As filed with the Securities and Exchange Commission on March 29, 2002

Registration Number 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

AECOM MERGER CORPORATION

(Exact name of Registrant as specified in its charter)

| Delaware | | 8711 | | 75-2988014 |

| (State or other jurisdiction | | (Primary Standard Industrial | | (I.R.S. Employer |

| of incorporation or organization) | | Classification Code Number) | | Identification No.) |

555 South Flower Street, Suite 3700

Los Angeles, California 90071

(213) 593-8000

(Address of principal executive offices, including zip code and telephone number)

Joseph A. Incaudo

Executive Vice President and Chief Financial Officer

AECOM Technology Corporation

555 South Flower Street, Suite 3700

Los Angeles, California 90071

(213) 593-8000

(Name, address and telephone number of agent for service)

Copies to:

| Richard A. Boehmer, Esq. | | J. Scott Hodgkins, Esq. |

| O’Melveny & Myers LLP | | Latham & Watkins |

| 400 South Hope Street | | 633 West 5th Street, Suite 4000 |

| Los Angeles, California 90071-2899 | | Los Angeles, California 90071 |

| Telephone: (213) 430-6643 | | Telephone: (213) 485-1234 |

| Fax: (213) 430-6407 | | Fax: (213) 891-8763 |

Approximate date of proposed sale to the public:As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

CALCULATION OF REGISTRATION FEE

| Title of Shares to be Registered | | Proposed Maximum

Aggregate Offering Price | | Amount of Registration Fee |

|---|

|

| Class B Common Stock, $.01 par value | | $230,000,000 | | $21,160 |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PROSPECTUS (Subject to Completion)

Issued , 2002

Shares

CLASS B COMMON STOCK

AECOM Technology Corporation is offering shares of its class B common stock. This is our initial public offering and no public market currently exists for our shares. We estimate that the initial public offering price will be between $ and $ per share.

We are applying to have our class B common stock traded on The New York Stock Exchange under the symbol “AEO.”

Investing in our class B common stock involves risks. See “Risk Factors” beginning on page 5.

PRICE$ A SHARE

| | | Price to

Public

| | Underwriting

Discounts and

Commissions

| | Proceeds to

AECOM

|

|---|

| Per Share | | $ | | $ | | $ |

| Total | | $ | | $ | | $ |

We have granted the underwriters the right to purchase up to an additional shares of class B common stock to cover over-allotments.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Morgan Stanley & Co. Incorporated expects to deliver the shares to purchasers on , 2002.

MORGAN STANLEY CREDIT SUISSE FIRST BOSTON

LEHMAN BROTHERS

| BANC OF AMERICA SECURITIES LLC |

BEAR, STEARNS & CO. INC.

, 2002

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

TABLE OF CONTENTS

|

In this prospectus, we use the terms AECOM, we, us and our to refer to AECOM Technology Corporation together with our subsidiaries, prior to our merger with a wholly owned subsidiary of AECOM Merger Corporation. We will also use such terms upon completion of the merger to mean the surviving corporation, which will change its name to AECOM Technology Corporation. We have filed a Registration Statement on Form S-4 in connection with the merger. We use the term class A common stock to refer to our class A-1, class A-2 and class A-3 common stock. Our certificate of incorporation provides for a conversion of class A-1, class A-2 and class A-3 common stock into class B common stock upon the expiration of the applicable restriction periods. We use the term common stock to refer to both our class A and class B common stock.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

All information in this offering assumes that the merger described under the caption “The Merger and the Tender Offer” is completed before the completion of this offering. We may choose not to proceed with this offering if the merger is not completed.

We have not taken any action to permit a public offering of shares of our common stock outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who have come into possession of this prospectus must inform themselves about and observe restrictions relating to the offering of shares of our common stock and the distribution of this prospectus outside of the United States.

Until , 2002, 25 days after the date of this prospectus, all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

This summary highlights information contained elsewhere in this prospectus and does not contain all the information you should consider before buying shares in this offering. You should read the entire prospectus carefully, especially the information under “Risk Factors.”

AECOM Technology Corporation

Overview

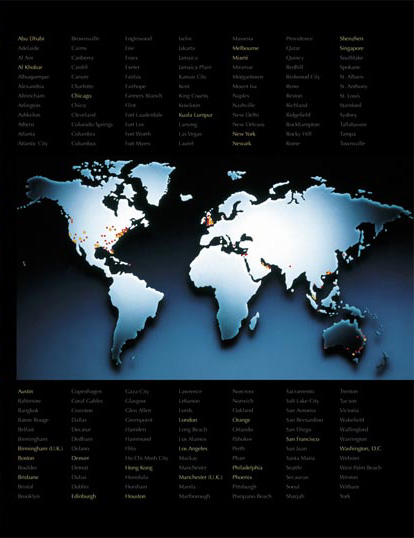

We are a worldwide leader in providing a broad range of technical professional services to government agencies and large corporations. We have built leading positions based on revenues in a number of industry sectors and strategic geographic markets through a global network of more than 25 major operating offices and 14,200 employees. Our revenues have increased from $724.5 million in fiscal 1997 to $859.5 million in fiscal 1998, $994.4 million in fiscal 1999, $1,401.7 million in fiscal 2000 and $1,529.7 million in fiscal 2001, which equals a compounded annual growth rate of 20.5%.

Our technical professional services include consulting and design services and program and construction management, as well as outsourced technical staffing and logistical support services. Our industry sectors include:

| Ÿ Transit, Rail and Maritime | | Ÿ Aviation |

| Ÿ Highways and Bridges | | Ÿ Government Facilities |

| Ÿ Water and Wastewater | | Ÿ Technical and Industrial Facilities |

| Ÿ Environmental Management | | Ÿ Commercial Facilities |

We provide our services in the major markets of the world, including the United States, Asia, Europe, Australia and the Middle East. This combination of providing a broad range of technical professional services in a number of industry sectors and strategic geographic markets made us one of the leading design firms in the United States based on revenue in 2000, according to the 2001 McGraw HillEngineering News Record Design Survey.

Our clients consist of the United States and other national governments, state and local governments and agencies and private entities. The majority of our projects are under multi-year contracts on a cost-plus or a negotiated-fee basis.

Our strategic advantage lies in our ability to build leadership positions with our clients across industry sectors, service lines and geographies. The dynamic interface among these three elements enables us to better serve our clients, drives our growth and positions us to take advantage of future opportunities.

Our Market Opportunity

The worldwide professional services industry encompasses companies that provide highly-specialized or value-added services to other organizations. Specific services provided include consulting (technical, accounting, management, legal and advertising), business support services (engineering, environmental and facilities management, and food services), human resources management (payroll and benefits) and permanent and temporary staffing (executive, professional, clerical, health care and information technology).

Technical professional services represents one segment of the professional services industry. This segment includes specialized engineering, consulting, design, program and construction management and outsourcing for business and government. These services are provided on infrastructure, environmental, industrial, government and commercial projects. Several thousand firms worldwide compete in this fragmented industry. According toEngineering News Record, the largest 100 global design firms generated over $41.3 billion of global revenues in 2000 and the largest 500 U.S. design firms grew at a compounded annual growth rate of 9.2% between 1998 and 2000. Design firms are a subset of technical professional services. Our design-related revenues accounted for more than 80% of our revenues in the last year.

The principal client base includes local, state and national governments, as well as private businesses, which are becoming increasingly reliant on professional services that are either not readily available from internal resources or are not within their core competencies. Industry growth is being further led by factors ranging from population growth, outsourcing and rapid economic development to increased globalization, competition and technological advancement.

Our Strategy

Our strategy is to maintain our leadership position in each industry sector, service line and geographic area in which we operate, using the following key elements:

Continue diversification in industry sectors, service lines and geographic regions, primarily through acquisitions. We will continue to seek out and acquire companies that have technical niche and regional leadership positions that will complement or expand our current expertise and geographic presence. We will expand the roles of the acquired companies and their management, while capitalizing on their brand names in their niches. Our acquisition approach enables our operating companies to continue to focus on their core businesses while we overlay strategic initiatives to cross-sell and share complementary talents.

