UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

| Meru Networks, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a(6)(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

Fellow Stockholders,

With the completion of our fiscal year 2010, our first fiscal close as a public company, I am very pleased to report that we had an outstanding year, and we continued to execute against our long term strategic business objectives and priorities. Throughout fiscal year 2010, we delivered record revenues, increased our gross margins, added more new customers and products, and expanded into new geographies. We delivered on our plan, establishing a solid platform upon which we can further capture market opportunities and growth.

The worldwide market for enterprise-class wireless LAN 802.11n solutions that can seamlessly support data, video, and voice over IP is being driven by the growth of new Wi-Fi-enabled mobile devices in the enterprise such as the iPad, tablets and smartphones. We believe the proliferation of these devices in the enterprise is at its infancy, and that microcell Wi-Fi meltdowns caused by the growing density of usage of mobile devices in the enterprise will become increasingly common occurrences every day across the enterprise. We believe Meru is the best positioned to solve the problem and has the strategy and products in place to capitalize on this fundamental shift.

Our virtualized wireless LAN solution cost-effectively optimizes the enterprise network to deliver the performance, reliability, predictability and operational simplicity of a wired network, with the advantages of mobility. We enable enterprises to migrate their business-critical applications from wired networks to wireless networks, and become what we refer to as All-Wireless Enterprises.

Key highlights of fiscal year 2010 include the following: the Company’s total revenue for 2010 was $85 million. Product and services revenue for 2010, excluding ratable revenue, was $73.7 million, up over 44% year-over-year. We added 1,400 new customers, growing our installed base to almost 4,400 customers, up approximately 50% from 2009. While we continue to add new customers from our traditional stronghold verticals of higher education, K through 12, and health care, we also added more Fortune 5000 enterprise customers from the retail, manufacturing, hospitality, entertainment, and logistics verticals.

Our customer base also expanded geographically in 2010 and today Meru’s virtualized wireless LAN solutions are deployed in production in 55 countries around the world, up from 36 countries at the end of 2009. In late 2010, we established a presence for Meru in China for the first time. We also signed a distribution agreement with one of China’s largest and most established IT products distribution organization, Digital China, which quickly delivered new customers in the fourth quarter.

We have continued to build on our track record of innovation and leadership toward meeting the growing needs of our customers. We introduced an innovative suite of applications and appliances called the Service Assurance Suite. This suite includes Meru’s Service Assurance Manager, EzRF Network Manager, Spectrum Analyzer and Manager, and PCI and Web Security appliances. We believe this particular expansion in our product portfolio enables us to further extend our competitive advantage and offer a broader value proposition to our existing customers and to the overall market. These products and services are all designed to optimize the wireless LAN application performance and accelerate the migration to an All-Wireless Enterprise.

Toward the end of 2010, we started shipping a new line of entry level enterprise access points — the AP1000i, our first 802.11n entry level solution for the extended enterprise. We believe the AP1000i delivers superior functionality and higher performance than any other entry level access point available in the market today, and that this new product line effectively more than doubles Meru’s target addressable market.

In 2010, our focus was to deliver revenue growth while carefully managing to our profitability priorities. As we look into 2011, we intend to apply the same focus on execution that allowed us to deliver record performance in

2010 to revenue growth this year. In order to take advantage of the market opportunities in front of us and to take market share, we intend to increase our investments in sales, marketing, and engineering. We believe we will see results from these investments most notably in the second half of 2011 and for 2012.

We believe the investments Meru is making will help us capitalize on market opportunities that are resulting from the growing proliferation of Wi-Fi-enabled devices and the inherent challenges of microcell wireless networks. We continue to see organizations migrating to wireless for their primary networks and turning to Meru’s differentiated solution to support the connectivity, mobility, and density required to manage the influx of wireless devices and wireless applications and avoid microcell Wi-Fi meltdowns.

I am pleased with our progress to date and we will continue to execute against our strategic business objectives. We will effectively manage the business in the short-term and we have the financial flexibility to think and act for the long-term. I believe we have the right strategy to capitalize on the fundamental shift occurring in the markets we are addressing.

Finally, I want to thank our current and prospective customers who are embracing our products, vision and strategy. Thank you for your continued investment in Meru Networks and I look forward to a successful 2011.

Sincerely,

Ihab Abu-Hakima

President and Chief Executive Officer

May 2011

MERU NETWORKS, INC.

894 ROSS DRIVE

SUNNYVALE, CALIFORNIA 94089

May 2, 2011

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Meru Networks, Inc., to be held at 894 Ross Drive, Sunnyvale, California, on June 8, 2011 at 10:00 a.m. Pacific Time.

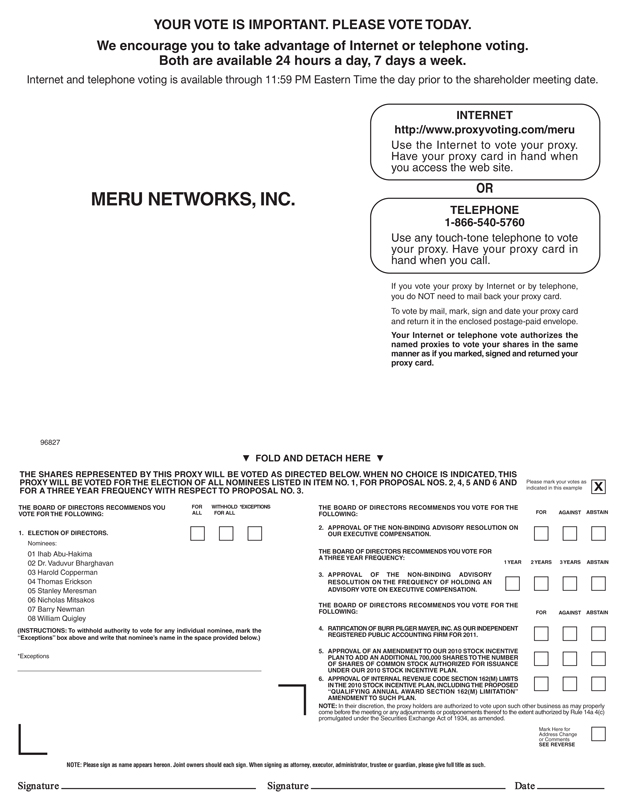

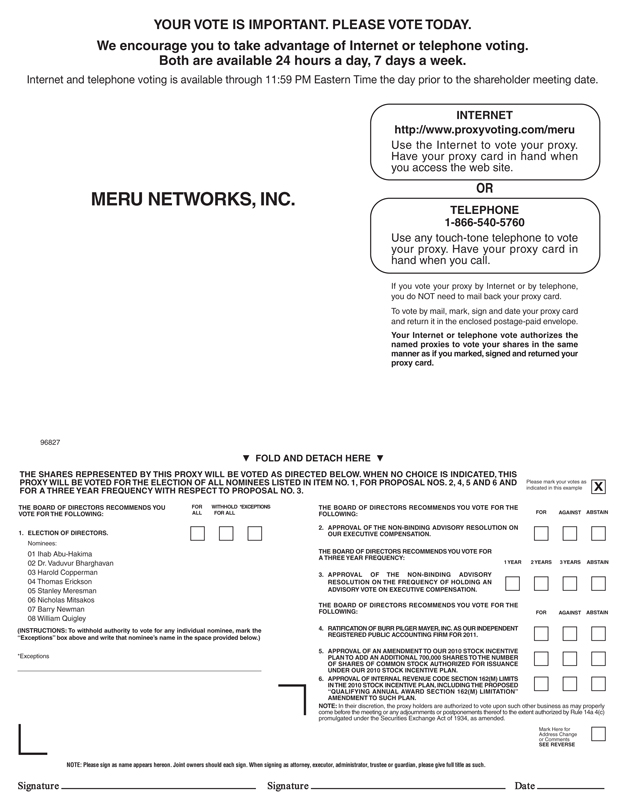

At the annual meeting, you will be asked to vote upon six proposals:

| | 1. | the election of our directors to serve until the next annual meeting or until their successors are duly elected and qualified; |

| | 2. | a non-binding advisory resolution on our executive compensation; |

| | 3. | a non-binding advisory resolution on the frequency of executive compensation advisory votes; |

| | 4. | the ratification of our independent registered public accounting firm for our fiscal year ending December 31, 2011; |

| | 5. | approval of an amendment to the 2010 Stock Incentive Plan; and |

| | 6. | approval of the Internal Revenue Code Section 162(m) limits of our 2010 Stock Incentive Plan. |

