May 6, 2014

Mr. Larry Spirgel

Assistant Director

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

| Re: | Comcast Corporation | |

| Form 10-K for the Year Ended December 31, 2013 | ||

| Filed February 12, 2014 | ||

| File No. 1-32871 |

Dear Mr. Spirgel:

We are writing this letter to respond to the comment letter (the “Form 10-K comment letter) of the Staff of the Securities and Exchange Commission (the “Staff”) dated April 11, 2014, relating to the review of our Form 10-K for the fiscal year ended December 31, 2013 (the “Form 10-K”). For your convenience, we have reproduced the Staff’s comment preceding our response below. Please let us know if you have any questions or if we can provide additional information or otherwise be of assistance in expediting the review process.

We note that the same comment raised in your Form 10-K comment letter was also raised as comment #29 in the Staff’s comment letter dated April 16, 2014 (the “Form S-4 comment letter”) regarding Comcast Corporation’s Registration Statement on Form S-4 filed on March 20, 2014 (File No. 333-194698). As discussed with Mr. Kisner, in our response to comment #29 of the Form S-4 comment letter, we will refer to our response in this letter.

Item 7: Management's Discussion and Analysis of Financial Condition and Results of Operations, page 46

Critical Accounting Judgments and Estimates, page 71

Valuation and Impairment Testing of Cable Franchise Rights, page 71

| 1. | Please tell us how you considered the factors in paragraphs 21-24 of ASC 350-30-35 in concluding that you have 3 units of accounting for your cable franchise rights impairment testing. Furthermore, please tell us which states and regional field operations comprise your 3 divisions or units of accounting. |

| Securities and Exchange Commission | May 6, 2014 |

Response

The following provides (i) an overview of our cable franchise rights impairment testing since the adoption of ASC 350-30-35 (formerly FAS No. 142), (ii) our division and regional structure, including the states in which we operate our cable communications business, (iii) the factors considered related to the specific indicators included in ASC 350-30-35 paragraphs 21-24 and (iv) our conclusion that, of the possible units of account, the Cable Communications Segment level or the Division level are the appropriate units of account for testing franchise rights for impairment.

Our possible units of account are: (i) Region, (ii) Division and (iii) Cable Communications Segment. Specifically, as of December 31, 2013, we had:

| · | 16 Regions (see “Division and Regional Structure” below for a listing of our Regions) |

| · | 3 Divisions (see “Division and Regional Structure” below for a listing of our Divisions) |

| · | 1 Cable Communications Segment |

While in previous correspondence with the Staff we had also noted that franchises, systems and areas, were possible units of account, we no longer track this information for management purposes as a result of the centralization of our operations.

Overview of our Cable Franchise Rights Impairment Testing Since the Adoption of ASC 350-30-35

We currently serve approximately 6,400 franchise areas in the United States. The value of a franchise derives from the economic benefits we receive from the right to solicit new cable customers and to market additional services to existing customers in a particular service area. The amounts we have recorded for cable franchise rights are the result primarily of cable system acquisitions, which often include multiple franchise areas. Typically when we acquire a cable system, the most significant asset we record is the value of the cable franchise rights intangible asset.

Our business model seeks to maximize financial return through economies of scale. We have gained scale primarily through numerous cable acquisitions occurring over a number of years that have enabled us to deliver our services across our increasingly national footprint. This scale allows us to enhance our franchise rights through our ability to offer an increasing number of services and products to all of our customers, including video, high-speed Internet and voice services, and home security and automation services, as well as advertising.

| · | It is important to emphasize that we are not a group of regional cable systems. Over the last ten years, we have spent hundreds of millions of dollars developing a nationwide network, with a number of platforms for national service delivery including our On Demand services, a core voice platform, national IT systems for customer care and self-service, and most recently, our X1 platform (“X1”). As a result, we have a nationwide network through our core IP backbone and cloud-based services. Among other things, our X1 platform allows us to upgrade X1 capable set-top boxes via the cloud across our footprint. We have developed the capability that allow customers to set their DVR or watch certain recorded or live programming while they are away from home on the Internet or through apps for mobile devices. The Xfinity TV Go app enables customers to watch live streaming of more than 35 linear channels directly on their mobile devices nationwide. We also are deploying a nationwide network of WIFI hot spots both |

