UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21034

SANFORD C. BERNSTEIN FUND II, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: September 30, 2009

Date of reporting period: September 30, 2009

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

2

SANFORD C. BERNSTEIN FUND II, INC.

INTERMEDIATE DURATION INSTITUTIONAL PORTFOLIO

ANNUAL REPORT

SEPTEMBER 30, 2009

Portfolio Manager Commentary

To Our Shareholders—November 23, 2009

This report provides management’s discussion of Portfolio performance for the one portfolio of the Sanford C. Bernstein Fund II, Inc. for the annual reporting period ended September 30, 2009.

Investment Objective and Strategy

Bernstein Intermediate Duration Institutional Portfolio (the “Portfolio”) seeks to provide safety of principal and a moderate to high rate of current income. The Portfolio will seek to maintain an average portfolio quality minimum of A, based on ratings given to the Portfolio’s securities by national rating agencies (or, if unrated, determined by AllianceBernstein L.P., the Adviser, to be of comparable quality). Many types of securities may be purchased by the Portfolio, including corporate bonds, notes, US Government and Agency securities, asset-backed securities (ABS), mortgage-related securities, bank loan debt, preferred stock and inflation-protected securities, as well as others.

The Portfolio may also invest up to 25% of its total assets in fixed-income, non-US dollar-denominated foreign securities, and may invest without limit in fixed-income, US dollar-denominated foreign securities, in each case in developed or emerging-market countries. The Portfolio may use derivatives, such as options, futures, forwards and swaps. The Portfolio may invest up to 25% of its total assets in fixed-income securities rated below investment grade (BB or below) by national rating agencies (commonly known as “junk bonds”). Not more than 5% of the Portfolio’s total assets may be invested in fixed-income securities rated CCC by national rating agencies. The Portfolio seeks to maintain an effective duration of three to six years under normal market conditions.

Investment Results

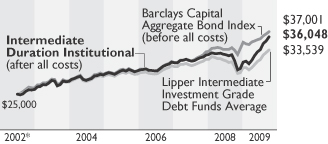

The chart on page 4 shows performance for the Portfolio compared with its benchmark, the Barclays Capital Aggregate Bond Index, for the six- and 12-month periods ended September 30, 2009.

The Portfolio outperformed the benchmark for the six- and 12-month periods ended September 30, 2009. The Portfolio’s US Investment Grade: Core Fixed Income Team’s (the “Team’s”) positioning of the Portfolio to capitalize on record wide yield spreads of credit benefited performance for the six- and 12-month periods. The following positions were positive: an overweight in investment-grade corporates and commercial mortgage-backed securities (CMBS), allocations in non-investment-grade corporates and an underweight in Treasuries. Leverage did not have any meaningful impact on performance for the six- or 12-month periods.

Market Review and Investment Strategy

The challenges of the latter part of 2008 continued into early 2009 as asset prices in many markets continued to fall and policymakers scrambled to combat the severe global economic downturn. By the second quarter of 2009, however, signs of a bottoming of the recession resulted in a significant rally in credit sectors as well as equities. Capital markets rebounded on growing evidence that aggressive policy action on a global scale had been successful at staving off a depression-type scenario. Risk assets continued the rally into the third quarter as evidence mounted that the global economy was emerging from a deep recession and appeared on track for a return to modest economic growth in 2010.

Bond returns were bifurcated during the 12-month period ended September 30, 2009, with negative non-government bond returns early in the period reflecting last fall’s financial crisis and risk aversion, while Treasury and government-related debt benefitted from investor risk aversion early in the period and then underperformed later in the period as investor risk appetite returned.

Investment-grade corporate bond spreads during the crisis peaked in excess of 600 basis points over duration matched Treasuries in mid-December 2008. The second half of the 12-month period was marked by historic recovery with investment-grade corporate bonds returning 19.41%; spreads tightened significantly from their wide levels to end the 12-month reporting period at 218 basis points over Treasuries. Spreads on CMBS similarly widened to historically high levels of almost 1600 basis points over Treasuries, before the period ended September 30, 2009, at 537 basis points over Treasuries. CMBS returned –15.14% between September 30, 2008–March 31, 2009 and 26.75% for the second half of the annual period. The events of the past year were historic as non-government bonds completed one of the fastest recoveries on record following the largest downturn on record.

While risk premiums remain high versus historical norms, they have receded dramatically from their heights at the peak of the credit crisis. Liquidity is returning and credit is becoming more readily available as the securitization markets unfreeze, although credit growth remains slow. Corporate earnings appear to have reached bottom after a two-year plunge, and positive earnings surprises are increasing. The economic

(Portfolio Manager Commentary continued on next page)

Portfolio Manager Commentary (continued)

recovery—which began in China and other parts of Asia in the second quarter—appeared to gain speed and traction globally in the third quarter. Industrial production has rebounded sharply around the world. In the US, the Institute for Supply Management manufacturing composite index has risen above the 50% threshold—which indicates expansion—for the first time in 18 months. Surging new orders have prompted automakers and other manufacturers to restock depleted inventories to meet pent-up demand.

Massive doses of coordinated monetary and fiscal stimulus from governments and central banks around the world have also provided impetus for the recovery—and just a portion of the nearly $800 billion of fiscal stimulus funds promised by the Obama administration have been disbursed or realized so far. The bulk of the spending is due in 2010.

Major central banks are unlikely to reverse their extraordinary monetary easing as long as inflation pressures remain low. The continuation of extremely accommodative monetary policies has supported the rebound in risk assets: by keeping short-term interest rates low, central banks are essentially raising the opportunity cost of staying in “safe” assets such as cash and short-term government bonds. Despite extremely low yields, significant pools of money remain on the sidelines. Reentry of these funds into the market could, in the Team’s view, extend the current credit rally. The Team believes opportunities in the credit markets remain compelling, and that investors may likely be rewarded for sticking to a disciplined, long-term approach to asset allocation.

| | |

| 2 | | Sanford C. Bernstein Fund II, Inc. |

Historical Performance

An Important Note About the Value of Historical Performance

The performance shown on page 4 represents past performance and does not guarantee future results. Performance information is as of the dates shown. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.bernstein.com and clicking on “Updated Mutual Fund Performance & Holdings” at the bottom of any screen.

The investment return and principal value of an investment in the Portfolio will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. Before investing in any portfolio of the Sanford C. Bernstein Fund II, Inc., a prospective investor should consider carefully the portfolio’s investment objectives, policies, charges, expenses and risks. For a copy of the Portfolio’s prospectus, which contains this and other information, visit our website at www.bernstein.com and click on “Prospectuses, SAIs and Shareholder Reports” at the bottom of any screen. You should read the prospectus carefully before investing. Returns do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. All fees and expenses related to the operation of the Portfolio have been deducted.

During the reporting period, the Adviser waived a portion of its advisory fee or reimbursed Bernstein Intermediate Duration Institutional Portfolio for a portion of its expenses to the extent necessary to limit the Portfolio’s expenses to 0.45%. This waiver extends through the Portfolio’s current fiscal year and may be extended by the Adviser for additional one-year terms. Without the waiver, the Portfolio’s expenses would have been higher and its performance would have been lower than that shown.

Benchmark Disclosures

Neither of the following indices or averages reflects fees and expenses associated with the active management of a mutual fund portfolio. The Barclays Capital Aggregate Bond Index represents the US investment-grade fixed-rate bond market, including government and credit securities, agency mortgage pass-through securities, ABS and CMBS. The Lipper Intermediate-Term Investment Grade Debt Funds Average is the equal-weighted average returns of the funds in the relevant Lipper Inc. category; the average fund in a category may differ in composition from the fund. The Lipper Intermediate-Term Investment Grade Debt Average contains funds that invest primarily in investment-grade debt issues (rated in the top four grades) with dollar-weighted average maturities of five to ten years. An investor cannot invest directly in an index or average, and their results are not indicative of the performance for any specific investment, including the Portfolio.

A Word About Risk

Bernstein Intermediate Duration Institutional Portfolio: Price fluctuation may be caused by changes in the general level of interest rates or changes in bond credit-quality ratings. Increases in interest rates may cause the value of the Portfolio’s investments to decline. Changes in interest rates have a greater effect on bonds with longer maturities than on those with shorter maturities. Investments in the Portfolio are not guaranteed because of fluctuation in the net asset value of the underlying fixed-income-related investments. Similar to direct bond ownership, bond funds have the same interest rate, inflation and credit risks that are associated with the underlying bonds owned by the fund. Portfolio purchasers should understand that, in contrast to owning individual bonds, there are ongoing fees and expenses associated with owning shares of bond funds. The Portfolio invests principally in bonds and other fixed-income securities. High-yield bonds involve a greater risk of default and price volatility than other bonds. Investing in non-investment-grade securities presents special risks, including credit risk. The Portfolio can invest up to 25% of its assets in below investment-grade (BB or below) bonds (“junk bonds”), which are subject to greater risk of loss of principal and interest, as well as the possibility of greater market risk, than higher-rated bonds.

The Portfolio can invest in foreign securities. Investing in foreign securities entails special risks, such as potential political and economic instability, greater volatility and less liquidity. In addition, there is the possibility that changes in value of a foreign currency will reduce the US dollar value of securities denominated in that currency. These risks are heightened with respect to investments in emerging-market countries where there is an even greater amount of economic, political and social instability.

In order to achieve its investment objectives, the Portfolio may at times use certain types of investment derivatives, such as options, futures, forwards and swaps. These instruments involve risks different from, and in certain cases, greater than, the risks presented by more traditional investments. The Portfolio’s risks are fully discussed in its prospectus.

(Historical Performance continued on next page)

Historical Performance (continued from previous page)

Intermediate Duration Institutional Portfolio vs. Its Benchmark and Lipper Average

| | | | | | | | | | | | | | | | |

| | | TOTAL RETURNS | | | AVERAGE ANNUAL TOTAL RETURNS | | | |

| THROUGH SEPTEMBER 30, 2009 | | PAST SIX

MONTHS | | | PAST 12

MONTHS | | | PAST

FIVE YEARS | | | PAST

10 YEARS | | SINCE

INCEPTION | | | INCEPTION DATE |

Intermediate Duration Institutional | | 14.35 | % | | 14.80 | % | | 4.75 | % | | — | | 5.24 | % | | May 17, 2002 |

Barclays Capital Aggregate Bond Index | | 5.59 | | | 10.56 | | | 5.12 | | | — | | — | | | |

Lipper Intermediate Investment Grade Debt Funds Average | | 11.43 | | | 10.91 | | | 3.40 | | | — | | — | | | |

| | | | |

Taxable Bond Portfolio | | | | |

| Intermediate Duration Institutional | | | | |

Growth of $25,000 | | | | |

| | | | |

| * | | The Portfolio’s inception date was May 17, 2002. |

The chart shows the growth of $25,000 for the Portfolio, benchmark and Lipper average from the first month-end after the Portfolio’s inception date, May 31, 2002, through September 30, 2009.