Accompanying this letter is the formal notice of annual meeting, proxy statement and proxy card relating to the annual meeting, as well as our annual report for the fiscal year ended December 31, 2010. The proxy statement contains important information concerning the matters to be voted upon at the annual meeting. We hope you will take the time to study it carefully.

All stockholders of record at the close of business on the record date, which is April 15, 2011, are entitled to vote at the annual meeting, and your vote is very important regardless of how many shares you own. Regardless of whether you plan to attend the annual meeting, we urge you to submit your proxy as soon as possible. Instructions on the proxy card will tell you how to submit your proxy over the Internet, by telephone or by returning your proxy card in the enclosed postage-paid envelope. If you plan to attend the annual meeting and vote in person, and your shares are held in the name of a broker or other nominee as of the record date, you must bring with you a proxy or letter from the broker or nominee to confirm your ownership of such shares.

|

Sincerely, |

|

|

Ihab Abu-Hakima President and Chief Executive Officer |

MERU NETWORKS, INC.

894 Ross Drive

Sunnyvale, California 94089

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 8, 2011

NOTICE IS HEREBY GIVEN that an annual meeting of stockholders of Meru Networks, Inc., a Delaware corporation, will be held at the 894 Ross Drive, Sunnyvale, California, on June 8, 2011 at 10:00 a.m. Pacific Time. At the annual meeting, our stockholders will be asked to consider and vote upon:

1. The election of eight directors to serve on our board of directors, each to serve until our annual meeting of stockholders to be held in 2012 and until his successor is elected and qualified, or until his death, resignation or removal.

2. A non-binding advisory resolution on our executive compensation.

3. A non-binding advisory resolution on the frequency of executive compensation advisory votes.

4. Ratification of the appointment of Burr Pilger Mayer, Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2011.

5. Approval of an amendment to our 2010 Stock Incentive Plan to add an additional 700,000 shares to the number of shares of common stock authorized for issuance under our 2010 Stock Incentive Plan.

6. Approval of the Internal Revenue Code Section 162(m) limits of our 2010 Stock Incentive Plan to preserve our ability to receive corporate income tax deductions that may become available pursuant to Section 162(m).

7. Transaction of such other business as may properly come before the annual meeting or before any adjournments or postponements thereof.

Only stockholders of record of our common stock at the close of business on April 15, 2011 are entitled to notice of, and to vote at, the annual meeting or any adjournments or postponements thereof.

|

By Order of the Board of Directors, |

|

|

Brett White Chief Financial Officer and Secretary |

Sunnyvale, California

May 2, 2011

IMPORTANT NOTICE

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. TO ENSURE THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING, YOU ARE URGED TO SUBMIT YOUR PROXY OVER THE INTERNET, BY TELEPHONE OR BY COMPLETING, DATING AND SIGNING THE ENCLOSED PROXY CARD AND MAILING IT PROMPTLY IN THE ENCLOSED POSTAGE-PAID ENVELOPE, REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME. YOU CAN WITHDRAW YOUR PROXY AT ANY TIME BEFORE THE MEETING. YOU MAY DO SO AUTOMATICALLY BY VOTING IN PERSON AT THE MEETING OR BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A DULY EXECUTED PROXY BEARING A DATE LATER THAN THE DATE OF THE PROXY BEING REVOKED.

TABLE OF CONTENTS

Meru Networks, Inc.,

894 Ross Drive

Sunnyvale, California 94089

PROXY STATEMENT

This proxy statement is being furnished to the stockholders of Meru Networks, Inc., a Delaware corporation, in connection with the solicitation of proxies by our board of directors for use at the annual meeting of stockholders to be held at 894 Ross Drive, Sunnyvale, California, on June 8, 2011 at 10:00 a.m. Pacific Time, and at any adjournments or postponements thereof. At the annual meeting, holders of our common stock will be asked to vote upon: (i) the election of eight directors to serve until the annual meeting of stockholders to be held in 2012 or until their successors are duly elected and qualified; (ii) a non-binding advisory resolution on our executive compensation; (iii) a non-binding advisory resolution on the frequency of executive compensation advisory votes; (iv) the ratification of Burr Pilger Mayer, Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2011; (v) approval of an amendment to the 2010 Stock Incentive Plan (the “2010 Plan”) to add an additional 700,000 shares to the number of shares of common stock authorized for issuance under the 2010 Plan; (vi) approval of the Internal Revenue Code Section 162(m) limits of our 2010 Plan to preserve our ability to receive corporate income tax deductions that may become available pursuant to Section 162(m); and (vii) any other business that properly comes before the annual meeting, or any adjournments or postponements thereof.

This proxy statement and the accompanying proxy card are first being mailed to stockholders on or about May 2, 2011. The address of our principal executive offices is 894 Ross Drive, Sunnyvale, California 94089.

VOTING RIGHTS AND PROXIES

Record Date; Outstanding Shares; Quorum

Only holders of record of our common stock at the close of business on the record date, which is April 15, 2011, will be entitled to notice of and to vote at the annual meeting. As of the close of business on the record date, there were 17,321,424 shares of our common stock outstanding and entitled to vote, held of record by 134 stockholders.

Pursuant to our bylaws, a majority of the outstanding shares of common stock, present in person or by proxy, will constitute a quorum for the transaction of business. Each of our stockholders is entitled to one vote for each share of common stock held as of the record date. For ten days prior to the annual meeting, a complete list of stockholders entitled to vote at the annual meeting will be available for examination by any stockholder, for any purpose germane to the meeting, during ordinary business hours at our principal executive offices at 894 Ross Drive, Sunnyvale, California 94089.

Voting of Proxies; Revocation of Proxies; Votes Required

Stockholders are requested to complete, date, sign and return the accompanying proxy card in the enclosed postage-paid envelope. All properly executed, returned and unrevoked proxies will be voted in accordance with the instructions indicated thereon.Executed but unmarked proxies will be voted FOR each director nominee listed on the proxy card, FOR the approval of the non-binding advisory resolution on our executive compensation, FOR a three-year frequency on the non-binding advisory resolution on the frequency of executive compensation advisory votes, FOR the ratification of our independent registered public accounting firm for the fiscal year ending December 31, 2011, FOR the approval of an amendment to our 2010 Plan to add an additional 700,000 shares to the number of shares of common stock authorized forissuance under our 2010 Plan, and FOR the approval of the Internal Revenue Code 162(m) limits in the

2010 Plan.Our board of directors (the “board” or our “board”) does not know of, and does not intend to bring, any business before the annual meeting other than that referred to in this proxy statement and specified in the notice of annual meeting. As to any other business that may properly come before the annual meeting, including any motion made for adjournment or postponement of the annual meeting (including for purposes of soliciting additional votes), the proxy card will confer discretionary authority on the proxies (who are persons designated by the board of directors) to vote all shares covered by the proxy card in their discretion.

