UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| þ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

| VERINT SYSTEMS INC. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PRELIMINARY COPY - SUBJECT TO COMPLETION - DATED APRIL 9, 2019

175 Broadhollow Road

Melville, New York 11747

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

We would like to take this opportunity to invite you to attend our 2019 Annual Meeting of Stockholders.

| Date and Time | Location |

[●], 2019 [●] Eastern Time | [●] |

PROPOSALS TO BE VOTED ON AT THE MEETING

| Proposal | Board Recommendation |

| Elect eight directors to serve until the 2020 Annual Meeting of Stockholders | FOR THE BOARD’S NOMINEES |

| Advisory vote to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the current fiscal year | FOR |

| Advisory vote to approve the compensation of our named executive officers (say-on-pay) | FOR |

| To approve the Verint Systems Inc. 2019 Long-Term Stock Incentive Plan | FOR |

Other matters that are properly brought before the meeting may also be considered.

Only stockholders at the close of business on [●], 2019 are entitled to vote.

Please vote your shares before the meeting, even if you plan to attend the meeting.

If you are a Verint stockholder, a WHITE proxy card is enclosed. Please vote your shares promptly by Internet, telephone, or mail as directed on the enclosed WHITE proxy card in order that your shares may be voted at the 2019 Annual Meeting of Stockholders.

The Board of Directors has nominated a full slate of eight directors for election at the 2019 Annual Meeting of Stockholders and is soliciting proxies for all eight nominees recommended herein.

Please note that Neuberger Berman Investment Advisers LLC (“Neuberger Berman”) has notified the Company of its intention to nominate a slate of three nominees for election as directors at the 2019 Annual Meeting of Stockholders in opposition to the eight nominees recommended by the Board of Directors.

The Board of Directors does NOT endorse the election of any of Neuberger Berman’s nominees and strongly urges you to vote FOR the eight nominees recommended by the Board of Directors. You may receive solicitation materials from Neuberger Berman or certain entities affiliated with Neuberger Berman, including a proxy statement and a proxy card. We are not responsible for the accuracy of any information provided by or relating to Neuberger Berman in any proxy solicitation

materials filed or disseminated by, or on behalf of, Neuberger Berman or any other statements that Neuberger Berman may otherwise make.

Your vote is important regardless of the number of shares you own. The Board of Directors unanimously recommends that you vote FOR our eight director nominees on the WHITE proxy card. We urge you to vote as soon as possible by telephone, by Internet, or by signing, dating, marking, and returning the enclosed WHITE proxy card by mail, even if you plan to attend the 2019 Annual Meeting of Stockholders.

The Board of Directors strongly urges you to NOT sign or return any proxy card sent to you by or on behalf of Neuberger Berman. If you previously have submitted a proxy card sent to you by Neuberger Berman, you can revoke that proxy by using the enclosed WHITE proxy card to vote your shares today by telephone, by Internet, or by signing, dating, marking, and returning the enclosed WHITE proxy card. Only your latest dated proxy card will count.

Your broker will not be able to vote your shares on any of the proposals for this year’s meeting unless you have given your broker instructions to do so.

If you have any questions, please contact [●], our proxy solicitor assisting us in connection with the 2019 Annual Meeting of Stockholders. Stockholders may call toll free at [●]. Banks and brokers may call collect at [●].

You can find additional information about our business performance for the year ended January 31, 2019 in our Annual Report on Form 10-K, which accompanies this proxy statement.

This Notice of 2019 Annual Meeting of Stockholders and the attached proxy statement are first being sent to stockholders of record as of [●], 2019 on or about [●], 2019.

| By Order of the Board of Directors, | |

| |

| Jonathan Kohl | |

| Senior Vice President, General Counsel and Corporate Secretary | |

[●], 2019

Instructions on How to Vote

If you are a registered holder (you hold shares directly with our transfer agent) | If you are a beneficial holder (you hold shares through a bank, broker, or other nominee) |

You can vote online, by phone, or by completing and mailing the attached WHITE proxy card. | You should use the voting instructions and materials provided to you by your bank, broker, or other nominee (which may also include instructions for voting online, by phone, or by completing and mailing a voting instruction card) |

Important Notice of the Internet Availability of Proxy Materials

The Proxy Statement and our Annual Report for the year ended January 31, 2019 are available to stockholders at www.proxyvote.com.

If you have any questions or need any assistance in voting your shares, please contact our proxy solicitor, [●].

TABLE OF CONTENTS

| Page | |

i

PROXY STATEMENT

| v | The enclosed proxy is solicited on behalf of the board of directors (the “Board”) of Verint Systems Inc. (“Verint” or the “Company”) in connection with our Annual Meeting of Stockholders (the “2019 Annual Meeting”) to be held on [●], 2019, at [●] Eastern Time or any adjournment or postponement of this meeting. |

| v | The 2019 Annual Meeting will be held at [●]. Directions to the 2019 Annual Meeting can be found at the back of this proxy statement. |

| v | We intend to mail this proxy statement, the accompanying WHITE proxy card and our previously filed Annual Report on Form 10-K for the year ended January 31, 2019 to each stockholder entitled to vote at our 2019 Annual Meeting on or about [●], 2019. |

1

QUESTIONS AND ANSWERS ABOUT THE 2019 ANNUAL MEETING

Although we encourage you to read this proxy statement in its entirety, we include this question and answer section to provide some background information and brief answers to several questions you might have about the 2019 Annual Meeting.

Q: Why am I receiving these materials?

A: The Board is providing these proxy materials to you in connection with its solicitation of your proxy to vote at the 2019 Annual Meeting because you were a holder of Verint Systems Inc. common stock as of the close of business on [●], 2019 (the “Record Date”) and are entitled to vote at the 2019 Annual Meeting. As of the Record Date, there were [●] shares of our common stock outstanding. This proxy statement summarizes the information you need to know to vote on the proposals expected to be presented at the 2019 Annual Meeting.

Q: What information will be sent to the stockholders?

A: This proxy statement, the accompanying WHITE proxy card and our Annual Report on Form 10-K for the year ended January 31, 2019 will be mailed on or about [●], 2019 to our stockholders of record as of the Record Date.

Q: Who is soliciting my vote?

A: In this proxy statement, the Board of Directors of Verint is soliciting your vote for matters being submitted for stockholder approval at the 2019 Annual Meeting. Giving us your proxy means that you authorize the proxy holders identified on the WHITE proxy card to vote your shares at the meeting in the manner you direct. You may vote for all, some or none of our director nominees. You also may abstain from voting. If you sign and return a WHITE proxy card but do not mark how your shares are to be voted, the individuals named as proxies will vote your shares, if permitted, in accordance with the Board’s recommendations.

Q: Whom should I contact if I have questions about the 2019 Annual Meeting?

A: If you have any questions or require any assistance with voting your shares, or if you need additional copies of the proxy materials, please contact: [●].

Q: What are the proposals and the voting recommendations of the Board?

A: The proposals to be considered, and the recommendation of the Board on each, are as follows:

| • | FOR each of our director nominees (Proposal No. 1); the Board unanimously recommends that you NOT vote for any members of the Neuberger Berman slate of nominees; |

| • | FOR ratification of the appointment of Deloitte & Touche LLP as Verint’s independent registered public accounting firm for the year ending January 31, 2020 (Proposal No. 2); |

| • | FOR approval, on a non-binding, advisory basis, of the compensation of the named executive officers as disclosed in this proxy statement (Proposal No. 3); and |

| • | FOR approval of the Verint Systems Inc. 2019 Long-Term Stock Incentive Plan (Proposal No. 4). |

| • | The Board recommends that you vote using the WHITE proxy card. |

Q: What vote is required to approve each proposal?

