Howe Barnes Hoefer & Arnett, Inc.

Annual Community Bank Conference

Community Bank Conference

August 13, 2007

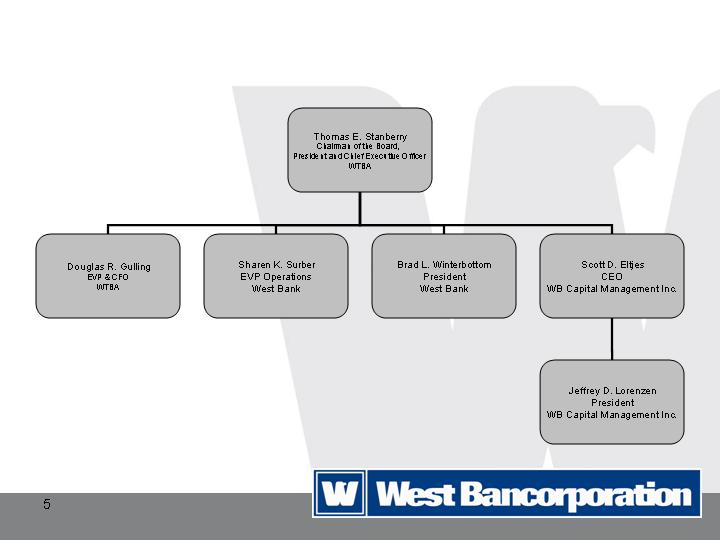

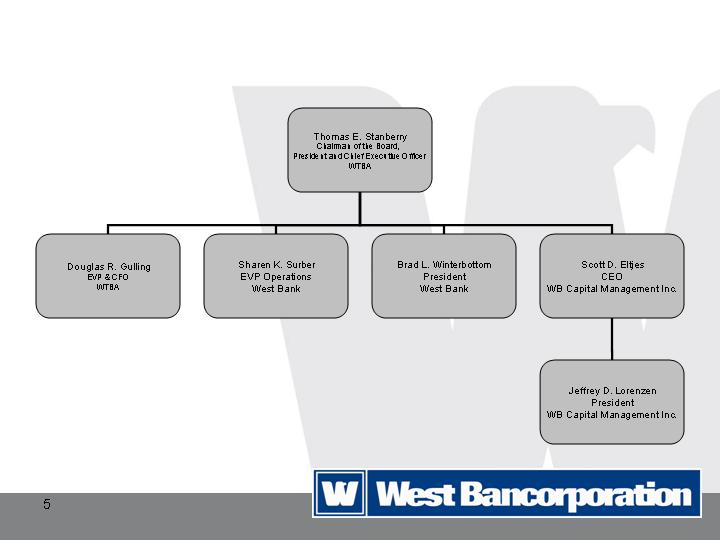

Thomas E. Stanberry

Chairman of the Board, President & Chief Executive Officer

Douglas R. Gulling

Executive Vice President & Chief Financial Officer

Forward-looking Statements

Certain market and demographic information provided herein was obtained from SNL Financial, Inc. and

Demographics Now. Certain peer group information was obtained from the FDIC’s Uniform Bank Performance

Report. West Bancorporation, Inc. did not prepare this information. The inclusion of this information is not and

does not imply an affiliation, sponsorship, adoption, endorsement, approval, investigation, verification or

monitoring by West Bancorporation, Inc. of any such information. In no event shall West Bancorporation, Inc. be

responsible for such information or your use of such information. The information in this presentation does not

constitute an offer to sell or solicitation of an offer to buy any security.

The information contained in this presentation may contain forward-looking statements about the Company’s

growth and acquisition strategies, new products and services, and future financial performance, including earnings

and dividends per share, return on average assets, return on average equity, efficiency ratio and capital ratio.

Certain statements in this presentation constitute “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking information is based upon certain underlying

assumptions, risks and uncertainties. Because of the possibility of change in the underlying assumptions, risks

and uncertainties, actual results could differ materially from these forward-looking statements. Risks and

uncertainties that may affect future results include: competitive pressures, pricing pressures on loans and

deposits, actions of bank and non-bank competitors, changes in local and national economic conditions, changes

in regulatory requirements, actions of the Securities and Exchange Commission and/or the Federal Reserve

Board, and customer’s acceptance of the Company’s products and services. The Company undertakes no

obligation to revise or update such statements to reflect current events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events.

Table of Contents

Company and Market Structure

Market Share

Key Attributes & Financial Performance

WB Capital Management Inc.