Increase cross-selling and technology transfer. Our strategic planning process emphasizes the cross-selling of our combined expertise and geographic presence among all our operating companies. This enables us to present ourselves to our clients as one of the world’s largest technical professional service companies when the project or client requires this capacity.

Maintain and expand our long-standing client relationships. We have developed long-standing relationships with a number of governments and agencies worldwide as well as many large corporations. We will continue to focus on our commitment to client satisfaction to strengthen and expand these relationships. In some cases, these relationships span decades.

Retain and recruit highly experienced personnel. The most valuable asset of any professional services company is its personnel. We have a highly talented, dedicated and experienced work force. We will continue to provide our personnel ownership and other incentives and benefits designed to optimize their performance and to enhance our ability to attract and retain personnel. We believe that these programs align the interests of our personnel with those of our clients and stockholders and foster the cross-selling and technology transfer described above.

THE OFFERING

| Class B common stock offered | | shares |

|

| |

|

Class B common stock to be outstanding after this

offering | | shares |

|

| |

|

| Over-allotment option | | shares |

|

| |

|

Class A common stock to be outstanding after this

offering | | shares |

|

| |

|

| Use of proceeds | | To repay borrowings under our credit facility, to fund a

cash tender offer for some of our class A common stock

and for general corporate purposes, including possible

future acquisitions. |

|

| |

|

| The merger | | Prior to this offering, AECOM Technology Corporation

will merge with a wholly owned subsidiary of AECOM

Merger Corporation. Shortly after this merger, AECOM

Technology Corporation will merge with and into

AECOM Merger Corporation with AECOM Merger

Corporation as the surviving corporation. AECOM

Merger Corporation will change its name to AECOM

Technology Corporation at that time. In the merger, our

stockholders will receive class A common stock in

exchange for their shares of common stock of AECOM

Technology Corporation. The class A common stock

and class B common stock referred to in this offering

will constitute our capital structure after the merger. |

|

| |

|

| The tender offer | | After this offering, we intend to use $50 million of the

net proceeds of this offering to fund a cash tender offer

for a portion of our shares of class A common stock

outstanding after the merger. The exact timing, offer

price and other specific terms of the tender offer are

within our discretion. |

|

| |

|

| Proposed New York Stock Exchange symbol | | AEO |

Common Stock to be outstanding after this offering does not include any purchases of our class A common stock under the proposed tender offer and, as of December 31, 2001:

| Ÿ | 4,069,600 shares of common stock issuable upon the exercise of employee stock options outstanding at a weighted average exercise price of $10.44 per share; |

| Ÿ | 904,000 additional shares of common stock available for issuance under our 2000 Stock Incentive Plan; |

| Ÿ | 1,500,000 additional shares of common stock available for issuance under our 2000 Stock Incentive Plan, assuming that our stockholders approve a current proposal to increase the authorized shares under such plan; |

| Ÿ | 2,500,000 additional shares of common stock available for issuance under our 2002 Employee Stock Purchase Plan, assuming that our stockholders approve such plan; |

| Ÿ | 44,344 shares of common stock issuable upon conversion of our convertible preferred stock and convertible preferred stock units; |

| Ÿ | 71,000 shares of common stock issuable upon the exercise of non-employee directors’ stock options at a weighted average exercise price of $9.33 per share; and |

| Ÿ | 4,463,579 shares issuable upon redemption of common stock units issued under our Non-Qualified Stock Purchase Plan. |

Except as otherwise indicated, all of the information in this prospectus assumes no exercise of the underwriter’s over-allotment option.

SUMMARY CONSOLIDATED FINANCIAL DATA

When you read this summary consolidated financial data, it is important that you also read the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements as of September 30, 2000 and 2001 and for the years ended September 30, 1999, 2000 and 2001 and the accompanying notes included in this prospectus. The summary consolidated financial data for the years ended September 30, 1997 and 1998 has been derived from audited financial statements not included in this prospectus. The consolidated financial data as of December 31, 2001 and for the three months ended December 31, 2001 and the accompanying notes were derived from our unaudited consolidated financial statements, which are included in this prospectus. Historical results are not necessarily indicative of future results.

| | | Year Ended September 30,

| | Three Months Ended

December 31,

|

|---|

| | | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2000

| | 2001

|

|---|

| | | (in thousands, except per share data) |

|---|

| Consolidated Statement of Income Data: | | | | | | | | | | |

| Total revenues | | $724,508 | | $859,461 | | $994,437 | | $1,401,730 | | $1,529,713 | | $351,835 | | $395,859 | |

| Other direct costs | | 342,062 | | 436,075 | | 511,611 | | 710,646 | | 626,244 | | 143,887 | | 147,580 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net service revenues | | 382,446 | | 423,386 | | 482,826 | | 691,084 | | 903,469 | | 207,948 | | 248,279 | |

| Cost of net service revenues | | 211,020 | | 237,188 | | 266,933 | | 386,889 | | 511,160 | | 116,476 | | 139,832 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Gross profit | | 171,426 | | 186,198 | | 215,893 | | 304,195 | | 392,309 | | 91,472 | | 108,447 | |

| General and administrative expenses | | 152,093 | | 163,866 | | 190,266 | | 263,965 | | 346,302 | | 81,133 | | 103,616 | (1) |

| ESOP contribution and stock matches | | 7,072 | | 4,132 | | 5,800 | | 10,010 | | 8,389 | | 1,948 | | 9,400 | (2) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income (loss) from operations | | 12,261 | | 18,200 | | 19,827 | | 30,220 | | 37,618 | | 8,391 | | (4,569 | ) |

| Interest expense, net | | 5,092 | | 4,692 | | 4,849 | | 8,784 | | 11,581 | | 2,415 | | 2,772 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income (loss) before income taxes | | 7,169 | | 13,508 | | 14,978 | | 21,436 | | 26,037 | | 5,976 | | (7,341 | ) |

| Provision for income taxes | | 4,324 | | 7,764 | | 4,436 | | 3,259 | | 8,593 | | 1,974 | | (2,422 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net income (loss) | | $ 2,845 | | $ 5,744 | | $ 10,542 | | $ 18,177 | | $ 17,444 | | $ 4,002 | | $ (4,919 | )(3) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net income (loss) per share(4): | | | | | | | | | | |

| Basic | | $ .23 | | $ .44 | | $ .73 | | $ .96 | | $ .74 | | $ .17 | | $ (.19 | )(3) |

| Diluted | | $ .22 | | $ .42 | | $ .70 | | $ .91 | | $ .71 | | $ .16 | | $ (.19 | )(3) |

| Shares used in per share calculations(4): | | | | | | | | | | |

| Basic | | 12,639 | | 13,001 | | 14,371 | | 18,938 | | 23,565 | | 24,076 | | 25,752 | |

| Diluted | | 13,011 | | 13,538 | | 15,053 | | 20,011 | | 24,704 | | 25,049 | | 25,752 | |

| |

|

| | | As of September 30,

|

|---|

| | | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | As of

December 31,

2001

|

|---|

| Other Data: | | | | | | | | | | |

| Number of full-time employees | | 5,900 | | 6,400 | | 7,200 | | 12,100 | | 12,700 | | 14,200 |

| (1) | Includes $8.5 million to fully vest participants in our Performance Unit Plan, which has been terminated. |

| (2) | Includes $2.8 million to fully accrue stock matches relating to the Senior Executive Equity Investment Plan, which were previously being accrued ratably over a ten-year vesting period, and $5.0 million to reflect the change in the stock match percentage. Subsequent to March 31, 2002, there will be no further stock matches. |

| (3) | Without the non-recurring charges referred to in footnotes (1) and (2) above, net income would have been $6.0 million, basic net income per share would have been $.23 and diluted net income per share would have been $.22. |

| (4) | In calculating per share data, the weighted average number of shares includes shares of common stock and common stock units outstanding during the relevant periods. |

| | | As of December 31, 2001

|

|---|

| | | Actual

| | As Adjusted(1)

|

|---|

| | | (in thousands) |

|---|

| Consolidated Balance Sheet Data: | | | | |

| Cash and cash equivalents | | $ 10,469 | | $ |

| Working capital | | 160,011 | | |

| Total assets | | 840,243 | | |

| Total long-term debt, excluding current portion | | 208,314 | | |

| Redeemable common stock and common stock units | | 75,631 | | |

| Stockholders’ equity | | 179,419 | | |

| (1) | Gives effect to the sale of shares of our common stock in this offering at an assumed initial public offering price of $ per share and the use of the estimated net proceeds as described under the caption “Use of Proceeds” in this prospectus, but not the purchase of shares of class A common stock pursuant to the proposed tender offer. |