A: So long as there is a quorum, the voting requirement for each of the proposals is as follows:

| • | Proposal No. 1 - Election of Directors - in order for a nominee to be elected, such nominee must receive a plurality of votes of the shares present in person or represented by proxy at the 2019 Annual Meeting and entitled to vote on the election of directors. That means the eight nominees receiving the highest number of votes will be elected. This is not considered a routine matter and banks, brokers, or other nominees may not vote without instructions from the stockholder. Because directors need only be elected by a plurality of the vote, abstentions, broker non-votes, and withheld votes will not affect whether a particular nominee has received sufficient votes to be elected. However, under our director resignation policy, any nominee for director who, in an uncontested election, fails to receive more votes “for” his or her election than “withheld” must promptly tender his or her resignation for consideration by the corporate governance & nominating committee and subsequently by the Board. Our director resignation policy is available on our website at https://www.verint.com/investor-relations/corporate-governance/corporate-governance-policies/index.html. |

2

| • | Proposal No. 2 - Ratification of independent registered public accountants - the proposal for the ratification of the appointment of Deloitte & Touche LLP as Verint’s independent registered public accountants for the year ending January 31, 2020 requires approval by the vote of the holders of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote. For the 2019 Annual Meeting, this is not considered a routine matter and banks, brokers, or other nominees may not vote without instructions from the stockholder. Broker non-votes will not affect whether this proposal is approved, however, abstentions will count as votes against this proposal. |

| • | Proposal No. 3 - Approval of the compensation of the named executive officers - the advisory vote to approve the compensation of the named executive officers as disclosed in this proxy statement requires approval by the vote of the holders of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote. This is not considered a routine matter and banks, brokers, or other nominees may not vote without instructions from the stockholder. Broker non-votes will not affect whether this proposal is approved, however, abstentions will count as votes against this proposal. |

| • | Proposal No. 4 - Approval of the Verint Systems Inc. 2019 Long-Term Stock Incentive Plan - the proposal to approve the Verint Systems Inc. 2019 Long-Term Stock Incentive Plan requires approval by the vote of the holders of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote. This is not considered a routine matter and banks, brokers, or other nominees may not vote without instructions from the stockholder. Broker non-votes will not affect whether this proposal is approved, however, abstentions will count as votes against this proposal. |

Q: Has Verint been notified that a stockholder intends to propose its own director nominees at the meeting in opposition to the Board of Directors’ nominees?

A: Yes. Neuberger Berman has notified Verint that it intends to nominate three nominees for election as directors at the 2019 Annual Meeting in opposition to the Board’s recommended eight nominees. The Board unanimously recommends that you vote FOR the eight director nominees recommended by the Board by using the enclosed WHITE proxy card accompanying these proxy materials. The Board strongly urges you NOT to sign or return any proxy card sent to you by or on behalf of Neuberger Berman. Neuberger Berman’s nominees have not been endorsed by the Board. We are not responsible for the accuracy of any information provided by or relating to Neuberger Berman contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Neuberger Berman or any other statements that Neuberger Berman may otherwise make.

Q: What should I do if I receive a proxy card from Neuberger Berman?

A: The Board urges you NOT to sign or return any proxy card sent to you by or on behalf of Neuberger Berman. Voting against Neuberger Berman’s nominees on its proxy card is not the same as voting for the Verint Board’s nominees, because a vote against Neuberger Berman’s nominees on its proxy card will revoke any previous proxy card submitted by you. If you have voted previously using a proxy card sent to you by or on behalf of Neuberger Berman, you can change your vote by executing the WHITE proxy card or by voting by telephone or Internet by following the instructions shown on the WHITE proxy card. Only the latest dated proxy you submit will be counted. If you have any questions or need assistance voting, please contact our proxy solicitor, [●].

Q: How many votes do I have?

A: Each share of common stock that you owned at the close of business on the Record Date is entitled to one vote. These shares include:

| • | shares held directly in your name as the “stockholder of record”; and |

| • | shares held for you as the beneficial owner through a broker, bank, or other nominee in “street name”. |

Q: What is the difference between holding shares as a stockholder of record and as a beneficial owner?

A: Most of our stockholders hold their shares through a broker, bank, or other nominee (beneficial ownership) rather than directly in their own name (record ownership). As summarized below, there are some distinctions between shares held of record and those owned beneficially.

| • | Stockholder of Record: If your shares are registered directly in your name with our transfer agent, Broadridge Corporate Issuer Solutions, Inc., you are considered the stockholder of record, and this proxy statement, the WHITE proxy card, and the Annual Report are being sent directly to you by us. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the 2019 Annual Meeting without further authorization from a third party. |

3

| • | Beneficial Owner: If your shares are held in a stock brokerage account, by a bank, or other nominee, you are considered the beneficial owner of shares held in street name by such third party, and this proxy statement, the WHITE proxy card, and the Annual Report are being forwarded to you by your broker, bank, or their nominee. As the beneficial owner, you have the right to direct your broker, bank, or other nominee on how to vote your shares and you are also invited to attend the 2019 Annual Meeting. Since you are not the stockholder of record, however, you may not vote these shares in person at the 2019 Annual Meeting unless you obtain a legal proxy from the record holder (your broker, bank, or other nominee). You may vote shares beneficially held by you as set out in the voting instruction card you receive from your broker, bank, or other nominee. WE STRONGLY ENCOURAGE YOU TO PROVIDE VOTING INSTRUCTIONS TO YOUR BROKER SO THAT YOUR VOTE WILL BE COUNTED. |

Q: How do I vote?

A: If you wish to vote your shares in person and you hold shares as the stockholder of record, you may come to the 2019 Annual Meeting and cast your vote there. However, if you are a beneficial owner and you wish to vote your shares in person, you must bring a legal proxy from the record holder of your shares (your broker, bank, or other nominee) indicating that you were the beneficial owner of the shares on the Record Date. In either case, you should also bring a valid photo identification in order to be admitted to the meeting.

If you wish to vote your shares without attending the meeting, you may do so in one of the following ways:

| • | Internet. If you hold shares as the stockholder of record, you can submit a proxy over the Internet to vote those shares at the 2019 Annual Meeting by accessing the website shown on the WHITE proxy card you received from us and following the instructions provided. If you are a beneficial owner of shares, your broker, bank, or other nominee may or may not permit you to provide them with instructions over the Internet for how to vote your shares; please refer to the instructions provided by your broker, bank, or other nominee on the voting instruction card you received from your broker, bank or other nominee. |

| • | Telephone. If you hold shares as the stockholder of record, you can submit a proxy over the telephone to vote your shares by following the instructions provided in the WHITE proxy card you received from us. If you are a beneficial owner of shares, your broker, bank or other nominee may or may not permit you to provide them with instructions over the phone for how to vote your shares; please refer to the instructions provided by your broker, bank or other nominee on the voting instruction card you received from your broker, bank, or other nominee. |

| • | Mail. You may submit a proxy or voting instructions by mail to vote your shares at the 2019 Annual Meeting. Please mark, date, sign, and return the WHITE proxy card or voting instruction card enclosed with the proxy materials you received from us or from your broker, bank or other nominee in the mail. |

If you have questions or need assistance voting your shares, please contact our proxy solicitor [●] by any of the methods below: [●].

Q: What does it mean if I receive more than one set of proxy materials from the Company?

A: It generally means that some of your shares are registered differently or are in more than one account. Please complete, sign, date, and return each WHITE proxy card to ensure that all your shares are voted.

Q: Can I change my vote or revoke my proxy?

