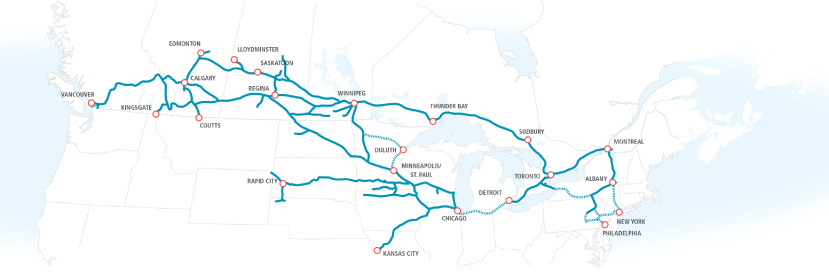

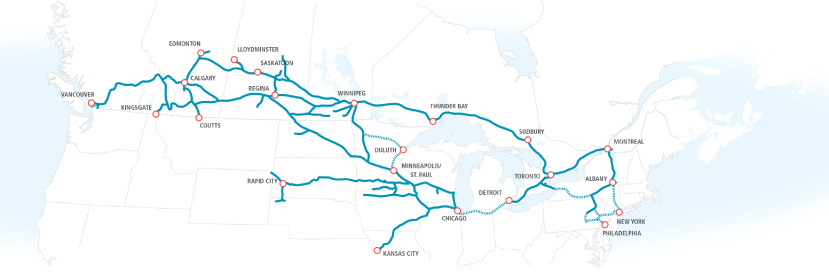

NETWORK MAP

| | |

1 | | Chairman’s Letter to Shareholders |

2 | | Chief Executive Officer’s Letter to Shareholders |

3 | | Management’s Discussion and Analysis |

55 | | Financial Statements |

100 | | Five-Year Summary |

102 | | Shareholder Information |

104 | | Directors and Committees |

105 | | Senior Officers of the Company |

CHAIRMAN’S LETTER TO SHAREHOLDERS

The Board of Directors recognizes that strong and experienced leadership is critical to drive shareholder value and to advance the best interests of Canadian Pacific’s investors, its employees, its customers and all other stakeholders.

CP’s independent Board is composed of directors with extensive, relevant experience in railroads and complementary industries including energy, natural resources, food and agriculture, as well as leaders from the fields of law, government, banking and finance. During the past year, the Board was pleased to announce the addition of Rick George. Mr. George is the Chief Executive Officer of Suncor Energy, Canada’s largest integrated energy company, a position he has held since 1991. Rick has had significant experience with the rail industry, as Suncor is both a supplier of fuel to the industry and a shipper of petroleum products by rail.

In 2011, the Board also announced the addition of Tony Ingram and Ed Harris, seasoned railroad executives who served at four of the seven Class I railroads in North America and together bring over 80 years of rail experience. Mr. Ingram and Mr. Harris have joined the Safety, Operations and Environment Committee, tasked by the Board with monitoring the progress of the Multi-Year Plan developed by management and fully endorsed by the Board. The additions of Rick, Tony and Ed have significantly strengthened our Board, and we look forward to benefiting from their broad range of experience for many years to come.

Under the close oversight of the Board, CP’s management team has been aggressively and successfully executing on the Plan and its core pillars of driving volume growth, expanding network capacity to safely and efficiently support higher volumes, and controlling costs. The disciplined implementation has led to materially enhanced operational efficiency and further increased service quality and reliability, setting the stage for additional meaningful improvements of key operating and financial metrics going forward. These improvements will translate into enhanced value for shareholders.

The Board as well as the Safety, Operations and Environment Committee are encouraged by the Plan’s most recent successes and will continue to hold CP’s senior management fully accountable for reaching an Operating Ratio of 70 to 72 per cent for 2014 and delivering further improvements thereafter.

To ensure that we continue to fulfill our responsibility of advancing the interest of shareholders, we continue our director education program to further expand our knowledge of CP and the railway industry. Over the past year we have received regular reports and presentations involving the changing regulatory and business environment. We have also made site visits to enhance our first-hand knowledge of rail operations, including a tour of the world-class TTCI transportation research and testing facility focused on the transportation industry, which provides emerging technology solutions that are central to CP’s strategy and Multi-Year Plan. I want to thank the directors for their ongoing, high level of engagement, their commitment to the railroad as well as for the extensive time they spend on CP matters every year.

Even through a challenging operating environment in 2011, CP has made great strides in the areas of governance, management and operations. The Board believes that Pershing Square’s demand for management change would put at severe risk the significant forward momentum the Company is making on the Multi-Year Plan.

On behalf of the Board, I would like to extend our appreciation to Fred Green and his management team for aggressively and successfully implementing our Multi-Year plan and creating superior value for our shareholders and customers.

I also thank all employees of CP for their continued hard work and their unremitting commitment to safely delivering against our objectives, achieving new operational records, and setting new efficiency benchmarks.

Thank you for your continued support of CP.

Sincerely,

John E. Cleghorn, O.C., FCA

Chairman of the Board

March 5, 2012

CHIEF EXECUTIVE OFFICER’S LETTER TO SHAREHOLDERS

Canadian Pacific’s mission is to deliver value to our shareholders by aggressively and successfully executing on the Multi-Year Plan. CP’s Multi-Year Plan is built on three pillars: driving volume growth, expanding network capacity to safely and efficiently support higher volumes and controlling costs. In addition, the Company is implementing its Multi-Year Plan through a focus on the organization’s core beliefs: service, safety, productivity and efficiency, people and growth.

In 2011, CP’s management team, with oversight from the Board of Directors, made meaningful progress in all three pillars of the Multi-Year Plan and we are beginning 2012 with operating momentum, excellent service and a stronger, more resilient rail network.

In the first half of 2011, the Company experienced extraordinary and prolonged weather that disrupted service and fluidity throughout the network. Our first priority was to re-establish the reputation for service which underpins our price and growth plans, and we have done just that. In grain, we filled 100 per cent of planned orders during the fourth quarter and achieved 92 per cent overall on-time daily car spotting. In Intermodal, we delivered on-time transcontinental train performance over 90 per cent during the fourth quarter.

CP also made improvements over the course of 2011 in our operating metrics, which are a leading indicator of both reliable service and financial results. Active cars online showed an improvement of 14 per cent versus fourth-quarter 2010 while handling five per cent more gross ton miles. We ended the year with record metrics in:

| ¨ | | Fuel efficiency of 1.17 gallons per 1,000 GTMs, matching the best-ever fourth-quarter performance; |

| ¨ | | Train weights, which set a new full-year record; and |

| ¨ | | Car miles per car day and terminal dwell, both fourth-quarter records, showing improvements of 20 per cent from the previous year. |

CP has made further improvements to its operating metrics in 2012. The improvements in these and other metrics are early evidence that our Multi-Year Plan is producing the desired results and we expect further improvements as the Plan progresses.

In 2011, the first year of CP’s post-recession multi-year capital program, we invested approximately $1.1 billion in our infrastructure. Under this program, we plan to invest between $1.1 and $1.2 billion in each of the next three years to deliver network improvements, locomotive upgrades and renewals, and enhanced information technology capability. The time, effort and capital invested in this program during 2011 contributed to CP achieving records in train weights, increased train speeds on our North Line and increased train lengths for export coal. These results are encouraging, but are only the first steps. We expect to see even greater operational and financial benefits as we deliver on years two, three and four of the capital program.

CP also finished the year with many successes in Marketing and Sales. During 2011, CP signed a number of commercial agreements with customers, terminal operators and ports that will drive supply chain improvement and enable growth. We have announced a new five-year agreement with Canadian Tire and a ten-year agreement with Canpotex. In addition, our scheduled grain program was successfully implemented in Canada.

CP is taking advantage of our network reach to expand markets for key bulk customers to meet Asian demand. We have used our Kansas City gateway and its Northeast U.S. destination points to extend our length of haul and increase revenue and profitability for oil and ethanol. Our successful market development activities have also enabled us to successfully take advantage of our access to the Bakken oil formation, the Marcellus gas formation and the Alberta oil sands area. As a result, CP is attracting new customers to invest in and ship energy-related products by rail. These products include crude oil, sulphur, fuels, diluents and materials key to the energy industry, such as frac sand and pipe. A key example of this kind of partnership is the recent announcement made by CP that it will be moving additional volumes of Bakken crude oil by unit train from the Van Hook logistics hub owned by the U.S. Development Group (USD), a high capacity facility that will become part of the largest crude by rail network in the US.

Given recent market successes and operating trends, in January we announced that we were able to narrow our operating ratio target for the next three years from the low 70s to 70-72 per cent, and we will not stop there — as the Company achieves its goals, we will set new targets. This team’s primary goal is to drive shareholder value by safely operating the business to realize our growth, service, and financial objectives.

