SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the registrant x

Filed by a party other than the registrant ¨

Check the appropriate box:

| x | | Preliminary proxy statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive proxy statement |

| ¨ | | Definitive additional materials |

| ¨ | | Soliciting material pursuant to Rule 14a-12 |

New England Bancshares, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | | Title of each class of securities to which transaction applies: |

Common stock, par value $0.01 per share

| (2) | | Aggregate number of securities to which transactions applies: |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

$

| (4) | | Proposed maximum aggregate value of transaction: |

$

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | | Amount previously paid: |

N/A

| (2) | | Form, schedule or registration statement no.: |

N/A

N/A

N/A

[NEW ENGLAND BANCSHARES LOGO]

MERGER PROPOSED—YOUR VOTE IS VERY IMPORTANT

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of New England Bancshares, Inc. The meeting will be held at , Enfield, Connecticut on , , 2003 at local time. A copy of the New England Bancshares, Inc. 2003 Annual Report to Stockholders accompanies this proxy statement.

At the annual meeting, you will be asked to approve the issuance of additional shares of our common stock, subject to adjustment, to Enfield Mutual Holding Company in connection with a merger between Enfield Federal Savings and Loan Association and Windsor Locks Community Bank, FSL. You will also be asked to elect three directors to our board of directors for a three-year term each and to ratify the appointment of Shatswell, MacLeod & Company, P.C. as our independent auditors for the fiscal year ending March 31, 2004.

The completion of the merger with Windsor Locks Community Bank is subject to certain conditions, including the approval of the proposal to issue additional shares of our common stock to Enfield Mutual Holding Company by the affirmative vote of our outstanding shares of common stock, excluding shares held by Enfield Mutual Holding Company. We urge you to read the attached proxy statement carefully. It describes the merger agreement in detail and includes a copy of the merger agreement as Appendix A.

Our board of directors has unanimously approved the merger agreement and recommends that you vote “FOR” approval of the proposal to issue additional shares of our common stock to Enfield Mutual Holding Company in connection with the merger.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to complete and mail the enclosed proxy card promptly. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card.

Thank you for your cooperation.

Sincerely, |

|

David J. O’Connor |

President and Chief Executive Officer |

Proxy statement dated , 2003 and first mailed on or about , 2003

New England Bancshares, Inc.

660 Enfield Street

Enfield, Connecticut 06082

(860) 253-5200

Notice of Annual Meeting of Stockholders

On , 2003, we will hold our annual meeting of stockholders at , Enfield, Connecticut. The meeting will begin at :00 .m., local time. At the meeting, you will be asked to consider and act on the following:

| | 1. | | The approval of the issuance of shares of common stock, $0.01 par value, of New England Bancshares, Inc., subject to adjustment, to Enfield Mutual Holding Company pursuant to the Agreement and Plan of Merger, dated as of January 22, 2003, by and among Enfield Mutual Holding Company, New England Bancshares, Inc., Enfield Federal Savings and Loan Association and Windsor Locks Community Bank, FSL, pursuant to which Windsor Locks Community Bank, FSL will merge with and into Enfield Federal Savings and Loan Association; |

| | 2. | | The election of three directors to serve for a term of three years each; |

| | 3. | | The ratification of the appointment of Shatswell, MacLeod & Company, P.C. as independent auditors for the year ending March 31, 2004; and |

| | 4. | | The transaction of any other business that may properly come before the meeting. |

NOTE: The board of directors is not aware of any other business to come before the meeting.

Only stockholders of record at the close of business on , 2003 are entitled to receive notice of and to vote at the meeting and any adjournment or postponement of the meeting.

Please complete and sign the enclosed form of proxy, which is solicited by the board of directors, and mail it promptly in the enclosed envelope. The proxy will not be used if you attend the meeting and vote in person.

BY ORDER OF THE BOARD OF DIRECTORS |

|

Cynthia G. Gray |

Corporate Secretary |

Enfield, Connecticut

, 2003

IMPORTANT: The prompt return of proxies will save us the expense of further requests for proxies to ensure a quorum. A self-addressed envelope is enclosed for your convenience. No postage is required if mailed in the United States.

Table of Contents

i

Terminating the Merger Agreement | | 36 |

Termination Fee and Reimbursement of Expenses | | 37 |

| |

Pro Forma Financial Information | | 38 |

New England Bancshares, Inc. and Windsor Locks Community Bank, FSL Unaudited Pro Forma Consolidated Condensed Combined Balance Sheet as of June 30, 2003 | | 39 |

New England Bancshares, Inc. and Windsor Locks Community Bank, FSL Unaudited Pro Forma Consolidated Condensed Combined Statement of Operations for the Three Months Ended June 30, 2003 | | 40 |

New England Bancshares, Inc. and Windsor Locks Community Bank, FSL Unaudited Pro Forma Consolidated Condensed Combined Statement of Operations For the Year Ended March 31, 2003 | | 41 |

Notes to the Unaudited Pro Forma Consolidated Condensed Combined Financial Statements | | 42 |

| |

Windsor Locks Community Bank Management’s Discussion and Analysis of Financial Condition and Results of Operation | | 46 |

| |

Stock Ownership | | 49 |

| |

Proposal No. 2: Election of Directors | | 50 |

Directors’ Compensation | | 52 |

Executive Compensation | | 53 |

| |

Proposal No. 3: Ratification of Appointment of Independent Auditors | | 57 |

| |

Audit Committee Report | | 58 |

| |

Stockholder Proposals and Nominations | | 60 |

| |

Where You Can Find More Information | | 60 |

| |

Form 10-KSB | | 61 |

| |

Index to Windsor Locks Community Bank, FSL Financial Statements | | |

APPENDIX A | | Agreement and Plan of Merger, dated as of January 22, 2003, by and among Enfield Mutual Holding Company, New England Bancshares, Inc., Enfield Federal Savings and Loan Association and Windsor Locks Community Bank, FSL (exhibits omitted) |

| |

APPENDIX B | | Opinion of FinPro, Inc. |

| |

APPENDIX C | | Audit Committee Charter |

ii

Questions and Answers About the Meeting

Question: What am I being asked to vote on and how does my board recommend that I vote?

Answer: You are being asked to vote on three matters:

| | 1. | | the issuance of shares of our common stock, subject to adjustment, to Enfield Mutual Holding Company as part of the merger of Windsor Locks Community Bank with and into Enfield Federal Savings and Loan Association, the wholly owned subsidiary of New England Bancshares; |

| | 2. | | the election of three directors to our board of directors for a three-year term each; and |

| | 3. | | the ratification of Shatswell, MacLeod & Company, P.C. as our independent auditors for the fiscal year ending March 31, 2004. |

Our board of directors has determined that the issuance of shares of our common stock, subject to adjustment, to Enfield Mutual Holding Company as part of the merger with Windsor Locks Community Bank are in the best interests of our stockholders and unanimously recommends that you vote “FOR” issuance of the shares. Our board of directors also recommends that you vote “FOR” election of each of the nominees and for the ratification of the independent auditors.

Question: Why are we merging with Windsor Locks Community Bank?

Answer: We believe that the merger will benefit our customers, employees and stockholders by creating a stronger financial institution that will be better positioned to compete in the financial services industry in Connecticut by offering a broader range of financial products and services and through more efficient operations. To review the background and reasons for the merger in greater detail, see pages through .

Question: What votes are required in connection with the proposed merger?

Answer:The Office of Thrift Supervision is requiring the issuance of shares of our common stock, subject to adjustment, to Enfield Mutual Holding Company to be approved by the affirmative vote of a majority of our outstanding shares of common stock, as well as a majority of our outstanding shares of common stock excluding shares owned by Enfield Mutual Holding Company. The approval of the merger agreement also requires the affirmative vote of a majority of the votes eligible to be cast by Windsor Locks Community Bank’s members.

Question: How will the merger effect my shares?

Answer: Your shares will remain outstanding and will not change as a result of the merger. However, as a result of the issuance of shares of our common stock to Enfield Mutual Holding Company, our stockholders (except Enfield Mutual Holding Company) are expected to experience a dilution in ownership interest of approximately % when the new shares are issued.