2

| Securities and Exchange Commission | May 6, 2014 |

through standalone equipment and through our wireless gateways that reside in customers’ homes. We would not have been able to develop this national network without our large collection of franchise rights, operating as single networked asset, to provide the scale and capabilities needed to achieve this. The proposed Time Warner Cable merger will allow us to continue to enhance our national network and thereby enhance our single franchise asset.

When we initially adopted FAS No. 142 in 2002, the unit of account at which we tested for impairment was the Cable Communications segment. As a result of the SEC comment letter process in 2003 (the “2003 Comment Letter”), we agreed to change the unit of account used for impairment testing. The Staff did not prescribe the level at which testing should be performed but indicated that the lowest levels (i.e., individual franchises, systems or areas) would not appear appropriate due to their significant number and the administrative burden impairment testing at such levels would create. Beginning in the first quarter of 2004, we changed the unit of account used for testing impairment to the 21 Regions in which we then operated. The Regions are part of larger geographic components, which represent our Divisions. The Regions mainly represent divisions of management span of control and monitoring mechanisms and do not represent groupings where the franchises are “operated as a single asset.” For example, a Region is not necessarily a specific metropolitan area (see “Division and Regional Structure” below).

In 2007, we reassessed our unit of account for franchise rights impairment testing, because we had been frequently reorganizing the Regions resulting from centralization of our operations. As a result of the multiple reorganizations at the regions and review of paragraphs 21 to 24 of ASC 350-35, we concluded that the Division level was the more appropriate unit of account. As stated in the memo memorializing our conclusions in 2007, we made the change because of the number of reorganizations at the Regional level that had occurred since we began testing at that level in 2004, and the expectation that we would further reduce the number of Regions in light of the further centralization of our operations, including setting up shared services centers for most of our administrative functions and new competition from companies with broad geographic reach.

Division and Regional Structure

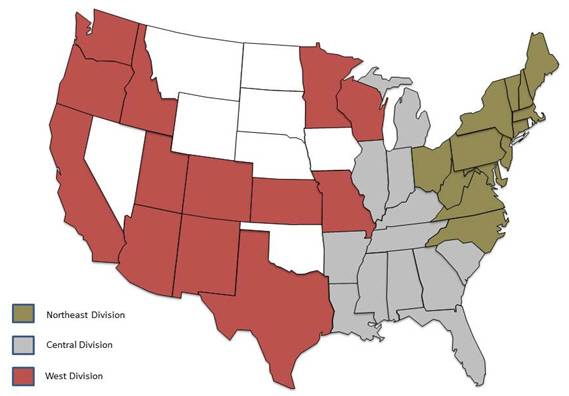

The following is a map of our current three Divisions followed by the 16 Regions included within those Divisions:

3

| Securities and Exchange Commission | May 6, 2014 |

| Northeast (5 Regions) | Central (4 Regions) | West (7 Regions) | ||||||

| 1. | Washington, D.C., portions of Maryland, Virginia, portions of Delaware, North Carolina and West Virginia | 1. | Central and northern Illinois, including the Chicago area, Northwest Indiana and southwest Michigan | 1. | California | |||

| 2. | Southeastern Pennsylvania, New Jersey and portions of Delaware | 2. | Florida | 2. | Colorado, New Mexico | |||

| 3. | Western New England including Connecticut, Vermont, portions of Massachusetts, portions of New Hampshire, and New York | 3. | Arkansas, Central Kentucky, Indiana and portions of Michigan | 3. | Texas |