Looking to 2012, CP expects to see continued strength in our operating performance and service reliability. These operating and service improvements are directly linked to the improved financial performance we expect starting in the first quarter of 2012. I would like to thank the employees of CP for their efforts in safely working through very challenging weather events in the first half of the year and delivering real operating improvements in the second half of 2011. We are already seeing the results of this hard work in 2012. In the year ahead, we are committed to delivering further operating improvement to drive enhanced financial performance and significant value for all stakeholders.

Sincerely,

Fred Green

President and Chief Executive Officer

March 5, 2012

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (“MD&A”) is provided in conjunction with the Consolidated Financial Statements and related notes for the year ended December 31, 2011 prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). All information has been prepared in accordance with GAAP, except as described in Section 15, Non-GAAP Measures of this MD&A. Except where otherwise indicated, all financial information reflected herein is expressed in Canadian dollars.

March 5, 2012

In this MD&A, “our”, “us”, “we”, “CP” and “the Company” refer to Canadian Pacific Railway Limited (“CPRL”), CPRL and its subsidiaries, CPRL and one or more of its subsidiaries, or one or more of CPRL’s subsidiaries, as the context may require. Other terms not defined in the body of this MD&A are defined in Section 25, Glossary of Terms.

Unless otherwise indicated, all comparisons of results for 2011 and 2010 are against the results for 2010 and 2009, respectively. Unless otherwise indicated, all comparisons of results for the fourth quarter of 2011 are against the results for the fourth quarter of 2010.

1.BUSINESS PROFILE

Canadian Pacific Railway Limited, through its subsidiaries, operates a transcontinental railway in Canada and the United States (“U.S.”) and provides logistics and supply chain expertise. Rail and intermodal transportation services are provided over a network of approximately 14,700 miles, serving the principal business centres of Canada from Montreal, Quebec, to Vancouver, British Columbia (“B.C.”), and the U.S. Northeast and Midwest regions. Our railway feeds directly into the U.S. heartland from the East and West coasts. Agreements with other carriers extend our market reach east of Montreal in Canada, throughout the U.S. and into Mexico. We transport bulk commodities, merchandise freight and intermodal traffic. Bulk commodities include grain, coal, sulphur and fertilizers. Merchandise freight consists of finished vehicles and automotive parts, as well as forest and industrial and consumer products. Intermodal traffic consists largely of high-value, time-sensitive retail goods in overseas containers that can be transported by train, ship and truck, and in domestic containers and trailers that can be moved by train and truck.

2.STRATEGY

Our vision is to become the safest and most fluid railway in North America. Our objective is to create long-term value for our customers, shareholders and employees by disciplined execution of our Integrated Operating Plan (“IOP”); by executing on our Multi-Year Plan which enhances and supports our IOP; and by aligning all parts of the organization around our five core beliefs:

| ¨ | | Service: Reliable and consistent service is our product. We are committed to executing our IOP in order to meet and exceed the needs of our customers in a cost-effective manner. |

| ¨ | | Safety: There is no job at CP that is so important that we can’t take the time to do it safely. Our comprehensive safety framework safeguards our employees, the communities we operate through, the environment and our customers’ freight enabling us to provide an effective transportation solution. |

| ¨ | | Productivity and Efficiency: Based on a culture of continuous improvement and accountability, we are always looking for better, less costly, more reliable ways to operate our business. |

| ¨ | | People: We pride ourselves in our well trained and knowledgeable team of railroaders. We are committed to executing the IOP and collaboratively working with our customers. |

| ¨ | | Growth: We invest in our franchise to enhance productivity and service, which allows us to capitalize on growth opportunities with new and existing customers at low incremental cost. |

Strategic Summary

We are taking a systematic approach to executing our strategy which is based on a disciplined execution of our IOP, the delivery of our Multi-Year Plan which supports the IOP and by ensuring clear accountabilities throughout the organization. CP’s Multi-Year Plan provides a clear blueprint with three key elements: driving volume growth, expanding network capacity to safely and efficiently support higher volumes and cost control. This strategy and related investments have set us firmly on track to deliver on our goal of bringing CP’s operating ratio down to 70% – 72% for 2014, and we will strive for continued improvement beyond 2014.

Integrated Operating Plan

The IOP is the foundation of our railway operations. All key aspects of the operation are scheduled to drive service reliability and on-time shipment performance. This encompasses road train operations, our First Mile-Last Mile program and all mechanical, engineering and other maintenance activities. The IOP continues to be enhanced through Lean continuous improvement, simplification and standardization of business processes and improved information systems. Our IOP is supported by a culture of accountability built on clear established metrics tied to each position in the organization and incentives tied to performance.

The underlying design principles of the IOP are:

| ¨ | | Velocity – keeping our assets moving through an efficient, scheduled 24/7 operation; |

| ¨ | | Balance – train and car movements are balanced daily in each corridor, yard and terminal, which drives efficiencies and asset velocity; and |

| ¨ | | Network – all aspects of the network’s operation are optimized to drive the best service, safety, productivity and efficiency outcome. |

We are continuing to improve the IOP with the following multi-year programs:

First Mile-Last Mile – this program drives improvements in service, asset velocity and enables low-cost growth by reducing railcars and creating additional terminal capacity.

Scheduled Bulk – we continue to schedule our bulk train operations as part of our IOP. In grain, our efforts involve leveraging our grain elevator footprint by scheduling all aspects of our grain shipments, including First Mile-Last Mile switching and bulk unit train operations, all centered around a simplified network of origin grain hubs.

Long Trains – this program is driving increased train lengths; improving service, safety, productivity and efficiency.

It includes targeted infrastructure enhancements and the use of proprietary train marshaling software, which maximizes the use of distributed locomotive power.

Fuel Efficiency – this program targets year-over-year improvements in fuel efficiency and reduced emissions. It consists of the acquisition of new locomotives, the remanufacturing of older locomotives and using new technologies which improve train handling and reduces idling. This program is enhanced by the disciplined execution of the IOP, improving velocity and driving fleet productivity.

Locomotive Reliability Centres – we are consolidating the number of major locomotive repair facilities from eight to four highly efficient super shops which will result in improved maintenance capabilities, lower unit costs, reduced overheads and improved locomotive availability and reliability.

Markets

Our Multi-Year Plan is based on three major sources of growth: Asian demand for commodities; growth in energy production and North American economic growth.

Strong long-term fundamentals support our bulk commodities business as Asian economies develop, expand and diversify. We have 10-year contracts with both Teck for metallurgical coal and with Canpotex for export potash. We continue to develop our extensive grain network through expansions at existing high-throughput grain elevators, new elevator development and collaboration in planned expansion of oil seed processing.

In the energy sector, our franchise accesses the Bakken Oil Formation in North Dakota and Saskatchewan, the Alberta Industrial Heartland supporting the Oilsands, and the Marcellus Gas Formation in the northeastern U.S. and allows us to develop new long-haul markets. With the strong global demand for energy we are growing our shipments in crude oil, ethanol and energy-related inputs such as pipe and frac sand.

North American economic growth will result in additional opportunities in a number of lines of business, including intermodal, automotive and forest products. We are leveraging our relationships, capital investments and the disciplined execution of our IOP to enable growth in these markets. In addition, we continue to enhance our intermodal franchise by expanding on our co-location model and terminal network.

Investments

CP is committed to the renewal of its infrastructure and making investments for productivity and growth through network enhancements, locomotive upgrades and information technology (“IT”) renewal. During 2011, we completed the first year of our multi-year accelerated capital program.

Our network investment plans include investing $75 to $100 million to increase the productivity in our Western Corridor which supports approximately 40% of our volumes. Our targeted infrastructure investments supports the operation of longer trains and enables low-cost growth.

In addition, approximately $250 million in upgrades over the next few years are underway on CP’s North Line, running from Winnipeg, Manitoba to Edmonton, Alberta. This program will result in an increase in track speeds and will support productivity and growth in potash, grain, energy related products and intermodal. By upgrading this portion of the network, route miles for some shipments will be reduced by between 5% – 10%. This upgrade will provide operating flexibility, with a second routing option for traffic currently traversing over the more southerly mainline, improving overall service reliability and network speed.

In order to capitalize on growth in energy, agriculture and potash shipments, we are investing approximately $90 million in enhancements to our North/ South corridors in the U.S. Midwest. These upgrades will increase capacity, enhance routing flexibility and lift the efficiency on all the business that travels on these lines. Similar to the North Line improvements, the investments will enhance network resiliency facilitating increased train speeds, car miles per car day, fuel efficiency and reducing terminal dwell.

Managing the movement of assets and information is a critical business process. Our multi-year IT program includes upgrades to our Shipment management and SAP suites. Predictive technologies will become important to driving even more efficiencies in field operations. These planned multi-year system upgrades position CP to enhance labour productivity, improve asset management and provide better shipment visibility to all parties.