1

Question: When is the merger expected to be completed?

Answer: We expect to complete the merger as soon as practicable after receiving all required stockholder, member and regulatory approvals and any waiting periods specified in the regulatory approvals have lapsed. We currently expect to complete the merger during the fourth calendar quarter of 2003.

Question: What are the tax consequences of the merger to me?

Answer: You should not recognize any gain or loss for federal income tax purposes solely as a result of the merger or the share issuance.

Question: What should I do now?

Answer: After you have carefully read this document, please indicate on your proxy card how you want to vote. Then, sign, date and mail the proxy card in the enclosed prepaid envelope as soon as possible. This will enable your shares to be represented at the meeting.

Question: If my shares are held in a stock brokerage account or by a bank or other nominee (i.e. in “street name”) will my shares automatically be voted for me?

Answer: With respect to the issuance of additional shares, your broker will not be able to vote your shares unless you provide instructions on how to vote. You should instruct your broker how to vote your shares, following the directions your broker provides. If you do not provide instructions to your broker on the proposal to issue additional shares, your shares will not be voted, and this will have the effect of voting against adoption of the proposal. Please check the voting form used by your broker to see if it offers telephonic or Internet voting.

With respect to the election of directors and the ratification of the independent auditors, your broker has the power to vote your shares in its discretion if you do not provide timely voting instructions.

Question: Who can help answer my questions?

Answer: If you want additional copies of this document, or if you want to ask any questions about the merger, you should contact:

David J. O’Connor

President and Chief Executive Officer

New England Bancshares, Inc.

660 Enfield Street

Enfield, Connecticut 06082

(860) 253-5200

2

Summary

This summary highlights selected information from this proxy statement and does not contain all the information that is important to you. For a more complete description of the terms of the proposed merger, we urge you to read carefully the entire document and the other documents to which we refer, including the merger agreement, attached as Appendix A.

THE COMPANIES

New England Bancshares, Inc. Enfield Federal Savings and Loan Association Enfield Mutual Holding Company 660 Enfield Street Enfield, Connecticut 06082 (860) 253-5200 | | New England Bancshares is a federally chartered stock holding company and the parent company of Enfield Federal Savings and Loan Association. Enfield Federal is a federally chartered stock savings and loan association headquartered in Enfield, Connecticut. Enfield Federal operates through six banking centers servicing the communities of Enfield, Manchester, Suffield and Windsor Locks, Connecticut. Enfield Federal is a community-oriented financial institution serving consumers and small businesses. Currently, 54% of our outstanding common stock is owned by Enfield Mutual Holding Company, a federally chartered mutual holding company. At June 30, 2003, we had total assets of $164.8 million, deposits of $130.8 million and stockholders’ equity of $23.4 million. |

| |

Windsor Locks Community Bank, FSL 20-I Main Street Windsor Locks, Connecticut 06096 (860) 623-2403 | | Windsor Locks Community Bank is a federally chartered mutual savings bank headquartered in Windsor Locks, Connecticut. It operates through two banking offices located in Windsor Locks and Broad Brook, Connecticut. Windsor Locks Community Bank is a community-oriented financial institution serving consumers and small businesses. At June 30, 2003, Windsor Locks Community Bank had total assets of $37.3 million, deposits of $34.6 million and capital of $2.3 million. |

|

| THE ANNUAL MEETING |

| |

| Place, Date and Time (page ) | | The annual meeting of stockholders will be held at , Enfield, Connecticut on , 2003 at , local time. |

| |

Purpose of the Annual Meeting (page ) | | At the annual meeting, you will be asked to approve the issuance of shares of our common stock, subject to adjustment, to Enfield Mutual Holding Company, to elect three directors for three-year terms, to ratify the appointment of Shatswell, MacLeod & Company, P.C. as our independent auditors for the fiscal year ending March 31, 2004, and to transact any other business that may properly come before the meeting. |

3

Who Can Vote at the Meeting (page ) | | You can vote at the annual meeting if you owned shares of our common stock at the close of business on , 2003. You will be able to cast one vote for each share of our common stock you owned at that time. As of , 2003, there were 2,086,296 shares of our common stock outstanding, including 1,127,431 shares held by Enfield Mutual Holding Company. |

| |

What Vote is Required to Approve the Merger Agreement (page ) | | The Office of Thrift Supervision is requiring the issuance of additional shares to be approved by a majority of the outstanding shares of our common stock and a majority of the outstanding shares of our common stock, excluding shares owned by Enfield Mutual Holding Company. You can vote your shares by attending the annual meeting and voting in person or by completing and mailing the enclosed proxy card. As of , 2003, our directors and executive officers owned approximately % of our outstanding common stock. Enfield Mutual Holding Company has indicated to us that it intends to vote its shares of common stock in favor of the proposal to issue additional shares. |

THE MERGER

A copy of the merger agreement is provided as Appendix A to this proxy statement. Please read the entire merger agreement carefully. It is the legal document that governs the merger.

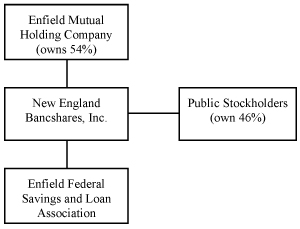

Overview of the Transaction (page ) | | In June 2002, we reorganized Enfield Federal into a stock savings and loan association with a mutual holding company structure. As part of that transaction we sold shares to our customers in a subscription offering. The majority of New England Bancshares’ outstanding shares were retained by Enfield Mutual Holding Company. As a result of the reorganization, our current organization structure is as follows: |

| |

| | |  |

4

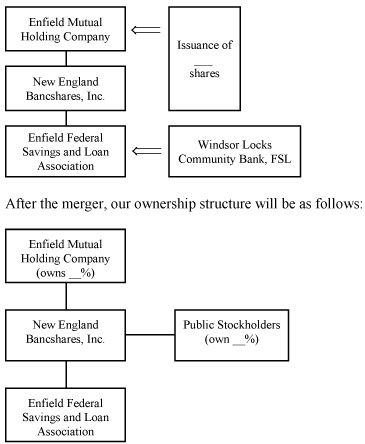

| | | Under the merger agreement, Windsor Locks Community Bank will merge with and into Enfield Federal. Enfield Federal will be the surviving institution. In connection with the merger, we will issue shares of our common stock to Enfield Mutual Holding Company in an amount equal to the value of Windsor Locks Community Bank as determined by an independent appraisal. |

| |

| | | |

| |

| | | |

| |

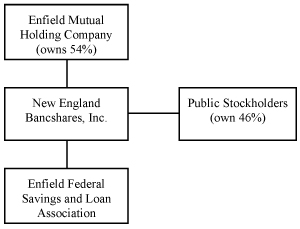

| | |  |

| |

Each Outstanding Share of Our Common Stock Will Remain Unchanged in the Merger (page ) | | Each of your shares of our common stock will remain outstanding and unchanged in the merger. However, as a result of the issuance of an additional shares of our stock (based on the market value of our common stock on , 2003) to Enfield Mutual Holding Company, you are expected to experience a dilution in ownership interest of approximately % when the new shares are issued. Members of Windsor Locks Community Bank will not receive any shares of our common stock in the merger. |

| |

Issuance of Our Shares to Enfield Mutual Holding Company (page ) | | In connection with the merger, the Office of Thrift Supervision, as the primary federal regulator of New England Bancshares, Enfield Federal and Windsor Locks |