4

| Securities and Exchange Commission | May 6, 2014 |

| Northeast (5 Regions) | Central (4 Regions) | West (7 Regions) | ||||||

| 4. | Central and Western Pennsylvania, Ohio and Western Maryland | 4. | Alabama, Georgia, Louisiana, Mississippi, Tennessee, South Carolina | 4. | Oregon and Southwest Washington | |||

| 5. | Maine, portions of Massachusetts, including the Boston area, and portions of New Hampshire | 5. | Utah, Arizona and Idaho | |||||

| 6. | Washington (except Southwest Washington) | |||||||

| 7. | Minnesota and portions of Missouri, Wisconsin and Kansas |

Factors Considered Related to the Specific Indicators in ASC 350-35

ASC 350-35 (formerly EITF 02-7) addresses the issues that arise when companies acquire intangible assets in separate transactions and those individual assets are collectively used in a manner that suggests they represent one asset. ASC 350-35 states that separately recorded indefinite-lived intangible assets should be combined into a single unit of account for purposes of impairment testing if they are operated as a single asset and, as such, are essentially inseparable from one another. Furthermore, the guidance acknowledges that determining whether several indefinite-lived intangible assets are essentially inseparable is a matter of judgment that depends on the relevant facts and circumstances.

When considering the appropriate unit of account level, it is important to note the following from the EITF 02-7 Issues Summary:

“there appeared to be general consensus that testing impairment of each individual asset would be unduly costly, and more importantly, would not be consistent with the manner in which an entity manages those assets.”

The following was also in the EITF 02-7 Issue Summary and taken from FAS No. 142, paragraph B103:

“It was important to the Board that the impairment test be performed at a level at which information about the operations of an entity and the assets and liabilities that support the operations are documented for internal reporting purposes (and possibly for external reporting purposes). That approach reflects the Board’s belief that the information an entity reports for internal use will reflect the way the overall entity is managed.”

The following are the indicators outlined in ASC 350-35 paragraphs 21 to 24 and our considerations in concluding that either the Division level or the Cable Communications Segment level is the appropriate unit of account.

5

| Securities and Exchange Commission | May 6, 2014 |

Indicators that two or more indefinite-lived intangible assets should be combined as a single unit of accounting for impairment testing purposes:

| a. | The intangible assets were purchased in order to construct or enhance a single asset (that is, they will be used together). |

As stated above, we have spent hundreds of millions of dollars in developing a technologically sophisticated network infrastructure and platforms that deliver consistent service throughout our footprint. Further, the key components and processes of our cable operations are controlled and managed by a centralized Cable Headquarters, including contracting for programming, capital and new technology development and deployment, plant engineering, customer service, marketing, legal and government/franchise affairs. These key components and other administrative processes are listed in Appendix A along with the level at which the relevant management oversight resides. Further, as stated above, our business model seeks to maximize financial return through economies of scale. This scale allows us to enhance our franchise rights through our ability to offer on an economical basis an increasing number of services and products to our customers across our footprint over this single asset, including video, high-speed Internet, voice and home security and automation services, as well as advertising.

Competition from telecommunications companies (e.g., Verizon and AT&T) has increased, and more recently, Google, has announced its intention to increase its deployment of fiber based video and high-speed Internet services. Competition has and will continue to cause a greater national focus on our cable network infrastructure and the marketing and advertising of our services. This national focus decreases the likelihood of separating our cable company into geographic regions; if anything, further consolidation of the industry appears more likely, as evidenced by our proposed merger with Time Warner Cable and the recently announced proposed transactions with Charter. As part of these transactions, we will not only gain customers, but will obtain more strategically located geographic areas.

| b. | Had the intangible assets been acquired in the same acquisition they would have been recorded as one asset. |

The franchise rights acquired in our acquisitions have been recorded as one asset and have only been allocated to individual franchises if required for tax or other compliance reporting purposes. Consistent with this, had all of our franchise rights been acquired in one acquisition, we would have recorded them as one asset at the segment level. For example, we acquired approximately 2,500 franchises in our acquisition of AT&T Broadband, which were recorded as one asset. Allocation of franchise rights below the cable segment level forces us to perform what is effectively an “arbitrary” valuation process and requires the development of separate long range plans in order to prepare valuations solely for the purpose of annual impairment testing.

