2009 Shareholders’ Meeting

April 16, 2009

1

2008 Year in Review

2

2008 Overview

Year of Conflicts

Many positive aspects to year

Doug will highlight 2008 financial picture

Brad will review activities at West Bank in 2008

Doug will discuss WB Capital Management

Extraordinary issues

Iowa’s largest homebuilder fails

Wholesale propane customer is defrauded

Investment impairment caused by failures in financial services

companies

American Equity Investment Life Holding makes an offer to acquire

company

Sold $36,000,000 of preferred stock to U.S. Treasury in Capital

Purchase Program

3

2008 Financial Review

4

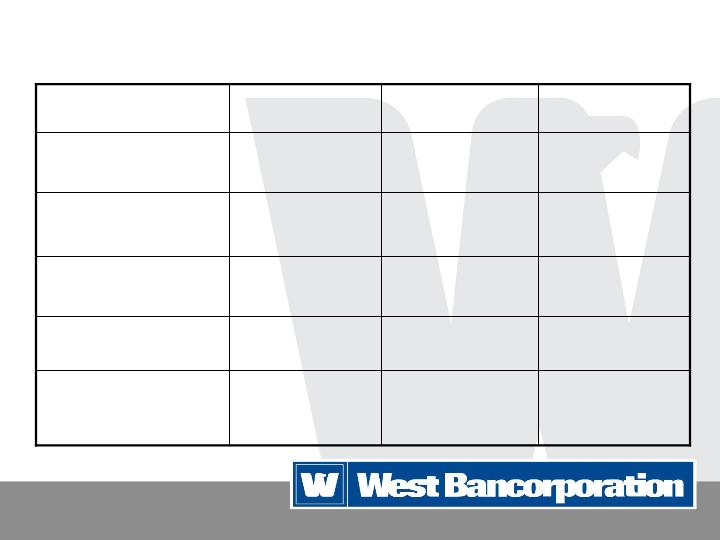

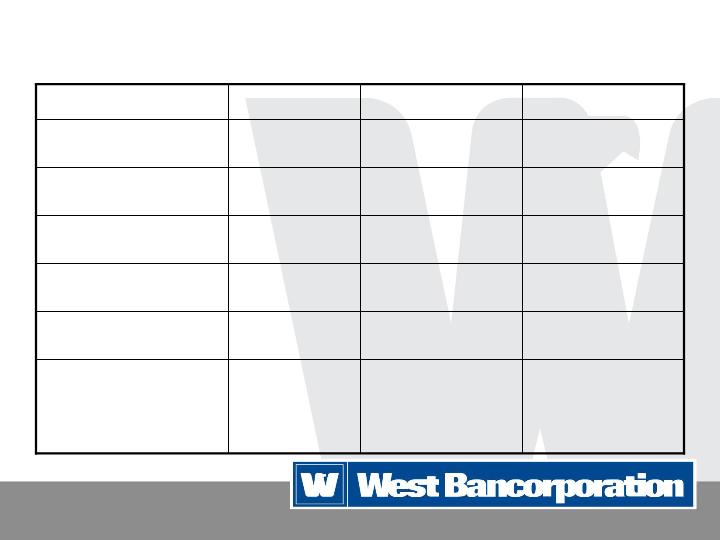

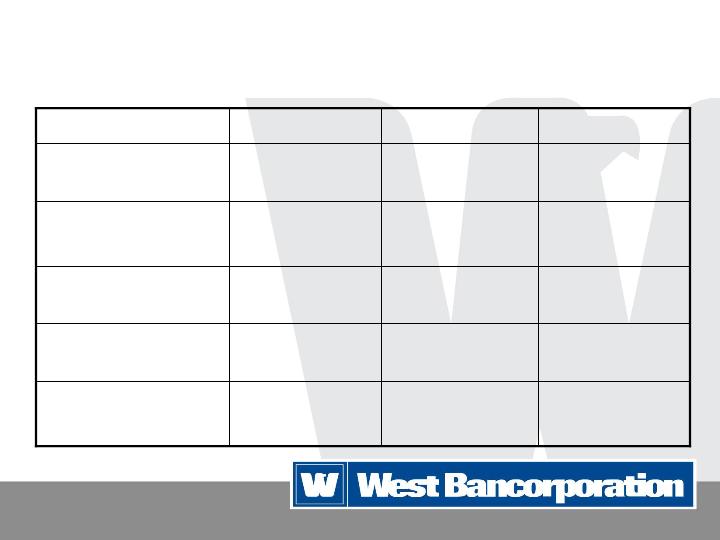

West Bancorporation, Inc.