Strategic Plan

Summary & Discussion

Section I

Company &

Market Structure

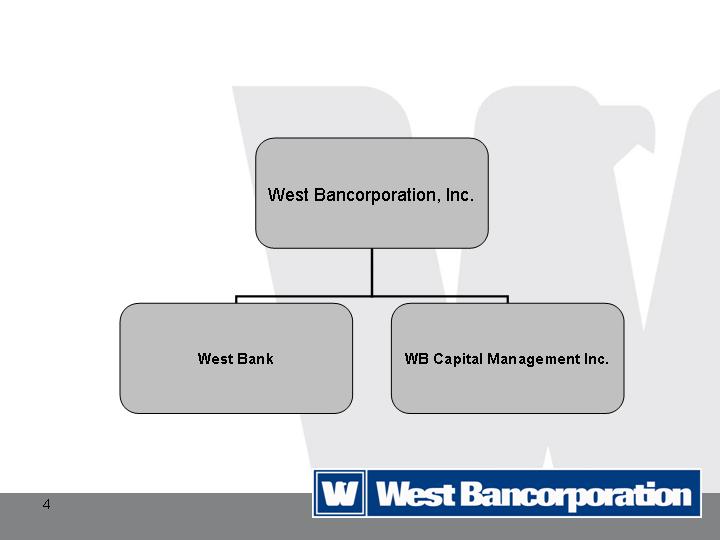

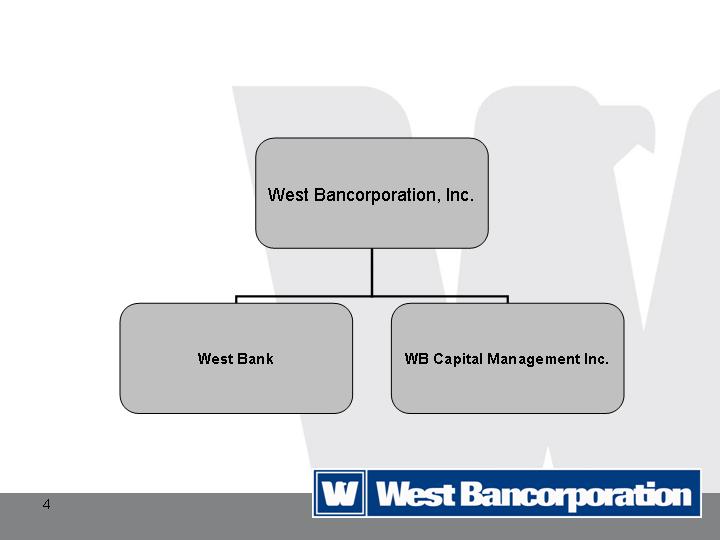

West Bancorporation, Inc. and

Wholly-owned Subsidiaries

Executive Leadership

Community bank

founded in 1893

Two Markets

Des Moines Metro

(7 locations)

Iowa City/Coralville

(3 locations)

Money manager

founded in 2003

Mid-west offices

West Des Moines

(headquarters)

Coralville

Des Moines MSA

Des Moines is known for its

outstanding quality of life.

Four-time "All American City"

Political, economic and cultural

center of Iowa

All the amenities of a large city -

shopping, sports, attractions, and

the arts

Located in the heart of the Midwest

at the junction of I-80 and I-35

Iowa City MSA

Iowa City has long served as a locus

for culture and education.

The economy is based upon a thriving

commerce, a major university, and a

number of national and international

businesses.

The University of Iowa offers more

than 100 areas of study for its 29,000

students. The academic, arts and

research mission of the University,

along with the health care services

provided at its hospitals and clinics,

have a tremendous economic impact

on the area

Iowa Growth Projections

53,978

321,679

151,767

58,868

221,204

Households

0.19%

6.98%

1.28%

7.39%

8.31%

Projected

population

change

2006-2011

750

990

973

1,051

992

Households per

branch

30,467

44,159

38,320

40,366

48,876

Deposits per

branch ($000)

143,086

14,351,696

5,977,858

2,260,468

10,410,612

Deposits ($000)

72

325

156

56

213

No. of Branches

Sioux City

Omaha-

Council Bluffs

Quad Cities

Iowa City

Des Moines

Section II

Market Share

Deposit Market Share Summary

State of Iowa

1.62

875,332

Stark Bank Group, Ltd.

10

1.69

911,430

Northwest Financial Corp

9

1.75

943,876

Bank of America corporation

8

1.78

961,220

BNP Paribus Group

7

1.91

1,029,941

West Bancorporation, Inc

6

1.99

1,076,746

Hills Bancorporation

5

2.20

1,186,871

Principal Financial Group, Inc.

4

2.35

1,270,925

BTC Financial Corp

3

7.30

3,940,559

U.S. Bancorp

2

8.96

4,841,476

Wells Fargo & Company

1

2006 Total

Market Share (%)

2006 Deposits in

market ($000)

Institution

2006

Rank

SNL Financial, Inc

Deposit Market Share Summary

Des Moines, IA - MSA

2.10

218,180

Iowa State Bank Holding Company

10

3.36

349,662

BNP Paribas Group

9

3.67

382,007

Stark Bank Group, Ltd.

8

3.91

406,565

Van Diest Investment Company

7

6.70

697,759

U.S. Bancorp

6

6.87

715,085

Bank of America Corporation

5

9.12

949,581

West Bancorporation, Inc.

4

10.77

1,121,012

BTC Financial Corporation

3

11.40

1,186,871

Principal Financial Group, Inc.

2

16.11

1,677,389

Wells Fargo & Company

1

2006 Total

Market Share (%)

2006 Deposits in

market ($000)

Institution

2006

Rank

SNL Financial, Inc.

Deposit Market Share Summary

Iowa City, IA - MSA

1.74

39,351

Solon Financial, Inc.

10

1.84

41,496

Wells Fargo & Company

9

2.64

59,758

Lone Tree Service Company

8

2.89

65,324

Washington Bancorp

7

3.56

80,360

West Bancorporation, Inc

6

5.10

115,242

Central Bancshares, Inc

5

6.62

149,555

W.S.B., Inc.

4

9.98

225,561

U.S. Bancorp

3

19.18

433,658

ISB Financial Corporation

2

37.36

844,525

Hills Bancorporation

1

2006 Total

Market Share (%)

2006 Deposits in

market ($000)