CP has deployed a series of strategies expected to deliver a 1% – 2% per year improvement in fuel efficiency. Our plans include: expanding the application of fuel trip optimizer technology that assist train crews in efficient train handling; remanufacturing a portion of our older yard and local locomotive fleet at a 3 for 4 replacement ratio; the introduction of new stop-start technology that will reduce cold weather idling; and the renewal of our mainline locomotive fleet. In addition to improved fuel efficiency, reduced emissions and enhanced service reliability, this program will result in a more homogeneous fleet, further enhancing shop productivity. The re-manufacturing of older units will enhance inter-operability allowing for further productivity gains.

Finance

To support the Multi-Year Plan, which includes an accelerated capital program, the Company has continued to focus its efforts on the balance sheet to provide financial flexibility and preserve its investment grade rating while maintaining a competitive dividend.

Over the last three years, we have made $1.85 billion of solvency deficit contributions of which $1.75 billion were voluntary pension prepayments to our main Canadian defined benefit pension plan in order to provide stability and reduce volatility of our future funding requirements. These pension prepayments are accretive to earnings and are tax efficient resulting in low cash taxes over the next several years.

Additional measures taken to mitigate our pension funding volatility include, reducing our asset allocation to public equities, increasing our asset/liability interest rate matching and implementing a dynamic de-risking plan that will further reduce our allocation to public equities as our funded ratio increases.

We have taken advantage of attractive interest rates and have tendered and refinanced a number of debt maturities by blending and extending them further into the future. As a result, we have no significant debt maturities over the next several years.

Principal sources of liquidity are generated from cash from operations and, where necessary, access to a recently negotiated $1 billion four year revolving credit agreement.

People

To successfully execute our strategy, Canadian Pacific is committed to investing in its people. We continue to promote an engaged and stable workforce through:

| ¨ | | an organizational structure that provides for clear accountability and alignment across all functions; |

| ¨ | | an understanding and focus on our five core beliefs; |

| ¨ | | selection and development of the right employee for a required role; |

| ¨ | | training and appropriate resources for success; and |

| ¨ | | appropriate salary and incentive program that rewards performance. |

2011 Summary

The first half of 2011 was challenging as CP experienced significant disruptions to its operations across our network. These disruptions were mainly due to unusually severe winter weather and the impact of subsequent flooding, in one case causing a mainline outage lasting for three weeks. These extraordinary conditions resulted in slower train speeds, reduced productivity and asset velocity and lower than expected volumes in the first half of the year. Our priority was to re-establish our reputation for service which underpins our price and growth plans.

In the second half of the year, we successfully reset our network. There was a strong focus on rebuilding our customer confidence, through improved service reliability. Despite these challenges, we were able to complete our planned capital program in 2011. Our continued work on building new sidings and extending our current ones to support our long-train strategy paid dividends; CP set a new full-year record in train weights. In addition, we set full year records in both terminal dwell and car miles per car day as a result of implementing our First Mile-Last Mile program in Canada. We expect further improvements as we continue to tighten standards in Canada and roll out the program in the U.S. We completed the second phase of our Locomotive Reliability Centre strategy, which will reduce the number of major locomotive repair facilities from eight to four highly efficient super shops with improved repair capabilities. These improved efficiencies will allow us to do more with less and to reduce our asset pools and associated costs.

CP has signed several commercial agreements with customers, terminal operators and ports that will drive improvements in supply chain performance. In early 2012, we announced a new five-year agreement with Canadian Tire and a ten-year agreement with Canpotex. In addition, CP has worked with its customers, leveraging technology to enhance car request management and implementing new productivity tools. Our scheduled grain program has been successfully implemented in Canada and the U.S. program will be implemented by August 2012. We are also developing new volumes of Powder River Basin coal for export off the west coast of British Columbia.

During 2011, we continued to strengthen our balance sheet in order to maintain financial flexibility and reduce volatility. We put our surplus cash to work in 2011 on our strategic network enhancements, supporting our capital plans. In addition, we:

| ¨ | | managed our overall indebtedness by repaying US$246 million of maturing 2011 debt and called US$101 million of 2013 debt; |

| ¨ | | made a $600 million voluntary prepayment to our main Canadian defined benefit pension plan; |

| ¨ | | financed our voluntary pension prepayment and new locomotives at very attractive interest rates; and |

| ¨ | | delivered consistent dividend growth by increasing our quarterly dividend to common shareholders by 11%, from $0.27 to $0.30 in 2011. |

3.FORWARD-LOOKING INFORMATION

This MD&A contains certain forward-looking statements within the meaning of the United StatesPrivate Securities Litigation Reform Act of 1995 and other relevant securities legislation. These forward-looking statements include, but are not limited to statements concerning our operations, anticipated financial performance, business prospects and strategies as well as statements concerning the anticipation that cash flow from operations and various sources of financing will be sufficient to meet debt repayments and future obligations in the foreseeable future, statements regarding future payments including income taxes and pension contributions, and capital expenditures. Forward-looking information typically contains statements with words such as “anticipate”, “believe”, “expect”, “plan” or similar words suggesting future outcomes.

Readers are cautioned not to place undue reliance on forward-looking information because it is possible that we will not achieve predictions, forecasts, projections and other forms of forward-looking information. Current economic conditions render assumptions, although reasonable when made, subject to greater uncertainty. In addition, except as required by law, we undertake no obligation to update publicly or otherwise revise any forward-looking information, whether as a result of new information, future events or otherwise.

By its nature, our forward-looking information involves numerous assumptions, inherent risks and uncertainties, including but not limited to the following factors: changes in business strategies; general North American and global economic and business conditions; the availability and price of energy commodities; the effects of competition and pricing pressures; industry capacity; shifts in market demands; inflation; changes in laws and regulations, including regulation of rates; changes in taxes and tax rates; potential increases in maintenance and operating costs; uncertainties of investigations, proceedings or other types of claims and litigation; labour disputes; risks and liabilities arising from derailments; timing of completion of capital and maintenance projects; currency and interest rate fluctuations; effects of changes in market conditions on the financial position of pension plans and liquidity of investments; various events that could disrupt operations, including severe weather, droughts, floods, avalanches and earthquakes; security threats and governmental response to them; and technological changes.

There are more specific factors that could cause actual results to differ materially from those described in the forward-looking statements contained in this MD&A. These more specific factors are identified and discussed in Section 21, Business Risks and elsewhere in this MD&A. Other risks are detailed from time to time in reports filed by CP with securities regulators in Canada and the United States.

2012 Financial Assumptions

Defined benefit pension contributions are currently estimated to be between $100 million and $125 million in each of the next few years, a decrease from previous estimates of $125 million to $150 million. These contribution levels reflect the Company’s intentions with respect to the rate at which we apply the voluntary prepayments to reduce contribution requirements. Defined benefit pension expense for 2012 is expected to be $41 million. For 2013, defined benefit pension expense is expected to be approximately $125 million, assuming normal equity market returns and modest increases in bond yields in 2012, discussed further in Section 22, Critical Accounting Estimates.

It is expected that expenditures on capital programs will be in the range of $1.1 billion to $1.2 billion in 2012, discussed further in Section 14, Liquidity and Capital Resources.

A tax rate in the range of 25% to 27% is expected in 2012, discussed further in Section 10, Other Income Statement Items. Undue reliance should not be placed on these assumptions and other forward-looking information.

4. ADDITIONAL INFORMATION

Additional information, including our Consolidated Financial Statements, Annual Information Form, press releases and other required filing documents, is available on SEDAR at www.sedar.com in Canada, on EDGAR at www.sec.gov in the U.S. and on our website at www.cpr.ca. The aforementioned documents are issued and made available in accordance with legal requirements and are not incorporated by reference into this MD&A.

5. FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | |

For the year ended December 31 (in millions, except percentages and per share data) | | 2011(1) | | | 2010 | | | 2009(2) | |

| | | | | | | | | | | | | |

Revenues | | $ | 5,177 | | | $ | 4,981 | | | $ | 4,402 | |

Operating income | | | 967 | | | | 1,116 | | | | 830 | |

Net income | | | 570 | | | | 651 | | | | 550 | |

| | | | | | | | | | | | | |

Basic earnings per share | | | 3.37 | | | | 3.86 | | | | 3.31 | |

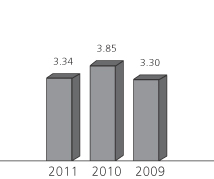

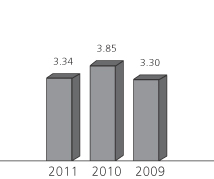

Diluted earnings per share (“EPS”) | | | 3.34 | | | | 3.85 | | | | 3.30 | |

Dividends declared per share | | | 1.1700 | | | | 1.0575 | | | | 0.9900 | |

| | | | | | | | | | | | | |

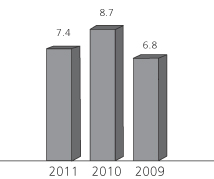

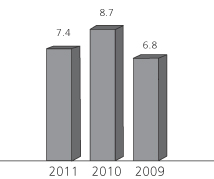

Return on capital employed (“ROCE”)(3) | | | 7.4 | % | | | 8.7 | % | | | 6.8 | % |

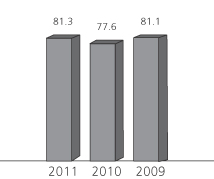

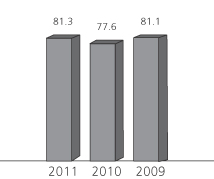

Operating ratio | | | 81.3 | % | | | 77.6 | % | | | 81.1 | % |

| | | | | | | | | | | | | |

Free cash(4)(5) | | | (724 | ) | | | (324 | ) | | | (91 | ) |

Voluntary prepayments to the main Canadian defined benefit pension plan (included in Free cash above) | | | (600 | ) | | | (650 | ) | | | (500 | ) |

| | | | | | | | | | | | | |

Total assets at December 31 | | | 14,110 | | | | 13,676 | | | | 14,155 | |

Total long-term financial liabilities at December 31(6) | | | 4,812 | | | | 4,170 | | | | 4,302 | |

| | | | | | | | | | | | | |

| | | | |

Diluted EPS ($) | | Operating ratio (%) | | Return on capital employed(3) (%) |

| |

| |

|

(1) The 2011 figures include a $37 million tax benefit resulting from the resolution of certain income tax matters and adjustments related to previous-year tax filings and estimates.

(2) The 2009 figures include a $79 million, or $68 million after tax, gain on sales of significant properties; $55 million, or $38 million after tax, loss on termination of lease with shortline railway; $56 million tax benefit; and $81 million, or $69 million after tax, gain on the sale of a partnership interest.

(3) ROCE is defined as earnings before interest and taxes, divided by the average for the year of total assets, less current liabilities excluding current portion of long-term debt, as measured under GAAP. It is an all-encompassing measure of performance which measures how productively the Company uses its assets.

(4) This measure has no standardized meaning prescribed by GAAP and, therefore, is unlikely to be comparable to similar measures of other companies. This measure is discussed further in Section 15, Non-GAAP Measures along with a reconciliation of free cash to GAAP cash position in Section 14, Liquidity and Capital Resources.

(5) Includes $600 million, $650 million and $500 million voluntary prepayments to the Company’s main Canadian defined benefit pension plan in 2011, 2010 and 2009, respectively, discussed further in Section 14, Liquidity and Capital Resources and Section 22, Critical Accounting Estimates.

(6) Excludes deferred taxes of $1,819 million, $1,945 million and $1,819 million, and other non-financial long-term liabilities of $1,620 million, $1,447 million and $1,770 million for the years 2011, 2010 and 2009, respectively.

6. OPERATING RESULTS

Income

Operating income was $967 million in 2011, a decrease of $149 million, or 13%, from $1,116 million in 2010.

This decrease was primarily due to:

| ¨ | | significant disruptions to train operations across the network in the first half of the year due to unusually severe winter weather and subsequent flooding; |

| ¨ | | the net unfavourable impact of higher fuel costs; |

| ¨ | | increased IT costs associated with outsourced infrastructure and maintenance services and planning expenses with respect to new applications in support of future growth; |

| ¨ | | higher crew training expenses to meet business demand and attrition; and |

| ¨ | | the net unfavourable impact of the change in foreign exchange (“FX”). |

This decrease was partially offset by lower incentive and stock-based compensation expenses.

Net income was $570 million in 2011, a decrease of $81 million, or 12%, from $651 million in 2010. This decrease was primarily due to lower operating income and the unfavourable impact of expenses associated with the redemption of the 2013 debt discussed further in Section 14, Liquidity and Capital Resources, the unfavourable impact of FX losses on working capital, along with increased advisory fees related to shareholder matters in Other income and charges. This decrease was partially offset by lower income tax expense, driven primarily by the resolution of certain income tax matters and lower taxable income, discussed further in Section 10, Other Income Statement Items.

Operating income was $1,116 million in 2010, an increase of $286 million, or 34%, from $830 million in 2009. This increase was primarily due to improved revenues as a result of a strengthened economy, discussed further in Section 8, Lines of Business, and continued cost management activities. The increase in 2010 Operating income reflected the fact that in 2009 CP incurred a loss of $55 million which arose from the termination of a lease with a shortline railway. This was partially offset by the 2009 gain on sales of significant properties and the unfavourable impact of the change in FX.

Net income was $651 million in 2010, an increase of $101 million, or 18%, from $550 million in 2009. This increase was primarily due to higher Operating income.

This increase was partially offset by:

| ¨ | | the 2009 gain on sale of a partnership interest, discussed further in Section 10, Other Income Statement Items; |

| ¨ | | an increase in income tax expense; and |

| ¨ | | income tax recoveries in 2009, discussed further in Section 10, Other Income Statement Items. |

Diluted Earnings per Share

Diluted EPS was $3.34 in 2011, a decrease of $0.51, or 13%, from $3.85 in 2010. This decrease was primarily due to lower Net income. Diluted EPS for 2011 includes a $0.22 per share income tax benefit, discussed further in Section 10, Other Income Statement Items. Diluted EPS was $3.85 in 2010, an increase of $0.55, or 17%, from $3.30 in 2009. This increase was primarily due to higher Net income, offset slightly by an increase in the number of common shares.

Operating Ratio

The operating ratio provides the percentage of revenues used to operate the railway, and is calculated as total operating expenses divided by total revenues. A lower percentage normally indicates higher efficiency in the operation of the railway. The operating ratio was 81.3% in 2011, an increase from 77.6% in 2010. The increase was primarily due to higher weather related costs and inefficiencies, higher fuel costs, increased IT costs and increased crew training costs. Our operating ratio was 77.6% in 2010, a decrease from 81.1% in 2009. This was primarily due to higher freight revenues and continued cost management initiatives.

Return on Capital Employed

Return on capital employed at December 31, 2011 was 7.4% compared with 8.7% in 2010 and 6.8% in 2009. Driving these fluctuations over this period were the changes in earnings. The decrease in 2011 was due to lower earnings while the 2010 increase reflected higher earnings.

Impact of Foreign Exchange on Earnings

Fluctuations in FX affect our results because U.S. dollar-denominated revenues and expenses are translated into Canadian dollars. U.S. dollar-denominated revenues and expenses decrease when the Canadian dollar strengthens in relation to the U.S. dollar.

| | | | | | | | | | | | |

Canadian to U.S. dollar Average exchange rates | | 2011 | | | 2010 | | | 2009 | |

| | | | | | | | | | | | | |

Year ended – December 31 | | $ | 0.99 | | | $ | 1.03 | | | $ | 1.15 | |

For the three months ended – December 31 | | $ | 1.02 | | | $ | 1.02 | | | $ | 1.07 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Canadian to U.S. dollar Exchange rates | | 2011 | | | 2010 | | | 2009 | |

| | | | | | | | | | | | | |

Beginning of year – January 1 | | $ | 0.99 | | | $ | 1.05 | | | $ | 1.22 | |

Beginning of quarter – April 1 | | $ | 0.97 | | | $ | 1.02 | | | $ | 1.26 | |

Beginning of quarter – July 1 | | $ | 0.96 | | | $ | 1.06 | | | $ | 1.16 | |

Beginning of quarter – October 1 | | $ | 1.05 | | | $ | 1.03 | | | $ | 1.07 | |

End of quarter – December 31 | | $ | 1.02 | | | $ | 0.99 | | | $ | 1.05 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Average Fuel Prices (U.S. dollars per U.S. gallon) | | 2011 | | | 2010 | | | 2009 | |

| | | | | | | | | | | | | |

Year ended – December 31 | | $ | 3.38 | | | $ | 2.50 | | | $ | 2.04 | |

For the three months ended – December 31 | | $ | 3.45 | | | $ | 2.68 | | | $ | 2.28 | |

| | | | | | | | | | | | | |

7. PERFORMANCE INDICATORS

| | | | | | | | | | | | | | | | | | | | |

| For the year ended December 31 | | 2011 | | | 2010(1) | | | 2009(1) | | | % Change | |

| | | | | 2011

vs. 2010 | | | 2010

vs. 2009 | |

| | | | | | | | | | | | | | | | | | | | | |

Operations performance | | | | | | | | | | | | | | | | | | | | |

Freight gross ton-miles (millions) | | | 247,955 | | | | 242,757 | | | | 209,475 | | | | 2 | | | | 16 | |

Train miles (thousands) | | | 40,145 | | | | 39,576 | | | | 34,757 | | | | 1 | | | | 14 | |