+606.4%

$2,350

$16,600

Provision for

loan losses

+23.4%

$121.6 mil

$150.1 mil

Stockholders'

equity

+26.8%

$911 mil

$1.155 bil

Total deposits

+15.9%

$1.340 bil

$1.553 bil

Total assets

-59.6%

$18,920

$7,636

Net income

% Change

2007

2008

5

West Bancorporation, Inc.

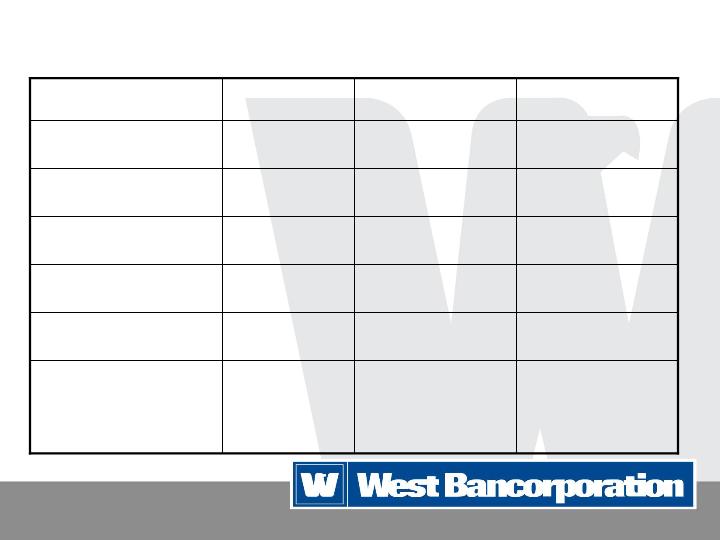

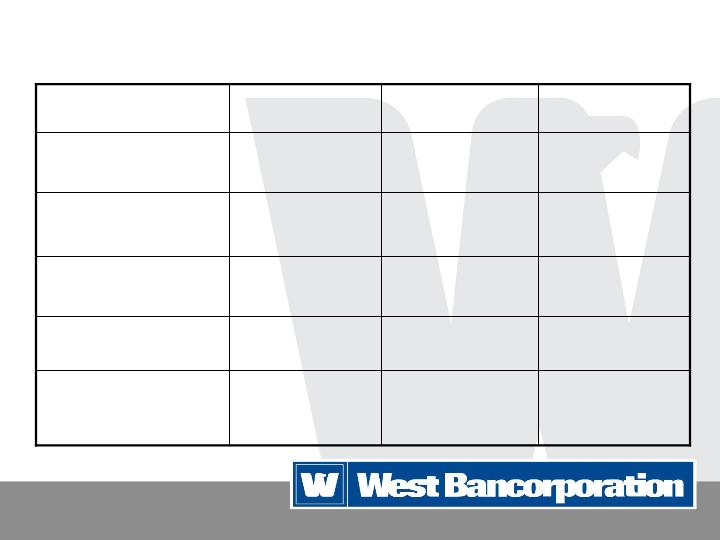

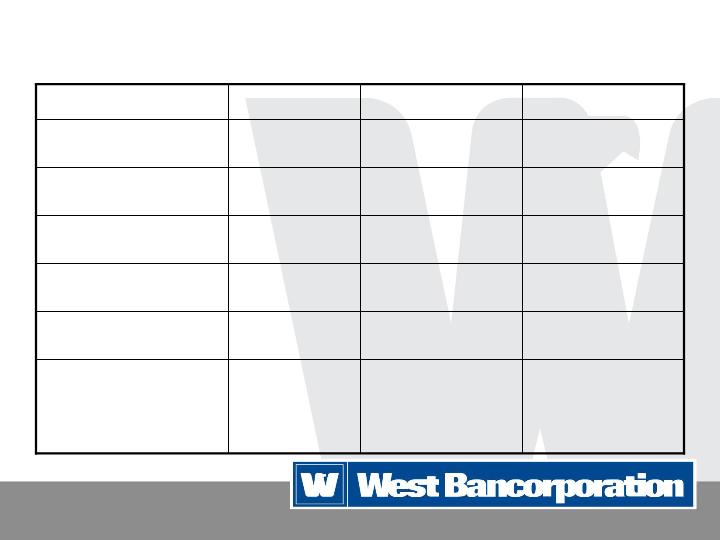

+6.4%

9.08%

9.66%

Equity: Assets

-17.9%

7.20%

5.91%

Tangible

common equity:

Tangible assets

-2.3%

44.23%

45.25%

Efficiency

+3.0%

3.28%

3.38%

NIM

-60.1%

16.21%

6.47%

ROE

-61.4%

1.45%

0.56%

ROA

% Change

2007

2008

6

West Bancorporation, Inc.