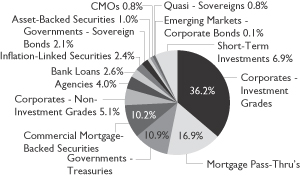

Portfolio Summary—September 30, 2009 (Unaudited)

| | | | |

| Taxable Bond Portfolio | | | | |

| Intermediate Duration Institutional |

| Security Type Breakdown* | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| * | | All data are as of September 30, 2009. The Portfolio’s security type breakdown is expressed as a percentage of the Portfolio’s total investments and may vary over time. |

See Historical Performance and Benchmark Disclosures on page 3.

| | |

| 4 | | Sanford C. Bernstein Fund II, Inc. |

Fund Expenses—September 30, 2009 (Unaudited)

Fund Expenses—As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses—The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes—The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | BEGINNING

ACCOUNT VALUE

APRIL 1, 2009 | | ENDING

ACCOUNT VALUE

SEPTEMBER 30, 2009 | | EXPENSES

PAID DURING

PERIOD* | | ANNUALIZED

EXPENSE

RATIO* | |

Intermediate Duration Institutional Portfolio | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,143.52 | | $ | 2.42 | | 0.45 | % |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,022.81 | | $ | 2.28 | | 0.45 | % |

| |

| * | | Expenses are equal to each Class’s annualized expense ratio, shown in the table above, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half-year period). |

Schedule of Investments

Sanford C. Bernstein Fund II, Inc.

Schedule of Investments

Intermediate Duration Institutional Portfolio

September 30, 2009

| | | | | | | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

| CORPORATES—INVESTMENT GRADES–36.9% |

| Industrial–21.2% |

| Basic–3.2% | | | | | | |

Alcoa, Inc.

6.75%, 7/15/18 | | $ | 1,025 | | $ | 1,027,546 |

ArcelorMittal

6.125%, 6/01/18 | | | 2,710 | | | 2,669,773 |

ArcelorMittal USA, Inc.

6.50%, 4/15/14 | | | 1,110 | | | 1,166,617 |

BHP Billiton Finance USA Ltd.

5.40%, 3/29/17 | | | 200 | | | 216,118 |

7.25%, 3/01/16 | | | 2,114 | | | 2,434,463 |

The Dow Chemical Co.

7.375%, 11/01/29 | | | 175 | | | 182,005 |

7.60%, 5/15/14 | | | 1,422 | | | 1,573,086 |

8.55%, 5/15/19 | | | 3,771 | | | 4,239,155 |

EI Du Pont de Nemours & Co.

5.875%, 1/15/14 | | | 1,370 | | | 1,517,085 |

Freeport-McMoRan Copper & Gold, Inc.

8.25%, 4/01/15 | | | 1,200 | | | 1,276,500 |

8.375%, 4/01/17 | | | 1,310 | | | 1,393,512 |

Inco Ltd.

7.75%, 5/15/12 | | | 3,855 | | | 4,195,443 |

International Paper Co.

5.30%, 4/01/15 | | | 1,235 | | | 1,250,807 |

7.50%, 8/15/21 | | | 1,082 | | | 1,146,449 |

7.95%, 6/15/18 | | | 1,530 | | | 1,658,456 |

Ispat Inland ULC

9.75%, 4/01/14 | | | 5 | | | 5,237 |

Packaging Corp. of America

5.75%, 8/01/13 | | | 885 | | | 920,758 |

PPG Industries, Inc.

5.75%, 3/15/13 | | | 2,035 | | | 2,151,435 |

Rio Tinto Finance USA Ltd.

6.50%, 7/15/18 | | | 2,585 | | | 2,779,754 |

Union Carbide Corp.

7.75%, 10/01/96 | | | 745 | | | 557,863 |

| | | | | | |

| | | | | | 32,362,062 |

| | | | | | |

| Capital Goods–1.1% | | | | | | |

Allied Waste North America, Inc.

6.125%, 2/15/14 | | | 85 | | | 87,094 |

Boeing Co.

6.00%, 3/15/19 | | | 2,325 | | | 2,607,974 |

Holcim US Finance Sarl & Cie SCS

6.00%, 12/30/19(a) | | | 236 | | | 240,222 |

John Deere Capital Corp.

5.25%, 10/01/12 | | | 2,365 | | | 2,557,518 |

Lafarge SA

6.15%, 7/15/11 | | | 1,489 | | | 1,550,853 |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Tyco International Finance SA

6.00%, 11/15/13 | | $ | 1,185 | | $ | 1,270,717 |

8.50%, 1/15/19 | | | 965 | | | 1,176,276 |

United Technologies Corp.

4.875%, 5/01/15 | | | 1,419 | | | 1,551,975 |

Vulcan Materials Co.

6.30%, 6/15/13 | | | 200 | | | 213,952 |

| | | | | | |

| | | | | | 11,256,581 |

| | | | | | |

| Communications—Media–2.1% | | | | | | |

BSKYB Finance UK PLC

5.625%, 10/15/15(a) | | | 1,245 | | | 1,347,547 |

CBS Corp.

5.625%, 8/15/12 | | | 585 | | | 606,742 |

6.625%, 5/15/11 | | | 500 | | | 523,764 |

8.875%, 5/15/19 | | | 1,255 | | | 1,384,183 |

Comcast Cable Communications Holdings, Inc.

9.455%, 11/15/22 | | | 1,140 | | | 1,464,898 |

Comcast Corp.

5.30%, 1/15/14 | | | 1,175 | | | 1,257,323 |

5.50%, 3/15/11 | | | 150 | | | 157,744 |

DirecTV Holdings LLC

6.375%, 6/15/15 | | | 735 | | | 744,188 |

DirecTV Holdings LLC / DirecTV Financing Co., Inc.

4.75%, 10/01/14(a) | | | 975 | | | 977,633 |

News America Holdings, Inc.

9.25%, 2/01/13 | | | 1,370 | | | 1,609,386 |

News America Inc.

6.55%, 3/15/33 | | | 760 | | | 777,859 |

Reed Elsevier Capital, Inc.

8.625%, 1/15/19 | | | 1,005 | | | 1,238,132 |

RR Donnelley & Sons Co.

4.95%, 4/01/14 | | | 570 | | | 548,477 |

11.25%, 2/01/19 | | | 1,395 | | | 1,657,134 |

Time Warner Cable, Inc.

7.50%, 4/01/14 | | | 1,140 | | | 1,307,501 |

Time Warner Entertainment Co.

8.375%, 3/15/23 | | | 2,480 | | | 2,974,859 |

WPP Finance UK

5.875%, 6/15/14 | | | 845 | | | 867,707 |

8.00%, 9/15/14 | | | 2,230 | | | 2,446,185 |

| | | | | | |

| | | | | | 21,891,262 |

| | | | | | |

| Communications—Telecommunications–4.8% | | | | | | |

AT&T Corp.

7.30%, 11/15/11(b) | | | 1,145 | | | 1,268,290 |

8.00%, 11/15/31(b) | | | 370 | | | 461,034 |

British Telecommunications PLC

5.15%, 1/15/13 | | | 2,155 | | | 2,245,090 |

9.125%, 12/15/10(b) | | | 270 | | | 290,703 |

Embarq Corp.

6.738%, 6/01/13 | | | 2,165 | | | 2,347,730 |

7.082%, 6/01/16 | | | 4,220 | | | 4,585,275 |

| | |

| 6 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

New Cingular Wireless Services, Inc.

7.875%, 3/01/11 | | $ | 1,740 | | $ | 1,888,307 |

8.125%, 5/01/12 | | | 7,920 | | | 9,036,791 |

Pacific Bell Telephone Co.

6.625%, 10/15/34 | | | 2,735 | | | 2,812,882 |

Qwest Corp.

7.50%, 10/01/14 | | | 2,070 | | | 2,090,700 |

7.875%, 9/01/11 | | | 2,415 | | | 2,490,469 |

8.875%, 3/15/12(b) | | | 1,850 | | | 1,947,125 |

Telecom Italia Capital SA

4.00%, 1/15/10 | | | 2,815 | | | 2,834,255 |

6.175%, 6/18/14 | | | 2,155 | | | 2,337,630 |

6.375%, 11/15/33 | | | 310 | | | 316,755 |

US Cellular Corp.

6.70%, 12/15/33 | | | 2,940 | | | 3,029,417 |

Verizon Communications, Inc.

4.90%, 9/15/15 | | | 1,000 | | | 1,056,927 |

5.25%, 4/15/13 | | | 1,510 | | | 1,635,022 |

Verizon New Jersey, Inc.

Series A

5.875%, 1/17/12 | | | 1,346 | | | 1,446,620 |

Vodafone Group PLC

5.35%, 2/27/12 | | | 200 | | | 214,200 |

5.50%, 6/15/11 | | | 1,860 | | | 1,975,578 |

7.75%, 2/15/10 | | | 2,640 | | | 2,706,003 |

| | | | | | |

| | | | | | 49,016,803 |

| | | | | | |

| Consumer Cyclical—Automotive–0.3% | | | |

Daimler Finance North America LLC

4.875%, 6/15/10 | | | 635 | | | 647,322 |

5.75%, 9/08/11 | | | 695 | | | 729,997 |

Volvo Treasury AB

5.95%, 4/01/15(a)(c) | | | 2,092 | | | 2,090,054 |

| | | | | | |

| | | | | | 3,467,373 |

| | | | | | |

| Consumer Cyclical—Entertainment–0.7% | | | |

Time Warner, Inc.

6.875%, 5/01/12 | | | 1,805 | | | 1,986,980 |

Turner Broadcasting System, Inc.

8.375%, 7/01/13 | | | 2,314 | | | 2,640,529 |

The Walt Disney Co.

5.50%, 3/15/19 | | | 1,925 | | | 2,090,246 |

| | | | | | |

| | | | | | 6,717,755 |

| | | | | | |

| Consumer Cyclical—Other–0.4% | | | | | | |

Marriott International, Inc.

Series J

5.625%, 2/15/13 | | | 2,601 | | | 2,653,551 |

MDC Holdings, Inc.

5.50%, 5/15/13 | | | 10 | | | 9,910 |

Toll Brothers Finance Corp.

5.15%, 5/15/15 | | | 300 | | | 288,481 |

6.875%, 11/15/12 | | | 855 | | | 902,032 |

| | | | | | |

| | | | | | 3,853,974 |

| | | | | | |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

| Consumer Cyclical—Retailers–0.1% | | | | | | |

Kohls Corp.

6.25%, 12/15/17 | | $ | 100 | | $ | 109,295 |

Wal-Mart Stores, Inc.

4.25%, 4/15/13 | | | 1,170 | | | 1,246,841 |

| | | | | | |

| | | | | | 1,356,136 |

| | | | | | |

| Consumer Non-Cyclical–5.4% | | | | | | |

Altria Group, Inc.