A: Yes, if you are a stockholder of record, you can change your vote or revoke your proxy at any time before the 2019 Annual Meeting by:

| • | notifying our Corporate Secretary in writing before the 2019 Annual Meeting that you have revoked your proxy; |

| • | signing and delivering a later dated proxy to our Corporate Secretary; |

| • | voting by using the Internet or the telephone (your last Internet or telephone proxy is the one that is counted); or |

| • | voting in person at the 2019 Annual Meeting. |

Any such written notice or later dated proxy must be received by our Corporate Secretary at our principal executive offices before 11:59 p.m. Eastern Time on [●], 2019, if you are notifying us in writing, or before the vote at the 2019 Annual Meeting, if you are attending the 2019 Annual Meeting in person.

If you are a beneficial owner, you may submit new voting instructions by contacting your bank, broker, or other nominee.

4

Q: What will happen if I do not instruct my bank, broker, or other nominee how to vote?

A: All of the proposals being presented at the 2019 Annual Meeting are non-routine matters, and banks, brokers, and other nominees cannot vote on these matters without instructions from the beneficial owner. Without your voting instructions on these matters, a “broker non-vote” will occur. Shares held by banks, brokers, or other nominees that do not have discretionary authority to vote uninstructed shares on non-routine matters are not counted or deemed to be present or represented for the purpose of determining whether stockholders have approved a particular matter, but will be counted in determining whether a quorum is present at the 2019 Annual Meeting. See “—Q: How are votes counted?” below for more information.

Q: Who are the proxies and what do they do?

A: The persons named as proxies in the proxy materials, Dan Bodner, our Chief Executive Officer, Douglas Robinson, our Chief Financial Officer, and Peter Fante, our Chief Administrative Officer, were designated by the Board to vote the shares of holders who are not able or not eligible to vote their shares in person at the 2019 annual meeting, based on valid proxies received by us.

Q: How are votes counted?

A: The shares represented by all valid proxies received will be voted in the manner specified on the proxies. If you are a stockholder of record and you sign, date, and return your WHITE proxy card without making specific choices, the persons named as proxies above will vote your shares in accordance with the recommendations of the Board. If you are a beneficial holder, your bank, broker, or other nominee must vote for you (unless you obtain a legal proxy from the record holder), and as noted above, if you do not provide specific voting instructions, your bank, broker, or other nominee will not be able to vote on your behalf. As a result, you are urged to specify your voting instructions by marking the appropriate boxes on the enclosed WHITE proxy card or on your voting instruction card, as applicable.

Q: Will any other matters be voted on?

A: We are not aware of any other matters that will be brought before the stockholders for a vote at the 2019 Annual Meeting. If any other matter is properly brought before the meeting, your proxy will authorize your appointed proxies to vote for you on such matters using their discretion.

Q: How many shares must be present to hold the 2019 Annual Meeting?

A: Holders of a majority of the issued and outstanding shares of our common stock as of the Record Date must be represented in person or by proxy at the 2019 Annual Meeting in order to conduct business. This is called a quorum. If you vote, your shares will be part of the quorum. Abstentions, “withhold” votes, and broker non-votes also will be counted in determining whether a quorum exists.

Q: Where can I find the voting results of the meeting?

A: The preliminary voting results will be announced at the meeting. The final voting results will be reported in a current report on Form 8-K, which will be filed with the SEC within four business days after the meeting. If our final voting results are not available within four business days after the meeting, we will file a current report on Form 8-K reporting the preliminary voting results and subsequently file the final voting results in an amendment to the current report on Form 8-K within four business days after the final voting results are known to us.

Q: What do I need to do to attend the 2019 Annual Meeting?

A: You are entitled to attend the 2019 Annual Meeting only if you were a stockholder of record or a beneficial owner of our shares as of the close of business on [●], 2019. You should be prepared to present photo identification for admittance. If you hold your shares through a broker, bank or nominee and you wish to attend the meeting, you will need to provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to [●], 2019, a copy of the voting instruction card provided by your broker, bank, or nominee, or similar evidence of ownership. If you are not a stockholder of record, note that you will not be able to vote your shares at the meeting unless you have a legal proxy from your broker. If you do not provide photo identification or comply with the other procedures outlined above, you may not be admitted to the 2019 Annual Meeting.

5

FORWARD-LOOKING STATEMENTS

This Proxy Statement contains “forward-looking statements” within the meaning of the Section 27A of the Securities Act, Section 21E of the Exchange Act and the Private Securities Litigation Reform Act of 1995. All statements relating to events or results that may occur in the future, including, but not limited to, Verint’s future costs of solicitation, record or meeting dates, compensation arrangements, plans or amendments (including those related to profit sharing and stock-based compensation), company policies, corporate governance practices, documents or amendments (including charter or bylaw amendments, stockholder rights plans or similar arrangements) as well as capital and corporate structure (including major stockholders, board structure and board composition), are forward-looking statements. Forward-looking statements generally can be identified by words such as “expect,” “will,” “change,” “intend,” “target,” “future,” “potential,” “estimate,” “anticipate,” “to be,” and similar expressions. These statements are based on numerous assumptions and involve known and unknown risks, uncertainties and other factors that could significantly affect Verint’s operations and may cause Verint’s actual actions, results, financial condition, performance or achievements to be substantially different from any future actions, results, financial condition, performance or achievements expressed or implied by any such forward-looking statements. For a detailed discussion of these risk factors, see our Annual Report on Form 10-K for the fiscal year ended January 31, 2019 and other filings we make with the SEC. The Company does not intend, and undertakes no obligation to update or publicly release any revision to any such forward-looking statements, whether as a result of the receipt of new information, the occurrence of subsequent events, the change of circumstance or otherwise. Each forward-looking statement contained in this Proxy Statement is specifically qualified in its entirety by the aforementioned factors. You are hereby advised to carefully read this Proxy Statement in conjunction with the important disclaimers set forth above prior to reaching any conclusions or making any investment decisions.

6

BACKGROUND OF SOLICITATION

Consistent with Verint’s regular practice of seeking input from stockholders, Verint has maintained regular and frequent communications with Neuberger Berman. In the last three years, representatives of Verint have had more than twenty phone conversations or in-person meetings with representatives of Neuberger Berman.

In early 2017, following numerous conversations between representatives of Verint and Neuberger Berman, Neuberger Berman requested that Verint appoint Ms. Penelope Herscher and Dr. Mark Greene to the Board. The Board thoroughly evaluated the qualifications of both of the candidates. After careful consideration, the Board determined that Dr. Greene did not add significant value to the Board compared to its existing composition and thus did not appoint Dr. Greene to the Board.

On March 24, 2017, the Board appointed Ms. Penelope Herscher to the Board effective April 1, 2017.

In March of 2018, Neuberger Berman suggested that Steve Hooley may be a qualified candidate to serve on the Board. Following discussion, Verint determined not to add Mr. Hooley to the Board.

On December 7, 2018, Dan Bodner, Verint’s Chairman of the Board and Chief Executive Officer, and Alan Roden, Verint’s Senior Vice President, Corporate Development and Investor Relations, met in person at Verint’s corporate headquarters with representatives of Neuberger Berman to discuss general matters involving the company.

On January 30, 2019, Mr. Roden was contacted by representatives of Neuberger Berman regarding Verint’s business and financial performance and board composition. Representatives of Neuberger Berman indicated that they would send Verint four names of potential board candidates for consideration. Later that day, representatives of Verint received an e-mail from representatives of Neuberger Berman identifying four potential board candidates, Mr. Hooley (“Candidate 1”), Warren Jenson (“Candidate 2”), Oded Weiss (“Candidate 3”), and John Hinshaw (“Candidate 4”).

Between February 5, 2019 and February 8, 2019, Verint and Neuberger Berman communicated in a series of e-mails, with Verint requesting resumes and contact information for Candidates 1-4.