You should carefully consider the risks described below before making a decision to buy our common stock. If any of the following risks actually occurs, our business could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. When determining whether to buy our common stock, you should also refer to the other information in this prospectus, including our consolidated financial statements and the accompanying notes.

Risks Relating to Our Business and Industry

We depend on long-term government contracts, most of which are funded on an annual basis. If appropriations are not made in subsequent years of a multiple-year contract, we will not realize all of our potential revenue and profit from that project.

The substantial majority of our revenues is derived from contracts with agencies and departments of national, state and local governments. During the fiscal years ended September 30, 1999, 2000 and 2001, approximately 63%, 64% and 62%, respectively, of our revenues were derived from contracts with government entities.

Most government contracts are subject to the continuing availability of legislative appropriation. Legislatures typically appropriate funds for a given program on a year-by-year basis, even though contract performance may take more than one year. As a result, at the beginning of a program, the related contract is only partially funded, and additional funding is normally committed only as appropriations are made in each subsequent fiscal year. These appropriations, and the timing of payment of appropriated amounts, may be influenced by, among other things, the state of the economy, competing priorities for appropriation, the timing and amount of tax receipts and the overall level of government expenditures. If appropriations are not made in subsequent years on our government contracts, then we will not realize all of our potential revenue and profit from that contract. In addition, slowdowns in tax receipts of our government contract clients could have a corresponding impact on our cash flow.

We depend on government contracts that may be terminated by the government, which may affect our ability to recognize all of our potential revenue and profit from the project.

Most government contracts are subject to termination by the government either at its convenience or upon the default of the contractor. If the government terminates a contract at its convenience, then we typically are able to recover only costs incurred or committed, settlement expenses and profit on work completed prior to termination, which could prevent us from recognizing all of our potential revenue and profit from that contract. If the government terminates the contract due to our default, we could be liable for excess costs incurred by the government in reprocuring services from another source.

Our contracts with governmental agencies are subject to audit, which could result in adjustments to reimbursable contract costs or, if we are charged with wrongdoing, possible temporary or permanent suspension from participating in government programs.

Our books and records are subject to audit by the various governmental agencies we serve and their representatives. These audits can result in adjustments to reimbursable contract costs and allocated overhead. In addition, if as a result of an audit, one of our subsidiaries is charged with wrongdoing or the government agency determines that a subsidiary is otherwise no longer eligible for federal contracts, that subsidiary, and conceivably our company as a whole, could be temporarily suspended or, in the event of convictions or civil judgments, could be prohibited from bidding on and receiving future government contracts for a period of time. Furthermore, as a U.S. government contractor, we are subject to an increased risk of investigations, criminal prosecution, civil fraud, whistleblower lawsuits and other legal actions and liabilities to which purely private sector companies are not, the results of which could have a material adverse effect on our operations.

We have submitted claims to government agencies for work we performed beyond the scope of some of our contracts. If the government agencies do not approve these claims, our net income and results of operations could be adversely impacted.

We have submitted claims under some of our government contracts for payment of work performed beyond the initial contractual requirements. At December 31, 2001, the recorded amount of these claims aggregated approximately $21.7 million. The applicable governmental entities have contested these claims and we cannot assure you that these claims will be approved in whole, in part or at all. If these claims are not approved, our net income and results of operations could be adversely impacted.

Our ability to grow and compete in our industry will be harmed if we do not retain the continued service of our key technical personnel and identify, hire and retain additional qualified technical personnel.

There is intense competition for qualified technical personnel in the industry sectors in which we compete. We may not be able to continue to attract and retain qualified technical personnel, such as engineers and architects, who are necessary for the development of our business or to replace qualified technical personnel. Any growth we experience is expected to place increased demands on our resources and will likely require the addition of technical personnel and the development of additional expertise by existing personnel. Also, some of our personnel hold security clearance levels required to obtain government projects and, if we were to lose some or all of these personnel, they would be difficult to replace. Loss of the services of, or failure to recruit, key technical personnel could limit our ability to complete existing projects successfully and to compete for new projects.

International operations expose us to legal, political and economic risks in different countries and currency exchange rate fluctuations could adversely affect our financial results.

During the fiscal years ending September 30, 1999, 2000 and 2001, revenues attributable to our Global Group operations were 3%, 11% and 18%, respectively. As a result of our recent acquisitions, we expect the percentage of revenues attributable to non-U.S. projects to increase. In fact, 24% of our revenues for the quarter ended December 31, 2001 were attributable to our Global Group operations. There are risks inherent in doing business internationally, including:

| Ÿ | currency exchange rate fluctuations; |

| Ÿ | imposition of governmental controls; |

| Ÿ | political and economic instability; |

| Ÿ | changes in U.S. and other national government policies affecting the markets for our services; |

| Ÿ | changes in regulatory practices, tariffs and taxes; and |

| Ÿ | potential non-compliance with a wide variety of non-U.S. laws and regulations. |

Any of these factors could have a material adverse effect on our business, results of operations or financial condition.

We have acquired and may continue to acquire businesses as strategic opportunities arise and may be unable to realize the anticipated benefits of those acquisitions.

We have acquired a number of companies in recent years and may continue to expand and diversify our operations with additional acquisitions as strategic opportunities arise. Some of the risks that may affect our ability to realize any anticipated benefits from companies that we acquire include:

| Ÿ | unexpected losses of key personnel or clients of the acquired business; |

| Ÿ | difficulties arising from the increasing scope, geographic diversity and complexity of our operations; |

| Ÿ | diversion of management’s attention from other business concerns; and |

| Ÿ | adverse effects on existing business relationships with clients. |

In addition, managing the growth of our operations will require us to continue to improve our operational, financial and human resources management systems and other internal systems and controls. If we are unable to manage any growth effectively, it could have a material adverse effect on our business.

Our business and operating results could be adversely affected by losses under fixed-price contracts.

Fixed-price contracts require us to either perform all work under the contract for a specified lump-sum or to perform an estimated number of units of work at an agreed price per unit, with the total payment determined by the actual number of units performed. A significant portion of our revenues comes from fixed-price contracts. Fixed-price contracts expose us to a number of risks not inherent in cost-plus contracts, including underestimation of costs, ambiguities in specifications, unforeseen costs or difficulties, problems with new technologies, delays beyond our control and economic or other changes that may occur during the contract period. Losses under fixed-price contracts could have a material adverse effect on our business.

Our industry is highly competitive and we may be unable to compete effectively, which could result in reduced profitability and loss of market share.

We are engaged in a highly competitive business. The extent of competition varies with the types of services provided and the locations of the projects. Generally, we compete on the bases of technical and management capability, personnel qualifications and availability, geographic presence, experience and price. Increased competition in our industry may result in our inability to win bids for future projects and loss of market share.

Our services expose us to significant risks of liability and our insurance policies may not provide adequate coverage.

Our services involve significant risks of professional and other liabilities that may substantially exceed the fees that we derive from our services. In addition, we sometimes contractually assume liability under indemnification agreements. We cannot predict the magnitude of potential liabilities from the operation of our business.