9.70%, 11/10/18 | | | 1,410 | | | 1,751,300 |

AstraZeneca PLC

5.40%, 9/15/12 | | | 200 | | | 219,197 |

Avon Products, Inc.

6.50%, 3/01/19 | | | 2,305 | | | 2,624,883 |

Baxter FinCo BV

4.75%, 10/15/10 | | | 2,428 | | | 2,523,768 |

Bottling Group LLC

6.95%, 3/15/14 | | | 2,060 | | | 2,400,831 |

Bunge Ltd. Finance Corp.

5.10%, 7/15/15 | | | 1,143 | | | 1,135,751 |

5.875%, 5/15/13 | | | 1,805 | | | 1,908,417 |

Cadbury Schweppes US Finance LLC

5.125%, 10/01/13(a) | | | 2,420 | | | 2,522,168 |

Campbell Soup Co.

6.75%, 2/15/11 | | | 1,950 | | | 2,092,541 |

The Coca-Cola Co.

5.35%, 11/15/17 | | | 2,210 | | | 2,413,229 |

ConAgra Foods, Inc.

7.875%, 9/15/10 | | | 33 | | | 34,930 |

Diageo Capital PLC

7.375%, 1/15/14 | | | 2,085 | | | 2,416,304 |

Fisher Scientific International, Inc.

6.125%, 7/01/15 | | | 362 | | | 376,027 |

6.75%, 8/15/14 | | | 500 | | | 517,687 |

Fortune Brands, Inc.

4.875%, 12/01/13 | | | 1,257 | | | 1,259,498 |

Johnson & Johnson

5.55%, 8/15/17 | | | 2,130 | | | 2,393,515 |

Kraft Foods, Inc.

4.125%, 11/12/09 | | | 400 | | | 401,348 |

5.25%, 10/01/13 | | | 815 | | | 858,356 |

6.25%, 6/01/12 | | | 5,355 | | | 5,823,241 |

The Kroger Co.

6.80%, 12/15/18 | | | 918 | | | 1,046,514 |

Pepsico, Inc.

4.65%, 2/15/13 | | | 2,215 | | | 2,384,886 |

5.00%, 6/01/18 | | | 200 | | | 214,094 |

Pfizer, Inc.

5.35%, 3/15/15 | | | 2,340 | | | 2,591,098 |

The Procter & Gamble Co.

4.70%, 2/15/19 | | | 2,325 | | | 2,429,902 |

Reynolds American, Inc.

7.25%, 6/01/13 | | | 2,420 | | | 2,633,069 |

7.625%, 6/01/16 | | | 2,455 | | | 2,626,906 |

Safeway, Inc.

5.80%, 8/15/12 | | | 15 | | | 16,259 |

6.50%, 3/01/11 | | | 395 | | | 419,856 |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Whirlpool Corp.

8.60%, 5/01/14 | | $ | 285 | | $ | 318,808 |

Wyeth

5.50%, 2/01/14 | | | 6,408 | | | 6,998,222 |

| | | | | | | | |

| | | | | | 55,352,605 |

| | | | | | | | |

| Energy–1.5% | | | | | | |

Amerada Hess Corp.

7.875%, 10/01/29 | | | 811 | | | 949,931 |

Anadarko Petroleum Corp.

5.95%, 9/15/16 | | | 249 | | | 263,830 |

6.45%, 9/15/36 | | | 741 | | | 765,077 |

Apache Corp.

5.25%, 4/15/13 | | | 1,295 | | | 1,389,250 |

5.625%, 1/15/17 | | | 100 | | | 108,889 |

Baker Hughes, Inc.

6.50%, 11/15/13 | | | 1,155 | | | 1,314,046 |

Canadian Natural Resources Ltd.

5.15%, 2/01/13 | | | 835 | | | 888,064 |

Conoco Funding Co.

6.35%, 10/15/11 | | | 25 | | | 27,395 |

Conoco, Inc.

6.95%, 4/15/29 | | | 5 | | | 5,868 |

Hess Corp.

6.65%, 8/15/11 | | | 45 | | | 48,290 |

Nabors Industries, Inc.

9.25%, 1/15/19 | | | 2,395 | | | 2,846,247 |

Noble Energy, Inc.

8.25%, 3/01/19 | | | 2,306 | | | 2,783,644 |

The Premcor Refining Group, Inc.

7.50%, 6/15/15 | | | 1,413 | | | 1,450,279 |

Valero Energy Corp.

6.875%, 4/15/12 | | | 1,465 | | | 1,576,664 |

Weatherford International Ltd.

5.15%, 3/15/13 | | | 1,025 | | | 1,076,652 |

6.00%, 3/15/18 | | | 395 | | | 409,262 |

| | | | | | | | |

| | | | | | 15,903,388 |

| | | | | | | | |

| Technology–1.6% | | | | | | |

Cisco Systems, Inc.

5.25%, 2/22/11 | | | 2,205 | | | 2,324,163 |

Computer Sciences Corp.

5.50%, 3/15/13 | | | 1,500 | | | 1,584,486 |

Dell, Inc.

5.625%, 4/15/14 | | | 1,450 | | | 1,602,251 |

Electronic Data Systems Corp.

Series B

6.00%, 8/01/13(b) | | | 3,473 | | | 3,875,243 |

IBM International Group Capital LLC

5.05%, 10/22/12 | | | 200 | | | 217,661 |

Motorola, Inc.

6.50%, 9/01/25 | | | 1,350 | | | 1,140,865 |

7.50%, 5/15/25 | | | 250 | | | 227,633 |

7.625%, 11/15/10 | | | 133 | | | 138,486 |

Oracle Corp.

4.95%, 4/15/13 | | | 1,260 | | | 1,363,713 |

5.25%, 1/15/16 | | | 925 | | | 1,006,279 |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Tyco Electronics Group SA

6.00%, 10/01/12 | | $ | 100 | | $ | 105,798 |

Xerox Corp.

7.625%, 6/15/13 | | | 510 | | | 523,758 |

8.25%, 5/15/14 | | | 1,920 | | | 2,182,447 |

| | | | | | | | |

| | | | | | 16,292,783 |

| | | | | | | | |

| Transportation—Railroads–0.0% | | | | | | |

Canadian Pacific Railway Co.

6.50%, 5/15/18 | | | 445 | | | 484,426 |

| | | | | | | | |

| | | | | | 217,955,148 |

| | | | | | | | |

| | | | | | | | |

| | | |

| Financial Institutions–12.0% | | | | | | |

| Banking–7.2% | | | | | | |

American Express Centurion Bank FRN

0.401%, 11/16/09(d) | | | 300 | | | 299,849 |

American Express Co.

8.125%, 5/20/19 | | | 2,390 | | | 2,826,631 |

ANZ National International Ltd.

6.20%, 7/19/13(a) | | | 1,175 | | | 1,272,337 |

Bank of America Corp.

4.50%, 8/01/10 | | | 135 | | | 138,101 |

4.875%, 1/15/13 | | | 3,110 | | | 3,190,061 |

7.625%, 6/01/19 | | | 1,455 | | | 1,639,481 |

Bank of Tokyo-Mitsubishi UFJ L

7.40%, 6/15/11 | | | 280 | | | 306,776 |

Barclays Bank PLC

8.55%, 6/15/11(a)(e) | | | 1,420 | | | 1,292,200 |

BBVA International Preferred SA Unipersonal

5.919%, 4/18/17(e) | | | 985 | | | 738,750 |

The Bear Stearns Co., Inc.

5.55%, 1/22/17 | | | 2,670 | | | 2,699,957 |

5.70%, 11/15/14 | | | 3,040 | | | 3,256,114 |

7.625%, 12/07/09 | | | 2,752 | | | 2,784,556 |

Citigroup, Inc.

5.00%, 9/15/14 | | | 3,726 | | | 3,545,606 |

5.30%, 1/07/16 | | | 20 | | | 19,459 |

5.50%, 4/11/13 | | | 1,835 | | | 1,877,803 |

6.50%, 1/18/11–8/19/13 | | | 105 | | | 109,073 |

8.50%, 5/22/19 | | | 2,690 | | | 3,036,566 |

Compass Bank

5.50%, 4/01/20 | | | 3,239 | | | 2,757,425 |

Countrywide Financial Corp.

5.80%, 6/07/12 | | | 420 | | | 443,060 |

6.25%, 5/15/16 | | | 1,140 | | | 1,141,802 |

Countrywide Home Loans, Inc.

Series L

4.00%, 3/22/11 | | | 1,224 | | | 1,243,993 |

Credit Suisse USA, Inc.

5.50%, 8/15/13 | | | 870 | | | 939,762 |

The Goldman Sachs Group, Inc.

4.75%, 7/15/13 | | | 760 | | | 793,131 |

5.125%, 1/15/15 | | | 845 | | | 883,049 |

7.35%, 10/01/09 | | | 596 | | | 596,000 |

7.50%, 2/15/19 | | | 4,275 | | | 4,888,963 |

| | |

| 8 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Huntington National Bank

4.375%, 1/15/10 | | $ | 980 | | $ | 980,927 |

JP Morgan Chase & Co.

6.75%, 2/01/11 | | | 185 | | | 196,497 |

JP Morgan Chase Capital XVIII

Series R

6.95%, 8/17/36 | | | 200 | | | 191,804 |

JP Morgan Chase Capital XXV

Series Y

6.80%, 10/01/37 | | | 4 | | | 4,025 |

JPMorgan Chase & Co. FRN

0.633%, 11/01/12(d) | | | 100 | | | 98,202 |

Manufacturers & Traders Trust Co.

8.00%, 10/01/10 | | | 300 | | | 311,829 |

Marshall & Ilsley Bank

5.00%, 1/17/17 | | | 2,310 | | | 1,687,032 |

Merrill Lynch & Co., Inc.

6.05%, 5/16/16 | | | 879 | | | 880,871 |

Morgan Stanley

5.625%, 1/09/12 | | | 2,475 | | | 2,622,507 |

6.60%, 4/01/12 | | | 1,625 | | | 1,765,866 |

6.625%, 4/01/18 | | | 2,525 | | | 2,669,993 |

National Capital Trust II

5.486%, 3/23/15(a)(e) | | | 705 | | | 509,362 |

National City Bank of Cleveland Ohio

6.25%, 3/15/11 | | | 2,680 | | | 2,735,873 |

Rabobank Nederland

11.00%, 6/30/19(a)(e) | | | 250 | | | 306,250 |

Regions Financial Corp.

6.375%, 5/15/12 | | | 2,845 | | | 2,670,434 |

Royal Bank of Scotland Group PLC

5.00%, 10/01/14 | | | 85 | | | 76,877 |

SouthTrust Corp.

5.80%, 6/15/14 | | | 15 | | | 15,260 |

UBS Preferred Funding Trust I

8.622%, 10/01/10(e) | | | 1,437 | | | 1,323,497 |

UFJ Finance Aruba AEC

6.75%, 7/15/13 | | | 520 | | | 577,837 |

Union Bank of California

5.95%, 5/11/16 | | | 2,790 | | | 2,774,248 |

Union Planters Corp.