Any stockholder who has given a proxy that does not state it is irrevocable may revoke it at any time before it is exercised at the annual meeting by (i) filing a written notice of the death or incapacity of the maker or revocation with, or delivering a duly executed proxy bearing a later date to, the Corporate Secretary of Meru Networks, Inc., 894 Ross Drive, Sunnyvale, California 94089, or (ii) attending the annual meeting and voting in person (although attendance at the annual meeting will not, by itself, revoke a proxy). If you hold shares through a brokerage firm, bank or other agent, you must contact that brokerage firm, bank or other agent to revoke any prior voting instructions.

Director elections are determined by a plurality of shares of common stock represented in person or by proxy and voting at the annual meeting. Approval of the non-binding advisory resolution on our executive compensation, approval of our independent registered public accounting firm for the fiscal year ending December 31, 2011, approval of an amendment to the 2010 Plan to add an additional 700,000 shares to the number of shares of common stock authorized for issuance under the 2010 Plan, and approval of the Internal Revenue Code Section 162(m) limits of the 2010 Plan to preserve our ability to receive corporate income tax deductions that may become available pursuant to Section 162(m) each requires the affirmative vote of a majority of the shares of common stock represented in person or by proxy, and entitled to vote on the matter. With respect to the non-binding advisory resolution on the frequency of executive compensation advisory votes, the alternative receiving the greatest number of votes shall be approved.

Effect of Abstentions

If an executed proxy is returned and the stockholder has specifically abstained from voting on any matter, the shares represented by such proxy will be considered present at the annual meeting for purposes of determining a quorum and for purposes of calculating the vote, but will not be considered to have been voted in favor of such matter. As such, an abstention will have the effect of a vote against the non-binding advisory resolution on our executive compensation, ratification of our independent registered public accounting firm, Burr Pilger Mayer, Inc. for the fiscal year ending December 31, 2011, the amendment to the 2010 Plan to add an additional 700,000 shares to the number of shares of common stock authorized for issuance under the 2010 Plan, and approval of the Internal Revenue Code Section 162(m) limits of the 2010 Plan.

Effect of “Broker Non-Votes”

If your shares are held by your broker, bank or other agent as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker, bank or other agent to vote your shares. If you do not give instructions to your broker, bank or other agent, they can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine on which your broker, bank or other agent may vote shares held in street name in the absence of your voting instructions, such as the vote for ratification of our independent registered public accounting firm. On non-discretionary items, such as the vote for election of directors, the non-binding advisory vote on executive compensation, the non-binding advisory vote on the frequency of executive compensation advisory votes, the amendment to the 2010 Plan to increase the number of shares authorized for issuance and approval of the Internal Revenue Code Section 162(m) limits of the 2010 Plan, if you do not give instructions to your broker, bank or other agent, the shares will not be voted and will be treated as broker non-votes.

2

If an executed proxy is returned by a broker, bank or other agent holding shares in street name that indicates that the broker does not have discretionary authority as to certain shares to vote on a proposal (“broker non-votes”), such shares will be considered present at the annual meeting for purposes of determining a quorum on all proposals, but will not be considered to be entitled to vote on such proposal.

If a quorum is present, the nominees for director receiving the highest number of affirmative votes of the shares present or represented and entitled to be voted for them shall be elected as directors. Therefore, broker non-votes will have no effect on the election of directors. The approval of the non-binding advisory resolution on our executive compensation, the ratification of Burr Pilger Mayer, Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2011, the amendment to the 2010 Stock Incentive Plan to increase the number of shares authorized for issuance, and the Internal Revenue Code Section 162(m) limits of our 2010 Plan require the approval of the affirmative vote of a majority of the shares present or represented by proxy and voting at the annual meeting. Because broker non-votes are not voted affirmatively or negatively, they will have no effect on the approval of these proposals. For the approval of the non-binding advisory vote on the frequency of executive compensation advisory votes, the required vote shall be a plurality of the votes cast and broker non-votes shall have no effect on the approval of this proposal.

Voting Electronically via the Internet or by Telephone

General Information for All Shares Voted via the Internet or by Telephone

Stockholders whose shares are registered in their own name may choose to grant a proxy to vote their shares either via the Internet or by telephone. The laws of Delaware, under which we are incorporated, specifically permits electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspector of elections can determine that such proxy was authorized by the stockholder.

The Internet and telephone voting procedures set forth below, as well as on the enclosed proxy card, are designed to authenticate stockholders’ identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders’ voting instructions have been properly recorded. Stockholders granting a proxy to vote via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, which must be borne by the stockholder.

For Shares Registered in Your Name

Stockholders of record may go tohttp://www.proxyvoting.com/Meru to grant a proxy to vote their shares by means of the Internet. They will be required to provide the control number contained on their proxy cards. The voter will then be asked to complete an electronic proxy card. Any stockholder using a touch-tone telephone may also grant a proxy to vote shares by calling 1-866-540-5760 and following the recorded instructions.

You may use the Internet to vote your proxy 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time (8:59 p.m. Pacific Time) on June 7, 2011. You may use a touch-tone telephone to vote your proxy 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time (8:59 p.m. Pacific Time) on June 7, 2011. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the annual meeting.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose shares are held in street name receive voting instruction forms from their banks, brokers or other agents, rather than our proxy card.

If on the record date your shares were held, not in your name, but rather in an account at a brokerage firm, bank or other agent, then you are the beneficial owner of shares held in “street name” and these proxy materials

3

have been forwarded to you by your broker, bank or other agent. The broker, bank or other agent holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting.

As a beneficial owner, you have the right to direct your broker, bank or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy issued in your name from your broker, bank or other agent.

Solicitation of Proxies and Expenses

We will bear the cost of the solicitation of proxies from our stockholders in the enclosed form. Our directors, officers and employees, without additional compensation, may solicit proxies by mail, telephone, letter, facsimile, electronically or in person. Following the original mailing of the proxies and other soliciting materials, we will request that brokers, custodians, nominees and other record holders forward copies of the proxy and other soliciting materials to persons for whom they hold shares of common stock and request authority for the exercise of proxies. In such cases, we will reimburse such record holders for their reasonable expenses incurred for forwarding such materials.

Voting Results

The preliminary voting results will be announced at the annual meeting. The final voting results will be tallied by our Inspector of Elections and published in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission, or the SEC, within four business days of the annual meeting.

Delivery of this Proxy Statement

The SEC has adopted rules that permit companies and intermediaries (for example, brokers) to satisfy the delivery requirements for annual reports and proxy statements with respect to two or more security holders sharing the same address by delivering a single annual report and proxy statement addressed to those security holders. This process, which is commonly referred to as “householding,” potentially means extra convenience for security holders and cost savings for companies.

A number of brokers with account holders who are our stockholders will be “householding” our proxy materials. A single annual report and proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or us that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. We will deliver promptly upon oral or written request a separate copy of the annual report or proxy statement to a security holder at a shared address to which a single copy of the documents was delivered. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate annual report and proxy statement, please notify your broker and either mail your request to Meru Networks, Inc., Attention: Corporate Secretary, 894 Ross Drive, Sunnyvale, California 94089 or call (408) 215-5300.

Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request “householding” of their communications should contact their broker and either mail your request to Meru Networks, Inc., Attention: Corporate Secretary, 894 Ross Drive, Sunnyvale, California 94089 or call (408) 215-5300.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2010, including the financial statements, list of exhibits and any exhibit specifically requested, filed with the SEC is available without charge upon written request to: Meru Networks, Inc., Attention: Corporate Secretary, 894 Ross Drive, Sunnyvale, California 94089.