Average number of active employees – expense | | | 14,169 | | | | 13,879 | | | | 13,619 | | | | 2 | | | | 2 | |

Average daily active cars on-line (thousands)(2) | | | 51.4 | | | | 50.9 | | | | 46.6 | | | | 1 | | | | 9 | |

Average daily active road locomotives on-line | | | 1,085 | | | | 1,016 | | | | 785 | | | | 7 | | | | 29 | |

Average train speed – AAR definition (mph)(2) | | | 21.3 | | | | 22.7 | | | | 25.4 | | | | (6 | ) | | | (11 | ) |

Average terminal dwell – AAR definition (hours) | | | 19.9 | | | | 21.4 | | | | 21.9 | | | | (7 | ) | | | (2 | ) |

Car miles per car day(2) | | | 160.1 | | | | 159.4 | | | | 142.6 | | | | – | | | | 12 | |

Fuel efficiency(3) | | | 1.18 | | | | 1.17 | | | | 1.19 | | | | 1 | | | | (2 | ) |

Average train weight – excluding local traffic (tons)(2) | | | 6,593 | | | | 6,519 | | | | 6,416 | | | | 1 | | | | 2 | |

Average train length – excluding local traffic (feet)(2) | | | 5,665 | | | | 5,660 | | | | 5,608 | | | | – | | | | 1 | |

Locomotive productivity (daily average GTMs/active horse power (“HP”))(2) | | | 166.7 | | | | 176.6 | | | | 187.4 | | | | (6 | ) | | | (6 | ) |

Employee productivity (million GTMs/expense employee) | | | 17.5 | | | | 17.5 | | | | 15.4 | | | | – | | | | 14 | |

Safety indicators | | | | | | | | | | | | | | | | | | | | |

FRA personal injuries per 200,000 employee-hours | | | 1.86 | | | | 1.67 | | | | 1.92 | | | | 11 | | | | (13 | ) |

FRA train accidents per million train-miles | | | 1.85 | | | | 1.65 | | | | 1.81 | | | | 12 | | | | (9 | ) |

| | | | | | | | | | | | | | | | | | | | | |

(1) Certain prior period figures have been reclassified to conform with current presentation or have been updated to reflect new information.

(2)Certain figures are excluding Dakota, Minnesota & Eastern Railroad Corporation (“DM&E”) for 2009.

(3) Fuel efficiency is defined as U.S. gallons of locomotive fuel consumed per 1,000 GTMs – freight and yard.

The indicators listed in this table are key measures of our operating performance. Definitions of these performance indicators are provided in Section 25, Glossary of Terms.

In the first half of 2011, we experienced significant disruptions to train operations across the network due to unusually severe winter weather and subsequent flooding which are reflected in our year-to-date operating metrics. In the second half of 2011, we saw a recovery of our network, and this set the stage for certain record setting operating metrics in the fourth quarter of 2011. Refer to Section 12, Fourth-Quarter Summary for a detailed explanation and analysis of our performance indicators for the fourth quarter of 2011.

Operations Performance

GTMs for 2011 were 247,955 million, which increased by 2% compared with 242,757 million in 2010. This increase was primarily due to traffic mix changes. GTMs for 2010 were 242,757 million, which increased by 16% compared with 209,475 million in 2009. This increase was primarily due to an increase in traffic across all lines of business, other than grain which was relatively flat year-over-year.

Train miles for 2011 were relatively flat year-over-year. Train miles for 2010 increased by 14% compared with 2009. This increase was primarily due to increased traffic volumes and was partially offset by management’s strategy of consolidating and running longer, heavier trains.

The average number of active expense employees for 2011 increased by 290, or 2%, compared with 2010. This increase was primarily due to additional hiring to address volume growth projections and attrition. The average number of active expense employees for 2010 increased by 260, or 2%, compared with 2009. This increase was primarily due to higher traffic volumes resulting from a stronger economy.

The average daily active cars on-line was relatively flat year-over-year. In the fourth quarter of 2011, there was a 14% improvement in average daily active cars on-line compared to the same period of 2010, reflecting improvements in dwell and speed. The average daily active cars on-line for 2010 increased by approximately 4,300 cars, or 9%, compared with 2009. This increase was primarily due to an increase in traffic across all lines of business, other than grain which was relatively flat.

The average daily active road locomotives on-line for 2011 increased by 69 units, or 7%, compared with 2010. This was primarily due to significant disruptions to train operations across the network due to unusually severe winter weather and flooding in the first half of the year which reduced network speed and added train miles for rerouting of traffic. The second half of 2011 saw a return to more normalized numbers. The average daily active road locomotives on-line for 2010 increased by 231 units, or 29%, compared with 2009. This increase was primarily due to increased volumes, traffic mix, and supply chain pipeline issues.

Average train speed was 21.3 miles per hour in 2011, a decline of 6%, from 22.7 miles per hour in 2010. This decline was primarily due to increased volumes, traffic mix, supply chain pipeline issues and significant disruptions to train operations across the network due to unusually severe winter weather and flooding in the first half of the year. The fourth quarter average train speed improved by 8% compared to the same period of 2010. Average train speed was 22.7 miles per hour in 2010, a decline of 11%, from 25.4 miles per hour in 2009. This decline was primarily due to increased volumes, traffic mix, and supply chain pipeline issues.

Average terminal dwell, the average time a freight car resides in a terminal, improved by 7% in 2011 to 19.9 hours, from 21.4 hours in 2010. In addition to the year-over-year improvements in terminal dwell, we realized a 20% reduction in the fourth quarter of 2011 compared to the same period of 2010, a record for CP. Average terminal dwell improved by 2% in 2010 when compared to 2009. These improvements were primarily due to programs supporting the execution of our IOP designed to improve asset velocity and a continued focus on the storage of surplus cars.

Car miles per car day were 160.1 in 2011, relatively flat compared to 159.4 in 2010. This was primarily due to poor operating fluidity as a result of significant disruptions to train operations across the network due to unusually severe winter weather and flooding in the first half of the year and was partially offset by various initiatives in the design and execution of our IOP focused on improving asset velocity. Our fourth quarter car miles per car day improved 20% compared to the same period in 2010, this was a record for CP. Car miles per car day were 159.4 in 2010, an increase of 12% from 142.6 in 2009. This increase was primarily due to various initiatives in the design and execution of our IOP focused on improving asset velocity.

Fuel efficiency declined by 1% in 2011 compared to 2010. This decline was primarily due to significant disruptions to train operations across the network due to unusually severe winter weather and flooding in the first half of the year. This decline was partially offset by the new fuel savings technology introduced on over 260 locomotives and continued focus on fuel conservation programs including idle reduction and train handling practices. Our fourth quarter fuel efficiency improved 3% compared to the same period of 2010. Fuel efficiency improved by 2% in 2010 compared with 2009. This improvement was primarily due to new fuel saving technology introduced on 200 locomotives and continued focus on fuel conservation programs including idle reduction and train handling practices.

Average train weight improved 1% to 6,593 tons in 2011 compared to 2010. This improvement was primarily due to our continued implementation of the long-train strategy in the bulk franchise. This was a record for CP. Average train weight improved in 2010 by 103 tons or 2% from 2009. This improvement was primarily due to increased traffic volumes and management’s strategy of consolidating and running longer, heavier trains.

Average train length was relatively flat year-over-year. Average train length increased in 2010 by 52 feet, or 1%, from 2009. This increase was primarily due to increased traffic volumes and management’s strategy of consolidating and running longer, heavier trains.

Locomotive productivity, as measured by daily average GTMs per active horse power, decreased in 2011 by 6% from 2010. This decrease was primarily due to significant disruptions to train operations across the network due to unusually severe winter weather and flooding in the first half of

the year. Locomotive productivity decreased in 2010 by 6% from 2009. The decrease in 2010 was mainly due to increased traffic volumes and supply chain issues.

Employee productivity, as measured by million GTMs per expense employee, was unchanged in 2011, compared to 2010. Employee productivity increased in 2010 by 14% from 2009. The increase was primarily due to management’s strategy of consolidating and running longer, heavier trains.

Safety Indicators

Safety is a key priority for our management and Board of Directors. Our two main safety indicators, personal injuries and train accidents, follow strict U.S. Federal Railroad Administration (“FRA”) reporting guidelines. CP strives to continually improve its safety performance through key strategies and activities such as training and technology.

The FRA personal injury rate per 200,000 employee-hours for CP was 1.86 in 2011, 1.67 in 2010 and 1.92 in 2009. The increase in 2011 was primarily due to a higher number of minor injuries.

The FRA train accident rate for CP in 2011 was 1.85 accidents per million train-miles, compared with 1.65 in 2010 and 1.81 in 2009. The increase in 2011 was primarily due to difficult operating conditions in the first half of the year.