We currently maintain comprehensive general liability, umbrella and professional liability insurance policies. Professional liability policies are “claims made” policies. Thus, only claims made during the term of the policy are covered. Additionally, our insurance policies may not protect us against potential liability due to various exclusions and retentions. Partially or completely uninsured claims, if successful and of significant magnitude, could have a material adverse affect on our business.

Also, the terrorist attacks that occurred on September 11, 2001 may have a material adverse effect on the insurance industry as a whole. Consequently, along with our competition, we will likely experience a significant increase in our insurance premiums in the future.

Our backlog of uncompleted projects under contract is subject to unexpected adjustments and cancellations, including future appropriations by the applicable contracting government agency, and is, therefore, an uncertain indicator of our future revenues and profits.

At December 31, 2001, our backlog of uncompleted projects under contract was approximately $1.6 billion, of which approximately $1.0 billion is expected to be completed by December 31, 2002. We cannot assure you that the revenues attributed to uncompleted projects under contract will be realized or, if realized, will result in profits. Many projects may remain in our backlog for an extended period of time because of the size or long-term nature of the contract. In addition, from time to time projects are scaled back or cancelled. These type of backlog reductions adversely affect the revenue and profit that we ultimately receive from contracts reflected in our backlog.

If we guarantee the performance standards of a project, we could incur additional costs to cover our guarantee obligations.

Although not typical, in some instances we guarantee that a project, when completed, will achieve specified performance standards. If the project subsequently fails to meet guaranteed performance standards, we may either incur significant additional costs or be held responsible for the costs incurred by the client to achieve the required performance standards. In some cases, where we fail to meet required performance standards, we may also be subject to agreed upon damages, which are fixed in amount by the contract. To the extent that these events occur, the total costs of the project could exceed our estimates and we could experience reduced profits or, in some cases, a loss on that project.

Risks Relating to this Offering and Our Common Stock

There has been no prior public market for our shares and an active market may not develop or be maintained, which could limit your ability to sell shares of our common stock.

Before this offering, there has not been a public market for our shares of common stock. Although we are applying for listing on the New York Stock Exchange, an active public market for our shares may not develop or be sustained after this offering. The initial public offering price will be determined by negotiations between the underwriters and our board of directors and may not be representative of the market price at which our shares of common stock will trade after this offering. In particular, we cannot assure you that you will be able to resell shares of our common stock at or above the initial public offering price.

The trading price of our common stock could be volatile.

In recent years, the stock market has experienced extreme price and volume fluctuations. The overall market and the trading price of our common stock may fluctuate greatly. The trading price of our common stock may be significantly affected by various factors, including:

| Ÿ | quarterly fluctuations in our operating results; |

| Ÿ | changes in investors’ and analysts’ perception of the business risks and conditions of our business; |

| Ÿ | broader market fluctuations; and |

| Ÿ | general economic or political conditions. |

Our quarterly operating results may fluctuate significantly, which could have a negative effect on the price of our common stock.

Our quarterly revenues, expenses and operating results may fluctuate significantly because of a number of factors, including:

| Ÿ | the spending cycles of our clients; |

| Ÿ | personnel hiring and utilization rates; |

| Ÿ | the number and significance of client engagements commenced and completed during a quarter; |

| Ÿ | the ability of clients to terminate engagements without penalties; |

| Ÿ | the ability of our project managers to estimate the percentage of the project completed; |

| Ÿ | delays incurred as a result of weather conditions; |

| Ÿ | delays incurred in connection with an engagement; |

| Ÿ | the size and scope of engagements; |

| Ÿ | the timing of expenses incurred for corporate initiatives; |

| Ÿ | the impairment of goodwill or other intangible assets; and |

| Ÿ | general economic and political conditions. |

Variations in any of these factors could cause significant fluctuations in our operating results from quarter to quarter and, as a result, the trading price of our common stock may decline.

Terrorism and the possibility of further acts of violence may have a material adverse effect on our operations.

Terrorist attacks, such as the attacks that occurred on September 11, 2001, the response by the United States and further acts of violence or war may affect the market on which our common stock will trade, the markets in which we operate, our operations and profitability and your investment. Further terrorist attacks against the United States or other countries may occur. The potential near-term and long-term effect of these attacks on our business, the market for our common stock and the global economy is uncertain. The consequences of any terrorist attacks, or any armed conflicts that may result, are unpredictable, and we may not be able to foresee events that could have an adverse effect on our business or the trading price of our common stock.

Our charter documents contain provisions that may delay, defer or prevent a change of control.

Provisions of our Restated Certificate of Incorporation and Restated Bylaws could make it more difficult for a third party to acquire control of us, even if the change in control would be beneficial to stockholders. These provisions include the following:

| Ÿ | division of our board of directors into three classes, with each class serving a staggered three-year term; |

| Ÿ | removal of directors for cause only; |

| Ÿ | ability of the board of directors to authorize the issuance of preferred stock in series without stockholder approval; |

| Ÿ | supermajority requirements to approve “business combinations”; |

| Ÿ | vesting of exclusive authority in the board of directors to determine the size of the board (subject to limited exceptions) and to fill vacancies; and |

| Ÿ | advance notice requirements for stockholder proposals and nominations for election to the board of directors. |

In response to the collapse of Enron Corporation, the U.S. government may legislate or take other actions that could result in significant sales of shares of our common stock held in our employee benefit plans, which could cause the trading price of our common stock to decline.

In the wake of the collapse of Enron Corporation, there has been a renewed scrutiny of employer stock in employee benefit plans. At February 28, 2002, approximately 11.4 million shares of our common stock were held in our employee benefit plans. In addition, there were approximately 4.5 million common stock units outstanding at the same date under our Non-Qualified Stock Purchase Plan. A number of bills have been introduced in Congress that would limit the amount of employer stock that could be held by employees through their retirement accounts and limit an employer’s ability to require an employee to continue to hold matching employer stock in his or her account. In addition, the Bush Administration has announced the formation of a working group to consider reforms to the retirement system. No assurances can be given as to what, if any, action will be taken by the U.S. government or how any action, if taken, will effect our employee benefit plans. If any ultimate action either requires or allows our employees to sell a significant percentage of our shares held in our employee benefit plans, those sales, or the perceived threat of those sales, could cause the trading price of our common stock to decline significantly.

Future sales of our common stock may cause the trading price of our common stock to decline.

As the restricted periods on class A common stock expire, those shares will be eligible to be sold, including in the public market, and upon such sale shall automatically convert into class B common stock. Assuming no shares of class A common stock are sold in the proposed tender offer, approximately 6.9 million shares of class A common stock will be eligible for sale 180 days after this offering, 6.9 million shares of class A common stock will be eligible for sale 360 days after this offering, and 6.9 million shares of class A common stock will be eligible for sale 540 days after this offering. In addition, approximately 12 months after this offering, certain of our officers will sell sufficient shares of class A common stock to repay loans under our Senior Executive Equity Investment Plan and our Stock Option Loan Program. Such loans aggregated $19,311,000 at December 31, 2001. Substantial sales could adversely affect the market value of the class B common stock and, therefore, the value of your shares. In addition, the perception in the public market that our existing stockholders might sell shares of common stock could depress the market price of our common stock, regardless of the actual plans of our existing stockholders. See the information under the caption “Shares Eligible for Future Sale” in this prospectus.

Purchasers in this offering will experience immediate substantial dilution in net tangible book value.