Non-Recurring Items

2008

$317,000

•Community Bank Unit Investment Trust

$1,800,000

•Lehman Brothers bond

$2,622,000

preferred security)

•ALESCO (a pooled trust

Securities impairments:

$3,300,000

•Customer impacted by fraud

$4,675,000

•Large home builder

Loan charge-offs:

7

WB Capital Management, Inc.

-6.6%

$8,137

$7,596

Revenue

+42.0%

3.00%

4.26%

WB Cap net

income as % of

consolidated net

income

-42.8%

$568

$325

Net income

-3.8%

$4.49 bil

$4.32 bil

Assets under

management

% Change

2007

2008

8

Loss on Lehman Brothers bond $458,000

WB Capital Management, Inc.

Non-Recurring Item

2008

9

2008 Bank Review

10

2008 West Bank Review

12% Loan Growth

(year over year)

11% Loan Growth

(average)

Late 3Q and 4Q loan

demand softened

Underwriting criteria

increased

27% Deposit Growth

(year over year)

6% Deposit Growth

(average)

Reward Me Checking

Small Commercial 3D

(Coffee Campaign)

CDARS

SmartyPig

11

Retail Banking

Remodeled Merle Hay

Branch

February 09 grand opening

New Waukee Branch

March 09 grand opening

Staffed retail, mortgage,

small business

New Personnel

Scott Jarvis, Head of Retail

Matt Klein, City Center

Matt Petersen, Waukee

Trisha Knepper, Urbandale

Training

Presentation Training

Sales Training & Coaching

Product Training

12

Trust

4% Revenue Growth

New Personnel

Carol Stone, former head of Trust Department

promoted to Chief Compliance Officer

Jim Benda, Senior Trust Officer, hired to lead

the department

13

Commercial Banking

New Personnel

Aldrich Cabildo, 1st Vice President

Steve Miller, 1st Vice President

Training

Sales and Coaching

Presentation Training

Product Training

Treasury Management

Expanded and improved existing product line

Positive Pay rollout 2009

14

Residential Mortgage

333% Increase in Gross Fees Earned in 2008

345% Increase in Gross Fees Earned 1Q09

New Personnel

Steve Federspiel, 2nd Vice President

Tim Bonert, 2nd Vice President

15

Credit Administration

Compliance

Lost Georgann Mefferd to Cancer

22 year employee

Financial Literacy, Hawthorne Hill

Ministries, Neighborhood Finance

Law Degree; Legal, credit and chief

compliance officer.

Promoted Carol Stone to Chief

Compliance Officer

Fmr Head of Trust Department

Extensive background in financial

compliance arena

Additions to staff to meet growing

regulatory challenges

2008 Compliance Exam

Asset Quality

Dave Milligan rejoined bank

Head of troubled loans

John Goranson

Head of Loan Audit

Additions to staff to meet growing

regulatory challenges

2008 Safety & Soundness Exam

CRM Introduced and Trained

Relationship Management Tool

Profitability

Sales tracking

Prospect tracking

Direct Marketing

Retention and Cross sell efforts

16

Bank Awards & Community Outreach

2009 Better Business Bureau

Integrity Award Recipient

2008 Community Champion

Award from the Greater Des

Moines Partnership

2009 United Way Leader in

Giving Award

Employee Community

Involvement

210 Employees contributed more than

10,000 community service hours

And hold 82 non profit board seats

Shred it Day (May 08)