8. LINES OF BUSINESS

Revenues

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | % Change | |

For the year ended December 31 (in millions) | | | 2011 | | | | 2010 | | | | 2009 | | |

| 2011

vs. 2010 |

| |

| 2010

vs. 2009 |

|

| | | | | | | | | | | | | | | | | | | | | |

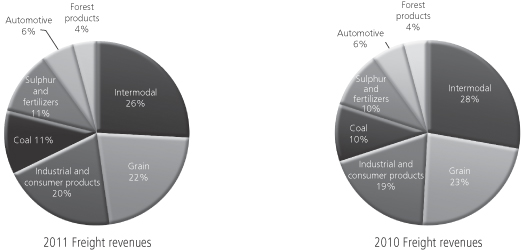

Freight revenues | | | | | | | | | | | | | | | | | | | | |

Grain | | $ | 1,100 | | | $ | 1,135 | | | $ | 1,137 | | | | (3 | ) | | | – | |

Coal | | | 556 | | | | 491 | | | | 444 | | | | 13 | | | | 11 | |

Sulphur and fertilizers | | | 549 | | | | 475 | | | | 309 | | | | 16 | | | | 54 | |

Forest products | | | 189 | | | | 185 | | | | 176 | | | | 2 | | | | 5 | |

Industrial and consumer products | | | 1,017 | | | | 903 | | | | 786 | | | | 13 | | | | 15 | |

Automotive | | | 338 | | | | 316 | | | | 230 | | | | 7 | | | | 37 | |

Intermodal | | | 1,303 | | | | 1,348 | | | | 1,198 | | | | (3 | ) | | | 13 | |

| | | | | | | | | | | | | | | | | | | | | |

Total freight revenues | | | 5,052 | | | | 4,853 | | | | 4,280 | | | | 4 | | | | 13 | |

Other revenue | | | 125 | | | | 128 | | | | 122 | | | | (2 | ) | | | 5 | |

| | | | | | | | | | | | | | | | | | | | | |

Total revenues | | $ | 5,177 | | | $ | 4,981 | | | $ | 4,402 | | | | 4 | | | | 13 | |

| | | | | | | | | | | | | | | | | | | | | |

Our revenues are primarily derived from transporting freight. Other revenue is generated from leasing of certain assets, switching fees, other engagements including logistical services, and contracts with passenger service operators.

In 2011, 2010 and 2009 no one customer comprised more than 10% of total revenues and accounts receivable.

2011 TO 2010 COMPARATIVES

Freight Revenues

Freight revenues are earned from transporting bulk, merchandise and intermodal goods, and include fuel recoveries billed to our customers. Freight revenues were $5,052 million in 2011, an increase of $199 million, or 4%, from $4,853 million in 2010.

This increase was primarily due to higher:

| ¨ | | shipments in industrial and consumer products, automotive, and potash; |

| ¨ | | fuel surcharge revenues due to the change in fuel price; and |

| ¨ | | freight rates for all lines of business. |

This increase was partially offset by:

| ¨ | | lower volumes of import/export intermodal traffic; |

| ¨ | | lower U.S. originating coal shipments; |

| ¨ | | lower U.S. originating grain shipments; and |

| ¨ | | the unfavourable impact of the change in FX. |

Fuel Cost Recovery Program

A change in fuel prices may adversely impact expenses and revenues. CP employs a fuel cost recovery program designed to mechanistically respond to fluctuations in fuel prices and help mitigate the financial impact of rising fuel prices.

Grain

Grain shipments consist of both whole grains, such as wheat, corn, soybeans, and canola, and processed products such as meals, oils, and flour. Canadian grain products are primarily transported to ports for export and to Canadian and U.S. markets for domestic consumption. U.S. grain products are shipped from the Midwestern U.S. to other points in the Midwest, the Pacific Northwest and Northeastern U.S. Grain revenue was $1,100 million in 2011, a decrease of $35 million, or 3%, from $1,135 million in 2010.

This decrease was primarily due to:

| ¨ | | lower U.S. originated shipments driven by reduced wheat production and export demand for feed grains; |

| ¨ | | lower Canadian grain shipments in the first half of the year due to unusually difficult weather and other supply chain issues; and |

| ¨ | | the unfavourable impact of the change in FX. |

This decrease was partially offset by:

| ¨ | | increased Canadian grain shipments resulting from the introduction of our scheduled grain program enabling us to recapture market share in the second half of the year; |

| ¨ | | higher fuel surcharge revenues due to the change in fuel prices; and |

| ¨ | | increased freight rates. |

Coal

Our Canadian coal business consists primarily of metallurgical coal transported from southeastern B.C. to the ports of Vancouver, B.C. and Thunder Bay, Ontario, and to the U.S. Midwest. Our U.S. coal business consists primarily of the transportation of thermal coal and petroleum coke within the U.S. Midwest and growing shipments of Powder River Basin coal for export off the Canadian west coast. Coal revenue was $556 million in 2011, an increase of $65 million, or 13%, from $491 million in 2010. This increase was primarily due to an increase in long-haul metallurgical coal shipments due to strong overall demand and increased freight rates for U.S. originated traffic. This increase was partially offset by lower U.S. originating volumes as certain short haul U.S. thermal coal contracts were not renewed, as well as the unfavourable impact of the change in FX.

Sulphur and Fertilizers

Sulphur and fertilizers include potash, chemical fertilizers and sulphur shipped mainly from western Canada to the ports of Vancouver, B.C., and Portland, Oregon, and to other Canadian and U.S. destinations. Sulphur and fertilizers revenue was $549 million in 2011, an increase of $74 million, or 16%, from $475 million in 2010.

This increase was primarily due to higher:

| ¨ | | export potash shipments as volumes fully recovered to pre-recession levels; |

| ¨ | | domestic potash and fertilizer shipments due to increased overall demand; |

| ¨ | | fuel surcharge revenues due to the change in fuel price; and |

This increase was partially offset by the unfavourable impact of the change in FX.

Forest Products

Forest products include lumber, wood pulp, paper products and panel transported from key producing areas in western Canada, Ontario and Quebec to various destinations in North America. Forest products revenue was $189 million in 2011, an increase of $4 million, or 2%, from $185 million in 2010.

This increase was primarily due to higher:

| ¨ | | shipments of pulp and paper products for the first three quarters of the year due to a re-opening of a mill on our line in 2010; |

| ¨ | | fuel surcharge revenues due to the change in fuel price; and |

This increase was partially offset by the unfavourable impact of the change in FX.

Industrial and Consumer Products

Industrial and consumer products include chemicals, plastics, aggregates, steel, mine, ethanol and other energy-related products (other than coal) shipped throughout North America. Industrial and consumer products revenue was $1,017 million in 2011, an increase of $114 million, or 13%, from $903 million in 2010.

This increase was primarily due to higher:

| ¨ | | overall industrial products volumes due to strong market demand and growth in the Bakken Oil Formation, the Alberta Industrial Heartland and the Marcellus Gas Formation and for energy related inputs; |

| ¨ | | fuel surcharge revenues due to the change in fuel price; and |

This increase was partially offset by the unfavourable impact of the change in FX.

Automotive

Automotive consists primarily of three core finished-vehicle traffic segments: import vehicles, Canadian-produced vehicles and U.S.-produced vehicles. These segments move through Port Metro Vancouver to eastern Canadian markets; to the U.S. from Ontario production facilities; and to Canadian markets, respectively. Automotive revenue was $338 million in 2011, an increase of $22 million, or 7%, from $316 million in 2010.

This increase was primarily due to higher:

| ¨ | | shipments as a result of higher North American auto sales and higher overall auto production by domestic producers; |

| ¨ | | fuel surcharge revenues due to the change in fuel price; and |

This increase was partially offset by reduced import volumes through the Port Metro Vancouver and production at certain North American plants which suffered from component delivery disruptions following the earthquake and tsunami in Japan, and the unfavourable impact of the change in FX.

Intermodal

CP’s intermodal portfolio consists of domestic and international services. Our domestic business consists primarily of the movement of manufactured consumer products in containers within North America. The international business handles the movement of marine containers between ports and North American inland markets. Intermodal revenue was $1,303 million in 2011, a decrease of $45 million, or 3%, from $1,348 million in 2010.

This decrease was primarily due to:

| ¨ | | lower overall volumes due to the loss of market share as a result of significant disruptions to train operations across the network due to unusually severe winter weather and flooding in the first half of the year; |

| ¨ | | lower shipments through the Port Metro Vancouver; and |

| ¨ | | the unfavourable impact of the change in FX. |

This decrease was partially offset by increased freight rates and higher fuel cost recovery revenues due to the increase in fuel price.

Other Revenue

Other revenue was $125 million in 2011, a decrease of $3 million, or 2%, from $128 million in 2010. This decrease was primarily due to lower passenger revenues and the unfavourable impact of the change in FX, partially offset by higher leasing and switching revenues.