On February 12, 2019, after receiving updated resumes and contact information from Neuberger Berman for Candidates 1-4, representatives of Verint began reaching out to the candidates suggested by Neuberger Berman in order to schedule initial interviews.

On February 14, 2019, Verint received a letter from Neuberger Berman criticizing Verint and its Board and reiterating its suggestion for Verint to consider Candidates 1-4.

On February 15, 2019, Mr. Roden contacted representatives of Neuberger Berman to report on progress on reviewing Neuberger Berman’s suggested candidates and to report that John Egan, Verint’s Lead Independent Director, was requesting an in-person meeting with representatives of Neuberger Berman to better understand the perspectives included in Neuberger Berman’s February 14th letter.

From February 15, 2019 through February 22, 2019, Verint conducted initial interviews with Candidates 1-4. During these interviews, Candidate 4 indicated that he did not wish to continue with the process of being considered for the Board.

On February 27, 2019, Messrs. Egan and Roden met in person with representatives of Neuberger Berman at Neuberger Berman’s offices in Florida. During this meeting, the parties discussed Neuberger Berman’s perspectives on Verint and Neuberger Berman’s suggested candidates (Candidates 1-4). Neuberger Berman indicated that it would suggest an alternative candidate in place of Candidate 4 who had withdrawn. Neuberger Berman also stated that it would consider having confidential discussions with Verint under the terms of a non-disclosure agreement. Messrs. Bodner and Egan sought the input of the members of the Board in advance of the meeting and provided an update to the Board following the meeting.

On February 28, 2019, representatives of Neuberger Berman contacted representatives of Verint to suggest Bob Schassler (“Candidate 5”) as a candidate for the Board, in place of Candidate 4. The next day, representatives of Verint reached out to Candidate 5 to schedule an initial interview.

On March 6, 2019, Mr. Egan held second round interviews with Candidate 1 and Candidate 3.

On March 7, 2019, Verint held an initial interview with Candidate 5.

7

On March 7, 2019, representatives of Verint received an e-mail from representatives of Neuberger Berman requesting to have an update discussion regarding Verint’s interview process with the suggested candidates.

On March 8, 2019, Mr. Roden held a telephonic conversation with representatives of Neuberger Berman to provide an update on the interview process including the timing of second round interviews for Candidate 2 and Candidate 5. During the discussion, Neuberger Berman again stated that it would consider having confidential discussions with Verint under a non-disclosure agreement.

On March 12, 2019, Mr. Egan held second round interviews with Candidate 2 and Candidate 5.

On March 15, 2019, Messrs. Egan and Roden again met with representatives of Neuberger Berman at its offices in Florida to have discussions regarding Verint’s review of the director candidates suggested by Neuberger Berman. Mr. Egan informed Neuberger Berman that, after careful consideration, Verint had determined that the remaining candidates (Candidates 1, 2, 3, and 5) did not meet the company’s requirements or did not add significant value to the Board compared to its existing composition. However, Mr. Egan indicated that the company intended to continue to refresh the Board over time and, as part of its ongoing process of developing a pipeline of qualified candidates for future Board refreshment, the company was speaking with some strong female candidates. Mr. Egan also proposed that Verint and Neuberger Berman enter into a non-disclosure agreement so that the parties could have more robust conversations and so that Verint could share with Neuberger Berman information that might include material, non-public information. Neuberger Berman stated that it would consider the proposal and revert back to Verint. Messrs. Bodner and Egan sought the input of the members of the Board in advance of the meeting and provided an update to the Board following the meeting.

On March 16, 2019, Mr. Egan received a text message from Candidate 5 indicating that he was removing himself from consideration to serve on the Board.

On March 18, 2019, representatives of Verint received an e-mail from representatives of Neuberger Berman indicating that Neuberger Berman was rejecting Verint’s proposal to have confidential conversations under a non-disclosure agreement. Instead, Neuberger Berman requested that Verint extend its director nomination window until April 10, 2019.

On March 20, 2019, Mr. Egan held a telephonic conversation with representatives of Neuberger Berman. Mr. Egan informed Neuberger Berman that Verint would not extend the nomination window. Mr. Egan reiterated that Verint remained willing to enter into confidential discussions with Neuberger Berman under a non-disclosure agreement. Neuberger Berman again rejected this proposal.

On March 22, 2019, Verint received a letter from Neuberger Berman formally nominating three nominees for election to the Board at the 2019 annual meeting of stockholders. The three nominees included one of the original four candidates, Candidate 3 (Oded Weiss), and two new candidates, Dr. Mark Greene (“Candidate 6”), whom the Board had considered and rejected in 2017, and Beatriz Infante (“Candidate 7”), a new name that Neuberger Berman had not previously mentioned to Verint. In the letter, Neuberger Berman reserved the right to withdraw the nominations of Candidate 3, Candidate 6 and/or Candidate 7 at any time.

On March 27, 2019, Verint announced fourth quarter and full year 2018 earnings.

On April 8, 2019, representatives of Verint called representatives of Neuberger Berman to request an update from Neuberger Berman regarding its nominations in light of Verint’s recently announced financial results. Later that same day, representatives of Neuberger Berman sent a letter to the Board reiterating its criticisms of Verint and the Board and requesting a meeting with the Board to discuss these criticisms.

Later in the day on April 8, 2019, members of the Board convened a call with management and counsel to discuss the Neuberger Berman letter.

On April 9, 2019, at the request of the Board, Mr. Egan provided a courtesy call to representatives of Neuberger Berman to confirm Neuberger Berman intended to pursue its nominations. Representatives of Neuberger Berman did not withdraw their nominations. Mr. Egan informed representatives of Neuberger Berman that Verint would proceed with the filing of its preliminary proxy statement. Mr. Egan also stated that, consistent with Verint’s regular shareholder engagement program, representatives of Verint were prepared to discuss a further meeting with representatives of Neuberger Berman.

8

PROPOSAL NO. 1

ELECTION OF DIRECTORS

All of our directors are elected at each annual meeting to serve until their successors are duly elected and qualified or their earlier death, resignation, or removal. The Board has nominated the persons named below, each of whom is presently serving on our Board, for election as directors. As of the date of this proxy statement, the Board consists of eight directors and no vacancies. Proxies cannot be voted for a greater number of persons than the number of nominees (eight nominees) named below.

Each of the nominees was recommended for reelection by the corporate governance & nominating committee and has been approved by the Board. Each of the nominees has consented to his or her name being submitted by the Company as a nominee for election as a member of the Board in its proxy statement and other solicitation materials to be filed with the SEC and distributed to the Company’s stockholders and in other materials in connection with the solicitation of proxies by the Company and its directors, officers, employees, and other representatives from stockholders to be voted at the 2019 Annual Meeting. Each of the nominees has further consented to serve for the new term if elected. If any nominee becomes unavailable to serve for any reason before the election, which is not anticipated, your proxy authorizes us to vote for another person nominated by the Board. The election of directors will be made by a plurality of votes cast at the 2019 Annual Meeting. That means the eight nominees receiving the highest number of votes will be elected. This is not considered a routine matter and banks, brokers, or other nominees may not vote without instructions from the stockholder. Because directors need only be elected by a plurality of the vote, abstentions, broker non-votes, and withhold votes will not affect whether a particular nominee has received sufficient votes to be elected. However, under our director resignation policy, any nominee for director who, in an uncontested election, fails to receive more votes “for” his or her election than “withheld” must promptly tender his or her resignation for consideration by the corporate governance & nominating committee and subsequently by the Board. Our director resignation policy is available on our website at https://www.verint.com/investor-relations/corporate-governance/corporate-governance-policies/index.html.