5

| | | Community Bank, will require us to issue shares of our common stock to Enfield Mutual Holding Company in an amount equal to the value of Windsor Locks Community Bank as determined by an independent appraiser. The independent appraisal has been prepared by RP Financial, LC., Windsor Locks Community Bank’s financial advisor, and states that the value of Windsor Locks Community Bank was $3.35 million as of July 25, 2003. Based on the market value of our common stock on , 2003 this would have resulted in us issuing shares of common stock to Enfield Mutual Holding Company. Issuing shares will cause you to experience a dilution in ownership interest of approximately %. The appraisal will be updated at the time the merger is consummated and the number of shares issued to Enfield Mutual Holding Company will be adjusted to reflect any change in the appraisal and any changes in the market price of our common stock. |

| |

| Our Stock Price | | Our common stock is quoted on the Over-the-Counter Electronic Bulletin Board under the symbol “NEBS.” On January 21, 2003, which was the last trading day before the merger was announced, our common stock closed at $14.60 per share. On , 2003, which is the last practicable trading day before the printing of this document, our common stock closed at $ per share. |

| |

Tax Consequences of the Merger (page ) | | We have received an opinion of counsel to the effect that, based on certain facts, representations and assumptions, the merger will be a “reorganization” for federal income tax purposes. As your shares of New England Bancshares common stock will remain unchanged, you will not recognize any gain or loss for federal income tax purposes upon completion of the merger or the issuance of additional shares of our common stock to Enfield Mutual Holding Company. |

| |

Our Board of Directors Recommends that You Vote to Approve the Issuance of Additional Shares, Elect the Nominees for Director and Ratify the Appointment of the Independent Auditors (page ) | | Our board of directors believes that the issuance of additional shares of our common stock to Enfield Mutual Holding Company in connection with the merger is fair to and in the best interests of our stockholders, and unanimously recommends that you vote “FOR” the proposal to approve the issuance of additional shares of our common stock in connection with the merger. Our board of directors also recommends that you vote “FOR” election of each of the nominees and for ratification of the independent auditors. |

| |

| | | For a discussion of the circumstances surrounding the merger and the factors considered by our board of directors in approving the merger agreement, see page . |

6

Windsor Locks Community Bank’s Independent Appraiser Has Determined the Value of Windsor Locks Community Bank to Establish the Number of Shares of Our Common Stock That We Must Issue to Enfield Mutual Holding Company (page ) | | RP Financial has delivered to the Windsor Locks Community Bank board of directors its appraisal of the value of Windsor Locks Community Bank, as of March 21, 2003 and updated as of July 25, 2003. A summary of the appraisal is contained on pages through . You should read the summary to understand the procedures followed, assumptions made, matters considered, and qualifications and limitations on the review made by RP Financial in providing this appraisal. This appraisal, as updated, will be used to establish the number of shares of our common stock that we will be required to issue to Enfield Mutual Holding Company in connection with the merger. Windsor Locks Community Bank agreed to pay RP Financial approximately $17,500 for preparation of the appraisal and the appraisal update, plus expenses, of which $8,700 has been paid as of , 2003. Additionally, Windsor Locks Community Bank will pay RP Financial $2,500 for each update of the appraisal that is required. |

| |

Our Financial Advisor Has Reviewed the Appraised Value of Windsor Locks Community Bank and Determined That the Merger and the Shares Issuance Are Fair to Our Stockholders (page ) | | FinPro, Inc., our financial advisor, has reviewed RP Financial’s appraisal of Windsor Locks Community Bank’s value. Additionally, our board of directors received an opinion from FinPro that the merger and the issuance of shares of our common stock to Enfield Mutual Holding Company are fair, from a financial point of view, to our stockholders. Our board considered this opinion in determining to approve the merger and the share issuance. You should read this opinion completely to understand the assumptions made, matters considered and limitations of the review undertaken by FinPro in providing its opinion. FinPro’s opinion is directed to our board of directors and does not constitute a recommendation to any stockholder as to any matters relating to the merger or the share issuance. We have agreed to pay FinPro approximately $25,000, plus expenses, for its services in connection with the merger, of which $25,459 has been paid as of , 2003. FinPro has previously provided us with services in connection with our reorganization to the mutual holding company form of organization for which FinPro was paid $25,182. |

| |

Certain of Our Obligations in Connection with the Merger (page ) | | In the merger agreement, we agreed to take certain actions with regard to Windsor Locks Community Bank’s directors and officers. These include: |

| |

| | | • offering employment as President of Enfield Federal to Frederick L. Stroiney, President and Chief Executive Officer of Windsor Locks Community Bank; |

7

| |

| | | • assuming the change in control agreements that Windsor Locks Community Bank previously entered into with Mr. Stroiney and two other officers; |

| |

| | | • indemnifying Windsor Locks Community Bank’s directors and officers and insurance for such directors and officers for events occurring before the merger; |

| |

| | | • appointing six Windsor Locks Community Bank directors to the board of directors of Enfield Federal; |

| |

| | | • appointing the current Chairman of the Board of Windsor Locks Community Bank’s board of directors to the New England Bancshares board of directors; and |

| |

| | | • appointing two members of the Windsor Locks Community Bank board of directors to the Enfield Mutual Holding Company board of directors. |

| |

Regulatory Approval Needed to Complete the Merger (page ) | | The merger cannot be completed unless it is first approved by the Office of Thrift Supervision. We received approval of the Office of Thrift Supervision on August 20, 2003. While we do not know of any reason why we would not be able to obtain this approval in a timely manner, we cannot be certain when or if we will receive it. |

| |

| Conditions to Completing the Merger (page ) | | The completion of the merger depends on a number of conditions being met. These conditions include: |

| |

| | | • approval of the stock issuance by our stockholders; |

| |

| | | • approval of the merger agreement by Windsor Locks Community Bank’s members; |

| |

| | | • approval of the merger by the Office of Thrift Supervision without any condition or requirement that would so materially affect the economic benefits of the merger that, had the condition or requirement been known, we would not have entered into the merger agreement; |

| |

| | | • the continued accuracy of certain representations and warranties made on the date of the merger agreement; and |

| |

| | | • the absence of material adverse changes in certain aspects |

8

| | | of Windsor Locks Community Bank’s operations and financial position. |

| |

| | | We cannot be certain when or if the conditions to the merger will be satisfied or waived, or that the merger will be completed. |

| |

Agreement Not to Solicit Other Proposals (page ) | | Windsor Locks Community Bank has agreed not to initiate, solicit, encourage or facilitate any acquisition proposal with a third party. Despite its agreement not to solicit other acquisition proposals, the Windsor Locks Community Bank board of directors may generally negotiate or have discussions with, or provide information to, a third party who makes an unsolicited, written, bona fide acquisition proposal, provided that its board of directors determines in good faith: |

| |

| | | • after consultation with and based upon the advice of its legal counsel, that failing to take such actions would cause the board to breach its fiduciary duties under applicable law; and |

| |

| | | • after consultation with its outside legal counsel and its financial advisor, that such proposal would be more favorable to the Windsor Locks Community Bank members than the merger with Enfield Federal. |

| |

Terminating the Merger Agreement (page ) | | New England Bancshares and Windsor Locks Community Bank can agree at any time not to complete the merger, even if our stockholders and Windsor Locks Community Bank’s members have approved it. Also, either of us can decide to terminate the merger agreement: |

| |

| | | • in response to a material breach by the other party, which is not or cannot be cured within 30 days; |

| |

| | | • if the merger is not completed by December 31, 2003; |

| |

| | | • if any required regulatory, stockholder or member approval is not obtained; or |

| |

| | | • in response to a withdrawal of the board of directors of its recommendation to approve the merger agreement or a modification or qualification of its recommendation in a manner adverse to the other party. |

| |

| | | Windsor Locks Community Bank may also terminate the merger agreement if its board of directors authorizes Windsor Locks Community Bank to enter into an agreement with a third party that the Windsor Locks Community Bank board |

9

| | | determines in good faith, after consulting with its legal counsel and its financial advisor, is a superior proposal to the Enfield Federal merger. In such case, Windsor Locks Community Bank must give us three days in which to match or exceed the superior proposal. |

| |

Termination Fee and Reimbursement of Expenses (page ) | | If the merger agreement is validly terminated by either party, we must reimburse Windsor Locks Community Bank its reasonable expenses incurred in connection with the merger up to $90,000. However, we do not have to make such payment to Windsor Locks Community Bank if we terminate due to a material breach of the merger agreement by Windsor Locks Community Bank (that cannot be cured within 30 days) or if the agreement is terminated because Windsor Locks Community Bank enters into another merger agreement with a third party. In the latter case, Windsor Locks Community Bank must pay us a termination fee of $125,000. We are also entitled to such termination fee if the agreement is terminated because of a willful or intentional material breach of the merger agreement by Windsor Locks Community Bank. |