Institution

2006

Rank

SNL Financial, Inc

Section III

Key Attributes

& Financial

Performance

Key Attributes

Emphasis on small- and medium-sized

businesses

Relationship Based

Experienced management

Continuity and expertise of staff

Strong financial performance

Loan Portfolio Composition – Real Estate

Loan Portfolio Composition – Commercial

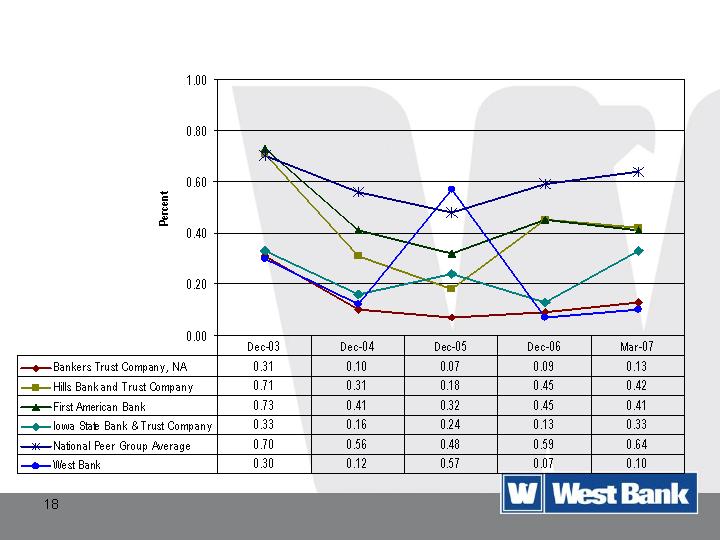

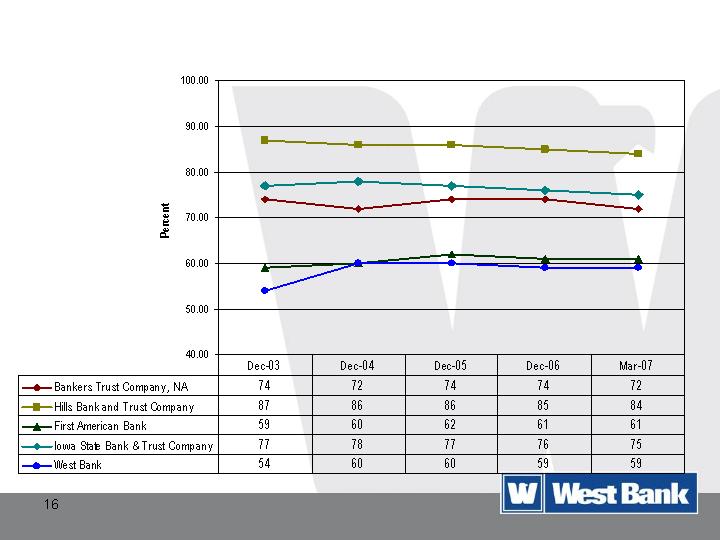

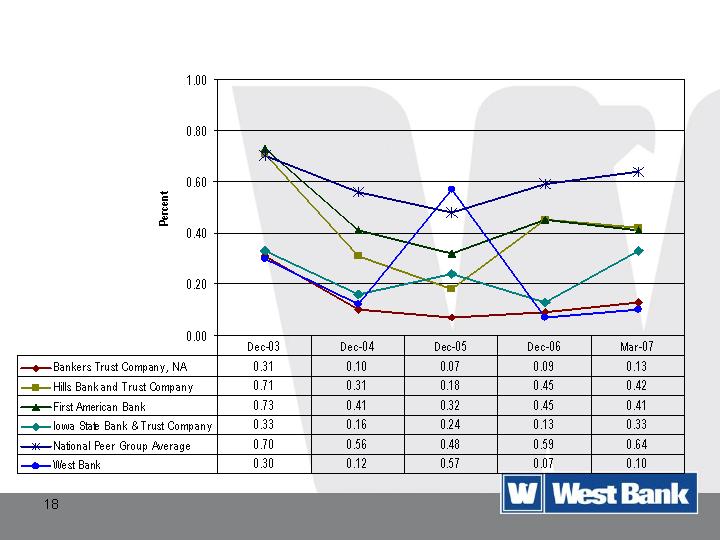

Non-Current Loans to Gross Loans

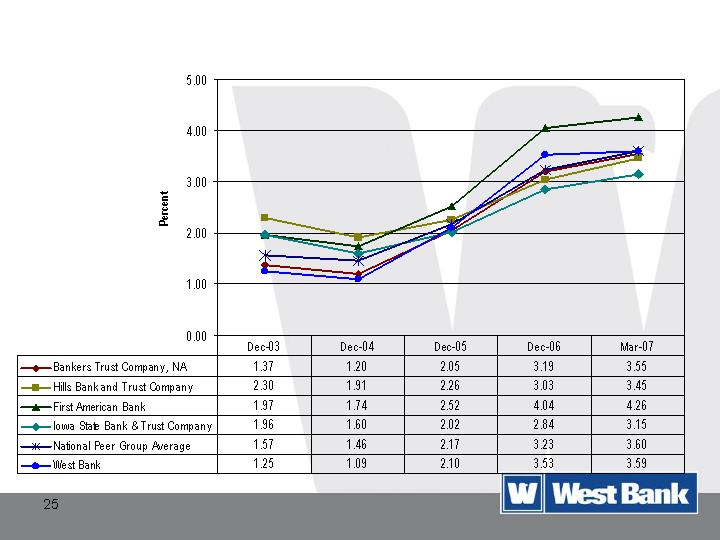

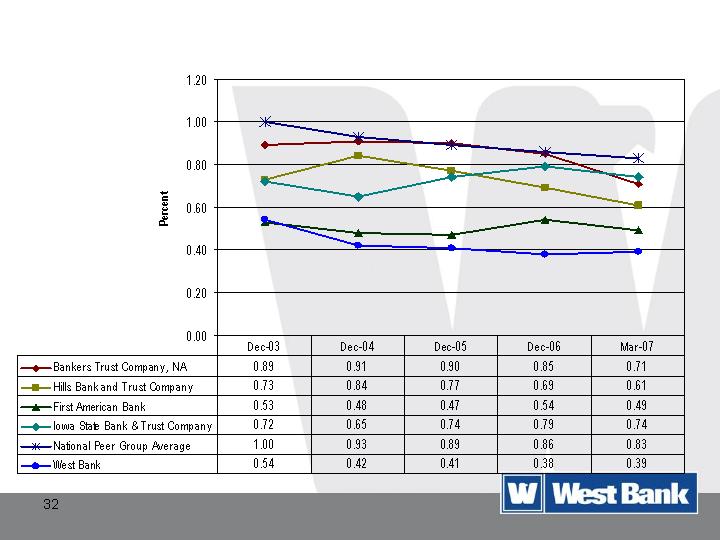