Central and Eastern Iowa

3rd Annual Event scheduled for May 16,

2009

West Bancorporation

Foundation

$250,000 in grants awarded

17

2008 WB Capital Management

Review

18

2009 First Quarter Results

and Dividend Declaration

19

Preliminary 2009 First Quarter Results

Earnings will be released on April 30th

Good core earnings with significant

one-time gains and losses

20

Preliminary First Quarter Results

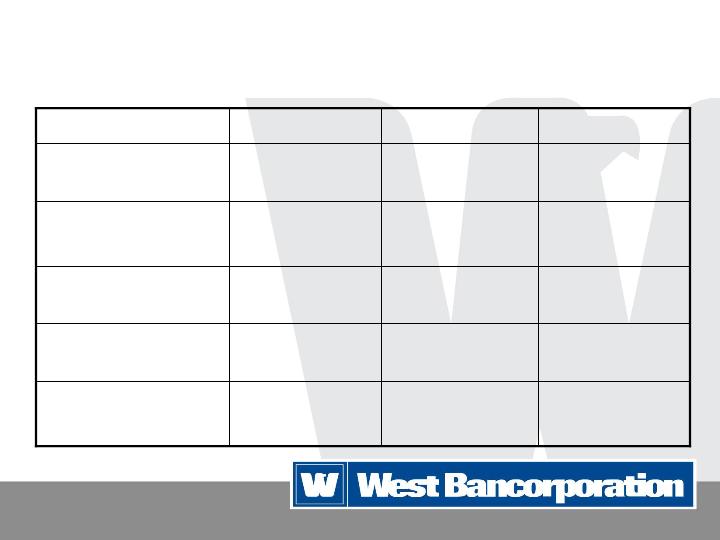

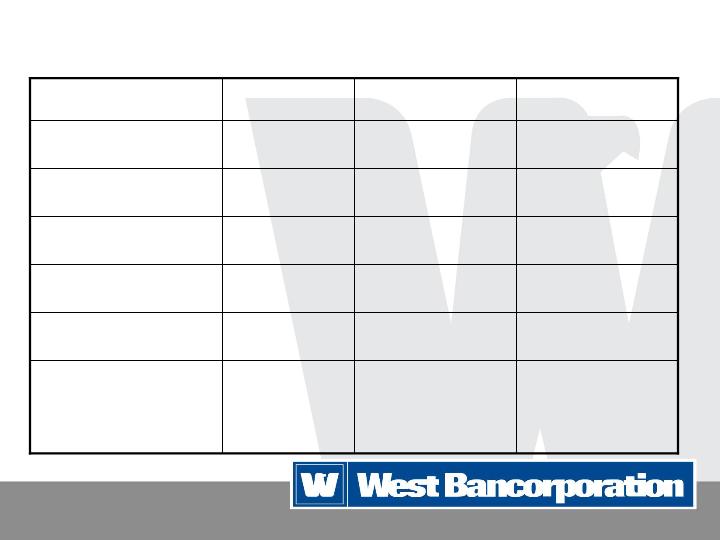

-37.5%

$5,600

$3,500

Provision for

loan losses

+26.8%

$119.3 mil

$151.3 mil

Stockholders'

equity

+35.1%

$884 mil

$1.194 bil

Total deposits

+20.9%

$1.333 bil

$1.612 bil

Total assets

+114.0%

$1,374

$2,941

Net income

% Change

2008

2009

21

Preliminary First Quarter Results

+4.6%

9.20%

9.62%

Equity: Assets

-18.5%

7.08%

5.77%

Tangible

common equity:

Tangible assets

-5.8%

47.45%

50.19%

Efficiency

-15.1%

3.38%

2.87%

NIM

+72.7%

4.54%

7.84%

ROE

+78.6%

0.42%

0.75%

ROA

% Change

2008

2009

22

Preliminary First Quarter Results

Non-Recurring Items

$1,453,000

Gains from the sale of investment securities

$840,000

Bank-owned life insurance death benefit

$35,000

•Community Bank Unit Investment Trust

$500,000

•Single-issue trust preferred security

$880,000

•Single-issue trust preferred security

Securities impairments:

23

2009 First Quarter Dividend

Declared a $0.01 per share dividend

Record date: April 27th

Payment date: May 13th

Objective is to increase tangible common

equity through retained earnings as

quickly as possible

24

2009 and Beyond

25

Business Plan through 2010

Loans

Adverse Assets

Resolution

Stricter underwriting

standards

Reduce out-of-market

lending

Improve compliance

process

Investments

Gradually eliminate all

corporate investments

Remain invested in

High-grade municipal

bonds,

Mortgage-backed

securities of government

agency

Direct government

agency debt

Focus on Asset Quality Improvement

26

Business Plan through 2010

Continue with steady but more

focused growth in market

share

Shift primary emphasis from

new customer development to

expanding existing customers’

relationships

Greater deposit growth than

loan growth

Remain a traditional community

bank, serving the needs of the

customer

Capital Requirements

Use of Capital Purchase

Program monies

Organic growth

Tangible common equity ratios

Repay CPP money as quickly as

possible

27

WB Capital Strategic Assessment

Under-performed our investment expectations

Reviewing all options

Change investment strategies

Market to different clients

Merge into trust department

Have not actively attempted to sell but will consider

meaningful unsolicited offers

Business Plan through 2010

28

Future of the Company

Continue as a traditional community bank

Stay on the offense

Enhance Customer Service

Introduce new products

Remain rate-competitive but price loans for risk

Commence strategic review of West Bank in May

Stay true to our core values

29

Question and Answer

30

2009 Shareholders’ Meeting

April 16, 2009

31