As described in detail below, our nominees have considerable professional and business experience, including service on other public company boards and/or as public company executives in the software and/or security industries as well as experience in subject areas such as corporate governance, finance and accounting, information technology, and executive compensation, among others. The recommendation of our Board is based on its carefully considered judgment that the experience, record, and qualifications of our nominees make them well qualified to serve on our Board. The Board believes that each of the nominees listed brings strong skills and extensive experience to the Board complementing one another and giving the Board as a group the right combination of skills, including, among others, in sales and marketing, mergers and acquisitions, business and cloud transformations, cyber security, public company accounting and operations, technology leadership, and customer preferences and perspectives, to exercise its oversight responsibilities, drive the Company’s strategy, and create stockholder value.

As discussed in further detail under the “Stockholder Engagement” section of the Compensation Discussion and Analysis below, under the supervision of our Board and our compensation committee, in FYE 19, we further enhanced the stockholder engagement program that we initiated in the prior year, deepening the level of engagement we had with our stockholders on strategy, compensation, and governance related topics. We value the feedback we receive from stockholders through this process. We also continue to refresh the composition of our Board of Directors with three new directors in the last three years. We believe that these actions demonstrate our Board’s desire to maintain an open line of communication with our stockholders and to be responsive to stockholder feedback.

We have received notice pursuant to Article II of our Bylaws that Neuberger Berman Investment Advisers LLC (“Neuberger Berman”) intends to nominate three of its own nominees for election to the Board at the 2019 Annual Meeting. Neuberger Berman has indicated its intention to furnish a proxy statement to stockholders of the Company, together with a proxy card. The Board does not endorse any of the Neuberger Berman nominees and unanimously recommends that you disregard any proxy card or soliciting materials that may be sent to you by Neuberger Berman. The Board unanimously recommends that you vote on the WHITE proxy card FOR the election of our nominees below.

9

DIRECTOR NOMINEES RECOMMENDED BY THE BOARD

| Name | Age | Director Since | Position(s) | |||

| Dan Bodner | 60 | 1994 | Chairman of the Board and Chief Executive Officer | |||

| John Egan | 61 | 2012 | Lead Independent Director | |||

| Stephen Gold | 60 | 2018 | Director | |||

| Penelope Herscher | 58 | 2017 | Director | |||

| William Kurtz | 61 | 2016 | Director | |||

| Richard Nottenburg | 65 | 2013 | Director | |||

| Howard Safir | 77 | 2002 | Director | |||

| Earl Shanks | 62 | 2012 | Director | |||

| Dan Bodner serves as our Chief Executive Officer and Chairman of the Board. Mr. Bodner has served as our President and/or Chief Executive Officer and as a director since the founding of the Company in 1994 and assumed the role of Chairman of the Board in August 2017. Under his leadership and his vision of Actionable Intelligence software, we experienced rapid growth and, in 2002, with over $100 million of revenue, we completed a successful IPO. Following the IPO, we continued to expand our portfolio of Actionable Intelligence solutions for the enterprise and security markets, achieving significant scale and global presence with over $1 billion of revenue. The Board has concluded that Mr. Bodner’s position as our Chief Executive Officer, his intimate knowledge of our operations, assets, customers, growth strategies, and competitors, his knowledge of the technology, software, and security industries, and his extensive management experience give him the qualifications and skills to serve as a director and our chairman. |

| John Egan has served as a director since August 2012, and as Lead Independent Director since August 2017. Mr. Egan is a founding managing partner of Egan-Managed Capital and has served as a managing partner of Carruth Associates, a financial services firm, since 1998. From 1986 to 1997, Mr. Egan held various executive roles at EMC Corporation, including serving as executive vice president of operations, executive vice president of products and offerings, and executive vice president of sales and marketing. Mr. Egan has served as a director of NetScout since 2001, where he is currently lead director, a member of the audit committee, a member of the finance committee and chairman of the nominating and governance committee, and Progress Software Corporation since 2011, where he is currently the non-executive chairman of the board and a member of the audit committee. Previously, he was a director of EMC Corporation and VMWare, prior to EMC being acquired by Dell in 2016. The Board has concluded that Mr. Egan’s financial and business expertise, including a diversified background of managing and serving as a director of several public technology companies and expertise in mergers and acquisitions, gives him the qualifications and skills to serve as a director. |

| Stephen Gold has served as a director since August 2018. Mr. Gold has served as Chief Technology Officer and Digital Operations Officer for Hudson’s Bay Company since May 2018 and previously served as Chief Information Officer of CVS Health Corporation from July 2012 to December 2017. In addition to his extensive management experience, Mr. Gold has served since September 2017 as a director and member of the Governance and the Technology and Operations Committees of World Fuel Service Corporation. The Board has concluded that Mr. Gold’s management experience, including serving as Chief Information Officer for both public and private companies and his experience with data analytics and the cloud, gives him the qualification and skills to serve as director. |

10

| Penelope Herscher has served as a director since April 2017. She has over 15 years of experience as a high-tech CEO and over 10 years serving on public company boards. She currently sits on the board of Lumentum Operations LLC, where she is chair of the compensation committee and a member of the governance committee, PROS Holdings, Inc., a cloud software provider, and Faurecia, an automotive supplier of cockpits and technology. Previously she served as a director of Rambus Inc., where she was the chair of the compensation committee from July 2006 to July 2017. From 2015 until 2017, Ms. Herscher served as the executive chairman at FirstRain, Inc., a privately held company in the unstructured data analytics space, where she was President & CEO until 2015. Prior to FirstRain, Ms. Herscher held senior executive positions at a number of software and technology companies, including Cadence Design Systems, Inc. and Simplex Solutions, Inc. The Board has concluded that Ms. Herscher’s financial and business expertise, including her diversified background of managing technology companies, serving as a chief executive officer, and serving as a director of public technology companies, give her the qualifications and skills to serve as a director. |

| William Kurtz has served as a director since September 2016. Until his retirement in January 2019, Mr. Kurtz served as Executive Vice President and Chief Commercial Officer of Bloom Energy Corporation (“Bloom”) where he held such position beginning in 2015, and served prior to that, as the company’s CFO and CCO beginning in 2008. Mr. Kurtz currently serves as a strategic advisor to Bloom. Prior to 2008, he held CFO or other senior finance roles for Novellus Systems (now Lam Research), Engenio Information Technologies, 3PARdata (now part of Hewlett Packard Enterprise), Scient Corporation, and AT&T Corporation. Mr. Kurtz previously served as the chairman of the audit committees of Violin Memory, of PMC-Sierra (now part of Microsemi Corporation), and of Redback Networks (now part of Ericsson). The Board has concluded that Mr. Kurtz’s financial and business expertise, including his prior service as the chief financial officer of public companies and his service on the audit committees of several companies, give him the qualifications and skills to serve as a director. |

| Richard Nottenburg has served as a director since February 2013, having previously served as a director from July 2011 to November 2011. Dr. Nottenburg is currently an Executive Partner at OceanSoundPartners LP, a private equity firm, and an investor in various early stage technology companies. Previously, Dr. Nottenburg served as President and Chief Executive Officer and a member of the board of directors of Sonus Networks, Inc. from 2008 through 2010. From 2004 until 2008, Dr. Nottenburg was an officer with Motorola, Inc., ultimately serving as its Executive Vice President, Chief Strategy Officer and Chief Technology Officer. Dr. Nottenburg is currently a member of the board of directors of Sequans Communications S.A., where he serves as a member of the compensation committee and the audit committee. He previously, served on the boards of directors of PMC-Sierra Inc., Aeroflex Holding Corp., Anaren, Inc., Comverse Technology, Inc. and Violin Memory, Inc. The Board has concluded that Dr. Nottenburg’s financial and business expertise, including his diversified background of managing technology companies, serving as a chief executive officer, and serving as a director of public technology companies, give him the qualifications and skills to serve as a director. |