The initial public offering price per share is expected to be substantially higher than the net tangible book value per share of our outstanding common stock. Purchasers of shares in this offering will experience immediate dilution in the net tangible book value of their shares. Based on an assumed initial public offering price of $ per share, dilution per share in this offering will be $ per share (or % of the price). In addition, we have issued options to acquire shares of our common stock at a weighted average exercise price of $ per share. To the extent these outstanding options are exercised, there will be further dilution to investors in this offering. See the information under the caption “Dilution” in this prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains statements which, to the extent that they do not recite historical fact, constitute forward-looking statements. The words “believe,” “expect,” “estimate,” “may,” “will,” “could,” “plan” or “continue” and similar expressions are intended to identify forward-looking statements. Such forward-looking information involves important risks and uncertainties that could materially alter results in the future from those expressed in any forward-looking statements made by us or on our behalf. These risks and uncertainties include, but are not limited to, those listed in this prospectus.

In addition, this prospectus contains industry data related to our business and the markets in which we operate. This data includes projections that are based on a number of assumptions. If these assumptions turn out to be incorrect, actual results could differ from the projections based on those assumptions.

We caution you that forward-looking statements are only predictions and that actual events or results may differ materially. In evaluating these statements, you should specifically consider the various factors that could cause actual events or results to differ materially from those indicated by the forward-looking statements, including the factors that we discuss in the section entitled “Risk Factors.”

We estimate that our net proceeds (after deducting underwriting discounts and commissions payable to the underwriters and our estimated offering expenses) from this offering will be $ million ($ million if the underwriters exercise their option to acquire additional shares), based upon an assumed initial public offering price of $ per share.

We expect to use approximately $80 million of the net proceeds to repay amounts outstanding under our unsecured line of credit, which bore interest at the Interbank Offered Rate plus 1.75%, or 3.68%, per annum at December 31, 2001. Of this amount, approximately $44.0 million was borrowed during the 12 months ended December 31, 2001 and was used to fund acquisitions, repurchase stock from our current and former employees, purchase capital assets and for working capital needs. We may reborrow amounts under this line of credit.

We intend to use $50 million of the proceeds from this offering to fund a cash tender offer for some of our class A common stock. The exact timing, offer price and specific terms of the tender offer are within our discretion. We currently anticipate commencing the tender offer shortly after this offering. The offer price in the tender offer will be determined by us after considering the trading price of our class B common stock. We intend for the tender offer to comprise the second step of a synthetic secondary offering, or, in other words, a primary offering followed by a stock purchase using the proceeds of the public offering to accomplish substantially the same goal as allowing existing stockholders to participate in the public offering.

Except as required by our employee benefits plans or by law, we intend to allow all of our holders of class A common stock to tender the greater of one-third of their holdings in class A common stock or $50,000 in value of class A common stock, based on the tender offer price. Approximately members of management, including all of senior management, will agree not to participate in the tender offer.

The class B common stock cannot be tendered in the tender offer.

We expect to use the remaining net proceeds for general corporate purposes, which may include future acquisitions of businesses. We have no current commitments or agreements with respect to any specific material acquisition.

Until we use the net proceeds as described above, we intend to invest the net proceeds in short-term, investment grade securities.

We have not declared or paid any cash dividends on our common stock, and we do not anticipate doing so in the foreseeable future. We currently intend to retain future earnings, if any, to operate our business and finance future growth strategies. Our presently outstanding indebtedness require us to obtain the consent of the lenders prior to the payment of any cash dividends above specified amounts.

The following table sets forth our capitalization as of December 31, 2001:

| Ÿ | as adjusted to give effect to the merger and our sale of shares of our class B common stock in this offering at an assumed initial offering price of $ per share and the application of the net proceeds from this offering, other than in connection with the purchase of our class A common stock pursuant to the proposed tender offer. |

| | | As of December 31, 2001

|

|---|

| | | Actual

| | As Adjusted

|

|---|

| | | (in thousands, except

share data) |

|---|

| Cash and cash equivalents | | $ 10,469 | | | $ | |

| | |

| | |

| |

| Debt: |

| Bank overdraft | | $ 6,364 | | | $ — | |

| Current portion of long-term debt | | 9,260 | | | | |

| Long-term debt, less current portion | | 208,314 | | | | |

| | |

| | |

| |

| Total debt | | 223,938 | | | | |

| Redeemable common stock and common stock units: | | 75,631 | | | 75,631 | |

| Common stock—issued and outstanding 3,315,435 shares actual and as adjusted | | | | | | |

| Common stock units—issued and outstanding 701,084 units actual and as adjusted | | | | | | |

| Stockholders’ equity: |

Preferred stock, $.01 par value, authorized 8,000,000 shares actual and 10,000,000 shares as

adjusted: |

Convertible preferred stock: authorized 2,500,000 shares actual and as adjusted; issued

and outstanding 6,827 shares actual and as adjusted | | 683 | | | 683 | |

Class B: authorized 5,000,000 shares actual and no shares as adjusted, issued and

outstanding 4,463,579 shares actual and no shares as adjusted(1) | | 45 | | | — | |

Common stock, $.01 par value, authorized 150,000,000(2) shares actual and no shares as

adjusted; issued and outstanding 17,412,377 shares actual and no shares as adjusted(3) | | 174 | | | — | |

Class A common stock, $.001 par value, authorized no shares actual and 45,000,000 shares as

adjusted; issued and outstanding no shares actual and shares as adjusted(3) | | — | | | | |

Class B common stock, $.001 par value, authorized no shares actual and 150,000,000 shares

as adjusted; issued and outstanding no shares actual and shares as

adjusted(3) | | — | | | | |

Common and preferred stock units, issued and outstanding 3,762,495 units actual and as

adjusted | | 46,614 | | | 46,614 | |

| Additional paid-in capital | | 121,194 | | | | |

| Retained earnings | | 39,783 | | | | |

| Notes receivable from stockholders | | (17,650 | ) | | (17,650 | ) |

| Accumulated other comprehensive income | | (11,424 | ) | | (11,424 | ) |

| | |

| | |

| |

| Total stockholders’ equity | | 179,419 | | | | |

| | |

| | |

| |

| Total capitalization | | $478,988 | | | $ | |

| | |

| | |

| |

| (1) | Upon completion of this offering, all of the shares of our Class B preferred stock will be redeemed at a price of $.01 per share. |

| (2) | Our authorized shares of common stock were increased to 150,000,000 in January 2002. |

| (3) | Common stock issued and outstanding does not include, as of December 31, 2001: |

| Ÿ | 4,069,600 shares of common stock issuable upon the exercise of employee stock options outstanding at a weighted average exercise price of $10.44 per share; |

| Ÿ | 904,000 additional shares of common stock available for issuance under our 2000 Stock Incentive Plan; |

| Ÿ | 1,500,000 additional shares of common stock available for issuance under our 2000 Stock Incentive Plan, assuming that our stockholders approve a current proposal to increase authorized shares under such plan; |

| Ÿ | 2,500,000 additional shares of common stock available for issuance under our 2002 Employee Stock Purchase Plan, assuming that our stockholders approve such plan; |

| Ÿ | 44,344 shares of common stock issuable upon conversion of our convertible preferred stock and convertible preferred stock units; |

| Ÿ | 71,000 shares of common stock issuable upon exercise of non-employee directors’ stock options at a weighted average exercise price of $9.33 per share; and |

| Ÿ | 4,463,579 shares issuable upon redemption of common stock units issued under our Non-Qualified Stock Purchase Plan. |