10

Selected Historical Consolidated Financial Information for

New England Bancshares

The data presented at June 30, 2003 and for the three months then ended are derived from the unaudited financial statements of New England Bancshares but, in the opinion of management, reflects all adjustments necessary to present fairly the results for that interim period. These adjustments consist only of normal recurring adjustments. The results of operations for the three months ended June 30, 2003 are not necessarily indicative of the results of operations that may be expected for the year ended March 31, 2004. The selected consolidated financial information of New England Bancshares at and for the years ended March 31, 2003, 2002 and 2001 is derived from the audited financial statements of New England Bancshares. For periods before June 4, 2002, the table reflects data for Enfield Federal.

| | | At June 30, 2003

| | At March 31,

|

| | | | 2003

| | 2002

| | 2001

|

| | | (In thousands) |

| Selected Financial Data: | | | | | | | | | | | | |

Assets | | $ | 164,807 | | $ | 161,184 | | $ | 136,311 | | $ | 122,939 |

Cash and cash equivalents | | | 17,763 | | | 20,963 | | | 12,472 | | | 17,759 |

Loans, net (1) | | | 94,179 | | | 93,581 | | | 80,468 | | | 66,372 |

Securities (2) | | | 45,214 | | | 38,888 | | | 36,985 | | | 32,824 |

Deposits | | | 130,761 | | | 128,953 | | | 114,998 | | | 108,478 |

Stockholders’ equity | | | 23,434 | | | 23,150 | | | 14,352 | | | 13,905 |

Allowance for loan losses | | | 1,068 | | | 1,008 | | | 773 | | | 603 |

Nonperforming loans | | | 237 | | | 240 | | | 201 | | | 669 |

Nonperforming assets | | | 237 | | | 240 | | | 201 | | | 939 |

| | | For the Three Months Ended June 30, 2003

| | For the Year Ended March 31,

|

| | | | 2003

| | 2002

| | 2001

|

| | | (In thousands) |

| Selected Operating Data: | | | | | | | | | | | | |

Interest and dividend income | | $ | 2,068 | | $ | 8,354 | | $ | 8,107 | | $ | 8,110 |

Interest expense | | | 733 | | | 3,346 | | | 4,142 | | | 4,514 |

| | |

|

| |

|

| |

|

| |

|

|

Net interest and dividend income | | | 1,335 | | | 5,008 | | | 3,965 | | | 3,596 |

Provision for loan losses | | | 60 | | | 240 | | | 200 | | | 194 |

| | |

|

| |

|

| |

|

| |

|

|

Net interest and dividend income after provision for loan losses | | | 1,275 | | | 4,768 | | | 3,765 | | | 3,402 |

Noninterest income | | | 145 | | | 471 | | | 432 | | | 278 |

Noninterest expense | | | 1,217 | | | 4,225 | | | 3,249 | | | 3,021 |

| | |

|

| |

|

| |

|

| |

|

|

Income before income tax expense | | | 203 | | | 1,014 | | | 948 | | | 659 |

Income tax expense | | | 60 | | | 306 | | | 292 | | | 168 |

| | |

|

| |

|

| |

|

| |

|

|

Net income | | $ | 143 | | $ | 708 | | $ | 656 | | $ | 491 |

| | |

|

| |

|

| |

|

| |

|

|

11

| | | At or

For the Three Months Ended June 30, 2003

| | | At or For the Year Ended

March 31,

| |

| | | | 2003

| | | 2002

| | | 2001

| |

| | | (In thousands) | |

Selected Financial Ratios and Other Data (3) | | | | | | | | | | | | |

Performance Ratios: | | | | | | | | | | | | |

Return on average assets | | 0.36 | % | | 0.47 | % | | 0.51 | % | | 0.41 | % |

Return on average equity | | 2.45 | | | 3.40 | | | 4.64 | | | 3.57 | |

Average equity to average assets | | 14.54 | | | 13.92 | | | 11.11 | | | 11.39 | |

Equity to total assets at end of period | | 14.22 | | | 14.36 | | | 10.53 | | | 11.31 | |

Average interest rate spread (4) | | 3.39 | | | 3.42 | | | 3.19 | | | 2.92 | |

Net interest margin (5) | | 3.61 | | | 3.69 | | | 3.41 | | | 3.20 | |

Average interest-earning assets to average interest-bearing liabilities | | 112.07 | | | 110.82 | | | 106.22 | | | 107.06 | |

Total noninterest expense to average assets | | 3.03 | | | 2.83 | | | 2.55 | | | 2.50 | |

Efficiency ratio (6) | | 82.23 | | | 77.11 | | | 73.89 | | | 77.98 | |

Regulatory Capital Ratios (7): | | | | | | | | | | | | |

Tangible capital ratio | | 13.07 | | | 13.25 | | | 10.59 | | | 11.26 | |

Core capital ratio | | 13.07 | | | 13.25 | | | 10.59 | | | 11.26 | |

Risk-based capital ratio | | 27.17 | | | 27.24 | | | 21.58 | | | 24.04 | |

Asset Quality Ratios: | | | | | | | | | | | | |

Nonperforming loans as a percent of loans (8)(9) | | 0.25 | | | 0.25 | | | 0.25 | | | 1.00 | |

Nonperforming assets as a percent of total assets (9) | | 0.14 | | | 0.15 | | | 0.15 | | | 0.76 | |

Allowance for loan losses as a percent of loans (8) | | 1.12 | | | 1.07 | | | 0.95 | | | 0.90 | |

Allowance for loan losses as a percent of nonperforming loans (9) | | 450.63 | | | 420.00 | | | 384.58 | | | 90.13 | |

| | | | |

Number of full-service banking facilities | | 6 | | | 6 | | | 4 | | | 4 | |

| (1) | | Loans, net, consist of loans receivable minus the allowance for loan losses, deferred loan origination fees, net and unadvanced loan funds. |

| (2) | | Securities include Federal Home Loan Bank of Boston stock of $820,000 as of June 30, 2003, March 31, 2003, 2002 and 2001. |

| (3) | | Asset quality ratios and regulatory capital ratios are end of period ratios. Ratios for the three months ended June 30, 2003 are annualized, where appropriate. |

| (4) | | The average interest rate spread represents the difference between the weighted average yield on average interest-earning assets (which includes Federal Home Loan Bank of Boston stock) and the weighted average cost of average interest-bearing liabilities. |

| (5) | | The net interest margin represents net interest income as a percent of average interest-earning assets. |

| (6) | | The efficiency ratio represents the ratio of noninterest expenses divided by the sum of net interest income and noninterest income. |

| (7) | | Capital ratios presented are for Enfield Federal. |

| (8) | | Loans include total loans before the allowance for loan losses. |

| (9) | | Nonperforming assets consist of nonperforming loans and other real estate owned. Nonperforming loans consist of all loans 90 days or more past due and other loans which have been identified by Enfield Federal as presenting uncertainty with respect to the collectibility of interest or principal. It is Enfield Federal’s policy to cease accruing interest on all such loans. |

12

Selected Historical Financial Information for

Windsor Locks Community Bank

The selected financial information of Windsor Locks Community Bank at and for the years ended June 30, 2003, and 2002 is derived from the audited financial statements and should be read in conjunction with the financial statements and accompanying notes of Windsor Locks Community Bank presented on Pages F-1 through F-18 in this proxy statement.

| | | At June 30,

|

| | | 2003

| | 2002

| | 2001

|

| | | (In thousands) |

Selected Financial Data: | | | | | | | | | |

Assets | | $ | 37,327 | | $ | 37,434 | | $ | 32,629 |

Cash and cash equivalents | | | 5,647 | | | 3,570 | | | 2,930 |

Loans, net (1) | | | 16,169 | | | 18,414 | | | 16,444 |

Securities (2) | | | 14,841 | | | 14,734 | | | 12,502 |

Deposits | | | 34,576 | | | 34,928 | | | 30,447 |

Capital | | | 2,325 | | | 2,084 | | | 1,848 |

Allowance for loan losses | | | 160 | | | 161 | | | 161 |

Nonperforming loans | | | 174 | | | — | | | — |

Nonperforming assets | | | 174 | | | — | | | 75 |

| | | For the Year Ended June 30,

|

| | | 2003

| | 2002

| | 2001

|

| | | (In thousands) |

Selected Operating Data: | | | | | | | | | |

Interest and dividend income | | $ | 1,969 | | $ | 2,229 | | $ | 2,036 |

Interest expense | | | 656 | | | 1,027 | | | 1,148 |

| | |

|

| |

|

| |

|

|

Net interest and dividend income | | | 1,313 | | | 1,202 | | | 888 |

Provision for loan losses | | | — | | | — | | | — |

| | |

|

| |

|

| |

|

|

Net interest and dividend income after provision for loan losses | | | 1,313 | | | 1,202 | | | 888 |