7.75%, 3/01/11 | | | 1,900 | | | 1,866,815 |

Wachovia Capital Trust III

5.80%, 3/15/11(e) | | | 65 | | | 44,850 |

Wachovia Corp.

5.35%, 3/15/11 | | | 50 | | | 52,118 |

5.50%, 5/01/13 | | | 2,630 | | | 2,814,024 |

Wells Fargo & Co.

4.20%, 1/15/10 | | | 1,040 | | | 1,048,206 |

5.625%, 12/11/17 | | | 2,530 | | | 2,657,489 |

| | | | | | |

| | | | | | 73,603,198 |

| | | | | | |

| Finance–1.9% | | | | | | |

General Electric Capital Corp.

4.80%, 5/01/13 | | | 5,420 | | | 5,626,421 |

Series A

4.375%, 11/21/11 | | | 10 | | | 10,328 |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

5.00%, 6/30/18(b) | | $ | 100 | | $ | 96,982 |

5.00%, 6/27/18 | | | 125 | | | 123,704 |

5.50%, 12/18/18(b) | | | 200 | | | 199,168 |

6.90%, 9/15/15 | | | 200 | | | 221,539 |

Series G

5.72%, 8/22/11 | | | 250 | | | 253,328 |

HSBC Finance Corp.

5.50%, 1/19/16 | | | 100 | | | 102,229 |

7.00%, 5/15/12 | | | 1,420 | | | 1,533,973 |

International Lease Finance Corp.

5.125%, 11/01/10 | | | 100 | | | 93,638 |

5.65%, 6/01/14 | | | 333 | | | 255,588 |

SLM Corp.

5.125%, 8/27/12 | | | 735 | | | 628,920 |

5.40%, 10/25/11 | | | 2,089 | | | 1,927,562 |

5.45%, 4/25/11 | | | 3,140 | | | 2,961,551 |

Series A

4.50%, 7/26/10 | | | 70 | | | 68,017 |

5.375%, 1/15/13–5/15/14 | | | 6,325 | | | 5,045,814 |

| | | | | | |

| | | | | | 19,148,762 |

| | | | | | |

| Insurance–2.3% | | | | | | |

Aegon NV

4.75%, 6/01/13 | | | 395 | | | 396,443 |

Allied World Assurance Co. Holdings Ltd.

7.50%, 8/01/16 | | | 745 | | | 778,573 |

The Allstate Corp.

6.125%, 5/15/37(e) | | | 2,495 | | | 2,020,950 |

Assurant, Inc.

5.625%, 2/15/14 | | | 705 | | | 725,498 |

Coventry Health Care, Inc.

5.95%, 3/15/17 | | | 540 | | | 484,191 |

6.125%, 1/15/15 | | | 210 | | | 202,500 |

6.30%, 8/15/14 | | | 1,670 | | | 1,639,793 |

Genworth Financial, Inc.

6.515%, 5/22/18 | | | 2,570 | | | 2,201,056 |

Humana, Inc.

6.30%, 8/01/18 | | | 1,170 | | | 1,115,879 |

6.45%, 6/01/16 | | | 240 | | | 242,068 |

7.20%, 6/15/18 | | | 510 | | | 516,154 |

Liberty Mutual Group, Inc.

5.75%, 3/15/14(a) | | | 895 | | | 842,453 |

Lincoln National Corp.

8.75%, 7/01/19 | | | 677 | | | 782,996 |

Massachusetts Mutual Life Insurance Co.

8.875%, 6/01/39(a) | | | 1,325 | | | 1,623,830 |

MetLife, Inc.

5.00%, 11/24/13 | | | 780 | | | 806,026 |

5.375%, 12/15/12 | | | 10 | | | 10,622 |

Nationwide Mutual Insurance Co.

9.375%, 8/15/39(a) | | | 2,195 | | | 2,252,136 |

Principal Financial Group, Inc.

7.875%, 5/15/14 | | | 1,905 | | | 2,105,154 |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Prudential Financial, Inc.

5.15%, 1/15/13 | | $ | 1,710 | | $ | 1,760,447 |

6.20%, 1/15/15 | | | 265 | | | 280,360 |

Series D

7.375%, 6/15/19 | | | 200 | | | 223,202 |

UnitedHealth Group, Inc.

5.25%, 3/15/11 | | | 15 | | | 15,590 |

6.00%, 2/15/18 | | | 770 | | | 809,151 |

Wellpoint Inc.

5.875%, 6/15/17 | | | 130 | | | 137,213 |

7.00%, 2/15/19 | | | 530 | | | 602,481 |

WellPoint, Inc.

4.25%, 12/15/09 | | | 8 | | | 8,055 |

XL Capital Ltd.

5.25%, 9/15/14 | | | 1,560 | | | 1,531,404 |

6.25%, 5/15/27 | | | 15 | | | 13,262 |

| | | | | | |

| | | | | | 24,127,487 |

| | | | | | |

| REITS–0.6% | | | | | | |

HCP, Inc.

5.95%, 9/15/11 | | | 15 | | | 15,407 |

Healthcare Realty Trust, Inc.

5.125%, 4/01/14 | | | 1,555 | | | 1,463,100 |

8.125%, 5/01/11 | | | 15 | | | 15,700 |

Nationwide Health Properties, Inc.

6.50%, 7/15/11 | | | 85 | | | 87,614 |

Simon Property Group LP

5.00%, 3/01/12 | | | 2,830 | | | 2,918,316 |

5.625%, 8/15/14 | | | 2,196 | | | 2,265,897 |

| | | | | | |

| | | | | | 6,766,034 |

| | | | | | |

| | | | | | 123,645,481 |

| | | | | | |

| | | | | | | | |

| | | |

| Utility–2.9% | | | | | | |

| Electric–1.6% | | | | | | |

Allegheny Energy Supply

5.75%, 10/15/19(a)(c) | | | 2,355 | | | 2,353,351 |

Carolina Power & Light Co.

6.50%, 7/15/12 | | | 1,395 | | | 1,542,389 |

FirstEnergy Corp.

Series B

6.45%, 11/15/11 | | | 241 | | | 260,656 |

Series C

7.375%, 11/15/31 | | | 1,663 | | | 1,864,102 |

MidAmerican Energy Holdings Co.

5.875%, 10/01/12 | | | 535 | | | 582,897 |

Nisource Finance Corp.

6.80%, 1/15/19 | | | 2,705 | | | 2,769,420 |

7.875%, 11/15/10 | | | 760 | | | 799,531 |

Pacific Gas & Electric Co.

4.80%, 3/01/14 | | | 1,195 | | | 1,274,471 |

6.05%, 3/01/34 | | | 5 | | | 5,562 |

Progress Energy, Inc.

7.10%, 3/01/11 | | | 482 | | | 510,972 |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Public Service Company of Colorado

Series 10

7.875%, 10/01/12 | | $ | 540 | | $ | 627,581 |

The Southern Co.

Series A

5.30%, 1/15/12 | | | 884 | | | 948,920 |

SPI Electricity & Gas Australia Holdings Pty Ltd.

6.15%, 11/15/13(a) | | | 1,180 | | | 1,240,069 |

Wisconsin Energy Corp.

6.25%, 5/15/67(e) | | | 1,279 | | | 1,074,360 |

| | | | | | | | |

| | | | | | | | 15,854,281 |

| | | | | | | | |

| Natural Gas–1.1% | | | | | | |

DCP Midstream LLC

6.875%, 2/01/11 | | | 239 | | | 248,656 |

Duke Energy Field Services Corp.

7.875%, 8/16/10 | | | 435 | | | 455,954 |

Energy Transfer Partners LP

6.70%, 7/01/18 | | | 2,260 | | | 2,418,419 |

7.50%, 7/01/38 | | | 2,575 | | | 2,971,187 |

Enterprise Products Operating LLC

Series G

5.60%, 10/15/14 | | | 700 | | | 745,582 |

TransCanada Pipelines Ltd.

6.35%, 5/15/67(e) | | | 2,725 | | | 2,387,484 |

Williams Co., Inc.

7.875%, 9/01/21 | | | 1,136 | | | 1,228,767 |

8.125%, 3/15/12 | | | 965 | | | 1,048,926 |

| | | | | | | | |

| | | | | | 11,504,975 |

| | | | | | | | |

| Other Utility–0.2% | | | | | | |

Veolia Environnement

6.00%, 6/01/18 | | | 1,725 | | | 1,856,160 |

| | | | | | | | |

| | | | | | 29,215,416 |

| | | | | | | | |

| | | | | | | | |

| | |

| Non Corporate Sectors–0.8% | | | |

| Agencies—Not Government Guaranteed–0.8% | | | |

Gaz Capital SA

6.212%, 11/22/16(a) | | | 4,975 | | | 4,776,000 |

TransCapitalInvest Ltd. for OJSC AK Transneft

8.70%, 8/07/18(a) | | | 2,705 | | | 2,961,975 |

| | | | | | | | |

| | | | | | 7,737,975 |

| | | | | | | | |

Total Corporates—Investment Grades

(cost $361,400,172) | | | | | | 378,554,020 |

| | | | | | | | |

| | | | | | | | |

| | |

| MORTGAGE PASS-THRU’S–17.2% | | | |

| Agency Fixed Rate 30-Year–15.7% | | | |

Federal Home Loan Mortgage Corp. Gold

Series 2005

4.50%, 8/01/35–12/01/35 | | | 7,417 | | | 7,534,473 |

| | |

| 10 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Series 2007

4.50%, 1/01/37 | | $ | 33 | | $ | 33,866 |

5.50%, 7/01/35 | | | 3,183 | | | 3,351,100 |

Series 2008 | | | | | | |

5.50%, 4/01/38 | | | 26 | | | 27,151 |

Federal National Mortgage Association

6.00%, TBA | | | 5,925 | | | 6,250,875 |

6.50%, TBA | | | 8,275 | | | 8,843,906 |

Series 2003 | | | | | | |

5.00%, 11/01/33 | | | 6,626 | | | 6,878,470 |

5.50%, 4/01/33–7/01/33 | | | 12,493 | | | 13,143,651 |

Series 2004 | | | | | | |

5.50%, 4/01/34–11/01/34 | | | 10,298 | | | 10,825,997 |

6.00%, 9/01/34 | | | 606 | | | 644,433 |

Series 2005 | | | | | | |

4.50%, 5/01/35–9/01/35 | | | 14,312 | | | 14,570,145 |

5.50%, 2/01/35 | | | 10,606 | | | 11,155,628 |

6.00%, 4/01/35 | | | 5,696 | | | 6,052,107 |

Series 2006 | | | | | | |

5.00%, 2/01/36 | | | 19,443 | | | 20,154,857 |

5.50%, 4/01/36 | | | 2,189 | | | 2,298,829 |

6.50%, 1/01/36 | | | 80 | | | 86,566 |

Series 2007 | | | | | | |

4.50%, 9/01/35–3/01/36 | | | 8,966 | | | 9,143,233 |

5.00%, 11/01/35 | | | 24 | | | 24,988 |

5.50%, 5/01/36 | | | 139 | | | 146,233 |

Series 2008 | | | | | | |

5.50%, 12/01/35–3/01/37 | | | 14,637 | | | 15,372,267 |

6.00%, 3/01/37 | | | 23,329 | | | 24,730,081 |

| | | | | | | | |

| | | | | | 161,268,856 |

| | | | | | | | |

| Agency ARMS–1.5% | | | | | | |

Federal Home Loan Mortgage Corp.