4

ELECTION OF DIRECTORS

(Item No. 1 on the Proxy Card)

Our board of directors currently consists of eight directors. At each annual meeting of stockholders, successors to directors whose term expires at that annual meeting will be elected for a term to expire at the succeeding annual meeting. The individuals so elected will serve until their successors are elected and qualified. This year the terms of our directors, currently consisting of Ihab Abu-Hakima, Dr. Vaduvur Bharghavan, Harold Copperman, Thomas Erickson, Stanley Meresman, Nicholas Mitsakos, Barry Newman and William Quigley will expire at the annual meeting. At the annual meeting, holders of common stock will be asked to vote on the election of eight directors, whose current term will expire at our 2011 annual meeting.

The board of directors has nominated each of Ihab Abu-Hakima, Dr. Vaduvur Bharghavan, Harold Copperman, Thomas Erickson, Stanley Meresman, Nicholas Mitsakos, Barry Newman and William Quigley to serve as a director for a one-year term that is expected to expire at our annual meeting in 2012 and until his successor is elected and qualified, or until his earlier death, resignation or removal. You can find the principal occupation and other information about the board’s nominees, as well as other board members, below.

The election of directors will be determined by the eight nominees receiving the greatest number of votes from shares eligible to vote. Unless a stockholder signing a proxy withholds authority to vote for one or more of the board’s nominees in the manner described on the proxy, each proxy received will be voted for the election of each of the board’s nominees. In the event that any nominee is unable or declines to serve as a director at the time of the annual meeting, the proxies will be voted for the nominee or nominees who shall be designated by the present board of directors to fill the vacancy. We are not aware that any of the nominees will be unable or will decline to serve as a director.

There are no family relationships between any of our directors, nominees or executive officers. There are also no arrangements or understandings between any director, nominee or executive officer and any other person pursuant to which he or she has been or will be selected as a director and/or executive officer.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ELECTION OF IHAB ABU-HAKIMA, DR. VADUVUR BHARGHAVAN, HAROLD COPPERMAN, THOMAS ERICKSON, STANLEY MERESMAN, NICHOLAS MITSAKOS, BARRY NEWMAN AND WILLIAM QUIGLEY DIRECTORS.

Information Regarding Our Nominees and Directors

The following table lists the nominees and current members of the board of directors by class, their ages as of April 1, 2011 and current positions with Meru Networks, Inc. Biographical information for each nominee and/or director is provided below. Our restated certificate of incorporation and bylaws provide that the number of our authorized directors, which is currently eight members, shall be fixed from time to time by a resolution of the majority of our board of directors. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Director Nominees

| | | | | | |

Name | | Age | | | Position |

Ihab Abu-Hakima | | | 55 | | | President, Chief Executive Officer and Director |

Dr. Vaduvur Bharghavan | | | 41 | | | Chief Technology Officer and Director |

Harold Copperman (1)(3) | | | 63 | | | Director |

Thomas Erickson (2) | | | 49 | | | Director |

Stanley Meresman (2)(3) | | | 64 | | | Director |

Nicholas Mitsakos (3) | | | 51 | | | Director |

Barry Newman (1)(2) | | | 52 | | | Director |

William Quigley (1) | | | 46 | | | Director |

5

| (1) | Member of the Nominating and Corporate Governance Committee. |

| (2) | Member of the Audit Committee. |

| (3) | Member of the Compensation Committee. |

Biographies

Nominees for Directors

Ihab Abu-Hakima has served as our President and Chief Executive Officer, and as a member of the board, since January 2005. Prior to joining us, Mr. Abu-Hakima served as Vice President of Sales and Corporate Development at Proxim Corporation, a broadband wireless systems provider, from 2002 to 2004, and Vice President of Marketing and Business Development at Western Multiplex Corporation, a broadband wireless systems provider, from 2000 to 2002. He worked at Liveknowledge.com, an internet-based knowledge exchange, from 1999 to 2000. Mr. Abu-Hakima worked at Silicon Graphics, Inc., a manufacturer of high-performance computing solutions from 1990 to 1996 and 1997 to 1999 where he rose to the position of Vice President and General Manager. He worked at Pictra, Inc., a digital photo sharing company, from 1996 to 1997. Mr. Abu-Hakima also previously worked at Hewlett-Packard Company, a technology company, and at the Bechtel Corporation, a construction and engineering company. Mr. Abu-Hakima holds a B.S. in Electrical Engineering, with honors, and an M.B.A. from McGill University in Montreal, Canada. Mr. Abu-Hakima’s experiences as the company’s Chief Executive Officer give him unique insights into the day-to-day operations of the company and his membership on the board allows him to share these insights with the board. He also brings to the board his strong background in senior management at companies in the wireless networking industry.

Dr. Vaduvur Bharghavan is one of our founders and has served as our Chief Technology Officer, and as a member of the board, since February 2002. Prior to co-founding Meru, Dr. Bharghavan founded Bytemobile Inc., a mobile internet solution provider, in 2000, where he served as Chairman and Chief Technology Officer from 2000 to 2002. From 1995 to 2000, he was on the faculty of the Electrical and Computer Engineering Department at the University of Illinois at Urbana-Champaign. Dr. Bharghavan holds a B.Tech in Computer Science from the Indian Institute of Technology at Madras and an M.S. and Ph.D. in Computer Science from the department of Electrical Engineering and Computer Science at the University of California, Berkeley. Dr. Bharghavan’s extensive expertise in the wireless networking industry, his insights into the direction of the company’s products, as well as his in-depth understanding of our company and business gained through his long tenure with us as a founder of the company and as a member of the board provides useful management perspective and strategic analysis to the board.

Harold Copperman has served as one of our directors since January 2010. Mr. Copperman has served as the President and Chief Executive Officer of HDC Ventures, Inc., a management and investment group focusing on enterprise systems, software, and services, since March 2002. From January 2000 to March 2002, Mr. Copperman was a consultant and a private investor. From 1993 to 1999, Mr. Copperman served as Senior Vice President and Group Executive at Digital Equipment Corp. Mr. Copperman also has held various executive positions at JWP, Inc., Commodore Business Machines, Inc. and Apple Computer, Inc. He also spent 20 years at IBM Corporation, where he held a variety of sales, marketing and executive positions. Mr. Copperman serves on the Board of Directors of ID Systems, Inc., a provider of RFID wireless solutions for tracking high-value assets. He also previously served as a director of Avocent Corporation, a publicly traded company that delivers IT operations management solutions, from 2002 until December 2009, at which time Avocent Corporation was acquired by Emerson Electric Co., a director of AXS-One Inc., a publicly traded company that provides high performance records compliance management solutions, from 2006 until June 2009, when AXS-One Inc. was acquired by Unify Corporation, and as a director of Epicor Software Corporation, a publicly held company that designs, develops, markets and supports enterprise application software solutions and services, from 2001 until 2008. Mr. Copperman received a B.S. in Mechanical Engineering from Rutgers University and served as a Captain in the U.S. Army. Mr. Copperman brings to our board vast experience and understanding of sales and management in large high technology organizations and his service on the boards of directors of several companies.