2010 TO 2009 COMPARATIVES

Revenue variances below compare 2010 to 2009 figures.

Freight Revenues

Freight revenues were $4,853 million in 2010, an increase of $573 million, or 13%, from $4,280 million in 2009.

This increase was primarily due to:

| ¨ | | higher traffic volumes due to an improved economy; |

| ¨ | | higher fuel surcharge revenues due to the change in fuel price; and |

| ¨ | | increased freight rates on average for all lines of business. |

This increase was partially offset by the unfavourable impact of the change in FX.

Grain

Grain revenue was $1,135 million in 2010, a decrease of $2 million from $1,137 million in 2009. This decrease was primarily due to lower Canadian grain shipments driven by lower overall production for the 2009/2010 crop year compared to above average production in the 2008/2009 crop year, and the unfavourable impact of the change in FX. The decrease was partially offset by increased U.S. originated shipments, higher fuel surcharge revenues due to the change in fuel prices, and increased freight rates.

Coal

Coal revenue was $491 million in 2010, an increase of $47 million, or 11%, from $444 million in 2009.

This increase was primarily due to:

| ¨ | | an increase in demand for metallurgical coal to Asia; |

| ¨ | | increased freight rates for U.S. originated traffic; and |

| ¨ | | higher fuel surcharge revenues due to the change in fuel price. |

This increase was partially offset by a reduced average length of haul as a result of changes in traffic mix, and the unfavourable impact of the change in FX.

Sulphur and Fertilizers

Sulphur and fertilizers revenue was $475 million in 2010, an increase of $166 million, or 54%, from $309 million in 2009.

This increase was primarily due to higher:

| ¨ | | export potash shipments as a result of the return of international buyers to the market; |

| ¨ | | domestic potash shipments due to increased overall demand and rising commodity prices, such as grain, in the second half of the year; |

| ¨ | | fuel surcharge revenues due to the change in fuel price; and |

This increase was partially offset by the unfavourable impact of the change in FX.

Forest Products

Forest products revenue was $185 million in 2010, an increase of $9 million, or 5%, from $176 million in 2009.

This increase was primarily due to:

| ¨ | | higher overall shipments of pulp and paper products due to the re-opening of a mill on our line in 2010; |

| ¨ | | higher fuel surcharge revenues due to the change in fuel price; and |

| ¨ | | increased freight rates and extended length of haul. |

The increase was partially offset by the unfavourable impact of the change in FX.

Industrial and Consumer Products

Industrial and consumer products revenue was $903 million in 2010, an increase of $117 million, or 15%, from $786 million from 2009.

This increase was primarily due to higher:

| ¨ | | shipments of steel, clay and aggregates driven by the improvement in the North American economy; |

| ¨ | | fuel surcharge revenues due to the change in fuel price; and |

This increase was partially offset by the unfavourable impact of the change in FX.

Automotive

Automotive revenue was $316 million in 2010, an increase of $86 million, or 37%, from $230 million in 2009.

This increase was primarily due to:

| ¨ | | increased overall auto production and higher North American auto sales; |

| ¨ | | the absence of a series of unusual plant shutdowns and curtailments of production caused by the restructuring of U.S. automakers in 2009; |

| ¨ | | higher fuel surcharge revenues due to the change in fuel price; and |

| ¨ | | increased freight rates. |

This increase was partially offset by the unfavourable impact of the change in FX.

Intermodal

Intermodal revenue was $1,348 million in 2010, an increase of $150 million, or 13%, from $1,198 million in 2009.

This increase was primarily due to:

| ¨ | | increased domestic container shipments particularly for cross border and retail traffic; |

| ¨ | | higher overall import/export volumes through the Port Metro Vancouver; |

| ¨ | | higher fuel surcharge revenues due to the change in fuel price; and |

| ¨ | | increased freight rates. |

This increase was partially offset by reduced volumes in short-haul lanes and the unfavourable impact of the change in FX and overall lower imports through the Eastern ports by CP served shipping lines.

Other Revenue

Other revenue was $128 million in 2010, an increase of $6 million, or 5%, from $122 million in 2009. This increase was primarily due to increased revenues from leasing and switching, partially offset by lower passenger revenues and the unfavourable impact of the change in FX.

Volumes

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | % Change | |

| For the year ended December 31 | | | 2011 | | | | 2010 | | | | 2009 | | |

| 2011 vs.

2010 |

| |

| 2010 vs.

2009 |

|

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

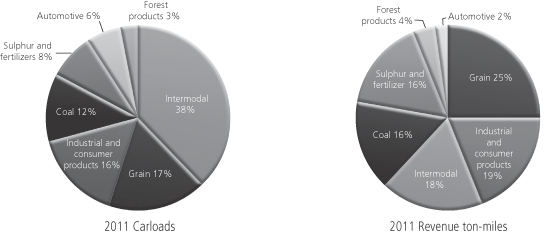

Carloads (in thousands) | | | | | | | | | | | | | | | | | | | | |

Grain | | | 450 | | | | 467 | | | | 469 | | | | (4 | ) | | | – | |

Coal | | | 313 | | | | 341 | | | | 305 | | | | (8 | ) | | | 12 | |

Sulphur and fertilizers | | | 199 | | | | 177 | | | | 109 | | | | 12 | | | | 62 | |

Forest products | | | 72 | | | | 72 | | | | 67 | | | | – | | | | 7 | |

Industrial and consumer products | | | 421 | | | | 397 | | | | 346 | | | | 6 | | | | 15 | |

Automotive | | | 145 | | | | 137 | | | | 104 | | | | 6 | | | | 32 | |

Intermodal | | | 997 | | | | 1,070 | | | | 963 | | | | (7 | ) | | | 11 | |

| | | | | | | | | | | | | | | | | | | | | |

Total carloads | | | 2,597 | | | | 2,661 | | | | 2,363 | | | | (2 | ) | | | 13 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Revenue ton-miles (in millions) | | | | | | | | | | | | | | | | | | | | |

Grain | | | 32,481 | | | | 34,556 | | | | 34,838 | | | | (6 | ) | | | (1 | ) |

Coal | | | 21,041 | | | | 19,021 | | | | 16,997 | | | | 11 | | | | 12 | |

Sulphur and fertilizers | | | 20,468 | | | | 17,687 | | | | 9,362 | | | | 16 | | | | 89 | |

Forest products(1) | | | 4,960 | | | | 5,091 | | | | 4,470 | | | | (3 | ) | | | 14 | |

Industrial and consumer products(1) | | | 24,122 | | | | 22,143 | | | | 17,653 | | | | 9 | | | | 25 | |

Automotive | | | 2,080 | | | | 2,067 | | | | 1,607 | | | | 1 | | | | 29 | |

Intermodal | | | 23,907 | | | | 25,863 | | | | 23,425 | | | | (8 | ) | | | 10 | |

| | | | | | | | | | | | | | | | | | | | | |

Total revenue ton-miles | | | 129,059 | | | | 126,428 | | | | 108,352 | | | | 2 | | | | 17 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

(1)Certain prior period figures have been reclassified to conform with current presentation.

Changes in freight volumes generally contribute to corresponding changes in freight revenues and certain variable expenses, such as fuel, equipment rents and crew costs. Volumes in 2011, as measured by total carloads, decreased by approximately 64,000 units, or 2%, compared to 2010.

This decrease in carloads was primarily due to lower volumes of:

| ¨ | | import/export intermodal traffic; |

| ¨ | | U.S. originating coal; and |

| ¨ | | U.S. originating grain shipments. |

This decrease in carloads was partially offset by increased:

| ¨ | | volumes of industrial and consumer products traffic; |

| ¨ | | volumes of export and domestic potash; and |

Volumes in 2010, as measured by total carloads, increased by approximately 298,000 units, or 13%, compared to 2009. This increase in carloads was a result of higher demand driven by an improved economy, a rebound in coal and fertilizer volumes, and inventory replenishment by our customers benefiting the majority of our lines of business in the year.

Revenue ton-miles (“RTMs”) in 2011 increased by 2,631 million, or 2%, compared to 2010.

This increase was primarily due to higher:

| ¨ | | volumes in industrial and consumer products; |

| ¨ | | volumes of export and domestic potash; and |

| ¨ | | long-haul metallurgical coal shipments. |

This increase in RTMs was partially offset by lower U.S. originating grain shipments and lower volumes of import/export intermodal traffic.

RTMs in 2010 increased by 18,076 million, or 17%, compared to 2009. This increase was a result of higher demand driven by an improved economy, a rebound in coal and fertilizer volumes, and inventory replenishment by our customers benefiting the majority of our lines of business in the year.