Series 2005

4.753%, 5/01/35(d) | | | 2,024 | | | 2,110,399 |

Series 2006 | | | | | | |

5.747%, 12/01/36(d) | | | 122 | | | 128,790 |

Series 2008 | | | | | | |

5.615%, 11/01/37(e) | | | 2,178 | | | 2,296,061 |

Federal National Mortgage Association | | | | | | |

Series 2003

4.762%, 12/01/33(e) | | | 1,949 | | | 2,047,279 |

Series 2006 | | | | | | |

5.457%, 2/01/36(e) | | | 2,355 | | | 2,476,255 |

6.194%, 3/01/36 | | | 1,963 | | | 2,075,151 |

Series 2007 | | | | | | |

4.731%, 3/01/34(e) | | | 1,949 | | | 2,020,281 |

5.912%, 3/01/37(e) | | | 22 | | | 23,668 |

5.936%, 2/01/37(d) | | | 23 | | | 23,995 |

Series 2009 | | | | | | |

4.422%, 5/01/38(d) | | | 2,447 | | | 2,549,740 |

| | | | | | | | |

| | | | | | | | 15,751,619 |

| | | | | | | | |

Total Mortgage Pass-Thru’s

(cost $168,688,165) | | | | | | 177,020,475 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | |

| GOVERNMENTS—TREASURIES–11.1% | | | |

| Canada–2.6% | | | | | |

Canadian Government Bond

3.75%, 6/01/19 | | CAD | | 27,005 | | $ | 26,128,501 |

| | | | | | | |

| Hungary–0.5% | | | | | |

Hungary Government Bond

Series 12/C

6.00%, 10/24/12 | | HUF | | 1,047,210 | | | 5,458,478 |

| | | | | | | |

| United States–8.0% | | | | | |

U.S. Treasury Bonds

4.50%, 2/15/36 | | $ | | 22,800 | | | 24,488,614 |

U.S. Treasury Notes

0.875%, 5/31/11 | | 4,870 | | | 4,881,605 |

1.75%, 11/15/11–1/31/14 | | 20,190 | | | 20,207,818 |

2.125%, 1/31/10 | | 25,595 | | | 25,760,958 |

2.625%, 7/31/14 | | 6,565 | | | 6,674,760 |

| | | | | | | |

| | | | | | | 82,013,755 |

| | | | | | | |

Total Governments—Treasuries

(cost $112,678,205) | | | | | 113,600,734 |

| | | | | | | |

| | | | | | | |

| |

| COMMERCIAL MORTGAGE-BACKED SECURITIES–10.4% |

| Non-Agency Fixed Rate CMBS–10.3% | | | | | |

Banc of America Commercial Mortgage, Inc.

Series 2005-6, Class A4

5.351%, 11/10/15 | | 250 | | | 243,223 |

Series 2006-5, Class A4 | | | | | |

5.414%, 9/10/47 | | 5,570 | | | 5,067,916 |

Series 2007-5, Class A4 | | | | | |

5.492%, 2/10/51 | | 30 | | | 24,449 |

Bear Stearns Commercial Mortgage Securities, Inc.

Series 2005-PWR7, Class A3

5.116%, 2/11/41 | | 220 | | | 215,373 |

Series 2005-T18, Class A4 | | | | | |

4.933%, 2/13/42 | | 2,995 | | | 2,915,984 |

Series 2006-PW12, Class A4 | | | | | |

5.903%, 9/11/38 | | 1,420 | | | 1,378,587 |

Series 2006-T24, Class A4 | | | | | |

5.537%, 10/12/41 | | 25 | | | 23,835 |

Commercial Mortgage Pass Through Certificates

Series 2005-C6, Class A5A

5.116%, 6/10/44 | | 1,700 | | | 1,617,065 |

Series 2006-C8, Class A4 | | | | | |

5.306%, 12/10/46 | | 3,895 | | | 3,389,827 |

Credit Suisse Mortgage Capital Certificates

Series 2006-C3, Class A3

6.02%, 6/15/38 | | 5,275 | | | 4,473,936 |

Series 2006-C4, Class A3 | | | | | |

5.467%, 9/15/39 | | 220 | | | 186,971 |

Series 2006-C5, Class A3 | | | | | |

5.311%, 12/15/39 | | 3,070 | | | 2,492,159 |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

CS First Boston Mortgage Securities Corp.

Series 2003-CK2, Class A2

3.861%, 3/15/36 | | $ | 75 | | $ | 74,458 |

Series 2004-C1, Class A4 | | | | | | |

4.75%, 1/15/37 | | | 1,220 | | | 1,215,928 |

Series 2005-C1, Class A4 | | | | | | |

5.014%, 2/15/38 | | | 4,400 | | | 4,334,378 |

Greenwich Capital Commercial Funding Corp.

Series 2005-GG3, Class A2

4.305%, 8/10/42 | | | 2,395 | | | 2,381,029 |

Series 2007-GG11, Class A4 | | | | | | |

5.736%, 12/10/49 | | | 40 | | | 36,017 |

Series 2007-GG9, Class A4 | | | | | | |

5.444%, 3/10/39 | | | 3,355 | | | 2,973,246 |

JP Morgan Chase Commercial Mortgage Securities Corp.

Series 2005-LDP1, Class A4

5.038%, 3/15/46 | | | 2,960 | | | 2,867,786 |

Series 2006-CB1, Class A4 | | | | | | |

5.481%, 12/12/44 | | | 1,460 | | | 1,371,075 |

5.814%, 6/12/43 | | | 4,980 | | | 4,696,699 |

Series 2006-CB16, Class A4 | | | | | | |

5.552%, 5/12/45 | | | 3,890 | | | 3,601,550 |

Series 2006-CB17, Class A4 | | | | | | |

5.429%, 12/12/43 | | | 5,825 | | | 5,386,447 |

Series 2007-C1, Class A4 | | | | | | |

5.716%, 2/15/51 | | | 40 | | | 29,171 |

Series 2007-LD11, Class A4 | | | | | | |

6.006%, 6/15/49 | | | 35 | | | 30,592 |

Series 2007-LDPX, Class A2S | | | | | | |

5.305%, 1/15/49 | | | 75 | | | 71,712 |

Series 2007-LDPX, Class A3 | | | | | | |

5.42%, 1/15/49 | | | 5,500 | | | 4,636,218 |

LB-UBS Commercial Mortgage Trust

Series 2003-C3, Class A4

4.166%, 5/15/32 | | | 3,920 | | | 3,877,576 |

Series 2005-C1, Class A4 | | | | | | |

4.742%, 2/15/30 | | | 2,000 | | | 1,953,977 |

Series 2006-C3, Class A4 | | | | | | |

5.661%, 3/15/39 | | | 620 | | | 580,923 |

Series 2006-C4, Class A4 | | | | | | |

6.08%, 6/15/38 | | | 125 | | | 118,356 |

Series 2006-C6, Class A4 | | | | | | |

5.372%, 9/15/39 | | | 4,610 | | | 4,198,200 |

Series 2006-C7, Class A3 | | | | | | |

5.347%, 11/15/38 | | | 3,915 | | | 3,619,318 |

Series 2007-C1, Class A4 | | | | | | |

5.424%, 2/15/40 | | | 25 | | | 20,966 |

Series 2008-C1, Class A2 | | | | | | |

6.318%, 4/15/41 | | | 3,290 | | | 3,190,853 |

Merrill Lynch Mortgage Trust

Series 2005-CKI1, Class A6

5.405%, 11/12/37 | | | 1,875 | | | 1,859,891 |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Merrill Lynch/Countrywide Commercial Mortgage Trust

Series 2006-2, Class A4

6.104%, 6/12/46 | | $ | 2,180 | | $ | 2,050,655 |

Series 2007-9, Class A4 | | | | | | |

5.70%, 9/12/49 | | | 30 | | | 23,693 |

Morgan Stanley Capital I

Series 2005-HQ5, Class A4

5.168%, 1/14/15 | | | 3,830 | | | 3,845,128 |

Series 2007-HQ13, Class A3 | | | | | | |

5.569%, 12/15/44 | | | 5,240 | | | 4,324,327 |

Series 2007-IQ15, Class A4 | | | | | | |

6.076%, 6/11/49 | | | 2,770 | | | 2,431,109 |

Series 2007-T27, Class A4

5.803%, 6/11/42 | | | 6,210 | | | 5,860,271 |

Wachovia Bank Commercial Mortgage Trust

Series 2006-C27, Class A3

5.765%, 7/15/45 | | | 5,315 | | | 4,772,276 |

Series 2007-C31, Class A4 | | | | | | |

5.509%, 4/15/47 | | | 5,345 | | | 4,139,519 |

Series 2007-C32, Class A3 | | | | | | |

5.929%, 6/15/49 | | | 4,140 | | | 3,291,853 |

| | | | | | | | |

| | | | | | | | 105,894,522 |

| | | | | | | | |

| Non-Agency Floating Rate CMBS–0.1% | | | |

GS Mortgage Securities Corp. II

Series 2007-EOP, Class E

0.694%, 3/06/20(a)(d) | | | 1,180 | | | 942,109 |

| | | | | | | | |

Total Commercial Mortgage-Backed Securities

(cost $114,565,056) | | | | | | 106,836,631 |

| | | | | | | | |

| | | | | | | | |

| | |

| CORPORATES—NON-INVESTMENT GRADES–5.2% | | | |

| | | |

| Industrial–3.1% | | | | | | |

| Basic–0.7% | | | | | | |

Ineos Group Holdings PLC

8.50%, 2/15/16(a) | | | 730 | | | 346,750 |

Steel Capital SA for OAO Severstal

9.75%, 7/29/13(a) | | | 1,035 | | | 1,045,350 |

Stora Enso Oyj

7.375%, 5/15/11 | | | 80 | | | 81,474 |

United States Steel Corp.

6.05%, 6/01/17 | | | 2,875 | | | 2,685,227 |

Westvaco Corp.

8.20%, 1/15/30 | | | 435 | | | 426,676 |

Weyerhaeuser Co.

6.75%, 3/15/12 | | | 2,410 | | | 2,510,688 |

| | | | | | | | |

| | | | | | | | 7,096,165 |

| | | | | | | | |

| Capital Goods–0.9% | | | | | | | | |

Case New Holland, Inc.

7.125%, 3/01/14 | | | 510 | | | 499,800 |

Masco Corp.