6

Thomas Ericksonhas served as one of our directors since 2004. Mr. Erickson has served as a co-founder and general partner of BlueStream Ventures, a venture capital firm, since 2000. From 1990 to 2000, Mr. Erickson worked as a network technology analyst for Dain Rauscher Wessels and its predecessor Wessels, Arnold & Henderson. Mr. Erickson holds a B.A. in Mathematics from St. Olaf College and an M.B.A. from the Kellogg School of Management at Northwestern University. He is a Chartered Financial Analyst. Mr. Erickson contributes his deep experience as an investment banker, his expertise with regard to analysts relations, and his understanding of our company and business due to his long tenure as a member of the board to our management team and the board.

Stanley Meresman has served as one of our directors since 2010. Mr. Meresman was a Venture Partner with Technology Crossover Ventures, a private equity firm, from January through December 2004, when he retired, and was General Partner and Chief Operating Officer of Technology Crossover Ventures from November 2001 to December 2003. During the four years prior to joining Technology Crossover Ventures, Mr. Meresman was a private investor and board member and advisor to several technology companies. From May 1989 to May 1997, Mr. Meresman was the Senior Vice President and Chief Financial Officer of Silicon Graphics, Inc. Prior to Silicon Graphics, he was Vice President of Finance and Administration and Chief Financial Officer of Cypress Semiconductor. Mr. Meresman is currently serving on the board of directors of Riverbed Technology, LinkedIn and HyTrust. From January 1995 to May 2007, Mr. Meresman served on the board of directors of Polycom. Mr. Meresman holds a B.S. in Industrial Engineering and Operations Research from the University of California, Berkeley and an M.B.A. from the Stanford Graduate School of Business. Mr. Meresman’s extensive financial and management expertise, including serving eight years as the chief financial officer of a publicly traded high technology company in Silicon Valley, and his service on the boards of directors of several companies, brings to the board the perspective of an experienced long-term investor in numerous technology companies as well as a strong financial management background. In addition, our board’s determination, in light of his experience as a principal financial officer and director overseeing or assessing the performance of public companies and auditors as described above, that Mr. Meresman is an “audit committee financial expert” lends further support to his financial acumen and qualifications for serving on our board and as the chairman of our audit committee.

Nicholas Mitsakoshas served as one of our directors since 2002. Since 1989, Mr. Mitsakos has served as the Chairman and CEO of Arcadia Holdings, Inc., an investment firm focused on private equity and venture capital. He has also served as a senior advisor to Sardis Capital, a London-based merchant bank since 2003, and to Franklin Templeton China, in Shanghai, China, since 2001, and Templeton International, since 1996. He holds B.S. degrees in Computer Science and Microbiology from the University of Southern California and an M.B.A. from Harvard University. He taught at UCLA’s Anderson School of Business from 1992 to 1998, and is also on the board of UCLA’s Center for Cerebral Palsy at the UCLA Medical School. Mr. Mitsakos’ experience in the venture capital industry as well as his understanding of our company and business gained through his long tenure with us as a member of the board provide valuable insight to the board.

Barry A. Newmanhas served as one of our directors since June 2006. Mr. Newman is a Managing Director at NeoCarta Ventures, Inc., a venture capital firm, which he joined in July 2006. From January 2005 until June 2006, Mr. Newman worked as an independent consultant and member of the board of directors for various private companies. Mr. Newman served as a Vice Chairman of the Technology Group at Bear, Stearns and Co. Inc. from 2001 to 2004, the Head of Global Technology Corporate and Investment Banking for Banc of America Securities L.L.C. and its predecessor Nationsbanc Montgomery Securities LLC from 1999 to 2001 and as the head of Global Technology Corporate finance at Salomon Brothers and Salomon Smith Barney from 1996 to 1999. Mr. Newman holds a B.S. degree in both Chemical Engineering and Life Sciences from the Massachusetts Institute of Technology, an M.B.A. and a J.D. from Stanford University and an L.L.M. (Taxation) from NYU. Mr. Newman’s vast experience as a venture capitalist as well as an investment banker, his expertise with regard to potential financing and other strategic transactions, and his understanding of our company and business due to his long tenure with us as a member of the board provides the board with significant experience in financial and transactional matters.

7

William Quigley has served as one of our directors since 2002. Mr. Quigley is a Managing Director at Clearstone Venture Partners, a venture capital firm. He joined Clearstone shortly after its formation in 1999, from Mid-Atlantic Venture Funds, where he served as an investor and Kauffman Fellow. Mr. Quigley holds a B.S. in Accounting, with honors, from the University of Southern California and he received his M.B.A., with distinction, from Harvard Business School. Mr. Quigley brings to the board extensive financial experience as well as his experience in the venture capital industry and his understanding of our company and business due to his long tenure with us as a member of the board.

Board Meetings, Committees and Corporate Governance

Our board of directors had thirteen meetings during 2010 and, in connection with each of those meetings, held executive sessions of independent directors. Our board of directors also acted by unanimous written consent on two occasions. During 2010, each incumbent director attended at least 75% of the aggregate number of (i) the meetings of the board of directors and (ii) the meetings of the committees on which he served (during the periods that he served). Our board of directors has determined that all of our board members, including Mr. Kissner for the period of 2010 during which he served on our board, other than Mr. Abu-Hakima and Dr. Bharghavan are independent, as determined under the rules of The NASDAQ Stock Market and the applicable Securities and Exchange Commission, or the SEC, rules. Our board of directors designated William Quigley as our chairman in May 2010. In reaching its conclusion regarding the independence of the directors, the board considered Mr. Meresman’s prior role as a consultant to the board and the resulting compensation. Our board of directors has established three committees of the board that are currently in place: the audit committee, compensation committee and the nominating and corporate governance committee.

Board Leadership

Our board’s leadership structure is comprised of our CEO, our founder and CTO, several independent directors, and our Chairman who is an independent director. In May 2010, the board of directors designated Mr. William Quigley as the Chairman of the board. The Chairman of the board presides at executive sessions of non-management or independent directors. The Chairman of the board also calls meetings of the independent or non-management directors as may be necessary from time to time. In addition, he discusses any significant conclusions or requests arising from the independent director sessions with our Chief Executive Officer, including the scheduling of, and requested agenda items for, future meetings of the our board of directors. He may also perform other duties as may be, from time to time, set forth in our bylaws or requested by our board of directors to assist it in the fulfillment of its responsibilities, by individual directors, or by our Chief Executive Officer.

Our board structure allows us to leverage the experience of our CEO and the independent perspective of our Chairman of the board. We believe that this structure, amplified by our strong committee system, meets the current corporate governance needs and oversight responsibilities of the board.

Role of the Board in Risk Oversight

The board of directors is actively involved the oversight of our risk management process. The board does not have a standing risk management committee, but administers this oversight function directly through the board as a whole, as well as through its standing committees that address risks inherent in their respective areas of oversight. In particular, our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking, our nominating and corporate governance committee monitors our major legal compliance risk exposures and our program for promoting and monitoring compliance with applicable legal and regulatory requirements and our board is responsible for monitoring and assessing strategic risk exposure, with assistance from time to time by our new technology strategy committee, and other risks not covered by our committees.

8

The full board, or the appropriate committee, receives reports on risks facing our company from our Chief Executive Officer or other members of management to enable it to understand our risk identification, risk management and risk mitigation strategies. We believe that our board’s leadership structure supports effective risk management because it allows our Chairman of the board, who is independent, and the independent directors on our committees to exercise oversight over management.