| Howard Safir has served as a director since 2002. Since 2010, Mr. Safir has served as Chairman and Chief Executive Officer of VRI Technologies LLC, a security consulting and law enforcement integrator. Previously, Mr. Safir served as the Chairman and Chief Executive Officer of SafirRosetti, a provider of security and investigation services and a wholly owned subsidiary of Global Options Group Inc., as well as the Vice Chairman of Global Options Group Inc. and the Chief Executive Officer of Bode Technology, another wholly owned subsidiary of Global Options Group Inc. Mr. Safir currently serves as a director of Citius, a developer of pharmaceutical products, and LexisNexis Special Services, Inc., a leading provider of information and technology solutions to governments, and previously served as a director of Implant Sciences Corporation. During his career, Mr. Safir served as the 39th Police Commissioner of the City of New York, as Associate Director for Operations, U.S. Marshals Service, and as Assistant Director of the Drug Enforcement Administration. Mr. Safir was awarded the Ellis Island Medal of Honor among other citations and awards. The Board has concluded that Mr. Safir’s extensive law enforcement background and his financial and business expertise, including a diversified background of managing and serving as a director of public technology and security-based companies and serving as a chief executive officer, give him the qualifications and skills to serve as a director. |

11

| Earl Shanks has served as a director since July 2012. Since March 2017, Mr. Shanks has served as a director of Gaming & Leisure Properties, Inc. Mr. Shanks served as the Chief Financial Officer of Essendant Inc., a leading supplier of workplace essentials, from November 2015 until May 2017. Previously, Mr. Shanks served as the Chief Financial Officer at Convergys Corporation, a global leader in relationship management solutions and a major provider of outsourced business services, and held various financial leadership roles with NCR Corporation, ultimately serving as the Chief Financial Officer. The Board has concluded that Mr. Shanks’ financial and business expertise, including his deep financial expertise serving as a chief financial officer of a public company, give him the qualifications and skills to serve as a director. |

In addition to the information above, Appendix A sets forth information relating to our directors, nominees for directors, and certain of our officers and employees who may be considered “participants” in our solicitation under the applicable SEC rules by reason of their position as directors, nominees for directors, officers, or employees of the Company or because they may be soliciting proxies on our behalf.

Your vote is important regardless of the number of shares you own. THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” OUR EIGHT DIRECTOR NOMINEES ON THE WHITE PROXY CARD. The Board of Directors does not endorse any of the Neuberger Berman nominees and urges you NOT to sign or return any proxy card sent to you by Neuberger Berman.

For stockholders of record, if no voting specification is made on a properly returned or voted WHITE proxy card, the person or persons voting your shares pursuant to instructions by proxy card will vote FOR this proposal.

12

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTANTS

The audit committee has appointed Deloitte & Touche LLP to act as Verint’s independent registered public accountants for the year ending January 31, 2020. The audit committee has directed that such appointment be submitted to our stockholders for ratification at the 2019 Annual Meeting. Deloitte & Touche LLP was Verint’s independent registered public accountants for the year ended January 31, 2019.

Stockholder ratification of the appointment of Deloitte & Touche LLP as Verint’s independent registered public accountants is not required. The audit committee, however, is submitting the appointment to the stockholders for ratification as a matter of good corporate governance. If the stockholders do not ratify the appointment, the audit committee will reconsider whether or not to retain Deloitte & Touche LLP or to appoint another firm. Even if the appointment is ratified, the audit committee, in its discretion, may direct the appointment of a different accounting firm at any time during the year ending January 31, 2020, if the audit committee determines that such a change would be in our best interests and in the best interests of our stockholders.

Representatives of Deloitte & Touche LLP are expected to be present at the 2019 Annual Meeting and will have an opportunity to make a statement, if they so desire. They will also be available to respond to appropriate questions.

The proposal for the ratification of the appointment of Deloitte & Touche LLP as Verint’s independent registered public accountants for the year ending January 31, 2020 requires approval by the vote of the holders of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote. For the 2019 Annual Meeting, this is not considered a routine matter and banks, brokers, or other nominees may not vote without instructions from the stockholder. Broker non-votes will not affect whether this proposal is approved, however, abstentions will count as votes against the proposal.

For stockholders of record, if no voting specification is made on a properly returned or voted WHITE proxy card, the person or persons voting your shares pursuant to instructions by proxy card will vote FOR this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” PROPOSAL NO. 2.

13

PROPOSAL NO. 3

ADVISORY VOTE TO APPROVE THE COMPENSATION OF

THE NAMED EXECUTIVE OFFICERS

Our stockholders are being asked to approve, on a non-binding, advisory basis, the compensation of our named executive officers, as described in this proxy statement. The Board has adopted a policy of providing for annual advisory votes from stockholders on executive compensation. As a result, the next say-on-pay vote (after the 2019 Annual Meeting) will be at the 2020 annual meeting of stockholders.

| • | This vote is not intended to address any specific item of compensation, but rather our overall compensation policies and practices relating to the named executive officers. Accordingly, your vote will not directly affect or otherwise limit any existing compensation or award arrangement of any of our named executive officers. |

| • | Although this say-on-pay vote is an advisory vote only and is not binding on Verint, the compensation committee, or the Board, the compensation committee and the Board value the opinions of our stockholders and will consider the outcome of the vote when making future compensation decisions. |

Stockholder Engagement Program

In addition to conducting annual say-on-pay votes, we regularly engage with our stockholders to solicit their feedback on executive compensation and corporate governance matters. Over the past two years, we have significantly enhanced our stockholder engagement program, reaching out to a large number and percentage in interest of our stockholders, with the direct participation of our compensation committee chairman.

We believe that this enhanced stockholder engagement was well-received by our investors, as our stockholders approved our say-on-pay proposal at approximately 92% at our last annual meeting. We were pleased with this significantly improved level of support (following a disappointing level of support in the prior two years). Notwithstanding this greatly improved level of support, in FYE 19, we further enhanced our stockholder engagement program, deepening the level of engagement we had with our stockholders on strategy, compensation, and governance related topics.

A majority of the investors we reached out to as part of this process told us that they were satisfied with our executive compensation program, did not have concerns they wished to share with us, and declined our invitation to speak with us in further detail. None of the stockholders we spoke to or communicated with indicated that they had significant issues with our executive compensation program and none suggested reducing the compensation of our CEO or any of our other officers.

We value all stockholder feedback we receive, and the compensation committee discusses and considers all such feedback even where only suggested by a single investor. In response to the feedback we have received from our stockholders over the last several years, we have made a number of key modifications to our executive compensation program for FYE 19 (and beyond), and have refreshed the composition of our Board with three new directors in the last three years. We also discussed and carefully evaluated additional stockholder feedback received in preparation for the FYE 20 compensation season.