Noninterest income | | | 94 | | | 52 | | | 75 |

Noninterest expense | | | 1,114 | | | 1,031 | | | 893 |

| | | | | |

|

| |

|

|

Income before income tax expense | | | 293 | | | 223 | | | 70 |

Income tax expense | | | 134 | | | 31 | | | 18 |

| | |

|

| |

|

| |

|

|

Net income | | $ | 159 | | $ | 192 | | $ | 52 |

| | |

|

| |

|

| |

|

|

13

| | | At or For the Year Ended

June 30,

| |

| | | 2003

| | | 2002

| | | 2001

| |

Selected Financial Ratios and Other Data (3) | | | | | | | | | |

Performance Ratios: | | | | | | | | | |

Return on average assets | | 0.43 | % | | 0.55 | % | | 0.24 | % |

Return on average equity | | 7.21 | | | 9.77 | | | 4.06 | |

Average equity to average assets | | 5.90 | | | 5.61 | | | 6.00 | |

Capital to total assets at end of period | | 6.23 | | | 5.57 | | | 5.66 | |

Average interest rate spread (4) | | 3.80 | | | 3.53 | | | 3.23 | |

Net interest margin (5) | | 3.83 | | | 3.65 | | | 3.13 | |

Average interest-earning assets to average interest-bearing liabilities | | 100.99 | | | 106.60 | | | 102.65 | |

Total noninterest expense to average assets | | 2.98 | | | 2.94 | | | 2.94 | |

Efficiency ratio (6) | | 79.18 | | | 82.22 | | | 92.73 | |

Regulatory Capital Ratios: | | | | | | | | | |

Tangible capital ratio | | 5.85 | | | 5.39 | | | 5.57 | |

Core capital ratio | | 5.85 | | | 5.39 | | | 5.57 | |

Tier 1 risk-based capital ratio | | 16.68 | | | 13.82 | | | 14.74 | |

Total risk-based capital ratio | | 17.91 | | | 14.92 | | | 15.99 | |

Asset Quality Ratios: | | | | | | | | | |

Nonperforming loans as a percent of loans (7)(8) | | 1.07 | | | — | | | — | |

Nonperforming assets as a percent of total assets (8) | | 0.47 | | | — | | | 0.23 | |

Allowance for loan losses as a percent of loans (7) | | 0.98 | | | 0.87 | | | 0.97 | |

Allowance for loan losses as a percent of nonperforming loans (8) | | 91.95 | | | — | | | — | |

| | | |

Number of full-service banking facilities | | 2 | | | 2 | | | 2 | |

| (1) | | Loans, net, consist of loans receivable minus the allowance for loan losses, deferred loan income and unadvanced loan funds. |

| (2) | | Securities include Federal Home Loan Bank of Boston stock of $188,000 as of June 30, 2003 and June 30, 2002 and $162,000 as of June 30, 2001. |

| (3) | | Asset quality ratios and regulatory capital ratios are end of period ratios. |

| (4) | | The average interest rate spread represents the difference between the weighted average yield on average interest-earning assets (which includes Federal Home Loan Bank of Boston stock) and the weighted average cost of average interest-bearing liabilities. |

| (5) | | The net interest margin represents net interest income as a percent of average interest-earning assets. |

| (6) | | The efficiency ratio represents the ratio of noninterest expenses divided by the sum of net interest income and noninterest income. |

| (7) | | Loans include total loans before the allowance for loan losses. |

| (8) | | Nonperforming assets consist of nonperforming loans and other real estate owned. Nonperforming loans consist of all loans 90 days or more past due and other loans which have been identified by Windsor Locks Community Bank as presenting uncertainty with respect to the collectibility of interest or principal. It is Windsor Locks Community Bank’s policy to cease accruing interest on all such loans. |

14

Summary Selected Pro Forma Combined Data

The following table shows selected financial information on a pro forma combined basis giving effect to the merger as if the merger had become effective at the end of the period presented, in the case of balance sheet information, and at the beginning of each period presented, in the case of income statement information. The pro forma information reflects the purchase method of accounting.

We anticipate that the merger will provide the combined company with financial benefits that include reduced operating expenses and the opportunity to earn more revenue. The pro forma information, while helpful in illustrating the financial characteristics of the new company under one set of assumptions, does not reflect these benefits and, accordingly, does not attempt to predict or suggest future results. It also does not necessarily reflect what the historical results of the new company would have been had our companies been combined during this period.

Because we have a March 31 fiscal year end and Windsor Locks Community Bank has a June 30 fiscal year end, Windsor Locks Community Bank’s historical information has been adjusted to correspond to our fiscal year end. For the year ended March 31, 2003, Windsor Locks Community Bank’s historical information was calculated by adding the results for the nine months ended March 31, 2003 and the results for the three months ended June 30, 2002.

You should read this summary pro forma information in conjunction with the information under “Pro Forma Financial Information” beginning on page .

| | | Three Months Ended June 30, 2003

| | Year Ended March 31, 2003

|

| | | | | (In thousands) |

Pro forma combined income statement data: | | | | | | |

Interest and dividend income | | $ | 2,492 | | $ | 10,385 |

Interest expense | | | 847 | | | 3,967 |

| | |

|

| |

|

|

Net interest and dividend income | | | 1,645 | | | 6,418 |

Provision for loan losses | | | 60 | | | 240 |

| | |

|

| |

|

|

Net interest and dividend income after provision for loan losses | | | 1,585 | | | 6,178 |

Noninterest income | | | 167 | | | 547 |

Noninterest expense | | | 1,479 | | | 5,341 |

| | |

|

| |

|

|

Income before income tax expense | | | 273 | | | 1,384 |

Income tax expense | | | 77 | | | 460 |

| | |

|

| |

|

|

Net income | | $ | 196 | | $ | 924 |

| | |

|

| |

|

|

| | | June 30, 2003

|

| | | (In thousands) |

Pro forma combined balance sheet data: | | | |

Total assets | | $ | 204,085 |

Securities | | | 59,949 |

Loans receivable, net | | | 111,052 |

Deposits | | | 165,644 |

FHLB advances | | | 7,843 |

Total stockholders’ equity | | $ | 27,067 |

Following the merger, the declaration of dividends will be at the discretion of our board of directors and will be determined after consideration of various factors, including earnings, cash requirements, our financial condition, applicable federal law and regulations and other factors deemed relevant by our board of directors. The merger agreement prohibits the payment of and distribution by Windsor Locks Community Bank of any dividend to its members pending consummation of the merger.

15

The Annual Meeting of Stockholders

This proxy statement is furnished in connection with the solicitation of proxies by our board of directors to be used at the annual meeting of stockholders of New England Bancshares.

Place, Date and Time

The annual meeting will be held at on , 2003 at , local time.

Purpose of the Meeting

The purpose of the meeting is to consider and vote on a proposal to approve the proposal to issue shares of our common stock, subject to adjustment, to Enfield Mutual Holding Company, to elect three directors to a three-year term each, to ratify the appointment of Shatswell, MacLeod as our independent auditors for the fiscal year ending March 31, 2004 and to act on any other matters brought before the meeting.

Who Can Vote at the Meeting; Record Date

You are entitled to vote your New England Bancshares common stock only if the records of New England Bancshares show that you held your shares as of the close of business on , 2003. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by your broker or nominee. As the beneficial owner, you have the right to direct your broker on how to vote. Your broker or nominee has enclosed a voting instruction card for you to use in directing it on how to vote your shares.