Our net tangible book value at December 31, 2001 was $16.8 million, or $.67 per share. Net tangible book value per share before the offering has been determined by dividing net tangible book value (total book value of tangible assets less total liabilities) by the number of shares of common stock, common stock units, redeemable common stock and redeemable common stock units outstanding at December 31, 2001. After giving effect to the sale of our class A common stock in this offering at an assumed initial public offering price of $ per share and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, other than in connection with the purchase of our class A common stock pursuant to the proposed tender offer, and after giving effect to the application of the estimated net proceeds as described under the caption “Use of Proceeds,” our adjusted net tangible book value at December 31, 2001 would have been $ million or $ per share. This represents an immediate increase in net tangible book value per share of $ to existing stockholders and dilution in net tangible book value per share of $ to new investors who purchase shares in the offering. The following table illustrates this per share dilution to new investors:

| Assumed initial public offering price per share | | | | $ |

| Net tangible book value per share at December 31, 2001 | | $.67 | | |

| Increase in net tangible book value per share attributable to new investors | | | | |

| | |

|

| Adjusted net tangible book value per share | | | | |

| |

|

| Dilution per share to new investors | | | | $ |

| | | | |

|

The discussion and table above exclude any purchases of our class A common stock pursuant to the proposed tender offer and, as of December 31, 2001:

| Ÿ | 4,069,600 shares of common stock issuable upon exercise of employee stock options outstanding at a weighted average exercise price of $10.44 per share; |

| Ÿ | 904,000 additional shares of common stock available for issuance under our 2000 Stock Incentive Plan; |

| Ÿ | 1,500,000 additional shares of common stock available for issuance under our 2000 Stock Incentive Plan, assuming that our stockholders approve a current proposal to increase authorized shares under such plan; |

| Ÿ | 2,500,000 additional shares of common stock available for issuance under our 2002 Employee Stock Purchase Plan, assuming that our stockholders approve such plan; |

| Ÿ | 44,344 shares of common stock issuable upon conversion of our convertible preferred stock and convertible preferred stock units; and |

| Ÿ | 71,000 shares issuable upon exercise of non-employee directors’ stock options at a weighted average exercise price of $9.33 per share. |

To the extent any of these options are exercised or purchases are made under our stock purchase and other investment plans, you will be further diluted.

SELECTED CONSOLIDATED FINANCIAL DATA

You should read the following selected consolidated financial data along with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the accompanying notes, which are included in this prospectus. We derived the consolidated statement of income data for each of the three years ended September 30, 2001 and the consolidated balance sheet data at September 30, 2000 and 2001 from our consolidated financial statements, which have been audited by Ernst & Young LLP, independent auditors, and are included in this prospectus. We derived the consolidated statement of income data for each of the years ended September 30, 1997 and 1998 and the consolidated balance sheet data as of September 30, 1997, 1998 and 1999 from our audited consolidated financial statements, which are not included in this prospectus. The consolidated financial data as of December 31, 2001 and for the three months ended December 31, 2001 and the accompanying notes were derived from our unaudited consolidated financial statements, which are included in this prospectus. Historical results are not necessarily indicative of future results.

| | | Year Ended September 30,

| | Three Months

Ended

December 31,

|

|---|

| | | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2000

| | 2001

|

|---|

| | | (in thousands, except per share data) |

|---|

| Consolidated Statement of Income Data: | | | | | | | | | | |

| Total revenues | | $724,508 | | $859,461 | | $994,437 | | $1,401,730 | | $1,529,713 | | $351,835 | | $395,859 | |

| Other direct costs | | 342,062 | | 436,075 | | 511,611 | | 710,646 | | 626,244 | | 143,887 | | 147,580 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net service revenues | | 382,446 | | 423,386 | | 482,826 | | 691,084 | | 903,469 | | 207,948 | | 248,279 | |

| Cost of net service revenues | | 211,020 | | 237,188 | | 266,933 | | 386,889 | | 511,160 | | 116,476 | | 139,832 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Gross profit | | 171,426 | | 186,198 | | 215,893 | | 304,195 | | 392,309 | | 91,472 | | 108,447 | |

| General and administrative expenses | | 152,093 | | 163,866 | | 190,266 | | 263,965 | | 346,302 | | 81,133 | | 103,616 | (1) |

| ESOP contribution and stock matches | | 7,072 | | 4,132 | | 5,800 | | 10,010 | | 8,389 | | 1,948 | | 9,400 | (2) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income (loss) operations | | 12,261 | | 18,200 | | 19,827 | | 30,220 | | 37,618 | | 8,391 | | (4,569 | ) |

| Interest expense, net | | 5,092 | | 4,692 | | 4,849 | | 8,784 | | 11,581 | | 2,415 | | 2,772 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income (loss) before income taxes | | 7,169 | | 13,508 | | 14,978 | | 21,436 | | 26,037 | | 5,976 | | (7,341 | ) |

| Provision for income taxes | | 4,324 | | 7,764 | | 4,436 | | 3,259 | | 8,593 | | 1,974 | | (2,422 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net income (loss) | | $ 2,845 | | $ 5,744 | | $ 10,542 | | $ 18,177 | | $ 17,444 | | $ 4,002 | | $ (4,919 | )(3) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net income (loss) per share(4): | | | | | | | | | | |

| Basic | | $ .23 | | $ .44 | | $ .73 | | $ .96 | | $ .74 | | $ .17 | | $ (.19 | )(3) |

| Diluted | | $ .22 | | $ .42 | | $ .70 | | $ .91 | | $ .71 | | $ .16 | | $ (.19 | )(3) |

| Shares used in per share calculations(4): | | | | | | | | | | |

| Basic | | 12,639 | | 13,001 | | 14,371 | | 18,938 | | 23,565 | | 24,076 | | 25,752 | |

| Diluted | | 13,011 | | 13,538 | | 15,053 | | 20,011 | | 24,704 | | 25,049 | | 25,752 | |

| (1) | Includes $8.5 million to fully vest participants in our Performance Unit Plan, which has been terminated. |

| (2) | Includes $2.8 million to fully accrue stock matches relating to the Senior Executive Equity Investment Plan, which were previously being accrued ratably over a ten-year vesting period, and $5.0 million to reflect the change in the stock match percentage. Subsequent to March 31, 2002, there will be no further stock matches. |

| (3) | Without the non-recurring charges referred to in footnotes (1) and (2) above, net income would have been $6.0 million, basic net income per share would have been $.23 and diluted net income per share would have been $.22. |

| (4) | In calculating per share data, the weighted average number of shares includes shares of common stock and common stock units outstanding during the relevant periods. |

| | | As of September 30,

|

|---|

| | | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | As of

December 31,

2001

|

|---|

| | | (in thousands, except for employee data) |

|---|

| Consolidated Balance Sheet Data: | | | | | | | | | | |

| Cash and cash equivalents | | $ 5,335 | | $ 25,569 | | $ 13,466 | | $ 44,662 | | $ 25,968 | | $ 10,469 |

| Working capital | | 58,974 | | 76,546 | | 90,901 | | 136,138 | | 155,152 | | 160,011 |

| Total assets | | 262,661 | | 323,571 | | 373,280 | | 711,694 | | 763,541 | | 840,243 |

| Total long-term debt, excluding current portion | | 42,983 | | 60,000 | | 60,000 | | 141,156 | | 147,622 | | 208,314 |

| Redeemable common stock and common stock units | | 18,480 | | 34,068 | | 42,720 | | 58,617 | | 77,734 | | 75,631 |

| Stockholders’ equity | | 60,974 | | 50,647 | | 80,230 | | 171,714 | | 172,093 | | 179,419 |

| Other Data: | | | | | | | | | | | | |

|---|

| Number of full-time employees | | 5,900 | | 6,400 | | 7,200 | | 12,100 | | 12,700 | | 14,200 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion in conjunction with our consolidated financial statements and the related notes and other financial information included in this prospectus.

Overview

We are a worldwide leader in providing a broad range of technical professional services to government agencies and large corporations. We have built leading positions based on revenues in a number of industry sectors and strategic geographic markets through a global network of more than 25 major operating offices and 14,200 employees.

Recent Acquisitions

One of our strategies is to focus on mergers and acquisitions of technical niche and regional companies to complement our business sectors and geographic expansion. Since the beginning of fiscal 1998, we have acquired 13 companies increasing our presence in several industry sectors and geographic regions.

Fiscal 1999. On March 19, 1999, we acquired Day & Zimmermann Infrastructure, Inc. (now part of DMJM Aviation), an aviation project/construction management firm. On March 31, 1999, we acquired W.F. Castella, an engineering/land surveying firm in San Antonio, Texas. On May 18, 1999, we acquired Spillis Candela & Partners, an architectural and engineering firm in Coral Gables, Florida. The aggregate consideration paid in these transactions was $35.1 million in a combination of cash and stock, no liabilities were assumed, other than as included in working capital, and the purchases resulted in goodwill of $28.6 million.