Key changes made to our executive compensation program for FYE 19 (and beyond) based on feedback received from our stockholder engagement program and the compensation committee’s annual evaluation process include:

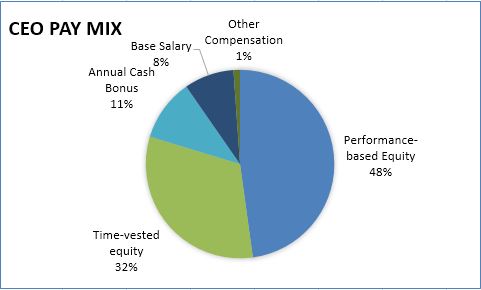

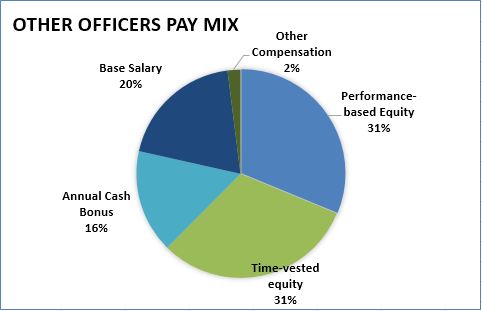

| • | Increasing the proportion of our CEO’s future annual equity awards that are performance-based from 50% to 60%. |

| • | Capping the maximum payout for the relative total stockholder return (TSR) component of our officer performance equity awards granted in 2018 and beyond at 100% if absolute TSR over the performance period is negative (even if relative TSR is strong). |

| • | Eliminating the management by objective (MBO) component of our officer annual bonus plans for FYE 19 and beyond to remove the more subjective elements of the program and make them 100% based on objective financial goals. |

We believe that these actions demonstrate our Board’s desire to maintain an open line of communication with our stockholders and to be responsive to stockholder feedback. Please see “Stockholder Engagement” in the Compensation Discussion and Analysis below for more information on our stockholder engagement efforts and our response.

14

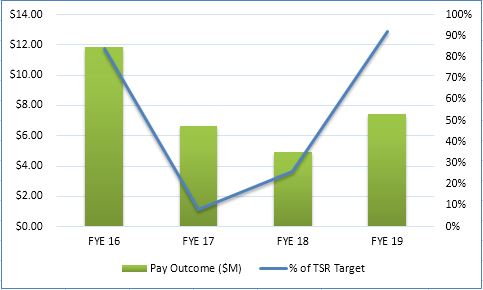

FYE 19 Performance and Pay

We were pleased to report our results for FYE 19 on our year-end conference call in March, with accelerating revenue growth and expanding margins, overachieving both our internal goals for key performance metrics and our guidance for both revenue and EPS. With the momentum we experienced throughout last year and improving visibility, we recently raised our guidance for the second time for FYE 20. We believe that our overachievement, as well as our improved guidance, reflect the successful execution of the growth strategy we started to implement approximately two years ago. This growth strategy has been focused on accelerating our pace of innovation by creating greater operational agility across Verint.

We believe that our FYE 19 executive compensation program demonstrates strong pay-for-performance alignment, with:

| • | Elements of our program tied to short-term goals (annual bonuses) paying above target in FYE 19, in line with short-term performance results above target for FYE 19. |

| • | Elements of our program tied to longer-term goals (performance stock units) also paying above target this year, in line with achievement above target for our two-year revenue and EBITDA goals (for the two-year period ended January 31, 2019). |

The compensation committee takes a long-term view in designing our executive compensation program, taking into account that the Company may experience variability in year by year performance. The compensation committee believes it is important that pay opportunities remain competitive with the peer group and the market at all times to attract and retain the talent needed to grow the Company over the long term.

Please see the Compensation Discussion and Analysis below for more information on our executive compensation program and why you should support it.

The Board strongly endorses our executive compensation program and recommends that stockholders vote “for” the following resolution:

“RESOLVED, that, on an advisory basis, the compensation paid to Verint’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion in this proxy statement, is hereby APPROVED.”

The advisory vote regarding the compensation of the named executive officers as disclosed in this proxy statement requires approval by the vote of the holders of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote. This is not considered a routine matter and banks, brokers, or other nominees may not vote without instructions from the stockholder. Broker non-votes will not affect whether this proposal is approved, however, abstentions will count as votes against this proposal.

If no voting specification is made on a properly returned or voted WHITE proxy card, the person or persons voting your shares pursuant to instructions by proxy card will vote FOR this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” PROPOSAL NO. 3.

15

PROPOSAL NO. 4

APPROVAL OF THE VERINT SYSTEMS INC.

2019 LONG-TERM STOCK INCENTIVE PLAN

On May 9, 2017, our Board of Directors approved (subject to the approval of our stockholders) the Verint Systems Inc. Amended and Restated 2015 Long-Term Stock Incentive Plan (the “Existing Plan”). The Existing Plan is our only active long-term incentive plan. The number of shares which remain available for issuance under the Existing Plan is not sufficient to meet our compensation goals in the coming years. To ensure that we have an adequate number of shares available to properly compensate our employees, directors, and consultants, we are asking our stockholders to approve a new long-term stock incentive plan (the “New Plan”).

The principal features of the New Plan are substantially similar to the principal features of the Existing Plan. Both the Existing Plan and the New Plan provide for several different forms of awards, including, among others, stock options and restricted stock units. Under both plans, grants of restricted stock units (or other so-called “full value” awards) count against the plan’s capacity at a higher rate than grants of stock options (or similar awards). Specifically, under the Existing Plan, each full value share awarded counts as 2.47 shares against the plan’s capacity, while under the New Plan, each full value share awarded would count as [●] shares against the plan’s capacity. As a result, the number of shares available for issuance under the New Plan will be higher on an “option-equivalent” basis than it is on a “full value” basis, however, to date, we have only used the Existing Plan to grant full value awards. In order to provide a more complete understanding of the plans and this share request, we have provided the share numbers below on both an option-equivalent basis and a full value basis.

Summary of the capacity of the Existing Plan, the share request under the New Plan, and the resulting capacity of the New Plan

| Existing Plan | 2019 Plan | ||||

| Starting Capacity | Available at [●], 2019 | New Request | Starting Capacity | ||

| Option-equivalent basis | [●] | [●] | [●] | [●] | |

| Full value basis | [●] | [●] | [●] | [●] | |

The figures in the table above (1) assume that outstanding performance awards vest at the maximum level of achievement (capacity will be higher to the extent performance awards vest at lower levels), (2) exclude any shares which are recycled under the terms of the Existing Plan or the New Plan, and (3) with respect to the new share request and the New Plan, give effect to the proposed adjustment to the rate at which full value shares count against the New Plan’s limit, as described below.

If the New Plan is approved by our stockholders, no new awards will be made under the Existing Plan following the date of such approval. Although no new shares may be granted under the Existing Plan following such approval, all previously granted shares would continue to be governed by the terms of the Existing Plan.

Non-Employee Director Compensation Limit

In connection with approving of the New Plan, the Board of Directors approved a proposal to include in the New Plan an outside limitation on the amount of compensation that can be paid to any non-employee director in respect of any single fiscal year. If the New Plan is approved, the maximum total compensation (including awards under the New Plan, determined based on the fair market value of such awards as of the grant date, as well as any retainer fees) paid to any non-employee director in respect of any single fiscal year would be limited to $[●] (the “Non-Employee Director Compensation Limit”). This limitation is not intended to serve as an increase to the amount of annual compensation that we currently pay our non-employee directors, and no changes were made to our existing non-employee director compensation arrangements in connection with approving the Non-Employee Director Compensation Limit; rather, this action was approved for the purpose of proposing a stockholder-approved limit on the amount of compensation the Board of Directors can pay its non-employee members in respect of any single fiscal year.

In connection with approving the New Plan, stockholders are being asked to ratify the Non-Employee Director Compensation Limit. By voting “FOR” approval of the New Plan, you will be deemed to have also ratified the Non-Employee Director Compensation Limit.

16

Additional Equity Plan Information as of [●], 2019

As of [●], 2019:

•There were a total of [●] shares of our common stock issued and outstanding.

•There were a total of [●] stock options outstanding, with an average exercise price of $[●] and an average remaining term of [●] years.

•There were a total of:

•[●] restricted stock units outstanding, including [●] performance based restricted stock units, at maximum achievement.