6.125%, 10/03/16 | | | 3,230 | | | 3,061,682 |

| | |

| 12 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Mohawk Industries, Inc.

6.875%, 1/15/16(b) | | $ | 2,945 | | $ | 2,930,667 |

Owens Corning, Inc.

6.50%, 12/01/16 | | | 1,812 | | | 1,767,954 |

Textron Financial Corp.

4.60%, 5/03/10 | | | 291 | | | 289,947 |

5.125%, 2/03/11 | | | 531 | | | 531,315 |

5.40%, 4/28/13 | | | 380 | | | 373,121 |

| | | | | | | | |

| | | | | | | | 9,454,486 |

| | | | | | | | |

| Communications—Media–0.2% | | | | | | |

Cablevision Systems Corp.

Series B

8.00%, 4/15/12(b) | | | 755 | | | 787,088 |

Clear Channel Communications, Inc.

5.50%, 9/15/14 | | | 1,640 | | | 723,650 |

CSC Holdings, Inc.

Series B

7.625%, 4/01/11 | | | 80 | | | 83,000 |

Univision Communications, Inc.

12.00%, 7/01/14(a) | | | 209 | | | 224,675 |

| | | | | | | | |

| | | | | | 1,818,413 |

| | | | | | | | |

| Communications—Telecommunications–0.1% | | | |

Cricket Communications, Inc.

7.75%, 5/15/16(a) | | | 455 | | | 461,825 |

Qwest Communications International, Inc.

7.50%, 2/15/14(b) | | | 425 | | | 419,687 |

Series B | | | | | | |

7.50%, 2/15/14 | | | 250 | | | 246,875 |

| | | | | | | | |

| | | | | | | | 1,128,387 |

| | | | | | | | |

| Consumer Cyclical—Automotive–0.1% | | | |

Ford Motor Credit Co. LLC

7.00%, 10/01/13 | | | 45 | | | 42,238 |

The Goodyear Tire & Rubber Co.

9.00%, 7/01/15(f) | | | 1,005 | | | 1,042,687 |

| | | | | | | | |

| | | | | | | | 1,084,925 |

| | | | | | | | |

| Consumer Cyclical—Other–0.5% | | | | | | |

Sheraton Holding Corp.

7.375%, 11/15/15 | | | 2,385 | | | 2,349,225 |

Starwood Hotels & Resorts Worldwide, Inc.

7.875%, 5/01/12 | | | 2,621 | | | 2,719,287 |

William Lyon Homes, Inc.

10.75%, 4/01/13 | | | 100 | | | 53,750 |

| | | | | | | | |

| | | | | | | | 5,122,262 |

| | | | | | | | |

| Consumer Cyclical—Retailers–0.0% | | | | | | |

Limited Brands, Inc.

6.90%, 7/15/17 | | | 409 | | | 385,668 |

| | | | | | | | |

| Consumer Non-Cyclical–0.3% | | | | | | |

Bausch & Lomb, Inc.

9.875%, 11/01/15 | | | 915 | | | 958,463 |

| | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | |

HCA, Inc.

8.50%, 4/15/19(a) | | $ | | 1,265 | | $ | 1,318,762 |

IASIS Healthcare LLC/IASIS Capital Corp.

8.75%, 6/15/14 | | 55 | | | 55,000 |

Stater Brothers Holdings

8.125%, 6/15/12 | | 65 | | | 65,325 |

Tyson Foods, Inc.

7.85%, 4/01/16 | | 15 | | | 15,300 |

8.25%, 10/01/11 | | 75 | | | 78,750 |

| | | | | | | |

| | | | | | | 2,491,600 |

| | | | | | | |

| Energy–0.1% | | | | | | | |

Pride International, Inc.

7.375%, 7/15/14 | | 5 | | | 5,125 |

Tesoro Corp.

6.50%, 6/01/17 | | 1,160 | | | 1,049,800 |

| | | | | | | |

| | | | | | | 1,054,925 |

| | | | | | | |

| Services–0.0% | | | | | | | |

Service Corp. International

6.75%, 4/01/16 | | 5 | | | 4,900 |

| | | | | | | |

| Technology–0.1% | | | | | | | |

Flextronics International Ltd.

6.50%, 5/15/13 | | 900 | | | 877,500 |

| | | | | | | |

| Transportation—Airlines–0.1% | | | | | | | |

UAL Pass Through Trust Series 2007-1

Series 071A

6.636%, 7/02/22 | | 1,139 | | | 956,528 |

| | | | | | | |

| Transportation—Railroads–0.0% | | | | | | | |

Trinity Industries, Inc.

6.50%, 3/15/14 | | 5 | | | 4,950 |

| | | | | | | |

| | | | | 31,480,709 |

| | | | | | | |

| | | | | | | |

| | |

| Financial Institutions–1.6% | | | |

| Banking–0.9% | | | |

ABN Amro Bank NV

4.31%, 3/10/16(e) | | EUR | | 625 | | | 507,599 |

BankAmerica Capital II

Series 2

8.00%, 12/15/26 | | $ | | 1,298 | | | 1,252,570 |

Commerzbank Capital Funding Trust I

| | | | | |

5.012%, 4/12/16(e) | | EUR | | 300 | | | 230,478 |

Dexia Credit Local

4.30%, 11/18/15(e) | | 700 | | | 507,051 |

HBOS Capital Funding LP

4.939%, 5/23/16(e) | | 117 | | | 92,454 |

HBOS Euro Finance LP

7.627%, 12/09/11(e) | | 437 | | | 415,664 |

KBC Bank Funding Trust III

9.86%, 11/02/09(a)(e) | | $ | | 1,910 | | | 1,317,900 |

Lloyds Banking Group PLC

5.92%, 10/01/15(a)(e) | | 1,300 | | | 741,000 |

6.267%, 11/14/16(a)(e) | | 2,715 | | | 1,547,550 |

6.657%, 5/21/37(a)(e) | | 2,400 | | | 1,464,000 |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

RBS Capital Trust III

5.512%, 9/30/14(e) | | $ | 2,085 | | $ | 959,100 |

Zions Bancorporation

5.50%, 11/16/15 | | | 935 | | | 718,319 |

| | | | | | | | |

| | | | | | | | 9,753,685 |

| | | | | | | | |

| Brokerage–0.1% | | | | | | | | |

Lehman Brothers Holdings, Inc.

6.20%, 9/26/14(g) | | | 1,108 | | | 188,360 |

7.875%, 11/01/09(g) | | | 2,323 | | | 394,910 |

Series G | | | | | | |

4.80%, 3/13/14(g) | | | 698 | | | 118,660 |

| | | | | | | | |

| | | | | | | | 701,930 |

| | | | | | | | |

| Finance–0.4% | | | | | | | | |

CIT Group, Inc.

5.00%, 2/01/15 | | | 5 | | | 3,202 |

5.125%, 9/30/14 | | | 595 | | | 381,167 |

5.85%, 9/15/16 | | | 2,450 | | | 1,544,071 |

7.625%, 11/30/12 | | | 2,365 | | | 1,540,351 |

5.80%, 12/15/16 | | | 250 | | | 116,840 |

CIT Group, Inc. FRN

0.10%, 12/14/16(d) | | | 200 | | | 98,124 |

| | | | | | | | |

| | | | | | | | 3,683,755 |

| | | | | | | | |

| Insurance–0.2% | | | | | | | | |

ING Capital Funding Trust III

8.439%, 12/31/10(e) | | | 1,570 | | | 1,051,900 |

ING Groep NV

5.775%, 12/08/15(e) | | | 525 | | | 336,000 |

Liberty Mutual Group, Inc.

7.80%, 3/15/37(a) | | | 1,240 | | | 942,400 |

| | | | | | | | |

| | | | | | | | 2,330,300 |

| | | | | | | | |

| REITS–0.0% | | | | | | | | |

AMR Real Estate PTR/FIN

7.125%, 2/15/13 | | | 560 | | | 539,000 |

| | | | | | | | |

| | | | | | 17,008,670 |

| | | | | | | | |

| | | | | | | | |

| | |

| Utility–0.5% | | | |

| Electric–0.5% | | | |

The AES Corp.

7.75%, 3/01/14–10/15/15 | | | 1,020 | | | 1,026,650 |

Dynegy Holdings, Inc.

8.375%, 5/01/16 | | | 1,175 | | | 1,098,625 |

Edison Mission Energy

7.00%, 5/15/17 | | | 865 | | | 722,275 |

NRG Energy, Inc.

7.25%, 2/01/14 | | | 1,085 | | | 1,066,012 |

7.375%, 2/01/16 | | | 635 | | | 614,363 |

RRI Energy, Inc.

7.625%, 6/15/14 | | | 575 | | | 564,219 |

| | | | | | | | |

| | | | | | 5,092,144 |

| | | | | | | | |

Total Corporates—Non-Investment Grades

(cost $58,148,378) | | | | | | | | 53,581,523 |

| | | | | | | | |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

| AGENCIES–4.1% | | | |

| Agency Debentures–4.1% | | | | | | |

Federal Home Loan Bank

5.00%, 11/17/17 | | $ | 13,190 | | $ | 14,409,112 |

Federal Home Loan Mortgage Corp.

4.125%, 12/21/12 | | | 100 | | | 107,305 |

5.125%, 11/17/17 | | | | | 14,171 | | | 15,745,129 |

Federal National Mortgage Association

3.25%, 4/09/13 | | | 180 | | | 189,211 |

6.25%, 5/15/29 | | | | | 8,440 | | | 10,355,737 |

6.625%, 11/15/30 | | | | | 560 | | | 722,799 |

| | | | | | | | |

Total Agencies

(cost $40,079,191) | | | | | | | | 41,529,293 |

| | | | | | | | |

| | | | | | | | |

| | |

| BANK LOANS–2.6% | | | |

| | |

| Industrial–2.2% | | | |

| Basic–0.2% | | | |

Georgia-Pacific LLC

3.53%–3.71%, 12/23/14(d) | | | 184 | | | 182,363 |

Hexion Specialty Chemicals, Inc.

2.56%, 5/05/13(d) | | | 89 | | | 74,362 |

2.88%, 5/05/13(d) | | | | | 413 | | | 343,206 |

Ineos US Finance LLC

12/16/13(h) | | | 100 | | | 83,750 |

12/16/14(h) | | | | | 100 | | | 84,083 |

John Maneely Co.

3.49%–3.76%, 12/09/13(d) | | | 768 | | | 625,617 |

Lyondell Chemical Company

3.75%, 12/20/13(d) | | | 86 | | | 55,950 |

4.00%, 12/22/14(d) | | | | | 52 | | | 33,964 |

7.00%, 12/22/14(d) | | | | | 225 | | | 147,378 |

Lyondell Chemical Company (New Money Dip)

13.00%, 12/15/09(d)(i) | | | 134 | | | 139,345 |

Lyondell Chemical Company (New Roll-Up Dip)

5.80%–6.56%, 12/15/09(d) | | | 134 | | | 130,064 |

Univar Corp. Opco

3.25%, 10/10/14(d) | | | 237 | | | 220,237 |

| | | | | | | | |

| | | | | | | | 2,120,319 |

| | | | | | | | |

| Capital Goods–0.1% | | | | | | | | |

Hawker Beechcraft Acquisition

3/26/14(h) | | | 142 | | | 108,291 |

3/26/14(h) | | | | | 8 | | | 6,391 |

Manitowoc Co., Inc.