Net Charge-Offs to Average Loans

Loan Loss Reserve to Total Loans

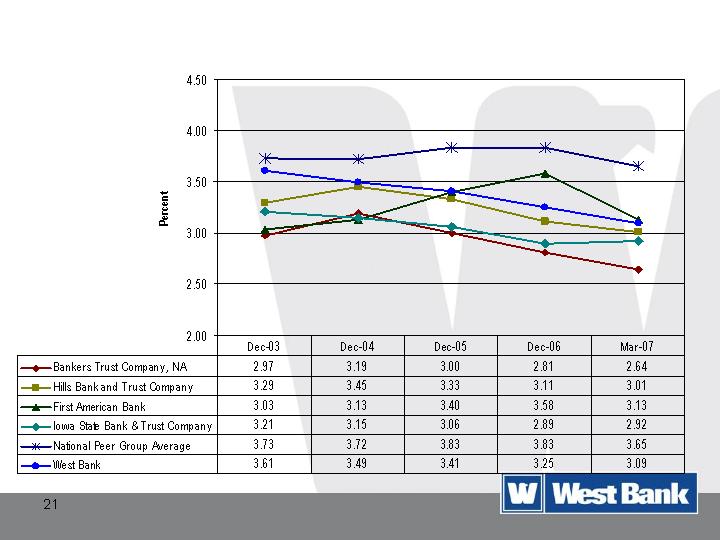

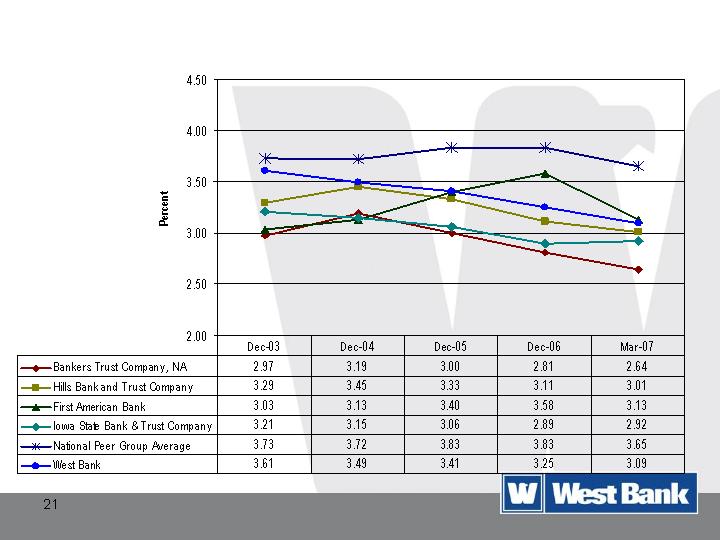

Net Interest Margin

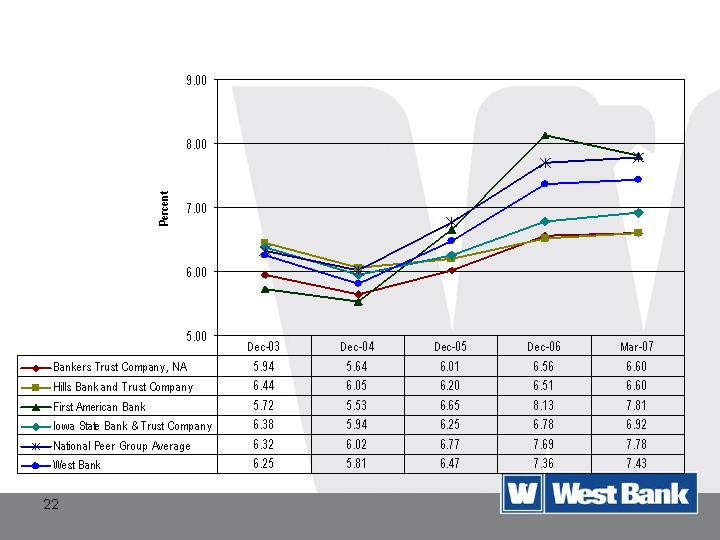

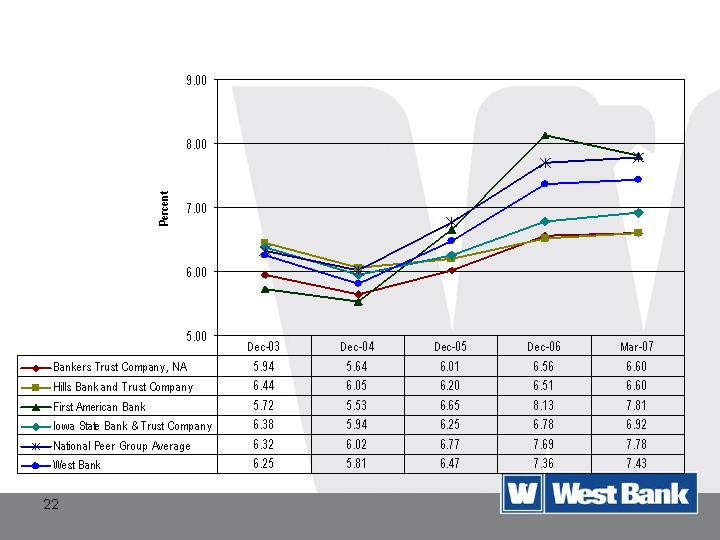

Average Yield on Total Loans

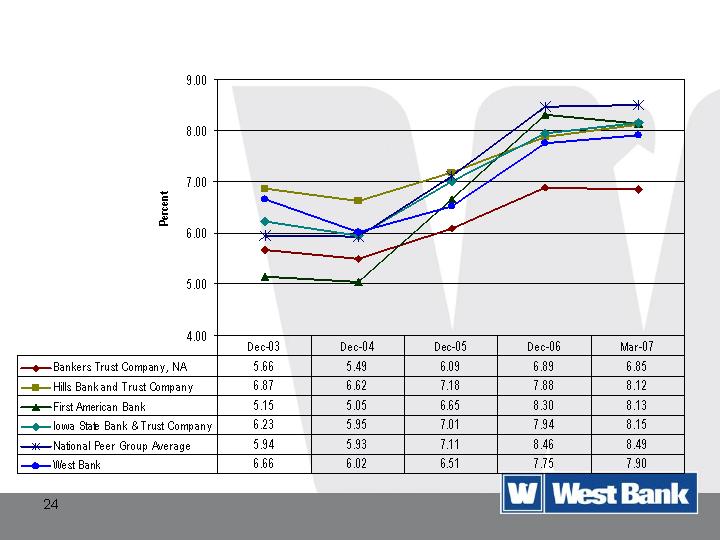

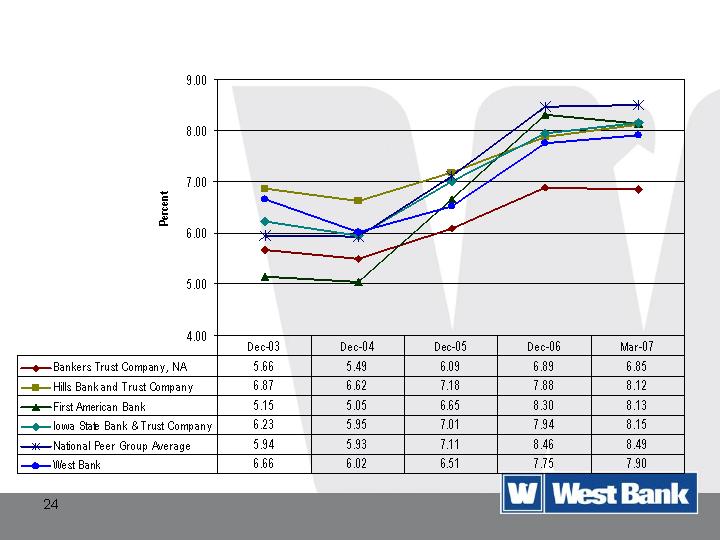

Average Yield on Real Estate Loans

Average Yield on Commercial & Industrial Loans

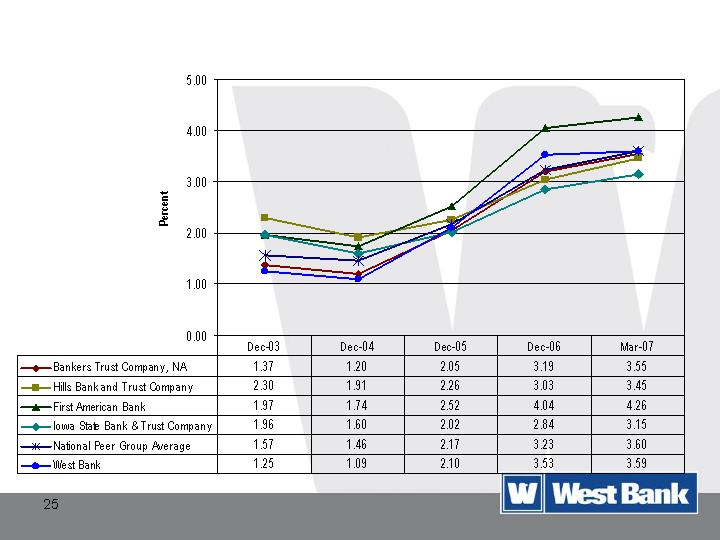

Average Rate Paid on Interest-Bearing Deposits

Average Yield on Total Investment Securities