Freight Revenue per Carload

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | % Change | |

For the year ended December 31 (dollars) | | | 2011 | | | | 2010(1) | | | | 2009(1) | | |

| 2011

vs. 2010 |

| |

| 2010

vs. 2009 |

|

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Freight revenue per carload | | | | | | | | | | | | | | | | | | | | |

Grain | | $ | 2,444 | | | $ | 2,430 | | | $ | 2,424 | | | | 1 | | | | – | |

Coal | | | 1,776 | | | | 1,440 | | | | 1,456 | | | | 23 | | | | (1 | ) |

Sulphur and fertilizers | | | 2,759 | | | | 2,684 | | | | 2,835 | | | | 3 | | | | (5 | ) |

Forest products | | | 2,625 | | | | 2,569 | | | | 2,627 | | | | 2 | | | | (2 | ) |

Industrial and consumer products | | | 2,416 | | | | 2,275 | | | | 2,272 | | | | 6 | | | | – | |

Automotive | | | 2,331 | | | | 2,307 | | | | 2,212 | | | | 1 | | | | 4 | |

Intermodal | | | 1,307 | | | | 1,260 | | | | 1,244 | | | | 4 | | | | 1 | |

| | | | | | | | | | | | | | | | | | | | | |

Total freight revenue per carload | | $ | 1,945 | | | $ | 1,824 | | | $ | 1,811 | | | | 7 | | | | 1 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

(1) Certain prior period figures have been reclassified to conform with current presentation.

Total freight revenue per carload in 2011 increased by 7% compared to 2010.

This increase was due to:

| ¨ | | higher fuel cost recovery revenues; |

| ¨ | | overall increased length of haul reflecting traffic mix changes; and |

| ¨ | | increased freight rates. |

This increase was partially offset by the unfavourable impact of the change in FX.

Total freight revenue per carload in 2010 increased by 1% compared to 2009. This increase was due to higher fuel surcharge revenues and increased freight rates. This increase was partially offset by the unfavourable impact of the change in FX.

Freight Revenue per Revenue Ton-Mile

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | % Change | |

For the year ended December 31 (cents) | | 2011 | | | 2010(1) | | | 2009(1) | | | 2011

vs. 2010 | | | 2010

vs. 2009 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Freight Revenue per Revenue Ton-Mile | | | | | | | | | | | | | | | | | | | | |

Grain | | | 3.39 | | | | 3.28 | | | | 3.26 | | | | 3 | | | | 1 | |

Coal | | | 2.64 | | | | 2.58 | | | | 2.61 | | | | 2 | | | | (1 | ) |

Sulphur and fertilizers | | | 2.68 | | | | 2.69 | | | | 3.30 | | | | – | | | | (18 | ) |

Forest products | | | 3.81 | | | | 3.63 | | | | 3.94 | | | | 5 | | | | (8 | ) |

Industrial and consumer products | | | 4.22 | | | | 4.08 | | | | 4.45 | | | | 3 | | | | (8 | ) |

Automotive | | | 16.25 | | | | 15.29 | | | | 14.31 | | | | 6 | | | | 7 | |

Intermodal | | | 5.45 | | | | 5.21 | | | | 5.11 | | | | 5 | | | | 2 | |

| | | | | | | | | | | | | | | | | | | | | |

Total freight revenue per revenue ton-mile | | | 3.91 | | | | 3.84 | | | | 3.95 | | | | 2 | | | | (3 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

(1) Certain prior period figures have been reclassified to conform with current presentation.

Freight revenue per RTM is the amount of freight revenue earned for every RTM moved, calculated by dividing the freight revenue for a commodity by the number of RTMs of the commodity transported in the period. Freight revenue per RTM increased by 2% in 2011 compared to 2010. This increase was primarily due to increased fuel surcharge revenues and increased freight rates. This increase was partially offset by traffic mix changes including strong growth in the sulphur and fertilizers line of business, which generates lower revenue per RTM, and the unfavourable impact of the change in FX.

Freight revenue per RTM decreased by 3% in 2010 compared to 2009. This decrease was primarily due to the unfavourable impact of the change in FX and a significant increase in shipments of potash and metallurgical coal, which generate lower freight revenue per RTM. This decrease was partially offset by increased fuel surcharge revenues and increased freight rates.

9. OPERATING EXPENSES

| | | | | | | | | | | | | | | | | | | | |

For the year ended December 31 (in millions) | | 2011 | | | 2010 | | | 2009 | | | % Change | |

| | | | | 2011

vs. 2010 | | | 2010

vs. 2009 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

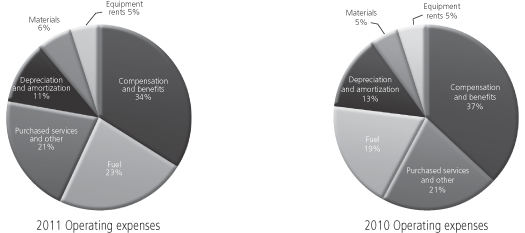

Operating expenses | | | | | | | | | | | | | | | | | | | | |

Compensation and benefits | | $ | 1,426 | | | $ | 1,431 | | | $ | 1,307 | | | | – | | | | 9 | |

Fuel | | | 968 | | | | 728 | | | | 580 | | | | 33 | | | | 26 | |

Materials | | | 243 | | | | 214 | | | | 217 | | | | 14 | | | | (1 | ) |

Equipment rents | | | 209 | | | | 206 | | | | 226 | | | | 1 | | | | (9 | ) |

Depreciation and amortization | | | 490 | | | | 489 | | | | 483 | | | | – | | | | 1 | |

Purchased services and other | | | 874 | | | | 797 | | | | 783 | | | | 10 | | | | 2 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | 4,210 | | | | 3,865 | | | | 3,596 | | | | 9 | | | | 7 | |

Gain on sale of significant properties | | | – | | | | – | | | | (79 | ) | | | – | | | | – | |

Loss on termination of lease with shortline railway | | | – | | | | – | | | | 55 | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | $ | 4,210 | | | $ | 3,865 | | | $ | 3,572 | | | | 9 | | | | 8 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Operating expenses were $4,210 million in 2011, an increase of $345 million, or 9%, from $3,865 million in 2010.

This was primarily due to higher:

| ¨ | | costs such as additional crew costs, wheel replacements and increased servicing of locomotives required to restore fluidity across our network due to significant disruptions to train operations across the network in the first half of the year due to unusually severe winter weather and subsequent flooding; |

| ¨ | | volume-related expenses; |

| ¨ | | IT costs associated with outsourced infrastructure and maintenance services and planning expenses with respect to new applications in support of future growth; |

| ¨ | | wage and benefits inflation; |

| ¨ | | crew training expenses due to increased hiring to meet business demand and attrition; and |

This increase was partially offset by lower incentive and stock-based compensation expense and the favourable impact of the change in FX.

2011 TO 2010 COMPARATIVES

Compensation and Benefits

Compensation and benefits expense includes employee wages, salaries and fringe benefits. Compensation and benefits expense was $1,426 million in 2011, a decrease of $5 million from $1,431 million in 2010. This decrease was primarily due to lower incentive and stock-based compensation and the favourable impact of the change in FX.

This decrease was partially offset by higher:

| ¨ | | crew costs driven by increased workload and less efficient operations due to significant disruptions to train operations across the network in the first half of the year due to unusually severe winter weather and subsequent flooding; |

| ¨ | | wage and benefits inflation; |

| ¨ | | crew training expenses as a result of increased hires to meet business demand and attrition; and |

Fuel

Fuel expense consists of fuel used by locomotives and includes provincial, state and federal fuel taxes and the impact of our hedging program. Fuel expense was $968 million in 2011, an increase of $240 million, or 33%, from $728 million in 2010. This increase was primarily due to higher fuel prices and increased consumption as a result of higher workload as measured by GTMs. This increase was partially offset by the favourable impact of the change in FX and hedging gains, discussed further in Section 17, Financial Instruments.

Materials

Materials expense includes the cost of material used for track, locomotive, freight car, and building maintenance. Materials expense was $243 million in 2011, an increase of $29 million or 14%, from $214 million in 2010.

This increase was primarily due to higher:

| ¨ | | number of wheels replaced for freight cars and higher servicing and repair costs for additional locomotives needed to assist in restoring fluidity across our entire network as a result of significant disruptions to train operations across the network in the first half of the year due to unusually severe winter weather and subsequent flooding; |

| ¨ | | non-locomotive fuel costs; and |

| ¨ | | workload as measured by GTMs, resulting in increased locomotive and freight car repair and servicing costs. |

This increase was partially offset by the favourable impact of the change in FX.

Equipment Rents

Equipment rents expense includes the cost to lease freight cars, intermodal equipment, and locomotives from other companies including railways, net of rent income received from other railways for the use of our equipment. Equipment rents expense was $209 million in 2011, an increase of $3 million or 1%, from $206 million in 2010. This increase was primarily due to higher workload as measured by GTMs, resulting in increased freight car and locomotive leasing costs including higher lease rates.

Depreciation and Amortization