•[●] shares available for future award under the Existing Plan on an option-equivalent basis, or [●] shares on a full value basis, at maximum achievement. If the New Plan is approved by our stockholders, no new awards will be made under the Existing Plan following the date of such approval.

•“Burn rate” measures the number of full value basis shares under outstanding equity awards granted during a given year (disregarding cancellations), as a percentage of basic weighted-average common stock outstanding for that fiscal year. Over the past three years, our burn rate was [●]%, [●]%, and [●]% (for the years ended January 31, 2017, 2018 and 2019, respectively), with a three-year average of [●]% on a full value basis (we have only awarded full value shares during these periods). Our three-year average burn rate would have been [●]% on an ISS option-equivalent basis, which is below the ISS three-year average cap of approximately [●]% for our industry.

•“Overhang” measures the total number of full value basis shares under all outstanding equity awards (i.e., share awards granted, less share award cancellations), as a percentage of basic weighted-average common stock outstanding as of the measurement date. Over the past three years, our average annual overhang was [●]%, [●]%, and [●]% (as of [●], 2017, 2018, and 2019, respectively).

•“Dilution” measures the total number of full value basis shares under all outstanding equity awards, plus the number of full value basis shares authorized for future plan awards (the “total actual and potential awards”) divided by the sum of the total actual and potential awards, plus the basic weighted-average common stock outstanding as of the measurement date. Over the past three years, our dilution was [●]% (excluding share capacity under an acquired company equity plan that was subject to restrictions on grant under applicable NASDAQ rules), [●]%, and [●]% (as of [●], 2017, 2018, and 2019, respectively). If the New Plan is approved by our stockholders, our dilution would be [●]%, based on the basic weighted-average common stock outstanding as of [●], 2019.

Reasons Why You Should Vote for Proposal 4

We believe our future success depends on our ability to attract, motivate, and retain high quality employees, directors, and consultants, and that the ability to continue to provide stock-based awards is critical to achieving this success as we compete for talent in an industry in which equity compensation is market practice and is expected by many existing personnel and candidates.

Moreover, we believe that equity compensation motivates employees to create stockholder value because the value employees realize from equity compensation is based on the performance of our stock. Equity compensation also aligns the goals and objectives of our employees with the interests of our stockholders and promotes a focus on long-term value creation.

If the New Plan is not approved, we expect that we would exhaust the remaining available shares under the Existing Plan in [●]. We believe we would be at a severe competitive disadvantage if we cannot use stock-based awards to recruit and compensate our personnel. This would reduce the alignment between our employees and our stockholders, increase our cash compensation expense, and utilize cash that could otherwise be used to grow our business, make acquisitions, repay debt, or for other corporate purposes.

As a result of the foregoing, we believe it is in our best interest and the best interest of our stockholders to adopt the New Plan to provide for additional capacity for awards to current and future employees, directors, and consultants. Our equity compensation practices are benchmarked against market practices and we believe our historical share usage has reflected this. As noted above, as of [●], 2019, we had [●] common shares outstanding. During the last three years, we have granted an average of approximately [●] million full value shares per year in our equity compensation programs, including the reservation of an average of approximately [●] shares per year in the event performance equity goals are overachieved at maximum levels. All of these awards have been in the form of time or performance-based restricted stock units, which count against the Existing

17

Plan capacity at a rate of 2.47 shares each, and would count against the New Plan capacity at a rate of [●] shares each. Assuming future annual share utilization remains at these levels, the [●] option-equivalent shares (or approximately [●] full value shares) that would be available under the New Plan after its approval would last for approximately [●] years assuming maximum levels of achievement or [●] years assuming target levels of achievement, net of forfeitures.

Plan Highlights

Below are select highlights from the New Plan that we feel reflect our commitment to adhering to the best practices set forth by industry standards. We ask that you consider these highlights when casting your vote on Proposal 4.

•Reasonable Plan Limits. Subject to adjustment as described in the New Plan, total awards under the New Plan are limited to the sum of (i) [●] on an option-equivalent basis, plus (ii) the number of shares available for issuance under the Existing Plan on the date the stockholders approve the New Plan, plus (iii) the number of shares that become available for issuance under Section 4(a)(ii) of the Existing Plan or the New Plan. These shares may be shares of original issuance or treasury shares or a combination of the foregoing. The New Plan also provides that, subject to adjustment as described in the New Plan:

| • | no participant will be granted awards under the New Plan for more than [●] shares of common stock during any one fiscal year; and |

| • | no non-employee member of our Board of Directors will be paid compensation (including awards under the New Plan, determined based on the fair market value of such awards as of the grant date, as well as any retainer fees) totaling more than $[●] in respect of any single fiscal year (the “Non-Employee Director Compensation Limit”). |

•Double-Trigger Vesting. The New Plan contains a so-called “double-trigger” vesting provision, which generally provides that outstanding awards will not be accelerated upon a change in control of us if (i) an acquiror replaces or substitutes outstanding awards in accordance with the requirements of the New Plan and (ii) a participant holding the replacement or substitute award is not involuntarily terminated within two years following the change in control.

•Independent Plan Administrator. The compensation committee, which is composed of independent directors, administers the New Plan, and retains full discretion to determine the number and amount of awards to be granted under the New Plan, subject to the terms of the New Plan.

•Full Value Awards Weighted More Heavily. The settlement of one share pursuant to a full value award is deemed to reduce the authorized share pool under the New Plan by [●] shares.

•No Discounted Stock Options. The New Plan requires that the exercise price for newly-issued stock options (other than substitute awards) may not be less than the fair market value per share on the date of grant.

•Prohibition of Dividends or Dividend Equivalents on Unvested Awards. The New Plan prohibits the current payment of dividends or dividend equivalents with respect to shares underlying awards prior to the vesting of such awards. Any such dividends or dividend equivalents will be deferred until, and contingent upon, vesting of the underlying award.

•Stockholder Approval of Material Amendments. The New Plan requires us to seek stockholder approval for any material amendments to the New Plan, such as materially increasing benefits accrued to participants, materially increasing the number of shares available, and increasing the Non-Employee Director Compensation Limit.

•Prohibition on Repricing. The New Plan prohibits the repricing of outstanding stock options without stockholder approval (outside of certain corporate transactions or adjustments specified in the New Plan). Similarly, the New Plan does not provide for the repricing of stock appreciation rights.

•No Transfers of Awards for Value. The New Plan requires that no awards granted under the New Plan may be transferred for value, subject to exceptions for certain familial transfers.

•Our Response to Detrimental Activity by Participants. The New Plan allows for the cancellation or forfeiture of an award or the forfeiture and repayment of any gain related to an award if a participant engages in activity detrimental to our company, whether discovered before or after the employment service period.

18

Summary of the New Plan

Set forth below is a summary of the principal features of the New Plan. The principal features of the New Plan are substantially similar to the principal features of the Existing Plan. This summary is not intended to be exhaustive and is qualified in its entirety by reference to the terms of the New Plan, a copy of which is included in this proxy statement as Appendix B.

Purpose

The purpose of the New Plan is to attract and retain employees, directors, and consultants of the Company and its subsidiaries and to motivate such individuals, provide them with incentives and enable them to participate in our growth and success.

The New Plan authorizes our Board of Directors to provide equity-based compensation in the form of (1) stock options, including incentive stock options (“ISOs”) entitling the participant to favorable tax treatment under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), (2) stock appreciation rights (“SARs”), (3) restricted stock, (4) restricted stock units (“RSUs”), (5) performance awards and (6) other stock-based awards (“Other Stock-Based Awards”). Each type of award is described below under “Types of Awards Under the New Plan.”

Awards under the New Plan that are not immediately vested and delivered as of the grant date will be evidenced by an award agreement setting forth the award’s terms and conditions.