As of the close of business on , 2003, a total of 2,086,296 shares of New England Bancshares common stock were outstanding, including 1,127,431 shares of common stock held by Enfield Mutual Holding Company. Each share of common stock has one vote. As provided in our charter, record holders of our common stock (other than Enfield Mutual Holding Company) who beneficially own, either directly or indirectly, in excess of 10% of our outstanding shares are not entitled to any vote in respect of the shares held in excess of the 10% limit.

Attending the Meeting

If you are a stockholder of record as of the close of business on , 2003, you may attend the meeting. However, if you hold your shares in street name, you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of our common stock held in street name in person at the meeting, you will have to get a written proxy in your name from the broker, bank or other nominee who holds your shares.

Quorum and Vote Required

Quorum. The annual meeting will be held only if a majority of the outstanding shares of our common stock entitled to vote (excluding any shares held in excess of the 10% limit) are represented at the meeting. If you return valid proxy instructions or attend the meeting in person, your shares will be

16

counted for purposes of determining whether there is a quorum present, even if you abstain from voting. Broker non-votes also will be counted for purposes of determining the existence of a quorum. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. Under applicable rules, brokers, banks and other nominees may not exercise their voting discretion on the proposal to approve the issuance of additional shares of our common stock and, for this reason, may not vote shares held for beneficial owners for that proposal without specific instructions from the beneficial owners.

Vote Required. Approval of the issuance of additional shares of our common stock requires the affirmative vote of a majority of our shares of common stock and a majority of the outstanding shares of our common stock, excluding shares owned by Enfield Mutual Holding Company. Failure to return a properly executed proxy card or to vote in person and abstentions and broker non-votes will have the same effect as a vote “AGAINST” the proposal to approve the issuance of additional shares of our common stock.

In voting on the election of directors, you may vote in favor of all nominees, withhold votes as to all nominees, or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Directors must be elected by a plurality of the votes cast at the annual meeting. This means that the nominees receiving the greatest number of votes will be elected. Votes that are withheld and broker non-votes will have no effect on the outcome of the election. In voting on the ratification of the appointment of Shatswell, MacLeod as independent auditors, you may vote in favor of the proposal, vote against the proposal or abstain from voting. The ratification of the appointment of Shatswell, MacLeod as independent auditors will be decided by the affirmative vote of a majority of the shares represented at the meeting and entitled to vote on the matter.On this matter, abstentions will have the effect as a vote “AGAINST” the proposal and broker non-votes will have no effect on the voting.

Enfield Mutual Holding Company owns 54% of the shares of common stock entitled to vote at the annual meeting. Enfield Mutual Holding Company has indicated to us that it intends to vote such shares of common stock “FOR” all three proposals, thereby ensuring a quorum at the annual meeting and the election of the director nominees and the ratification of the appointment of the independent auditors.

Shares Held by Officers and Directors; Voting Agreements

As of , 2003, our directors and executive officers owned approximately % of the outstanding shares of our common stock. All of our directors and executive officers have entered into voting agreements with Windsor Locks Community Bank to vote all of the shares of our common stock owned by them in favor of the proposal to approve the issuance of additional shares of our common stock.

Voting by Proxy

Our board of directors is sending you this proxy statement for the purpose of requesting that you allow your shares of New England Bancshares common stock to be represented at the annual meeting by the persons named in the enclosed proxy card. All shares of our common stock represented at the annual meeting by properly executed proxies will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by our board of directors.Our board of directors unanimously recommends a vote “FOR” approval of the proposal to issue additional shares of New England Bancshares

17

common stock to Enfield Mutual Holding Company, “FOR” the approval of the election of directors and “FOR” the approval of the ratification of the appointment of the independent auditors.

If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will use their best judgement to determine how to vote your shares. This includes a motion to adjourn or postpone the annual meeting to solicit additional proxies. However, no proxy voted against any of the proposals will be voted in favor of an adjournment or postponement to solicit additional votes in favor of the proposals. If the annual meeting is postponed or adjourned, New England Bancshares common stock may be voted by the persons named in the proxy card on the new annual meeting date as well, unless you have revoked your proxy. We do not know of any other matters to be presented at the annual meeting.

If your common stock is held in street name, you will receive instructions from your broker, bank or other nominee that you must follow to have your shares voted. Your broker or bank may allow you to deliver your voting instructions via the telephone or the Internet. Please see the instruction form that accompanies this proxy statement.

Revocability of Proxies

You may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy you must either advise our Corporate Secretary in writing before your common stock has been voted at the annual meeting, deliver a later dated proxy card, or attend the meeting and vote your shares in person. Attendance at the annual meeting will not in itself constitute revocation of your proxy.

Solicitation of Proxies

We will pay the cost of this proxy solicitation. In addition to solicitation of proxies by mail, we have retained Georgeson Shareholder Communications, Inc. to assist in the solicitation of proxies. We will pay Georgeson $5,000, plus expenses. We have also agreed to indemnify Georgeson Shareholder Communications against certain liabilities and expenses, including liabilities under the federal securities laws. Proxies may also be solicited, in person or by telephone, by our directors, officers and other employees, who will receive no compensation for their services other than their normal salaries. Brokerage houses, nominees, fiduciaries, and other custodians are requested to forward soliciting material to the beneficial owners of shares held of record by them and will be reimbursed for their expenses in doing so.

Participants in Enfield Federal’s ESOP and 401(k) Plan

If you participate in the Enfield Federal Savings and Loan Association Employee Stock Ownership Plan (the “ESOP”) or if you hold shares through the Enfield Federal Savings and Loan Association Employees’ Savings & Profit Sharing Plan (the “401(k) Plan”), you will receive a vote authorization form for each plan that reflects all shares that you may direct the trustees to vote on your behalf under the plans. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but each participant in the ESOP may direct the trustee how to vote the shares of New England Bancshares common stock allocated to his or her account. The ESOP trustee, subject to the exercise of its fiduciary duties, will vote all unallocated shares of common stock held by the ESOP and allocated shares for which no timely voting instructions are received in the same proportion as shares for which the trustee has received voting instructions. Under the terms of the 401(k) Plan, you are entitled to direct the

18

trustee how to vote the shares of New England Bancshares common stock held in the New England Bancshares, Inc. Stock Fund credited to your account. The trustee will vote all shares of New England Bancshares common stock for which no directions are given or for which timely instructions were not received in the same proportion as shares for which the trustee received voting instructions. The deadline for returning your voting instructions to each plan’s trustee is , 2003.

Proposal No. 1: The Issuance of Additional Shares

of Our Common Stock Pursuant to the Merger

The following discussion of the merger is qualified by reference to the merger agreement, which is attached to this proxy statement as Appendix A. You should read the entire merger agreement carefully. It is the legal document that governs the merger. All information contained in this proxy statement with respect to Windsor Locks Community Bank has been supplied by Windsor Locks Community Bank for inclusion herein and has not been independently verified by us.

The Parties to the Merger

New England Bancshares, Inc.

Enfield Federal Savings and Loan Association

Enfield Mutual Holding Company

New England Bancshares became the federally chartered stock holding company for Enfield Federal in connection with the conversion of Enfield Federal from the mutual to stock form and the reorganization of Enfield Federal into a mutual holding company structure on June 4, 2002. In connection with the reorganization, Enfield Mutual Holding Company was organized and became the majority holder of New England Bancshares’ outstanding common stock. As federally-chartered savings and loan holding companies, New England Bancshares and Enfield Mutual Holding Company are regulated by the Office of Thrift Supervision. Since their formation, New England Bancshares’ and Enfield Mutual Holding Company’s principal activities have been to direct and coordinate the business of Enfield Federal. At June 30, 2003, we had total assets of $164.8 million, total deposits of $130.8 million and total stockholders’ equity of $23.4 million.

Enfield Federal, a federally chartered stock savings and loan association located in Enfield, Connecticut, was chartered in 1916. Enfield Federal is regulated by the Office of Thrift Supervision and its deposits are insured by the Federal Deposit Insurance Corporation up to applicable limits. Enfield Federal operates through six banking centers in Enfield, Manchester, Suffield, and Windsor Locks, Connecticut.