| c. | The intangible assets as a group represent the highest and best use of the assets (for example, they yield the highest price if sold as a group). This may be indicated if it is unlikely that a substantial portion of the assets would be sold separately or the sale of a substantial portion of the intangible assets individually would result in a significant reduction in the fair value of the remaining assets as a group. |

6

| Securities and Exchange Commission | May 6, 2014 |

We believe that the aggregation of multiple geographically contiguous franchises with national reach represent the highest and best use of the assets. Our experience in the industry has shown that the combined value of multiple franchises owned is significantly greater than the sum of the values of the individual franchises. This is supported by SNL Kagan in a 2013 report in which they cited that “the 10-year averages of VPS (Value Per Subscriber) and cash flow multiples clearly show the premium that has been put on size over the years, with systems with more than 100,000 subs getting a big jump in value versus smaller systems”. The increased value of the aggregated franchises is due to economies of scale gained in capital and new technology deployment, programming, advertising, customer service, and other areas. For this reason, we would not sell a substantial portion of our assets separately unless it were part of a broader transaction to increase our national footprint, such as our transaction with Time Warner Cable in 2006 resulting from the cable systems divested in the Adelphia bankruptcy, or our proposed merger with Time Warner Cable. We also engage in transactions to rationalize and consolidate our footprint as with the recently announced transactions with Charter. In the 2006 transaction, we exchanged systems with Time Warner Cable, but in that overall transaction we increased video customers by 1.7 million. Likewise, in the proposed merger with Time Warner Cable and related transactions with Charter, we will ultimately gain over 7 million customers, even with our proposed 3.9 million customer divestiture. As part of this transaction, we will not only gain customers, but with the proposed exchange with Charter, we will obtain more strategically located geographic areas. Were it not for regulatory considerations, in fact, we would not have offered to divest subscribers in connection with the TWC merger. If we were to sell a substantial portion of our franchises, it would reduce the value of the remaining assets. While there have been limited instances where we have disposed of non-strategic systems, they were de minimis to our operations and not geographically strategic.

| d. | The marketing or branding strategy provides evidence that the intangible assets are complementary, as that term is used in paragraph 805-20-55-18. |

All marketing efforts and plans are developed and coordinated at Cable Headquarters. One hundred percent of our media advertising is deployed on a national basis through national advertising agencies. We market our residential cable services nationally under the Xfinity brand and our business service under Comcast Business. We can sell and market these services this way because of our large portfolio of franchise rights operating as a single asset. The Xfinity brand was launched in February 2010 and was introduced coincident with the deployment of DOCSIS 3.0 and the all-digital migration of our TV programming. The Xfinity brand name stands for “cross platform,” “infinite content,” and “always improving.” Since the launch in 2010, the pace of innovation has accelerated significantly, as many new product improvements, features and services have been introduced into the marketplace through our marketing and branding campaigns. This includes our Xfinity TV apps that provide access to content with the ability to watch recorded and some live programming from mobile devices or to use mobile devices as a remote control for the TV and numerous other products and services under the Xfinity brand. There are no media campaigns developed outside of Cable Headquarters and the branding and the messaging are the same across our national footprint. Only the support staff needed to deploy the campaigns and to tailor the campaigns for a particular area occurs outside of Cable Headquarters. All tailored local offers are reviewed and approved by Cable Headquarters.

Indicators that two or more indefinite-lived intangible assets should not be combined as a single unit of accounting for impairment testing purposes:

| e. | Each intangible asset generates cash flows independent of any other intangible asset (as would be the case for an intangible asset licensed to another entity for its exclusive use). |

7

| Securities and Exchange Commission | May 6, 2014 |

Our individual franchises could rarely be operated as a single asset, and certainly not on a profitable basis. Revenue can be captured at the franchise level, but it would only represent the cash inflows and only certain direct costs incurred. The full costs associated with these revenues are not fully allocated because contracting for programming, capital and new technology development and deployment, plant engineering, customer service, marketing, legal and government/franchise affairs, and other administrative functions are all managed at Cable Headquarters (see Appendix A). To obtain meaningful cash flow information at the Region, System or Franchise level, significant cost allocations would need to be prepared. As such, we do not prepare separate fully allocated historical income statement and balance sheet information at the Region, System or Franchise level nor do we prepare fully allocated budgets and long range plans at these levels.

