7 GAAP Product revenue$ 48.4 $ 57.5 $ 105.9 GAAP Service revenue 555.9 179.6 735.5 GAAP Service revenue 138.1 45.2 183.3 Total GAAP revenue 740.1 395.1 1,135.2 Total GAAP revenue 186.5 102.7 289.2 Product costs 34.7 92.3 127.0 Product costs 8.8 25.0 33.8 Service expenses 197.6 61.5 259.1 Service expenses 51.6 16.7 68.3 Amortization of acquired technology 22.2 16.0 38.2 Amortization of acquired technology 4.3 3.1 7.4 Stock-based compensation expenses (1) 6.9 1.6 8.5 Stock-based compensation expenses (1) 0.6 0.2 0.8 Shared support service allocation (2) 9.2 4.8 14.0 Shared support service allocation (2) 2.5 1.3 3.8 Total GAAP cost of revenue 270.6 176.2 446.8 Total GAAP cost of revenue 67.8 46.3 114.1 GAAP gross profit$ 469.5 $ 218.9 $ 688.4 GAAP gross profit$ 118.7 $ 56.4 $ 175.1 GAAP gross margin 63.4% 55.4% 60.6% GAAP gross margin 63.7% 54.9% 60.6% For Ye ar Ende d For Three Months Ended January 31, 2018 April 30, 2018 Customer Cyber Customer Cyber Engagement Intelligence Consolidated Engagement Intelligence Consolidated GAAP gross profit$ 469.5 $ 218.9 $ 688.4 GAAP gross profit$ 118.7 $ 56.4 $ 175.1 GAAP gross margin 63.4% 55.4% 60.6% GAAP gross margin 63.7% 54.9% 60.6% Revenue adjustments related to acquisitions 15.0 0.3 15.3 Revenue adjustments related to acquisitions 2.7 0.1 2.8 Amortization of acquired technology 22.2 16.0 38.2 Amortization of acquired technology 4.3 3.1 7.4 Stock-based compensation expenses (1) 6.9 1.6 8.5 Stock-based compensation expenses (1) 0.6 0.2 0.8 Acquisition expenses, net (3) 0.1 - 0.1 Acquisition expenses, net (3) - - - Restructuring expenses (3) 1.4 0.8 2.2 Restructuring expenses (3) 0.3 0.1 0.4 Non-GAAP gross profit$ 515.1 $ 237.6 $ 752.7 Non-GAAP gross profit$ 126.6 $ 59.9 $ 186.5 Non-GAAP gross margin 68.2% 60.1% 65.4% Non-GAAP gross margin 66.9% 58.3% 63.9% (1) Represents the stock-based compensation expenses applicable to cost of revenue, allocated proportionally to our year ended January 31, 2018 annual operations and service expense wages, which we believe provides a reasonable approximation for purposes of understanding the relative GAAP and non-GAAP gross margins of our two businesses. (2) Represents the portion of our shared support expenses (as disclosed in footnote 15 to our Form 10-Q for the three months ended April 30, 2018) applicable to cost of revenue, allocated proportionally to our year ended January 31, 2018 annual non-GAAP segment revenue, which we believe provides a reasonable approximation for purposes of understanding the relative GAAP and non-GAAP gross margins of our two businesses. (3) Represents the portion of our acquisition expenses, net and Restructuring expenses applicable to cost of revenue, allocated proportionally to our year ended January 31, 2018 annual non-GAAP segment revenue, which we believe provides a 40 reasonable approximation for purposes of understanding the relative GAAP and non-GAAP gross margins of our two businesses.