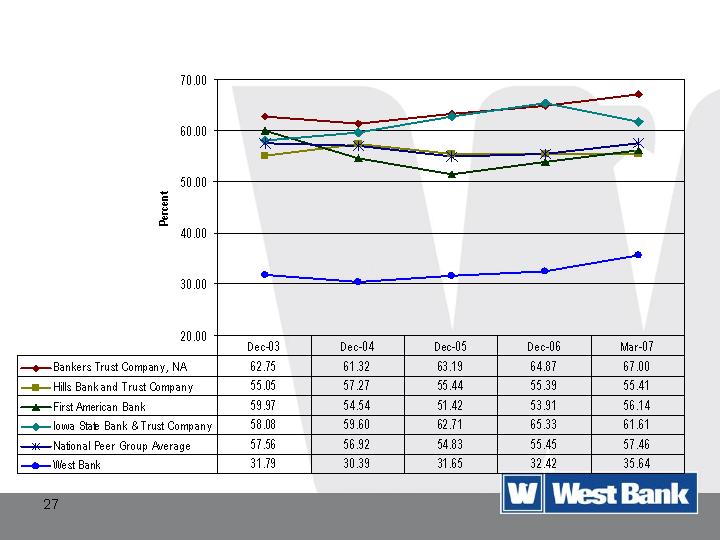

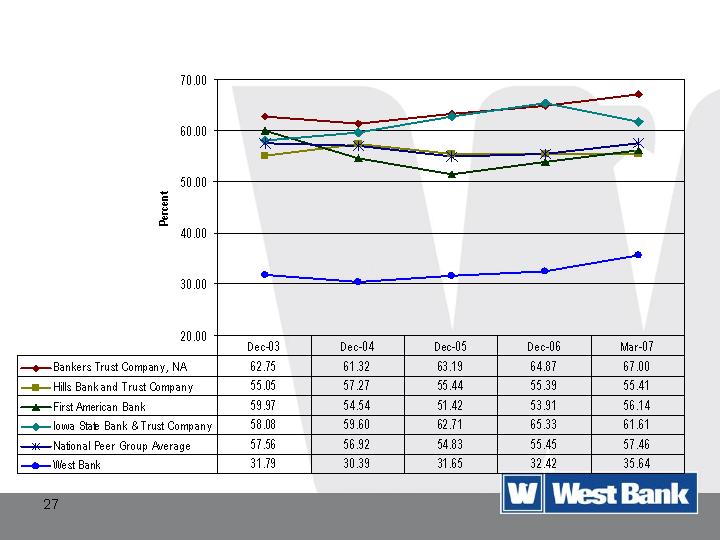

Efficiency Ratio

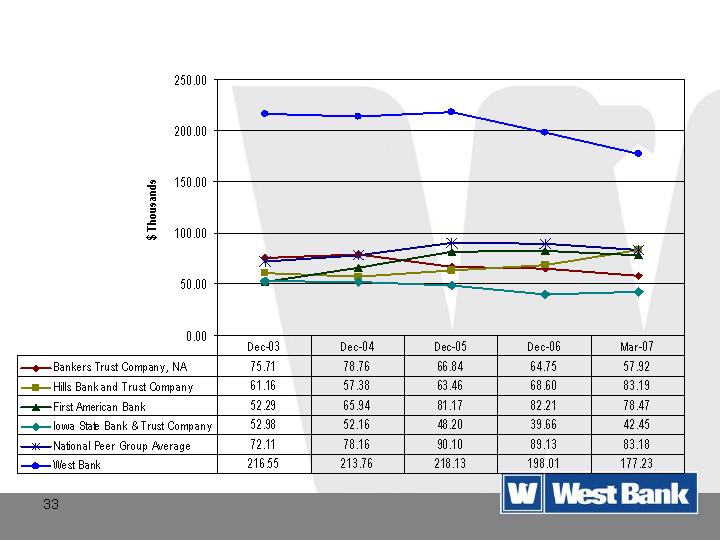

Assets per Employee

Loans per Employee

Personnel Expense as % of Average

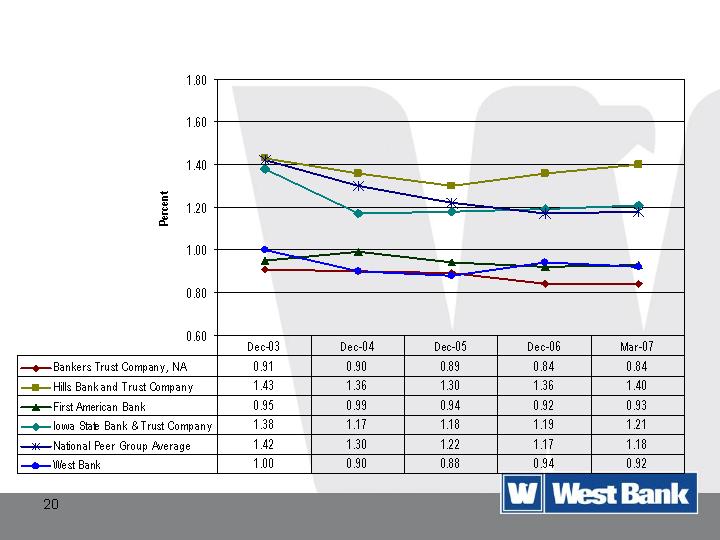

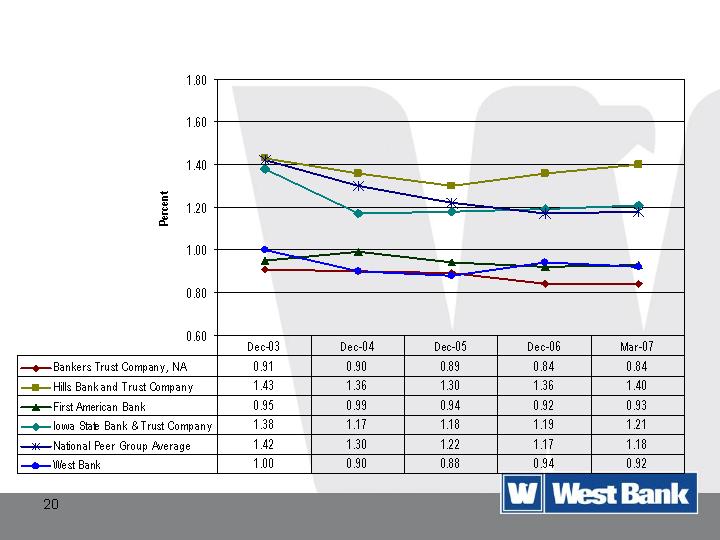

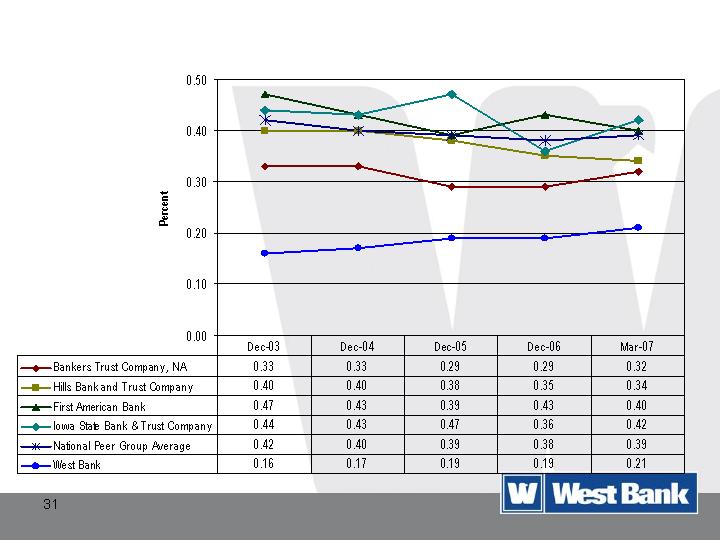

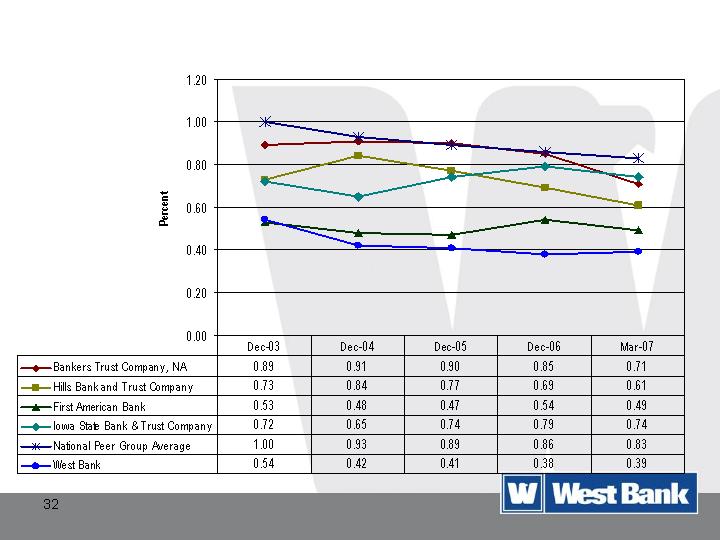

Assets

Occupancy Expense as % of Average

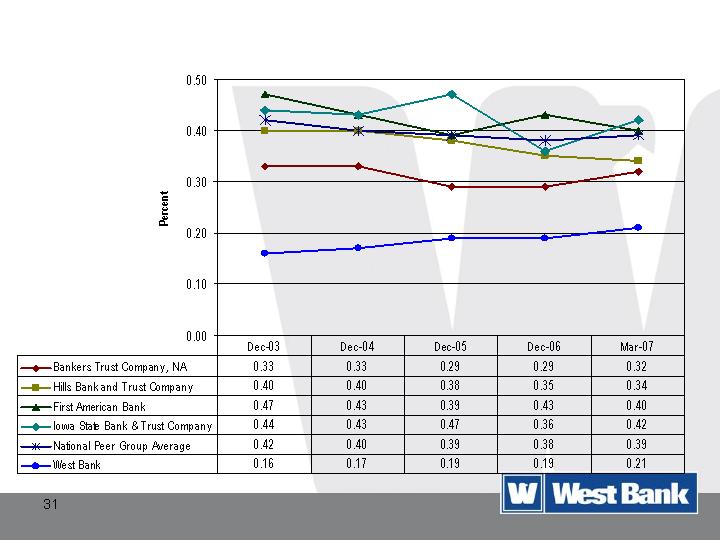

Assets

Other Operating Expenses as % of

Average Assets

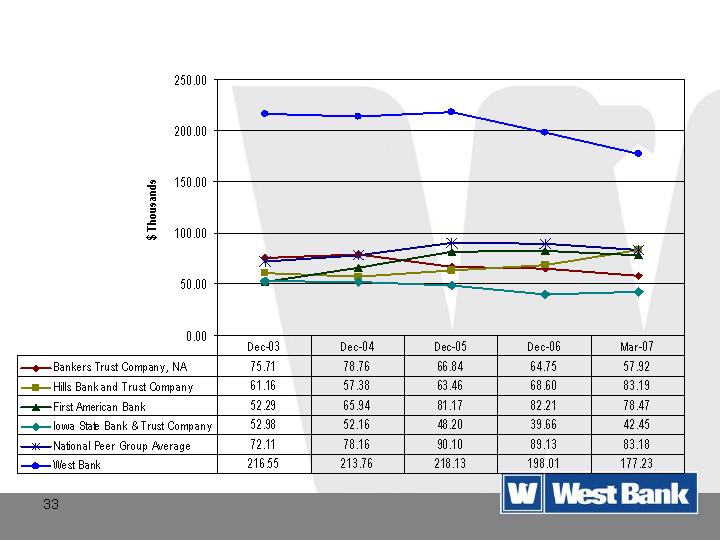