Windsor Locks Community Bank, FSL

Windsor Locks Community Bank, a federally chartered mutual savings and loan association headquartered in Windsor Locks, Connecticut, was chartered in 1913 under Connecticut law as Windsor Locks Building & Loan Association. Windsor Locks Community Bank converted to a federal savings association charter in April 2002. Windsor Locks Community Bank is regulated by the Office of Thrift Supervision and its deposits are insured by the Federal Deposit Insurance Corporation up to applicable limits. At June 30, 2003, Windsor Locks Community Bank had total assets of $37.3 million, total deposits of $34.6 million and capital of $2.3 million. Windsor Locks Community Bank operates through two full-service banking offices located in Windsor Locks and Broad Brook, Connecticut.

19

Form of the Merger

The merger agreement provides for the merger of Windsor Locks Community Bank with and into Enfield Federal. Enfield Federal will be the surviving institution of the merger. The merger agreement provides that we may change the structure utilized to combine with Windsor Locks Community Bank, provided that any change cannot jeopardize receipt of any required regulatory approval in such a manner as to delay the consummation of the merger beyond December 31, 2003, adversely affect the rights of the depositors or members of Windsor Locks Community Bank or change the benefits or other arrangements that the merger agreement provides will be made to or on behalf of Windsor Locks Community Bank’s directors, officers and employees.

We Will Issue Additional Shares to Enfield Mutual Holding Company

Enfield Mutual Holding Company currently owns 54% of our outstanding common stock. As part of the merger, we will issue additional shares of our common stock to Enfield Mutual Holding Company in an amount equal to the value of Windsor Locks Community Bank as determined by an independent appraisal. Windsor Locks Community Bank’s independent appraiser, RP Financial, LC., has determined that the value of Windsor Locks Community Bank was $3.35 million as of July 25, 2003. FinPro, Inc., our financial advisor, reviewed RP Financial’s appraisal and determined that the appraised value in RP Financial’s appraisal is fair to our stockholders and members.

At the effective time of the merger, we will issue such shares to Enfield Mutual Holding Company to preserve the interests of the Windsor Locks Community Bank members that are being transferred to Enfield Mutual Holding Company in the merger. The issuance of these shares to Enfield Mutual Holding Company will increase its ownership interest in New England Bancshares relative to that of other stockholders. Windsor Locks Community Bank’s members will become members of Enfield Mutual Holding Company after the merger and will have a pro rata interest in Enfield Mutual Holding Company’s larger interest in New England Bancshares. After the merger, each member of Windsor Locks Community Bank who continues to be a depositor of Enfield Federal, will have a membership interest in Enfield Mutual Holding Company, including liquidation rights based on the relative size of the members’ deposit accounts to the deposit accounts of other members of Enfield Mutual Holding Company.

RP Financial will update its appraisal of the fair value of Windsor Locks Community Bank shortly before the time the merger is to be consummated. FinPro will also review RP Financial’s updated appraisal. To determine the amount of shares to be issued to Enfield Mutual Holding Company, RP Financial will divide the amount of its updated appraisal by the average of the closing bid price of our common stock over the 15 trading days that end on the fifth day before the effective date of the merger.

Windsor Locks Community Bank’s Deposit Accounts and Loans After the Merger

All deposit accounts in Windsor Locks Community Bank will continue to be insured up to the applicable limits by the Federal Deposit Insurance Corporation in the same manner as such deposit accounts were insured immediately before the merger. In addition to a deposit account in Enfield Federal, each depositor of Windsor Locks Community Bank who continues to be a depositor of Enfield Federal after the merger, will have a pro rata ownership interest in the equity of Enfield Mutual Holding Company. The ownership interest may only be realized if Enfield Mutual Holding Company is liquidated. The ownership interest is based on the amount of a depositor’s account relative to the deposit accounts of other members, and has no tangible market value separate from the deposit account.

20

Accordingly, if a depositor reduces or closes an account, the depositor’s ownership interest in the equity of Enfield Mutual Holding Company will be reduced or eliminated.

All loans of Windsor Locks Community Bank will retain the same status that they had prior to the merger. The amount, interest rate, maturity and security for each loan will remain as they were contractually fixed prior to the merger.

Windsor Locks Community Bank’s Members Will Become Members of Enfield Mutual Holding Company

As a federally-chartered mutual holding company, Enfield Mutual Holding Company does not have authorized capital stock and, thus, has no stockholders. The merger will result in the depositors of Windsor Locks Community Bank becoming depositors of Enfield Federal and, therefore, members of Enfield Mutual Holding Company as long as they continue to maintain a deposit account with Enfield Federal. Such members will be entitled to vote on all questions requiring action by the members of Enfield Mutual Holding Company including, without limitation, the election of directors of Enfield Mutual Holding Company.

Windsor Locks Community Bank’s Members Will Have Subscription Rights if a Second-Step Conversion Occurs

In the future, Enfield Mutual Holding Company may convert from the mutual to capital stock form, in a transaction commonly known as a “second-step” conversion. Under current Office of Thrift Supervision regulations, a second-step conversion requires the approval of a majority of the shares of our common stock, other than Enfield Mutual Holding Company and a majority of the total votes eligible to be cast by Enfield Mutual Holding Company. In a second-step conversion, members of Enfield Mutual Holding Company at such time would have subscription rights to purchase shares of the converted Enfield Mutual Holding Company on a priority basis. Our stockholders would be entitled to exchange their shares of common stock for shares of the converted Enfield Mutual Holding Company. It is expected that our public stockholders would own the same percentage of the resulting entity as they owned immediately prior to the second-step conversion. Our board of directors has no current plan to undertake a “second-step conversion” transaction.

Material Federal Income Tax Consequences of the Merger

This discussion is based on the Internal Revenue Code, Treasury regulations, administrative rulings and judicial decisions, all as in effect as of the date of this proxy statement and all of which are subject to change (possibly with retroactive effect) and to differing interpretations. Tax considerations under state, local and foreign laws are not addressed in this document.

Based upon facts and representations and assumptions regarding factual matters that were provided by New England Bancshares and by Windsor Locks Community Bank, Muldoon Murphy & Faucette LLP has opined with respect to the material federal income tax consequences of the merger that: (1) the merger will be treated for federal income tax purposes as a reorganization within the meaning of Section 368(a) of the Internal Revenue Code; and (2) New England Bancshares and Windsor Locks Community Bank will each be a party to that reorganization within the meaning of Section 368(b) of the Internal Revenue Code.

21

As your shares of New England Bancshares common stock will remain unchanged, you should not recognize any gain or loss for federal income tax purposes upon the completion of the merger or the issuance of additional shares of our common stock to Enfield Mutual Holding Company. However, neither New England Bancshares nor Windsor Locks Community Bank has requested or will request a ruling from the Internal Revenue Service as to any of the tax effects to New England Bancshares’ stockholders or Windsor Locks Community Bank’s members of the transactions discussed in this proxy statement, and no opinion of counsel has been or will be rendered to New England Bancshares’ stockholders or Windsor Locks Community Bank’s members with respect to any of the tax effects of the merger to such stockholders or members.

Recommendation of Our Board; Our Reasons for the Merger and Issuance of the Shares

Our board of directors has unanimously approved the merger agreement and recommends that you vote “FOR” the approval of the issuance of additional shares of our common stock in connection with the merger.