Fiscal 2000. On April 7, 2000, we acquired Metcalf & Eddy, Inc., an international environmental engineering and consulting company. On April 18, 2000, we merged with Guy Maunsell International Limited (“Maunsell”), a consulting firm specializing in civil engineering and related disciplines. The aggregate consideration paid in these transactions was $145.0 million, net of excess cash on hand, in a combination of cash, stock and notes, no liabilities were assumed, other than as included in working capital, and the purchases resulted in goodwill of $122.2 million.

Fiscal 2001. On November 21, 2000, we acquired the transportation planning practice of KPMG Consulting. On December 7, 2000, we acquired the two-thirds of Halpern Glick Maunsell, a Perth-based engineering firm, that we did not already own. On April 26, 2001, we acquired the Warren Group, a UK-based water engineering firm. These transactions and three other small acquisitions were completed for an aggregate consideration of $21.7 million in a combination of cash, stock and notes, no liabilities were assumed, other than as included in working capital, and the purchases resulted in goodwill of $13.3 million.

Fiscal 2002. On October 11, 2001, we acquired the UK-based engineering firm Oscar Faber plc and on October 31, 2001, we acquired the Denver-based consulting firm, design Alliance, for an aggregate consideration of $45.0 million, consisting of cash, stock and notes. Consideration for Oscar Faber consisted of $5.0 million in cash, $19.4 million in stock and $17.5 million in notes. No liabilities were assumed, other than included in working capital, and the preliminary purchase price allocation resulted in goodwill of $46.2 million. The preliminary purchase price allocation includes an estimated liability of $15 million for an underfunded pension obligation. The actual liability and goodwill will be adjusted pending completion of an actuarial valuation.

All of our acquisitions have been accounted for as purchases and the results of operations of the acquired companies have been included in the consolidated results since the dates of acquisition.

Components of Income and Expense

Revenues. We recognize revenues using the percentage-of-completion method. Under this method, revenue is recorded generally on the basis of the ratio of direct labor hours incurred to the estimated total direct labor hours. We review our progress on each contract periodically and losses, if any, are recognized as soon as we determine that the contract will result in a loss.

Other Direct Costs. When we are responsible for other direct costs or “pass throughs” (e.g. for third party field labor, subcontracts, or the procurement of materials or equipment), we reflect them in our accounts as revenues when the costs of these items are incurred. Other than in rare circumstances, we do not earn profits from pass throughs that are not associated with the level of effort expanded, and in those cases the amount is insignificant. However, on projects where the client elects to pay those items directly, the items are not reflected in our revenues or expenses. Thus, other direct costs can fluctuate significantly.

Net Service Revenues. Net service revenues reflect revenues recognized for services performed by us on projects and exclude other direct costs which are “passed through” to the client. Net service revenues and gross profit (as a % of net service revenues) are non-GAAP measures and may not be comparable to similarly titled items reported by other companies. We believe that net service revenues is a more accurate measure of our profitability because revenues include other direct, or pass through, costs.

Cost of Net Service Revenues. Cost of net service revenues reflect the direct cost of our own personnel (including fringe benefits and overhead expense) associated with net service revenue.

General and Administrative Expenses. General and administrative expenses include all corporate overhead expense, including personnel, occupancy, administrative, performance unit plan accruals, taxes and benefits and other operating expenses and prior to fiscal 2002, the amortization of costs in excess of net assets purchased. SFAS No. 142 prohibits amortization of goodwill after fiscal 2001.

ESOP Contribution and Stock Matches. We have employee benefit plans that provide for stock matches on employee purchases of our common stock and common stock units. The matching percentages for fiscal years 2001, 2000 and 1999 were 30.7%, 27.3% and 33.5%, respectively, based upon the formula in our plan. In anticipation of this offering, the board of directors approved a change to the previously announced 25% stock match percentage for fiscal 2002. The new percentage will be the greater of a 100% match on purchases of common stock and common stock units in the first quarter of fiscal 2002 or a 50% match on purchases during the first six months of fiscal 2002, ending March 31, 2002. After March 31, 2002, there will be no further stock matches. Matches are contributed to the ESOP in common stock and credited to the Non-Qualified Stock Purchase Plan in common stock units.

Segment Analysis

We have three reportable segments: Americas-Infrastructure Group; Americas-Facilities Group; and Global Group. This segmentation corresponds to how we manage our business as well as the underlying characteristics of our markets.

As discussed above, a significant portion of our revenues relates to services provided by subcontractors and other non-employees that we categorize as “other direct costs.” Those pass through costs are typically paid to service providers upon our receipt of payment from the client. We have included information on net service revenues as we believe that it is a more accurate measure on which to base gross margin.

| | | Year ended September 30,

| | Three months

ended December 31,

|

|---|

| | | 1999

| | 2000

| | 2001

| | 2000

| | 2001

|

|---|

| | | (In thousands) |

|---|

| Total Revenues | | | | | | | | | | | | | | | |

| Americas—Infrastructure | | $415,485 | | | $ 548,189 | | | $ 684,433 | | | $148,639 | | | $170,662 | |

| Americas—Facilities | | 545,532 | | | 701,113 | | | 564,339 | | | 141,274 | | | 128,931 | |

| Global | | 32,919 | | | 151,334 | | | 277,475 | | | 61,788 | | | 96,251 | |

| | |

| | |

| | |

| | |

| | |

| |

| Total(1) | | $993,936 | | | $1,400,636 | | | $1,526,247 | | | $351,701 | | | $395,844 | |

| | |

| | |

| | |

| | |

| | |

| |

| Net Service Revenues | | | | �� | | | | | | | | | | | |

| Americas—Infrastructure | | $291,556 | | | $ 376,482 | | | $ 469,641 | | | $105,151 | | | $114,607 | |

| Americas—Facilities | | 170,968 | | | 200,487 | | | 201,962 | | | 51,847 | | | 52,175 | |

| Global | | 19,801 | | | 113,021 | | | 228,400 | | | 50,816 | | | 81,482 | |

| | |

| | |

| | |

| | |

| | |

| |

| Total(1) | | $482,325 | | | $ 689,990 | | | $ 900,003 | | | $207,814 | | | $248,264 | |

| | |

| | |

| | |

| | |

| | |

| |

| Gross Profit | | | | | | | | | | | | | | | |

| Americas—Infrastructure | | $136,732 | | | $ 175,006 | | | $ 217,914 | | | $ 49,145 | | | $ 54,462 | |

| Americas—Facilities | | 69,683 | | | 85,994 | | | 85,346 | | | 23,247 | | | 23,675 | |

| Global | | 8,977 | | | 42,101 | | | 85,583 | | | 18,946 | | | 30,295 | |

| | |

| | |

| | |

| | |

| | |

| |

| Total(1) | | $215,392 | | | $ 303,101 | | | $ 388,843 | | | $ 91,338 | | | $108,432 | |

| | |

| | |

| | |

| | |

| | |

| |

| Gross Profit (as a % of Total Revenues) | | | | | | | | | | | | | | | |

| Americas—Infrastructure | | 33 | % | | 32 | % | | 32 | % | | 33 | % | | 32 | % |

| Americas—Facilities | | 13 | | | 12 | | | 15 | | | 16 | | | 18 | |

| Global | | 27 | | | 28 | | | 31 | | | 31 | | | 31 | |

| | |

| | |

| | |

| | |

| | |

| |

| Total | | 22 | % | | 22 | % | | 25 | % | | 26 | % | | 27 | % |

| | |

| | |

| | |

| | |

| | |

| |

| Gross Profit (as a % of Net Service Revenues) | | | | | | | | | | | | | | | |

| Americas—Infrastructure | | 47 | % | | 46 | % | | 46 | % | | 47 | % | | 48 | % |