Net Income per Employee (pre-tax)

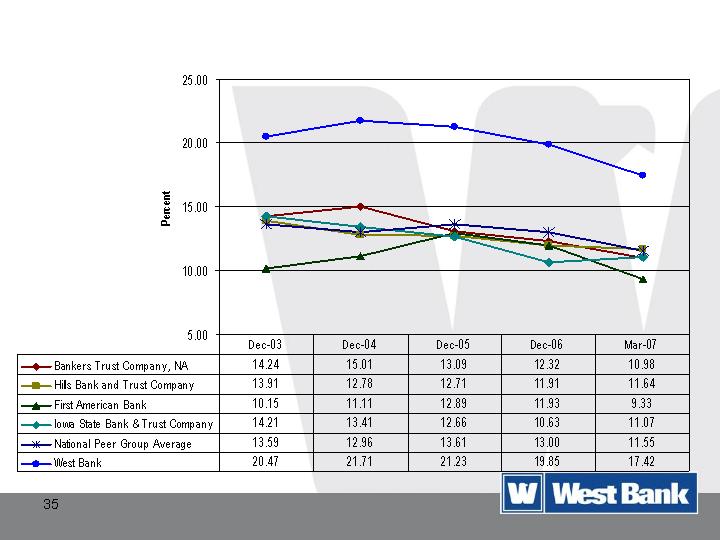

Return on Assets

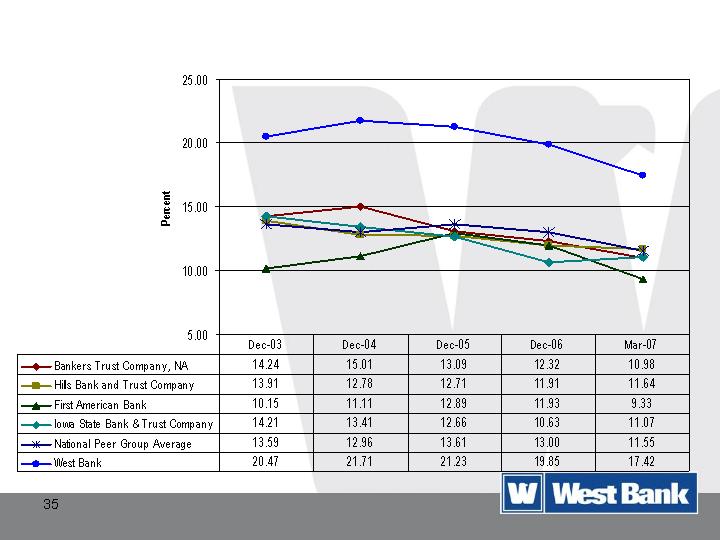

Return on Equity

Consolidated Financial Results

44.25%

44.46%

43.35%

41.54%

Efficiency Ratio

3.39%

3.29%

3.35%

3.33%

Net Interest Margin

1.47%

1.47%

1.49%

1.55%

Return on Average

Assets

18.09%

16.84%

18.56%

17.80%

Return on Average Equity

$9,427

$9,571

$4,882

$5,127

Net income ($000)

2006

2007

2006

2007

Three months ended

June 30

Six months ended

June 30

Section IV

WB Capital

Management Inc.

Overview

WB Capital Management Inc. formed in

October 2003 as a registered investment

advisor

Acquired assets of VMF Capital, LLC on

October 1, 2003

Acquired assets of Investor’s Management

Group on December 21, 2005

Assets under management as of June 30, 2007

was approximately $4.4 billion

Provides portfolio management services to

individuals, retirement plans, corporations,

governmental entities,foundations and

endowments

Minimum investment is $250,000 per account

Investment Strategies

Investment decisions are driven by the opportunity to increase

returns while managing portfolio risk.