Our board of directors has determined that the issuance of additional shares in connection with the merger is fair to, and in the best interests of, New England Bancshares and New England Bancshares’ stockholders. In approving the merger agreement and the share issuance, the board of directors consulted with legal counsel regarding its legal duties and the terms of the merger agreement. In arriving at its determination, the board of directors also considered a number of factors, including the following:

| | • | | No Consideration Being Paid. The terms of the merger agreement, the structure of the merger and that we will not be required to pay consideration to Windsor Locks Community Bank’s members in the merger. |

| | • | | Due Diligence Review. Information concerning the businesses, earnings, operations, financial condition and prospects of New England Bancshares and Windsor Locks Community Bank, both individually and as combined. Our board took into account the results of our due diligence review of Windsor Locks Community Bank. |

| | • | | Complementary Markets. The complementary nature of the businesses and market areas of Enfield Federal and Windsor Locks Community Bank. |

| | • | | Greater Resources. The size of the combined company, which would permit us to pursue other acquisitions. |

| | • | | Continuity of Management. That our management team immediately before the merger will remain intact following the merger, and that our board of directors will be increased to accommodate the addition of the current Chairman of the Windsor Locks Community Bank board of directors. |

| | • | | Fairness Opinion. The opinion rendered by FinPro, as our financial advisor, that the merger and the issuance of shares of our common stock to Enfield Mutual Holding Company are fair, from a financial point of view, to our stockholders. |

| | • | | Cost Savings. The opportunities for decreasing operating expenses for the combined company, including savings of approximately $150,000 annually after the first year in |

22

connection with the consolidation of the Windsor Locks Community Bank office at 20-I Main Street with the Enfield Federal office at 20 Main Street in Windsor Locks.

| | • | | Current Environment. The current and prospective economic, competitive and regulatory environment facing New England Bancshares, Enfield Federal, Windsor Locks Community Bank and the financial services industry. |

| | • | | Termination Fee. The $125,000 termination fee to which we would be entitled under certain circumstances. |

| | • | | Reimbursement of Expenses. That we might be required to reimburse Windsor Locks Community Bank its reasonable expenses up to $90,000 if the merger agreement is terminated under certain circumstances. |

| | • | | More Competitive. The board of directors’ assessment that we would be better able to serve the convenience and needs of its customers and communities by becoming a larger institution better suited for competing against regional financial institutions in its market area. |

| | • | | Accretive to Earnings. That, based on historical earnings for the year ended June 30, 2003, the merger is expected to be accretive to earnings by $0.04 per share in the first year after the merger and the belief that the business and financial advantages contemplated in connection with the merger will likely be achieved within a reasonable time frame. |

| | • | | Likelihood of Consummation. That Windsor Locks Community Bank had thoroughly reviewed its strategic planning options and the likelihood that the proposed merger would receive the required approvals, and the anticipated impact of the foregoing on the successful consummation of the transaction. |

| | • | | Intended to Receive Tax-Free Treatment.That the merger is intended to be tax_free for U.S. federal income tax purposes for our stockholders and Windsor Locks Community Bank members. |

| | • | | Windsor Locks Community Bank’s CRA Rating. The “satisfactory” Community Reinvestment Act rating at the most recent examination of Windsor Locks Community Bank. |

The discussion of the information and factors considered by our board of directors is not intended to be exhaustive, but includes all material factors considered by our board of directors. In reaching its determination to approve and recommend the issuance of additional shares to Enfield Mutual Holding Company, our board of directors did not assign any specific or relative weights to any of the foregoing factors, and individual directors may have weighed factors differently.

The Independent Appraisal

We are issuing additional shares to Enfield Mutual Holding Company to ensure that the value of Windsor Locks Community Bank is transferred to the mutual interest in New England Bancshares. The number of shares to be issued is based on the pro forma market value of Windsor Locks Community

23

Bank, as determined by RP Financial, and the market price per share of our common stock. RP Financial utilized the market value approach to valuation, prepared in accordance with the written valuation guidelines of the Office of Thrift Supervision, applicable regulatory interpretations thereof and verbal guidance provided by the Office of Thrift Supervision staff regarding appropriate valuation methodologies for this type of transaction. Windsor Locks Community Bank retained RP Financial to prepare the independent valuation. RP Financial will receive a fee of $15,000 for the initial valuation, a $2,500 fee for each updated valuation, and will be reimbursed for expenses incurred in preparing the independent appraisal. Windsor Locks Community Bank has agreed to indemnify RP Financial and its employees and affiliates against certain losses (including any losses in connection with claims under the federal securities laws) arising out of its services as appraiser, except where RP Financial’s liability results from its negligence or bad faith.

The independent valuation was prepared by RP Financial in reliance upon audited financial information of Windsor Locks Community Bank, unaudited internal financial statements, and the information contained in the proxy materials. RP Financial also considered the following factors, among others:

| | • | | the present and projected operating results and financial condition of Windsor Locks Community Bank and the economic and demographic conditions in Windsor Locks Community Bank’s existing market area; |

| | • | | Windsor Locks Community Bank’s historical financial and related operating information; |

| | • | | a comparative evaluation of the operating and financial statistics of Windsor Locks Community Bank with those of other publicly traded subsidiaries of mutual holding companies; |

| | • | | the aggregate amount of the pro forma market valuation; |

| | • | | the impact of the merger transaction on Windsor Locks Community Bank’s equity and earnings potential; |

| | • | | the trading market for securities of other publicly traded subsidiaries of mutual holding companies; |

| | • | | the pro forma effect of the merger on both Windsor Locks Community Bank and New England Bancshares, including the issuance of new shares of New England Bancshares to Enfield Mutual Holding Company, the treatment of the merger using purchase accounting methods and the resulting balance of intangible assets that will be created; and |

| | • | | the pro forma effect of the valuation on our public stockholders, including the potential dilution in ownership interests and the impact on earnings per share and tangible book value per share of the merger. |

In applying the accepted valuation methodology set forth under the Office of Thrift Supervision valuation guidelines, RP Financial considered (1) the price-to earnings ratio, (2) the price-to-book value

24

ratio and (3) the price-to-assets ratio. In determining the pro forma fair market value of Windsor Locks Community Bank, it was assumed that:

| | • | | proceeds of $3.35 million were raised from the sale of common stock in a public offering; |

| | • | | offering expenses were 8% of the proceeds; |

| | • | | pro forma consolidated net income assumes that net proceeds had been invested at 4.12%; and |

| | • | | a tax rate of 37.6% was applied to earnings on the net proceeds. |

RP Financial also assumed that stock benefit plans, in the form typically implemented in a mutual-to-stock conversion, had been implemented, including the purchase of 8% of the common stock by the employee stock ownership plan, which was amortized on a straight-line basis over ten years, and the purchase of 4% of the common stock by a recognition and retention plan, which was amortized on a straight-line basis over five years.

The following table presents a summary of selected pricing ratios for the peer group companies used in RP Financial’s valuation analysis, with such ratios adjusted to their fully-converted equivalent basis, and the resulting pricing ratios for Windsor Locks Community Bank on a fully-converted equivalent basis (i.e., the pro forma market value of Windsor Locks Community Bank assuming that $3.35 million of shares of Windsor Locks Community Bank were sold in a public offering). Compared to the average fully-converted pricing ratios of the peer group, Windsor Locks Community Bank’s pro forma fully-converted pricing ratios indicated a 39.9% discount on price-to-earnings basis, a discount of 25.4% on a price-to-book value basis and a discount of 60.1% percent on a price-to-assets basis.

| | | Fully Converted

Equivalent Pro Forma

Price-To- Earnings Multiple

| | Fully Converted

Equivalent Pro Forma

Price-To-Book Value Ratio

| | | Fully Converted

Equivalent Pro Forma

Price-To-Assets Ratio

| |

Windsor Locks Community Bank | | 15.41x | | 69.50 | % | | 8.39 | % |

| | | |

Averages of valuation of peer group companies as of July 25, 2003 | | 25.63x | | 93.19 | % | | 21.04 | % |

On the basis of the foregoing, RP Financial advised Windsor Locks Community Bank that as of July 25, 2003, the estimated pro forma market value of the common stock of Windsor Locks Community Bank was $3.35 million. Based on the average closing price of our common stock of $ per share for the fifteen trading days ended , 2003, this valuation equates to the issuance of shares of our common stock to Enfield Mutual Holding Company.

The board of Windsor Locks Community Bank reviewed the independent valuation and, in particular, considered: (1) Windsor Locks Community Bank’s financial condition and results of operations for the twelve months ended December 31, 2002; (2) financial comparisons in relation to other financial institutions, including other publicly traded subsidiaries of mutual holding companies; and (3) stock market conditions generally and in particular for financial institutions, all of which are set forth

25

in the independent valuation. The board also reviewed the methodology and the assumptions used by RP Financial in preparing the independent valuation. The estimated pro forma market value may be amended with the approval of the Office of Thrift Supervision, if necessitated by subsequent developments in Windsor Locks Community Bank’s financial condition or market conditions generally.