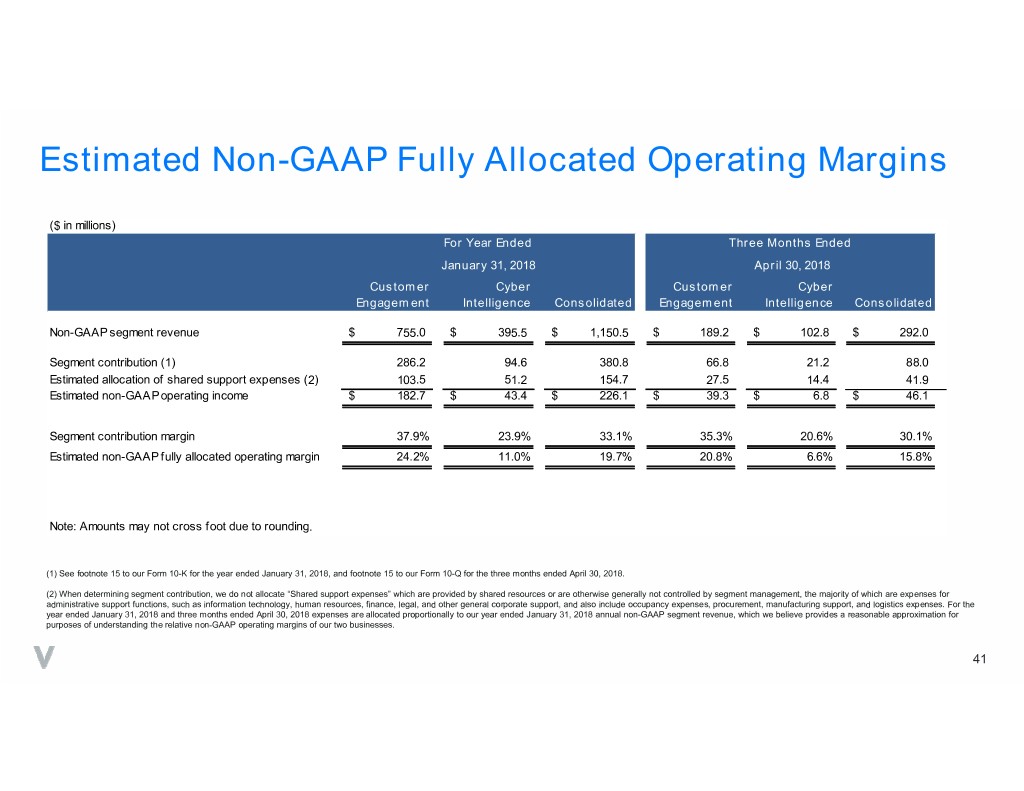

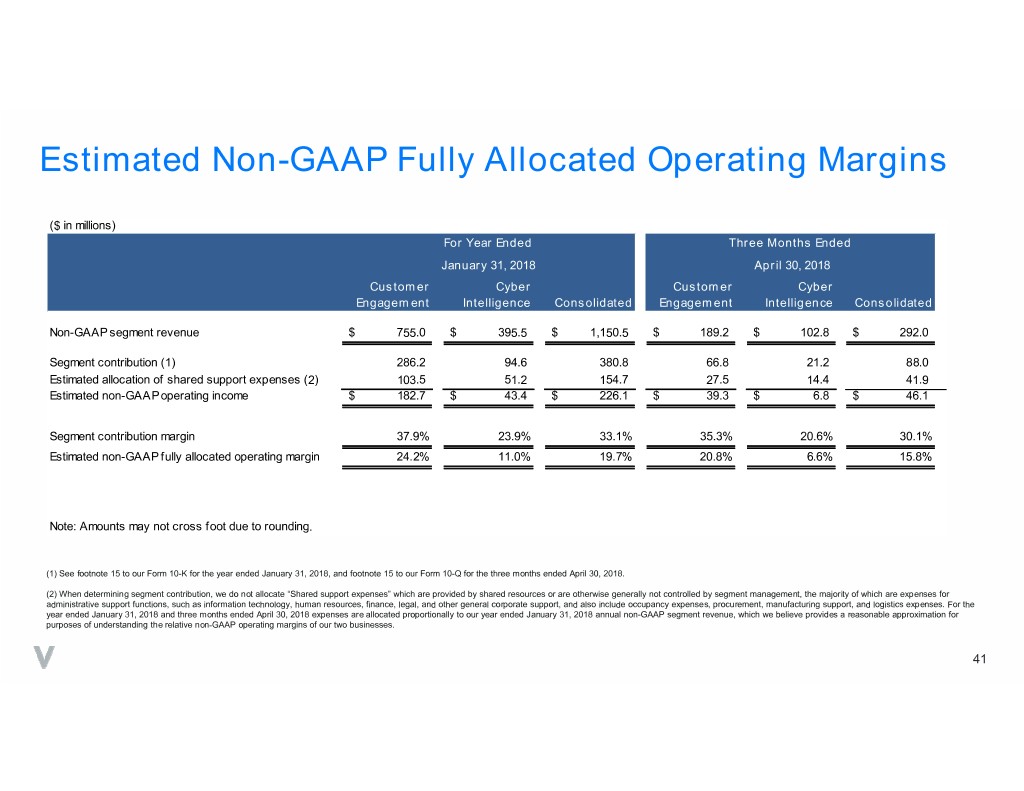

Estimated Non-GAAP Fully Allocated Operating Margins ($ in millions) For Year Ended Three Months Ended January 31, 2018 April 30, 2018 Customer Cyber Customer Cyber Engagement Intelligence Consolidated Engagement Intelligence Consolidated Non-GAAP segment revenue$ 755.0 $ 395.5 $ 1,150.5 $ 189.2 $ 102.8 $ 292.0 Segment contribution (1) 286.2 94.6 380.8 66.8 21.2 88.0 Estimated allocation of shared support expenses (2) 103.5 51.2 154.7 27.5 14.4 41.9 Estimated non-GAAP operating income$ 182.7 $ 43.4 $ 226.1 $ 39.3 $ 6.8 $ 46.1 Segment contribution margin 37.9% 23.9% 33.1% 35.3% 20.6% 30.1% Estimated non-GAAP fully allocated operating margin 24.2% 11.0% 19.7% 20.8% 6.6% 15.8% Note: Amounts may not cross foot due to rounding. (1) See footnote 15 to our Form 10-K for the year ended January 31, 2018, and footnote 15 to our Form 10-Q for the three months ended April 30, 2018. (2) When determining segment contribution, we do not allocate “Shared support expenses” which are provided by shared resources or are otherwise generally not controlled by segment management, the majority of which are expenses for administrative support functions, such as information technology, human resources, finance, legal, and other general corporate support, and also include occupancy expenses, procurement, manufacturing support, and logistics expenses. For the year ended January 31, 2018 and three months ended April 30, 2018 expenses are allocated proportionally to our year ended January 31, 2018 annual non-GAAP segment revenue, which we believe provides a reasonable approximation for purposes of understanding the relative non-GAAP operating margins of our two businesses. 41