Audit Committee

Our audit committee is comprised of Mr. Stanley Meresman, who is the chair of the committee, and Messrs. Barry Newman and Thomas Erickson. Mr. Quigley was chair of the committee during 2010 until the end of March 2011. Mr. Quigley departed the committee to ensure independence under Rule 10A-3 of the Securities Exchange Act of 1934, as amended, Rule 301 of the Sarbanes-Oxley Act and Rule 5605 of the NASDAQ Listing Rules. The composition of our audit committee meets the requirements for independence under the current NASDAQ Stock Market and SEC rules and regulations. Each member of our audit committee is financially literate. In addition, our audit committee includes a financial expert within the meaning of Item 407(d)(5)(ii) of Regulation S-K promulgated under the Securities Act of 1933, as amended, or the Securities Act. All audit services to be provided to us and all permissible non-audit services to be provided to us by our independent registered public accounting firm will be approved in advance by our audit committee. Our audit committee recommended, and our board of directors has adopted, a charter for our audit committee. Our audit committee, among other things:

| | • | | selects a firm to serve as the independent auditors for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for us; |

| | • | | helps to ensure the independence of the auditors; |

| | • | | discusses the scope and results of the audit with the independent auditors, and reviews, with management and that firm, our interim and year-end operating results including our disclosures under the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our reports filed with the SEC; |

| | • | | establishes procedures for employees to submit anonymously concerns about questionable accounting or audit matters; |

| | • | | discusses with management our major financial risk exposures and the steps management has taken to monitor such exposures including our policies with respect to risk assessment and risk management; |

| | • | | reviews and discusses with management and the independent auditors the adequacy and effectiveness of our internal control over financial reporting and the effectiveness of our disclosure controls and procedures; |

| | • | | reviews and considers “related person transactions” under, and takes other actions contemplated by, our related person transactions policy; and |

| | • | | reviews any proposed waiver of our code of conduct and makes a recommendation to the board of directors with respect to the disposition of any proposed waiver. |

The audit committee met eight times during 2010, including meetings with our independent registered public accounting firm to review our quarterly and annual financial statements and their review or audit of such statements. The audit committee operates pursuant to the audit committee charter, which has been posted on our website athttp://investors.merunetworks.com/governance.cfm.

Compensation Committee

Our compensation committee is comprised of Mr. Harold Copperman, who is the chair of the committee, and Messrs. Nicholas Mitsakos and Stanley Meresman. Mr. Charles Kissner resigned from the compensation committee and from our board of directors on September 7, 2010, and was replaced on the compensation

9

committee by Mr. Meresman. The composition of our compensation committee meets the requirements for independence under the current NASDAQ Stock Market and SEC rules and regulations. The purpose of our compensation committee is to discharge the responsibilities of our board of directors relating to compensation of our executive officers. Our compensation committee recommended, and our board of directors has adopted, a charter for our compensation committee. Our compensation committee, among other things:

| | • | | reviews and approves the corporate goals and objectives relevant to the compensation of our Chief Executive Officer and the other executive officers; |

| | • | | administers our stock and equity incentive plans; |

| | • | | reviews and makes recommendations to our board of directors with respect to incentive compensation and equity plans; and |

| | • | | establishes and reviews general policies relating to compensation of our employees. |

The compensation committee met eight times during 2010. The compensation committee operates pursuant to the compensation committee charter. Under its charter, which has been posted on our website athttp://investors.merunetworks.com/governance.cfm, the compensation committee has authority to retain compensation consultants, outside counsel and other advisors that the committee deems appropriate, in its sole discretion, to assist it in discharging its duties, and to approve the terms of retention and fees to be paid to such consultants. In December 2009, our compensation committee retained Compensia, Inc. (“Compensia”), an independent compensation consulting firm, to help evaluate our compensation philosophy and provide guidance in administering our compensation program in connection with the completion of 2009 and the review of compensation for 2010, and to assess the risks associated with such practices, policies and programs. The risk-mitigating factors considered by the compensation committee, in addition to those described in “—Role of Board in Risk Oversight,” include:

| | • | | the use of different types of compensation that provide a balance of short-term and long-term incentives with fixed and variable components; |

| | • | | the design of our executive bonus plans to ensure our named executive officers remain focused on financial performance metrics that drive long-term stockholder value, such as revenue and non-GAAP operating income. At the same time, our use of equity balances against short-term decision making; |

| | • | | equity grants typically vest over a four-year vesting period to encourage our named executive officers to maintain a long-term perspective. Any performance based options granted in 2010 were based on a three-year performance period to avoid short term risk taking; |

| | • | | caps on bonus awards to limit windfalls; and |

| | • | | the named executive officers must obtain permission from our General Counsel before the sale of any shares of our common stock, even during an open trading period. |

The specific determinations of the compensation committee with respect to executive compensation for fiscal year 2010, and additional discussion regarding the role of Compensia in executive compensation, are described in greater detail in the Compensation Discussion and Analysis section of this proxy statement.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is comprised of Mr. Barry Newman, who is the chair of the committee, and Messrs. Harold Copperman and William Quigley. Mr. Charles Kissner resigned from our nominating and corporate governance committee and from our board of directors on September 7, 2010, and was replaced on the nominating and corporate committee by Mr. Newman. The composition of our nominating and corporate governance committee meets the requirements for independence under the current NASDAQ Stock

10

Market and SEC rules and regulations. Our nominating and corporate governance committee has recommended, and our board of directors has adopted, a charter for our nominating and corporate governance committee. Our nominating and corporate governance committee, among other things:

| | • | | identifies, evaluates, recruits and recommends nominees for our board of directors and committees of our board of directors; |

| | • | | establishes procedures for the submission and consideration of candidates for nomination to our board of directors recommended by stockholders; |

| | • | | oversees the self-evaluation process of our board of directors and each of its committees; |

| | • | | oversees matters of corporate governance, including the development and monitoring of a process to assess the effectiveness of our board of directors; |

| | • | | considers and makes recommendations to our board of directors regarding the composition of our board of directors and its committees; |

| | • | | develops and recommends to our board of directors a code of business conduct and a code of ethics; |

| | • | | evaluates our risk management process and system in light of the nature of the material risks we face and the adequacy of our policies and procedures designed to address risk; and |

| | • | | develops and recommends to our board of directors corporate governance guidelines and reviews and recommends to our board of directors any changes deemed appropriate. |

The nominating and corporate governance committee met three times during 2010. The nominating and corporate governance committee operates pursuant to the nominating and corporate governance committee charter, which has been posted on our website athttp://investors.merunetworks.com/governance.cfm.

The nominating and corporate governance committee will consider nominees recommended by stockholders for election as directors. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected identified candidates as appropriate. Candidates for the board of directors are generally selected based on desired skills and experience in the context of the existing composition of the board and needs of the board and its committees at that time, including the requirements of applicable SEC and NASDAQ rules. The nominating and corporate governance committee does not assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all candidates, and will choose candidates to recommend for nomination based on the specific needs of the board and our company at that time. Although the nominating and corporate governance committee does not have a specific policy on diversity, in its consideration of the specific needs of the board and our company, the committee considers diverse backgrounds so that the board composition reflects a broad spectrum of experience and expertise. Final approval of nominees to be presented for election is determined by the full board.

The nominating and corporate governance committee recommended to the board that Messrs. Quigley, Newman, Erickson, Mitsakos, Copperman, Meresman, and Abu-Hakima and Dr. Bharghavan be nominated to serve as directors.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics for that applies to all of our officers, directors and employees. We have also adopted an additional written code of ethics, the Code of and Ethics for Directors and Senior Executive Officers. These codes are available in the “Investor Relations” section of our website athttp://www.merunetworks.com. If we make any substantive amendments to the codes or grant any waiver from a provision of the codes to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website, as well as via any other means then required by NASDAQ listing standards or applicable law.