7.50%, 11/06/14(d) | | | 347 | | | 328,617 |

Ravago Holding America, Inc.

3.38%, 1/30/14(d) | | | 486 | | | 398,725 |

Sequa Corp.

3.58%–3.94%, 12/03/14(d) | | | 278 | | | 239,793 |

Tegrant Corp. (SCA Packaging)

5.79%, 3/08/15(d) | | | 300 | | | 99,000 |

| | |

| 14 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

TRW Automotive Inc.

6.25%, 2/09/14(d) | | $ | 216 | | $ | 214,986 |

| | | | | | | | |

| | | | | | | | 1,395,803 |

| | | | | | | | |

| Communications—Media–0.2% | | | | | | |

Cequel Communications LLC (Cebridge)

2.24%–4.25%, 11/05/13(d) | | | 245 | | | 230,864 |

Charter Communications Operating LLC

6.25%, 3/06/14(d) | | | 1,171 | | | 1,102,624 |

Clear Channel Communications, Inc.

1/29/16(h) | | | 250 | | | 187,707 |

Nielsen Finance LLC

2.25%, 8/09/13(d) | | | 292 | | | 274,835 |

4.00%, 5/01/16(d) | | | | | 159 | | | 149,216 |

Univision Communications, Inc.

2.53%, 9/29/14(d) | | | 625 | | | 526,706 |

| | | | | | | | |

| | | | | | | | 2,471,952 |

| | | | | | | | |

| Communications—Telecommunications–0.2% | | | | | | |

Sorenson Communications, Inc.

2.75%, 8/16/13(d) | | | 853 | | | 806,259 |

7.25%, 2/16/14(d) | | | | | 828 | | | 768,004 |

| | | | | | | | |

| | | | | | | | 1,574,263 |

| | | | | | | | |

| Consumer Cyclical—Automotive–0.1% | | | | | | |

Ford Motor Co.

3.25%–3.51%, 12/15/13(d) | | | 463 | | | 410,186 |

Lear Corp.

7.86%, 4/25/12(d)(g) | | | 300 | | | 269,501 |

Visteon Corp.

8.35%, 6/13/13(d)(g) | | | 300 | | | 241,071 |

| | | | | | | | |

| | | | | | | | 920,758 |

| | | | | | | | |

| Consumer Cyclical—Other–0.1% | | | | | | | | |

Harrah’s Operating Co., Inc.

3.28%–3.50%, 1/28/15(d) | | | 418 | | | 337,677 |

Las Vegas Sands LLC

2.04%, 5/23/14(d) | | | 521 | | | 434,834 |

On Assignment, Inc.

6.75%, 1/31/13(d) | | | 429 | | | 405,807 |

VML US Finance LLC

5.79%, 5/27/13(d) | | | 249 | | | 236,882 |

| | | | | | | | |

| | | | | | | | 1,415,200 |

| | | | | | | | |

| Consumer Cyclical—Retailers–0.1% | | | | | | |

Michaels Stores, Inc.

2.50%–2.56%, 10/31/13(d) | | | 250 | | | 222,187 |

Neiman Marcus Group, Inc.

2.25%–2.32%, 4/06/13(d) | | | 500 | | | 432,500 |

| | | | | | | | |

| | | | | | 654,687 |

| | | | | | | | |

| Consumer Non-Cyclical–0.4% | | | | | | |

Best Brands Corp.

7.51%, 12/12/12(d)(j) | | | 385 | | | 330,882 |

CHS/Community Health Systems, Inc.

2.50%–2.62%, 7/25/14(d) | | | 351 | | | 329,799 |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Fenwal, Inc.

2.62%, 2/28/14(d) | | $ | 823 | | $ | 712,113 |

HCA, Inc.

2.53%, 11/18/13(d) | | | 911 | | | 858,747 |

Health Management Associates, Inc.

2.03%, 2/28/14(d) | | | 368 | | | 344,675 |

Talecris Biotherapeutics Holdings Corp.

3.96%, 12/06/13(d) | | | 680 | | | 664,831 |

Wrigley Jr Company

6.50%, 9/30/14(d) | | | 289 | | | 293,442 |

| | | | | | | | |

| | | | | | 3,534,489 |

| | | | | | | | |

| Energy–0.1% | | | | | | |

Ashmore Energy International

3.25%, 3/30/12(d) | | | 90 | | | 80,801 |

3.28%, 3/30/14(d) | | | 375 | | | 337,633 |

Dalbo, Inc.

3.85%, 8/27/12(d) | | | 370 | | | 253,645 |

Infrastrux Group, Inc.

4.50%, 11/03/12(d)(j) | | | 786 | | | 746,847 |

| | | | | | | | |

| | | | | | 1,418,926 |

| | | | | | | | |

| Other Industrial–0.1% | | | | | | |

Education Management LLC

2.06%, 6/03/13(d) | | | 469 | | | 445,722 |

Swift Transportation Co., Inc.

5/12/14(h) | | | 338 | | | 311,001 |

| | | | | | | | |

| | | | | | 756,723 |

| | | | | | | | |

| Services–0.2% | | | | | | |

Collins & Aikman Floorcoverings, Inc. (Tandus)

2.74%–3.78%, 5/08/14(d) | | | 470 | | | 321,870 |

Sabre, Inc.

2.50%–2.74%, 9/30/14(d) | | | 500 | | | 439,325 |

Travelport LLC

2.75%–2.78%, 8/23/13(d) | | | 333 | | | 307,838 |

2.78%, 8/23/13(d) | | | 67 | | | 62,084 |

West Corp.

2.62%, 10/24/13(d) | | | 965 | | | 910,169 |

| | | | | | | | |

| | | | | | 2,041,286 |

| | | | | | | | |

| Technology–0.4% | | | | | | |

Avaya Inc.

10/24/14(h) | | | 250 | | | 200,832 |

Dealer Computer Services, Inc.

2.25%, 10/26/12(d) | | | 754 | | | 660,659 |

5.75%, 10/26/13(d) | | | 500 | | | 385,000 |

Dresser, Inc.

2.68%, 5/04/14(d) | | | 485 | | | 453,745 |

First Data Corp.

3.00%–3.04%, 9/24/14(d) | | | 243 | | | 208,831 |

Freescale Semiconductor, Inc.

2.01%, 11/29/13(d) | | | 500 | | | 398,525 |

IPC Systems, Inc.

2.50%–2.53%, 6/02/14(d) | | | 695 | | | 563,371 |

5.53%, 6/01/15(d) | | | 750 | | | 427,500 |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Sitel, LLC (ClientLogic)

5.74%–6.05%, 1/30/14(d) | | $ | 683 | | $ | 553,226 |

Sungard Data Systems, Inc.

2.00%, 2/28/14(d) | | | 17 | | | 15,691 |

3.95%–4.09%, 2/28/16(d) | | | 224 | | | 217,849 |

| | | | | | | | |

| | | | | | 4,085,229 |

| | | | | | | | |

| Transportation—Airlines–0.0% | | | | | | |

Delta Airlines

3.50%, 4/30/14(d) | | | 498 | | | 415,145 |

| | | | | | | | |

| Transportation—Services–0.0% | | | | | | |

Oshkosh Truck Corp.

6.33%–6.60%, 12/06/13(d) | | | 158 | | | 157,834 |

| | | | | | | | |

| | | | | | 22,962,614 |

| | | | | | | | |

| | | | | | | | |

| |

| Utility–0.2% |

| Electric–0.2% | | | | | | |

Calpine Corp.

3.17%, 3/29/14(d) | | | 244 | | | 223,563 |

FirstLight Power Resources, Inc.

4.81%, 5/01/14(d) | | | 800 | | | 680,000 |

GBGH, LLC (US Energy)

4.00%, 6/09/13(d)(k)(l) | | | 308 | | | 156,299 |

12.00%, 6/09/14(d)(j)(k)(l) | | | 93 | | | 0 |

Texas Competitive Electric Holdings Company LLC

3.75%–3.78%, 10/10/14(d) | | | 1,376 | | | 1,094,000 |

| | | | | | | | |

| | | | | | 2,153,862 |

| | | | | | | | |

| | | | | | | | |

| |

| Financial Institutions–0.2% |

| Finance–0.1% | | | | | | |

CIT Group, Inc.

13.00%, 1/20/12(d) | | | 720 | | | 741,089 |

LPL Holdings

2.00%–2.03%, 6/28/13(d) | | | 219 | | | 205,848 |

| | | | | | | | |

| | | | | | 946,937 |

| | | | | | | | |

| REITS–0.1% | | | | | | |

Crescent Resources, LLC

8.36%, 9/07/12(d)(g) | | | 1,808 | | | 584,488 |

13.50%, 6/10/10(d) | | | 300 | | | 301,500 |

| | | | | | | | |

| | | | | | 885,988 |

| | | | | | | | |

| | | | | | 1,832,925 |

| | | | | | | | |

Total Bank Loans

(cost $30,973,535) | | | | | | 26,949,401 |

| | | | | | | | |

| | | | | | | | |

| | |

| INFLATION-LINKED SECURITIES–2.4% | | | |

| United States–2.4% | | | | | | |

U.S. Treasury Notes

3.00%, 7/15/12 (TIPS)

(cost $24,470,685) | | | 23,225 | | | 24,691,236 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

| GOVERNMENTS—SOVEREIGN BONDS–2.1% | | | |

| Brazil–0.8% | | | | | | |

Republic of Brazil

8.25%, 1/20/34 | | $ | 6,010 | | $ | 7,924,185 |

| | | | | | | | |

| Peru–0.5% | | | | | | |

Republic of Peru

8.375%, 5/03/16 | | | 1,470 | | | 1,789,725 |

9.875%, 2/06/15 | | | 3,150 | | | 3,994,200 |

| | | | | | | | |

| | | | | | 5,783,925 |

| | | | | | | | |

| Poland–0.5% | | | | | | |

Poland Government International Bond

6.375%, 7/15/19 | | | 4,340 | | | 4,854,724 |

| | | | | | | | |

| Russia–0.3% | | | | | | |

Russian Federation

7.50%, 3/31/30(a)(b) | | | 3,142 | | | 3,411,411 |

| | | | | | | | |

Total Governments—Sovereign Bonds

(cost $19,058,054) | | | | | | 21,974,245 |

| | | | | | | | |

| | | | | | | | |

| | |

| ASSET-BACKED SECURITIES–1.1% | | | |

| Home Equity Loans—Floating Rate–0.9% | | | |

Citigroup Mortgage Loan Trust, Inc.