| f. | If sold, each intangible asset would likely be sold separately. A past practice of selling similar assets separately is evidence indicating that combining assets as a single unit of accounting may not be appropriate. |

As stated above, further consolidation of the cable industry is likely, as evidenced by our proposed merger with Time Warner Cable. The competitive environment and the technology necessary to deliver advanced video and high-speed Internet services are among the primary reasons for this consolidation. As such, a single franchise would not likely be sold to be operated independently. In the late 1990’s and early 2000’s, we entered into exchange transactions involving certain of our franchises for those held by other cable operators to fill geographic gaps in our franchise areas, though the purpose of these transactions was to enhance the value of the portfolio of our franchises as a whole. These exchanges occurred prior to our 2002 acquisition of AT&T Broadband, a transaction that tripled the size of our company and resulted in our achieving a national scale. As stated above, in our 2006 transaction with Time Warner Cable resulting from the cable systems divested in the Adelphia bankruptcy, we exchanged systems with Time Warner Cable but in that transaction we increased our video customers by 1.7 million.

| g. | The entity has adopted or is considering a plan to dispose of one or more intangible assets separately. |

As stated above, in the proposed merger with Time Warner Cable and related transactions with Charter, we have agreed to divest 3.9 million video customers. However as part of these transactions, we will gain over 7 million customers, and through the proposed exchange with Charter, we will obtain more strategically located geographic areas. Again, this disposition is part of a much larger transaction, where we are otherwise expanding and enhancing our geographic footprint and the value of our cable franchise asset.

| h. | The intangible assets are used exclusively by different asset groups (see the Impairment or Disposal of Long-Lived Assets Subsections of Subtopic 360-10). |

We acknowledge that, for purposes of identifying long-lived asset groups to be tested for recoverability under ASC 360-10, we would likely test for recoverability at the region level or lower depending on the circumstances. However, it is important to understand that major portions of the assets and processes are shared, such as the network and delivery platforms, such that if a triggering event occurred that required a detailed fair value assessment of one of these long-lived asset groups, we would have to prepare fully allocated cash flows by long lived asset group, and significant cost allocations would be required given our organizational structure. As illustrated in one of the examples in the guidance (350-30-55 paragraphs

8

| Securities and Exchange Commission | May 6, 2014 |

36-38), it is likely not unusual to have long-lived asset groups being tested at a lower level, and we do not believe that this specific indicator is determinative.

| i. | The economic or other factors that might limit the useful economic life of one of the intangible assets would not similarly limit the useful economic lives of other intangible assets combined in the unit of accounting. |

We have concluded that our cable franchise rights have an indefinite useful life since there are no legal, regulatory, contractual, competitive, economic or other factors that limit the period which these rights will contribute to our cash flows. However, there could be factors, such as competition or obsolescence caused by the development of new technology that could conceivably impact the value or useful life determination of our franchises in the future. If such factors were to arise, we believe that these factors would impact all of our franchises as a single unit, not any of our franchises individually, and likely would impact the entire cable industry as a whole.

Conclusion

We believe that our Cable Communications segment is the most appropriate unit of account for purposes of the impairment testing of our cable franchise rights intangible. However, in light of the 2003 Comment Letter, we have used our three Divisions as the units of account, which we believe are the lowest appropriate unit of account, since 2007. Our conclusion is based on the factors outlined above, including that (i) all of the critical processes associated with the franchise rights are managed and operated at the Cable Headquarters or Division level, (ii) our franchises utilize our national network infrastructure and platforms that deliver the services that underlie the value of our franchise asset, and (iii) Cable Headquarters is the level at which discrete fully allocated financial information, including actual results, annual budgets and long range plans, are prepared and available.