Fixed Income

The investment process emphasizes

three central tenets:

Capital preservation

Risk-aware portfolio construction

A focus on our long-term view of

the economy and financial

markets

Four investment strategies

Low Duration

Intermediate Core

Intermediate Government

Core Fixed Income

Equity

The investment process focuses on

three fundamental factors:

Cash flows

Return on assets

Risk controls such as sector and

individual security weights

Six investment Strategies

Core Forty

Large Cap Value

Mid Cap Equity

Small Cap Core Equity

SMID Capital

Core Select

Investment Performance Equity Composites*

9.87%

13.31%

15.93%

21.87%

6.23%

4.93%

-2.34%

Russell 1000 Value

7.62%

11.87%

15.60%

19.67%

9.06%

8.10%

-1.51%

Large Cap Value

13.37%

14.17%

15.15%

18.51%

11.98%

5.84%

-2.18%

S&P 400 Mid Cap Index

11.86%

16.39%

17.16%

20.83%

9.90%

5.30%

-2.25%

Russell Mid Cap

9.88%

10.90%

14.04%

19.32%

15.36%

7.65%

-1.05%

Mid-Cap

4.39%

9.28%

8.70%

19.04%

8.13%

6.86%

-1.49%

Russell 1000 Growth

7.12%

10.70%

11.67%

20.57%

6.95%

6.27%

-1.66%

S&P 500

7.58%

9.25%

9.07%

15.98%

3.56%

5.41%

-1.45%

Large-Cap Growth

7.12%

10.70%

11.67%

20.57%

6.95%

6.27%

-1.66%

S&P 500

5.47%

8.63%

10.84%

21.86%

8.18%

7.81%

-1.31%

Diversified Equity

11.27%

14.36%

14.47%

16.04%

8.56%

5.18%

-1.64%

S&P 600 Small-Cap Index

9.06%

13.88%

13.45%

16.43%

6.45%

4.41%

-1.46%

Russell 2000

n/a

18.28%

13.47%

22.54%

9.90%

6.17%

-0.67%

Small-Cap Core

6.86%

8.25%

8.38%

14.51%

4.78%

3.70%

-0.99%

S&P 500/SHLGCI

n/a

7.17%

7.03%

11.84%

2.82%

3.33%

-0.96%

Balanced Core

10 Year

5 Year

3 Year

1 Year

YTD

3 Month

1 Month

(Gross of Fees) as of 06.30.07

*Based on preliminary, unreconciled data

Investment Performance Fixed Composites*

5.06%

3.97%

3.62%

4.53%

0.51%

-0.34%

-0.26%

ML 2-17 Muni

4.75%

3.63%

3.27%

4.50%

0.66%

-0.25%

-0.29%

Core Municipal

6.01%

4.48%

3.98%

6.12%

0.98%

-0.52%

-0.29%

Lehman Aggregate

6.09%

4.48%

4.40%

6.26%

1.06%

-0.51%

-0.33%

Core Fixed Income

n/a

3.19%

3.15%

5.34%

2.16%

0.71%

0.43%

Lehm 1-3 Yr Govt/Credit

n/a

3.46%

3.68%

5.78%

2.18%

0.70%

0.33%

Low Duration

50% 3 Mo Treasury

n/a

2.98%

3.46%

5.27%

2.35%

0.99%

0.41%

50% Lehm 1-3 Yr Govt/Credit

n/a

3.33%

3.78%

5.26%

2.09%

0.72%

0.40%

Enhanced Cash

3.79%

2.76%

3.77%

5.21%

2.54%

1.27%

0.39%

3 Mo T-Bill

4.04%

2.94%

4.00%

5.42%

2.65%

1.32%

0.43%

Taxable Cash

10 Year

5 Year

3 Year

1 Year

YTD

3 Month

1 Month

(Gross of Fees) as of 06.30.07

*Based on preliminary, unreconciled data

Section V

Our Future

Strategic Initiatives

West Bank

Shift growth plans in new markets from

acquisition to de novo

Select markets with 15% per annum projected growth

and high households per branch

Create new bank as hub and add branches in

successive years

Expand presence in Iowa Markets

Additional central and eastern Iowa branches

Increase emphasis on consumer banking in defined

niches.

Strategic Initiatives

WB Capital Management Inc.

Focus on institutional money management with wealth

management capabilities

Provide consistent investment performance by

exceeding benchmarks over a rolling three-year period

Expand annual organic growth of assets under

management with new sales and service team approach

Shift assets under management mix to 25% equity/75%

fixed income

Increase net operating margin through improved

efficiencies

Section VI

Summary

Summary

Future is bright at West Bancorporation

West Bank

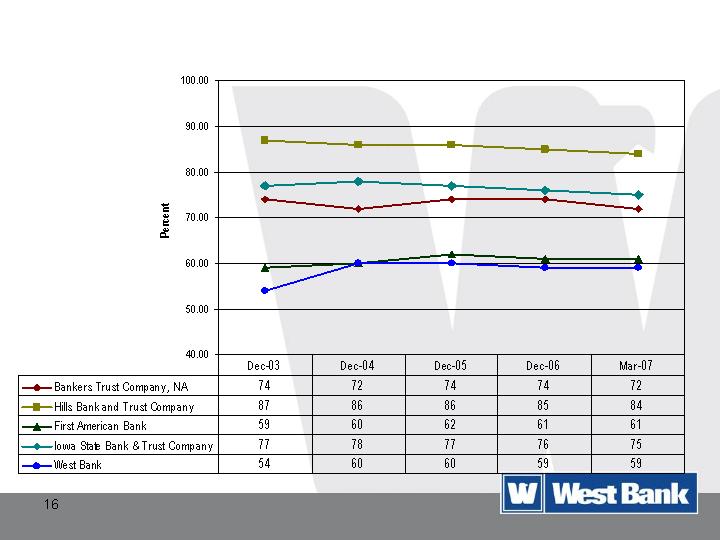

Consistently outperforms peer banks

Growth opportunities in current markets

Expansion into new markets

WB Capital Management Inc.

Consistent investment performance

Sales-, service- and compliance–driven culture

Strong growth opportunities

Discussion