| Americas—Facilities | | 41 | | | 43 | | | 42 | | | 45 | | | 45 | |

| Global | | 45 | | | 37 | | | 37 | | | 37 | | | 37 | |

| | |

| | |

| | |

| | |

| | |

| |

| Total | | 45 | % | | 44 | % | | 43 | % | | 44 | % | | 44 | % |

| | |

| | |

| | |

| | |

| | |

| |

| General and Administrative Expenses | | | | | | | | | | | | | | | |

| Americas—Infrastructure | | $112,101 | | | $ 142,656 | | | $ 177,129 | | | $ 43,432 | | | $ 45,976 | |

| Americas—Facilities | | 60,709 | | | 74,923 | | | 86,826 | | | 19,966 | | | 20,049 | |

| Global | | 6,300 | | | 32,854 | | | 65,229 | | | 15,341 | | | 25,441 | |

| | |

| | |

| | |

| | |

| | |

| |

| Total(1) | | $179,110 | | | $ 250,433 | | | $ 329,184 | | | $ 78,739 | | | $ 91,466 | |

| | |

| | |

| | |

| | |

| | |

| |

| ESOP Contribution and Stock Matches | | | | | | | | | | | | | | | |

| Americas—Infrastructure | | $ 2,922 | | | $ 3,651 | | | $ 3,591 | | | $ 917 | | | $ 3,912 | |

| Americas—Facilities | | 1,282 | | | 2,152 | | | 2,142 | | | 541 | | | 2,088 | |

| Global | | — | | | 823 | | | 831 | | | 183 | | | 448 | |

| | |

| | |

| | |

| | |

| | |

| |

| Total(1) | | $ 4,204 | | | $ 6,626 | | | $ 6,564 | | | $ 1,641 | | | $ 6,448 | |

| | |

| | |

| | |

| | |

| | |

| |

| Income from Operations | | | | | | | | | | | | | | | |

| Americas—Infrastructure | | $ 21,709 | | | $ 28,699 | | | $ 37,194 | | | $ 4,795 | | | $ 4,574 | |

| Americas—Facilities(2) | | 7,692 | | | 8,919 | | | (3,622 | ) | | 2,741 | | | 1,538 | |

| Global | | 2,677 | | | 8,424 | | | 19,523 | | | 3,422 | | | 4,406 | |

| | |

| | |

| | |

| | |

| | |

| |

| Total(1),(3) | | $ 32,078 | | | $ 46,042 | | | $ 53,095 | | | $ 10,958 | | | $ 10,518 | |

| | |

| | |

| | |

| | |

| | |

| |

| Segment Assets | | | | | | | | | | | | | | | |

| Americas—Infrastructure | | $159,192 | | | $ 251,916 | | | $ 282,144 | | | $254,678 | | | $320,594 | |

| Americas—Facilities | | 183,287 | | | 200,883 | | | 214,265 | | | 190,433 | | | 196,982 | |

| Global | | 6,955 | | | 201,392 | | | 219,107 | | | 188,981 | | | 275,313 | |

| | |

| | |

| | |

| | |

| | |

| |

| Total(1) | | $349,434 | | | $ 654,191 | | | $ 715,516 | | | $634,092 | | | $792,889 | |

| | |

| | |

| | |

| | |

| | |

| |

| (1) | For a reconciliation to the consolidated totals, see Note Q to the Notes to our Consolidated Financial Statements appearing elsewhere in this prospectus. |

| (2) | Fiscal 2001 includes an $8.8 million increase in reserves for revenues previously recognized on a percentage-of-completion basis and unreimbursed contract costs on contracts completed in prior years at one of the operating companies. |

| (3) | Does not include corporate general and administrative expenses and other unallocated items totalling $15.5 million, $15.8 million and $12.3 million in fiscal 2001, 2000 and 1999, respectively, or $15.1 million and $2.7 million for the three months ended December 31, 2001 and 2000, respectively. See the reconciliation in Note Q to the Notes to our Consolidated Financial Statements and Note E to the Notes to our Interim Consolidated Financial Statements appearing elsewhere in this prospectus. |

Results of Operations

The following table presents our consolidated income statement data for the periods indicated as a percentage of total revenues:

| | | Year Ended September 30,

| | Three Months

Ended

December 31,

|

|---|

| | | 1999

| | 2000

| | 2001

| | 2000

| | 2001

|

|---|

| Total revenues | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Other direct costs | | 51.4 | | | 50.7 | | | 40.9 | | | 40.9 | | | 37.3 | |

| | |

| | |

| | |

| | |

| | |

| |

| Net service revenues | | 48.6 | | | 49.3 | | | 59.1 | | | 59.1 | | | 62.7 | |

| Cost of net service revenues | | 26.8 | | | 27.6 | | | 33.4 | | | 33.1 | | | 35.3 | |

| | |

| | |

| | |

| | |

| | |

| |

| Gross profit | | 21.8 | | | 21.7 | | | 25.7 | | | 26.0 | | | 27.4 | |

| General and administrative expenses | | 19.2 | | | 18.8 | | | 22.6 | | | 23.0 | | | 26.1 | (1) |

| ESOP contribution and stock matches | | .6 | | | .7 | | | .6 | | | .6 | | | 2.4 | (2) |

| | |

| | |

| | |

| | |

| | |

| |

| Income from operations | | 2.0 | | | 2.2 | | | 2.5 | | | 2.4 | | | (1.1 | )(1),(2) |

| Interest expense, net | | .5 | | | .7 | | | .8 | | | .7 | | | .7 | |

| | |

| | |

| | |

| | |

| | |

| |

| Income before income taxes | | 1.5 | | | 1.5 | | | 1.7 | | | 1.7 | | | (1.8 | )(1),(2) |

| Provision for income taxes | | .4 | | | .2 | | | .6 | | | .6 | | | (.6 | ) |

| | |

| | |

| | |

| | |

| | |

| |

| Net income | | 1.1 | % | | 1.3 | % | | 1.1 | % | | 1.1 | % | | (1.2 | )%(3) |

| | |

| | |

| | |

| | |

| | |

| |

| (1) | Includes 2.1% attributable to fully vesting participants in our Performance Unit Plan, which will be terminated after this offering. |

| (2) | Includes 2.0% attributable to fully vesting participants in the Senior Executive Equity Investment Plan, which were previously being accrued ratably over a ten-year vesting period, and to reflect the change in the stock match percentage. |

| (3) | Includes, net of tax, 2.7% attributable to the fall vesting of the Performance Unit Plan, the Senior Executive Equity Investment Plan stock match and the change in the stock match percentage. |

The following table presents our consolidated income statement data for the periods indicated as a percentage of net service revenues:

| | | Year Ended September 30,

| | Three Months

Ended

December 31,

|

|---|

| | | 1999

| | 2000

| | 2001

| | 2000

| | 2001

|

|---|

| Net service revenues | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Cost of net service revenues | | 55.3 | | | 56.0 | | | 56.6 | | | 56.0 | | | 56.3 | |

| | |

| | |

| | |

| | |

| | |

| |

| Gross profit | | 44.7 | | | 44.0 | | | 43.4 | | | 44.0 | | | 43.7 | |

| General and administrative expenses | | 39.4 | | | 38.2 | | | 38.3 | | | 39.1 | | �� | 41.7 | (1) |

| ESOP contribution and stock matches | | 1.2 | | | 1.4 | | | .9 | | | .9 | | | 3.8 | (2) |

| | |

| | |

| | |

| | |

| | |

| |

| Income from operations | | 4.1 | | | 4.4 | | | 4.2 | | | 4.0 | | | (1.8 | )(1),(2) |

| Interest expense, net | | 1.0 | | | 1.3 | | | 1.3 | | | 1.2 | | | 1.2 | |

| | |

| | |

| | |

| | |

| | |

| |