Series 2007-AMC4, Class M1

0.516%, 5/25/37(d) | | | 65 | | | 2,214 |

Countrywide Asset-Backed Certificates

Series 2002-4, Class A1

0.986%, 2/25/33(d) | | | 4 | | | 1,931 |

Series 2006-S5, Class A1

0.356%, 6/25/35(d) | | | 5 | | | 3,888 |

Credit-Based Asset Servicing and Securitization LLC

Series 2003-CB1, Class AF

3.95%, 1/25/33(d) | | | 52 | | | 45,279 |

HFC Home Equity Loan Asset Backed Certificates

Series 2005-3, Class A1

0.506%, 1/20/35(d) | | | 758 | | | 640,698 |

Series 2006-1, Class M1

0.526%, 1/20/36(d) | | | 30 | | | 23,699 |

Series 2007-1, Class M1

0.626%, 3/20/36(d) | | | 110 | | | 62,145 |

Series 2007-2, Class M1

0.556%, 7/20/36(d) | | | 40 | | | 22,790 |

Home Equity Asset Trust

Series 2007-2, Class M1

0.676%, 7/25/37(d) | | | 4,620 | | | 100,748 |

Series 2007-3, Class M1

0.596%, 8/25/37(d) | | | 4,590 | | | 128,470 |

HSI Asset Securitization Corp. Trust

Series 2006-OPT2, Class M2

0.636%, 1/25/36(d) | | | 1,515 | | | 317,256 |

Series 2007-WF1, Class 2A2

0.376%, 5/25/37(d) | | | 7,980 | | | 5,283,595 |

| | |

| 16 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Indymac Residential Asset Backed Trust

Series 2006-D, Class 2A2

0.356%, 11/25/36(d) | | $ | 149 | | $ | 106,962 |

Master Asset Backed Securities Trust

Series 2006-NC2, Class A3

0.356%, 8/25/36(d) | | | 220 | | | 113,898 |

Newcastle Mortgage Securities Trust

Series 2007-1, Class 2A1

0.376%, 4/25/37(d) | | | 3,108 | | | 1,861,624 |

Novastar Home Loan Equity

Series 2007-2, Class M1

0.546%, 9/25/37(d) | | | 25 | | | 599 |

Option One Mortgage Loan Trust

Series 2006-3, Class M1

0.476%, 2/25/37(d) | | | 1,200 | | | 24,624 |

RAAC Series

Series 2006-SP3, Class A1

0.326%, 8/25/36(d) | | | 164 | | | 157,799 |

Residential Asset Mortgage Products, Inc.

Series 2005-RS3, Class AIA2

0.416%, 3/25/35(d) | | | 44 | | | 43,827 |

Series 2005-RZ1, Class A2

0.446%, 4/25/35(d) | | | 43 | | | 43,147 |

Soundview Home Equity Loan Trust

Series 2007-OPT2, Class 2A2

0.376%, 7/25/37(d) | | | 85 | | | 35,128 |

Wells Fargo Home Equity Trust

Series 2004-1, Class 1A

0.546%, 4/25/34(d) | | | 62 | | | 37,315 |

| | | | | | | | |

| | | | | | 9,057,636 |

| | | | | | | | |

| Home Equity Loans—Fixed Rate–0.1% | | | |

Asset Backed Funding Certificates

Series 2003-WF1, Class A2

1.391%, 12/25/32 | | | 546 | | | 347,298 |

Bayview Financial Acquisition Trust

Series 2005-D, Class AF2

5.402%, 12/28/35 | | | 90 | | | 82,961 |

Citifinancial Mortgage Securities, Inc.

Series 2003-1, Class AFPT

3.36%, 1/25/33 | | | 546 | | | 390,907 |

Countrywide Asset-Backed Certificates

Series 2007-S1, Class A3

5.81%, 11/25/36 | | | 124 | | | 27,109 |

Credit-Based Asset Servicing and Securitization LLC

Series 2005-CB4, Class AF2

4.751%, 8/25/35 | | | 117 | | | 109,171 |

Home Equity Mortgage Trust

Series 2005-4, Class A3

4.742%, 1/25/36 | | | 78 | | | 78,660 |

| | | | | | | | |

| | | | | | 1,036,106 |

| | | | | | | | |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

| Other ABS—Fixed Rate–0.1% | | | | | | |

DB Master Finance, LLC

Series 2006-1, Class A2

5.779%, 6/20/31(a) | | $ | 700 | | $ | 658,000 |

| | | | | | | | |

| Other ABS—Floating Rate–0.0% | | | | | | |

Petra CRE CDO Ltd.

Series 2007-1A, Class C

1.366%, 2/25/47(a)(d) | | | 1,410 | | | 42,300 |

| | | | | | | | |

Total Asset-Backed Securities

(cost $28,278,263) | | | | | | 10,794,042 |

| | | | | | | | |

| | | | | | | | |

| | |

| CMOS–0.8% | | | |

| Non-Agency ARMS–0.5% | | | | | | |

Bear Stearns Alt-A Trust

Series 2006-3, Class 22A1

5.948%, 5/25/36(e) | | | 69 | | | 35,362 |

Series 2007-1, Class 21A1

5.619%, 1/25/47(e) | | | 183 | | | 102,305 |

Citigroup Mortgage Loan Trust, Inc.

Series 2005-2, Class 1A4

5.122%, 5/25/35(e) | | | 2,555 | | | 2,125,278 |

Series 2006-AR1, Class 3A1

5.50%, 3/25/36(d) | | | 160 | | | 101,483 |

Countrywide Alternative Loan Trust

Series 2006-OA7, Class 1A1

3.129%, 6/25/46(e) | | | 4,252 | | | 1,723,171 |

Deutsche Mortgage Securities, Inc.

Series 2005-WF1, Class 1A1

5.139%, 6/26/35(a) | | | 378 | | | 368,770 |

Indymac Index Mortgage Loan Trust

Series 2006-AR7, Class 4A1

5.901%, 5/25/36(e) | | | 1,483 | | | 774,055 |

Merrill Lynch Mortgage Investors, Inc.

Series 2005-A9, Class 2A1A

5.159%, 12/25/35(e) | | | 9 | | | 7,927 |

Residential Funding Mortgage Securities, I Inc.

Series 2005-SA3, Class 3A

5.249%, 8/25/35(e) | | | 87 | | | 71,827 |

| | | | | | | | |

| | | | | | 5,310,178 |

| | | | | | | | |

| Non-Agency Floating Rate–0.3% | | | | | | |

Banc of America Funding Corp.

Series 2007-B, Class A1

0.456%, 4/20/47(d) | | | 99 | | | 45,861 |

Countrywide Alternative Loan Trust

Series 2005-62, Class 2A1

1.901%, 12/25/35(d) | | | 955 | | | 515,712 |

Series 2006-OA14, Class 3A1

1.751%, 11/25/46(d) | | | 2,721 | | | 1,153,475 |

JP Morgan Alternative Loan Trust

Series 2006-S1, Class 3A1

0.356%, 3/25/36(d) | | | 0 | | | 161 |

Lehman XS Trust

Series 2007-4N, Class M1

0.696%, 3/25/47(d) | | | 145 | | | 890 |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

MLCC Mortgage Investors, Inc.

Series 2003-F, Class A1

0.566%, 10/25/28(d) | | $ | 9 | | $ | 7,478 |

Sequoia Mortgage Trust

Series 2007-3, Class 1A1

0.446%, 7/20/36(d) | | | 44 | | | 33,762 |

Structured Asset Mortgage Investment, Inc.

Series 2004-AR5, Class 1A1

0.576%, 10/19/34(d) | | | 879 | | | 598,516 |

WaMu Mortgage Pass Through Certificates

Series 2005-AR13, Class B1

0.846%, 10/25/45(d) | | | 58 | | | 3,730 |

Series 2005-AR13, Class B2

0.876%, 10/25/45(d) | | | 58 | | | 2,606 |

Series 2007-OA1, Class A1A

1.751%, 2/25/47(d) | | | 84 | | | 40,366 |

Series 2007-OA3, Class B1

0.696%, 4/25/47(d) | | | 25 | | | 375 |

| | | | | | | | |

| | | | | | 2,402,932 |

| | | | | | | | |

| Non-Agency Fixed Rate–0.0% | | | | | | |

JP Morgan Alternative Loan Trust

Series 2006-A3, Class 2A1

6.048%, 7/25/36 | | | 93 | | | 49,774 |

Merrill Lynch Mortgage Investors, Inc.

Series 2005-A8, Class A1C1

5.25%, 8/25/36 | | | 276 | | | 247,040 |

| | | | | | | | |

| | | | | | 296,814 |

| | | | | | | | |

| Agency Fixed Rate–0.0% | | | | | | |

Fannie Mae Grantor Trust

Series 2004-T5, Class AB4

0.553%, 5/28/35 | | | 323 | | | 294,160 |

| | | | | | | | |

Total CMOs

(cost $14,784,635) | | | | | | 8,304,084 |

| | | | | | | | |

| | | | | | | | |

| | |

| QUASI-SOVEREIGNS–0.8% | | | |

| Quasi-Sovereign Bonds–0.8% | | | |

| Russia–0.8% | | | | | | |

RSHB Capital SA for OJSC Russian Agricultural Bank

6.299%, 5/15/17(a) | | | 2,825 | | | 2,712,000 |

7.75%, 5/29/18(a) | | | 5,380 | | | 5,554,850 |

| | | | | | | | |

Total Quasi-Sovereigns

(cost $8,014,025) | | | | | | 8,266,850 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value | |

| | | | | | | | | |

| EMERGING MARKETS—CORPORATE BONDS–0.1% | | | | |

| Industrial–0.1% | | | | |

| Energy–0.1% | | | | | | | |

Ecopetrol SA

7.625%, 7/23/19(a)

(cost $855,965) | | $ | 859 | | $ | 940,605 | |

| | | | | | | | | |

| | | | | | | | | |

| | | |

| | | Shares | | | |

| PREFERRED STOCKS–0.0% | | | | |

| Non Corporate Sectors–0.0% | | | | |

| Agencies—Government Sponsored–0.0% | | | | |

Federal Home Loan Mortgage Corp.

Series Z

8.375%(e) | | | 39,550 | | | 71,585 | |

Federal National Mortgage Association

8.25%(e) | | | 59,175 | | | 95,272 | |

| | | | | | | | | |

Total Preferred Stocks

(cost $2,468,125) | | | | | | 166,857 | |

| | | | | | | | | |

| | | | | | | | | |

| | | |

| | | Principal Amount (000) | | | |

| SUPRANATIONALS–0.0% | | | | |

European Investment Bank

5.125%, 5/30/17

(cost $16,368) | | $ | 15 | | | 16,658 | |

| | | | | | | | | |

| | | | | | | | | |

| | | |

| | | Shares | | | |

| SHORT-TERM INVESTMENTS–7.0% | | | | |