11

Compensation Committee Interlocks and Insider Participation

During 2010, our compensation committee consisted of Messrs. Copperman, Kissner, Mitsakos and Meresman. On September 7, 2010, Mr. Kissner resigned from the board of directors and the compensation committee. No member of the compensation committee has at any time in the last fiscal year or previously been one of our officers or employees and none has had any relationships with our company of the type that is required to be disclosed under Item 404 of Regulation S-K. None of our executive officers has served as a member of the board of directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our board of directors or compensation committee during 2010. During 2010, prior to joining our board of directors, Mr. Meresman served as a consultant to the audit committee and board of directors. During his capacity as a consultant, Mr. Meresman received stock options from the company. When Mr. Meresman joined the board of directors, the consultancy relationship was terminated, as were the unvested options he received in his capacity as a consultant. The value of the vested portion of the options he received as a consultant equaled approximately $30,000. The board of directors has considered Mr. Meresman’s consultant relationship with the board in making its determination that Mr. Meresman meets the requirements for independence under the current NASDAQ Stock Market and SEC rules and regulations.

Director Compensation

The compensation committee evaluates the appropriate level and form of compensation for non-employee directors and recommend changes to the board when appropriate. The board has adopted the following policies with respect to the compensation of non-employee directors:

Cash Compensation

In 2010, each non-employee member of the board of directors declined cash compensation. We do not pay fees to directors for attendance at meetings of our board of directors and its committees, but we reimburse our directors for reasonable expenses in connection with attendance at board and committee meetings. Each non-employee director who continues to serve on our board of directors will receive an annual cash retainer in the amount of $35,000.

Equity Compensation

In 2010, each person who was not an employee who became a member of our board of directors was granted an initial option to purchase shares of our common stock, as well as restricted stock awards, upon election to our board of directors. Each non-employee director who continues to serve on our board of directors will automatically be granted restricted stock units of our common stock, or RSUs, in an amount intended to convey $90,000 of value to each non-employee director on an annual basis. The RSUs will have a grant price equal to the fair market value of our common stock on the date of grant, will have a ten-year term and will terminate 90 days following the date the director ceases to serve on our board of directors for any reason other than death or disability, or 12 months following that date if the termination is due to death or disability. Each RSU grant vests at a rate of 25% for every 3 months of continued service; provided that in the event that during the fourth three-month period of vesting, we hold our next annual stockholder meeting and the director does not stand for re-election at such meeting (or is otherwise not reelected), such that the end of the director’s regular term in office occurs prior to full vesting of the RSUs, such annual-grant RSUs shall nonetheless be deemed fully vested by virtue of service until such next annual meeting.

Upon the election of new non-employee directors to our board, each such new non-employee director is automatically granted a stock option, in an amount intended to convey $125,000 of value to each non-employee director vesting monthly over four years.

12

Directors will have the option to receive, in lieu of all or a portion of the cash to be paid, an RSU grant with an intrinsic value equal to the value of the cash to be received. The RSU grant will be for the full annual amount, and will vest at the rate of 25% for every 3 months of continued service in the role for which the cash amount corresponding to such portion of the RSUs would be paid.

2010 Compensation

The following table provides information for our fiscal year ended December 31, 2010 regarding all plan and non-plan compensation awarded to, earned by or paid to each person who served as a non-employee director in 2010. Other than as set forth in the table and the narrative that follows it, to date we have not paid any fees to our directors, made any equity or non-equity awards to directors, or paid any other compensation to directors. All compensation that we paid to Mr. Abu-Hakima and Dr. Bharghavan, our only employee directors, is set forth in the tables summarizing executive officer compensation below. No compensation was paid to Mr. Abu-Hakima or Dr. Bharghavan in their capacity as directors.

| | | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash | | | Restricted

Stock Awards (1) | | | Stock

Options (2) | | | Total | |

Harry Copperman (3) | | | — | | | $ | 73,130 | | | $ | 271,580 | | | $ | 344,710 | |

Thomas Erickson | | | — | | | | 65,625 | | | | 103,894 | | | | 169,519 | |

Charles Kissner (4) | | | — | | | | 70,634 | | | | 271,580 | | | | 342,214 | |

Stanley Meresman (5) | | | — | | | | 113,959 | | | | 257,948 | | | | 371,907 | |

Nicholas Mitsakos (6) | | | — | | | | 65,625 | | | | 196,928 | | | | 262,553 | |

Barry Newman | | | — | | | | 65,625 | | | | 103,894 | | | | 169,519 | |

William Quigley (7) | | | — | | | | 75,626 | | | | 103,894 | | | | 179,520 | |

| (1) | In April 2010, in connection with our annual stockholders meeting and consistent with the equity compensation policy adopted by the board, we granted each non-employee director Messrs. Copperman, Erickson, Kissner, Mitsakos, Newman, and Quigley 3,500 shares of restricted stock, or RSAs. The fair value of each such RSA was $18.75 per share. Each of these RSAs: (i) vests in full on the 12 month anniversary; and (ii) contains change of control provisions such that all unvested shares vest immediately upon the closing of a change of control transaction. As of December 31, 2010, each director held outstanding RSAs that had not yet vested as to the following number of shares: Harold Copperman: 3,712; Thomas Erickson: 3,500; Stanley Meresman: 8,300; Nicholas Mitsakos: 3,500; Barry Newman: 3,500; and William Quigley: 3,783. |

| (2) | In April 2010, in connection with our annual stockholders meeting and consistent with the equity compensation policy adopted by the board, we granted each non-employee director options to purchase 10,000 shares of our common stock at an exercise price of $18.75 per share. Each of these options: (i) vests as to 1/12th of the shares of common stock underlying it monthly beginning one month after the vesting start date; and (ii) contains change of control provisions such that all unvested shares vest immediately upon the closing of a change of control transaction. Amounts shown in this column do not reflect dollar amounts actually received by the non-employee director. Instead, these amounts reflect the aggregate full grant date fair value calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation — Stock Compensation, (formerly SFAS 123R), or ASC 718, for awards granted during 2010. See Note 12 of the Notes to our Consolidated Financial Statements in our annual report on Form 10-K for 2010 for a discussion of all assumptions made in determining the grant date fair values. As of December 31, 2010, each director held outstanding options to purchase the following number of shares: Harold Copperman: 38,653; Thomas Erickson: 10,000; Stanley Meresman: 35,072; Nicholas Mitsakos: 34,193; Barry Newman: 10,000; and William Quigley: 10,000. |

| (3) | In addition, we awarded Mr. Copperman 424 shares of restricted stock in April 2010 and options to purchase 28,653 shares our common stock at an exercise price of $9.10 per share in January 2010. The fair values of each such RSA and option were $17.70 and $5.85 per share, respectively. The restricted stock award: (i) vests quarterly and in full on the 12 month anniversary; and (ii) contains change of control provisions such that all unvested shares vest immediately upon the closing of a change of control |