These factors are supported by our interpretation of the underlying principle and intent of ASC 350-35 that the unit of account testing level should not be unduly costly and, most importantly, should be consistent with the manner in which an entity manages those assets. This principle of “how the asset is managed” is consistent with how the wireless industry concluded that their multiple geographic FCC wireless spectrum licenses should be aggregated into one unit of account, as reflected in the disclosures below.

AT&T - FCC licenses are tested for impairment on an aggregate basis, consistent with the management of the business on a national scope.

Verizon - We aggregate our wireless licenses into one single unit of accounting, as we utilize our wireless licenses on an integrated basis as part of our nationwide wireless network.

Our conclusion is also consistent with our components for goodwill impairment testing (one level below the segment level) and with most of our cable industry peers.

* * *

9

| Securities and Exchange Commission | May 6, 2014 |

In connection with our response to the Staff’s comments, Comcast Corporation acknowledges that:

| · | Comcast Corporation is responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | Comcast Corporation may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Please do not hesitate to call me at (215) 286-8514 with any questions you may have with respect to the foregoing.

/s/ Lawrence J. Salva |

Senior Vice President, Chief Accounting Officer and Controller Comcast Corporation |

Brian L. Roberts, Chairman of the Board and Chief Executive Officer Michael J. Angelakis, Vice Chairman and Chief Financial Officer Arthur R. Block, Senior Vice President, General Counsel and Secretary J. Michael Cook, Director and Chairman of Audit Committee Bruce K. Dallas, Davis Polk & Wardwell LLP Michael Titta, Deloitte & Touche LLP |

10

| Securities and Exchange Commission | May 6, 2014 |

APPENDIX A

| Key Business Process | Cable HQ | Divisions | Regions | Comments | |||||

| Budget and Long Range Plans (LRP)- Including revenue & cash flow and free cash flow growth targets | X | Budget and LRP targets are developed by Cable HQ. | |||||||

| Accounting | X | Through a shared services group within Cable HQ, including payables and payroll. | |||||||

| Operating Cash Flow Analysis | X | X | X | Revenue available at Cable HQ, Divisions and Regions. Expenses are not fully allocated below Cable HQ. | |||||

Balance Sheet Analysis | X | ||||||||

| Programming Rates | X | All programming contracts are negotiated centrally by Cable HQ management. Channel line-ups are managed by Cable HQ. | |||||||

| Pricing | X | X | Standardization of pricing, driven by Cable HQ and annual pricing strategy developed at Cable HQ with execution by Divisions. | ||||||

| Significant operating strategies impacting asset valuation | X | X | Cable HQ develops overall business strategies that impact asset valuation with execution by Divisions. | ||||||

| New Product Launches | X | X | Development of new products principally resides at the Cable HQ level. Operational execution of new product launches (timing, etc.) is determined at the Cable HQ & Division levels. | ||||||

11

| Securities and Exchange Commission | May 6, 2014 |

| Key Business Process | Cable HQ | Divisions | Regions | Comments | |||||

| Marketing | X | X | Centralized & standardized marketing messages are developed at Cable HQ and Divisions. Media 100% nationally managed. | ||||||

| Revenue Assurance Management | X | X | Centralized function at Cable HQ with reporting metrics sent to Divisions for execution. | ||||||

| Product Catalog | X | Development of standard listing of products & pricing to streamline provisioning & billing system setup processes. | |||||||

| Customer Service Call Centers | X | X | Standardization of processes driven by Cable HQ and executed by Divisions. | ||||||

| Procurement | X | Managed at Cable HQ level. | |||||||

| Capital Management | X | X | Cable HQ is responsible for budgeting, forecasting and deploying capital with execution by Divisions. | ||||||

| Inventory / Logistics Management | X | X | Cable HQ is responsible for deployment of inventory and logistics with execution by Divisions. | ||||||

| Network Infrastructure Management | X | X | Managed by Cable HQ with execution by Divisions. | ||||||

| Government Affairs/Legal | X | Managed at Cable HQ. |

12