13

| | transaction. Each of these options: (i) vests as to 1/48th of the shares of common stock underlying it monthly beginning one month after the vesting start date; and (ii) contains change of control provisions such that all unvested shares vest immediately upon the closing of a change of control transaction. |

| (4) | In addition, we awarded Mr. Kissner 283 shares of restricted stock in April 2010 and options to purchase 28,653 shares our common stock at an exercise price of $9.10 per share in January 2010. The fair values of each such RSA and option were $17.70 and $5.85 per share respectively. The restricted stock award: (i) vested quarterly and in full on the 12 month anniversary; and (ii) contained change of control provisions such that all unvested shares vest immediately upon the closing of a change of control transaction. Each of these options: (i) vested as to 1/48th of the shares of common stock underlying it monthly beginning one month after the vesting start date; and (ii) contained change of control provisions such that all unvested shares vest immediately upon the closing of a change of control transaction. Mr. Charles Kissner resigned from our from our board of directors on September 7, 2010 and all of his shares of restricted stock and options to purchase shares of our common stock ceased vesting at that time. |

| (5) | Prior to be elected as our board director, Mr. Meresman was awarded options to purchase 28,653 shares of our common stock at an exercise price of $9.10 per share in February 2010 in exchange for his service as a consultant. He exercised the vested 3,581 shares of his options on September 15, 2010. The market close price of a share of our common stock on September 15, 2010 was $17.58. The total grant date fair value of these options was $38,000 which was not included in the board of directors’ compensation table. The remaining unvested shares of this grant in the amount of 25,072 shares were cancelled in September 2010. Upon his election to our board of directors, we awarded Mr. Meresman 8,300 shares of restricted stock and options to purchase 35,072 shares of our common stock at an exercise price of $13.73 per share in September 2010 consistent with the equity compensation policy adopted by the board. The fair values of each such RSA and option were $13.73 and $7.35 per share. Of these RSAs: (i) 3,500 shares vested in full on April 6, 2011 and 25% of the remaining 4,800 shares vested on April 6, 2011, and the remaining RSAs will vest annually thereafter, such that 100% of the RSAs will become fully vested on April 6, 2014; and (ii) contains change of control provisions such that all unvested shares vest immediately upon the closing of a change of control transaction. Of these options: (i) 25,072 shares vest as to 1/40th and 10,000 shares vest as to 1/7th of the shares of common stock underlying it monthly beginning one month after the vesting start date; and (ii) contains change of control provisions such that all unvested shares vest immediately upon the closing of a change of control transaction. |

| (6) | We awarded Mr. Mitsakos options to purchase 12,860 shares our common stock at an exercise price of $9.10 per share in February 2010. The fair value of each such option was $7.23 per share. Each of these options: (i) vests as to 1/48th of the shares of common stock underlying it monthly beginning one month after the vesting start date; and (ii) contains change of control provisions such that all unvested shares vest immediately upon the closing of a change of control transaction. |

| (7) | We awarded Mr. Quigley 565 shares of restricted stock in April 2010. The fair value of each such RSA was $17.70. This restricted stock: (i) vests quarterly and in full on the 12 month anniversary; and (ii) contains change of control provisions such that all unvested shares vest immediately upon the closing of a change of control transaction. |

14

ADVISORY VOTE ON EXECUTIVE COMPENSATION

(Item No. 2 on the Proxy Card)

In accordance with recent legislation and related SEC regulations, we are providing stockholders with a non-binding advisory vote on compensation programs for our named executive officers, also known as “say on pay.”

Stockholders are urged to read the Compensation Discussion and Analysis section of this proxy statement, which discusses how our executive compensation policies and procedures implement our compensation philosophy, and the Executive Compensation section of this proxy statement, which contains tabular information and narrative discussion about the compensation of our named executive officers. The Compensation Committee and the board believe that these policies and procedures are effective in implementing our compensation philosophy and in achieving its goals.

As described in the section of this proxy statement entitled “Compensation Discussion and Analysis,” our executive compensation program is designed to attract, retain, and motivate talented individuals with the executive experience and leadership skills necessary for us to increase stockholder value by driving long-term growth in revenue and profitability. We seek to provide executive compensation that is competitive with companies that are similar to us. We also seek to provide near-term and long-term financial incentives that reward well-performing executives when strategic corporate objectives designed to increase long-term stockholder value are achieved. We believe that executive compensation should include base salary, cash incentives and equity awards. We also believe that our executive officers’ base salaries should be set at approximately median levels relative to comparable companies, and cash and equity incentives should generally be set at levels that give executives the opportunity to achieve above-average total compensation reflecting above-average company performance. In particular, our executive compensation philosophy is to promote long-term value creation for our stockholders by rewarding improvement in selected financial metrics, and by using equity incentives. Please see our “Compensation Discussion and Analysis” (beginning on page 31) and related compensation tables for detailed information about our executive compensation programs, including information about the fiscal 2010 compensation of our executive officers.

As an advisory vote, this proposal is not binding. However, the Compensation Committee, which is responsible for designing and administering our executive compensation program, values the opinions expressed by stockholders in their vote on this proposal and will consider the outcome of the vote when considering future compensation decisions for our named executive officers.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE FOLLOWING RESOLUTION:

“RESOLVED, that Meru Networks, Inc.’s stockholders approve, on an advisory basis, the compensation of the executive officers, as disclosed in Meru Networks, Inc.’s proxy statement for the 2011 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables and narrative discussion.”

15

ADVISORY VOTE ON THE FREQUENCY OF EXECUTIVE COMPENSATION ADVISORY VOTES

(Item No. 3 on the Proxy Card)

In addition to providing stockholders with the opportunity to cast an advisory vote on executive compensation, in accordance with recent legislation and related SEC regulations, we are proposing a non-binding advisory vote on whether the advisory vote on executive compensation should be held every one, two or three years, also known as “say-on-pay” frequency.

The board believes that a frequency of three years for the advisory vote on executive compensation is the optimal interval for conducting and responding to a “say-on-pay” vote.

Because of its emphasis on equity compensation, our executive compensation program is designed to support long-term value creation, and a triennial vote will allow stockholders to better judge our executive compensation program in relation to our long-term performance. As described in the Compensation Discussion and Analysis section, one of the core principles of our executive compensation program is to ensure management’s interests are aligned with our stockholders’ interests to support long-term value creation. Accordingly, we grant equity awards with multi-year vesting periods to encourage our named executive officers to focus on long-term performance, and we accordingly recommend a triennial vote to allow our executive compensation programs to be evaluated over a similar time-frame and in relation to our long-term performance. In addition, a triennial vote will provide stockholders additional time to evaluate the effectiveness of our executive compensation policies and decisions and the related business outcome from a pay-for-performance perspective.

A triennial vote will provide us with the time to thoughtfully respond to stockholders’ sentiments and to implement changes. We carefully consider changes to our program to maintain the effectiveness and consistency of the program, which is important in motivating and retaining our employees.

Although this advisory vote on the frequency of the “say-on-pay” vote is nonbinding, the board and the compensation committee will take into account the outcome of the vote when considering the frequency of future advisory votes on executive compensation.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE OPTION OF THREE YEARS FOR FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION.

16

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM,

BURR PILGER MAYER, INC., FOR FISCAL YEAR ENDING DECEMBER 31, 2011

(Item No. 4 on the Proxy Card)

Our audit committee has selected, and is submitting for ratification by the stockholders its selection of, the firm of Burr Pilger Mayer, Inc., or BPM, to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2011 and until their successors are appointed. Representatives of BPM are expected to be at the annual meeting. Representatives of BPM will be given the opportunity to make a statement if they desire to do so, and they will be available to respond to appropriate questions.

Although action by stockholders is not required by law, the audit committee has determined that it is desirable to request approval of this selection by the stockholders. Notwithstanding the selection, the audit committee, in its discretion, may direct the appointment of a new independent registered public accounting firm at any time during the year, if the audit committee feels that such a change would be in the best interests of our company and stockholders. In the event of a negative vote on ratification, the audit committee will reconsider the selection of BPM as our independent registered public accounting firm.

Principal Accountant Fees and Services

The following table sets forth the aggregate fees and related expenses for professional services provided by BPM during 2010 and 2009. The audit committee considered the provision of the services corresponding to these fees, and the audit committee believes that the provision of these services is compatible with BPM maintaining its independence.

| | | | | | | | |

| | | Fiscal Years | |